Biweekly Global Business Newsletter Issue 149, Tuesday, December 9, 2025

“The future of trade will belong to the economiesthat move the fastest, not the largest.”

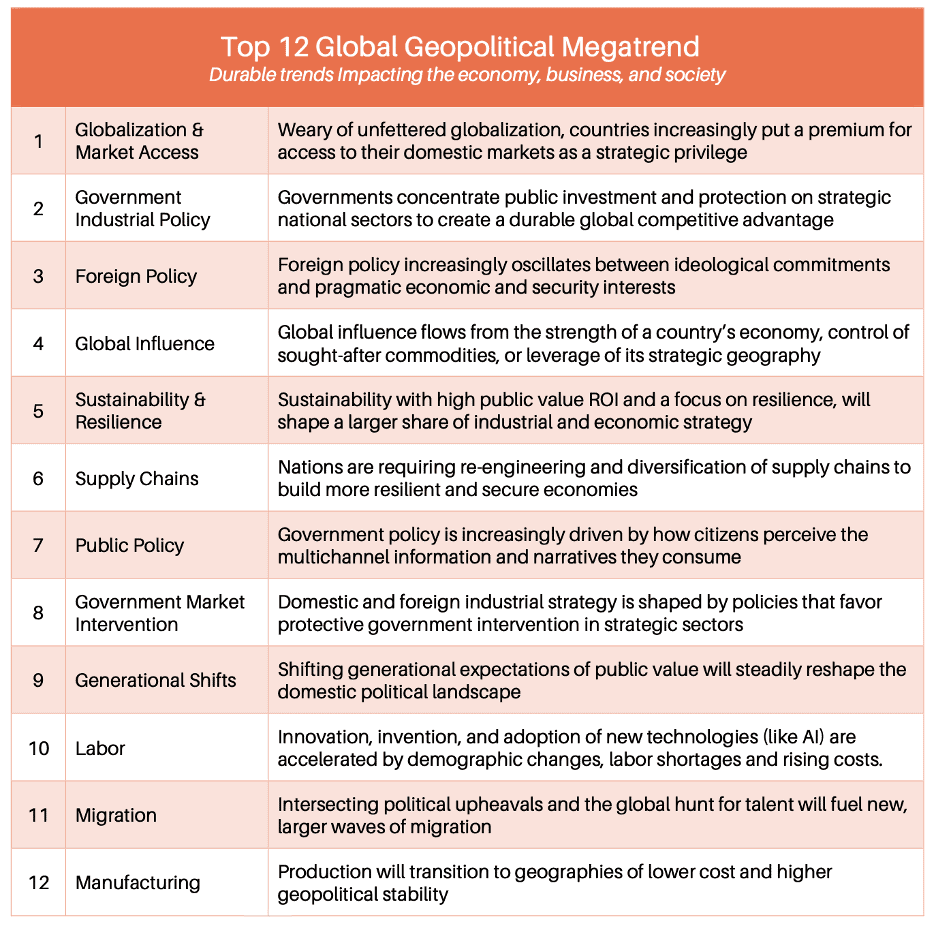

Welcome to the 149th Edition of the Global Business Update – The final weeks of 2025 bring a world economy marked by uneven momentum, persistent uncertainty, and several deep structural shifts reshaping global business. A new report on Geopolitical Megatrends highlights the accelerating forces now moving beneath the surface of daily events — durable, long-term transformations at the intersection of geography, economics, technology, and power.

Growth remains mixed across major markets as inflation edges higher in many developed economies and policy uncertainty continues to influence investment decisions. The U.S. government shutdown, U.S.–China tariff dynamics, and energy-driven inflation shifts in Europe all contribute to a business environment defined by volatility rather than stability. The upcoming 2026 review of the USMCA USA-Mexico-Canada trade agreement is already prompting vigorous debate on the future of North American integration.

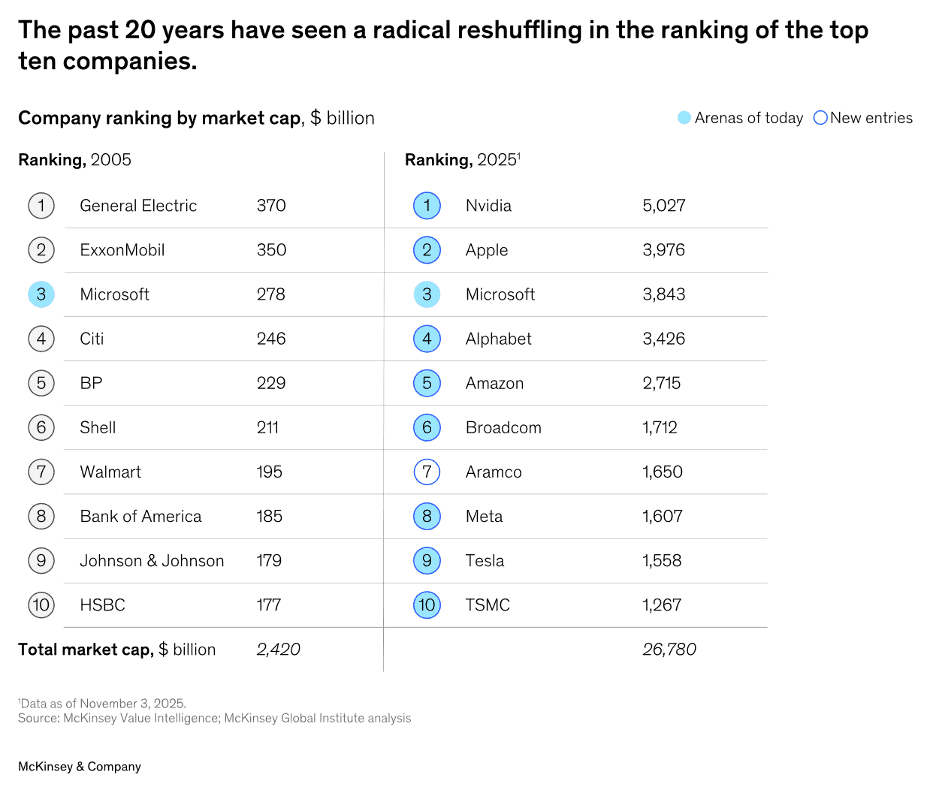

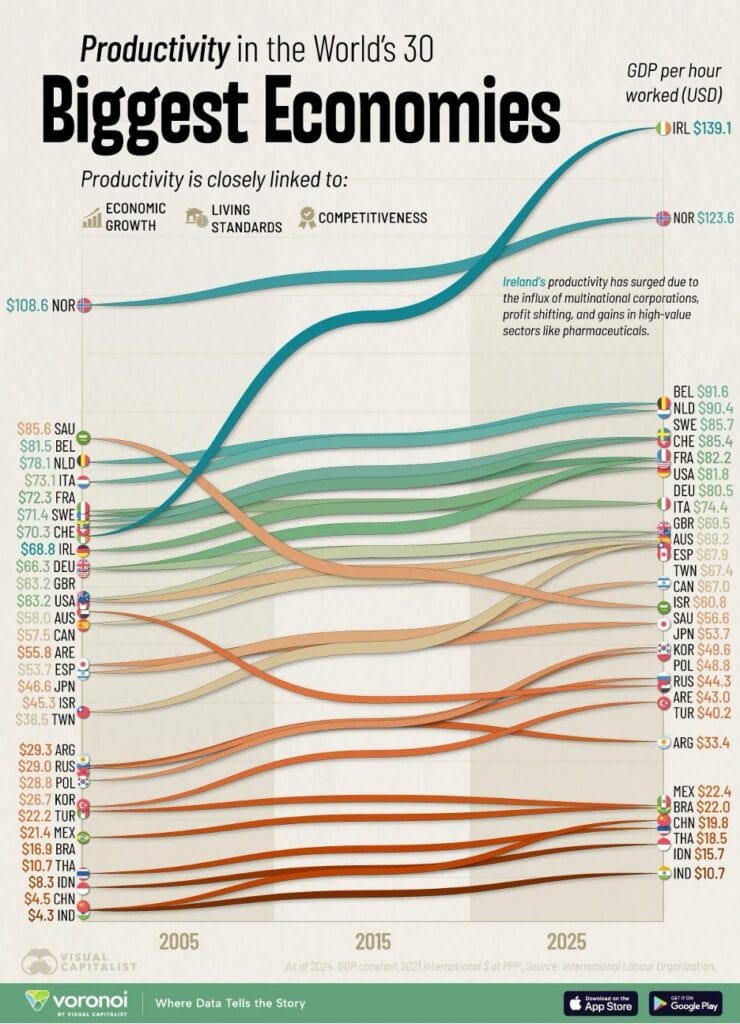

McKinsey’s analysis of “business arenas” underscores how quickly competitive landscapes are shifting: only one company appears on both the 2005 and 2025 lists of the world’s most valuable firms. Productivity trends tell a similar story, with China’s long surge moderating, Ireland’s tax-driven distortions widening, and Saudi Arabia grappling with a slow transition away from hydrocarbons.

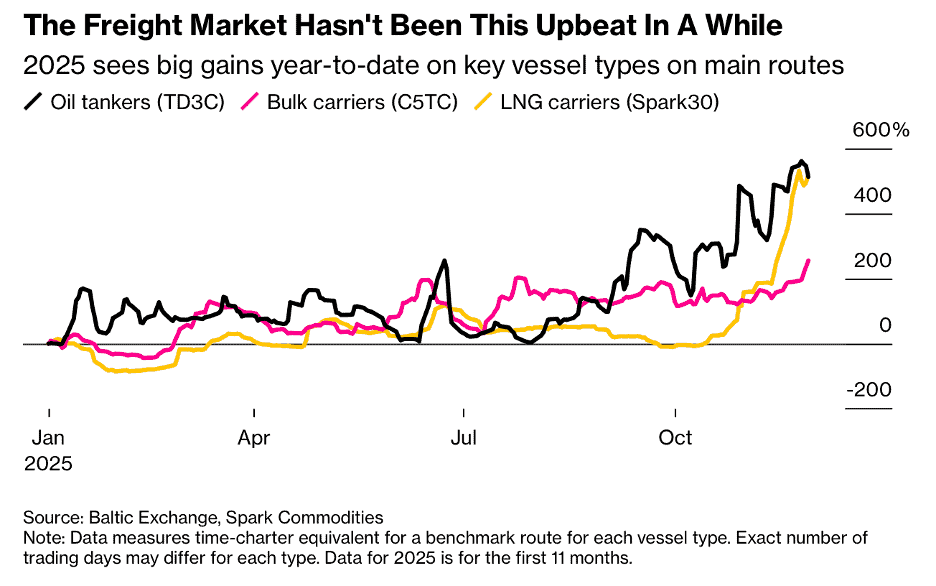

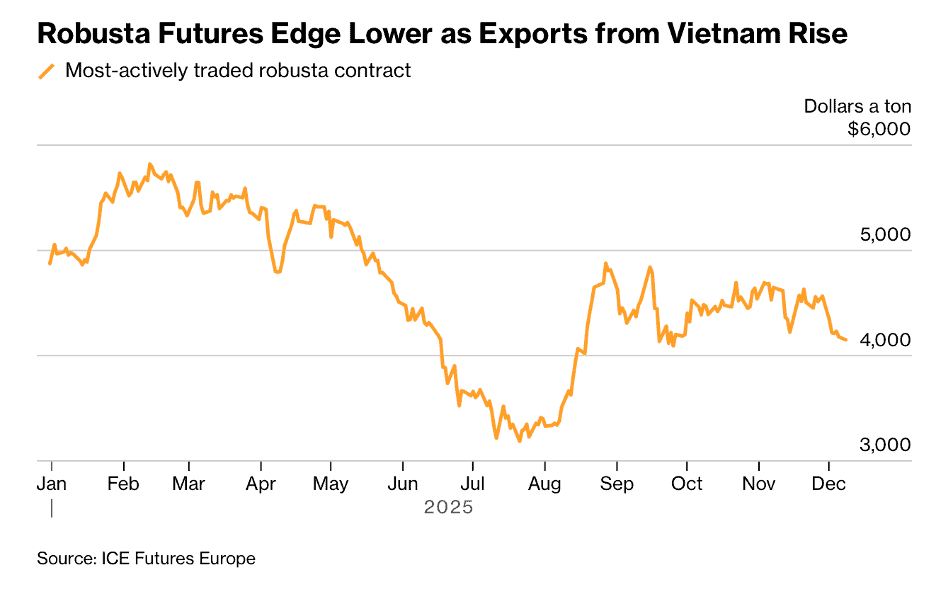

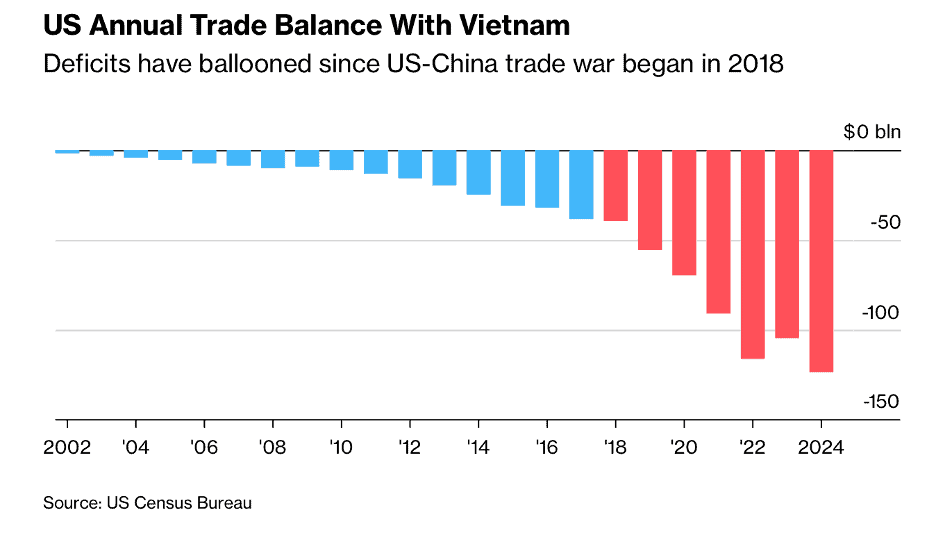

Global freight rates have spiked sharply amid geopolitical disruptions, China is deepening export ties with Southeast Asia in response to U.S. tariffs, and Vietnam has emerged as a major U.S. supplier despite rising trade frictions. But coffee prices are starting to come down!

This edition’s book review highlights a “Borderless Business: How Smart Entrepreneurs Expand Globally”, by Dr Raymond Hopkins, who draws on 30+ years of hands-on experience in global contracting and international trade to deliver a practical, actionable playbook for entrepreneurs seeking to grow beyond their home markets. Rather than selling theory, Hopkins offers real-world frameworks grounded in decades of negotiating complex contracts, managing supply chains, and adapting to diverse regulatory, cultural and economic environments.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“The future of trade will belong to the economies that move the fastest, not the largest.”, 2025 Global Competitiveness Forum

“A leader is one who knows the way, goes the way, and shows the way.”, John C. Maxwell.

“Treat people well, it’s the only investment that never loses value.”, Justin Wright

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #149:

Top 12 Geopolitical Megatrends Insights for Businesses & Governments Leaders

Productivity of the World’s Largest 30 Economies (2005-2025)

Robusta Coffee Falls on Ample Supply From Top Grower Vietnam

Costco Joins Companies Suing for Refunds If Trump’s Tariffs Fall

2026 Travel Trends – An evolving travel and loyalty industry

Franchise Global News Section: Chick-fil-a®, Denny’s® and Wingstop®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Top 12 Geopolitical Megatrends Insights for Businesses & Governments Leaders – We live in an age defined not by calm progress, but by constant motion, churn, and noise. Information is everywhere. Scarce is wisdom and judgement. The ability to pull insight from complexity in our environment is now one of the essential skills of leadership. When John Naisbitt first used the word “megatrends,” he named the powerful forces moving beneath daily events. Today those forces are faster, more tightly linked, and harder to ignore. The twelve megatrends in this report are durable, structural shifts at the intersection of geography, economics, and power.”, Report and analysis by Dr. John Pournoor, Government Analytica®.

=============================================================================================

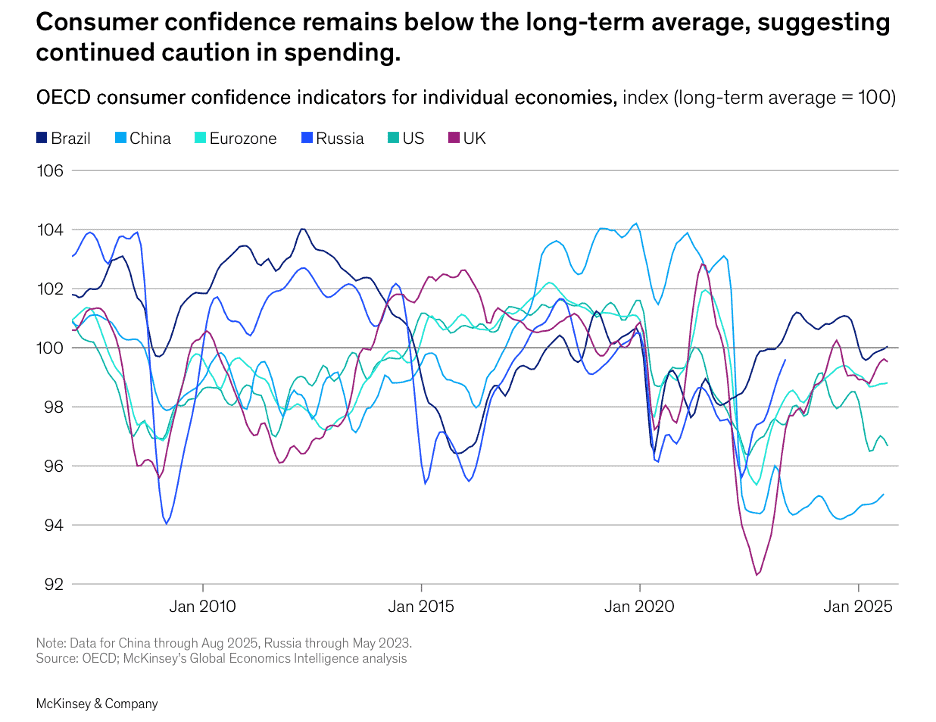

“Global Economics Intelligence executive summary, October 2025 – Global growth remains uneven amid policy uncertainty and trade realignments. US government shutdown adds downside risk, while US–China tariff talks and gradually easing inflation offer some optimism. Inflation among developed economies continues to accelerate and is moving away from the targets set by most central banks. In the US, the consumer price index (CPI) rose 3.0% for the 12 months ending September, after increasing 2.9% over the 12 months ending August. Core inflation was slightly up, to 3.0% (annualized). In the eurozone, headline inflation ticked up to 2.2% in September, but the rise was entirely driven by a smaller annual decline in energy prices. Core inflation remained stable at 2.3% for the fourth consecutive month. In the UK, it’s a different story: inflation remains elevated. Headline CPI inflation reached 3.8% in September, one of the highest rates among developed economies, largely driven by transportation and hotels/recreation prices.”, McKinsey & Co., November 25, 2025

===============================================================================================

“The power of arenas – Arenas are industries that transform the business landscape. The industrial landscape has shifted dramatically over the past 20 years. Just look at the top ten most valuable companies in 2005 and 2025. Only one company appears on both lists. And the rest of the 2025 leaders are worth about ten times more than the 2005 leaders they replaced.”, McKinsey & Co., November 20, 2025

=============================================================================================

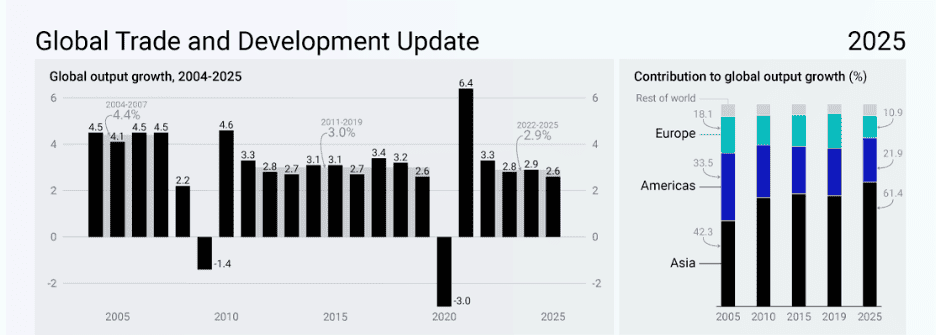

“Global Growth Continues Its Descent – A U.S. import surge lifted world trade at the start of the year, but it’s over now. According to the latest U.N. Trade and Development Report, global economic sentiment remains negative. Output growth is still slowing, and the dominant trend is prolonged uncertainty as economies struggle to adjust to shifting external conditions. It also underscores a widening gap between global trade and global finance, a sign of deeper structural imbalances.”, Geopolitical Futures, December 5, 2025

============================================================================================

“Productivity of the World’s Largest 30 Economies (2005-2025) – China’s productivity has surged by about 340% since 2005, driven by rapid industrial upgrades and investment in technology. However, growth has slowed in recent years. Ireland’s productivity appears high due to a tax system that lets global tech and pharma firms book profits and intellectual property earnings in the country, even though most of the money goes back to their parent companies. Saudi Arabia’s productivity has declined over the past two decades, mainly due to lower oil prices in the mid-2010s and OPEC+ production cuts that limited output. Non-oil sectors are growing, but the economy still depends heavily on hydrocarbons.”, International Labour Organization, November 27, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“The Debate Over a USMCA Overhaul in 2026 Kicks Off in Washington – The deal Trump negotiated in his first term comes up for review in 2026 and a contentious debate is under way. Policy leaders and business groups began a three-day hearing to air their concerns about the $2 trillion deal on Wednesday in Washington, kicking off a mandated review period ahead of July 1. ‘Mexico and Canada, together, are now America’s largest customers, largest investors and most important suppliers all in one,’ said former Ways & Means Chair Kevin Brady, who is set to testify Thursday. ‘Our argument is going to be: No trade agreement is ever perfect, especially one with such large economies so closely integrated,’ Brady said Wednesday. ‘The review is an opportunity to continue to strengthen the agreement, to look for ways to improve it.’”, Bloomberg, December 4, 2025

=================================================================================================

“Costco Joins Companies Suing for Refunds If Trump’s Tariffs Fall – Costco Wholesale Corp. is suing the Trump administration to ensure eligibility for refunds if the US Supreme Court strikes down the president’s global tariffs policy. The company filed a complaint in the US Court of International Trade due to uncertainty that refunds will be guaranteed for all businesses that have been paying duties if the Supreme Court declares the tariffs unlawful. Costco argues that it needs a court intervention immediately because Customs and Border Protection denied its request to extend the schedule for finalizing tariff determinations under Trump’s use of the International Emergency Economic Powers Act.”, Bloomberg, December 1, 2025

===============================================================================================

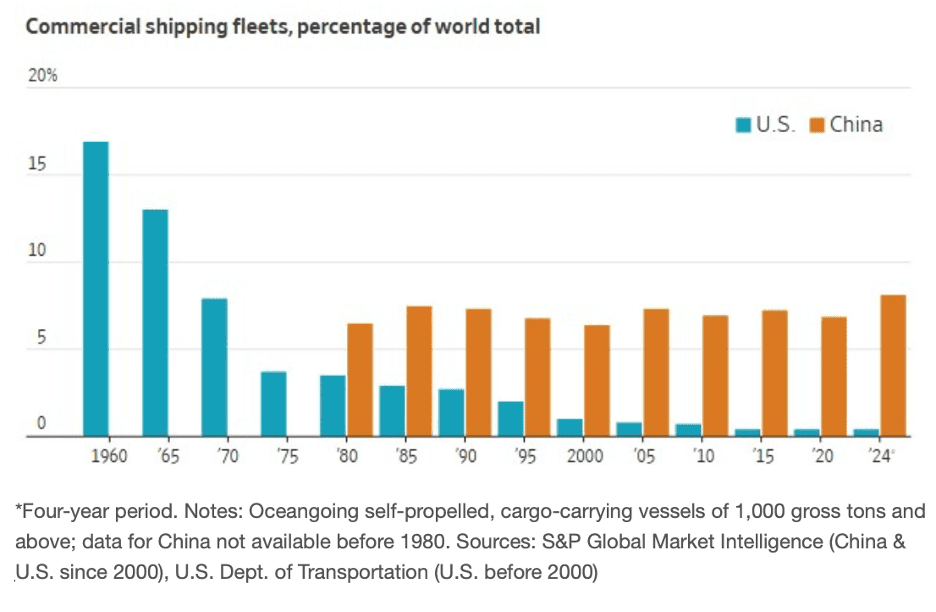

“U.S. Jobs at Sea Go Begging – Very little cargo currently moves on American-flagged ships, partly because of staffing, and shipping companies, which are generally required to hire Americans, say they are starved of crews. Yet, despite high pay and generous perks, maritime jobs go begging, the WSJ’s Daniel Michaels writes. The U.S. employs an estimated 10,000 commercial sailors, a number that has fallen sharply over recent decades as America outsourced much of its shipping demands to China and other countries. Shipping companies have begun offering fat signing bonuses. To retain hires, they are lifting salaries while improving onboard gyms, connectivity and cuisine. As AI threatens more office jobs, hands-on work like sailing is increasingly appealing, especially to the mechanically inclined, though many young people aren’t aware that the jobs exist.”, The Wall Street Journal, December 2025

============================================================================================

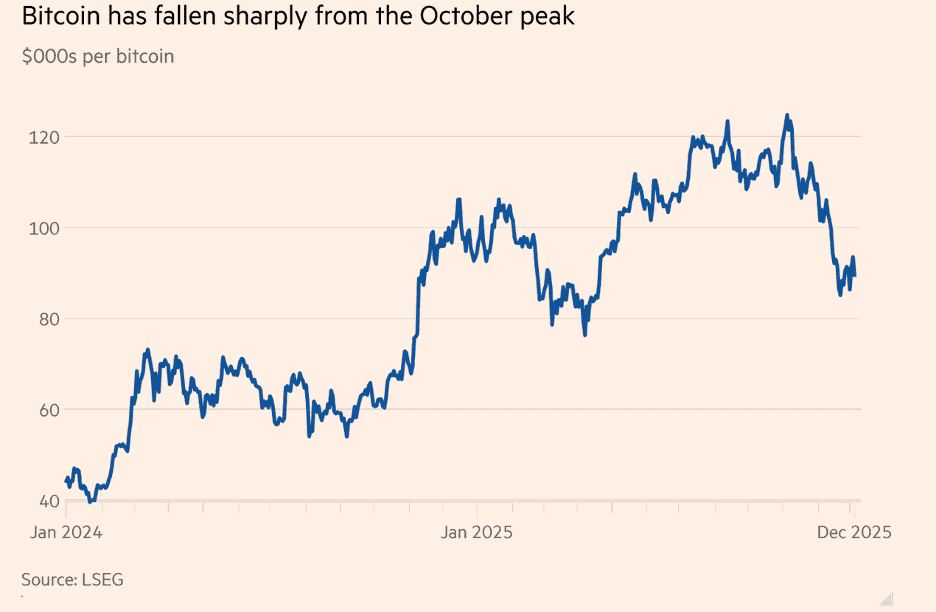

“Crypto’s rocky year – The industry was hugely optimistic when Donald Trump returned to the White House. But bitcoin has fallen by a quarter in two months. Explanations for the sell-off — more than $1tn has been erased from the combined capitalisation of about 18,000 digital tokens over the past two months — range from uncertainty surrounding the path of US interest rates to concerns about lofty tech stock valuations that have spilled over into other risky assets. ‘Unlike prior crashes, driven primarily by retail speculation, this year’s downturn has occurred amid substantial institutional participation,’ said Deutsche Bank analysts Marion Laboure and Camilla Siazon.”, The Financial Times, December 5, 2025

=============================================================================================

“Ship Rates Spiking 467% Marks Upended Trade Across Commodities – Conflicts, sanctions, and swelling output upending global supply lines. Daily earnings to transport crude have seen the biggest jump this year, while rates to ship liquefied natural gas and commodities such as iron ore have increased more than fourfold and twofold, respectively. Shipping executives expect tightness in the market to continue at least through early next year, with vessels spending more time at sea transporting cargo and contributing to the spike in freight costs. For crude tankers, rates rallied following a ramp-up in Middle Eastern production, along with higher Asian demand for their barrels after US sanctions on two Russian oil giants. Meanwhile, the cost to ship LNG from the US to Europe recently climbed to the highest level in two years as new projects in North America tied up more vessels to deliver the fuel. More broadly, hostilities around key routes have contributed to an overall increase in costs.”, Bloomberg, December 3, 2025

============================================================================================

“Robusta Coffee Falls on Ample Supply From Top Grower Vietnam – The market has been pressured recently by expectation that Vietnam will deliver its biggest crop in four years despite heavy rains. The country’s November coffee exports were seen climbing almost 40% from a year earlier to 88,000 tons, according to the National Statistics Office. Shipments for the January-November period were up 15%.”, Bloomberg, December 8, 2025

==============================================================================================

“Navigating Non-Tariff Barriers and Global Trade Challenges – The Global Chamber® Export-Import Forum, moderated by Anita Rodal, featured Bill Edwards, CEO and Global Trade Advisor at Edwards Global Services (Your newsletter Editor!!!), in a dynamic and highly informative discussion on international trade challenges and non-tariff barriers (NTBs) that impact businesses especially small to medium-sized enterprises (SMEs). Bill emphasized that while tariffs are often discussed in trade policy, non-tariff barriers — including certification requirements, labeling regulations, customs procedures, and shifting political environments — often create even greater obstacles for small exporters. ‘About half of all non-tariff barriers serve legitimate public purposes,’ Bill explained, ‘But the other half can act as discriminatory trade barriers — depending on market.’”, Global Chamber, October 23rd. Please go to this link for the YouTube webinar:

https://www.youtube.com/watch?v=i7_pH5kSF6Q

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“2026 Travel Trends – An evolving travel and loyalty industry – New technology, a changing economic landscape, shifting consumer behaviors and fierce brand competition: Travel and loyalty look markedly different today than 10 years ago — and the evolution of the industry doesn’t show signs of slowing down. That’s why it’s more important than ever that savvy travelers stay updated on changing government and industry policies. It also remains vital to be flexible when planning travel and to take advantage of all the tools that can help improve the experience (without breaking the bank). Here are the top trends TPG experts are seeing across the industry — and what they mean for travelers in 2026.”, The Points Guy, December 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Borderless Business: How Smart Entrepreneurs Expand Globally”, Dr Raymond Hopkins. In “Borderless Business”, Dr. Raymond Hopkins draws on 30+ years of hands-on experience in global contracting and international trade to deliver a practical, actionable playbook for entrepreneurs seeking to grow beyond their home markets.

Rather than selling theory, Hopkins offers real-world frameworks grounded in decades of negotiating complex contracts, managing supply chains, and adapting to diverse regulatory, cultural and economic environments.

Through detailed guidance on market evaluation, entry strategy, product and pricing adaptation, compliance, logistics, and global partnerships — as well as the integration of technology and AI — the book shows how nimble companies can transform from domestic players into global competitors.

Whether you’re a startup ready to export or an established business seeking international scale, Hopkins argues that borderless business is not optional — it’s the modern path to resilience, growth, and long-term competitiveness.

Five Key Takeaways for Global Business Leaders

Global expansion must be intentional and strategic — not accidental. Success starts with rigorous market evaluation and selection, not a “spray and pray” approach.

Entry strategy matters. Exporting, licensing, joint-ventures or direct investment — the right model depends on the product, market conditions, and long-term vision.

Adaptation is essential. Products, pricing, positioning — all must be tailored to local market needs and expectations rather than simply transplanted from home markets.

Technology (including AI) is now a core enabler of borderless growth. From supply-chain optimization to compliance, digital tools reduce friction for companies scaling globally.

Risk, compliance, and cultural awareness can make or break expansion. Success requires navigating regulation, logistics, partnerships, and relationships — not just chasing opportunity.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

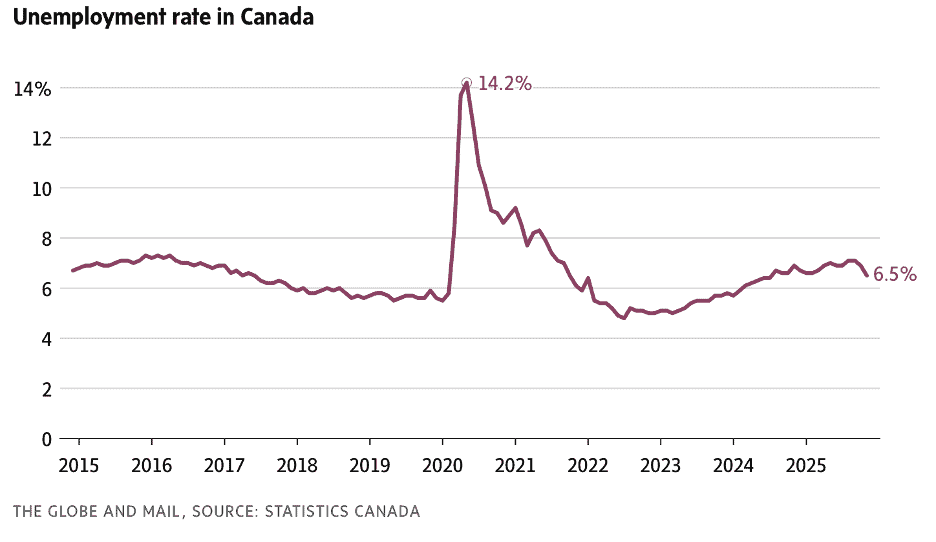

“Canada’s jobless rate falls to 6.5% driven by rise in part-time, youth employment – Canadian employment surged in November for the third consecutive month as young people picked up tens of thousands of positions, with the results easily outperforming tepid predictions from economists. The country’s unemployment rate fell to 6.5 per cent in November from 6.9 per cent in October, Statistics Canada reported Friday in its Labour Force Survey. The decrease was fuelled by growth in part-time jobs, and a corresponding decline in the youth unemployment rate, which reached a four-year peak in September of this year. Over all, the economy added 54,000 jobs in November, bringing the cumulative increase in jobs for September through November to 181,000.”, The Globe and Mail, December 5, 2025

===========================================================================================

China

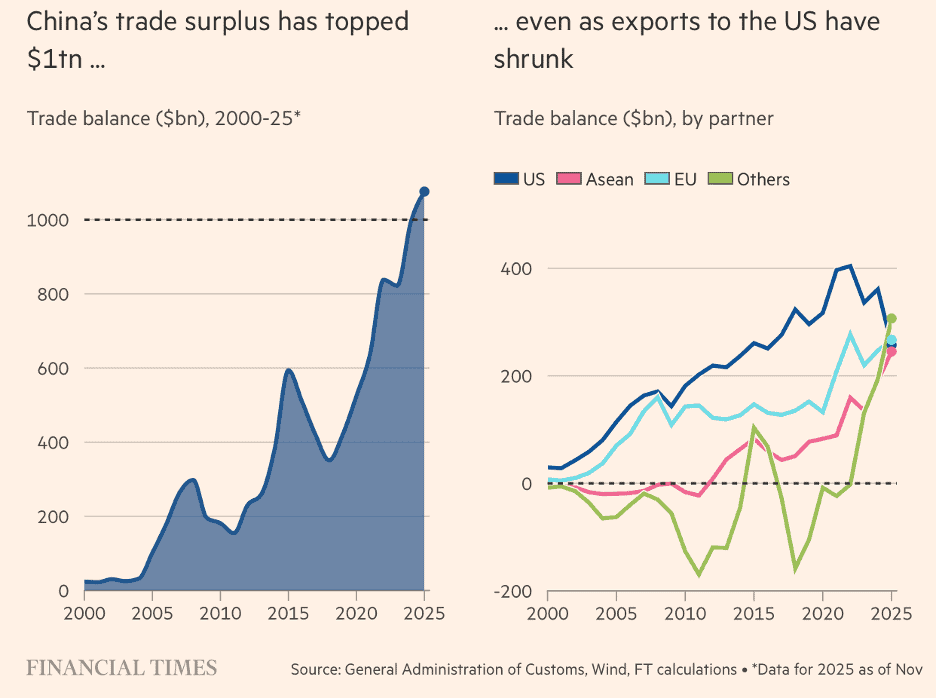

“China’s trade surplus tops US$1tn for first time – Exports soar despite tensions between Washington and Beijing. China’s trade surplus in goods has surpassed $1tn this year for the first time, as exports boomed despite US President Donald Trump’s tariff war. In the first 11 months of this year, China’s trade surplus in dollar terms was $1.076tn, according to data released on Monday by the country’s customs administration, which covers goods but not services. China’s trade surplus in goods for the full year in 2024 was just shy of $1tn.”, The Financial Times, December 8, 2025

=============================================================================================

Eurozone Countries

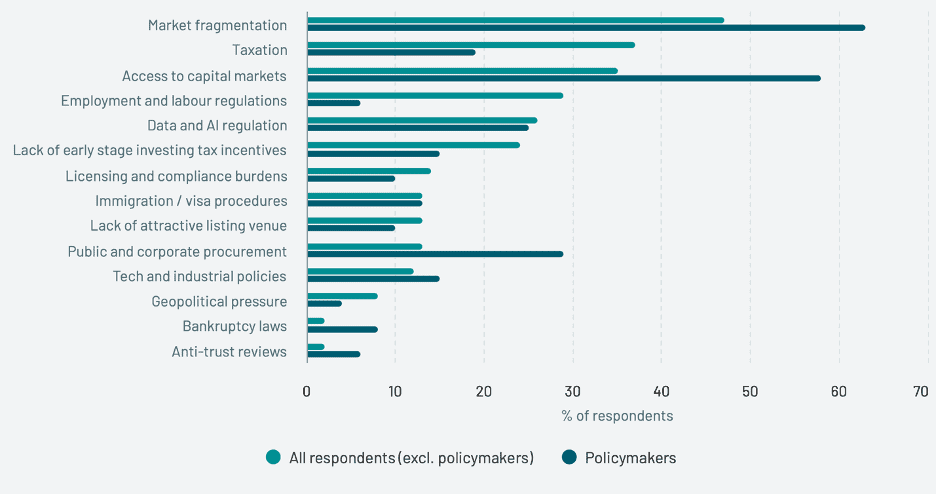

“State of European TECH 25 – The continent’s tech ecosystem has reached a certain level of maturity, but long-term competitiveness depends on whether it can turn its promise into global strategic assets. Europe effectively stands at a crossroads. We don’t lack talent or innovation — what Europe does lack is alignment between ambition and commitment. The policy barriers holding the ecosystem back. It’s overwhelmingly clear what the (European) ecosystem needs. Fifty percent are calling for the end of the market fragmentation, unencumbered access to capital markets, and changes to taxation. Policymakers themselves are indexing strongly on the top two — but show less appetite to reform taxation and employment and labour regulations, even though nearly one in three respondents overall rank these as a high priority.”, Atomico, December 2025

============================================================================================

Malaysia

“Anwar to Cut Small Business Costs After Poor Poll, Bernama Says – Malaysian Prime Minister Anwar Ibrahim announced measures to help reduce cost burdens for small and medium enterprises. Anwar has raised the threshold to exempt businesses from an e-invoicing initiative by the Inland Revenue Board to 1 million ringgit (US$243,267) in annual revenue from 500,000 ringgit, Bernama said. He also doubled government funds to expedite tax refunds to small businesses, to 4 billion ringgit from 2 billion ringgit, according to the report.”, Bloomberg, December 6, 2025

===========================================================================================

United States

“U.S. Manufacturing Contracts for Ninth Straight Month – Tariffs, which have increased costs for sourcing materials, continue to weigh on U.S. producers. U.S. manufacturing activity contracted for the ninth consecutive month in November, with the ISM’s PMI at 48.2, down from 48.7 in October. Manufacturers attribute the decline largely to tariffs, which have increased costs for sourcing materials and created uncertainty regarding duty levels. A separate S&P Global survey showed manufacturing PMI at 52.2, a slight decrease from 52.5 in October, with slowed demand growth, especially in export markets. ‘It really is all about tariffs,’ said ISM Chair Susan Spence. ‘We do not see anything on the horizon that’s going to turn this ship.’”, The Wall Street Journal, December 1, 2025

=============================================================================================

Vietnam

“Vietnam’s US Exports Jump, Surplus Rises Despite Tariffs – The Southeast Asian nation, which ships everything from footwear to furniture to America, reported a trade surplus with the US of $121.6 billion in the first 11 months of 2025, up 27.5% from a year earlier, according to data released by the National Statistics Office in Hanoi Saturday. Exports to the US climbed to $138.6 billion in the first 11 months, that’s up 27.3% from a year prior, data from the statistics office showed. Vietnam has repeatedly promised to buy more big-ticket American items in a bid to reduce its ballooning trade imbalance with the US, which last year was the third-largest behind only China and Mexico.”, Bloomberg, December 5, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Wingstop hits 3,000th restaurant milestone – The company has expanded its global footprint by 50% in the past two years. The company said it is growing at a record pace, opening nearly 800 restaurants and expanding its global footprint by 50% in the past two years. During its most recent quarter, Wingstop opened 114 restaurants. Wingstop has also recently entered six new markets, including Australia, Bahrain, Kuwait, Puerto Rico, Saudi Arabia, and The Netherlands, giving it a presence in 47 U.S. states and 15 countries. The chain is expecting to enter Thailand, Italy, and Ireland soon as well.”, National Restaurant news, November 26, 2025

==================================================================

“Get Ready, America: Here Come China’s Food and Drink Chains – China’s fast-food and beverage brands have an opportunity to expand in the United States and escape cutthroat competition at home. The economic relationship between the United States and China is as fraught as it has been in recent memory, but that has not stopped a wave of Chinese food and beverage chains from moving aggressively into the United States for the first time. Chinese tea shops in New York and Los Angeles are offering consumers drinks topped with a milk or cheese foam. Fried chicken sandwich joints are trying to lure diners in California with affordable fast food. Restaurant and drink brands, some with thousands of stores in China, are taking root in American cities to escape punishing competition at home.”, The New York Times, December 1, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Restaurant Brands International: International Business Still Shines; Shares Fairly Valued – While the restaurant backdrop remains sour, RBI’s growth story remains intact. A strong suite of global brands, stepped-up investment, and a well-capitalized franchise base have propelled global system sales growth to 8% over the last three years, outpacing the global industry’s 5.5% rate.”, Morningstar, November 28, 2025

============================================================================================

“10 Up-And-Coming Chain Restaurants We’ll See Everywhere In 2026 – These booming restaurant chains — from coffee shops to smoothie cafes and more — are thankfully nowhere near suddenly shutting down or facing financial woes, unlike other popular chains that faced bankruptcy in 2025. In fact, the following spots will probably be popping up in your neighborhood by next Christmas.”, Tasting Table, November 29, 2025

=============================================================================================

“Can Denny’s bounce back from the doldrums? As private-equity investors spend $620M to buy the brand and take it private, a lot is riding on the deal – For decades, Denny’s was the iconic U.S. diner destination — the go-to spot for cheap coffee, late-night meals and highway-side comfort. But that’s all changed in the past few years. While the helpings are still generous, the once-ubiquitous chain has been shrinking as Denny’s struggles with rising menu prices, declining customer traffic and a wave of restaurant closures. Now Denny’s is being sold to a consortium of private-equity and franchise investors in a $620-million deal that will take the brand private.”, Moneywise, November 29, 2025

=============================================================================================

“Chick-fil-A is making a major change to 425 restaurants nationwide – Chick-fil-A’s big shift for hundreds of restaurants nationwide will reshape its business forever. Chick-fil-A is converting its licensed locations, found on college campuses, in hospitals, and at theme parks (excluding airports), to its owner-operator model. Under this franchise system, operators run the restaurant, manage daily operations, and share profits with the company, while Chick-fil-A retains ownership of the business assets.”, The Street, December 5, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link: