Biweekly Global Business Newsletter Issue 134, Tuesday, May 13, 2025

“When the winds of change blow, some build walls, others build windmills.”

Chinese Exporters Elated by Reprieve in US-China Trade War

The World’s 50 Most Valuable Companies in 2025

These 18 Industries Could Reshape the Global Economy by 2040

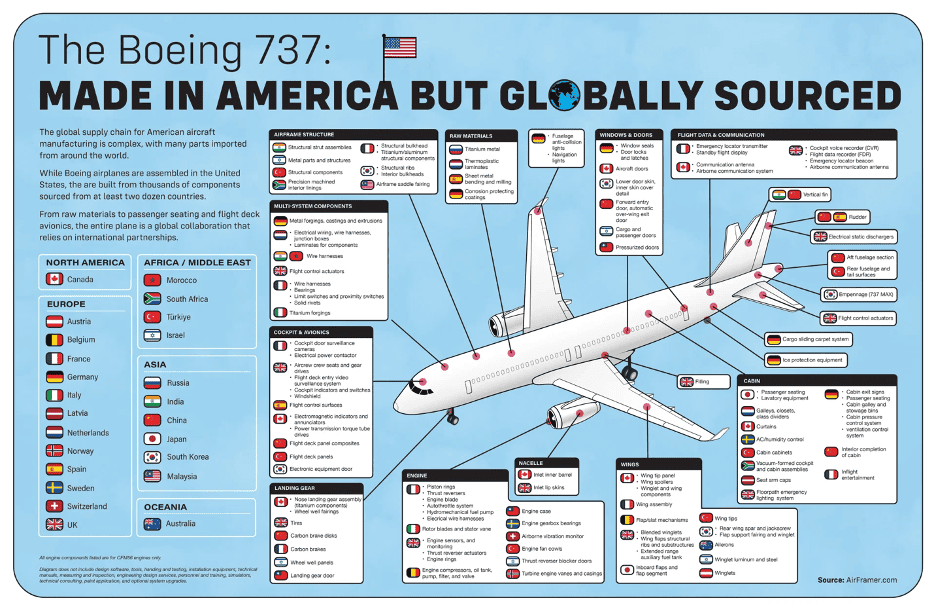

Boeing 737: American Made but Globally Sourced

Chinese Exports to US Slump 21% But Soar to Asia and Europe

Indonesia to Cut Fuel Imports From Singapore in Favor of US

Disney Announces Its First Middle East Theme Park in Abu Dhabi

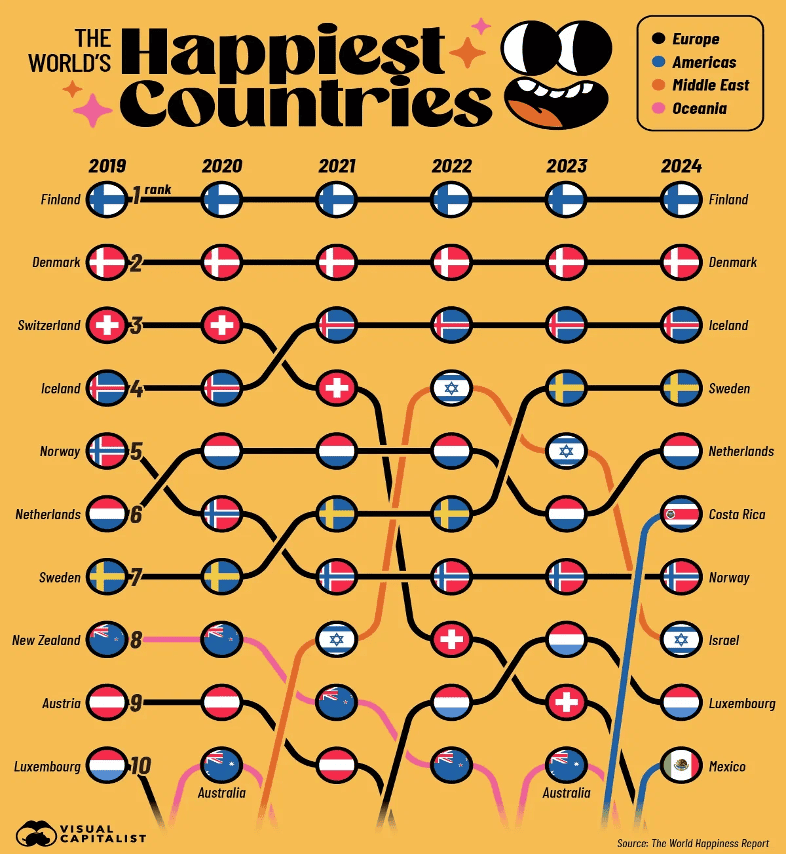

Commentary about the 134th Issue: Perhaps it is the fact that I lived in China in the 1980s and have taken several U.S. brands into the country over the years but I always like Chinese proverbs as they are often based on thousands of years of history and not just what is happening to us today. There’s an old Chinese proverb that applies to where we find ourselves today: “When the winds of change blow, some build walls, others build windmills.” It’s a simple idea, but incredibly relevant in today’s global business landscape. Change is always coming—whether it’s new technology, shifting consumer behavior, or economic and political uncertainty. Some people try to block it out, stick with what’s familiar, and hope things settle down. That’s building a wall. But the smart ones, the successful leaders I’ve seen around the world, they do the opposite. They lean in. They find ways to use those winds to generate momentum. That’s building a windmill. They adapt, innovate, and look for new opportunities in the disruption. It’s not about avoiding risk—it’s about being strategic with it. In international business, especially, the ability to harness change instead of resisting it can make all the difference.

One More Thing…On Monday morning, May 12, 2025, the U.S. White House released a statement that the U.S. and China had reached agreement on new trade policies for at least the next 90 days. Under the agreement, China agreed to reduce its tariff on U.S. goods from 125 % to 10% and the U.S. agreed to slash its levy on China from 145% to 30%. The immediate result is that goods destined for the U.S. market for Christmas will probably make it on time and at a fairly low tariff of 30%.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“When the winds of change blow, some build walls, others build windmills.”, Chinese Proverb

“To improve is to change; to be perfect is to change often.”, Winston Churchill

“In a time of drastic change, it is the learners who inherit the future.”, Eric Hoffer

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #134:

Chinese Exporters Elated by Reprieve in US-China Trade War

The World’s 50 Most Valuable Companies in 2025

These 18 Industries Could Reshape the Global Economy by 2040

Boeing 737: American Made but Globally Sourced

Chinese Exports to US Slump 21% But Soar to Asia and Europe

Indonesia to Cut Fuel Imports From Singapore in Favor of US

Disney Announces Its First Middle East Theme Park in Abu Dhabi

Brand Global News Section: Dairy Queen®, Krispy Kreme®, Luckin®, McDonalds®, Starbucks®, TGI Fridays® and Wendy’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

SPECIAL EVENT ANNOUNCEMENT

Join us on May 28th at the Beall Center for Innovation and Entrepreneurship on the campus of the University of California, Irvine for an evening filled with very timely world-class keynote speakers, engaging panel discussions, and unparalleled business-to-business networking opportunities at 11th Annual Orange County World Trade Week Forum Event. This is your chance to connect with key trade organizations, international business groups, the diplomatic corps, academics and to earn about the extensive global resources available in Southern California.

Presented by the District Export Council of Southern California and supported by key partners such as the Greater Irvine Chamber of Commerce, The Ports Of Los Angeles and Long Beach and the U.S. Commercial Services, this gathering is essential for those in Southern California ready to embrace the future of international trade. Don’t miss this opportunity to propel your trade ambitions forward! Please register for this Wednesday, May 28th event at this link: bit.ly/OCWTC2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

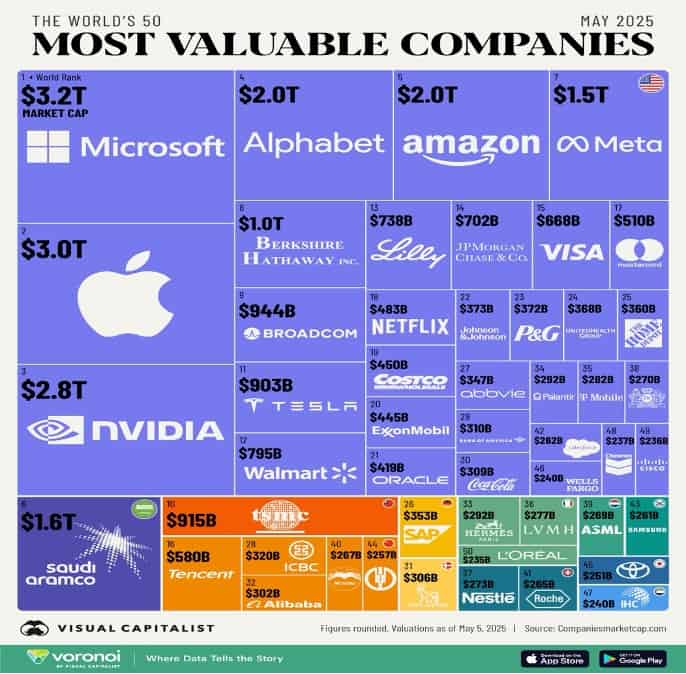

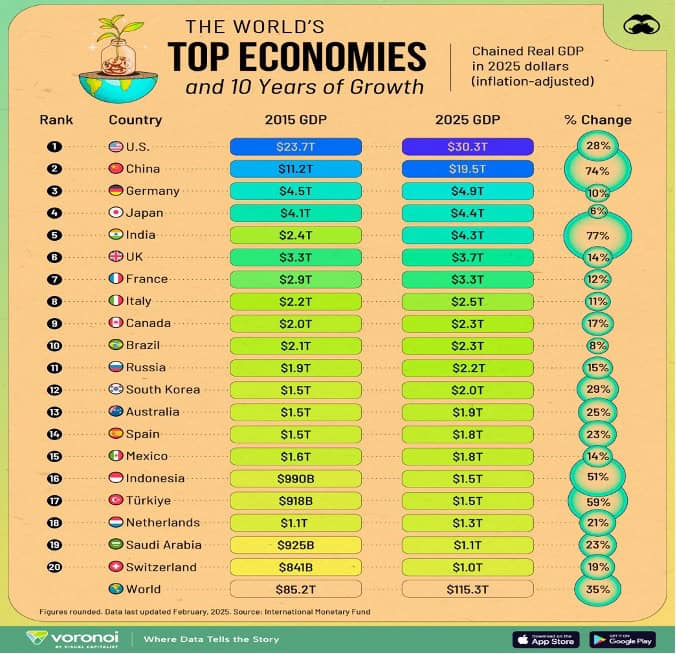

“The World’s 50 Most Valuable Companies in 2025 – The world’s most valuable companies hold immense sway over the global economy, shaping everything from technology to consumer trends. As of May 2025, U.S. giants like Apple, Microsoft, and Nvidia are worth trillions of dollars, reflecting America’s long-standing leadership in innovation and capital markets. The figures we used to create this graphic were sourced from companiesmarketcap.com, as of May 5, 2025.”, Visual Capitalist, May 9, 2025

==================================================================================================

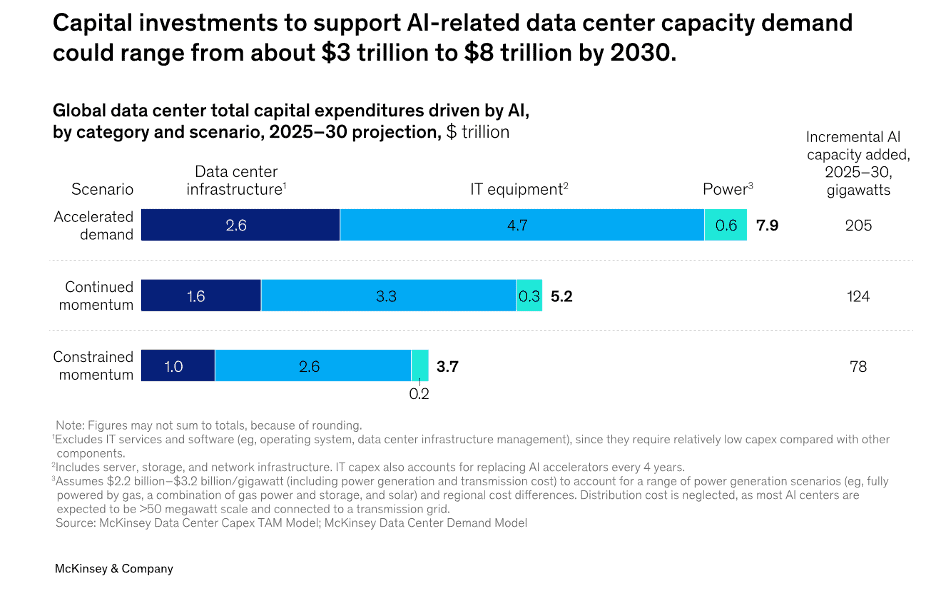

“The cost of compute: A $7 trillion race to scale data centers – Our research shows that by 2030, data centers are projected to require $6.7 trillion worldwide to keep pace with the demand for compute power. Data centers equipped to handle AI processing loads are projected to require $5.2 trillion in capital expenditures, while those powering traditional IT applications are projected to require $1.5 trillion in capital expenditures (see sidebar “What about non-AI workloads?”). Overall, that’s nearly $7 trillion in capital outlays needed by 2030—a staggering number by any measure.”, McKinsey & Co., Aoril 28, 2025

============================================================================================

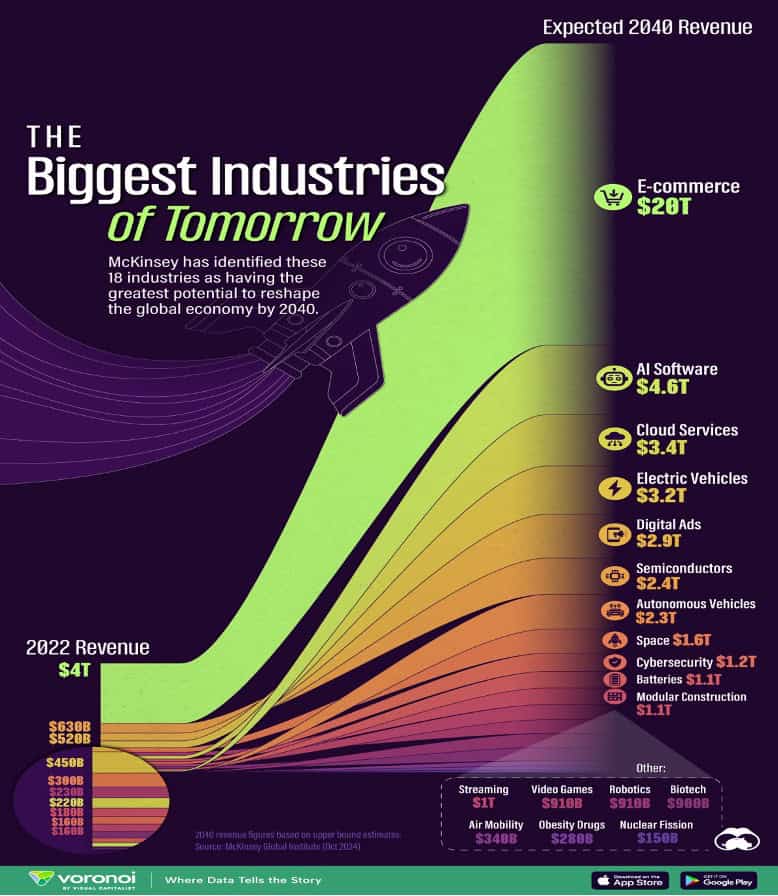

“These 18 Industries Could Reshape the Global Economy by 2040 – McKinsey identified these industries as having the most potential for future growth, generating up to $48 trillion in revenues by 2040. AI Software & Services is expected to have a CAGR of up to 25% between 2022 and 2040. As the world evolves, new industries are emerging as the key drivers of future economic growth. According to McKinsey Global Institute, there are 18 high-growth arenas—including AI, cybersecurity, biotech, and air mobility—which could generate up to $48 trillion in annual revenue by 2040.”, Visual Capitalist and McKinsey & Co., May 7, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Chinese Exporters Elated by Reprieve in US-China Trade War – The US-China deal temporarily lowering tariffs comes as a relief for Chinese exporters in limbo since the onset of a trade war between the world’s two largest economies. The Trump administration’s 145% duties on most Chinese imports will be cut to 30% by May 14, while China’s 125% retaliatory levy on US goods will drop to 10% during a 90-day cooling off period, Beijing and Washington said Monday following negotiations in Geneva.”, Bloomberg, May. 12, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“US Lawmakers Request $400 Million in Transit Aid for World Cup – Next year’s games are expected to be the most highly attended in FIFA’s history, with more than five million fans expected to attend the tournament’s 104 matches in the US, Canada and Mexico. Boston, New York City, Kansas City, Philadelphia and Los Angeles are among the 11 host US cities. The nonprofit advocacy group US Travel Association said that the US would need to make more than $10 billion in transit infrastructure upgrades to be able to shuttle visitors to and from the games. ‘The tournament’s anticipated economic impact of over $17 billion will rely on the successful movement of people across our cities,” wrote Representative Sharice Davids and 55 other lawmakers in a letter penned to the Subcommittee on Transportation, Housing and Urban Development. It will be officially sent to the appropriations committee on May 23. “Adequate funding is critical to ensure that transit systems meet the heightened safety, security, and efficiency demand.’ ‘, Bloomberg, May 5, 2025

============================================================================================

“Business travel was making a post-Covid comeback — until the trade war diverted it – Corporate bookings haven’t collapsed, but U.S. policy swings have upended what was a sunny outlook for the $1 trillion global industry just months ago. Business travel’s four-year crawl out the pandemic was on track to continue this year, but the U.S. trade war has scrambled that outlook. ‘The big word is uncertainty,’ said Suzanne Neufang, CEO of the Global Business Travel Association, which had forecast worldwide spending to surge to $1.64 trillion in 2025, up from an expected $1.48 trillion in 2024. Last year’s estimated total, if preliminary data bears out, would mark the first time the sector surpassed its pre-Covid levels. Now, about 29% of U.S. corporate travel managers and an equal share abroad expect business travel to decline this year due to government actions, according to a recent GBTA survey. The expected pullbacks could dent business trips by as much as 22%, the group found. Industry experts caution that souring expectations so far haven’t translated to a collapse in bookings, despite signs of cooler demand. Business travel ‘hasn’t fallen off a cliff, said Jonathan Kletzel, a travel, transportation and logistics leader at the consulting firm PwC.”, NBC News, May 10, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In Peak Human: What We Can Learn from the Rise and Fall of Golden Ages, historian Johan Norbergdelivers a compelling analysis of seven of history’s most remarkable civilizations—Ancient Athens, the Roman Republic, Abbasid Baghdad, Song China, Renaissance Italy, the Dutch Republic, and the modern Anglosphere. Through these case studies, Norberg identifies the patterns that led to their ascents and the missteps that precipitated their declines. The book serves as both a celebration of human progress and a cautionary tale about the fragility of prosperity.

Norberg’s central thesis is that openness—to ideas, trade, and diversity—is the cornerstone of societal flourishing. He argues that societies thrive when they embrace external influences and foster internal innovation. Conversely, periods of decline often follow when societies become insular, resistant to change, or overly reliant on past successes.

For global business leaders, Peak Human offers valuable insights into the dynamics of cultural and economic vitality. Norberg’s analysis underscores the importance of adaptability, inclusivity, and forward-thinking leadership in sustaining growth and competitiveness.

Five Key Takeaways for Global Business Leaders:

1. Openness Drives Innovation: Historical golden ages were characterized by a willingness to adopt and adapt foreign ideas and technologies. Modern businesses should similarly cultivate openness to external insights and diverse perspectives to foster innovation.

2. Inclusivity Enhances Resilience: Societies that encouraged participation across different segments of the population were more adaptable and resilient. Companies that promote inclusive cultures can better navigate challenges and seize opportunities.

3. Learning from Others Accelerates Progress: Just as past civilizations advanced by learning from their neighbors, businesses can benefit from benchmarking against industry leaders and adopting best practices.

4. Complacency Leads to Decline: A recurring theme in the book is that success can breed complacency. Organizations must remain vigilant and proactive to avoid stagnation.

5. Optimism Fuels Growth: A culture that believes in progress and the possibility of improvement is more likely to invest in the future. Leaders should inspire optimism to drive sustained growth.

Peak Human is a thought-provoking read that combines historical analysis with practical lessons for today’s leaders.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

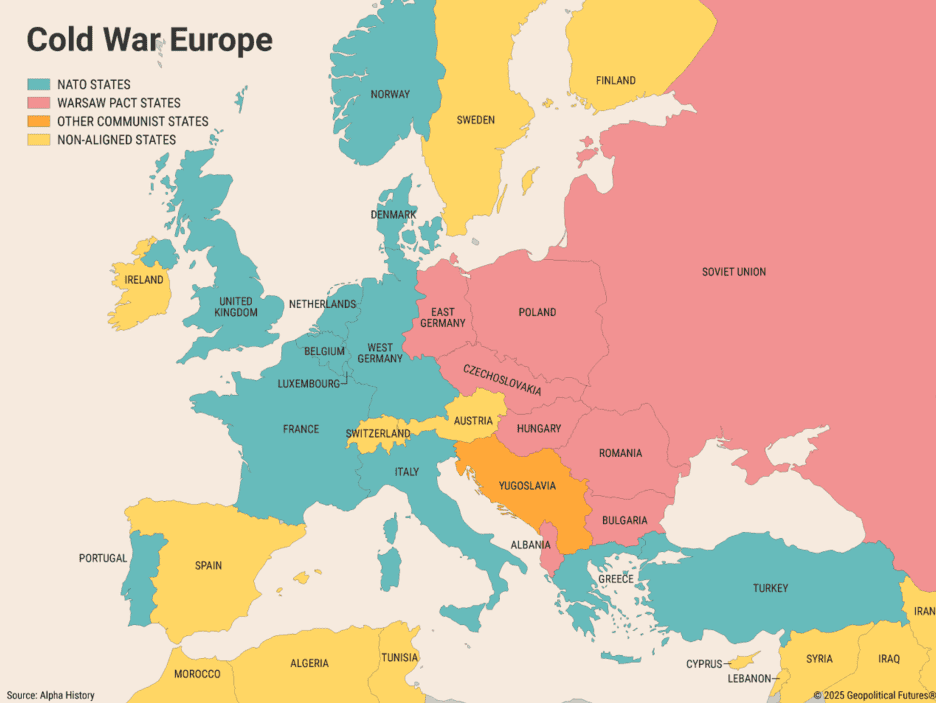

Country & Regional Updates

Canada

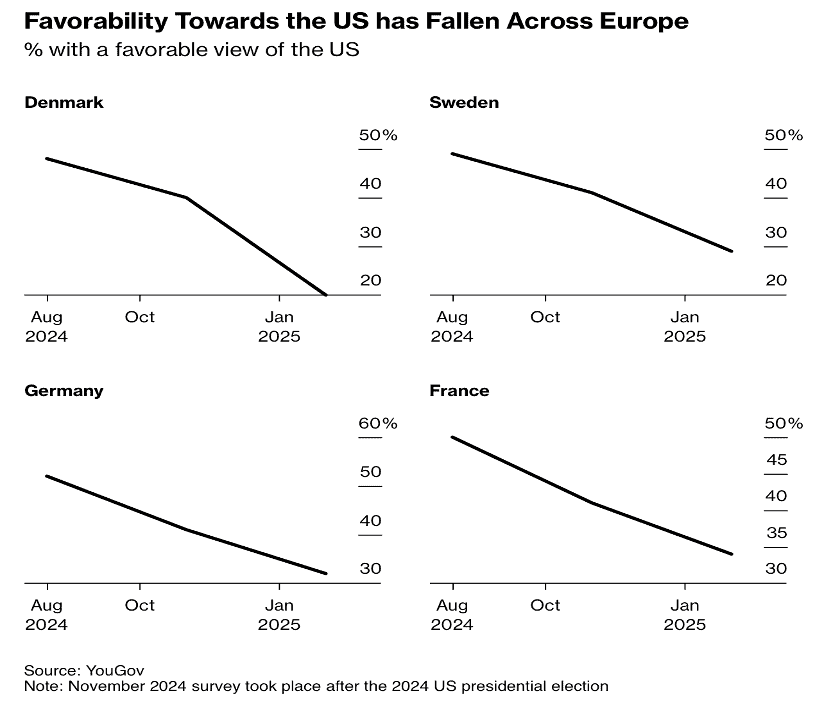

“Canadian companies shift focus to Europe for exports, growth – For decades, most Canadian businesses rarely looked beyond the United States for export opportunities and expansion plans. The move southward made sense given the size and proximity of the U.S., and the long history of free trade between both countries. In a matter of months, Mr. Trump has upended those deeply entrenched ties and alienated Canadians by mocking former prime minister Justin Trudeau and calling for the annexation of Canada. As companies assess the fallout of Mr. Trump’s actions, many have begun looking elsewhere for new customers, especially to Europe. There’s also been renewed interest in the trade deal between Canada and the European Union, known as the Comprehensive Economic and Trade Agreement, which was signed in 2016. A similar pact that governs trade between Canada and Britain came into force in 2021.”, The Globe and Mail, May 9, 2025

=============================================================================================

China

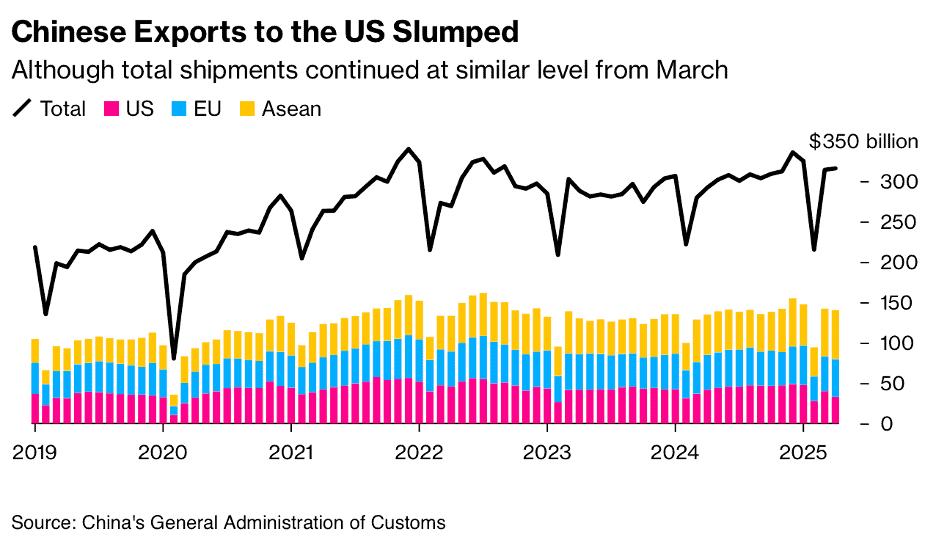

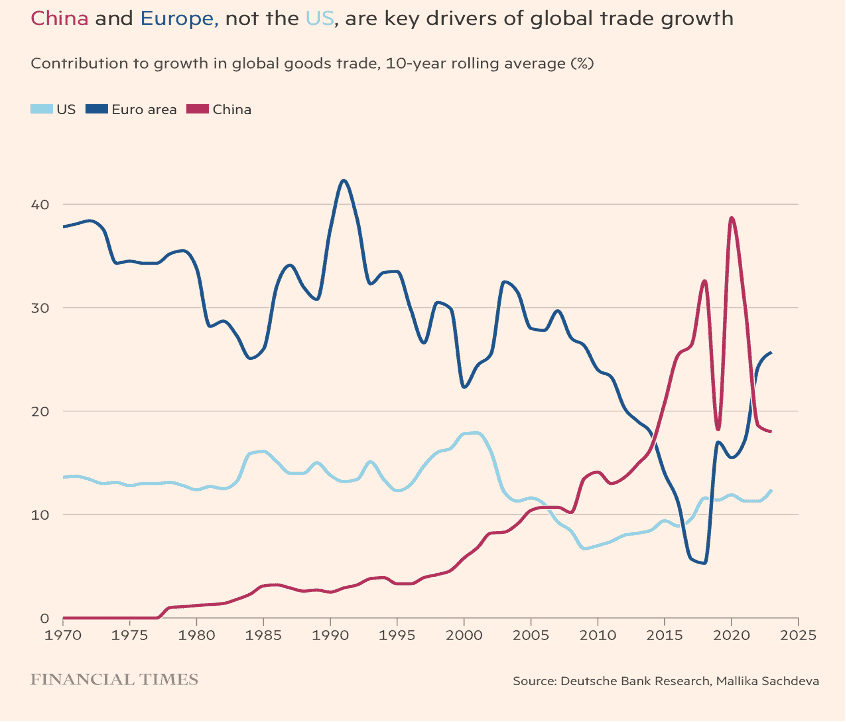

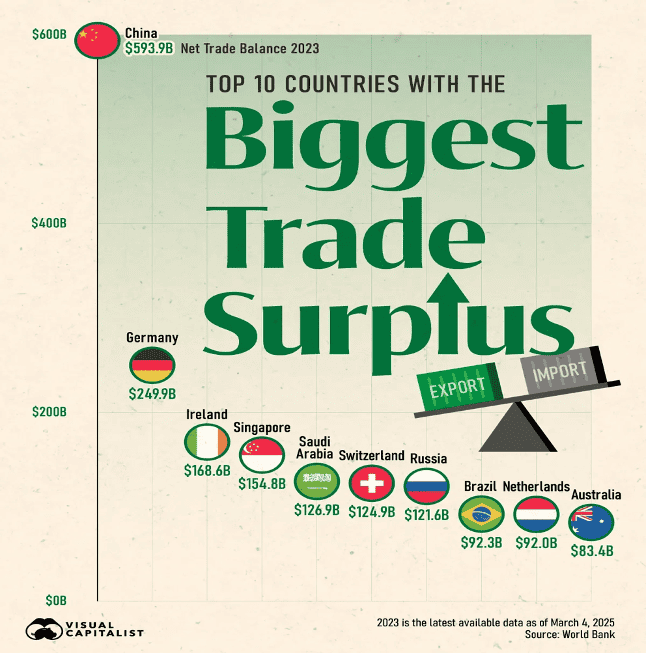

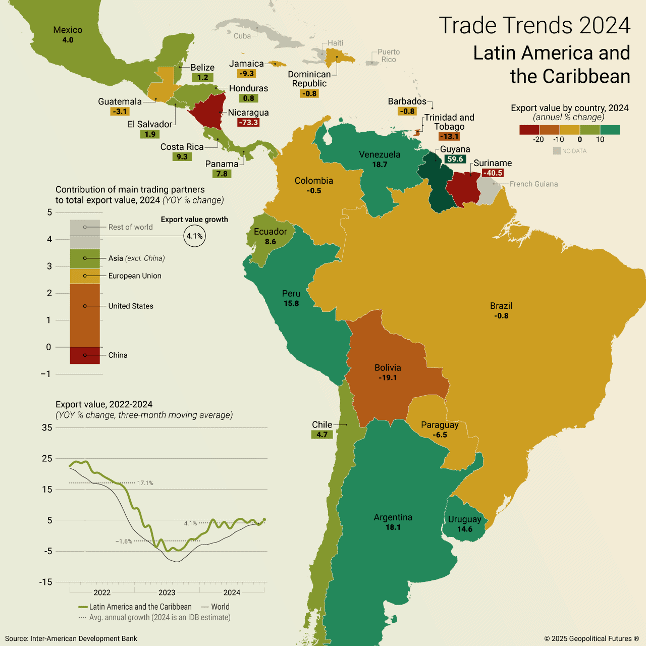

“Chinese Exports to US Slump 21% But Soar to Asia and Europe – Shipments to the US fell 21% from a year earlier after the imposition of duties earlier in April, according to data from the customs administration Friday. China’s tariffing of American goods meant that imports from the US fell almost 14% last month. Shipments to India and the 10 Southeast Asian nations in the Asean group soared by more than 20%, while exports to the European Union were up 8%. Imports fell 0.2% for the second straight monthly decline, leaving a trade surplus of $96 billion.”, Bloomberg. May 8, 2025

==============================================================================================

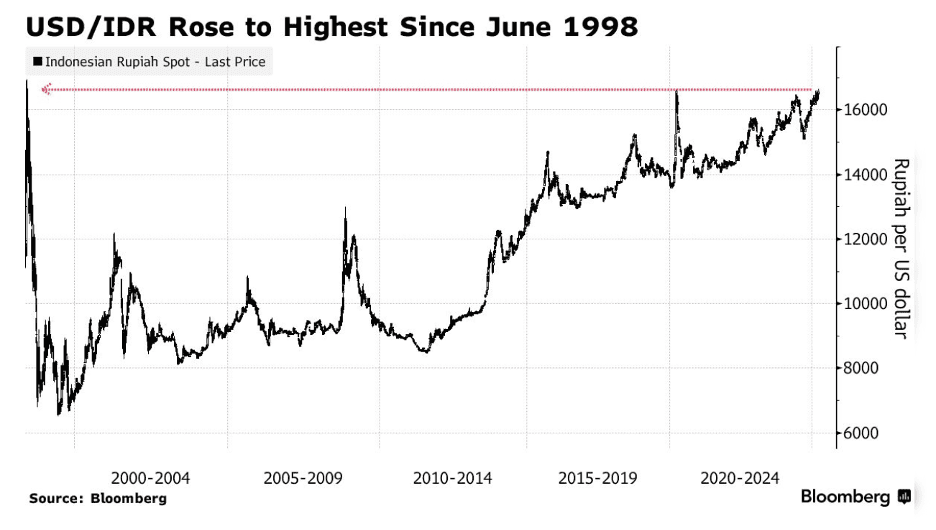

Indonesia

“Indonesia to Cut Fuel Imports From Singapore in Favor of US – Southeast Asia’s largest economy will look to gradually eliminate its shipments of oil products from Singapore, which account for more than half its imports, Energy Minister Bahlil Lahadalia told reporters on Friday. Purchases will be switched to suppliers in the US and Middle East as Indonesia seeks lower prices and a “better balance” in the changing global geopolitical environment, Lahadalia said. ‘It is not only a matter of price but also geopolitical issues, we need to have a balance with other countries,’ Lahadalia said, adding that imports from Singapore would be reduced to zero ‘some day’.”, Bloomberg, May 9, 2025

=============================================================================================

United Arab Emirates

“Disney Announces Its First Middle East Theme Park in Abu Dhabi – The company’s 13th park will be built, owned and operated by the Miral Group, according to the announcement Wednesday. Disneyland Abu Dhabi will be constructed on Yas Island, a major tourism hub in the United Arab Emirates that includes the Miral-built Ferrari World, Warner Bros. World and SeaWorld parks. It will be the company’s first all-new location since the Shanghai Disney Resort opened in 2016. The resort will be Disney’s most technologically advanced, and Miral will fund the entirety of the project…..The new park will give the company a footprint in the largest global airline hub in the world, with more than 120 million passengers traveling annually through Abu Dhabi and Dubai — without any capital commitment. Officials at Disney have been in talks with Miral for about 18 months……”, Bloomberg, May 7, 2025

=============================================================================================

United Kingdom

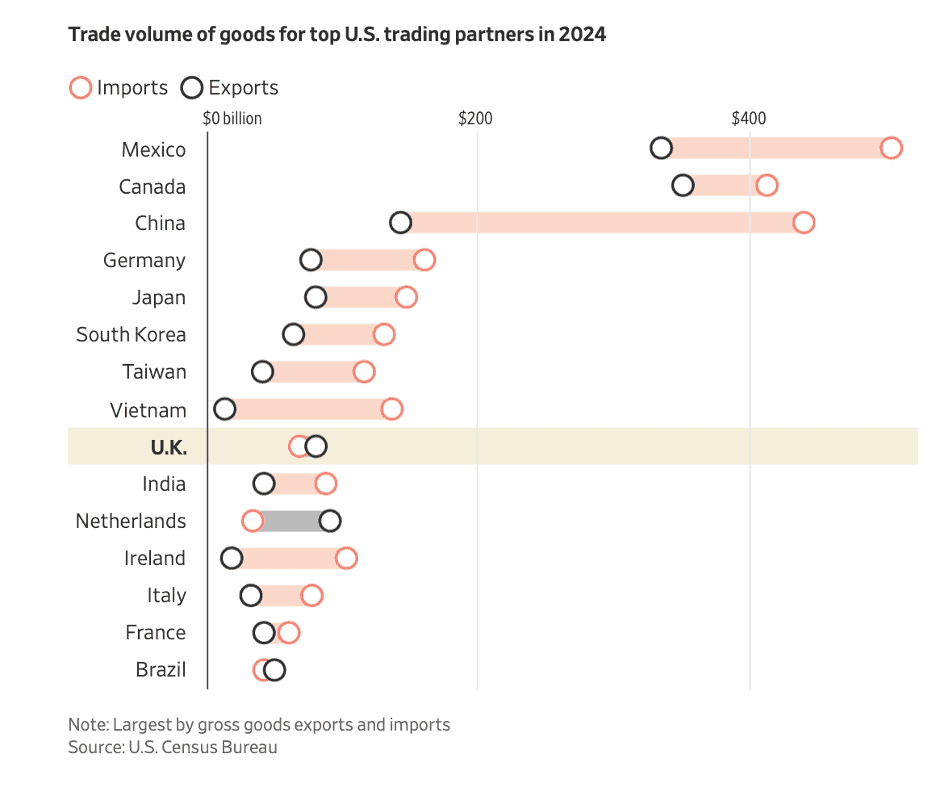

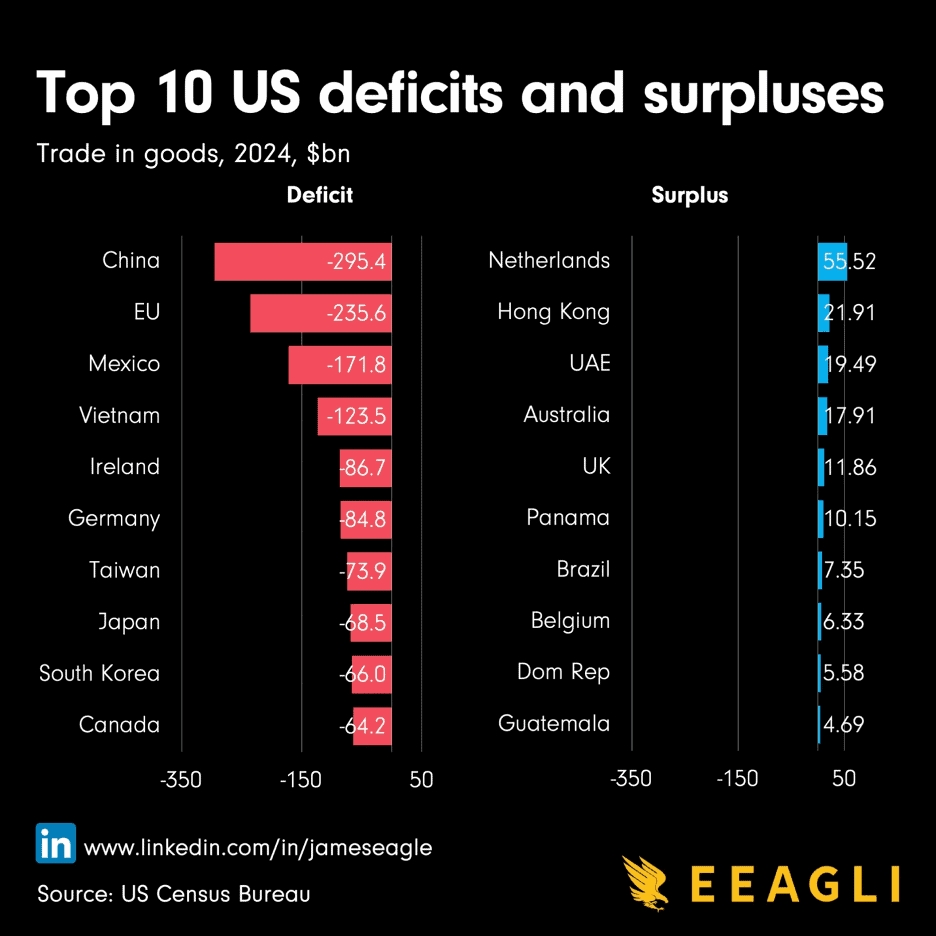

“The U.S.-U.K. Trade Relationship Is Unique. Here’s Why – Cars, oil, aircraft parts and pharmaceuticals are among the goods crossing the Atlantic between the countries. The U.S. and the U.K. have long vaunted their special relationship, and trade is no different. The U.S. runs a trade deficit in goods with nine of its 10 biggest trading partners. The sole exception: the U.K., where the U.S. is ahead. The U.K. is now an exception in another way: It is the first country to have reached a trade deal with the U.S. after President Trump announced on Thursday what he called a “full and comprehensive” pact between the nations. The deal will retain a global 10% tariff on most goods. When it comes to goods, the U.S. counts the U.K. as its ninth-largest trading partner, ranking after Vietnam and before India. The U.S. exported $79.9 billion worth of stuff to the U.K. in 2024 and imported $68.1 billion, according to the Census Bureau—a goods trade surplus of $11.9 billion. In contrast, the U.S. ran goods trade deficits of $16.4 billion with France, $44 billion with Italy and $84.8 billion with Germany.”, The Wall Street Journal, May 8, 2025

============================================================================================

United States

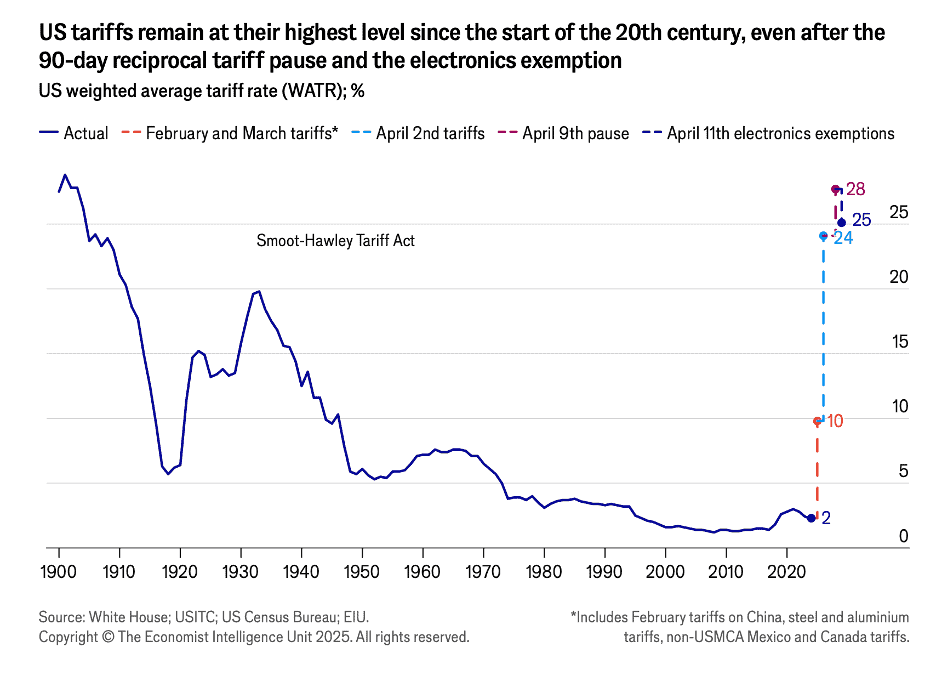

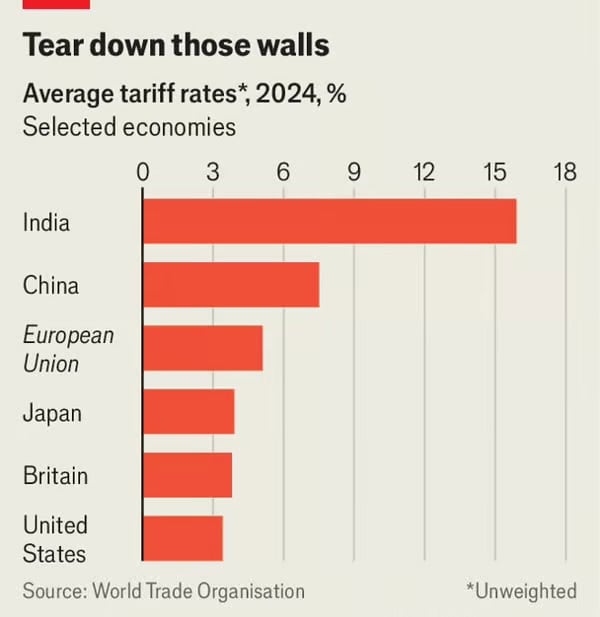

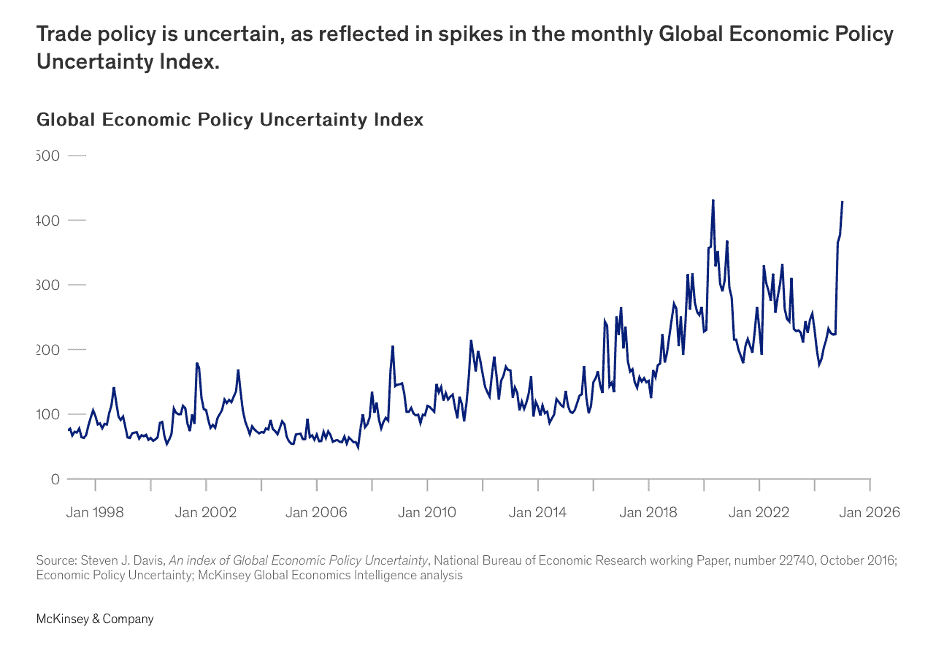

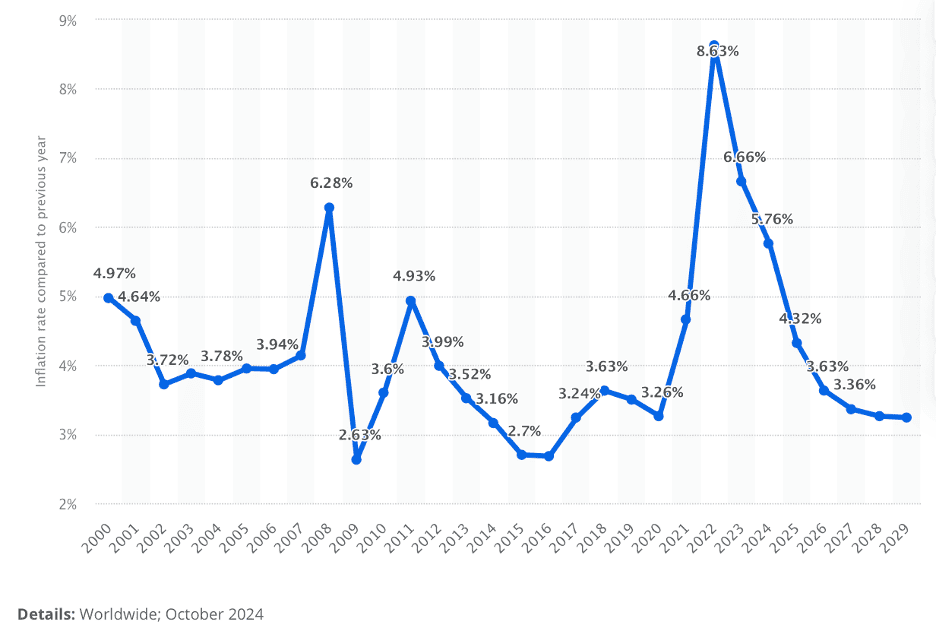

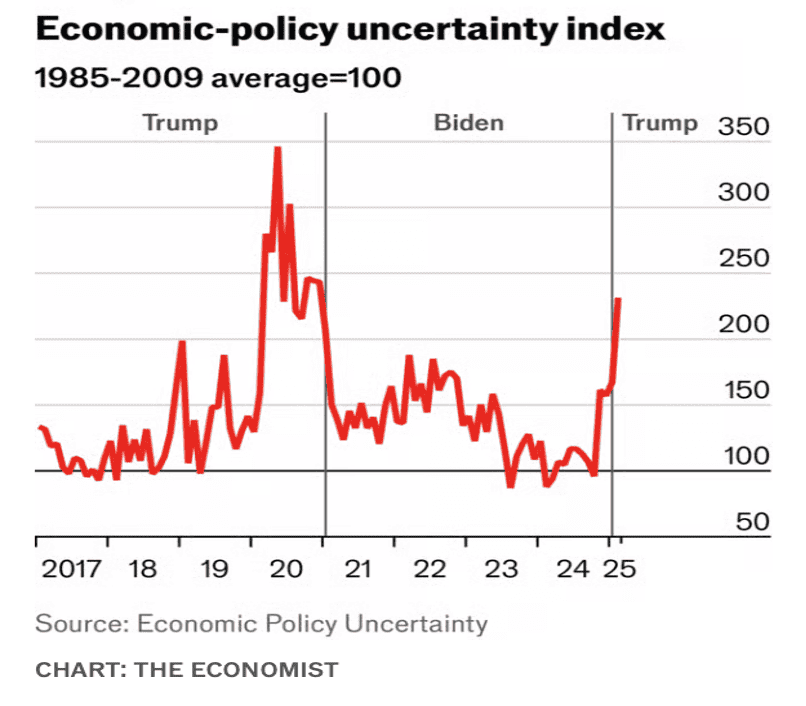

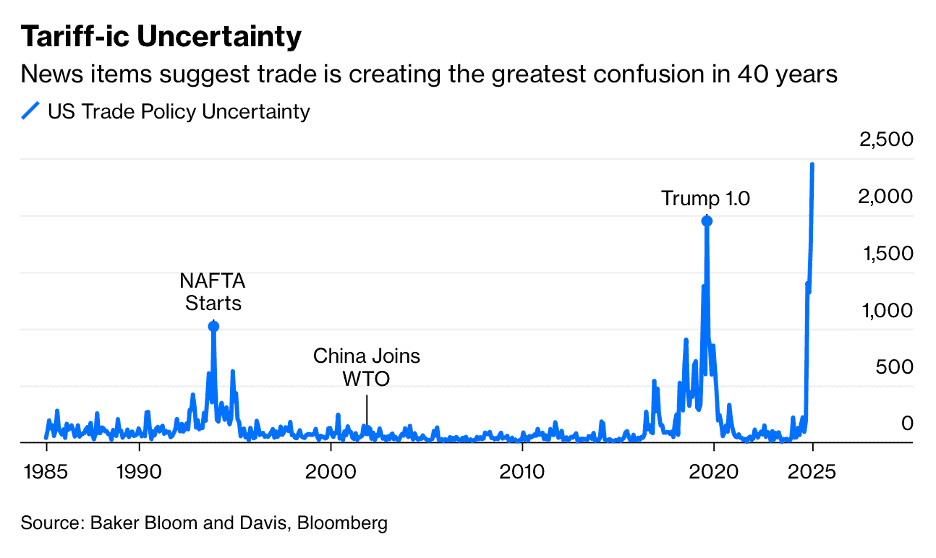

“The US takes a wrecking ball to global trade – Mr. Trump has sent a wrecking ball through the global trade system and imperilled the US and many other economies. Policy

uncertainty stemming from new US tariffs – whether they are retained or rolled back – will upend global supply chains and could have unpredictable, non-linear effects that will pose risks in financial markets. Higher US tariffs form part of the Trump administration’s efforts

to rebalance the US’s economic and security relations. The chaotic manner in which the agenda is being pursued, however, will strain traditional US alliances and drive geopolitical and economic realignment. The risk of policy error will be high in this changing environment. In economic policy, miscalculations are possible as tariff-related price shocks make inflation trends difficult to decipher. In geopolitics, constraints on brinkmanship are weakening as rules related to territorial sovereignty erode, alliance commitments come under question and as trade conflicts – notably between the US and China – feed competition.”, Economist intelligence Unit, May 2025

==============================================================================================

“Boeing 737: American Made but Globally Sourced – Boeing collaborates with suppliers across various nations to import thousands of parts for all of its airplanes. While the exact number of contributing countries can vary over time, this diagram charts key foreign suppliers for the 737 model as of April 2025, according to AirFramer.com. Every supplier part on an aircraft must meet strict airworthiness standards and approval from aviation regulators. This means that the requirements placed upon the suppliers are extremely high. Parts and manufacturing abroad must be tested and certified before they’re assembled into the airplane at Boeing’s facilities in the US. Furthermore, many parts are imported for their specific tooling and machining processes currently only available from other countries. As the American aviation industry braces for uncertain times ahead with new tariffs, maintaining strong international partnerships remains essential for ensuring both innovation and resilience in aircraft production.”, AirFramer.com, May 2, 2025

===========================================================================================

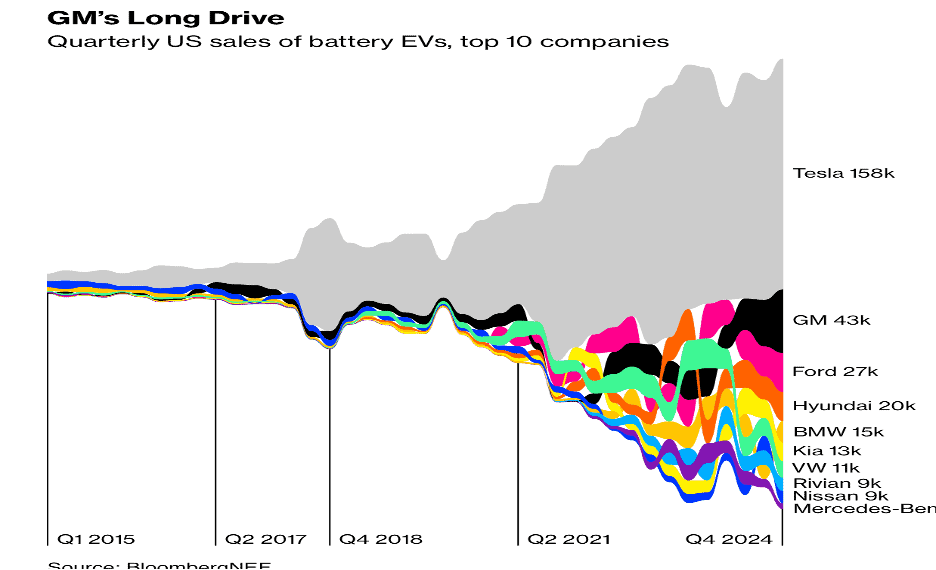

“GM’s Mary Barra Has to Make a $35 Billion EV Bet Work in Trump’s America – The US automaker is up against tariffs, an oil-loving president and Elon Musk in the White House. After an entire career at the automaker—from inspecting fenders and hoods at the age of 18 to spending the last 11 years as chief executive officer—Barra has staked her legacy on EVs. Her bet has gotten riskier over the past year, first due to a slowdown in EV sales and then the return of Donald Trump and his tariff regime. Those factors encouraged other carmakers to hedge their bets on EVs by shifting more production back to gas cars or to hybrids. Barra has mostly stayed the course. GM depends on a global supply chain, and Trump has been waging a trade war with nearly every single country. The two most affordable EVs in GM’s current lineup, the $35,000 Chevy Equinox and larger Blazer, are manufactured in Mexico, and most of them are brought in over the border to be sold to Americans. GM is on the hook to pay the new tariff on the foreign parts in all cars that come across the northern or southern borders, a 25% tax on other components starting in May and 145% on the materials it ships in by boat from China.”, Bloomberg, April 14, 2025

===========================================================================================

Vietnam

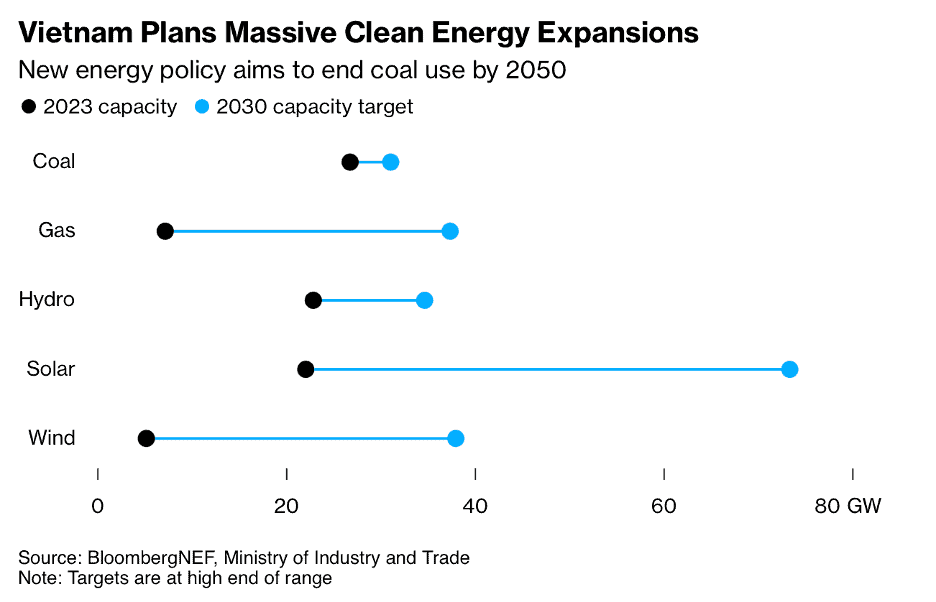

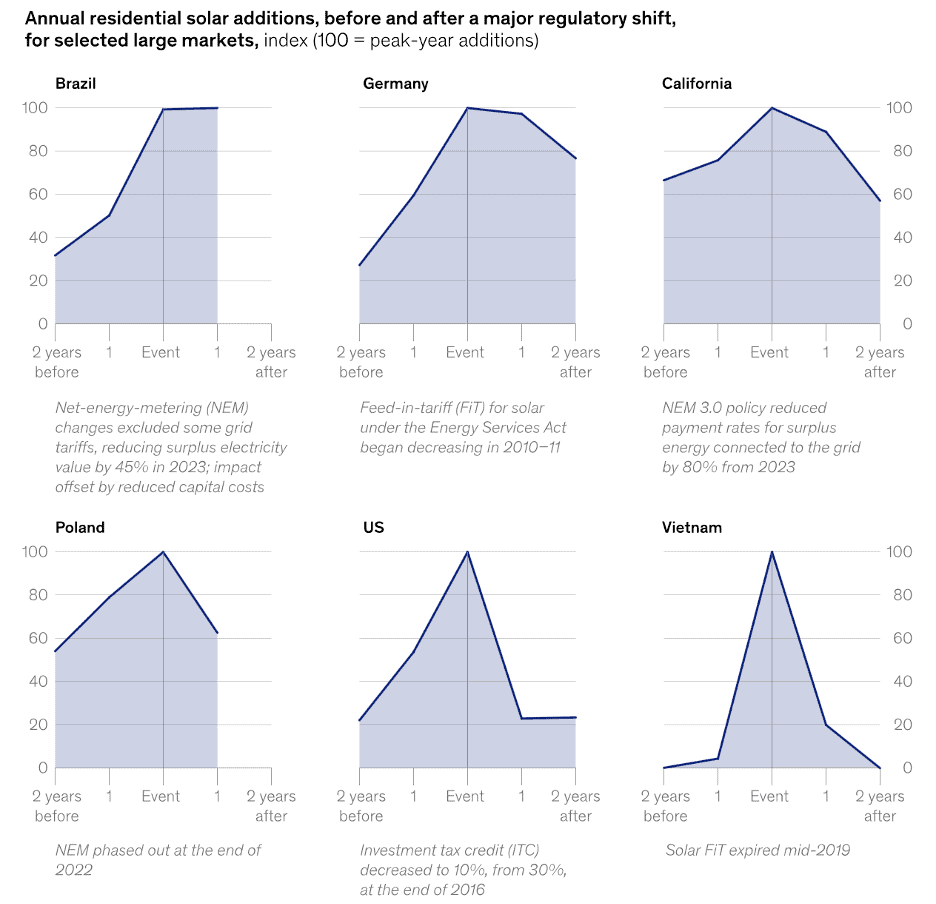

“Vietnam Eyes Huge Wind and Solar Farms to End Coal Use by 2050 – The latest amendments to the Power Development Plan VIII, approved by the government earlier this week, call for the nation to more than double its total generating ability by 2030 from 2023 levels, with the aim of increasing capacity nearly 10-fold by 2050. Officials expect power demand to soar as they aim for economic growth of at least 8% this year and double-digits through the end of the decade. The clean energy targets far outstrip what analysts expect the country to be able to achieve. The roadmap calls for as much as 73 gigawatts of solar and 38 gigawatts of wind by 2030 — but BloombergNEF forecasts that the country will have about 32 gigawatts of solar and 12 gigawatts of wind by then. By 2050, Vietnam is targeting as much as 230 gigawatts of wind and 296 gigawatts of solar.”, Bloomberg, April 16, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

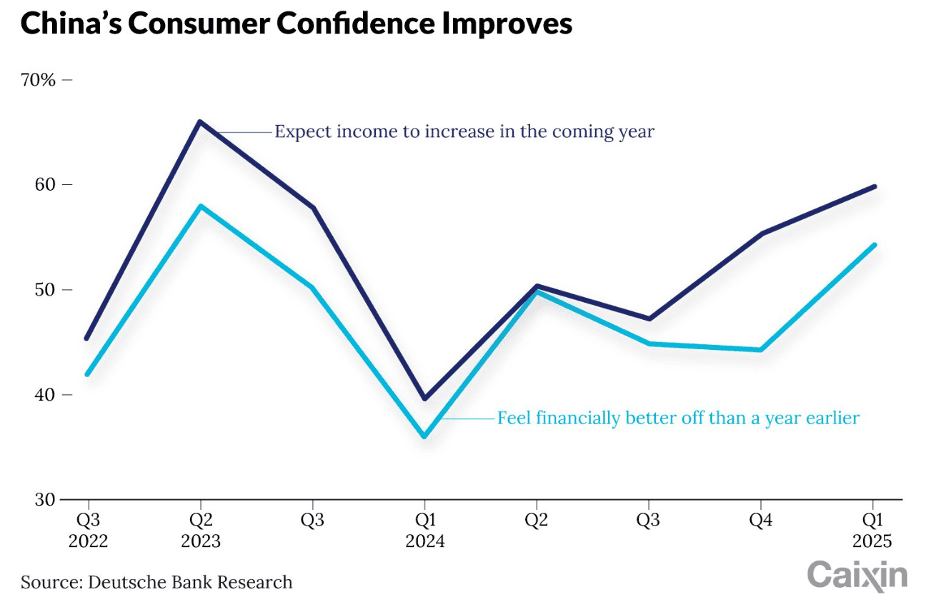

Global Brand & Franchise Sector News

“Starbucks Luckin get buzz from smaller city coffee sales in China – ‘There is still ample room for growth in lower-tier markets,’ analyst says. As coffee chains in China struggle with a bitter combination of sluggish consumption and cutthroat pricing, Starbucks and Luckin Coffee regained momentum in the last quarter by focusing on lower-tier cities. Same-store sales were flat for Starbucks’ China operations in the quarter ended March 30, but a 4 per cent increase in transactions helped to offset a 4 per cent decline in the average tab, the company said last month. This came after the Seattle-based firm suffered an 8 per cent decline in comparable-store sales in the country in the year ended September 29. Luckin, Starbucks’ biggest competitor in China, is also seeing improvements in its performance thanks to expansion. In addition, its new milk-tea drinks helped to capture sales from tea-drink makers like Chagee.”, South China Morning Post, May 11, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Franchising Across the Tasman: A Smart First Step – Expanding a business internationally can feel like a huge leap, while your closest country neighbor might offer the most logical and achievable next step. This was learned firsthand when we expanded our own consulting business, Tereza Murray Franchising (TMF), across the Tasman from New Zealand to Australia several years ago. What began as a response to client demand quickly became a natural evolution of our brand. For those looking to scale internationally, Australia and New Zealand are uniquely well-matched, and expanding into one from the other is often far simpler than people expect.”, Franchising.com, May 8, 2025. From an article by Tereza Murray is a leading franchise and business consultant and CEO of Tereza Murray Franchising (TMF).

===============================================================================================

“Beloved Restaurant Chain Is Shrinking Rapidly After Closing 185 Locations – The chain filed for bankruptcy. TGI Fridays used to be a popular restaurant chain, familiar to people throughout the US. But now the number of restaurants that remain open is shrinking rapidly. According to the chain’s website, there are now only 85 TGI Fridays restaurants left in the entire U.S. The restaurants are located in 19 states. Georgia has the most remaining with seven, according to the website. The company told CNN in April 2025 that TGI Fridays is ‘now led by franchisees, with a franchisee advisory board empowering and shaping brand-wide decisions’. However, according to the company’s website, TGI Fridays has more locations in other countries, 44 in all. There are a total of 461 restaurants in all of those countries, the site says, calling the chain ‘the original casual dining bar and grill.’”, Men’s Journal, May 11, 2025

==============================================================================================

“Krispy Kreme Announces Disappointing News on McDonald’s Partnership – The donut chain had major plans with the fast food giant. Krispy Kreme announced last week it was pausing its partnership with McDonald’s. The donut chain began selling its products at McDonald’s in March 2024. Currently, Krispy Kreme products are available under the Golden Arches at more than 2,400 locations nationwide. However, on Thursday, when the company released its first quarter earnings report, it announced it would not be expanding its operations to any additional McDonald’s restaurants in the second quarter of this year. ‘The Company is reassessing the deployment schedule together with McDonald’s while it works to achieve a profitable business model for all parties and does not expect to launch in any additional restaurants in the second quarter of 2025,’ Krispy Kreme said in a press release. When the partnership between the two franchises was unveiled over a year ago, the original stated goal was to have Krispy Kreme sold at every McDonald’s in America by the end of 2026.”, Men’s Journal, May 11, 2025

==============================================================================================

“Dairy Queen sets bold target: $10 billion in sales by 2030 – The Bloomington-based company, a Berkshire Hathaway holding, stands apart from its fast food competitors like McDonald’s, KFC and Wendy’s that are seeing declines in traffic because of higher prices and economic uncertainty. Last year, Dairy Queen restaurants around the world brought in $6.4 billion in sales. By 2030, the Bloomington-based company wants franchisees to hit $10 billion. That’s more than 4,500 Blizzards sold per minute around the clock. So to reach that $10 billion goal, Dairy Queen needs to emphasize value while expanding its global reach. There are more than 7,700 franchised DQ locations around the world, including 4,100 in the U.S. At the current rate of new store openings, it won’t be long until more than half of all locations are outside the U.S.”, Minnesota Star Tribune, May 12, 2025

===============================================================================================

“Wendy’s To Lean Heavily on International Growth in Latest Plans for Expansion – The fast-food burger chain has a goal of opening 1,000 new restaurants globally by 2028 to increase to a total of 8,100 to 8,300 units worldwide. The expansion is expected to be primarily driven by growth outside of the United States, with foreign markets accounting for 70 percent of the planned additions. Wendy’s plans to add 125 new restaurants in Latin America and is targeting other key international markets in the UK and India.”, Franchsing.com, May 9, 2025.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 133, Tuesday, April 29, 2025

Resilience is no longer a buzzword—it’s a board-level mandate

Commentary about the 133th Issue: In global business today, resilience is no longer optional—it’s a required core competency for success in doing global business. Companies navigating international markets in 2025 are facing constant disruption: new U.S. tariffs are reshaping trade dynamics, geopolitical tensions are redrawing supply routes, and AI is transforming how we operate and compete. Amid this turbulence, adaptability has become the key currency of global success. Veteran international executives know that growth across borders has never followed a straight line. It requires a mindset grounded in anticipation, flexibility, and a deep understanding of local realities.

Resilient organizations aren’t just prepared for shocks—they’re built to pivot with purpose. They localize intelligently, form durable partnerships, and continuously invest in forward-looking strategies that make them stronger over time. Resilience now lives at the core of every global playbook. It’s not a reaction—it’s readiness. And the companies that embed it deeply are those best positioned to lead with confidence in this new era we find ourselves in.

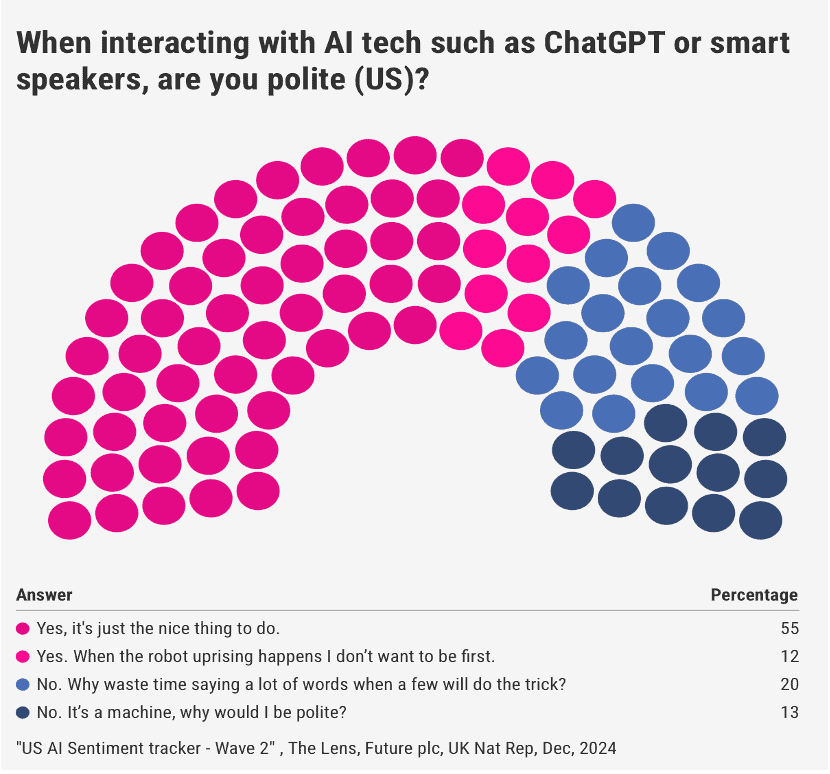

One More Thing…On another more interesting subject, this issue has several global AI references. And we learn that in the US, 67% of people who use AI are polite to it, while in the UK 71% are polite……

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“In an era of volatility, the most resilient businesses aren’t the strongest—they’re the most adaptable.”, Kristalina Georgieva, Managing Director, IMF

AI isn’t replacing jobs—it’s replacing borders. The new workforce is global, digital, and 24/7.”, Tsedal Neeley, Harvard Business School, author of The Digital Mindset

“Resilience is no longer a buzzword—it’s a board-level mandate. Every global supply chain is being reimagined in real time.”, Ngozi Okonjo-Iweala, Director-General, World Trade Organization

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #133:

Global growth forecast slashed by IMF over tariff impact

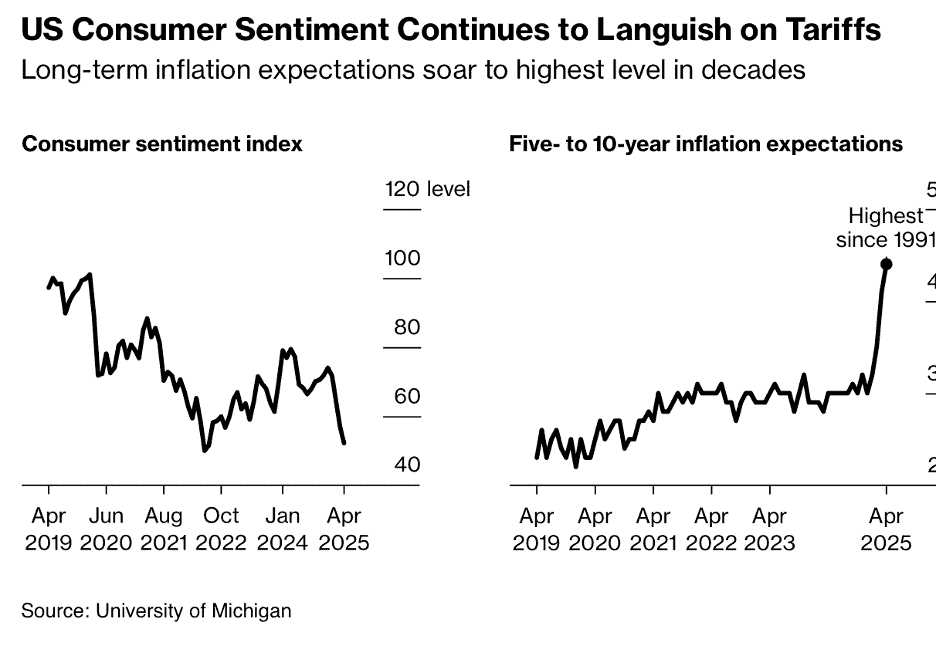

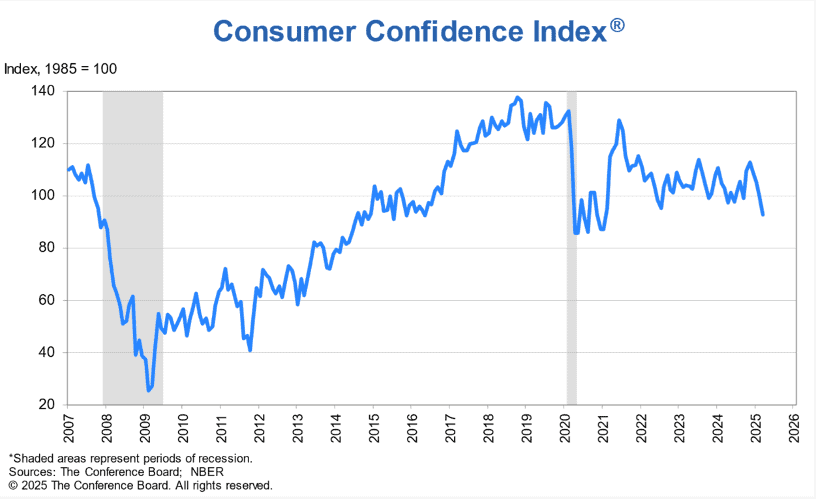

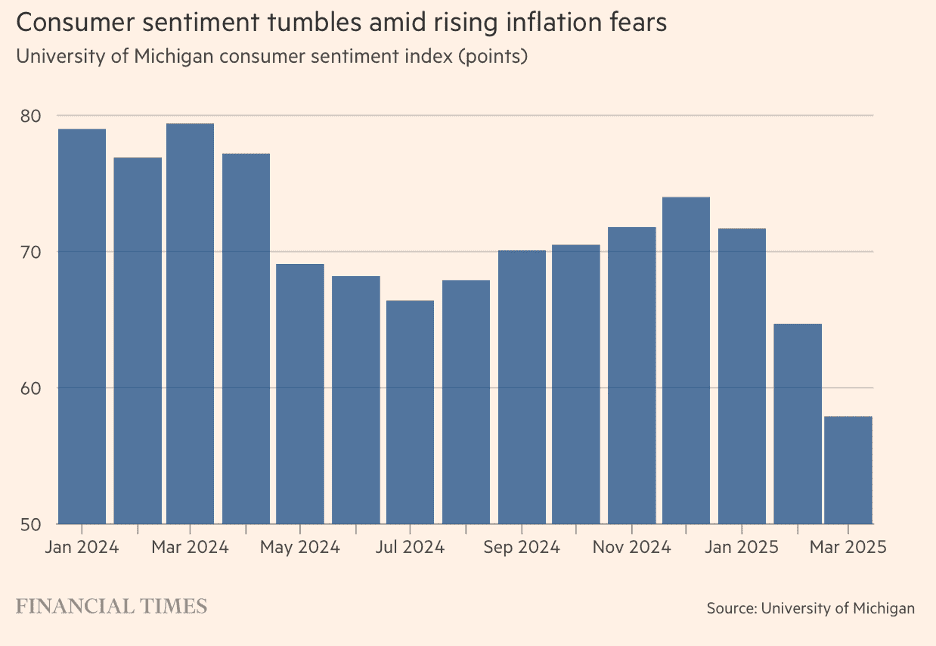

US Consumer Sentiment Plummets on Trump Trade War

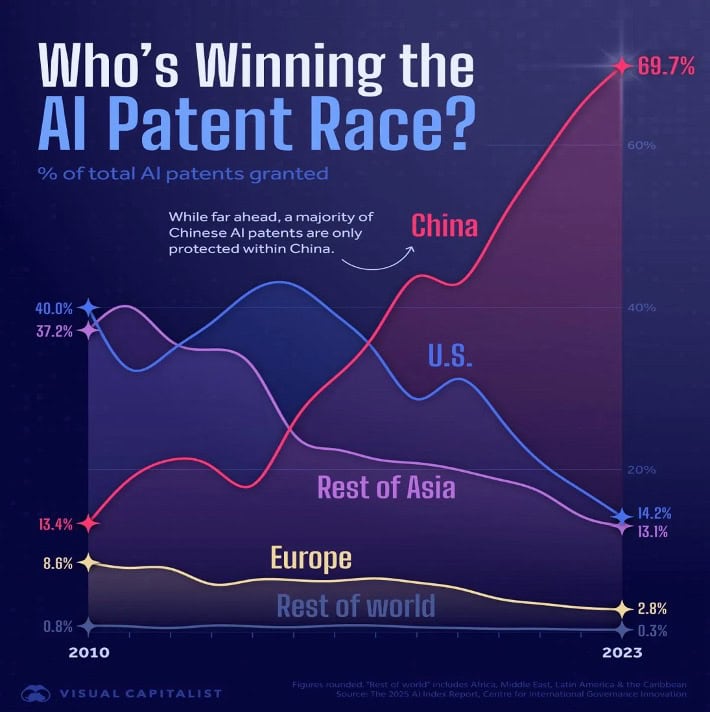

China Has Accumulated 70% of the World’s AI Patents

Visualizing Global AI Investment by Country

How Top Economies Generated Electricity in 2024

Brand Global News Section: IHOP®, KFC® and Texas Roadhouse®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

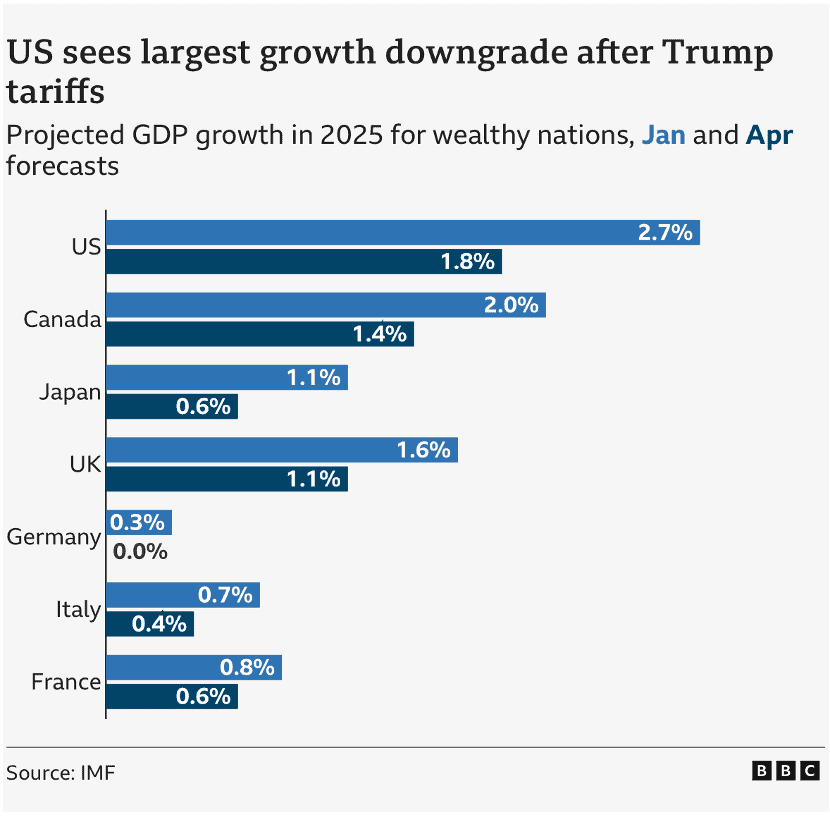

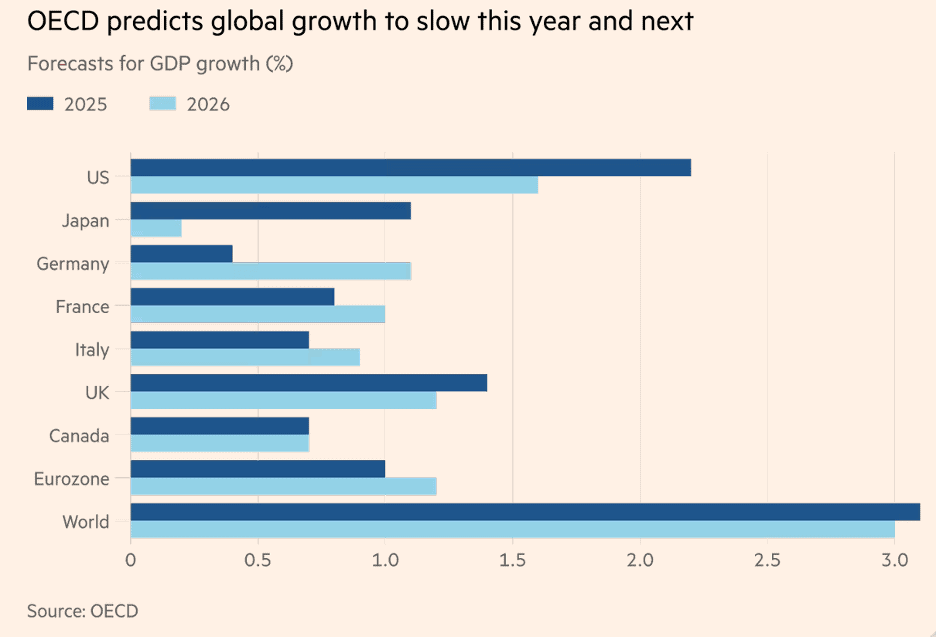

“Global growth forecast slashed by IMF over tariff impact – The forecast for US economic growth for this year has been given the biggest downgrade among advanced economies by the International Monetary Fund (IMF) due to uncertainty caused by trade tariffs. Growth is now expected to be 1.8% this year, down from the IMF’s estimate of 2.7% for the US in January. The sharp increase in tariffs and uncertainty will lead to a “significant slowdown” in global growth, the Fund predicts. The IMF predicts the global economy will grow by 2.8% this year, down from its previous forecast of 3.3%, and by 3.0% in 2026.”, BBC, April 22, 2025

==================================================================================================

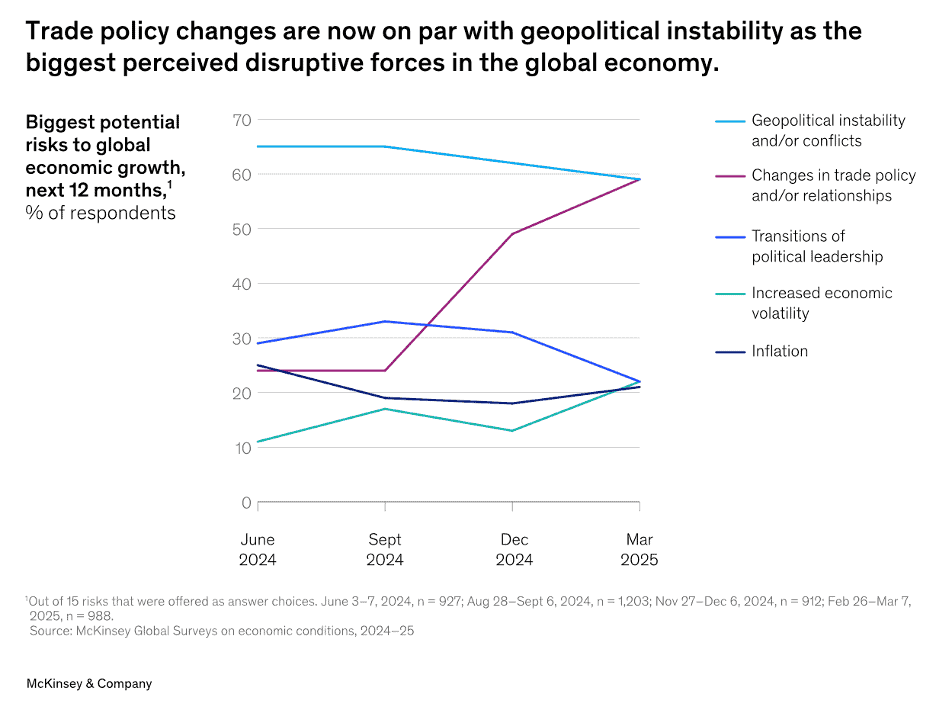

“Trade turmoil takes hold – Uncertainty looms in the latest McKinsey Global Survey on economic conditions, say Senior Partner Sven Smit and coauthors. Trade policy changes and geopolitical instability are now seen as the primary disruptors. Geopolitical risks have dominated survey respondents’ focus for the past three years, but concerns related to trade issues have surged and are now on par with geopolitics. In fact, over the past six months, the share of respondents citing trade-related changes as a major disruption to the global economy has more than doubled.”, McKinsey & Co., April 23, 2025

============================================================================================

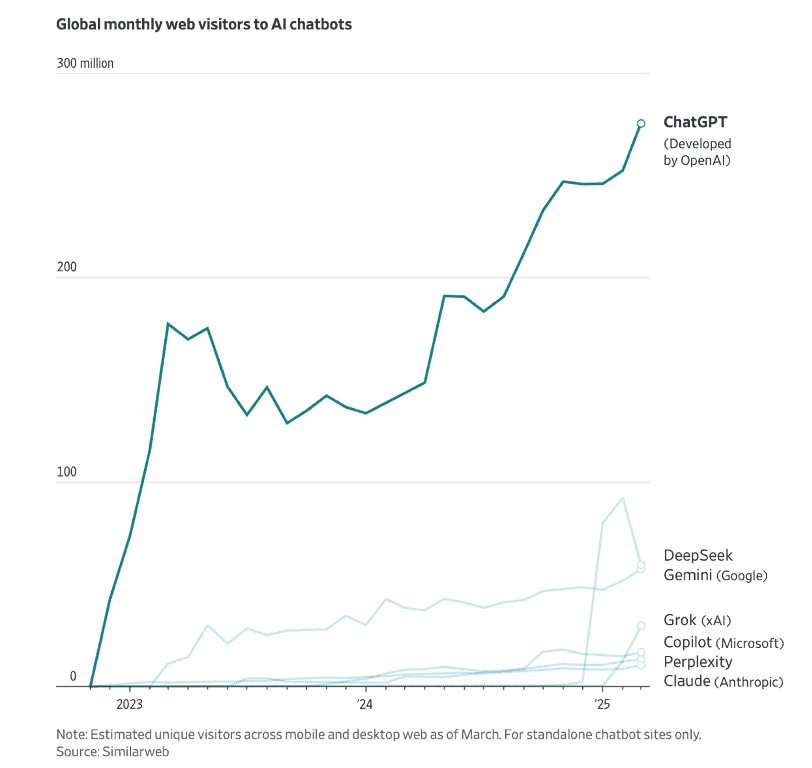

“Here’s How Big the AI Revolution Really Is – OpenAI launched ChatGPT on Nov. 30, 2022, as a “low-key research preview.” In reality, it heralded the arrival of mainstream generative AI, the kind of artificial intelligence that creates and interprets text and images in an almost humanlike way. Google, Meta and other tech behemoths immediately shifted gears to focus on this new flavor of AI, and a boom was born. More than two years later, OpenAI still has the most popular product. This web-user data doesn’t even reflect people using ChatGPT on mobile apps, where it has a similar lead. But its competitors, including Google and China’s DeepSeek, are gaining their own audiences on the web—and in their respective apps.”, The Wall Street Journal, April 23, 2025

=============================================================================================

“Are you polite to ChatGPT? Here’s where you rank among AI chatbot users – Most of us are nice, but some only out of fear. For some 12% of respondents to a new survey, it really is the case that they’re polite to AI because they fear the future consequences. That’s according to in-depth research conducted in December 2024 by Future, the publisher which owns TechRadar. The survey of more than 1,000 people found that while roughly 1 in 2 people use AI (51% of surveyed people in the US, and 45% in the UK), not everyone is kind to chatbots such as ChatGPT and their smart speakers. In the US, 67% of people who use AI are polite to it, while in the UK 71% are polite.”, Techradar, February 2, 2025

============================================================================================

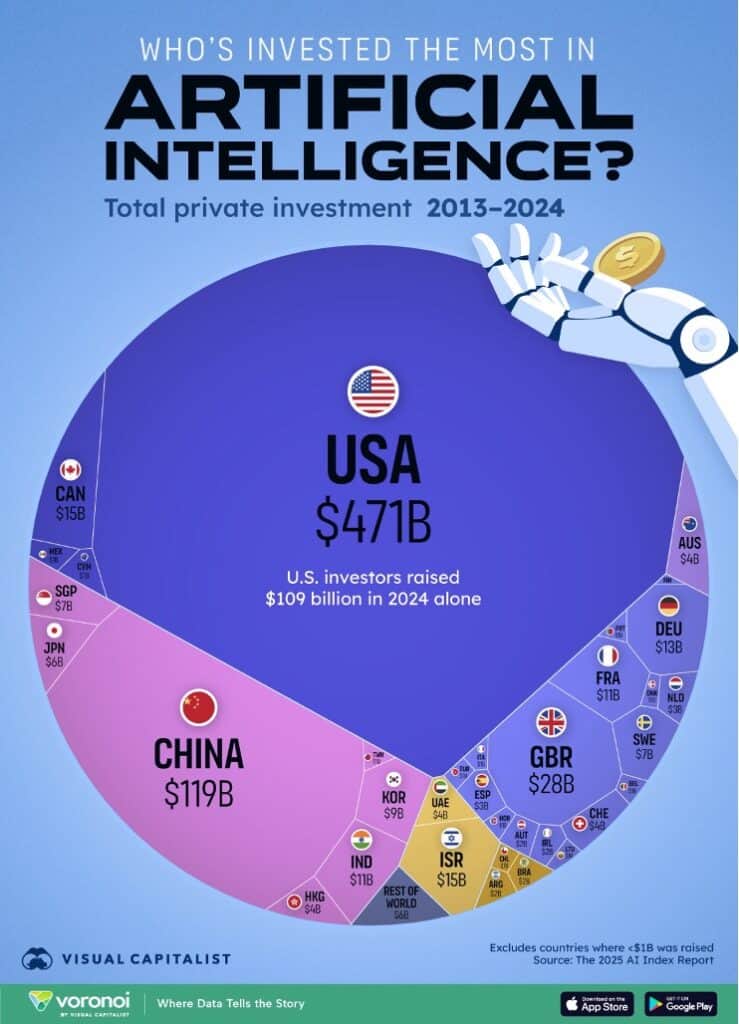

“Visualizing Global AI Investment by Country – From 2013 to 2024, the U.S. has raised nearly half a trillion dollars in private investment for AI. The next three countries are China ($119B), the UK ($28B), and Canada & Israel ($15B each). Countries are investing heavily in artificial intelligence to position themselves for a future that could look significantly different from today. Greater investment in AI typically translates into stronger innovation ecosystems, which can attract top talent and fuel groundbreaking research that drives long-term economic growth.”, Visual Capitalist, April 21, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

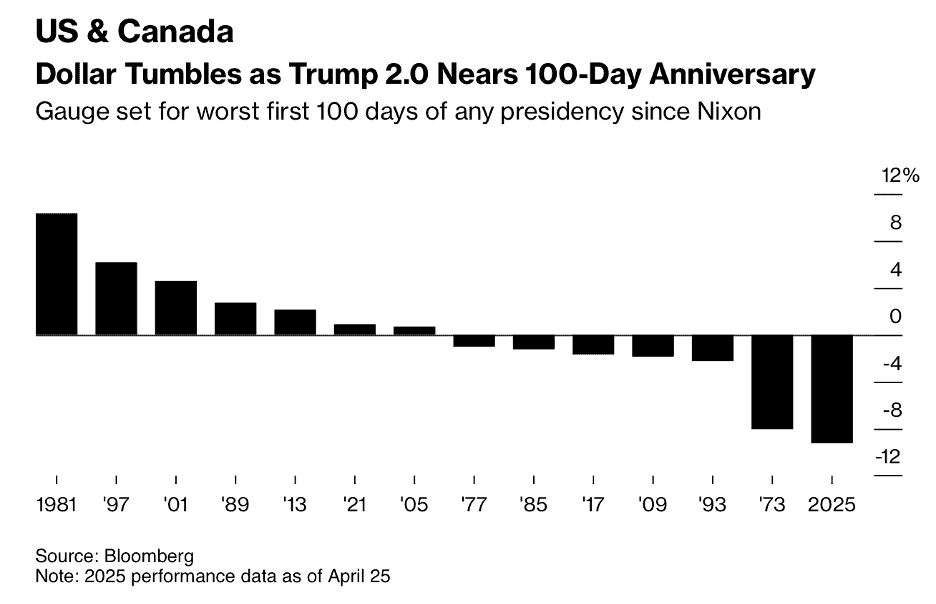

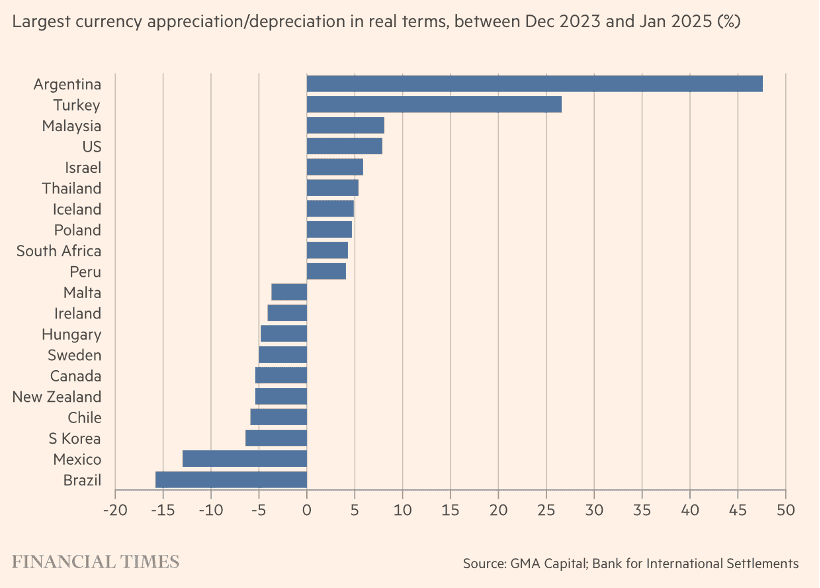

“Charting the Global Economy: US Dollar Slide Evocative of Nixon – The dollar is on pace for its worst performance during the first 100 days of a US presidency since Richard Nixon was in the White House as Donald Trump imposes tariffs and attempts to reshape global trade. Trump’s trade policy — aimed at rejuvenating domestic manufacturing, shoring up the industrial base and improving national security — has pushed investors into assets outside of the US. That’s led to a weakening in the greenback and lifted other currencies alongside gold. Meanwhile, data this week showed China remains dependent on foreign demand and South Korean exports to the US declined this month. Government forecasts pointed to a German economy that will struggle to expand this year.”, Bloomberg, April 26, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

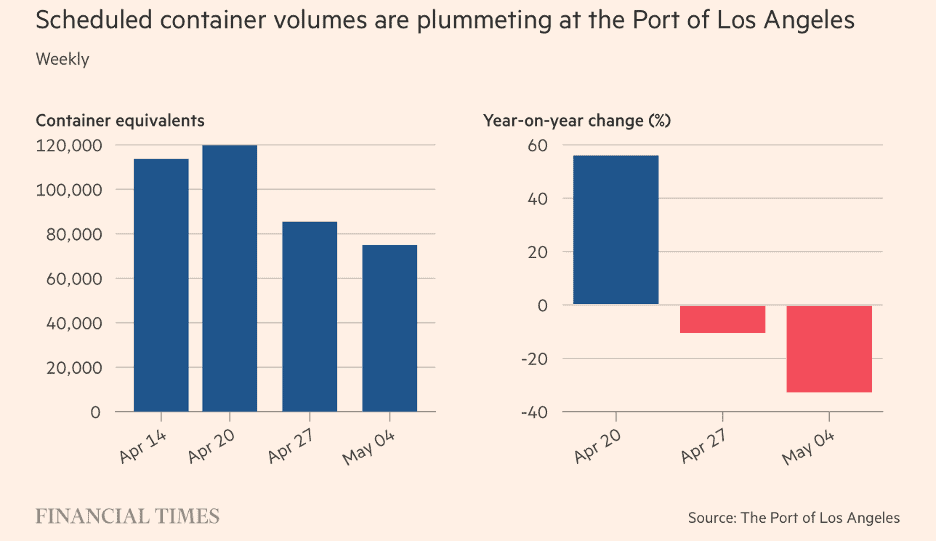

“Demand slump fuelled by Trump tariffs hits US ports and air freight – Bookings plunge as importers hold off on shipping goods to America in hope of Beijing-Washington deal. Logistics groups said container bookings to the US have fallen sharply since the introduction of 145 per cent tariffs on Chinese imports to the US. The Port of Los Angeles, the main route of entry for goods from China, expects scheduled arrivals in the week starting May 4 to be a third lower than a year before, while airfreight handlers have also reported sharp falls in bookings. Bookings for standard 20-foot shipping containers from China to the US were 45 per cent lower than a year earlier by mid-April, according to the latest available data from container tracking service Vizion.”, The Financial Times, April 27, 2025

================================================================================================

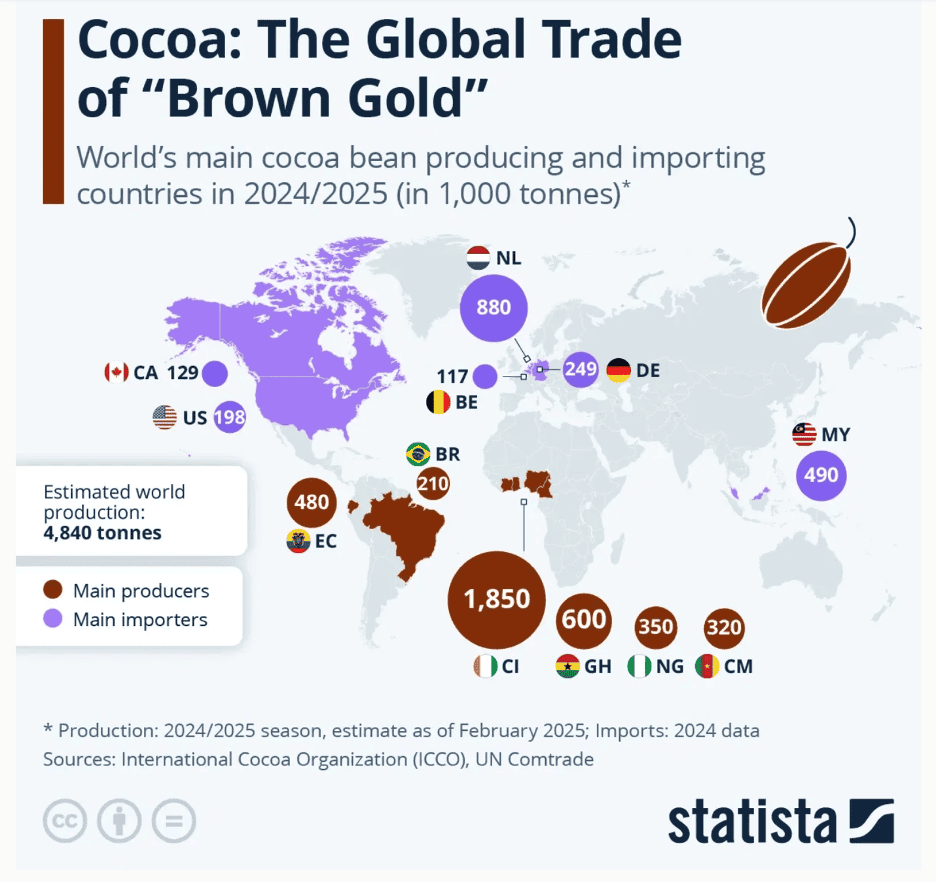

“Cocoa: The Global Trade of “Brown Gold” – Last year, a cocoa shortage drove up prices for European chocolate makers and consumers. This was largely due to an exceptionally wet rainy season as well as a viral cocoa disease that severely impacted the 2023/2024 harvest in West Africa. However, the situation is expected to improve this year, according to industry experts. In a note published at the end of February, the International Cocoa Organization (ICCO) estimated that the 2024/2025 harvest is expected to show a surplus, after three consecutive years of deficit…….global cocoa market relies heavily on harvests in the Gulf of Guinea for its supply. Nearly 65 percent of the world’s cocoa is harvested in just four West African countries: Côte d’Ivoire (38 percent), Ghana (12 percent), Nigeria (7 percent), and Cameroon (7 percent). South America comes in a distant second place for volume, with Ecuador and Brazil as the main producing countries, accounting for 10 percent and 4 percent of global production, respectively.”, Visual Capitalist and International Cocoa Organization, April 18, 2025

==============================================================================================

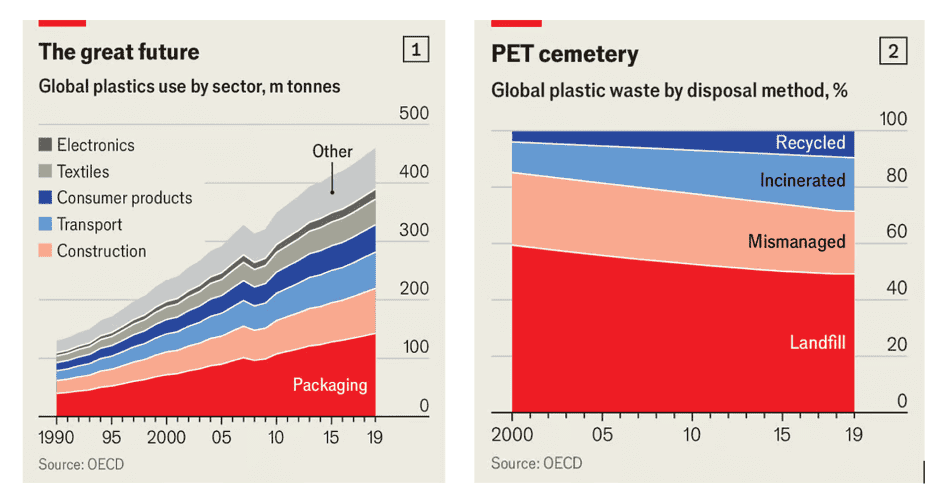

“Plastics are greener than they seem – Even if the world needs to become much better at managing their waste. In 2000 some 234m tonnes of plastic were produced. By 2021 annual production had roughly doubled, with the trade in plastics (and goods containing it) estimated to be worth $1.2trn each year. The production of plastics, which generally involves breaking down fossil fuels into their constituent hydrocarbon building blocks, such as ethylene and propylene, releases lots of carbon dioxide. The production and disposal of plastics is currently responsible for around 3.4% of the world’s annual greenhouse-gas emissions, more than the aviation industry’s 2.5%. Then there is what happens to the 350m tonnes that are thrown away each year. Possible health risks have generated a renewed focus on where much of the world’s plastic waste ends up and have led to a growing number of countries adopting ambitious recycling targets. The eu, for example, wants to recycle 55% of all plastic packaging by 2030. Yet only 9% or so of used plastic is ever turned into something else, up from 4% in 2000.”, The Economist, April 16.

===============================================================================================

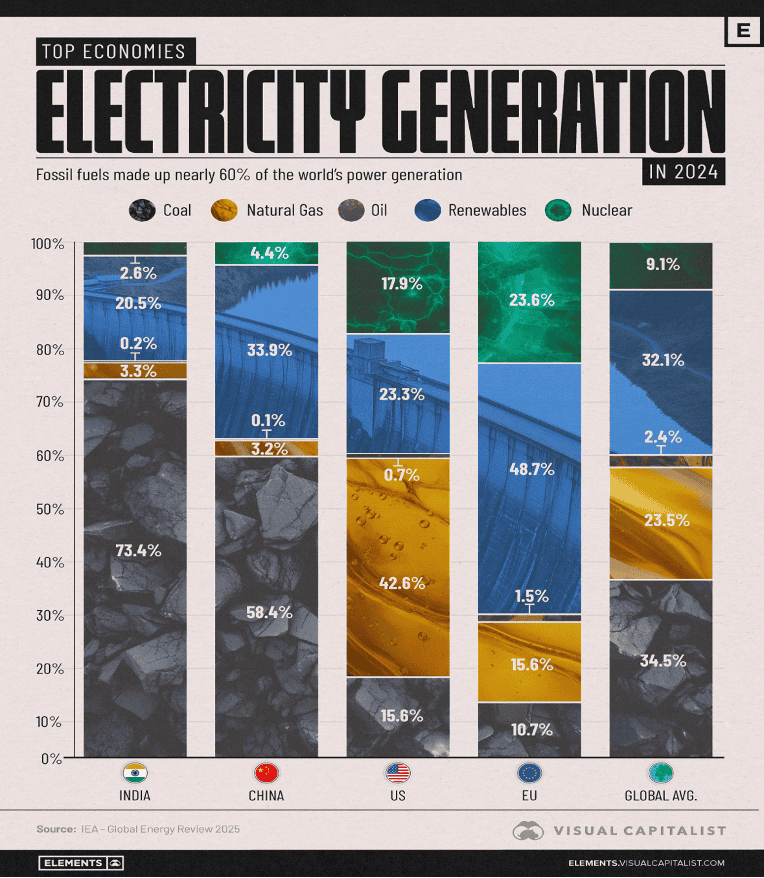

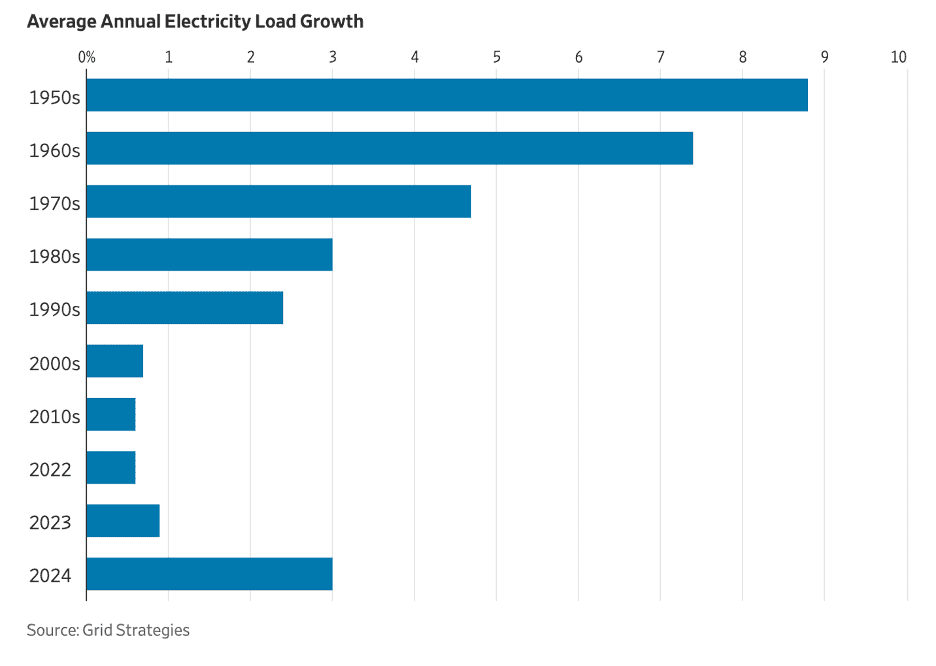

“How Top Economies Generated Electricity in 2024 – Fossil fuels made up nearly 60% of 2024 electricity generation. Coal accounts for 35% of total power generation. Global energy demand grew faster than average in 2024, driven by rising electricity use across sectors. The power sector led the surge, with demand growing nearly twice as fast as overall energy use—fueled by increased cooling needs, industrial activity, transport electrification, and the expansion of data centers and AI. Despite a growing push toward cleaner energy sources, coal remains the leading source of electricity generation worldwide. In 2024, fossil fuels accounted for nearly 60% of global power generation, with coal alone contributing 35%, according to the International Energy Agency. While renewable energy continues to expand, making up about one-third of total electricity production, the global energy mix still leans heavily on traditional sources.”, IEA – Global Energy Review 2025, April 18, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Southwest Airlines drops forecast as US trade war shakes industry – Southwest Airlines became the latest U.S. carrier on Wednesday to withdraw its financial forecast as President Donald Trump’s trade war has created the biggest uncertainty for the industry since the COVID-19 pandemic. With little clarity on how consumers will behave in the face of a potentially worsening economy, airlines are struggling to accurately forecast their business. Alaska Air Group also pulled its 2025 profit forecast on Wednesday, citing the prevailing macroeconomic uncertainty. Earlier this month, Delta Air Lines and Frontier scrapped their forecasts. Last week, United Airlines gave two different forecasts, a highly unusual move, saying it was impossible to predict the macro environment this year.”, MSN, April 23, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Our Dollar, Your Problem, By Kenneth Rogoff (2025) . In Our Dollar, Your Problem, Harvard economist and former IMF chief economist Kenneth Rogoff delivers a compelling analysis of the U.S. dollar’s dominant role in the global economy and the internal challenges threatening its supremacy.Rogoff argues that the era of “Pax Dollar”—where the dollar serves as the world’s primary reserve currency—is under threat, not from external competitors like the euro or renminbi, but from within the United States itself. He highlights issues such as rising public debt, fiscal irresponsibility, and potential political interference in institutions like the Federal Reserve as key factors undermining global confidence in the dollar. The book provides historical insights spanning seven decades and warns that continued fiscal mismanagement could lead to a sudden loss of the dollar’s global standing, echoing Hemingway’s depiction of bankruptcy: gradually, then suddenly.

Rogoff’s work is particularly relevant in light of recent U.S. tariff policies and their implications for international trade and financial stability. It serves as a crucial read for global business leaders seeking to understand the evolving dynamics of currency dominance and the importance of maintaining fiscal discipline to ensure economic resilience. Financial Times

Editor’s Note: This summary is from the book’s listing on Amazon.com. This past weekend this new book also hahd rfeviews in both the Financial Times and the Wall Street Journal.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

“China Has Accumulated 70% of the World’s AI Patents – America’s share has fallen from roughly 40% in 2010, to 14% in 2023. In the U.S., AI patenting is largely concentrated among companies like IBM, Microsoft, and Google. In China, AI patenting is more distributed across tech firms (e.g. Baidu, Tencent), government organizations, and universities. Note that 2023 is the most recent year for which data is accessible. All figures were sourced from patent-level bibliographic records in PATSTAT Global, provided by the European Patent Office (EPO).”, Visual Capitalist, April 17, 2025

==============================================================================================

India

“India’s Economy to Grow 6.5% Despite Global Swings, RBI Says – “While this rate is lower than in recent years and falls short of India’s aspirations, it remains broadly in line with past trends and the highest among major economies,” Reserve Bank of India Governor Sanjay Malhotra said in a speech in Washington on Friday and posted on RBI’s website Sunday. The outlook for global growth has taken a beating as US President Donald Trump’s tariffs spark a global trade war. To support growth, the RBI cut interest rates in early April and changed its policy stance to accommodative, signaling more easing.”, Bloomberg, April 27, 2025

=============================================================================================

United States

“Rubio unveils sweeping reorganization of State Department – The Trump administration’s proposed shake-up targets human rights programs and others focused on war crimes and democracy. The effort targets some human rights programs and others focused on war crimes and democracy, according to internal documents shared with The Washington Post. As part of the plan, senior officials would submit to department leadership a path to reduce U.S.-based staff by 15 percent, according to the documents, potentially affecting hundreds of jobs, though there would be no immediate layoffs. This plan includes the elimination of 132 offices and 700 positions, said a congressional aide who reviewed the documents. Many others would be transferred or “reorganized,” though such changes were not clearly explained — leaving questions about how the proposed shake-up would functionally alter things, the aide said.”, The Washington Post, April 22, 2025

==============================================================================================

“US Consumer Sentiment Plummets on Trump Trade War – As US President Donald Trump departed for Italy to attend the funeral of Pope Francis, the news at home for his administration was not good as the week came to an end. On the economic front, there is record fear among his constituents. US consumer sentiment fell to one of the lowest readings on record and long-term inflation expectations climbed to the highest since 1991 on worries over the domestic consequences from his tariffs. Economists see Trump’s policies, and in particular his global trade war, as making the chances of a self-induced recession a coin flip.”, Bloomberg, April 25, 2025

===========================================================================================

Vietnam

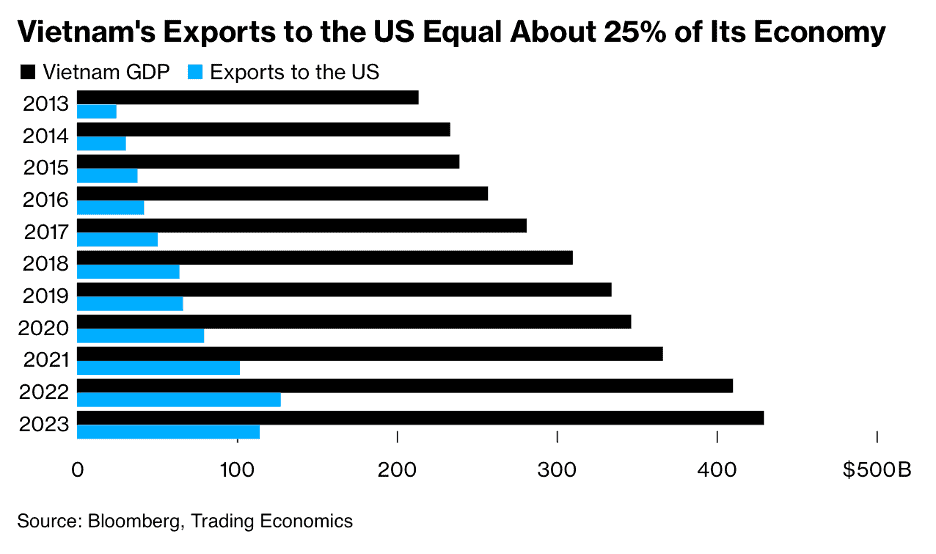

“Tariff Threat Throws Vietnam’s Factories Into Race to Ship Goods – Vietnam furniture exporter Paul Yang is in a 90-day race. The vice president of a factory that makes indoor wood furnishings for the likes of Williams-Sonoma, Inc. and Crate & Barrel Holdings Inc. is being urged by American customers to ship “anything that’s ready” to them in the window of normalcy President Donald Trumpgranted before the risk of punishingly high levies hits Vietnamese products exported to the US. It may be the last opportunity to secure revenue from a customer base that buys goods equivalent to over a quarter of a $400 billion economy if the Southeast Asian country doesn’t secure a deal before Trump’s grace period ends. Nowhere is the perilous situation felt more deeply than in Vietnam’s southern industrial province Binh Duong. With almost half of the $34.5 billion of goods exported out of Binh Duong last year shipped to the US, the region is especially vulnerable to tariff shocks.”, Bloomberg, April 16, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“New Reciprocal Tariffs Impact on Franchisors and Franchisees and Recommended Proactive Measures – The current tariff increases and volatility are creating challenges. In April 2025, President Trump implemented new “reciprocal” tariffs, introducing a 10% tariff on goods from most countries, and significantly higher rates for goods from countries with which the US has the largest trade deficits….As of April 9, there is a 90-day pause on the increase in reciprocal tariffs for all countries with reciprocal tariff rates above 10%, except for China. Many franchise-driven industries are impacted, including service-based brands and retail franchises.”, Franchising.com, April 24, 2025.

Editor’s Note: This is a second article on the impact of tariffs on franchises by Joyce Mazero, co-chair of Polsinelli’s Global Franchise and Supply Network practice, Josh Goldberg, an associate in Polsinelli’s Global Franchise and Supply Network practice and Alissa Chase, an associate in Polsinelli’s International Trade practice group.

==============================================================================================

“How AI is Revolutionizing Franchise Development: Smarter Sales for Responsible Growth – Imagine a franchise sales environment where every lead receives personalized attention, every follow-up is timely and relevant, and every sales process continually evolves based on real-time data insights. It might sound futuristic, but thanks to Artificial Intelligence (AI), this is already becoming a reality in franchise development.”, BrightFran, April 28, 2025. Compliments of The Franchise Consortium

==============================================================================================

“Webinar provides a close look at NZ prospects for U.S. franchises -In a well-attended webinar held yesterday, organised by the U.S. Commercial Service and the International Trade Organisation, U.S.-based franchisors and suppliers to the sector were given a comprehensive overview of the New Zealand franchise market. Jonathan Watt of the U.S. Commercial Service gave an overview of the New Zealand franchise market, explaining firstly that the population of New Zealand is comparable to that of New York, Singapore, or Hong Kong, but spread across a land mass similar to the UK or Japan. Stewart Germann of Stewart Germann Law Office in New Zealand, and well-known to many attendees as a CFE-accredited IFA member, spoke next, covering a range of important legal considerations of bringing a franchise to New Zealand from the United States. Daniel Cloete, the National Franchise Manager for Westpac New Zealand spoke next, advising attendees that there are four main banks funding franchise businesses in New Zealand, along with several smaller finance companies, indicating a robust financial support system for franchises. Dr. Callum Floyd of Franchize Consultants explained the main functions of the Franchise Association of New Zealand (FANZ), a membership-based organisation established in 1996, including their important advocacy, research partnership and compliance roles and the events that help bring NZ franchising networks together every year.”, Franchise New Zealand magazine, April 24, 2025

===============================================================================================

“The Chain Restaurant Charging You Nearly 100% More For Breakfast In 2025 – Budget-savvy readers are likely wondering about the dishes to avoid ordering at IHOP. The country-fried steak and eggs saw an individual raise of 95%, from $7.99 to $15.59. The sought-after 2x2x2 combo is now priced 129% higher at an eye-watering $12.59 rather than $5.49. Times are certainly changing. Even the humble milkshake couldn’t escape, with a 111% rise to $7.99. Second in sky-high command? Texas Roadhouse was the runner-up, with a 46% increase in its menu prices. Admittedly, that’s considerably less than IHOP’s 82% — a colossal difference despite being in close quarters on the leaderboard.”, Tasting Table, April 28, 2025

============================================================================================

“5 Of The World’s Most Unique KFC Locations – Whether you’re exploring Egypt or find yourself on a road trip across the United States, you may want a familiar taste to keep you fueled during your adventures. We’ve rounded up a list of five KFC locations that offer some points of interest to consider while you sink your teeth into crispy chicken and refresh yourself with a cold beverage.”, The Tasting Table, April 25, 2025

==========================================================================================

“Legal Impacts of the Economic Uncertainty Created by the Multiple Announcements of New Tariffs on the Quebec Franchise Sector – The current economic uncertainty, exacerbated by the new tariffs imposed by the U.S. Trump administration, poses major challenges in a wide range of sectors in Quebec, and the franchise sector is obviously no exception. This article explores the legal implications of this situation, focusing on the obligations of Quebec, Canadian and American franchisors, as well as the importance of sound trademark management by franchisors operating a network of Canadian franchises, and more specifically Quebec franchises, in these times of economic change.”, TCJ, March 31, 2025. Article compliments of Franchise New Zealand magazine.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 132, Tuesday, April 15, 2025

Uncertainty, Historic Market Rally, Tariff Chaos , CEO Confidence

Commentary for the 132nd issue: The quotes in this issue are all about the tariff and trade situation we find ourselves in today. In stunning U-turn, Trump walks back some tariffs, triggering historic market rally. Extreme’ US-China decoupling could cost US$2.5 trillion in equity, bond sell-off: Goldman. Companies Getting ‘A Bit Tired’ of Tariff Chaos, DHL CEO Says . Uncertainty returns CEO confidence to pre-election levels.

One More Thing: Ladies and Gentlemen, this is getting serious – China has ordered its airlines not to take any further deliveries of Boeing Co. jets or parts from the US as part of the tit-for-tat trade war that’s seen US President Donald Trump levy tariffs of as high as 145% on some Chinese goods.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Tariffs will raise prices, slow growth, and increase recession risk.” – Jamie Dimon, CEO, JPMorgan Chase

“Most CEOs I speak with believe the U.S. is already in recession.” – Larry Fink, CEO, BlackRock

“We’re committed to keeping prices low during this turbulent time.” – Doug McMillon, CEO, Walmart

“Apple is accelerating India-made iPhone shipments to avoid tariff impacts.” – Tim Cook, CEO, Apple

“Tariffs raise prices, cut profits, and increase unemployment.” – David Kelly, Global Strategist, J.P. Morgan AM

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #132:

In stunning U-turn, Trump walks back some tariffs, triggering historic market rally

Extreme’ US-China decoupling could cost US$2.5 trillion in equity, bond sell-off: Goldman

Companies Getting ‘A Bit Tired’ of Tariff Chaos, DHL CEO Says

China Orders Boeing Jet Delivery Halt as Trade War Expands

Why Europe is a Prime Destination for U.S. Restaurant Franchise Brands

Uncertainty returns CEO confidence to pre-election levels [Q1 2025 CEO Index]

Agentic AI: What It Is, How It Works, and Why It Matters

Brand Global News Section: Burger King®, McDonalds® and Tim Hortons®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Companies Getting ‘A Bit Tired’ of Tariff Chaos, DHL CEO Says – Fatigue is setting in among companies and manufacturers trying to navigate President Donald Trump’s whipsawing tariff moves, according to DHL Group Chief Executive Officer Tobias Meyer. Meyer, head of one of the world’s biggest logistics companies, warned companies and people are getting “a bit tired” with the constantly shifting announcements. ‘They don’t know, even if something is announced, whether two days later it’s not changed again,” Meyer said in an interview on Bloomberg Television. “You really see some fatigue of decision makers in manufacturing and also in the distribution sector.’, Bloomberg, April 13, 2025

==================================================================================================

‘From Anxious to Petrified’: Consumer Sentiment Plunges Further – The University of Michigan’s closely watched index hit its second-lowest reading on record, dragged down by fears of higher prices and unemployment. The University of Michigan’s consumer-sentiment index, released Friday, nosedived to 50.8 in April from 57 last month. Sentiment has been falling steadily throughout 2025. Expectations for inflation also hit the highest level in 44 years, according to the survey. Sentiment is now at its second-lowest level in history, according to the survey. It was slightly lower in June 2022, when inflation was soaring thanks to snarled supply chains and pandemic buying. Back in 2022, the index touched 50, which was the lowest reading on record going back to 1952. Sentiment declined for Democrats, Republicans and independents alike.”, The Wall Street Journal, April 11, 2025

============================================================================================

Agentic AI: What It Is, How It Works, and Why It Matters – Agentic AI isn’t exactly a new concept. Researchers have been digging into it for years. But over the past year, interest has really taken off, and it’s not just hype. According to Deloitte’s State of Generative AI in the Enterprise report, survey respondents identified agentic AI (52%) and multi-agent systems (45%), its more advanced form, as AI’s two most intriguing aspects today. Agentic AI is an advanced form of artificial intelligence designed to complete tasks with minimal human involvement. It addresses challenges in real time using AI agents — machine learning models that simulate human decision-making. In a multi-agent system, each of these agents takes a smaller task, and when they work together, they’re coordinated seamlessly to hit a larger goal. Traditional AI follows tight rules and requires human input, whereas agentic AI is more autonomous.”, From a LinkedIn post on April 14, 2025 by Neil Sahota, Chief Executive Officer ACSILabs Inc

=============================================================================================

Uncertainty returns CEO confidence to pre-election levels [Q1 2025 CEO Index] – Uncertainty rules, much like it did through the recovery phase of a post-pandemic economy. The hopes and beliefs following the election for a pro-business tax and regulatory environment, along with stabilized inflation and interest rates and increased business activity, have been replaced by mounting concerns about economic instability. With this uncertainty comes a reversal in post-election optimism, as the Vistage CEO Confidence Index fell 22.1 points to 78.5 in Q1 2025. The dramatic quarter-over-quarter drop is historic on the surface, but in reality, it’s just a 6.6-point drop from the Q3 2024 reading of 85.1 and is still above levels recorded in 2022 and 2023.”, Vistage, April 7, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Chaos at European ports as trade war leaves ships in limbo – Queues are building across UK and Europe amid tit-for-tat tariffs and plan to impose $1m fee on Chinese-made vessels docking in the US. Major ports across the UK and mainland Europe are clogging up as ships carrying goods between the US and China are left in limbo due to the trade war between the world’s largest two economies. Donald Trump’s decision to impose tariffs of 145 per cent on Chinese imports — and Beijing’s retaliatory taxes of 125 per cent — has sparked chaos among shipping operators as end-customers renege on orders. Hundreds of ships are queuing up to enter ports across Germany, Italy, the Netherlands and the UK, with industry executives now worried that the chaos could be just the start of serious disruption. US officials will this week unveil plans for a $1 million fee — up from between $20,000 and $50,000 — to be imposed on all Chinese-made vessels docking at American ports.”, The Times of London, April 13, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

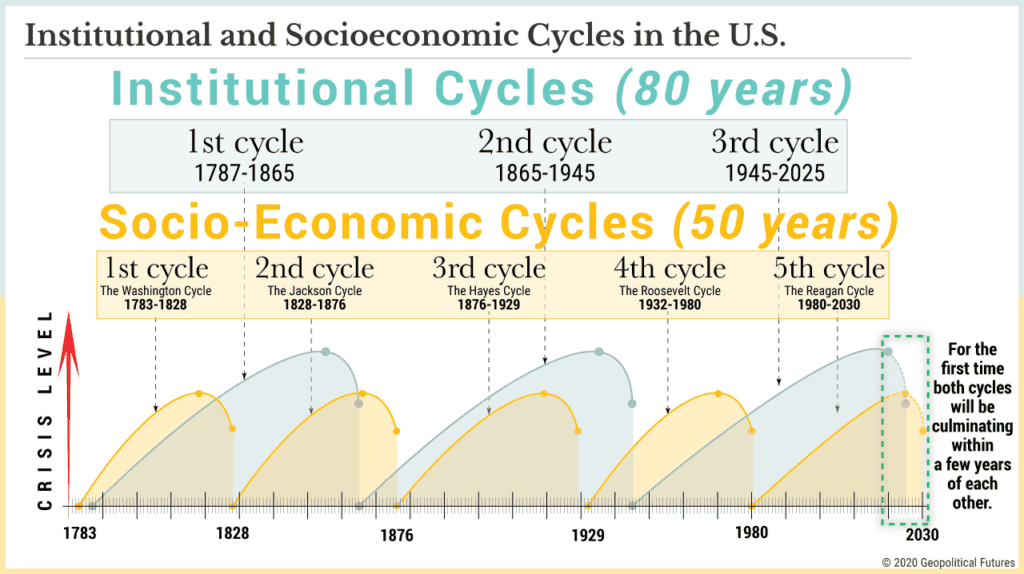

The Storm Before the Calm: America’s Discord, the Coming Crisis of the 2020s, and the Triumph Beyond

The master geopolitical forecaster and New York Times bestselling author of The Next 100 Years focuses on the United States, predicting how the 2020s will bring dramatic upheaval and reshaping of American government, foreign policy, economics, and culture.

In his riveting new book, noted forecaster and bestselling author George Friedman turns to the future of the United States. Examining the clear cycles through which the United States has developed, upheaved, matured, and solidified, Friedman breaks down the coming years and decades in thrilling detail.

American history must be viewed in cycles—particularly, an eighty-year “institutional cycle” that has defined us (there are three such examples—the Revolutionary War/founding, the Civil War, and World War II), and a fifty-year “socio-economic cycle” that has seen the formation of the industrial classes, baby boomers, and the middle classes. These two major cycles are both converging on the late 2020s—a time in which many of these foundations will change. The United States will have to endure upheaval and possible conflict, but also, ultimately, increased strength, stability, and power in the world.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“How Milei made Argentina deserving of an IMF bail-out – He offers the only way out of a supremely difficult situation. Since December, when the imf’s last agreement with Argentina ran out, the country’s president has sought a fresh bail-out. Indeed, his efforts include an executive order to remove the need for Congress to approve the deal. Since its first bail-out in 1958, the country has become the fund’s most difficult customer, endlessly stacking up debts, which now come to $41bn (or 28% of all of the imf’s lending). Mr Milei’s first deal will be Argentina’s 23rd. As the fund contemplates just how much cash to hand over, the question is whether his vim can overcome the country’s spendthrift tendencies.”, The Economist, April 3, 2025

==============================================================================================

Brazil

“Brazil’s Stagnant Economy Is the Poster Child for High Tariffs – While high tariffs protect some jobs in the country, they have also driven up costs for consumers and helped make domestic industry inefficient. Brazil’s World War II-era policy of protectionism has kept some jobs home but has also driven up costs for consumers and, according to economists, stifled competition and innovation. That iPhone 16 made in Brazil costs almost twice as much as a Chinese-made model sold in the U.S. for $799. The strategy has done little to boost Brazil’s industrial production. On the contrary, it has lowered productivity and led to some notorious price-fixing scandals, economists said. Manufacturing made up 36% of gross domestic product in 1985. Now it has fallen to about 14%, the worst example of “premature deindustrialization” in the world, according to the São Paulo-based Institute for the Study of Industrial Development. Growing at a little over 2% a year on average for the past two decades, Brazil never became the economic powerhouse its leaders once envisioned, limiting its influence on the world stage. Brazil’s labor productivity is about a quarter of that of the U.S., according to Our World in Data, a database compiled at the University of Oxford.”, The Wall Street Journal, April 12, 2025

===============================================================================================

China

| “China Orders Boeing Jet Delivery Halt as Trade War Expands – China has ordered its airlines not to take any further deliveries of Boeing Co. jets as part of the tit-for-tat trade war that’s seen US President Donald Trump levy tariffs of as high as 145% on Chinese goods, according to people familiar with the matter. Beijing has also asked that Chinese carriers halt any purchases of aircraft-related equipment and parts from US companies, the people said, asking not to be identified discussing matters that are private. The order came after China unveiled retaliatory tariffs of 125% on American goods this past weekend, the people said. Those levies on their own would have more than doubled the cost of US-made aircraft and parts, making it impractical for Chinese airlines to accept Boeing planes.”, Bloomberg, April 15, 2025 ============================================================================================ |

| “UPS reinstates China-to-US fee — with no end date – The $0.29 per pound surcharge is returning April 13 as the two countries’ trade war continues to escalate. The parcel carrier did not list an end date for the “Surge Fee,” which has a rate that can be adjusted at any time. The fee applies to a shipment’s billable weight and is also subject to UPS’ fuel surcharge. UPS previously levied the Surge Fee from March 16-29. The company said with the added surcharge, it aims to continue satisfying shippers’ needs ‘without compromising on the quality or timeliness of service expected from us.”’ The surcharge’s return comes as supply chains attempt to navigate volatile trade relations between the U.S. and China, and heavy price hikes for goods traveling between the two countries.”, Supply Chain Dive, April 11, 2025 ============================================================================================== “‘Extreme’ US-China decoupling could cost US$2.5 trillion in equity, bond sell-off: Goldman – Threat of decoupling emerged after Treasury Secretary Scott Bessent said delisting of US-traded Chinese companies was back on the table. US investors could be forced to sell nearly US$800 billion of Chinese stocks trading on American exchanges in case of a decoupling, the US investment bank’s analysts led by Kinger Lau and Timothy Moe said in a report on Monday. On the flip side, China could liquidate its US Treasury and equity holdings amounting to US$1.3 trillion and US$370 billion, respectively. The sell-off was based on the assumption that US investors would be restricted by US regulations from such investments, they said.”, South China Morning Post, April 14, 2025 |

=============================================================================================

India

“How India’s middle-class debt crisis is threatening growth – A rise in unsecured credit among a consumer group that symbolises the country’s investment potential is hurting its economic ambitions. ‘Everybody wants a laptop, everybody wants a TV, everybody wants a smartphone,’ says Anil Agarwal, the billionaire chair of Indian natural resources and energy conglomerate Vedanta. ‘They want a car, they want a scooter and their children to study in a good school — demand is tremendous.’ But a day of reckoning is fast approaching. Household debt has grown to about 43 per cent of GDP in June, from just over 35 per cent in March 2020, according to the latest RBI data. A crackdown in 2023 by the Reserve Bank of India, which warned retail lending was getting out of hand, has hit financial sector earnings just as many Indians are struggling to repay their loans.”, The Financial Times, April 13, 2025

==============================================================================================

“India sees opportunity, as well as risk, in Trump’s trade war – Narendra Modi hopes to strike a deal that will unleash growth. On April 2nd Mr Trump unveiled “reciprocal” tariffs on America’s trade partners, including a 27% levy on Indian goods. In public, Indian officials sound upbeat. They suggest India can weather any short-term pain and quickly agree to a trade deal with America that would unleash growth. Some even compare it to 1991. But privately many worry that any deal would face fierce resistance at home. And a drawn-out trade war could jeopardise the ambitious economic and political agenda of the prime minister, Narendra Modi. India had tried to appease Mr Trump by reducing tariffs on goods including bourbon and motorbikes before Mr Modi visited Washington in February.”, The Economist, April 2, 2025

================================================================================================

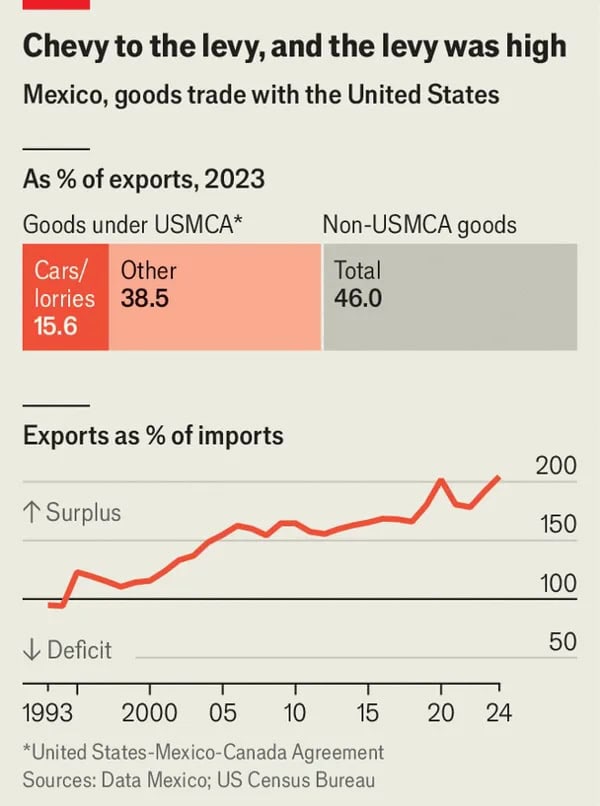

Mexico

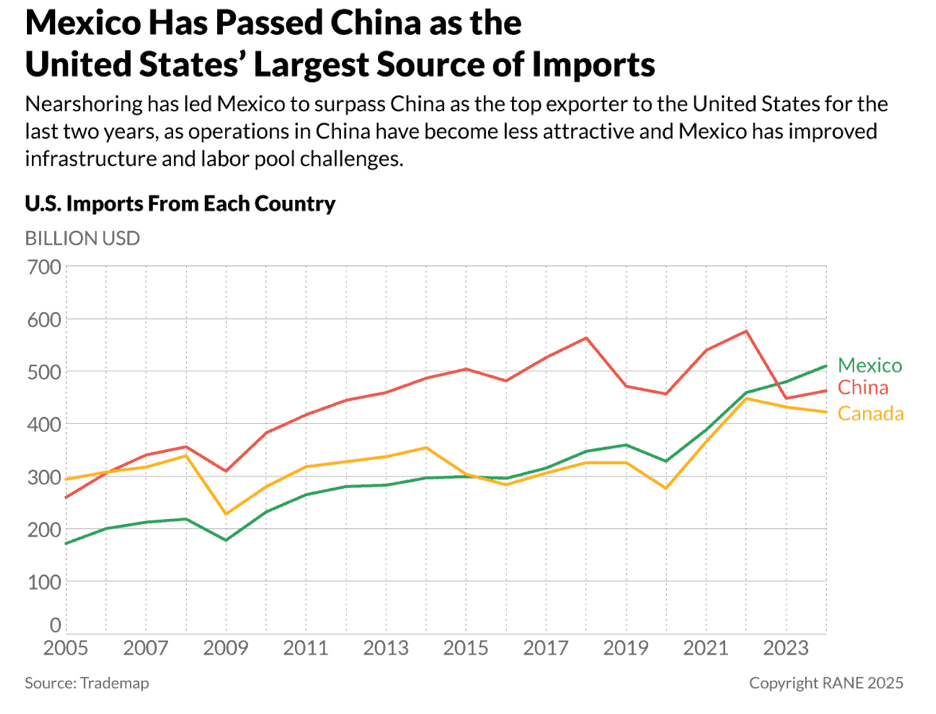

“Can Mexico make hay after avoiding the reciprocal-tariff tantrum? It may struggle to do so. The United States is Mexico’s key trading partner, receiving more than 80% of Mexican exports—equivalent to just under 30% of Mexico’s gdp. This is a larger share than any other emerging market’s. Although Mexico is still vulnerable to Mr Trump’s fickle policymaking, for the time being it has an opportunity to seize. Today 49% of Mexican exports travel under the rules-of-origin requirements of the United States-Mexico-Canada Agreement (usmca), and continue to enjoy tariff-free access. The rest is subject to a 25% tariff that Mr Trump announced in February.”, The Economist, April 10, 2025

==============================================================================================

New Zealand

New Zealand

“New Zealand Central Bank Cuts Rates, Keeps Door Open to More – The central bank cut the official cash rate to 3.50% from 3.75%. New Zealand’s central bank has lowered interest rates, making it one of the first central banks to respond to the economic threats posed by the escalating trade war. The Reserve Bank of New Zealand on Wednesday brought its official cash rate to 3.50% from 3.75% and left the door open to further cuts “as the extent and effect of tariff policies become clearer.” It said the Trump administration’s trade policies could slow global growth soon. Will the U.S. follow suit? Federal Reserve Chair Jerome Powell said last week that the central bank doesn’t need to rush to lower rates, indicating that a cut isn’t on the table at its May meeting. He said the Fed would know more “as the months go by.”, The Wall Street Journal, April 9, 2025

===============================================================================================

United Kingdom

“Britain is unusually well shielded from a tariff shock – Credit good luck more than diplomatic ingenuity. But as Donald Trump’s on-and-off-again tariff rodeo shakes the world economy, Britain has found itself in the rather unfamiliar position of being quite well insulated, and even in places poised to benefit from the turmoil. Certainly, any global slowdown would be bad news for an open and internationally exposed economy like Britain’s. But the direct hit from Mr Trump’s new tariffs is unlikely to be vast. Even before Mr Trump appeared to climb down on April 9th, offering a 90-day pause on tariffs above 10% to all countries except China, Britain had landed with the lowest 10% rate on most of its goods exports. Unlike every other economy of comparable size, though, the bulk of British exports are in services, which are not directly affected by the tariff conversation. America is Britain’s second-largest trading partner, after the European Union (eu), but two-thirds of that trade is in services, mostly in desk work like banking or law.”, The Economist, April 8, 2025

===============================================================================================

United States