Biweekly Global Business Newsletter Issue 147, Tuesday, November 11, 2025

“If you want to go fast, go alone. If you want to go far, go together.”

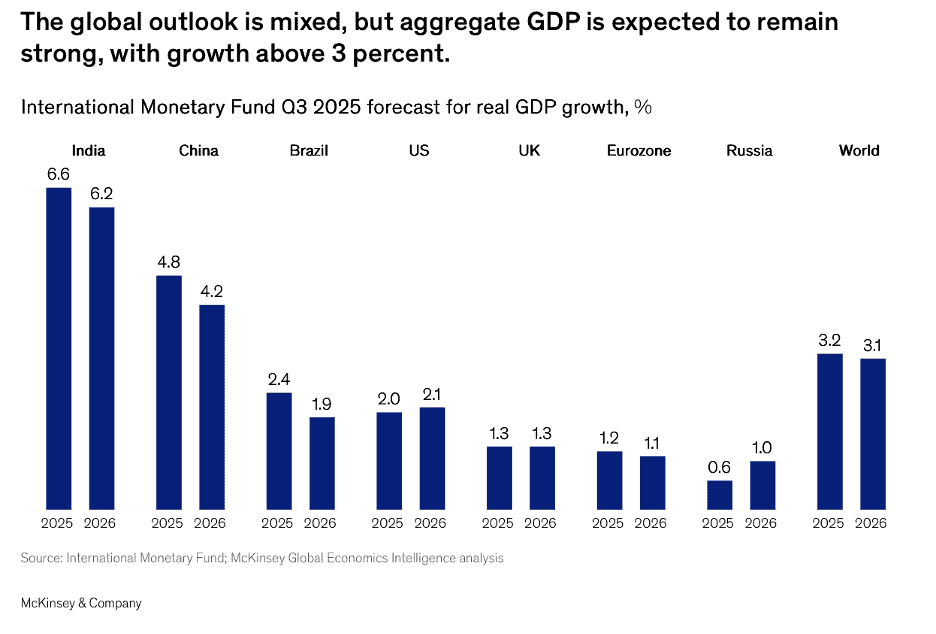

Welcome to the 147th Edition of the Global Business Update – Global economic indicators reveal resilience amid uneven regional recovery. The IMF projects roughly 3 percent growth for 2025-26, with the U.S. constrained by a government shutdown, China’s slowdown deepening, and Europe wrestling with fiscal and political instability.

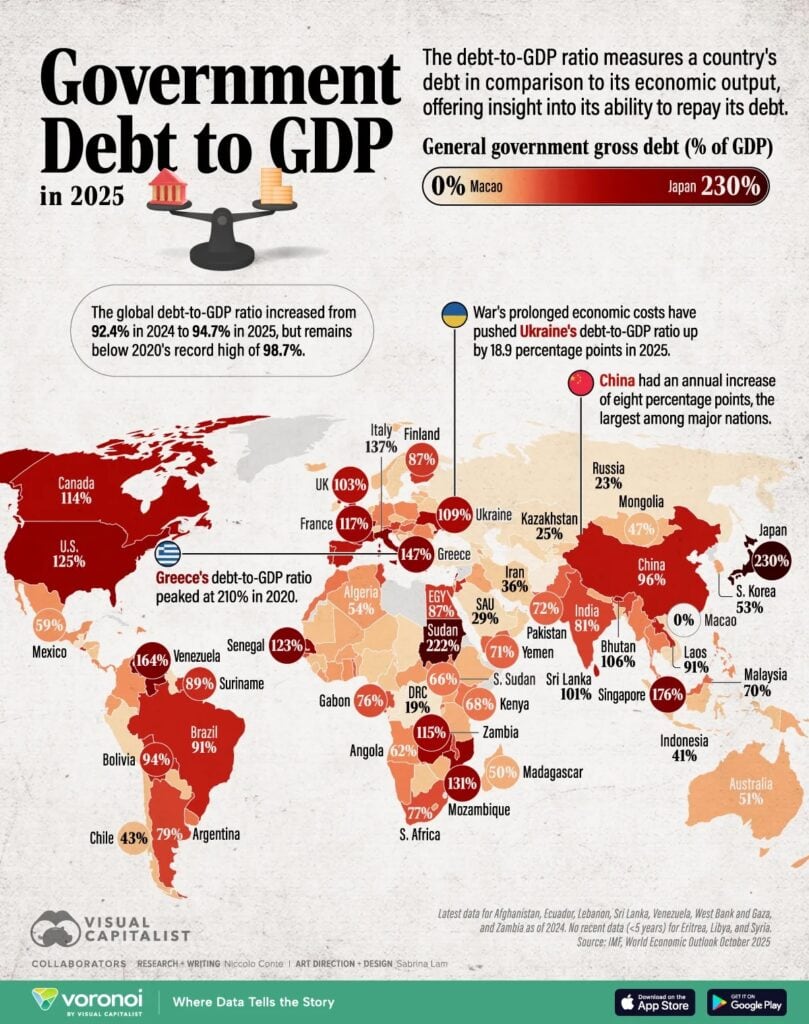

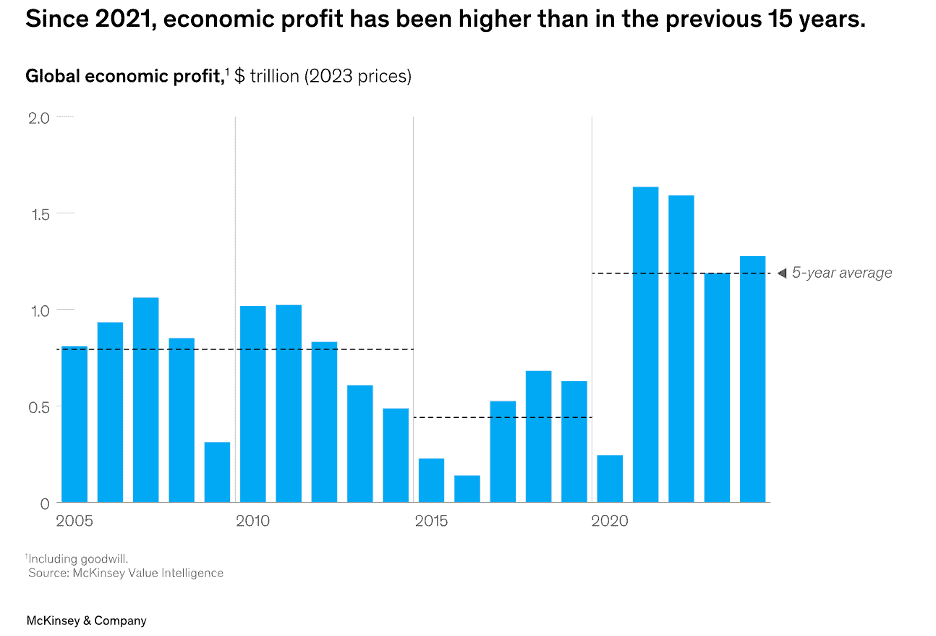

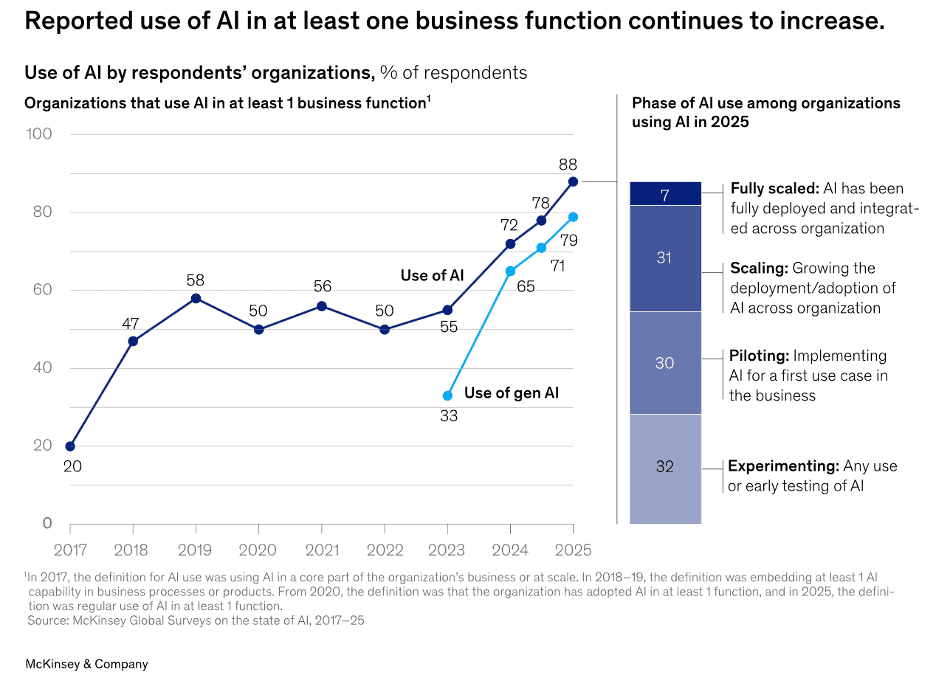

Global debt continues to climb, reaching 94.7 percent of GDP, while McKinsey reports a rebound in worldwide economic profits—driven by technology, energy, and materials sectors. AI adoption remains high, though many firms are still early in scaling enterprise-wide value.

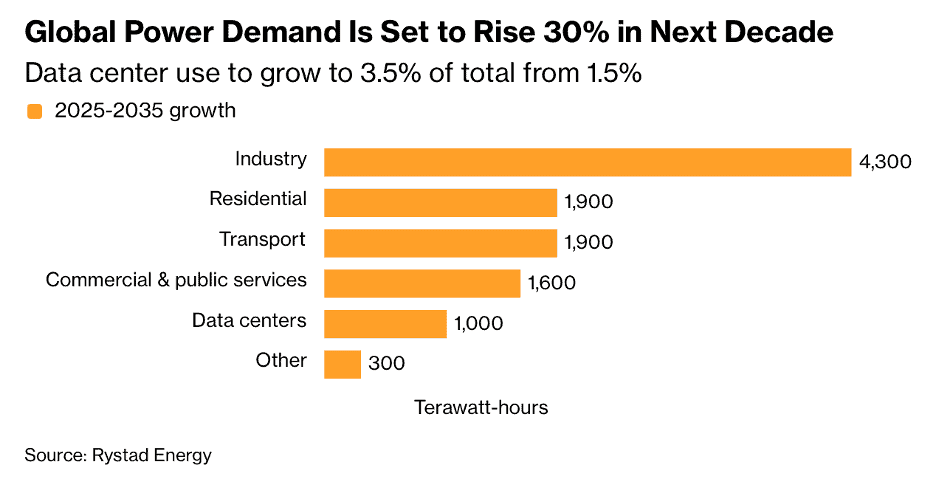

In energy, OPEC+ faces conflicting pressures as surplus risks meet renewed sanctions on Russia; meanwhile, tanker earnings and shipping activity surge. Rystad Energy forecasts a 30 percent rise in global power demand by 2035. Visual Capitalist notes that Greece, China, and Japan now control 40 percent of global shipping capacity.

In trade and geopolitics, your Editor, EGS CEO Bill Edwards, highlighted non-tariff barriers as a growing challenge for SMEs in a webinar at the Global Chamber Export-Import Forum.

Franchise section headlines include the $620 million sale of Denny’s to private equity, Brinker’s strong Chili’s results, Yum China’s record expansion, Starbucks’ China joint venture with Boyu Capital and Burger King China also selling part of its business.

Overall, 2025 continues to be defined by moderate economic optimism, strong energy logistics, accelerating AI transformation, and renewed global franchise activity—tempered by political volatility and consumer caution.

This edition’s book review highlights The Art of Less – How to Focus on What Really Matters at Work by Mats Alvesson and André Spicer argue that many organizations and professionals are burdened by excess — too many meetings, overlapping initiatives, training programs, targets, rules and bureaucratic structures that distract from core work and value creation. They label this burden “organizational sludge” — the accumulation of practices, procedures and policies that consume time and energy yet deliver little meaning or impact.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“If you want to go fast, go alone. If you want to go far, go together.”, African Proverb

“Successful entrepreneurs are givers and not takers of positive energy.” , Anonymous

“You miss 100% of the shots you don’t take.” – Wayne Gretzky

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #147:

Global Economics Intelligence executive summary, September 2025

The state of AI in 2025: Agents, innovation, and transformation

Government Debt to GDP by Country in 2025

Navigating Non-Tariff Barriers and Global Trade Challenges

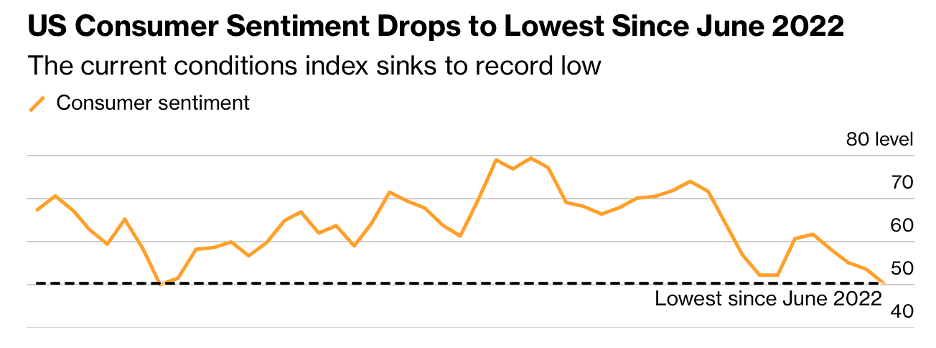

US Consumer Sentiment Is at Near-Record Lows

World Power Demand to Rise Almost a Third by 2035

Franchise Global News Section: Burger King®, Chili’s®, Club Pilates®, Denny’s®, Pizza Hut®, Starbucks®, Wendy’s® and YUM China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Global Economics Intelligence executive summary, September 2025 – The global economy is showing resilience, although growth remains uneven across regions. IMF projections indicate global growth of around 3% for 2025 and 2026, but underlying data is mixed. Currently, the United States faces a government shutdown, China’s momentum continues to slow, and Europe is contending with persistent political and fiscal turbulence. Central banks are cautiously pivoting toward easing, yet uncertainty surrounding trade dynamics, tariff policies, and the trajectory of AI markets continues to cloud the outlook.”, McKinsey & Co., October 31, 2025

=============================================================================================

“Government Debt to GDP by Country in 2025 – The global debt-to-GDP ratio rose 2.3 percentage points to 94.7% in 2025, but is still below the pandemic-era peak of 98.7% in 2020. Japan remains the world’s most indebted nation at 230% of GDP, followed by Sudan (222%) and Singapore (176%). Global debt levels continue to rise, with 2025 marking another year of fiscal strain across both advanced and developing economies. This map shows how much each country’s government debt compares to its economic output, measured as debt-to-GDP ratio, offering insight into fiscal resilience and vulnerability worldwide.”, Visual Capitalist & IMF World Economic Outlook, October 27, 2025

=================================================================================================

“Global economic profit bounces back to an all-time high – After years of decline, economic profits rebounded with a vengeance—driven by tech companies, performance in the energy and materials sector, and capital growth in China and North America. When adjusted for inflation, and despite the impact of the COVID-19 pandemic, economic profit between 2020 and 2024 increased to about $1.2 trillion per annum—50 percent above levels between 2005 and 2009. This is a notable shift from the past 15 years, when, as our previous research showed, companies’ aggregate economic profit—or their profit above the total cost of capital—mostly shrank.”, McKinsey & Co., September 4, 2025

===============================================================================================

“The state of AI in 2025: Agents, innovation, and transformation – Three years since the introduction of gen AI tools triggered a new era of artificial intelligence, nearly nine out of ten survey respondents say their organizations are regularly using AI—but the pace of progress remains uneven. Almost all survey respondents say their organizations are using AI, and many have begun to use AI agents. But most are still in the early stages of scaling AI and capturing enterprise-level value. High curiosity in AI agents: Sixty-two percent of survey respondents say their organizations are at least experimenting with AI agents.”, McKinsey & Co., November 5, 2025

============================================================================================

“How Franchises Can Properly Structure AI for Success – A recent study from MIT delivered a sobering finding: 95 percent of AI initiatives fail to generate measurable return on investment. For many brands, this statistic has been a wake-up call. In a recent six-month study, Goldfish Swim School and Heights Wellness Retreat offered two early proof points. Instead of trying to overhaul their entire tech stack, each brand zeroed in on a single, high-impact question: how can they help their franchise business coaches identify underperforming units faster, understand what’s driving the issues, and act on the right next steps? A second factor is human-centered design that integrates AI into existing workflows. Systems that operate in isolation, or attempt to replace human judgment entirely, often struggle to gain adoption.”, Franchising.com, October 22, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

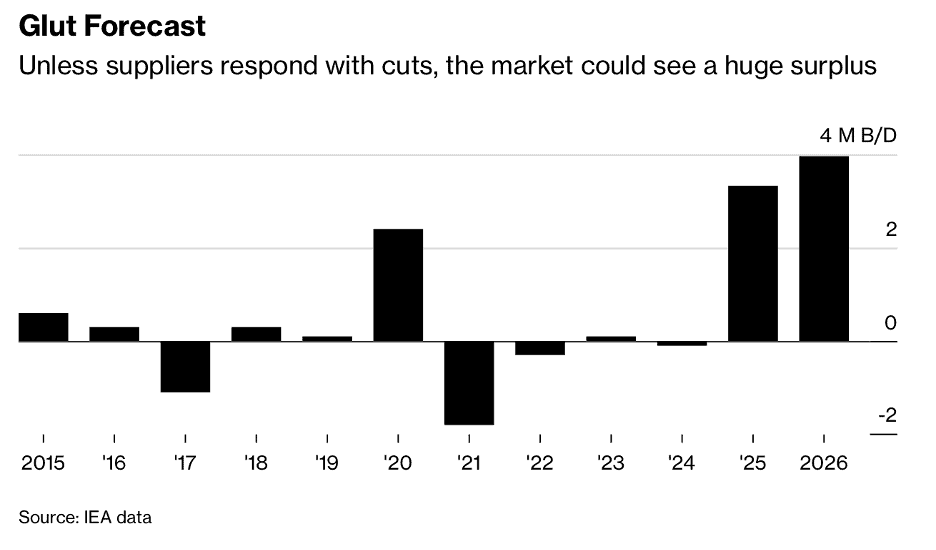

“OPEC+ Balances Oil Risks From Surplus to Sanctions – When OPEC+ meets this weekend, it’ll confront an oil market assailed by hazards on all sides. First, there are growing signs that a long-predicted supply surplus — swollen by the group’s production increases this year — is finally showing up. With Chinese demand cooling, top forecasters are bracing for a record glut in 2026. Then there are new US sanctions that threaten to disrupt exports from OPEC+ co-leader Russia. Finally, there’s the one-year trade truce reached this week between Washington and Beijing, which has allayed some of the concerns over oil demand and buoyed Brent crude futures near $65 a barrel.”, Bloomberg, October 31, 2025

============================================================================================

“Navigating Non-Tariff Barriers and Global Trade Challenges – The Global Chamber® Export-Import Forum, moderated by Anita Rodal, featured Bill Edwards, CEO and Global Trade Advisor at Edwards Global Services (Your newsletter Editor!!!), in a dynamic and highly informative discussion on international trade challenges and non-tariff barriers (NTBs) that impact businesses especially small to medium-sized enterprises (SMEs). The conversation explored regulatory, compliance, and cultural challenges that companies face when entering global markets, and how to navigate these obstacles effectively through market research, local partnerships, and access to international resources. Bill emphasized that while tariffs are often discussed in trade policy, non-tariff barriers — including certification requirements, labeling regulations, customs procedures, and shifting political environments — often create even greater obstacles for small exporters. ‘About half of all non-tariff barriers serve legitimate public purposes,’ Bill explained, ‘But the other half can act as discriminatory trade barriers — depending on market.’”, Global Chamber, October 23rd. Please go to this link for the YouTube webinar:

https://www.youtube.com/watch?v=i7_pH5kSF6Q

================================================================================================

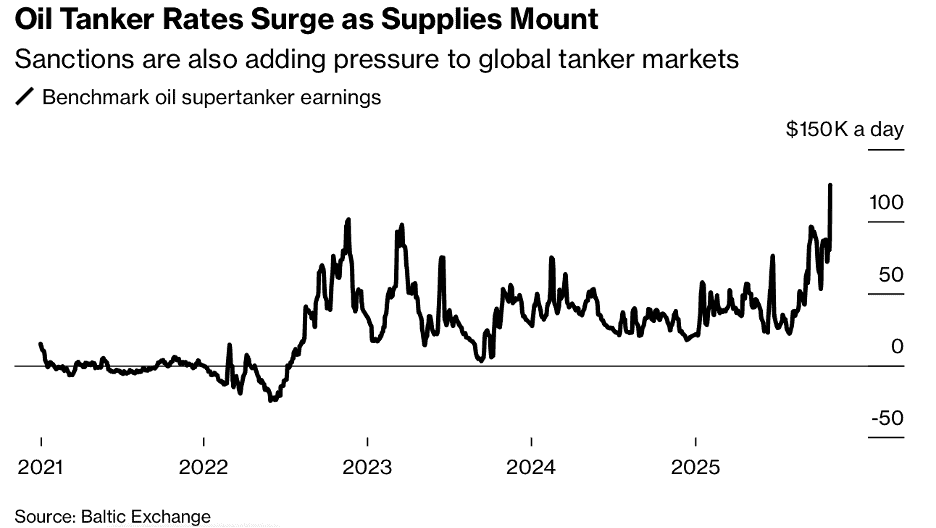

“Oil Supertanker Earnings Soar to $125,000 a Day as Supply Swells – Earnings for ships that can carry two million barrels of crude from the Middle East to China jumped 40% to $125,000 a day, according to the Baltic Exchange. It’s the highest since April 2020, when the global pandemic forced traders to hoard oil at sea. Rates have been steadily rising as global oil supplies climb, with production growing both inside and outside of the OPEC+ alliance.”, Bloomberg, October 29, 2025

==============================================================================================

“Three Nations Control the Global Fleet – The top three ship-owning nations by capacity, Greece, China, and Japan, account for over 40 percent of the world fleet by deadweight tonnage. Measured by vessel count, these three nations control nearly one-third of the global fleet. The combined share of the top 10 ship-owning countries reaches 67.3 percent of global fleet capacity. Much of the capacity owned by these top 10 ship-owning countries is registered under foreign flags.”, Visual Capitalist, October 31, 2025

==============================================================================================

“World Power Demand to Rise Almost a Third by 2035 – Global power demand will continue to grow rapidly over the next decade, jumping about 30% as electric vehicles, data centers and the need to heat and cool buildings increases, although the source of that electricity will shift markedly, according to Rystad Energy. Legacy industrial sectors such as iron and steel, which were also key in seeing electricity consumption double over the past two decades, will be the biggest drivers, the energy research company said in a report. While data centers are becoming a notable source of demand growth, their power usage will remain a relatively small part of the total — at 3.5% in 2035.”, Bloomberg, October 30, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

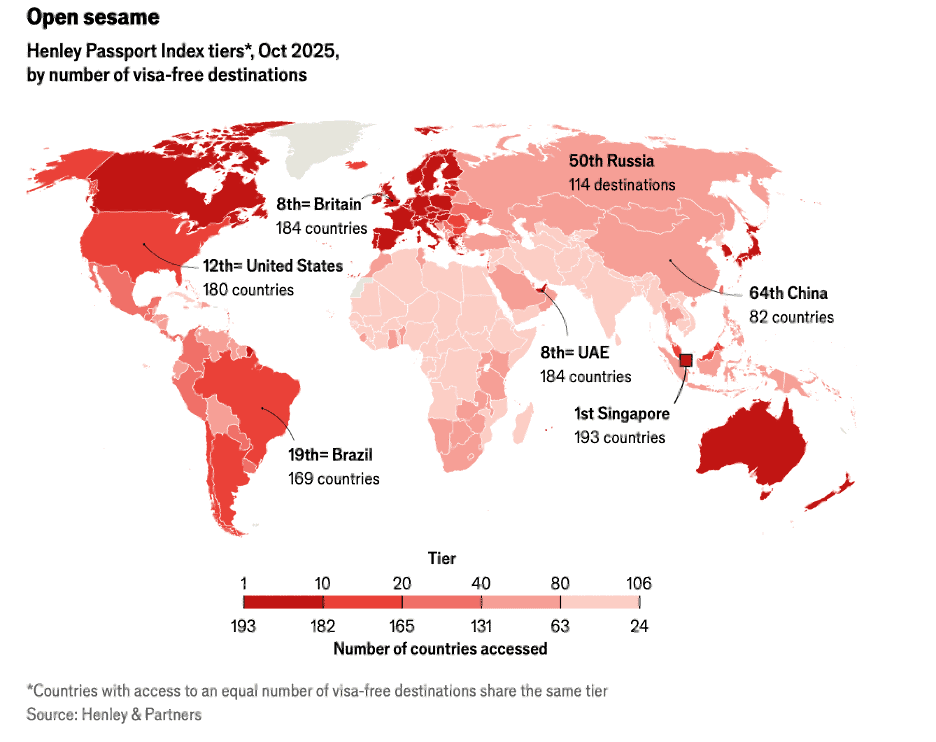

“The world’s most—and least—powerful passports – Americans’ travel documents aren’t as muscular as they used to be. Citizens of some countries can speed through the gates; citizens of others must submit to interrogation and delay. Henley & Partners, a consultancy that helps rich people acquire citizenship in attractive countries, ranks passports by the number of countries their holders can enter without a visa. Its latest assessment of passport power shows that America is sliding down the table. Our map shows how countries compare this year.”, The Economist, October 16, 2025

===============================================================================================

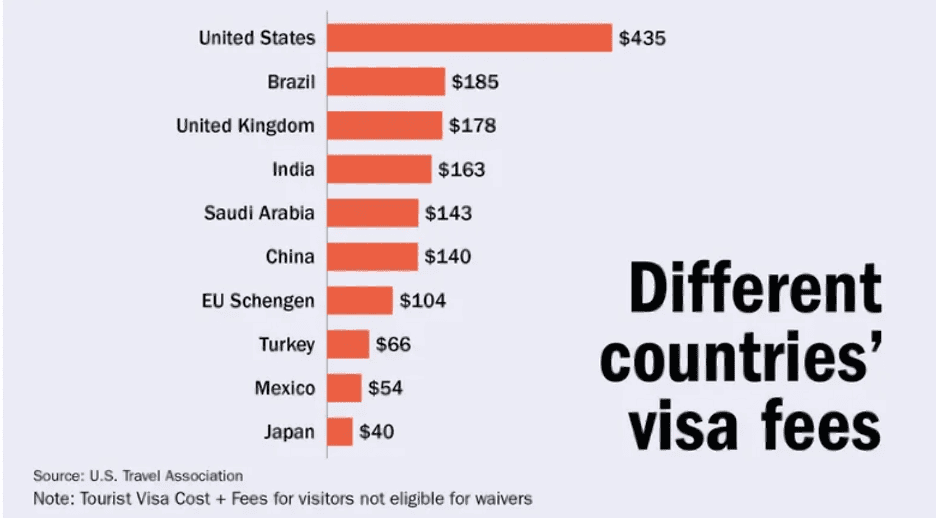

“Visa fees may blunt U.S. travel gains from weakened dollar – According to Morgan Stanley, the value of the U.S. dollar against other currencies dropped about 11% in the first half of 2025, the biggest decline in more than 50 years. Travel industry leaders are hopeful this might convert into more inbound visitation. But for many international visitors, a $250 visa fee introduced this month for visitors from countries that are not part of the Visa Waiver Program, including top markets Mexico, China, India and Brazil, makes visiting the U.S. more expensive. It does not apply to visitors from Canada or countries in the Visa Waiver Program, which includes most of Europe, Australia, Chile, Japan and South Korea.”, Travel Weekly, October 29, 2025.

=============================================================================================

“The world’s best airports for business travellers revealed – The Booking.com for Business study analysed 50 of the world’s busiest airports based on factors such as the number of business class routes and proximity to the local business district. It comes as global business travel spending is forecast to climb to £1.2trillion by the end of 2025, before accelerating with 8.1 per cent growth in 2026. With a score of 9.55, Dubai International Airport holds the coveted top position in the Business Travel Airport Index. Singapore Changi Airport takes second place with a Business Travel Airport Index score of 9.01.”, The Daily Mail, November 5, 2025

Editor’s Note: Airports in both the United Kingdom and the United States did not make the top ten in the world for business travelers.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In The Art of Less – How to Focus on What Really Matters at Work by Mats Alvesson and André Spicer argue that many organizations and professionals are burdened by excess — too many meetings, overlapping initiatives, training programs, targets, rules and bureaucratic structures that distract from core work and value creation. They label this burden “organizational sludge” — the accumulation of practices, procedures and policies that consume time and energy yet deliver little meaning or impact.

The book explains how sludge arises (from over‑standardization, risk aversion, stakeholder demands and managerial interventions), how it proliferates via a “sludge cycle”, and the ways in which it throttles productivity, stifles innovation and demoralizes employees. In the final section the authors propose a “de‑sludging” agenda: diagnosing what is truly meaningful work, challenging assumptions about mandatory activities, streamlining structures, creating space for judgment and initiative, and instituting “institutional minimalism” — doing fewer things, but doing them better.

For global organizations especially, the book emphasizes that focus, clarity and simplicity become even more critical in complex transnational contexts where cultural, structural and regulatory burdens can multiply. The central message: doing less of the unnecessary enables more of what matters.

Five Key Takeaways for Global Businesspeople

Identify and eradicate “sludge” – In multinational operations you’ll often encounter layers of processes, approvals, trainings or reporting systems that serve local comfort rather than real value. Ask: What practices don’t help but hinder?

Prioritize meaningful work – Especially in global teams with time‑zones and cultural differences, ensure that the tasks people spend most time on align with value‑creation, not just activity.

Empower judgement rather than rigid controls – Standardizing globally can pull you into high sludge. Give local teams discretion so they can focus on what really matters in their context.

Streamline structures and governance – Franchising, licensing, global joint ventures: all benefit from “less but sharper” rules. Avoid duplicative procedures across countries that slow responses and innovation.

Embed minimalism in culture – Build a mindset of “do fewer things, do them better” across your global organization: fewer horizons, fewer KPIs, fewer initiatives but higher impact. A global business that executes fewer priorities well will outperform one stretched thin across many weak ones.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

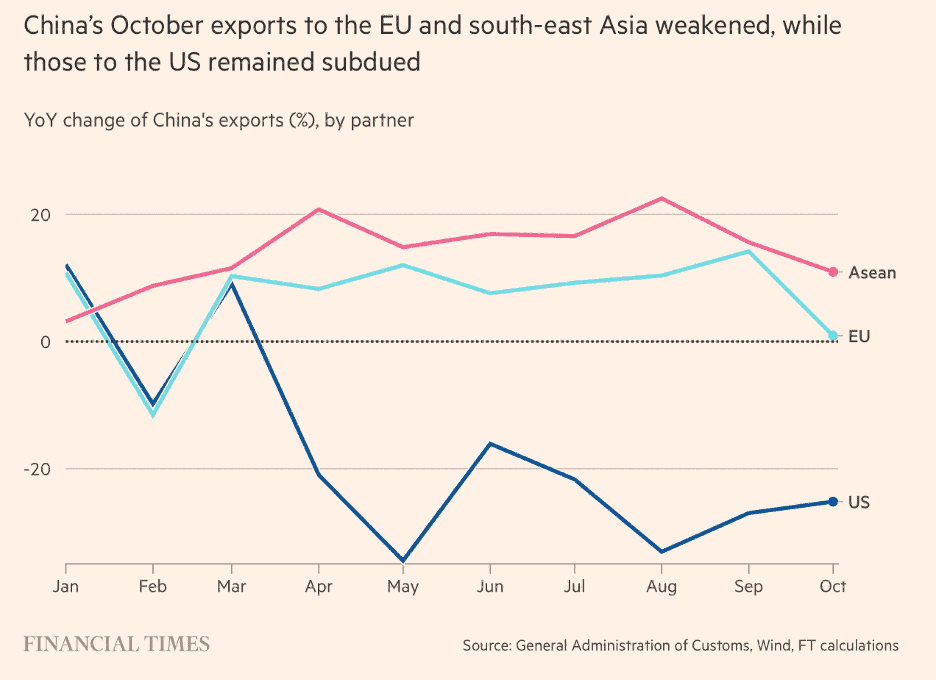

“China’s exports fall for first time since ‘liberation day’ trade tariffs – China’s exports have declined for the first time since the US unleashed its “liberation day” tariffs in April, highlighting the impact of months of trade tensions even as the two powers struck a truce. Exports from the world’s second-biggest economy were down 1.1 per cent year-on-year in dollar terms in October, China customs data showed on Friday. The last time they fell was in February. The unexpected decline comes after months of strong export growth, including an 8.3 per cent rise in September. Analysts polled by Reuters had expected a 3 per cent increase last month.”, The Financial Times, November 6, 2025

=============================================================================================

Eurozone Countries

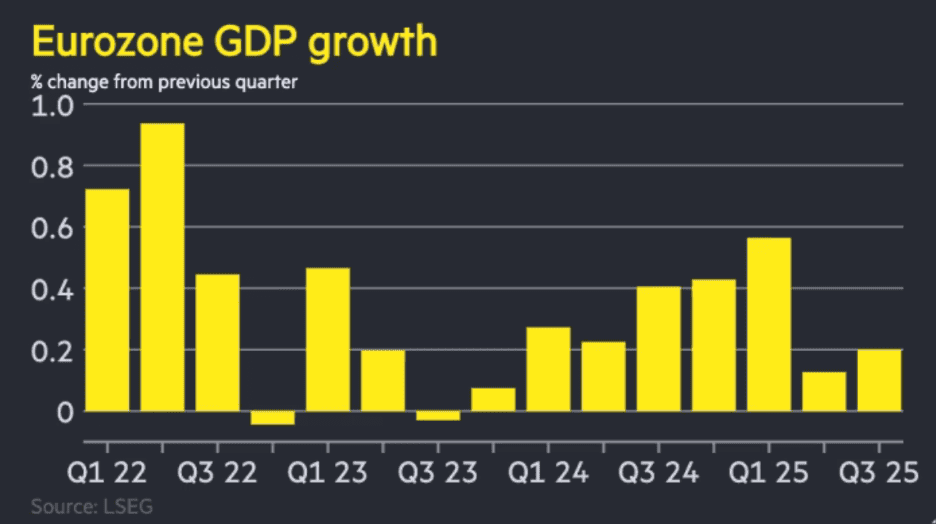

“Eurozone economy expands 0.2% in third quarter – Better than expected performance comes after French output grows at fastest pace since 2023. It came after France’s statistical office Insee said earlier on Thursday that the Eurozone’s second-biggest economy grew by a better than expected 0.5 per cent in the third quarter, despite the country’s recent political turmoil. By contrast, Germany and Italy failed to grow in the third quarter.”, The Financial Times, October 30, 2025

============================================================================================

Mexico

“Mexico City Is the Most Video-Surveilled Metropolis in the Americas – Despite 83,000 public cameras, crime in Mexico City remains high—and widespread surveillance raises myriad ethical issues. This video surveillance system helps to offer traffic alternatives, to follow up demonstrations or road accidents, and to track robbery suspects in real time. It is a fundamental piece in the security plan promoted by city authorities. Although Mexico City’s video surveillance system is a tool to prevent and punish crimes, the city still registers the highest crime rate in the country, with 54,473 crimes per 100,000 inhabitants.’, Wired, November 7, 2025

=============================================================================================

United States

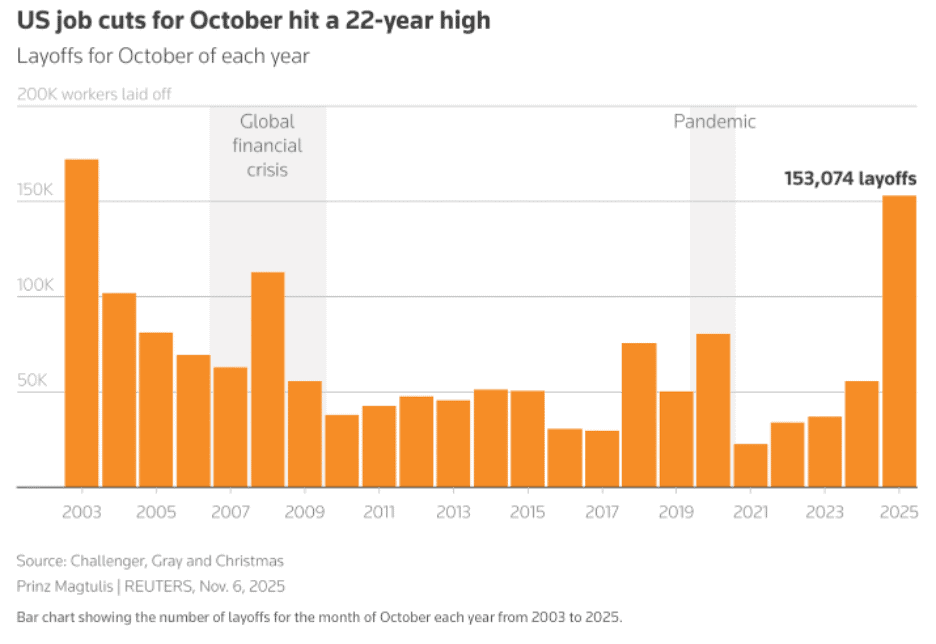

“Private reports suggest US labor market weakened in October – Revelio Labs data shows job losses in October, including in the government sector. AI and cost-cutting drive surge in planned layoffs, Challenger reports. Chicago Fed estimates unemployment rate rose to 4.36% in October. The U.S. economy shed jobs in October amid losses in the government and retail sectors, while cost-cutting and the adoption of artificial intelligence by businesses led to a surge in announced layoffs, data showed on Thursday. The reports, including an estimate from the Chicago Federal Reserve that the unemployment rate edged up last month from September, would at face value suggest a deterioration in labor market conditions. But a shutdown of the government, the longest on record, and the accompanying official economic data blackout have made it impossible to gauge the labor market status.”, Reuters, November 6, 2025

==============================================================================================

“US Consumer Sentiment Is at Near-Record Lows – American consumers are not happy campers. Sentiment across the country is close to the lowest it has ever been as rising inflation, rising unemployment, mass firings, a global trade war and now a record-breaking government shutdown have combined to make people less than cheery as the holidays approach. Unemployment expectations rose for a third straight month as consumers assigned an average 43% probability—the highest since April—to the likelihood the unemployment rate will be higher a year from now.”, Bloomberg, November 7, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“These Are The Fastest-Growing Chain Restaurants In 2025 – While legacy chains like McDonald’s (founded in 1940), Chick-fil-A (founded in 1946), and Starbucks (founded in 1971) continue to dominate the market, ambitious restaurant chains are racing to claim real estate across the country. Private equity firms are buying up chains that have mastered the franchise model. Pandemic-era shifts in dining habits have created opportunities for brands to refine takeout, delivery, and drive-thru services. And consumers, heavily influenced by social media and always hungry for the next big thing, are embracing both nostalgic comfort food and bold new flavors.”, Tasting Table, November 4, 2025

Editor’s Note: Leading the charge to open lots of new restaurants a year are Dave’s Hot Chicken®, Raising Cane’s®, Jersey Mike’s Subs®, Bojangles® and Bonchon®.

============================================================================================

“Denny’s to be acquired by group of investors for $620M – TriArtisan Capital Advisors, Treville Capital Group and Yadav Enterprises will take the diner chain and its sister brand Keke’s private in a surprising deal. Spartanburg, S.C.-based Denny’s consists of the 1,484-unit namesake diner chain as well as the 74-unit Keke’s Breakfast Cafe. It has been publicly traded since 1997, and there had been no indications that it was for sale.”, Restaurant Business, November 3, 2025

==============================================================================================

“Brinker Profit Rises as Chili’s Shrugs Off Restaurant Slowdown – The chain recorded 13% growth in traffic. Chili’s owner Brinker International reported higher first-quarter profit and sales despite broader industry concern about consumers pulling back from restaurants due to higher prices. Top-line gains were fueled by 21% comparable sales growth for Chili’s. Restaurants have reported weaker earnings in recent months as consumers pull back from higher prices. But Chili’s has been able to draw customers, who see the chain as having better value than other restaurants.”, The Wall Street Journal, October 29, 2025

=============================================================================================

“Burger King Owner Sells Majority of China Unit to Speed Growth – Restaurant Brands International Inc. agreed to sell a majority stake in the China unit of its Burger King chain, part of a plan to ignite growth there. The Burger King owner entered a joint venture with CPE, an Asia-based asset manager. CPE will invest $350 million in the entity to boost Burger King locations there to more than 4,000 by 2035 — up from 1,250. After completion of the transaction, CPE will own about 83% of the business.”, Bloomberg, November 10, 2025

==============================================================================================

“Behind Yum China’s solid Q3: Franchising gains and cost discipline pay off – Yum China delivered another solid quarter with a revenue jump of 4 per cent to US$3.2 billion. For the three months ended September 30, operating profit rose 8 per cent year-on-year to US$400 million, setting a third-quarter record. Expansion accelerated to 536 net new stores in the quarter, bringing Yum China’s footprint to 17,514 locations across six brands. The company remains on track for 1600 – 1800 net new stores this year and 20,000 by the end of next year, with franchisees accounting for about one-third of the new units this quarter. The franchise mix reached 41 per cent for KFC and 27 per cent for Pizza Hut, a key part of the company’s strategy to lower capital intensity and improve returns.”, Inside Retail AU, November 7, 2025

==========================================================================================

“Starbucks China is valued at over 13 billion and Boyu Capital will acquire a 60 percent stake in the joint venture – Starbucks Enterprise Management (China) Co., Ltd. announced on its official Weibo account that Starbucks Coffee Company and Boyu Capital, a Chinese alternative asset management company, have reached a strategic cooperation agreement. The two parties will establish a joint venture to jointly operate Starbucks’ retail business in the Chinese market. Under the agreement, Boyu Capital will hold up to 60% of the joint venture, while Starbucks will retain 40% and continue to license the Starbucks brand and intellectual property to the newly established joint venture. Boyu Capital, founded in 2011, is an alternative asset management company with a strong presence in the Chinese market and a global footprint. Currently, Boyu Capital has offices in Hong Kong, Beijing, Shanghai, and Singapore, with a portfolio of over 200 companies, and has built a diversified investment management platform covering private equity, public markets, infrastructure, and venture capital.”, Caijing.com.cn, November 4, 2025. Translation provided by Paul Jones, Jones & Co., Toronto

===========================================================================================

“Club Pilates Announces Thailand Master Franchise Agreement – Club Pilates announced today it has signed a Master Franchise Agreement in Thailand, with a commitment to open 20 studios in Bangkok, the municipality and Chonburi Province.”, Franchising.com. October 15, 2025

============================================================================================

“Wendy’s to Close Hundreds of Stores as Consumers Cut Restaurant Spending – Wendy’s said it would close hundreds of locations through next year as consumers continue to pull back on spending at restaurants. Interim Chief Executive Ken Cook said on the company’s earnings call that it would close a midsingle-digit percentage of its U.S. restaurants beginning this year and continuing into next year. Wendy’s has roughly 6,000 restaurants in the U.S.”, The Wall Street Journal, November 7, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link: