EGS Biweekly Global Business Newsletter Issue 105, Tuesday, April 2, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

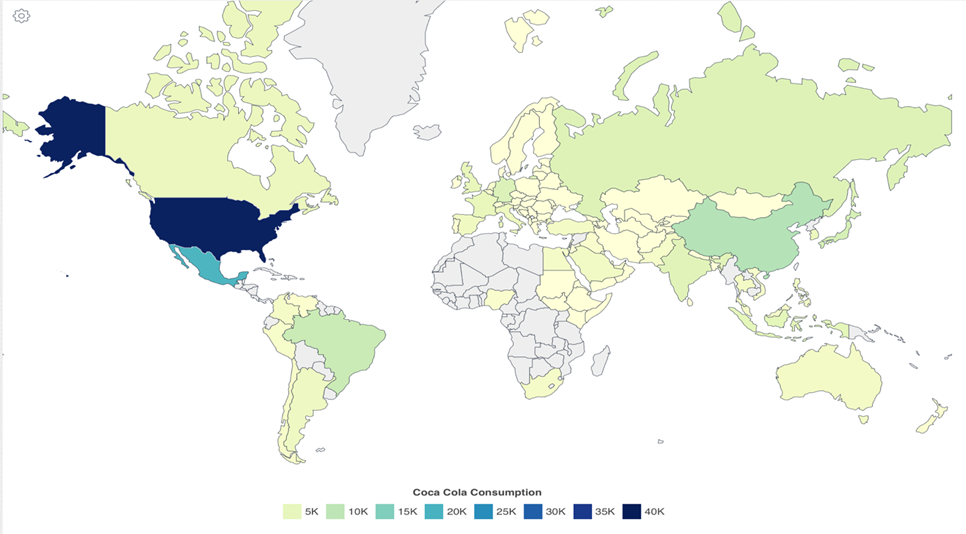

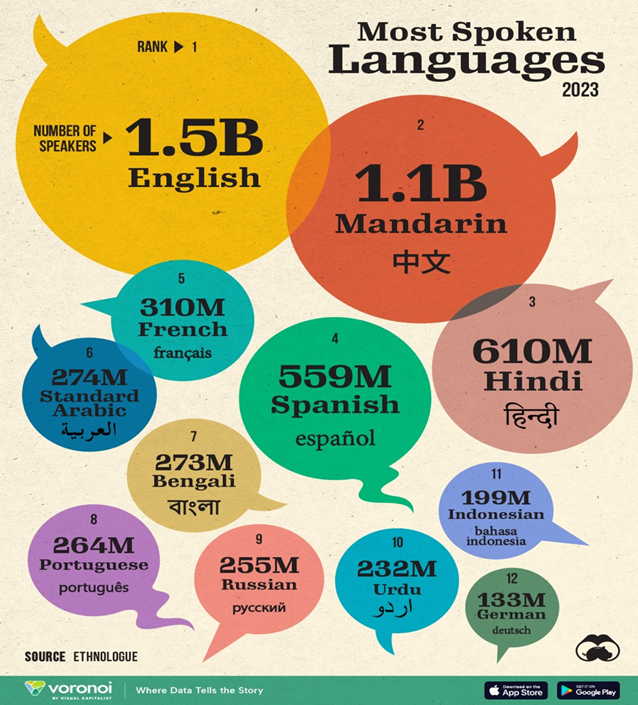

Introduction: Coca-Cola worldwide comsumption. Consumer sentiment is rising, inflation is falling, countries in Latin America are dropping interest rates, the first-ever call on a mobile phone was made 50 years ago. ‘Friendshoring’ is growing away from China. But China does finally remove the Australian wine boycott. China relaxes control of the flow of data in and out of country due to business pressure. And we look at the 12 most spoken languages in the world.

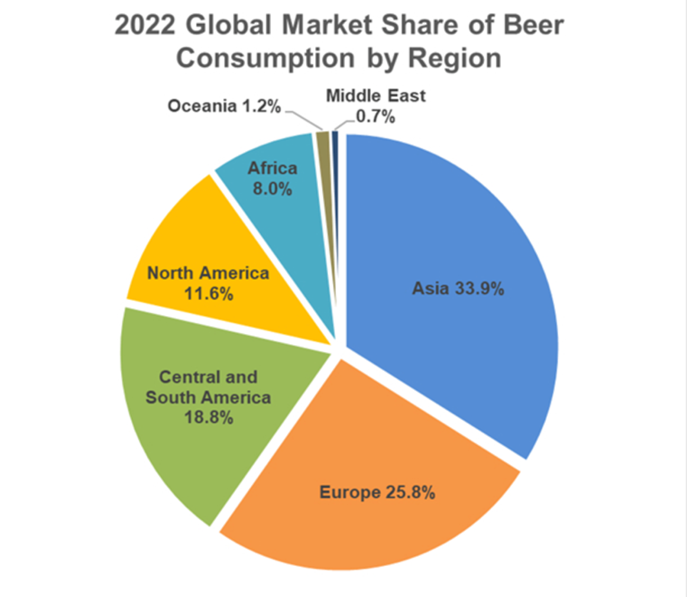

This year chocolate easter eggs were subject to ‘shrinkflation’. Egypt got another financial bailout. Starbucks® is now the second largest food brand in the world after McDonalds®, taking over from Subway®. Big tech increasingly has challenges finding energy to power their data centers. Global beer consumption explained. And AI data centers are spurring the use of more natural gas.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

Some of the information sources that we provide links to require a paid subscription for our readers to access. This means that some of the links to articles may not work if the reader does not have a subscription to that service. We maintain a paid subscription to ~30 information sources to be able to bring the reader the latest in global business trends.

First, A Few Words of Wisdom From Others For These Times

“Your time on earth is limited. Don’t try to ‘age with grace’, age with mischief, audacity, and a good story to tell.”, Compliments of Doug Bruhnke, Founder of the Global Chamber

“The secret of change is to focus all your energy not on fighting the old but on building the new.”, Socrates, father of Western philosophy

“Ideas are easy. Implementation is hard.”, Guy Kawasaki

Highlights in issue #105:

Coca Cola Consumption by Country 2024

China Loosens Cross-Border Data Rules on Business Pressure

U.S. Economic Growth Remains Robust, No Matter How You Slice It

Mexico becomes the latest major Latin American economy to cut rates

The 12 Most Spoken Languages In the World

Brand Global News Section: Anytime Fitness®, Dominos®, Olive Garden®, Orangetheory Fitness®, McDonalds®, and Starbucks®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Coca Cola Consumption by Country 2024 – In 1971, the Coca-Cola Company released a TV commercial that promoted quite lofty goals for a soft-drink company. At a tense time globally, “I’d Like to Teach the World to Sing” invited everyone on our planet to put aside their differences and come together to enjoy friendly music and a friendly beverage. Looking at total consumption figures by country, the number varies from year to year, but Mexico holds the honor as of 2023, with an average of 634 8-ounce servings consumed per year by the 128 million residents, slightly down from 665 reported in 2016.

With three exceptions – Cuba, North Korea, and Russia — Coca-Cola is everywhere.”, Our World In Data, March 2024

“The 12 Most Spoken Languages In the World – The top languages spoken in the world reflect economic trends, populated countries, and even colonial history. These are the most spoken languages around the world as of 2023. These figures come from Ethnologue, which publishes a list of the largest languages every year. English was born in the United Kingdom but today belongs to the modern world as the main international language of business and politics. That’s why it’s not very surprising to find English as the world’s most spoken language, with 1.5 billion speakers as of 2023.”, Visual Capitalist and Ethnologue, February 29, 2024

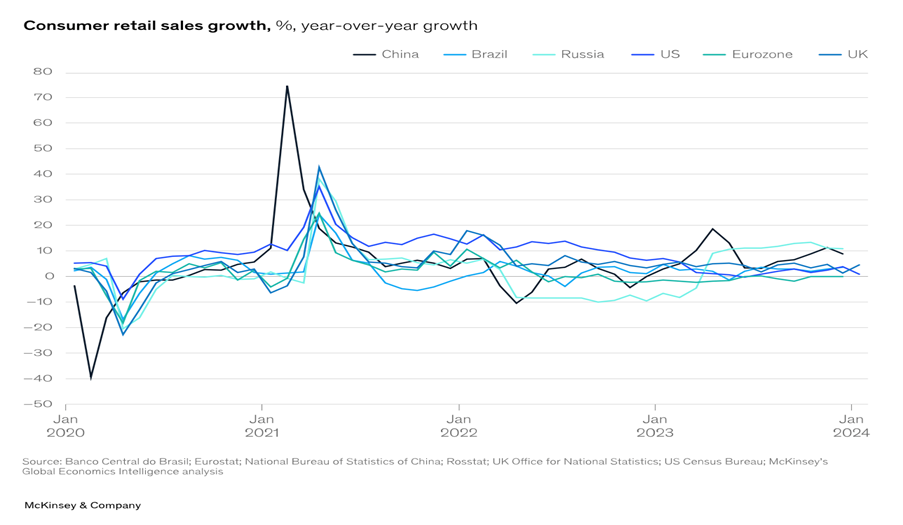

“(Global) Consumers Remain Upbeat – (In February 2024)Global economic uncertainty elevated but consumers upbeat; China faces deflation, real estate problems, and FDI decline; EU growth stagnant; high US interest rates affecting households and companies. Consumers remain upbeat as retail sales in the main economies show steady growth, despite elevated prices (Exhibit 1). Growing sentiment in the US saw the Consumer Confidence Index (Conference Board) rise to 114.8 in January, up from a revised 108.0 in December. By contrast, consumer confidence in Brazil dropped to its lowest level since May 2023 but is still 5.0 points higher than in January 2023. Automobile sales in India (which are a proxy for consumer sales) grew by 37.3% to 393,074 units (286,390 in December). Passenger vehicles saw their highest-ever sales in January, posting a growth of around 14% compared with the previous year. Meanwhile, official news from China was that consumption during the 2024 Spring Festival holiday underwent a notable increase.”, McKinsey & Co., March 20, 2024

“Global Beer Consumption by Country in 2022 – Global beer consumption exceeded 2019, showing a return to scale to pre-COVID levels despite unstable global conditions. China was the largest overall consumer for the 20th straight year, with Asia the leading region. The Czech Republic remained the top per-capita consumer for the 30th consecutive year.”, Kirin Holdings, December 22, 2023

“Replicating the Mobile Revolution – On April 3, 1973, Martin Cooper, an engineer from Motorola, made the first-ever call on a mobile phone to another engineer at a telecommunications rival company. Fifty years later, the mobile phone is arguably the most transformational invention in recent human history. In just 50 years, the number of people using the device went from zero to more than 7.1 billion as of 2021. Over 91 percent of the world owns a mobile phone, and 90 percent of the world is covered by a commercial wireless signal.”, The Center for Strategic & International Studies, March 19, 2024

“10 Conflicts to Watch in 2024 – More leaders are pursuing their ends militarily. More believe they can get away with it. 2024 begins with wars burning in Gaza, Sudan and Ukraine and peacemaking in crisis. Worldwide, diplomatic efforts to end fighting are failing. Gaza, Wider Middle East War, Sudan, Ukraine, Myanmar, Ethiopia, The Sahel, Haiti, Armenia-Azerbaijan and U.S.-China are the conflicts to watch this year.”, The International Crisis Group, January 1, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

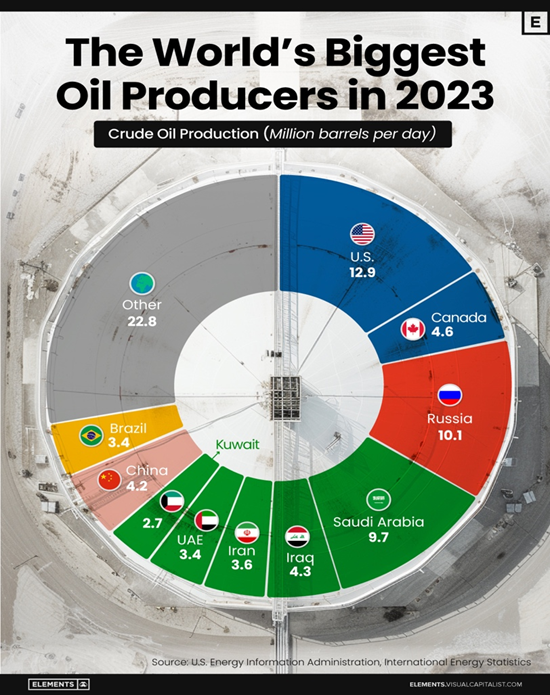

“Three Countries Accounted for One-Third of Global Oil Production in 2023 – Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage. This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA). In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.8 million barrels per day to global oil production. In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer.”, Visual Capitalist and the U.S. Energy Information Administration (EIA), March 26, 2024

“Big Tech’s Latest Obsession Is Finding Enough Energy – The AI boom is fueling an insatiable appetite for electricity, which is creating risks to the grid and the transition to cleaner energy sources. It isn’t clear just how much electricity will be required to power an exponential increase in data centers worldwide. But most everyone agreed the data centers needed to advance AI will require so much power they could strain the power grid and stymie the transition to cleaner energy sources. After a long period of stagnant demand for electricity, utilities are dialing up forecasts by astonishing amounts. The five-year projection of U.S. electricity demand growth has doubled from a year ago, according to a report from consulting firm Grid Strategies.”, The Wall Street Journal, March 24, 2024

“AI revolution will be boon for natural gas, say fossil fuel bosses – Data centres’ need for reliable power supply set to soar. A surge in demand for electricity to feed data centres and to power an artificial intelligence revolution will usher in a golden era for natural gas, producers say. AI’s soaring energy needs will rise well beyond what renewable energy and batteries can deliver, executives argue, making more planet-warming fossil fuel supplies crucial even as governments vow to slash their use.”, The Financial Times, April 1, 2024

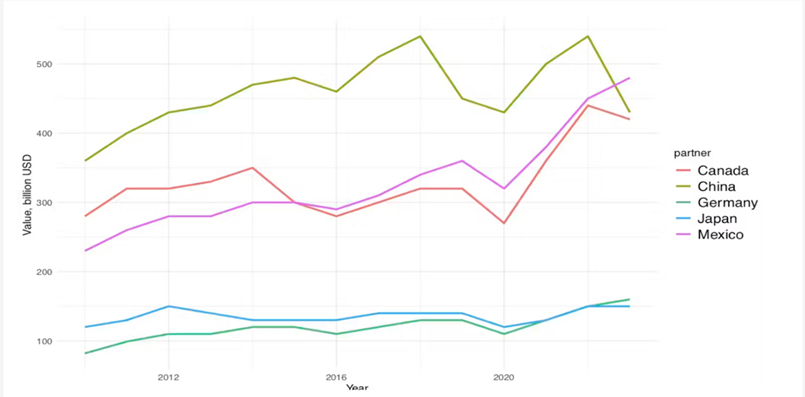

“Friend-shoring having the desired anti-China effect – Biden’s drive to trade more with allies and less with rivals has seen Canada and Mexico supplant China as America’s largest trading partners. One of the most high-profile results of a friend-shoring policy is that Canada and Mexico have recently replaced China as America’s largest trading partners by total trade, while Mexico has overtaken China as America’s top importer.”, AsiaTimes, March 21, 2024

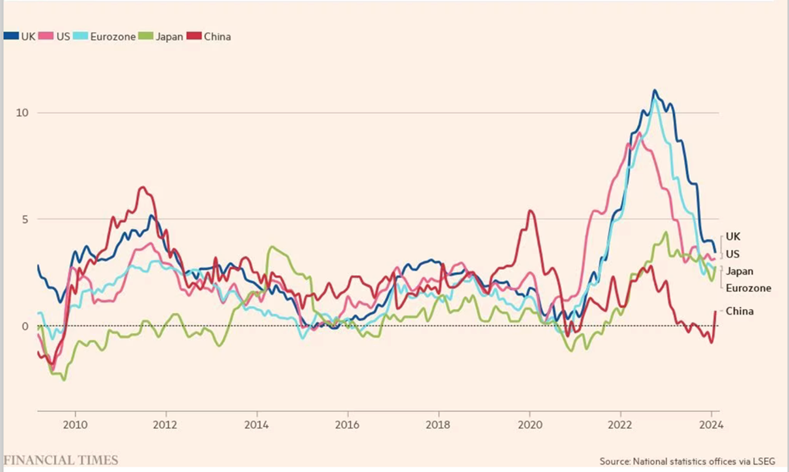

“Which country will be last to escape inflation? A new dividing line in the global fight. In January prices across the rich world rose by 5.7% year on year, down from a peak in late 2022 of 10.7%. This conceals wide variation, however. Some countries have slain the inflation beast. Others are still in the fight of their lives. Countries in the eu and Asia perform well; in the English-speaking world, inflation is taking longer to fade. Australia tops the ranking. Britain and Canada are not far behind. America is doing better, but even there inflation remains entrenched.”, The Economist, March 27, 2024

“‘Shrinkflation’ is coming for your Easter egg – Higher prices for smaller products are drawing the ire of politicians on both sides of the Atlantic. Last year, a Maltesers truffles luxury Easter egg could be snapped up in Waitrose for £8. Now it costs £13, according to UK consumer group Which? A Terry’s chocolate orange Easter egg with mini eggs has shrunk by 30g and a large Mars milk chocolate egg has dropped from 252g to 201g. It’s not just Easter eggs that are getting smaller and more expensive. So-called shrinkflation is hitting economies and consumers across the world and drawing the ire of politicians on both sides of the Atlantic.”, The Financial Times, March 28, 2024

“Global inflation and interest rates tracker – Inflationary pressures are beginning to wane but not all central banks have taken action yet. Central banks around the world are expected to lower borrowing costs as global inflation eases from the multi-decade highs reached in many countries over the past two years.”, The Financial Times, March 28, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“China removes punishing tariffs on Australian wine trade – China is removing punishing tariffs on Australian wine imposed more than three years ago, restrictions that have all but destroyed a $1.2 billion export market for hundreds of local wineries. The Chinese Ministry of Commerce, late on Thursday, said the tariffs would be removed on Friday. They were imposed in late 2020.”, The Australian Financial Review, March 28, 2024

China

“China Loosens Cross-Border Data Rules on Business Pressure – More information will be exempt, top internet regulator says Foreign businesses have complained about the data rules. China relaxed rules governing cross-border data flows, addressing a key concern of foreign businesses that had complained previous regulations were disrupting their operations. Data collected in international trade, cross-border travel, manufacturing, academic research, and marketing that don’t contain either personal information or “important” information will be exempt from security evaluations when transfered out of the country, China’s top internet regulator said in a statement Friday.”, Bloomberg, March 22, 2024

“Tim Cook opens Asia s biggest Apple Store – People flocked to the Jing’an Temple area in Shanghai for the opening of Asia’s biggest Apple Store on Thursday night, and to see Apple’s chief executive Tim Cook. Shanghai now has eight Apple Stores, compared to six in Hong Kong and five in Beijing. New York city has seven. Since its first store in Shanghai – Apple Pudong – opened in July 2010, more than 163 million people have visited Apple’s seven retail locations in the city.”, Shine.cn, March 21, 2024. Compliments of Paul Jones, Jones & Co., Toronto

Egypt

“After pushing its economy to the brink, Egypt gets a bail-out – But a record-setting investment from the UAE will not fix its chronic problems. On February 23rd Egypt and the United Arab Emirates (UAE) signed a $35bn deal to develop Ras el-Hekma, a wedge of land jutting off Egypt’s Mediterranean coast. Within weeks of the announcement, the IMF more than doubled the $3bn loan it promised Egypt in December 2022, to $8bn. The European Union (EU) announced a €7.4bn ($8bn) aid package, and the World Bank stumped up another $6bn. All told, Egypt hauled in more than $50bn, a sum that dwarfs the central bank’s $35bn in foreign reserves.”, The Economist, March 27, 2024

Japan

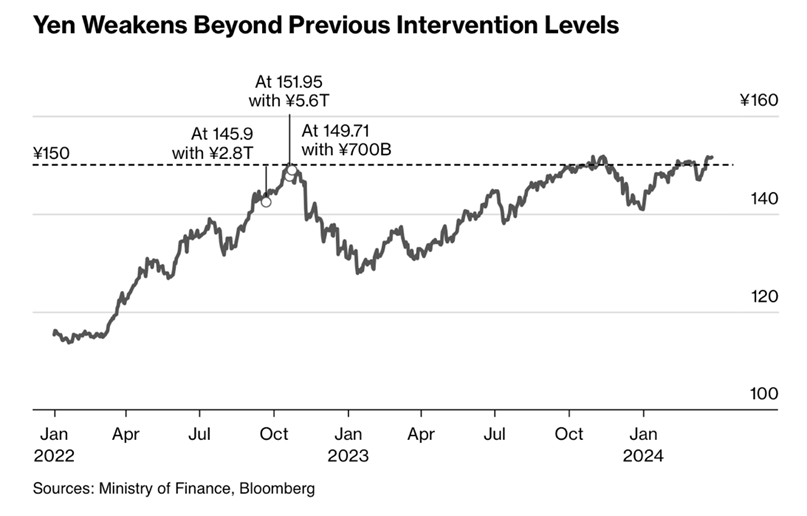

“Japan Steps Closer to Intervention as Yen Hits Lowest Since 1990 – Finance Minister Suzuki ramps up forex intervention threat. Yen may quicken drop if 152 barrier broken, say traders. The yen dipped to 151.97 versus the dollar early on Wednesday in Tokyo, before recovering after comments from Finance Minister Shunichi Suzuki, and his top currency official Masato Kanda indicating that Japan was ready to act.

South Korea

“South Korea prepares financial support for small businesses, builders – The government, together with commercial banks, plans to provide 40.6 trillion won ($30.3 billion) of financial support for small and medium-sized companies through loan guarantees and lower interest rates from April, the Financial Services Commission (FSC) said in a statement. The ministry in charge of financial policies also said it would continue to expand its joint scheme with commercial banks that returns interest income to small businesses and self-employed people who have taken out loans.”, Reuters, March 26, 2024

Mexico

“Mexico becomes the latest major Latin American economy to cut rates – Region has already begun unwinding its response to soaring inflation that has affected monetary policy around the world. The decision by the Bank of Mexico on Thursday to cut rates by 25 basis points to 11 per cent comes as most central banks in developed countries have yet to loosen monetary policy. Latin American central bankers’ swift response to soaring inflation after the coronavirus pandemic has transformed their credibility as they emerge from the most serious wave of price pressures in decades.”, The Financial Times, March 21, 2024

United Kingdom

“UK inflation falls to 3.4% as Bank of England mulls interest rate cut – Inflation slid faster than expected to its lowest level in two and a half years in February, strengthening hopes that the Bank of England will cut interest rates in the coming months, official figures showed. Inflation is now running at its slowest pace since September 2021. City analysts and the Bank of England had anticipated the rate to decline to 3.5 per cent. Inflation peaked at 11.1 per cent in October 2022, lifted by higher energy prices after Russia’s invasion of Ukraine.”, The Times of London, March 21, 2024

“UK Restaurants and Bars Cut Hours as Costs Soar by £3.4 Billion – Hospitality sector is facing higher wages and business rates Sites are reducing shifts and opening hours to cope with costs. Restaurants and bars across Britain are having to slash staff working hours to cushion the blow of a £3.4 billion ($4.3 billion) spike in annual costs, according to the head of the sector’s trade body. Kate Nicholls, chief executive officer of UKHospitality, said sites were also cutting back their opening hours to deal with a ‘tsunami of costs.’”, Bloomberg, April 1, 2024

“Domestic energy production falls to lowest level on record – Britain imported a net 41.1 per cent of its energy last year, up from 37.3 per cent in 2022, primarily from Norway and America. North Sea oil production last year fell to the weakest level since records began in 1948 and gas output was the second lowest, according to figures from the Department for Energy Security and Net Zero. A rise in wind, solar and hydroelectric output failed to offset the fall in more carbon-intensive fuels, which meant that total UK energy production was 9 per cent lower than in 2022 and down by more than two thirds on 1999, when domestic production peaked. Maintenance outages and plant closures meant that nuclear output was also at a fresh low.”, The Times of London, March 29, 2024

United States

“U.S. Economic Growth Remains Robust, No Matter How You Slice It – The Bureau of Economic Analysis said real gross domestic product grew 3.4% in the last three months of 2023, an upward revision from its previous estimate of 3.2%. That was driven by the fact that government spending, particularly at the local and state level, was higher than originally estimated. After trailing GDP dramatically throughout 2023, real gross domestic income jumped by 4.8% in the fourth quarter. It was the first quarter that GDI outpaced GDP growth since the third quarter of 2022.”, Barrons, March 28, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Anytime Fitness to Expand into United Arab Emirates – High-profile financier Mark Mobius leads an investment group that will bring Anytime Fitness® to the United Arab Emirates, according to a news release from the gym brand’s parent, Self Esteem Brands. The umbrella franchisor owns a portfolio of diverse health and wellness brands. With the expansion into the UAE, Self Esteem Brands will have Anytime Fitness clubs operating 24/7/365 in more than 40 countries and territories around the world. Anytime Fitness is a fast-growing brand that serves nearly 5 million members at more than 5,200 clubs globally.”, FranchiseWire, March 24, 2024

“3 Important Considerations in Adapting Your Restaurant Menu for Global Success – If you want to expand your restaurant franchise and reach a global audience, you must adapt your menu accordingly. Updating your menu items when you open locations in other countries is essential for your restaurant’s long-term stability and success. Recognize cultural sensitivities. Evaluate profit margins and cost considerations. Retain brand consistency while adapting.”, Franchising.com, March 29, 2024

“International Growth Session Highlights from the 2024 Multi-Unit Franchising Conference – A high-level panel discussion at last week’s 2024 Multi-Unit Franchising Conference (“How Franchise Brands Grow Outside Their Home Country”) provided advice—both encouraging and cautionary—for franchise brand attendees looking to expand outside of their national borders. Whether U.S. brands eyeing overseas growth, or international brands looking to expand into the U.S., the expert panel had something for everyone. Franchising, March 27, 2024

“Domino’s China Franchisee Expands in Smaller Cities For Growth – The Chinese franchisee of Domino’s Pizza Inc. is accelerating store expansions as consumers outside the country’s top cities show a bigger appetite for western food.The pizza chain wants to tap demand for fast food among residents in less prominent Chinese cities and towns that aspire to the lifestyle of glitzy megacities, Aileen Wang, chief executive officer of DPC Dash Ltd, also known as Domino’s Pizza China, told Bloomberg in an interview in Shanghai Thursday. Bloomberg, March 28, 2024

“Quebec franchisees sue Tim Hortons, claiming declining profits – Nearly a dozen Quebec franchisees are suing Tim Hortons QSR-T, claiming their profits have declined by millions of dollars in recent years. The store owners say the gap has narrowed between their own costs for supplies and menu prices, both of which are controlled by the company. Tim Hortons currently has more than 3,900 locations in Canada, approximately 615 of which are in Quebec. The company has acknowledged that franchisee profits fell during that time: The average Tim Hortons location made $320,000 in earnings before interest, taxes, depreciation and amortization (EBITDA) in 2018, a number that declined to $220,000 by 2022.”, The Globe and Mail, March 29, 2024

“Olive Garden’s earnings just pulled back the curtain on the economy: The rich are dining out while the poor are falling back. ‘We’re clearly seeing consumer behavior shifts,’ Darden CEO Rick Cardenas said in a third-quarter earnings call on Thursday. ‘Transactions from incomes below $75,000 were much lower than last year. And at every brand, transactions fell from incomes below $50,000.’ Meanwhile, transactions for higher-income individuals were higher than last year, according to the earnings call, so households earning at least $150,000 were dining out more.”, Fortune, March 22, 2024

“Second-biggest restaurant chain in the world behind McDonald’s will surprise you – The burger chain is the biggest-restaurant chain in the world by unit, according to a Restaurant Business report, a publication focused on the foodservice industry. Hot on the heels in the No. 2 slot this year is a newcomer. For the first time, coffee giant Starbucks pushed past Subway to become the second-largest restaurant chain in the world. The Seattle-based coffee brand added 3,000 new locations in 2023, bringing the total number globally to 38,587, according to data from Technomic, an industry research and consulting firm. Starbucks operates 2,000 more locations than Subway, which once was the largest chain in the world by total unit count.”, Penn Live, March 23, 2024

“Orangetheory Fitness and Self Esteem Brands Announce Intent to Merge as Equals, Creating a New Company Representing One of the Largest Footprints of Fitness, Health and Wellness Services……the new company will represent $3.5 billion in systemwide sales and approximately 7,000 franchise locations across 50 countries and territories on all seven continents. The merger will result in significant international scale for the new company, with continued investments in leading-edge data and analytics, technology, products and services that help franchisees across its brands outpace growing consumer demands for holistic health and wellness services.”, PR Newswire, February 29, 2024

“18 International Starbucks Bakery Items You Need To Know About……the drink selection — and even more noticeably, the bakery options — tend to differ drastically at Starbucks locations outside the U.S. This makes sense, of course. The retailer operates stores in a staggering 80 countries as of March 2024, after all, and has made a conscious effort to adapt to the local culinary culture in each market. Here are 18 international Starbucks bakery items you need to know about.”, The Tasting Table, March 23, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. And our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

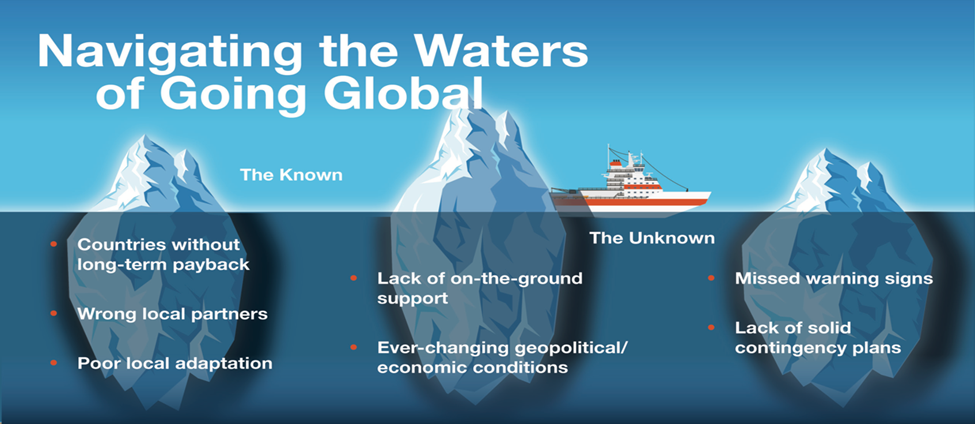

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link: