EGS Biweekly Global Business Newsletter Issue 84, Tuesday, June 13, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, the state of economic freedom around the world in 2023, inflation continues to ‘cool’, international firms are cutting their office space needs, 5 lessons COVID taught businesses, lower global birth rates, Europe’s economy slows, what the Chinese consumer is spending on and worker productivity in Latin America

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Change is the law of life. And those who look only to the past or present are certain to miss the future.”, John F. Kennedy

“Life is not about how fast you run or how high you climb, but how well you bounce.”, Vivian Komori

“Opportunities don’t happen. You create them.”, Chris Grosser

Highlights in issue #84:

- Brand Global News Section: Luckin Coffee®, Pizza Hut®, Starbucks®, Subway® and Sweetgreen®’

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

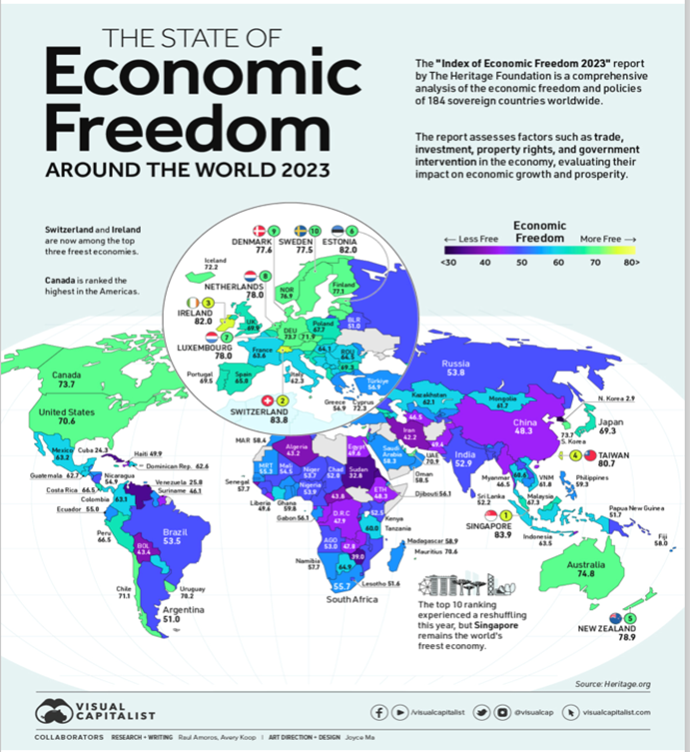

“The State of Economic Freedom in 2023 – The concept of economic freedom serves as a vital framework for evaluating the extent to which individuals and businesses have the freedom to make economic decisions. In countries with low economic freedom, governments exert coercion and constraints on liberties, restricting choice for individuals and businesses, which can ultimately hinder prosperity. The map above uses the annual Index of Economic Freedom from the Heritage Foundation to showcase the level of economic freedom in every country worldwide on a scale of 0-100, looking at factors like property rights, tax burdens, labor freedom, and so on. The ranking categorizing scores of 80+ as free economies, 70-79.9 as mostly free, 60-69.9 as moderately free, 50-59.9 as mostly unfree, and 0-49.9 as repressed.”, Visual Capitalist / Index Of Economic Freedom, June 6, 2023

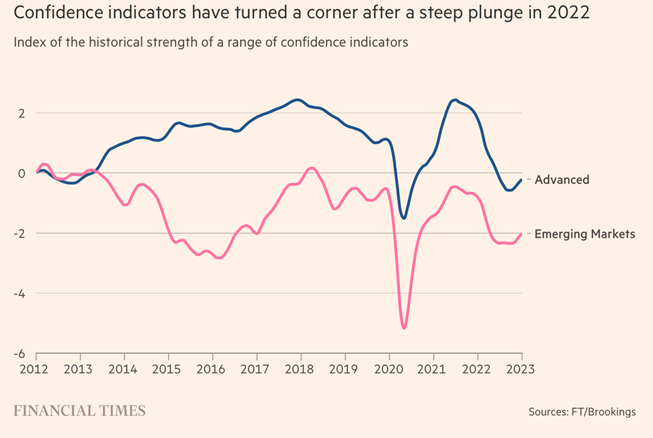

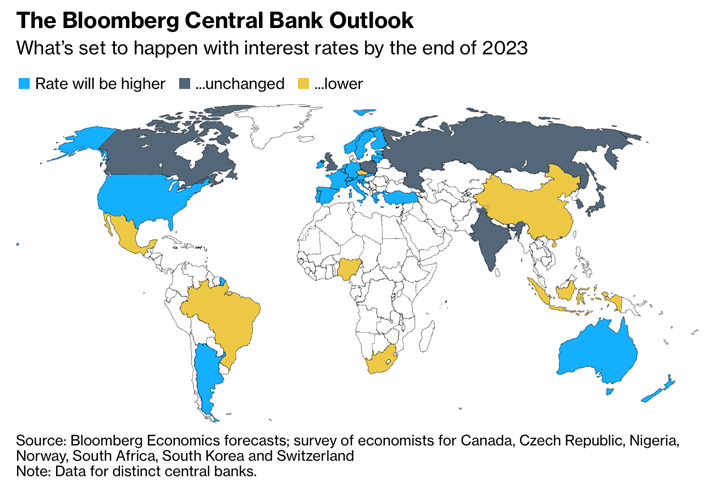

“World Bank Brightens View of Global Growth This Year, Downgrades 2024 – Bank warns of risks to poorer nations from rising interest rates. The World Bank sees better global economic growth than previously estimated in 2023, thanks to resilient U.S. consumer spending and China’s faster-than-expected reopening in the early part of the year. The bank still expects slowing growth in the second half of this year and a muted expansion into next year, according to its forecast released Tuesday. It warned that stubbornly high inflation and interest-rate increases are weighing on economic activity around the world, particularly in developing countries.”, The Wall Street Journal, June 6, 2023

“These are the top 10 countries where small businesses are flourishing globally – E-commerce company Shopify partnered with Deloitte to create a database that measures the top countries and U.S. states where entrepreneurship is flourishing. To calculate this, they measured the impact of entrepreneurs on GDP, jobs supported, exports, and business activity. According to the index, the top 10 countries where entrepreneurship is thriving are:

United States

Lithuania

Romania

United Kingdom

Czech Republic

Australia

Denmark

China

Hong Kong

Japan

Fast Company, May 16, 2023

“Half of big international firms to cut office space in next three years – Survey of 350 businesses shows 56% favour hybrid working. The survey of 350 businesses by property consultants Knight Frank and commercial real estate firm Cresa found that 50% the largest businesses they questioned – those with more than 50,000 employees – expect to shrink their global workspaces, although most are only planning to reduce by between 10% and 20%. However, this contrasts with the expectations of smaller firms surveyed – those with up to 10,000 employees – just over half (55%) of whom said they were expecting to increase their global office space.”, The Guardian, June 6, 2023

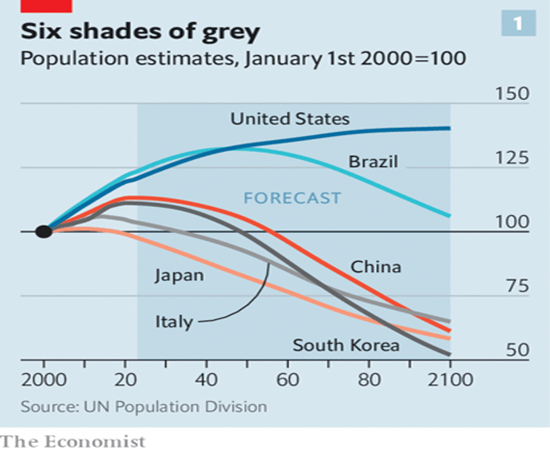

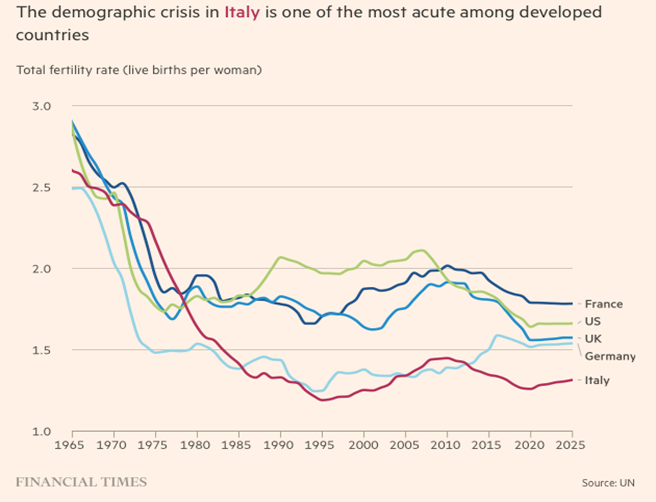

“It’s not just a fiscal fiasco: greying economies also innovate less – That compounds the problems of shrinking workforces and rising bills for health care and pensions. Italy and Japan, in particular, are the poster pensioners for demographic decline and its economic consequences. In both countries the fertility rate (the number of children a typical woman will have over her lifetime) fell below 2.1 in the 1970s. That level is known as the replacement rate, since it keeps a population stable over time. Anything lower will eventually lead to a declining population.”, The Economist, May 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Today’s supply chain disruptions reaffirm the importance of a multilateral trading system based on WTO rules – Economic security has come to the forefront of policy discussions, as a series of crises—most recently the COVID-19 pandemic and the war in Ukraine—have disrupted global supply chains. Governments around the world are looking for ways to make their countries less vulnerable to such disruptions, especially now that rising geopolitical tensions add new uncertainty. In this regard, reshoring and friend-shoring have become popular policy prescriptions, and talk of global fragmentation abounds.”, International Monetary Fund, June 2023

“These Are the World’s 20 Most Expensive Cities for Expats in 2023 – New York has leapfrogged Hong Kong as the world’s most expensive city to live in as an expat, while skyrocketing rents saw Singapore crash into the top five, according to a new study. Soaring inflation and rising accommodation costs were cited as reasons for New York topping ECA International’s Cost of Living Rankings for 2023, while Geneva and London remained in third and fourth places. These are the world’s top 20 most expensive places for expats to live (with the 2022 rankings in parentheses):

New York, US (2022 ranking: 2)

Hong Kong, China (1)

Geneva, Switzerland (3)

London, UK (4)

Singapore (13)

Zurich, Switzerland (7)

San Francisco, US (11)

Tel Aviv, Israel (6)

Seoul, South Korea (10)

Tokyo, Japan (5)

Bern, Switzerland (16)

Dubai, UAE (23)

Shanghai, China (8)

Guangzhou, China (9)

Los Angeles, US (21)

Shenzhen, China (12)

Beijing, China (14)

Copenhagen, Denmark (18)

Abu Dhabi, UAE (22)

Chicago, US (25)

Bloomberg, June 6, 2023

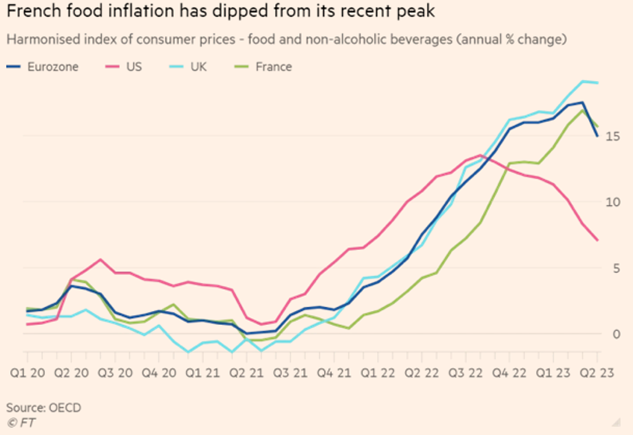

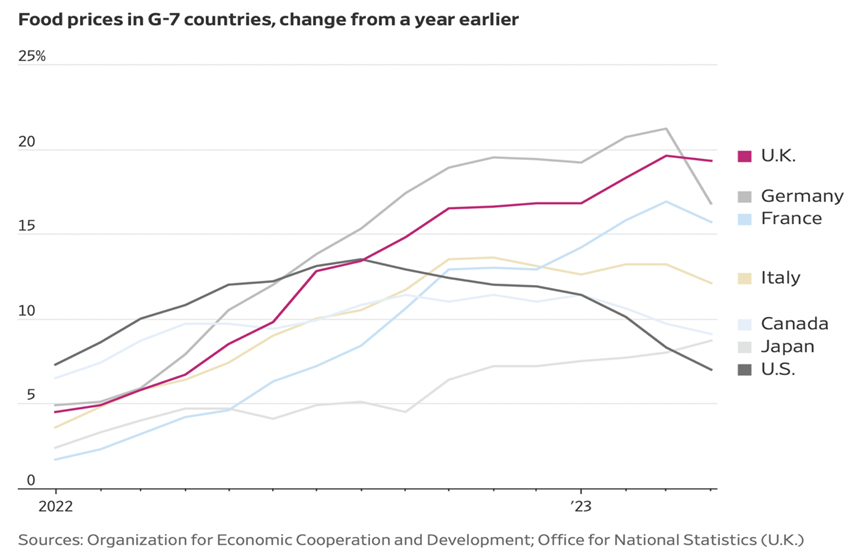

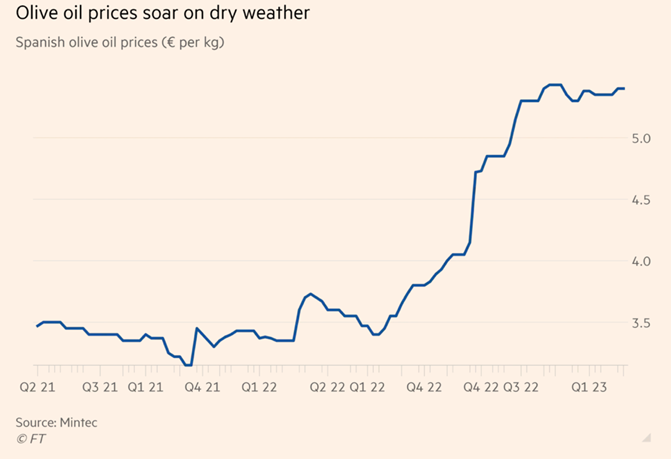

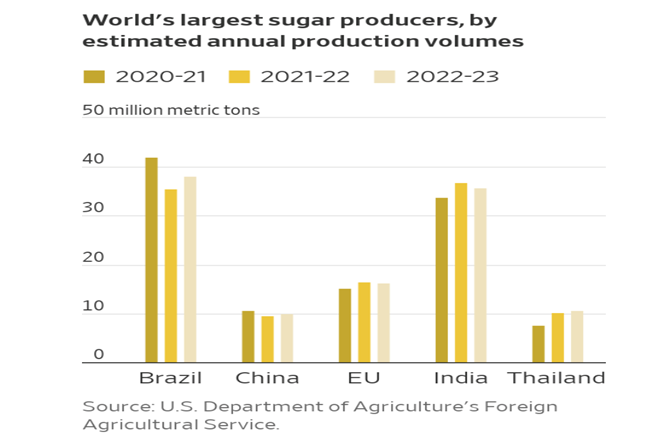

“Food producers agree to cut prices in France after government pressure – Finance minister Bruno Le Maire says 75 groups will make reductions in line with falling wholesale costs. French food prices rose 14.1 per cent in the year to May, close to the eurozone average, and have overtaken energy as the region’s biggest driver of inflation, raising alarm among politicians and consumer groups. Some French food prices have risen faster: olive oil prices are up a quarter and eggs cost a fifth more.”, The Financial Times, June 9, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Heathrow strikes: security staff announce summer of walkouts – More than 2,000 staff who scan bags and frisk passengers at the UK’s biggest airport will walk out for all but two of the busiest weekends of the year, the Unite union said yesterday. The 31 days of strike action, between June 24 and August 27, will affect passengers flying from terminals 3 and 5, the two busiest departure points. It raises the prospect of long delays for security screening during the school summer holidays and the August bank holiday weekend.”, The Times of London, June 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

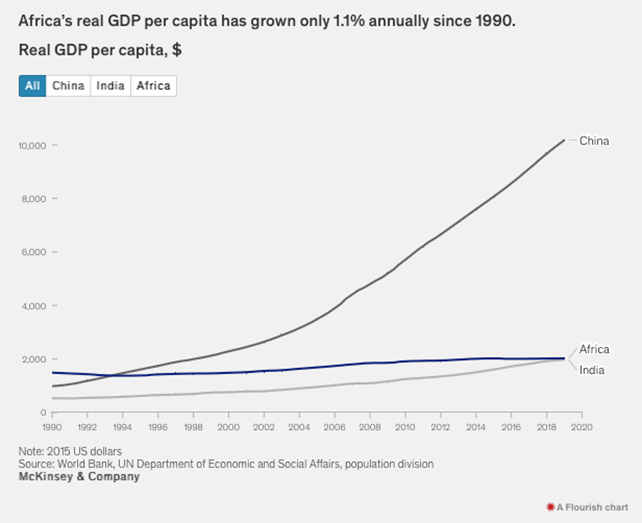

“Reimagining economic growth in Africa: Turning diversity into opportunity – Africa’s economy downshifted over the last decade, yet half of its people live in countries that have thrived on the continent. Africa has the human capital and natural resources to accelerate productivity and reimagine its economic growth, which is, more than ever, vital for the welfare of the world.”, McKinsey & Co., June 5, 2023

Australia

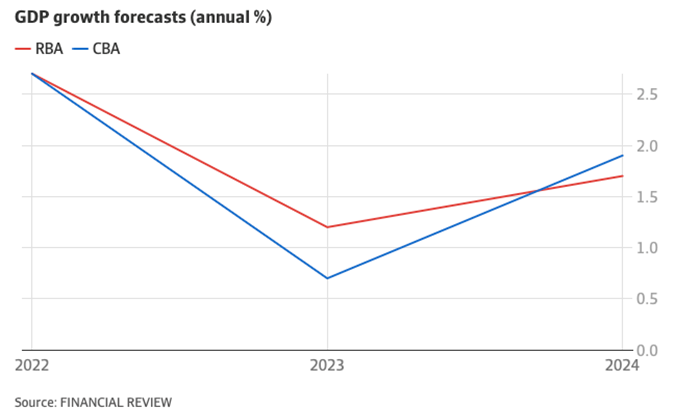

“CBA cuts growth forecasts, places odds of recession at 50pc – Economists are warning of the serious risk of recession this year after sticky inflation and concerns about wages fuelling price pressures forced the Reserve Bank of Australia to lift interest rates and flag more rises to come. Commonwealth Bank of Australia and HSBC economists now both put the odds of a recession at 50 per cent, after cutting their economic growth forecast in response to the RBA raising the cash rate a quarter percentage point to 4.1 per cent on Tuesday.”, Australia Financial Review, June 9, 2023

Canada

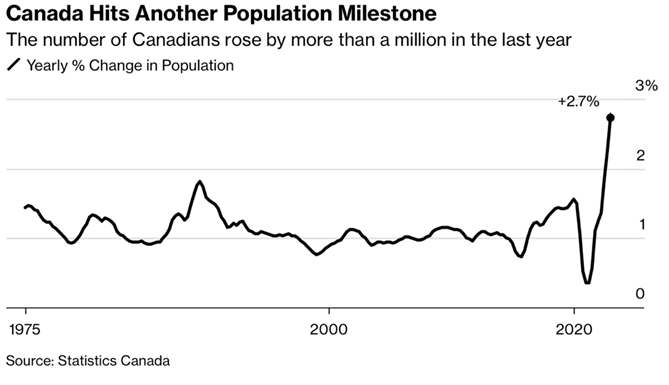

“Canada lost 17,000 jobs in May, bringing interest rate hike into question – The drop was driven largely by a fall in youth employment, as 77,000 people between the ages of 15 and 24 lost their jobs. The lacklustre jobs report raised questions over whether the Bank of Canada may have acted too quickly in raising interest rates Wednesday, some economists suggested.”, The Toronto Star, June 9, 2023

“Complexities of international sanctions – Canada is increasingly using international trade sanctions. These sanctions target foreign individuals and entities, and compliance has become increasingly complex and important for companies operating abroad. What happens when you have been added to a sanctions list and want to be removed? We consider below two recent cases on this topic.”, Dentons, June 7, 2023

China

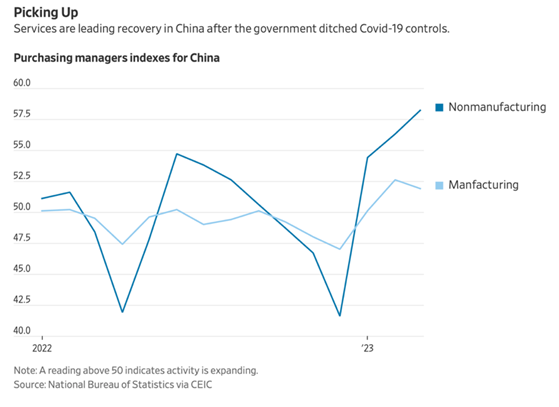

“China’s Services Sector Continues to Rebound Faster Than Industrial Sector – The combined profits of major state-owned industrial companies declined 17.9% year-on-year in the first four months, the National Bureau of Statistics (NBS) reported May 27. Over the same period, total profits of state-owned enterprises (SOEs) in all sectors climbed 15.1%, the Ministry of Finance said the following day. Since the beginning of 2023, the year-on-year growth of the service production index published by the NBS has been consistently higher than increases in industrial value added.”, Caixing Global, May 31, 2023

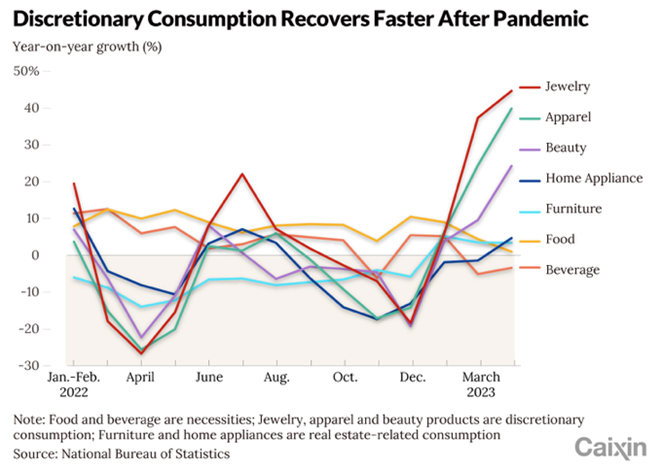

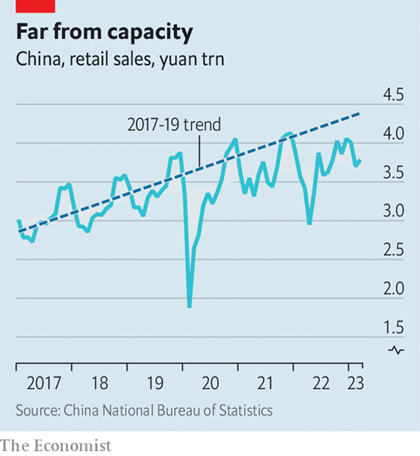

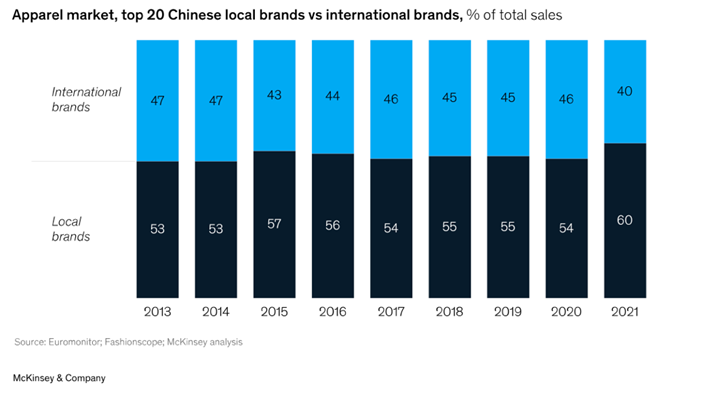

“Where Are Chinese Consumers Willing to Spend? Chinese consumers are resuming spending on travel and dining out but are not buying necessities and other consumer goods as much as before the pandemic. Spending on services was the main driving force for the first-quarter rebound in consumption. Retail sales of consumer goods in the first quarter rose 5.8% year-on-year, significantly rebounding from a decline of 2.7% in the fourth quarter of 2022, data from the National Bureau of Statistics (NBS) showed. Per capita spending on services grew 6.2% year-on-year in the period, faster than overall consumption growth, a report by KPMG showed.”, Caixing Global, June 8, 2023

“U.S. Business Interest In China Is Slowly Recovering, Ex-American Diplomat Says – Strained relations between Washington and Beijing appear to be stabilizing, a shift that is stirring renewed business interest in China among U.S. companies, a former long-term U.S. diplomat who is the current chairman of the American Chamber of Commerce in Shanghai told Forbes on Tuesday. ‘There are some positive signs in the relationship, particularly the high-level contact among the two countries’ economic officials,’ said Sean Stein in Beijing via Zoom. That advance, however, is constrained by continuing concerns about security issues and the economic outlook, he added.”, Forbes, June 7, 2023

European Union

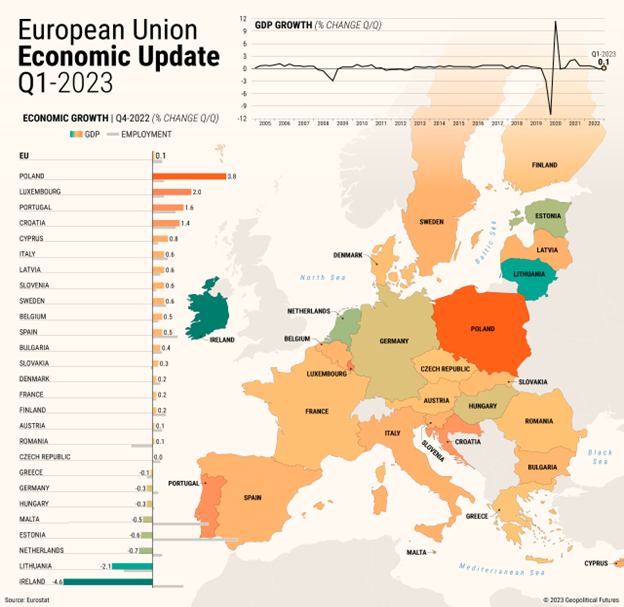

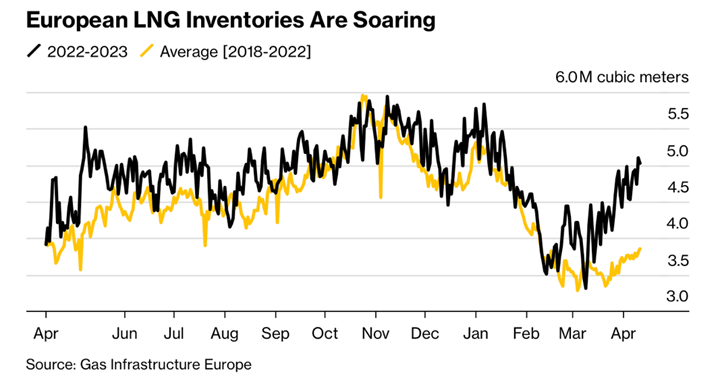

“Europe’s Economy at a Standstill – Ukraine and uncertainty about prices remain the major obstacles to EU growth. The European Union as a whole achieved slight economic growth in the first quarter of the year, but weaknesses abound……Poland recorded 3.8 percent growth compared with final quarter of 2022, powered by household consumption and exports. The war and uncertainty about prices remain the major obstacles to European growth. On the other hand, employment is still rising and energy prices have returned to Earth.”, Geopolitical Futures, June 9, 2023

Latin America

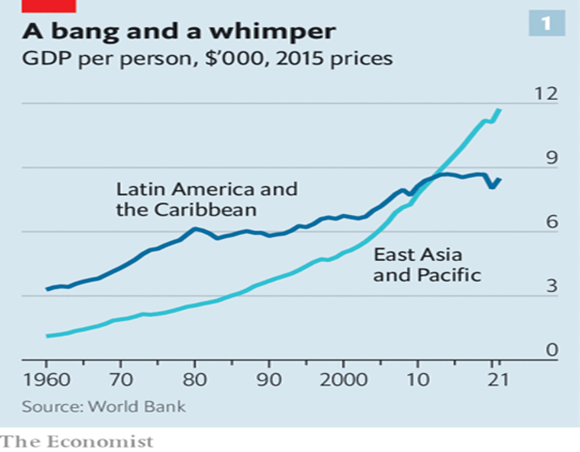

“Why are Latin American workers so strikingly unproductive? Blame education, corruption and a huge shadow economy. In 1962 Latin America’s income per person was three times that of East Asia. By 2012 both regions had the same level. By 2022 East Asia’s was roughly 40% higher than Latin America’s (see chart 1). When the differences in purchasing power are taken into account, Latin Americans’ gdp per person has been stuck at little more than a quarter of that of their neighbours in the United States for the last three decades. According to the World Bank, between 2010 and 2020 Latin America was the world’s slowest-growing regional economy.”, The Economist, June 8, 2023

India

“India Inflation Cools to 25 Month Low of 4.25% in May – India’s retail inflation cooled faster-than-expected in May, providing relief to policymakers even as risks from an uneven monsoon remain. Food prices, which make for about half of the index, rose 2.91%, while fuel and light prices gained 4.64%. Clothing and footwear prices increased 6.64% and housing prices rose 4.84%. Core inflation, which strips volatile food and fuel prices from the headline, moderated to 5.11%, from 5.30% in April.”, Bloomberg, June 12, 2023

Italy

“Baby bust: Italy faces a ‘demographic winter’ – Alarmed by the falling birth rate, the government is trying to entice women into having children. But many are sceptical of the approach. Low birth rates — and greying populations — are a concern for many advanced economies, including European nations and Japan as well as China, now confronting the fallout from its draconian one-child policy. Challenges of older populations include pressure on state pension schemes; strained national healthcare systems; potential hits to sovereign credit ratings; and pervasive labour shortages as employers struggle to find manpower, including care for the elderly. Italy’s demographic crisis, though, is among Europe’s most acute — the result of decades of economic stagnation and political indifference to women’s aspirations.”, The Financial Review, June 7, 2023

United Arab Emirates

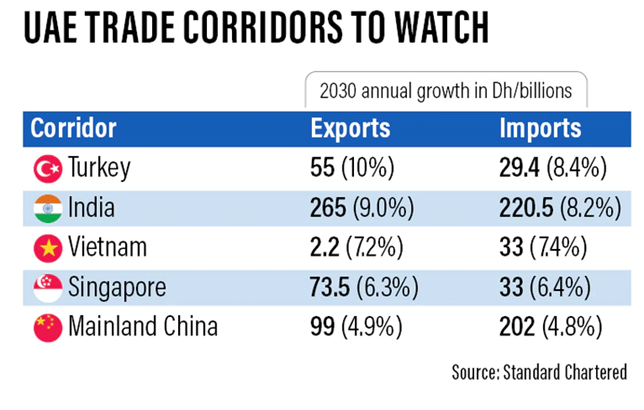

“UAE exports forecast to reach $545bn by 2030, Standard Chartered says – The Emirates’ progressive policies are supporting trade growth, with India to remain largest partner. The country’s exports are projected to increase by 5.5 per cent annually, with metals and minerals (accounting for 73 per cent of exports by 2030) and plastics and rubbers set to drive growth, Standard Chartered said in a report on Thursday.”, The National News, June 1, 2023

United Kingdom

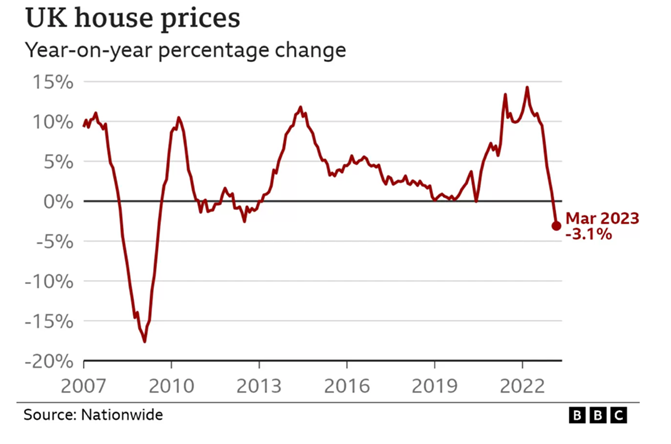

“Britain to steer clear of recession – Britain will avoid a recession this year, according to new forecasts, as energy prices retreat and supply chain disruption abates. Economists warned that companies and consumers were still in for a tough year, however, with stubborn levels of inflation raising the risk of more pain for borrowers while the Bank of England battles to reduce it. KPMG no longer expects a recession in the UK this year, forecasting that gross domestic product will rise by 0.3 per cent.”, The Times of London, June 12, 2023

“Regional workers back in the office four days a week – Office occupancy outside London is back to 93 per cent of pre-pandemic levels, with workers turning up for an average of four days a week. The latest survey from Regional Reit, the owner of 154 largely office properties, found that 65 out of 100 desks were occupied during business hours compared with 70 out of 100 before Covid. Stephen Inglis, chief executive of the company’s asset manager, London & Scottish Property Investment Management, said he was seeing “a steadily improving environment with more people back in the office”. He said the finding that regional workers were back for an average of 4.2 days a week came as a pleasant surprise for his business. “I was expecting three to four days”, he said.”, The Times Of London, June 7, 2023

United States

“The Global Brands Coming to a (U.S.) Shopping Mall Near You – Some retailers now view U.S. expansion as the surest way to boost revenue amid a shaky global economy. American consumers have long been renowned for their spending power. Now global retailers want a bigger slice of the action. Once wary of America, foreign fashion brands such as Mango, Uniqlo and Zara are joining retail giants including Lego and IKEA in pursuing major U.S. expansions. Executives say they are encouraged by the country’s upbeat economic prospects relative to other parts of the world, and a growing sense that American shoppers have become more receptive to new brands.”, The Wall Street Journal, June 7, 2023

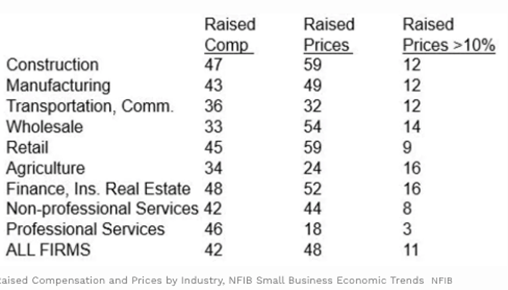

“Who Is Raising Wages On (U.S.) Main Street? The share of firms raising worker compensation reached record-high levels in the past few years, reaching 51% in June 2022. The most difficult cost to cut is compensation. It is also the largest cost for most small employer firms. When the costs of non-compensation inputs fall, the benefit drops to the bottom line and can be passed on to customers by reducing selling prices. Competition is the force that gets this to happen. But when those cost inputs fall because of a slowing economy, wages generally stay the same; they are commitments made to individuals.”, Forbes, June 9, 2023

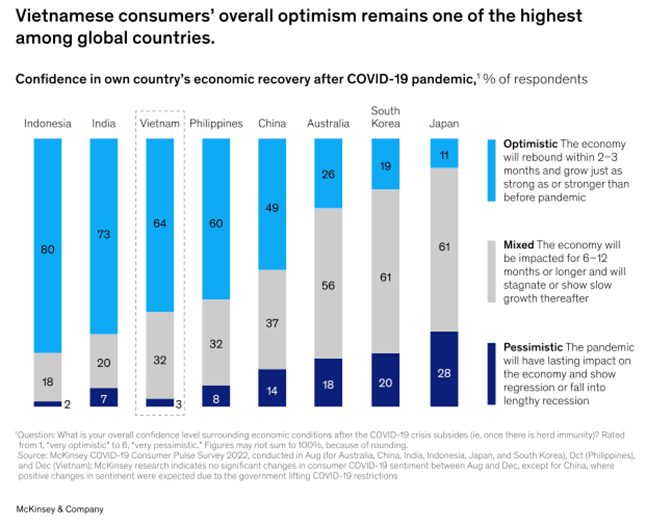

Vietnam

“Vietnamese consumers are coming of age in 2023: How businesses can stay ahead – For the past few years, the middle class in Vietnam has been on the rise, spreading out geographically and growing increasingly diverse.1 Consumers are growing in number and becoming more demanding and discerning. It is estimated that more than half of the Vietnamese population will enter the global middle class by 2035, creating more disposable income and fueling consumption.”, McKinsey & Co., May 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“What Covid Has Taught Us: 5 pandemic lessons for franchising – March marked the third anniversary of the global Covid-19 pandemic, and while many of us are keen to move forward, it’s important for businesses to reflect on the takeaways and build on lessons learned through our shared, global experiences.”, Franchising.com article by Catherine Monson, June 7, 2023

“Sweetgreen Stores Are Expected To Be Completely Automated In 5 Years – Dubbed the “Infinite Kitchen,” the chain has been testing a 100% robotic production line that assembles all of Sweetgreen’s orders from start to finish. Prep is still human-orchestrated, as employees make the ingredients, but robots are assembling those ingredients in the bowls. The first Infinite Kitchen prototype opened less than a month ago in Naperville, Illinois, and if it’s any indication of what’s to come, Sweetgreen is thrilled. So far, it isn’t affecting the overall customer experience, and it’s reportedly saving the chain big money.”, Tasting Table, June 10, 2023

“Starbucks says on track to meet 9000 store goal on Chinese mainland – Starbucks’ new global CEO Laxman Narasimhan on Tuesday highlighted China’s huge market potential and suggested the company’s goal of opening 9,000 stores on the Chinese mainland by 2025 remained unchanged. China’s per capita coffee consumption is increasing but still lags far behind Japan and the United States, thus leaving much room for business growth, Narasimhan said during his visit to Shanghai, home to more than 1,000 Starbucks stores, which is more than any other city in the world. The US coffee giant opened its first store on the Chinese mainland in 1999. As of April 2, it had operated over 6,200 stores across 244 cities on the Chinese mainland.”, Shine.con, May 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks’ China rival Luckin Coffee opens 10,000th shop amid fight for expected 1 trillion yuan market. Luckin Coffee opened 1,137 stores in the first quarter, beating Starbucks, which opened 153 and trails the domestic chain by more than 3,700 locations. Luckin recorded first-quarter revenue of 44.4 billion yuan (US$6.2 billion), with a net profit of 564.8 million yuan. The company, which was formerly listed on the Nasdaq before a scandal forced it to delist, accomplished the 10,000-store milestone within six years. It had already surpassed Starbucks in terms of total stores in China in 2021.”, South China Morning Post, June 7, 2023

“Pizza Hut Australia Purchased by US Group That Owns Taco Bell, Wendy’s Locations – Flynn Restaurant Group expects to gain $300 million in sales The deal marks the company’s first international acquisition. The San Francisco-based group already owns 945 Pizza Huts in its home market. The acquisition will give Flynn about 2,600 locations across the two countries and boost annual sales to roughly $4.5 billion from $4.2 billion. Flynn says it is the largest franchise operator in the world, with a portfolio of restaurants that includes Applebee’s, Taco Bell, Panera Bread, Arby’s and Wendy’s locations in 44 US states.”, Bloomberg, June 7, 2023

“Subway threatens to yank run-down stores from franchisees as company searches for buyer – Subway has ordered some franchisees to spend as much as $100,000 on remodeling their sandwich shops as the company scrambles to sell itself — and is threatening to take away their stores if they don’t comply, The Post has learned. The struggling fast-food giant — which has faced a lackluster response as it attempts to auction the chain for $10 billion, according to sources — is meanwhile demanding that some franchisees make major investments to upgrade their shops in a matter of months, sources said.”, The New York Post, June 11, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

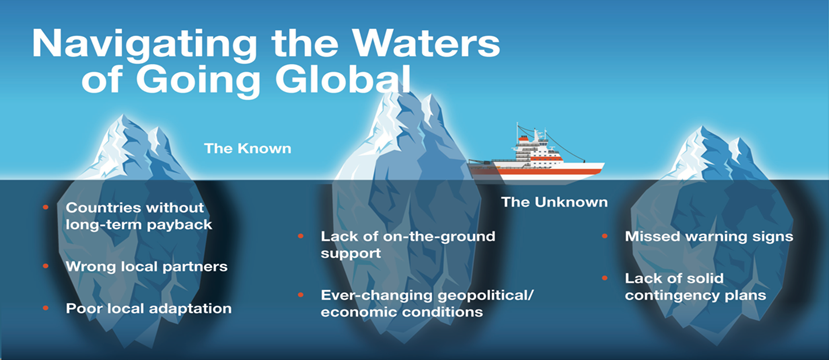

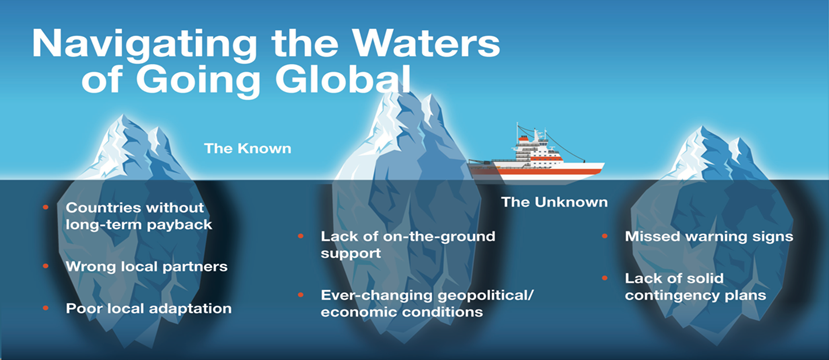

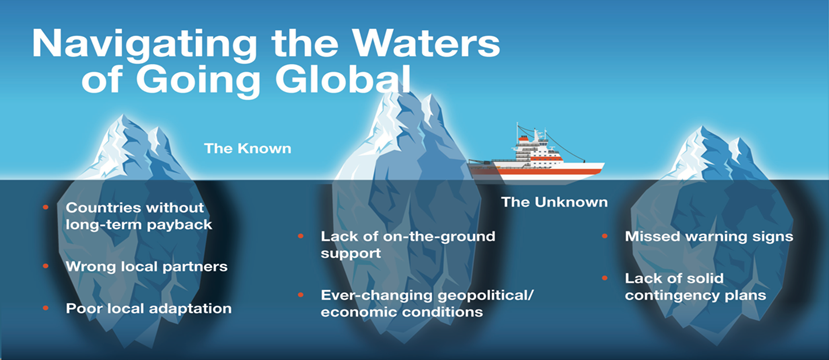

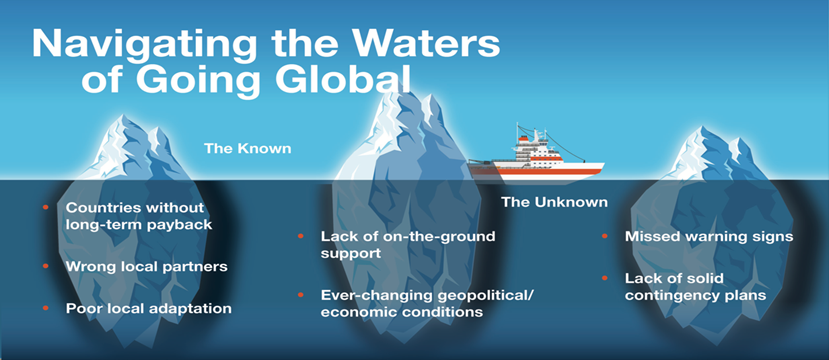

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 83, Tuesday, May 30, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, solar power investment is set to outstrip spending on oil production this year for the first time. There are new rules for business travel to China. The cost of renting shipping containers falls due to reduced consumer demand. Almost everyone has resumed travel at pre-pandemic levels which is driving up ticket prices.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Don’t limit yourself. Many people limit themselves to what they think they can do. You can go as far as your mind lets you. What you believe, remember, you can achieve.”, Mary Kay Ash

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.”, Seth Godin

“The more that you read, the more things you will know. The more that you learn, the more places you’ll go.”, Dr. Seuss

Highlights in issue #83:

- Brand Global News Section: Chargrill Charlies®, Dairy Queen®, Jolibee®, Panera Bread®, Shake Shack®, Tera Wellness®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

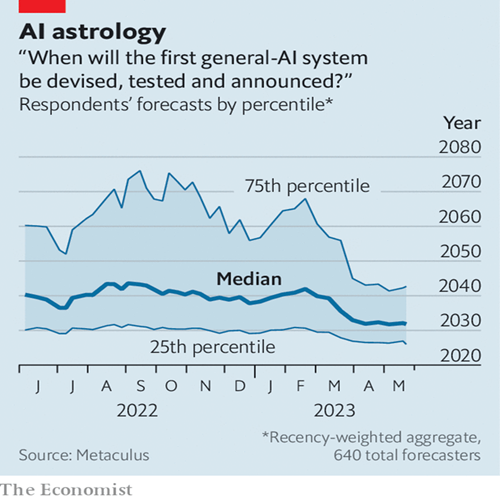

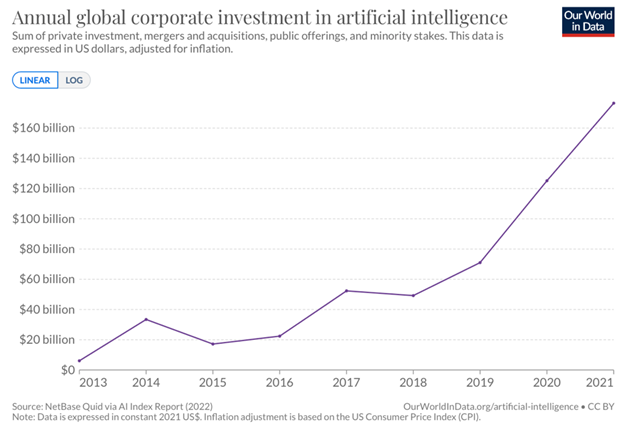

“What would humans do in a world of super-AI? The road to a general ai—one better than the very best of humanity at everything—could take longer than expected. Nevertheless, the rising possibility of ultra-powerful ai raises the question of what would be left for humans when it arrives. Would they become couch potatoes as in “Wall-E”? Here is a thought experiment, guided by the principles of economics, to provide something of an answer.”, The Economist, May 23, 2023

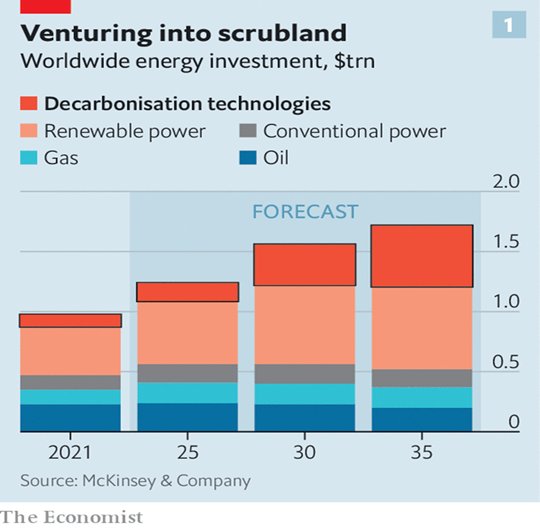

“Can carbon removal become a trillion-dollar business? Quite possibly—and not before time. The boom in carbon removal, whether from the air or from industrial point sources, cannot come fast enough. The un-backed Intergovernmental Panel on Climate Change assumes that if Earth is to have a chance of warming by less than 2°C above pre-industrial levels, renewables, electric vehicles and other emissions reductions are not enough. Wood Mackenzie, an energy consultancy, reckons various forms of carbon removal account for a fifth of the global emissions reductions needed to emit no net greenhouse gases by 2050. If Wood Mackenzie is right, this would be equivalent to sucking up more than 8bn tonnes of CO2 annually.”, The Economist, May 21, 2023

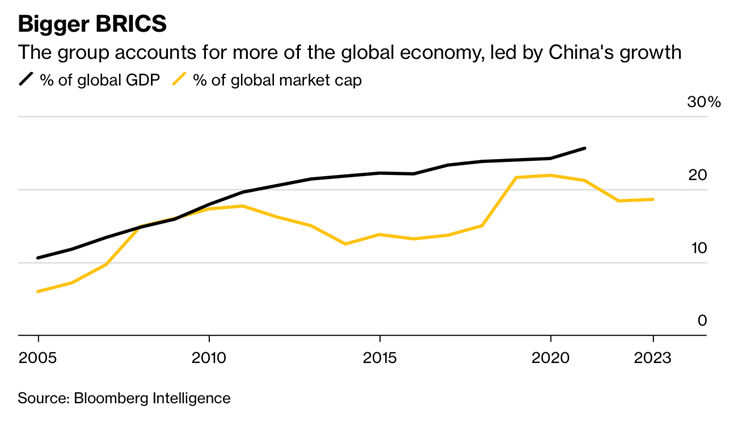

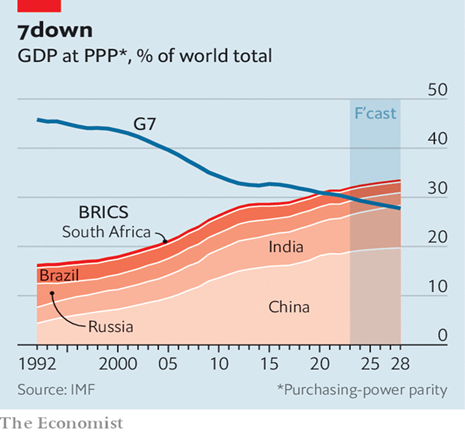

“How BRICS Became a Real Club and Why Others Want In – The BRICS group of emerging markets — Brazil, Russia, India and China, with South Africa added later — has gone from a slogan dreamed up at an investment bank to a real-world club that also controls a major development bank. It once might have seemed ironic to see Communist Party-ruled China embrace the Wall Street conceit. But now countries of all political stripes, including Iran and Saudi Arabia, are clamoring to join.”, Bloomberg, May 28, 2023

“Can the West win over the rest of the world? The G7 wants to build a broader alliance to resist Chinese and Russian coercion. The g7’s relative economic strength has been declining, and with it the pull of the international order it represents: the club-members’ share of global gdp in nominal terms peaked at nearly 70% in the late 1980s, but dipped to under 45% in 2021. In purchasing-power parity terms, the brics grouping, of Brazil, Russia, India, China and South Africa, has surpassed the g7’s share.”, The Economist, May 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

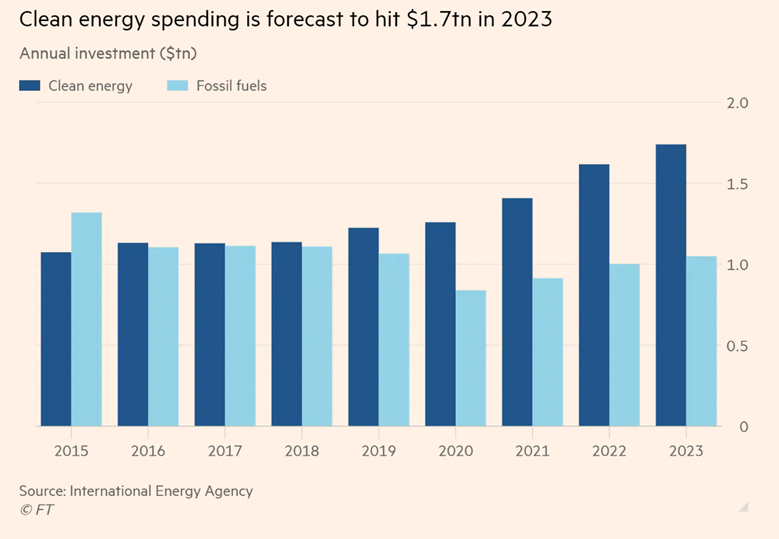

“Solar power investment to exceed oil for first time, says IEA chief – Solar power investment is set to outstrip spending on oil production this year for the first time, the head of the International Energy Agency has said, highlighting a surge in clean energy development that will help curb global emissions if the trend persists. This year $1.7tn is forecast to be spent on clean technologies compared with $1tn on fossil fuels.”, The Financial Times, May 25, 2023

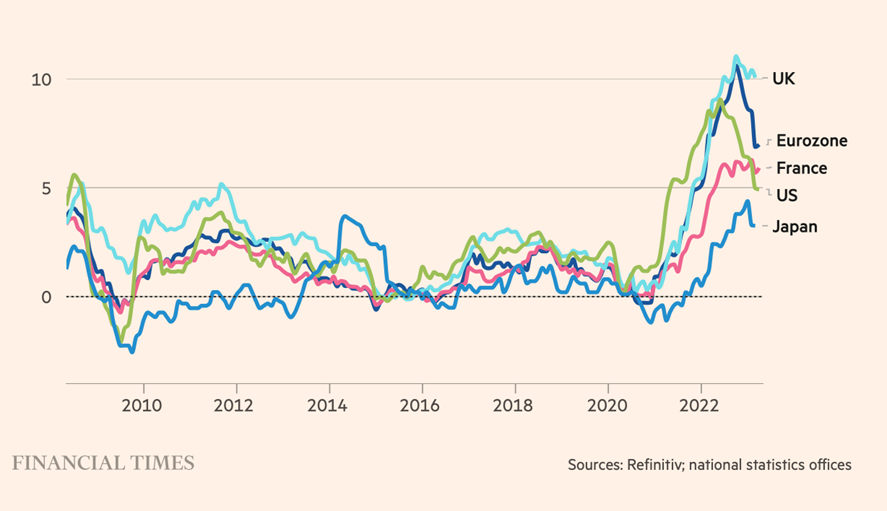

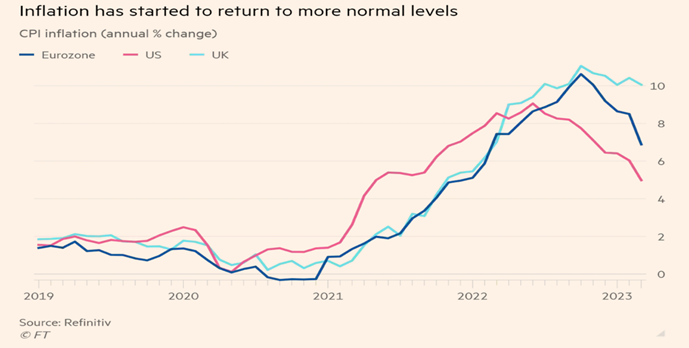

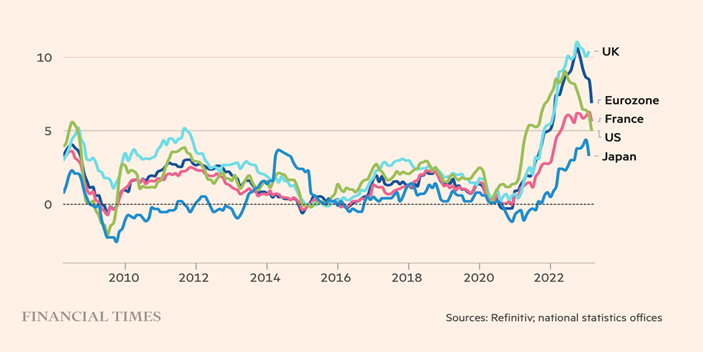

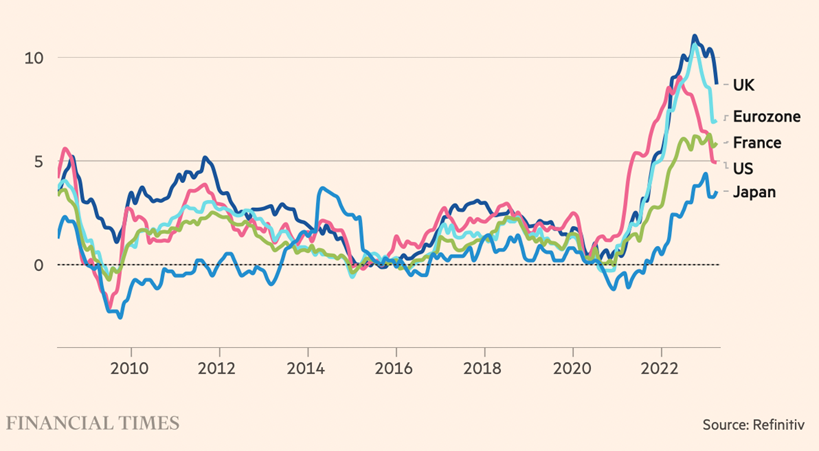

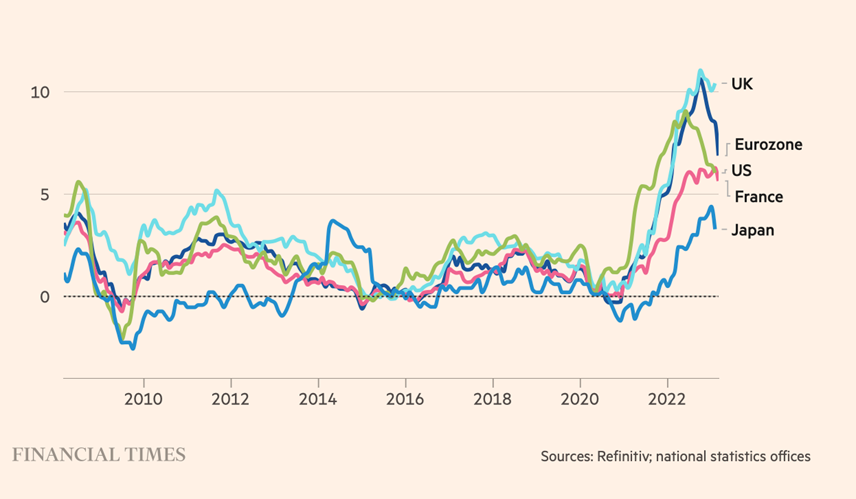

“High inflation remains geographically broad-based, even if it is lower in many parts of Asia. Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. Central banks have reacted with a series of interest rate rises, even though higher borrowing costs could exacerbate the squeeze on real incomes.”, The Financial Times, May 24, 2023

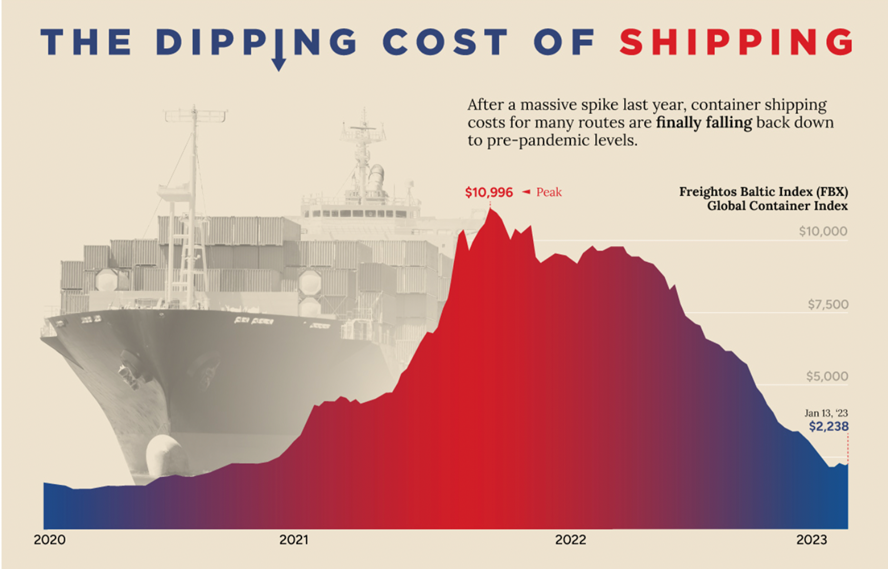

“The Dipping Cost of Shipping – A little over one year ago, congestion at America’s West Coast ports were making headlines, and the global cost of shipping containers had reached record highs. Today, shipping costs have come back down to Earth, with some routes approaching pre-pandemic levels. The Freightos Baltic Index (FBX)—a widely recognized benchmark for global freight rates—has fallen 80% since its peak in late 2021. A recent study from the IMF, which included 143 countries over the past 30 years, found that shipping costs are an important driver of inflation around the world. In fact, when freight rates double, inflation increases by 0.7 of a percentage point.”, Visual Capitalist, January 2023

“It Just Had an Energy Crisis, Now Europe Faces a Food Shock – Food prices continue to rise at a rapid pace, surprising central banks and pressuring debt-laden governments. The continued surge in food prices has caught central bankers off guard and pressured governments that are still reeling from the cost of last year’s emergency support to come to the rescue. And it is pressuring household budgets that are also under strain from rising borrowing costs.”, The Wall Street Journal, May 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Most companies have resumed pre-pandemic travel levels – Most companies have resumed pre-pandemic travel levels. Nearly 70% of business travelers who were polled in the American Hotel & Lodging Association’s Hotel Booking Index survey said their employers have resumed or increased pre-pandemic levels of travel. In addition, 49% of respondents said the typical length of business trips is the same as before the pandemic, with 22% reporting that trips are longer now.”, Hotel Business, May 22, 2023

“France has banned short-haul flights, but will it make an impact? In a bid to cut carbon emissions, France has officially banned domestic short-haul flights for journeys where train alternatives are in place. The ban was formally signed into law Tuesday and comes two years after lawmakers voted to end domestic flight routes where a train alternative that takes less than 2 1/2 hours is in operation. Currently, only commercial flights must adhere to the ban, and private jets will reportedly be unaffected by the restrictions.”, The Points Guy, May 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Inflation is changing the way Canadians are spending – Inflation has been eating into Canadians’ buying power for the past two years, causing people to shop more at discount grocery stores, or make the switch to private-label products over name brands. More recently, consumer sentiment has taken a sharper turn down. This week, the Canada Mortgage and Housing Corp. warned that Canada’s household debt has surged to the highest level of any Group of Seven country.”, The Globe and Mail, May 27, 2023

China

“‘Confidence is a big problem’: China’s economic recovery loses steam – Weak property sales, industrial output and consumption sap confidence in rapid bounceback from Covid. Industrial production and profits, property sales and credit growth have all fallen short of analysts’ projections in April and early May, recent data showed, sapping confidence in the growth prospects for the world’s second-largest economy. Consumer spending, which initially jumped after the Covid-19 controls were eased at the beginning of the year, has also fallen back on a gloomy economic outlook.”, The Financial Times, May 28, 2023

“The New Rules for Business Travel to China – From burner phones to inquisitive border agents, the WSJ has consulted experts on the do’s and don’ts in an era of heightened tensions. Security advisers say the risk for foreign executives traveling to China is on the rise, following Beijing’s new anti-espionage law, raids on consulting firms that work with foreign companies and a tightening of the flow of information to the outside world. Despite any concerns, advisers say, they are getting more calls from business travelers looking to return to China for long-delayed visits to clients, suppliers and local offices now that pandemic restrictions have lifted.”, The Wall Street Journal, May 27, 2023

European Union

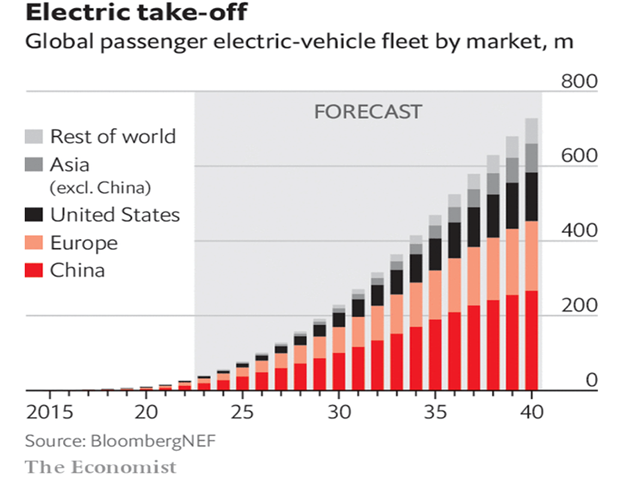

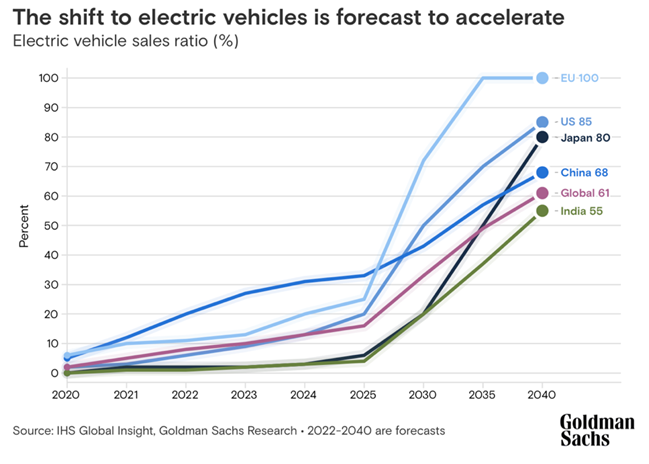

“Electric cars could be crucial for the EU to meet its climate goals – But only if the charging infrastructure is ramped up much faster. Fully battery-powered cars accounted for 12.1% of cars registered in the European Union (eu) last year, compared with 9.1% for evs in 2021 and just 1.9% in 2019. A wider category, alternatively powered vehicles (apvs), which lumps together pure electric and plug-in and non-plug-in hybrids, made up more than half the eu car market during the last quarter of 2022, with over 1.3m vehicles registered in total. It was the first time that apvs surpassed purely hydrocarbon-powered cars.”, The Economist, May 22, 2023

Germany

“Fall in German GDP increases threat of sustained recession in EU’s largest economy – First-quarter decline, on weak consumer and industrial activity, is second consecutive contraction in output. Economists said the second consecutive quarterly decline in GDP — output contracted by a downwardly revised 0.5 per cent in the final quarter of last year — met the technical definition for Europe’s industrial powerhouse to be in a recession. Most analysts expect Germany to achieve weak growth this year.”, The Financial Times, May 25, 2023

India

“India’s Economy Is Buzzing But Weaker Exports Could Be a Drag – Record tax mop-up, boost in services serve as growth drivers Weakening global demand, rising unemployment sour optimism. India’s economic activity picked up pace in April on record tax collections and a booming services sector though rising unemployment and weaker trade metrics could sap some sentiment.”, Bloomberg, May 23, 2023

“Apple supplier list shows gradual production shift from China to India – Apple’s Supplier List, published in May, represents 98% of the company’s direct spending on materials, manufacturing, and assembly of products for the fiscal year of 2022. The list is extensive, covering almost all manufacturers of note within its supply chain. According to SCMP, the list changes has Apple removing 19 suppliers while adding 18, on a global basis. For China specifically, eight companies were cut from the list, while only five were added.”, Apple Insider, May 29, 2023

Ireland

“Ireland’s Population Tops 5 Million for the First Time Since 1840s – After decades of continuous decline in the Irish population since 1841, it is now 83% higher than its low point in 1961 when the total was 2.8 million. There was an increase of almost 390,000 people living in Ireland between 2016 and 2022, with statisticians saying that this was because of the natural increase – the number of people who died subtracted from the number of people born in Ireland – and net migration – the number of people arriving minus the numbers of people leaving Ireland.”, Bloomberg, May 30, 2023

Russia

“Brands were not treated like partners – The number of new franchises this year may be reduced. Due to the crisis at the end of this year, according to experts, the market will be replenished with only 500 new franchises. This is 16% less than it was a year ago. The reduction of the segment is due to a decrease in the interest of entrepreneurs in such a business development model. Now they are least interested in opening franchises for retailers, vape shops and beauty salons. In 2023, about 500 new franchises will enter the Russian market, which is 16% less year-on-year, follows from the TopFranchise.ru report, which Kommersant has read.”, Kommersant.ru, May 24, 2023. English translation compliments of Paul Jones, Jones & Co., Toronto

Singapore

“Singapore’s Q1 GDP contraction raises recession risk – China revival key. Singapore’s economy contracted in the first quarter, raising the risk of a recession in the city state as the global economic outlook weakens and major trading partner China struggles for a post-COVID lift-off. Singapore, a major financial hub, is reliant on trade flow to keep its economy humming, though external demand has faltered in the wake of rising borrowing costs and still-strong inflationary pressures.”, Reuters, May 24, 2023

“Singapore ranks as most expensive city in Asia to buy or rent, as home prices in Hong Kong return to 2017 levels – In terms of affordability, the median private home price in Singapore was 13.7 times the median household income, according to a new report. Singapore’s median private-sector home price increased more than 8 per cent in the past year, it said, while Hong Kong’s fell 8.7 per cent.”, South China Morning Post, May 30, 2023

United Kingdom

“UK inflation falls to 8.7% in April but food prices still rising – Consumer prices rose at their slowest rate in a year in April but in worrying news for households and the government key measures of prices continued to rise. Worryingly, food price inflation remained close to historic highs at 19.1 per cent in April compared to the same period last year. Surging food prices have hit household budgets and prompted an inquiry from the UK’s competition authority. A closely watched measure of core inflation, which captures the strength of underlying inflationary pressures that excludes energy and food, accelerated from 6.2 per cent to 6.8 per cent, the highest rate in 31 years.”, The Times of London, May 24, 2023

United States

“U.S. holiday air passenger travel tops 2019 pre-COVID levels – The TSA said nearly 9.8 million passengers were screened or passed though security checks over the four-day weekend, about 300,000 more than over the same holiday period in 2019, the agency said on Tuesday. Reuters, May 30, 2023

“What Costco’s Baskets Reveal About Consumer Finances – The upper middle class is feeling the economic squeeze too. The retailer on Thursday said comparable sales excluding fuel in constant currency rose 3.5% in the quarter ended May 7 compared with a year earlier—lower than the 4.2% growth Wall Street analysts expected. It was also the weakest comparable sales growth Costco has seen since 2017. This follows Dollar Tree DLTR 4.24%increase; green up pointing triangle reporting more business from shoppers who earn annual incomes of $80,000 or more in its stores.”, The Wall Street Journal, May 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

Shake Shack Follows McDonald’s and Burger King But In a New Way – Shake Shack is taking competitors ideas and trying to make it better. Shake Shack only just entered the fast-food market in 2004, but already serves roughly 80 different countries with over 360 locations and had $900 million in revenue in 2022. Shake Shack debuted its Veggie Shack after years of testing, and it may have finally found its match.”, The Street, May 27, 2023

“Panera Bread parent announces CEO transition as it prepares for ‘eventual IPO’ – JAB Holding is preparing to take Panera Brands public through an initial public offering by switching up its leadership. Panera Brands CEO Niren Chaudhary will be succeeded by Einstein Bros. Bagels CEO Jose Dueñas, effective July 1. The restaurant company’s revenue surpassed $4.8 billion last year.”, CNBC, May 23, 2023

“From one chicken shop to a private equity buyout – Chargrill Charlie’s co-founders are convinced the chain will one day be a national player, with the deeper pockets of its new private equity owner better able to drive growth beyond its Sydney roots. Chargrill Charlie’s will sit alongside the bigger fast food brands of Red Rooster, Oporto and Chicken Treat already housed in the Craveable Brands stable.”, The Financial Review, May 9, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Berkshire’s Dairy Queen considers Australian expansion – Dairy Queen chief executive Troy Bader said Australia was a logical market for expansion, but that more work needed to be done on the cost of logistics and consumer tastes. The Financial Review, May 9, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Shanghai gym chain secures new investment amid unhealthy speculation – Shanghai’s largest gym chain Tera Wellness has announced a new round of financing worth 115 million yuan (US$16.4 million), amid speculation over store operation and refunding woes. The investment, led by Junzhuo Capital Investment, is the biggest fund-raising effort in China’s pandemic-hit gym industry in recent times, and the money will be used to improve its overall store operation and explore business opportunities like metaverse fitting, the gym brand said on its WeChat account on Tuesday afternoon. Tera Wellness, founded in 2001 in Shanghai, has 150 outlets nationwide (many in Shanghai) and 1.3 million members.”, Shine.cn, May 23, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Jollibee Foods exits Vietnamese restaurant chain Pho24 joint venture – Jollibee Foods Corporation’s subsidiary SuperFoods, which owns Highlands Coffee, has transferred all of its assets of Vietnamese noodles chain Pho24 to East-West Restaurant Concepts. Founded in 2003 by Vietnamese businessman Ly Quy Trung, Pho 24 currently has 14 stores in Vietnam. East-West Restaurant Concepts is wholly owned by Viet Thai International Joint Stock Co and based in Vietnam.”, Inside Retail, May 16, 2023

“Sweetgreen’s Salad Robot Is Almost Ready for Lunch – Automating food prep is harder than it seems. ‘We’ve been trying to be very quiet about it, because it’s not proven out, and we don’t want to promise anything.’ Nathaniel Ru, Sweetgreen’s co-founder and chief brand officer, is standing inside a soon-to-open location of the bougie salad chain. He’s talking about a steel-and-glass contraption the size of a 1960s computer mainframe that’s looming behind the front counter. The device is called the Infinite Kitchen, and its job will be to assemble the hundreds of harvest bowls, kale Caesars and many other permutations of kinda-fancy salads this restaurant will churn out daily.”, BusinessWeek, May 17, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 82, Tuesday, May 16, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Artificial Intelligence apps are impacting all aspects of business but in different ways in different countries. Airports are fuller than 2019. Inflation continues its slow decline from on high. ‘Hybrid’ workers have a better life, apparently. McDonalds® find a way to become accepted in France while Starbucks® opens in Rome.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“It is not the strongest or the most intelligent who will survive, but those who can best manage change.”, Leon C. Megginson

“All failure is failure to adapt, all success is successful adaptation.”,

Max McKeown

“Honesty is the best policy in international relations, interpersonal relations, labor, business, education, family and crime control because truth is the only thing that works and the only foundation on which lasting relations can build.”, Ramsey Clark

Highlights in issue #82:

- Brand Global News Section: Burger King®, Carl’s Jr.® & Hardees®, Dominos®, McDonalds® and Tim Horton’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

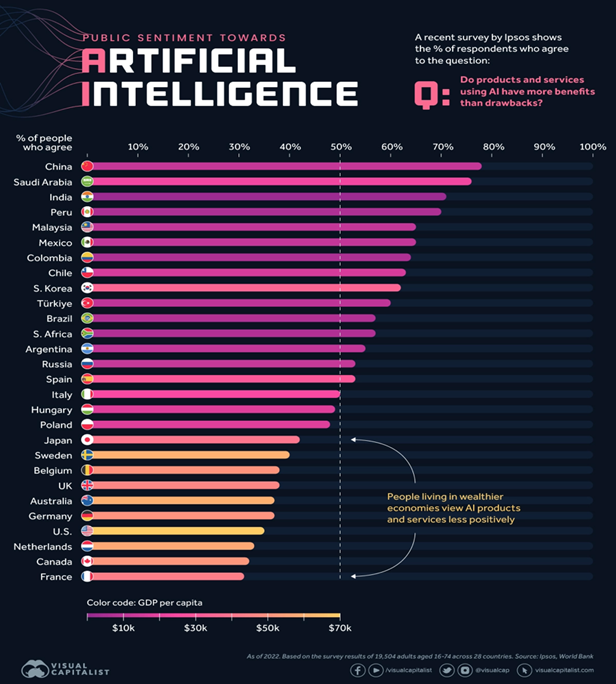

“Visualizing Global Attitudes Towards AI – Artificial intelligence (AI) is one of the fastest growing and most disruptive technologies in the world today. Because it has the potential to drastically impact society, it’s important to measure how people are feeling towards it. This infographic visualizes survey data from market research firm, Ipsos, to see how attitudes towards AI varies by country. By including each country’s GDP per capita, we can see that wealthier populations are more skeptical about products and services that use the technology. This data is based on a 28-country survey of 19,504 adults aged 18 to 74. Polling took place between November and December 2021, and the results were published in January 2022.”, Visual Capitalist, May 9, 2023

“The jobs AI won’t take yet – A March 2023 report from Goldman Sachs estimated that AI capable of content generation could do a quarter of all the work currently done by humans. Across the European Union and US, the report further notes, 300 million jobs could be lost to automation. Thankfully, it’s not all bad news. The experts issue their warnings with a caveat: there are still things AI isn’t capable of – tasks that involve distinctly human qualities, like emotional intelligence and outside-the-box thinking. And moving into roles that centre those skills could help lessen the chances of being replaced.”, BBC New, May 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies still make for worrying reading, with price pressures remaining high as the war in Ukraine continues to keep energy and food prices elevated. But in some countries pressures have eased and energy and food wholesale prices have declined. Economist and investors also expect inflationary levels to stabilise in the next few years.”, The Financial Times, May 10, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

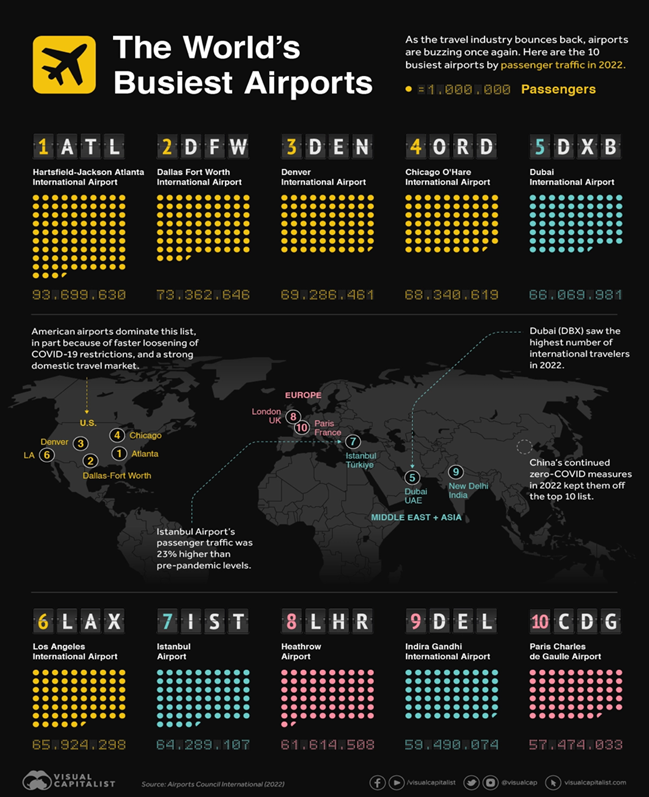

“The World’s Busiest Airports, by Passenger Count – The infographic above uses data from Airports Council International (ACI) to rank the top 10 busiest airports in the world, looking at total passengers enplaned and deplaned, with passengers in transit counted once. In 2022, worldwide passenger traffic came near to 7 billion, an increase of almost 54% from 2021, and a 74% recovery from pre-pandemic levels.”, Visual Capitalist, May 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Hybrid workers are eating healthier, sleeping and exercising more, survey finds – A recent report by IWG, a global operator of flexible workspaces, found these workers eat healthier, exercise more and drink less alcohol, too. The company’s survey of 2,000 workers in Canada shows: More than 70 per cent of hybrid workers now cook and eat healthier meals; Workers enjoy an extra 73 hours of sleep a year; Exercise over 40 minutes per week longer compared to before the pandemic; More than a quarter (27 per cent) said they have decreased their alcohol consumption. Overall, 82 per cent of respondents believe hybrid working has improved their quality of life and 66 per cent reported improved mental health and well-being.” The Globe and Mail, May 14, 2023

China

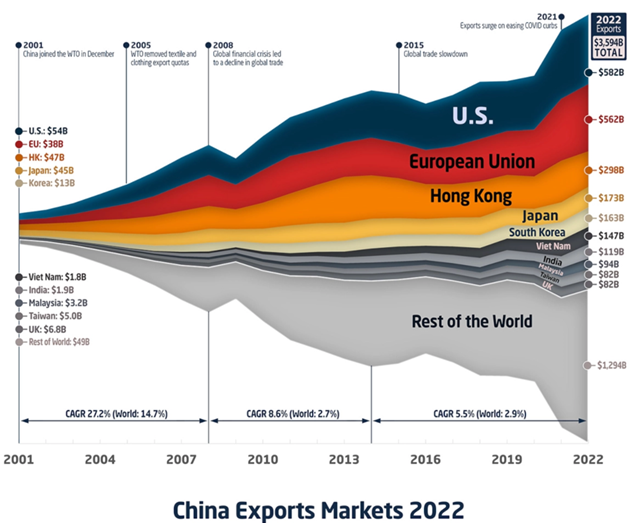

“Charting and Mapping China’s Exports Since 2001 – In 2001, when China joined the World Trade Organization, the value of its merchandise exports stood at $266 billion. Over the next seven years, the country’s exports grew uninterrupted until the 2008 financial crisis caused a sharp decline in global trade. This cycle would repeat again with consecutive growth until 2015 (another global trade slowdown), followed by slowed growth until 2020 (the onset of the COVID-19 pandemic). But merchandise exports skyrocketed by 30% in 2021, and by the end of 2022 had grown to an estimated $3.6 trillion per year. That means China’s exports alone are bigger than the entire economies of countries like the UK, India, and France.”, Visual Capitalist, May 2, 2023

“China’s data-security laws rattle Western business executives – Authorities go after foreign companies for hazily defined data transgressions. Chinese firms that sell information about the Chinese economy and companies are being forced by their domestic overseers to curtail their operations abroad. Firms supplying Chinese corporate records, such as Qichacha, are no longer permitted to do so outside China. To the dismay of academics around the world, cnki, a digital subscription platform for Chinese research papers, suddenly became inaccessible to accounts outside the country in March. In just the past few months many of the links that have helped the world understand China have been severed.”, The Economist, May 4, 2023

Greece

“Once Europe’s Headache, Greece Finds Its Feet – Ahead of elections, doubts on country’s euro membership have gone away. Greece’s economy nearly broke the euro last decade. Now it is one of the fastest-growing in Europe’s common-currency zone. Nobody frets about Grexit any more in Greece’s once-again bustling capital city. In streets that were previously blighted by closed storefronts, locals complain about rising rents and the spread of Airbnb apartments.”, The Wall Street Journal, May 13, 2023

India

“Slowest India Inflation in 18 Months Boosts Rate Hold Calls – Consumer prices rose 4.70% in April versus 4.76% estimate within target band will give RBI room to support growth. A third straight month of cooling prices brings the marker closer to the mid-point of the Reserve Bank of India’s 2%-6% target.”, Bloomberg, May 11, 2023

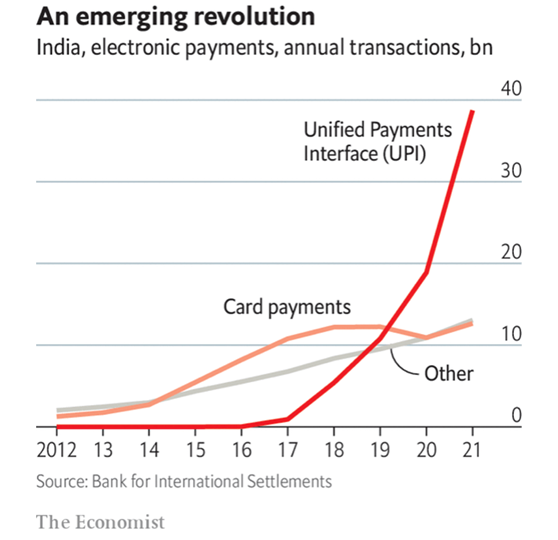

“A digital payments revolution in India – How emerging economies from India to Brazil built alternative payments models. The Unified Payments Interface (upi) is a platform that allows free and fast account-to-account transfers using fintech apps such as PhonePe or Google Pay. Unlike AliPay in China, it is open, so users are not locked into a single company and can take their financial history to competitors, notes Praveena Rai, the chief operating officer of the National Payments Corporation of India (npci), which manages the platform. And it is facilitated by qr codes or easy-to-remember virtual ids.”, The Economist, May 15, 2023

Indonesia

“Indonesia emerges as world’s second-largest cobalt producer – Fast-growing supply depresses prices but raises fears about China’s control of market. The south-east Asian country generated 9,500 tonnes of cobalt last year — 5 per cent of the global supply — up from minimal volumes before 2021, according to an annual market report by the Cobalt Institute, an industry group. That means it has overtaken established producers Australia and the Philippines.” , The Financial Times, May 9, 2023

Italy

“Starbucks moves into central Rome as Italy surrenders to Frappuccino – Starbucks has advanced its stealthy conquest of Italy by opening its first café in central Rome, close to the city’s parliament, allowing Italian MPs the chance to pop out for a frappuccino during recess. Long considered off limits by the Seattle coffee giant, Italy is fast surrendering to the company’s large pots of milky, frothy, fruit-flavoured coffee, with 25 stores now open and more to come. ‘Italy is not easy, but people are appreciating the coffee,’ said Vincenzo Catrambone, the chain’s Italy general manager.”, The Times Of London, May 11, 2023

The Philippines

“Cooling Philippine Inflation Boosts Odds of Rate Pause – Month-on-month consumer price index fell 0.2%, same as March Central bank says risks to CPI outlook ‘tilted heavily’ upside. Philippines’ overall inflation cooled for a third straight month in April from a year ago and was below all analysts estimates, supporting the case for a pause in monetary policy tightening.”, Bloomberg, May 4, 2023

United Kingdom

“Bank of England boosts forecasts for UK growth – The upgrade is the largest in the monetary policy committee’s 26-year history and contrasts with dire warnings last autumn that the UK was heading for the longest recession in half a century. The outlook has shifted so much because global wholesale gas prices have fallen below their levels before the Ukraine war and household spending has been boosted by government support measures. Unemployment also remains low. The Bank warned inflation would fall more slowly than previously projected, dropping to 5 per cent at the end of 2023, compared with February estimates of 3.9 per cent.”, The Times of London, May 12, 2023

“Mortgage lenders offer 100% loans for first time since 2008 – This will be the first 100 per cent mortgage available since the last financial crisis. The deal will be fixed for over two years to guard against the risk of borrowers ending up in negative equity. Some banks, including Barclays, Lloyds and some smaller building societies, are willing to lend up to 100 per cent of a property’s value but only if the borrower’s family put down a deposit of up to 20 per cent.”, The Times of London, May 8, 2023

United States

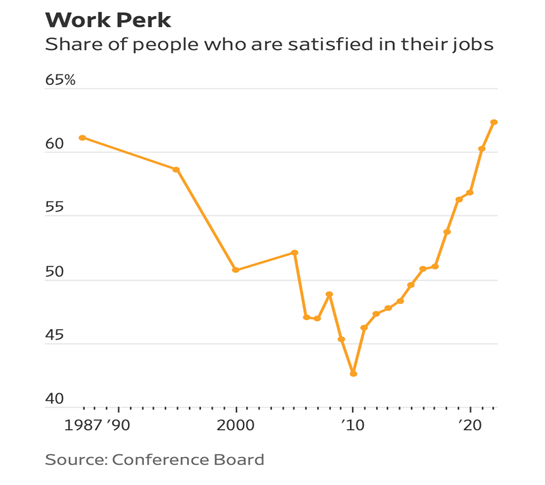

“(U.S) Workers Are Happier Than They’ve Been in Decades – Labor shortages and shifting expectations lead to improvement for millions, survey shows. Job satisfaction hit a 36-year high in 2022, reflecting two effects of the tight pandemic labor market: The quality of jobs improved as wages and work flexibility increased, and workers moved into positions that were a better fit. Last year, 62.3% of U.S. workers said they were satisfied with their jobs, according to new data from the Conference Board, up from 60.2% in 2021 and 56.8% in 2020. The business-research organization polled workers on 26 aspects of work, and found that people were most content with their commutes, their co-workers, the physical environment of their workplace and job security.”, The Wall Street Journal, May 11, 2023

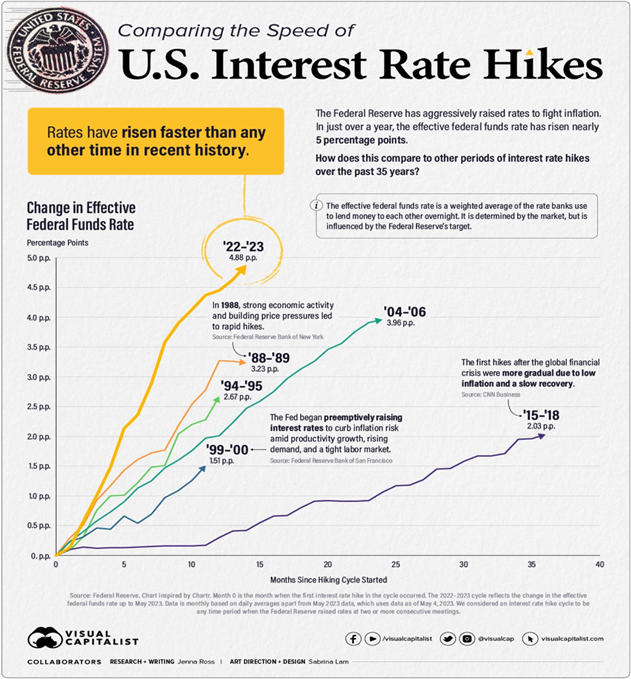

“Comparing the Speed of Interest Rate Hikes (1988-2023) – After the latest rate hike on May 3rd, U.S. interest rates have reached levels not seen since 2007. The Federal Reserve has been aggressive with its interest rate hikes as it tries to combat sticky inflation. In fact, rates have risen nearly five percentage points (p.p.) in just 14 months. In this graphic— inspired by a chart from Chartr —we compare both the speed and severity of current interest rate hikes to other periods of monetary tightening over the past 35 years.”, Visual Capitalist, May 7, 2023

“SBA Research Sheds New Light on Small Business Exporters – The U.S. Small Business Administration (SBA) released new findings from a commissioned study on the Total Addressable Market (TAM) of small business exporters in America. Among the key findings from the study is new data, based on recent business surveys, that places the number of exporting small businesses at 1.3 million – an almost fivefold increase over the estimates previously published by the federal government. Furthermore, the research places the potential market size, or total addressable market, at over 2.6 million small businesses, representing 42 percent of all small employer businesses.”, U.S. SBA press release, March 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“This Fast-Food Chain (Burger KING®) Is Shutting Down Up to 400 Restaurants – The affected restaurants will close by the end of 2023. By the end of 2023, Burger King will shut down hundreds of its nearly 7,000 restaurants across the country. Up to 400 Burger King locations will close by the end of 2023, in addition to 124 locations that have shut down this year already.”, Taste Of Home, May 11, 2023

“Carl’s Jr. and Hardee’s to roll out A.I. drive-thru ordering nationwide – CKE Restaurants, the parent of Carl’s Jr. and Hardee’s, has partnered with Presto and OpenCity, which both have the ability to launch at the company’s locations nationwide. Presto Voice is already used at Del Taco and Checkers & Rally’s restaurants, while OpenCity’s Tori has been used by a Popeyes franchisee. Additionally, Valyant AI has a deal with CKE to use its voice-ordering tech at 32 locations, with the ability to expand to another 21 restaurants in the coming months.”, CNBC, May 4, 2023

“Domino’s Pizza eyes 420 more stores in China after Hong Kong IPO – DPC Dash entered the cities of Qingdao, Changzhou, and Wenzhou last Saturday, taking the store count to 638 as of April 30. ‘The recent listing was a great achievement for DPC Dash as well as for our global franchisor, Domino’s Pizza,’ said Frank Paul Krasovec, director and chairman at DPC Dash. ‘With the newly raised proceeds, we aim to aggressively expand across the greater China region and to bring our comprehensive product offerings to hundreds of millions of potential Chinese consumers.’”, Inside Retail Asia, May 5, 2023

“Tim Hortons to enter South Korea this year – Canadian coffee chain Tim Hortons is set to expand into South Korea this year through a master franchise agreement with local quick-service restaurant firm BKR. ‘South Korea is one of the world’s largest and fastest-growing coffee markets,’ said David Shear, president international of Restaurant Brands International. According to the Korea Agro-Fisheries & Food Trade Corporation, the number of coffee shops in the country reached its peak last year with about 99,000 stores, increasing 17.4 per cent year on year.”, Inside Retail, May 11, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“The Genius Way McDonald’s Held Its Own In France – One of McDonald’s’ earliest targets, however, was also one of its trickiest: France. Unsurprisingly, one of the culinary capitals of the world took some convincing to get on board with McDonald’s hegemony. Shockingly, though, it’s now quite popular there, all because McDonald’s eventually embraced French culture. McDonald’s didn’t have success in France until the turn of the millennium, when executives decided to really lean into McDonald’s becoming French.”, The Daily Meal, May 10, 2023

“NZ attractive to international franchise brands – The latest quarterly GlobalVue™ chart from Edwards Global Services (EGS) once again ranks New Zealand in the top 10 countries in the world for franchises to consider when expanding internationally. In fact, New Zealand comes in equal third, just behind the USA and the United Kingdom, and on a par with Spain, the United Arab Emirates, Canada and Israel, and marginally ahead of Australia, France and Saudi Arabia. The long-running ranking chart from the US franchise consultants is significant because it reflects conditions in 40 countries on an international basis, regardless of short-term media stories.”, Franchise New Zealand, May 9, 2023. Compliments of Simon Lord, Publisher, Franchise New Zealand, Auckland

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 81, Tuesday, May 2, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, inflation continues to fall for most developed economies. AI may give as many jobs as it takes away….over time. The numbers for China seem mixed. European consumer trends report. Some developing countries try to move away from the US$. And we track the interesting growth of gold production over 200 years.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“To be successful, you must act big, think big and talk big.”, Aristotle Onassis

“Whenever you see a successful business, someone once made a courageous decision.”, Peter F. Drucker

The secret of getting ahead is getting started.”, Mark Twain

Highlights in issue #81:

- Brand Global News Section: Anytime Fitness®, Johnny Rockets, McDonalds®, Popeyes®, Shake Shack® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

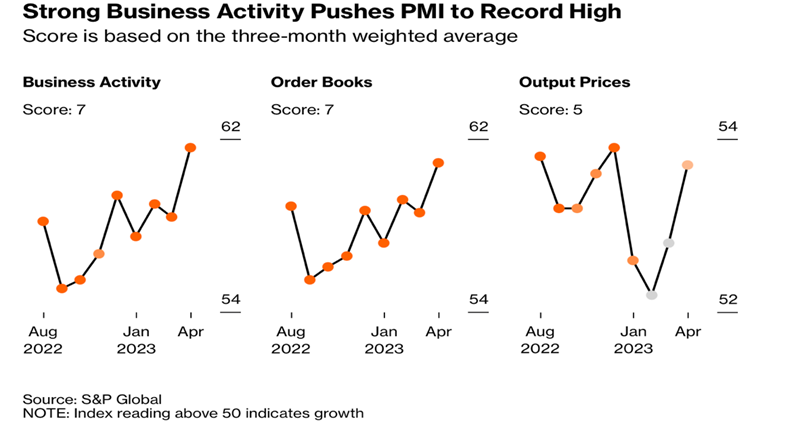

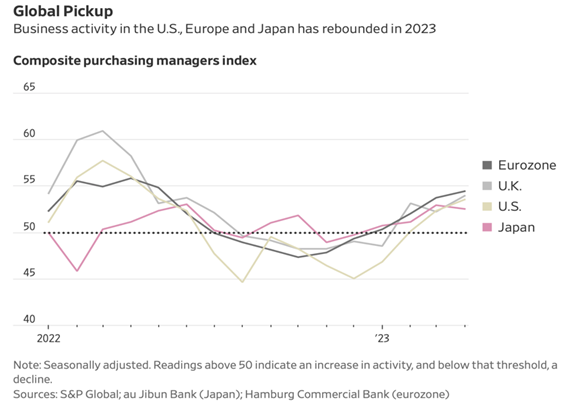

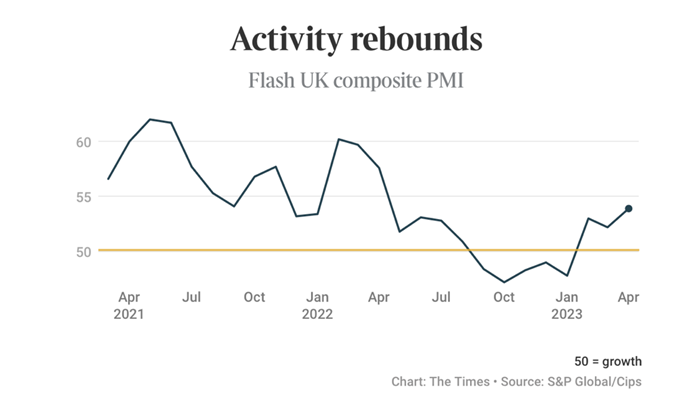

“Global Economy Gets Boost but Inflation Worries Linger – U.S., European business activity accelerated in April, but price pressures picked up as central banks consider additional interest-rate increases. U.S. and European business activity rose in April at the fastest pace in about a year, a boost for the global economy but a potentially complicating factor for central banks working to reduce high inflation. Demand for services drove the growth, according to surveys by data firm S&P Global covering U.S., eurozone and U.K. businesses. That kept pressure on price increases in regions where inflation last year reached its highest level in decades.”, Wall Street Journal, April 21, 2023

“What is generative AI? Generative artificial intelligence (AI) describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, simulations, and videos. Recent breakthroughs in the field have the potential to drastically change the way we approach content creation. While many have reacted to ChatGPT (and AI and machine learning more broadly) with fear, machine learning clearly has the potential for good.”, McKinsey, January 19, 2023

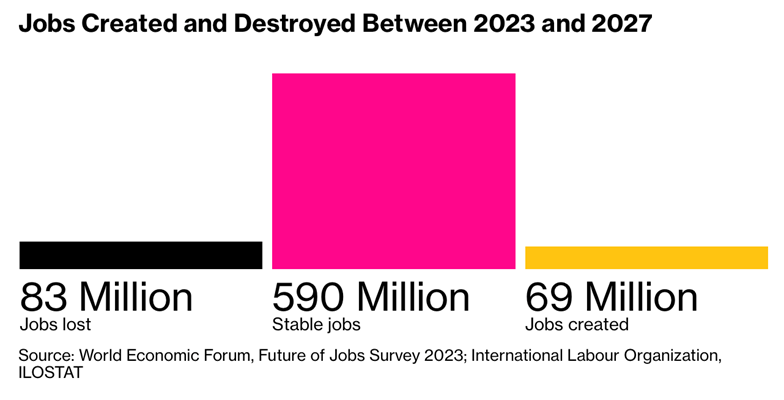

“Tech, AI Driving Job Changes for Nearly a Quarter of All Workers – Technology may eliminate 26 million jobs over next five years. Green transition will provide opportunities for job creation. Over the next five years, nearly a quarter of all jobs will change as a result of AI, digitization and other economic developments like the green energy transition and supply chain re-shoring, according to a report published by the World Economic Forum in Geneva on Monday. While the study expects AI to result in “significant labor-market disruption,” the net impact of most technologies will be positive over the next five years as big data analytics, management technologies and cybersecurity become the biggest drivers of employment growth.”, Bloomberg, April 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“The ECB’s inflation dilemma: can Lagarde silence her critics again? – The Financial Times has spoken to a dozen current and former members of the ECB’s rate-setting governing council in the past few weeks as well as several economists, financiers and analysts who follow the central bank closely. Most of them praise Lagarde for rebuilding unity among ECB monetary policymakers and preventing recent economic shocks from spiralling into a financial crisis. But critics complain she lacks economic expertise, was late to react to soaring inflation and should communicate more clearly.”, The Financial Times, April 30, 2023

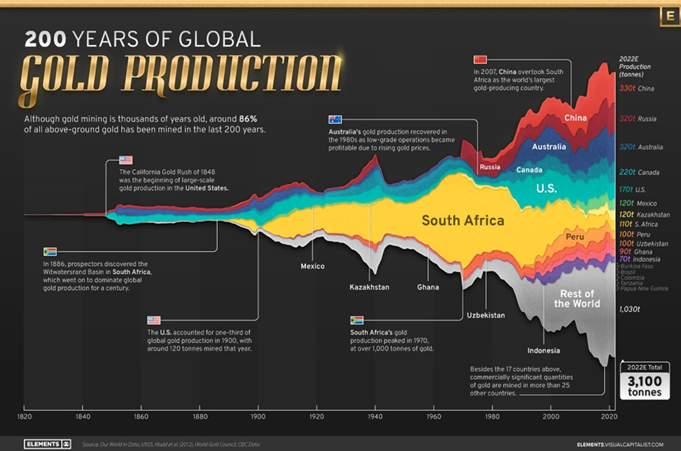

“Visualizing Global Gold Production Over 200 Years – Although the practice of gold mining has been around for thousands of years, it’s estimated that roughly 86% of all above-ground gold was extracted in the last 200 years. With modern mining techniques making large-scale production possible, global gold production has grown exponentially since the 1800s. The above infographic uses data from Our World in Data to visualize global gold production by country from 1820 to 2022, showing how gold mining has evolved to become increasingly global over time.”, Visual Capitalist / Our World In Data, April 26, 2023

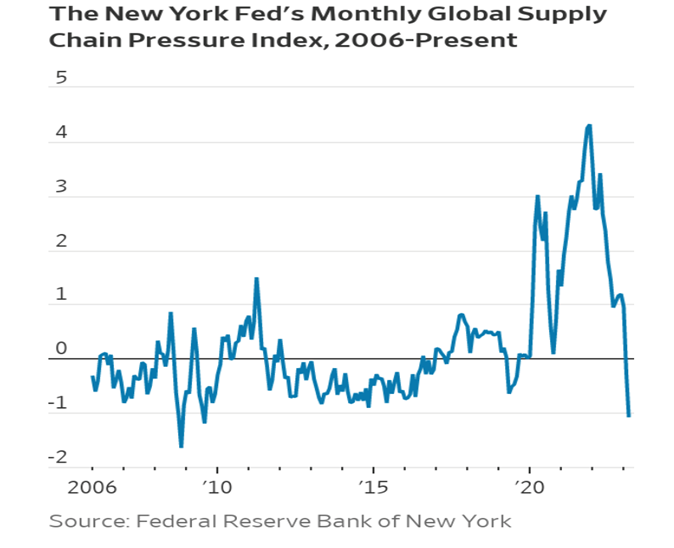

“Here’s How Supply Chains Are Being Reshaped for a New Era of Global Trade –

Nearshoring. Automation. Supplier diversification. Sustainability. Companies are adapting their operations to changing market pressures and geopolitics. When a measure of strains on global supply chains fell earlier this year to levels last seen before the Covid-19 pandemic, it signaled to some that the product shortages, port bottlenecks and shipping disruptions of the past three years were over and that a new era of stability was on the horizon.”, The Wall Street Journal, April 24, 2023

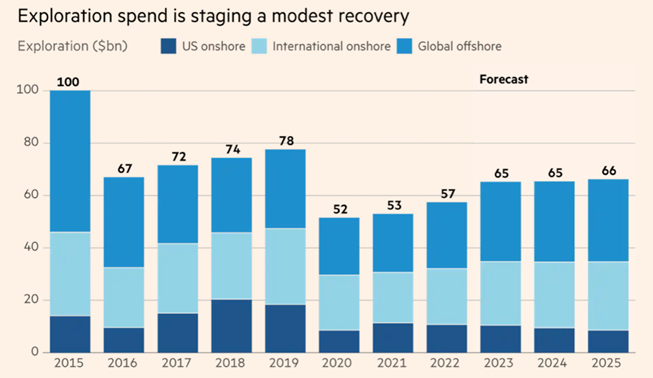

“Oil exploration: modest revival leaves majors ahead by a whisker – Total spend on exploration is set to rise to $65bn in 2023, from $57.5bn last year. It takes a brave oil and gas major to wager on wildcat wells, as risky drilling is termed. Most have taken an axe to budgets, believing the energy transition will stem demand for fossil fuels. Now there are inklings of excitement in exploration. That is good news for the likes of Shell, TotalEnergies and drilling services groups. But investors yearning for the return of roustabout rock ‘n’ roll in London stocks will be disappointed.”, The Financial Times, April 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“American Airlines Sees Topping Profit Forecast as Global Demand Grows – Airline is boosting capacity for international flights. Ease of Covid restrictions is boon for overseas travel. The company, like its largest rivals, is seeing a rebound in flights outside the US after travelers pulled back on those trips last year when many Covid-related restrictions were still in place. The airline is devoting 80% of its capacity growth this quarter to long-haul international routes.”, Bloomberg, April 27, 2023

“These Airlines Are Using AI to Make Long-haul Flights More Efficient – The goal is to cut down on delays and cancellations. Airlines like Air New Zealand and Qantas are using AI-powered software to determine fuel-efficient routes in efforts to prevent having to stop to refuel, Bloomberg reported. (The former launched a 17.5-hour flight from New York City to Auckland, New Zealand. The latter plans to launch the longest flights in the world between Sydney to New York and London with its Project Sunrise.) The software, which is designed to get better the more it’s used, warns pilots about bad weather, helps them catch a tailwind, and more.”, Travel & Leisure magazine, April 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Small businesses expect to grow in next 6 months despite economic challenges – 62% of small and medium-sized businesses anticipate growth. Business leaders of Canadian small and medium-sized companies are optimistic about the future, with 62 per cent expecting to grow in the next six months, according to a new report by Zoho Corp. More specifically, 38.2 per cent expect growth of one to 10 per cent, 15.4 per cent estimate growth of 10 to 20 per cent and 8.5 per cent forecast growth of above 20 per cent, the Zoho Canada SMB Outlook Report, which surveyed 1,016 Canadian business leaders in March, showed. However, 31.2 per cent are expecting zero growth and only 7.8 per cent are expecting declines.”, The Financial Post, April 21, 2023

China

“US firms’ confidence in China’s economy is rising, but so are fears over bilateral tensions – AmCham China poll finds a sharp increase in negative sentiment regarding the impact of souring relations between the world’s two largest economies. However, more business executives are visiting China, and more foreigners say they would consider moving to China. A total of 59 per cent of 109 respondents had a positive outlook on China’s economic recovery in AmCham’s latest “flash survey” conducted from April 18-20, marking a significant increase from 33 per cent in the previous survey results released in March after 319 respondents were polled in October, November and February. Yet, pessimistic views on bilateral relations have worsened, rising across the two surveys from 73 per cent to 87 per cent.”, South China Morning Post, April 26, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“If China’s growth is so strong, why is inflation so weak? This newspaper described China’s reopening as the biggest economic event of the year. So why has it had such a small effect on prices? Some suspect the recovery is weaker than the official statistics portray. Analysts at China Beige Book, which relies on independent surveys to track the country’s economy, told clients they were “snickering” at official figures showing that retail sales surged by 10.6% in March compared with the previous year.”, The Economist, April 27, 2023

Eurozone

“Eurozone returns to weak growth in first quarter – GDP fails to hit expectations as German stagnation weighs on outlook. The eurozone economy returned to growth in the first three months of the year as output expanded by 0.1 per cent. But the figure undershot economists’ expectations of stronger growth as stagnation in Germany, the region’s largest economy, offset expansions elsewhere in the bloc. The eurozone’s economy is now 1.3 per cent larger than in the first quarter of 2022. That compares with US growth of 1.6 per cent over the same period and a 4.5 per cent expansion of the Chinese economy in the same period.”, The Financial Times, April 28, 2023

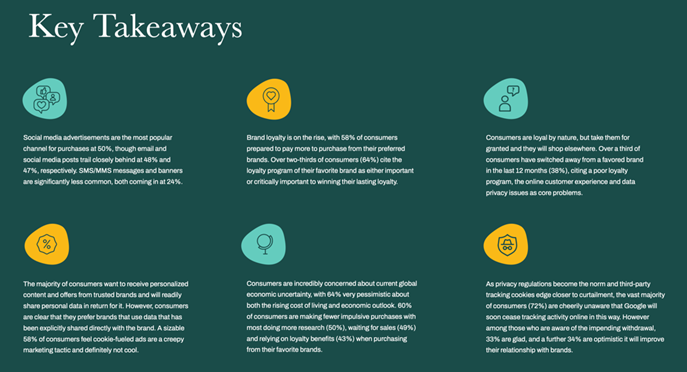

“2023 European Consumer Trends & Attitudes – Are European consumers different from consumers elsewhere in the world? Marigold, in conjunction with Econsultancy, asked 7,392 consumers across Europe (U.K., Germany, France, Spain, Denmark, Sweden, and the Benelux region) for their thoughts on 2023. Here’s some of what they found, all reported in the Europe Consumer Trends Index 2023. The 41-page report focuses on European consumer attitudes and trends in six areas: messaging, brand loyalty, privacy and personalization, the rising cost of living, and consumer sentiment by industry.”, Euroconsultancy, April 2023. Compliments of Eddy Goldberg, Franchising.com

India

“India Pushes Rupee Settlements With Trade Partners Amid Dollar Shortages. – New Delhi is boosting its efforts to expand the use of the Indian rupee (INR) in international trade, as it seeks to increase exports to nations facing a shortage of the U.S. dollar. The United Arab Emirates, a rising economy in the Middle East, is now set to join 18 other countries that are settling cross-border trade transactions with the rupee. India’s push to advance rupee transactions in global trade follows in the lines of similar efforts by other countries, notably China and Russia, to ditch the dollar as the world looks warily at the weaponization of the greenback by the United States.”, International Business Times, May 1, 2023

Japan

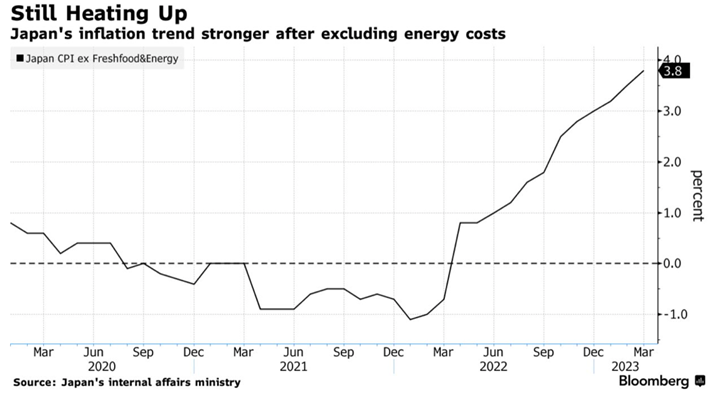

“Japan Inflation Outpaces Forecasts Again as BOJ Prepares to Meet – Gauge of underlying price trend at strongest since 1981. Consumer prices excluding fresh food rose 3.1% in March from a year ago, matching the pace of the previous month, the internal affairs ministry said Friday. Economists had expected the inflation measure to ease to 3%. A separate gauge of price growth that excludes both energy and fresh food also proved stronger than expected, climbing to 3.8% for its highest reading since 1981.”, Bloomberg, April 20, 2023

Spain

“No rain in Spain pushes olive oil prices to record levels – Continuing drought conditions leave traders and analysts worried about this year’s output. Olive oil prices have surged almost 60 per cent since June to roughly €5.4 per kilogramme, on the back of a severe drought in Europe that last year ruined olive crops across the continent. Spain, the largest olive oil producer, was hit particularly hard. The country’s farmers typically produce half of the world’s olive oil, though annual supplies have roughly halved to about 780,000 tonnes in the past 12 months.”, The Financial Times, April 23, 2023

United Kingdom

“Demand for services pushes private sector to 12-month high – The flash composite purchasing managers’ index (PMI), which is compiled by the Chartered Institute of Procurement and Supply and S&P Global, jumped by more than expected to hit 53.9 on the index this month, up from 52.2 in March. City economists had predicted that it would stay at 52.2. It is the third consecutive month in which there has been a rise in business activity, adding to signs that the wider economy is holding up despite the cost of living squeeze on households.”, The Times of London, April 21, 2023

United States

“US manufacturing contracts again in April, but pace slows – Manufacturing PMI rises to 47.1 in April New orders improve moderately; prices paid pick up. U.S. manufacturing pulled off a three-year low in April as new orders improved slightly and employment rebounded, but activity remained depressed amid higher borrowing costs and tighter credit, which have raised the risk of a recession this year.Despite the weakness in factory activity and demand for goods reported by the Institute for Supply Management (ISM) on Monday, there was a build-up of inflation pressures last month.”, Reuters, May 1, 2023

“US growth slowed sharply in first quarter as Fed pushed rates higher – GDP climbed 1.1% on annualised basis as consumers spent heavily in face of elevated inflation. The world’s largest economy grew 1.1 per cent on an annualised basis between January and March, according to preliminary data released by the commerce department on Thursday. The figures marked an abrupt deceleration from the 2.6 per cent pace registered in the final three months of 2022 and came in well below economists’ expectations of a 2 per cent increase.”, The Financial Times, April 27, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Information statement for prospective franchisees – The Australian government has released a new version of the ‘Information statement for prospective franchisees. This document must be given to potential franchisees by a franchisor if they express an interest in a franchise. It must be given as soon as practicable, but not later than 7 days after interest is expressed. The information statement must be given to the potential franchisee before giving them any other documents. It is part of Australia’s Franchising Code of Conduct and is a legal requirement for every foreign or local franchisor to comply with if offering franchises in Australia.”, Australian Competition and Consumer Commission, April 2023. Compliments of Rod Young, Chairman, DC Strategy, Sydney