Biweekly Global Business Newsletter Issue 154, Tuesday, February 17, 2026

“It always seems impossible until it’s done.”

Welcome to the 154th Edition of the Biweekly Global Business Update – The above quotation is attributed to Nelson Mandala and sees appropriate as we plan for doing global business in 2026. As we move deeper into 2026, the signals coming from global markets are both clear and complex. In this edition we cover China, India, Japan, Taiwan, the United Arab Emirates, the United Kingdom and the United States.

Global power demand is accelerating alongside AI infrastructure buildout. Fertility rates continue to decline across developed economies. Trade frameworks remain fluid. The world’s largest economies are widening their scale advantage, while cost-of-living pressures persist in major urban centers.

For global business leaders, this is not a moment for reaction — it is a moment for disciplined positioning.

In this edition, we analyze the 2026 Global Cost of Living Index and what it signals for talent mobility, compensation planning, and location strategy. We review the world’s 50 largest economies by projected GDP and examine how output concentration is reshaping competitive dynamics. We explore the accelerating “Age of Electricity” and the implications of surging power demand for data centers, manufacturing siting, and national industrial policy. We assess evolving tariff structures, shifting trade alignments, and regulatory adjustments that are quietly influencing cross-border capital flows.

In the franchise sector, we review global restaurant expansion trends, cross-border brand movement, and the implications of shifting consumer spending patterns in both emerging and mature markets. As labor costs, urban density, and middle-class growth diverge by region, franchisors must align market selection, capital deployment, and local operating partnerships with greater precision than ever before.

This edition’s book review highlights: “Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition Irrelevant” by W. Chan Kim , Renée A. Mauborgne and Renee Mauborgne. More than a decade after its original release, Blue Ocean Strategy remains one of the most influential strategy books in global business. In the Expanded Edition, W. Chan Kim and Renée Mauborgne refine and reinforce their central thesis: companies achieve breakthrough growth not by battling competitors in crowded ‘red oceans,’ but by creating uncontested market space — ‘blue oceans’ — where competition becomes irrelevant.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“It always seems impossible until it’s done.”, often attributed to Nelson Mandela

“Happiness depends more upon the internal frame of a person’s own mind than on the externals in the world”, 1st US President, George Washington

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.”, Peter Drucker

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #154:

The Global Cost of Living Index 2026

The World’s 50 Largest Economies by GDP in 2026

Full-service restaurants led industry’s job growth in 2025 –

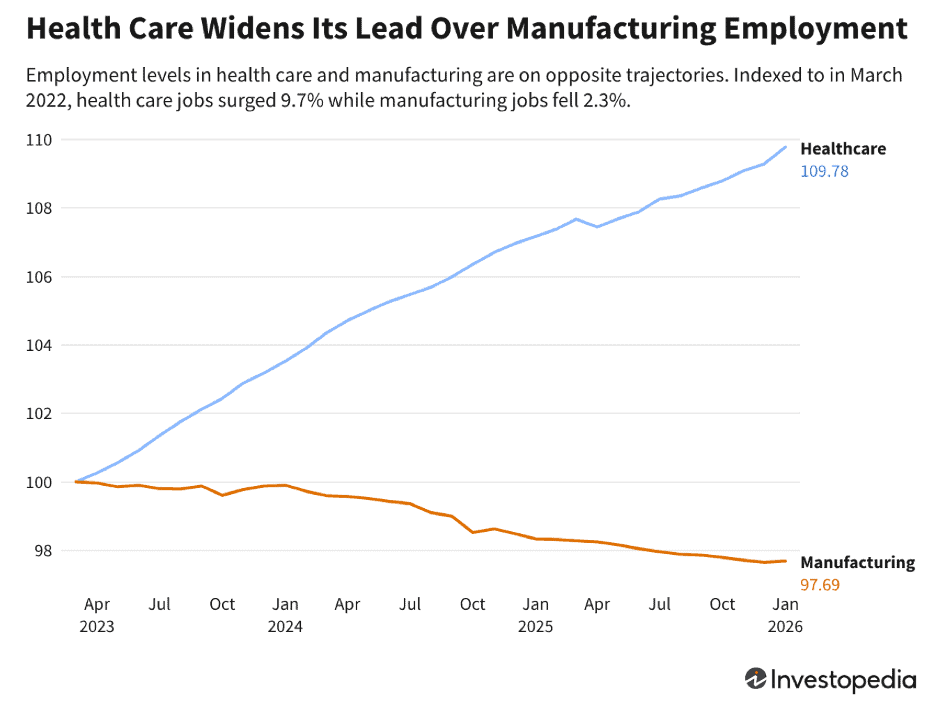

For Better or Worse, Health Care Is America’s Employment Engine

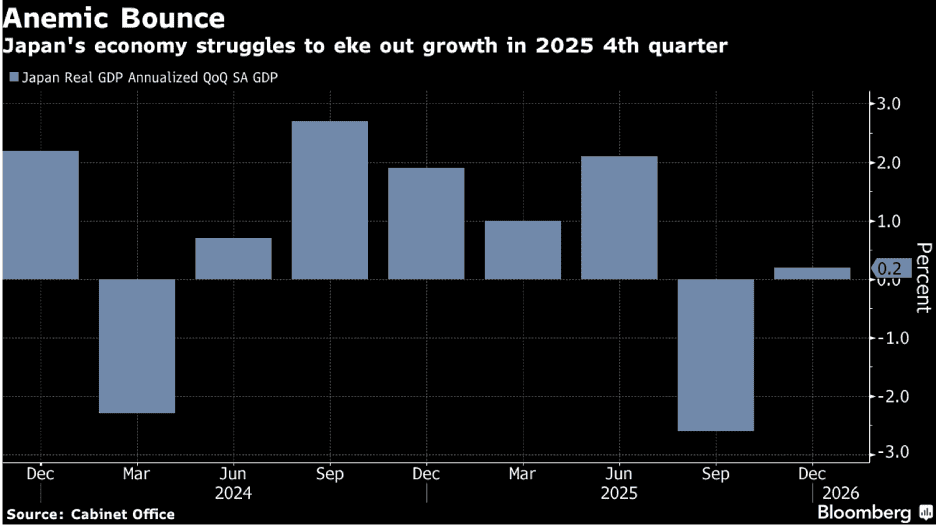

Japan’s Economy Ekes Out Anemic Growth as Takaichi Eyes Spending

Franchise Global News Section: Bob Evans®, Krispy Kreme®, McDonalds®, TGI Fridays® and Wendy’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

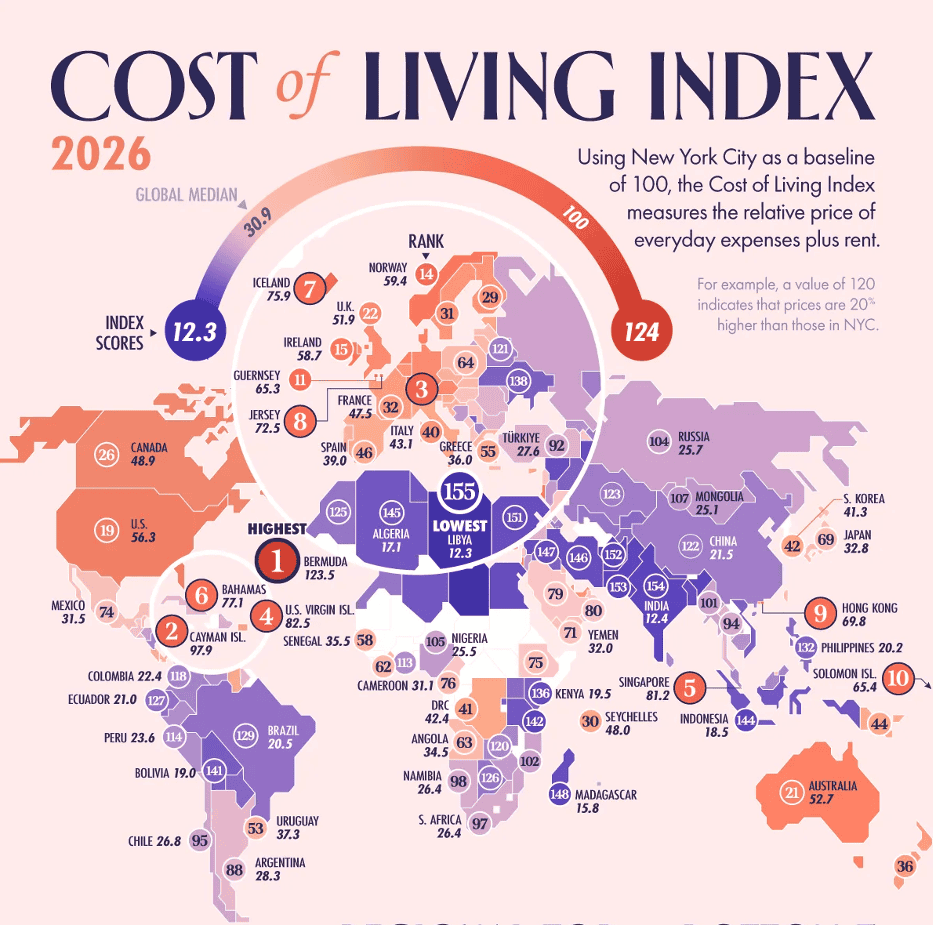

“The Global Cost of Living Index 2026 – Bermuda is the most expensive place to live in the world in 2026, with prices 23.5% higher than New York City. Switzerland leads Europe, while Singapore is the most expensive in Asia. This graphic visualizes Numbeo’s Global Cost of Living Index, which measures the price of everyday expenses, including rent, relative to New York City (baseline of 100). If a country has an index score of 80, prices are 20% lower than in New York. Scores above 100 indicate higher everyday costs. While inflation has eased in many regions, the cost of living remains a major global challenge. Across 28 countries, home prices have risen more than 50% since 2020, and grocery costs have risen sharply in countries such as Mexico, Germany, and Malaysia, continuing to strain household budgets worldwide.”, Visual Capitalist & Numbeo, February 9, 2026

===============================================================================================

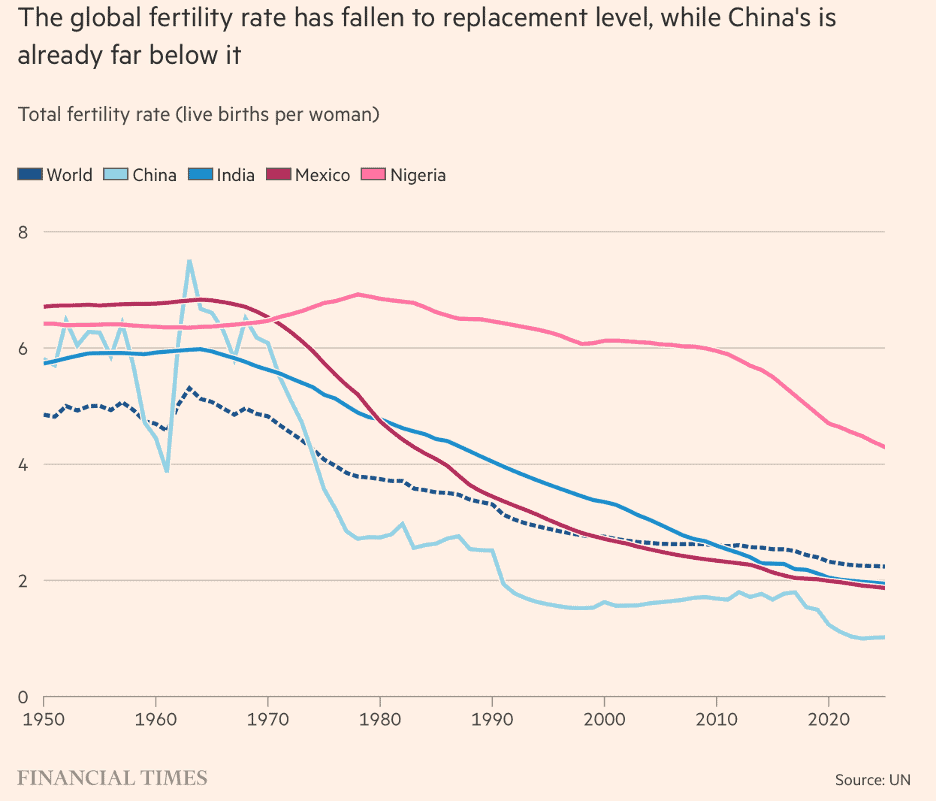

“Why are fertility rates collapsing? Gender roles. A big part of female graduates’ decision to have children depends on how they expect their husbands to behave. The decline in fertility has occurred in almost every country in the world. Humanity is unprecedentedly well off and yet has far fewer children relative to its numbers than before. Quality children are expensive everywhere, but in some countries they are exorbitantly so. Please use the sharing tools found via the share button at the top or side of articles. Gender norms will need to be even more equal and societal help with the costs of children even greater if there is to be much hope of raising fertility rates. But a big rise seems unlikely. A declining population looks inevitable in a huge number of rich countries, if mass immigration is ruled out.”, The Financial Times, February 10, 2026

============================================================================================

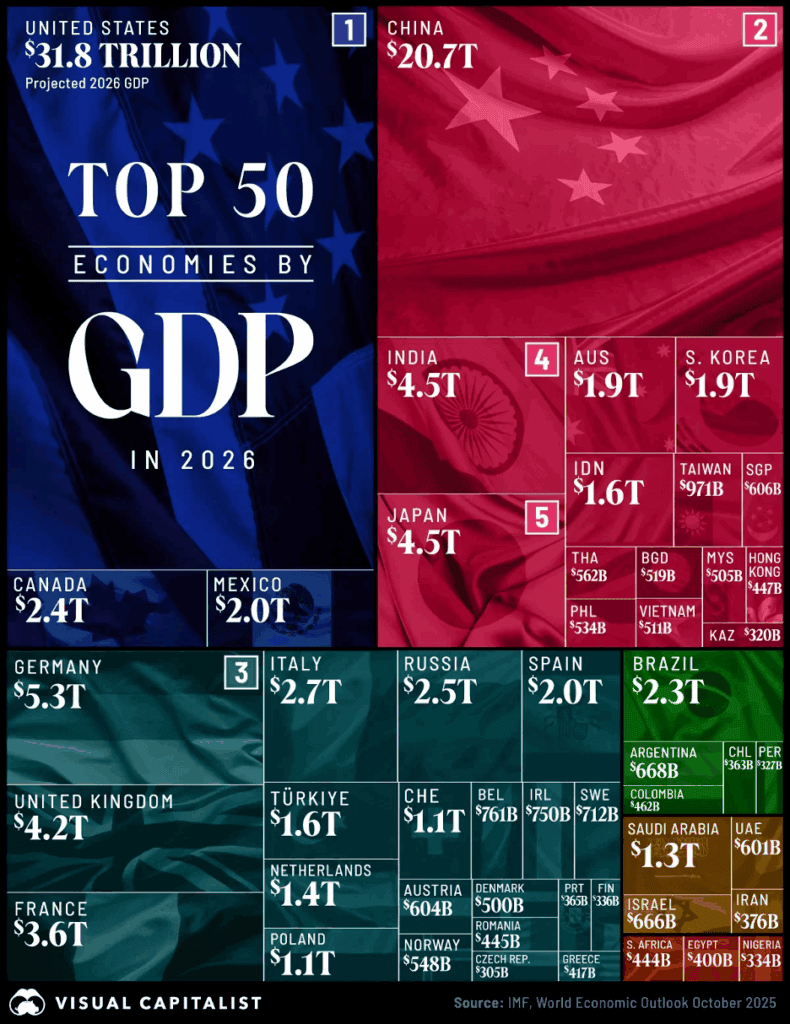

“The World’s 50 Largest Economies by GDP in 2026 – This infographic ranks the world’s 50 largest economies by projected nominal GDP in 2026, based on data from the IMF’s World Economic Outlook (October 2025). The global economy is projected to reach $123.6 trillion in 2026. The United States remains the world’s largest economy, accounting for over $31.8 trillion in GDP. The top five economies generate more than 55% of global economic output.”, Visual Capitalist & the International Monetary Fund, January 29, 2026

===============================================================================================

“Global AI Battle Turbocharged by 50% Power Demand Surge – Governments have only begun to grasp the major shifts in policies and politics the “age of electricity” may bring. In a Davos presentation last month, the Nvidia Corp. boss unveiled his vision of the artificial intelligence buildout in the form of a “five-layer cake.” Near the top is where economic value is created, via the models that drive AI and the applications that make it work for businesses. But the base layer – the sponge in the cake — is energy. Right now that means electricity, with power-hungry data centers springing up around the world to drive the new technology. Those centers are effectively competing with humans, who of course rely on electric power to heat and cool their homes and increasingly to get around in cars or trains. The obvious conclusion is, we’re going to need a lot more of it. That’s also the key finding of the new annual report on power production and markets by the International Energy Agency – which heralds the dawning of an “Age of Electricity.” In the coming five years, the IEA predicts global demand for power is set to grow roughly 50% faster than it did during the previous decade – and more than twice as fast as energy demand overall.”, Bloomberg, February 14, 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“Donald Trump plans to roll back tariffs on metal and aluminium goods – Latest softening of levies comes amid persistent voter anxiety about affordability in US. The US president hit steel and aluminium imports with tariffs of up to 50 per cent last summer, and has expanded the taxes to a range of goods made from those metals including washing machines and ovens. But his administration is now reviewing the list of products affected by the levies and plans to exempt some items, halt the expansion of the lists and instead launch more targeted national security probes into specific goods, according to three people familiar with the matter. The people said trade officials in the commerce department and US trade representative’s office believed the tariffs were hurting consumers by raising prices for goods such as pie tins and food and drink cans. Trump’s tariff blitz has pushed US duties to their highest level since before the second world war.”, The Financial Times, February 13, 2026

===============================================================================================

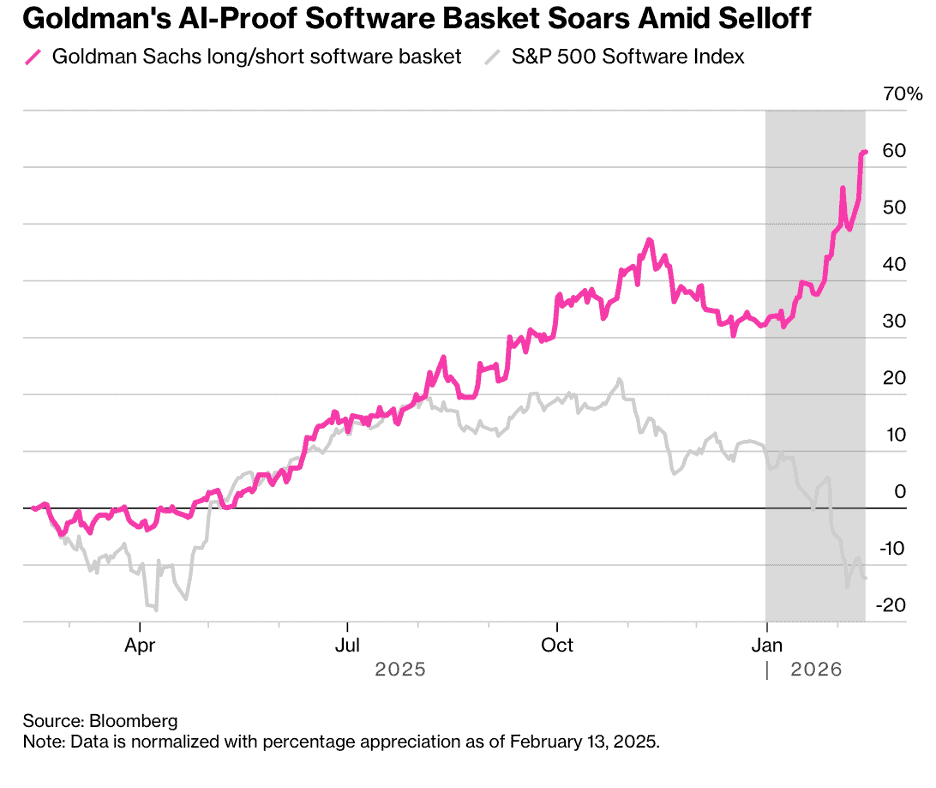

“Goldman Traders Launch AI-Proof Software Basket Amid Sector Rout – Goldman Sachs Group Inc. has introduced a software pair trade basket that goes long companies whose businesses are seen as difficult for AI to displace and shorts firms whose workflows AI could automate or replicate internally. The basket includes companies such as Cloudflare Inc., CrowdStrike Holdings Inc., and Microsoft Corp. on the long side, and Monday.com Ltd., Salesforce Inc., and Duolingo Inc. on the short side. The launch comes as anxiety over AI’s disruptive potential intensifies, with software stocks trading at about 27 times earnings, down from roughly 51 times earnings a year ago, and earnings expectations remaining broadly intact.”, Bloomberg, February 13, 2026

============================================================================================

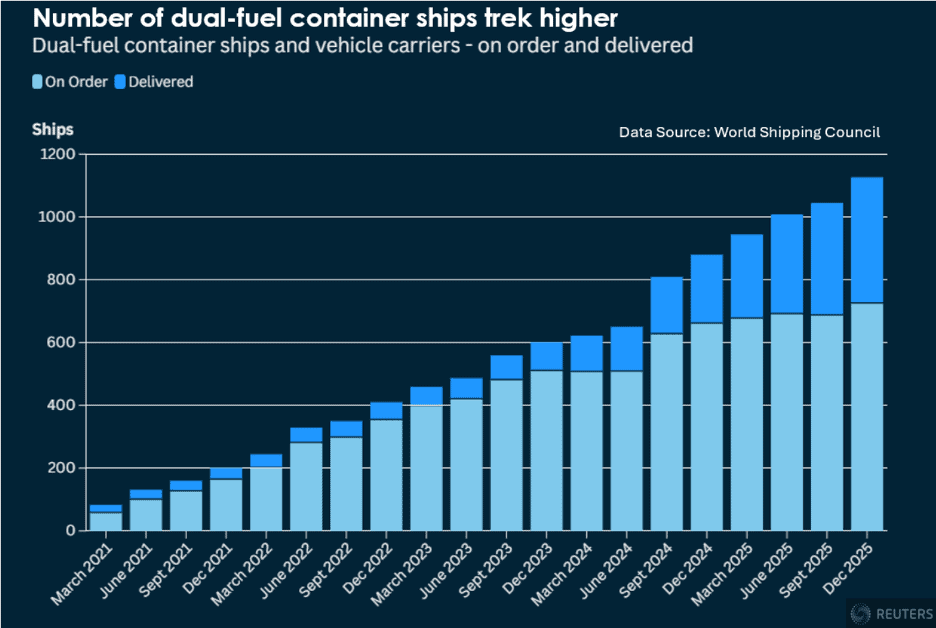

“Global shipping industry sticks with green investments, despite carbon price delay – Shipping accounts for nearly 3% of greenhouse gas emissions. he shipping industry’s biggest players are shrugging off Trump administration opposition to a global carbon price and are forging ahead with billions of dollars in emissions-reducing investments, according to company officials and a Reuters analysis of data. Europe, Brazil and a host of other nations are pushing the sector, which is responsible for nearly 3% of the world’s greenhouse gas emissions, to go green. But, in October, the U.S. and Saudi Arabia, the world’s two largest oil producers, successfully spearheaded efforts to postpone by one year a decision on the International Maritime Organization’s proposal of a $380-per-metric-ton levy.”, Reuters, February 12, 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“3 US Carriers Included In The World’s 25 Safest Airlines For 2026 – A “recently released report on the world’s 25 safest full-service airlines for 2026 included Alaska Airlines, Delta Air Lines, and American Airlines. “Dubbed No. 1 on the list of this year’s safest full-service airlines was Etihad Airways. Notably, the latter is one of the United Arab Emirates (UAE)’s two official flag carriers. The country’s other national airline, Emirates, ranked fifth. Cathay Pacific (Hong Kong) ranked second on the list of the world’s safest airlines in 2026. It was followed by Qantas (Australia) in third and Qatar Airways (Qatar) in fourth.”, Travel Noire, February 13, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition Irrelevant” by W. Chan Kim , Renée A. Mauborgne and Renee Mauborgne. More than a decade after its original release, Blue Ocean Strategy remains one of the most influential strategy books in global business. In the Expanded Edition, W. Chan Kim and Renée Mauborgne refine and reinforce their central thesis: companies achieve breakthrough growth not by battling competitors in crowded ‘red oceans,’ but by creating uncontested market space — ‘blue oceans’ — where competition becomes irrelevant.

The authors challenge the traditional assumption that strategy is about outperforming rivals. Instead, they argue that lasting growth comes from value innovation — simultaneously increasing buyer value while reducing costs. Through case studies ranging from Cirque du Soleil to Nintendo and emerging-market innovators, the book demonstrates how redefining industry boundaries can unlock new demand rather than fight over existing customers.

The Expanded Edition adds updated case examples and deeper guidance on execution risks, organizational alignment, and the human side of transformation — areas often overlooked in strategy discussions. Importantly, Kim and Mauborgne emphasize tools, not just theory. The Strategy Canvas and Four Actions Framework provide practical, visual methods for rethinking competitive positioning.

For global business leaders navigating saturated markets, geopolitical uncertainty, and margin pressure, Blue Ocean Strategy is not simply about innovation. It is about disciplined differentiation and strategic courage. In a world obsessed with benchmarking competitors, this book reminds leaders to step back and ask a more powerful question: What if we changed the game entirely?

Five Takeaways for Global Business Leaders

- Competing harder is not the same as competing smarter. Growth often comes from redefining the market, not dominating it.

- Value innovation drives durable advantage. Raise what matters to customers while eliminating or reducing what does not.

- Noncustomers matter. Expanding demand beyond current buyers can unlock global growth.

- Strategy must be visual and simple. Tools like the Strategy Canvas clarify trade-offs and sharpen decision-making.

- Execution risk is cultural. Organizational resistance, not idea scarcity, is the biggest obstacle to blue ocean moves.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

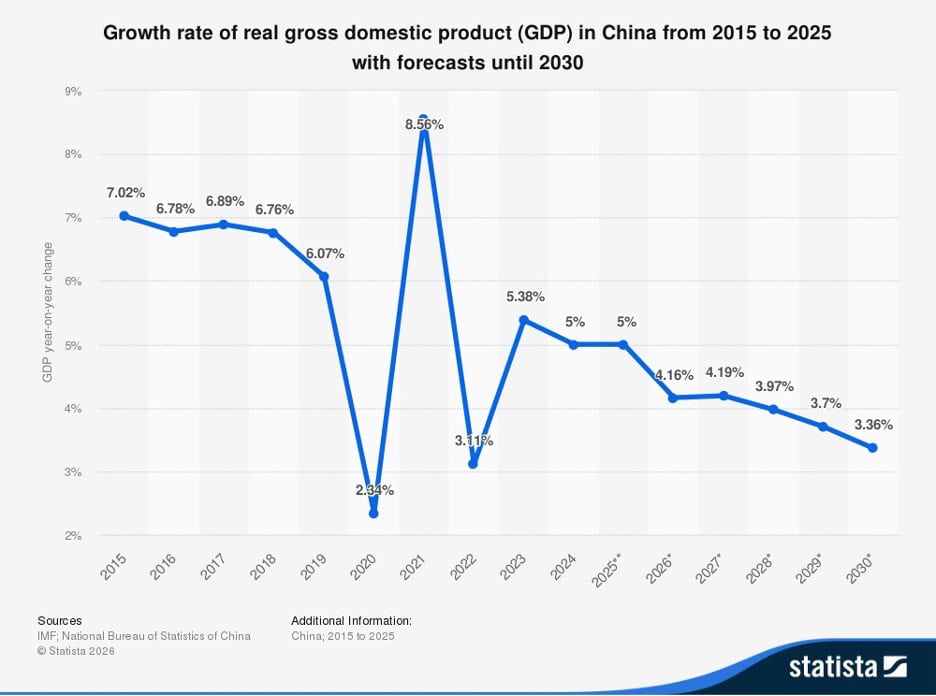

“Gross domestic product (GDP) growth rate in China 2015-2030 – As of 2024, China was among the leading countries with the largest gross domestic product worldwide, second only to the United States which had a GDP volume of almost 29.2 trillion U.S. dollars. The Chinese GDP has shown remarkable growth over the past years. Upon closer examination of the distribution of GDP across economic sectors, a gradual shift from an economy heavily based on industrial production towards an economy focused on services becomes visible, with the service industry outpacing the manufacturing sector in terms of GDP contribution. According to preliminary figures, the growth of real gross domestic product (GDP) in China amounted to 5.0 percent in 2025. For 2026, the IMF expects a GDP growth rate of around 4.2 percent.”, Published for Statista by C. Textor, Jan 19, 2026

=============================================================================================

India

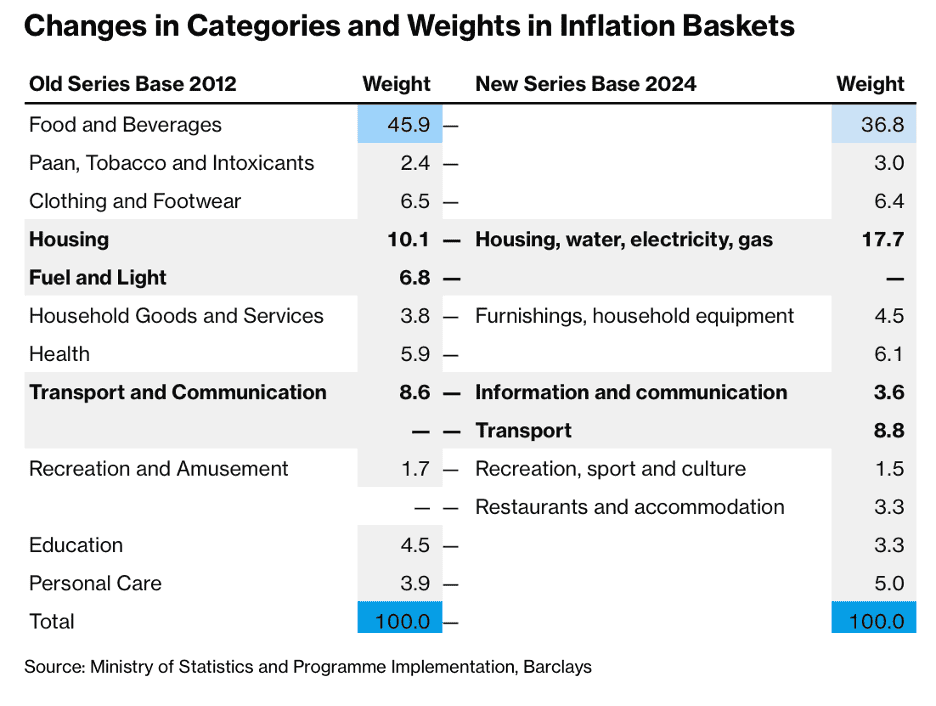

“India’s New CPI May Give Central Bank Reason to Stay on Hold – India will publish inflation figures based on a new index, which may show elevated price pressures in the economy, giving the central bank reason to keep interest rates on hold. The new consumer price index will reflect changes in spending patterns since the last overhaul, with the weighting of volatile items such as food reduced and new spending categories like rentals for rural housing and online shopping added. The changes could lift the January inflation reading and prompt the central bank to hold off on any further rate cuts, potentially pushing up bond yields further and influencing financial market participants’ expectations for interest rates.”, Bloomberg, February 11, 2026

=============================================================================================

Japan

“Japan’s Economy Ekes Out Anemic Growth as Takaichi Eyes Spending – Japan’s economic output in the fourth quarter of 2025 was much weaker than expected, registering anemic growth after a deep contraction in the previous period, underscoring the case for Prime Minister Sanae Takaichi’s proactive spending policies following her election triumph. Japan’s real gross domestic product grew 0.2% on an annualized basis in the three months through December, according to a Cabinet Office report Monday. That was weaker than economists’ median estimate of 1.6% growth. Consumer spending, the biggest component of GDP, grew 0.1%, showing the fragility of domestic demand as households continue to cope with inflation that hovered above the Bank of Japan’s 2% target for four years through 2025.”, Bloomberg, February 15, 2026

============================================================================================

Singapore

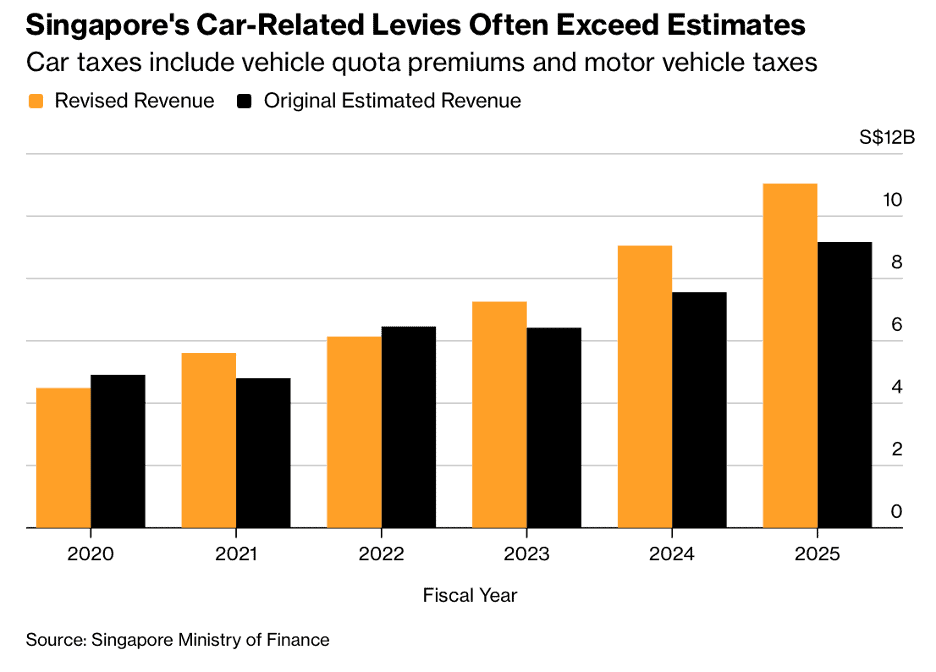

“Singapore’s Car Tax Revenue Now So High It Exceeds Fiji’s GDP – “Vehicle quota premiums raisedS$8.66 billion ($6.9 billion) in the year ending March 2026, about 31% more than the government initially estimated a year ago. When combined with motor vehicle taxes, it brings the total to S$11.05 billion — an amount greater than the annual gross domestic product of Fiji. The government projects that vehicle quota premiums and motor vehicle taxes will raise a combined S$12.22 billion in the year ending March 2027. Singapore has a unique system for allowing cars to stay on the road. Every vehicle must be granted a Certificate of Entitlement as part of a bidding process, which grants permission for it to be driven for a maximum of 10 years.”, Bloomberg, February 13, 2026

===========================================================================================

Taiwan

“U.S.-Taiwan Trade Agreement Leaves Major Questions Open – The U.S.-Taiwan Reciprocal Trade Agreement should provide welcome stability to bilateral economic ties, but differences over the trade balance, semiconductor manufacturing, and currency intervention will remain. Taiwan has become only the seventh U.S. trading partner to reach a Reciprocal Trade Agreement with the Trump administration. Under the terms of the deal, the United States will reduce the reciprocal tariff rate on Taiwanese goods to 15 percent, Taiwan will reduce tariffs and non-tariff barriers, Taiwanese firms will invest at least $250 billion in the United States for semiconductor production, and Taiwan will guarantee $250 billion in credit for these companies. Taiwan also committed to increasing its purchases of American products, including $44.4 billion of liquefied natural gas and crude oil, $15.2 billion of aircraft and engines, and $25.2 billion of power-generation equipment.”, Council on Foreign Relations, February 12, 2026

============================================================================================

United Arab Emirates

“UAE ‘surpassing Hong Kong’, challenging Singapore for global trade crown – With non-oil trade nearly doubling, analysts say the UAE has secured a first-mover advantage that leaves regional rivals trailing behind. Driven by an aggressive post-pandemic strategy of “economic statecraft,” the nation’s non-oil trade reached $1.03 trillion in 2025, hitting its 2031 targets six years ahead of schedule. By maintaining a non-aligned stance that balances Western partnerships with a role as a hub for diverse capital flows, the UAE has attracted significant global investment and talent. Dubai-based DP World now rivals Hong Kong’s Hutchison Ports and is positioned to challenge Singapore’s PSA International for global leadership in port operations. Beyond logistics, the UAE is investing heavily in AI to secure a first-mover advantage in the next frontier of trade technology.”, South China Morning Post, February 14, 2026

=============================================================================================

United Kingdom

“UK labour reforms to cut hiring by one in three employers, survey shows – “More than one in three UK employers plan to cut their hiring of permanent staff due to costs introduced by the government’s labour law reforms, a survey showed on Monday. The Chartered Institute of Personnel and Development, a professional body for the human resources sector, said overall hiring intentions remained at their lowest level on record excluding the first year of the COVID pandemic, adding to the risks that an ongoing jobs market slowdown deepens.”, Reuters, February 16, 2026

============================================================================================

United States

“For Better or Worse, Health Care Is America’s Employment Engine – Off The Charts: The Visual Says It All. “Manufacturing, once the largest employer in the U.S. economy, has shed jobs consistently since 2022. Health care has gained them. The two sectors have been on opposite trajectories since 2008, when health care employment first exceeded manufacturing. As of January, more than 18 million people worked in health care, compared to 12 million in manufacturing, according to the Bureau of Labor Statistics. And those two sectors have been headed in opposite directions in recent years.”, Investopedia, February 13, 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“How Franchise Economics Can Fuel YUM’s Next Growth Cycle – Yum! Brands is making franchise “What Franchisors Need to Get Right Before Expanding Internationally – International expansion is a milestone. It’s proof that a franchise system has “made it” at home, and there’s enough demand for your brand to start growing beyond its borders. But, going global isn’t about planting flags on a map. It’s about discipline, clarity, and an honest understanding of what makes your concept work, and what doesn’t translate automatically across borders. Not every successful domestic franchise is suited for international expansion.”, Franchising.com, February 13, 2026. This article is by Stephen P. Smith who is the founder & CEO of Hotworx.

=============================================================================================

“Full-service restaurants led industry’s job growth in 2025 – The segment added a net 55,000 jobs during the year, however, it remains below pre-pandemic levels…..eating and drinking establishments added a net 27,800 jobs in January on a seasonally-adjusted basis, up from 13,900 jobs in December. January marked the eighth consecutive monthly increase in restaurant employment, according to the National Restaurant Association. In the last eight months, eating and drinking places added a net 172,000 jobs, versus the overall economy, which has added just 129,000 jobs. The association notes that the industry’s recent employment trends suggest that many operators continue to prioritize boosting staffing levels, even amid a challenging business environment.”, Nation’s Restaurant News, February 11, 2026

==============================================================================================

“Bob Evans is acquired by private-equity firm 4×4 – The 400-unit family-dining chain had been owned by Golden Gate Capital since 2017. Its new owner is planning long-term growth. 4×4 said it plans to grow the New Albany, Ohio-based chain, known for its “farm-fresh” comfort food and low prices. Bob Evans management including CEO Mickey Mills will stay in place. It also closed about 75 locations, going from 505 to 430. It generated $761.2 million in sales in 2024, or about $1.8 million per restaurant. It has largely been shrinking since 2005, when it had 590 locations and $1 billion in annual sales. Bob Evans is one of the older restaurant brands in the country, having been founded in Ohio in 1948 by its namesake. The original restaurant was supported by Evans’ sausage-making business, which would later become Bob Evans Farms.”, Restaurant Business, February 4, 2026

===============================================================================================

“McDonald’s has a $73B impact on the U.S. economy – The fast-food giant also supports 1 million jobs, including 740,000 people who work in the chain’s restaurants, according to a study the company commissioned by Oxford Economics. One of the most visible parts of this effort involves what McDonald’s calls “the 1 in 8,” referring to the one out of eight Americans who worked in one of the chain’s restaurants at some point in their lives. The company buys $5.9 billion worth of ingredients every year, including 671 million pounds of beef, 130 million pounds of cheese, 2.8 billion pounds of potatoes and 2.1 billion eggs. McDonald’s also noted that it supports nearly $20 billion in tax revenue nationwide.”, Restaurant Business, February 3, 2026

===============================================================================================

“Krispy Kreme to sell Japan business to Unison Capital in $65m deal – The brand currently operates 89 outlets in Japan, alongside around 300 fresh delivery points in Tokyo, Osaka and other major urban areas. The transaction, described as Krispy Kreme’s first international refranchising agreement since it set out a turnaround plan in August, is expected to complete in the first quarter of 2026. Krispy Kreme CEO Josh Charlesworth said: ‘We are pleased to announce our first international refranchising agreement since launching our turnaround plan in August, marking meaningful progress on a key pillar of the plan.’”, Verdict Food Service, December 22, 2025

==============================================================================================

“Inside TGI Fridays’ ambitious path to 1K units by 2030 – CEO Ray Blanchette said the chain has signed 150 agreements within the past six months, and franchisees are excited to grow again. With this annual growth and the addition of alternative development channels like hotels and airports, 1,000 units by 2030 is attainable, he said. Blanchette returned as CEO of the chain in 2025, shortly after the chain emerged from bankruptcy with an eye on growth, menu innovation and franchising. He is a long-time Fridays franchisee through his company Sugarloaf Hospitality and originally served as Fridays CEO from 2018 to 2023. One of the chain’s biggest growth focuses is non-traditional space, like airports and hotels.”, Restaurant Dive, February 9, 2026

=============================================================================================

“Restaurant Brands shares fall despite earnings beat, strong international growth – Restaurant Brands International reported quarterly earnings and revenue that topped Wall Street’s expectations. Strong international sales fueled company-wide same-store sales growth of 3.1%. Popeyes was the laggard of the portfolio, with same-store sales declining during the quarter. However, executives said that Burger King’s progress on remodeling U.S. restaurants slowed last year in response to higher costs, and the chain will no longer meet its 2028 deadline to modernize 85% of its domestic locations. Outside of the U.S. and Canada, Restaurant Brands’ same-store sales climbed 6.1%. International Burger King restaurants, which represents the bulk of the segment, saw same-store sales growth of 5.8%.”, CNBC, February 12, 2026

==============================================================================================

“McDonald s Malaysia to launch 100 new restaurants with 254M investment – McDonald’s Malaysia plans to invest RM1 billion ($254 million) over the next five years to roll out 100 new restaurants, upgrade existing outlets and boost its digital capabilities. Managing director and local operating partner Datuk Azmir Jaafar said the planned investment underscores the company’s long-term commitment to developing a Malaysian workforce while expanding its restaurant footprint nationwide, according to state-owned news outlet Bernama. 60% of the funding will be allocated for new restaurant openings, while 20% will be for refurbishing and modernising more than 150 existing McDonald’s Malaysia restaurants, and the remaining 20% for technology and digitalization initiatives, he said.”, VN Express International, February 8, 2026. Compliments of Paul Njones, Jones & Co., Toronto

============================================================================================

“Wendy’s Sales Dented by Persistent U.S. Struggles – The fast-food chain said same-restaurant sales fell 10.1% in the fourth quarter from a year ago, mostly driven by a drop in domestic sales. The report comes as Wendy’s is working to close a number of U.S. restaurants in an attempt to turn around performance. The company plans to close 5% to 6% of its roughly 6,000 U.S. locations……. Sales were also dented by lower advertising funds revenue, franchise loyalty revenue and franchise fees.”, The Wall Street Journal, February 13, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 153, Tuesday, February 3, 2026

“Global commerce is being reshaped by both opportunity and friction”

Welcome to the 153rd Edition of the Biweekly Global Business Update – The global business environment continues to reset—quietly in some places, forcefully in others. Economic optimism is returning in parts of Asia and emerging markets, even as uncertainty lingers across North America and Europe. Capital is shifting, currencies are moving, and long-standing trade patterns are being rewritten in real time.

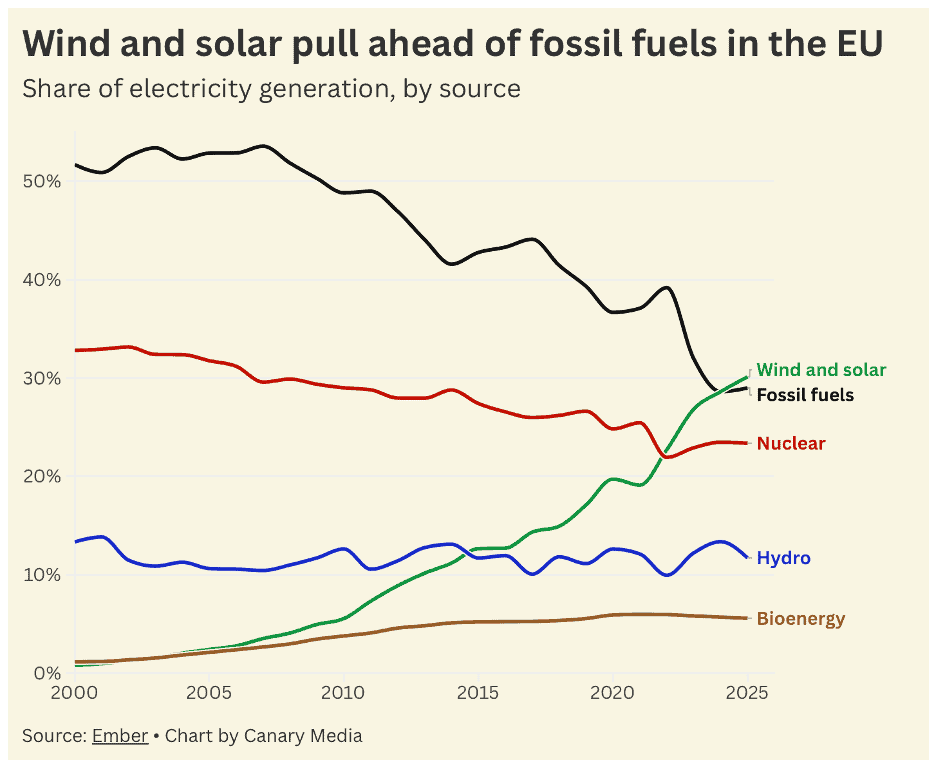

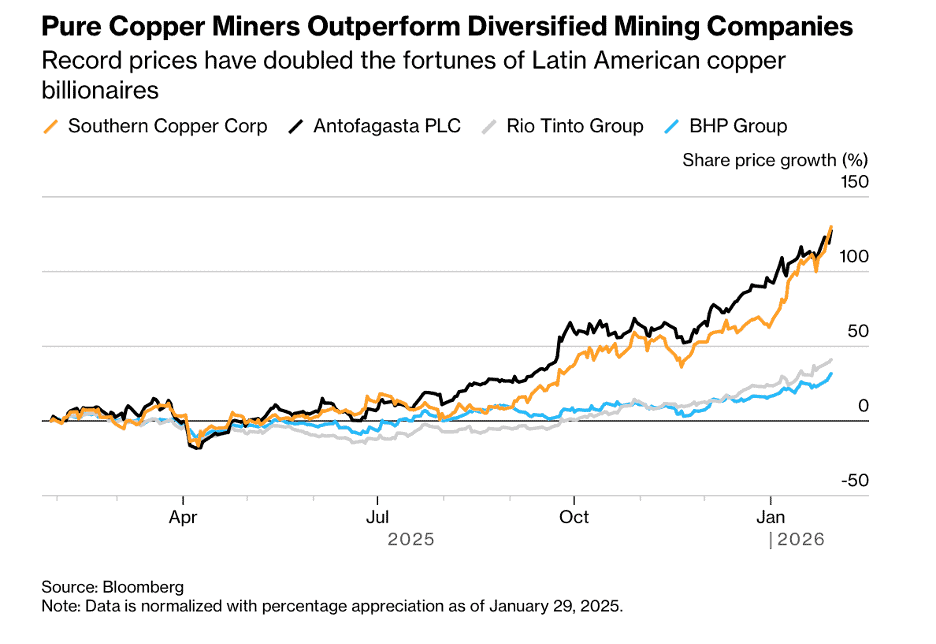

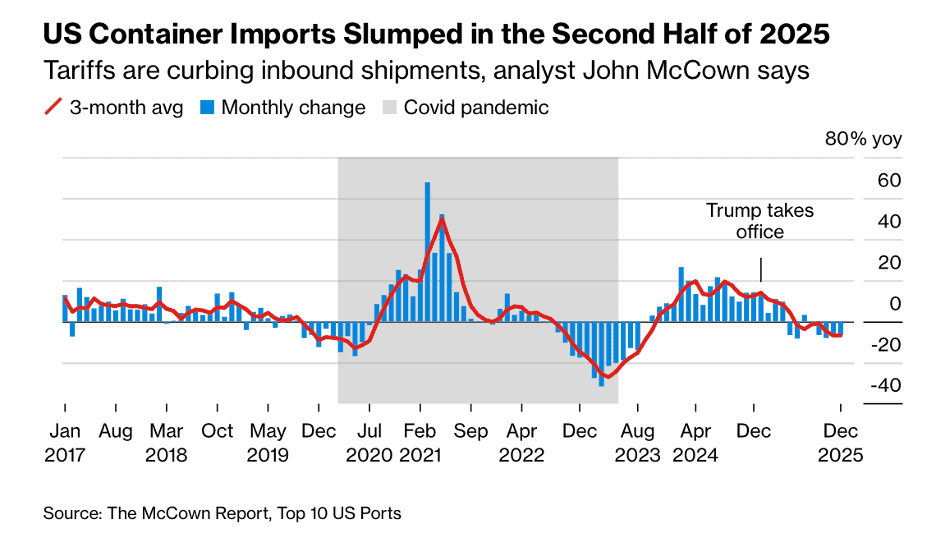

In this wide ranging issue we look at: global economic optimism, the movement of top economies up and down the ranking over time, where the world’s population is today, Europe and the AI race, wind and solar pull ahead of oil and gas in the European Union, the fast rise of copper prices, US container shipment changes. energy issues in Canada and China, uneven economic growth in the European Union, Poland entering the global top 10 economies, London as the leading world startup capital outside the USA, America’s top trading partners and the decline of US consumer confidence

Global franchise leaders continue to prioritize unit-level economics, operational efficiency, and disciplined expansion as the foundation for sustainable growth. At the same time, rising debt burdens and evolving regulatory frameworks underscore the importance of capital discipline and governance as brands expand internationally.

This edition’s book review highlights: “The Science of Scaling: Grow Your Business Bigger and Faster Than You Think Possible“ by Dr. Benjamin Hardy and Blake Erickson. This book challenges one of the most common myths in business—that growth is primarily about working harder or expanding incrementally. Instead, Hardy and Erickson argue that meaningful scale comes from strategic leverage, identity shifts, and systems thinking, not effort alone. Drawing on behavioral psychology, case studies, and performance science, the book reframes scaling as a process of elimination, focus, and multiplication, rather than accumulation.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Technology moves at digital speed; regulation moves at political speed. Global leaders must manage both.”, Christine Lagarde

“AI is not merely a tool for efficiency, but a transformative force reshaping workforce dynamic.”, Hussain Sajwani, UAE business leader

“Trade is changing……global commerce is being reshaped by both opportunity and friction.”, World Economic Forum trade insights from Davos 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #153:

How Major Economies Have Shifted Since 2000

America’s Top Trading Partners in 2025

US Container Growth Vanishes With World Trade Flows ‘Moving On’

US Consumer Outlook at Its Darkest in 12 Years

Franchise Global News Section: Chili’s®, Fat Brands, Starbucks®, YUM Brands and Wingstop®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please join me and 200+ other Southern California senior executives at the February 12th ReINVENT SUMMIT at the University of California, Irvine to learn the latest business trends across many diverse business sectors that can help you be more successful in 2026.

I will be interviewing Dr. Noel Hacegaba, CEO of the Port Of Long Beach, on his view of global trade going forward. Register to attend the afternoon of Thursday, February 12th at the Beall Center for Innovation at UCI at this link:

https://enpinstitute.com/event/emerge-26/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

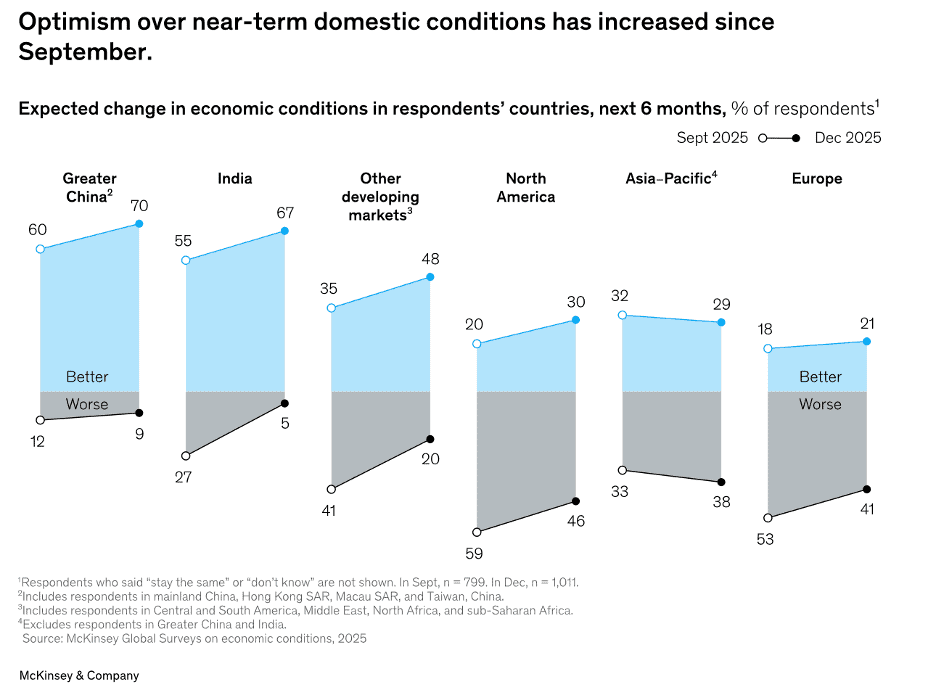

“Economic optimism returns – Executives around the globe have shown increased optimism about their domestic economies compared with just a few months earlier, according to a December 2025 McKinsey survey. Senior Partner Sven Smit and coauthors note that survey respondents in Greater China and India remain the most optimistic, with more than two-thirds in each region expecting economic conditions to improve in the next six months. Although sentiment has also brightened in North America and Europe, a significant share of executives in those regions still anticipate that conditions may worsen.”, McKinsey & Co., January 29, 2026

===============================================================================================

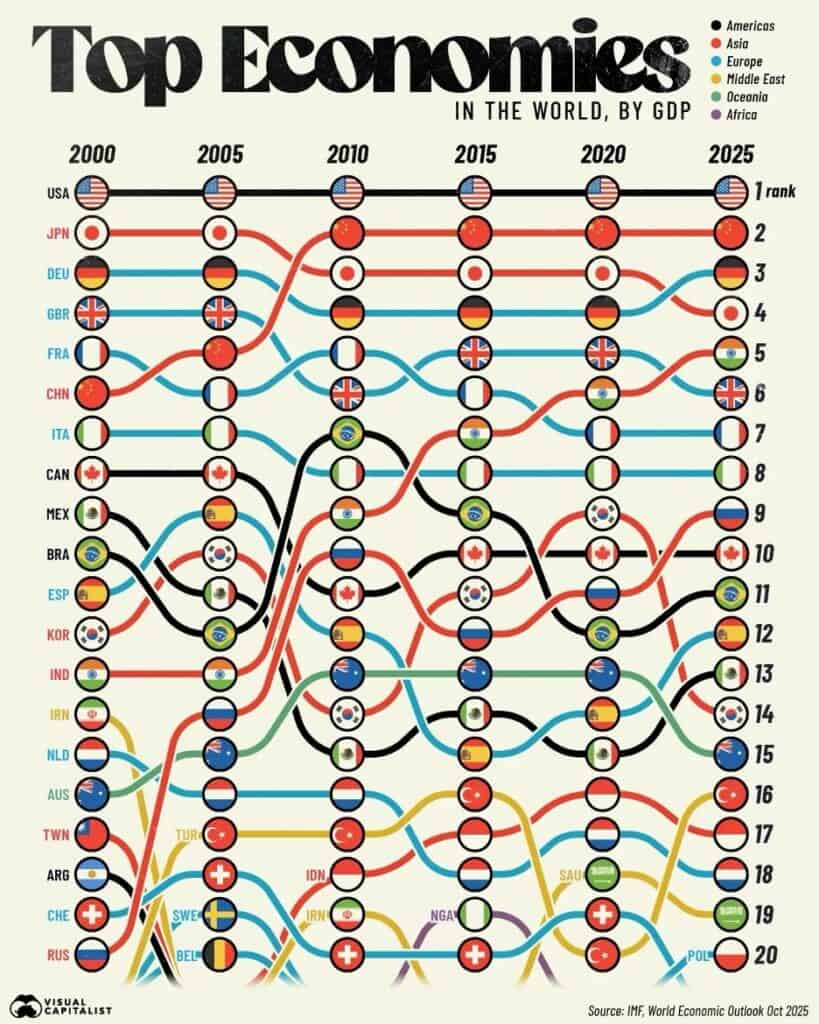

“How Major Economies Have Shifted Since 2000 – This graphic shows the top economies by GDP over the past quarter century, based on data from the International Monetary Fund. America has long held the title as the world’s largest economy, rising from a GDP of $10.3 trillion in 2000 to $30.6 trillion in 2025. China emerged as the second-biggest economy in 2010, with its economy growing by a factor of nearly 17 since 2000. The global balance of power looks very different than it did 25 years ago. In 2000, Japan was the world’s second-largest economy and China was only in sixth place. Since then, the global hierarchy has shifted dramatically, driven by the rapid rise of China and India.”, Visual Capitalist and the IMF, January 19, 2026

============================================================================================

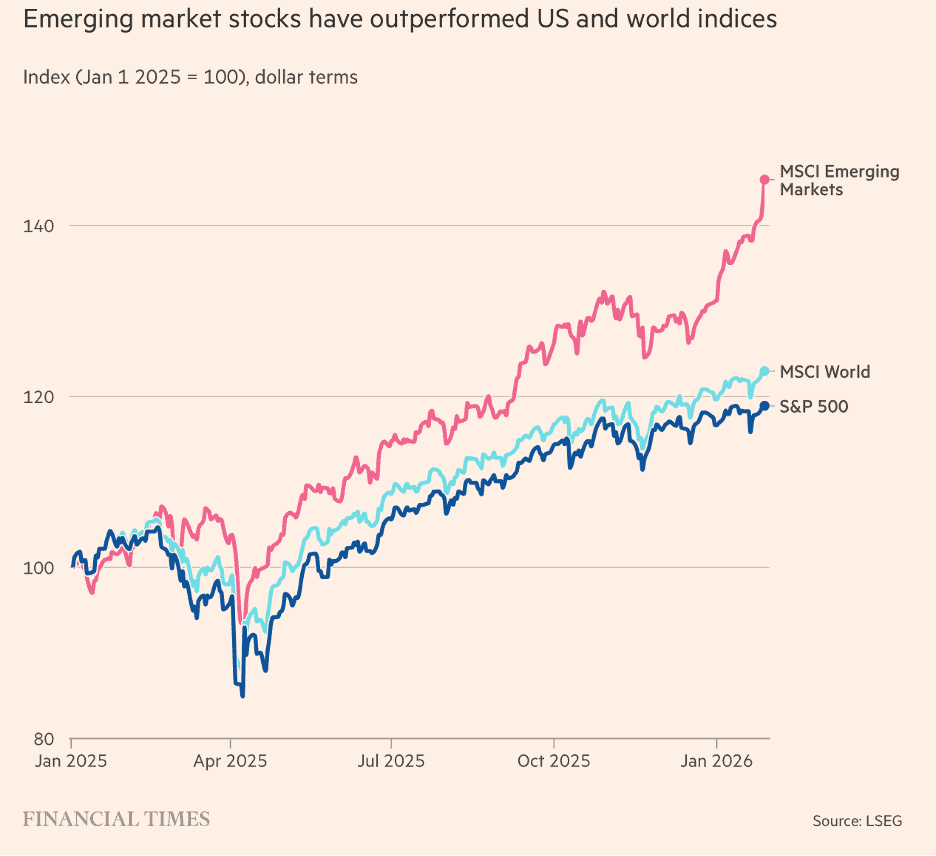

“Emerging markets make roaring start to 2026 as dollar slides – Stocks, bonds and currencies have all soared as dollar weakness puts focus on fundamentals. ‘Fundamentals in emerging markets have been improving for a while but it took the weak dollar for global investors to pay attention,’ said David Hauner, head of global emerging markets fixed-income strategy at Bank of America. Many emerging-market central banks have boosted interest rates well above inflation in recent years in an attempt to retain capital that was being enticed away by the rise in US interest rates since 2022, which helped drive a decade-long strengthening in the dollar. In comparison, the MSCI World index of advanced economy stocks is up 2.8 per cent this year, while the S&P 500 index of US blue-chip stocks is up 1.6 per cent.”, The Financial Times, January 29, 2026

=============================================================================================

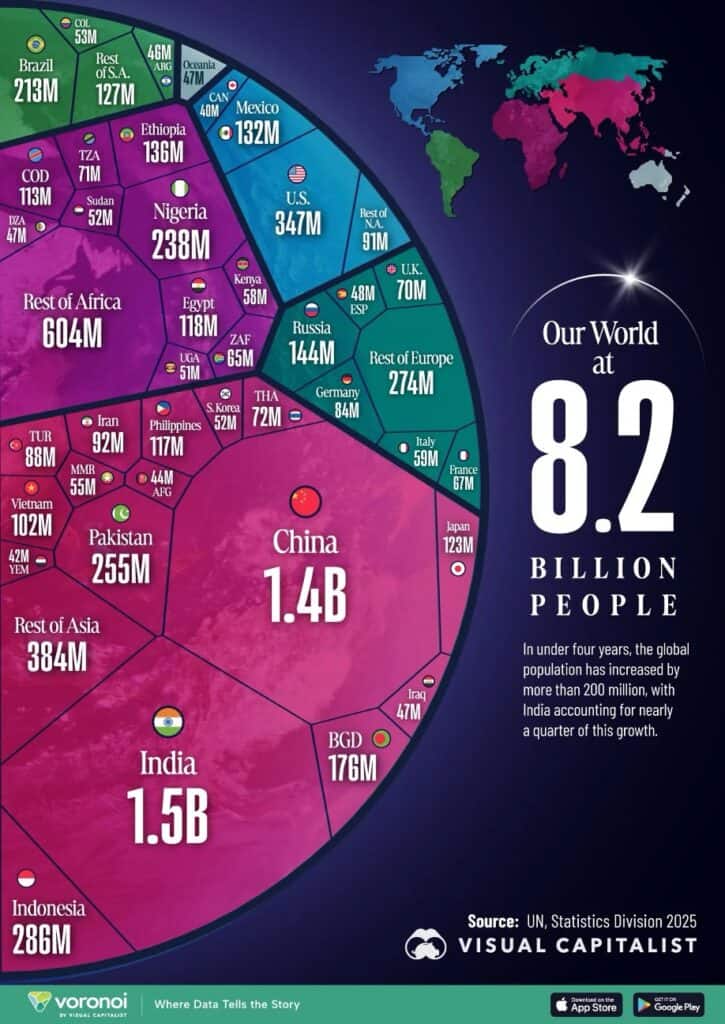

“The Entirety of the World’s 8.2 Billion Population in One Chart – The global population surpassed 8.2 billion in 2025, up from 8.0 billion in 2022. India drove nearly a quarter of global population growth over the period, with its population now close to 1.5 billion. After reaching 1 billion people in 1804, the world’s population has expanded eightfold over roughly 200 years. Since 2022, the global population has increased by more than 200 million despite widespread declines in birth rates. While the populations of China and Brazil have shrunk, India and Nigeria have been significant drivers of overall population growth.”, Visual Capitalist and the UN Statistics Division, January 25, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

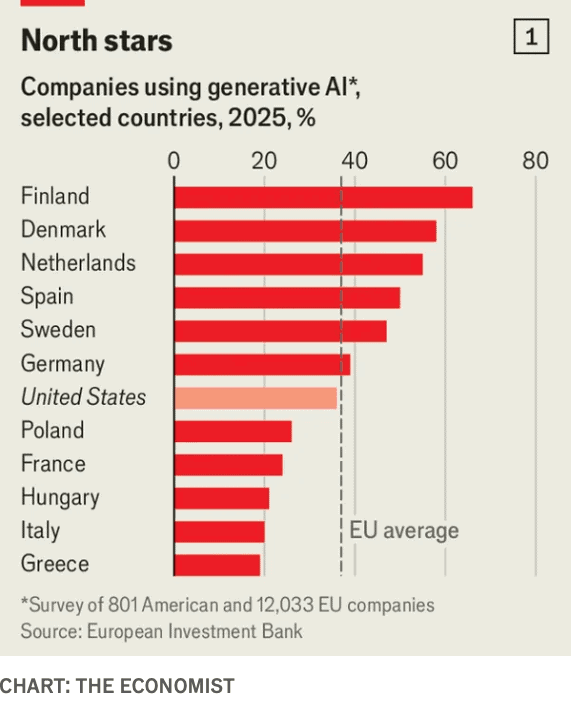

“Europe can still win the other AI race – Use of the technology is picking up pace. From cloud-computing to 5g, European companies have tended to be slow in adopting new technologies. Many feared that the same would happen with the most recent wave of so-called generative ai. The opportunity is big. Europe has a large industrial base and it is hunting for ways to boost economic growth. Already Europeans as individuals are among the most enthusiastic adopters of generative ai. According to research from Microsoft, a software giant, 32% of them use the technology, based on a population-weighted average of European countries, compared with 28% of Americans and 16% of Chinese.”, Economist, January 22, 2206

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“Dollar sinks to 4-month low and gold soars past $5,000 as yen leaps – Japanese currency climbs sharply on speculation of joint US-Japan market intervention, adding to pressure on greenback. The dollar, which analysts said was also suffering from concerns over a potential US government shutdown, fell 0.6 per cent on Monday against a broader group of major currencies, extending the losses sparked by last week’s Greenland crisis. As US risks pushed investors out of the dollar, they sought safety in precious metals, sending gold to an all-time high and silver to its highest level since 2008.”, The Financial Times, January 25, 2026

===============================================================================================

“In the EU, wind and solar surpass fossil fuels for first time – The watershed moment comes as the region looks to prioritize clean, domestic energy sources over dirty coal or imported natural gas. In 2025, wind and solar produced more electrons for the EU than fossil fuels did, per a new Ember report — the first time that’s ever happened over the course of an entire year. Though wind still produces more power for the EU than solar does, it was the blistering growth of the latter that drove last year’s achievement. Last year, coal accounted for just 9.2% of the region’s electricity, and several EU nations have already phased it out entirely or committed to doing so before 2030.”, Canary Media, January 30, 2026

============================================================================================

“Copper Billionaires’ Fortunes Double as Metal Prices Soar – The wealth of Latin America’s two richest copper billionaires has doubled over the past year, fueled by record-setting prices for copper. German Larrea and Iris Fontbona have generated $64 billion in new wealth in the past year, with Larrea’s fortune jumping to $71.6 billion and Fontbona’s net worth increasing 91% to $55.6 billion. Copper prices have soared due to shipments flowing into US warehouses, disruptions to copper supplies, and favorable longer-term factors, including the need for more cables for data centers, electric vehicles, and electronics. Copper supplies have been further disrupted by a string of incidents at major mines around the world, while a weakening dollar and lower interest rates create additional support for commodities. A normalization of supply disruptions could see prices retreat, but underpinning the market are favorable longer-term factors.”, Bloomberg, January 29, 2026

=============================================================================================

“US Container Growth Vanishes With World Trade Flows ‘Moving On’ – US container imports ended 2025 in a four-month skid that’s likely to lengthen this year as trade shifts to other economies to avoid President Donald Trump’s tariffs. Inbound volumes in December dropped 6.4% from a year earlier to 1.9 million 20-foot container units, after a 5.7% slide the previous month. The result is an upheaval in international commerce that ING Groep NV economists called “a global recalibration and the start of a new era” with the US lagging much of the world in growth rates for container shipping. Trump has used import taxes — actual or threatened — as leverage against trading partners, hoping to reduce the US trade deficit and increase domestic production. In response, major economies such as China and the European Union are seeking ways to reduce their reliance on the American market, and signing trade deals with other countries or blocs.”, Bloomberg, January 31, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“The Science of Scaling: Grow Your Business Bigger and Faster Than You Think Possible” by Dr. Benjamin Hardy and Blake Erickson challenges one of the most common myths in business: that growth is primarily about working harder or expanding incrementally. Instead, the authors argue that meaningful scale comes from strategic leverage, identity shifts, and systems thinking, not effort alone. Drawing on behavioral psychology, case studies, and performance science, the book reframes scaling as a process of elimination, focus, and multiplication, rather than accumulation.

For leaders operating across borders, the message is particularly relevant. Global growth amplifies complexity, and the authors are clear: without clarity of vision, disciplined priorities, and the right partnerships, scale actually destroys value. The book’s strength lies in its insistence that leaders must first scale themselves—their decision-making, time allocation, and tolerance for change—before attempting to scale organizations.

The Science of Scaling offers a mindset and framework that translates well to franchising, licensing, and cross-border expansion.

5 Takeaways for Global Business Leaders

- Scale follows focus, not geography

- Eliminate before you expand

- Leverage partnerships, not just capital

- Systems beat heroics at scale

- Leadership identity must evolve before the business can

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

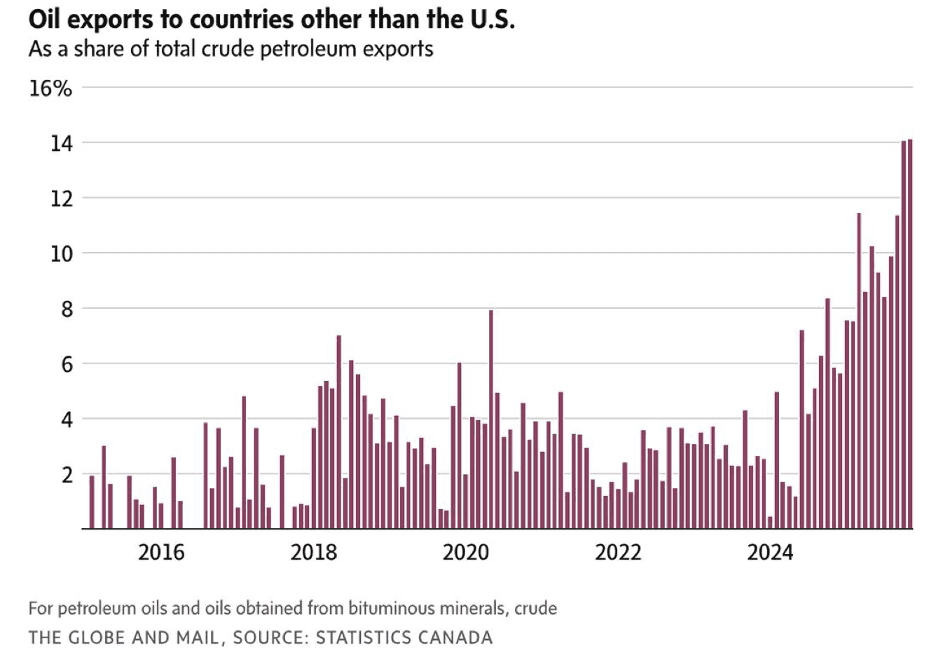

“Canada shipped a record share of oil to non-U.S. countries in November – The share of Canada’s crude petroleum flowing to countries other than the United States hit an all-time high in November, topping the previous month’s record, as the Trans Mountain pipeline boosted Canada’s trade diversification efforts. But while the latest trade numbers from Statistics Canada show the pivot away from the U.S. is working, the gains elsewhere have not been enough to make up for slumping demand from south of the border. Canada shipped 14.1 per cent of its crude to the rest of the world in November, with China alone accounting for 10 per cent of Canada’s total oil exports that month.”, The Globe and Mail, January 30, 2026

===============================================================================================

China

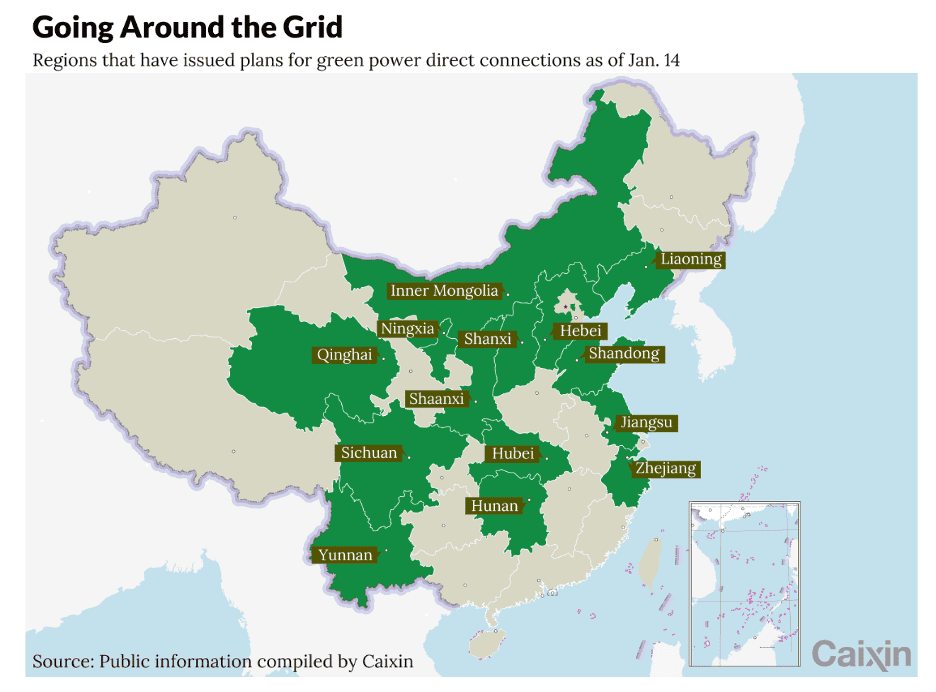

“China Takes on Green Energy Gridlock With Direct Connections – Unlike most wind farms across China, the 500-megawatt facility run by Swan Electric Power in Sanmenxia in the central province of Henan does not feed electricity into the national grid. Rather, it delivers power through a dedicated transmission line into a self-operated distribution network, bypassing the state-run utility system to directly supply end users. This setup — known as a “green power direct connection” — is emerging as one of Beijing’s most closely watched experiments in fixing a growing imbalance that has emerged from China’s energy transition. The country has built renewable capacity faster than its grid can handle it, leading to widespread waste. The policy-backed direct connection model is expected to ease pressure on the grid, lower energy costs for factories, and create an outlet for projects that might otherwise sit idle.”, Caixin Global, January 23, 2026

=============================================================================================

European Union

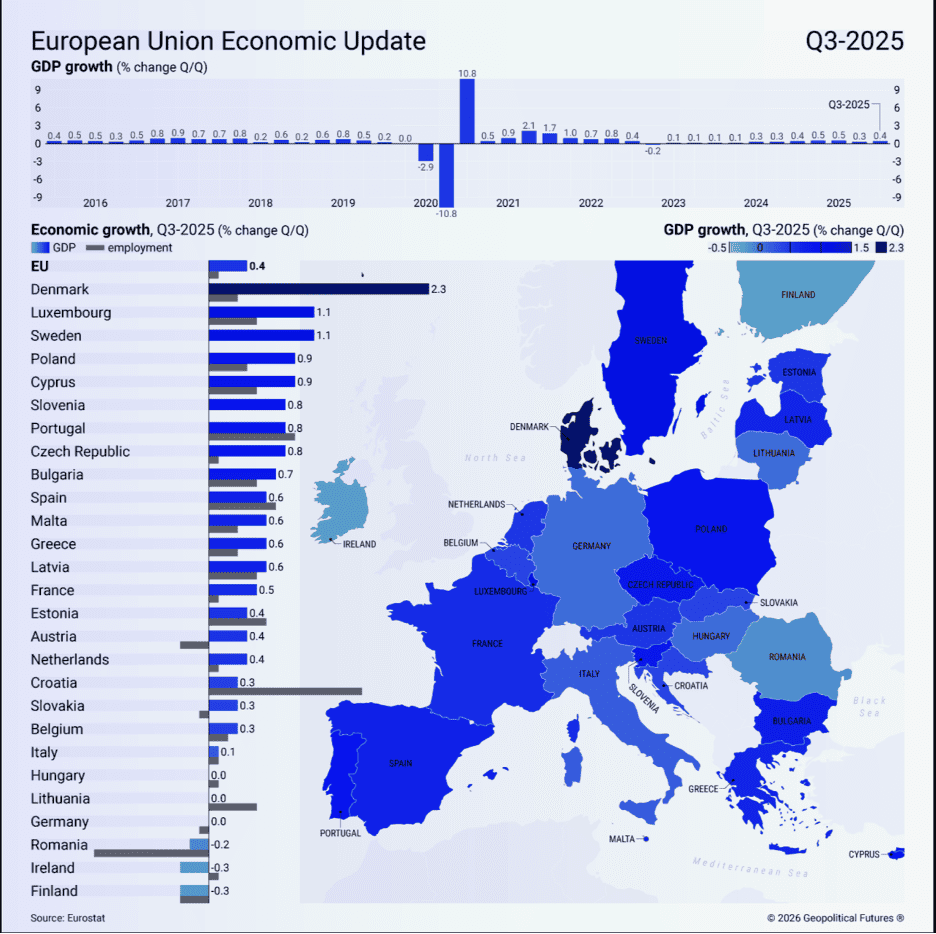

“Uneven Growth Continues to Plague Europe – Germany and France are lagging behind. Gross domestic product in the European Union grew 0.4 percent in the third quarter of 2025 relative to the previous quarter, demonstrating resilience in the face of immense challenges, including trade disputes with the U.S. and fierce competition from China. Denmark saw the highest rate of growth, driven by its pharmaceutical industry. However, growth across the Continent was again highly uneven. While less economically developed countries surged ahead (in Poland, for example, household consumption and rising consumer sentiment fueled increases in GDP and employment), key European heavyweights remain in limbo. In Germany, the EU’s traditional economic engine, unemployment reached a 12-year high, and political instability in France is also leaving its mark on growth. Additionally, Europe’s shift away from cheaper Russian energy has left it dependent on a limited number of costlier alternatives.”, Geopolitical Futures, January 30, 2026

=============================================================================================

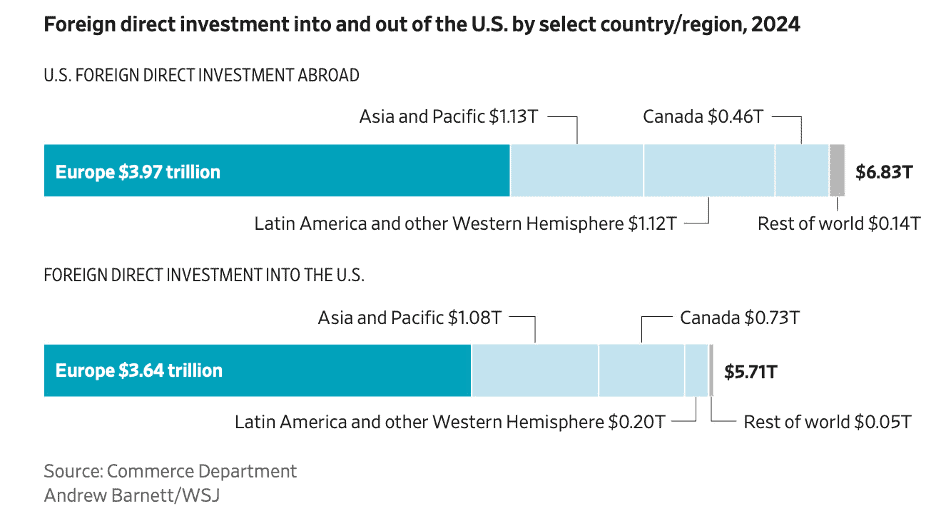

“What a Break With Europe Means for the American Economy – Europe is the U.S.’s biggest trading partner, largest investor and closest financial ally. The economies of the U.S. and Europe are intertwined. The European Union is the U.S.’s biggest trading partner—and Europe is the largest source of foreign direct investment in the U.S., with $3.6 trillion invested into the U.S. as of 2024. It goes the other way, too: U.S. companies make a fortune selling software, financial products and oil across the Atlantic. While the trans-Atlantic goods trade has grown more slowly since the 2007-09 recession, U.S. services exports have continued to expand rapidly. That includes financial, legal and insurance services, but increasingly centers on digital services and cloud computing provided by leading American tech companies such as Microsoft, Amazon.com, Google and International Business Machines. The European Union is the largest destination for U.S. services exports, which for the bloc totaled $294.7 billion in 2024.”, Wall Street Journal, January 19, 2026.

============================================================================================

Poland

Poland

“Poland’s Economy Set to Enter Global Top 20 Following Another Strong Year – Strong private consumption and sustained public investment helped the economy hit $1 trillion in 2025. The milestone, confirmed by data released Friday by the country’s statistics agency, likely lifted Poland into the world’s top 20 economies for 2025. It is expected to supplant Switzerland, which hasn’t yet released its end-of-year tally. Poland now sits right behind No. 19 Saudi Arabia’s $1.3 trillion economy. Three-and-a-half decades ago, under an isolated communist regime, the purchasing power of an average Pole—adjusted for local prices—was on par with Jamaica. Now, it’s higher than Japan. The European Commission expects Poland’s budget deficit to narrow to 6.3% of GDP in 2026.”, The Wall Street Journal, January 30, 2026

============================================================================================

United Kingdom

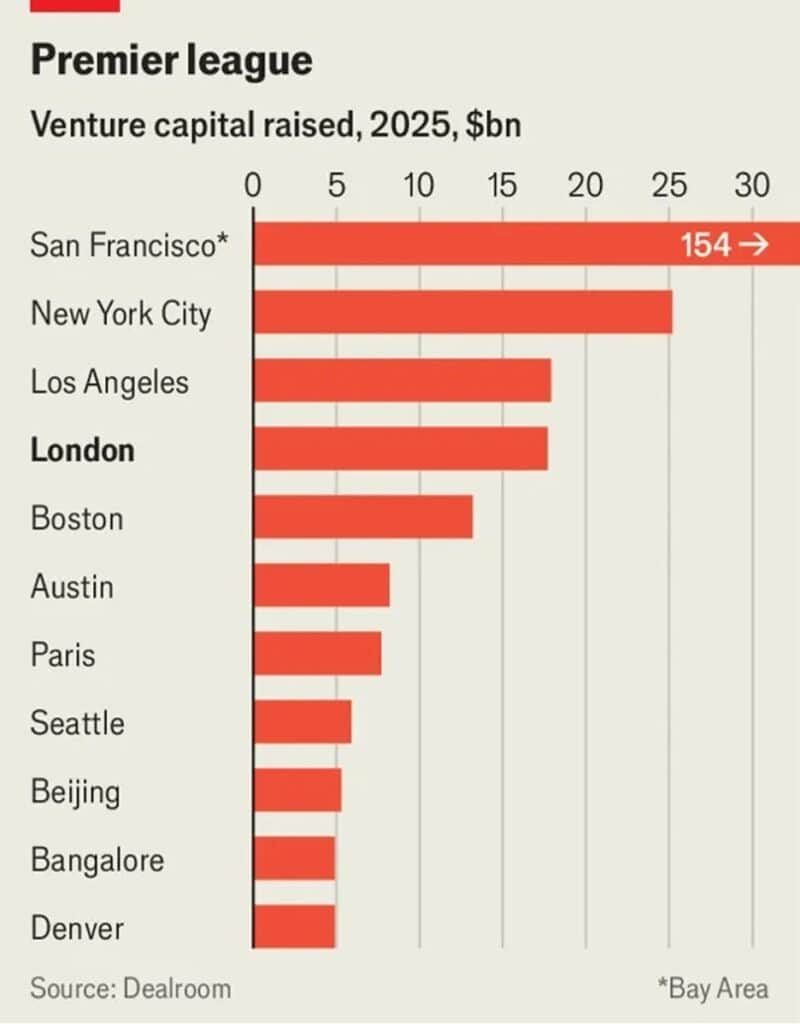

“How London became the rest of the world’s startup capital – Outside America, no other city comes close. London is one of the best places in the world to start a company. It has produced more unicorns ($1bn-plus startups) than Berlin, Paris and Tokyo combined. Their alumni are now spawning a second generation of firms. It is the world’s fourth-largest venture hub, according to Dealroom, a data provider. In 2025 its startups raised $17.7bn, behind only the Bay Area, New York and Los Angeles. Three main ingredients explain the city’s enduring success. The most important is talent. London is one of the world’s most diverse startup hubs. More than half of Britain’s fastest-growing startups were founded by immigrants. Capital is the third ingredient. London struggles to fund companies at later stages (hence the flight problems). But it excels at nourishing them early on and is beginning to attract more specialist investors for that crucial early stage.”, The Economist, January 26, 2026

===========================================================================================

United States

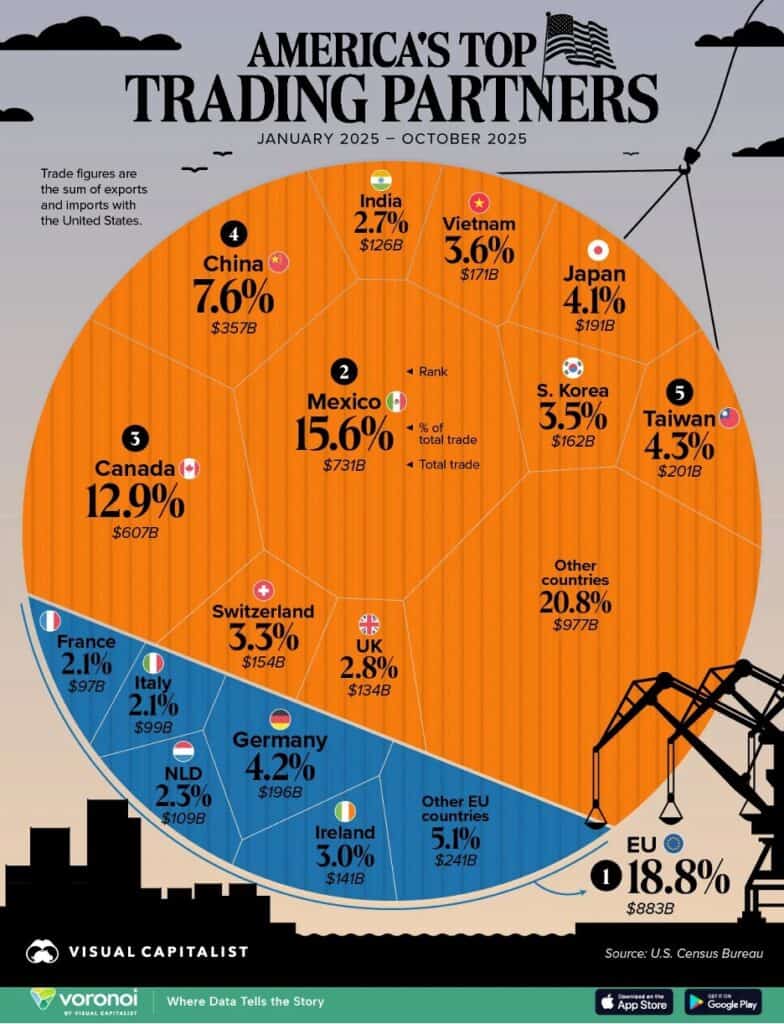

“America’s Top Trading Partners in 2025 – This graphic shows America’s biggest trading partners in 2025 through October, based on data from the U.S. Census Bureau. U.S. bilateral trade reached $4.7 trillion between January and October 2025, in a volatile year for trade policy. The European Union accounted for 18.8% of all U.S. trade in the first 10 months of 2025, valued at $883.3 billion. China ranks as America’s fourth-largest trading partner, with U.S. imports declining 26.7%, given rising tensions. In August 2025, the U.S. and EU agreed to a framework that set a 15% tariff ceiling on most goods, while existing 50% U.S. tariffs on steel and aluminum were left in place for all global trading partners. Mexico follows, with $731.2 billion in cross-border trade in 2025. After the U.S. announced tariffs on Mexican imports in February 2025, subsequent negotiations led to delays and partial exemptions. Ranking in third is Canada, with $606.7 billion in trade value.”, U.S. Census Bureau and Visual Capitalist, January 25, 2026

============================================================================================

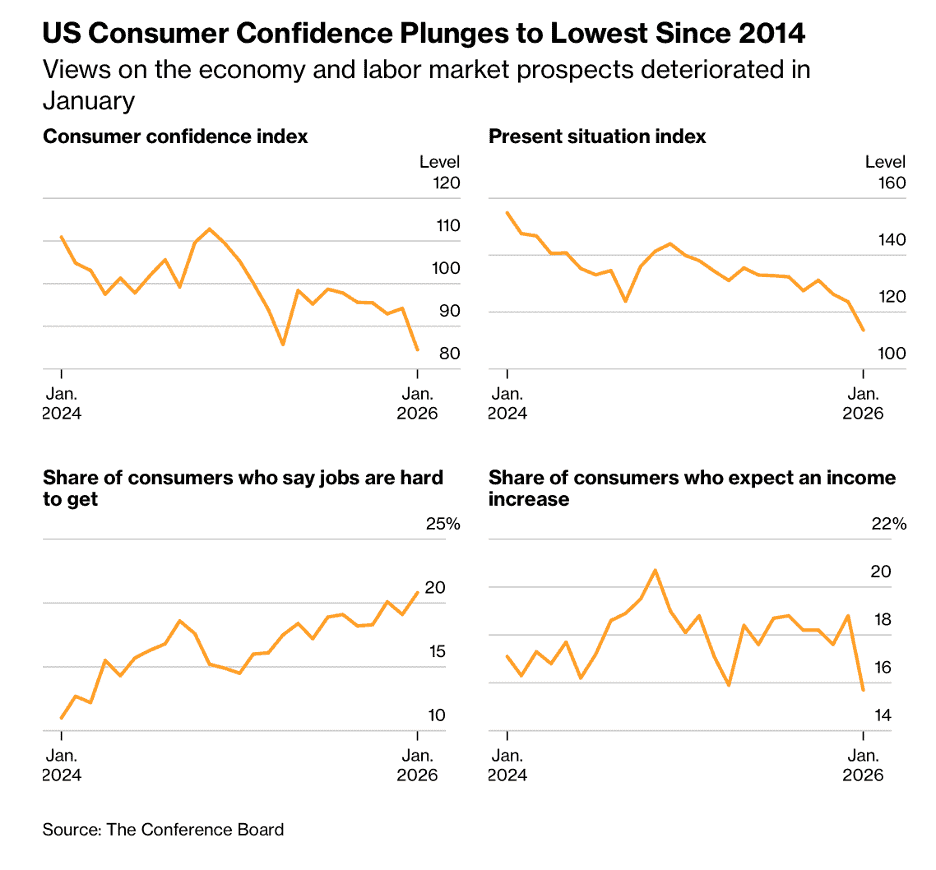

“US Consumer Outlook at Its Darkest in 12 Years – US consumer confidence plummeted in January to the lowest level in 12 years on more pessimistic views from Americans worried about the nation’s economy, inflation and a weakening labor market. The gauge by the Conference Board decreased to 84.5, from an upwardly revised 94.2 last month, data out Tuesday showed. The figure was the lowest since May 2014 and fell short of all estimates in a Bloomberg survey of economists. In write-in responses to the survey, consumers often mentioned prices of oil, gas and groceries, said Dana Peterson, chief economist at the Conference Board. Mentions of politics, the labor market and health insurance also rose.”, Bloomberg,

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“How Franchise Economics Can Fuel YUM’s Next Growth Cycle – Yum! Brands is making franchise economics the core driver of unit growth and long-term value creation. KFC and Taco Bell grew system sales and restaurant margins despite inflation in labor and commodities. YUM is using scale, supply-chain leverage and the Byte platform to boost franchise productivity. Yum! Brands, Inc.’s next growth phase appears increasingly tied to a single, deliberate priority: improving franchise-level economics. Management has made it clear that unit expansion, margin durability and long-term value creation all hinge on how attractive the four-wall economics look for franchise partners. The strategy is already showing traction. Yum! Brands delivered solid system sales growth alongside expanding restaurant-level margins at both KFC and Taco Bell, despite inflationary headwinds in commodities and labor.”, Zacks, January 25, 2026

===========================================================================================

“More of the same’ for Chili’s as sales soar again – The chain seems to have perfected a formula for growth in casual dining and shows no signs of letting up. Next up is a new chicken sandwich and remodeled restaurants. Same-store sales jumped 8.6% year over year for the three months ending Dec. 24, continuing a spectacular run since CEO Kevin Hochman arrived in 2022 with a plan to revive the Dallas-based casual-dining chain. The sales growth included a 4.4% price increase, 2.7% traffic growth and a 1.5% mix improvement. In an earnings call Wednesday, the company chalked up its ongoing momentum to the playbook Hochman put in place nearly four years ago: Improved food and operations backed by widespread, value-based marketing.”, Restaurant Business, January 28, 2026

============================================================================================

““Wingstop’s COO Revival: Raj Kapoor’s Rise Amid Expansion Push” – Wingstop reinstates COO role with Rajneesh Kapoor’s promotion, targeting ops amid 2025 sales dips and 475+ new units. Tech like Smart Kitchen drives efficiency as chain eyes 10,000 stores globally. Wingstop’s franchise-heavy model—98% franchised—relies on such efficiencies. Domestic average unit volumes hit $2.1 million in 2024, with pilots showing Smart Kitchen slashing ticket times nearly in half via AI-driven demand forecasting using over 300 variables like weather and sports schedules, as detailed by Restaurant Business Online.”, Web Pro News, January 25, 2026

===========================================================================================

“Starbucks China Revenue Jumps Amid Restructuring Push – Starbucks China s revenue is projected to grow by 11 percent in the fourth quarter of 2025. The company’s China business saw comparable store sales grow 7% during the period after years of stagnation, driven by a 5% rise in comparable transactions and a 2% jump in average ticket, the report said. In November, Starbucks announced a deal to form a joint venture (JV) with private equity firm Boyu Capital to operate its retail business in China, with the transaction expected to close in the spring, subject to regulatory approvals. Overall, Starbucks posted total revenue of $9.9 billion for the quarter, a 5.5% increase, while net income dropped 62.4% to $293 million. However, the international segment saw a 19% rise in operating income, helped by cost reductions after the company classified its China retail assets as held-for-sale and ceased related depreciation and amortization.”, Caixing Global, January 29, 2026. Compliments of Paul Jones, Jones & Co., Toronto

===========================================================================================

“Is UK franchising law about to change? Key takeaways for businesses. The UK government may soon take a closer look at the legislative framework governing franchising relationships, an area that, unlike many other jurisdictions, currently operates without a dedicated statutory framework, relying instead on contract law principles and voluntary codes. The result is a pronounced power imbalance between franchisors and individual operators. For now, franchising in the UK continues to rely on contract law and voluntary industry codes. However, if the government proceeds with reforms, we could see new requirements emerge around disclosure, fair‑dealing standards and more accessible arbitration routes.”, Lexology, January 26, 2026

==============================================================================================

“Fat Brands, burdened with heavy debt, declares bankruptcy – The owner of Fazoli’s, Round Table Pizza and several other brands is seeking Chapter 11 debt protection. The company owes $1.45 billion in securitized debt, most of which is through a series of whole business securitizations (WBS) taken out in 2020 and 2021 to fund several acquisitions. Yet those securitizations left the company without enough funds to cover its costs, effectively ‘starving the business,’ according to a court filing this week. Fat Brands started out as Fatburger, owned by Wiederhorn, until 2017 when the company acquired Ponderosa and Bonanza and went public that year through a so-called mini-IPO. It mostly acquired small brands at super-low prices until 2020, when it started using a series of securitization financings to acquire some $900 million worth of restaurant chains. It acquired Johnny Rockets and Round Table Pizza owner Global Franchise Group, along with Fazoli’s and Twin Peaks, and later Nestle Toll House Café and Smokey Bones. Fat Brands’ various restaurant chains have 2,200 locations and 7,500 locations.”, Restaurant Business, January 27, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking