Biweekly Global Business Newsletter Issue 144, Tuesday, September 30, 2025

“Plans cannot keep pace with change.” — Chinese Proverb

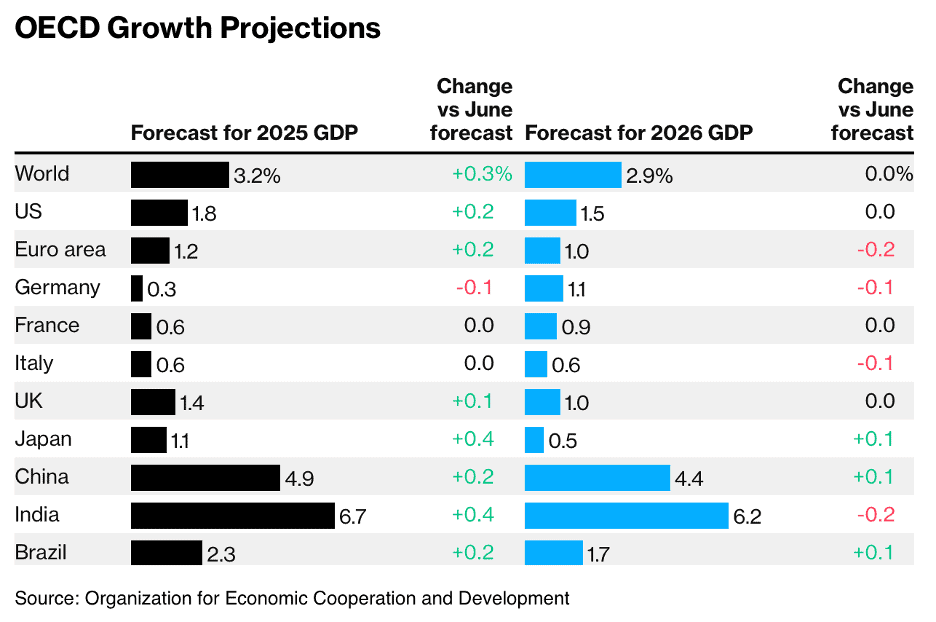

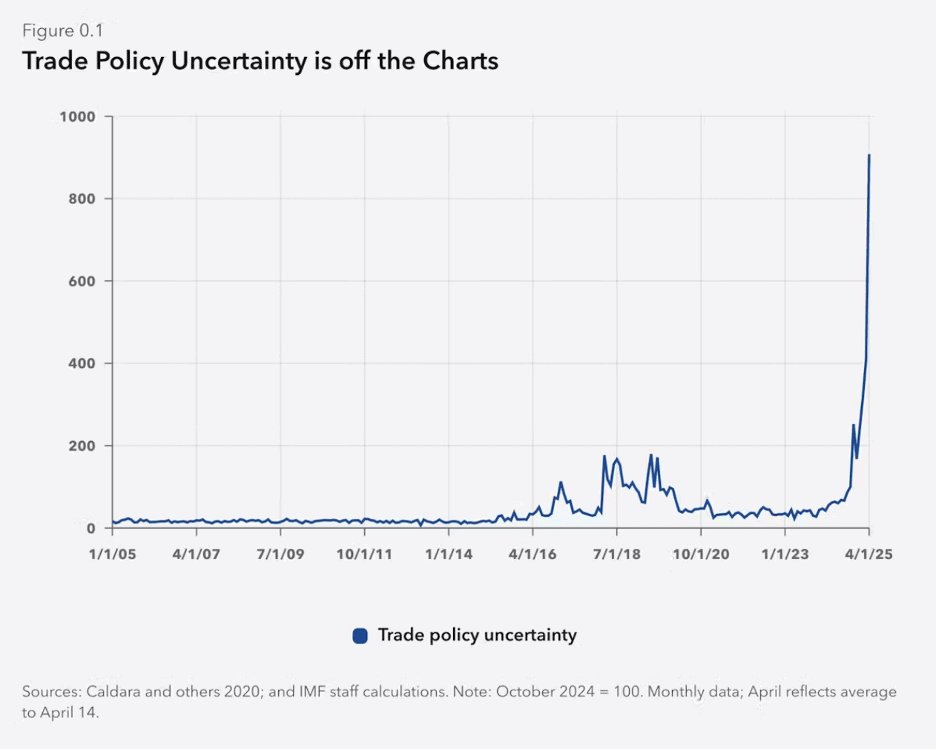

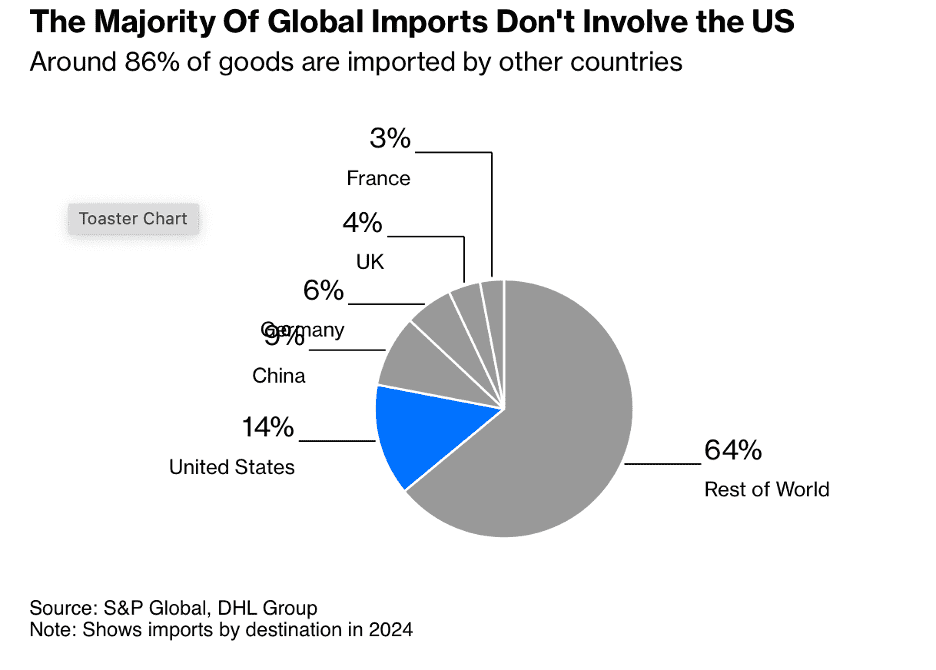

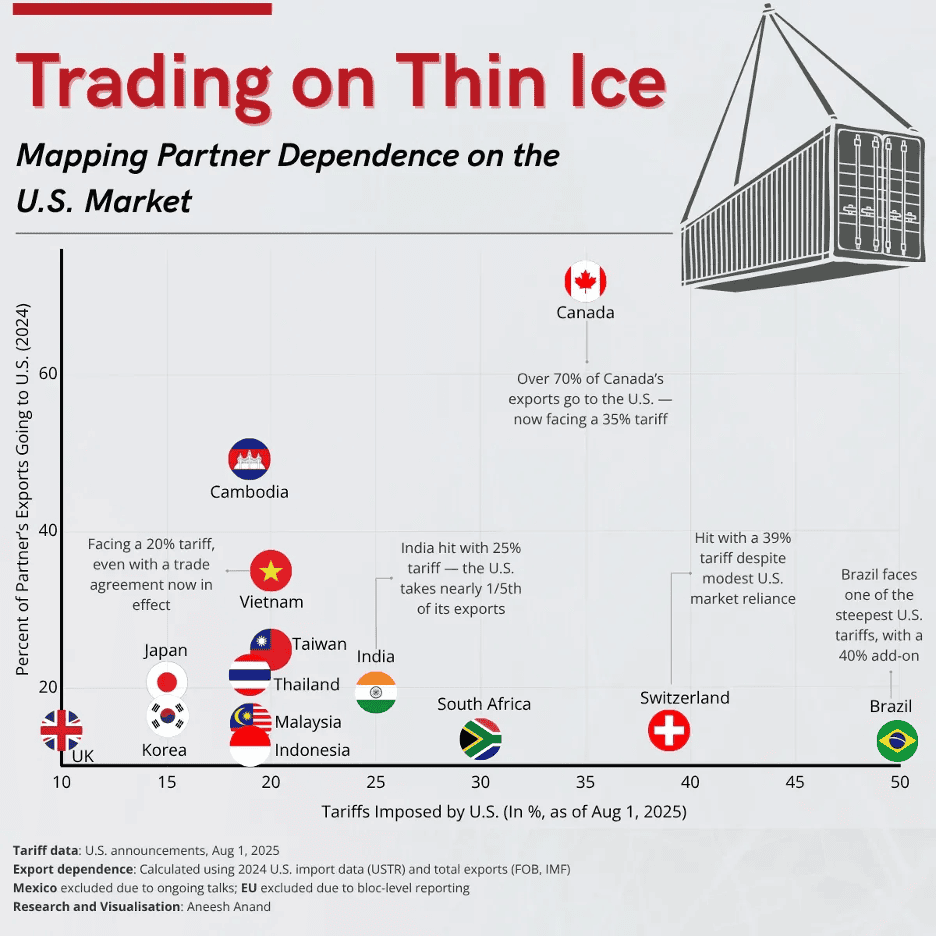

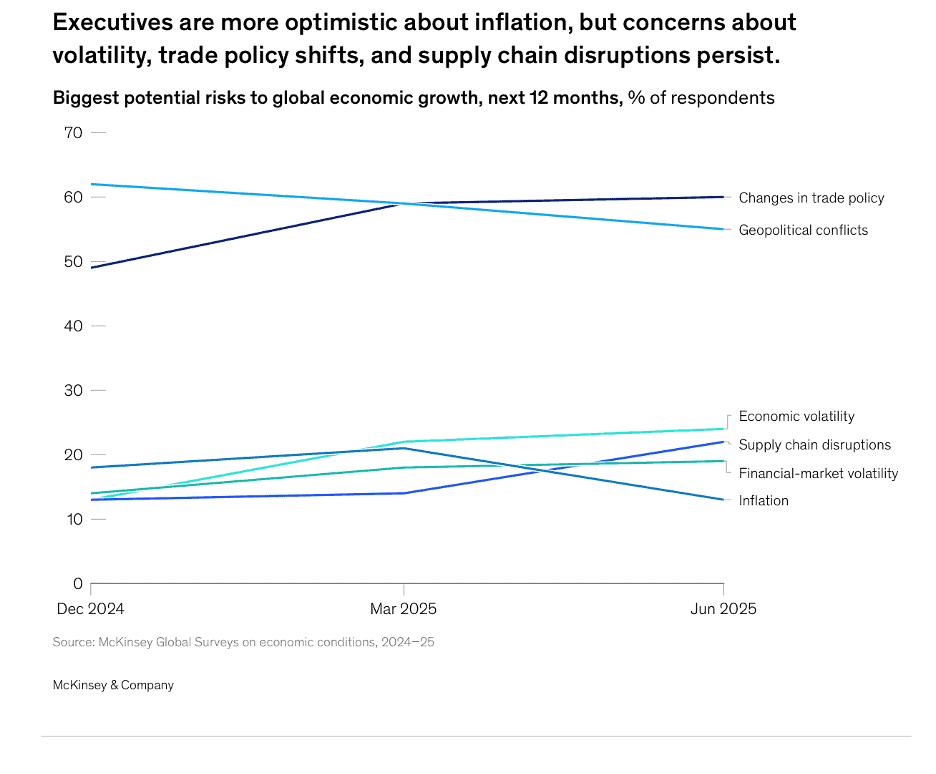

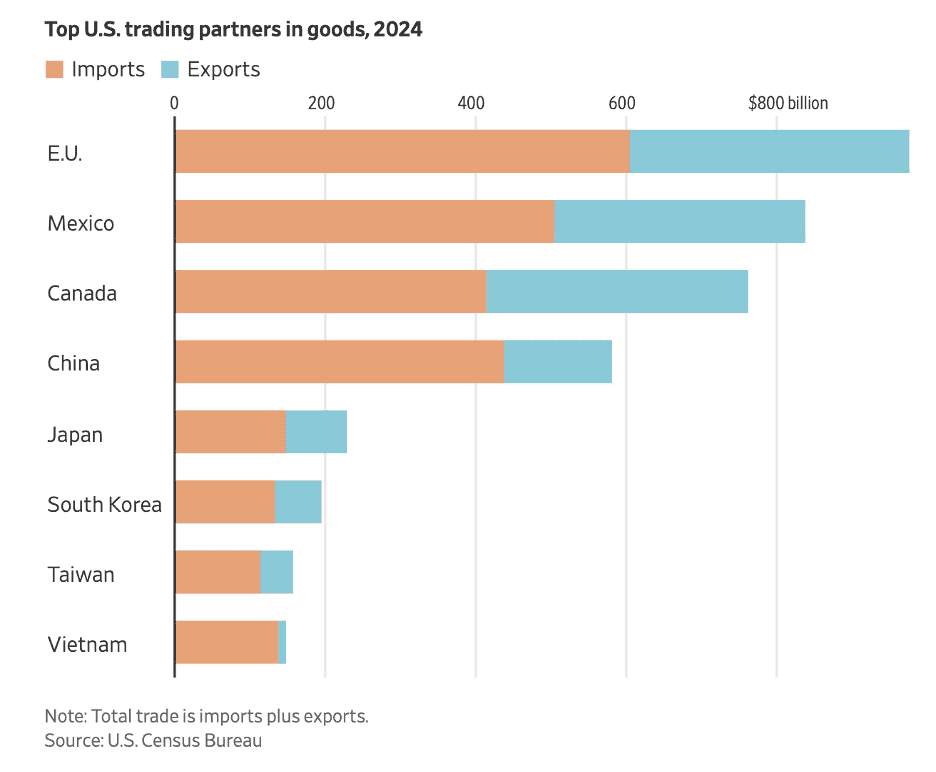

Welcome to the 144th Edition of the Global Business Update – This issue comes at a time when resilience and uncertainty are colliding in the global economy. The OECD has raised its growth outlook for 2025, noting that economies are performing better than expected—but also warned that new tariffs set for 2026 could slow global expansion to 2.9% from 3.2%. But trade policy uncertainty is at is highest level in at least 20 years. The message is clear: businesses must adapt quickly, because plans made today may not hold up tomorrow.

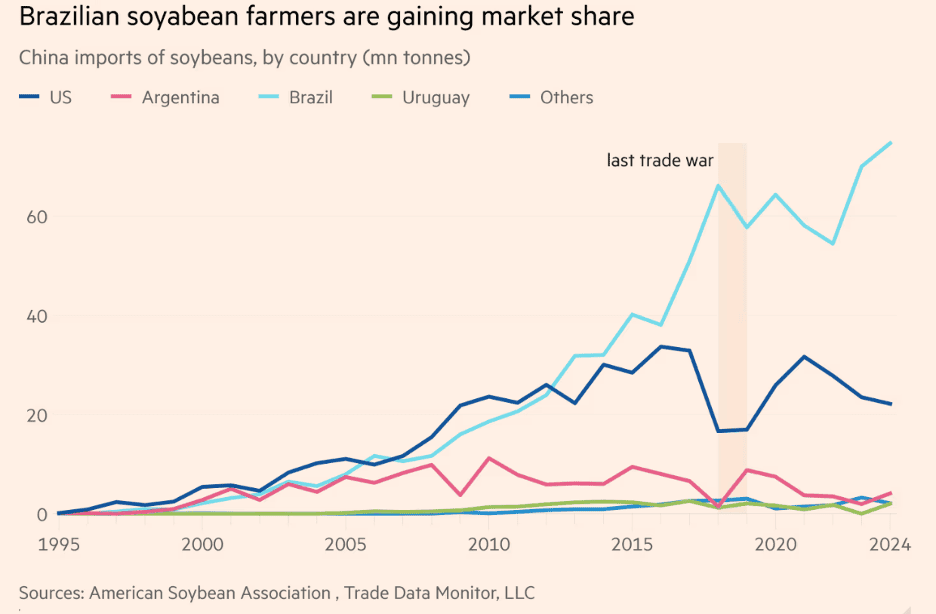

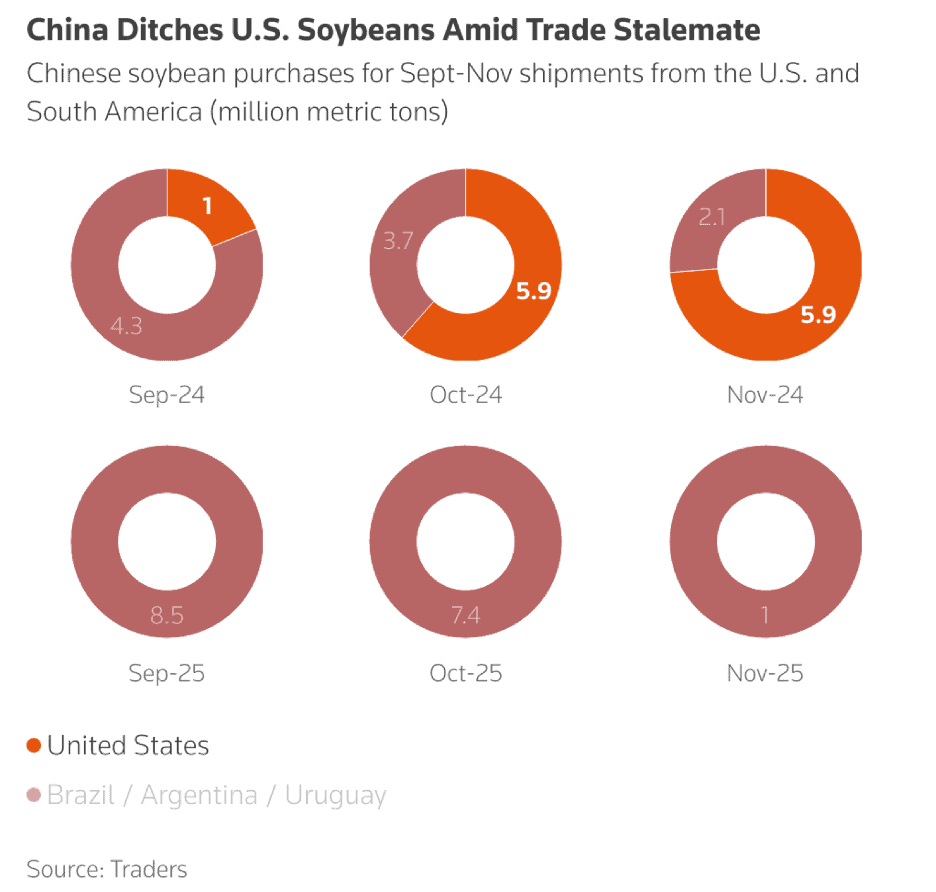

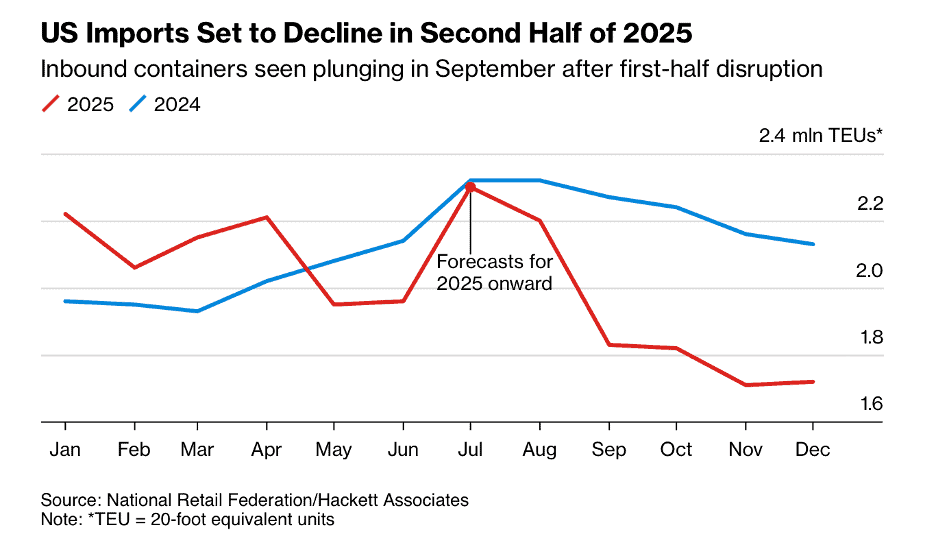

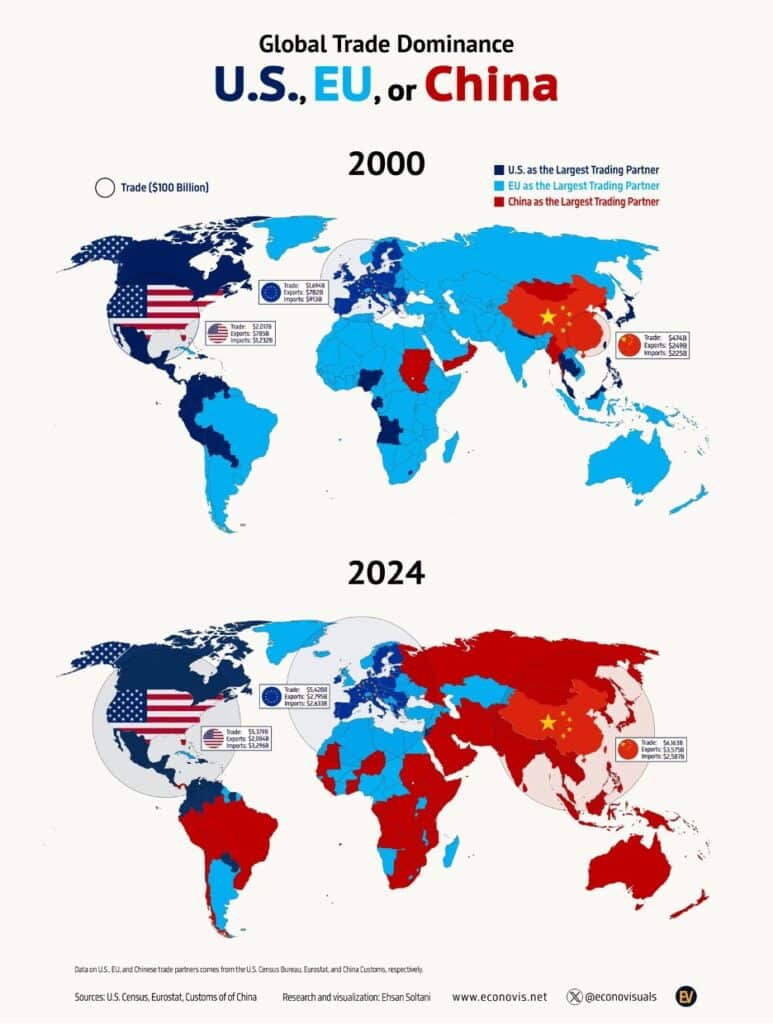

Trade disruptions are already reshaping supply chains. U.S. soybean exports to China have collapsed, with Beijing turning instead to Brazil, leaving American farmers squeezed. Meanwhile, Canada is bracing for an economic rebound in 2026, while simultaneously deepening its trade ties to Asia, with record cargo volumes at the Port of Vancouver.

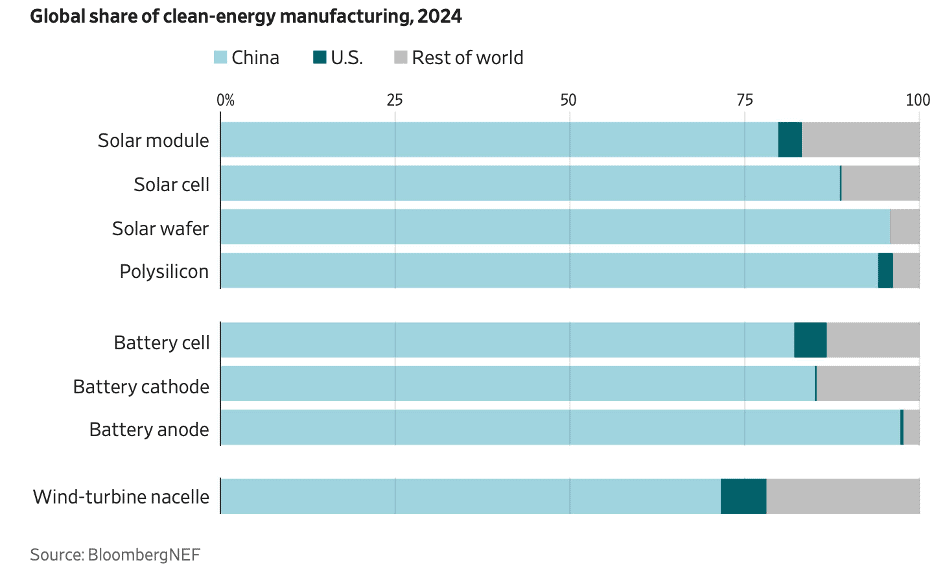

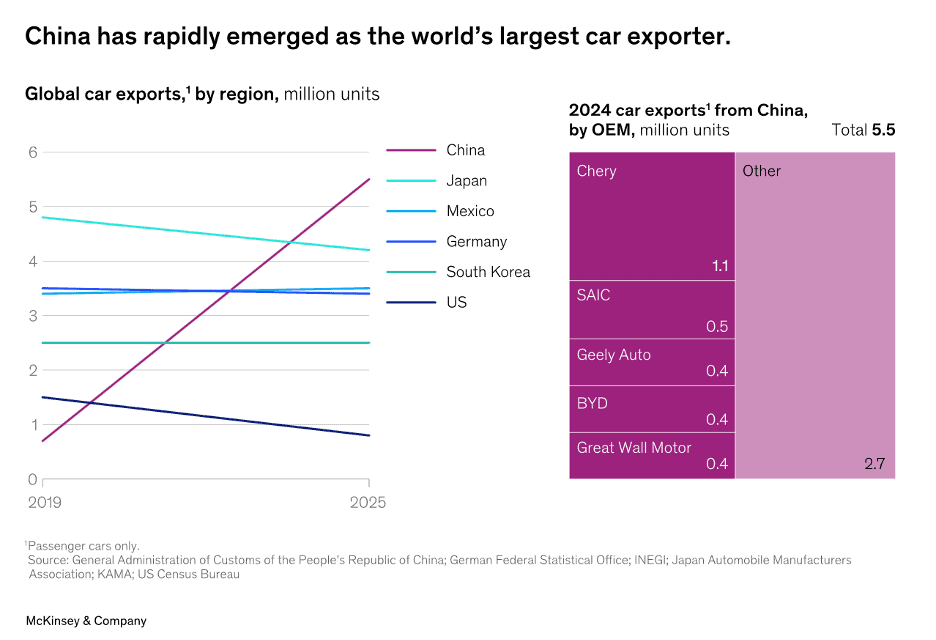

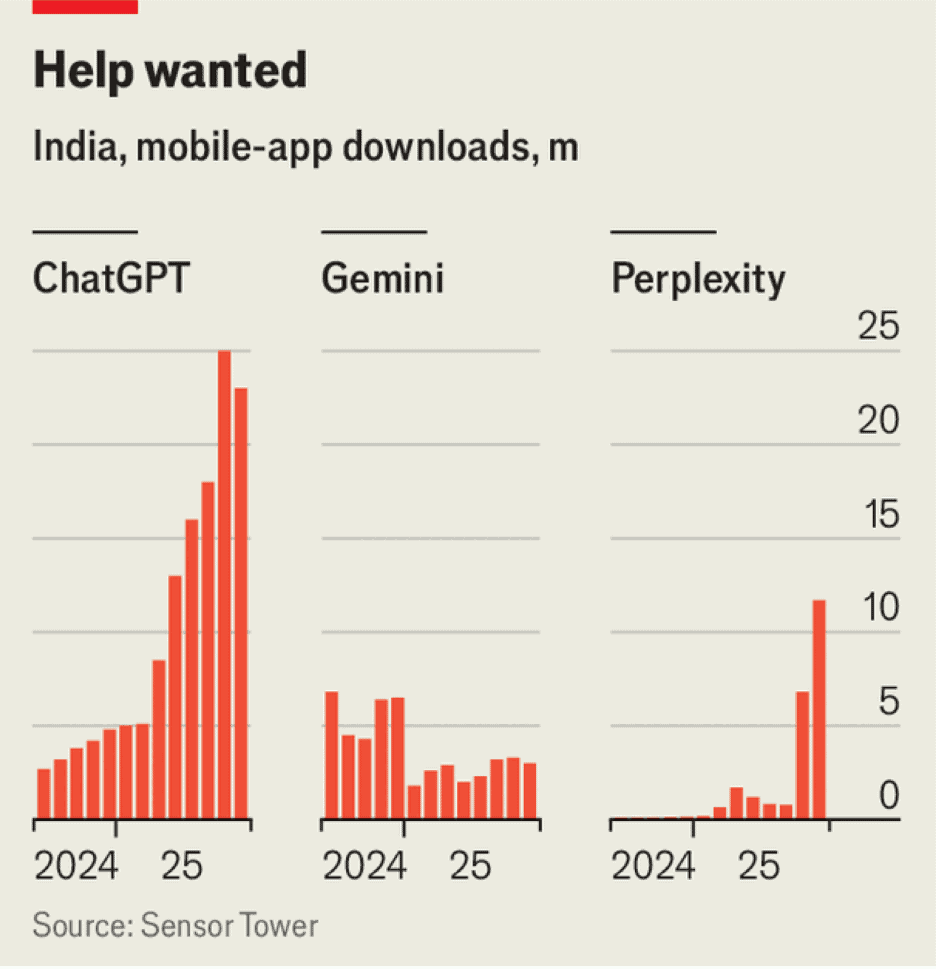

China’s role continues to expand—installing more renewable power in seven months than the U.S. projects for the entire year and overtaking Japan and Germany as the world’s largest car exporter. Europe shows a split picture: Spain has become the continent’s standout growth economy, while consumer sentiment across the EU remains cautious. And AI is truly erupting in India!

Starbucks is restructuring, Shake Shack is opening in Vietnam, Guzman y Gomez is growing, and Elegant Hoopoe® is pioneering AI-driven wellness franchising with global ambitions. And McDonalds China will invest US$56 million to train 10,000 employees in 2025.

The stories in edition 144 illustrate both the risks and the opportunities for companies seeking growth abroad. As this edition makes clear, success in today’s global economy will not come from rigid plans but from adaptability, resilience, and a willingness to see change as opportunity.

This issue’s book review highlights “What Matters Next: A Leader’s Guide to Making Human-Friendly Tech Decisions in a World That’s Moving Too Fast by Kate O’Neill, a timely new book on how leaders can make technology decisions that are fast yet human-friendly. In a world where global business moves at breakneck speed, O’Neill offers practical tools for balancing urgency with foresight, and efficiency with humanity. It’s a framework that resonates strongly with today’s global challenges. As global business leaders, we can’t slow the pace of change—but we can choose to guide it responsibly. Ultimately, the book is a playbook to help leaders make tech-enabled change that is not only efficient but human‑friendly.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Plans cannot keep pace with change.” — Chinese Proverb

“In a fragmented world, the future belongs to those who build bridges, not walls.”, Inspired by Óscar Arias

“When you have exhausted all possibilities, remember this—you haven’t.”, Thomas Alva Edison

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #144:

Resilient World Economy Set for Tariff Hit in 2026, OECD Says

Are You Ready To Spend 29 Hours On The World’s Longest Flight?

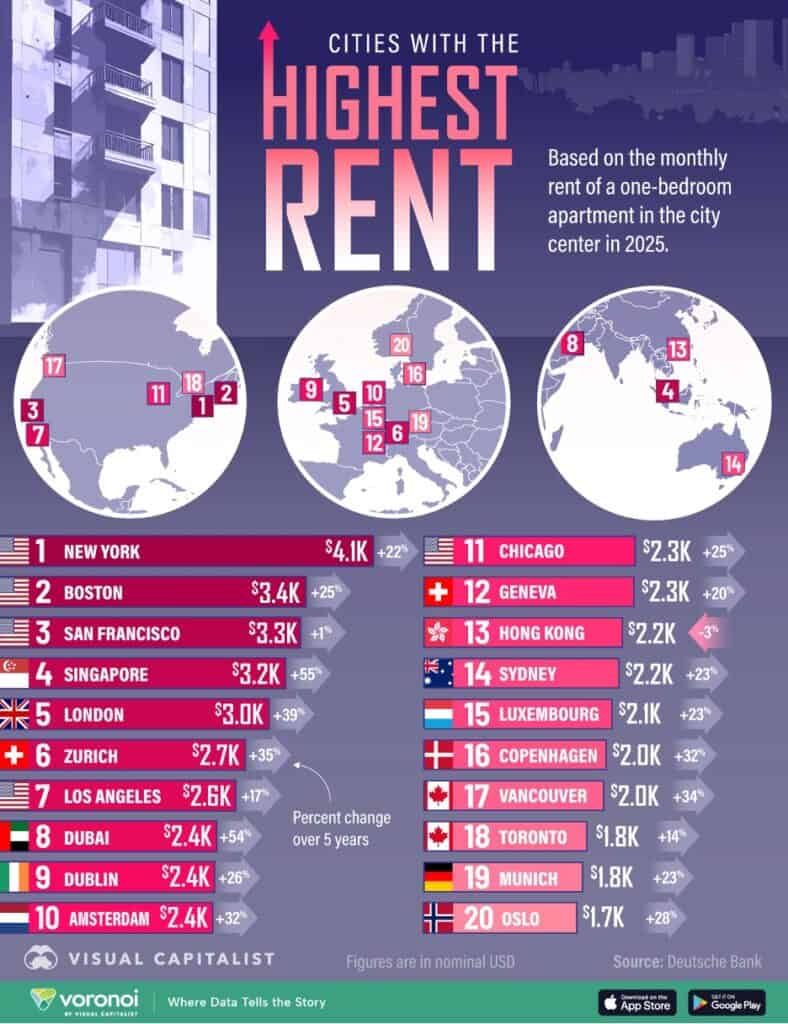

Which Cities Have the Most Expensive Rent in the World in 2025?

Canadian economy poised for upturn in 2026, but risks abound, Deloitte says in fall outlook

Why so many US fast food chains are expanding fast in Britain

Brand Global News Section: Elegant Hoopoe®, Guzman y Gomez®, McDonalds® China, Shake Shack® and Starbucks®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Resilient World Economy Set for Tariff Hit in 2026, OECD Says – The OECD said the global economy is still on course for a substantial blow from Donald Trump’s trade measures despite showing greater resilience than expected in recent months. The OECD raised its 2025 outlook for world growth and most individual economies, citing the impact of front-loading in anticipation of higher tariffs. The OECD expects global growth to drop to 2.9% from 3.2% in 2026 amid higher import duties and elevated uncertainty, with the full impact of the trade measures yet to be felt. In new forecasts published on Tuesday, the Paris-based organization raised its 2025 outlook for world growth and most individual economies, citing the impact of front-loading in anticipation of higher tariffs. The US also saw strong investment in artificial intelligence, while China benefited from fiscal support.”, Bloomberg, September 25, 2025

=============================================================================================

“IMF 2025 Annual Report: Getting to Growth in an Age of Uncertainty – The global economy faces exceptional levels of uncertainty. The 2025 IMF Annual Report shows that low-income countries in particular, already strained by past shocks, risk falling further behind. Growth is the central challenge for all. And achieving it will require bold reforms at home and collaboration to address imbalances between countries.”, International Monetary Fund, LinkedIn, September 26, 2025

============================================================================================

“Which Cities Have the Most Expensive Rent in the World in 2025? Across major cities worldwide, the cost of rent has climbed sharply in recent years. Record-high housing prices, paired with a wave of remote workers moving into new markets, are reshaping rental dynamics. At the same time, limited supply is tightening conditions even further, compounding challenges for renters in countless regions. New York has the highest rental costs globally, averaging $4,100 in 2025. Over the past five years, rent has surged across European cities, sparking protests. Singapore has the highest rent in Asia, at $3,300 per month, given its role as a financial hub.”, Visual Capitalist & Deutsche Bank, September 19, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

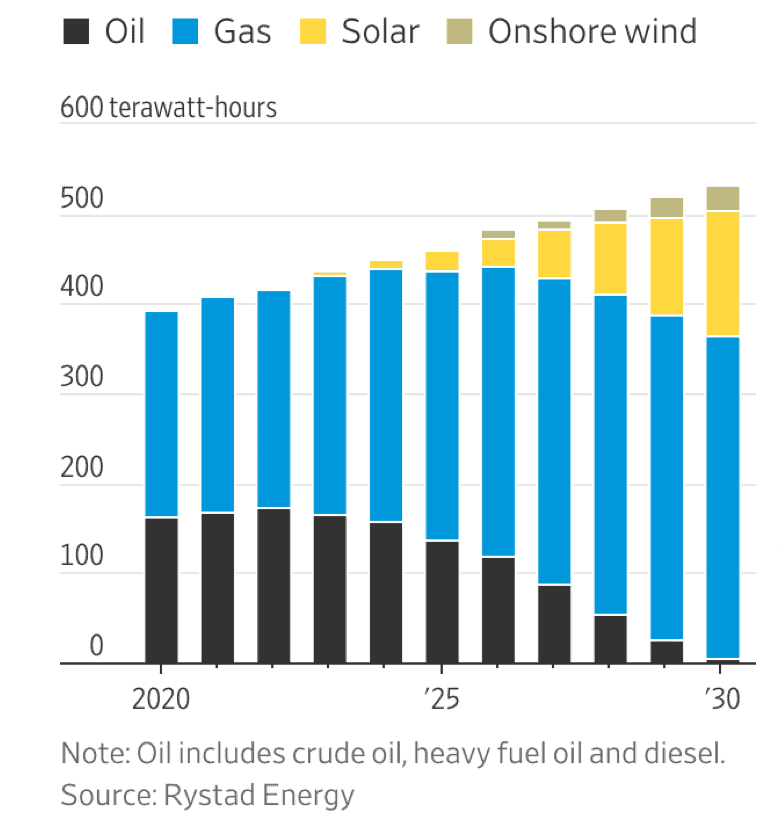

“The U.S. Is Forfeiting the Clean-Energy Race to China – As President Trump doubles down on fossil fuels, the U.S. and China offer competing visions for the future of energy. The U.S. renewables retreat goes far beyond the tax bill that is winding down more than $400 billion in estimated subsidies. Federal agencies have tightened rules for new development. The rapid pace of EV adoption in China and elsewhere casts a long shadow over oil demand. Natural gas will be burned for decades, but increasingly competitive solar panels and batteries might sap how much of it the world will need. China installed 277 gigawatts of wind and solar capacity in the first seven months of the year, quadruple the utility-scale additions federal analysts in the U.S. project across all power sources for 2025.”, The Wall Street Journal, September 21, 2025

===============================================================================================

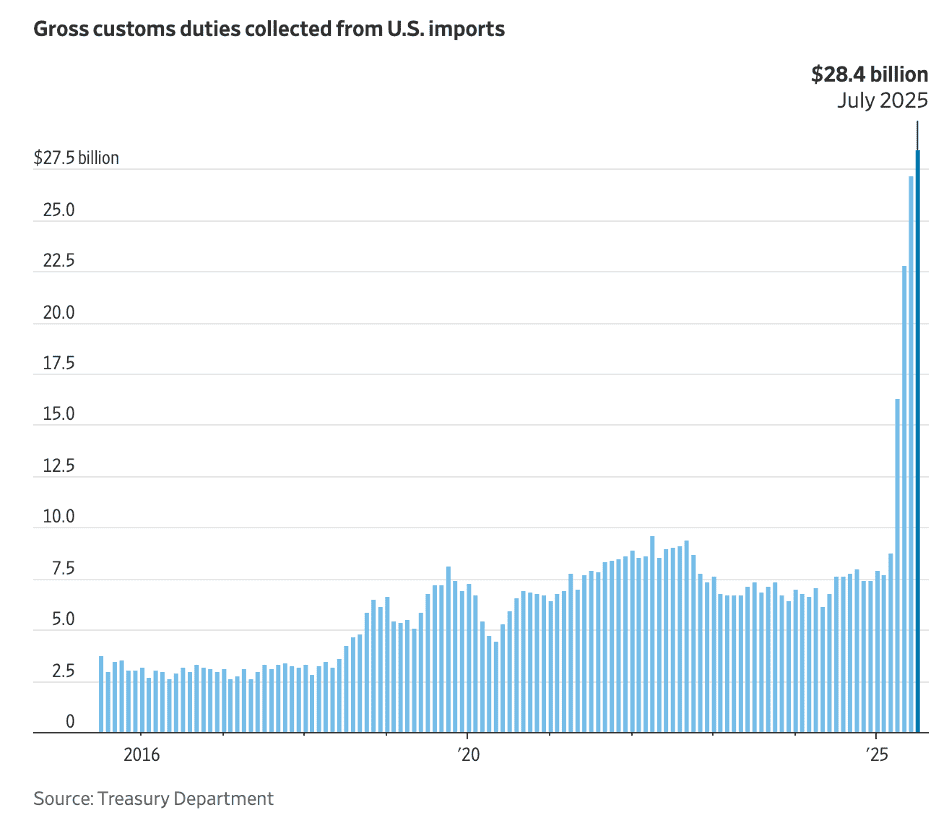

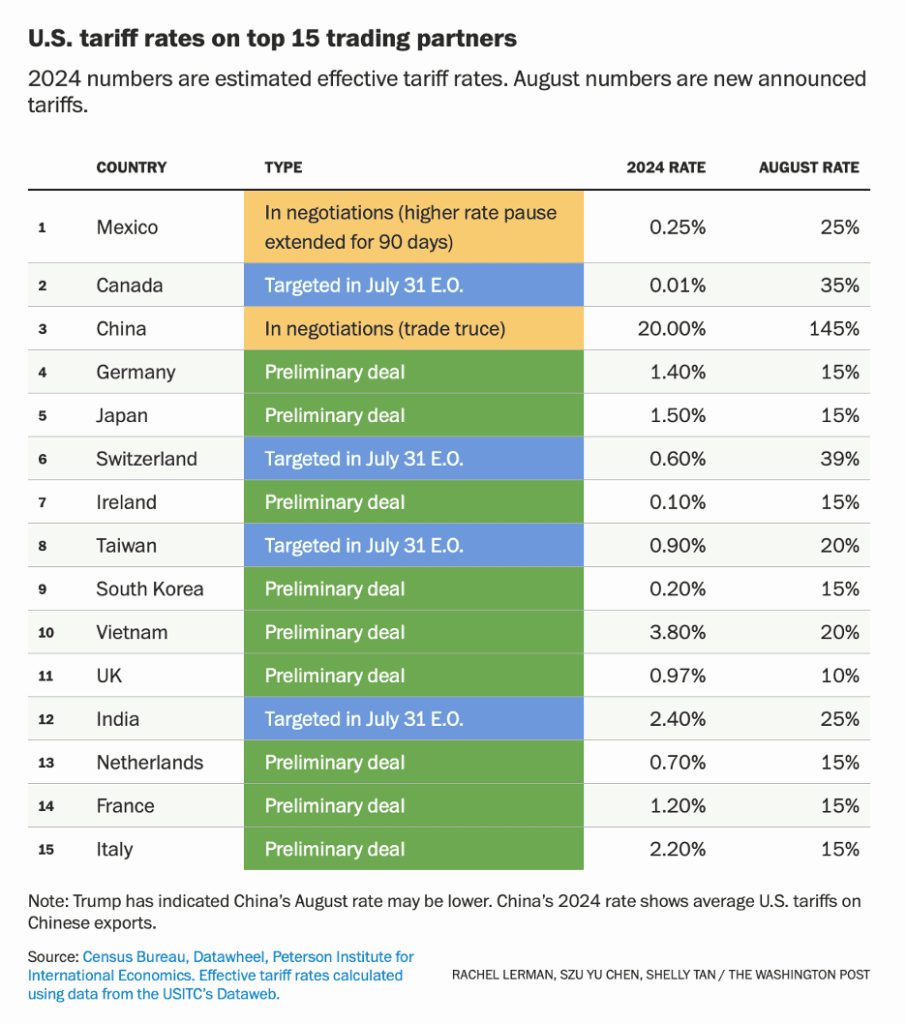

“U.S. Importers Eye Refund Options as Tariff Fight Goes to Supreme Court – Uncertainty over the fate of President Trump’s duties spurs firms to see whether they could claw back billions of dollars. The Trump administration on Wednesday asked the Supreme Court to quickly hear its appeal of last week’s lower court ruling. The courts are weighing the legality of 10% baseline tariffs the Trump administration imposed this year on most trading partners, as well as steeper tariffs on China, Mexico and Canada.”, The Wall Street Journal, September 6, 2025

===============================================================================================

“US soyabean farmers squeezed as China blocks imports and stockpiles rise – Overseas sales of top US export crop plummet as trade talks between Washington and Beijing stall. The new export season for soyabeans has opened with no sales or shipments to China, government data shows — a sharp break from a year ago, when it had already booked 6.5mn tons. For decades, more than half of all US soyabeans went to China, the world’s biggest buyer. But this year, as trade talks between Washington and Beijing stall, not a single American soyabean has headed east, leaving farmers struggling to stay afloat as bins fill and prices sag while China turns to record supplies from Brazil.”, The Financial Times, September 26, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“US Travel Association Warns Government Shutdown Could Cost Industry Billions – With a government shutdown looming, the U.S. Travel Association is calling on lawmakers to avert the crisis, which could have ramifications for the travel economy and the traveling public. ‘A shutdown is a wholly preventable blow to America’s travel economy—costing $1 billion every week—and affecting millions of travelers and businesses while placing unnecessary strain on an already overextended federal travel workforce’. 60 percent of Americans said they would cancel or avoid trips by air in the event of a shutdown.”, Travel Pulse, September 25, 2025

===============================================================================================

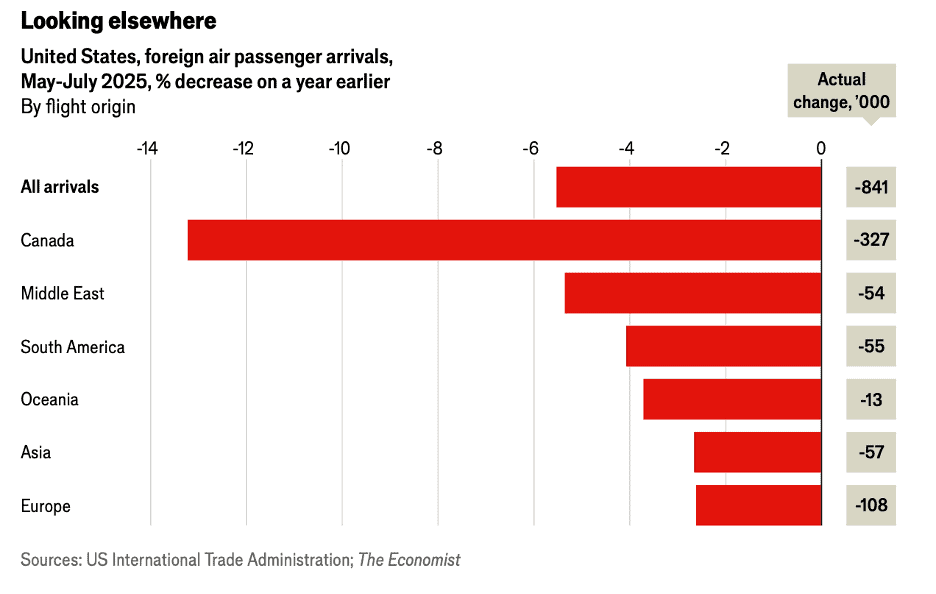

“Have foreign tourists really avoided America this year? Using monthly data on arrivals at all airports from America’s International Trade Administration, a government agency, The Economist finds that foreign arrivals at American airports are down by 3.8% compared with 2024, or 1.3m fewer people. The slump was steepest between May and July, when arrivals fell by 5.5% year on year. That bucked the global trend as tourism finally recovered to pre-pandemic levels. Travel and tourism make up around 3% of America’s gdp. But so far hotel operators have reported that higher spending by well-off domestic travellers has softened the blow.”, The Economist, August 26, 2025

==================================================================================================

“Are You Ready To Spend 29 Hours On The World’s Longest Flight? China Eastern Airlines is launching twice-a-week service from Shanghai to Buenos Aires, with Boeing 777-300ER widebody aircraft. As today’s airliners are not capable of flying the full 12,299 mile distance without refueling, the direct flight will have a “technical stop” in Auckland, New Zealand. China Eastern described “The Shanghai Pudong-Auckland-Buenos Aires route.. as an important measure to build a new ‘Air Silk Road’ channel between Asia-Pacific and South America.” The flight will be “the world’s first commercial route connecting antipodal cities,” as Shanghai and Buenos Aires are literally on opposite sides of the earth. The southerly flight path will skirt Antarctica, flying over vast empty expanses of ocean.”, Forbes, September 27, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

What Matters Next: A Leader’s Guide to Making Human‑Friendly Tech Decisions in a World That’s Moving Too Fast by Kate O’Neill addresses the tensions leaders face in an era of rapid technological change: how to move decisively without abandoning human values. O’Neill argues that many tech decisions fail because they are made either too hastily (with unintended harmful consequences) or too slowly (letting opportunity slip or compounding risk). She introduces a conceptual framework to help navigate this balancing act.

Central to her approach is the Now‑Next Continuum, which treats decisions as part of a temporal spectrum rather than binary between “now” and “future.” Leaders are encouraged to shift from asking immediate “how” questions toward cultivating deeper insights and bankable foresights—that is, plausible projections grounded in evidence that can guide future actions. She also emphasizes through‑line thinking: tracing how current decisions connect to future outcomes, so that seemingly small choices aren’t disconnected from long‑term purpose.

O’Neill further explores the “Harms of Action vs. Harms of Inaction,” showing that both false starts and delays carry costs. Her idea of ethical acceleration encourages leaders to accelerate responsibly—moving neither recklessly nor inertly—by embedding human-centric values into innovation. She weaves in case examples, decision heuristics, and leadership mindset shifts that allow organizations to embed humanity (meaning, dignity, context) into technology strategies. Ultimately, the book is a playbook to help leaders make tech-enabled change that is not only efficient but human‑friendly.

5 Key Takeaways

Balance urgency with deliberation: Acting too quickly risks unintended consequences; waiting too long means missed opportunity. The sweet spot lies in “ethical acceleration,” where speed is tempered by foresight and values.

Think in continuums rather than binaries: The Now‑Next Continuum helps leaders avoid false dichotomies (e.g. “do now vs. wait”) by seeing decisions as nodes in a continuous trajectory.

Shift from “how” to “insight → foresight”: Rather than jumping to execution, begin with framing better questions, seeking insights, then developing “bankable foresights” that anchor future actions.

Trace through‑lines to connect decisions across time: Through‑line thinking ensures that short-term tech choices align with longer-term purpose, reducing disjointed or contradictory strategies.

Embed humanity in technology strategy: Use human values (meaning, dignity, context) as guardrails. For example: design systems that preserve agency, context, privacy, and human judgment rather than fully automating away human roles.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

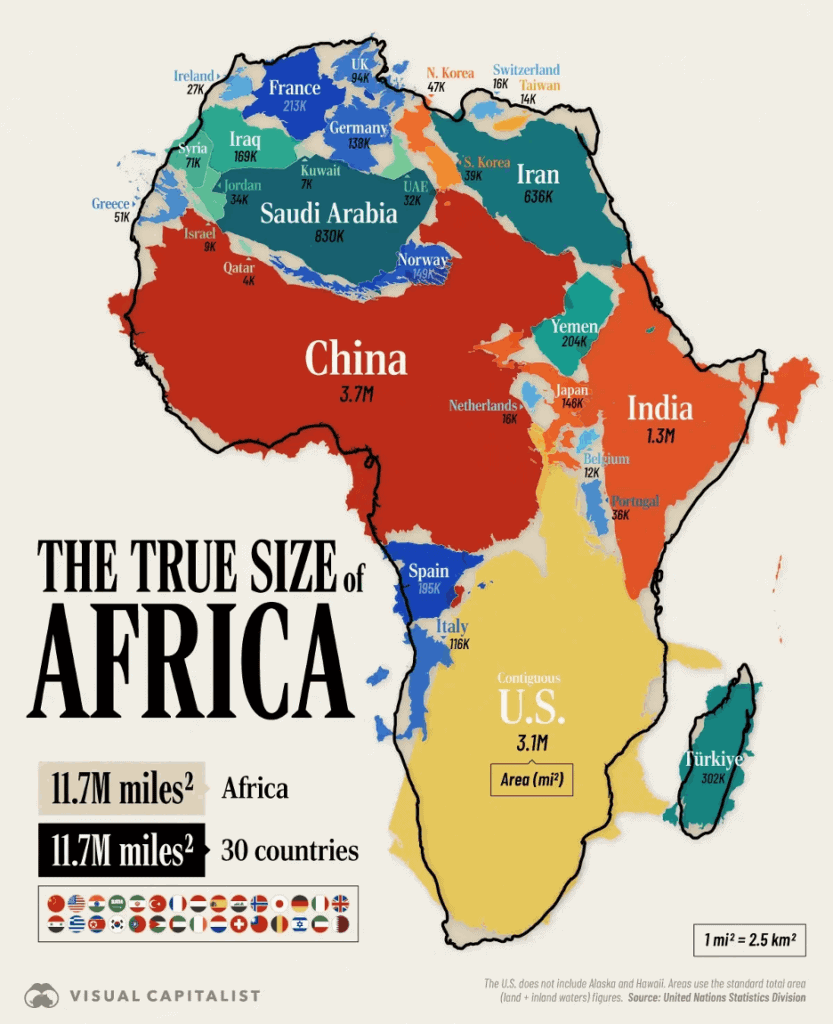

“How Many Countries Fit in Africa? Visualizing the Continent’s True Size – The continent of Africa covers 11.7 million mi² (30.4 million km²), roughly equal to the size of 30 countries. These 30 include some of the world’s largest countries like the (contiguous) U.S., China, and India. However, the most common map projection, called the Mercator projection, makes Africa appear smaller than it actually is. For reference, Africa is the second-largest continent, both by size and population (1.6 billion people).”, Visual Capitalist & United Nations Statistics Division, September 20, 2025

==============================================================================================

Canada

“Canadian economy poised for upturn in 2026, but risks abound, Deloitte says in fall outlook – After months of sluggish activity under U.S. tariffs, the economy is expected to rebound in 2026 as lower interest rates and federal spending take hold – provided the carve-outs that keep most exports tariff-free survive, a new economic outlook from Deloitte Canada shows. The country’s gross domestic product will grow 1.1 per cent in 2025 and 1.6 per cent next year, gaining momentum from falling borrowing costs, infrastructure spending and rising business investment, according to projections from Deloitte’s fall economic outlook.”, The Globe and Mail, September 29, 2025

============================================================================================

“Port of Vancouver handles record volumes as Canadian trade shifts toward Asia – The Port of Vancouver’s cargo volumes rose 13 per cent to set a record level of activity for the first six months this year as data show a trend toward Canada trading more with Asia and reducing reliance on the United States. The port’s midyear statistics show that it handled a record 85.4 million tonnes of cargo in the first six months of 2025, compared with 75.7 million tonnes for the same period last year. China is by far the largest trading partner with Canada at the West Coast port. China accounted for 25.4 million tonnes of exported and imported cargo in this year’s first half, up 25 per cent from the year-earlier period.”, The Globe and Mail, September 26, 2025

===============================================================================================

China

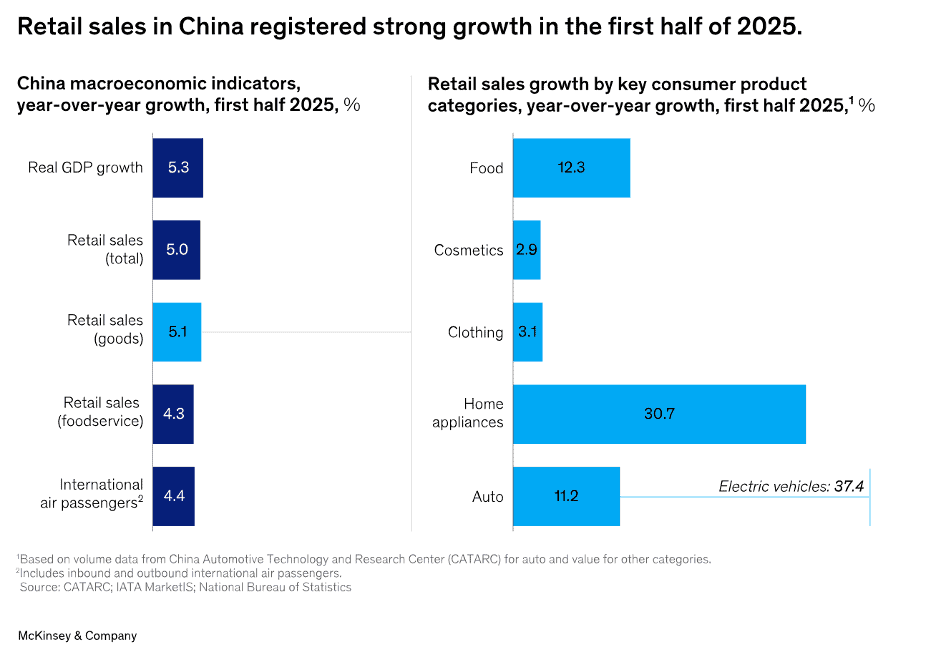

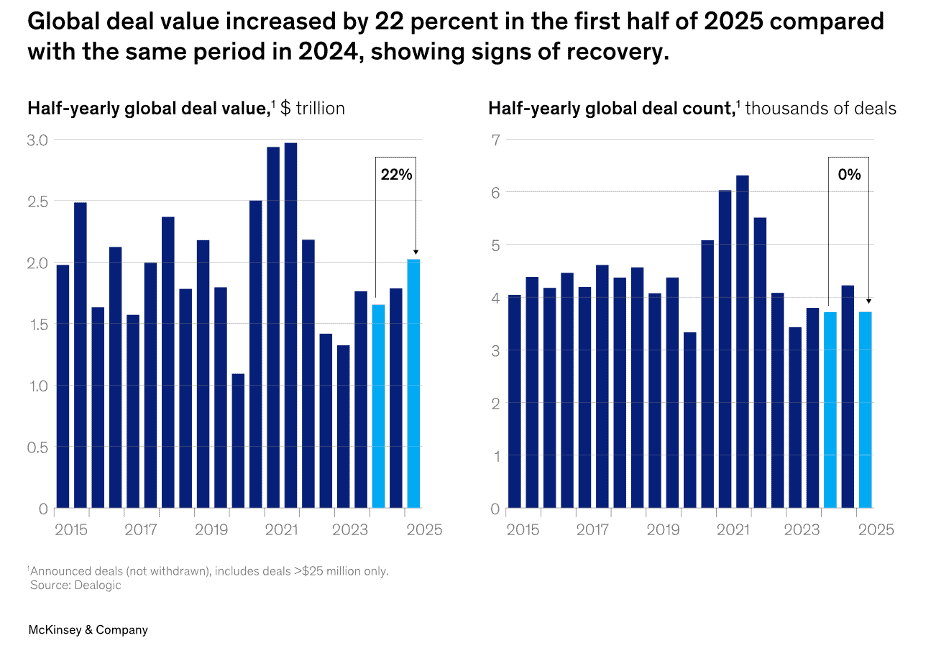

“China drives to the top – China has rapidly become the world’s largest car exporter, fueled in part by a surge in electric vehicle (EV) sales, positioning China as a key global player. In 2019, the country exported 0.7 million cars, but by 2024, that number had risen to 5.5 million, surpassing Japan, Mexico, and Germany. EVs composed nearly 40 percent of China’s passenger vehicle exports in 2024 and nearly half in the first half of 2025.McKinsey & Co., September 23, 2025

=============================================================================================

European Union

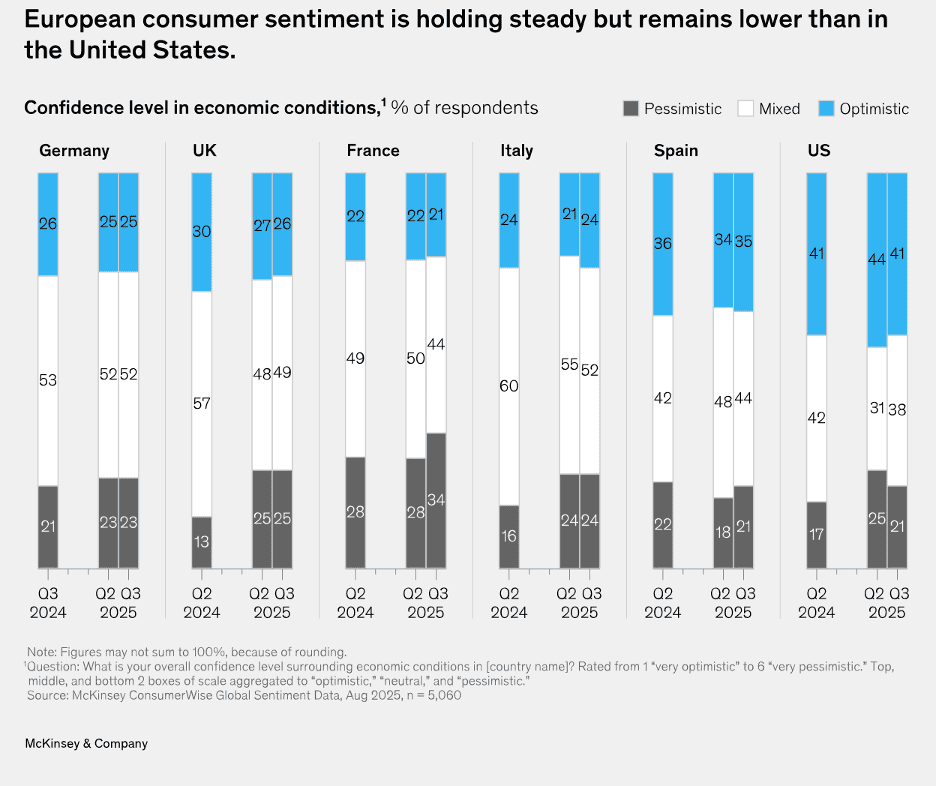

“An update on European consumer sentiment: Cautious, but gearing up for the holidays – Despite geopolitical and economic uncertainty, European consumer sentiment is holding steady heading into the holiday season—with spending intentions remaining in line with last year’s levels. Inflation remains the top concern for consumers, but its gradual stabilization in the eurozone has allowed many shoppers to maintain their holiday budgets. Across EU-5 nations, net consumer sentiment—the difference between optimism and pessimism—remains relatively unchanged compared to previous surveys. Stable inflation rates and a resilient job market are likely strong drivers for this trend. However, France stands out as the exception, experiencing a significant uptick in pessimism with minimal corresponding movement in optimism. In contrast, sentiment in the United States has been more volatile, though it remains higher than European levels.”, McKinsey & Co., September 5, 2025

=============================================================================================

India

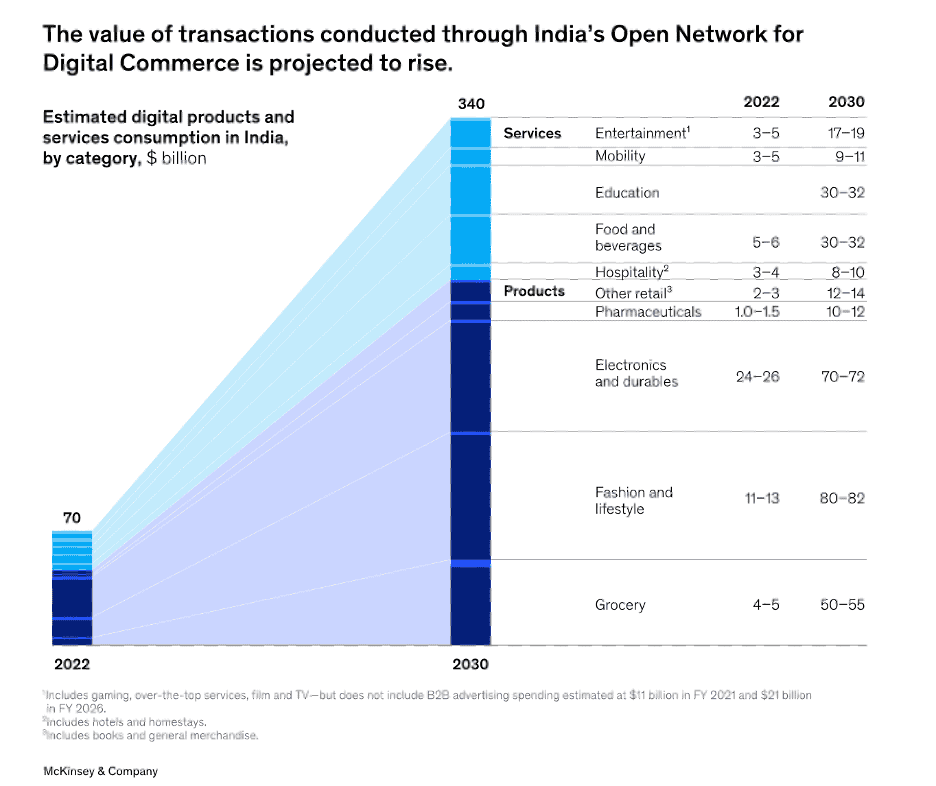

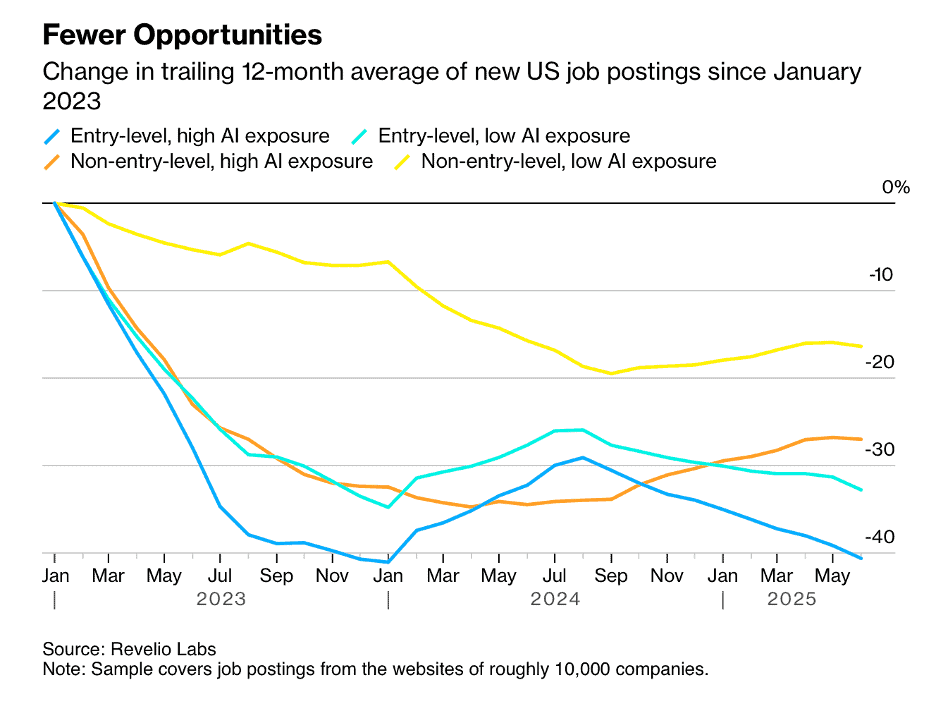

“AI is erupting in India – American firms are piling on users—and sucking up mountains of data. Sam altman is bullish about India. The co-founder of Openai, the firm behind Chatgpt, says the country’s adoption of artificial intelligence (ai) has been “unmatched anywhere in the world”. India is already Openai’s second-largest market by number of users and could soon be its biggest. For Indians, the battle promises cutting-edge ai tools at extremely low cost. For ai firms, the payoff may lie less in revenue than in reach: the chance to lock in hundreds of millions of users, and the torrents of data they create. The opportunities in India are staggering. The country has around 900m internet users; only China has more. But unlike China, India is open to American tech firms.”, The Economist, September 17, 2025

===========================================================================================

Spain

“Spain has become Europe’s standout economy – But it must combine immigration-led growth with productivity improvements. Since the start of 2024, the Spanish economy has grown at an average annual rate of 3 per cent, compared with just over 1 per cent for the Eurozone as a whole. In recent weeks, S&P Global Ratings has upgraded its credit rating, and the Bank of Spain raised its 2025 growth forecast to 2.6 per cent — underscoring the nation’s position as Europe’s fastest-growing major economy, and one of the strongest in the advanced world. Tourism has recovered from the pandemic. The government has been spending grants from the EU’s Next Generation EU fund on improving infrastructure….Cheap renewable energy has also attracted foreign direct investment. Earlier reforms, including an initiative in 2021 to boost the stability of employment, have helped too. But Spain’s biggest motor has been immigration. While other European nations have been keen to tighten their borders, Spain has adopted a more liberal approach.”, The Financial Times, September 28, 2025

=============================================================================================

United States

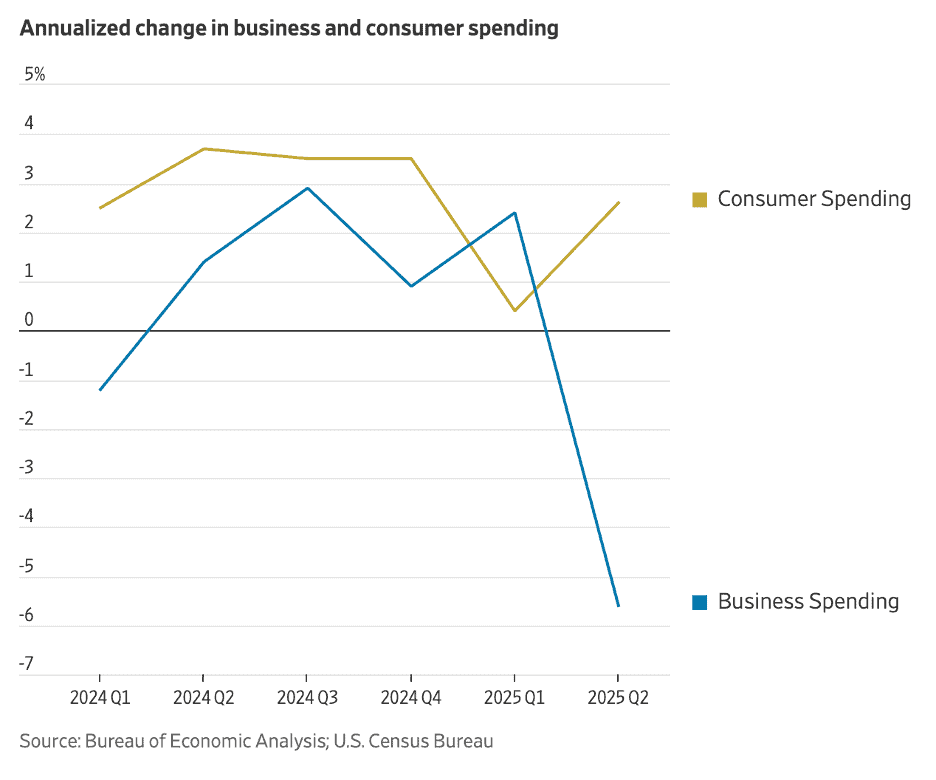

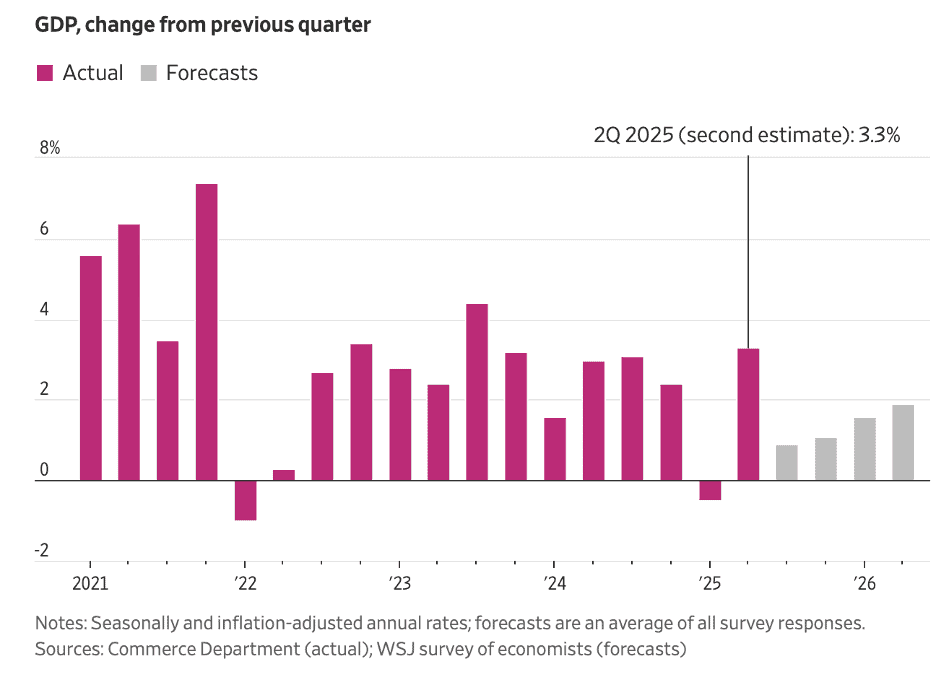

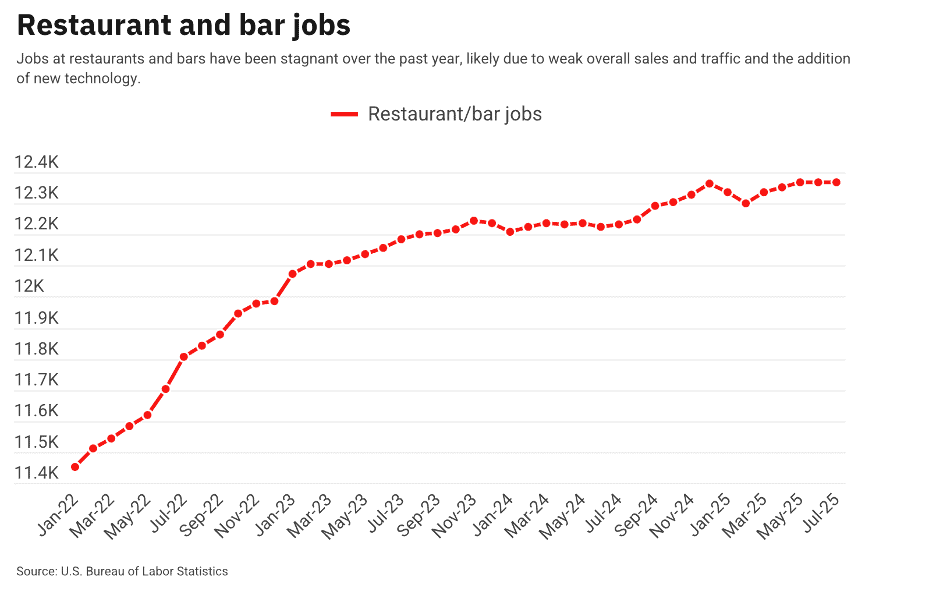

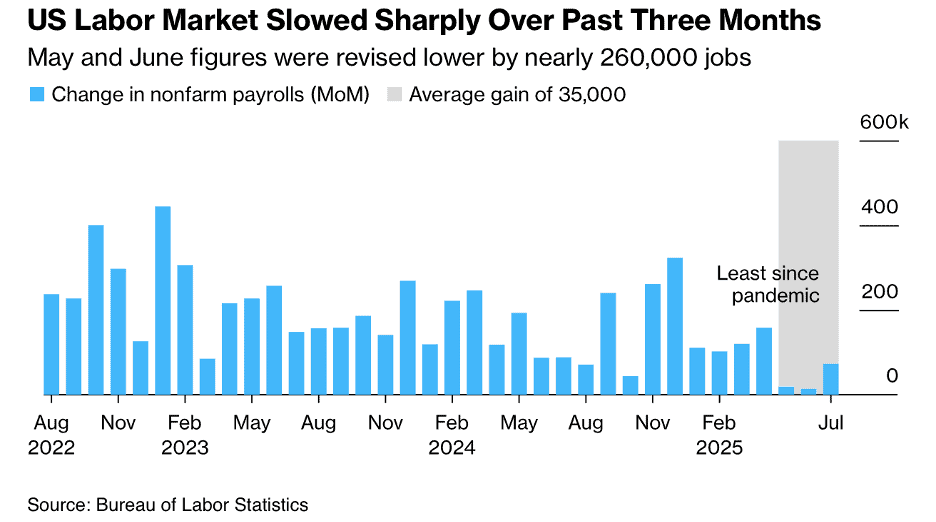

“Beneath the GDP, a Recession Warning – Business spending dropped sharply in the second quarter. Blame the trade war. Buried in last week’s BEA report is a much more reliable measure of the economy—gross output, or GO. It measures spending at all stages of production, totaling an estimated $63 trillion this year—more than twice GDP of $30 trillion. GO revealed that economic growth is slowing to a crawl, ahead only 1.2% in real terms. If you include all transactions in wholesale and retail trade, the adjusted GO is up only 0.3%. More important, overall business spending fell sharply, by an annualized 5.6% in real terms. These results are much more consistent with the weak labor-market data.”, The Wall Street Journal, September 28, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

Starbucks to close stores, lay off workers in $1 billion restructuring plan – Starbucks announced a $1 billion restructuring plan Thursday that involves closing some of its North American coffeehouses and laying off more workers. Approximately 900 non-retail employees will be laid off, Starbucks said. This is the second round of layoffs in Niccol’s tenure, after 1,100 corporate workers were let go earlier this year. The number of company-operated stores in North America will decline by about 1% in fiscal 2025, accounting for both openings and closures, the company said in a Securities and Exchange Commission filing. That figure translates to roughly 500 gross closures, according to TD Cowen estimates.”, CNBC, September 25, 2025

=============================================================================================

“Shake Shack plans first restaurant in Vietnam for next year – It is expanding its partnership with licensee Maxim’s Caterers Limited, which already operates 52 Shake Shack locations in China, including Hong Kong and Macau, and Thailand. Maxim’s has a total of 2,000 outlets globally throughout China and Southeast Asia. Those include many concepts exclusive to Asia, but also The Cheesecake Factory and Lawry’s The Prime Rib, as well as Starbucks, of which it has coffeehouses in Hong Kong, Macau, Vietnam, Cambodia, Singapore, Thailand, and Laos, according to its web site.”, Nation’s Restaurant News, August 12, 2025

=============================================================================================

“McDonalds China Hamburger University will invest 400 million yuan (US$56 million) in talent development over the next three years revealing its plan to train 10,000 people annually – As of now, there are 11 Hamburg universities around the world. Each year, nearly 10,000 trainees at McDonald’s China complete training at Hamburger University, and over 200,000 employees learn online. ‘When Hamburger University was founded in 2010, we had more than 1,000 restaurants across China. Today, we have over 7,400 restaurants, serving over 1.3 billion customers annually,’ said Zhang Jiayin, CEO of McDonald’s China.”, Yical, September 24, 2025. English translation and article compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

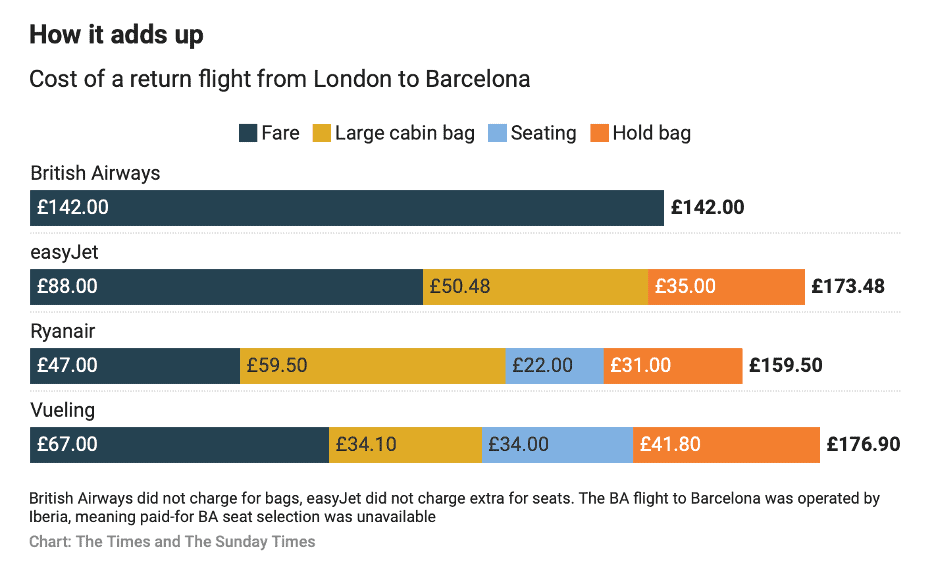

“Why so many US fast food chains are expanding fast in Britain – It’s not just McDonald’s: brands like Chick-fil-A, Denny’s and Chuck E Cheese plan to open more than a thousand outlets this year. What’s behind their appetite? Ten American firms with little or no presence in the UK have revealed plans for hundreds of outlets, on top of the 700 new diners announced by established brands such as McDonald’s and KFC. US companies have long seen the UK as the obvious first step in their plans for global expansion, in part because of Britain’s familiarity with American film and television.”, The Tines of London, September 21, 2025

=============================================================================================

“Guzman y Gomez to open a dozen new stores by year’s end – Fast-growing Mexican food chain Guzman y Gomez plans to deliver on 40 per cent of its new store openings planned this financial year within the last three months of 2025 alone, with 12 new locations planned across VIC, NSW, QLD and the ACT. The company has revealed 12 of these will be between October and December, of which five will be corporate run and seven will be franchised as GYG welcomes five new franchisees. This compares to 11 new openings for the same period in 2024, as the group works towards a rhythm of 40 new store openings annually in Australia while it strives to hit a footprint of 1,000 locations over the long term. The current store count is more than 250.”, Business news Australia, September 23, 2025

==============================================================================================

“Elegant Hoopoe unveils AI-powered wellness franchise targeting $1.5 trillion global wellness market with expansion to over 200 clinics – Hoopoe Holding, the first AI-powered, IP-protected wellness franchise, is rapidly progressing toward its ambitious global expansion targeting 200+ clinics worldwide under its elegant hoopoe brand, positioning itself to capture a significant share of the $1.5 trillion global wellness economy. The UK has been identified as the primary European launch market, with advanced discussions underway with capital partners and operators across the USA, Canada, France, Germany, Switzerland, and Italy.”, TMC Net News, September 23, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 143, Tuesday, September 16, 2025

“Protectionism is back in force, but global opportunity remains for those who adapt.”

Welcome to the 143rd Edition of the Global Business Update – – The theme of this edition reflects a statement by Larry Fink, CEO of BlackRock: “Protectionism is back in force.” This captures a defining reality of 2025. While globalization is far from over, its shape is changing. National interests, trade barriers, and geopolitical rivalries are reshaping supply chains and investment flows, creating both new obstacles and unexpected openings for global companies.

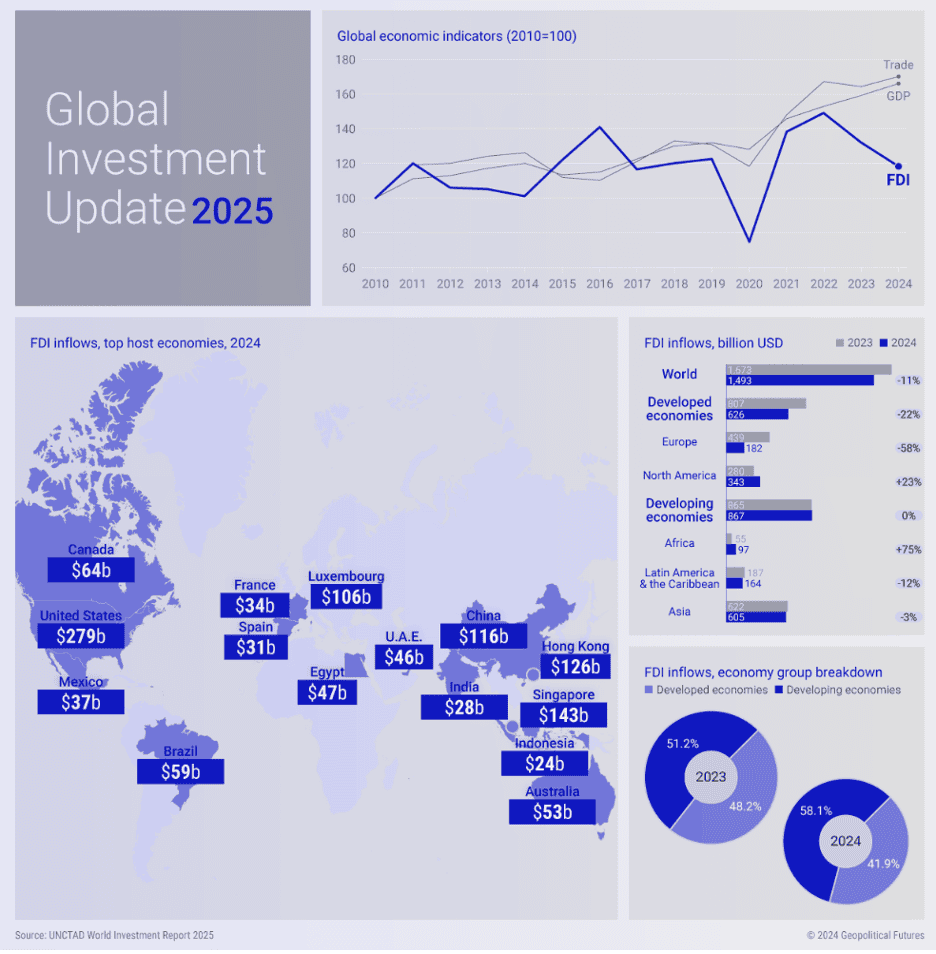

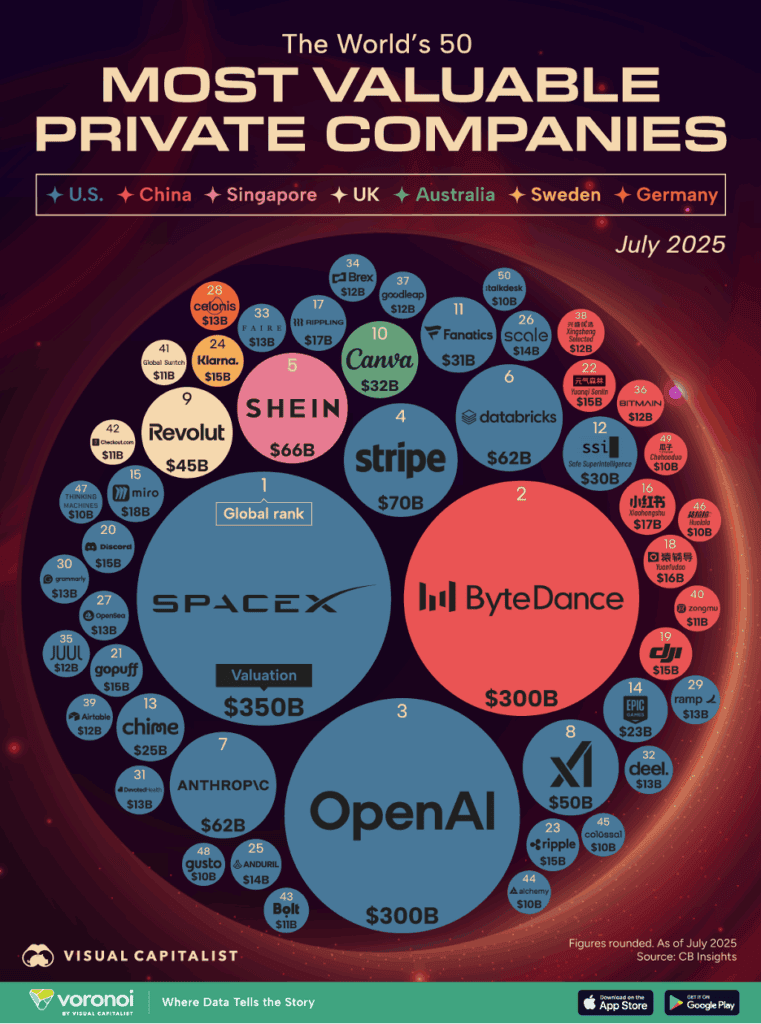

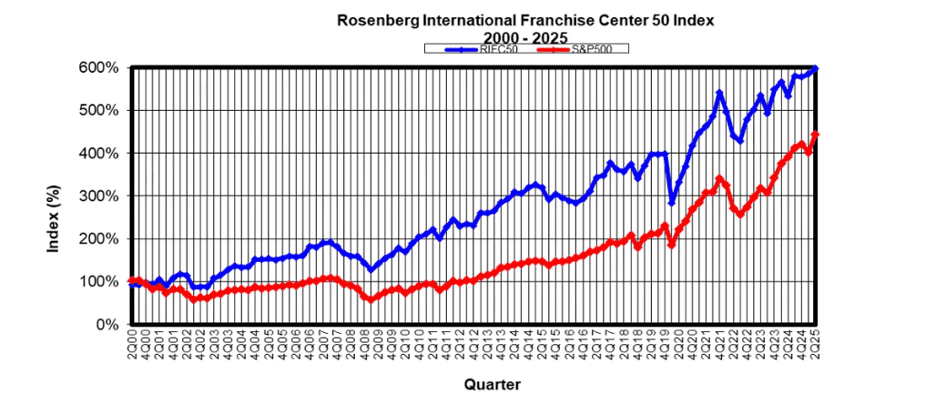

We see this contrast everywhere. Global brand value has reached a record $10.7 trillion, with artificial intelligence driving growth well beyond the tech sector. At the same time, foreign direct investment has fallen for the second year in a row, reflecting caution among investors navigating tariffs, regulatory shifts, and political uncertainty. For global franchisors and investors, the message is clear: opportunity remains robust, but adaptation is essential.

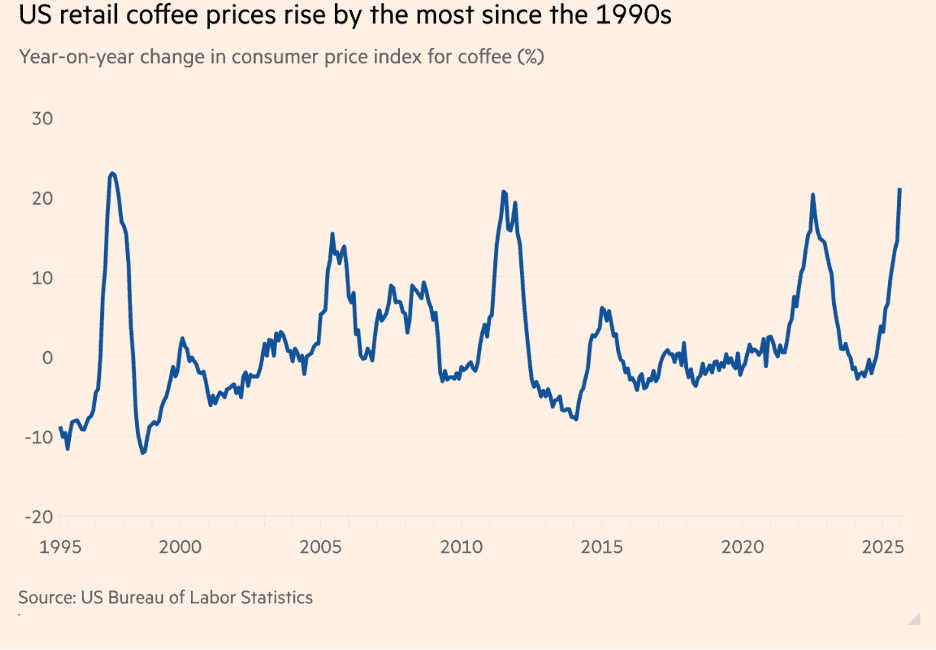

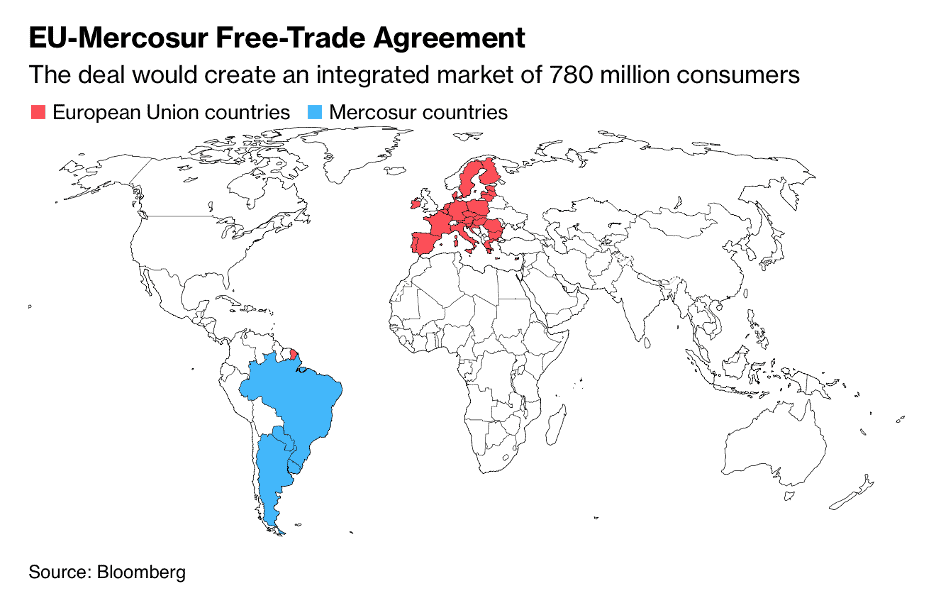

Examples abound. Coffee prices in U.S. supermarkets are at their highest since the 1990s due to tariffs, while soybean demand has shifted away from U.S. growers toward South America. Europe continues to negotiate its long-delayed Mercosur pact, Morocco is emerging as a new manufacturing hub, and Saudi Arabia is positioning itself as a global leader in solar power.

Global franchising continues to evolve with both growth opportunities and new challenges. Captain D’s is expanding beyond the U.S. with plans for entry into the United Kingdom and Canada, reflecting how strong operational results at home can fuel international ambitions. At the same time, franchise executives emphasize that while new market entry is exciting, long-term success depends on maintaining strong relationships with existing partners. Your Editor’s just published article on adapting franchise brands abroad and my article on U.S. franchisors facing persistent non-tariff barriers, reinforcing the need for due diligence and strong local partnerships abroad are in this edition.

This issue’s book Chokepoints: American Power in the Age of Economic Warfare – Summary & Insights by Edward Fishman, a former U.S. State Department sanctions strategist, argues in Chokepoints that global business has entered a new era where power is exercised not through tariffs or armies alone, but through the control of economic chokepoints — the critical supply chains, technologies, and financial systems that underpin globalization.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Protectionism is back in force, but global opportunity remains for those who adapt.”, Larry Fink, CEO of BlackRock

“AI is no longer a side project — it’s reshaping the way global business operates.”, Satya Nadella & McKinsey reports)

“Uncertainty is now a persistent reality for business leaders… draw on ‘muscle memory’ — past lessons and experiences — to navigate challenges.”, Janet Truncale, EY Global Chair & CEO

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #143:

The Most Valuable Global Brands in 2025

The Biggest Tourism Economies in 2024

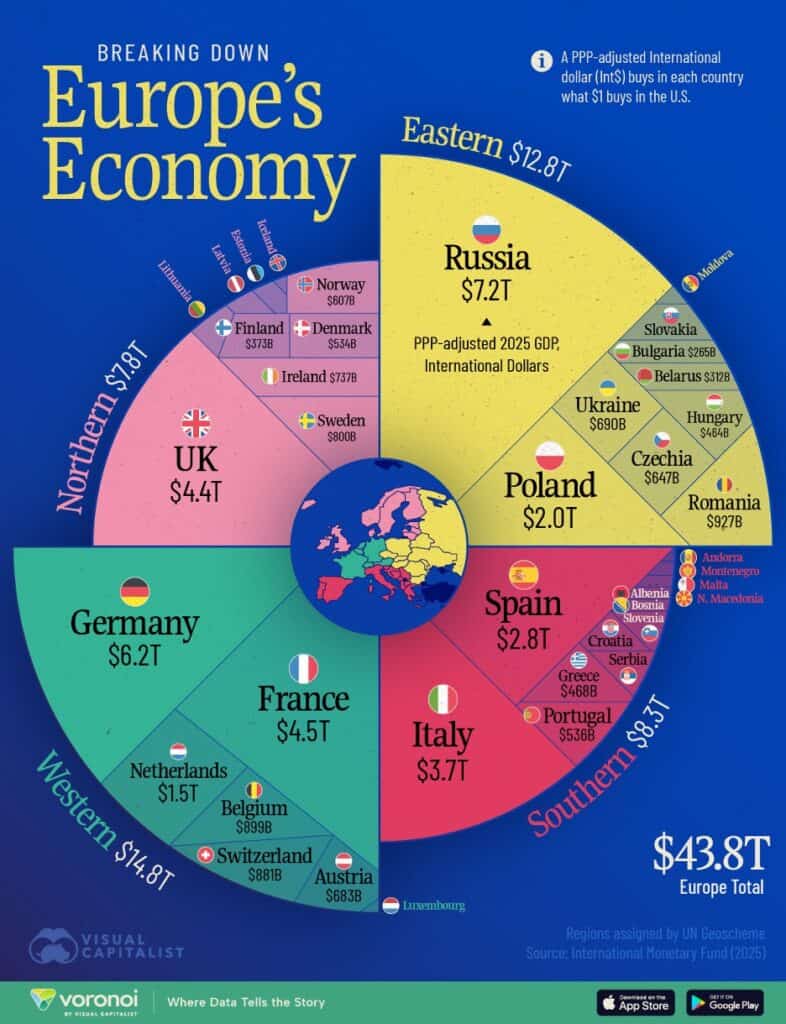

The Size of European Economies by GDP (PPP) in 2025

Chinese Public Wants a Balanced Approach to the United States

Non-Tariff Barriers Faced by U.S. Franchisors Expanding Internationally

Brand Global News Section: Captain D’s®, Costa Coffee®, McDonalds®, Potbelly® and Starbucks®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“The Most Valuable Global Brands in 2025 – Artificial intelligence is rewriting the rules of brand growth, and it’s not just the tech giants that are benefiting. According to the 2025 Kantar BrandZ rankings, Apple, Google, Microsoft, Amazon, and NVIDIA continue to dominate the leaderboard, but AI-driven momentum is boosting brand value across retail, media, and other sectors as well. Global brand value jumped 29% in the past year, reaching a record $10.7 trillion. While tech brands continue to lead, sectors like retail, luxury, finance, and telecom also secured top 20 positions. Together, the rankings reveal how consumer trust, innovation, and investor sentiment are shaping the global marketplace in 2025; and where retail investors may want to keep a closer watch.”, Kantar.com, September 12, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

“Global Investment Keeps Falling – For the second straight year, FDI fell by double digits. According to the U.N. Trade and Development organization, global foreign direct investment (FDI) dropped 11 percent in 2024. Much of the decline can be explained by trade tensions and rising uncertainty. With investor uncertainty still high, the outlook for 2025 is pessimistic as well. Closer inspection reveals some bright spots, however. For instance, although FDI flows to developed economies fell by 22 percent in 2024, investment in developing countries was stable. As a result, developing economies’ share of FDI inflows rose to 58 percent from 51 percent a year earlier. Ten countries (including China, Brazil, Mexico, Indonesia and India) accounted for roughly three-fourths of these inflows. Similarly, investment in the digital economy increased by double digits, outpacing global GDP growth.”, Geopolitical Futures, September 5, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“US coffee prices surge at the supermarket amid supply crunch – Donald Trump’s tariffs on Brazil are poised to compound the fastest cost increase since the 1990s. US retail coffee prices have posted the steepest year-on-year rise of this century, as tariffs on imports from Brazil, the world’s biggest producer, are poised to compound the effects of a global supply shortage. Ground coffee hit a record $8.87 a pound at groceries in August, while a consumer price index for coffee rose 21 per cent year on year, the fastest pace since 1997, according to data published on Thursday by the US Bureau of Labor Statistics. Global coffee markets have soared over the past year after poor harvests in major exporting countries drove down production.”, The Financial Times, September 11, 2025

=============================================================================================

“US misses out on billions of dollars of China soybean sales midway through peak season – South American soybeans cover 95% of China’s October demand. US faces potential export loss of 14 mln-16 mln tons. USDA may pare 2025/26 US soybean export forecast. South American soybeans cover 95% of China’s October demand. US faces potential export loss of 14 mln-16 mln tons. U.S. farmers are missing out on billions of dollars of soybean sales to China halfway through their prime marketing season, as stalled trade talks halt exports and rival South American suppliers step in to fill the gap, traders and analysts said. Chinese importers have booked around 7.4 million metric tons of mainly South American soybeans for October shipment, covering 95% of China’s projected demand for the month and 1 million tons for November, or about 15% of expected imports, according to two Asia-based traders.”, Reuters, September 10, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“The Biggest Tourism Economies in 2024 – The above graphic shows how America’s tourism economy is the largest globally by far—contributing $2.4 trillion to the country’s GDP in 2024, or about 3% of the total. While many international tourists are shunning America this year given trade rifts, travel data shows that its impact is mixed across U.S. regions. While Boston, Chicago, and New York are seeing at least 7% declines in international arrivals, Florida has seen an increase compared to last summer. China stands as the second-largest tourism economy worldwide at $1.3 trillion, surpassing Germany by more than twofold. If we look at India, its $232 billion tourism economy now ranks in eighth globally, surpassing Spain and Italy as the country saw record international visitor spending in 2024.”, World Travel & Tourism Council, July 6, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Chokepoints: American Power in the Age of Economic Warfare – Summary & Insights by Edward Fishman, a former U.S. State Department sanctions strategist, argues in Chokepoints that global business has entered a new era where power is exercised not through tariffs or armies alone, but through the control of economic chokepoints — the critical supply chains, technologies, and financial systems that underpin globalization.

Fishman highlights how chokepoints such as semiconductor production, global shipping lanes, rare earth minerals, and financial clearing systems are increasingly being weaponized. The book shows how governments, especially the U.S., use sanctions, export controls, and regulatory dominance to advance national security goals. For businesses, this means that global operations are no longer shaped solely by markets — but also by geopolitics.

For corporate leaders, Fishman’s message is clear: recognize chokepoints, prepare for sudden disruptions, and build resilience before crises hit.

Five Takeaways for Global Business Leaders

Geopolitics is embedded in supply chains – sourcing decisions must factor in political stability, not just cost.

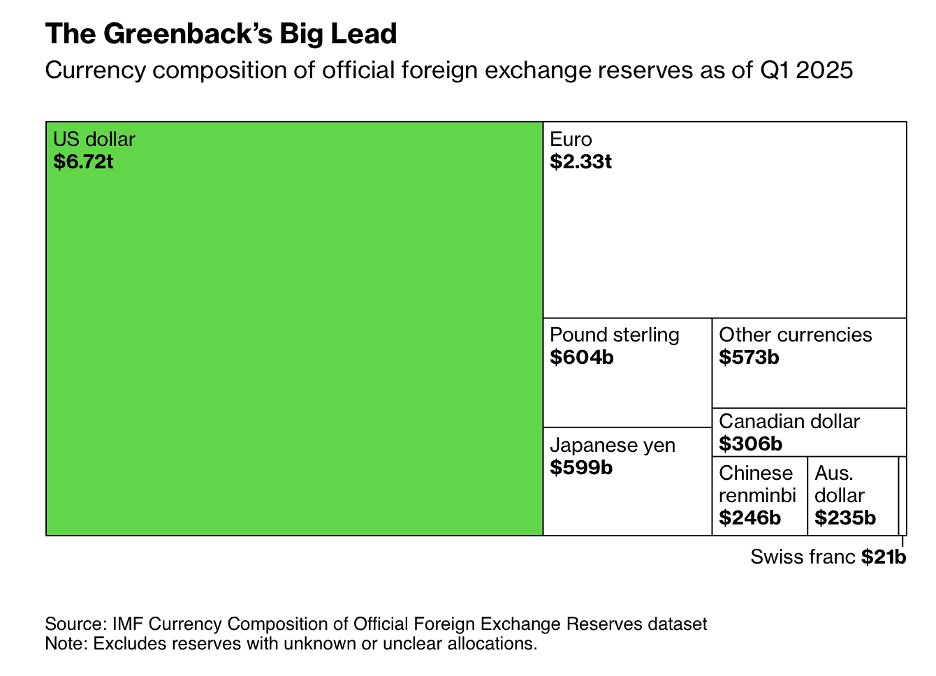

Financial flows are chokepoints – U.S. dominance in banking and the dollar gives Washington powerful levers.

Technology is a frontline – export controls on semiconductors or AI can reshape entire industries overnight.

Resilience beats efficiency – companies need redundancy and diversification, even at higher cost.

Scenario planning is essential – boards should stress-test against chokepoint disruptions just as they do for cybersecurity.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

“US-China tensions drive business confidence to new lows, survey says – Record low optimism in five-year China business outlook. Geopolitics, domestic competition, economic slowdown are biggest challenges. US-China tariffs expected to impact 2025 revenue for 64% of firms. Political tensions, fierce domestic competition and China’s slowing economic growth are sapping the confidence of U.S. businesses in the country, with optimism about their five-year outlook falling to a record low, a survey showed. Only 41% of U.S. firms were optimistic about their five-year China business outlook, a drop of six percentage points from last year, according to the survey published on Wednesday by the American Chamber of Commerce in Shanghai. This was the weakest level of optimism reported since the AmCham Shanghai Annual China Business Report was introduced in 1999.”, Reuters, September 9, 2025

================================================================================================

“Chinese Public Wants a Balanced Approach to the United States – Few see the United States as a friend to China, but a majority want Beijing to use a mix of cooperation and containment in its approach to Washington. New research conducted by the Chicago Council on Global Affairs and The Carter Center offers a rare window into the attitudes of everyday Chinese citizens on international affairs. Most Chinese (61%) say China should pursue a dual-pronged approach to the United States, undertaking either friendly cooperation or limiting US power when appropriate. The Chinese public is divided over which country—China or the United States—is stronger economically or militarily. Those who see the United States as a stronger economic power are more likely to favor friendly cooperation with the United States (32% vs. 23% overall). Those who see China as stronger are more likely to favor actively limiting American power (25% vs 15% overall). The top two perceived threats to China both involve the United States: 57 percent say a US-China conflict over Taiwan is a major threat, and 55 percent say economic competition with the United States is a major threat. Most Chinese say trade between China and the United States does more to strengthen China’s national security (71%) than it does to weaken it (28%).”, Chicago Council on Global Affairs, September 2, 2025

=============================================================================================

European

“The Size of European Economies by GDP (PPP) in 2025 – Western Europe makes up the largest portion of the $43.8 trillion PPP-adjusted European economy, when measured in International dollars. Eastern Europe ($12.8T) outperforms both Northern ($7.8T) and Southern Europe ($8.3T) in PPP terms, helped in large part by the Russian economy ($7.2T). However, by nominal USD terms, Eastern Europe is the smallest ($4.6T), outweighed by just the Germany economy ($4.7T). While many people picture Europe’s prosperity through the lens of its Western powerhouses, a closer look at Europe’s GDP by region reveals a more nuanced regional picture. The visualization breaks down purchasing-power-parity (PPP)-adjusted output in 2025, showing how different parts of Europe contribute to the continent’s collective wealth.”, Visual Capitalist & the International Monetary Fund, September 9, 2025

=============================================================================================

“EU Pushes Ahead to Ratify Trade Deal With South American Nations – The European Union is advancing its efforts to ratify a proposed trade deal with Mercosur countries by the end of the year after proposing safeguard measures. The EU and the Mercosur nations (Argentina, Brasil, Uruguay and Paraguay) completed talks on a preliminary agreement in December after more than two decades of negotiations. Ratification of the agreement would create an integrated market of 780 million consumers, providing a boost to the EU’s embattled manufacturing sector and Mercosur’s vast agricultural industry. The agreement needs approval by the European Parliament and a qualified majority of its 27 member states, and some countries, including France and Poland, have expressed reservations about the deal’s impact on the European agricultural sector.”, Bloomberg, September 3, 2025

===========================================================================================

Morocco

“Morocco is now a trade and manufacturing powerhouse – The country’s ports and factories are humming. Morocco’s position on Europe’s southern doorstep (and as a northern entry to Africa) has helped it insert itself into global supply chains. Foreign investment has risen swiftly. According to fdi Markets, a data firm, the country has drawn about $40bn of greenfield manufacturing investment since 2020, catapulting itself into the list of the world’s largest recipients. The country’s officials attribute this success to the investor-friendly policies of King Muhammad vi, Morocco’s leader. To please overseas businesses, his government has poured money into electricity generation, ports, railways, roads and solar facilities. It spent between 25% and 38% of gdp a year on infrastructure from 2001 to 2017, which is among the most in the world.”, The Economist, September 4, 2025

=============================================================================================

Saudi Arabia

“Oil Giant Saudi Arabia Is Emerging as a Solar Power – The kingdom is betting that sunshine can power new AI data centers and help boost oil exports. Saudi Arabia is rapidly expanding its solar power capacity, aiming for 50% clean energy by 2030 to power new projects. The shift is driven by the falling costs of Chinese solar panels and batteries, making solar a cost-effective alternative to burning oil. The world’s ultimate petrostate is turning to solar power. Saudi Arabia is building some of the world’s biggest solar farms, along with giant arrays of batteries to store their electricity till after dark. The rapid rollout is making the country into one of the fastest-growing markets for solar power from a near-standing start. Saudi Arabia’s ACWA Power is undertaking power projects in Africa and Asia, exploring sending electricity to Europe in the future.”, The Wall Street Journal, September 10, 2025

============================================================================================

United States

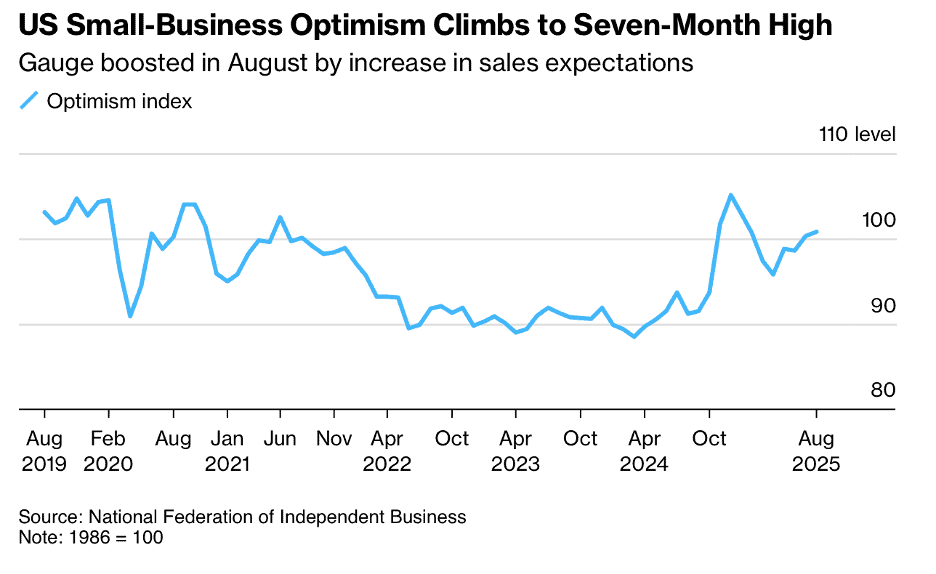

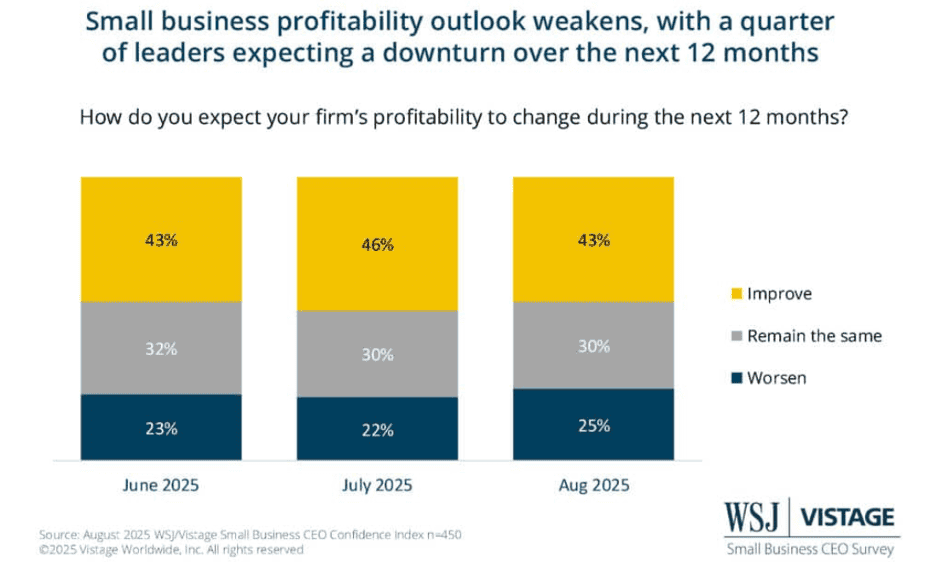

“US Small-Business Optimism Edges Higher on Better Sales Outlook – Sentiment among US small businesses edged higher in August, led by the most favorable sales expectations in six months as owners grew more sanguine about the health of their companies. A net 12% of owners expect higher retail sales volumes in the next three months, up 6 points and contributing the most to the increase in the overall optimism index. The group’s uncertainty index fell by 4 points to 93 last month, but that was still the 11th highest reading in more than 51 years, according to NFIB. When asked to rate the overall health of their business, 68% of owners said it as either excellent or good, up from last month, while 31% said it was either fair or poor, down from July.”, Bloomberg, September 9, 2025

============================================================================================

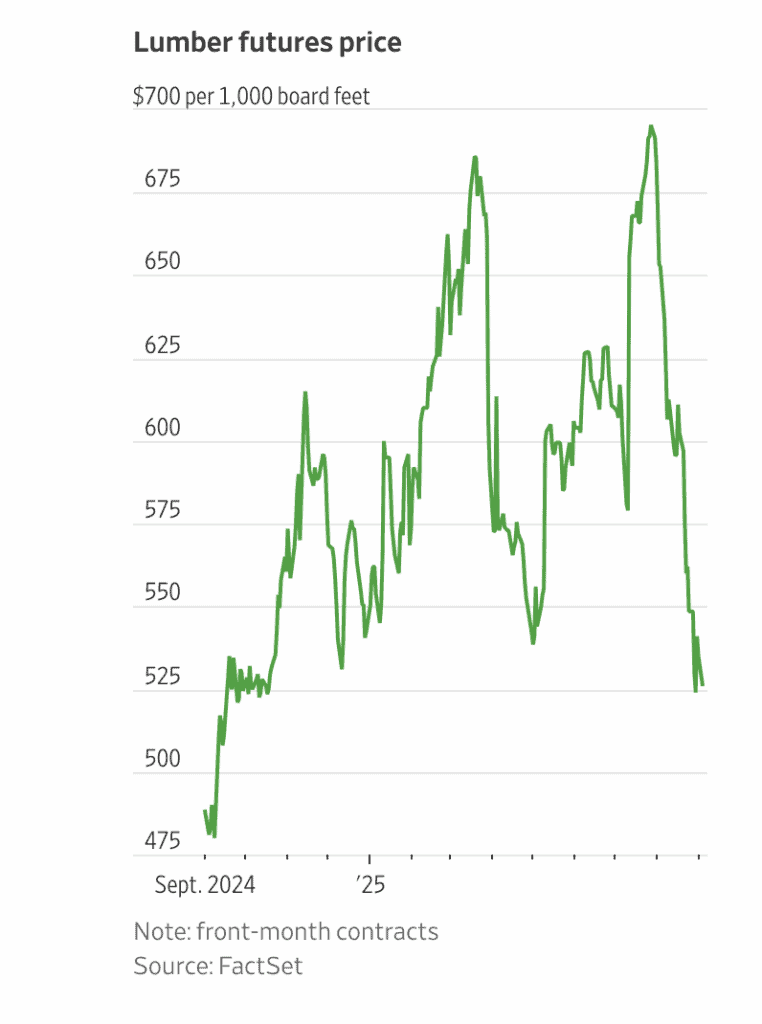

“Lumber Prices Are Flashing a Warning Sign for the U.S. Economy – Wood prices are sliding and mills are cutting back because of uncertainty over tariffs and a building slump. Falling lumber prices are sounding an alarm on Wall Street about potential problems on Main Street. Wood markets have been whipsawed of late by trade uncertainty and a deteriorating housing market. Futures have dropped 24% since hitting a three-year high at the beginning of August and ended Monday at $526.50 per thousand board feet. The price drop might have been greater—but two of North America’s biggest sawyers said last week that they would curtail output, slowing the decline. Crashing wood prices are troubling because they have been a reliable leading indicator on the direction of the housing market as well as broader economic activity.”, The Wall Street Journal, September 8, 2025

==============================================================================================

Vietnam

“Vietnam Accelerates IPOs, Enables Higher Foreign Stock Ownership – Vietnam is rolling out a series of regulatory reforms aimed at attracting more overseas investors into its stock market, which has outperformed regional peers this year. A newly-issued decree eliminates the ability of public companies to unilaterally impose foreign ownership limits that are lower than those allowed by domestic law or international agreements…. Vietnam has taken a series of steps to boost the attractiveness of its equities to global funds in recent years, including seeking to be classified as an ‘emerging market’ by the FTSE Russell indexes.”, Bloomberg, September 13, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Potbelly Sandwich Chain to Sell Itself to Convenience-Store Operator RaceTrac – The $566 million deal is expected to close this year; companies don’t plan to ‘put a Potbelly in every RaceTrac’. Potbelly Chief Executive Robert Wright said that Potbelly and RaceTrac would remain distinct brands after the deal closes. ‘Their strategy isn’t necessarily to put a Potbelly in every RaceTrac,’ he said. Rather, Wright said, the sandwich brand hopes the new ownership will help it reach its goal of 2,000 stores. Potbelly currently operates more than 445 stores across the U.S.”, The Wall Street Journal, September 10, 2025

==============================================================================================

“Adapt Without Compromise – When Franchises Reinvent Themselves Abroad – Franchising internationally isn’t just about exporting a proven concept—it’s about transforming that concept for a different world while maintaining brand integrity. Brands that thrive overseas are those that make smart, respectful changes without compromising their identity. The more thoughtfully you adapt, the more successfully you scale in other countries. Here are some standout examples of brands that didn’t just adjust; they reinvented themselves for success in a new culture while maintaining brand integrity.”, Franchise Update, 3rd Quarter 2025. Article. By William Edwards, Editor

=============================================================================================

“The Seafood Chain That Could Be Swimming Towards A Comeback – As of 2025, Captain D’s operates over 530 locations across 23 states, with state number 24 on the agenda for this year as part of an expansion plan into more northeastern states. Competitor seafood restaurants may have struggled financially during the COVID-19 pandemic, but Captain D’s emerged victorious, “enjoying double-digit sales and double-digit traffic,” according to a press release. Thanks to changes in business operations and restaurant layout, Captain D’s is on track to expand into the United Kingdom and Canada over the next few years, as well as continuing expansion domestically.”, Tasting Table, September 6, 2025

==============================================================================================

“From Renewal to Launch: How Strong Master Franchise Relationships Fuel Further Global Expansion– Taking a successful franchise brand abroad for the first time is filled with excitement and nerves. When the brand continues its international growth trajectory, each new country comes with the same level of excitement, along with greater confidence and less anxiety. But beyond simply planting flags in new international markets, it’s essential for a franchisor to not lose sight of their existing partnerships, ones they’ve already spent years nurturing and growing. Those established agreements must remain strong and relevant as their success will eventually serve as the foundation for each new developing market.”, Franchising.com, September 12, 2026. Article by Larisa Walega, the chief growth officer of Ziebart International Corporation.

=============================================================================================

“Drive-thru operator could switch from Starbucks to Costa Coffee – Coca-Cola may sell coffee chain for as little as £2 billion. Britain’s biggest Starbucks operator is weighing an audacious move to jettison its sites to unlock a cut-price swoop on rival Costa Coffee. EG Group, owned by private equity firm TDR Capital and Blackburn forecourt tycoons Mohsin and Zuber Issa, is understood to be considering proposals to sell the franchise rights to the 140 Starbucks “drive-thru” and “drive-in” sites that it operates across the UK. EG must do so to allow it or TDR to bid for Costa, whose owner, Coca-Cola, has begun sounding out potential suitors.”, The Times of London, September 6, 2025

=============================================================================================

“McDonald’s Escalates Restaurant Industry’s Fight Over Tipping – Burger giant says all workers should receive a base wage, including tipped servers employed by rivals. McDonald’s opposes wage rules allowing restaurants to pay tipped workers below the standard minimum wage. CEO Chris Kempczinski says all workers should earn at least the minimum wage, regardless of tips received. The McDonald’s critique aligns it with labor groups advocating against tipped wages. McDonald’s has gone so far as to withdraw from the National Restaurant Association, the industry’s main U.S. trade group, as a result of its stance on the tipped wage and other issues.”, The Wall Street Journal, September 4, 2025

===========================================================================================

“Non-Tariff Barriers Faced by U.S. Franchisors Expanding Internationally – When U.S. franchisors expand into new international markets, they often encounter non-tariff barriers that can significantly impact their ability to establish and grow. Unlike tariffs, which are direct taxes on imports, non-tariff barriers include regulatory, cultural, and operational challenges that vary by country. Understanding and addressing non-tariff barriers is critical for U.S. franchisors to succeed internationally. Comprehensive due diligence, market assessments, and strong local partnerships are key strategies for overcoming these challenges.”, William Edwards, September 12, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 142, Tuesday, September 2, 2025

“The old maps no longer apply. We need new compasses

and the courage to use them.”

Welcome to the 142nd Edition of the Global Business Update – Global business activity this period reflects both persistent headwinds and major structural shifts. U.S. food companies are pressing for relief from new tariffs, arguing that sectors dependent on imported seafood and produce cannot source substitutes domestically. In Europe, Brussels has struck a deal with Washington to scrap tariffs on U.S. industrial goods in exchange for moderating auto levies, underscoring the delicate balance in transatlantic trade.

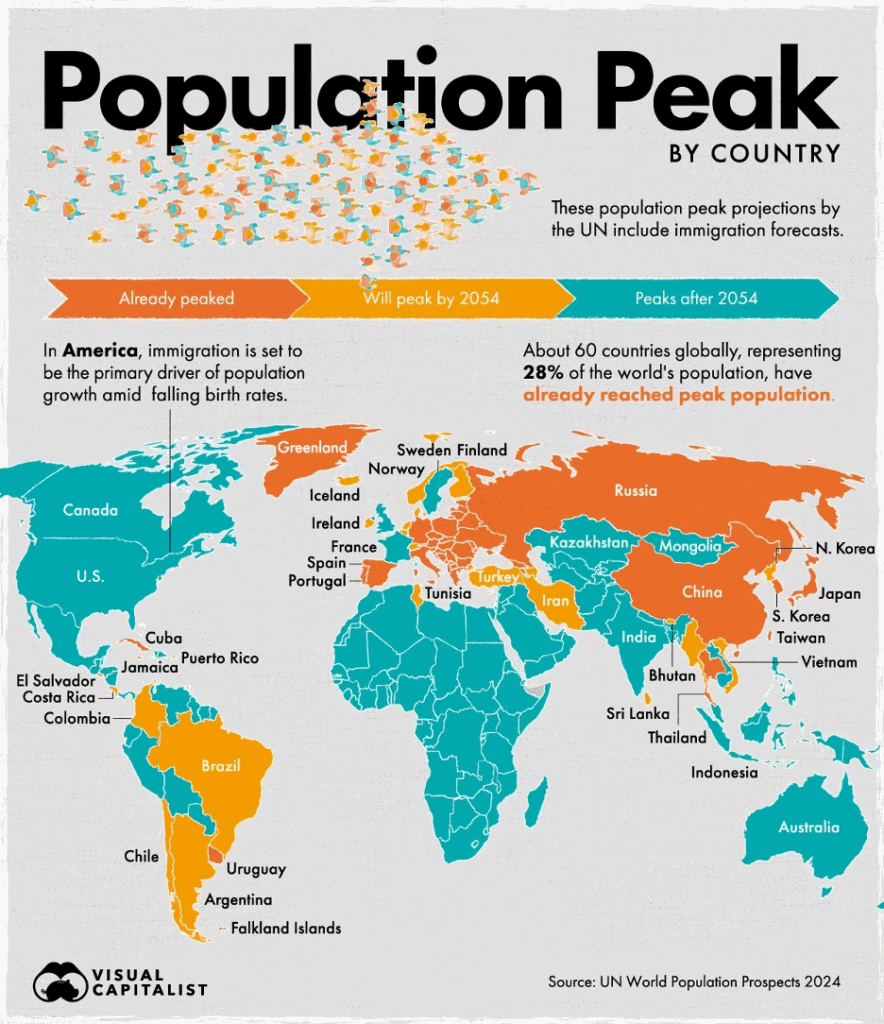

Demographics remain another powerful theme: more than 60 countries, including China, Japan, and Germany, have already peaked in population, while India, Nigeria, and the U.S. will continue to expand, driven by immigration and younger age profiles. On the energy front, 2025 marks a milestone, with global renewable investment forecast to hit $780 billion—well above oil spending.

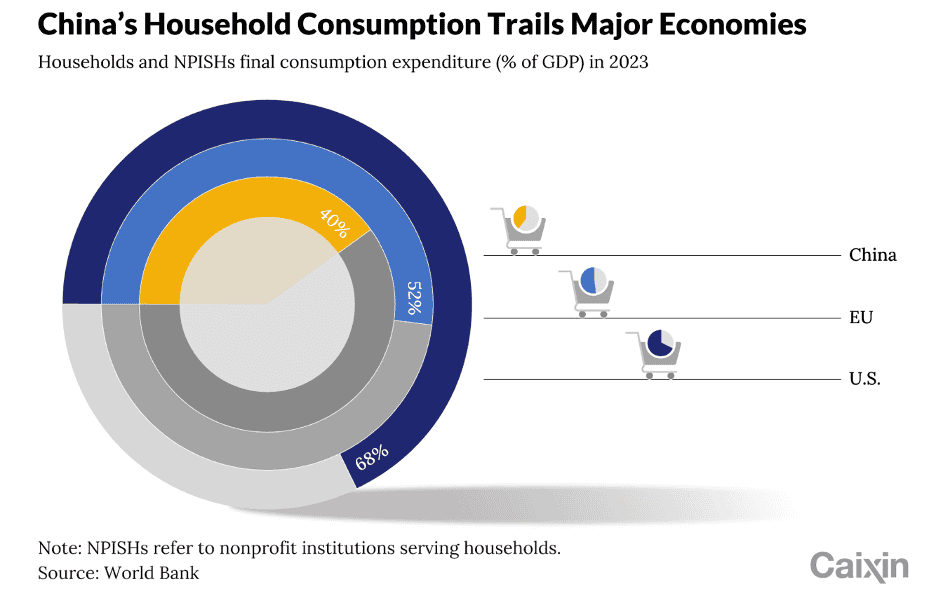

China presents a mixed picture: consumer confidence is subdued, and property challenges persist, yet retail categories are growing, auto exports are surging, and Hangzhou has become the first city to mandate AI education, a signal of the country’s long-term priorities, energy, and technology are converging to redefine business strategy globally.

The global franchise sector remains dynamic. Papa John’s is re-entering India with plans for 650 stores, while Chick-fil-A is preparing its first locations in the UK and Singapore. Dave’s Hot Chicken is accelerating across Europe with a deal for 180 restaurants following its viral UK success. Meanwhile, U.S. restaurants still face profitability pressures, Burger King has closed nearly all outlets in Hong Kong, and regulatory changes in Indonesia are complicating market entry. By contrast, Tims China has passed 1,000 outlets, reflecting strong consumer appetite and the continued resilience of franchise growth globally. More global franchise updates than usual this edition. Lots going on in the global franchise world!!!!

“Ports, Politics, & The Price Of Trade: A Frontline Economic View” – this webinar that I did on August 22nd is now on YouTube and brings you up to date on these key subjects.

This issue’s book is: Peak Human: What We Can Learn From History’s Greatest Civilizations, by Johan Norberg who argues that peak performance comes not from longer hours but from aligning energy, recovery, and purpose. Drawing lessons from neuroscience, psychology, and history’s great civilizations, the book offers practical strategies for leaders to foster resilience, deep focus, and trust-based cultures that multiply both individual and organizational success.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“The old maps no longer apply. We need new compasses and the courage to use them.”, Kearney CEO Retreat 2025

“Economic globalization remains irreversible.”, Li Qiang – China

“The entrepreneur always searches for change, responds to it, and exploits it as an opportunity.” – Peter Drucker

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #142:

63 Countries Have Already Reached Peak Population

Why every company now needs a Chief Geopolitical Officer –

Restaurant profitability has taken a hit since the pandemic

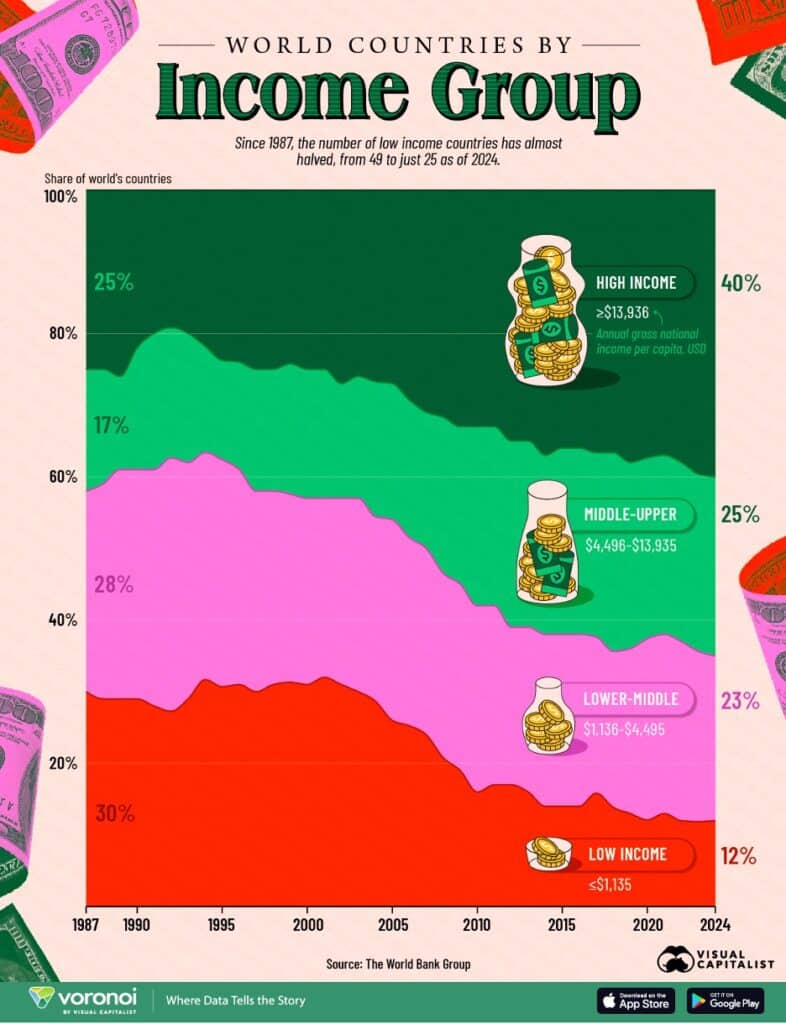

Share of the World’s Countries by Income (1987-2024)

New $250 visa fee risks deepening US travel slump

Brand Global News Section: Americana, Burger King®, Chick-fil-A®, Cracker Barrel®, Dave’s Hot Chicken, Dominos®, Papa John’s®, TH International and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

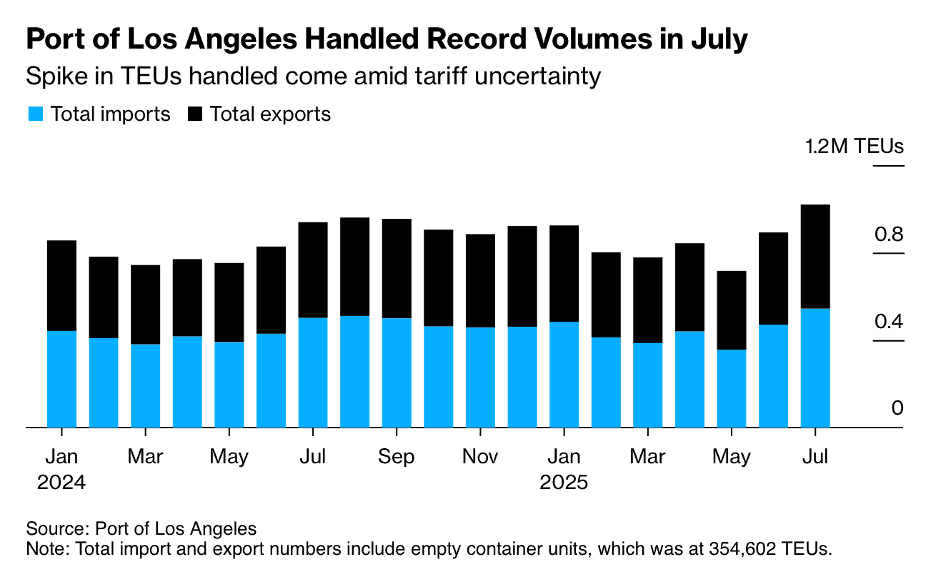

“Ports, Politics, & The Price Of Trade: A Frontline Economic View” – This current affairs webinar, hosted by the World Affairs Council of Orange County, featured presentations by Ferdinando (Nando) Guerra and William (Bill) Edwards (Your Editor!!). The discussion focused on the critical role of the Port of Long Beach and the Port of Los Angeles in the U.S. and in today’s global economy, the impact of tariffs and trade policy, as well as the broader challenges facing international businesspeople today. Click on the link to go to the YouTube webinar.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“US food groups plead for relief from Donald Trump’s tariffs – Piecemeal approach leaves seafood and produce sectors fighting to win individual carve-outs. Industry groups warn that the food sector is uniquely vulnerable to tariffs because some affected countries grow ingredients that will never be produced in quantity in the US. But lobby groups are taking a piecemeal approach by pleading for exemptions rather than attacking tariffs overall. Most food consumed in the US is produced domestically by its vast farm sector. But about a fifth is imported, according to the US agriculture department.”, The Financial Times, August 24, 2025

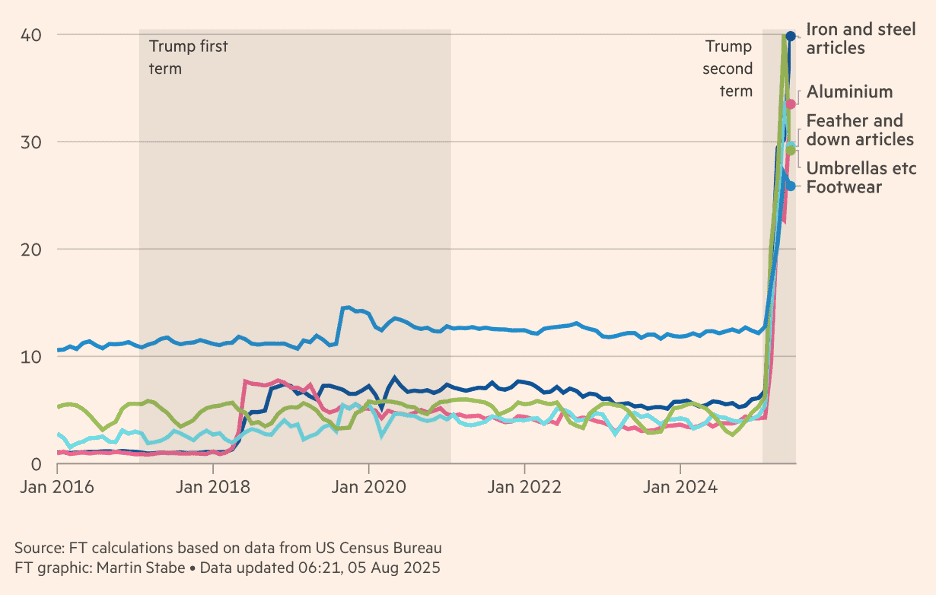

Editor’s Note: The left axis of this chart is the effective US tariff rate (%) as of the time of this article.

=============================================================================================

“Share of the World’s Countries by Income (1987-2024) – The number of low-income countries has almost halved, with their global share dropping from 30% in 1987 (49 countries) to 12% in 2024 (25 countries).Middle-income is now the plurality. Upper-middle (25%) and lower-middle (23%) income groups together account for almost half of the world’s countries in 2024, underscoring a broad shift out of extreme poverty but not yet into the richest tier. The world’s income landscape has shifted dramatically over the last four decades.From 1987 to 2024, more of the world’s countries have steadily risen out of the low-income category, reshaping the global distribution of prosperity.”, Visual Capitalist and the World Bank, August 27, 2025

============================================================================================

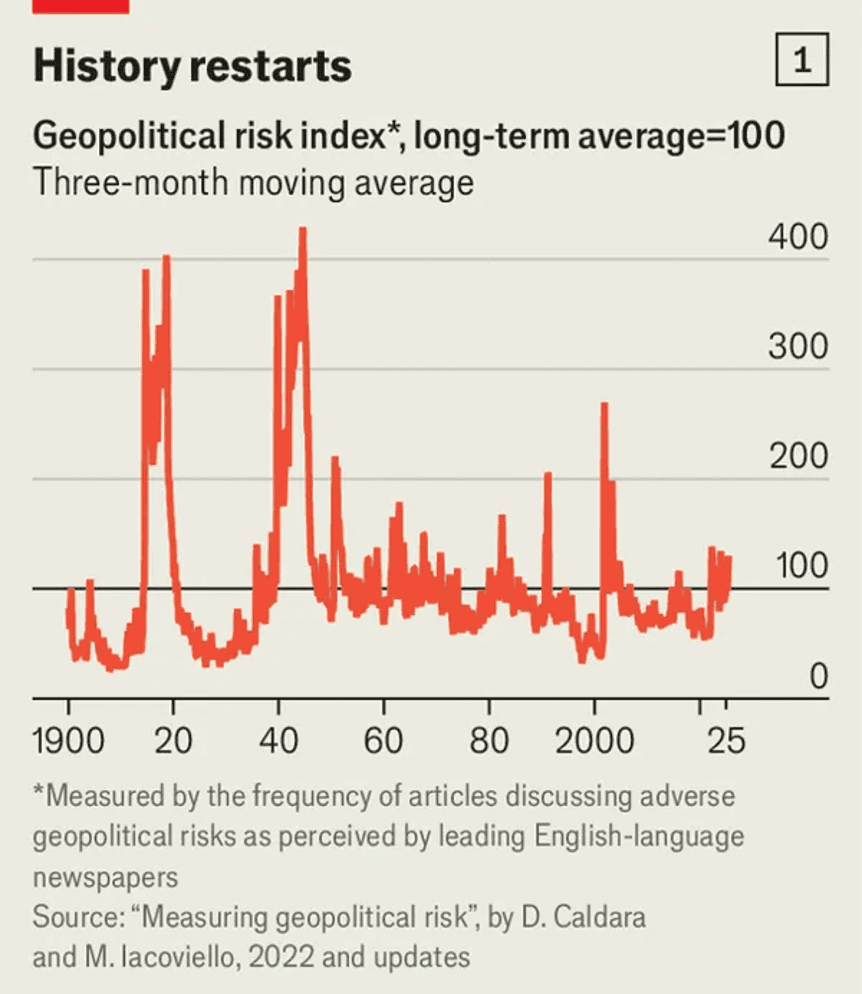

“Why every company now needs a Chief Geopolitical Officer – With governments and international institutions acknowledging the fragmenting global order, the creation of a Chief Geopolitical Officer role is an urgent priority for business. The CGO role is designed to integrate sophisticated geopolitical intelligence into core business decision-making. When both governments and international institutions are explicitly warning businesses about geopolitical risks, traditional corporate approaches to navigating international relations are no longer sufficient. The solution isn’t merely better government relations or enhanced risk management; it’s the emergence of an entirely new C-suite role: the Chief Geopolitical Officer (CGO). While the CGO title is new and rare, the function isn’t. Meta’s Vice President of Global Affairs – held until recently by former British Deputy Prime Minister Nick Clegg – is a role that has existed for over 10 years in the company. His experience was sought as the tech giant needed to navigate the intricate web of EU privacy regulations, US content moderation demands, and other challenges of entering complex markets.”, World Economic Forum, July 16, 2025

============================================================================================

“63 Countries Have Already Reached Peak Population – China, Germany, and Japan have all reached peak population by 2024. Across 48 countries, populations are projected to peak between 2025 and 2054, representing 10% of the world population. Meanwhile, 126 countries are forecast to grow through 2054, including India, Pakistan, Nigeria, and America. Countries are growing (or declining) at different levels due to factors like fertility rates, mortality, and immigration. The UN’s latest population prospects finds that more than a quarter of the global population live in countries that are shrinking in population size. On the other hand, immigration will be a primary driver of population growth in countries like the U.S. and Canada, while high fertility rates and younger demographics are set to propel growth in Angola, Somalia, and Niger.”, Visual Capitalist & UN World Population Prospects 2024, August 25, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“The Shift in Global Energy Investment (2015-2025) – In 2025, global renewable energy investment is projected to hit $780 billion, outpacing oil investment by $237 billion. Over the past decade, investment in renewables has surged 109%. Global energy investment has shifted dramatically in the last decade. As the world transitions to cleaner sources, capital is flowing into technologies that support electrification and decarbonization. Bolstering this trend are rapidly declining costs across solar and wind power, in particular.”, Visual Capitalist and the IEA, August 26, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“New $250 visa fee risks deepening US travel slump – Fee impacts travelers from non-visa waiver countries like Mexico, India, China. Travel from Mexico, Argentina, Brazil sees growth despite overall decline. Visa fee raises total cost to $442, among highest globally. Overseas travel to the U.S. fell 3.1% year-on-year in July to 19.2 million visitors, according to U.S. government data. It was the fifth month of decline this year, defying expectations that 2025 would see annual inbound visitors finally surpass the pre-pandemic level of 79.4 million.”, Reuters, August 30, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Peak Human: What We Can Learn From History’s Greatest Civilizations, by Johan Norberg – Peak Human explores how individuals and organizations can unlock their highest levels of performance by aligning biology, mindset, and systems. Drawing from neuroscience, psychology, and leadership research, the book argues that sustainable success comes from optimizing not just productivity but also energy, recovery, and purpose.

The author emphasizes that today’s workplace rewards agility, resilience, and creativity more than sheer output. Leaders must therefore reframe success away from constant busyness toward intentional performance cycles that balance stress with renewal. Practical strategies include leveraging daily rituals, cultivating deep focus, and building resilience through recovery practices like sleep and mindfulness.

The book also highlights how social and organizational environments shape performance. Leaders who create cultures of trust, connection, and psychological safety unleash far greater discretionary effort. Ultimately, *Peak Human* is both a manual for personal mastery and a guide for building high-performing, human-centered organizations.

5 Key Takeaways for Businesspeople

Energy > Time – Performance is not about managing hours but about managing physical, emotional, and mental energy. Business leaders should design work rhythms that sustain energy, not deplete it.

Stress + Recovery = Growth – Like elite athletes, professionals grow when cycles of challenge are paired with proper recovery. Burnout happens when recovery is neglected.

Deep Work Drives Value – In an age of distraction, the ability to focus deeply on high-impact tasks is a competitive advantage. Leaders should protect and prioritize time for such work.

Culture Multiplies Individual Effort – Trust, connection, and a sense of belonging enable teams to perform beyond the sum of their parts. Leaders must model empathy and authenticity.

Purpose Fuels Resilience – When individuals tie their work to a meaningful purpose, they access higher levels of motivation, adaptability, and perseverance—critical in uncertain markets.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“An 83-Year-Old Pizza Tycoon Fights to Save 3,500 Domino’s – Billionaire Jack Cowin built a fast-food empire by bringing fried chicken to 1960s Australia. Now, at 83, he’s back to attempt a turnaround of the biggest Domino’s Pizza franchisee outside the US. Cowin is the largest shareholder of Sydney-listed Domino’s Pizza Enterprises Ltd., which has more than 3,500 stores from Australia to Europe. The stock has plunged 91% from its peak four years ago as rising costs and competition eroded its market share. The US-listed Domino’s Pizza Inc. has slid just about 10% over the same period. The octogenarian has much to gain from reviving the pizza chain. His near 25% stake in the firm is part of his $3.2 billion fortune, which the Bloomberg Billionaires Index has calculated for the first time. Domino’s Pizza Enterprises said Wednesday it swung to loss of A$3.7 million ($2.4 million) in the year ended June 29 from a profit of A$96 million a year earlier.”, Bloomberg, August 26, 2025

=============================================================================================

China

“Five surprises from China’s consumer market – Although macro indicators remain mixed and headwinds persist, several lesser-known developments are signaling deeper shifts in how China consumes, innovates, and competes both at home and on the global stage. China’s economy in the first half of 2025 presents a complex and often contradictory picture. Consumer confidence remains low, the property market is under sustained stress, and households continue to save at historically high levels. Retail sales are climbing in key categories, air travel has surpassed 2019 levels, auto exports have risen to the top globally, and Chinese pop culture is gaining an international foothold. Despite the return of growth in several sectors, China’s Consumer Confidence Index (CCI) remains near historic lows and has only gradually been recovering. Concerns about employment, economic stability, and especially the ongoing property downturn are still top of mind.”, McKinsey & Co., August 13, 2025

=============================================================================================

“China’s Hangzhou makes AI classes compulsory in schools amid nationwide push – Local governments are beginning to take action after Beijing said it wants all primary and secondary students to study the advanced tech. Hangzhou, in China’s Zhejiang province, will introduce mandatory artificial intelligence (AI) courses for primary and secondary schools starting in the new semester – part of a nationwide strategy to nurture talent in the rapidly growing sector. The initiative seeks to build a talent pipeline while improving educators’ ability to use smart tools and protect data, covering both student and teacher training, according to two documents released by the city’s education bureau.Schools will have flexibility in how they deliver the lessons – either by concentrating them within a single week or integrating AI content into subjects like information technology and science.”, The South China Morning Post, August 26, 2025

==============================================================================================

European Union

“E.U. to Scrap Duties on U.S. Industrial Goods as It Scrambles to Soften Auto Tariff Blow – Brussels and Washington agreed to cut levies on European autos to 15% from a provisional rate of 27.5%. The European Union will move to eliminate all tariffs on U.S. industrial imports and expand access for American farm products, part of an effort to shield European automakers from steeper duties on their exports to the U.S. The proposals follow a joint statement last week in which Brussels and Washington agreed to cut levies on European autos to 15% from a provisional rate of 27.5%. In return, the EU committed to lowering tariffs on a range of U.S. goods. Under the EU’s proposal, tariffs on U.S. industrial goods would be scrapped entirely, while American seafood and certain non-sensitive agricultural products would receive preferential access to the European market. A separate proposal would extend tariff-free treatment for U.S. lobster, including processed varieties of the shellfish. The measures will now go to other EU institutions for approval.”, The Wall Street Journal, August 28, 2025

===========================================================================================

Middle East

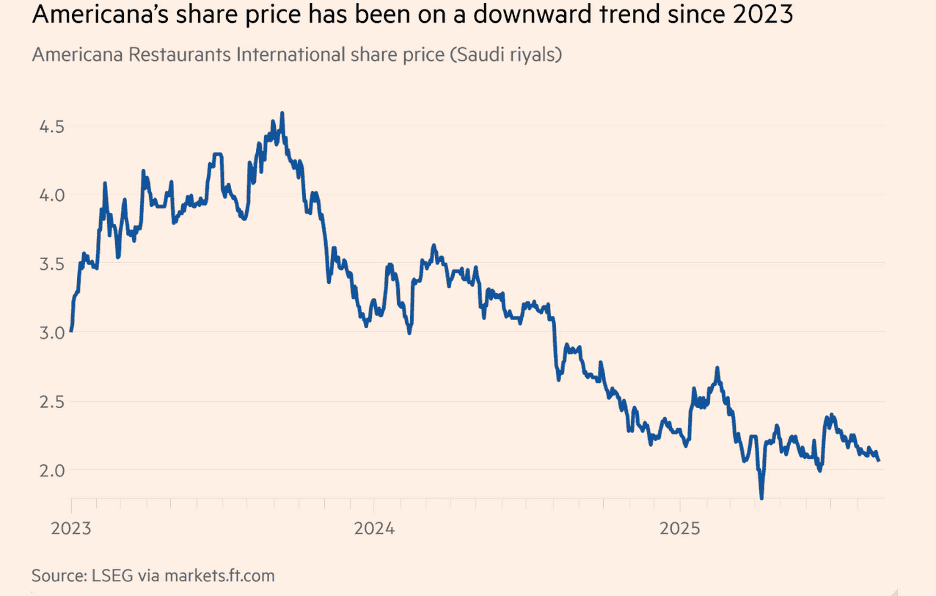

“Middle East KFC operator Americana to diversify into local brands after Gaza boycott – Sales at fast-food franchise operator tumbled when consumers turned on western outlets over American support for Israel. Americana, the Middle East’s biggest fast-food franchise operator, is planning to diversify away from US brands after profits generated from the likes of KFC and Krispy Kreme were hit by local boycotts. Full-year net profits at the company fell nearly 40 per cent to $159mn last year, as consumers in the region rejected US-linked eateries and products over Washington’s support for Israel during the war in Gaza. The Middle East and north Africa’s fast-food market is worth about $33bn, according to data analytics company Euromonitor International, with average annual growth of nearly 9 per cent since 2020. McDonald’s was among the fast-food chains that had been hit by the consumer boycott but said in February that its Middle East business had picked up again.”, The Financial Times, August 29, 2025

=============================================================================================

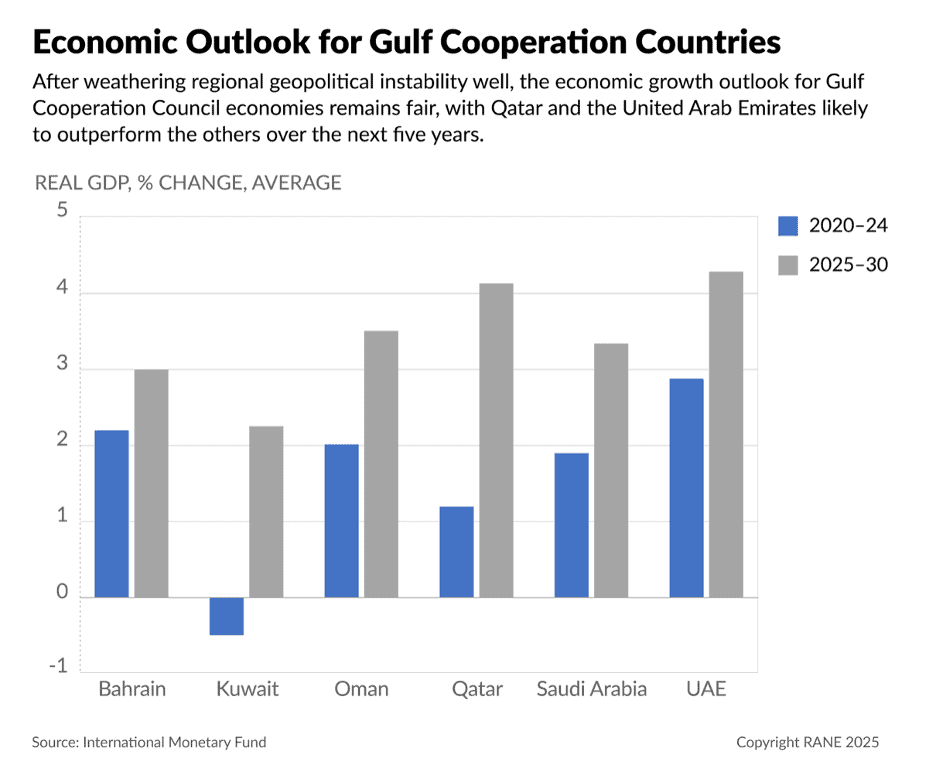

“Solid Fundamentals Shield GCC Economies From Global Volatility – Gulf Arab states’ solid macroeconomic and financial fundamentals will keep the region resilient in the face of global economic uncertainty, including a potential sustained drop in oil prices over the next few quarters. According to the International Monetary Fund (IMF), the members of the Gulf Cooperation Council (GCC) are expected to sustain solid economic growth over the next five years against the backdrop of low inflation and strong current account and external financial positions. Oil prices and production levels, particularly in the case of swing producers like Saudi Arabia and the United Arab Emirates, will continue to strongly contribute to economic growth, despite Gulf states’ decades-long and ongoing efforts to diversify away from oil and gas production.”, RANE Worldview, August 19, 2025

=============================================================================================

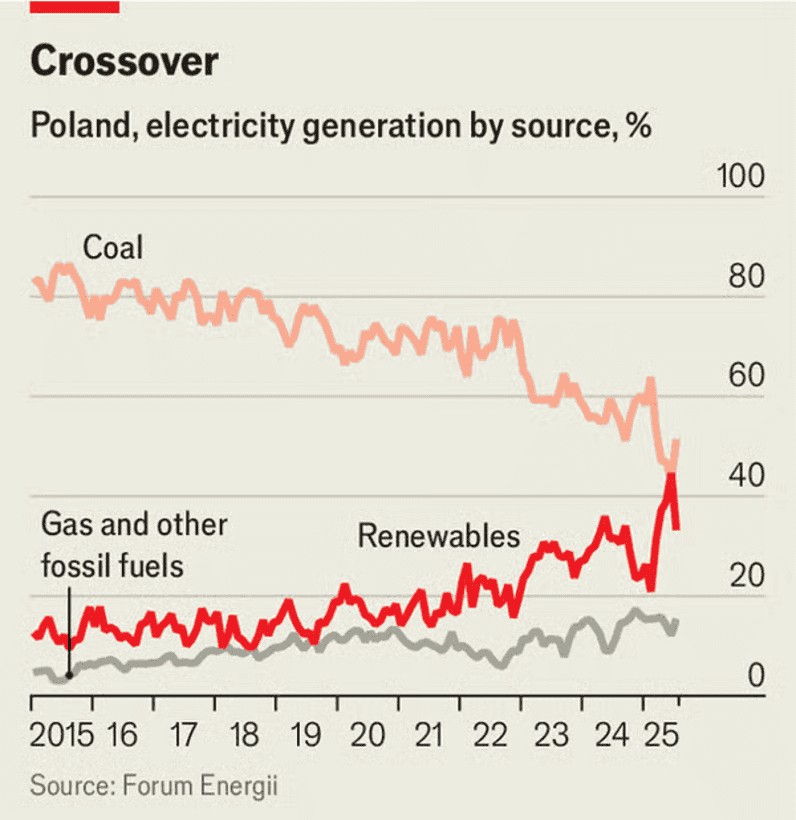

Poland

“Why Poland is becoming less central European and more Baltic – Thanks to energy and security concerns, its centre of gravity is shifting north. Poland’s south, home to most of its coal mines and heavy industry, has long been the country’s engine room. That is changing. Poland plans to phase out coal by 2049, so as to align with euclean-energy targets. Increasing mining costs are also helping the economy go green. In June of this year, Poland’s renewables generated more power than coal for the first time. Energy is leading the way.Poland plans to phase out coal by 2049, so as to align with euclean-energy targets. Increasing mining costs are also helping the economy go green. In June of this year, Poland’s renewables generated more power than coal for the first time. Poland is increasingly looking to the Baltic coast to meet its energy needs. The country has already boosted capacity at its only lng(liquefied natural gas) terminal, in Swinoujscie, to 8.3bn cubic metres (bcm) per year, and plans to open a second one, capable of handing another 6.1bcm, in Gdansk in 2028. A pipeline stretching from Norway through Denmark, launched in 2022, can provide up to 10bcm more gas. Wind power, which now accounts for 14.7% of Poland’s energy mix, up from 0.3% two decades ago, is also moving north, and offshore.”, The Economist, August 28, 2025

============================================================================================

United States