EGS Biweekly Global Business Newsletter Issue 51, Tuesday, March 8, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Since living and working in Eastern European countries coming out of decades of communist rule, I have closely watched what Russia does and how it might impact the Czech Republic, Hungary and Poland. In this issue there is a special section on the impact of the war on trade and how the surrounding democratic countries have responded. Actually, most of this issue deals with this immensely important event.

First, A Few Words of Wisdom

“Regimes planted by bayonets do not take root.”, Ronald Regan

“Quality is the best business plan.”, John Lasseter

“Being positive in a negative situation is not naive. It’s leadership.”, Ralph Marston

Highlights in issue #51:

- Brand Global News Section: Burger King®, Jolibee®, KFC, McDonalds’s®, Phenix Salon Suites®, Retail Food Group and Wingstop®

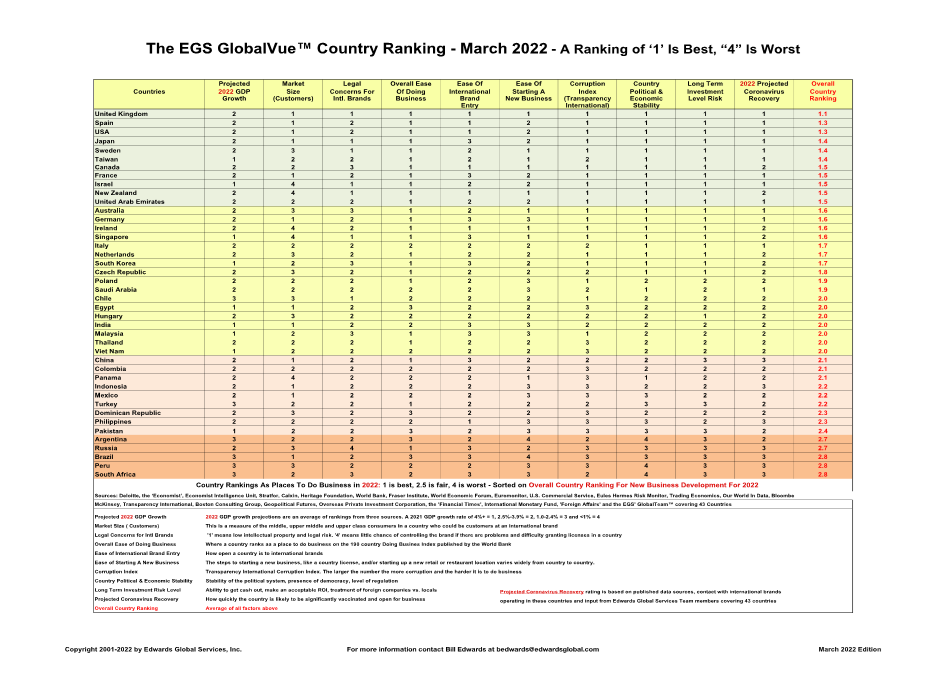

Our latest GlobalVue™ 40 country ranking – Last week we released our quarterly update on how countries rank as places to do business. Our only change would be to give Russia ‘4’ – lowest ranking – for political and economic security.

The Impact of the Ukraine War

“A new Europe is emerging from the tragedy of Ukraine – The war has prompted urgent EU membership applications from countries seeking sanctuary from Russian aggression. Jean Monnet, a founding father of the EU, said that Europe “will be forged in crises”. He is being proved right again. It took the Covid pandemic for the EU to make the giant step of financing a huge recovery plan with common debt. Now a war on the continent has moved the EU to decide, over the course of a weekend, to finance weapons deliveries by member states to a country outside the union, thus turning an economic and political organisation into a security provider. Chancellor Olaf Scholz, then Germany’s finance minister, called the EU recovery fund, agreed in May 2020, “a Hamiltonian moment” for Europe, in reference to Alexander Hamilton’s mutualisation of American war debt in the late 18th century.”, The Financial Times, March 6, 2022

“These Are the Companies Cutting Ties With Russia Over Ukraine – Exits reverse 30 years of investment by foreign businesses Criticism of banks and companies seen doing too little grows. International sanctions, the closure of airspace and transports links due to the war, and the financial restrictions on SWIFT and capital controls have made it difficult if not impossible for many companies to supply parts, make payments and deliver goods to and from Russia. Added to that, the potential international consumer backlash against any company perceived as helping Vladimir Putin’s regime means that the exodus of corporations from Russia has become a stampede.”, Reuters, March 7, 2022

“Businesses worldwide are cutting off Russian trade – ‘The private sector is doing what the U.S. and E.U. were more reticent to do: Punish Russia’s oil and gas sector directly,’ one expert told NBC News. It is an apt metaphor: Russian economic activity has ground to a near halt, stymied by a sudden lack of access to such products and services as software, payment processing and insurance — often-overlooked cogs in the machinery of commerce but vital nevertheless. Transportation, energy and banking are three sectors in which these sudden omissions are likely to cut the deepest, according to experts.”, NBC News, March 5, 2022

“Sainsbury’s renames chicken kievs and pulls Russian-made vodka – UK’s second biggest supermarket switches Soviet-era spelling of capital city to preferred Ukrainian version. Sainsbury’s is changing the name of its chicken kiev to chicken kyiv and is joining Waitrose, Aldi and Morrisons in withdrawing a Russian-made vodka from the shelves in the latest action by British retailers to signal solidarity with the people of Ukraine.

The UK’s second biggest supermarket said the packaging for the poultry dish would change in the next few weeks, switching the Soviet-era name for the country’s capital for the Ukrainian version.”, The Guardian, March 4, 2022

“Russia-Ukraine war: Global shipping titans suspend bookings to, from Russia – Ocean Network Express (ONE), Maersk, MSC and Hapag-Lloyd have suspended operations. Ocean Network Express (ONE), Maersk, MSC and Hapag-Lloyd all suspended operations in the country this week, as Bloomberg first reported. ONE — the world’s sixth-largest container carrier and Asia’s second-largest — announced Tuesday that due to the ongoing conflict, it has suspended bookings to and from Odesa, Ukraine; Novorossiysk, Russia; and St. Petersberg, Russia, effective immediately.”, Fox Business, March 1, 2022

“McDonald’s distributes food, KFC opened kitchens for war – The management of the McDonald’s Ukraine restaurant chain has decided to provide food from restaurants for the needs of Ukrainians during martial law, and KFC has opened kitchens for cooking to hospitals, military and territorial defense.

‘Our restaurants are closed for safety reasons, but we provide food to local councils from restaurants where it is currently safe (as far as possible) for our employees. Local authorities take away products and distribute them where they are most needed,’ the statement said. McDonald’s Ukraine. The KFC restaurant chain has opened its kitchens for cooking for military hospitals, hospitals, territorial defense, military, etc. ‘We appeal to the restaurant business, all over Ukraine, to also join, open their kitchens to cook and deliver food to those who need it most now,’ the statement said.”, Extracted from the Ukrainian ‘Economic Truth’ publication on February 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto.

“Magna to idle Russian operations in response to Ukraine invasion – Magna International Inc., the Canadian auto-parts giant, says it is idling its Russian operations in response to the country’s invasion of Ukraine. Magna, which once boasted of ties to the country’s leadership, had said earlier this week that it was focused on the “business continuity” of its Russian operations, but changed tack on Thursday night.”, The Globe and Mail, March 3, 2022

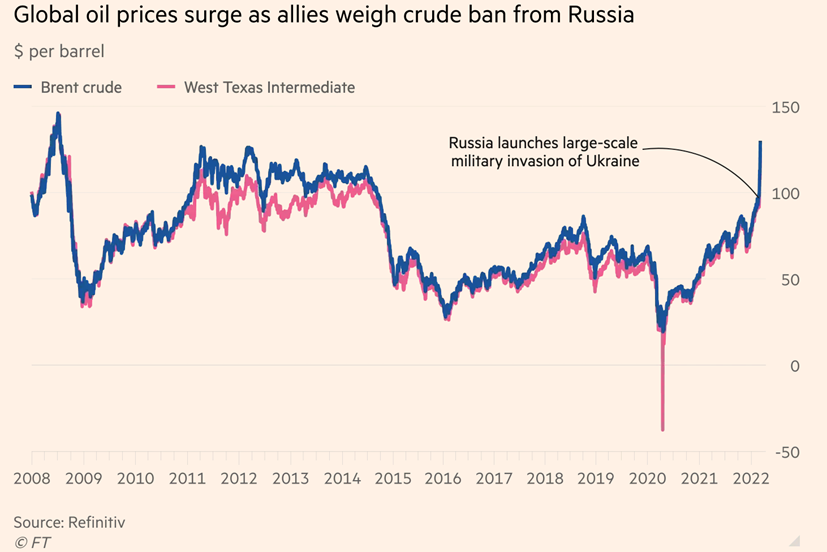

Global Energy

“Oil price rises to highest level since 2008 on talk of Russia oil sanctions – Loss of Russian supplies would remove crucial barrels from an exceptionally tight oil market. The price of Brent oil soared to almost $140 a barrel, its highest price since 2008, in early trading on Monday, after reports that western countries were discussing a possible embargo on crude supplies from Russia, the world’s second-biggest exporter. The price spike came after US secretary of state Antony Blinken said on Sunday that Washington was in “very active discussions” with European allies about a ban on Russian oil exports.”, The Financial Times, March 7, 2022

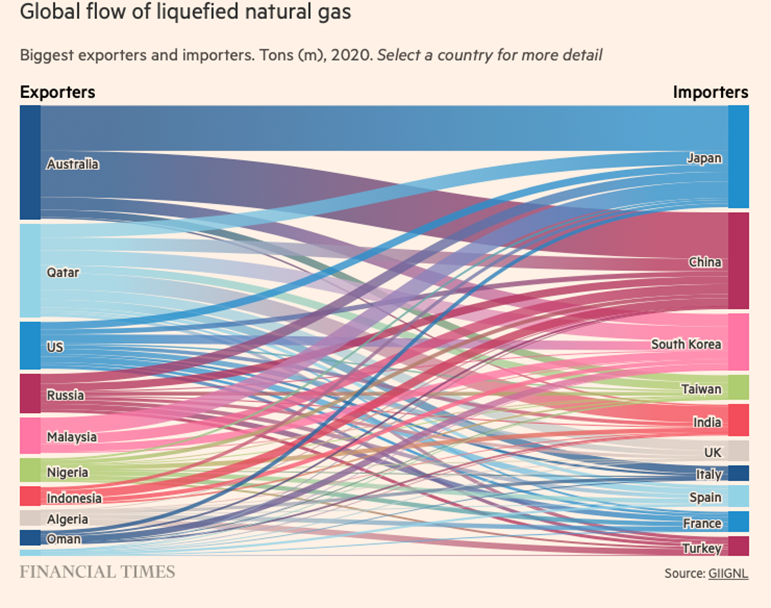

“Global LNG Supply Will Fall 100 Million Tons Short by Mid-2020s – The gap between supply and demand for liquefied natural gas (LNG) will reach 100 million tons a year globally by the mid-2020s, reflecting increased demand and limited supply growth, global oil and gas giant Shell said Monday in its latest annual LNG outlook report. Global trade in LNG expanded 6% in 2021 to 380 million tons as economies rebounded from the Covid-19 pandemic. Demand is expected to almost double to 700 million tons a year by 2040, Shell said in the report.”, Caixin Global, February 23, 2022

Global Supply Chain & Trade Update

“Ukraine Crisis Creates New Strains On Global Supply Chains – Fragile and sensitive supply chains are facing new challenges in the aftermath of Russia’s invasion of Ukraine. But as bad as things are now, they are likely to get worse for hundreds of thousands of businesses around the world. According to a new report from Dun & Bradstreet, the international domino effect of global dependencies on businesses in the Ukraine region is already being felt.

Why? Because 374,000 businesses worldwide rely on Russian suppliers—90% of these businesses are based in the U.S. About 241,000 businesses rely on Ukrainian suppliers and 93% are based in the U.S., according to Dun & Bradstreet.”, Forbes, March 6, 2022

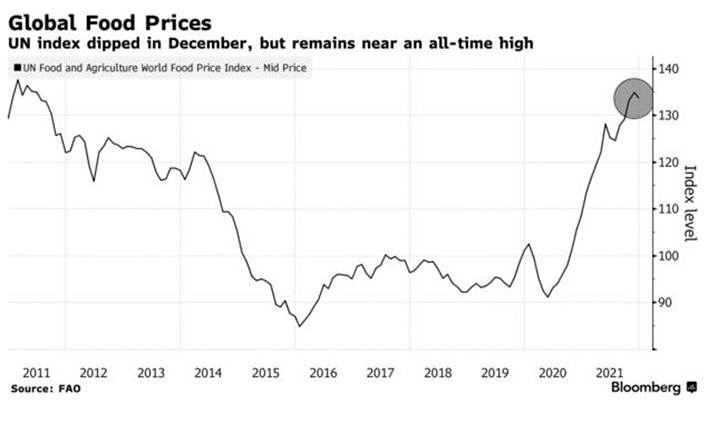

“Charting the Global Economy: Commodities Fuel Yet More Inflation – Russia’s invasion of Ukraine has sparked a feverish run-up in the prices of just about every commodity — from oil to grains to metals — that will inflict even more financial pain on consumers already struggling with rampant inflation.

Global food prices hit a record last month and consumer price indexes across major economies are on the rise. That’s bad news for households everywhere as wage growth largely lags inflation, underscored by the latest U.S. hourly earnings figures that missed all estimates.”, Bloomberg, March 5, 2022

“Food prices jump 20.7% yr/yr to hit record high in Feb, U.N. agency says – Higher food prices have contributed to a broader surge in inflation as economies recover from the coronavirus crisis and the FAO has warned that the higher costs are putting poorer populations at risk in countries reliant on imports. FAO economist Upali Galketi Aratchilage said concerns over crop conditions and export availabilities provided only a partial explanation to the increase in global food prices.”, Reuters, March 5, 2022

“You Think Groceries Are Expensive in America? Try Shopping in These 6 Countries. American consumers have felt plenty of pain at the supermarket of late, due to the effects of inflation. Overall costs in the U.S. are rising at a 7.5% annual rate. Some food items are going up by as much 20%, according to reports. But shoppers in the U.S. still may not have it as bad as those in Switzerland and South Korea.

In a recent analysis of prices in 36 major nations, the British website Money.co.uk found that those two countries had the highest costs for groceries, based on a fairly standard shopping list that included milk, eggs, cheese, apples, bananas, oranges, tomatoes, onions, lettuce, bread, rice, potatoes, chicken and beef.”, Barron’s, March 1, 2022

Global, Regional & Local Travel Updates

“How Russia’s invasion of Ukraine is changing air travel – The Russian invasion of Ukraine is turning into a seismic event for the aviation industry just as it emerges from the COVID-19 downturn. According to Umang Gupta, managing director at Alton Aviation Consultancy, the typical flight time between Europe and Asia is about 11.8 hours, and 13.5 hours flying the reverse leg.

‘In a best-case scenario, more than two hours of flight time will be added in each direction,” Gupta told Axios. The roundtrip fuel burn would increase by more than 20%, he said, and that’s for the most fuel-efficient wide body aircraft flying today, such as the Boeing 787-9 or Airbus A350-900. At today’s oil prices of around $100/bbl, this will translate into nearly $25,000 of additional expenditure for the airline round trip,’ Gupta said. To cover costs, airlines would need to increase fares by more than $120 for a round trip ticket.”, Axios, March 5, 2022

“Should you change your European travel plans in light of Russia’s invasion of Ukraine? Whether you’re currently booked for a trip to Europe or you’re thinking of booking, there are a handful of rational inferences we can draw from the conflict between Europe and the Kremlin.”, The Points Guy, March 6, 2022

“Many Travel Restrictions Are Being Eased. Here’s The Latest For March 2022 – We’re approaching the start of the spring travel season as the weather starts to warm north of the equator. Additionally, many positive domestic and international travel developments make it easier to pack your bags and hop on a plane. Here is some of the travel news to know about for March 2022, including several restrictions that have been eased.”, Forbes, March 6, 2022

“Asia-Pacific travel faces bumpy recovery – Booking.com exec – Travel in Asia-Pacific is trailing the rest of the world and should expect a bumpy recovery, a Booking.com executive said on Monday, as countries in the region have been slower to open borders than other destinations. With North Asian countries still largely restricting entry and Southeast Asian countries reopening cautiously, the region’s tourism recovery will not be quick, Laura Houldsworth, the online travel agency’s managing director for Asia-Pacific said in an interview.”, Reuters, March 7, 2022

“Indonesia, Malaysia to ease COVID curbs on foreign visitors further – Indonesia is considering a quarantine waiver for foreign visitors to its holiday island of Bali from next week, officials said on Saturday, while neighbour Malaysia announced the removal of curbs on travellers from Thailand and Cambodia.”, Reuters, March 5, 2022

Global COVID & Vaccine Update

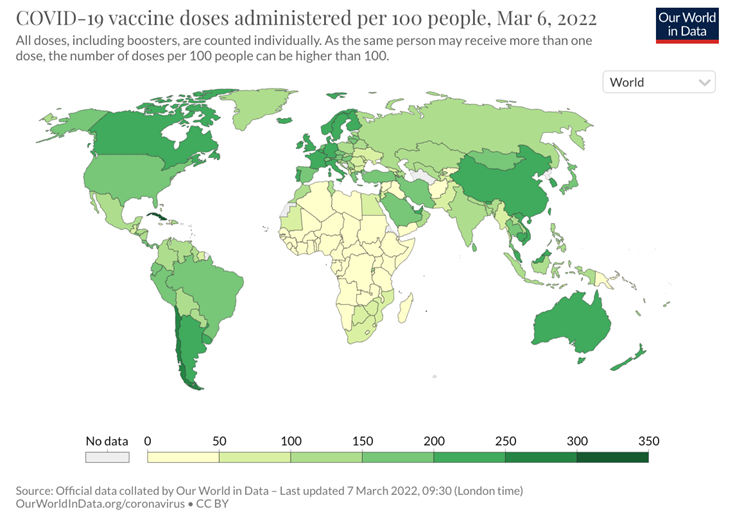

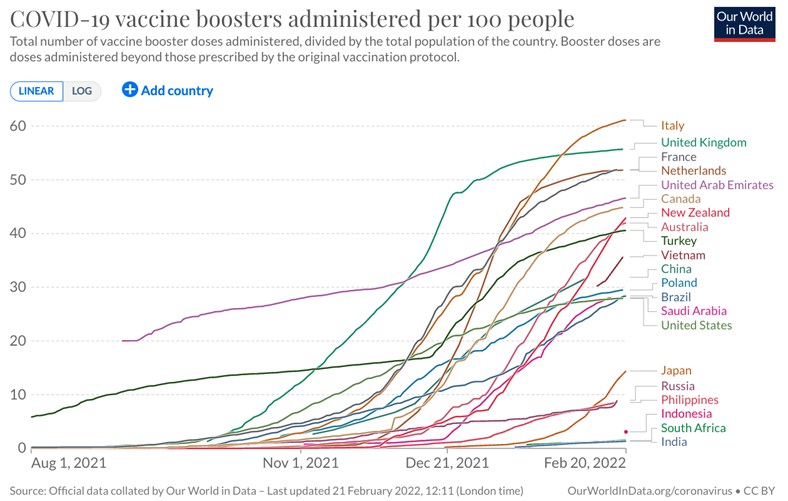

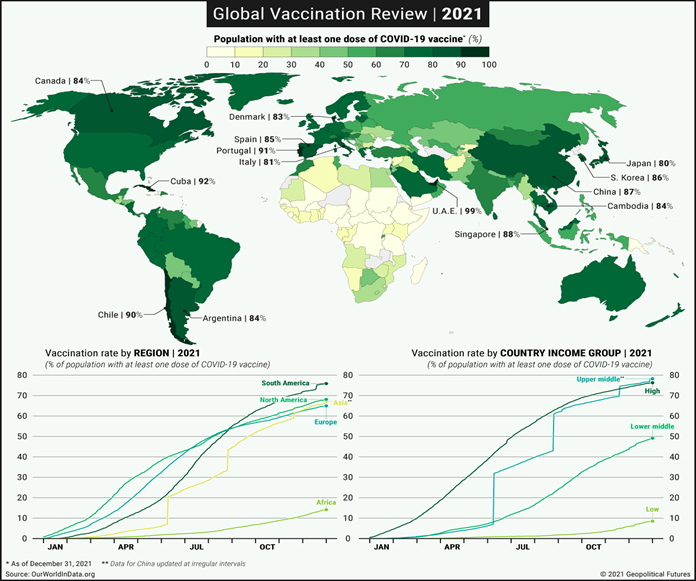

“63.3% of the world population has received at least one dose of a COVID-19 vaccine. 10.88 billion doses have been administered globally, and 19.2 million are now administered each day. Only 13.6% of people in low-income countries have received at least one dose., Our World In Data, March 6, 2022

Country & Regional Updates

Asia Pacific Region

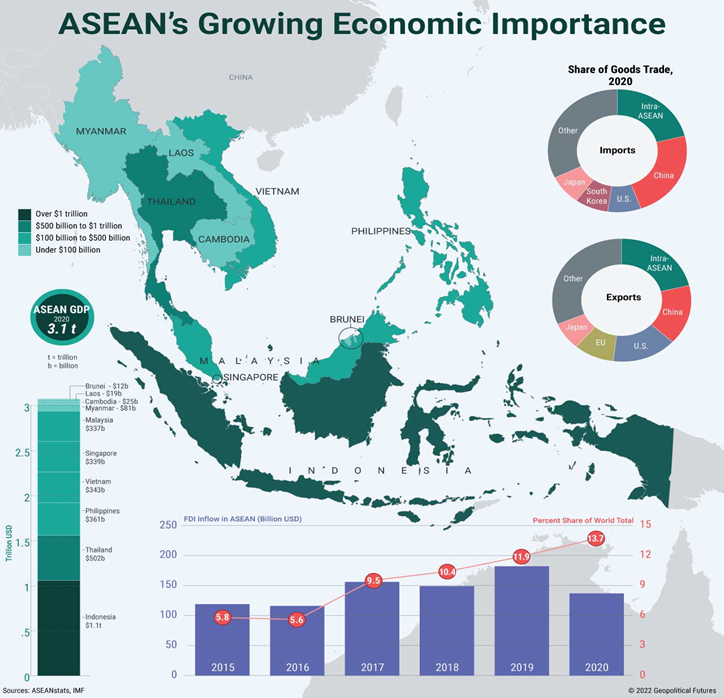

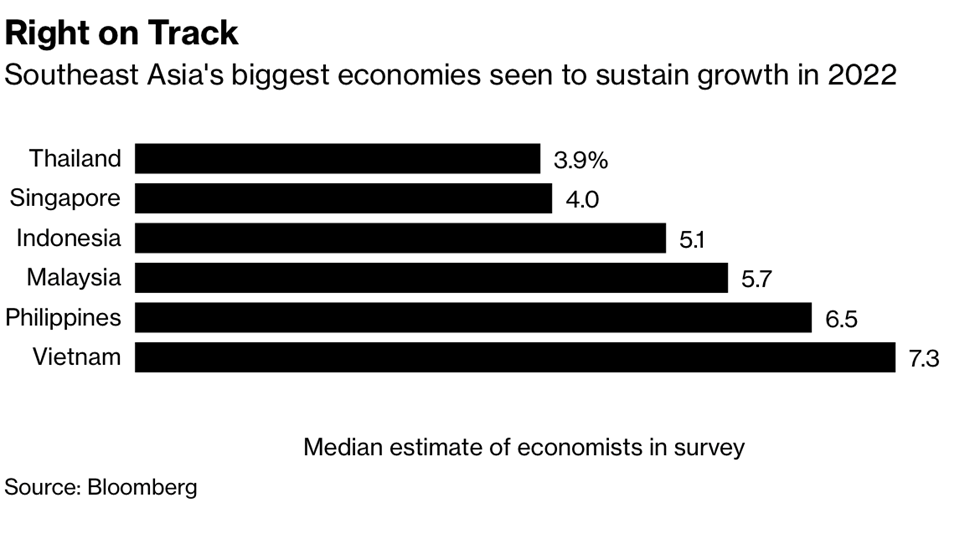

“ASEAN’s Growing Economic Importance – The bloc has one of the largest economies in the world. The Association of Southeast Asian Nations is an increasingly important player in global trade. The 10 members of the grouping together comprise the world’s fifth-largest economy. Its economic resources aren’t quite evenly spread, however. Indonesia has the largest economy among the members, accounting for one-third of its total gross domestic product. It’s followed in a distant second by Thailand and then the Philippines. Still, with its strategic location, ample natural resources and abundant human resources, the region stands out as an attractive destination for foreign direct investment.”, Visual Capitalist and Geopolitical Futures, February 25, 2022

Australia

“Western Australia finally reopens, uniting the country but leaving questions – For months, as waves of the delta and omicron variants led other states and territories to abandon their goal of reaching “zero covid,” Western Australia remained the lone holdout. With almost no local cases but vaccination rates lagging other regions, Premier Mark McGowan kept the border shut. Life inside the state largely went on as normal. ‘The virus is already here and we cannot stop its spread,’ he said last month. ‘Having the border is no longer effective.’”, The Washington Post, March 2, 2022

“Eat your hearts out, McDonald’s Australia is launching a national loyalty program where you can get free food. As if you needed another excuse to cruise through the McDonald’s drive-thru, but now you have one that can financially justify a splurge on a treat from the all the offerings on the coveted McMenu.”

MyMacca’s Rewards, where from Thursday, March 3, customers can earn points with each purchase, which will then earn then even greater rewards. For every $1 spent on eligible food and drink purchases with the MyMacca’s app, customers will earn 100 points.”, The Honey Kitchen, March 1, 2022

China

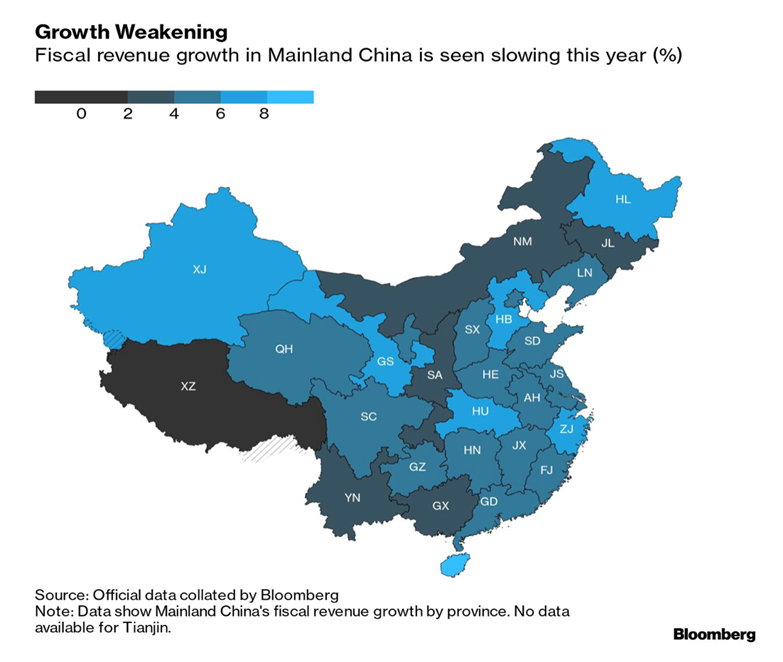

“China’s Ambitious GDP Goal a Boost to Slowing World Economy – Beijing’s 5.5% target will require modest investment stimulus Focus on curbing debt growth will limit the global impact. Beijing on Saturday announced a gross domestic product growth goal of “about 5.5%” for 2022, at the higher end of many economists’ estimates. If achieved, that would be notably quicker than the 4.8% expansion forecast by the International Monetary Fund and the 5.2% seen by economists.”, Bloomberg, March 6, 2022

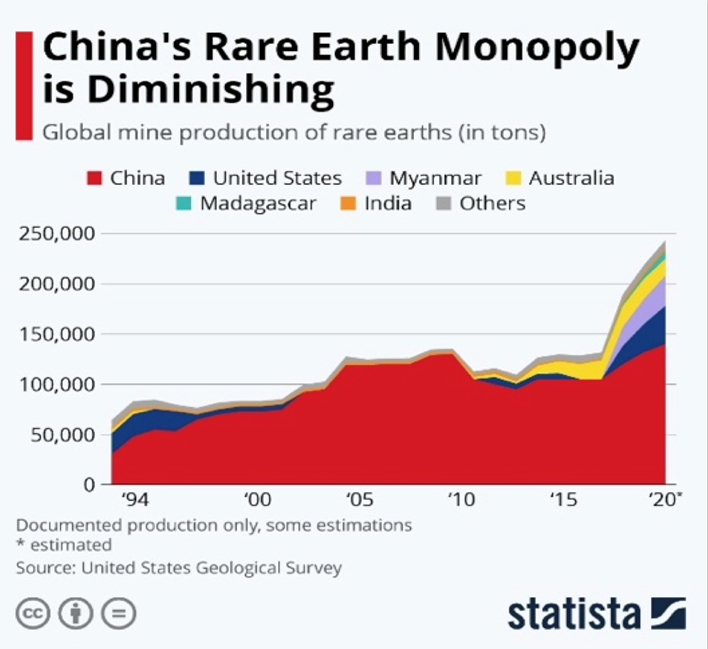

“China to meet ‘severe’ commodity price volatility by boosting coal supply, oil and gas exploration – China to focus on increasing coal, oil and gas supply, while strengthening reserves and maintaining stable imports, says economic planner. The coronavirus pandemic, shifting monetary policies of major economies and geopolitical conflict are stoking volatility in commodity prices. China’s top economic planning agency said on Monday it would steady energy supply this year in the face of escalating geopolitical conflicts, such as the Russian invasion of Ukraine that has roiled global oil and gas markets.”, South China Morning Post, March 7, 2022

“China Overhauls $23 Trillion Supply Chain Finance Mechanism – China is about to rein in its booming, 167.23 trillion ($23 trillion) market for commercial acceptance bills, a risky, controversial form of business financing that played a role in the 2019 collapse of Inner Mongolia-based regional lender Baoshang Bank.

Stung by that financial calamity, China’s central bank and top banking regulatory agency are about to overhaul the 25-year-old regulations governing the bills. The rapid growth in their use in recent years and their involvement in fraudulent financing and other violations spurred regulators to close loopholes and tighten supervision of the instruments.”, Caixing Global, February 26, 2022

Japan

“Ukraine crisis may hurt Japan’s economy via fuel spike, says BOJ policymaker – Japan’s consumer inflation could briefly approach the central bank’s elusive 2% target due in part to sharp rises in energy costs triggered by the crisis, Bank of Japan (BOJ) board member Junko Nakagawa said. But such a rise in inflation alone would not be reason to dial back stimulus, Nakagawa said, adding that Japan’s economy was still in the midst of recovering from the pandemic’s wounds.”, Rueters, March 2, 2022

“Japan PM signals more sanctions on Russia, braces for price rises at home – Japan’s prime minister indicated on Thursday that the country will impose more sanctions on Russia including a possible airspace ban, and he promised support for Japanese households and companies over looming price rises. ‘As for additional measures including a ban on Russian airplanes in Japan’s airspace, we need to take appropriate steps while working with the G7 and international community,’ Prime Minister Fumio Kishida told a press conference.”, Reuters, March 3, 2022

Mexico

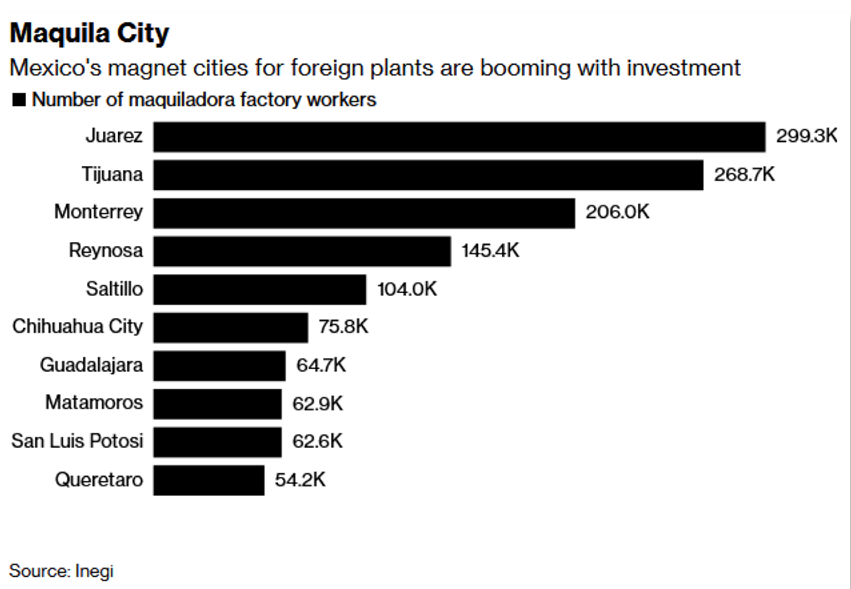

“Mexico’s “magnet cities” are attracting renewed U.S. investment as an alternative to Asian sourcing. Whereas freight from Asia to North America takes roughly 110 days, freight from Mexico takes only five to 10 days. Today, Mexico’s maquiladoras are booming with investment from manufacturers desperate to alleviate supply chain woes.”, Exiger Trends Report, February 2022

Ukraine

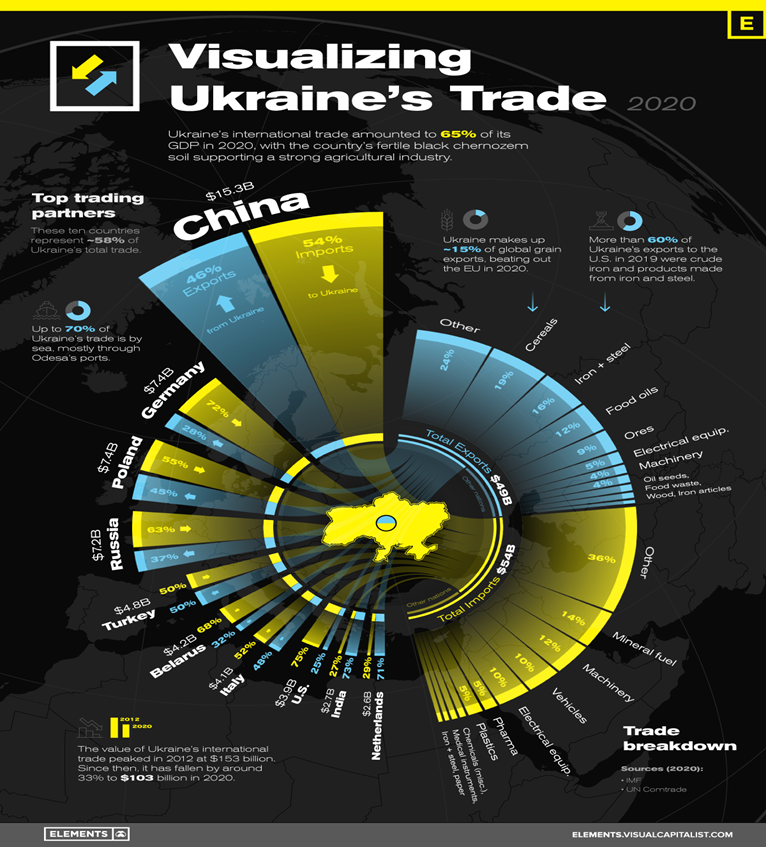

“Visualizing Ukraine’s Top Trading Partners and Products – International trade was equal to 65% of Ukraine’s GDP in 2020, totaling to $102.9 billion of goods exchanged with countries around the world. Ukraine’s largest trading partner in 2020 was China, with the value of trade between the two countries reaching $15.3 billion, more than double the value of any other trading partner.”, Visual Capitalist, March 3, 2022

Brand News

“Burger King shrinks chicken nuggets meal size as inflation eats into margins – The fast-food giant has also removed its popular Whopper as a core discount item. Burger King’s largest franchisee, Carrols Restaurant Group, revealed that the fast-food giant has reduced the number of chicken nuggets in its meals from 10 pieces to eight, in order to ‘limit the impact of higher input costs and help improve restaurant-level profitability.’”, Fix Business, March 1, 2022

“Popular Filipino fast food chain Jollibee finally opens in Vancouver – Anthony Bourdain called Jollibee the “jolliest place on earth” — and one just opened on Granville Street. People from across the Metro lined up for hours on Saturday for a taste of Jollibee, a hugely popular Filipino fast-food chain that just opened in downtown Vancouver. The Granville Street location opened Friday after a two-year delay due to COVID-19.”, Vancouver Sun, February 26, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“KFC Pizza Hut operator Yum China calls time on its struggling East Dawning fast food chain as Covid 19 impact deals fatal blow’. Yum China said its last five outlets of the Chinese-style quick-service restaurant (QSR) brand would cease to operate within 2022. The pandemic was the final straw for the brand, though it had been losing ground for years to the likes of Da Niang Dumpling and Yang’s Dumplings.”, South China Morning Post, March 7, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Phenix Salon Suites Trailblazes International Growth – Phenix Salon Suites, the leading salon suites brand turned international trailblazer, is continuing its impressive growth spurt.

Since starting to franchise over a decade ago, the brand has continued to reinforce its stellar reputation as the leading salon suite rental franchise. With more than 150 combined licenses sold, Phenix Salon Suites had a monumental year in more ways than one. From opening the first international salon location in Manchester, U.K. to surpassing 300 locations domestically to signing a countrywide development agreement for Sweden, Phenix Salon Suites is experiencing its strongest growth in the company’s history.”, Franchising.com, March 4, 2022

“Higher average spend, overseas growth boost Retail Food Group’s first half – Retail Food Group operates Gloria Jean’s, Donut King, Brumby’s Bakery, Michel’s Patisserie, Crust Gourmet Pizza, Pizza Capers, Cafe2U and The Coffee Guy. It also roasts and wholesales coffee under the Di Bella Coffee brand.”, Inside Retail AU, February 23, 2022

“Wingstop has filed a trademark to sell chicken wings in the metaverse – The chicken-wing chain followed other restaurants, including McDonald’s and Panera Bread, when it filed the trademark applications to the US Patent and Trademark Office on February 25.

The application covers “downloadable virtual goods,” including non-fungible tokens (NFTs) and virtual food and drink. It also includes the creation of an online marketplace where people can trade NFTs, digital assets, and artwork. The multi-class trademark also covers downloadable software for trading cryptocurrency, NFTs, and digital tokens as well as downloadable loyalty and reward cards that the company says can be redeemed for food in both the real and virtual worlds.”, Business Insider, March 3, 2022

Articles & Studies For Today And Tomorrow

“Going International? Taking Your U.S. FDD Abroad – Based on my experience as a master franchisee in five countries, a franchisor executive leading an international operations and development department, and working with more than 40 franchises over the past 20 years in more than 35 countries and cultures, here are the (U.S.) FDD sections I have found international candidates are most interested in, the ones that will most affect their investment decision.”, Franchising.com, March 1, 2022. Your newsletter Editor, William (Bill) Edwards, is the author of this article.

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To receive our biweekly newsletter click on this link: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 50, Tuesday, February 22, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Lots of unusual global brand news in this, our 50th edition. The Big Mac Index is updated. 62% of the world’s population has received at least one vaccination shot. The United Kingdom ends COVID restrictions. Canada’s labor force is ahead of 2019. Fast food chains in Asia are running out of French fires. You will soon be able to order a Big Mac virtually in the metaverse.

First, A Few Words of Wisdom

“Run when you can, walk if you have to, crawl if you must, just never give up.”, Winston Churchill

“The ladder of success is never crowded at the top.”, Napoleon Hill

“Someone is sitting in the shade today because someone planted a tree a long time ago.”, Warren Buffett

Highlights in issue #50:

- Brand Global News Section: Grill’d®, McDonalds®, Pret-A-Manger®, Starbucks®, Taco Bell®, YUM Brands® and White Castle®

Interesting Data and Studies

“The Big Mac Index: A Measure of Purchasing Power Parity – The Big Mac was created in 1967 by Jim Delligati, a McDonald’s franchise owner in Pennsylvania. It was launched throughout the U.S. the following year, and today you can buy one in more than 70 countries. However, the price you pay will vary based on where you are, as evidenced by the Big Mac Index.”, The Economist and Visual Capitalist, February 16, 2022

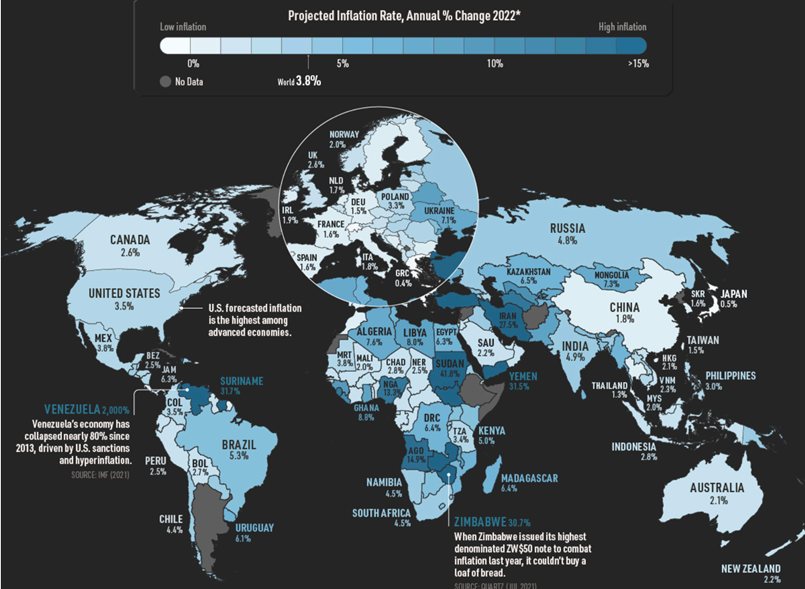

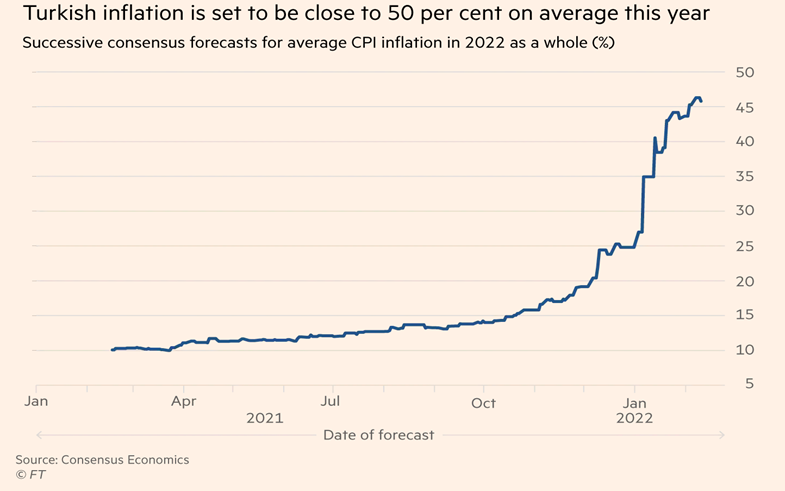

“Mapped: Inflation Forecasts by Country in 2022 – Today, this is a question on many investors’ minds. Across several countries, inflation has hit its highest level in decades. Supply shortages and massive monetary stimulus have contributed to increasing consumer prices. Asset prices, including houses, have also risen significantly. In this Markets in a Minute from New York Life Investments we show inflation by country in 2022 according to IMF projections.”, Visual Capitalist, February 10, 2022

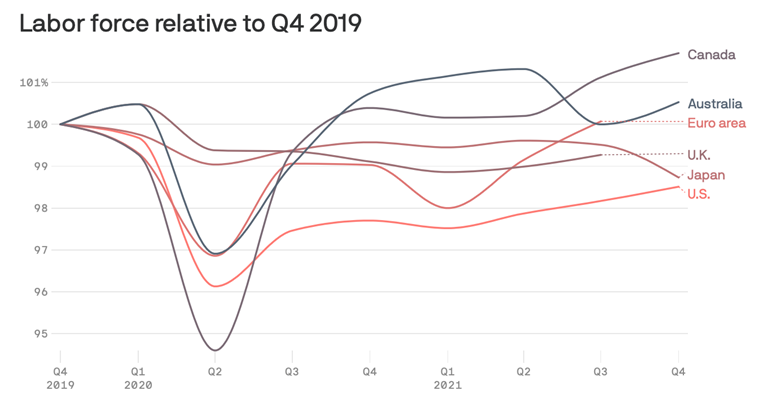

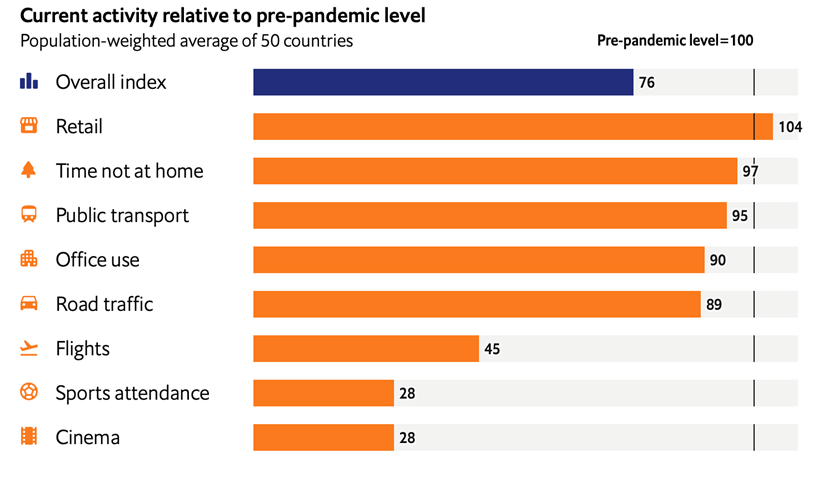

“Labor markets rebound – “Labor markets in advanced economies bounced back super-fast relative to pre-pandemic levels, but the U.S. is slightly behind. Why it matters: Consider it took years for jobs to come back after the 2008 financial crisis. This is like no other economic recovery in history, said Claire Li, an assistant vice president at Moody’s who helped put together this data. The United Kingdom and Euro area are ahead partly because of the way they headed off job losses at the start of COVID, using fiscal relief to keep workers attached to the job market — instead of paying unemployment benefits to workers.”, Axios, February 10, 2022

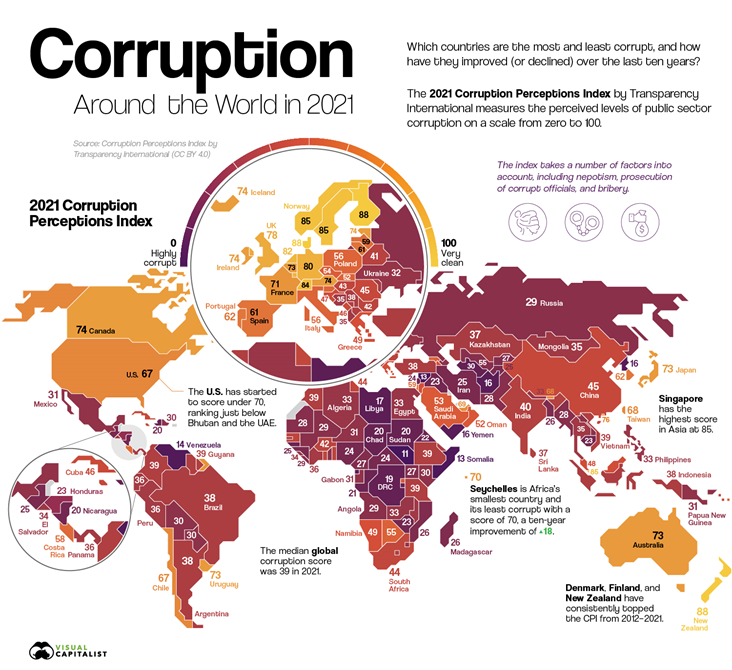

“Mapped: Corruption Around the World – For more than a decade, the Corruption Perceptions Index (CPI) by Transparency International has been the world’s most widely-used metric for scoring corruption. This infographic uses the 2021 CPI to visualize corruption in countries around the world, and the biggest 10-year changes.”, Visual Capitalist and Transparency International, February 10, 2022

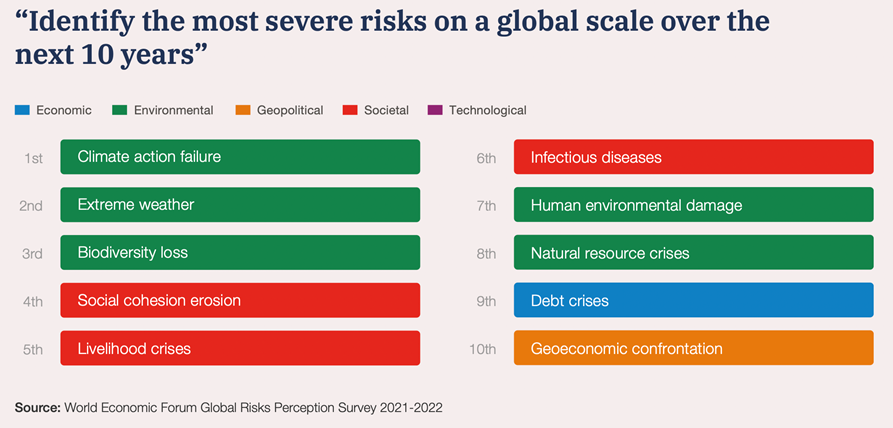

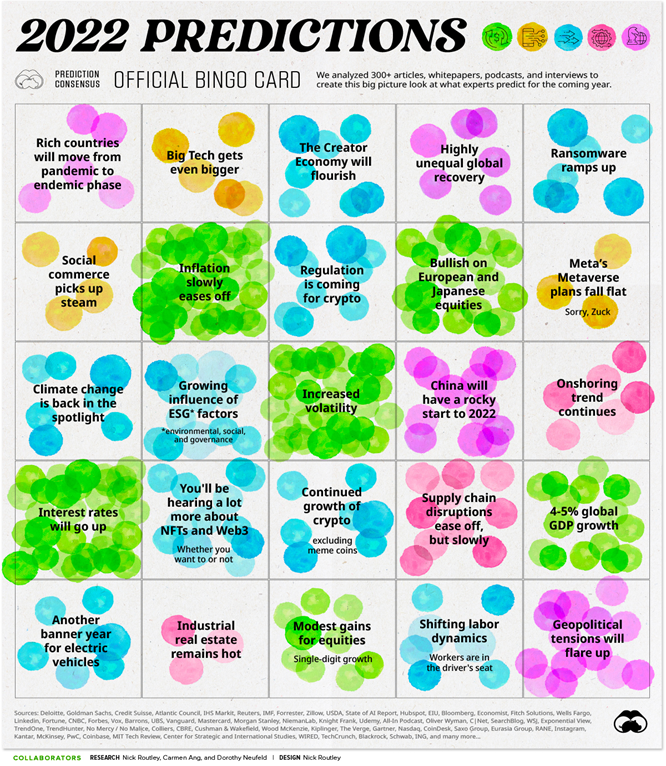

“A Global Risk Assessment of 2022 and Beyond – Since the start of the global pandemic, we’ve been navigating through tumultuous waters, and this year is expected to be as unpredictable as ever. In the latest annual edition of the Global Risks Report by the World Economic Forum (WEF), it was found that a majority of global leaders feel worried or concerned about the outlook of the world, and only 3.7% feel optimistic.”, Visual Capitalist and World Economic Forum, January 31, 2022

Global Energy

“China’s Reliance on Foreign Oil Declines for First Time in 20 Years – China’s crude oil imports and reliance on foreign oil declined for the first time in two decades, reflecting rising global petroleum prices, expanding domestic production and strengthened supervision of local refiners.”, Caixing Global, February 18, 2022

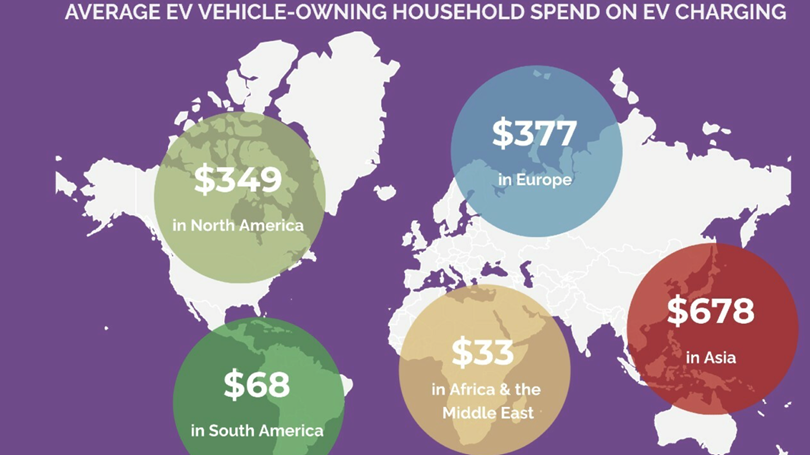

“Here’s How Much You’ll Be Spending to Charge Your Electric Car by 2026 – Expect a 390% growth in electric-vehicle spending globally over the next five years. According to Juniper Research, the lower cost and convenience associated with home charging will lead to a 390% increase in global spend over the next five years. This means the $3.4 billion that was spent on EV charging at home in 2021 will rise to $16 billion by 2026.”, PC Magazine, February 18, 2022

“Battery Swapping Boosts Appeal for New-Energy Heavy Trucks – Almost every new-energy heavy truck sold in China last month had a swappable battery, in a sign Chinese fleet operators are embracing the technology to beat the traditional limits of electric vehicles and reduce their operating costs. All but 20 of the 2,283 new-energy heavy vehicles sold in January were equipped with a power replenishing system capable of replacing the exhausted battery with a fully charged one in just a few minutes.”, Caixing Global, February 21, 2022

Global Supply Chain & Trade Update

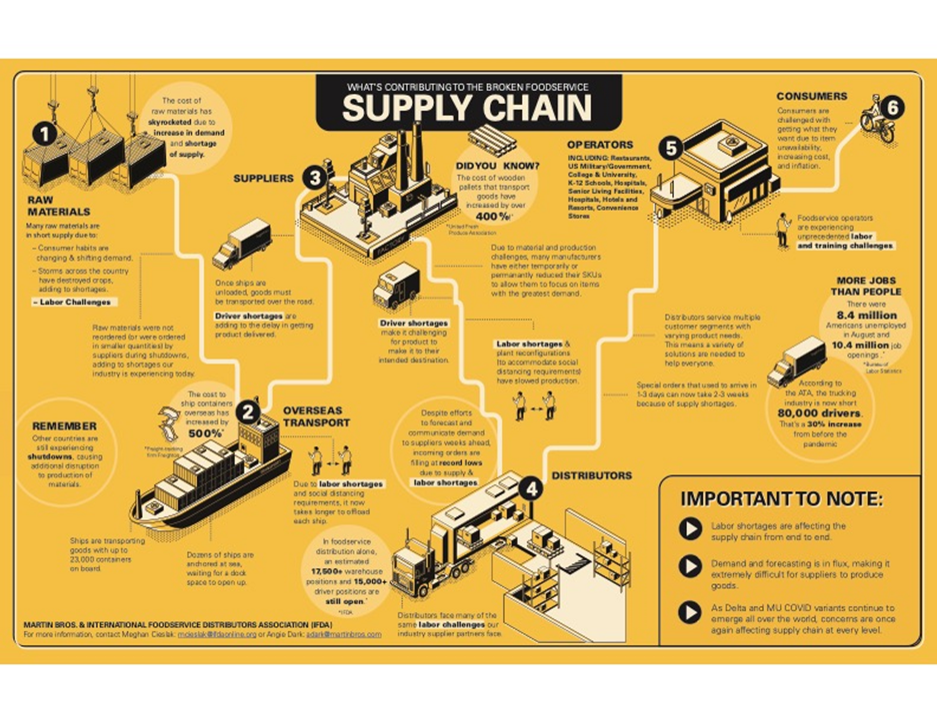

“Fast food chains in Southeast Asia are running out of french fries – Signs at some of Yum! Brands Inc.’s KFC outlets in Singapore informed customers that the company would replace side orders of fries with potato waffles due to a “global supply disruption.” McDonald’s Corp. stores in Malaysia and Indonesia halted sales of large-size portions of fries late last month for the same reason, according to company notices posted on Twitter.”, Fortune, February 18, 2022

“Asia rethinks ‘just-in-time’ strategy as pandemic upends logistics industry – Pandemic-era disruptions have upended distribution networks and exposed vulnerabilities in supply chains from Hong Kong to Singapore to Australia. Businesses are starting to stockpile more and diversify their suppliers, as regional governments look to shore up supplies of raw materials and essential goods.” South China Morning Post, February 19, 2022

“How Supply Chain Issues Continue To Impact The Restaurant Industry – As more independents and franchised QSR’s, Fast Casual and full service restaurants reopen to standard capacity, increasing supply chain issues and problems have made it challenging for business owners, dealers, and operators in the industry……In addition, did you know that continued demand for takeout has exacerbated shortages of items, such as coffee cups, plastic straws, and to-go containers?”, Forbes, February 14, 2022

Global, Regional & Local Travel Updates

“12 things to consider for international business travel – To help you prepare for an international business trip, we asked business leaders and travel professionals this question for their best insights. From updating your vaccinations to securing your devices, there are several considerations that may help you best prepare for your international business travels.”, AZ Big Media, February 20, 2022

“Australia’s border reopens to international visitors – Australia has reopened its international border for the first time in nearly two years, bringing joyful family reunions and a boost to tourism. The country imposed some of the world’s strictest travel bans after shutting itself off in March 2020 due to Covid.”, BBC News, February 19, 2022

“Air France to Introduce 200 New Direct Flights From the U.S. to Paris This Summer – Air France is restoring several flights between the U.S. and Paris this summer, the airline announced recently, as Europe heads into what the World Health Organization described as a “long period of tranquility” in the ongoing COVID-19 pandemic.”, Travel & Leisure, February 14, 2022

“Vietnam to Lift Curbs on Tourists March 15 – International tourists must have proof of being vaccinated or recovery from COVID-19 with a negative test result ahead of departure under the current plan, the website reported. They would be required purchase Covid-19 medical insurance coverage worth $10,000.”, Bloomberg, February 16, 2022

Global COVID & Vaccine Update

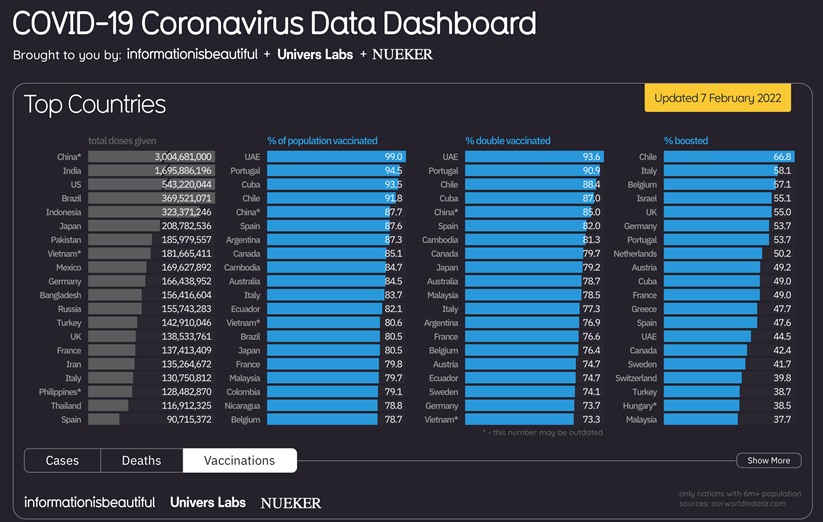

“62.3% of the world population has received at least one dose of a COVID-19 vaccine. 10.57 billion doses have been administered globally, and 31.82 million are now administered each day. Only 11.4% of people in low-income countries have received at least one dose.”, Our World In Data, February 20, 2022

Country & Regional Updates

European Union

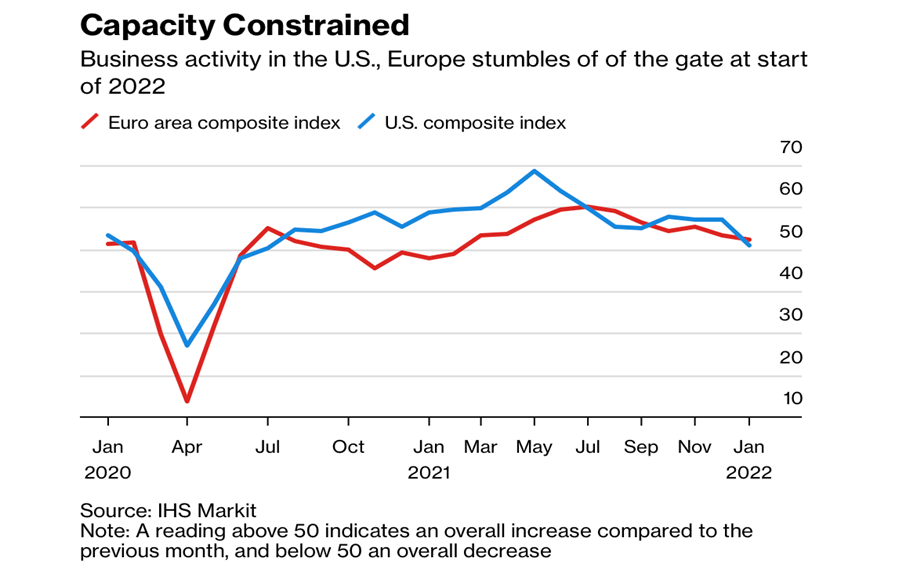

“Eurozone economic activity rises at fastest pace since September – February PMI shows strong momentum in manufacturing and services while signalling concern over rising prices. The flash purchasing managers’ composite index for the eurozone, an important measure of the health of the manufacturing and services sectors, rose to 55.8 in February, up from 52.3 in January and the highest since September.”, The Financial Times, February 20, 2022

China

“China Tries a Balancing Act as Economy Hits Cross-Currents – As China’s property slump slows its economy, there’s increasing focus on how the central bank and government are going to support growth. As for government spending, that hasn’t ramped up as quickly as some had been expecting. While authorities have emphasized infrastructure investment, their actual spending hasn’t matched the rhetoric.”, Bloomberg, February 21, 2022

“Hershey officially denies withdrawing from China saying it is working with dealers to resolve supply issues – On February 11, in response to the rumors of withdrawing from the Chinese market, Hershey told Caijing.com today that China has always been one of the important markets for Hershey Company, and Hershey Company will still maintain an operation team . Continue to invest in the Chinese market and lead the continuous business promotion of distributors in China.”, Caijing (Chinese), February 11, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Japan

“Japan’s Economy Recovered in Fourth Quarter – GDP expanded at annualized rate of 5.4% after Covid-19 restrictions were lifted, but the new year has brought a surge in infections. The growth was due largely to private spending, which increased 2.7% from the previous quarter. Spending on services recovered solidly after a state of emergency in Tokyo and other cities was lifted on Sept. 30. About 80% of the nation’s population was vaccinated by the end of 2021, making people feel safer to dine out or travel.”, The Wall Street Journal, February 14, 2022

Turkey

“Can Erdogan’s gamble keep the Turkish lira steady? Erdogan argues that his “new economic model” will attract foreign direct investment that will bring hard currency into the country. Even with rock bottom valuations, western investors who have traditionally been the strongest source of FDI into Turkey remain hesitant due to concerns about the country’s economic management and the rule of law.”, The Financial Times, February 19, 2022

United Kingdom

“U.K.’s Boris Johnson Ends Covid Rules in England in Major Policy Shift – U.K. premier says Covid restrictions in England to be lifted Plan welcome by ruling Tories key to his political survival. Boris Johnson said the U.K. must learn to live with coronavirus as he ended pandemic rules in England, becoming the first major Western government to do so even as his scientific advisers warned infections will rise.”, Bloomberg, February 20, 2022

“The (UK) economy has shaken off the effects of Omicron restrictions at the start of the year to rebound this month. The flash IHS Markit/CIPS composite purchasing managers’ index rose to 60.2 in February, from 54.2 in January, well above the consensus, 55.3. A figure above 50 indicates growth. A strong recovery in consumer spending on travel, leisure and entertainment boosted services companies. The flash services PMI increased to 60.8, from 54.1. Meanwhile, manufacturing PMI held steady at 57.3 as weaker employment growth offset a rise in the output balance.”, The Times of London, February 20, 2022

United States

“U.S. Retail Sales Rise Most in 10 Months in Broad-Based Rebound. Total value of receipts jumps 3.8% after dropping in December. Non-store retailers, furniture and autos among biggest gains. The value of overall purchases rose 3.8% in January after a downwardly revised 2.5% drop in the prior month, Commerce Department figures showed Wednesday. The advance was nearly double the median estimate of 2%.”, Bloomberg, February 16, 2022

Brand News

“Why Grill’d next move could put some customers off – Customers will have to shell out more money for some of their favourite items as burger chain Grill’d flagged increasing prices in the coming months. Grill’d co-founder and managing director Simon Crowe blamed rising supply chain costs and inflationary pressures as the reason for the rises, noting he hadn’t seen this level of pricing pressures from all angles for over 10 years. It’s turned two of its restaurants entirely plant-based, renaming the new venues which are based in Darlinghurst in Sydney and Collingwood in Melbourne, as Impossibly Grill’d.”, News.com.au, February 9, 2022. Compliments of Jason Gehrke, President, the Franchise Advisory Centre, Brisbane

“Get Ready to Order Your Big Mac from a Virtual McDonald’s in the Metaverse – Earlier this week, trademark attorney Josh Gerben reported that McDonald’s had filed 10 new trademark applications indicating that it is planning to open a virtual restaurant in the online metaverse.”, Food and Wine, February 11, 2022

“Why Pret-A-Manger’s UK Customers Are Seeing Red Over Its Coffee – It must have sounded like a good idea at the time for British chain Pret-a-Manger to offer guests five daily handcrafted beverages, covering choices that included “up to five organic coffees, teas, lattes, hot chocolates and more every day” if they paid a flat fee of 20 GBP ($27.22) monthly (via Pret-a-Manger). But things don’t always go according to plan.”, Mashed, February 19, 2022

“Can Starbucks China s Price Increase for Some Products Win the Future? Starbucks has already taken the lead in raising prices in the US domestic market. CEO Kevin Johnson said at the earnings conference that some product price hikes were aimed at countering the impact on profits from wage hikes and other cost increases.”, Caixin.com (Chinese), February 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Taco Bell sets sights on reaching 1,000 units outside the U.S. – The brand’s largest international market surpassed the 100-unit milestone and others are soon to follow. As a member of the Yum portfolio, Taco Bell’s strength has come from domestic growth over the past few years. But now Taco Bell is standing out for its success with international locations. The Irvine, Calif.-based chain ended the year with 7,791 units, of which 789 were international — and that growth outside the U.S. is a 25% increase from the roughly 600 international units at the beginning of 2021.”, Nation’s Restaurant News, February 15, 2022

“White Castle to hire 100 robots to flip burgers – The robotics program will take place in nearly one-third of the company’s locations. The hamburger chain announced plans this week to install Miso Robotics’ “Flippy 2” in 100 locations. The Ohio-based chain has been experimenting with the robotic fry cook since September 2020, when the original “Flippy” was installed in a Chicago area restaurant.”, Today.com, February 18, 2022

“Yum China’s fourth quarter 2021 net profit drops 93 percent, plans to add 1,000 stores in 2022. Affected by the epidemic, same-store sales, an important indicator of chain restaurants, fell further in the fourth quarter of 2021, down 11% year-on-year, with KFC and Pizza Hut down 12% and 8% respectively.”, Caixin (Chinese), February 9, 2022. Compliments of Paul Jones, Jones & Co., Toronto

This Issue’s Cartoon

Articles & Studies For Today And Tomorrow

“2022 Franchising Outlook – Franchising had an exceptional year in 2021, and 2022 looks to be another strong year of recovery. Bolstered by both the strengthening labor market and steady consumer spending, franchising is expected to continue to expand, trending upwards with the United States’ overall economic progression, but the pace of the growth in 2022 is most likely to moderate, due to the current headwinds in the economy.”, The International Franchise Association and FRANdata, February 2022

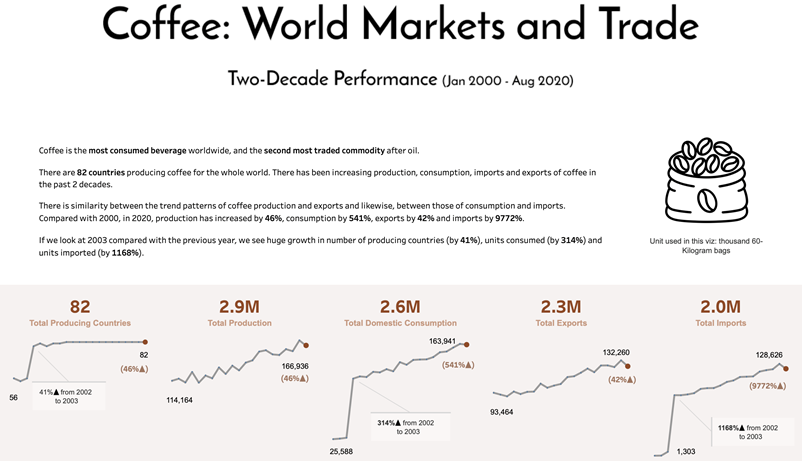

“Coffee production and consumption have been consistently on the rise in the past 2 decades. Interestingly, there are some periods that production were surpassed by domestic consumption. Top 10 producing countries provide 83% of world coffee beans. Top 10 markets consumes 81% of world beans. Top market is European Union which consumes 40% of the world beans. United States as a single country consumes 22% of the world beans.”, Tableau Public, 2021

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country Ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 49, Tuesday, February 8, 2022

Trends in this issue:

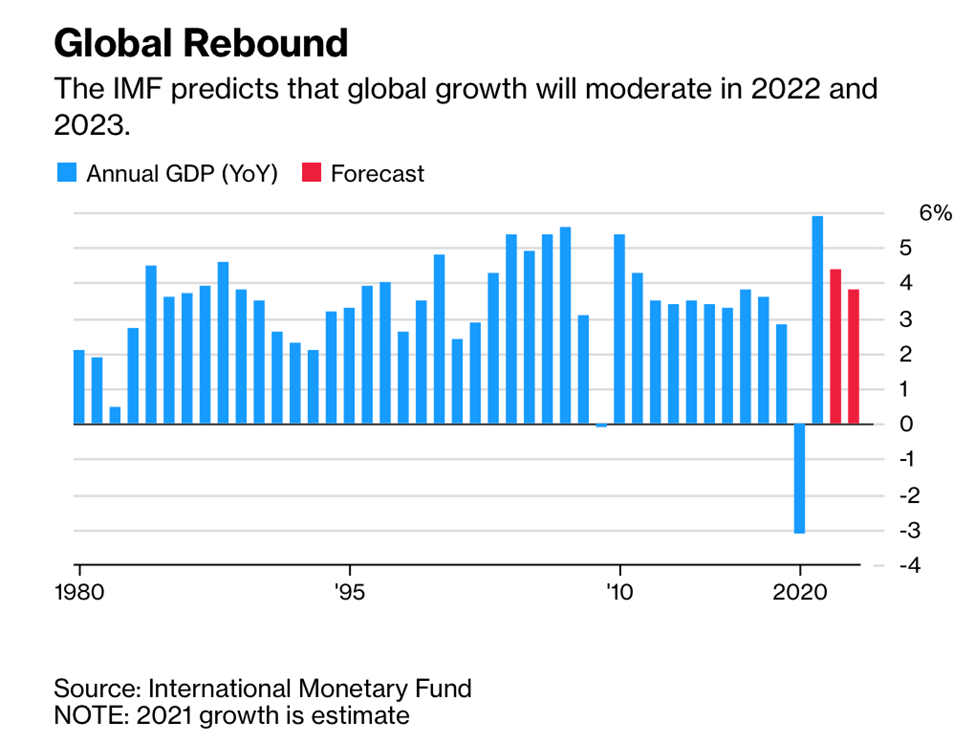

Australia and New Zealand reopen, the European Union sees declining COVID cases, global supply chain continues to be a mixed situation, the IMF sees a global GDP rebound in 2022 but global unemployment is highly variable across the world.

First, A Few Words of Wisdom

“If you don’t ask, the answer is always no.”, Nora Roberts

“Please think about your legacy, because you’re writing it every day.”, Gary Vaynerchuk

“Success usually comes to those who are too busy to be looking for it.”, Henry David Thoreau

Highlights in issue #49:

- Australia and New Zealand finally reopening for travel

- Brand Global News Section: Dunkin’ Donuts®, KFC®, Restaurant Brands NZ, Wingstop®

Interesting Data and Studies

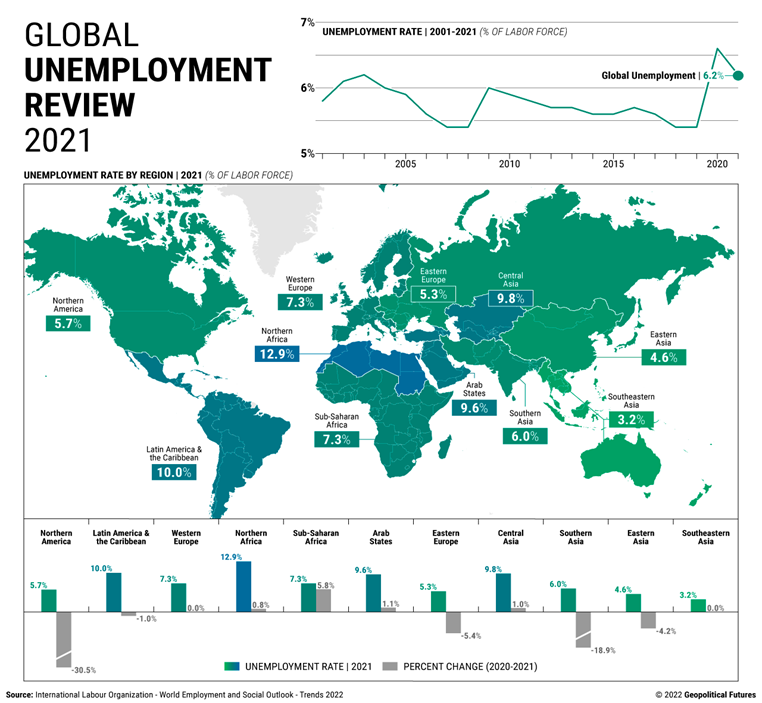

“The global labor market faces a deficit of 52 million full-time jobs, and unemployment affects 207 million people. The global unemployment rate of 6.2 percent is the second highest since 2003 and isn’t expected to return to pre-pandemic levels this year.”, Geopolitical Futures, January 28, 2022

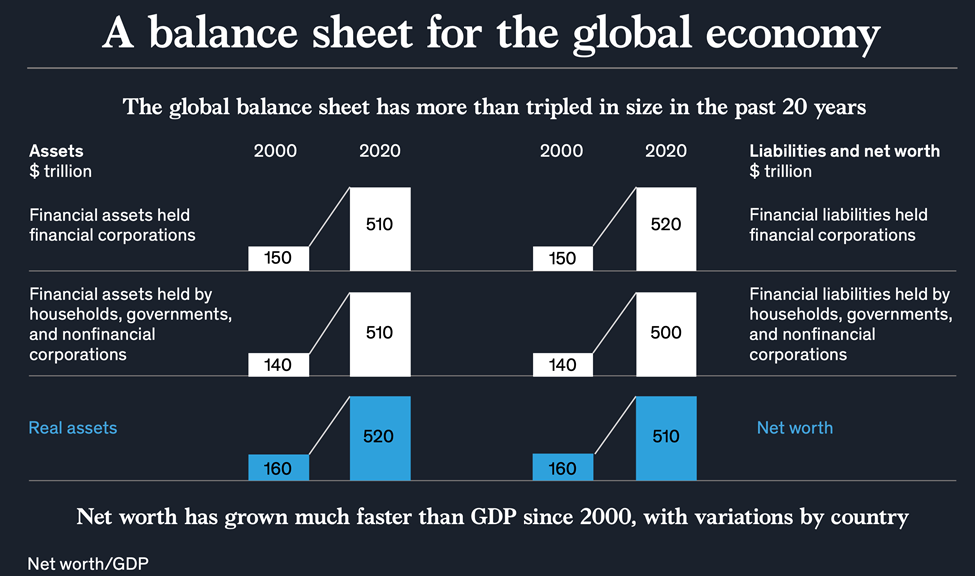

“The rise and rise of the global balance sheet – The market value of the global balance sheet tripled in the first two decades of this century. The world has never been wealthier, with large variations across countries, sectors, and households.”, McKinsey, November 2021

Global Supply Chain & Trade Update

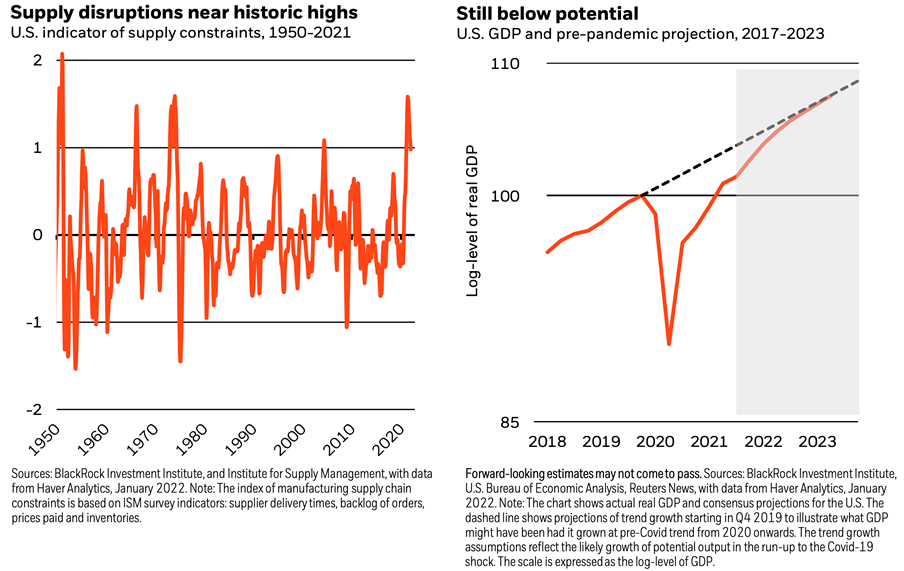

“A world shaped by supply – We’ve entered an era where supply constraints are the driving force of inflation, rather than excess demand. This will likely bring more macro volatility and force policymakers to live with higher inflation. We are in a new and unusual market regime, underpinned by a new macro landscape where inflation is shaped by supply constraints.”, Blackrock, January 2022 study

“Why supply-chain problems aren’t going away – Results season shows the financial effects of supply-chain snarl-ups on industrial firms. Supply chains have seldom featured in companies’ earnings reports over the three decades since globalisation took off in earnest, save for the occasional mention of the benefits of low costs and lean inventories. This earnings season, though, covid-induced shortages are among the first problems mentioned by many firms.”, The Economist, January 29, 2022

“World Food Prices Are Climbing Closer Toward a Record High – UN’s index of global food costs advanced 1.1% last month Unfavorable weather, energy crisis threaten further increase. The United Nations’ index of prices rose 1.1% in January, pushed up by more expensive vegetable oils and dairy. The gauge is edging closer to 2011’s all-time high, and unfavorable weather for crops and the fallout from an energy crisis threaten to keep prices high going forward. Inflation has been running rampant across the globe, and the latest leg higher in the UN’s food index could further stretch household budgets.”, Bloomberg, February 3, 2022

From a Private Director’s Association webinar, “Supply Chain Structure: Future Risks and Opportunities”, January 27, 2022

“Supply Chain Surges & Shortages, Exiger Trends Report, January 2022

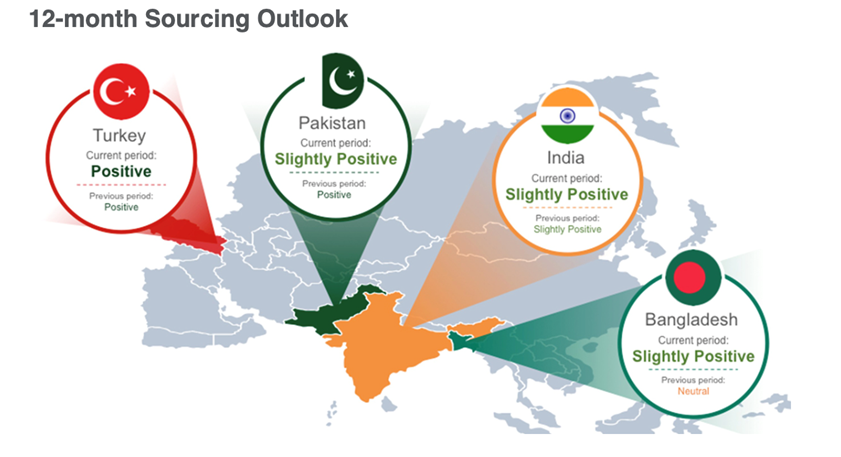

““Asia Sourcing Update – South and West Asia – Bangladesh, India, Pakistan and Turkey.”, FUNG Business Intelligence, January 30, 2022

Global, Regional & Local Travel Updates

“Travel & Tourism’s Contribution to Global Economy Could Reach $8.6 Trillion in 2022 – In 2019 the travel and tourism industry’s contribution to the global economy was almost $9.2 trillion, it said. The institution added that the sector’s contribution to global employment could reach over 330 million jobs, just 1% below pre-pandemic levels and 22% above 2020.”, The Wall Street Journal, February 2, 2022

“Chinese State-Owned Airlines Took Heavy Losses in 2021 – Over the past year, the aviation market in China has still been heavily impacted by the pandemic. The authority maintained the zero-tolerance policy against the virus, and one of the consequences was low travel demands from both domestic and international markets. All three airlines attributed the main reasons for heavy losses to the influence of the pandemic. During the traditional peak travel seasons in China, heavy restrictions were put in place to reduce traffic, especially in and out of areas that had Covid-19 cases.”, Airline Geeks, February 3, 2022

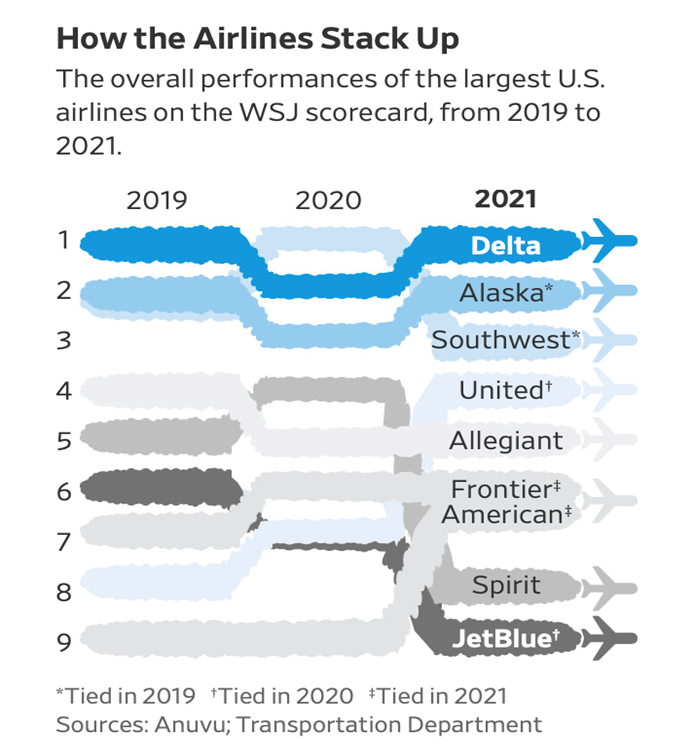

“The Best and Worst U.S. Airlines of 2021 – As Omicron infections and weather challenges hampered operations, some carriers struggled more than others to return to some version of pre-pandemic normal. The good news: Flying is more like it used to be. The bad news: Flying is more like it used to be. Leisure travel came roaring back in 2021. So did cancellations, delays and other flight problems. Airlines began to resemble their pre-pandemic selves, even if they still flew less overall than they did in 2019.”, The Wall Street Journal, January 28, 2022

Global COVID & Vaccine Update

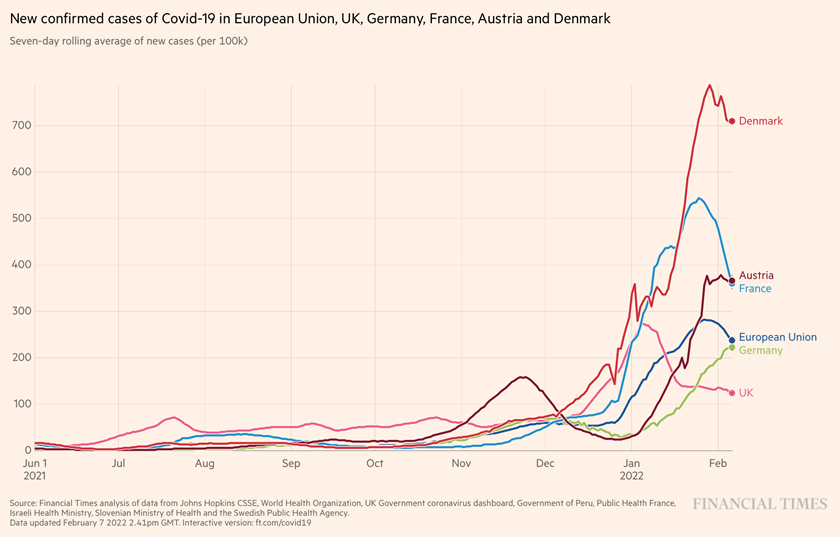

“Europe entering Covid pandemic ‘ceasefire’, says WHO – The World Health Organization’s (WHO) Europe director says the continent could soon enter a ‘long period of tranquillity’ in the Covid-19 pandemic. Dr Hans Kluge cited high vaccination rates, the end of winter and the less severe nature of the Omicron variant. It comes as a number of European nations end Covid-19 restrictions. Speaking to reporters, he said: ‘This period of higher protection should be seen as a ‘ceasefire’ that could bring us enduring peace.’”, BBC News, February 3, 2022

“Information is beautiful chart, February 7, 2022

New cases of COVID-19 begin to decline in most of the European Union countries and in the United Kingdom coming out of the latest variant. The Financial times, February 7, 2022

Country & Regional Updates

European Union

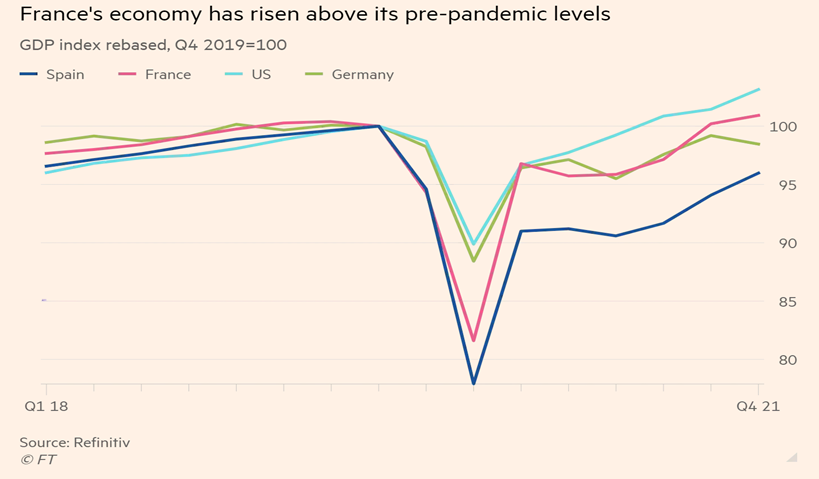

“The French national statistics office said average growth in 2021 was its fastest rate since 1969, at the peak of the postwar period known as “les trente glorieuses”. The economy has bounced back sharply from its 8 per cent contraction in 2020. The eurozone’s second-largest economy returned to its pre-pandemic level of GDP in the third quarter, it said.”, The Financial Times, January 28, 2022

Southeast Asia

Australia

“After two years of closed borders, Australia welcomes the world back – Australia said on Monday it will reopen its borders to vaccinated travellers this month, ending two years of misery for the tourism sector, reviving migration and injecting billions of dollars into the world No. 13 economy. The move effectively calls time on the last main component of Australia’s response to the COVID-19 pandemic, which it has attributed to relatively low death and infection rates.”, Reuters, February 7, 2022

China

“It was in China, specifically the city of Wuhan, where the first cases of COVID-19 were detected in early 2020 before quickly spreading worldwide. China is now pushing a zero COVID policy using contact tracing, mass testing, a special app and lockdowns to try to eliminate the virus completely. Similar strategies have been adopted in other countries but were eventually abandoned in the recognition that COVID-19 is here to stay. But China is holding firm, imposing regulations very similar to the ones adopted at the beginning of the outbreak”, Geopolitical Futures, February 5, 2022

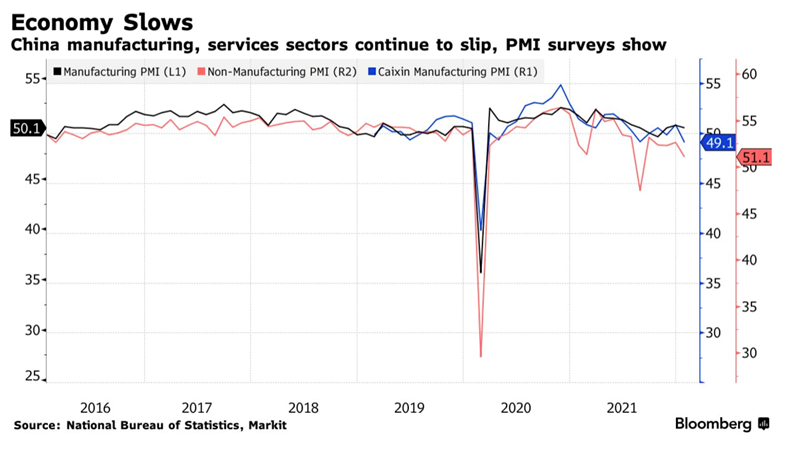

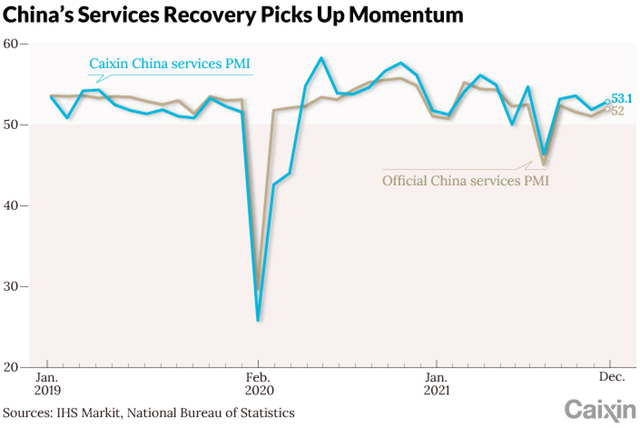

“China Manufacturing Slips in Latest Sign of Slowing Economy – PMI surveys signal slowdown in factories, services sector. Small businesses under pressure, Caixin survey shows. The official purchasing managers’ surveys released on Sunday showed a moderation in factory production and services in January. Small businesses bore the brunt of the pain, with a separate private index dropping to its lowest in almost two years.”, Bloomberg, January 30, 2022

Japan

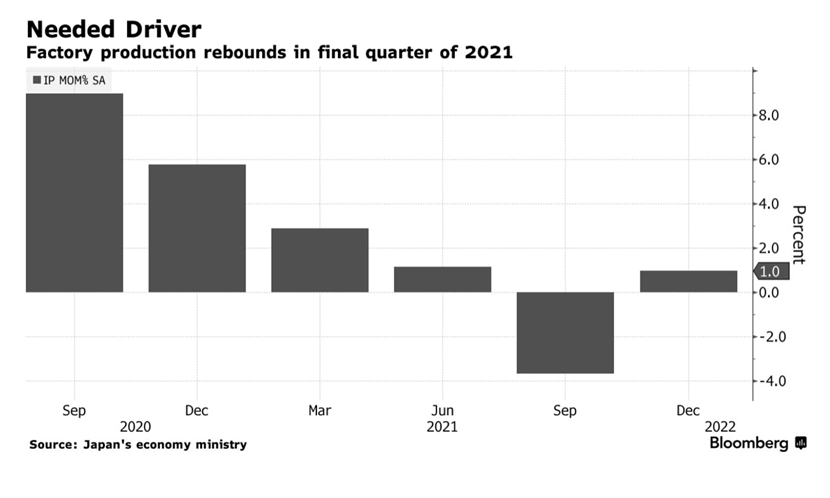

“Japan Quarterly Output Gain Signals Growth Return Before Omicron – Auto production led fourth quarter rebound in manufacturing Supply chain problems persist and omicron now clouds outlook. Japan’s industrial production rebounded last quarter, with the recovery in manufacturing likely helping restore economic growth at the end of 2021 before the omicron variant started its rapid spread.”, Bloomberg, January 30, 2022

New Zealand

“New Zealand will finally start to reopen its borders this month – New Zealand is putting an end to its quarantine requirements for incoming travelers and will start reopening its borders with a five-phase plan in March. The island nation, which has implemented some of the toughest border restrictions in the world since the start of the COVID-19 pandemic, announced Thursday it’s going to begin a phased reopening of its borders, the AP reported. New Zealand is putting an end to its quarantine requirements for incoming travelers and will start reopening its borders with a five-phase plan in March.”, The Points Guy, February 3, 2022

United States

“A Record 50% of U.S. Small Businesses Raised Wages in January to Lure Workers – A record 50% of U.S. small-business owners said they raised compensation in January amid still-elevated job openings, the National Federation of Independent Business said Thursday. With some 47% of small businesses reporting job openings last month that they could not fill, employers have been raising wages to attract skilled candidates — a trend that doesn’t appear to be reversing any time soon.”, Bloomberg, February 3, 2022

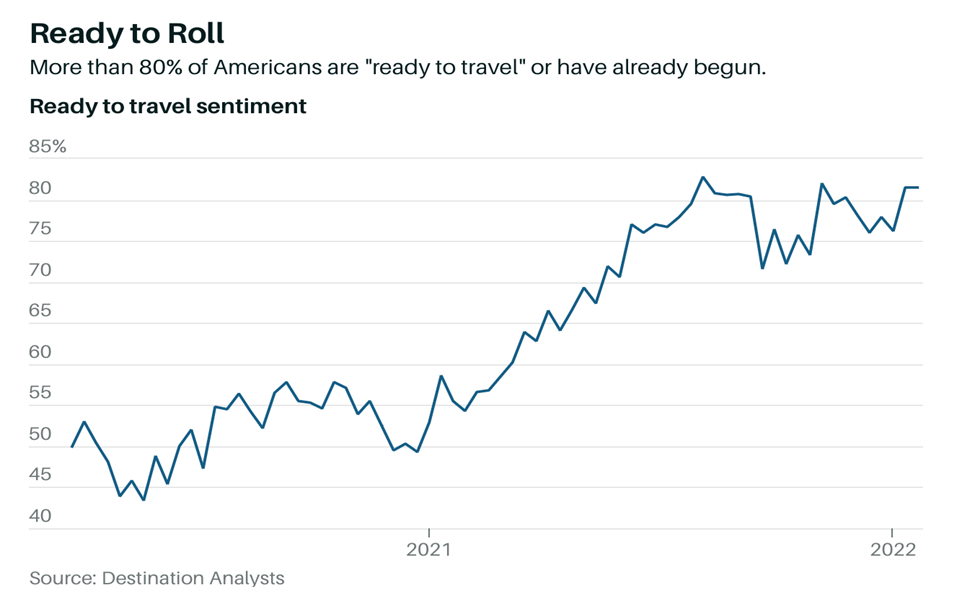

“With Omicron Waning, Americans Are Ready for the Reopening – A transition to a new pandemic normal holds major implications for the U.S. economy, and particularly for the hard-hit services sector, where recovery so far has been stunted even as spending elsewhere has soared. Even the perception of a pandemic lull this time around could have a significant effect. “People are going to, I think, have an even more euphoric attitude toward this if we do feel like this is really the actual end of the pandemic,” says Jefferies economist Tom Simons. ‘That will feel like a boom.’”, Barron’s, February 7, 2022

“California finally reopens: Mammoth and Tahoe ski resorts reopen lodgings after rollback of state’s COVID order. Mammoth and Lake Tahoe area ski resorts and mountain towns are reopening hotels and lodges to leisure visitors after California’s governor on Monday lifted statewide regional orders that had closed lodging to most travelers.”, Los Angeles Times, January 25, 2022

Brand News

“New research shows 84% of franchise companies report revenues are now equal to or higher than pre-pandemic levels – Franchise Business Review today announced the release of its 2022 Franchising Outlook Report. The report is based on research from over 31,000 franchise owners across 350 brands, 6,000 employees at both the corporate office and unit-level, and 200 franchise executives.”, Franchise Business Review, February 2, 2022

“How Dunkin’ Changed Franchising Forever – The first Dunkin’ was opened back in 1948, in Quincy, Massachusetts, after William Rosenberg had the idea to start selling donuts and coffee for just $0.05 and $0.10 each, respectively. Because of his dream and drive to make it a reality, Rosenberg remains a key pioneer of the fast food industry. In 2000, The LA Times reports, he was honored by the Nation’s Restaurant News as one of the top 100 people who ‘changed retailing and food service in the 20th century.’”, Mashed, January 30, 2022

“KFC Australia makes its drone delivery debut – CMO says the pilot of drone food delivery was prompted by dramatic changes to consumer behaviours during the pandemic. KFC Australia has teamed up with drone service provider, Wing, to pilot a delivery service of both hot and fresh menu items in Australia.”, CMO Australia, February 4, 2022

“Restaurant Brands lifts NZ sales by $51m; Covid closures cost it $26m – The fast-food company that owns the local franchises for KFC, Pizza Hut, Taco Bell and Carl’s Jr, made an extra $51 million in sales in New Zealand last year, but estimates it lost about $26m of sales as a result of Covid-19.”, Stuff New Zealand, January 27, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane, Australia

“Wingstop creates digital-only, cashless storefront unit – Dallas prototype serves as testing ground for innovations — from sustainable uniforms and cashless transactions to a kitchen display system and grease extraction for bio-fuels. Wingstop Inc. in December opened a “Restaurant of the Future” in a Dallas strip mall, featuring cashless 100% digital transactions and serving as testing ground for new ideas, from new layouts and uniforms to a kitchen display system.”, Nation’s Restaurant News, February 3, 2022

Cartoon Of The Issue: Leadership!

Articles & Studies For Today And Tomorrow

“AI in Restaurants? The Possibilities are Limitless – The global AI market as a whole is expected to grow to a value of $190.61 billion by 2025. It looks like 2022 is shaping up to be a very interesting year in restaurant technology, especially in the quick-serve and fast-casual spaces. For example, we learned in December that TikTok was teaming up with a ghost-kitchen company to open 300 virtual kitchens in March, aiming to reach 1,000 by the end of the year. On the menu? Recipes that have gone viral on the video-sharing app.”, QSR Magazine, January 28, 2022

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country RankingFor advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 48, Tuesday, January 25, 2022

Trends in this issue:

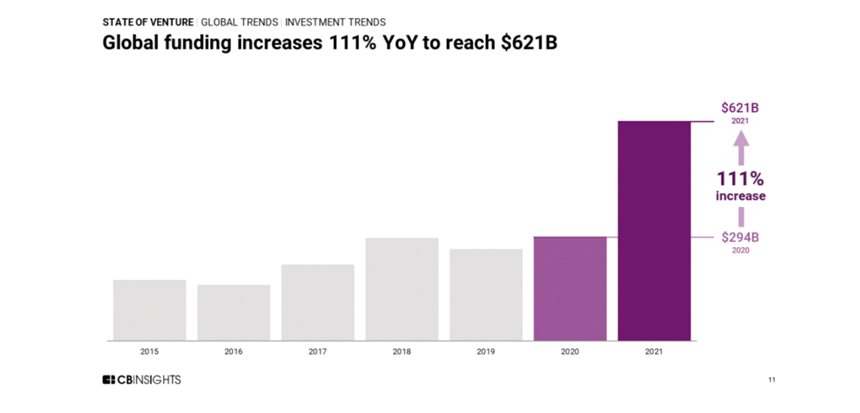

The reinvention of company culture, an explosion of new small businesses, venture capital grew 111% worldwide in 2021, falling shipping rates may mean an end to the global supply chain crisis, working from to be a permanent part of how jobs are done. And a zoom cartoon to reduce stress!

First, A Few Words of Wisdom

“Try to be a rainbow in someone’s cloud.”, Maya Angelou

“Your success in life isn’t based on your ability to simply change. It is based on your ability to change faster than your competition, customers and business.”, Mark Sanborn

“People begin to be successful the minute they decide to be.”, Harvey Mackay

Highlights in issue #48:

- Brand Global News Section: Checkers & Rally’s®, Denny’s®, KFC China, McDonalds®, Phenix Salon Suites®, Starbucks®, TGI Friday’s®, Tropical Smoothie®

Bolded article titles are live links, if the article is available without subscription

Interesting Data and Studies

“State Of Venture 2021 Report – It was a record year for global & US venture funding, exits, unicorns, and more. Global venture deals and dollars reached record highs in 2021. Funding more than doubled year-over-year as startup investment soared across sectors and geographies.”, CB Insights, January 12, 2022

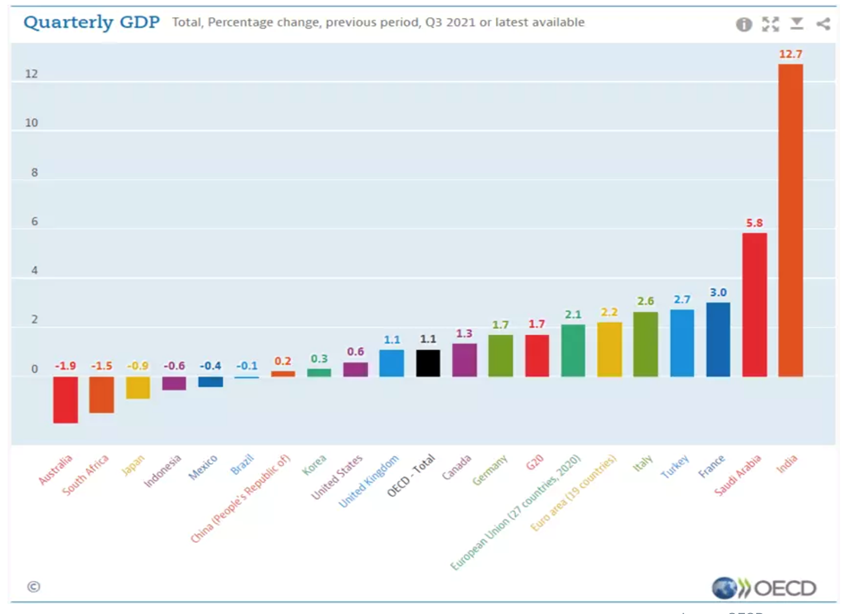

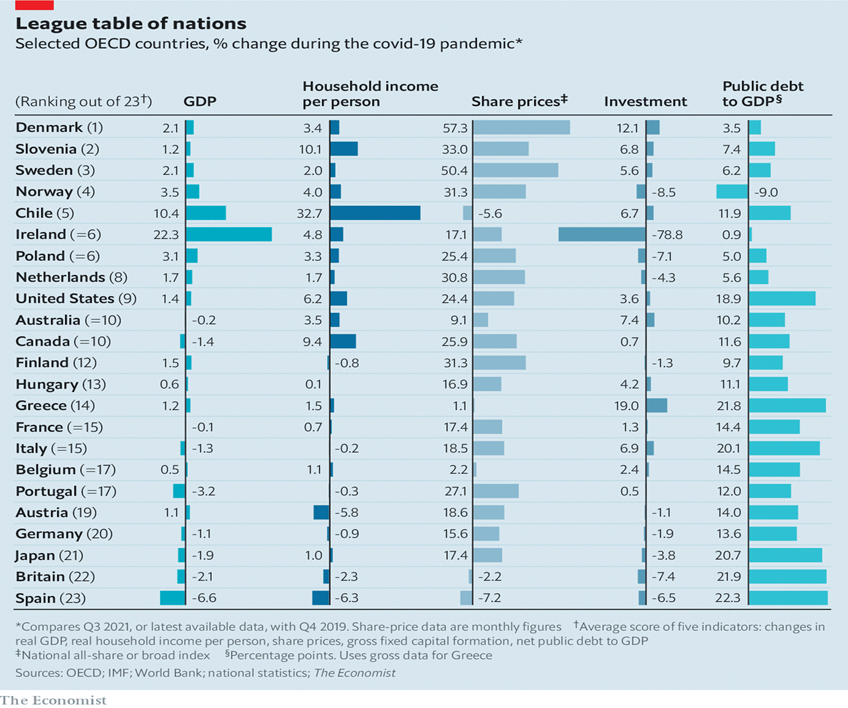

“GDP is growing fastest in these countries – what it means – Countries including India and Turkey saw strong GDP growth in the third quarter of 2021. While other countries, including China, Australia and Japan, saw their GDP slow or fall. The OECD says GDP growth in half the G20 major economies is still below pre-pandemic levels.”, World Economic Forum, January 17, 2022

“Inflation: Seven reasons the cost of living is going up around the world – From buying groceries to heating our homes, the cost of living is rising sharply – not just in the UK but around the world. Global inflation – the rate at which prices rise – is at its highest since 2008. Here are some of the reasons why.”, BBC News, January 20, 2022

“The knot around the global economy from intractable supply networks is still holding tight at the start of the new year as the omicron variant complicates recovery efforts. According to fresh IHS Markit data, U.S. supplier delivery times lengthened slightly in early January. Still, there’s reason for optimism. Europe’s factories were able to lift output as shipping delays and materials shortages eased somewhat. German businesses expectations for the coming months improved recently. In the U.S., the ISM’s index of future manufacturing output climbed to the highest level in more than a year.”, Bloomberg, January 25, 2022

“The Global Risks Report 2022, 17th Edition – In some societies, rapid progress on vaccination, leaps forward on digitalization and a return to pre-pandemic growth rates herald better prospects for 2022 and beyond. Others could be weighed down for years by struggles to apply even initial vaccine doses, combat digital divides and find new sources of economic growth.”, World Economic Forum, January 2022

Global Supply Chain & Trade Update

“Omicron, Supply-Chain Troubles to Slow Growth, World Bank Says – Bank forecasts 4.1% growth in 2022, down from 5.5% last year. The global economy is poised to slow down in 2022, the World Bank forecast Tuesday, citing the effects of the Omicron variant, supply-chain disruptions, labor shortages and the winding down of government economic support. Japan, Indonesia, Thailand, Malaysia and Vietnam are among countries expected to strengthen in 2022. The report projects growth to slow further, to 3.2%, in 2023.”, Wall Street Journal, January 11, 2022

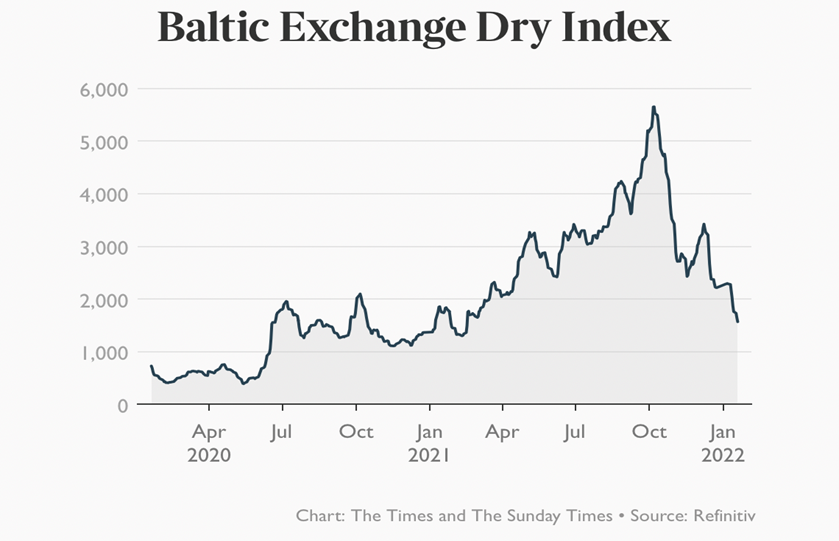

“Falling shipping rates point to end of the great supply chain crisis – The Baltic Dry Index……….measures the price of shipping bulk materials around the world and as such is used as a proxy to measure the stability and efficiency of worldwide supply chains. In times of market dislocation, it rises sharply to reflect the difficulties in transporting goods — and during the pandemic it has done little else but rise, peaking at more than 5,700. That peak in the Baltic Dry was hit on October 7. Since then, the index has fallen sharply, halving within a month. Though it jumped in the run-up to Christmas, it has dropped back again since. Yesterday it fell further, its tenth consecutive daily decline, to 1,570.”, The Times of London, January 21, 2022

“ Race to Measure Supply Chain Snarls Draws a Crowded Field – Jumping in this month were logistics giant Kuehne+Nagel, economists at Citigroup and Morgan Stanley, and researchers at the New York Fed. Analysts at Bloomberg, Flexport and the White House have already launched such data points and are making refinements as the crisis drags on.”, Bloomberg, January 24, 2022

“Challenges at ports, bad weather conditions or vessel issues can impact your shipments and cause disruptions in your supply chain. Currently, more than 561 vessels of the major carriers are anchored off ports, as many ports on every continent are facing disruptions in their operations.”, Sea Explorer, January 25, 2022

“Canada Faces Empty Shelves as Trucking Snarls Hit Food Supplies – About $45 billion worth of goods crosses the border every month, and Canada is the top export market for 32 U.S. states, according to the Department of Commerce. Most trade between Canada and the U.S. travels by truck.”, Bloomberg, January 21, 2022

Global Energy

“Europe’s Energy Shock Rattles Consumers – Wholesale gas prices are up almost 300% in the past year because of unusually low storage levels, increased demand from economies emerging from the pandemic and capped flows from Russia. That has driven inflation higher, and analysts at Bank of America estimate that household energy costs will rise 50% this year, and aid from governments to shield households will only offset about a quarter of that.”, Bloomberg, January 12, 2022

Global, Regional & Local Travel Updates

“A Brighter Outlook For Airlines In 2022? – Airlines are on the cusp of facing their third year dealing with the Coronavirus pandemic. The challenges have continued relentlessly, ranging from new variants of the virus, to shifting government policies on travel restrictions and testing. The impact on customer confidence and on airlines’ ability to plan and operate predictable schedules has hit revenues and finances severely. However, compared with the outlook when I reviewed the landscape 12 months ago, there are reasons for cautious optimism for 2022.”, Forbes, January 23, 2022

“When will international travel return? A country-by-country guide to coronavirus recovery. The emergence of the omicron variant of the COVID-19 virus created upheaval on an international scale……Many countries also changed their entry requirements over the last weeks of 2021, with some decreasing the number of days allowed for pre-travel testing and others once again requiring fully vaccinated travelers to present pre-travel negative test results.”, The Points Guy, January 22, 2022

“The biggest travel trend of 2022: Go big, spend big – If 2021 was about domestic travel, 2022 may be the year of the ‘bucket list’ trip. This is one of the biggest trends that travel insiders expect this year, despite 2022’s tumultuous start as the omicron Covid-19 variant snarled the industry.”, CNBC, January 20, 2022

“How China’s Zero-COVID Goal Is Impacting The Aviation Industry – Inbound international flights to China are operating at a fraction of comparable 2020 numbers and don’t look like recovering any time soon. If anything, capacity may further tighten. Among many industries, the aviation industry is a casualty of China’s zero-COVID policy. China closed its international borders to nearly all foreigners in March 2020, shutting down the inbound tourism and business markets. China has not relaxed that policy since. If anything, they’ve become tougher on who they award the few visas they grant to.”, Simple Flying, January 14, 2022

Global COVID & Vaccine Update

“Europe Slowly Starts to Consider Treating Covid Like the Flu – New metrics are needed as Covid becomes endemic, Spain PM says Hospitalization rates remain manageable despite surging cases. Spain is calling for Covid-19 to be treated as an endemic disease, like the flu, becoming the first major European nation to explicitly suggest that people live with it.”, Bloomberg, January 11, 2022

Country & Regional Updates

Australia

“Chicken shortage to continue for weeks to come, Australian Chicken Meat Federation warns – The continued supply chain strain of Omicron and a national shortage means Australia’s most popular protein will remain off the menu for weeks yet to come.”, News.com.au, January 20, 2022

Canada

“Ontario restaurants take pragmatic approach as they come out of yet another lockdown – As restaurants in Ontario prepare to reopen from the fifth wave of the pandemic, business owners say they’re going to be more cautious this time by bringing in measures such as smaller menus and limited operating hours to ensure they don’t suffer large losses in the case of another lockdown.”, The Globe and Mail, January 23, 2022

China

“Beijing Winter Olympics Will Spotlight a Richer, More Confident China – The country is richer, more confident, and more assertive than it was when the 2008 Summer Games were held in Beijing.”, Bloomberg, January 21, 2022

“Starbucks to widen online reach in China through new alliance with Meituan ending coffeehouse chains partnership with Alibaba – Seattle-based Starbucks said the collaboration with Meituan, which operates China’s largest online food delivery platform, will enable more consumers across the mainland to make reservations at its stores and get their coffee delivered, according to a statement published on Tuesday on the American firm’s official WeChat account.”, South China Morning Post, January 19, 2022. Compliments of Paul Jones, Jones & Co., Toronto

The Philippines

“Philippines Sets Vaccination Mandate For Unrestricted Air Travel – As of January 17th, only fully vaccinated individuals will be allowed to take public transportation to, from, and within the national capital region of the Philippines. While there are exceptions to this policy provided, the blanket policy will apply to air travel as well, which would appear to cover a large portion of flights since Manilla is the country’s largest air hub.”, Simple Flying, January 15, 2022

Poland

“Poland’s Biggest Convenience Chain Overtakes Amazon In European Race For Autonomous Stores – Using contactless, AI-powered computer vision technology from U.S. tech player AiFi—a system similar to Amazon’s Just Walk Out set-up—the concept enables shopping to be checkout-free and fast.”, Forbes, January 18, 2022

Spain

“Spain’s tourist sector seen reaching 88% of pre-pandemic size in 2022 – Spain was the world’s second most visited country before the pandemic. Holidaymakers flocked to its beaches and historic buildings while trendy cities like Barcelona and Madrid were popular for short breaks. Industry association Exceltur expects Spain’s tourism gross domestic product to be worth 135 billion euros ($155 billion) in 2022, 88% of pre-pandemic levels, versus 57% in 2021, when a partial recovery of domestic tourism didn’t offset a contraction in international travellers.”, Reuters, January 13, 2022

United Kingdom

“Britain ‘will be among first’ to emerge from Covid pandemic – Hospital admissions have stopped rising across most of England. The northeast and Yorkshire is the only part of England where admissions are still clearly rising, with London seeing falls and the rest of the country broadly level or starting to decline, adding to confidence in weathering the Omicron wave.”, The Times of London, January 11, 2022

United States

“How Much Are You Willing to Pay for a Burrito? The pandemic has led to the largest price spikes at fast-food restaurants in two decades. The pandemic has led to price spikes in everything from pizza slices in Manhattan to sides of beef in Colorado. And it has led to more expensive items on the menus at fast-food chains, traditionally establishments where people are used to grabbing a quick bite that doesn’t hurt their wallet.”, New York Times, January 21, 2022

“The flip side of the ‘great resignation’ — a small-business boom. From January through November, just under 5 million new businesses were launched, a jump of 55 percent over the same period in 2019. “This time has been really fertile. We’ve seen a huge increase in new businesses since the pandemic started,” said Julia Pollak, the chief economist at ZipRecruiter. ‘There are more opportunities out there.’”, NBC News, December 30, 2022

“Starbucks, McDonald’s, more are cutting hours due to staffing shortages – Starbucks reached out to customers about shortened hours, halt on features and products as omicron cases surge; McDonald’s also announces shorter hours. With a double whammy of surging omicron cases and continued labor shortages, several major restaurant chains are cutting back on hours and services to deal with the challenges, including Starbucks, and Chipotle.”, Nation’s Restaurant News, January 14, 2022

Brand News

“2021 Reflections, 2022 Predictions for Franchising – Naturally, hiring and retention will be crucial in 2022, as will all relationship “soft skills,” from development teams nurturing candidates to FBCs supporting franchisees to being attuned to customer desires. So what else does the future hold for 2022? See what these franchising pros are predicting.”, Franchising.com, January 2022

“Checkers and Rally’s hope to serve up turnaround and debt refinancing – Checkers and Rally’s, backed by private equity firm Oak Hill Capital Partners, “hopes” to refinance its debt within a year, conditioned upon stable markets, CEO Frances Allen told Axios. Why it matters: The beleaguered burger chain is making headway under Allen, who was brought in to turn around the business in early 2020.”, Axios, January 13, 2022

“Denny’s Fuels Growth with Innovative Development Initiatives – The chain is rolling out an upfront cash incentive development program to help domestic franchisees capitalize on market opportunities. The incentive ranges from $50,000 to $400,000, with more money going toward underpenetrated markets.”, FSR Magazine, January 14, 2022

“Phenix Salon Suites Signs 8-Unit Development Deal in Sweden – Phenix Salon Suites, the nation’s leading salon suite brand turned international trailblazer, has announced another global development deal. Randa Shebly-Cobb, who opened the brand’s 300th salon location in Atlanta earlier this year, will soon bring Phenix Salon Suites’ brand to Sweden.”, Franchising.com, January 22, 2022

“TGI Fridays launching new format – TGI Fridays is launching Fridays on the Fly, a small-format restaurant concept that is designed to meet rising consumer demand for delivery and takeout. At approximately 2,500-sq. ft., the new format will be focused on filling delivery and takeout orders. It will also offer in-door dining, but with a smaller dining space than a traditional TGI Fridays.”, Chain Store Age, January 21, 2022

“Tropical Smoothie Cafe Considers Going Public – Coming off a record year, Tropical Smoothie Cafe is reportedly planning to go public later in 2022, according to Bloomberg. The red-hot fast casual could be valued at at least $1 billion, sourced told the media outlet. Tropical Smoothie is said to be working with Morgan Stanley and Jefferies Financial Group.”, QSR Magazine, January 11, 2022

Cartoon Of The Week: Recent Zoom Call!

Articles & Studies For Today And Tomorrow

“European sales of electric cars overtake diesel models for first time – Switch to battery-powered vehicles enjoys record growth on back of government subsidies and emissions regulations. More than a fifth of new cars sold across 18 European markets, including the UK, were powered exclusively by batteries, according to data compiled for the Financial Times by independent auto analyst Matthias Schmidt, while diesel cars, including diesel hybrids, accounted for less than 19 per cent of sales.”, The Financial Times, January 16, 2022

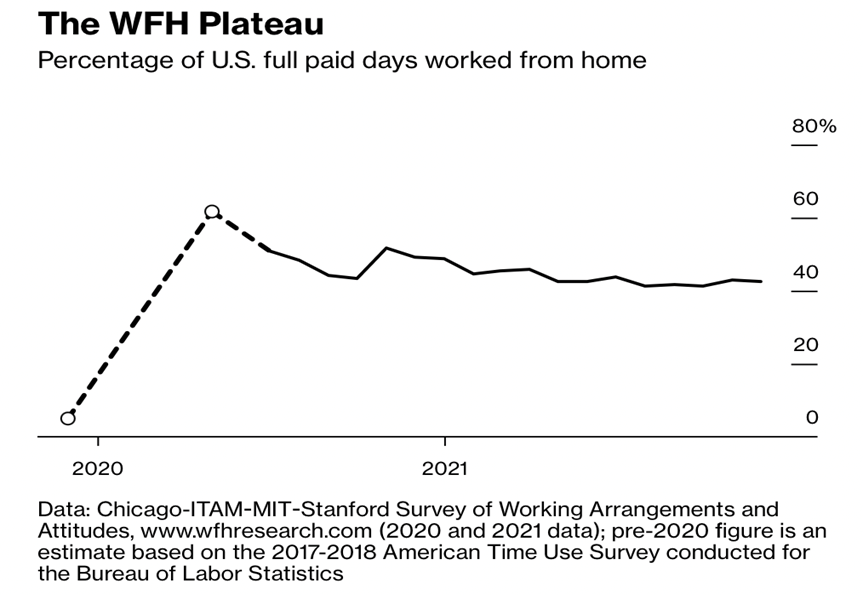

“Work From Home Is Becoming a Permanent Part of How Jobs Are Done – Data show we can expect 30% to 40% of workdays to be remote, long after the pandemic is over. In the second-to-last week of December, 42.4% of U.S. workdays were worked from home. Before the pandemic, WFH accounted for about 5% of U.S. paid full workdays.”, Bloomberg, January 18, 2022

“79% of baby boomers want to keep working, but with more flexibility. Is this the end of retirement? Baby boomers nearing retirement age don’t want to kick up their feet and relax through their sunset years. Instead, most of them want to continue working, but just fewer hours or in less demanding roles, according to a new survey.”, Fortune, January 12, 2022

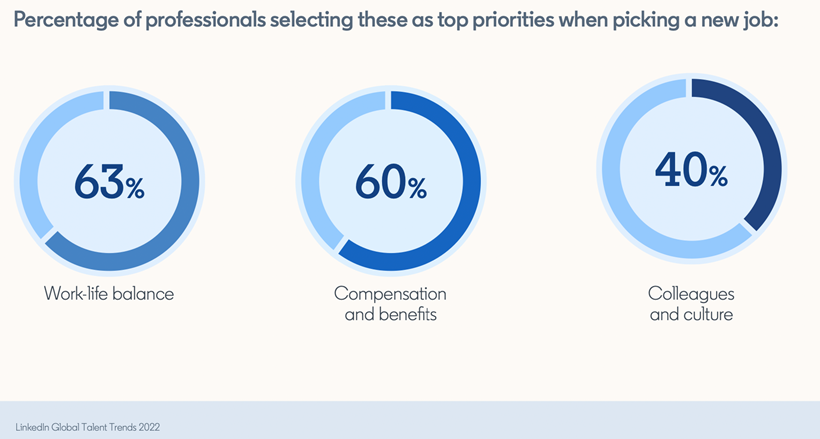

“2022 Global Talent Trends – The Reinvention of Company Culture. Because of the pandemic, employees are rethinking their priorities and their relationships with employers. They’re seeking flexible work arrangements and more work-life balance. They want to work for employers who value their physical and emotional well-being. And they’re ready to walk away from those who don’t.”, LinkedIn Talent Solutions, January 2022

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.