Biweekly Global Business Newsletter Issue 124, Tuesday, December 24 , 2024

Navigating Global Business in Uncertain Times:

Insights for 2024 and Beyond

Commentary about the 124th Issue: I wish all our 4,600 subscribers Happy Holidays and a prosperous and healthy 2025. It will certainly be an ‘interesting’ year for global business!

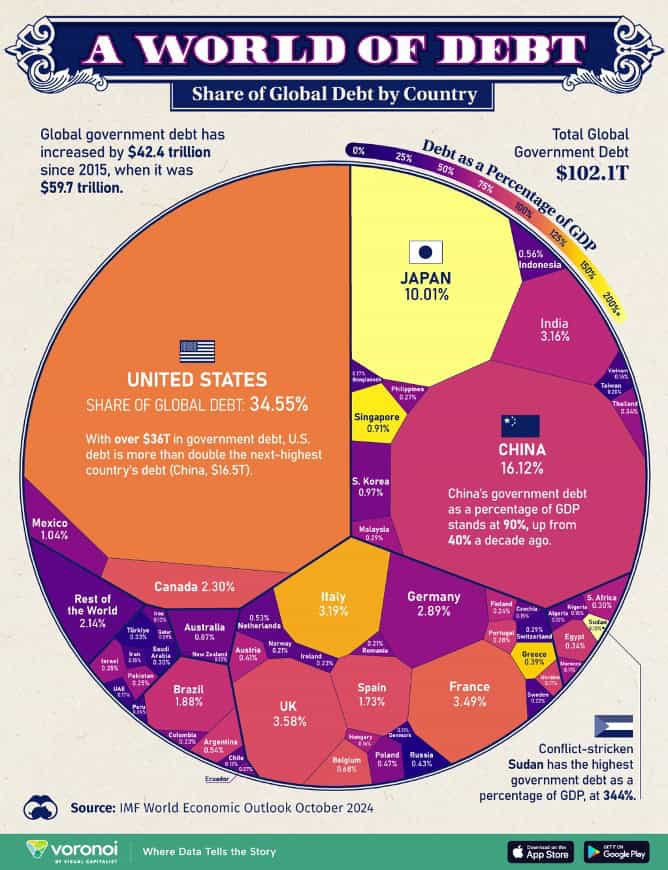

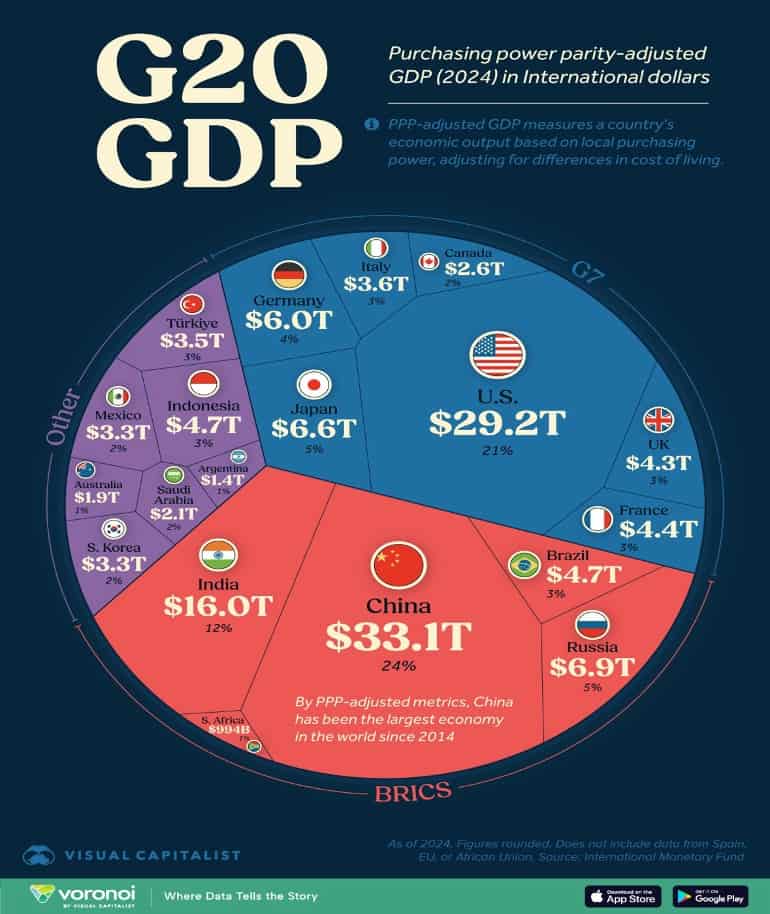

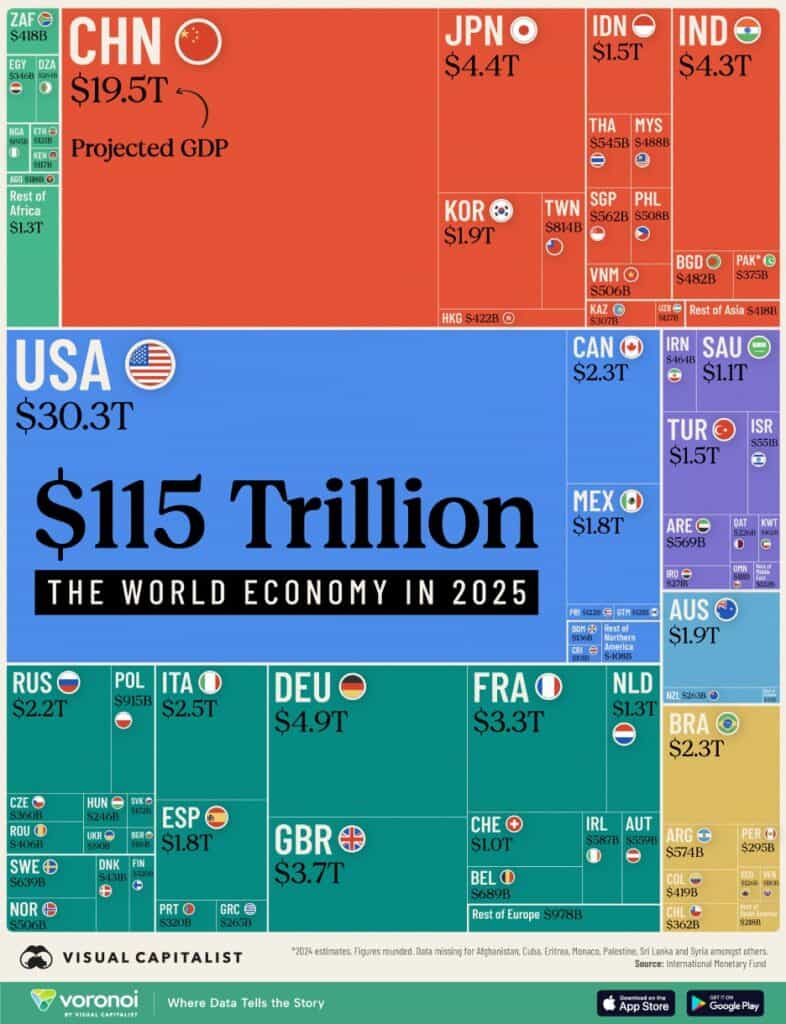

In conjunction with our last edition for 2024, we release the December 2024 GlobalVue™ 40 country ranking as places to do business, have a graphic showing the countries that make up US$115 trillion of gross domestic product (GDP) as well as a graphic that show the US$102 trillion of debt!

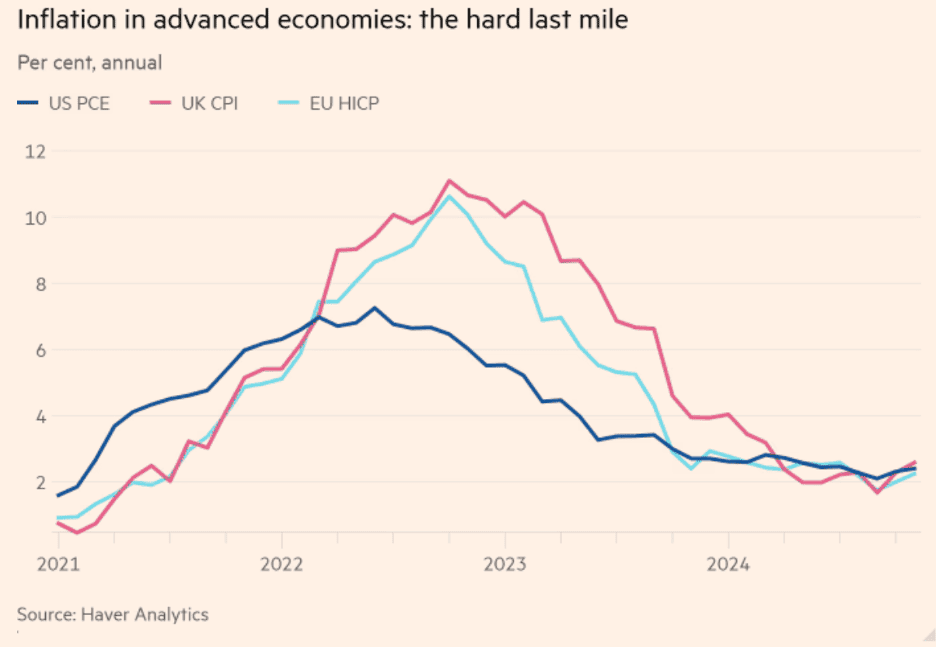

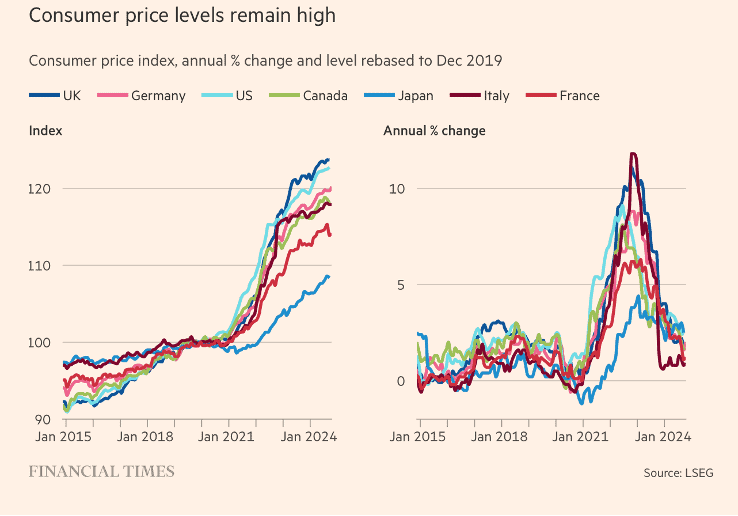

Inflation in first world countries is stubbornly staying a bit above 2% on an annual basis. The ‘Economist’ says Spain had the best major country economy in 2024. At the end of the year, we had 76 national elections which will have consequences on places to do business in 2025. And do not miss the special article by Don Southerton on the Impeachment of South Korean President Yoon Suk-yeol and the International Business Implications.

A case study on how NOT to successfully take a global brand into China and India. Versus three entrepreneurs who started their first Wingstop® fried chicken franchise six years ago in the United Kingdom and have just sold their business for a whopping £400 million!

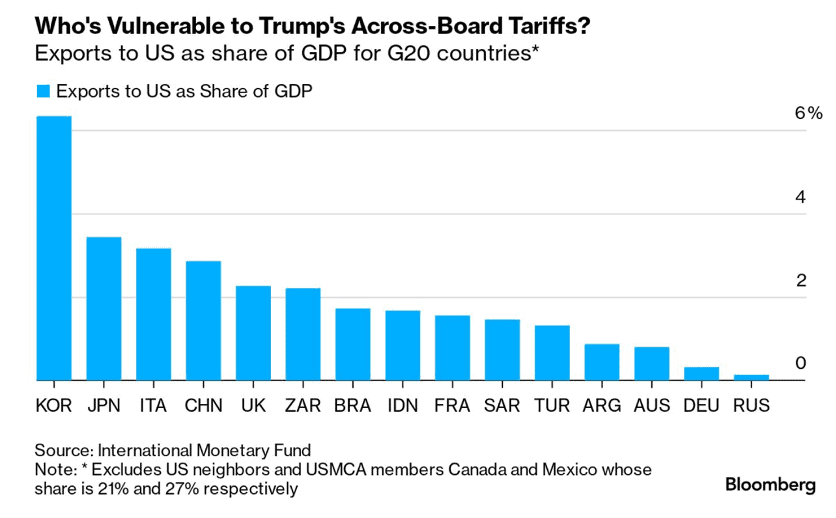

The Future: After November 5th, searches for “Trump’s tariff plan” increased by more than 1650%, and queries about “who pays tariffs” rose by 350% (The Nightly, Australia). We expect that by the February 4th edition of our newsletter the business world will know much more about what tariffs will be imposed by the USA.

One More Thing: The price of cocoa just hit US$12,000 per ton, up from US$4,000 per ton in February of this year!!!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier. Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Done is better than perfect.”, Sheryl Sandberg

“Successful people keep moving. They make mistakes, but they don’t quit.”, Conrad Hilton

“Action is the foundational key to all success.”, Pablo Picasso

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #124:

The $115 Trillion World Economy in One Chart

Visualizing $102 Trillion of Global Debt in 2024

The World’s 20 Largest Economies, by GDP (PPP)

Why Dunkin’s Expansion Into China And India Was A Total Failure

How Poland became one of Europe’s biggest success stories

The Impeachment of South Korean President Yoon Suk-yeol and the International Business Implications

Brand Global News Section: Burger King®, Dominos¢, Dunkin® and Wingstop®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

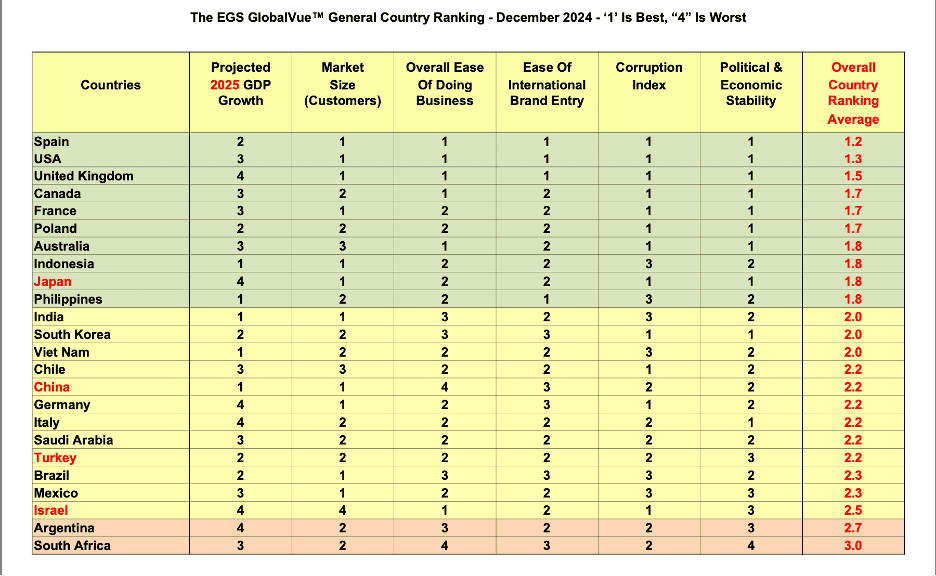

Interesting Data, Articles and Studies

GlobalVue™ December 2024 – This is the short version of the 40 country December ranking as places to do business in 2025. Since the September 2024 version, Japan has gone up the ranking while China, Isreal and Turkey fell down the chart. The 76 natiobnal elections in 2024 had consequences. Many countries will see changes in business taxation and regulations due to elections. Click on the chart to download the full 40 country version.

=======================================================================================

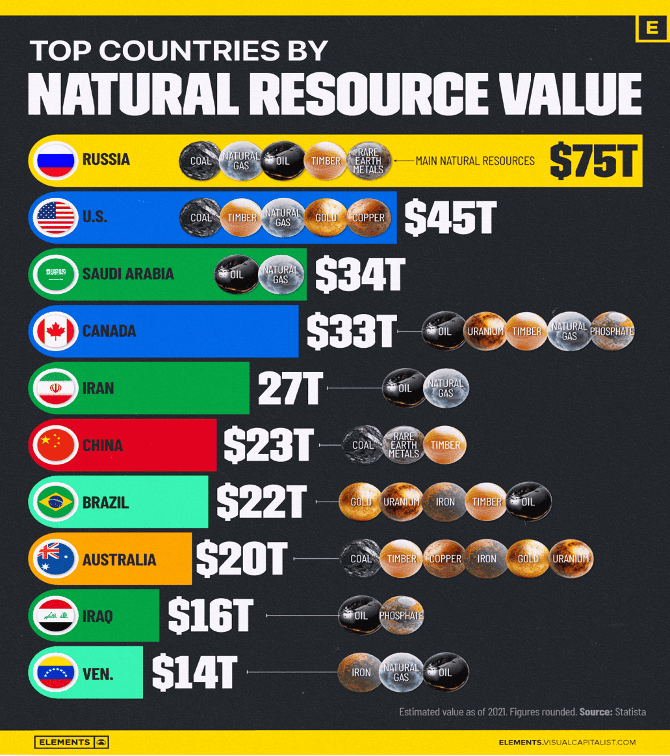

“Visualizing $102 Trillion of Global Debt in 2024 – In 2024, global public debt is forecast to reach $102 trillion, with the U.S. and China largely contributing to rising levels of debt. As the world’s largest economy, the U.S. debt pile continues to balloon, accounting for 34.6% of the world’s total government debt. Over the next five years, China’s debt to GDP ratio is projected to hit 111.1% of GDP, up from 90.1% in 2024. In Europe, the UK has amassed the most debt, about $3.65 trillion, equal to 101.8% of GDP. This is far higher than the regional average, standing at 77.4% of GDP in 2024. Europe has a lower debt to GDP than North America and the Asia-Pacific, but European budgets likely face increasing pressures looking ahead, due to sluggish economic growth, trade wars, and aging populations”, Visual Capitalist & the IMF, December 17, 2024

===========================================================================================

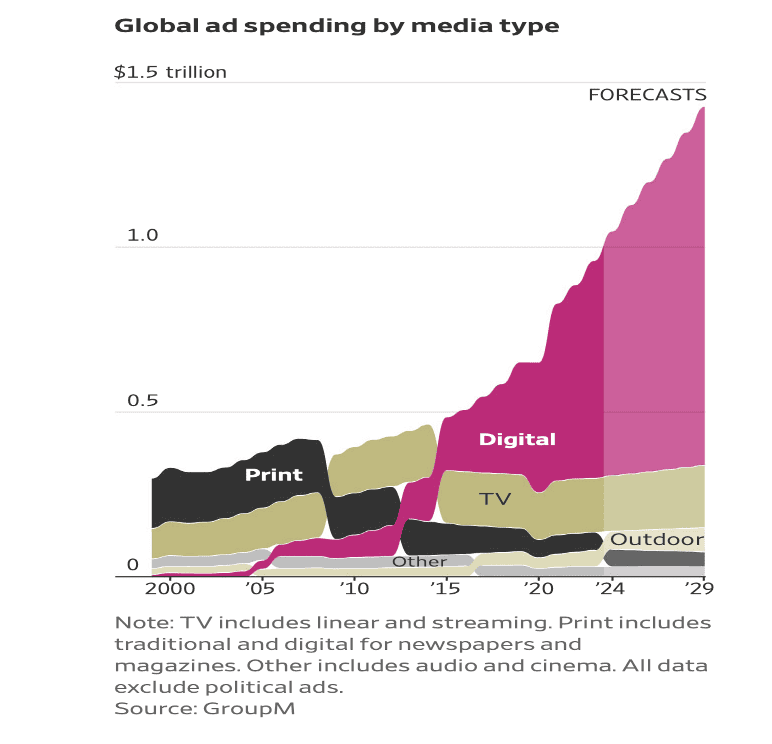

“Sorry, Mad Men. The Ad Revolution Is Here – Two advertisers are combining into a $30 billion behemoth to harness the data, tech and AI expertise now dominating Madison Avenue—and all the marketing you see. Tech giants control more than half of the $1 trillion ad market, and quants armed with reams of data direct ad buying. Now, generative artificial intelligence is sending shock waves through the marketing world, promising to create and personalize ads cheaper and faster than ever. Many industries talk about preparing for AI. With this blockbuster deal, the ad industry is trying to transform for it.”, The Wall Street Journal, December 13, 2024

=============================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“The global inflation battle is stalling and diverging – Trump’s agenda and domestic uncertainty shroud the rate-cutting cycle. The global battle against inflation is entering a new phase. After price pressures dropped steeply last year, central banks in advanced economies began slashing interest rates in earnest this summer. But pulling inflation back to its 2 per cent target, persistently, has proved difficult. As the year-end approaches, fresh inflationary threats are on the horizon, and the future path of interest rates is becoming more uncertain.”, The Financial Times, December 20, 2024

=============================================================================================

“Trump tariffs as confrontation, deterrence and art of the deal – Three possible futures for the global economy if Trump imposes new trade tariffs as threatened and vowed. The last time Donald Trump was US president, he entered trade wars with China and Europe. But despite his bravado and tariffs, the US trade deficit did not improve. In fact, it deteriorated from US$195 billion in the first quarter of 2017 to $260 billion in the same period of 2021. Scenario 1: Confrontation; Scenario 2: The art of the deal; and Scenario 3: Deterrence.”, Asia Times, December 23, 2024

=============================================================================================

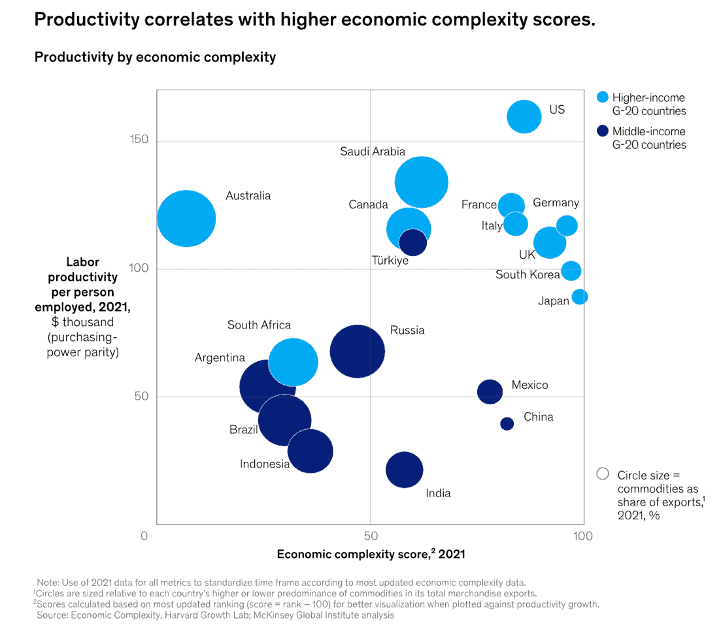

“The World’s 20 Largest Economies, by GDP (PPP) – Born during the 1970s oil crisis, the G7 emerged as a group of the world economy’s cool kids: large, mature, high-income economies dominating key global sectors.

Then, in the 2000s, BRICS showed up—a collection of countries mostly from the “Global South”— vying for influence with their steadily growing economic might, boosted by globalization. Now they’re positioned as competitors to the G7. Together, both groups are in the G20, the world’s 20 largest economies, which accounts for 70–85% of the world economy (depending if nominal or PPP-adjusted GDP is used). Despite its name, the G20 only has 19 members who are sovereign states. The EU and African Union are regional organizations that are also members of the group but are excluded from calculations in this article. This chart shows the value of each G20 member’s GDP in 2024, adjusted for purchasing power parity (PPP). Data is sourced from the International Monetary Fund as of October, 2024.

Editor’s Notes: This chart compares countries based on ‘Purchase Power Parity’ and not the standard nominal GDP that most publications use.

Nominal GDP Growth measures the total economic output of a country in current prices, without adjusting for cost-of-living differences between countries or inflation. Best for comparing economies over time in a single currency.

PPP GDP Growth adjusts for differences in the cost of goods and services between countries, reflecting what people can actually buy with their income. Best for comparing living standards or economic size across countries.

In short, Nominal GDP focuses on market exchange rates, while PPP GDP accounts for local purchasing power.

==================================================================================================

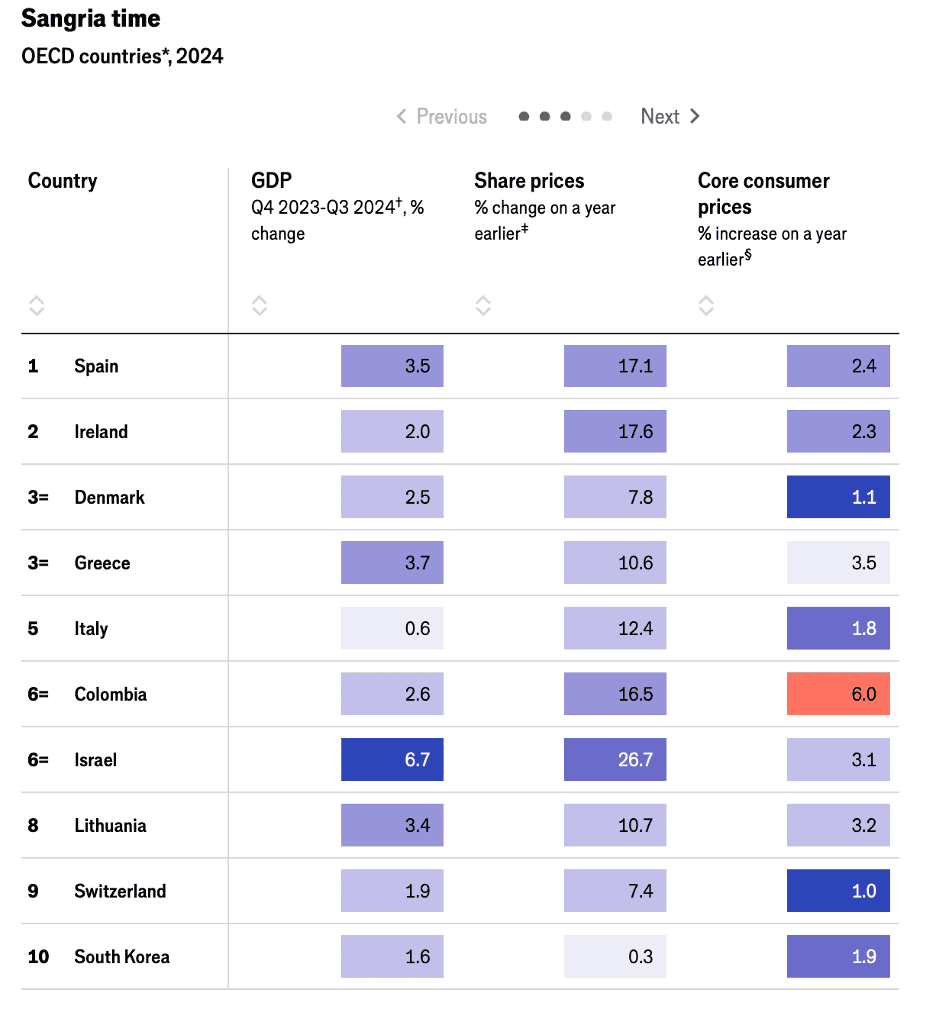

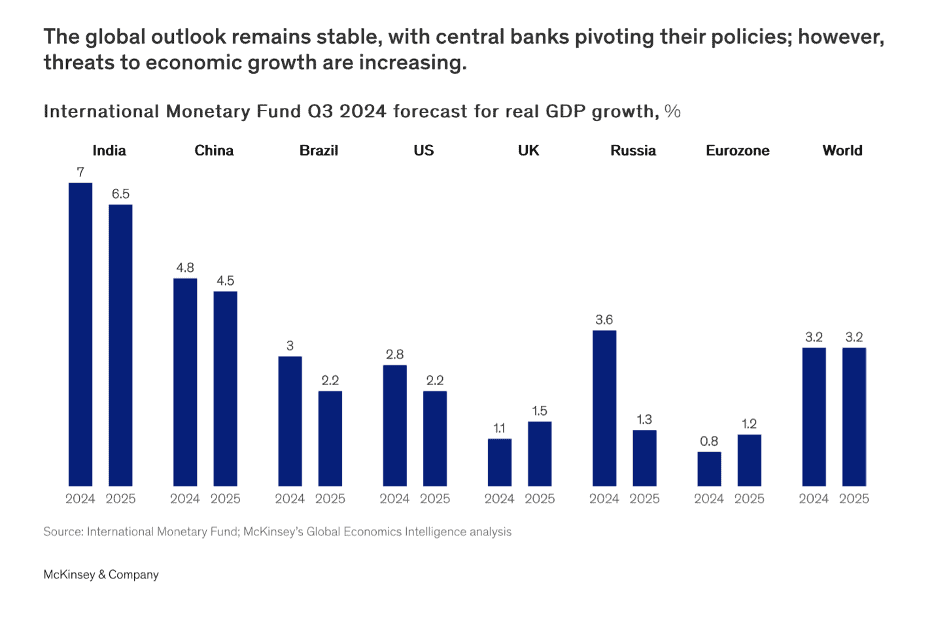

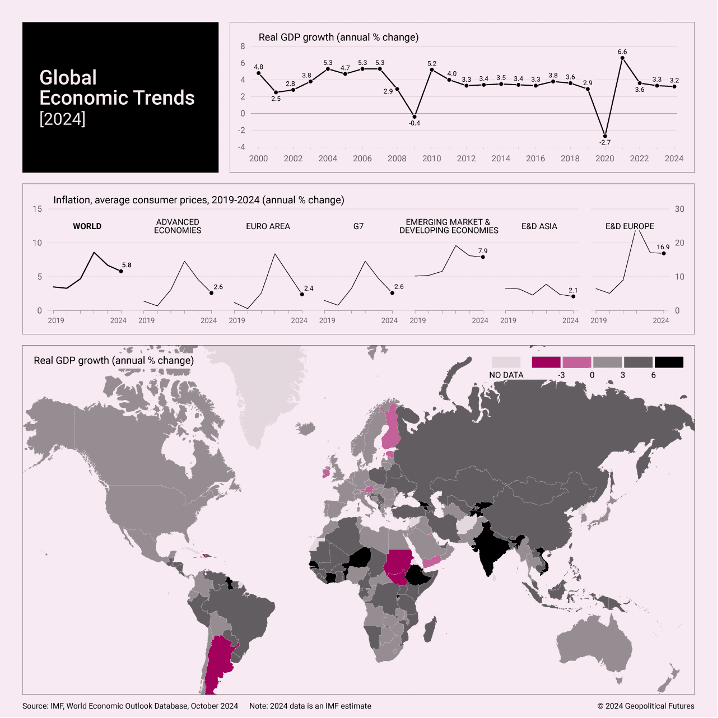

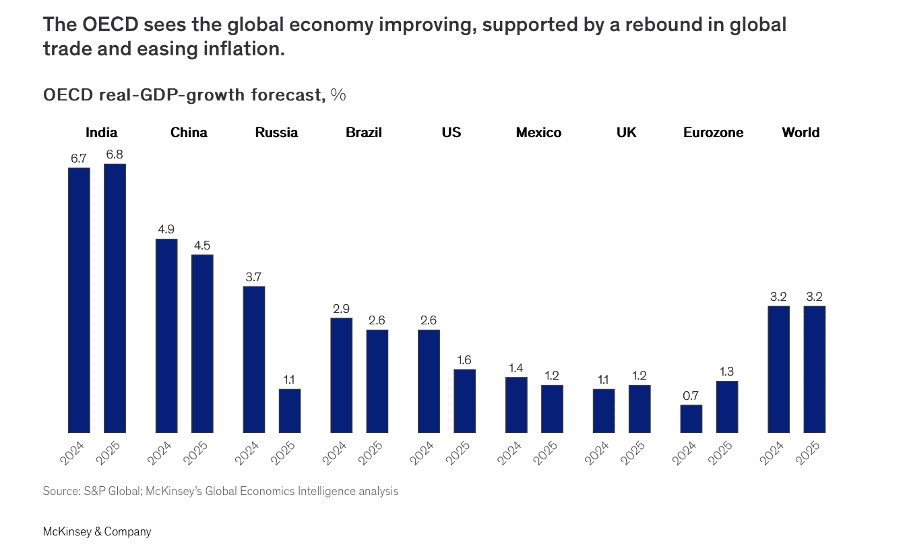

“Which economy did best in 2024? – The world economy delivered another strong performance in 2024; according to the IMF, global gdp will grow by 3.2%. Inflation has eased and employment growth remains solid. Stockmarkets have risen by more than 20% for a second consecutive year. Yet, as ever, the rosy global picture conceals wide variation between countries. To assess these differences, we have compiled data on five economic and financial indicators—gdp, stockmarket performance, core inflation, unemployment and government deficits—for 37 mostly rich countries. The Mediterranean’s rally rolls on for the third consecutive year, with Spain at the top of this year’s list. Greece and Italy, once emblematic of the euro zone’s woes, continue their recoveries. Ireland, which has attracted tech firms, and Denmark, home to Novo Nordisk of Ozempic fame, round out the top five.”, The Economist, December 10, 2024

=============================================================================================

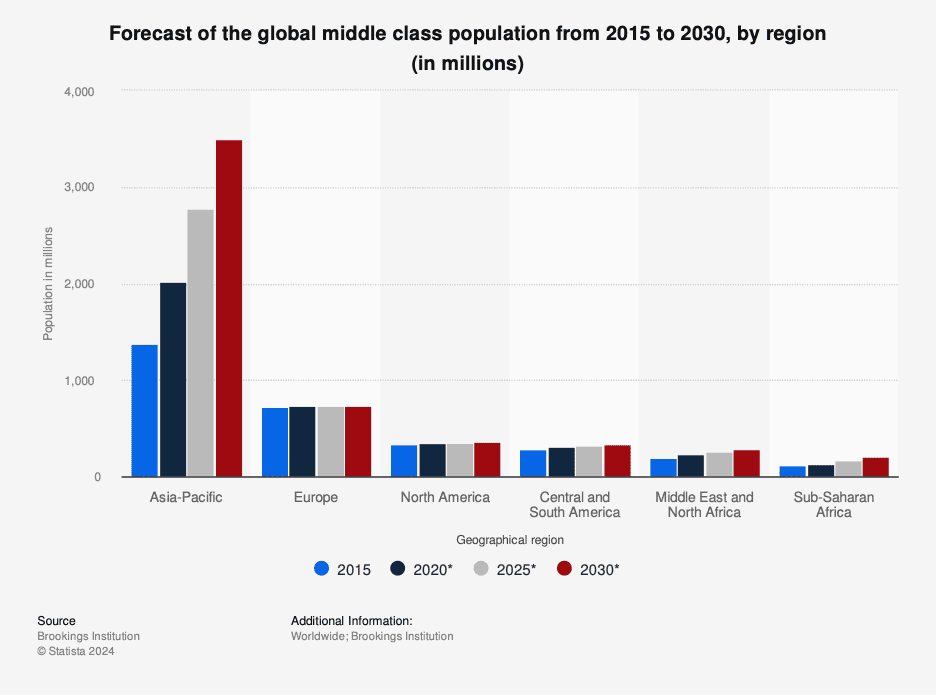

“The $115 Trillion World Economy in One Chart – There’s nothing quite like a big chart to really get into the data. In this edition we take a look at the massive $115 trillion world economy in 2025, along with how it breaks down per country. Data is sourced from the International Monetary Fund’s GDP estimates for 2025 (except for Pakistan). All figures are rounded and in nominal USD. Second-largest China ($19.5 trillion) will also hold its position, now on a 15-year streak. The top two together account for over two-fifths (43%) of the world’s $115 trillion GDP. Germany ($4.9 trillion) overtook Japan ($4.4 trillion) in 2024 as the third-largest economy. Meanwhile India ($4.3 trillion) passed the UK ($3.7 trillion) as 5th largest in 2020. All three countries are expected to retain their positions till 2026—when India is projected to first pass Japan for fourth, and then Germany for third place in 2028. Meanwhile, around the top 10 mark, Australia is predicted to overtake Spain for 13th place this year. And Brazil is expected to make the top eight by 2028.”, Visual Capitalist & IMF, December 19, 2024

==============================================================================================

“Cocoa Surges Past (US)$12,000 on Supply Concerns – Dry weather across West Africa could hurt harvest volumes in the coming months. Prices have more than doubled since the start of the year, as severe droughts resulted in poor harvests in Ghana and Ivory Coast—the world’s biggest producers of cocoa beans—reducing global supplies. Low stock levels have also left the market extremely sensitive.”, The Wall Street Journal, December 18, 2024, and Trading Economics (chart)

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“The 10 best airline upgrades that are worth the money — with flat bed seats and tons of legroom – Researchers evaluated 49 different international airlines, including Virgin Atlantic, Delta Airlines, and Qatar Airways. They included seat size and type, in-flight entertainment, food reviews, Wi-Fi availability, and overall Tripadvisor review scores. Singapore Airlines landed on top with an 87.46% overall score — that’s mostly due to its luxury business class seating that converts into flat beds with a 9.5-inch width, the experts explained. In second place was Iberia, which was able to earn a still-impressive 82.59% score. The airline’s business class cabin is the roomiest in the entire ranking, the number crunchers said, offering an average of 40 inches more than you get in economy. Delta Airlines came in third, with a ranking of 81.64% for overall experience. The airline was the only US-based and North American air carrier to crack the top ten. Qatar, Air New Zealand and Virgin Atlantic rounded out the top five, according to the publication.”, The New York Post, December 18, 2024

===============================================================================================

“What is the strongest passport in the world? According to the Henley Passport Index, Singapore currently holds the title of the world’s most powerful passport. If you’re a Singaporean passport holder, you can travel to 195 destinations out of 227 around the world visa-free.”, The Manual, December 18, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

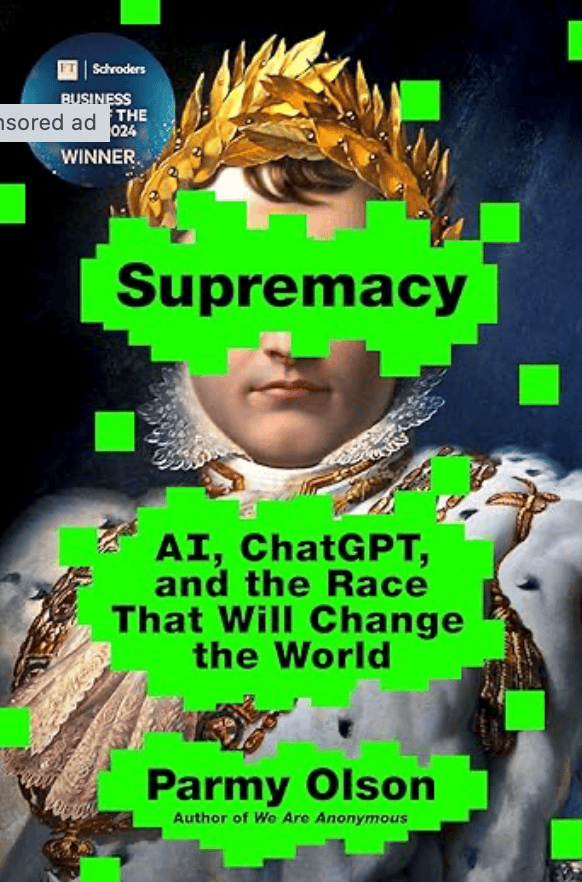

“Supremacy: AI, ChatGPT, and the Race that Will Change the World” – In Supremacy, Parmy Olson dives deep into the AI revolution, showcasing how artificial intelligence tools like ChatGPT are reshaping industries and altering the global power dynamic. The book highlights the fierce competition between tech giants and nations striving for dominance in the AI space. Olson explores how AI is revolutionizing sectors such as healthcare, education, and finance, enabling groundbreaking innovations while raising critical ethical questions about bias, privacy, and control.

The book doesn’t shy away from discussing the disruptive impact of AI on jobs, societal structures, and geopolitics. Olson presents a balanced narrative, celebrating AI’s potential to address global challenges like climate change and disease while cautioning against risks like misinformation and deepening inequality.

Through meticulous research and compelling storytelling, Olson paints a vivid picture of the new age of technological supremacy, where the race for AI dominance is as much about innovation as it is about power and survival.

Recognized as the Financial Times Business Book of the Year for 2024, Supremacy is an essential read for professionals, policymakers, and anyone looking to grasp the profound changes shaping our world. This is a call to stay informed and prepared in the face of unprecedented technological evolution.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Brazil

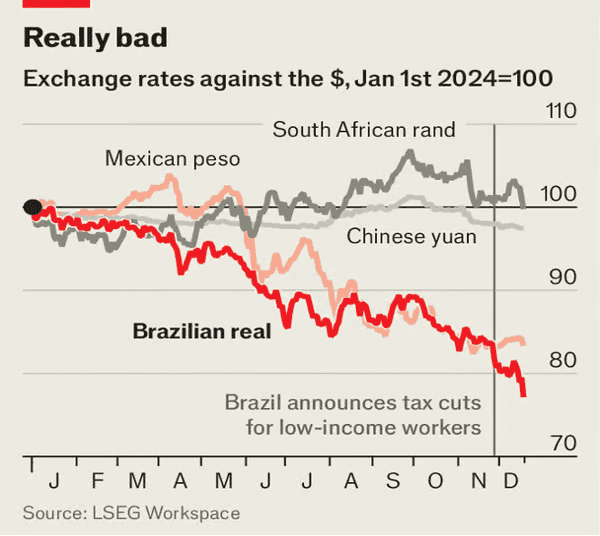

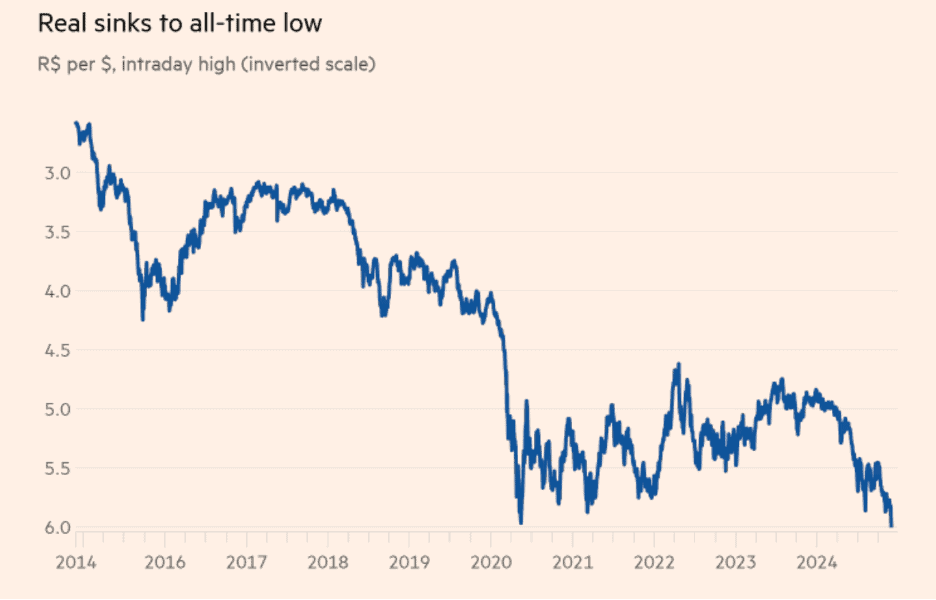

“Why Brazil’s currency is plunging – Fiscal and monetary policy are now pitted against one another. THE BRAZILIAN real holds an ignominious title this year: it is the worst-performing major currency, down by more than 20% to a record low of almost 6.3 to the dollar. The slump is fuelled by panic about fiscal plans. Given Brazil’s budget deficit of almost 10% of gdp and gross debt of nearly 90% of gdp, jitters are understandable. On December 17th the central bank sold over $3bn in currency reserves in a failed attempt to prop up the real. But monetary hawkishness is not cutting the mustard. Financial markets are clamouring for a fiscal u-turn, which the government is reluctant to offer.”, The London Economist, December 19, 2024

============================================================================================

China

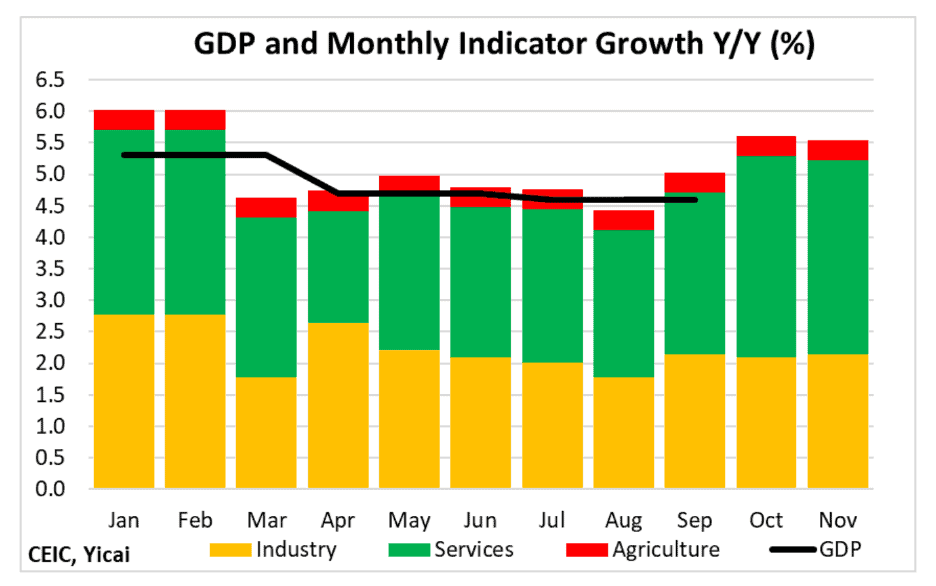

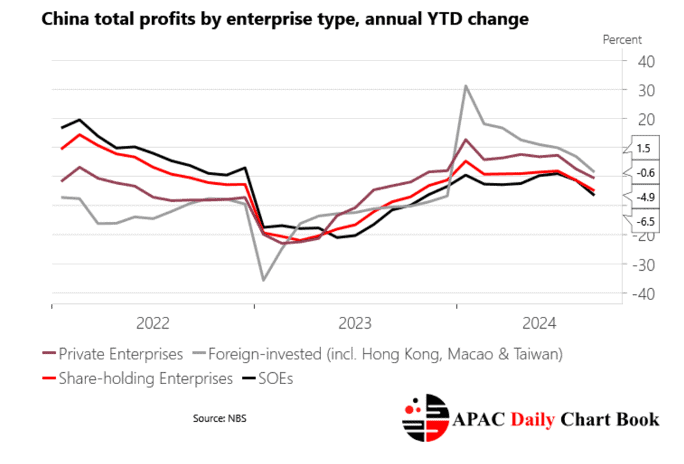

“Five Percent GDP Growth Within Sight – The November data released by the National Bureau of Statistics suggest that China’s economy rebounded significantly in the fourth quarter and it is on track to meet the 5 percent target set by the authorities. Our indicator suggests that economic activity grew more rapidly in October and November compared to the rates recorded in the third quarter (Figure 1). Most of this acceleration came from the service sector, which grew by 6.2 percent year-over-year in October-November, up from 4.8 percent in Q3. The growth of industrial value added also accelerated by a modest 0.4 percentage points.”, Yicai, December 23, 2024

==============================================================================================

“Starbucks hires its first-ever China chief growth officer as it battles fierce local competition – Starbucks is creating an entirely new position to fix its China problem. For years, the U.S. coffee chain enjoyed success as Chinese consumers, optimistic about China’s economic prospects, flocked to Western brands. But changing tastes and tighter budgets are now pushing China’s coffee drinkers to cheaper local alternatives. Starbucks’ new chief growth officer will have his work cut out for him. The U.S. coffee company’s China revenue is falling as local chains win over Chinese coffee drinkers. Starbucks faces fierce competition from newer coffee chains with larger footprints and more affordable drinks.”, Fortune, December 10, 2024. Compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

South Korea

The Impeachment of South Korean President Yoon Suk-yeol and the International Business Implications – The very timely article on this very important subject form those doing business in South Korea is by Don Southerton, THE go to person for knowledge of doing business in South Korea. From Don’s article on December 16, 2024

“The National Assembly (Parliament) has passed a motion to impeach President Yoon Suk-yeol for issuing a short-lived martial law on December 3rd. The motion suspends Yoon’s role as South Korea’s president. Prime Minister Han Deok-soo will step in as acting president to lead the nation until Yoon returns to office or until a new president is elected. The Constitutional Court has six months to review the impeachment motion. If the court upholds the motion, a new presidential election will be held within two months of the court’s decision. I assume he will be impeached, as most feel the reasons President Yoon’s grounds for martial law were political rather than his reason to “investigate election fraud manipulated by North Korea.”

=================================================================================================

New Zealand

“New Zealand’s Economy Expected to Recover Supported by Aggressive Rate Cuts – Increased deficit will lead to sovereign debt rising to NZ$192.8 billion by mid-2025. A midyear update of the budget forecasts the farm-rich economy to grow 0.5% for the fiscal year ending June 30, 2025, before accelerating to 3.3% in the next fiscal year. However, the stronger growth momentum won’t speedily patch up the government’s budget bottom line with a return to surplus not expected until 2029. The pace of the economic recovery will be limited by constrained supply capacity, with weakness in labor productivity expected to continue, the budget update said. With inflation well-contained the Reserve Bank of New Zealand has indicated that significant cuts to the official cash rate are likely next year, with another 50 basis points cut in February, bringing the total reduction in the official cash rate since August to 175 basis points.”, The Wall Street Journal, December 16, 2024

===============================================================================================

Poland

“How Poland became one of Europe’s biggest success stories – The country’s focus on productivity and EU membership have been key to growth that is the envy of bigger economies. he International Monetary Fund thinks that Polish GDP will expand by 3 per cent this year, by 3.5 per cent next year and 3.4 per cent in 2026. Many G7 finance ministers would view these rates with envy.Astoundingly, they are a slight slowdown from recent highs. Between 2004 and 2019, the Polish economy grew at an average annual rate of about 4 per cent, OECD stats show. Membership of another centralised body, the European Union, has aided Poland’s rapid economic development. After joining in 2004, the country immediately benefited from access to the single market, European labour, more public money, foreign direct investment flows and greater investor interest.”, The Times of London, December 17, 2024

============================================================================================

United Kingdom

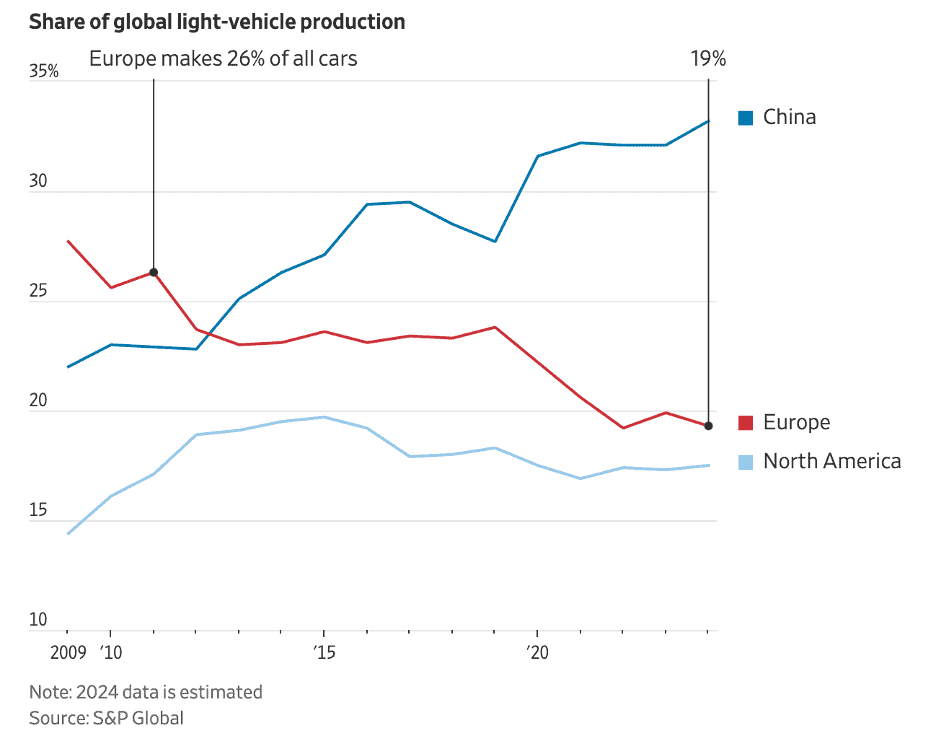

“British car production falls to lowest level since 1980 – Year-on-year output was down by nearly a third in November, with electric vehicles hit hardest amid weak consumer demand. The number of cars rolling off British production lines fell by almost a third in November to the lowest level for the month since 1980, amid industry upheaval and weak consumer demand. A total of 64,216 units were manufactured in the month, down 27,711 on November 2023, in the ninth consecutive month of decline, according to the Society of Motor Manufacturers and Traders (SMMT). Of those, just under a third (19,165) were battery electric or hybrid vehicles, representing a 45.5 per cent fall year-on-year. Overall it was the worst performance for the month since November 1980, when 62,728 units were produced….”, The Times of London, December 10, 2024

===============================================================================================

“Budget has caused economy to stagnate, Bank of England says – Andrew Bailey, governor of the Bank, said that there would be a gradual approach to cutting interest rates because of concerns over the impact of tax rises and a higher minimum wage. A survey of businesses by the Bank of England suggested that companies were responding to the £25 billion national insurance tax raid by increasing prices and cutting jobs.”, The Times of London, December 10, 2024

================================================================================================

United States

“Burger chain named as America’s most expensive fast-food restaurant: ‘Overpriced’ – Customers have complained of price increases at fast-food chains amid inflation. The study conducted by Preply said Shake Shack was ranked the most overpriced restaurant for chains, followed by Five Guys and the Sugar Factory. To make their determinations, researchers analyzed the language of 57,245 reviews for over 10,000 restaurants in 50 cities across the country. To determine the scores for being overpriced, the authors looked for keywords — such as “pricey” or “rip-off” — in restaurant reviews in each city and analyzed how frequently they were used by patrons. The study comes as many restaurants and fast-food chains have hiked prices. In May, McDonald’s USA President Joe Erlinger defended the hikes, refuting reports that the increases were significant.”, Fox Business, December 18, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Why Dunkin’s Expansion Into China And India Was A Total Failure – When Dunkin’ brought its signature pink-and-orange branding overseas to China and India, the company found that the average consumer didn’t quite resonate with donuts for breakfast. To counteract this, Dunkin’ implemented some small menu changes to help regionalize its menu to the unique tastes and palates of these nations. In 1994, Dunkin’ (then known as Dunkin’ Donuts), attempted to break into the Chinese market. While the company had great aspirations for success, the brand wasn’t strong enough in China to get consumers into its cafés as it expected. 1n 2012, Dunkin’ chose to provide exclusivity in its Indian franchising to Jubilant FoodWorks Ltd., a food service company with over 3,000 restaurants across six global markets. Since 1996, Jubilant FoodWorks has been responsible for the highly successful Indian expansion of Domino’s Pizza, which saw its 2,000th store opening in June 2024. But unlike Domino’s, Dunkin’ struggled to connect with the average Indian consumer. For one, the American-style, on-the-go breakfast isn’t the norm in the country….Dunkin’s signature item — the donut — isn’t regarded as a breakfast food in India, but rather a sweet pastry that’s consumed as a dessert from time to time on special occasions.”, Tasting Table, December 22, 2024

===============================================================================================

“Fried chicken trio in line for fortune after selling much-loved chain for a whopping £400MILLION to US firm – after winging it and starting restaurant from scratch six years ago – Three entrepreneurs who started a fried chicken franchise have sold their business for a whopping £400million. In one of the biggest take-overs deals for a restaurant brand in Britain, the UK arm of Wingstop will be acquired by California-based private equity firm Sixth Street. The restaurant was started from scratch in 2018 by Tom Grogan, Herman Sahota, and Saul Lewin who opened the first Wingstop in central London. The company now boasts 57 sites and employs 2,500 staff, The Times reports.”, The Daily Mail, December 22, 2024

=================================================================================================

“Bain Capital in talks to acquire mega-franchisee Sizzling Platter, report says – The Utah-based franchise group operates more than 750 restaurants across eight brands, including Little Caesars, Wingstop, Dunkin’ and more. The mega-franchisee is owned by CapitalSpring, which has been working with investment bankers at UBS and Deutsche Bank on a sale process for several months, according to the report. Bain Capital acquired the casual-dining chain Fogo de Chao last year, and was reportedly in talks to acquire Subway at one point, but the sandwich chain was sold in the end to Roark Capital for nearly $10 billion.”, Restaurant Business Online, December 10, 2024

===============================================================================================

“UK’s Domino’s Pizza eyes digital growth with new franchise deal – The UK’s Domino’s Pizza Group (DPG) (DOM.L) has reached a new five-year agreement with its franchise partners, it said on Monday, as the fast-food chain looks to expand its store network and increase investment in its digital platform. The new Profitability and Growth Framework, which the company said had the “unanimous support” of its franchise partners, allows for shared investment in marketing and technology, and provides incentives for new store openings. The London-listed pizza chain, which operates under the umbrella of U.S.-based Domino’s Pizza (DPZ.N) in the UK and Ireland, is targeting 2 billion pounds ($2.55 billion) of sales by 2028 from more than 1,600 stores, around 200 more than currently.”, Reuters, December 9, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

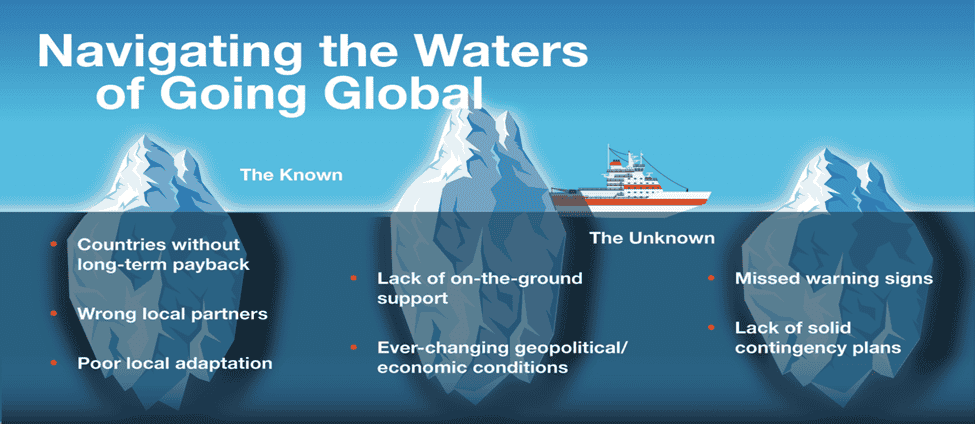

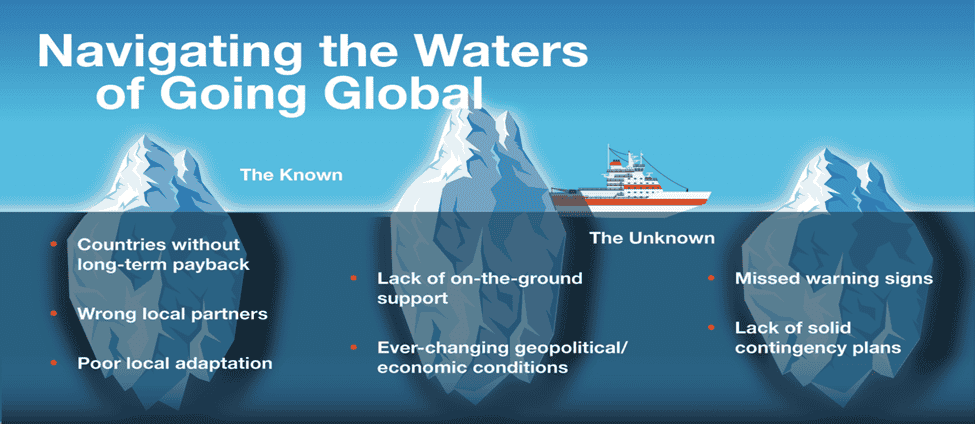

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 123, Tuesday, December 10 , 2024

Global trade to hit record $33tn in 2024, uncertainty looms for 2025

Commentary about the 123th Issue: As the year winds down, predictions for 2025 are rolling in, and the outlook for global business is anything but dull. In this edition of my biweekly newsletter, I’m sharing stats, charts, and insights from trusted sources to help you prepare for what’s ahead.

Global trade is set to hit a record $33 trillion in 2024, but uncertainty looms large for 2025. Why? Here’s a glimpse: 71 countries—representing nearly half the world’s population and over half of global GDP— held elections in 2024. Talk about “elections have consequences” on a global scale. The ripple effects will reshape how and where we do business in 2025.

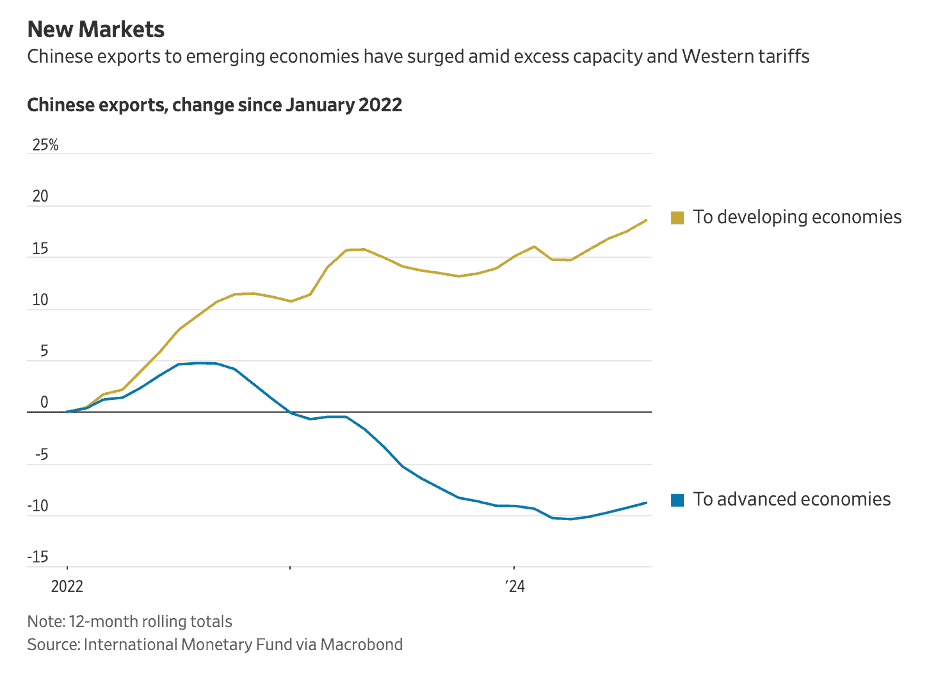

Add to this the impact of upcoming tariffs and China’s aggressive export of excess manufactured goods, and 2025 starts to look like a year of both challenges and opportunities. The need for careful planning and flexibility has never been greater.

And the Chinese government has finally announced new stimulus to try to bring back consumer spending…………

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier. Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“In the middle of every difficulty lies opportunity.” – Albert Einstein

“The world is a book, and those who do not travel read only one page.” – Saint Augustine

“Alone we can do so little; together we can do so much.” – Helen Keller

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #122:

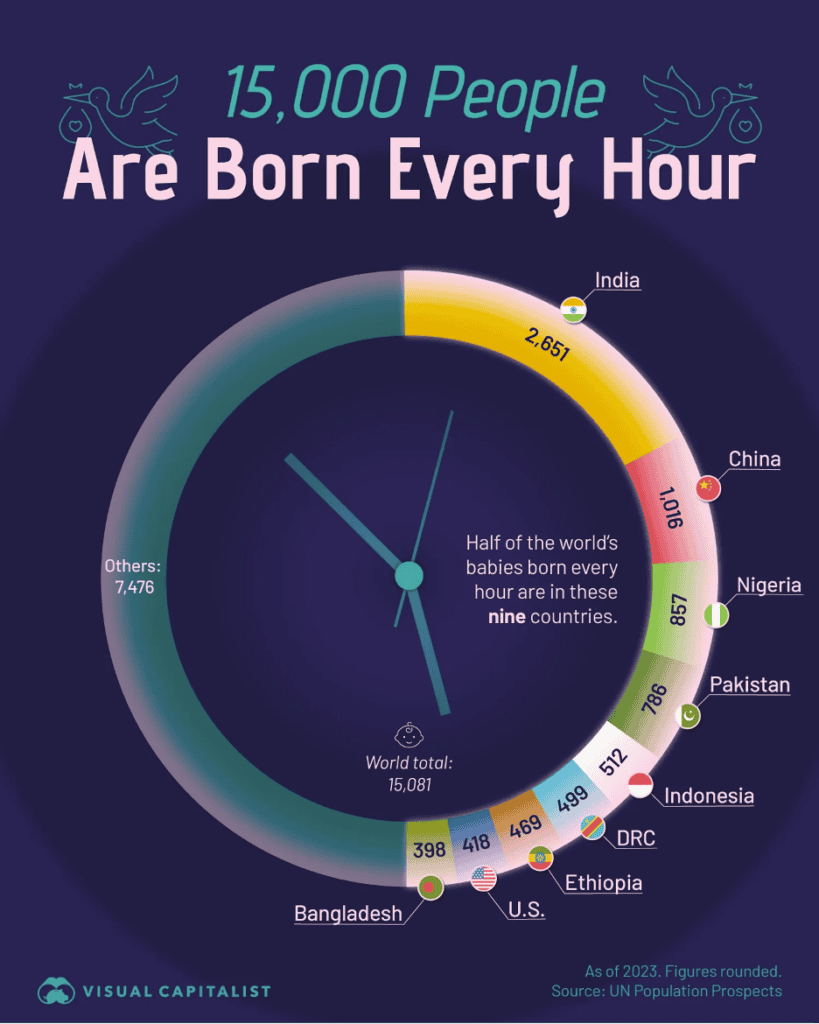

Here’s Where The Most Babies Are Born Every Hour

The World’s Biggest Importers of Goods

Global trade to hit record $33tn in 2024, but uncertainty looms for 2025

China eases monetary policy for the first time in 14 years

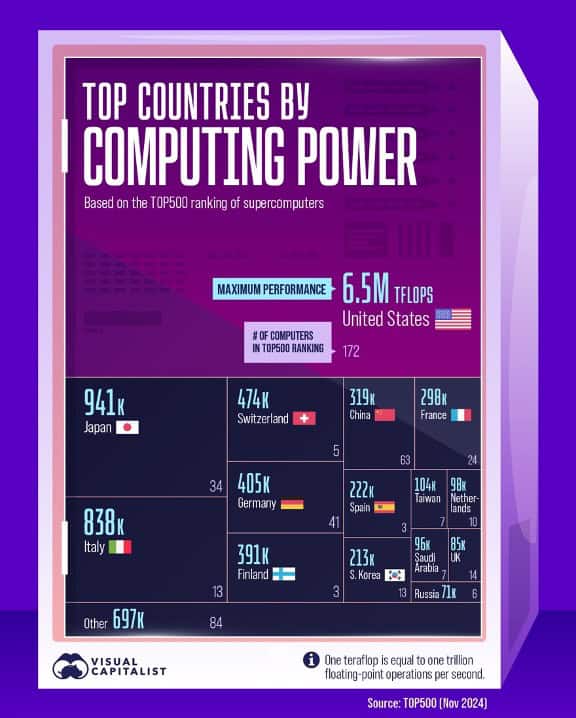

Top Countries by Computing Power

Revolution Time: AI is Transforming the Franchising Industry

Brand Global News Section: Jolibee® and McDonalds®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Top Countries by Computing Power – As of November 2024, the United States has the most systems in the TOP500 ranking, at 172. It also has the highest combined value of maximum achievable performance, at 6.5 million TFlops (Teraflops). After the U.S., other top countries by computing power include Japan, Italy, and Switzerland. Today, China is ranked seventh, with only 63 systems making it into the TOP500—but this ranking is most likely being skewed downwards. Many believe that China is withholding details about its newest supercomputers for geopolitical reasons.”, Visual Capitalist & TOP500, December 1, 2024

============================================================================================

“Global trade to hit record $33tn in 2024, but uncertainty looms for 2025 – Outlook remains uncertain due to risks of expanded trade wars, US policy shifts and geopolitical challenges. The trade value will increase by about $1 trillion this year, reflecting 3.3 per cent annual growth, the UN Trade and Development (Unctad) said in its new Global Trade Update report on Thursday. However, the outlook for next year remains uncertain due to risks of expanded trade wars and geopolitical challenges, prompting calls for strategic action from developing economies. It is clouded by potential US policy shifts, including broader tariffs that could disrupt global value chains and affect trading partners, the report said.”, The National, December 5, 2024

===============================================================================================

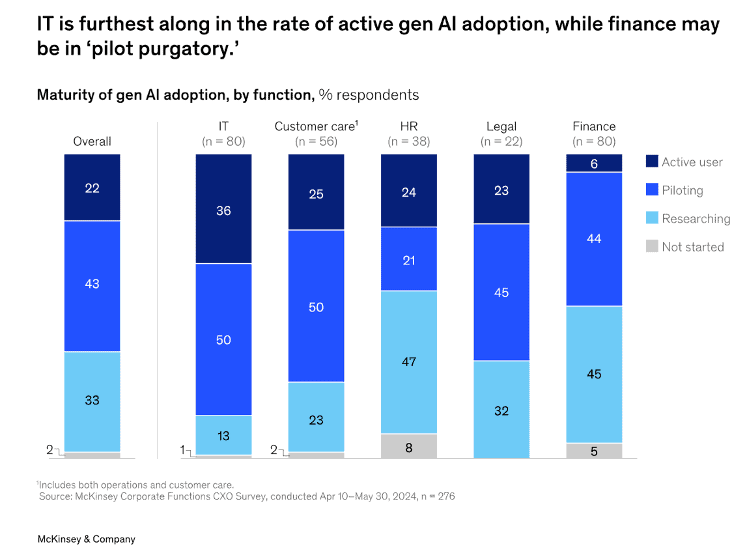

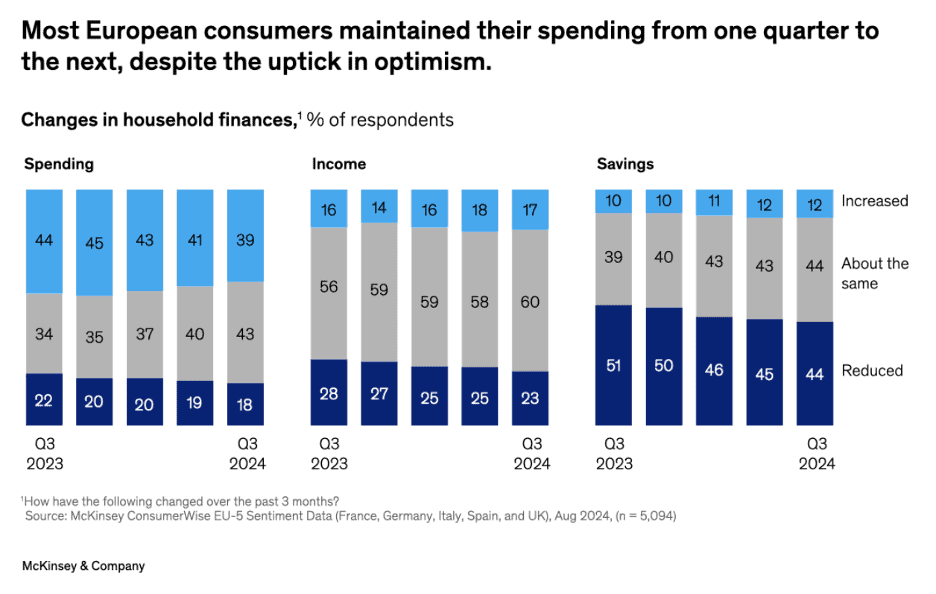

“(McKinsey & Co.) Global Economics Intelligence executive summary – Third-quarter GDP reports reveal a mixed global economy. China faces an economic slowdown; the United States sees growth; and the eurozone is stable. The IMF forecasts a slow but stable global trajectory into 2025. Unsurprisingly, forecasts for 2024 and 2025 see emerging markets and developing economies growing fastest at 4.2% across both years, while the advanced economies collectively are expected to grow 1.8% annually.”, McKinsey & Co., November 22, 2024

===========================================================================================

“Here’s Where The Most Babies Are Born Every Hour – Half of all global births each hour happen in just nine countries, with one in four taking place in India or China. Five of the nine are in Asia and another three in Africa, with the U.S. the only representative from the rest of the world. However, birth rates are falling across the globe. Combined with low immigration and steady death rates, population declines are expected soon for countries like China.”, Visual Capitalist & UN Population Prospects, December 6, 2024

=============================================================================================

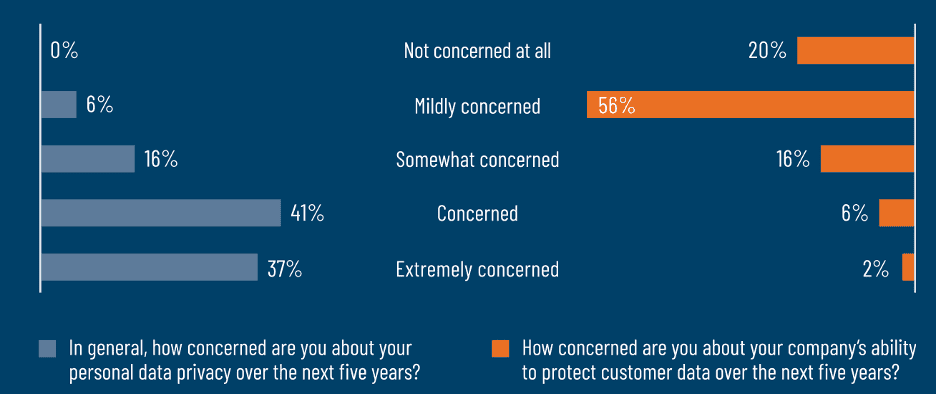

“Protiviti-Oxford survey shows ‘us vs. them’ disconnect in how global execs view data privacy – 86% of executives say they are confident or extremely confident their company is doing everything it possibly can to protect customer data. Only 8% of global executives say they are concerned or extremely concerned about their company’s ability to protect customer and client data over the next five years. 80% of global business leaders say AI will be beneficial for their company’s data privacy and cybersecurity strategies over the next five years. Only 5% said AI would be harmful to those efforts.”, Protiviti-Oxford survey Executive Outlook on the Future of Privacy, 2030.

===============================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

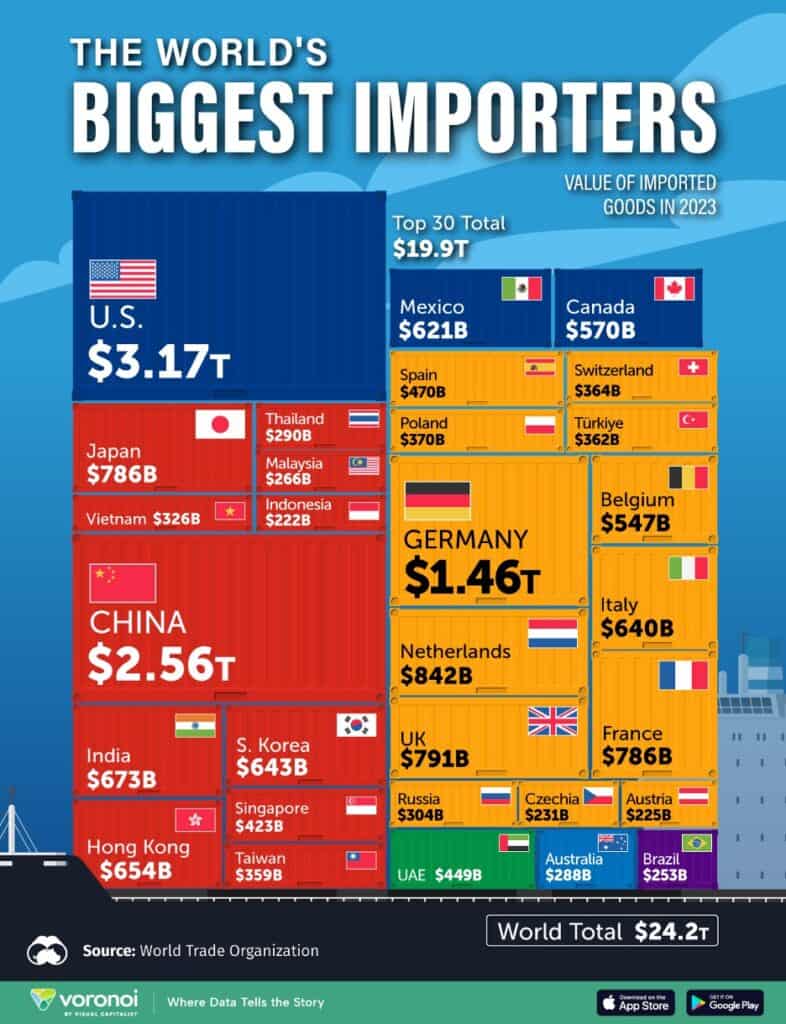

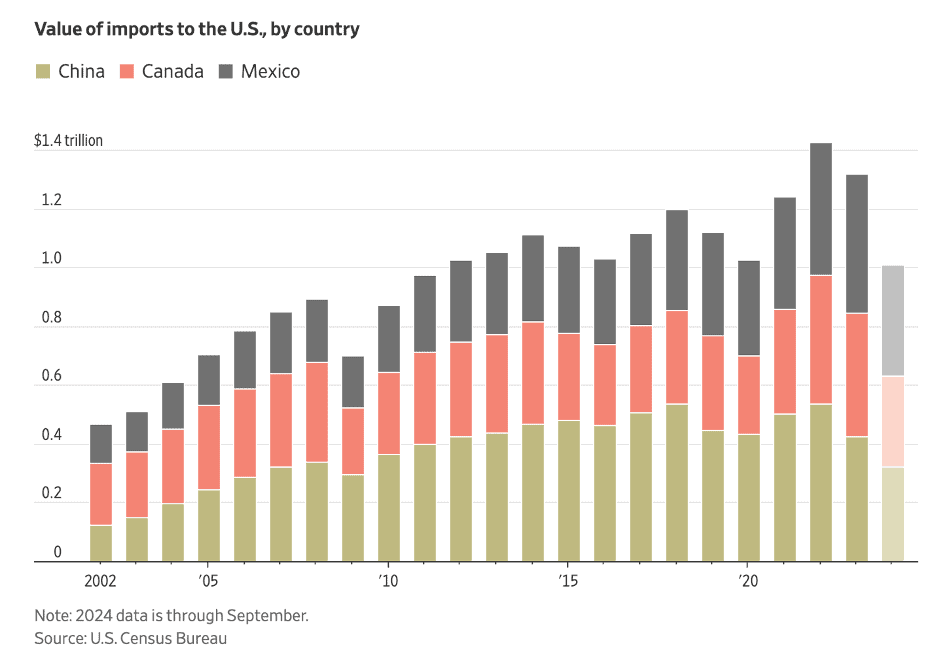

“The World’s Biggest Importers of Goods – Today, 10 countries account for imports worth $12.4 trillion, representing more than half of the global total. From the U.S. to India, the world’s leading importers are characterized by robust economies and sizable consumer markets. Factors such as business investment, disposable income, and exchange rates also play a significant role in shaping import dynamics. Due to its large consumer base and advanced economy, the U.S. is the world’s largest importer of many product categories including cars, electronics, industrial machinery, and pharmaceuticals.”, Visual Capitalist & The World Trade Organization, November 27, 2024

=================================================================================================

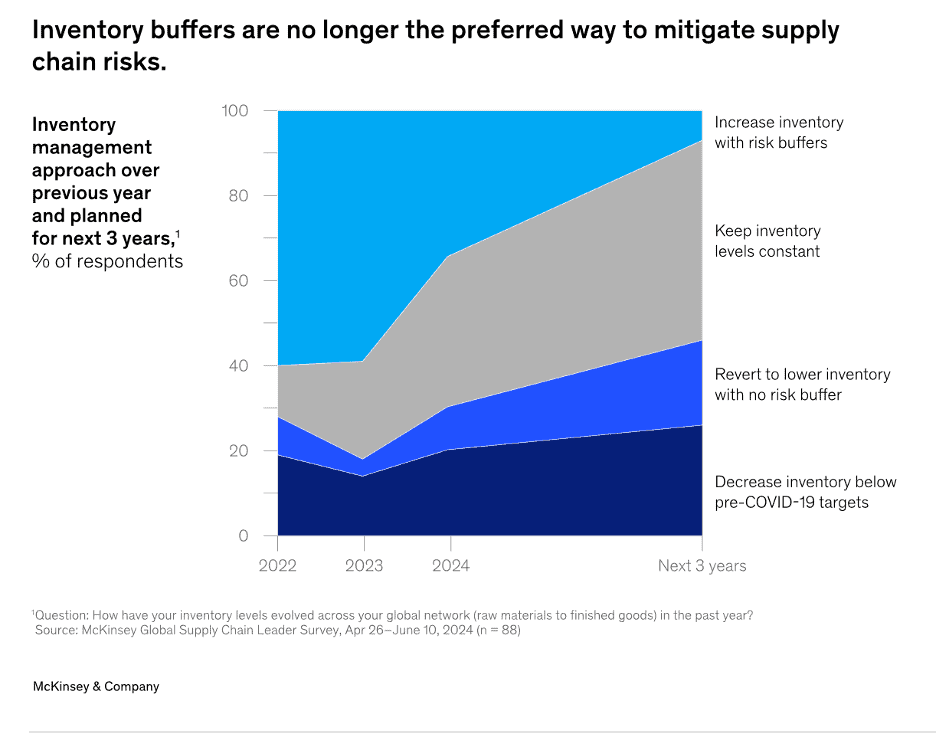

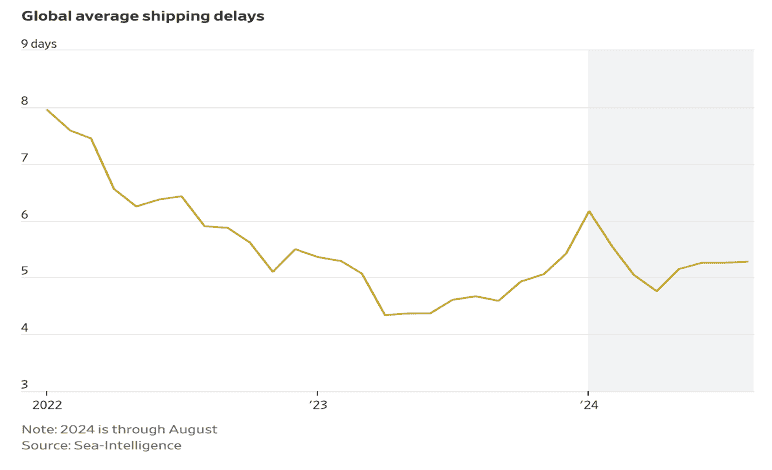

“Supply chain inventory inertia – 2020 marked a year of unparalleled supply chain chaos largely due to the COVID-19 pandemic. However, disruptions still persist and, worryingly, many companies seem to be easing their focus on supply chain resilience… in the latest McKinsey Global Supply Chain Leader Survey, while 47 percent of respondents plan to maintain current inventory levels, 46 percent anticipate decreasing or nixing risk buffers, with inventories dropping to or below prepandemic levels. Only 7 percent intend to up network inventory.”, McKinsey & Co., December 3, 2024

==================================================================================================

“Why Europe’s Vaunted Car Industry Is in Crisis, in Charts – New tariffs under Donald Trump would pose yet another challenge for Volkswagen, Mercedes-Benz and BMW. Europe’s carmakers used to rule the world. Now they are fighting battles on every front. At home, tougher emissions rules are forcing them to sell more electric vehicles, which are less profitable. In China, the rise of local competition is bringing the curtain down on a golden era for German brands. The latest threat is in the U.S., where President-elect Donald Trump champions tariffs. The turmoil is already leading to thousands of job losses and risks inflicting further damage on Europe’s economy, which has struggled to grow as fast as the U.S. in recent years. The automotive industry accounts for roughly 7% of gross domestic product in the European Union—far higher than stateside.”, The Wall Street Journal, December 3, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“Want to know what will shape travel in 2025? Amadeus thinks it knows – The new year will bring in a new era of travel, defined by nostalgia, personalization and the rise of destination hotels. And with Asia’s tourism sector experiencing a remarkable boom, travelers are increasingly drawn to authentic experiences that foster spontaneous connections, a new survey has revealed. According to the Travel Trends 2025 study by Amadeus and forecasting agency Globetrender, five key trends will shape the travel landscape in 2025.”, Hotels Magazine, November 29, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

The Art of Uncertainty: How to Navigate Chance, Ignorance, Risk, and Luck” by David Spiegelhalter delves into the pervasive role of uncertainty in everyday life and how individuals and societies can better understand and manage it.

The book begins by acknowledging that uncertainty is an unavoidable aspect of life, from personal decisions to global challenges like climate change and pandemics. Spiegelhalter argues that instead of fearing uncertainty, we should embrace it as an opportunity to apply critical thinking and probabilistic reasoning.

Spiegelhalter explores real-world examples, such as medical diagnoses, weather forecasting, and financial market predictions, to demonstrate how misinterpreting probabilities can lead to flawed decisions. He critiques the over-reliance on statistical models, highlighting their limitations, especially in complex systems

In the end, Spiegelhalter encourages readers to adopt a mindset that blends logic and flexibility. By understanding the principles of probability and the limitations of certainty, we can navigate life’s uncertainties more confidently and make better-informed decisions. This book serves as both a philosophical exploration and a practical guide to thriving in a world where chance and risk are ever-present.

Editor’s Note: This book is now available in the United Kingdom amd will be available in the USA in March 2025.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

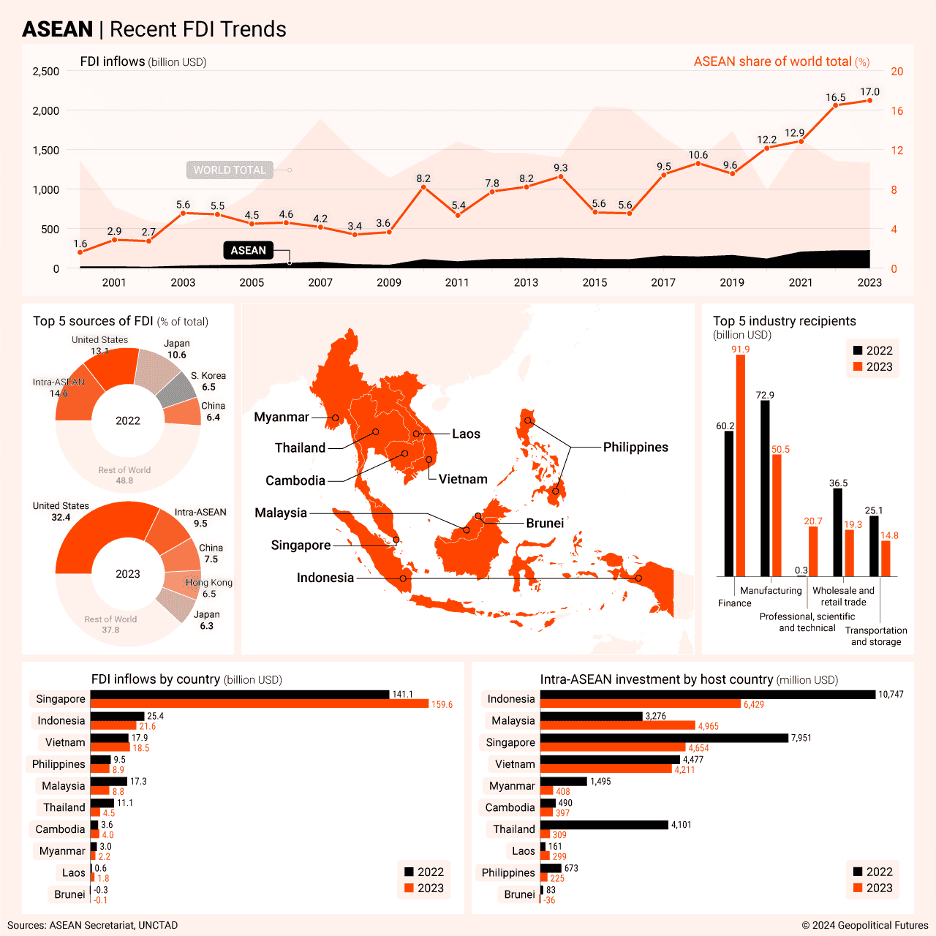

Asean Countries – Association of Southeast Asian Nations

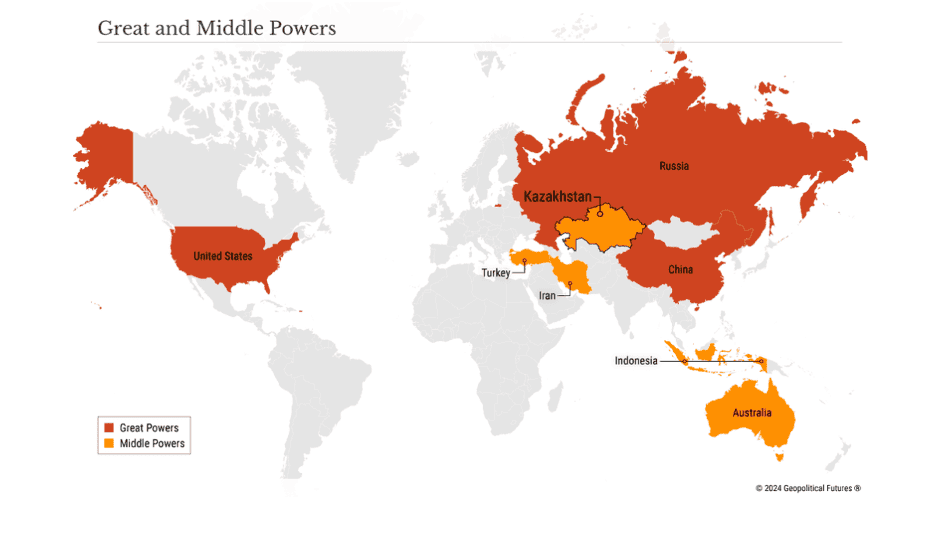

“ASEAN: Beneficiaries of Global Trade’s Realignment – More than a sixth of all foreign direct investment in 2023 flowed into the Southeast Asian bloc. Amid global uncertainties, companies diversifying supply chains away from China have driven a surge in foreign direct investment into the countries that make up the Association of Southeast Asian Nations (ASEAN). In 2023, FDI inflows to the region reached $236 billion, up sharply from the annual average of $190 billion from 2020 to 2022. ASEAN’s share of global FDI rose to 17 percent in 2023, compared to an average of just 6 percent from 2006 to 2015.”, Geopolitical Futures, December 5, 2024

==============================================================================================

Brazil

“Brazilian real hits all-time low on worries over public finances – Brazil’s currency hit an all-time low against the US dollar after government pledges of R$70bn (US$12bn) in cost savings failed to quell investor anxiety over the state of public finances in Latin America’s largest economy. The real fell more than 0.9 per cent to touch R$5.99 to the greenback on Thursday morning, before recovering some of its losses, as investors digested long-awaited measures from the administration of President Luiz Inácio Lula da Silva designed to balance the budget.”, The Financial Times, November 28, 2024

==============================================================================================

China

“GM to Take More Than $5 Billion in Charges on China Operations – U.S. auto giant General Motors Co. expects to take more than $5 billion in charges on its China joint venture with SAIC Motor Corp. Ltd. The two charges are related to a restructuring of the JV — including plant closures — and its reduced value. GM’s China business, once a major profit driver, is now taking on losses, underscoring foreign carmakers’ struggle to compete with domestic rivals in the world’s largest auto market.”, Caixin Global, December 5, 2024

==========================================================================================

“China eases monetary policy for the first time in 14 years – China’s top officials have announced that the country would pursue a “moderately loose” monetary policy stance after new data revealed that deflationary forces continued to affect the world’s second-largest economy. The shift to a more accommodative monetary policy stance from a “prudent” approach was the first change in 14 years. It comes as leaders prepare to convene their annual meeting, known as the Central Economic Work Conference, this month to set out their economic agenda for the year ahead. Officials said the country would ‘implement more proactive fiscal policies’ to revive slowing economic growth.”, The Times of London, December 9, 2024

===============================================================================================

“China’s Flood of Cheap Goods Is Angering Its Allies, Too – Torrent of exports to the developing world is causing factories to close and killing jobs. A deluge of cheap Chinese goods washing over the developing world is jacking up tensions between China and the Global South, complicating Beijing’s plans to build alliances as it confronts escalating trade tensions with the U.S. But many of those countries are pushing back, as cut-price Chinese imports put pressure on their factories, killing jobs and blocking efforts to grow manufacturing at home.”, The Wall Street Journal, December 3, 2024

===============================================================================================

Turkey

“Turkey’s Economy Tumbles Into Recession as Central Bank Tightening Takes Effect – The GDP shrinkage comes after months in which Turkey’s central bank has kept its key interest rate at 50%. Turkey’s economy sank into a recession over the summer, with economic activity squeezed by high interest rates as the country’s central bank sought to tame inflation. Gross domestic product shrank by 0.2% on a quarterly basis between July and September, according to data from the Turkish statistical agency on Friday, matching the contraction of the prior quarter, which had been revised downward. A recession is typically defined as two consecutive quarters of declining economic output.”, The Wall Street Journal, November 29, 2024

============================================================================================

United Arab Emirates

“Heineken to open first brewery in Dubai – Dutch giant signs joint-venture deal that will start producing brands such as Amstel and Birra Moretti in 2027. Its hotels, beaches and attractions, such as the world’s tallest tower, the Burj Khalifa, attracted some 17 million people last year, many from Europe, Russia and India. Known as the party capital of the Gulf because of its beach clubs and more liberal attitude compared with “dry” neighbours such as Saudi Arabia and Kuwait, it has been implementing secularising reforms to attract more tourists. These include liberalising laws governing alcohol consumption and changing the working week to align with the West.”, The Times of London, November 28, 2024

================================================================================================

United States

Oil, Raspberries, Smartphones: What the U.S. Imports From Canada, Mexico and China – Trump administration could change America’s relationship with its three biggest trading partners. Avocados. Tequila. Laptops. Lumber. These are some of the common items America buys from Canada, Mexico and China. There are also other, perhaps less expected items: America purchases a lot of frozen french fries from Canada. If Donald Trump carries through on his new tariff threats, consumers could see prices rise on lots of basic items for their everyday lives. The cost of home construction might go up, as the U.S. buys billions of dollars of lumber from Canada that is used for such things as framing, flooring and building-interior details including cabinets and furniture.”, The Wall Street Journal, November 28, 2024

==============================================================================================

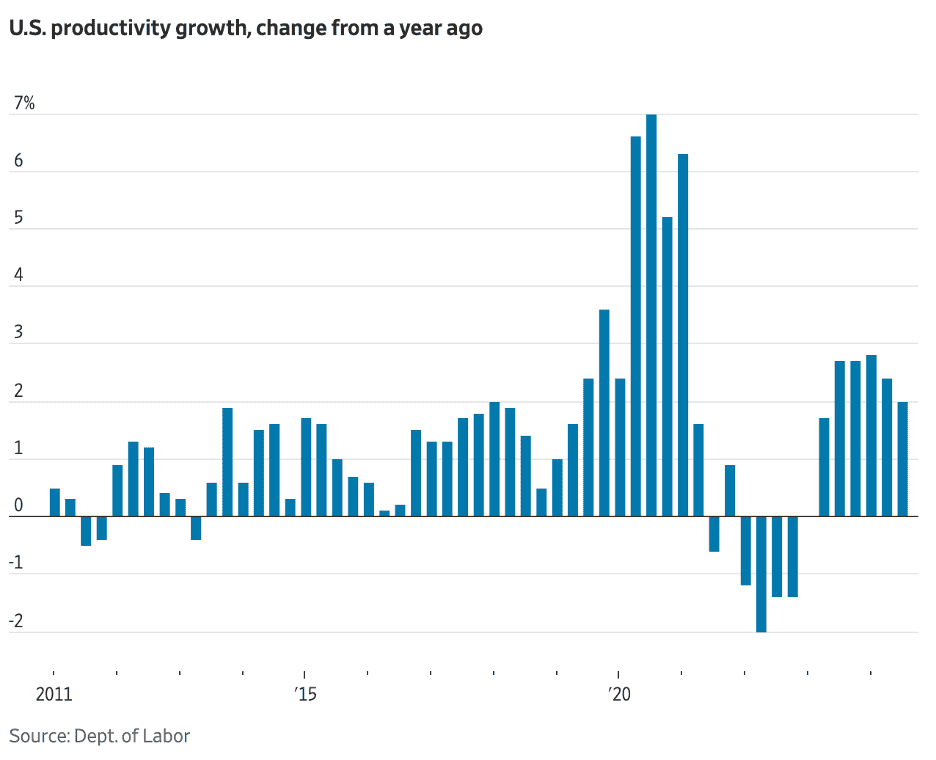

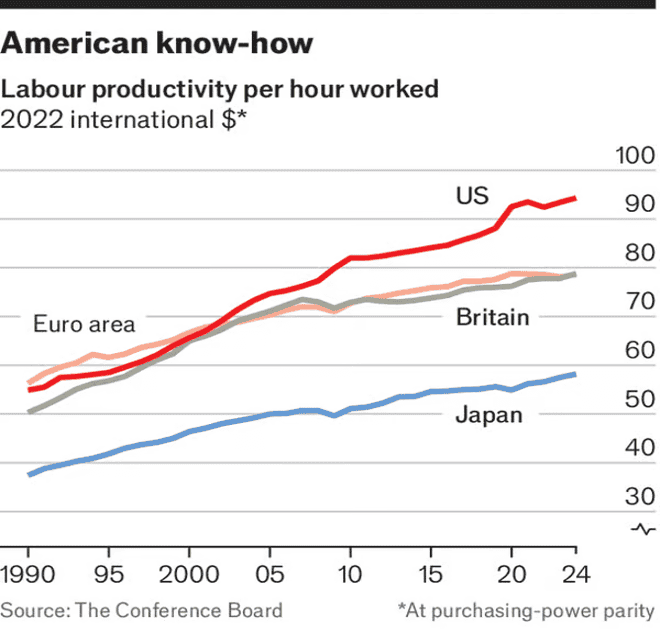

“U.S. Economy Is Doing What Few Others Are: Getting More Productive – Many businesses have been able to do more with less and increase their revenue without passing on higher costs to customers. Inflation and the labor market are both cooling, but a subtle force has powered strong U.S. economic growth nonetheless. Americans keep finding ways to get more done at work. As a result, many businesses have been able to do more with less and up their revenue without passing on higher costs to customers… Over the past five years, quarterly year-over-year productivity growth has averaged 2.1%, a sharp improvement from growth over the 10 years prior. In Europe, productivity has grown by less than a 1% compounded annual rate since 2015. In Canada, annual productivity growth has averaged barely better than 0% since 2019.”, The Wall Street Journal, December 5, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Revolution Time: AI is Transforming the Franchising Industry – The integration of artificial intelligence (AI) into franchising is reshaping the industry. As franchisors and franchisees adapt to the evolving digital landscape, AI is becoming a pivotal tool for enhancing efficiency, improving customer service, and driving growth. By leveraging AI, franchises can enhance their operations, deliver superior customer experiences, and foster a culture of continuous improvement.”, Evan Hackel, Franchising.com, December 2024

===============================================================================================

“McDonald’s Vs Jollibee: The Obscure Fast Food Rivalry, Explained – Filipino fast food chain Jollibee provides a remarkable case study in how savvy marketing can create a socio-economic bullseye that even McDonald’s hasn’t fully managed to hit. By 1981, McDonald’s had begun its colossal rollout to the Philippines, putting pressure on smaller franchises to sell out. Tan Caktiong instead flew to the U.S., analyzed what fast food giant McDonald’s was doing right, then sought to infuse that model with his unique understanding of Filipino tastes and values.” Mashed, December 7, 2024

===============================================================================================

“New tea drinks enter the US market preparation period lasts a year founders work on local regulations – The potential of the American milk tea market is not small. However, it is not easy to enter the American market and take root. At present, the tea industry in the United States is undergoing a quiet change. From the introduction of pearl milk tea in the 1960s to the emergence of various new tea brands today, the US market has become a new battlefield for global tea brands to compete, with pearl milk tea, fruit tea, light milk tea and other subcategories emerging in the US market. At present, Heytea has opened more than ten stores in the U.S., mainly in the core business districts of New York, Los Angeles, Seattle, Irvine and other cities. In July 2024, Heytea opened its first West Coast store in Beverly Hills, California.” Vicai News (Mandaran), December 5, 2024. Compliments of Paul Jones, Jones & Co., Toronto

================================================================================================

“Responsible Franchising: What Does it Really Look Like? Franchising is much more than a business model — it’s a personal journey. A responsible franchisor must be completely transparent and honest about both the opportunities and the risks. Owning a business is hard work, and opening a franchised business is no different. Long hours, challenges, and perseverance are part of the package. A franchisor’s responsibility is to communicate that truth, clearly and early. One of the key components in responsible franchising is ensuring that franchisees are going to be a good fit for the brand. Franchising is a unique way to make entrepreneurial dreams come true, and responsible franchising proves that when partners support one another, everyone wins.”, Kelsey Stuart, Franchising.com, December, 2024

==============================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 122, Tuesday, November 26 , 2024

Almost 100% of Gen Zers Surveyed Admitted to Using AI Tools at Work

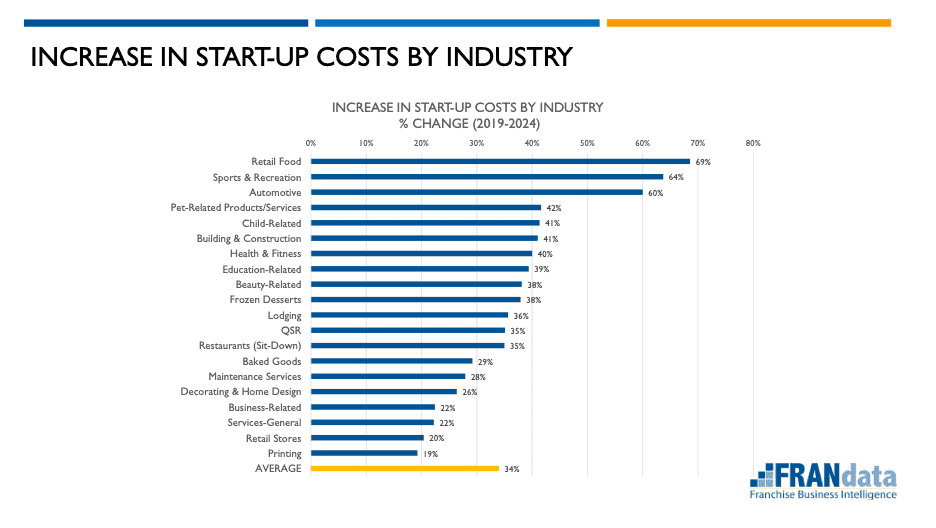

Increasing energy demands, the world’s largest exporter, USA companies are accelerating commodity purchases ahead of expected January tariffs, what region has the most copper reserves, and which country imports far more copper than it produces. Almost 100% of Gen Z uses A.I. Who are the world’s biggest exporters and where is the world’s wealth? There has been an astounding 34% increase in the cost of opening a new business since 2019. A great new book on the Road to

Entrepreneurship was just published. Jersey Mikes® sells to Blackstone for U$8 billion and YUM China is focused on 20,000 locations in that country.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier. Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

==============================================================================================

First, A Few Words of Wisdom From Others For These Times

“A problem well stated is a problem half-solved.”, Charles F. Kettering. Compliments of Beth Adkisson, Vistage Master Chair

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.” – Mark Twain

“If one does not know to which port one is sailing, no wind is favorable.” – Lucius Annaeus Seneca

v+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #122:

- Brand Global News Section: YUM China, Jersey Mike’s®, KFC® and Taco Bell®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

B2B Payments Platform For Global Businesses

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“The World’s 30 Largest Exporters – As protectionism continues to rise around the world, global trade flows are adapting. Despite facing a wave of tariffs, China’s goods exports show resilience. In 2023, China’s export volumes neared all-time highs as the price of its manufactured exports fell 10%, on average. Overall, the world’s largest exporter delivered $500 billion in goods to America last year, but this could drastically change under the Trump administration. Last year, global exports of goods totaled $23.8 trillion, declining by 5% compared to 2022. Overall, the dollar value of exports dropped across 20 of the top 30 largest exporters in the world as the number of trade restrictions rose to almost 3,000 worldwide—approximately fivefold levels seen in 2015. Visual Capitalist & the World Trade Organization, November 21, 2024

============================================================================================

“Almost 100% of Gen Zers Surveyed Admitted to Using AI Tools at Work – Here’s Why They Say It Is a ‘Catalyst’ for Their Careers. Despite most of Gen Z thinking that their jobs could be replaced with AI in the next decade, the vast majority are still using AI to help complete office tasks — and they’re open about it. A new survey released on Monday from Google assessed the AI habits of 1,005 full-time U.S.-based knowledge workers aged 22 to 39. Google called the group “young leaders” because they’re currently in leadership positions or aspire to hold one at work. The survey found that 93% of Gen Z respondents from 22 to 27 years old are using two or more AI tools like ChatGPT or Google Gemini AI per week. In comparison, 79% of millennials ages 28 to 39 indicate that they’re doing the same.”, Entrepreneur magazine, November 25, 2024

===============================================================================================

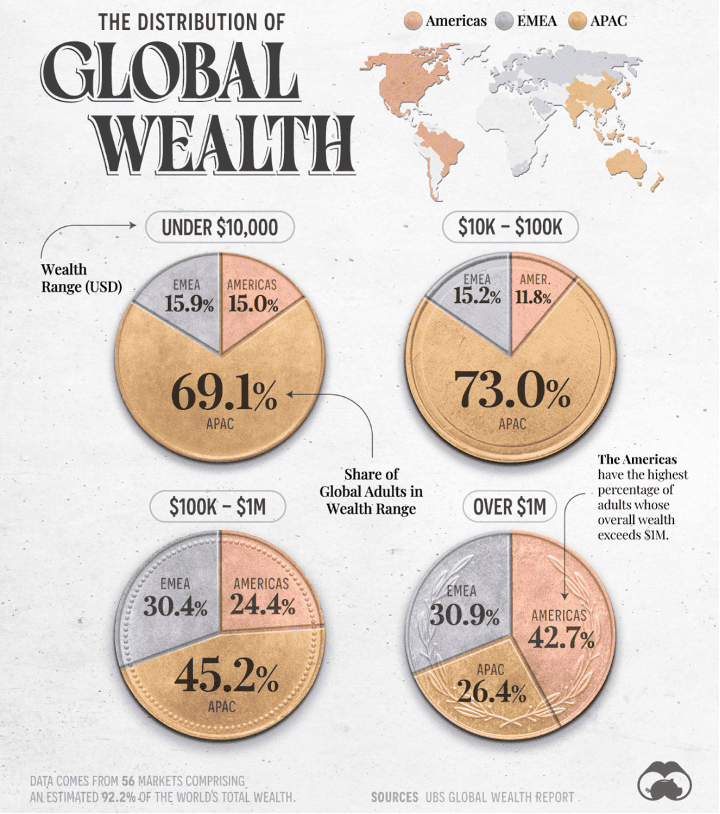

“Global Wealth Distribution by Region in 2023 – Wealth distribution varies significantly across the world’s regions, reflecting the economic disparities shaped by differences in development, resource availability, and financial access. The data comes from the UBS Global Wealth Report 2024 and encompasses 56 markets representing an estimated 92.2% of total global wealth. The UBS report’s data does not include a majority of African countries. The majority of adults in the lowest wealth bracket (under $10K) are concentrated in the Asia-Pacific (APAC) region, where nearly 70% of people in this wealth bracket being from the region. On the other end, the highest wealth bracket (over $1M) is dominated by the Americas along with the grouped region of Europe, the Middle East, and Africa (EMEA). Visual Capitalist and the UBS Global Wealth Report, November 12, 2024

===========================================================================================

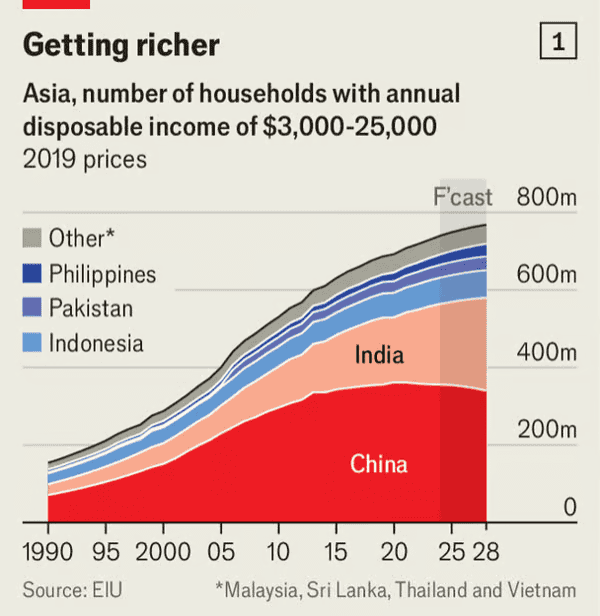

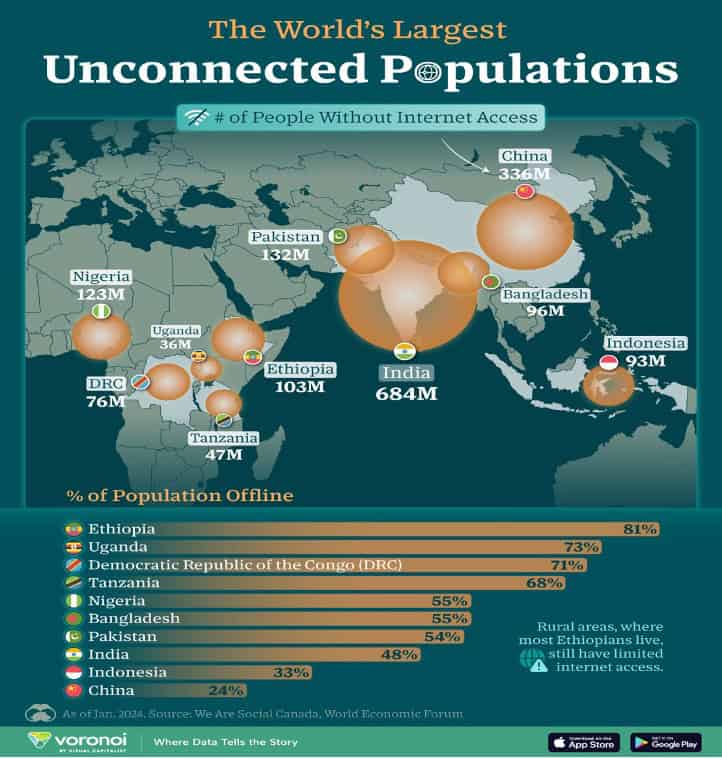

“The surprising stagnation of Asia’s middle classes – It could shake up everything from profits to politics. In August Indonesia’s statistician-in-chief, appeared in parliament with bad news. The country’s middle class had shrunk. Between 2021 and 2024, 6m Indonesians had fallen into the “aspiring middle class”, an official euphemism for being a stone’s throw away from poverty. The middle-class share of the population had fallen to 17% from 22% before the pandemic. Asked about the grim trend the next day, Joko Widodo, then the president, deflected: ‘This issue exists in almost all countries.’ Between 1991 and 2014, the average annual growth rate in the number of Asian middle-class households was 6%, according to our analysis. In the past decade, it has slowed to 2%. In a few countries, including China, it has shrunk. Exclude India, where the middle class is still growing, and Asia’s middle classes have stagnated. At stake are the futures of 2.7bn people in the middle class, or 72% of the population of developing Asia.”, The Economist, November 21, 20242024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Simple, secure currency transfers

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

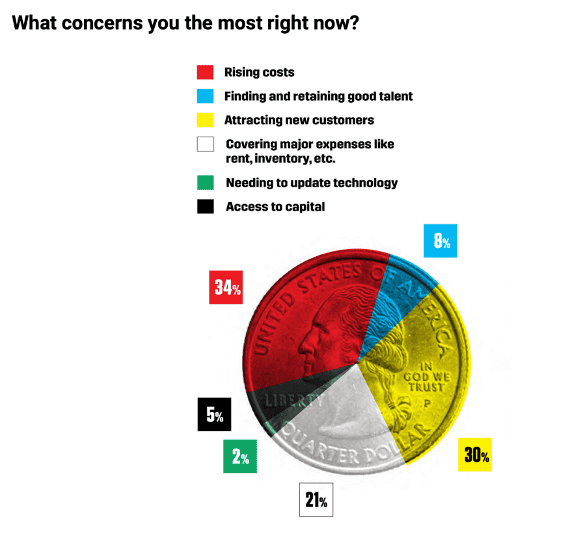

“Increase In Start-up Costs By Industry – At last week’s fall advisory board meeting of the Titus Center for Franchising at Palm Beach Atlantic University Edith Wiseman, President at FRANdata, presented this slide which shows the increase in cost to start-up a single franchise unit in various industries over the past 5 years. The average single unit start-up cost increased 34% from 2019 until this year.

=================================================================================================

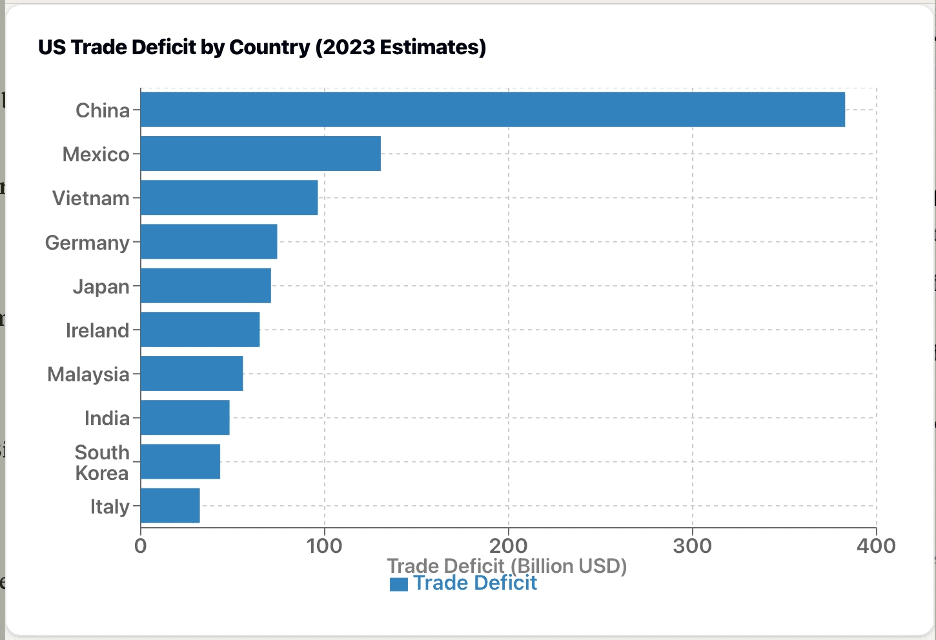

US Trade Deficits By Country – This chart visualizes the estimated US trade deficits with its top 10 trading partners in 2023. China remains the country with the largest trade deficit for the United States, at approximately $382.9 billion. Mexico is the second-largest deficit country, with around $130.5 billion. These are estimated figures based on recent economic reports. The data represents the difference between imports and exports. The data for this chart is extracted from McKinsey & Co., International Monetary Fund (IMF), the World Economic Forum, the Financial Times and the Economist, November 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

“Emerging energy demands – Global energy demand has taken off once again after a dip in 2020. It is projected to grow 11 percent by 2050 if momentum continues at its current pace. Most of the energy demand growth is expected in emerging economies such as the Association of Southeast Asian Nations (ASEAN), India, and the Middle East, senior partner Alessandro Agosta and colleagues note. ASEAN countries in particular are expected to propel this growth, which may reshape global energy trade flows.” McKinsey & Co., November 15, 2024

=================================================================================================

Book Review

The Road to Entrepreneurship Starts With Why: Drastic Steps to Success by Toni Harris Taylor, Azaniah Israel, Carol Schillne, Gloria Solomon, Jeanna Bumpas, Lea Rutherford, Lisa McClease Kelly, Melanie Cotten, Pankaj Kumar , Patrika Romano and Keith Gerson. This just published book is an empowering anthology that challenges aspiring entrepreneurs to dig deep and uncover their true motivations. This book is more than a guide; it’s a collection of powerful stories from individuals who have faced significant hurdles yet persevered, driven by a clear sense of purpose—their “Why.”

The premise is simple yet profound: understanding why you want to be an entrepreneur is crucial to navigating the highs and lows of the journey. Each chapter introduces a different voice, offering insights into the contributors’ personal struggles and triumphs. From overcoming financial obstacles to embracing bold, life-changing decisions, the contributors reveal the drastic steps they took to achieve success. Their authenticity makes this book relatable, and their stories are a testament to resilience and the transformative power of self-awareness.

Taylor’s editorial touch ensures the lessons are practical, not just motivational. She provides actionable advice, encouraging readers to connect their business goals with their passions and core values. The book also emphasizes the importance of community, mentorship, and embracing risks—valuable themes for any entrepreneur.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Keith Gerson and Bill Edwards Join Forces To Offer Trusted Suppliers To The Franchise Community

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

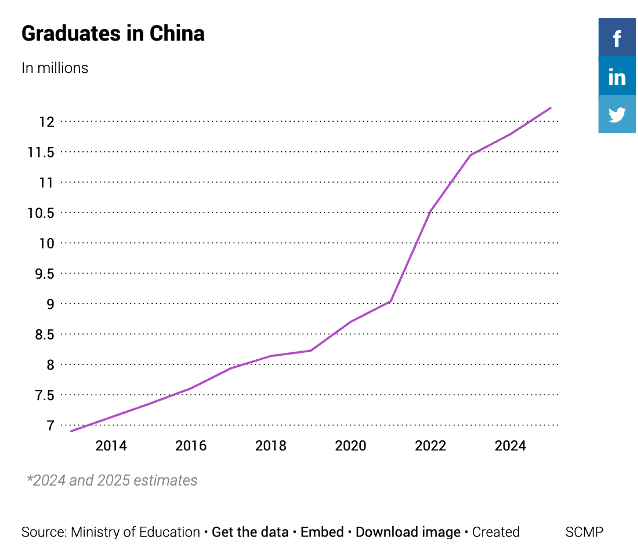

“China’s job market braces for record number of fresh graduates next year – Ministry estimates that number of university graduates next year will hit a record 12.22 million. This year, as an estimated 11.79 million graduates flooded the job market, the unemployment rate for 16- to 24-year-olds, excluding students, rose in July and August, when it reached 18.8 per cent, the highest level since the data was revised last year.”, South China Morning Post, November 14, 2024

==============================================================================================

“Mondelēz International increases investment in China – Snack giant expands into baking market. As the world’s largest manufacturer of baked goods and chocolate products, Mondelēz International has many well-known brands, including “Oreo”, “Xuanmai”, “Qiduoduo”, “Taiping” and “Toblerone” chocolate, which are well-known to Chinese consumers. With rising raw material prices, inflationary pressure and reduced consumer spending, Mondelēz is facing a new transformation cycle. Mondelēz China President François Frédéric said: “The Chinese market is the strategic growth engine of Mondelēz worldwide. China has a huge middle class, the number of which is still expanding, and the pace of urbanization is accelerating, which is a huge opportunity for every foreign-invested enterprise. This huge investment is the best reflection of this and means that Mondelēz’s development in China has entered a new stage.”, eeo.com.cn, November 19, 2024. Translation and article provided by Paul Jones, Jones & Co., Toronto

==============================================================================================

Euro Zone

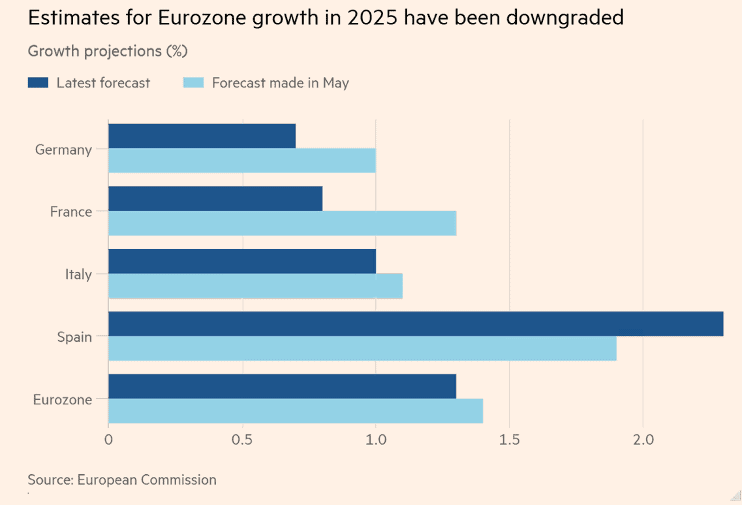

“Eurozone growth gap to widen with US, as Brussels cuts forecasts – Germany’s economic struggles weigh down region as US continues to outpace Europe. The Eurozone economy is set to fall further behind the US, the European Commission said on Friday, as it downgraded its 2025 growth forecast for the region to 1.3 per cent. While Germany, France and Italy are all expected to grow less in 2025 than was anticipated by the commission in May, Spain’s projections were upgraded. It is expected to remain the fastest-growing large EU economy for the second consecutive year after a strong 2024.”, The Financial Times, November 15, 2024

==========================================================================================

India

“India’s economy will soon overtake Japan’s – Will that cause an “India shock” for the world economy? China overtook Japan in 2010 to become the world’s second largest economy, a title Japan had held for almost 40 years. Will the world see such a rise again? India hopes so. In 2025 it could overtake Japan to become the second-biggest economy in Asia and the fourth largest in the world (behind America, China and Germany). India’s population is already bigger than China’s and its economy is likely to grow significantly faster in the next few years. India’s leaders want its GDP to reach $5trn by 2028 and its exports of goods and services to reach $1trn apiece by 2030.”, The Economist, November 20, 2024

==================================================================

“Unilever to Double Down on India Under New Strategic Shift – CEO Hein Schumacher said India is the best opportunity for Unilever over the next couple of years and will be the key for all its group businesses. He added that India’s gross domestic product per capita is estimated to grow to about 4,500 euros ($4,713) by 2033, representing an 85% increase in 10 years.”, The Wall Street Journal, November 22, 2024

===============================================================================================

Latin America

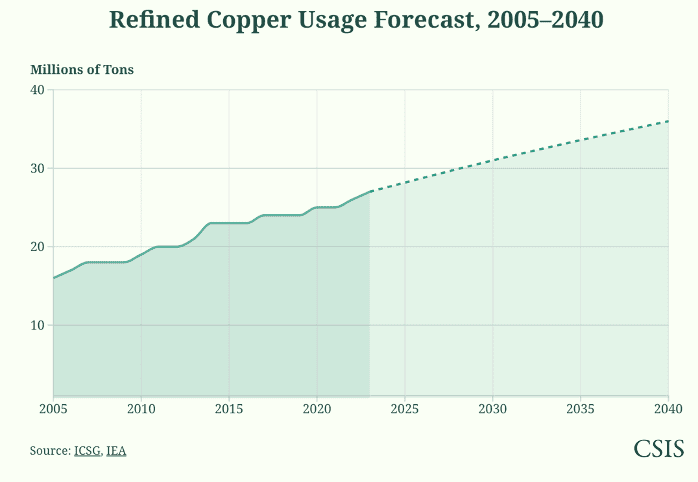

“The World’s Copper Stronghold – Copper is vital to U.S. national, economic, and energy security. Everything—from clean energy technologies, electronics, and automotives, to power transmission infrastructure, data centers, and defense systems—depends on copper. However, the United States only mines 5 percent of the world’s copper. Latin America, which cumulatively mines nearly half (46 percent) of the world’s raw copper—the largest share of any global region—holds significant potential as a sourcing partner. Chile and Peru have the two largest copper reserves globally. To meet the Biden administration’s net-zero carbon emissions targets, American annual copper supply will need to double by 2035. Infrastructure for artificial intelligence and data centers could require a projected additional 2.6 million tons of copper. By 2030, the International Energy Agency predicts that the total copper production from existing mines and mines under construction will only meet 80 percent of the world’s copper needs.”, Center for Strategic and International Studies, November 13, 2024

============================================================================================

United States

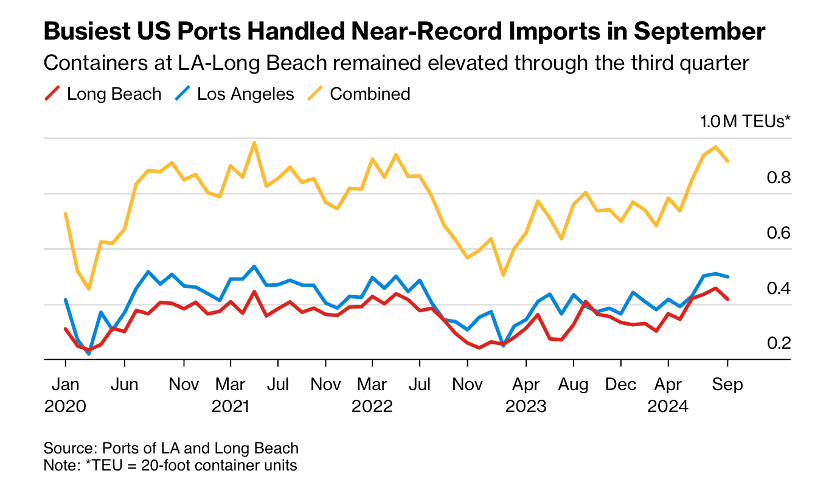

“American Companies Are Stocking Up to Get Ahead of Trump’s China Tariffs – Businesses plan to stockpile, raise prices and accelerate shift to manufacturing elsewhere. American businesses are dusting off a playbook they used during Trump’s first term: stocking up on imported goods before tariffs are enacted. They are also considering how to cope with the levies if and when enacted—whether they will be able to raise prices and whether they will need to find alternatives to their Chinese manufacturers. Already, exports from China surged last month, which some economists think could have been driven at least in part by front-loading amid uncertainty around election results. Outbound shipments from China rose nearly 13% in October from a year earlier, well above consensus expectations and up sharply from 2.4% growth in September. Chinese exports growth should remain strong through the next few months because of front-loading, Wall Street economists said.”, Wall Street Journal, November 29, 2024

==============================================================================================

Vietnam

“Under Trump Tariffs, ‘Made In Vietnam’ Will Be The New ‘Made In China’ – For decades, the Southeast Asian nation has opened its doors to major firms like Apple, Samsung and Intel. Now it’s poised to do even bigger business. ‘If previously it was made in China, now it’s going to be made in Vietnam,’ Jason Miller, a professor of supply chain management at Michigan State University, told Forbes. ‘That production is not coming back to America.’ Vietnam has a number of advantages over other regional rivals like India. First, as a single-party authoritarian state, Vietnam can and does set new business-friendly policy quickly. Additionally, the country is geographically well-positioned: it already has three of the world’s top 50 busiest ports, and is next-door to China, making trade and logistics between the two countries easier. Critically, Vietnam also has a free-trade agreement with the European Union – the only other regional country besides Singapore to have one.”, Forbes, November 20, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“He Bought a Sub Shop as a Teen. Now He’s Selling Jersey Mike’s for $8 Billion – Peter Cancro started slinging subs at his local shop at 14. Now he’s selling the national chain he built to Blackstone. ‘We’re not a chain. We’re the mom-and-pop shop in every town,’ Cancro said in an interview last year. Cancro declined to comment for this article through a spokeswoman.

Cancro kept the formula simple: meat and cheese sliced right in front of a customer, fresh dressings and a large amount of food for the money. Another key ingredient: Franchisees are tasked with keeping deep ties in the communities in which they operate. Jersey Mike’s did $3.3 billion in U.S. sales across 2,680 locations last year, its revenue growing 25% from 2022 levels, according to Technomic. Cancro had long contemplated what’s next for his business. During the interview last year, he said he could consider Jersey Mike’s going public but had no specific plans. He was most focused on growth, with a target of reaching 10,000 sub shops in the U.S. one day.

Blackstone has spent the past three years getting Cancro comfortable with a deal, people familiar with the talks said. Cancro wasn’t going to hand over control to someone who didn’t understand his vision and Jersey Mike’s focus on fresh ingredients and ample portions that customers have grown to love and expect, the people said.”, The Wall Street Journal, November 22, 2024

================================================================================================

“Yum China targets 20 000 stores – accelerated franchising – Yum China, operator of KFC, Pizza Hut, Taco Bell and Lavazza, reported robust third quarter results, aiming to operate 20,000 stores by 2026 and vowing to strengthen franchising efforts. The company said its strategic focus on operational efficiency and innovation has yielded impressive results, with a total store count reaching 15,861, including 11,283 KFC and 3,606 Pizza Hut locations. In the third quarter alone, the company opened 438 new stores, with franchisees contributing 145 new stores, accounting for around a third of the total. Customer loyalty has been a cornerstone for Yum China, with the total membership of KFC and Pizza Hut surpassing 510 million. Member sales now account for about 64 percent of system-wide sales for both brands combined.”, China Daily, November 19, 2024

===========================================================================================

“Q&A: offer and sale of franchises in Chile – Franchising is very widespread in Chile and most of the biggest international brands are already in the country due to its franchising development. The main sectors are clothing, food and beverages, convenience stores, drug stores, car rental, dry cleaning, language academies and real estate brokers, etc. In general, Chile has a business-friendly environment, as it has been recognised in various rankings and studies, such as the business environment ranking developed by the Economic Intelligence Unit, which ranks Chile 30th worldwide and as the most prominent country in Latin America. there are no specific regulatory barriers and the relation between franchisor and franchisee will be ruled mainly by what they have freely agreed.”, Porzio Rios Garcia, Lexology, July, 2024

=============================================================================================

“Jollibee parent fully acquires Hong Kong’s Michelin-rated Tim Ho Wan dim sum chain – Jollibee Food Corporation buys remaining 8 per cent stake in company for S$20.2 million. Jollibee Food Corporation, which runs fast-food chains across Asia, owned 92 per cent of the dim sum company in January, and the latest deal gives it full ownership. Tim Ho Wan runs about 80 stores in 11 markets including Singapore, Shanghai, Beijing, Melbourne, Tokyo, Macau, South Korea and Manila. The deal comes at a time when Hong Kong’s food and beverage industry faces an uphill battle to retain customers, with many residents crossing the border to mainland China for leisure. Consumption has also slowed on the mainland, with Beijing rolling out a raft of stimulus measures in a bid to electrify the economy.”, South China Morning Post, November 6, 2024

==============================================================================================

To receive this biweekly newsletter in your email every other Tuesday, click here https://insider.edwardsglobal.com

===========================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 121, Tuesday, November 12 , 2024

The World’s Elections Have Consequences

This edition is primarily focused to the projected impact on doing business around the world post USA national election last week. The new USA administration that will take office on January 20th has said that it will take a different economic, political, diplomatic and business approach here at home and in other countries than the current administration that has been in office and in charge of economic and foreign policy for the past almost 4 years. In this edition we look at what numerous reports say will be the business policies that those of us who do business in other countries will need to factor into our plans in order to be successful going forward.