Biweekly Global Business Newsletter Issue 124, Tuesday, December 24 , 2024

Navigating Global Business in Uncertain Times:

Insights for 2024 and Beyond

Commentary about the 124th Issue: I wish all our 4,600 subscribers Happy Holidays and a prosperous and healthy 2025. It will certainly be an ‘interesting’ year for global business!

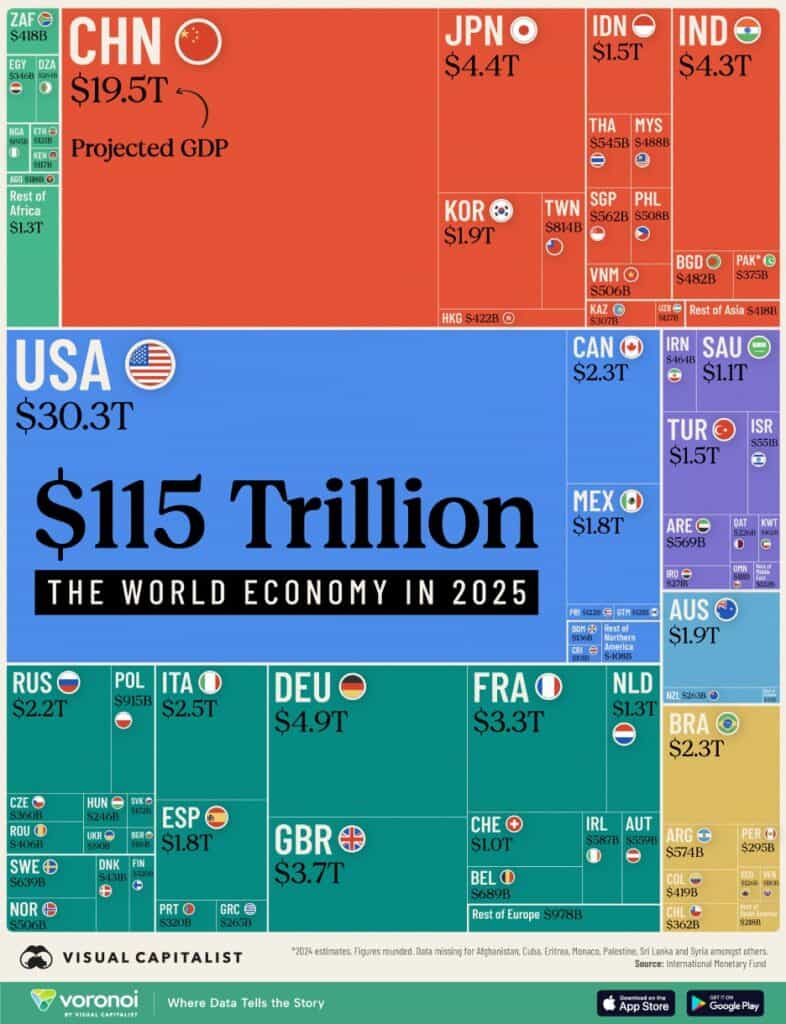

In conjunction with our last edition for 2024, we release the December 2024 GlobalVue™ 40 country ranking as places to do business, have a graphic showing the countries that make up US$115 trillion of gross domestic product (GDP) as well as a graphic that show the US$102 trillion of debt!

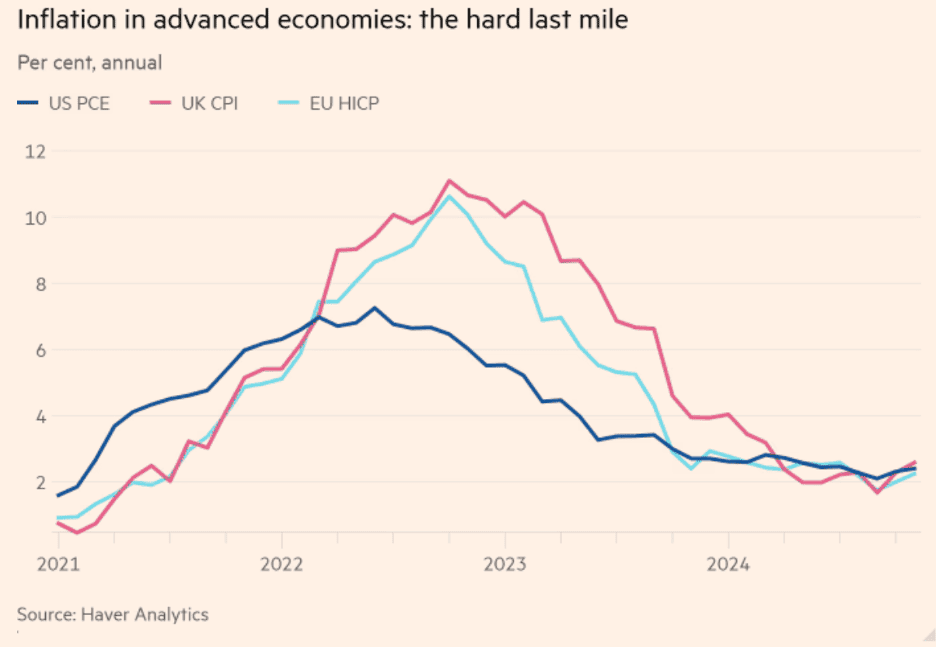

Inflation in first world countries is stubbornly staying a bit above 2% on an annual basis. The ‘Economist’ says Spain had the best major country economy in 2024. At the end of the year, we had 76 national elections which will have consequences on places to do business in 2025. And do not miss the special article by Don Southerton on the Impeachment of South Korean President Yoon Suk-yeol and the International Business Implications.

A case study on how NOT to successfully take a global brand into China and India. Versus three entrepreneurs who started their first Wingstop® fried chicken franchise six years ago in the United Kingdom and have just sold their business for a whopping £400 million!

The Future: After November 5th, searches for “Trump’s tariff plan” increased by more than 1650%, and queries about “who pays tariffs” rose by 350% (The Nightly, Australia). We expect that by the February 4th edition of our newsletter the business world will know much more about what tariffs will be imposed by the USA.

One More Thing: The price of cocoa just hit US$12,000 per ton, up from US$4,000 per ton in February of this year!!!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier. Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Done is better than perfect.”, Sheryl Sandberg

“Successful people keep moving. They make mistakes, but they don’t quit.”, Conrad Hilton

“Action is the foundational key to all success.”, Pablo Picasso

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #124:

The $115 Trillion World Economy in One Chart

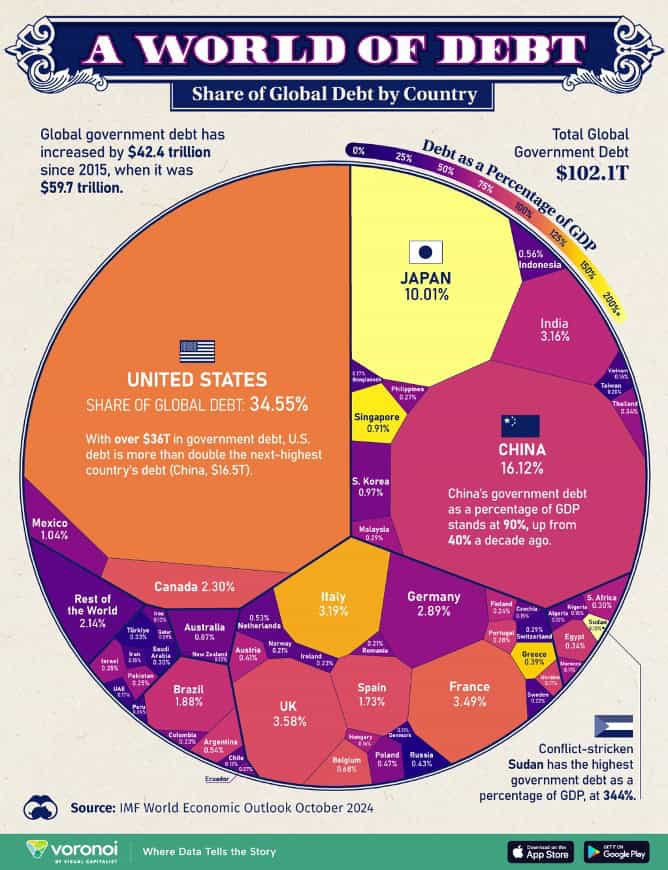

Visualizing $102 Trillion of Global Debt in 2024

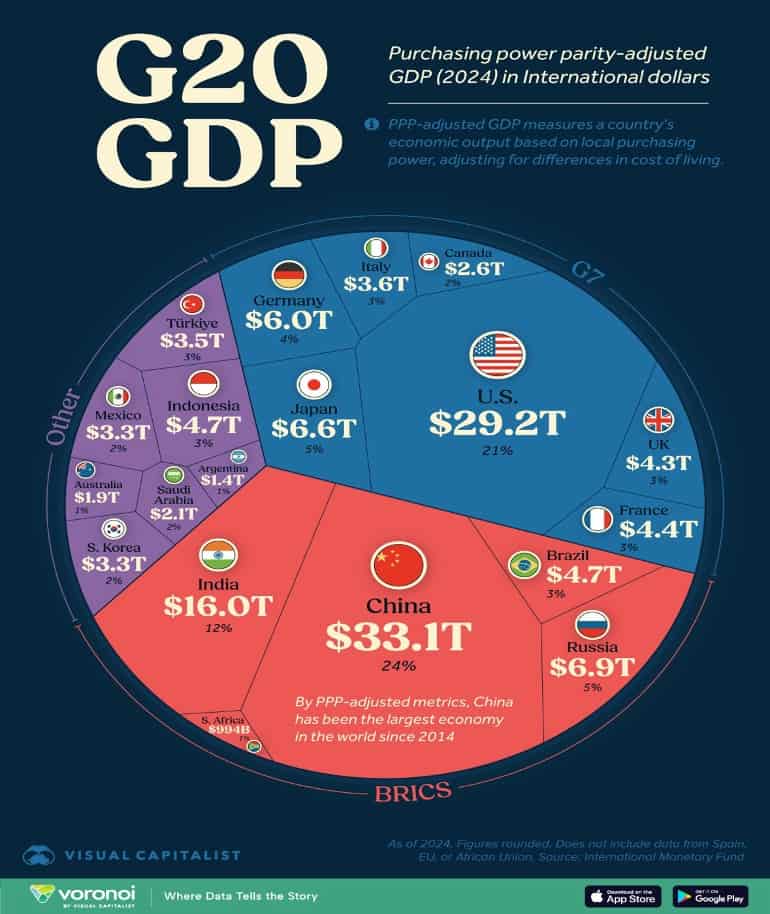

The World’s 20 Largest Economies, by GDP (PPP)

Why Dunkin’s Expansion Into China And India Was A Total Failure

How Poland became one of Europe’s biggest success stories

The Impeachment of South Korean President Yoon Suk-yeol and the International Business Implications

Brand Global News Section: Burger King®, Dominos¢, Dunkin® and Wingstop®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

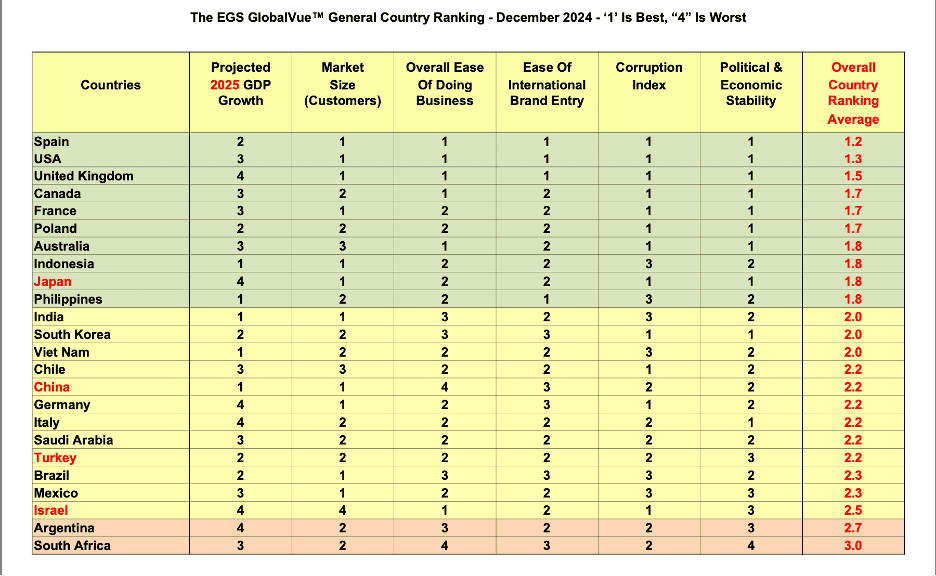

GlobalVue™ December 2024 – This is the short version of the 40 country December ranking as places to do business in 2025. Since the September 2024 version, Japan has gone up the ranking while China, Isreal and Turkey fell down the chart. The 76 natiobnal elections in 2024 had consequences. Many countries will see changes in business taxation and regulations due to elections. Click on the chart to download the full 40 country version.

=======================================================================================

“Visualizing $102 Trillion of Global Debt in 2024 – In 2024, global public debt is forecast to reach $102 trillion, with the U.S. and China largely contributing to rising levels of debt. As the world’s largest economy, the U.S. debt pile continues to balloon, accounting for 34.6% of the world’s total government debt. Over the next five years, China’s debt to GDP ratio is projected to hit 111.1% of GDP, up from 90.1% in 2024. In Europe, the UK has amassed the most debt, about $3.65 trillion, equal to 101.8% of GDP. This is far higher than the regional average, standing at 77.4% of GDP in 2024. Europe has a lower debt to GDP than North America and the Asia-Pacific, but European budgets likely face increasing pressures looking ahead, due to sluggish economic growth, trade wars, and aging populations”, Visual Capitalist & the IMF, December 17, 2024

===========================================================================================

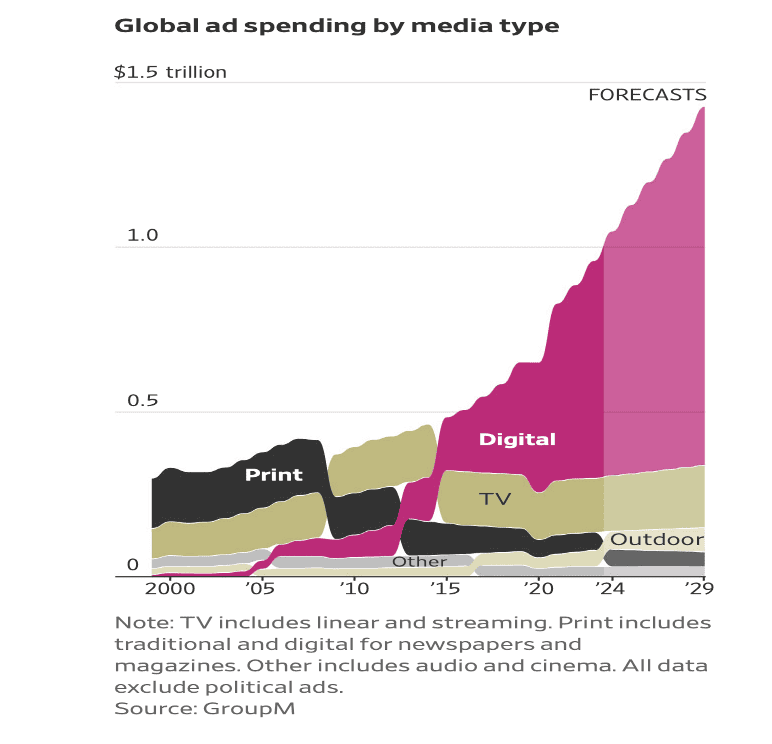

“Sorry, Mad Men. The Ad Revolution Is Here – Two advertisers are combining into a $30 billion behemoth to harness the data, tech and AI expertise now dominating Madison Avenue—and all the marketing you see. Tech giants control more than half of the $1 trillion ad market, and quants armed with reams of data direct ad buying. Now, generative artificial intelligence is sending shock waves through the marketing world, promising to create and personalize ads cheaper and faster than ever. Many industries talk about preparing for AI. With this blockbuster deal, the ad industry is trying to transform for it.”, The Wall Street Journal, December 13, 2024

=============================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“The global inflation battle is stalling and diverging – Trump’s agenda and domestic uncertainty shroud the rate-cutting cycle. The global battle against inflation is entering a new phase. After price pressures dropped steeply last year, central banks in advanced economies began slashing interest rates in earnest this summer. But pulling inflation back to its 2 per cent target, persistently, has proved difficult. As the year-end approaches, fresh inflationary threats are on the horizon, and the future path of interest rates is becoming more uncertain.”, The Financial Times, December 20, 2024

=============================================================================================

“Trump tariffs as confrontation, deterrence and art of the deal – Three possible futures for the global economy if Trump imposes new trade tariffs as threatened and vowed. The last time Donald Trump was US president, he entered trade wars with China and Europe. But despite his bravado and tariffs, the US trade deficit did not improve. In fact, it deteriorated from US$195 billion in the first quarter of 2017 to $260 billion in the same period of 2021. Scenario 1: Confrontation; Scenario 2: The art of the deal; and Scenario 3: Deterrence.”, Asia Times, December 23, 2024

=============================================================================================

“The World’s 20 Largest Economies, by GDP (PPP) – Born during the 1970s oil crisis, the G7 emerged as a group of the world economy’s cool kids: large, mature, high-income economies dominating key global sectors.

Then, in the 2000s, BRICS showed up—a collection of countries mostly from the “Global South”— vying for influence with their steadily growing economic might, boosted by globalization. Now they’re positioned as competitors to the G7. Together, both groups are in the G20, the world’s 20 largest economies, which accounts for 70–85% of the world economy (depending if nominal or PPP-adjusted GDP is used). Despite its name, the G20 only has 19 members who are sovereign states. The EU and African Union are regional organizations that are also members of the group but are excluded from calculations in this article. This chart shows the value of each G20 member’s GDP in 2024, adjusted for purchasing power parity (PPP). Data is sourced from the International Monetary Fund as of October, 2024.

Editor’s Notes: This chart compares countries based on ‘Purchase Power Parity’ and not the standard nominal GDP that most publications use.

Nominal GDP Growth measures the total economic output of a country in current prices, without adjusting for cost-of-living differences between countries or inflation. Best for comparing economies over time in a single currency.

PPP GDP Growth adjusts for differences in the cost of goods and services between countries, reflecting what people can actually buy with their income. Best for comparing living standards or economic size across countries.

In short, Nominal GDP focuses on market exchange rates, while PPP GDP accounts for local purchasing power.

==================================================================================================

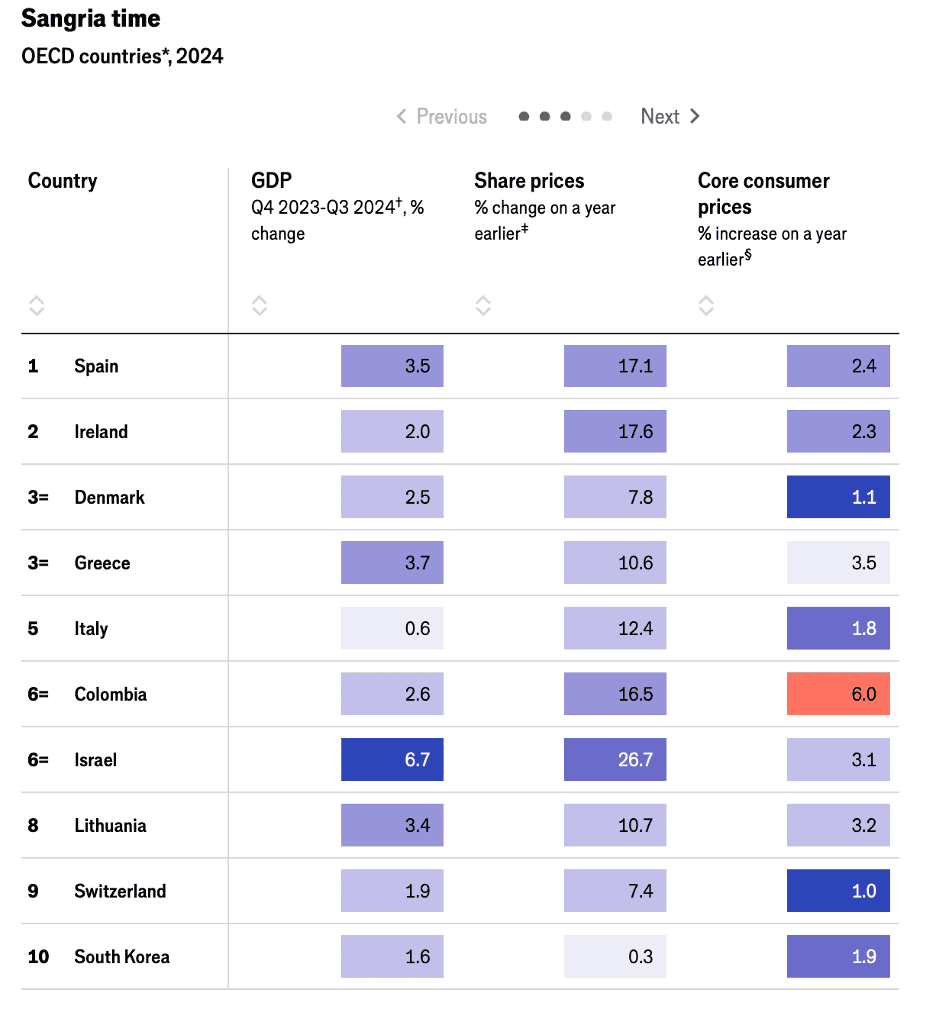

“Which economy did best in 2024? – The world economy delivered another strong performance in 2024; according to the IMF, global gdp will grow by 3.2%. Inflation has eased and employment growth remains solid. Stockmarkets have risen by more than 20% for a second consecutive year. Yet, as ever, the rosy global picture conceals wide variation between countries. To assess these differences, we have compiled data on five economic and financial indicators—gdp, stockmarket performance, core inflation, unemployment and government deficits—for 37 mostly rich countries. The Mediterranean’s rally rolls on for the third consecutive year, with Spain at the top of this year’s list. Greece and Italy, once emblematic of the euro zone’s woes, continue their recoveries. Ireland, which has attracted tech firms, and Denmark, home to Novo Nordisk of Ozempic fame, round out the top five.”, The Economist, December 10, 2024

=============================================================================================

“The $115 Trillion World Economy in One Chart – There’s nothing quite like a big chart to really get into the data. In this edition we take a look at the massive $115 trillion world economy in 2025, along with how it breaks down per country. Data is sourced from the International Monetary Fund’s GDP estimates for 2025 (except for Pakistan). All figures are rounded and in nominal USD. Second-largest China ($19.5 trillion) will also hold its position, now on a 15-year streak. The top two together account for over two-fifths (43%) of the world’s $115 trillion GDP. Germany ($4.9 trillion) overtook Japan ($4.4 trillion) in 2024 as the third-largest economy. Meanwhile India ($4.3 trillion) passed the UK ($3.7 trillion) as 5th largest in 2020. All three countries are expected to retain their positions till 2026—when India is projected to first pass Japan for fourth, and then Germany for third place in 2028. Meanwhile, around the top 10 mark, Australia is predicted to overtake Spain for 13th place this year. And Brazil is expected to make the top eight by 2028.”, Visual Capitalist & IMF, December 19, 2024

==============================================================================================

“Cocoa Surges Past (US)$12,000 on Supply Concerns – Dry weather across West Africa could hurt harvest volumes in the coming months. Prices have more than doubled since the start of the year, as severe droughts resulted in poor harvests in Ghana and Ivory Coast—the world’s biggest producers of cocoa beans—reducing global supplies. Low stock levels have also left the market extremely sensitive.”, The Wall Street Journal, December 18, 2024, and Trading Economics (chart)

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“The 10 best airline upgrades that are worth the money — with flat bed seats and tons of legroom – Researchers evaluated 49 different international airlines, including Virgin Atlantic, Delta Airlines, and Qatar Airways. They included seat size and type, in-flight entertainment, food reviews, Wi-Fi availability, and overall Tripadvisor review scores. Singapore Airlines landed on top with an 87.46% overall score — that’s mostly due to its luxury business class seating that converts into flat beds with a 9.5-inch width, the experts explained. In second place was Iberia, which was able to earn a still-impressive 82.59% score. The airline’s business class cabin is the roomiest in the entire ranking, the number crunchers said, offering an average of 40 inches more than you get in economy. Delta Airlines came in third, with a ranking of 81.64% for overall experience. The airline was the only US-based and North American air carrier to crack the top ten. Qatar, Air New Zealand and Virgin Atlantic rounded out the top five, according to the publication.”, The New York Post, December 18, 2024

===============================================================================================

“What is the strongest passport in the world? According to the Henley Passport Index, Singapore currently holds the title of the world’s most powerful passport. If you’re a Singaporean passport holder, you can travel to 195 destinations out of 227 around the world visa-free.”, The Manual, December 18, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Supremacy: AI, ChatGPT, and the Race that Will Change the World” – In Supremacy, Parmy Olson dives deep into the AI revolution, showcasing how artificial intelligence tools like ChatGPT are reshaping industries and altering the global power dynamic. The book highlights the fierce competition between tech giants and nations striving for dominance in the AI space. Olson explores how AI is revolutionizing sectors such as healthcare, education, and finance, enabling groundbreaking innovations while raising critical ethical questions about bias, privacy, and control.

The book doesn’t shy away from discussing the disruptive impact of AI on jobs, societal structures, and geopolitics. Olson presents a balanced narrative, celebrating AI’s potential to address global challenges like climate change and disease while cautioning against risks like misinformation and deepening inequality.

Through meticulous research and compelling storytelling, Olson paints a vivid picture of the new age of technological supremacy, where the race for AI dominance is as much about innovation as it is about power and survival.

Recognized as the Financial Times Business Book of the Year for 2024, Supremacy is an essential read for professionals, policymakers, and anyone looking to grasp the profound changes shaping our world. This is a call to stay informed and prepared in the face of unprecedented technological evolution.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Brazil

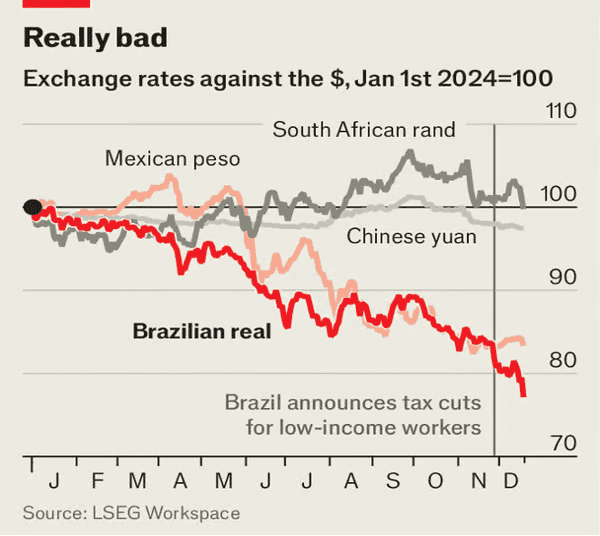

“Why Brazil’s currency is plunging – Fiscal and monetary policy are now pitted against one another. THE BRAZILIAN real holds an ignominious title this year: it is the worst-performing major currency, down by more than 20% to a record low of almost 6.3 to the dollar. The slump is fuelled by panic about fiscal plans. Given Brazil’s budget deficit of almost 10% of gdp and gross debt of nearly 90% of gdp, jitters are understandable. On December 17th the central bank sold over $3bn in currency reserves in a failed attempt to prop up the real. But monetary hawkishness is not cutting the mustard. Financial markets are clamouring for a fiscal u-turn, which the government is reluctant to offer.”, The London Economist, December 19, 2024

============================================================================================

China

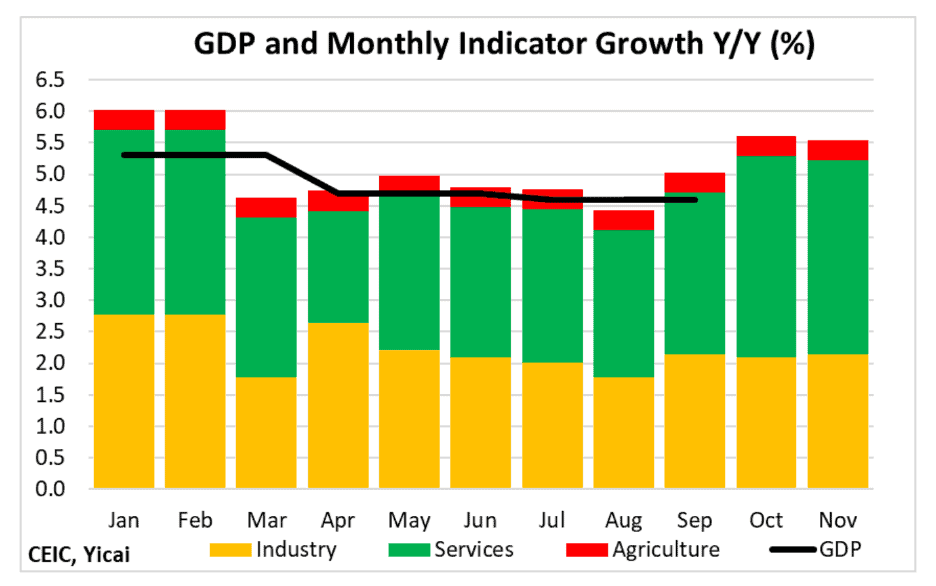

“Five Percent GDP Growth Within Sight – The November data released by the National Bureau of Statistics suggest that China’s economy rebounded significantly in the fourth quarter and it is on track to meet the 5 percent target set by the authorities. Our indicator suggests that economic activity grew more rapidly in October and November compared to the rates recorded in the third quarter (Figure 1). Most of this acceleration came from the service sector, which grew by 6.2 percent year-over-year in October-November, up from 4.8 percent in Q3. The growth of industrial value added also accelerated by a modest 0.4 percentage points.”, Yicai, December 23, 2024

==============================================================================================

“Starbucks hires its first-ever China chief growth officer as it battles fierce local competition – Starbucks is creating an entirely new position to fix its China problem. For years, the U.S. coffee chain enjoyed success as Chinese consumers, optimistic about China’s economic prospects, flocked to Western brands. But changing tastes and tighter budgets are now pushing China’s coffee drinkers to cheaper local alternatives. Starbucks’ new chief growth officer will have his work cut out for him. The U.S. coffee company’s China revenue is falling as local chains win over Chinese coffee drinkers. Starbucks faces fierce competition from newer coffee chains with larger footprints and more affordable drinks.”, Fortune, December 10, 2024. Compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

South Korea

The Impeachment of South Korean President Yoon Suk-yeol and the International Business Implications – The very timely article on this very important subject form those doing business in South Korea is by Don Southerton, THE go to person for knowledge of doing business in South Korea. From Don’s article on December 16, 2024

“The National Assembly (Parliament) has passed a motion to impeach President Yoon Suk-yeol for issuing a short-lived martial law on December 3rd. The motion suspends Yoon’s role as South Korea’s president. Prime Minister Han Deok-soo will step in as acting president to lead the nation until Yoon returns to office or until a new president is elected. The Constitutional Court has six months to review the impeachment motion. If the court upholds the motion, a new presidential election will be held within two months of the court’s decision. I assume he will be impeached, as most feel the reasons President Yoon’s grounds for martial law were political rather than his reason to “investigate election fraud manipulated by North Korea.”

=================================================================================================

New Zealand

“New Zealand’s Economy Expected to Recover Supported by Aggressive Rate Cuts – Increased deficit will lead to sovereign debt rising to NZ$192.8 billion by mid-2025. A midyear update of the budget forecasts the farm-rich economy to grow 0.5% for the fiscal year ending June 30, 2025, before accelerating to 3.3% in the next fiscal year. However, the stronger growth momentum won’t speedily patch up the government’s budget bottom line with a return to surplus not expected until 2029. The pace of the economic recovery will be limited by constrained supply capacity, with weakness in labor productivity expected to continue, the budget update said. With inflation well-contained the Reserve Bank of New Zealand has indicated that significant cuts to the official cash rate are likely next year, with another 50 basis points cut in February, bringing the total reduction in the official cash rate since August to 175 basis points.”, The Wall Street Journal, December 16, 2024

===============================================================================================

Poland

“How Poland became one of Europe’s biggest success stories – The country’s focus on productivity and EU membership have been key to growth that is the envy of bigger economies. he International Monetary Fund thinks that Polish GDP will expand by 3 per cent this year, by 3.5 per cent next year and 3.4 per cent in 2026. Many G7 finance ministers would view these rates with envy.Astoundingly, they are a slight slowdown from recent highs. Between 2004 and 2019, the Polish economy grew at an average annual rate of about 4 per cent, OECD stats show. Membership of another centralised body, the European Union, has aided Poland’s rapid economic development. After joining in 2004, the country immediately benefited from access to the single market, European labour, more public money, foreign direct investment flows and greater investor interest.”, The Times of London, December 17, 2024

============================================================================================

United Kingdom

“British car production falls to lowest level since 1980 – Year-on-year output was down by nearly a third in November, with electric vehicles hit hardest amid weak consumer demand. The number of cars rolling off British production lines fell by almost a third in November to the lowest level for the month since 1980, amid industry upheaval and weak consumer demand. A total of 64,216 units were manufactured in the month, down 27,711 on November 2023, in the ninth consecutive month of decline, according to the Society of Motor Manufacturers and Traders (SMMT). Of those, just under a third (19,165) were battery electric or hybrid vehicles, representing a 45.5 per cent fall year-on-year. Overall it was the worst performance for the month since November 1980, when 62,728 units were produced….”, The Times of London, December 10, 2024

===============================================================================================

“Budget has caused economy to stagnate, Bank of England says – Andrew Bailey, governor of the Bank, said that there would be a gradual approach to cutting interest rates because of concerns over the impact of tax rises and a higher minimum wage. A survey of businesses by the Bank of England suggested that companies were responding to the £25 billion national insurance tax raid by increasing prices and cutting jobs.”, The Times of London, December 10, 2024

================================================================================================

United States

“Burger chain named as America’s most expensive fast-food restaurant: ‘Overpriced’ – Customers have complained of price increases at fast-food chains amid inflation. The study conducted by Preply said Shake Shack was ranked the most overpriced restaurant for chains, followed by Five Guys and the Sugar Factory. To make their determinations, researchers analyzed the language of 57,245 reviews for over 10,000 restaurants in 50 cities across the country. To determine the scores for being overpriced, the authors looked for keywords — such as “pricey” or “rip-off” — in restaurant reviews in each city and analyzed how frequently they were used by patrons. The study comes as many restaurants and fast-food chains have hiked prices. In May, McDonald’s USA President Joe Erlinger defended the hikes, refuting reports that the increases were significant.”, Fox Business, December 18, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Why Dunkin’s Expansion Into China And India Was A Total Failure – When Dunkin’ brought its signature pink-and-orange branding overseas to China and India, the company found that the average consumer didn’t quite resonate with donuts for breakfast. To counteract this, Dunkin’ implemented some small menu changes to help regionalize its menu to the unique tastes and palates of these nations. In 1994, Dunkin’ (then known as Dunkin’ Donuts), attempted to break into the Chinese market. While the company had great aspirations for success, the brand wasn’t strong enough in China to get consumers into its cafés as it expected. 1n 2012, Dunkin’ chose to provide exclusivity in its Indian franchising to Jubilant FoodWorks Ltd., a food service company with over 3,000 restaurants across six global markets. Since 1996, Jubilant FoodWorks has been responsible for the highly successful Indian expansion of Domino’s Pizza, which saw its 2,000th store opening in June 2024. But unlike Domino’s, Dunkin’ struggled to connect with the average Indian consumer. For one, the American-style, on-the-go breakfast isn’t the norm in the country….Dunkin’s signature item — the donut — isn’t regarded as a breakfast food in India, but rather a sweet pastry that’s consumed as a dessert from time to time on special occasions.”, Tasting Table, December 22, 2024

===============================================================================================

“Fried chicken trio in line for fortune after selling much-loved chain for a whopping £400MILLION to US firm – after winging it and starting restaurant from scratch six years ago – Three entrepreneurs who started a fried chicken franchise have sold their business for a whopping £400million. In one of the biggest take-overs deals for a restaurant brand in Britain, the UK arm of Wingstop will be acquired by California-based private equity firm Sixth Street. The restaurant was started from scratch in 2018 by Tom Grogan, Herman Sahota, and Saul Lewin who opened the first Wingstop in central London. The company now boasts 57 sites and employs 2,500 staff, The Times reports.”, The Daily Mail, December 22, 2024

=================================================================================================

“Bain Capital in talks to acquire mega-franchisee Sizzling Platter, report says – The Utah-based franchise group operates more than 750 restaurants across eight brands, including Little Caesars, Wingstop, Dunkin’ and more. The mega-franchisee is owned by CapitalSpring, which has been working with investment bankers at UBS and Deutsche Bank on a sale process for several months, according to the report. Bain Capital acquired the casual-dining chain Fogo de Chao last year, and was reportedly in talks to acquire Subway at one point, but the sandwich chain was sold in the end to Roark Capital for nearly $10 billion.”, Restaurant Business Online, December 10, 2024

===============================================================================================

“UK’s Domino’s Pizza eyes digital growth with new franchise deal – The UK’s Domino’s Pizza Group (DPG) (DOM.L) has reached a new five-year agreement with its franchise partners, it said on Monday, as the fast-food chain looks to expand its store network and increase investment in its digital platform. The new Profitability and Growth Framework, which the company said had the “unanimous support” of its franchise partners, allows for shared investment in marketing and technology, and provides incentives for new store openings. The London-listed pizza chain, which operates under the umbrella of U.S.-based Domino’s Pizza (DPZ.N) in the UK and Ireland, is targeting 2 billion pounds ($2.55 billion) of sales by 2028 from more than 1,600 stores, around 200 more than currently.”, Reuters, December 9, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896