Traveling On Business In China And The Great China Firewall

What do Dropbox, Southwest Airlines, Box.com, Google, Facebook, LinkedIn, Gmail and the New York Times have in common?

Their websites are all blocked in Mainland China. This means no Google mail and no access to cloud based files for many of the standard sources we in the West use today. However, WeTransfer seems to work fine for file transfer. Microsoft Outlook also works, most of the time.

No google.com, but yahoo.com is available. Southwest Airlines? Who knew they were a problem? In Hong Kong and Taiwan none of these websites are blocked.

Often before a Western website will fully load there is a delay as the Great China Firewall decides if the content is forbidden. If there has been an article that is negative to China you can also expect ‘The Economist’, the ‘Wall Street Journal’ and ‘Financial Times’ websites to be blocked. Usually this is only for a few days.

I have just returned from two weeks in Taipei, Shanghai, Wuhan, Chengdu and Hong Kong on business for three of the US franchises that our company represents around the world.

The good news is that high speed bandwidth Internet is available in major cities in Mainland China. And there is typically no charge for Internet at the major hotel chains. That is not the case in the USA where several large hotel chains still charge high prices for Internet access. And in the USA the bandwidth at such hotels can be ‘iffy’.

The Great China Firewall is alive and prospering. But manageable.

A Global Franchising Update for Selected Countries

Our company, Edwards Global Services, Inc., is honored to work with some of the very best U.S. franchisors to take them global.

We closely monitor consumer spending in over 50 countries as consumers are the target market for the U.S. franchise brands we represent. Often media reports look at a country’s economy from the macro or 30,000 foot perspective. We look at a country’s economic activity from about 50 feet: what is the consumer doing and are they spending?

Here are a few updates on our clients’ recent and planned international openings, plus, an update on a ‘new’ or ‘reawakened’ market: Argentina.

Argentina – For decades, this European-style country has experienced political and economic challenges. After only a few months in power, Argentina’s new government has already taken significant steps to address the country’s economic problems. Argentine President Mauricio Macri has removed export taxes for agricultural products, slowed the printing of pesos, abolished most currency controls, and taken steps to remove subsidies on electricity, food and natural gas.

He has removed export tariffs on beef, soybeans, wheat, and corn, giving exporters greater leeway to sell their products abroad. Macri also plans to eliminate subsidies on electricity, food, and natural gas, thereby reversing the inefficiencies that have burdened Argentina’s economy in previous years. (“Argentina’s New President Lays the Groundwork for a Better Economy”, Stratfor, January 19, 2016)

Argentina was a strong franchise market in the past, and we are beginning to see interest by U.S. franchisors in re-entering this large, well educated, and sophisticated market in Latin America.

Italy – While Italy is considered a slow growing market in the European Union, with significant economic challenges, there are opportunities for new consumer brands in certain sectors. Burgers are one of those sectors. Just over a year ago, Fuddruckers® burger brand opened its first European location in Milan, Italy. Today there are two locations in Milan and a new location in Warsaw, Poland. Europe loves Fuddruckers’ burgers and wings!

Near Milan, Italy

Japan – This is generally considered a slow growth country that has been slow for several decades. That is not true in the consumer sector, and certainly not in the burger sector, where several U.S. brands have entered recently to challenge McDonald’s 3,000 unit monopoly. Carl’s Jr.® recently announced the opening of its first restaurant in Tokyo. In this photo, Ned Lyerle, President of CKE Restaurants International, is on the right, along with our company’s Japan Associate, Ichiro (Roy) Fujita.

Carl’s Jr.®

Philippines – In December 2015 it was announced that Denny’s® has signed a license agreement with the Bistro Group, who also is the Philippines licensee for TGI Friday’s® and Buffalo Wild Wings®. The first Denny’s® restaurant in the Philippines will open in Manila in mid-2016. The Philippine economy is expected to grow at 6.5% in 2016. U.S. food franchise brands are greatly desired.

Poland – This is the one country in Europe where GDP growth did not turn negative between 2008-2012. This year the country’s economy is expected to grow at 3.1%, the highest in the European Union. This is driven almost entirely by consumer spending.

International Dairy Queen entered Europe last year. This 75-year old brand, with 6,500 stores in 28 countries, now has three stores in Warsaw. Yes, the iconic Blizzard® is present in Poland and selling well, even in the winter!

International Dairy Queen

Turkey – Two years ago, Build-A-Bear Workshop®, the world’s largest children’s entertainment retail brand, opened its first store in Istanbul. Today there are three stores in Istanbul and one in Ankara. Turkish families love to spend money on their kids and Build-A-Bear Workshop® helps!

Build-A-Bear Workshop®

United Arab Emirates – The UAE continues to see annual Gross Domestic Product (GDP) growth in excess of 3% per year. Dubai is the center of tourism and financial business in the region. New U.S. food brands are continuing to enter this lucrative market.

In December 2015, Denny’s® opened its first restaurants in the Middle East in Dubai. In this picture are John Miller, the CEO of Denny’s®, and Steve Dunn, The Denny’s® Global Chief Development Officer.

Denny’s®

Vietnam – With a GDP annual growth rate of over 6% and a very fast growing middle class consumer market, Vietnam is one of the top developing markets in Asia. U.S. franchise brands are highly desired. Recently our company finalized the country license for PJ’s Coffee of New Orleans® to open 10 or more high end coffee shops in Vietnam over the next 5-7 years. Vietnamese are very big coffee drinkers and love the social aspects of meeting for coffee and pastries with their friends.

The Fastest 2 Minutes in International Franchising

Our GlobalTeam™ of highly experienced international specialists on the ground in 32 countries contributed to the following brief summary of the franchise world opportunities for 1st quarter 2016. Countries to watch for franchise opportunities in 2016: Argentina, the Philippines, the UAE, Spain, Poland and Peru.

| Asia | China Japan Malaysia The Philippines Thailand Viet Nam |

Consumer economy growing at 8.2% per year Only large corporations are investing in new projects Political unrest, declining Foreign Direct Investment Many new US F&B brands opening 4% GDP growth expected in 2016 6.5% GDP growth, prefer US franchise brands |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

Dramatic change, new positive government Economy is stalled, inflation climbing, political uncertainty Declining investment in F&B, tax focused new government 3.7% GDP growth for 2016. Government regulations? Show me the money and where it came from Mexico City, Monterrey and Cancun booming Lima is a city of cranes and new foreign franchises US$15/hour minimum wage kills margins. Election year |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

GDP growth of 3.5% projected for 2016 Difficult to find investors/risk takers for new foreign brands 3%+ GDP growth for 2016. Slow new franchise investment Not now 2.7% GDP growth for 2016. Recovery speeding up Political unrest leading to drop in new project investment 2.2% GDP growth, but normal investment analysis paralysis |

| Middle East | Egypt Saudi Arabia Dubai |

Pent-up consumer demand, high growth, iffy security Challenges to get new businesses open due to regulations New building push, large expat influx, airport & airline soaring |

| Elsewhere | Australia India South Africa |

GDP growth of 2.5% but falling commodity exports. Jobs iffy? Not another country, another universe. But opportunities. Low growth, high unemployment (25%), low new investment |

The Fastest 2 Minutes in International Business

Our GlobalTeam™ of highly experienced international project managers – on the ground in 32 countries – contributed to the following brief summary of the franchise world opportunities for 4th quarter 2015.

| Asia | China Japan Malaysia Mongolia The Philippines Thailand Viet Nam |

Watch the consumer economy not the overall GDP growth. Large corporations are investing in new consumer projects. Ringgit drop of 25% against the US$ plus political unrest. US pizza and coffee franchises flourishing. Seriously. Middle class buying power accelerating. Stable politics. Military dictatorships often are stable. US sailors on shore leave, 6%+ GDP growth. |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

You still get paid in soybeans, if at all. Economy is stalled, inflation climbing, corruption rife. Tim Horton’s and Burger King are now one??? New President negative on business. Investment stopped. Show me the money and where it came from. Mexico City, Monterrey and Cancun booming. Lima is a city of cranes and new foreign F&B brands. US$15/hour minimum wage means no margins, less jobs. |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

GDP growth of 3.5% projected for 2016. Difficult to find investors/risk takers for new foreign brands. 3.5% GDP growth for 2015 is the highest in the EU. Foreign brands with US$ denominated rents are closed GDP growth for 2016 estimated to be 2.6%. Political unrest leading to drop in new project investment. 2.4% GDP growth, but normal investment analysis paralysis. |

| Middle East | Egypt Saudi Arabia Dubai |

Pent up consumer demand, high growth but scary security. Challenges to get new businesses open due to regulations. New building push, large expat influx, airport & airline soaring. |

| Elsewhere | Australia India South Africa |

GDP growth of 2.6% but falling commodity exports. Jobs iffy? Not another country, another universe. Low growth, high unemployment (25%), low new investment |

Goodbye Fellow Traveler

Recently, my partner in the world for the past 50 years passed away.

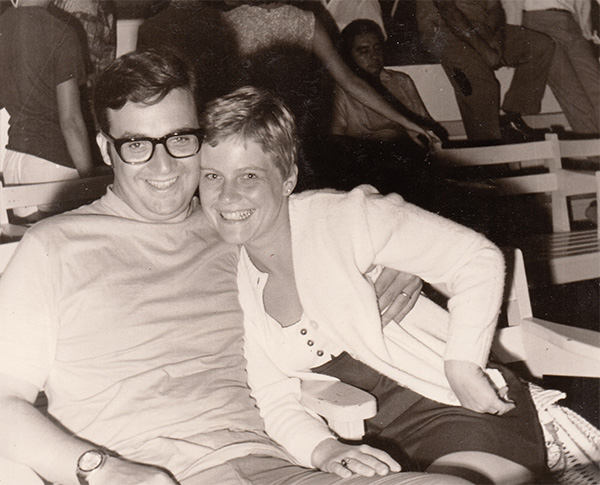

We met in March 1965 on a blind date set up by her sorority and my fraternity in the 2nd semester of our freshman year at St. Louis University. In June 1968 we were married on the south side of Chicago and the rest is, truly, a global story.

Together we traveled to over 40 countries and lived in 5 countries. We adopted a daughter in Surabaya, Indonesia and have a daughter born in Anchorage, Alaska. Along the way we lived in many states in continental USA and in Alaska twice. We lived in 3 countries in Asia, in Turkey and in Eastern Europe. During many of the years we were posted outside the USA we had a home in Maui, Hawaii for our daughters and us to visit each summer during home leave.

These living and travel experiences provided us, and our daughters, with an appreciation of the value of other cultures and what we have in our home country. Our lives were immensely enriched and changed by this experience.

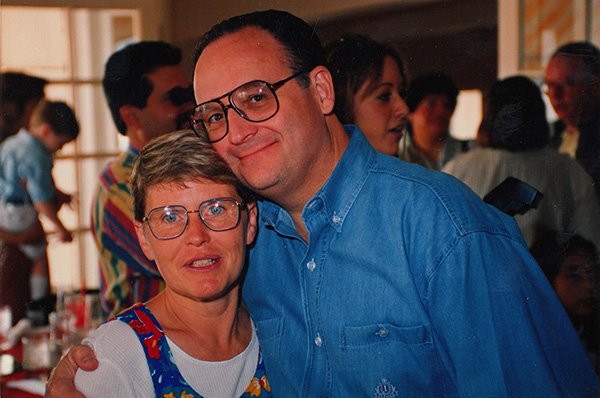

We made many good, longtime friends in all these places over the 40 years of our wanderings. My partner was the social one, which is why we have these friends across so many borders, languages and cultures. She was the one with the smile and easygoing approach.

While I was doing oil and gas exploration and later developing franchises in various countries, my partner was doing social welfare work to bring better medical care and training to areas of the world that were trying to improve their lives and that of their families. Easygoing, but globally street smart!

She traveled to small villages on the island of Java to train nurses and medical staff on how to help patients in small clinics and hospitals. One time even conducting medical staff training sessions in a leper colony. She visited small villages in central Turkey to help local women learn how to market authentic native crafts. She raised money among the foreign oil companies to rid orphanages in Ankara, Turkey of roaches. She even helped veterinary doctors in Hong Kong give physical therapy to race horses in Olympic sized pools. In Alaska, she developed burn therapy techniques with the U.S. Army that reduced treatment pain to Alaskan natives burned in their villages.

We lived several times in the USA, and there my partner practiced physical therapy and managed large numbers of physical, occupational, speech and recreational therapist focused on geriatric medicine. Her bedside manner was exceptional as a clinician. And as a mother and wife!

While I flew to over 70 countries on business, my partner raised our daughters with a strong sense of values, manners, responsibility and a belief from our time in many countries that all people and cultures are of equal quality, value and importance.

In her mid-50s, at the height of her career and contribution to our lives and the larger world, she was diagnosed with early onset Alzheimer’s disease. The disease she and her medical teams had dealt with in hundreds of patients over the years.

That was 12 years ago. The longest 12 years of her life, and that of our mine and our daughters. Now Nancy Edwards is at rest after a very long battle with this horrible disease. We, her adoring family and friends, are helping her live on to fight this disease by contributing to medical institutions focused on finding a cure for Alzheimer’s. The Nancy Imlay Edwards Foundation has a website (www.nancyslegacy.org) that also seeks to educate the large world of our family on this disease.

We were truly blessed to have Nancy as long as we did. But I have to ask: what could Nancy have done with those 12 years and many more to follow? Certainly much more than I could ever hope to accomplish.

Thank you, my partner, friend, wife and lover, for enriching the lives of literally thousands of people on four continents. And for making Amy, Heather and me who we are.

You are missed. By so many, in so many places, and in so many ways.

The Fastest 2 Minutes in International Business

For 2015, EGS’ U.S. clients are seeking licensees in over 20 countries. Our GlobalTeam™ of highly experienced international project managers on the ground in 35 countries contributed to the following brief summary of the world mid-2015:

| Asia | China Japan Malaysia Mongolia The Philippines Thailand Viet Nam |

Citizens: you didn’t really lose money in the Shanghai market. Large corporations are investing in new consumer projects. Prime Minister didn’t really put US$1B in his bank account. U.S. pizza and coffee franchises flourishing. Seriously. Subic Bay is operating again, U.S. Embassy doubling in size. Stable politics. Military dictatorships often are stable. U.S. sailors on shore leave, 6%+ GDP growth. |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

You still get paid in soybeans, if at all. Economy is stalled, inflation climbing, corruption rife. Tim Horton’s and Burger King are now one??? New President negative on business. Investment stopped. Still ‘show me the money and where it came from.’ Mexico City, Monterrey and Cancun booming. Lima is a city of cranes and new foreign F&B brands. US$15/hour minimum wage means no margins, less jobs. |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

GDP growth of 3% in 2015, high for the EU. Difficult to find investors/risk takers for new foreign brands. 3.4% GDP growth for 2015 is the highest in the EU. Foreign brands with US$ denominated rents are closed GDP growth for 2015 of 2.9%. Major 2016 comeback. Finally realized they should shoot at ISIS. 2.4% GDP growth, but normal investment analysis paralysis. |

| Middle East | Egypt Saudi Arabia UAE |

Pent-up consumer demand, scary security and future. Challenges to get new businesses open due to regulations. New building push, large expat influx, airport & airline soaring. |

| Elsewhere | Australia India South Africa |

Economy soaring but tied to commodity exports. Jobs iffy? Not another country, another universe. Low growth, high unemployment (26%), low new investment |

Updated: July 27, 2015