EGS Biweekly Global Business Newsletter Issue 10, Monday, August 10, 2020

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“Every day is an opportunity to be a better version of ourselves. Progress is more important than perfection.” Simon Sinek.

“Great leaders believe they work for their team. Average leaders believe their team works for them.” Alexander Den Heijer

“Nothing is worth more than this day. You cannot relive yesterday. Tomorrow is still beyond our reach.” Johann Wolfgang Von Goethe

Introduction

We monitor 30+ countries, 25 daily international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our team on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Many of our newsletter readers send us their input and perspectives to help us publish a balanced overview about the world every other week. Our contact information is at the bottom of this newsletter.

Highlights In This Issue

This issue focuses on what is happening in more than 20 countries that impact new trends, health, consumer spending, business investment and travel. A few highlights:

- What global brands are doing to survive COVID-19

- S. State Department lifts the ‘do not travel’ advisory in place since March 19

- Reimagining European restaurants post COVID-19

- the June Economist Intelligence Unit’s Global Business Barometer (GBB), tracked sentiment as global executives started thinking about recovery. Readings reveal a variety of views.

- Several updates on international travel ups and down

- The new Global Markets Complexity Index (GMCI) launches to helps multinationals navigate international expansion and contraction

Coping With COVID – What Global Brands are Doing to Survive

In 46 years of doing international business and living in 7 countries, I have seen numerous wars, natural disasters, political meltdowns, and trade disputes. But nothing prepared us for the 2020 Covid-19 global disaster. I have been monitoring what franchisors have done from February to July to manage their international operations. Restaurant, retail, and fitness franchisors have seen their units shut down worldwide, resulting in drastically lower sales and royalties. Unit revenues often fell to zero for several months, as they did in the U.S. My recent article on Franchising.com shows best practice examples of what top international franchisors have done to save their international business and prepare for a better future.

https://bit.ly/WhatGlobalBrandsAreDoing

Cell Phone Technology Now and Then

Ashley Short, Director of Operations for Tim Hortons®, published this graphic on LinkedIn. Having owned one of these phones when living in Central Europe in 2000, this is self-explanatory!

The Growth of Digital Business Due to COVID-19

“Yum!’s Digital Business Has Gained Over $1 Billion: Yum! generated $3.5 billion in digital sales in Q2, a 40 percent year-over-year boom that equated to a $1 billion step-up from 2019 levels.”, QSR Magazine, July 2020.

https://bit.ly/YUMDigitalGrowth

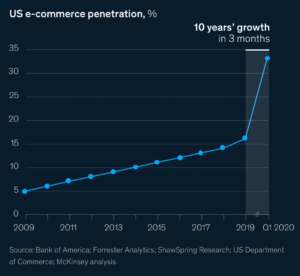

It took the COVID-19 crisis to cause an uptick in e-commerce sales in the U.S.

International Travel Updates

“US State Dept. lifts “do not travel” global travel advisory, but COVID-19 is still a worldwide risk. The U.S. State Department just revoked the emergency “Level 4: Do Not Travel” global advisory implemented on March 19. ‘With health and safety conditions improving in some countries and potentially deteriorating in others, the Department is returning to our previous system of country-specific levels of travel advice,’ the department stated in a press release dated Thursday, Aug. 6. ‘We continue to recommend U.S. citizens exercise caution when traveling abroad due to the unpredictable nature of the pandemic.’”, The Points Guy, August 6, 2020

This is NOT a joke: “Taiwanese airlines offer fun flights to Japan, but don’t expect to land: Carriers and cruise lines seek to give people an escape from Covid-19 with a range of local holiday packages. Idea comes after Songshan Airport in Taipei began offering airport tours and the chance to sit on a stationary plane on a runway.”, South China Morning Post, August 2, 2020

https://bit.ly/SCMPSpecialFlights

“When will international travel return? A country-by-country guide to coronavirus recovery: The bad news is very few countries are open to tourism right now. The good news is that some countries are slowly opening up again and more are providing timelines on when travel might again be possible.”, The Points Guy, July 31, 2020

https://bit.ly/TPGCountryReopening

“What to Look for If You Have to Travel for Business: Take these factors into consideration when planning your accommodations during business travel. For a business traveler, traveling and staying in a hotel during the coronavirus pandemic might be a cause for concern. While you may have prepared the company for business travel, it may still feel overwhelming trying to keep up with all of the information that is constantly changing. If you might have to book a business flight soon and find accommodations, you’ll want to be sure you are doing it safely.”, INC.com, August 9, 2020

https://bit.ly/INCBusinessTravel

“This is what it’s like to fly across the Pacific during COVID: The flying experience has been turned upside down since the coronavirus pandemic began affecting travel earlier this year. Perhaps nowhere is the disruption to air travel more pronounced than on international flights, which have borne the worst fallout of the pandemic. So, what is it like to fly overseas right now?”, The Points Guy, August 4, 2020

https://bit.ly/TPGFlyingToAsia

“The Path Forward: The Airline Industry with Delta CEO Ed Bastian: ‘We are focused on restoring confidence in air travel, particularly the safety and the health of our people, our employees as well as our customers.’”, The Washington Post, August 4, 2020

https://bit.ly/DeltaCEOGuidance

“Lufthansa Boosts Its Fall Destinations: Boosting its fall season, Lufthansa (LH) has announced that it will operate five further European destinations. The services are set to begin in September and October. Starting on September 7, the carrier will offer services from Munich (MUC) to Marseille (France), Gothenburg (Sweden), Kiev (Ukraine) and Sibiu (Romania). In addition, on October 5, the German company will fly again to Graz (Austria). With these additions, LH expects to operate an increased MUC timetable by the end of October. These include 86 destinations in Germany and Europe and 13 long-haul destinations.”, Airways Magazine, August 4, 2020

“China Adds Flights From Japan and South Korea as Travel Curbs Ease: China allowed more scheduled passenger flights from Japan and South Korea as the Asian countries gradually ease coronavirus travel curbs. But finding affordable tickets is still difficult for many travelers as average prices are up nearly tenfold amid high demand. There will be 15 passenger flights between China and Japan every week in August, up from 12 a week last month, according to the Japanese embassy in China and airline companies.”, Caixin, August 6, 2020

“A growing number of cruise lines are canceling sailings into 2021: The first Crystal voyage now available for booking isn’t until Jan. 5, 2021. Crystal isn’t alone. A growing number of cruise lines are giving up on efforts to bring back voyages before the end of the year. Among them are Celestyal Cruises, which recently canceled all sailings through March 6, 2021, and Victory Cruise Lines, which has dropped all sailings until April 24, 2021. Canada cruise specialist Adventure Canada also has canceled all 2020 departures. One of the world’s biggest cruise lines, Princess Cruises, recently canceled nearly all its sailings in the Caribbean and many other regions through at least Dec. 15.”, The Points Guy, August 8, 2020

Latin America

“Covid-19 Derails Latin America’s Bid for Middle-Class Prosperity: Region faces a record GDP decline this year and will likely lag behind other emerging markets in any recovery. The pandemic has devastated hundreds of thousands of businesses across Latin America, setting back the clock on the social and economic gains made over the past two decades when a global commodities boom powered breakneck growth. Now Latin America’s economy is expected to contract 9.4% this year, according to the International Monetary Fund, the worst downfall on record for a region that was already wrestling with political turmoil and social unrest before it became a hot spot for Covid-19.”, The Wall Street Journal, August 6, 2020

Australia

The state of Victoria is on a Stage 4 lock down. “A curfew is in place between the hours of 8pm until 5am. This means you must be at your home during these hours. The only reasons to leave home between 8pm and 5am will be work, medical care and caregiving.

The four reasons that you can leave home remain, but further limitations are now in place for: shopping for food or other essential items; exercise (applies to outdoor exercise, and with only one other person); permitted work; and caregiving, for compassionate reasons or to seek medical treatment also remains a permitted reason to leave home. As much as you can, you must stay at home. When you leave home, you must use a face covering, unless you have a lawful reason for not doing so.”, Victoria State Government, Health and Human Services, August 2, 2020

https://bit.ly/VictoriaShutDown

“Restructuring Virgin Australia to shed wide-body jets, shrink to an all-Boeing 737 airline. The Brisbane-based carrier will prune its more fleet of more than 130 planes to just about around 75 Boeing 737s and will shrink its network to include only domestic Australia and short-haul international routes, Virgin Australia said Wednesday.”, The Points Guy, August 5, 2020

“McDonald’s closes restaurants and moves to delivery only in Melbourne while the city is under coronavirus curfew: McDonald’s stores in Melbourne move to delivery-only under Stage 4 lockdown. Popular fast food restaurant said there doors will be shut between 8pm and 5am. Those looking to fix their French fry craving will need to download an app.”, Daily Mail, August 6, 2020

“Pandemic Leave Disaster Payment: Prime Minister Scott Morrison today announced that the pandemic leave offer of $1500 may extend to states and territories outside of Victoria. The Prime Minister this week announced a new $1500 payment which will be available to workers who have exhausted, or do not have, sick leave and have been directed to self-isolate or quarantine by a public health official. People will be able to access the payment more than once, if they need to self-isolate more than once. The payment does not apply to people on JobKeeper or JobSeeker.”, Australian Retailers Association, August 5, 2020

Brazil

“Brazil’s economy: nowhere to go but up?: Brazil’s central bank is expected to cut its benchmark interest rate today to 2%—a record low— amid a devastating recession and the world’s second-highest number of covid-19 deaths. Paulo Guedes, the economy minister, has had to abandon his trademark austerity in favour of measures to help businesses and boost spending, including a monthly payment of 600 reais ($115) to more than 60m Brazilians. The central bank has sought to dispel gloomy predictions. Its president said recently that the economy has started a “V-shaped” recovery and that a previous GDP forecast of -6.4% for 2020 was too pessimistic. The economy ministry thinks the drop will be -4.7%. It is betting on congress to pass an ambitious tax reform that would simplify accounting for businesses and attract more foreign investment. The reform has been years in the making—and has spent years on the shelf—but during a pandemic, anything is possible.”, The Economist, August 5, 2020

Mainland China

“China factory activity expands at fastest rate in 9 years: Manufacturing survey data beat expectations….The Caixin manufacturing purchasing managers’ index, a private sector survey, beat expectations to hit 52.8 in July, its highest level in more than nine years. A figure of more than 50 indicates expansion compared with the previous month. The reading reflects a bounce back of activity after a sharp contraction earlier this year, when the country was under lockdown because of the coronavirus pandemic. China’s economy returned to growth in the second quarter and factory activity has increased in each of the past three months.”, The Financial Times, August 3, 2020

“China becomes a refuge for U.S. companies after overcoming COVID-19: U.S. companies, including Nuke and tesla, have been buoyed by strong results from China.”, The Wall Street Journal, August 7, 2020

Costa Rica

“Costa Rica to begin staggered reopening as July coronavirus cases jump: The Costa Rican government will begin an economic reopening on Saturday in a bid to reverse a sharp coronavirus-induced slowdown, the president said on Wednesday, even though the official tally shows the COVID-19 caseload continuing to rise. The government will allow businesses and restaurants to reopen during the first nine days of August, but will then pause the effort for the following 12 days and resume restrictions, according to Alvarado’s plan, who added that the cycle was expected to be repeated.”, Reuters, July 29, 2020

Europe

“Reimagining European restaurants for the next normal: To win in the next normal, European restaurants will need to embrace innovation in their channel strategy, menu offerings, and business model.”, McKinsey, August 5, 2020

https://bit.ly/ReimagingingEuropeRestaurants

France

“Paris Rolls Out Red Carpet for Those Who Can Make It: Travel restrictions on the U.S. and China, and the threat of a coronavirus rebound, have kept most foreigners away. How desperate is the City of Light for tourists these days? Even the waiters are friendly. The lines are gone. Public transportation is a breeze, with plenty of seating and social-distancing. Hotels and restaurants—bereft of deep-pocketed American, Chinese and Middle Eastern clientele—are hustling to fill rooms and tables. The main beneficiaries: other Europeans.”, The Wall Street Journal, August 1, 2020

Ireland

“Ireland to Introduce COVID-19 Testing at Airports: The Irish government is to introduce COVID-19 testing at airports. The measure is a response to the rise in cases in other countries. Health Minister Stephen Donnelly said, ‘We’re introducing random testing at the airports and an increased public health presence…We’re examining other options as well for further restrictions on non-essential travel.’”, Airways Magazine, August 2, 2020

Japan

“Japan Sees 1,000-Plus Daily Hikes In Coronavirus Cases As Economy Slowly Rebounds: Japan, which initially saw success in keeping the coronavirus from swamping the nation, posted more than 1,000 new cases for at least five consecutive days between July 29 and Aug. 2, according to local reports, even as the nation eases some portions of a travel ban to boost its economic recovery…the Japanese case counts have been rising, according to Kyodo News and Nipon.com, as the Tokyo metropolitan government on Tuesday reported 309 new cases, with people in their 20s and 30s accounting for about 62% of Tuesday’s cases in the capital.”, Forbes, August 4, 2020

Kenya

“Kenya Airways Restarts International Flights: Kenya Airways (KO) resumed today its international flights. The carrier is set to fly to about 30 destinations since the routes were suspended due to COVID-19 in March. The airline resumed domestic flights in mid-July after the government cleared local air travel. Air France KLM holds a small stake in KO.”, Airways Magazine, August 1, 2020

Kuwait

“Kuwait Bans Commercial Flights from 31 Countries Over Covid-19: While other flights will resume, countries on the barred list include India, Iran, China, Brazil, Lebanon, Spain, Singapore, Egypt and Sri Lanka, the Directorate General of Civil Aviation said in a statement. The airport resumed commercial flights on Saturday as part of a phased re-opening after a five-month suspension when the country imposed measures to control the spread of the coronavirus. It plans to reach full capacity by mid-2021.”, Bloomberg, August 1, 2020

Mexico

“Carl’s Jr. to open new restaurants in Baja California Sur: Outlets to open soon Cabo San Lucas, San José del Cabo. At a time when restaurants are failing worldwide due to the coronavirus pandemic, American fast-food chain Carl’s Jr. says it is expanding in Baja California Sur (BCS).”, Mexico News Daily, July 28, 2020

New Zealand

“Coronavirus: New Zealand marks 100 days without community spread: New Zealand has gone 100 days without recording a locally transmitted Covid-19 case, a milestone that has both been welcomed and brought warnings against complacency. The last case of community transmission was detected on 1 May, days after the country started easing its lockdown. Sunday was the fourth day in a row that no new cases of Covid-19 were reported.”, BB News, August 9, 2020

Panama

“Copa Airlines will resume commercial operations in mid-August, bringing to an end an almost five-month period where the Star Alliance member’s entire fleet has been grounded because of the COVID-19 pandemic. A wider network expansion is planned from early September, providing additional coronavirus-related travel restrictions are not imposed. The August flight program will only include 10 cities in the region. Copa plans to reach 30%-40% of the company operation by December 2020.”, Enrique Tellez, Franchise Consultant, Panama City

The Philippines

“Philippine Airlines Suspends Domestic Service from Manila: Following the Philippines’ decision to resume lockdown, Philippine Airlines (PR) announced the suspension of its domestic flights at Manila’s Ninoy Aquino International Airport (MNL) until August 18. However, the airline will continue to fly between the capital and international destinations when circumstances allow it. Apart from Manila, PR has not announced the suspension of any other domestic route.”, Airways Magazine, August 5, 2020

Russia

“Russia Resumes International Flights To Select Destinations: After approximately four months of international isolation, on Aug. 1 some airports in Russia were able to welcome international departure to a small number of foreign destinations. Earlier in the month, Russian consumer watchdog Rospotrebnadzor had sent a memo to the Transport Ministry and the Federal Air Transport Agency containing a list of 13 countries that meet epidemiological safety requirements for safe welcome of travelers. The list included the U.K., Hungary, Germany, Denmark, Italy, the Netherlands, Norway, Poland, Finland, Vietnam, China, Mongolia and Sri Lanka, online outlet eTN reported.”, Airline Geeks, August 2, 2020

Saudi Arabia

“For the first time in Saudi history, the government barred Muslims from entering the kingdom from abroad for the (annual) Hajj. Some 2.5 million pilgrims usually visit the Saudi Arabian cities of Mecca and Medina for the week-long ritual – a once-in-a-lifetime duty for every able-bodied Muslim who can afford it. But this year as few as 1,000 people already residing in Saudi Arabia will take part in the gathering in an effort to control the spread of COVID-19.”, Sky News, July 29, 2020

Singapore

“Singapore Deploys Drones to Monitor Social Distancing: Will Other Tourist Destinations Follow? Singapore‘s police have been trialling two pilotless drones developed by Israel’s Airobotics to help enforce social distancing measures aimed at containing the spread of COVID-19. The small machines weigh 10 kg (22 pounds) and are programmed to track anomalies such as gatherings and stream footage to the police.”, Skift, August 8, 2020

Thailand

“The American Chamber of Commerce in Thailand (AmCham Thailand) has presented a white paper in responding to the government’s “New Normal” initiative, offering advice about long-term measures to support sustainable economic growth in Thailand.

In the white paper “Better than Before — Creating Long Term Growth in Thailand Post-Covid-19”, AmCham demonstrates its support for the Thai government’s vision of making the nation a high-income country by 2037 and suggests cooperation in key areas such as trade relations, global supply chains, digital economy, small and medium enterprises, tourism, healthcare, and energy to accelerate US investment in the region.”, The Bangkok Post, July 31, 2020

https://bit.ly/BPThailandGovernmentIncentives

United Arab Emirates

“Emirates Introduces COVID-19 Insurances to Passengers, Cuts Crew Costs: Emirates, a Dubai-based airline, is trying a new method to boost confidence for international travel by introducing a brand-new insurance to passengers. Emirates’ new program will compensate passengers if they are diagnosed with COVID-19 during their travel. According to an airline press release, the program is valid from now until the end of October and offered for free to Emirates customers regardless of the passenger’s nationality, class of travel or destination. Passengers will be covered for medical expenses up to 150,000 euros ($176,000) and quarantine costs of 100 euros per day for 14 days. The insurance is valid for 31 days from the start of the passenger’s journey. Passengers will be covered automatically when booking with the carrier and don’t need to register. ‘We are now taking it to a next level, by being the first in the industry to offer our customers free global cover for COVID-19 medical expenses and quarantine costs should they incur these costs during their travel,’ said HH Sheikh Ahmed bin Saeed Al Maktoum, the chairman and chief executive of Emirates Group.”, Airline Geeks, July 29, 2020

United Kingdom

“UK manufacturing began the third quarter on a stronger footing with output in July growing at its fastest pace in nearly three years. The closely watched manufacturing purchasing managers’ index (PMI) rose to 53.3 from 50.1 in June as the lockdown eased and demand picked up. A reading above 50 indicates growth. While the figure was slightly less than the flash estimate of 53.6, it is the highest since March 2019. Orders grew for the first time in five months and optimism increased by the most in two years. Economists cautioned that the sector would take a while to recover from the pandemic. Rob Dobson, at survey compiler IHS Markit, said: ‘There is a significant risk of further redundancies and of furloughed workers not returning unless demand and confidence stage more substantial and long-lasting rebounds in the months ahead.’”, The Times Of London, August 3, 2020

Trend? “Apple asks UK retail landlords to cut rent by 50% and offer a ‘rent-free period’ due to COVID-19. The report explains that Apple would like its rent to match what is being paid by other retailers amid the slowdown caused by the COVID-19 pandemic. In light of the COVID-19 shutdown and much lower foot traffic, many mall operators in the UK offered discounted rent to their tenants. Simply put, mall operators are looking to incentivize struggling tenants to stick to their lease despite the economic downturn.”, 9to5MAC, August 2, 2020

“More British workers are staying at home than in any other major European nations – but those who have gone back are doing so for longer. Little more than a third (34 per cent) of UK staff are back at their desks. Contrasts with 83 per cent of French office staff and 70 per cent of Germans. But Britons who have returned are doing so for more days a week than rivals.”, The Daily Mail, August 6, 2020

“The British Museum will be re-opening selected galleries to the public from Thursday 27 August. A new one-way route round the Ground Floor and Lower galleries will allow you to see objects from ancient Egypt, Greece, Rome and Assyria, before exploring Africa, North America, Mexico and the Enlightenment Gallery. everyone – including Members – will need to book a free ticket in advance to visit the Museum. In recognition of your invaluable support, Members will have the opportunity to book ahead of the general public.”, British Museum Friends, August 7, 2020

United States

“63% of U.S. consumers are willing to pay more to have seats blocked. Many airlines instituted blocking middle seats to increase safety for passengers amid the coronavirus, but some have already stopped. Here’s a roundup of airline policies.

https://bit.ly/USAirliinePolicies

Fish Consulting has issued an update on the status of the U.S. restaurant, travel 7 hospitality, fitness, health & wellness, home services, retail and beauty sectors.

https://bit.ly/USSectorUpdates

“Regal Crown theaters are schedule to reopen on August 21st in California”, Regal Crown Club member email, August 6, 2020

“Here are five charts illustrating U.S. economic trends amid the coronavirus pandemic: States are taking differing approaches to reopening and closing, and the economy is feeling the impact differently depending on the sector. The economic worry tied to rising coronavirus cases has impacted the health of certain areas of the economy.”, CNBC, August 2, 2020

https://bit.ly/USAIn5Charts

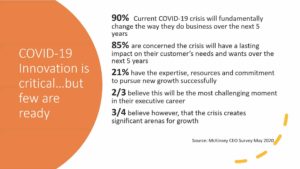

Articles And Charts About Doing Business in The Times Of COVID-19 and Beyond

“COVID-19 seems to have changed lifestyles for good: Google search traffic for cooking, exercise and crafts remains above normal levels.”, The Economist, August 5, 2020

“The third edition of the Economist Intelligence Unit’s Global Business Barometer (GBB), fielded in June, tracked sentiment as global executives started thinking about recovery. Readings reveal a variety of views. The most optimistic would create a V-shaped chart. Should more disruption follow, we might see a volatile W-shaped chart. More likely is a U-shape, where economies tred the bottom for a period before gradual upturn.”, Economist Intelligence Unit, July 2020

Innovation: “Panera’s Unlimited Coffee Subscription Program Is Already A Big Success: Panera launched an unlimited subscription coffee program in late February, a move CEO Niren Chaudhary called ‘disruptive.’ Indeed, no other chain had launched such a program without restrictions on size, daypart or channel. Then the pandemic hit. Workers stopped commuting to the office (and leaving their homes in general), and the only thing that was actually disrupted was business as usual. Still, Panera has so far managed to break the 835,000-subscriber level on its fledgling, $8.99-a-month program, including over 700,000 sign-ups alone in July.”, Forbes, August 4, 2020

Global Markets Complexity Index: A Guide for Multinationals Navigating Expansion and Contraction Developed in Association with The Wall Street Journal. The GMCI is a framework for geographic footprint strategy that helps multinationals navigate international expansion and contraction. Explore the analysis of market, operational, and regulatory complexity across 100 countries…”, Wilson Perumal & Company, August 10, 2020

https://bit.ly/GlobalMarketsComplexityIndex

“Your ultimate guide to working from home productively: As the remote work experiment drags on, here are five critical things you should be doing every day to maximize productivity. The remote work shift has crystallized into a long-term reality, with many workers accepting (and even looking forward to) this new way of life. Research shows that the longer workers operate remotely, the more likely this habit will stick. Kate Lister, president of Global Workplace Analytics, anticipates 25-30% of the workforce will be working at home multiple days a week by the end of 2020.”, Fast Company, August 4, 2020

Who We Are And What We Do

Edwards Global Services, Inc. (EGS) provides a complete International solution for U.S. businesses Going Global. From initial global market research and country prioritization, to developing new international markets and providing operational support around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Founded in 2001, Edwards Global Services, Inc. (EGS) takes U.S. businesses global and currently has activity in 25 countries. Our Clients are all consumer-faced brands. Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence

Find out more about the services we provide U.S. companies Going Global at: www.edwardsglobal.com

William Edwards has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards was named to the District Export Council of Southern California by the U.S. Secretary of Commerce in 2016 and again in 2019.

William Edwards, CFE, is CEO and Global Advisor to Chief Executives, of Edwards Global Services (EGS). Contact Bill at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 9, Monday, July 27, 2020

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“A pessimist is one who makes difficulties of his opportunities; an optimist is one who makes opportunities of his difficulties.” Harry Truman, the 33rd President of the United States

“Do the best you can until you know better. Then when you know better, do better.” — Maya Angelou

“The main thing is to have good health and to embrace opportunities which come along every day. As Sir Winston Churchill once said: “Success is not final, failure is not fatal; it is the courage to continue that counts!”, Stewart Germann, Auckland

Introduction

The goal of this biweekly newsletter is to update the economic and business situation in key trading countries across the world. In our business, we monitor 30+ countries, 25 daily international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our team on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Many of our newsletter readers send us their input and perspectives to help us publish a balanced overview about the world every other week. Our contact information is at the bottom of this newsletter.

Highlights In This Issue

This issue focuses on what is happening in more than 20 countries that impact health, consumer spending, business investment and travel. A few highlights:

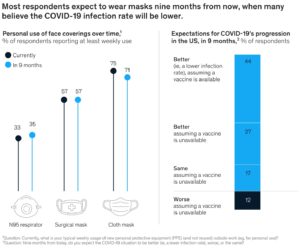

- McKinsey U.S. Survey says masks will be on people’s faces at least through early 2021

- Google to Keep Employees Home Until Summer 2021 Amid Coronavirus Pandemic

- The World Trade Organization has five charts that indicate the worst may be over for coronavirus and global trade

- Patty power: The Economist’s latest Big Mac index: The McDonald’s Big Mac hamburger. It costs about US$3.10 in China and $5.71 in America. See below for what a Big Mac costs in key countries.

- How retail shopping and eating will change as result of the pandemic

McKinsey Survey says masks will be on people’s faces at least through early 2021

“As of late May/early June, 88 percent of respondents in the United States thought the coronavirus infection rate would be the same or lower in the first quarter of 2021—whether there’s a vaccine or not. But most expect to still be wearing masks.”, McKinsey, July 14, 2020

International School Openings

“Some Countries Reopened Schools. What Did They Learn About Kids and Covid? Studies from around the world suggest that success depends on class size, distancing, the age of the students, and how prevalent the virus is locally. As school officials try to figure out whether to open classrooms this fall, the science they need to make these tough choices is still evolving. A few things are clear: That most kids don’t become as seriously ill from Covid-19 as adults, and have much lower fatality rates. That’s according to data from the US and China published by the Centers for Disease Control.”, WIRED, July 27, 2020

https://bit.ly/WIREDReopeningSchools

International Travel Updates

“Here Are The New Rules For Air Travel After The Pandemic: Canceled flights. Mandatory masks. Temperature screenings. Air travel just isn’t the same since the COVID-19 outbreak. We’re flying in a strange and often confusing world. So what are the new rules for air travel after the pandemic? Some changes, like new airline refund policies and mandatory face coverings, are widely known. Others aren’t. And it’s these unpublicized shifts — happening quietly behind the scenes — that suggest passengers have an advantage that they haven’t had in years.”, Forbes, July 24, 2020

https://bit.ly/ForbesNewTravelRules

“Business travel changed– but not forever: In the thick of the pandemic, it seemed hard to imagine that we would ever travel for business again. Health and hygiene concerns coupled with global lockdowns, conspired to take all our meetings online. However, now the future is looking brighter, will businesses stay loyal to Zoom, or will we return to the old ways of travel and doing business face-to-face?

https://bit.ly/RegusBusinessTravelChanges

“EU extends travel ban on Americans amid spike in US coronavirus cases: The European Union extended its travel ban on Americans on Thursday, as coronavirus infections continued to rise across the United States. The EU first started lifting international travel restrictions on July 1, welcoming visitors from 14 countries, including Canada, South Korea and Australia. The U.S. was left off that initial list and Americans remain barred from visiting the bloc for at least another two weeks under Thursday’s decision, announced by the European Council.”, USA Today, July 16, 2020

“U.S., Canada, Mexico to Keep Land Border Closed Until August: The borders will be closed until at least Aug. 21. ‘Based on the success of the existing restrictions and close collaboration with Mexico and Canada, @DHSgov will continue to limit non-essential travel at our land ports of entry with Canada and Mexico until Aug 20,’ Chad Wolf, the acting U.S. Secretary of Homeland Security, said in a tweet. ‘Close collaboration with our neighbors has allowed us to respond to #COVID19 in a North American approach and slow the travel-related spread of the virus.’ Canadian Prime Minister Justin Trudeau said the extension was a move ‘to keep people in both our countries safe.’ Since the land border was closed, passenger crossings have dropped by 90 percent or more, Reuters reported.”, Travel and Leisure magazine, July 26, 2020

“Virgin Atlantic resumed passenger flights on July 20, ending a three-month hiatus caused by the coronavirus outbreak. The first flight was London’s Heathrow Airport to Hong Kong. The first service, operated by a Boeing 787-9 aptly named Leading Lady, had special measures implemented to ensure that passengers can fly safely. These included mandatory face masks and a Health Pack for each passenger, which included three masks, surface wipes and hand gel. Since this flight, Virgin has resumed services to two additional destinations. These include New York, operated by an Airbus A350 named Queen of Hearts, and Los Angeles, which was served by the Dreamliner called Queen Bee.”, Airline Geeks, July 22, 2020

“U.S. passenger flights to India can resume July 23: The government of India has agreed to allow U.S. air carriers to resume passenger services in the U.S.-India market starting July 23, the U.S. Transportation Department said on Friday.”, Reuters, July 17, 2020

“Set sail and social distance: Taiwan resumes ocean cruise amid pandemic: Taiwan resumed an island-hopping ocean cruise on Sunday, joining a handful of places in the world to restart voyages after the coronavirus pandemic brought the industry to a virtual standstill. Some 900 holiday makers are adapting to new safety measures when boarding Genting Hong Kong’s (0678.HK) Explorer Dream embarking from Taiwan’s northern Keelung port. The company now offers trips of up to five days from Taiwan to its scenic outlying islands of Penghu, Kinmen and Matsu.”, Reuters, July 26, 2020

“Southwest Airlines backtracks on a full schedule by year-end as recovery stalls. It was less than two months ago when Southwest Airlines unveiled plans to fly a nearly full schedule by December in an effort to grow out of the coronavirus pandemic as it has past recessions. Dallas-based Southwest plans to fly about 25% less than it flew at the end of 2019 by December, CEO Gary Kelly said during the airline’s second quarter earnings call on Thursday.”, The Points Guy, July 26, 2020

Africa

“Welcome to Africa: A country-by-country guide to reopening: We’ve been doing a lot of stories about our dream trips and when we can realistically book them. Africa is at the top of our wish list. And several countries in Africa have reopened to tourism.”, The Points Guy, July 26, 2020

https://bit.ly/TPGGettingtoAfricaNow

Greater Asia

“A Country-by-Country Look at How Asia Is Reopening: All the reopening statuses and current travel restrictions. Nearly every country in the world has been touched by the virus, there are travel restrictions at most borders and, for the imminent future, we’re all staying pretty close to home. But because countries in Asia like China, Japan, and South Korea were impacted early on, they’ve also been earlier to peak, earlier to flatten their curves, and, generally, earlier to reopen.”, CNN Traveler, July 15, 2020

https://bit.ly/CNNTravelerAsiaReopening

Australia

“McDonald’s to open its 1,000th store in Australia – and the cutting-edge super green Melbourne restaurant will use solar panels, fibre cutlery and renewable energy. McDonald’s is set to open its 1,000th restaurant following 50 years in Australia at the end of the year.”, Daily Mail, July 25, 2020

“Australia extends jobs support as new COVID-19 outbreaks threaten economy: Australia will spend A$16.8 billion ($11.8 billion) to extend its wage subsidies for businesses hit by the coronavirus pandemic, as a surge in new infections in the country’s southeast threatens to keep the economy in recession.”, Reuters, July 20, 2020

“Bank chief executives have backed the government’s revamp of a scheme to provide up to $40 billion in taxpayer-backed loans to help the recovery of small and medium-sized firms. Changes to the $40 billion scheme include lending larger amounts for longer terms of up to $1 million for five years, which is an increase from the scheme’s initial limits of $250,000 for up to three years.”, The Brisbane Times, July 20, 2020, compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

Canada

“WestJet Announces Schedule Expansion for August: As the summer travel season moves forward, Canada’s WestJet is expanding its August schedule and continuing its flight operations for July. The Calgary, Canada-based carrier plans to add more than 200 flights to 48 destinations across Canada and beyond. Even though there seems to be no end in sight for the global pandemic, the airline is also dedicating efforts to safeguard its passengers.”, Airline Geeks, July 20, 2020

Mainland China

“Chinese GDP grows 3.2% in second quarter: Gross domestic product grew 3.2 per cent in the three months to the end of June, compared with the same period last year. The positive economic data follow the first annual decline in decades in the previous quarter, when China’s GDP fell 6.8 per cent as the country struggled to deal with the impact of the Covid-19 crisis.”, The Financial Times, July 16, 2020

“Passengers Now Need a Negative Covid Test Certificate Before Flying to China: The test, paperwork, and five-day time frame all add up to a lot of extra work for the traveler. Those airlines that are allowed to fly to China will probably be hoping it’s a very temporary measure.”, July 21, 2020

“Getting Expats Back to China During COVID-19: With the new school year due to resume in the fall, some AmCham China members are having to arrange alternative plans for their children’s schooling to contend with the very real possibility that they will not be able to return to China in time for the start of the fall term.”, AmCham China, July 24, 2020

https://bit.ly/GettingExpatsBacktoChina

“Yum China Holdings Inc was named as an official retail food services sponsor for the Beijing 2022 Winter Olympics, the KFC operator in China said on Monday. Yum China’s brands, including KFC and Pizza Hut, will be on site at the Olympic and Paralympic Winter Games in Beijing. The company, a licensee of Yum Brands Inc in mainland China, was also named as an official sponsor of the Chinese Olympic Committee through the end of 2024.”, Reuters, July 20, 2020

https://bit.ly/YUMChinaOlympics

“Beijing partially reopens movie theaters as coronavirus threat recedes: Cinemas in parts of the city deemed at low risk of cross-infection began admitting moviegoers under social distancing rules. Tickets must be booked in advance, attendance is capped at 30% of capacity and no eating or drinking is allowed during the show. As with most venues in China, a temperature check and online travel record were required for entry. Cinemas have been closed for around six months but began reopening this week in major cities throughout the country.’ Fortune and Associated Press, July 24, 2020

“Cinemas in China begin to reopen after six-month coronavirus closure: Some cinemas in Chinese cities from Shanghai to Chengdu reopened on Monday after a six-month closure, raising hope that the world’s second largest movie market can start to recover from painful losses during the coronavirus pandemic.”, Reuters, July 20, 2020

“Chinese car stocks get Covid-19 sales boost as consumers look for safer alternative to public transportation. Car sales improved in June as buyers returned to showrooms after worst of the coronavirus”. South China Morning Post, July 20, 2020

https://bit.ly/SCMPChinaautosales

The EURO Zone

“Eurozone business activity rebounds from pandemic hit: Bloc’s services sector posts notable uptick and German manufacturing recovers. Services sector businesses across the eurozone reported a substantial strengthening in July, according to the IHS Markit flash purchasing managers’ index that rose to 55.1, from 48.3 in June. The result exceeded the expectations of economists polled by Reuters, who had forecast a reading of 51.The index for manufacturing rose from 47.4 in June to 51.1 in July, and the composite PMI, an average of the two sectors, improved from 48.5 in the previous month to 54.8, above the 51.1 forecast by analysts.”, The Financial Times, July 24, 2020

France

“Disneyland Paris Is the Latest Disney Theme Park to Reopen Amid the Coronavirus Pandemic. Disneyland Paris welcomed guests back this week for the first time in months.”, Travel And Leisure magazine, July 16, 2020

Germany

“In Germany, the COVID-19 induced economic dive has led to a surge in Franchise leads by at least 50 percent; however, not all sectors are benefitting equally. There is massive interest for franchise systems that are doing well despite the downturn such as logistics brands InXpress or Mail Boxes Etc., security brand Signal 88 or care concept Home Instead. But buyers shun others, especially from the food, retail, fitness and wellness sectors out of fear of a second wave and another lockdown. “Candidates will be much more selective than in the past and will look at sectors that are COVID- and recession proof,” summarizes Franz-Josef Ebel, Managing Director of Master Franchise Germany.

“German cruise ship, Mein Schiff 2, sails with 1,200 people on board in first return voyage: Occupancy was limited to 60% so passengers can keep their distance. There were 1,200 people on board compared to the ship’s normal 2,900 capacity. The ship sailed from the port of Hamburg toward Norway, and passengers will spend the weekend at sea with no land stops before returning to Germany on Monday.”, USA Today, July 25, 2020

Italy

“It has been another important week for Lagardère Travel Retail Italia, which continues with the reopening of its stores around the country. Thanks to the collaboration of all the staff, we have achieved this new success, putting the safety of our employees and customers first. We are happy to celebrate these results once again, as we keep on looking into the future, working hard every day, to remain an important point of reference for Italians and international travelers.”, Lagardère, LinkedIn post, July 24, 2020

Japan

“Theme parks in Japan are telling visitors to ‘scream inside your heart’ — and it’s 2020 in a nutshell: As weird as this year has been, though, we didn’t see this new policy in Japan coming — namely, that you’ll have to “scream inside your heart” while riding roller coasters to stop the spread of COVID-19.”, The Points Guy, July 17, 2020

Mexico

“Mexico tightens coronavirus curbs in tourist spots, other pockets: The spread of the coronavirus has spurred Mexican authorities to impose local restrictions on mobility, commerce, and leisure, particularly in popular tourist destinations, even as the government seeks to revive the battered economy.”, Reuters, July 16, 2020

New Zealand

“There are lots of good things happening with business – new franchisors are preparing to break forth and multiple, and existing franchise systems are appointing new franchisees as many people are keen to own their own business and help shape their destiny….As a nation we should embrace the good things happening and not dwell on the negative – yes, there are escapees from hotels under isolation and that will continue, there are new cases of Covid but no community spread so far, and we live in NZ with our borders closed except for Kiwis returning from overseas.”, Extracted from a July 16, 2020 LinkedIn post by Stewart Germann, Germann Law Office, Auckland

Panama

“Panama has delayed the process of reopening the economy due to the increase in Covid-19 cases. There are only two economic sectors open out of six sectors . Restaurants were scheduled to open in June but because of the above reason, the entire opening process has been paused until an undetermined date. air travel suspended. Reopening of airport pending.”, Jose Enrique Tellez, Franchise and Business Consultant, Panama City

“Copa Airlines Pushes Back Restart for Fourth Time: The Panamanian carrier Copa Airlines was repeatedly forced to modify the restart date of regular operations. According to ALNNEWS, the Civil Aeronautical Authority (CAA), extended for the fourth time the suspension that weighs since March 22 on commercial aviation in Panama. Due to the suspension of flying until August 22, Copa Airlines reported that the new restart date would be September 5. With this new postponement, the 102 aircraft fleet will have been grounded for a total of 6 months.”, Airline Geeks, July 25, 2020

Saudi Arabia

The government is expected to restart travel to and from the Kingdom in August or September according to a Riyadh consulting firm.

Spain

“Spain’s coronavirus epidemic is under control, government says: Spain’s coronavirus epidemic is under control, the (Spanish) foreign ministry said on Sunday, after the British government imposed a 14-day quarantine on all travellers returning from the Mediterranean country in response to a surge in new cases there. Hospitals are coping well with the increase in infections and more than half of new cases are asymptomatic, the ministry said, adding that outbreaks in Catalonia and Aragon should soon be brought under control.”, Reuters, July 26, 2020

South Africa

“After Early Success, South Africa Buckles Under Coronavirus Surge: Lauded in the early stages of the pandemic for taking decisive steps to limit Covid-19 infections, South Africa is now battling one of the world’s fastest-growing outbreaks that is overpowering hospitals and has caused a dramatic increase in deaths. Public schools, which partially reopened in early June, will close for four weeks starting Monday, as the country enters a peak-infection period that models suggest could stretch into September. Africa’s most developed economy now has confirmed 434,200 cases of Covid-19, the fifth-highest toll in the world behind the more-populous U.S., Brazil, India and Russia. ‘The coronavirus storm has indeed arrived,’ President Cyril Ramaphosa said Thursday, in his 11th address to the nation since the first case of coronavirus was identified in early March.”, The Wall Street Journal, July 26, 2020

United Kingdom

“Retail sales rose by a better-than-expected 13.98 per cent month-on-month in June as they continued to recover after record falls at the height of the lockdown, according to data released this morning by the Office for National Statistics. City economists had forecast an 8 per cent rise. Jonathan Athow, from the ONS, said: “Retail continued to recover from the sharp falls seen in April, with overall sales now almost back to pre-pandemic levels.”, The Times of London, July 24, 2020

“Coronavirus: Gyms and swimming pools reopen in England as tourists are welcomed back to Wales: Indoor gyms, swimming pools, dance studios and leisure centres in England are allowed to reopen today for the first time in four months – but at least a third of public facilities are expected to remain shut due to financial hardship. Earlier this month, Culture Secretary Oliver Dowden announced that gyms and leisure centres would be able to reopen today, with strict hygiene and social-distancing measures.”, Sky News, July 25, 2020

“McDonald’s has announced plans to reopen hundreds of restaurants for dine-in services across the UK from this week. Last week, it was reported that the fast food chain was testing safety measures as it moved towards reopening dine-in restaurants in the near future. The firm has now stated that around 700 restaurants across the UK will be reopened for dine-in customers from Wednesday 22 July.”, The Independent, July 21, 2020

“Coronavirus: Heathrow packed as passengers turn up eight hours before flights: Concern grows as families prepare for big getaway this weekend. Air passengers are arriving up to eight hours before flights at Britain’s biggest airport, fuelling concerns over crowding in terminals. Passengers told of being packed in “like sardines” at Heathrow with claims that some were failing to wear facemasks or comply with one metre-plus social distancing rules.”, The Times of London, July 23, 2020

“Air passengers from commercial hotspots like New York, Singapore and Dubai could be made exempt from quarantine in bid to boost economy: Government is being urged to approve new ‘test-on-arrival’ scheme at airports. Would see all passengers tested and, if negative, avoid 14 days of quarantine. Hoped new scheme would encourage business travel and boost the UK economy.”, Daily Mail, July 25, 2020

United States (including Hawaii)

“Hawaii islands could allow visitors to quarantine in ‘resort bubbles’: Officials on three Hawaiian islands – Maui, Kauai, and the Big Island – are considering a plan to let tourists have a vacation-like experience while adhering to their 14-day quarantine. The concept is known as the “resort bubble,” and it would let visitors roam beyond their hotel rooms as long as they stay within a “geofence,” or within the confines of the property where they’re staying. The plan, which is still tentative, would be in effect for selected resorts..”, Business Insider, July 26, 2020

“American Airlines has flown more than its competitors during the pandemic, and it’s paying off: Faced with the worst crisis in airline history, American cut less of its schedule and did so at a slower pace than either Delta or United in March. But by April, it had decided to fly a more robust schedule for the upcoming summer, providing connectivity across the country that presumed ‘some recovery in demand,’ as American vice president of network planning Brian Znotins put it. Soon, American’s hubs in Charlotte (CLT) and Dallas/Fort Worth (DFW) were hopping once again. So much so that DFW was the busiest airport in the U.S. in May. There were even traveler complaints about crowded flights despite the airline never promising to block middle seats — even in the early days of the pandemic. Then, in a clear signal that America was ready to move again, more and more people kept buying plane tickets and flights filled up. So many people were buying seats that the carrier lifted what caps it had bookings even as competitors extended seat blocking measures saying they were needed to assure customers.”, The Points Guy, July 24, 2020

“Universal canceling Halloween Horror Nights because of virus: It’s hard to scare the bejesus out of someone in a haunted house while socially distancing, which may explain the decision by Universal to cancel its Halloween Horror Nights this year at its U.S. theme parks.”, ABC News, July 25, 2020

Articles About Doing Business in The Times Of COVID-19 and Beyond

“Google to Keep Employees Home Until Summer 2021 Amid Coronavirus Pandemic: Search-engine giant pushes back return to normalcy. Google will keep its employees home until at least next July, making the search-engine giant the first major U.S. corporation to formalize such an extended timetable in the face of the coronavirus pandemic. The move will affect nearly all of the roughly 200,000 full-time and contract employees across Google parent Alphabet Inc., GOOG +0.92% and is sure to pressure other technology giants that have slated staff to return as soon as January.”, The Wall Street Journal, July 27,2020

https://bit.ly/Googletokeepemployeeshome

“COVID-19 and the great reset: Economic recovery depends on the return of the consumer—but shopping will never be the same. New McKinsey research considers the possibilities.”, McKinsey, July 23, 2020

https://bit.ly/COVIDbusinessreset

“5 charts that show the worst may be over for coronavirus and global trade: World trade fell steeply in the first half of 2020 as the COVID-19 pandemic hit. Government and central bank intervention helped stem the losses. World Trade Organization economists now say we have avoided the worst-case scenario. Risks to the outlook include a second wave of COVID‑19 or trade restrictions. The worst-case scenario for global trade in the wake of the COVID-19 pandemic has been avoided, according to economists from the World Trade Organization (WTO).,” World Economic Forum, July 15, 2020

https://bit.ly/WEFGlobalTradeRecovering

“How Retail Shopping and Eating Will Change as a Result of the Pandemic: Both the retail and restaurant markets have been in a constant state of evolution, responding to generational shifts, technological advancements… and now, Covid-19. Will shopping at retail stores ever be the same post–Covid-19? How about dining at retail stores? The incorporation of food into retail stores was on the rise before Covid-19 (partially owing to the emerging Millennial generation and their experiential preferences), and is now on pause with stores closing or limiting their customer capacity.”, Franchising.com, July 26, 2020

https://bit.ly/FranchisingcomHowRetailWillChange

“Patty power: The Economist’s Big Mac index: In foreign-exchange markets, 7 yuan will buy you a dollar. But 7 yuan stretches further in China than a dollar does in America. One example is the McDonald’s Big Mac hamburger. It costs about 21.70 yuan (US$3.10) in China and $5.71 in America, according to prices collected by The Economist. July 16, 2020

About US

Edwards Global Services, Inc. (EGS) provides a complete International solution for U.S. businesses Going Global. From initial global market research and country prioritization, to developing new international markets and providing operational support around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Founded in 2001, Edwards Global Services, Inc. (EGS) takes U.S. businesses global and currently has activity in 25 countries. Our Clients are all consumer-faced brands. Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence

Find out more about the services we provide U.S. companies Going Global at: www.edwardsglobal.com

William Edwards has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East.

Mr. Edwards was named to the District Export Council of Southern California by the U.S. Secretary of Commerce in 2016 and again in 2019.

William Edwards, CFE, is CEO and Global Advisor to Chief Executives, of Edwards Global Services (EGS). Contact Bill at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 8, Monday, July 13, 2020

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“Risk comes from not knowing what you are doing.” – Warren Buffett

“I don’t think of all the misery, but of the beauty that still remains.” – Anne Frank

“Hope is a renewable option: If you run out of it at the end of the day, you get to start over in the morning.” – Barbara Kingsolver, Novelist

Introduction

The goal of this biweekly newsletter is to update the economic and business situation in key trading countries across the world. In our business, we monitor 30+ countries, 25 daily international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our team on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Although we search for pertinent articles for this newsletter every day, this edition is mainly made of very recent articles due to the very rapidly changing COVID-19 case and travel situation worldwide.

Many of our newsletter readers send us their input and perspectives to help us publish a balanced overview about the world every other week. Our contact information is at the bottom of this newsletter.

Highlights In This Issue

This issue focuses on what is happening in 20 countries that impact consumer spending, business investment and travel. A few highlights:

⦁ COVID-19 has re-emerged in several countries causing governments to curtail business openings and add travel restrictions

⦁ “COVID-19 Travel and Tourism Reopening and Recovery Guidelines”, The U.S. Commercial Services has provided us with an extensive and detailed 44 Greater Europe country and territory reopening and recovery guidelines document

⦁ Disneyworld in Orlando, Florida and LEGOLAND near San Diego, California reopened

⦁ The UK government is investing £500 million next month to give diners 50% off meals at local restaurants

⦁ Melbourne, Australis is back on a 6 week lockdown

⦁ “Accelerating Recovery With Innovation – 5 Things to Keep in Mind’, there is link to this important coming out of COVID-19 article on by innovating efficiently and effectively near the end of this newsletter.

How Will the Global Economy be Different After COVID-19?

“Many trends already underway in the global economy are being accelerated by COVID-19, and even after the pandemic, may never fully return to their previous trajectories.” This excellent webinar brings together, Gillian Tett, Chair of Editorial Board and Editor-at-Large, US, Financial Times, Mohamed El-Erian, Chief Economic Advisor, Allianz and James Manyika, Senior Partner, McKinsey & Company and Chairman and Director, McKinsey Global Institute. Click on the link below to access this timely YouTube webinar.

https://bit.ly/WAGlobalEconomy

International Travel Updates

“COVID-19 Travel and Tourism Reopening and Recovery Guidelines”, The U.S. Commercial Service posts in Greater Europe have produced an extensive and detailed 44 Greater Europe country and territory reopening and recovery guidelines document as of early July which can be accessed at this link:

“United Airlines adding about 25,000 flights in August, including Denver routes: United Airlines is adding nearly 25,000 domestic and international flights in August as travel demand slowly starts to pick up, although the number of flights is down 40% from where it was last year. The Chicago-based airline said its schedule for August is triple the number of flights it had in June, but travel demand remains “a fraction” of what it was at the end of 2019.”, Denver Business Journal July 1, 2020

“Why I believe we need to start traveling internationally again: A few days ago, in an interview on Irish radio, I made an argument in favor of renewing foreign travel. I talked about how the travel industry had cranked the gears and was cautiously coming back to life after months of mothballed inactivity. How Europe was open to visitors from other European countries. How Ryanair, Europe’s largest airline, had ramped up its schedule from July 1 and was now flying 1000 flights a day – less than half of the 2400 flights it operates normally but still a combative expression of optimism in the face of a crisis without parallel in our lifetimes.”, Lonely Planet, July 10, 2020 Read the full article at this link:

https://bit.ly/LPTravelInternationallyAgain

“American Airlines Delays Resuming Hong Kong Flights Over Mandatory Coronavirus Testing: American Airlines Group Inc said on Thursday it delayed flights to Hong Kong, a day after the city introduced mandatory virus tests for all arriving crew members. Airline crew were previously exempted from tests and quarantine obligations in Hong Kong, but a recent surge in COVID-19 cases in the city prompted its health chiefs to introduce stricter measures to combat rising concerns of a community outbreak. “Starting July 8, crew members of aircrafts entering Hong Kong via the Hong Kong International Airport will be subject to mandatory COVID-19 testing…in addition to a 14-day medical surveillance,” a spokesman for Hong Kong’s Department of Health said in an email to Reuters.”, Skift, July 9, 2020

“Emirates Adds Covid-19 Testing Requirement For 12 Countries: If you’re hoping to jet off on Emirates, you may soon need a negative covid-19 PCR test, or risk denied boarding, wherever your final destination may be. In fact, if you’re traveling from one of 12 countries, you absolutely will, and it’ll be at your own expense. Travelers originating from 12 countries will be subject to the new rules effective July 10th, 2020 in an effort to keep active covid-19 cases off of planes, and restore confidence to the skies. Recent negative covid-19 tests taken within 96 hours of departure will be mandatory.”, godsavethepoints.com, July 12, 2020

“EU travel unity unravels into confusion of border controls: European Union countries and their open border neighbours were supposed to ease restrictions in unison in mid-June and then start allowing non-EU visitors in this month. However, the coordinated opening agreed by ambassadors last week has started to unravel, with a patchwork of widely differing rules and countries going it alone with new controls. One senior EU diplomat said the issue was extremely difficult because the situation was unprecedented and dynamic, saying: “It’s learning by doing, and it is a moving target.”, Reuters, July 10, 2020

“Lufthansa, Austrian and Qatar announce more flights: For Lufthansa, that means thrice-weekly service between Frankfurt and both Boston and Los Angeles beginning Thursday. Frequencies on those routes will increase to five times weekly in August and to daily flights in September. Austrian, for its part, resumed three-times weekly service from Vienna to Washington, Chicago and Newark on July 1 according to Tal Mescal, a Lufthansa Group spokesman. Meanwhile in the Middle East, Qatar announced a resumption of service to 11 destinations beginning Wednesday, including Boston, Los Angeles and Washington. On July 4, the airline will also begin flying to Toronto for the first time with thrice-weekly service.”, The Points Guy, July 1, 2020

The Americas

“The continued shutdown of Latin America and Caribbean is hurting regional airlines: With COVID-19 infections accelerating, the majority of Latin America and Caribbean countries still closed to commercial travel, and Europe imposing travel restrictions, the tourism and aviation industry risks losing millions of jobs and seeing more airlines filing bankruptcy, two leading industry organizations say. On Thursday, the International Air Transport Association and the World Travel & Tourism Council called on regional governments not to abandon the airline industry in the midst of the global coronavirus pandemic. They also reiterated demands for financial support for regional carriers, and clear restart dates for commercial travel from regional governments. ‘We need governments to support and strengthen the restart by quickly implementing the International Civil Aviation Organization’s global guidelines for restoring air connectivity,’ said Alexandre de Juniac, director general and CEO of International Air Transport Association.”, Miami Herald, July 10, 2020

Australia

“Westfield owner Scentre Group said it has seen a lift in customer visitation across its shopping centres. Over the weekend, despite some businesses still being restricted from operating as usual, customer visitation in Westfield shopping centres across the country returned to 86 per cent of what it was at the same time last year. In some centres, daytime visitation, which is 10am to 4pm, was back to 90 per cent of what it was compared with the same period last year. Night-time visitation is expected to lift throughout July as entertainment and leisure options open up.”, Inside Retail Australia, June 30, 2020. Contribute by Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane.

“Australia places Melbourne under 6-week coronavirus lockdown: Authorities to reimpose measures after rise in new Covid-19 cases: Australian authorities will reimpose a lockdown on Melbourne to contain a rise in coronavirus cases, reversing recent measures to relax restrictions in a country that was seen a leader in managing the pandemic….People will be allowed to leave their homes to buy essential items, such as groceries, or for exercise, medical care or work. Restaurants and cafés, which had begun to reopen with social distancing measures in place, will now only be allowed to service takeaway food and drinks.”, The Financial Times, July 7, 2020

“Qantas Halts International Service Until 2021: In the past few days, QF has removed inventory on all international flights [aside from New Zealand] through March 28, 2021. While the flights have not yet been formally canceled, a removal of inventory is almost always followed by a cancelation.”, Airwaysmag.com, July 11, 2020

Brazil

“Rio de Janeiro Beaches Will Remain Closed Until There’s a Vaccine: Rio’s mayor has rolled back June reopenings. This announcement follows a series of reopening measures—and subsequent rollbacks—that have taken place in a matter of weeks within the city. In June, Rio de Janeiro beaches opened after months during which residents were completely forbidden from stepping on the sand. But the quick amassing of crowds, as reported by the Financial Times, led to a July 2 move in which the local government forbade citizens from sunbathing and restricted beach activity to exercise.:, CNN Traveler, July 10, 2020

Croatia

“Croatia makes face masks compulsory in public indoor spaces: Croatia said on Saturday that wearing face masks will be obligatory in most closed public spaces from next week as the number of COVID-19 cases keeps rising. The number of new infections reached 140 on Saturday, the highest recorded so far in a single day. Most cases are in the capital Zagreb and in east of the country.”, Reuters, July 11, 2020

Mainland China

“Coronavirus: Beijing’s economic recovery from June outbreak offers hope ahead of China GDP release: The sight of more than a dozen patrons sitting on stools outside a popular barbecue restaurant on Beijing’s famous Gui Jie food street waiting to be seated is not only good for China’s services industry, but also offers hopes that it can maintain a delicate balance between containing the coronavirus and growing its economy. This typical scene on a normal Wednesday evening would have been unthinkable last month when the street lived up to the literal translation of its name, ghost street, after an outbreak of coronavirus originating from the Xinfadi wholesale food market sprang up in Beijing.”, South China Morning Post, July 10, 2020

France

“Eiffel Tower’s terrace reopens for post-pandemic partying: Visitors to the Eiffel Tower can once more enjoy a drink and even dance on its summer terrace, which opened this week to stunning views of Paris under a warm, blue sky. The tower shut in mid-March due to the coronavirus outbreak, its longest period out of action since World War Two, but re-opened to the public on June 25.”, Reuters, July 10, 2020

Germany

“German experience gives hope for pub reopening, says Mitchells & Butlers: Mitchells & Butlers is hoping that its business in Germany provides a pointer to how trading will be in the UK as it prepares to reopen the majority of its pubs and restaurants to paying customers this weekend. The All Bar One and Harvester operator has about 44 bar-restaurants across Germany under the Alex brand and it reported that sales levels had grown each week since reopening in mid to late May.”, The Times Of London, July 2, 2020

Hungary

“Hungary Imposes Quarantines on Arriving Citizens and Other Travelers: Hungary has imposed new restrictions on cross-border travel as of next Wednesday in order to prevent the spread of the coronavirus after a surge in new cases in several countries, Prime Minister Viktor Orban’s chief of staff said on Sunday. Hungary lifted most of its lockdown restrictions in May and opened its borders to travellers from European Union states and neighbouring non-EU members. On Sunday, Gergely Gulyas told an online news conference that new restrictions were needed to keep the coronavirus ‘outside the borders’ in order to avoid the re-introduction of domestic lockdown measures.”, Skift, July 12, 2020

India

“India reimposes lockdowns as coronavirus cases soar: India is set to reinstate mandatory lockdowns for cities as medical facilities across the country are strained due to a recent surge in new coronavirus infections, The New York Times reports. India’s total case count rose to the third highest in the world this week, with more than 820,000 confirmed infections and 22,123 deaths, according to Johns Hopkins University data.”, Axios, July 11, 2020

“India Extends Blanket Ban for International Flights: DGCA, the Indian Directorate of Civil Aviation, announced today the renewal of the blanket ban of all international flights to and from India. The ban is valid until 23:59 on July 31; however, according to DGCA, there is some talking regarding the possibility of “bubble flights” taking place from Europe, Canada, the US, and the Gulf States.”, Airways Magazine, July 3, 2020

Indonesia

“Garuda Indonesia Set to Launch Nonstop Flight to Bali from U.S., France and India: The Indonesian flag carrier Garuda Indonesia is slated to launch nonstop flights from Los Angeles, San Francisco, Paris, New Delhi and Mumbai to the country’s tourism hotspot Bali. The plan was unveiled after the Governor of Bali announced on Monday that the island would open its doors to international tourists as of Sept. 11, 2020.”, Airline Geeks, July 8, 2020

Ireland

“Ireland launches COVID-19 app using Apple and Google’s technology: Ireland is the latest country to use Apple and Google’s Exposure Notification API. Users who download the app will be able to track symptoms, anonymously warn others if they have tested positive, and be alerted if they have been exposed to someone with the virus.”, iMore.com, July 6, 2020

Japan

“Tokyo shopkeepers brace for another slowdown as coronavirus flares: Two straight days of record novel coronavirus infections in the Japanese capital have dashed shopkeepers’ hopes that business can get back to normal any time soon.”. Reuters, July 10, 2020

“Government statistics shows 85 percent of companies in the Japanese retail industry stated that they experienced some level of setback from COVID 19 – pandemic on their activities and if include those companies who thinks they may have some impact in the future, close to 97 percent of the companies have been impacted. In June, the government allowed Vietnam and Taiwan to resume flights between the two countries.

Japan has started negotiations to relaunch business travel between ten additional Asian countries including China and South Korea as first step followed by Brunei, Cambodia, Laos, Malaysia , Myanmar and Singapore.

Tokyo Disneyland reopened with social distancing as has Professional Baseball with fans admitted on a limited basis. Theaters, Professional Soccer League, Sumo Wrestling are also reopening. The majority of restaurants are re-opening while emphasizing the social distancing measures. The government has allowed bars to open. Many restaurants are reopening with caution and with limiting seating and opening hours as customers retain wary.”, Ichiro (Roy)Fujita, President, I. Fujita International, Tokyo and Torrance, California

“Japan Domestic Demand Increases, Full Recovery Expected by October: According to local media, Japan Airlines is expecting a full recovery of its domestic demand as early as this October following the diminished demand caused by the coronavirus crisis. ‘We expect to recover to 80 percent in August and fully operate in line with our normal schedule around October,’ Shunsuke Honda, an executive officer of Japan Airline said. He mentioned that the country is seeing a surge in travel demand since recent travel restrictions were lifted. In response to a slight uptick in COVID-19 cases in Tokyo in recent weeks, Honda believes the airline can increase the number of flights it operates or use larger aircraft to avoid fully booked flights.”, Airline Geeks, July 7, 2020

“Tokyo Disney reopens, sending Mickey Mouse fans ‘over the moon: Tokyo Disney Resort welcomed visitors on Wednesday for the first time in four months after being closed due to the coronavirus, with fans practicing social distance as they returned to see Mickey Mouse and other beloved characters. Visitors in face masks queuing on floor marks clapped as the gates of the Magic Kingdom reopened, and were encouraged to clean hands, pay without cash and avoid screaming while enjoying one of Japan’s largest theme parks. The resort will operate at a 50% capacity for the foreseeable future, while parades and shows remain suspended. “, Fox Business, July 1, 2020

New Zealand

“Air New Zealand Pauses New Bookings to Ease Burden on Quarantine Facilities: New Zealand said on Tuesday its national airline will not take new bookings for three weeks as the country looks to limit the number of citizens returning home to reduce the burden on overflowing quarantine facilities. As the Covid-19 pandemic worsens globally, thousands of New Zealanders are returning to South Pacific nation, which is among a handful of countries to have contained the coronavirus, reopened its economy and restored pre-pandemic normalcy. Bookings on Air New Zealand flights will be managed to ensure the government can safely place citizens into managed isolation facilities, Housing Minister Megan Woods said in a statement.”, Skift, July 7, 2020

Norway

“Norway lifts many European travel curbs, including parts of Sweden: Norway will lift travel restrictions to and from more than 20 European countries from July 15, including France, Germany and Britain as well as three of the 21 provinces of neighbouring Sweden, the government said on Friday. Norway, which is not a member of the European Union but belongs to the passport-free Schengen Area travel zone, currently has some of Europe’s strictest limitations on travel due to the coronavirus pandemic.”, Reuters, July 10, 2020

Sweden

“As Swedish Travel Impossible, Passports Exchanged for Burgers: Sweden’s passport was considered one of the world’s most powerful, but since its handling of Covid-19, Swedish travelers–unlike their neighbours–face severe travel restrictions, rendering passports ineffective. Now Burger King has seized the opportunity and is offering Swedish citizens the chance to exchange a stamp in their passports for up to five free burgers per person.”, Forbes, July 10, 2020

Thailand

“What an amazing time for the SSP Thailand team, with 14 restaurants opened in the past 14 days throughout Thailand. Suvarnabhumi Airport – Camden Foods, Don Mueang Airport – Burger King, Camden Foods, Bill Bentley, Dairy Queen, Noodle Express, Yentafo, Chang Mai – Dairy Queen, Had Yai – Ritazza Café.”, Shane Beyer, Managing Director, South East Asia, SSP, in a LinkedIn post on July 9,2020

https://bit.ly/LagardereThailand

“Thailand plans to set up an centre to help revitalise an economy hit by the coronavirus outbreak and is considering more relief measures for small businesses, government officials said on Friday. The government plans to extend debt moratoria for small-and medium sized enterprises (SMEs) from October as the pandemic is likely to continue for a while…”, Reuters, July 10, 2020

Turkey