Global Business Predictions for 2019

Despite global trade fears, new investment projects and new business development around world in 2019 will continue to be tied to a country’s Gross Domestic Product (GDP) growth. Generally, the higher the annual GDP growth rate in country, the more new investment is being made in an economy.

While the International Monetary Fund (IMF) believes global growth will slow a bit to about 3.7% in 2019, there remain several countries where the annual GDP growth rate will exceed 5%, including China, India, Indonesia, the Philippines and Vietnam. These high annual GDP growth countries have rapidly growing middle classes that need high growth rates to ensure there are sufficient jobs for the young consumer.

Argentina – “IMF support and fiscal reforms have pleased financial markets, but high interest rates are slowing domestic consumption and the economy is expected to have GDP growth of less than 2% in 2019. The second half of 2019 will be the time to begin looking at this market again.” Robert Jones, Chief International Officer, EGS

Brazil – Although the recent election of new President Jair Bolsonaro is somewhat of a wild card, he is expected to push fiscal reforms during his first year signaling a very positive message to the market, attracting domestic and foreign investors. Pro-business policies are expected to stimulate the economy and generate 2.4% GDP growth in 2019, creating new opportunities for foreign brands.

Canada – A GDP growth rate of 1.7% due to lower oil prices, new employment laws and regulations plus high business taxes will keep new brand investment and development down in this country in 2019.

Chile – Continued strong domestic demand and solid fiscal discipline should result in a GDP growth rate of 3.4% in 2019, making Chile a solid prospect for foreign brands.

China – Trade tensions with the U.S. and EU, as well as Chinese government controls and barriers, have increased the foreign investment difficulty factor in this market. GDP is expected to slow to 6.3% in 2019 as the government attempts to establish a more sustainable level of growth for the long-term. This ‘low’ GDP growth relative to recent years may be tied to lower consumer spending for the first time in almost 30 years

India – Although higher oil costs are a drag on the economy, GDP growth is expected to exceed 7% in 2019. This is slightly down form 2018. If the government implements regulatory and economic reforms, which it has announced it will do, the business climate could improve for foreign companies in 2019.

Indonesia – Strong domestic demand is expected to sustain a GDP growth rate of 5.2% in 2019. Foreign brand investment will continue due to the rapidly growing middle class consumer base. The presidential election needs watching for its impact on consumer confidence.

Italy – A higher fiscal deficit and disagreement with the EU regarding the new government’s budget have resulted in an estimated GDP of 1.2% in 2019; however, American brands are popular in this market and there is a demand despite the economy’s challenges.

Japan – Manufacturing has recently slowed somewhat and varying oil prices are a negative, but increasing domestic demand should maintain a GDP growth rate of 1.1% in 2019. This relatively low annual GDP growth rate is still good for this economy

Middle East – “The Middle East (Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman and Bahrain), has experienced an economic contraction over the past several years with lower oil prices. Nevertheless, the restaurant segment continues to be strong. Retail is highly competitive and the B2B and B2C sectors offer limited opportunity for compelling new investment opportunities.” Paul Cairnie, CEO, World Franchise Associates.

Peru – Consumer spending is up, the government is pro-business growth, and increased export growth supports a prediction of 4% GDP growth for 2019, providing a solid opportunity for new investors.

Philippines – With an expected GDP growth rate of 6% in 2019, a fast-growing middle class consumer base, and a robust new investment environment, this country will continue to see continued new international brand entry this coming year.

Poland – Although the country’s very strong growth is expected to moderate somewhat in 2019, the current estimate of 3.6% is one of the European Union’s highest economic growth rates. This market offers solid opportunities for foreign franchisors, but market analysis and selection of the correct partner are keys for success.

Saudi Arabia – The 2019 GDP growth rate is expected to be an anemic 2% in 2019. Low oil prices, little new local investment plus fallout from recent legal issues, mean little new foreign investment in 2019.

Singapore – Weaker manufacturing will be offset by stronger consumer demand, with a 2.9% GDP growth rate estimated for 2019. Anti-immigrant legislation has made finding service workers difficult and choice retail space is priced at a premium.

South Africa – With a new government, the country could have an estimated GDP growth rate of 1.7% due to a program of fiscal stimulus. But security and rule of law challenges remain in a country with a huge middle class consumer upside.

Spain – Although 2019 annual GDP growth is expected to slow down from 2.7% in 2018, the pace of new development should continue to be high, especially in the food and beverage sector, in 2019. Retail rents are the price level before the 2008 recession.

Thailand – “As a center for global tourism, Thailand supports more international brands than its own population could support. It is also an excellent showcase of brands and proof-of-concept for the region. The Thai international brand market is crowded and tightly focused on selected urban areas. But there is a subset of strong, risk tolerant and qualified investors willing to invest in well-established American brands.” Greg Wong, Senior Commercial Officer, U.S. Commercial Service, Bangkok.

United Kingdom – “The United Kingdom is open for business, but until the details of what Brexit is going to look like have been confirmed, there will continue to be uncertainty in the marketplace. There are, however, still many good opportunities for the brave!” Iain Martin, The Franchising Centre, London.

Vietnam – This market continues to have strong retail sales and has benefitted from factories relocating from China. GDP growth of 6.6% is expected in 2019. American brands are highly desired in this market.

Projected 2019 GDP growth rates for this article are from the ‘Economist’ magazine.

William Edwards is CEO of Edwards Global Services (EGS). Contact him at bedwards@edwardsglobal.com or on +1 949 224 3896. With 45 years’ experience as a leader in international operations, business development and franchising, William “Bill” Edwards helps clients worldwide navigate the complex and often turbulent global business landscape. EGS provides a complete International Operations and Development Solution for Franchisors. From the initial global market research and country prioritization, to developing new international markets and providing operational support around the world, EGS offers the complete solution based on:

- Experience as Franchisors, International Licensees, Franchisees and Consultants working with 30+ U.S. franchise brands across 40 countries

- Knowledge across Food & Beverage, Retail and Service sectors and diverse cultures

- An operations and development team in over 40 countries experienced in finding,

- qualifying, signing, starting up, growing and fixing intentional licensees

- Trademarked processes and services based on decades of problem-solving experience

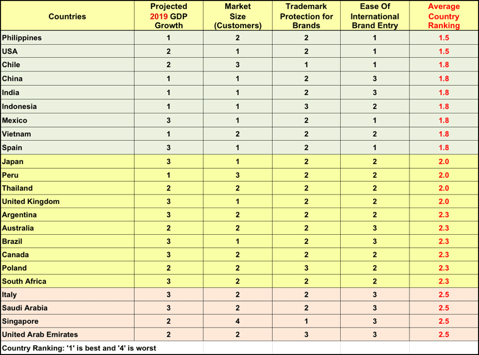

The EGS GlobalVue™ Country Ranking for Selected Countries in 2019

This blog is adapted from an article to appear this month in ‘Franchise Update’ magazine.

EGS is the International Extra Strength Pain Reliever for Franchisors

EGS is the International Extra Strength Pain Reliever for Franchisors

Our company is best known for helping franchisors find, qualify and sign international licensees.

But, we also provide franchisors with international operations support such as new licensee startup, licensee compliance and audits in country. Additionally, we can assist in fixing, terminating when necessary and even replacing international licensees.

Research indicates that up to 40% of all international licensees of franchisors do not reach their development commitments resulting in lower royalties for franchisors.

We provide the only complete International Operations and Development Solution for Franchisors.

In effect, we are the International Extra Strength Pain Reliever for Franchisors!!!

From the initial global market research and country prioritization, to developing new international markets and providing operational support around the world, EGS offers the complete solution based on:

- Experience as Franchisors, International Licensees, Franchisees and Consultants working with 30+ U.S. franchise brands across 40 countries

- Knowledge across Food & Beverage, Retail and Service sectors and diverse cultures

- An operations and development team in over 40 countries experienced in finding, qualifying, signing, starting up, growing and fixing intentional licensees

- Processes and services based on decades of problem-solving experience

Global Franchise Development

- International Development Services – Identify the best countries for a specific brand and then find, qualify and sign the most qualified international licensees. EGS provides this service on a global or regional basis, managing the Going Global process for our U.S. franchise Clients.

- GlobalAssess™ – Determines the readiness of a franchisor for going global and prioritizes markets around the world for their specific brand.

- GlobalCheck™ – Candidate vetting and background check service confirms the history and credibility of a potential international licensee company or individual.

- GlobalData™ – EGS’ database of international licensees, potential licensee candidates and multi-brand franchise companies to assist in finding licensees for our Clients.

- LicensePro™ – Defines the average unit revenues & expenses in a specific country for both the licensee and franchisor and projects Going Global revenue and expense over time.

Global Franchise Operations

- International Operations Services – Franchisor in-country operational support including new licensee startup, site selection, menu development, supply chain development, international licensee reviews, compliance, audits and resolving operational challenges.

- Operation Fixit™ – Fixing, upgrading, terminating when necessary and then replacing international licensees.

International Market Research – EGS conducts country and sector specific research using our GlobalTeam™, in-country sources, international publications, EGS analysis, global databases and websites to generate cultural adaptation, sector and brand market research reports.

International Consulting Services – One-on-one consultation with the world’s foremost experts in global franchising.

Download our complete service offering

Contact us to learn how we can help your franchise grow worldwide 1+949.224.3896 • info@edwardsglobal.com

Our company is expanding our customer base

After 15 years focusing on exporting U.S. franchise companies, EGS is expanding our portfolio to include market research, trend analysis, and project management for rapidly growing companies in other sectors and countries with companies who are seeking to increase stakeholder value by going global. We are taking on an increased role with private equity companies seeking to acquire franchise brands or evaluate the global potential of those they already own.

Our U.S.-based team has lived in 15 countries and worked on projects in more than 70 countries. Our GlobalTeam™ is based in 40+ countries in Africa, the Americas, Asia, Europe, and the Middle East. We have hands-on experience operating companies in other countries.

Our Trademarked Business Tools Apply Across Many Business Sectors

GlobalVue™ – economic, political and operations country analysis

GlobalSurvey™- brand country priority analysis

LicensePro™ – brand country financial and development modeling

GlobalAssess™ – define a company’s readiness to go global and prioritize countries

Our Specialties

- Business and personal country culture analysis

- International project planning, development and management

- Operations support and monitoring in-country

- Licensee and partner identification, evaluation and negotiation services

- Brand and business sector analysis by country and region

- Supply chain resources and analysis

- Company due diligence and analysis

- Global business, economic and political research, and analysis

- F&B, retail, fitness, oil and gas, and service sector experience

- Franchise evaluation for private equity groups

- Evaluation of a company’s global potential based on proven processes

For further information on how we might help your company realize its full global potential, contact William Edwards on +1 949 224 3896 or at bedwards@edwardsglobal.com.

An Update on Countries as Places to Do Business in 2018

Our company conducts country and regional market analysis for our clients who are considering what countries to take their business into. We tap into more than 25 international information sources and the real-time knowledge of our GlobalTeam™ members on the ground in 43 countries. Here are some snippets from our recent research in key countries at the start of the second quarter of 2018.

The International Monetary Fund (IMF) predicts 3.7% global growth for 2018, the highest level in 10 years. While risks to global growth include political meltdowns, economic disasters, wars and unrest, investment risk, and intellectual property concerns, economic growth is robust in many parts of the world.

The Americas

Argentina – After 20+ years in the economic, exchange rate, and political wilderness, the Latin American & Caribbean Director of The Economist Intelligence Unit noted in a recent webinar that Argentina is now in a new period of extended, stable economic growth. Structural reforms, business friendly policies, less regulations, higher levels of direct foreign investment; dropping interest rates and efforts to lower the public deficit have resulted in an expected level of GDP growth of about 3% over the next few years.

Brazil – For the past five years the economy has stalled, inflation has been high, and there have been numerous government and corruption problems. A recent Wall Street Journal article (March 1, 2018) stated, “Brazil’s economy returned to growth in 2017 (1.0%) after two years of contraction . . . Gross Domestic Product (GDP) increased 2.1% in the fourth quarter of 2017 from the same period a year earlier. Economist magazine expects Brazil to grow 2.6% this year and 2.8% in 2019. This will mean new investment opportunities.

Peru – GDP growth is expected to be 3.9% in 2018. This has been the fastest growing economy in Latin America for many years. The government is pro new business creation because this means new and better jobs for their people.

Asia Pacific

China – The Chinese consumer economy is growing at over 8% per year. The middle class is approaching 300 million people. There are 160 cities with a population of more than 1,000,000 people. In 2016, Shanghai and the two adjacent provinces had a combined GDP of that of Italy and Mexico combined. Today’s Chinese consumers want the quality, brand, convenience and service associated with Western brands.

As excellent example of the spending Chinese middle class consumer is the fact that in 1990 less than 1 million Chinese took a commercial airline flight. In 2017 over 600 million Chinese flew a commercial airline flight.

Indonesia – The world’s fourth most populous nation is experiencing a rapid expansion in the middle class, which includes over 30 million households. Like many other Asian countries, the middle class in Indonesia is characterized not only by their purchasing power, but also their generally higher levels of skills and education.

Japan – Although Japan has an expected GDP growth rate of 1.5% in 2018, this is up considerably from past years. There has been a transformation of Japanese consumer spending patterns in recent years. Consumers are spending money on physical experiences rather than purchasing tangible goods and products.

The Philippines – Growth in disposable income has resulted in a more comfortable and better lifestyle. This has contributed to the growing sophistication of consumers across age, income and gender groups. A very strong acceptance of social media allows businesses to connect with the young middle class consumer.

Europe

2017 was Europe’s strongest year of economic expansion in over a decade, with average Gross Domestic Product (GDP) growth of 2.5%. In 2018, Ireland is expected to lead the pack with GDP growth of 4.1%, with estimated growth rates of 2.4% in Germany and even 2.1% in France which is its best performance in years. While 2018 will feature a great deal of political melodrama as negotiations between the EU and United Kingdom occupy headlines, the economies of this region are moving ahead strongly and this is good news for new franchise development. Consumer confidence is the highest it has been in decades and average unemployment is at a nine-year low.

Italy – The expected relatively low 2018 GDP growth rate of 1.5% is offset by increased business investment and significant household consumption. Most of the new investment in 2018 will be in the north centered around Milan.

Poland – Economic growth remains strong. Rising social transfers and a booming labor market are underpinning rapid consumption growth. The unemployment rate is at a record low level, labor shortages are spreading, and there are early signs of accelerating wages. The labor market is expected to tighten further, leading to somewhat faster wage and price inflation.

Spain – With 2018 GDP growth estimated at 2.7%, Spain is benefiting from a dynamic economy, record levels of tourism, rapidly declining unemployment, and domestic consumption and new business investment.

Middle and Near East

United Arab Emirates – The International Monetary Fund (IMF) expects GDP to recover from recent oil and gas price woes to grow at 3.4% in 2018. The UAE has three major consumer types: (1) the local Emiratis (about 400,000); the ex-pat foreigners who work at the regional headquarters of international companies; and the high number of tourists who come to the UAE because it is a regional vacation and shopping opportunity.

India – This country is set to be the fastest growing economy in the world again in 2018. The World Bank says India’s growth is expected to be over 7% in 2018, overtaking China. The World Bank believes strong private consumption and services are expected to continue to support economic activity. Exports for the last month that data is available rose 30% year over year. The Purchasing Managers’ Index expanded the fastest it has in five years. At least one international ratings agency has upgraded India’s credit rating.

For further information on how we might help your company realize its full global potential, contact William Edwards on +1 949 224 3896 or at bedwards@edwardsglobal.com.

The Fastest 2 Minutes in International Franchising

Our GlobalTeam™ of highly experienced international specialists in the USA and on the ground in 32 countries contributed to this summary of today’s world business opportunities. Countries to watch for excellent business development opportunities in 2017: the Philippines, the UAE, Spain and Poland.

| Asia | China Japan Malaysia The Philippines Thailand Viet Nam |

Consumer economy growing at over 8% per year Corporations are seeking consumer investments Political and currency unrest Many new US international businesses opening Starting a comeback from post-coup recession 6%+ GDP growth, USA franchises desired |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

Dramatic change, new government, improving economy Economy, stalled, inflation up, government problems New tax-focused government Government regulations increased Uneven growth, low new investment Post US election new investment stoppage New pro-business government, US brand friendly Renewed business confidence: lower taxes, regulations |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

Good GDP growth, slow to see new investment Difficult to find investors for foreign brands Highest EU GDP growth Not now!!! Recovery speeding up, heavy new investment Political unrest and terrorism = no new investment BREXIT & election fallout slowing new investment |

| Middle East | Egypt Saudi Arabia United Arab Emirates |

Security and hard currency problems Difficult to get new businesses open once built New US brands entering, strong new investment |

| Elsewhere | Australia India New Zealand South Africa |

Challenge to find investors for foreign brands Challenge to find licensees who follow system Few consumers, but pro foreign brands High unemployment (25%), low new investment |

Keeping ahead of the wars, economic meltdowns, and political disasters

One of our jobs for our U.S. clients is to look two to three years ahead, figure out where wars will raging, where economic meltdowns will be occurring, and where political disasters are looming – then take our clients elsewhere!

The key to successful international business is constant monitoring of the economies around the world and being ready to move quickly to higher potential and calmer countries.

Why do we need to do all this? Our company exports U.S. franchise brands.

We act as an outsourced international development department for brands such as Build-A- Bear Workshop®, Denny’s®, International Dairy Queen, Lawry’s® The Prime Rib, Massage Heights®, Everlast Fitness® and Mosquito Squad®. One of our primary tasks is helping the brands prioritize the countries they enter, focusing on countries that have the highest ROI potential for the specific brand.

Recently, the CEO of one of the brands we work with told me that our job was to look two to three years ahead, figure out where the wars will be and take them elsewhere.

It turns out this is just a little bit funny – while at the same time being quite serious.

I would restate this to looking two to three years ahead not only to determine the potential for war, but also the potential for economic meltdowns and political disasters.

This is important due to the fact that it can take two to three years to find and sign a country licensee, and then another one to two years to get the first unit of the franchise open in a country.

How do we do this? Research, research and more research.

We subscribe to 25 international business data and analysis sources. We have team members on the ground in 32 countries. And our US-based executive team collectively has 120 years of international experience living and working in over 69 countries. We have a full time Director of Research who monitors our sources and watches for trends.

That being said, there are still ‘exciting’ events that change the potential for finding investors in a target country that are ready and willing to make the new investment required to acquire the license of one of our U.S. franchise brands.

Two examples are the recent United Kingdom Brexit vote and the disintegration of Turkey as a place to do business.

No one really thought about what the consequences of actually voting to leave the European Union would be. Now we are beginning to see consequences – and all is not good. Where were the adults when this was happening?

I lived in Turkey in the mid 1980s and it was a great place to reside and to work. It was the world’s only secular, Muslim democracy. Turkey had a female Supreme Court judge before the USA, and a female Prime Minister in the 1990s. Over the past 10 years, things have gradually changed, and now Turkey is no longer secular and it is not really a democracy. The Ottoman Sultan seems to have returned after 100 years. The rapid GDP growth rate is being replaced with the rapid growth of inflation. In recent weeks, inward investment has stopped, and Turkish business people are not making any new investments. Our company has closed our office in Istanbul.

On the other side of the coin is Argentina. For several decades this country has been run by poor governments that defaulted on international loans and paid foreign franchisors their royalties in soy beans. Early in 2016 a new and radically different government came into power. In a matter of a few months they settled the long standing debt problem and made the local currency float free against the dollar. New inward investment is staggering as this first world country with a highly educated population is starved for new products, services and brands. We have started marketing U.S. franchise brands in Argentina for the first time since the mid 1990s. As a local business person told me, “The U.S. dollars have come out of the Argentinean mattresses for the first time in decades.”

At the end of the day we have learned that constant research is key to looking ahead. We have also learned that there will always be surprises. The key to successful international business is constant monitoring of the economies around the world and being ready to move quickly to higher potential and calmer countries.

EGS publishes research projects related to global business development, most notably the GlobalVue™ franchise country ranking, which has been published quarterly since 2001. The latest version of this country ranking tool can be downloaded at the following link: EGS-Dual-GlobalVue-0716.pdf

William Edwards, CEO of Edwards Global Services, Inc., has 40 years of international business experience. He has lived in 7 countries, worked on projects in more than 60, and has advised more than 50 U.S. companies on international development. Contact him at +1 949 375 1896, bedwards@edwardsglobal.com, or read his blog at Geowizard.biz

A version of this blog first appeared In the Fall 2016 edition of the International Executive Resources Group (IERG) Fall 2016 ‘IERG Connect’ newsletter.