Biweekly Global Business Newsletter Issue 152, Tuesday, January 20, 2026

“We live in excessively interesting times”

Welcome to the 152nd Edition of the Global Business Update – As 2026 begins, global business is neither unraveling nor stabilizing—it is recalibrating. New research from McKinsey and the World Economic Forum shows that while global cooperation remains intact, its structure is changing. Traditional multilateral frameworks are weakening, replaced by more flexible, issue-specific arrangements around data, services trade, capital flows, and technology. For executives, this means a more fragmented, regional, and less predictable operating environment. This edition has news from Canada, China, the European Union, Malaysia, Taiwan, the United Kingdom, the USA and Vietnam. Silver and copper are making news.

Business confidence is cautiously improving. CEO sentiment has rebounded from early-2025 lows not because uncertainty has eased, but because leaders are learning to operate within it. Trade volatility, shifting tariff regimes, geopolitical friction, and supply-chain reconfiguration are no longer viewed as temporary disruptions—they are now baseline planning assumptions. Layer on the rapid commercialization of AI, uneven technology adoption, and rising economic nationalism, and it is clear that global strategy today requires resilience, flexibility, and deep local insight—not just scale.

The data in this issue reinforces a consistent message: growth still exists, but it is uneven and increasingly shaped by demographics, consumer behavior, and national policy choices. Markets such as Vietnam, the UAE, and parts of Asia continue to outperform, while others face slower consumption, trade realignment, or rising cost pressures.

Against this backdrop, global franchising remains one of the most effective vehicles for international expansion. Recent deals and development activity confirm that brands with adaptable models, strong local partners, and market-specific strategies are still scaling globally. In this edition we see global development news from Costa Coffee®, Denny’s®, Domino’s Pizza (Australia), Fat Burger®, Jolibee®, Mr. Transmission®, Pollo Tropical®, Raising Canes® and TGI Friday’s®.

This edition’s book review highlightsIn The Triangle of Power: Rebalancing the New World Order, Alexander Stubb avoids simplistic narratives about a new Cold War and instead offers a clear, usable framework for understanding today’s global order. He argues that power is no longer concentrated in a single bloc or defined solely by U.S.–China rivalry. Instead, it is distributed across three interacting forces: the Global West, the Global East, and the Global South.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“We live in excessively interesting times”, Bronwen Maddox, Executive Director, Chatham House

“Uncertainty is bad for business.” — IMF Managing Director Kristalina Georgieva

“Globalization is a fact of economic life.” — Carlos Salinas de Gortari, former President of Mexico

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #152:

The Global Cooperation Barometer 2026

The Economic Toll of Trump’s Policies Will Soon Be Visible

China’s Slowdown Is Set to Deepen as Pivot to Consumption Stalls

Here are four ways AI and talent trends could reshape jobs by 2030]

Franchise Global News Section: Costa Coffee®, Denny’s®, Domino’s Pizza (Australia), Fat Burger®, Jolibee®, Mr. Transmission®, Pollo Tropical®, Raising Canes® and TGI Friday’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

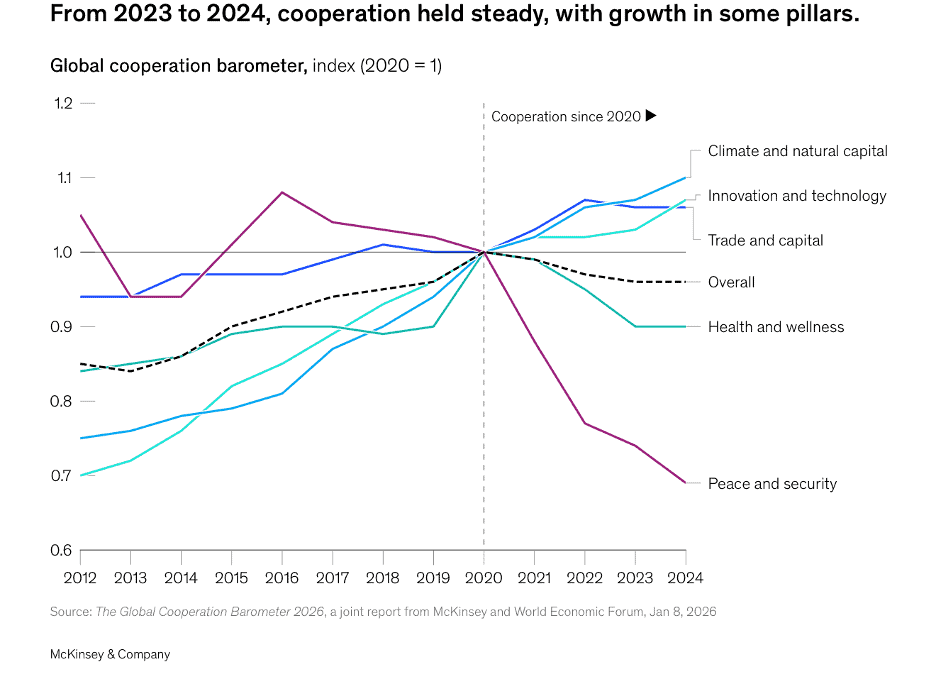

“The Global Cooperation Barometer 2026 – New research from McKinsey and the World Economic Forum finds that global cooperation is holding steady, but its shape is evolving. The 2026 edition of the Global Cooperation Barometer shows that overall cooperation is largely unchanged from previous years, but its composition appears to be changing (exhibit). Metrics relating to multilateralism weakened the most. Metrics in which more flexible and smaller arrangements of cooperation can operate—in data flows, services trade, and select capital flows, for example—have continued to grow, including in 2025.”, McKinsey & Co., January 8, 2026

===============================================================================================

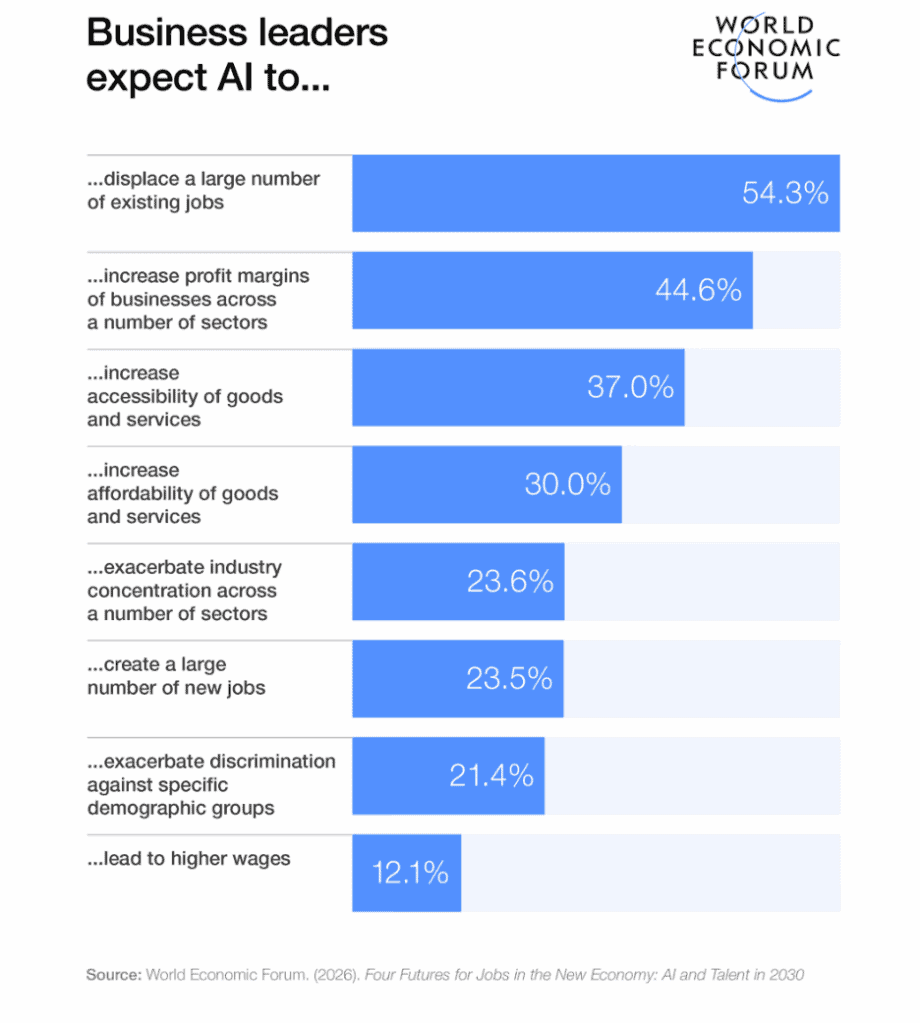

“Here are four ways AI and talent trends could reshape jobs by 2030 – More than two-thirds of chief strategy officers expect the commercialization of AI and emerging technologies to shape business strategies over the next five years. The pace and trajectory of AI advancement has deepened uncertainty about its implications for businesses, workers and the global economy. The second edition in the World Economic Forum’s Scenarios for the Global Economy Dialogue Series explores how AI and talent trends could shape the future of jobs, with varying implications for corporate strategies and investment decisions. Fast-developing technologies such as artificial intelligence, robotics and autonomous systems are redefining how businesses operate, how tasks are performed and what skills are required to stay competitive. As they move from experimentation to workflow integration – including the diffusion of agentic AI – their advancement creates both new growth opportunities and risks.”, World Economic Forum, January 7, 2026

============================================================================================

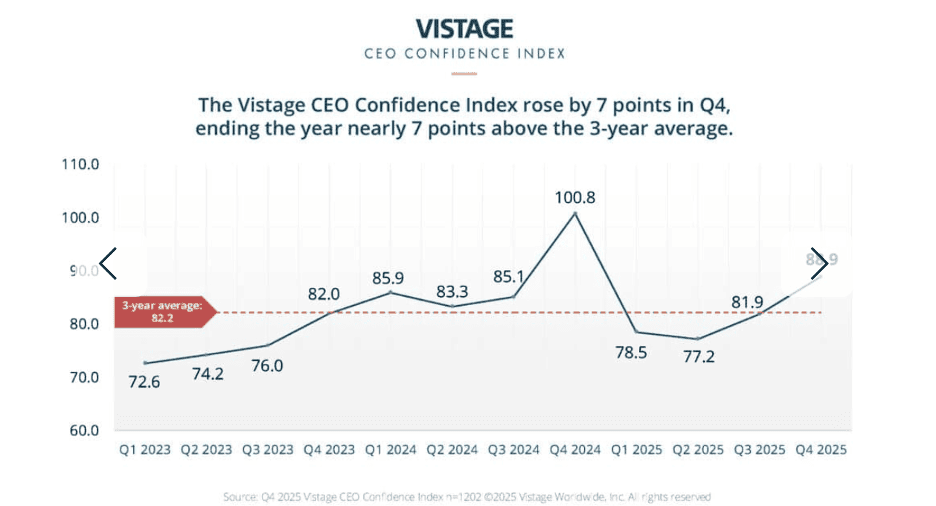

“CEO Confidence Enters 2026 with Measured Optimism – Often, heightened optimism gives way to a phase of adjustment as expectations meet reality. One year ago, CEO confidence surged as post-election optimism fueled expectations of pro-business policies, easing inflation, and lower borrowing costs. That enthusiasm faded quickly. Shifting trade policy, rising costs, and uneven demand made planning difficult, sharply lowering confidence in early 2025 before it gradually stabilized. That context matters as the Q4 2025 Vistage CEO Confidence Index shows a modest but meaningful improvement. Confidence rose to 88.9, an increase of 7 points from last quarter. More notably, this is also nearly 7 points above the 3-year average. This increase does not signal a return to euphoria. Instead, it reflects a growing acceptance of the conditions CEOs expect to face and a clearer view of both risks and opportunities for their business heading into 2026.”, Vistage, January 14, 2026

=============================================================================================

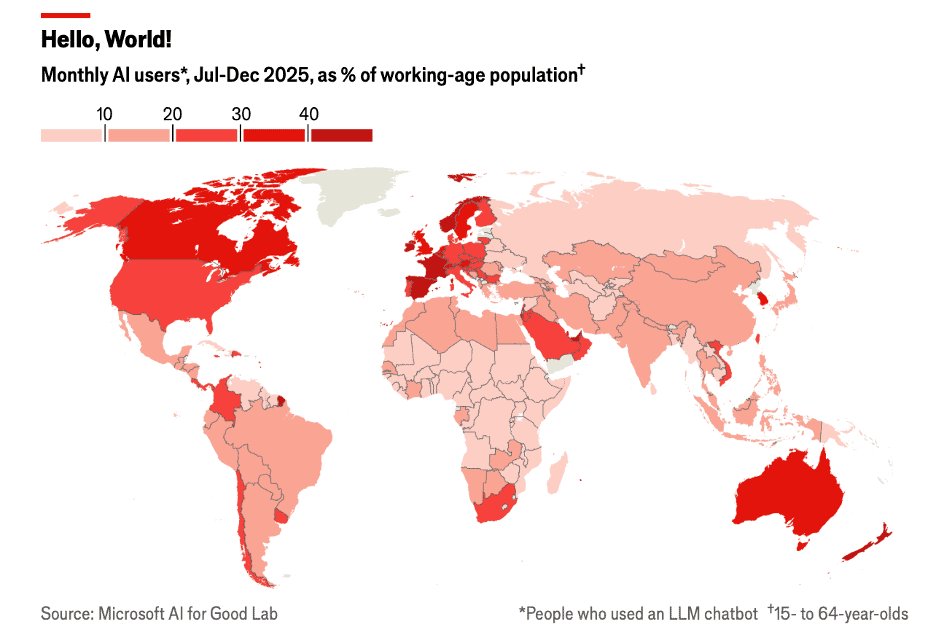

“Which countries are adopting AI the fastest? Rich populations and tech-friendly governments help. Measuring the spread of ai is not straightforward. One method, used by researchers at Microsoft, is to identify the share of people who used Microsoft desktop devices to get access to ai tools—such as Chatgpt, Claude, DeepSeek or Gemini—in a given month. The researchers combined this information with other data, such as Microsoft’s market share and mobile-phone use in a country, to estimate ai usage among the working-age population in 147 economies. Residents of the United Arab Emirates, Singapore, Norway, Ireland and France were the top ai adopters. In both the uae and Singapore more than 60% of the working-age population used ai chatbots. Governments there were quick to promote the technology.”, The Economist, January 12, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“All of the World’s Silver Reserves by Country, in One Visualization – Silver prices surged to new all-time highs in December, extending a powerful end-of-year rally supported by geopolitical uncertainty and a weaker U.S. dollar. Silver futures briefly touched around $80, marking an unprecedented 160% rally in 2025 that outpaced even gold. Against this backdrop, understanding where the world’s silver reserves are concentrated provides crucial context for future supply dynamics. The data for this visualization comes from the U.S. Geological Survey’s Mineral Commodity Summaries (January 2025). It estimates total global silver reserves at about 641,400 metric tons.”, Visual Capitalist and the U.S. Geological Survey, January 6, 2026

============================================================================================

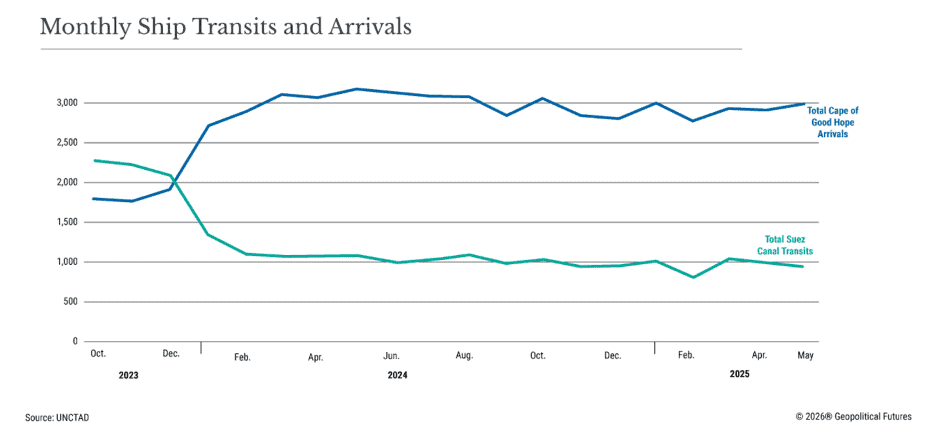

“The New Maritime Operating Environment – Rerouting, rising war-risk premiums and infrastructure surveillance have turned maritime security into a hidden tax on global trade. The prediction that threats to key sea lanes would place global trade under unprecedented pressure proved correct, though the language now needs refinement. The crisis in the Red Sea and Bab el-Mandeb did not dissipate after early disruptions. It instead became the most sustained corridor shock since the pandemic-era supply chain breakdowns. Rerouting around the Cape of Good Hope, higher insurance premiums and uncertainty over Suez transits reshaped Asia-Europe shipping economics throughout 2024 and 2025. Rerouting around the Cape of Good Hope added roughly 30 percent more time (10-12 days) to Asia-Europe journeys and cut effective container capacity by about 9 percent.”, Geopolitical Futures, January 6, 2026

===============================================================================================

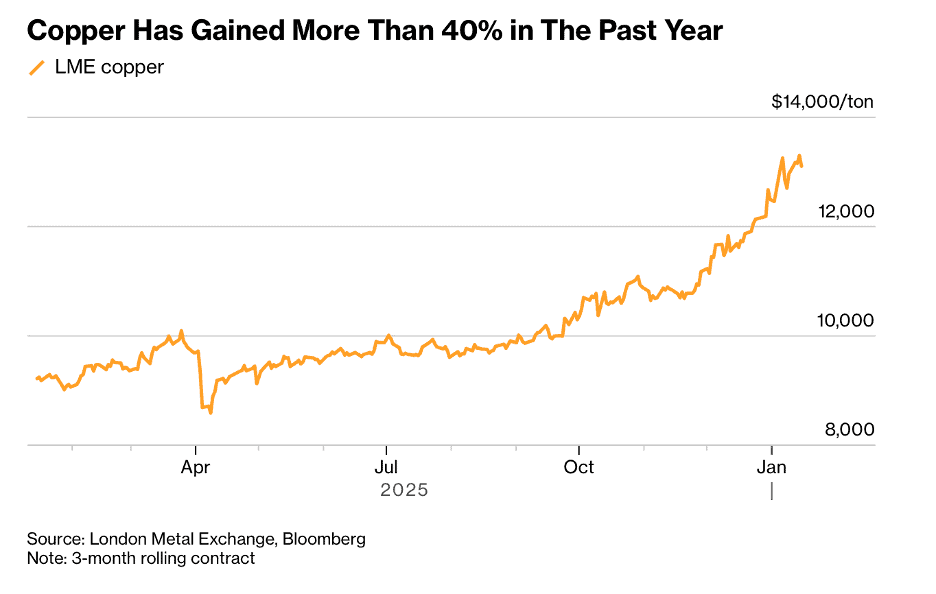

“Copper Drifts Lower as Traders Weigh Rally’s Impact on Demand – Copper eased from an all-time-high, as markets took stock of a record rally that could hit physical demand for the crucial industrial input, and fell 0.6% on the London Metal Exchange on Thursday. Analysts at Goldman Sachs Group Inc. cautioned that the copper price is increasingly vulnerable to a correction and see LME copper falling to $11,000 a ton by year-end, noting that the fundamental physical supply and demand balance had weakened in recent months. Nickel also fell, after surging to the highest level since mid-2024, as top producer Indonesia signaled a potential drop in output, with the country likely to issue quotas for 250 million to 260 million tons of nickel ore this year.”, Bloomberg, January 14, 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

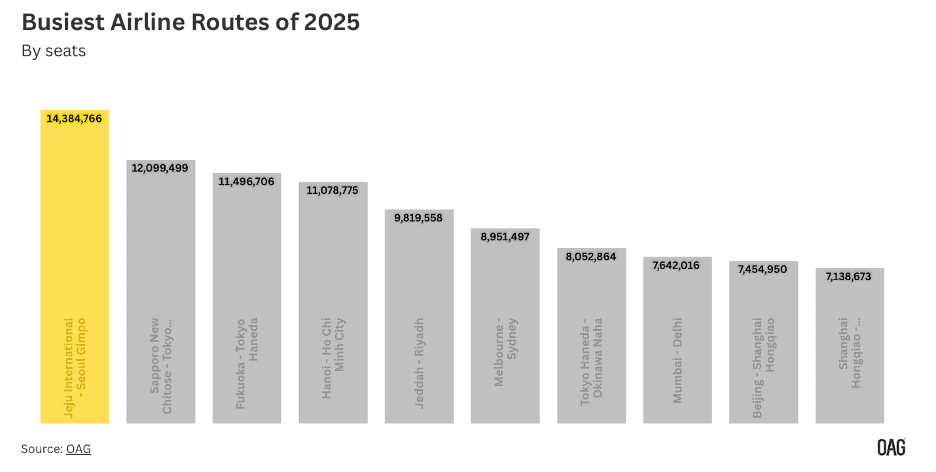

“The Busiest Flight Routes of 2025 – Nine of the Top Ten Busiest Routes operate in the Asia Pacific region. The busiest airline route of 2025 is Jeju (CJU) to Seoul Gimpo (GMP). This route has 14.4 million scheduled seats in 2025, this is equivalent to almost 39,000 daily seats operating on this short sector of just 243 nautical miles. Capacity on the route is 1% above 2024 levels, but remains 17% behind 2019 levels. Seven carriers operate on this very competitive route. Airfares have dropped by 11% year-on year to $44 one-way. The second and third placed busiest routes are both in Japan – which continues to maintain a strong position despite an extensive high speed rail network covering the country. Vietnam’s largest domestic route between Hanoi (HAN) and Ho Chi Minh City (SGN) is the fourth busiest route. The fastest growing route in the top ten is fifth placed Jeddah (JED) to Riyadh (RUH).”, OAG.com, January 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In The Triangle of Power: Rebalancing the New World Order, Alexander Stubb avoids simplistic narratives about a new Cold War and instead offers a clear, usable framework for understanding today’s global order. He argues that power is no longer concentrated in a single bloc or defined solely by U.S.–China rivalry. Instead, it is distributed across three interacting forces: the Global West, the Global East, and the Global South.

The Global West continues to dominate in capital markets, institutions, and advanced technology, but faces internal political and demographic constraints. The Global East, led by China, leverages scale, state coordination, and industrial policy to project influence. The Global South has become the decisive swing player — pragmatic, growth-oriented, and increasingly unwilling to align permanently with any single bloc.

For global business leaders, Stubb’s core message is practical rather than ideological: geopolitics has become a permanent operating condition. Market access, supply chains, capital flows, and regulatory environments are now shaped as much by political alignment as by economics. Companies that assume stability, fixed alliances, or frictionless globalization risk strategic blind spots.

The Triangle of Power provides a calm, executive-level roadmap for navigating this multipolar reality — emphasizing diversification, resilience, and geopolitical awareness as essential tools for sustainable global growth in 2026 and beyond.

Five Takeaways for Global Business Leaders

Political literacy is a core leadership skill

The world is multipolar, not bipolar

The Global South is the strategic swing factor

Geopolitics is structural risk, not background noise

Resilience now beats efficiency in global strategy

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

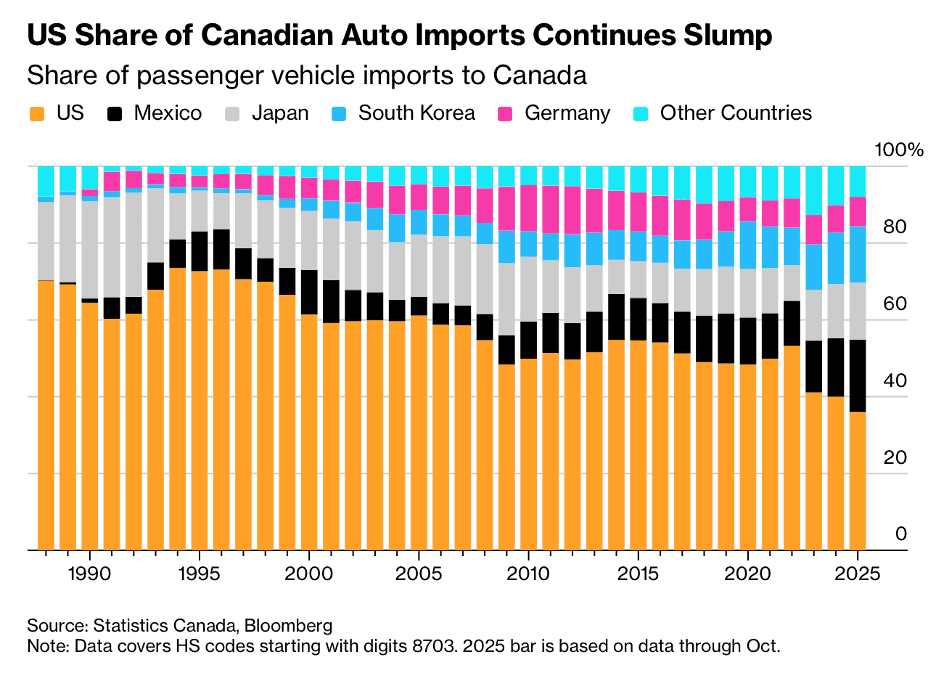

“US Auto Market Share in Canada Hits Record Low on Tariff Turmoil – US factories’ share of the Canadian vehicle market has tumbled to a new low due to automobile tariffs. Just 36% of passenger vehicles imported to Canada were manufactured in the US during the first 10 months of 2025, compared to an average of 49% in the 10 years before that. The trade war has changed the business, with Mexican and South Korean-made vehicles gaining a bigger share of sales at Canadian auto dealers. Canada is the largest buyer of American-made new cars and trucks, by far. But the numbers help illustrate how the trade war started by President Donald Trump’s administration has changed the business. Mexican and South Korean-made vehicles are gaining a bigger share of sales at Canadian auto dealers.”, Bloomberg, January 16, 2026

===============================================================================================

China

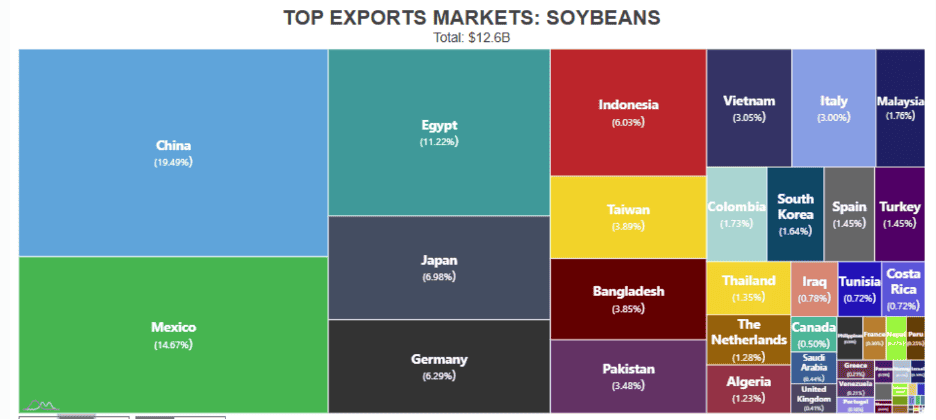

“China Purchased No U.S. Soybeans For An Unprecedented Fifth Straight Month – China was under 20% of all U.S. exports of soybeans through October of 2025, the latest U.S. Census Bureau data available. For 14 of the last 17 years for the same time period, that percentage was above 40%. For the first time in more than two decades, the United States did not export any soybeans in the month of October, the traditional start of the exporting season, to the world’s largest market, China. October was also an unprecedented fifth consecutive month without any U.S. soybean exports to China in at least three decades, according to the latest U.S. Census Bureau data. It matters. U.S. soybean farmers export about 55% of all soybeans they produce, whether as whole bean, which is the most common, or “crushed” into meal form or as oils, a much smaller percentage, according to the U.S. Soybean Export Council.”, Forbes, January 18, 2026

=============================================================================================

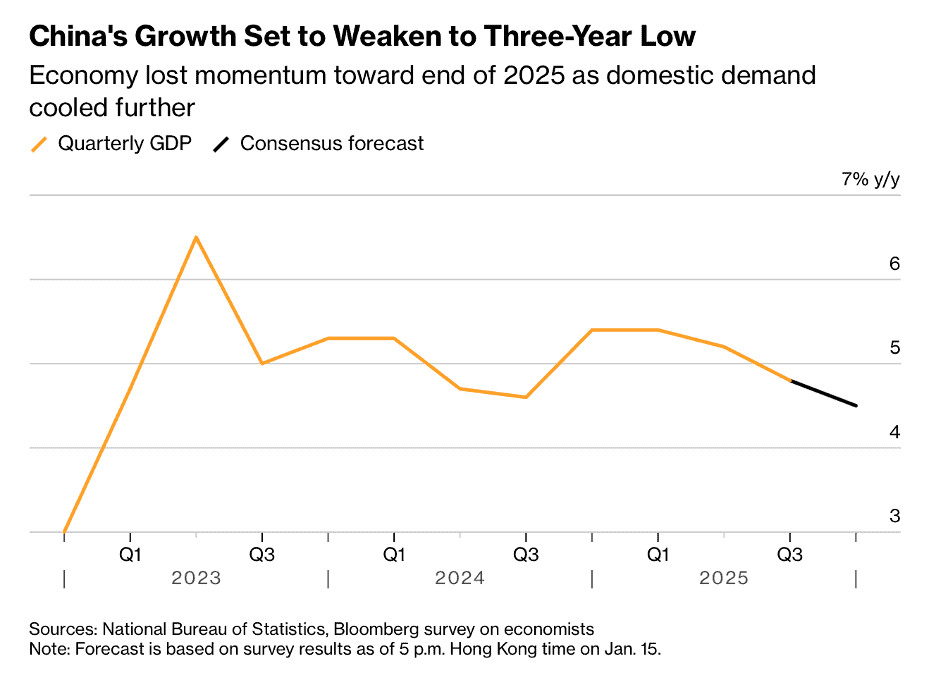

“China’s Slowdown Is Set to Deepen as Pivot to Consumption Stalls – China’s economy likely had its weakest quarterly growth in three years, with a reliance on exports over consumption. Gross domestic product likely gained 4.5% in the fourth quarter from the same period a year prior, according to the median prediction of economists. The uneven growth pattern will likely persist in 2026, buoyed by a positive outlook for exports, with consumption and investment remaining the economy’s weak links.”, Bloomberg, January 15, 2026

=============================================================================================

European Union

“Housing in the EU: Who Owns, Who Rents, and at What Cost – This infographic looks at housing conditions across the EU through three key lenses: the balance between home ownership and renting, the average/median cost of renting and buying per square meter, and the extent of household overcrowding. Together, these indicators help illustrate how affordable, accessible, and adequate housing is across member states. The data reveals strong contrasts. Countries with high levels of home ownership, such as Romania, still face significant overcrowding, highlighting that ownership alone does not guarantee adequate living conditions. Meanwhile, countries like Germany show a very different model, with a large share of renters and relatively stable average rental prices.”, Visual Capitalist, January 7, 2026

=============================================================================================

Malaysia

“In an act of boycott, Malaysia makes its own ‘McDonald’s’ – In Malaysia, customers who have sworn off global restaurant chains in solidarity with Palestine have fuelled a boom in local brands. Malaysia is by no means a make-or-break market for major global brands. The size of the food service industry in the country will almost double to US$27.5 billion (S$35.5 billion) by 2030, said estimates research company Mordor Intelligence. In comparison, in the US, it will surpass US$1.5 trillion. But the loss of its customers still has commercial implications, especially since Malaysia is not the only country rethinking its relationship with global consumer brands. Coca-Cola Icecek, which bottles and sells Coke products in the Middle East, reported a loss of market share in Turkey and Pakistan this summer, following calls to boycott Western companies with perceived links to Israel.”, Straits Times, December 15, 2025

============================================================================================

Taiwan

“US to cut tariffs on Taiwanese goods after investment pledge – The US said it had agreed to cut the tariffs it charges on goods from Taiwan to 15%, in exchange for hundreds of billions of dollars in investment aimed at boosting domestic production of semiconductors. The Commerce Department said the island’s semiconductor and technology enterprises had committed to “new, direct investments” worth at least $250bn (£187bn). The deal also provides carve-outs from tariffs for Taiwanese semiconductor companies investing in the US. As well as the direct investments from companies, the Taiwanese government will provide $250bn in financing to support firms, according to the Commerce Department.”, BBC, January 15, 2026

============================================================================================

United Kingdom

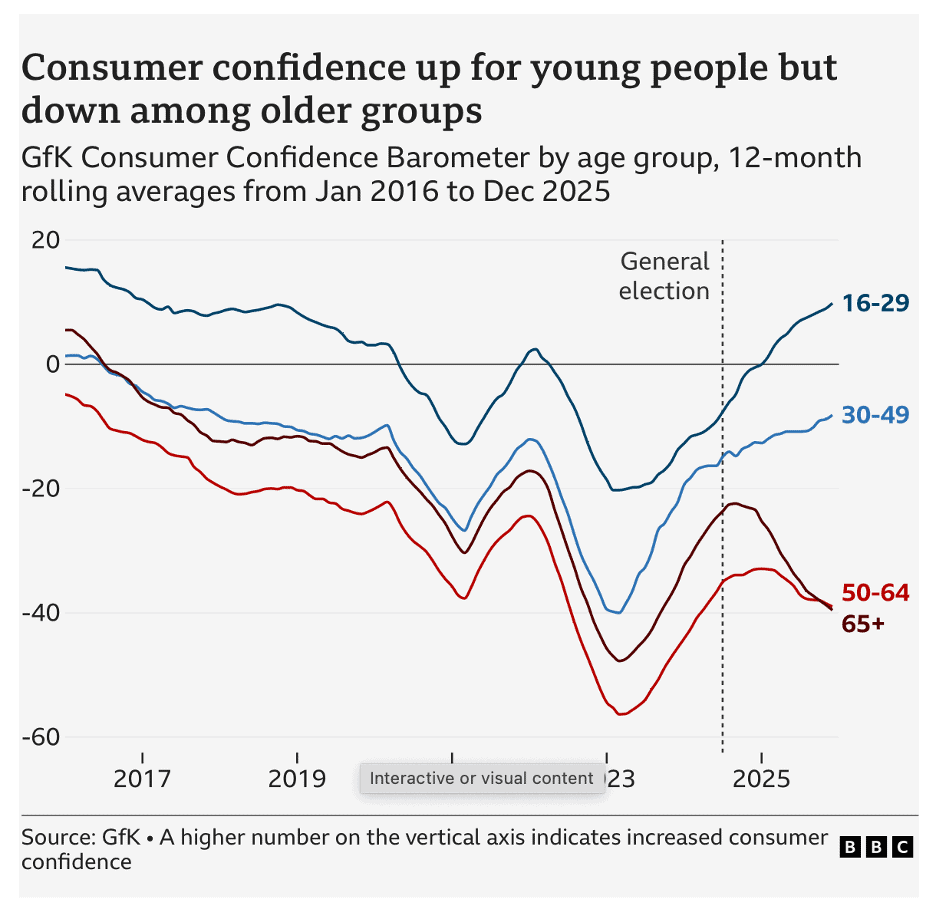

“The one measure that can tell us a lot about the state of the UK economy – There is one chart that might explain quite a lot about both the state of and the prospects for the UK economy. And it might say a fair bit about the political direction of the UK too. It is consumer confidence. These are the long-running surveys that essentially put the nation on the economic psychiatric couch. How do you feel about the economy’s prospects? Are you likely to buy a major piece of equipment? How are your personal finances? Younger people have a generally sunnier starting point but that dims as they age – not a great surprise – and all age groups react to events similarly.”, BBC, January 17, 2026

===========================================================================================

United States

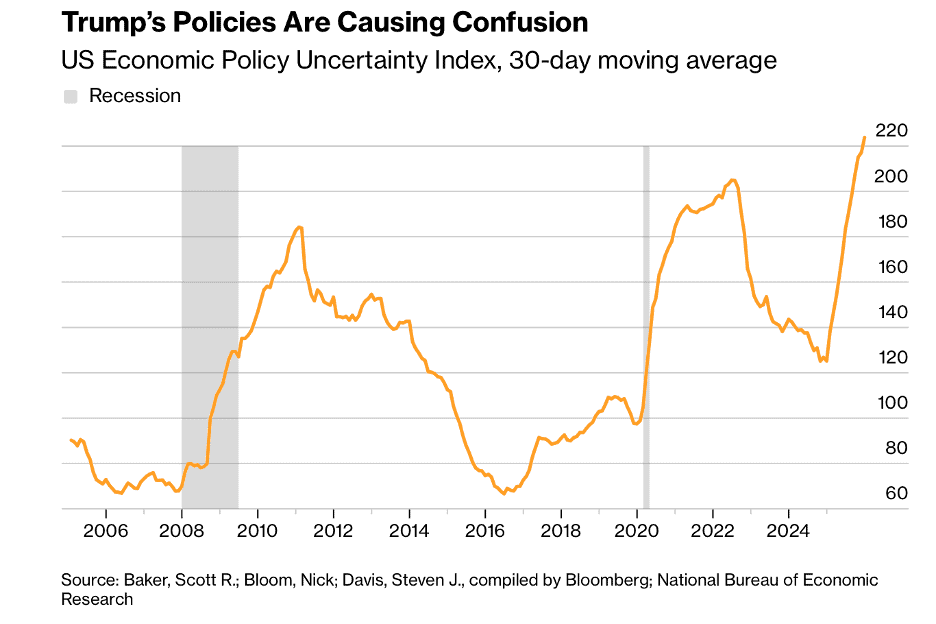

“The Economic Toll of Trump’s Policies Will Soon Be Visible – Mainstream economists have underestimated the cost of all the confusion the administration has unleashed, particularly on trade and immigration. Many forecasters and investors misinterpret the state of the American economy due to a fundamental misunderstanding of how government-induced uncertainty affects it. The effects of President Donald Trump’s trade and immigration policies, such as tariffs and deportations, are expected to become more evident in 2026, leading to stagflationary effects and inflationary pressures. The uncertainty caused by Trump’s policies has delayed decision-making by businesses, households, and investors, but as this uncertainty is resolved, shortages and inflation are expected to rise, potentially forcing employers to raise wages and adding to inflationary pressures.”, Bloomberg, January 13, 2026

============================================================================================

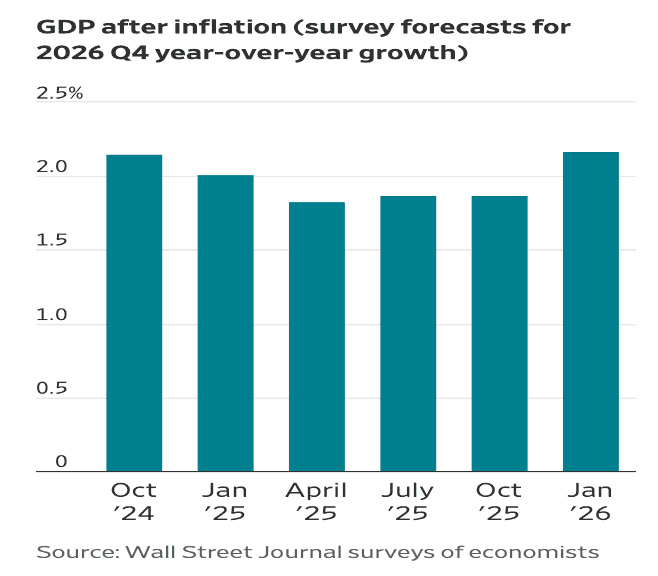

“Economists Shrug Off Trumponomics, Boost 2026 Growth Outlook Back Above 2% – Last year, economists slashed expectations amid tariffs and other Trump policies. The latest survey shows those concerns have largely receded. Economists have learned to stop worrying about Trumponomics. The forecasts are based on 74 surveys from academic and business economists received by the Journal between Jan. 9 and Jan. 15, before Trump’s latest threat to impose tariffs on countries that resist his demands to acquire Greenland. Not every forecaster answered every question. ‘The effective tariff rate will likely peak a little above 13% in the first quarter and that’s almost half the pace of April 2nd—but it’s still more than four times the pace of a year ago,’ said KPMG’s chief economist Diane Swonk. ‘It wasn’t as bad as it could have been.’”, The Wall Street Journal, January 18, 2026

============================================================================================

“Vietnam Economy Expands Despite Tariffs, Beating Estimates – Vietnam’s economy grew faster than expected last quarter as manufacturing, investment and trade gained momentum despite President Donald Trump’s tariffs. Gross domestic product expanded 8.46% in the October-December period from a year earlier, beating all estimates in a Bloomberg survey. Vietnam maintained its status as one of the world’s fastest-growing economies, supported by resilient exports and increased public investment, despite facing risks such as liquidity shortages and inflation management.”, Bloomberg, January 5, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Pollo Tropical owner hints at long-term IPO plans – Authentic Restaurant Brands, which also owns Primanti Bros, P.J. Whelihan’s and other regional chains, suggested that it could go public in three to five years. It also wants to acquire more brands. While many PE-backed restaurant brands aspire to national growth, ARB is strictly focused on expanding brands within their home markets. When it buys a brand, it keeps management in place and invests in G&A, an area where other firms typically look to cut.”, Restaurant Business, January 14, 2026

==============================================================================================

“Denny’s Corporation Announces Completion of Acquisition by TriArtisan Capital Advisors, Treville Capital Group and Yadav Enterprises – Denny’s Corporation (the “Company” or “Denny’s”) (NASDAQ: DENN), owner and operator of Denny’s Inc. and Keke’s Inc., today announced the successful completion of its previously announced acquisition by TriArtisan Capital Advisors LLC (“TriArtisan”), Treville Capital Group (“Treville”) and Yadav Enterprises, Inc. (“Yadav Enterprises”). The transaction closed following approval by Denny’s stockholders as well as satisfaction of all required regulatory and customary closing conditions. With the support of TriArtisan, Treville and Yadav Enterprises, Denny’s will have enhanced flexibility and resources to invest in its brands, support franchisees and accelerate its growth initiatives.”, Global Newswire, January 16, 2026

==============================================================================================

“Raising Cane’s plans to enter Mexico in 2026 – The fast-growing chain signed a development agreement with Alsea to debut in the market. The agreement with Raising Cane’s includes plans to explore additional opportunities in the region following its debut next year. The chain currently operates more than 950 restaurants across 43 U.S. states and the Middle East and has also recently announced plans to expand into the United Kingdom next year.”, National Restaurant News, December 9, 2026

==============================================================================================

“Moran Family of Brands Goes Global with Acquisition of Mister Transmission – In a milestone moment that reflects the strength and growth of the automotive aftermarket industry, Moran Family of Brands is expanding into Canada with the acquisition of Mister Transmission, creating a unified North American leader in automotive service and repair. Already owning U.S.-based Mr. Transmission, Moran has expanded its portfolio on an international scale to continue meeting the evolving needs of automotive customers.”, PR Newswire, December 8, 2025

============================================================================================

“Fatburger Brings a Taste of Hollywood to Japan with Okinawa Opening – FAT (Fresh. Authentic. Tasty.) Brands Inc. announces the opening of its newest Fatburger location in Okinawa in partnership with Green Micro Factory Inc., marking the brand’s highly anticipated return to Japan.”, Franchising.com, December 16, 2025

===========================================================================================

“Domino’s Pizza (Australia) names fast food veteran Merrill Pereyra as CEO – With more than 30 years of experience in the quick-service restaurant industry, Pereyra has held several regional leadership positions at McDonald’s, and at Domino’s Pizza Indonesia, where he was CEO. He joined QSR Brands, a part of Yum! Brands franchisee for KFC and Pizza Hut as executive director and CEO. In 2019, as MD of Pizza Hut India, Pereyra led a sales turnaround. Inside Retail, January 12, 2026

=============================================================================================

“TGI Fridays targets 1K units, $2B revenue by 2030 – The once-bankrupt chain will focus on global growth, improving franchisee profitability and boosting the guest experience as part of a new strategic vision. TGI Fridays unveiled its “1-2-3 Strategic Vision” on Monday with a plan to target over 1,000 units and $2 billion in annual revenue by 2030, according to a press release. The plan covers four strategic pillars, including activating the brand, growing across markets, improving its franchised system and investing in people and leadership development. Fridays, which has nearly 400 units across more than 40 countries, has signed several development agreements to open over 150 units worldwide, the press release said.”, Restaurant Dive, January 12, 2026

================================================================================================

“Jollibee Looks to Tap Deep US Investor Base for Overseas Unit – Jollibee Foods Corp. plans a US listing to tap into the nation’s deep investor base. The company expects to spin off its international unit and list in the US by late 2027, while its domestic business will remain on the Philippine bourse. Listing in the US will introduce Jollibee to broader research coverage by company analysts, according to Richard Shin, global chief financial officer of Jollibee. The company, which increasingly aims to compete globally with giants such as McDonald’s and Yum! Brands Inc., expects to spin off its international unit and list in the US by late 2027, while its domestic business will remain on the Philippine bourse, among the world’s worst-performing exchanges in the past decade.”, Bloomberg, January 14, 2026

============================================================================================

“Costa (Coffee) sale scrapped, sector cutting emissions and recovering millions, half of pubs closing early et al – Coca-Cola scraps plans to sell Costa after bids fall short: Coca-Cola has ditched plans to sell Costa Coffee after bids from private equity suitors fell short of its expectations. Firms in the latter rounds of negotiations included Asda owner TDR Capital and Bain Capital’s special situations fund, owner of Gail’s and PizzaExpress, the FT reported. Coca-Cola had been seeking about £2bn for Costa, roughly half the £3.9bn it paid to acquire the UK’s largest coffee shop brand from Premier Inn owner Whitbread in 2018. Talks over a deal with TDR would have seen Coca-Cola retain a minority stake in Costa. Private equity firms Apollo, KKR and Centurium Capital, owner of China’s Luckin Coffee brand, were involved at earlier stages of the process, which was handled by Lazard, according to people familiar with the matter.”, Propel UK, January 14, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link: