EGS Biweekly Global Business Newsletter Issue 41, Monday, October 18, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Inflation, supply chains, vaccination levels, air travel remain the major trends for this issue of our newsletter: “Wages are surging across the rich world”, “Ikea warns stock shortages likely to last another year”, “where are the world’s worst port delays?”, Thailand and the USA to reopen to vaccinated tourists, “India faces electricity crisis as coal supplies run critically low”, “UK job vacancies hit record amid Brexit and Covid staff shortages”, “Nearly all major (USA) airlines mandate COVID vaccine for employees”, “There is no quick fix for Europe’s self-manufactured energy crisis”, etc.

Words of Wisdom from Others

“If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.”, Zig Ziglar

“Success is the sum of small efforts, repeated day in and day out.”, R. Collier

“The secret of change is to focus all of your energy not on fighting the old, but building on the new.”, Socrates

Highlights in issue #41:

- What matters most? Five priorities for CEOs in the next normal (McKinsey)

- The US reopens to international travelers on November 8 — what you need to know.

- Covid Australia: Sydney celebrates end of 107-day lockdown

- China GDP: economic recovery stalls, growth slows to 4.9 per cent in third quarter

- Why Tropical Smoothie Cafe is Bucking the Ghost Kitchen Trend

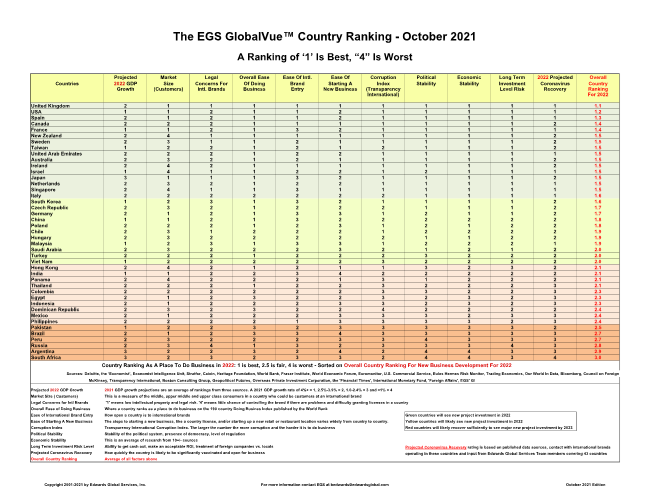

- Download the October EGS GlobalVue™ 40+ country ranking chart

- Brand News Section: Burger-Fi®, Carl’s Jr®, Denny’s®, Dominos®, Home Instead®, KFC® Russia, Tropical Smoothie®

Our Mission and Information Sources

Bolded article titles are live links, available without subscription

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground in 27 countries covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

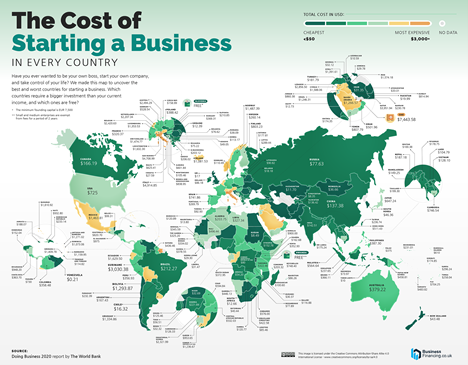

Our latest GlobalVue™ country ranking chart as places to do business in 2022 can be downloaded at this link: https://edwardsglobal.com/globalvue/

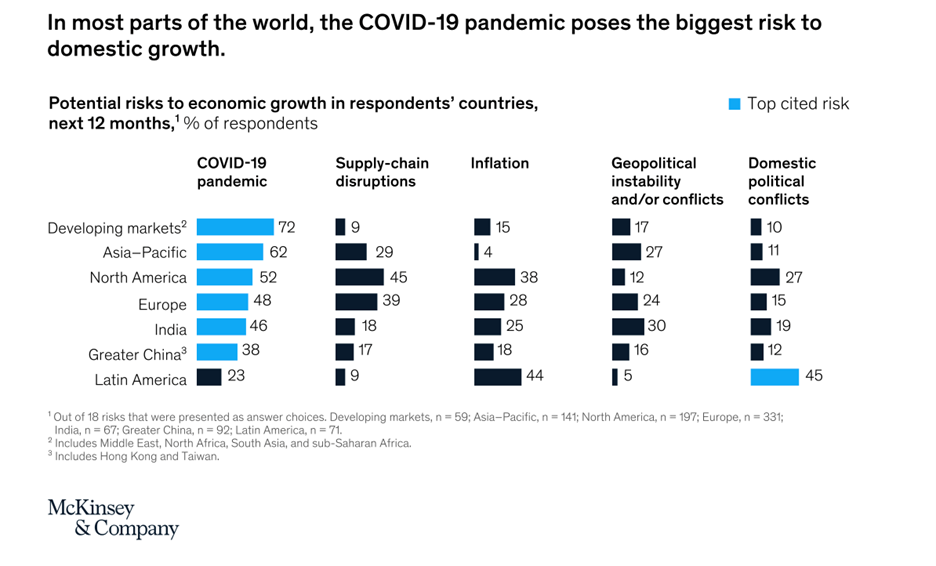

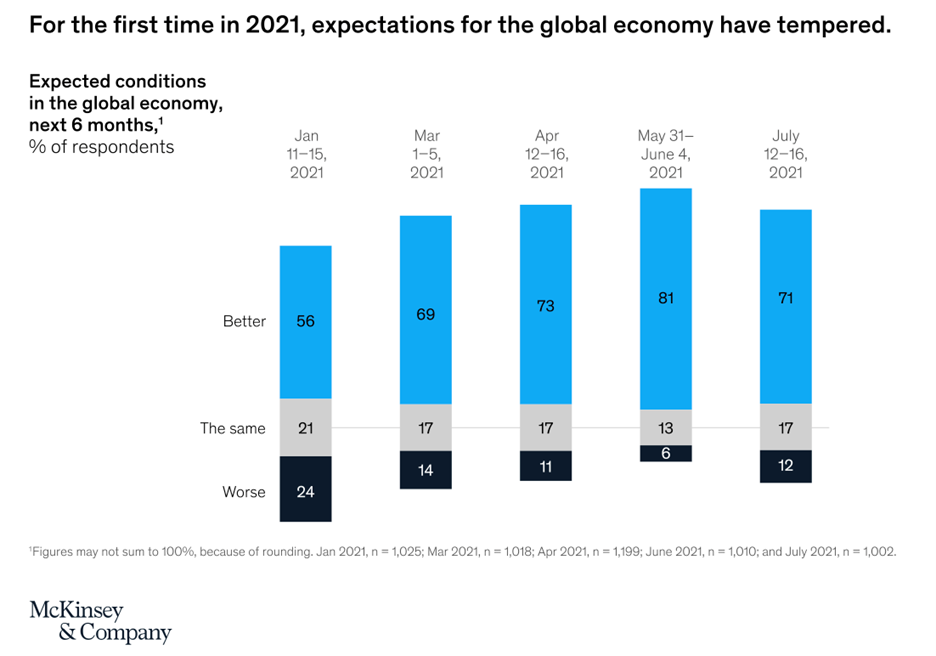

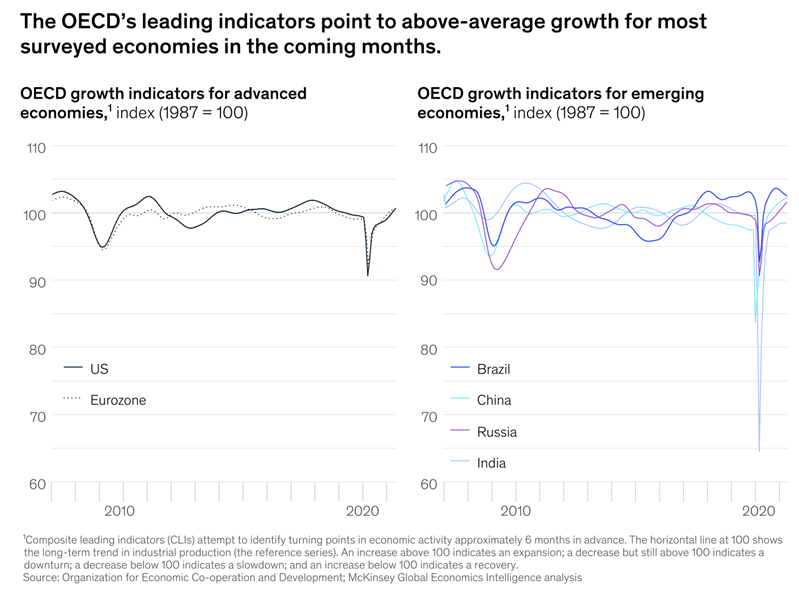

“The coronavirus effect on global economic sentiment – Eighteen months into the COVID-19 pandemic, executives’ responses to our latest McKinsey Global Survey suggest that they believe the economy is on track toward a recovery. 1 Throughout 2021, their views have, on average, been consistently positive. And they continue to report largely positive expectations: 71 percent of respondents predict that conditions in the global economy will improve in the next six months, down from an all-time high of 81 percent who said so last quarter.”, McKinsey, September 29, 2021

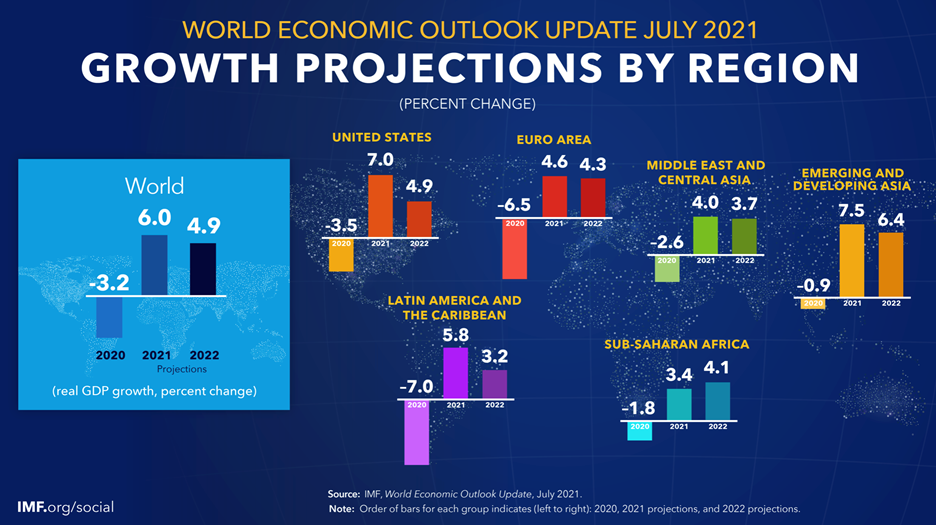

“IMF Revises Down Projected 2021 Growth – On Oct. 12, the International Monetary Fund announced a marginal revision down of its 2021 forecast for the global economy to 5.9%, though the adjustment does not reflect large changes for some countries. The IMF’s 2022 projection is unchanged at 4.9%…. The World Economic Outlook cited “dangerous divergence” across countries as a result of the “great vaccine divide” and differences in policy support by governments. Emerging market and developing countries face tighter financing conditions and the risk of “de-anchoring” inflation expectations, with the group’s output remaining 5.5% below pre-pandemic levels in 2024 amid deteriorating living standards. Supply bottlenecks, coupled with the release of pent-up demand, are also contributing to inflation.”, Stratfor, October 12, 2021

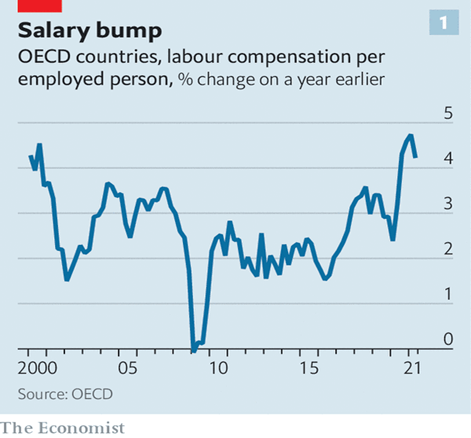

“Wages are surging across the rich world – When lockdowns were imposed poorly paid people in service jobs dropped out of the workforce, for instance, which had the effect of raising average pay as measured by statisticians. Even so, wage growth seems to have been stronger than the scale of the economic downturn alone would have suggested. Goldman Sachs, a bank, has created a “tracker” that corrects for pandemic-related distortions. Underlying wage growth, at about 2.5% across the (G)10 group of large economies, is as fast as it was in 2018.”, The Economist, October 16, 2021

“Coal Shortages in China and India – China’s attempts to resolve its ongoing power crunch hit a new snag. New flooding in the central Shanxi province over the weekend shut down a number of coal mines, hitting China’s plans to offset the loss of coal imports with a surge in domestic output. Several Indian states are reporting shortages of coal and warning of possible power cuts. Tamil Nadu and Kerala are running low on supplies, while Andhra Pradesh and Maharashtra have shut down power generation units because of coal shortages.” Geopolitical Futures, October 11, 2021

Supply Chain & Energy – Worldwide Issues

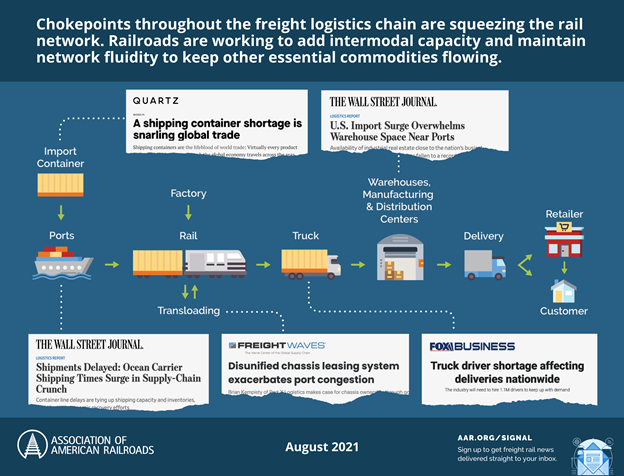

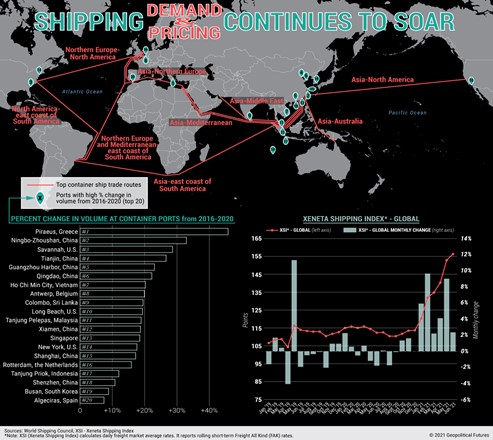

“Port Gridlock Stretches Supply Lines Thin in Blow for Economies – Delays may get worse before improving, several experts warn. Christmas gifts are sitting on the dock of a bay, wasting time. Global ports are growing more gridlocked as the pandemic era’s supply shocks intensify, threatening to spoil the holiday shopping season, erode corporate profits and drive up consumer prices.”, Bloomberg, October 16, 2021

“The waiting game: where are the world’s worst port delays? From Shenzhen to Los Angeles, storms, Covid and labour shortages are causing disruption. The nearly 100 ships waiting on the horizon to berth at the Hong Kong and Shenzhen container ports are just the latest sign of the problems to have snarled global supply chains, pushed up consumer prices in Europe and the US, and led to shortages of goods ranging from Christmas toys to furniture…..Globally, there are now 584 container ships stuck outside ports, nearly double the number at the start of the year, according to real-time data from Kuehne+Nagel, one of the world’s largest freight forwarders.”, The Financial Times, October 15, 2021

“Dubai to restrict cargo imports into airport to clear shipment backlog – Cargo logjam at regional trade and financial hub blamed on labour shortages. Dubai will restrict imports of cargo into its international airport for six days from Tuesday to clear a backlog caused by “extraordinarily high” volumes of inbound shipments. Dnata, the cargo handling arm of government-owned airline group Emirates, said the restrictions would also include transit cargo en route to other destinations in the United Arab Emirates. Certain categories of essential freight would be exempted.”, The Financial Times, October 15, 2021

“Stranded at sea with the cargo – Unvaccinated crews growing desperate to get off ships….Some 300,000 of these migrant merchant sailors have been stranded on vessels at sea or in ports around the world, according to the International Transport Workers’ Federation, a London-based trade union that is among the maritime agencies lobbying governments to address what’s been labeled the ‘crew-change crisis.’ They endure unbroken monotony and growing desperation. Their unions and charity groups describe exhaustion, despair, suicide and violence at sea, including at least one alleged murder on a cargo ship headed to Los Angeles.”, The Los Angeles Times, October 2021. Compliments of Guy Fox, Chairman of the Board, International Seafarers Center, Ports of Long Beach & Los Angeles

“China’s energy crisis threatens lengthy disruption to global supply chain – Buyers in Europe and US must wait longer for supplies as factories are forced to slash operating capacity. Factory owners in China and their customers worldwide have been told to prepare for power supply disruptions becoming part of life as President Xi Jinping doggedly weans the world’s second-biggest economy off its dependence on coal.”, The Financial Times, October 16, 2021

“Don’t expect supply chain challenges to end anytime soon – Port backups are delaying equipment deliveries for months. Here’s why it’s happening, and how long it will last. Shipping delays can be expected to last until late next year. Restaurants looking to replace old fryers or build new locations have found it can sometimes take months to get equipment in the door, thanks to a backlog of imports that has left two dozen or more container ships waiting outside of U.S. ports. Such waits are likely to continue to be a problem for the foreseeable future.”, Restaurant Business Online, September 24, 2021

“(The commissioner of the Federal Maritime Commission), Carl Bentzel, discusses State of US Ports at International Forum – The shipping challenges the nation is currently experiencing are, he says, “the largest meltdown since World War II.” It is the first time since WWII that cargo shipments are not getting into the U.S. at a time when people want shipments. There are two primary factors behind this meltdown. The first reason is the dislocation of products and closures brought about by the COVID-19 pandemic. In California alone, cargo decreased by 20%–30% for a three-month period. The second factor is the resumption of activity after the COVID-19 closures, which led to an almost 30% surge in cargo. So, the industry quickly saw a swing of 60% in volume, he explains.”, California Chamber of Commerce, October 12, 2021

“Ikea warns stock shortages likely to last another year – World’s largest furniture retailer faces supply chain struggles but pandemic has shifted sales online. Ikea has become the latest retailer to warn on supply chain problems, saying on Thursday that stock shortages were likely to last another year…..Reporting its annual results, the world’s largest furniture retailer also said the pandemic had helped its business and sped up its transformation.”, The Financial Times, October 14, 2021

Global, Regional & Local Travel Updates

“The US reopens to international travelers on November 8 — what you need to know. Although we now have a confirmed date of Nov. 8, some questions remain regarding acceptable proof of vaccinations and what the entire process will look like. Here’s what we know so far about the U.S. reopening.”, The Points Guy, October 15, 2021

“European Cities Top Travel Openness Ratings in New Analysis – U.S. lags behind; Asian cities dominate bottom of Bloomberg’s ranking. European finance and tourism capitals dominate a Bloomberg ranking of 70 global cities most open to travelers, based on vaccination rates, local public health rules and Covid-19 travel restrictions.”, Bloomberg, October 10, 2021

“Nearly all major (USA) airlines mandate COVID vaccine for employees….. the largest pilots association and most major carriers — United Airlines, American Airlines, Southwest Airlines, JetBlue, Alaska Airlines and Hawaiian Airlines — confirm they will follow President Biden’s executive order requiring workers to get the shots.”, CBS News, October 12, 2021

“Canada Announces Vaccine Mandate for Air, Rail and Cruise Travelers – The Canadian government announced Wednesday that domestic and international travelers arriving in the country via commercial flight, train or cruise ship must be fully vaccinated. According to the official website of Canada, Prime Minister Justin Trudeau revealed that all travelers 12 years of age and older entering or departing the country via federally regulated modes of transportation must be fully vaccinated by October 30.”, Travel Pulse, October 7, 2021

“LATAM Colombia Exceeds 2019 Passenger Numbers – LATAM Airlines Colombia exceeded the number of passengers moved during the third quarter of the year compared to the same period of 2019. The carrier transported a total of 1,742,988 passengers between its 15 destinations and 25 domestic routes handled in Colombia. With these results, the Colombian market remains one of the key countries in the LATAM Airlines Group’s strategy, with a trend that has continued to rise in recent months.”, Airline Geeks, October 12, 2021

“Phuket’s sandbox to Singapore’s travel corridors: as Asia wakes up to travel, destinations weigh risks and rewards – Thailand and Singapore are at the vanguard of Asia’s tourism reawakening and their moves will be eagerly watched by other destinations seeking an insight into what works and what doesn’t. Early data looks encouraging, but experts say such schemes are small steps. Increased costs, the risk of new variants emerging, and a lack of demand from Chinese tourists are all hurdles on the long road to full recovery.”, South China Morning Post, October 16, 2021

“Asian Destinations Are Finally Cracking Open For U.S. Travelers – In general, there are very few Asian destinations that an American leisure traveler can visit right now. A couple of destinations, including the Maldives and Sri Lanka, stand out as exceptions in welcoming tourists since early 2021. Yet slowly but surely, the tourism doors are starting to crack open, if ever so hesitantly and with many restrictions still in place. Here’s a tentative timeline for countries that have recently announced rolling out a conditional welcome mat for U.S. travelers.”, Forbes, October 11, 2021

“The Best Airports in the World: 2021 Readers’ Choice Awards – The airports you can’t wait to fly into again. 10. London Heathrow Airport (LHR), 9. Zurich Airport (ZRH), 8. Athens International Airport (ATH), 7. Marrakech Menara Airport (RAK), 6. Dubai International Airport (DXB), 5. Hamad International Airport (DOH), 4. Seoul Incheon International Airport (ICN), 3. Tokyo Narita International Airport (NRT), 2. Istanbul Airport (IST) and as usual 1. Singapore Changi Airport (SIN)”, CNN Traveler, October 8, 2021

Global Vaccine Update

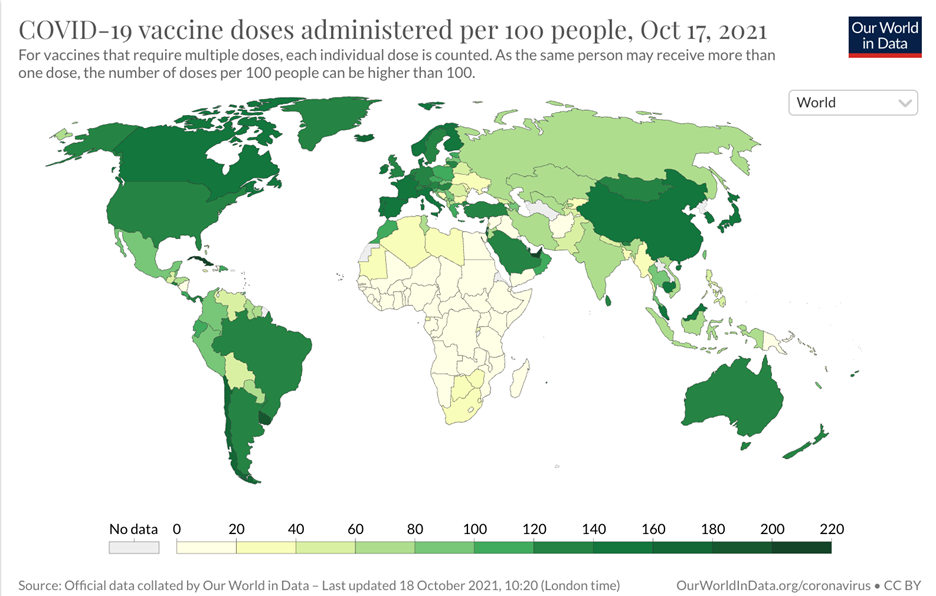

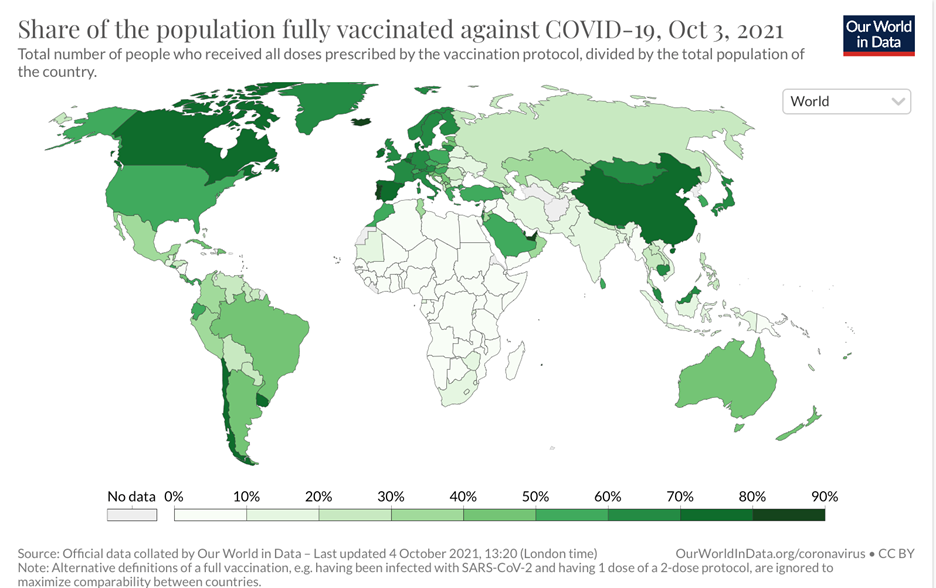

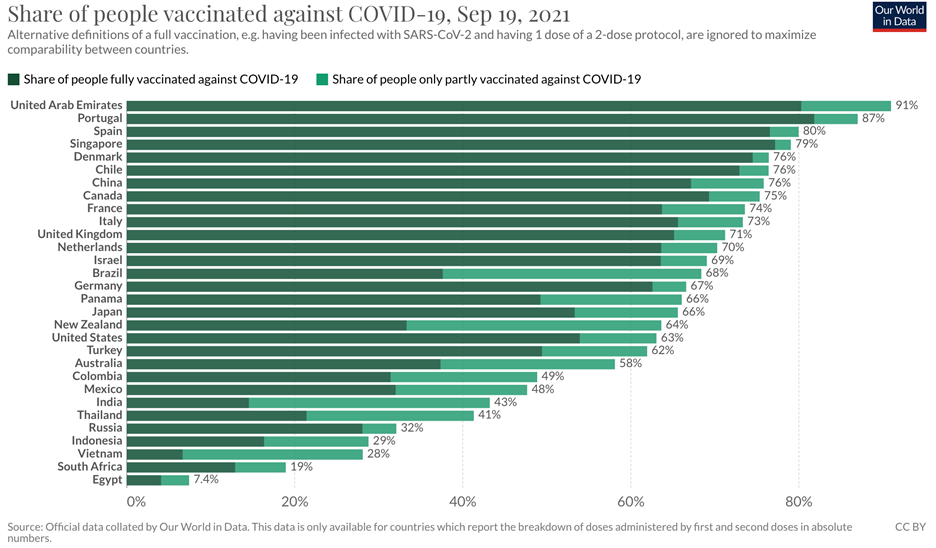

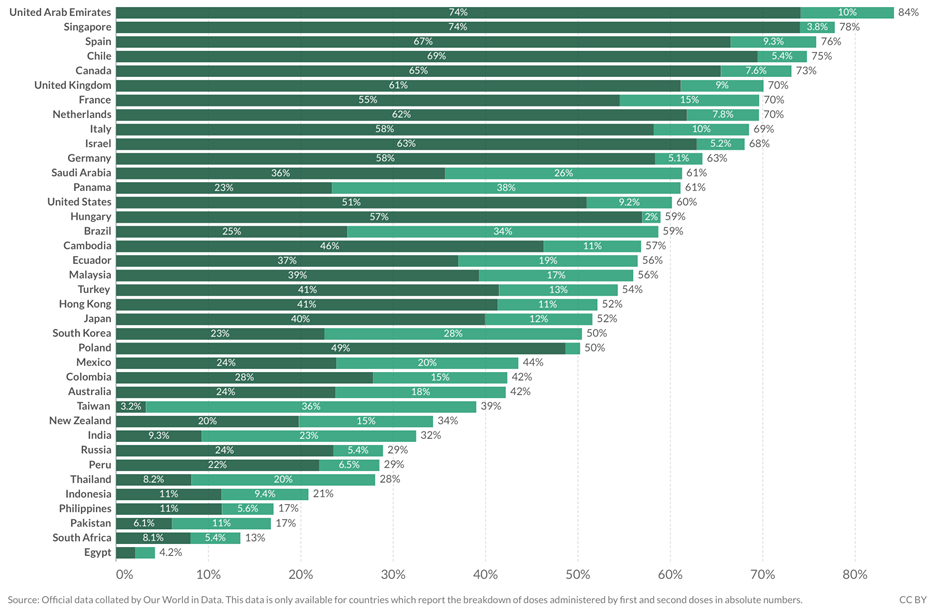

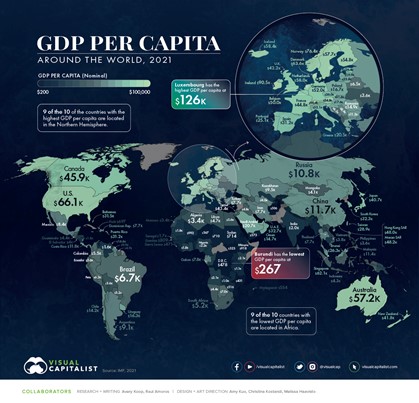

“47.6% of the world population has received at least one dose of a COVID-19 vaccine. 6.67 billion doses have been administered globally, and 19.23 million are now administered each day. Only 2.7% of people in low-income countries have received at least one dose.”, Our World In Data, October 18, 2021

Country & Regional Updates

Australia

“Covid Australia: Sydney celebrates end of 107-day lockdown – Midnight rush for shops and pubs as Sydney reopens. Australia’s largest city, Sydney, has emerged from Covid lockdown after almost four months, with locals celebrating a range of new freedoms. People queued for pubs and shops that opened at midnight on Monday. Many others have been enjoying anticipated reunions with relatives and friends.”, BBC October 12, 2021

Brazil

“Brazil Comes Out of Pandemic and Hits the Next Hardship—Inflation – Prices of electricity and cooking gas are up 30% or more over the year, while meat prices are up 25%. Prices rose in September at the fastest pace for the month since 1994, while the 12-month figure reached 10.25%, returning Brazil to double-digit inflation for the first time in more than five years, the country’s national statistics agency, IBGE, said Friday.”, Wall Street Journal, October 8,2021

Canada

“A remarkable milestone’: Canadian employment jumps back to prepandemic levels – The country added 157,100 positions last month, building on a gain of 90,200 in August, Statistics Canada said Friday. Hiring was considerably stronger than the 60,000 positions that economists were expecting. The unemployment rate fell to 6.9 per cent from 7.1 per cent. In September, around 19.13 million people were employed – the same as in February, 2020, marking a significant milestone in the country’s recovery from the pandemic.”, The Global and Mail, October 8, 2021

China

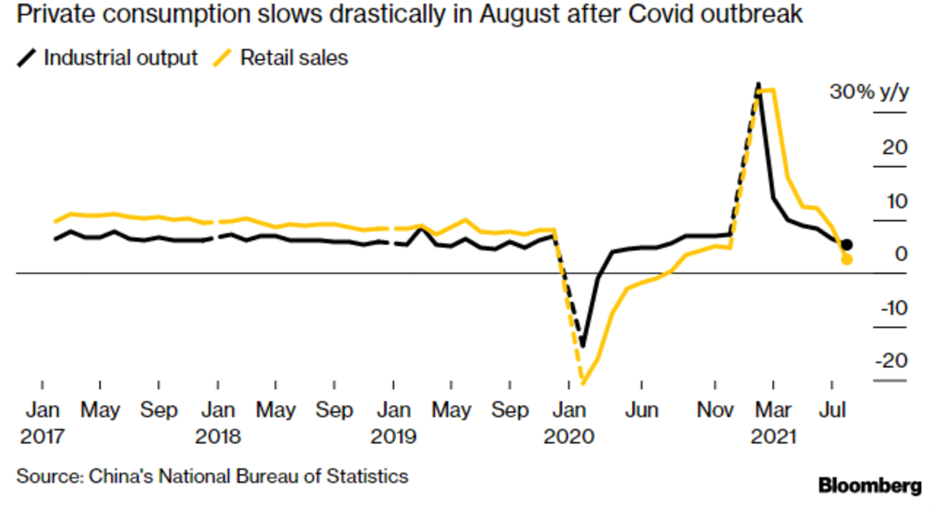

“China GDP: economic recovery stalls, growth slows to 4.9 per cent in third quarter – China’s economy grew by 4.9 per cent in the third quarter of 2021 compared with a year earlier, down from the 7.9 per cent growth seen in the second quarter. Retail sales and industrial production rose by 4.4 per cent and 3.1 per cent, respectively, in September from a year earlier.”, South China Morning Post, October 18, 2021

“China goes back to coal to combat power crisis ahead of Cop26 – China has ordered coalmines to increase production by tens of millions of tonnes before the end of the year as President Xi prioritises a nationwide power crisis over reducing Beijing’s dependence on fossil fuels…..The power shortage and rationing of electricity has seen factories halt assembly lines in the manufacturing hubs of Zhejiang, Jiangsu and Guangdong provinces.”, The Times of London, October 10, 2021

“China inflation: factory-gate prices rise at fastest pace on record due to surging coal costs amid power crisis – China’s official producer price index (PPI) rose by 10.7 per cent in September from a year earlier, compared with 9.5 per cent in August. The consumer price index (CPI) rose by 0.7 per cent in September from a year earlier, compared with a 0.8 per cent rise in August.”, South China Morning Post, October 14, 2021

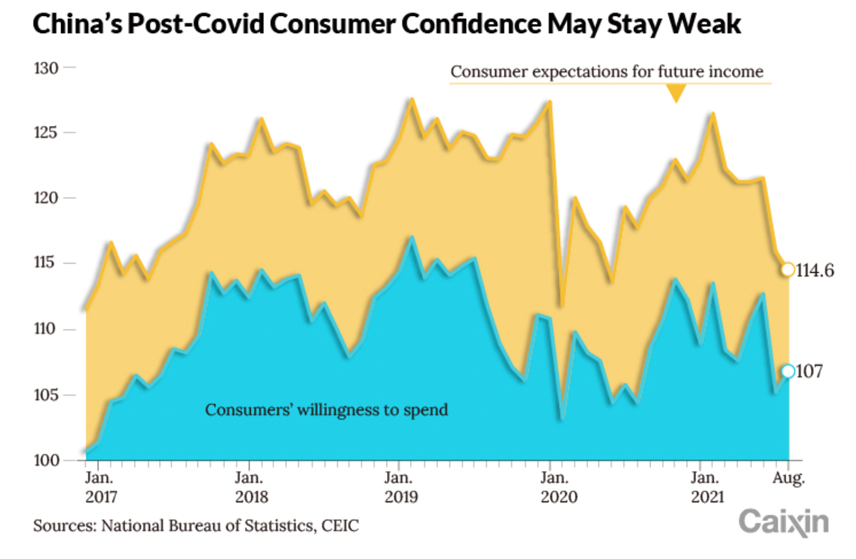

“China’s Consumer Spending May Suffer ‘Long Covid’ Contraction, Economists Warn – Surely one of the most commonly asked questions by people in China and indeed all over the world is: when will the Covid-19 pandemic end and life finally return to normal? Unfortunately, the answer from experts appears increasingly that it remains some time off.”, Caixing Global, October 7, 2021

European Union

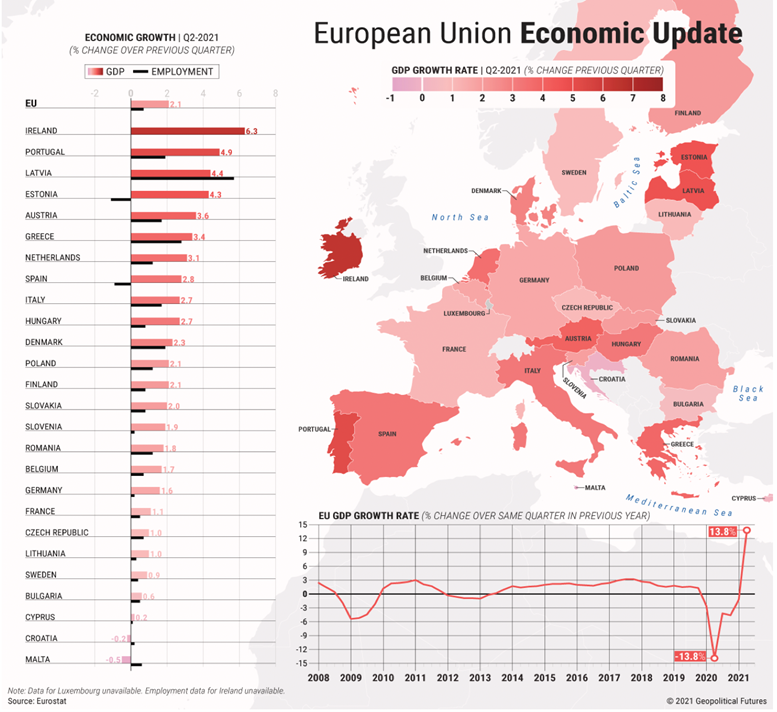

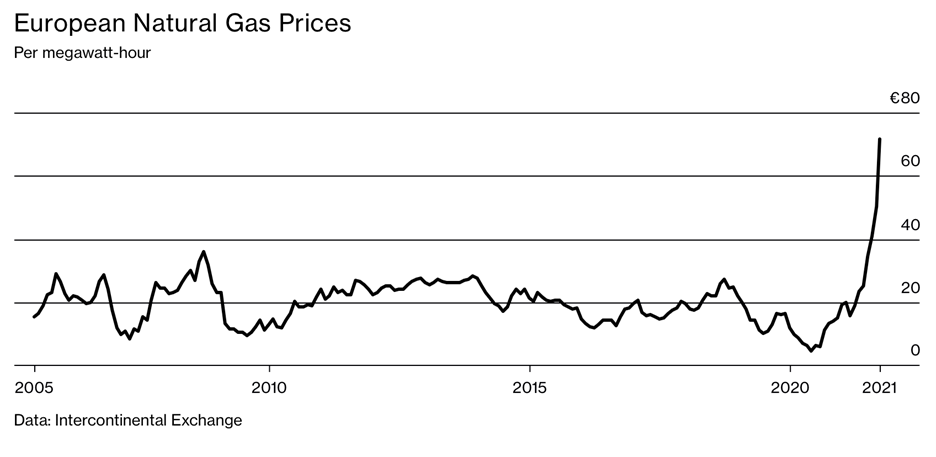

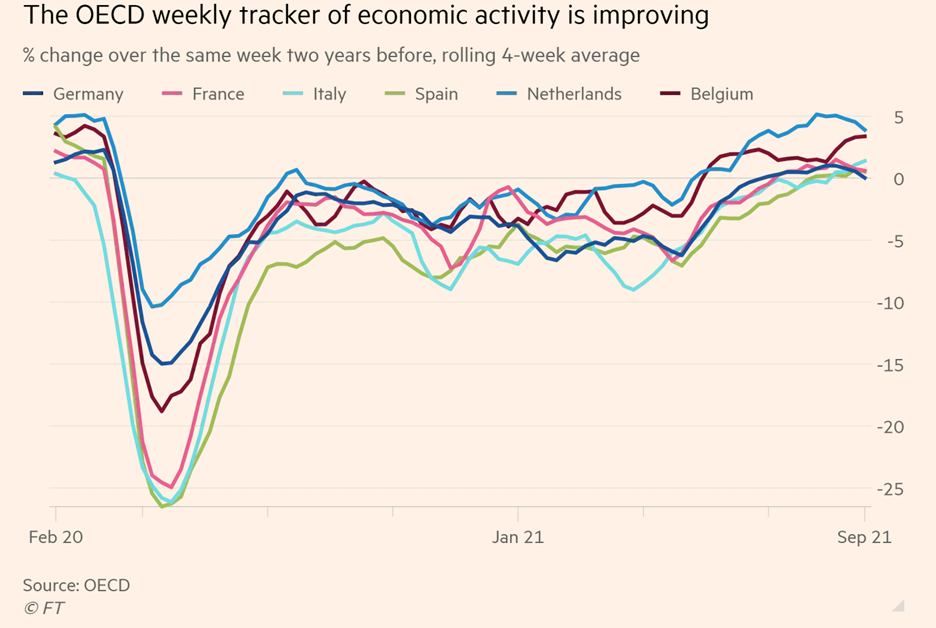

“Europe’s Faltering Economy (???) – As the COVID-19 vaccination campaign proceeds, the pandemic seems almost under control in Europe….But like the rest of the world, European supply chains can’t keep pace with demand. Industrial production in some states is faltering due to supply shortages…..Supply issues are also evident in the energy sector, where gas and electricity prices are hitting record highs, causing energy firms across the continent to shut down and putting upward pressure on inflation – a particularly sensitive issue in the eurozone….Put it all together and the supply bottlenecks, rising energy prices and inflationary pressures are headwinds that could hamper the European economic recovery.”, Geopolitical Futures, October 15, 2021

“There is no quick fix for Europe’s self-manufactured energy crisis – A bit more than a decade ago, a concerted effort was launched within the European Union countries and a few others on the continent to phase out their coal-fired generating plants to clean the skies and slow the pace of global warming. That’s the good news. The bad is that the Europeans are guilty of spectacularly bad planning. What was lost – coal-fired plants and their ability to meet peak demand fairly quickly – was never adequately replaced. Yes, loads of solar and wind power came on stream, but not enough. And – surprise! – solar and wind power became utterly useless when the sun did not shine and the wind did not blow.”, The Global and Mail, October 8, 2021

India

“India faces electricity crisis as coal supplies run critically low – Eight in 10 thermal power stations within days of running out as state blackouts spark protests. States across India have issued panicked warnings that coal supplies to thermal power plants, which convert heat from coal to electricity, are running perilously low.”, The Guardian, October 12, 2021

The Philippines

“Why the Philippines Became the Worst Place to Be in Covid – The Philippines fell to last place in Bloomberg’s Covid Resilience Ranking of the best and worst places to be amid the pandemic, capping a steady decline over the course of 2021. The monthly snapshot — which measures where the virus is being handled the most effectively with the least social and economic upheaval — ranks 53 major economies on 12 datapoints related to virus containment, the economy and opening up.”, Bloomberg, September 29, 2021

Thailand

“Thailand to reopen for some vaccinated tourists from November – Visitors from Britain and the US among those permitted as country seeks to boost its crucial tourism sector. Thailand plans to fully re-open to vaccinated tourists from countries deemed low risk from 1 November, the country’s leader said, citing the urgent need to save the kingdom’s ailing economy.”, The Guardian, October 12, 2021

United Kingdom

“UK job vacancies hit record amid Brexit and Covid staff shortages – Job vacancies soared to a record high of almost 1.2m in September, according to official figures, as employers hunted for staff to meet shortages brought on by Brexit and the pandemic. The Office for National Statistics (ONS) figures also showed a 207,000 increase in the number of people on payrolls to a record 29.2 million – 120,000 above pre-pandemic levels.”, The Guardian, October 12, 2021

“Containers of Christmas gifts turned away as Felixstowe port hits capacity – The problem was described yesterday as a “perfect storm” caused by a shortage of lorry drivers to move the containers, restrictions at ports because of Covid, and a surge in imports. One shipping boss said: ‘I don’t want to sound like a Grinch but there are going to be gaps on shelves this Christmas.’ The delay threatens to become the latest emergency to hit Britain after fuel shortages at the pumps and rising gas prices.”, The Times of London, October 13, 2021

“Warehouse space harder to find after online boom – Amid a desperate battle for space, several companies have agreed recently to pay 20 per cent above the asking price, CBRE said. ‘Supply levels are now critical, particularly in the northern belt that straddles the M62 motorway,’ Jonathan Compton, senior director for UK logistics at CBRE, said. Reflecting the change in shopping habits, of all the warehouse space taken in the most recent quarter, 39 per cent was leased by online retail companies.”, The Times of London, October 2, 2021

United States

“The ‘Great Resignation’ is likely to continue, as 55% of Americans anticipate looking for a new job – Most Americans expect to look for a new job as the pandemic continues. Some 55% of people in the workforce, meaning that they’re currently working or actively looking for employment, said they are likely to look for a new job in the next 12 months, according to Bankrate’s August jobseeker survey, published Monday. YouGov Plc conducted the survey of 2,452 adults for Bankrate from July 28 to July 30.”, CNBC, August 25, 2021

“Will Gen Z save malls and stores from their online rivals? Physical retailers have a rare chance to make shopping attractive again this holiday season. New US data from Accenture suggests 70 per cent of Gen Z customers plan to make most of their holiday purchases in store, while 54 per cent of Baby Boomers plan to buy largely online. Younger consumers are driven partly by fear of shortages — they would rather physically pick up items than risk shipping delays — but also by a desire to get out and do things with other people…..That means brands and malls that lost ground to online sales last year have a vital chance to fight back.”, The Financial Times, October 13, 2021

Brand News

“BurgerFi to acquire Anthony’s Coal Fired Pizza & Wings – Palm Beach, Fla.-based fast-casual burger chain BurgerFi International announced Monday the intention to acquire Anthony’s Coal Fired Pizza & Wings for $161.3 million from growth investment firm L Catterton. When the deal goes through, likely in the fourth quarter of 2021, L Catterton will become one of the largest shareholders of Burger Fi International.”, Nation’s Restaurant News, October 11, 2021

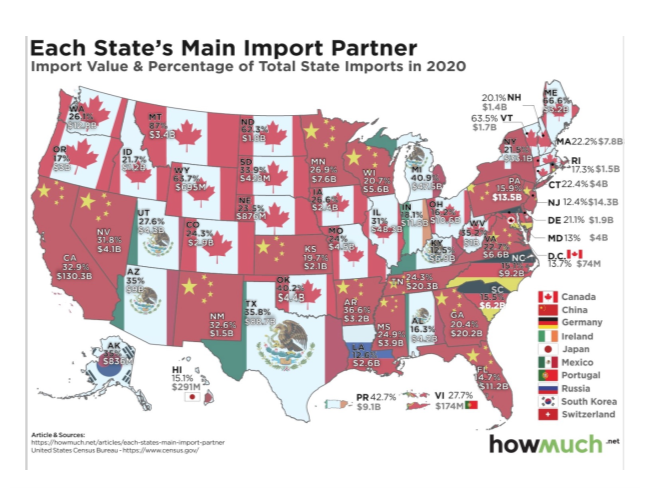

“US burger giant Carl’s Jr. states intention to enter the UK market – Popular US burger restaurant chain Carl’s Jr. is looking to enter the UK for the first time with plans to open restaurants in the capital and beyond. The brand, best known for its charbroiled burgers, is actively seeking companies to invest in franchises to open its first restaurants on UK soil. Founded in 1941, Carl’s Jr. is one of the most popular QSR chains in the world with more than 1,000 restaurants in 28 markets worldwide. The company already has a presence in Europe, with 79 restaurants across France, Denmark, Spain, Turkey and Russia and has just signed a 300-restaurant deal in Russia and is now targeting the UK as well as Germany for further expansion.”, Big Hospitality, October 7, 2021

“Denny’s Corporation: Catalyst Rich Third Quarter Likely To Deliver Strong Growth – Dine-in sales are likely to benefit significantly from pent-up customer demand. Additional growth is expected as 60% of the footprint that was operating with limited hours reverts back to the 24/7 schedule. The launch-to-date success of the virtual brands indicates a possible new leg of growth.”, Seeking Alpha, October 14, 2021

“Domino’s Pizza Enterprises Ltd celebrates official 3000th store opening – – in Dresden, Germany. In 2021 the Company has opened 206 new stores and has acquired its 10th market Taiwan and over the next 3-5 years plans to open new stores at a rate of 9-11% of the network annually.”, Dominos Australia, October 7, 2021. Compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

“Why Founders Sold $2.1B Home Instead After Resisting for Years – ‘It’s different, that’s for sure,’ said co-founder Paul Hogan when reached in late September, about his life after selling Home Instead to Honor Technology in August. How hard was it to decide to sell the homecare franchise that he and his wife, Lori, built from zero in 1994 to $2.1 billion in systemwide sales in 2020? ‘It was like this Olympic wrestling match with this decision.’”, Franchise Times, September 30, 2021

“KFC will go Straight” – The (Russia) network launched its own delivery – High rates of food delivery aggregators are forcing large fast food chains to develop their sales channels. KFC, five years after an unsuccessful attempt to create such a service, again decided to launch its own delivery. KFC has launched its own delivery in Moscow and St. Petersburg, the company itself told Kommersant. They added that in the near future the service will work in other cities with a population of over one million, which ‘will increase the volume of orders by 15-20%.’”, Kommersant.ru, October 10, 2021. Compliments of Paul Jones, Jones & Co., Toronto

“Why Tropical Smoothie Cafe is Bucking the Ghost Kitchen Trend – The 1,000-unit brand is letting franchisees dictate the path forward…… Ghost kitchens? CEO Charles Watson says they are not a part of the chain’s sizable growth plans. For Watson, it comes down to the brand’s roots as a franchisee-led organization. Since operators haven’t expressed overwhelming interest to jump in, it’s likely not in the company’s path forward. But the reasons go beyond that.”, QSR Magazine, October 6, 2021

Articles, Podcasts & Studies For Today And Tomorrow

I was featured in a Global Chamber podcast last week which can be heard at this link: Globinar Featuring Bill Edwards on “Global Business Recovery from the Trenches”

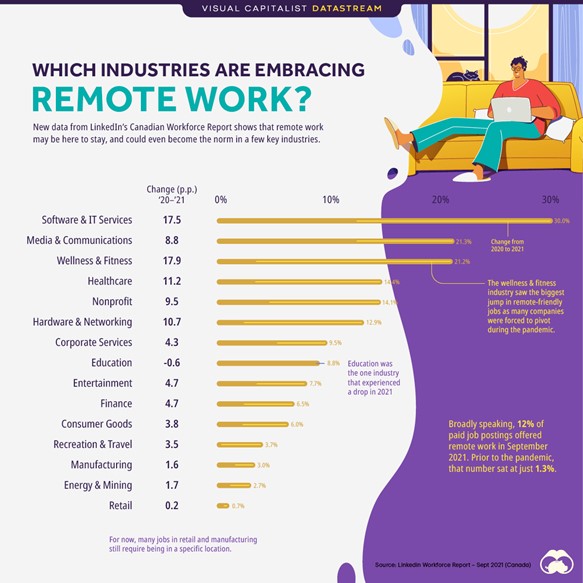

“Charting the Continued Rise of Remote Jobs – When the pandemic first took hold in 2020, and many workplaces around the world closed their doors, a grand experiment in work-from-home began. Today, well over a year after the first lockdown measures were put in place, there are still lingering questions about whether remote work would now become a commonplace option, or whether things would generally return to the status quo in offices around the world.”, LinkedIn Work Force Report, September 2021

“What matters most? Five priorities for CEOs in the next normal – The pandemic has both revealed and accelerated a number of trends that will play a substantial role in the shape of the future global economy. In our conversations with global executives, they have identified five priorities. Companies will want to adopt these five priorities as their North Star while they navigate the trends that are molding the future.”, McKinsey, September 8, 2021

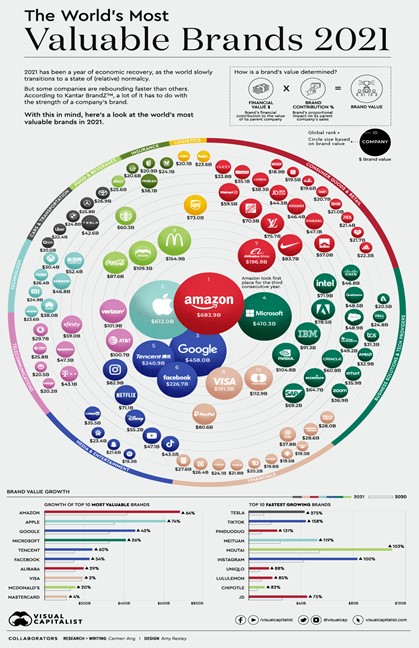

“The World’s 100 Most Valuable Brands in 2021 – In 2020, the global economy experienced one of the worst declines since the Great Depression. Yet, while the ripple effects of COVID-19 have thrown many businesses into disarray, some companies have not only managed to stay afloat amidst the chaos—they’ve thrived. Using data from Kantar BrandZ, this graphic looks at the top 100 most valuable brands of 2021.”, Visual Capitalist, October 6, 2021

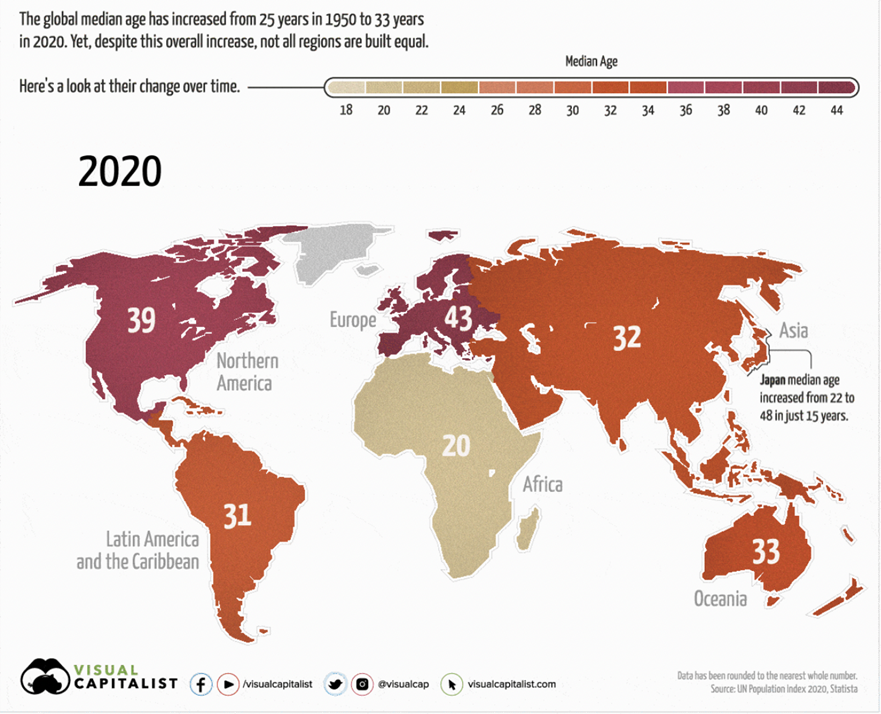

“Over the last 70 years, the global population has gotten older. Since 1950, the worldwide median age has gone from 25 years to 33 years. Yet, despite an overall increase globally, not all regions have aged at the same rate. For instance, Europe’s median age has grown by 14 years, while Africa’s has only increased by 1 year. Today’s animated map uses data from the UN Population Index to highlight the changes in median age over the last 70 years, and to visualize the differences between each region. We also explain why some regions skew older than others.”, Visual Capitalist / UN Population Index / Statista, July 10, 2020

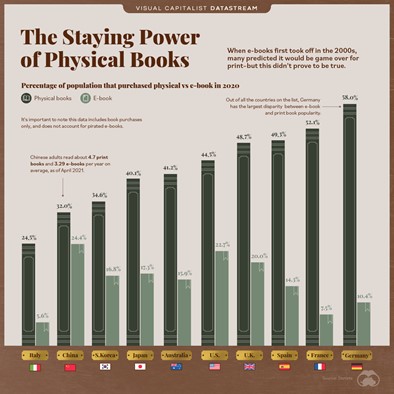

“E-books are certainly not a new phenomenon. In fact, they’ve been around longer than the internet. Yet, while the emergence of e-books dates back to the early 1970s, they didn’t hit the mainstream until the 2000s, when big companies began launching their own e-book readers, and digital libraries started to become more accessible to the public. Around this time, sales for e-books started to soar, and by 2013, e-book sales made up 20%of all books sales in America. Many wondered if this was the end for print books. But fast forward to 2021, and e-books haven’t made print books obsolete. At least, not yet.”, Statista / Visual Capitalism, October 2021

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Bill recently was published on Franchising.com in an article about how global franchise supply chain management is critical for international success. Read the full article here: https://bit.ly/3io0BuK

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest 40 country ranking chart at this link:

July 2021 GlobalVue™ Country Ranking Chart

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.

EGS Biweekly Global Business Newsletter Issue 40, Monday, October 4, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The key issues in the world today are: supply chain disruptions; rising energy prices; COVID Vaccinations in emerging markets; and finally, the reopening of the USA for international travelers.

Words of Wisdom from Others

“Growth and comfort do not coexist.”, Ginni Rometty, former CEO of IBM

“Working hard for something we don’t care about is called STRESS. Working hard for something we love is called PASSION.”, Simon Sinek

“Unless you have courage, a courage that keeps you going, always going, there is no certainty of success. It is really an endurance race.”, Henry Ford

Highlights in issue #40:

- China, one of the world’s few ‘COVID-zero’ holdouts, sets a loose timeline for easing virus measures

- Brand News Section: Denny’s®, Dickeys®, Five Guys®, FranConnect, Impossible Foods®, LEGO®, Subway®, Tortilla®

Our Mission and Information Sources

Bolded article titles are live links, if available without subscription

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground in 27 countries covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

“Report Measures The Economic Importance Of Franchise Operators – A first-of-its-kind report from the International Franchise Association (IFA) and Oxford Economics sheds light on the impact and importance of franchising in America. The report, The Value of Franchising, details how franchisees are local business leaders who contribute to economic growth, job creation, and charitable endeavors in their communities.”, Franchising.com, September 29, 2021

“Europe’s Energy Crisis Is Coming for the Rest of the World, Too – Millions of people around the globe will feel the impact of soaring natural gas prices this winter. Nations are more reliant than ever on natural gas to heat homes and power industries amid efforts to quit coal and increase the use of cleaner energy sources. But there isn’t enough gas to fuel the post-pandemic recovery and refill depleted stocks before the cold months.”, Bloomberg Businessweek, October 1, 2021

“Eurozone consumer activity returns to pre-pandemic levels, mobility data show – Europeans are leaving their houses to go shopping, eat out, travel and visit cinemas as much as they did before the pandemic, in a sign of returning consumer confidence which suggests that the eurozone’s economic rebound remains intact, for now.”, The Financial Times, September 28, 2021

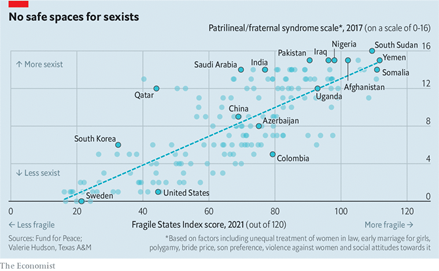

“Societies that treat women badly are poorer and less stable – Oppressing women is not only bad for women; it hurts men, too. It makes societies poorer and less stable, argue Valerie Hudson of Texas A&M University and Donna Lee Bowen and Perpetua Lynne Nielsen of Brigham Young University. In “The First Political Order: How Sex Shapes Governance and National Security Worldwide”, Ms Hudson, Ms Bowen and Ms Nielsen rank 176 countries on a scale of 0 to 16 for what they call the ‘patrilineal/fraternal syndrome’.”, The Economist, September 11, 2021

Supply Chain & Energy – Worldwide Issues

“The World Braces for a Period of High Energy Prices – High global energy prices are likely to remain through the end of the Northern Hemisphere’s winter, which will undermine COVID-19 economic recoveries in energy-importing countries, hurting low-income population segments the hardest. The higher prices will also exacerbate the global manufacturing sector’s fragile recovery and ongoing supply chain challenges, while increasing pressure on governments’ energy transition plans.”, Stratfor, October 1, 2021

“Why Global Shortages Won’t Ruin the (US) Holidays – ‘You’ve heard it here first: Christmas will happen on Dec. 25,’ says Gene Seroka, executive director of the Port of Los Angeles. ‘Many of our savvy retailers and importers advanced their orders. We started seeing Christmas goods arrive on our shores back in June of this year. Normally, that arrival would take place at the end of August, beginning of September.’”, Barron’s, October 3, 2021

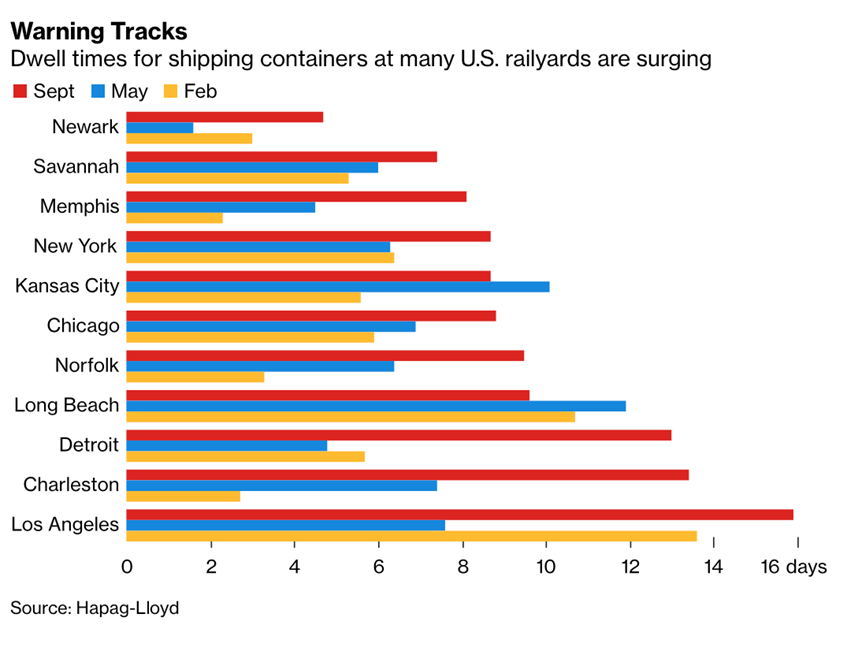

“Containers Piling Up at U.S. Rail Yards Add to Port Strains – To understand why more than 100 container ships are waiting to enter U.S. ports from Southern California to Savannah, Georgia, it helps to keep tabs on the congestion that’s building at another key junction of freight transportation: rail yards. The so-called dwell time for containers at 11 major railroad depots reached an average of 9.8 days this month, according to a tally of its own boxes maintained by Hapag-Lloyd AG, the world’s fifth-largest container carrier.”, Bloomberg, September 29, 2021

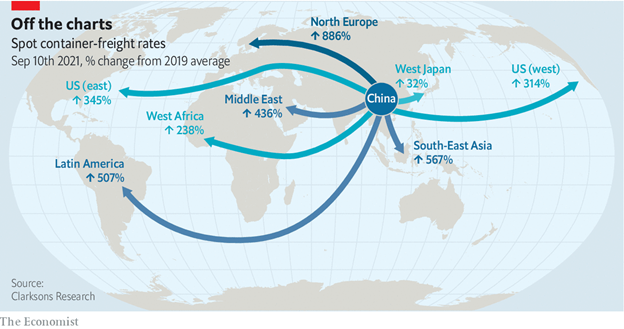

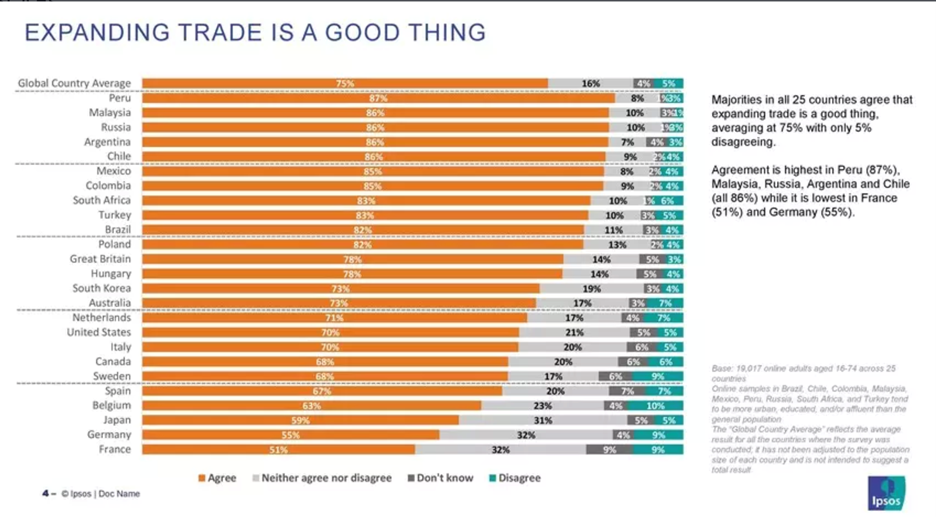

“In the first seven months of 2021, cargo volumes between Asia and North America were up by 27% compared with pre-pandemic levels, according to BIMCO, a shipowners’ association. Port throughput in America was 14% higher in the second quarter of 2021 than in 2019. There has been little growth elsewhere: throughput in northern Europe is 1% lower. Yet rates on all routes have rocketed, because ships have set sail to serve lucrative transpacific trade, starving others of capacity.”, The Economist, September 16, 2021

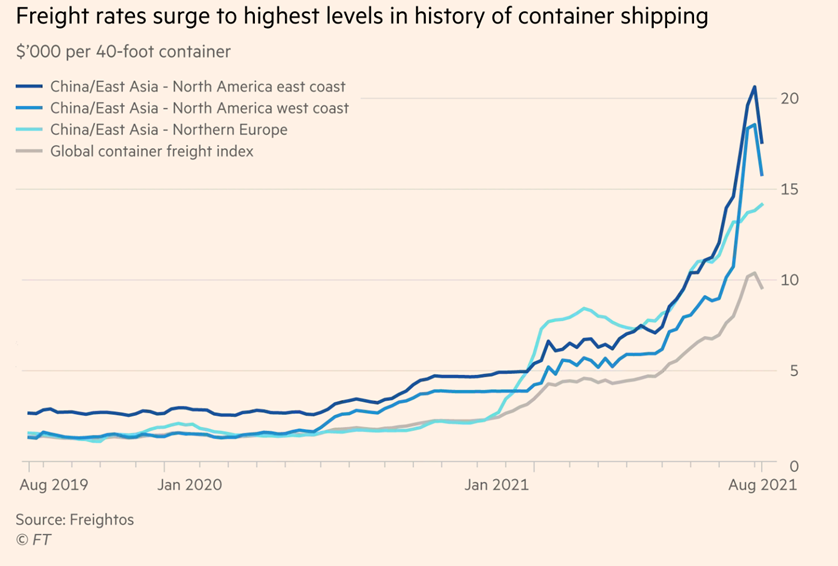

“Reality bites as supply chaos hits – Bosses scramble to keep firms afloat amid cargo delays and staff shortages. John Lyttle, chief executive of online fashion group Boohoo, said prices of container shipments from Asia have increased sixfold in recent months as freight companies jack up their rates. Air freight prices were also up two to three times’ normal levels, he said, as the lack of passenger flights usually used for cargo meant companies like his had to charter whole aircraft. “I don’t see the situation easing until some time in 2022.”, The Times of London, October 3, 2021

Global, Regional & Local Travel Updates

“Airlines Add Winter Flights Between U.S., Europe in Sign of Hope – The number of flights from Western Europe to North America is poised to jump by 7.5% between late October and early November, when the U.S. ban lifts on visits from most European countries, based on data from BloombergNEF. Traffic will then head for a peak in late December.”, Bloomberg, September 28, 2021

“Australia to Lift International Travel Ban in November – Australia is racing ever faster toward reopening its international borders, with Prime Minister Scott Morrison on Friday announcing that bans on international travel will be lifted in November, a month ahead of schedule. The shift will allow states that have reached the 80% vaccination rate to welcome immunized overseas visitors, while Australians will be able to travel abroad with no restrictions on destination.”, Bloomberg, September 30, 2021

“Qantas to Resume International Flights on November 14 – In a press release today, QF says it will have three weekly round-trip flights to both London (LHR) and Los Angeles (LAX) using its Boeing 787-9 Dreamliners. The airline will add more flights as demand returns.”, Airways Magazine, October 1, 2021

“Air New Zealand becomes latest airline to announce international passengers will need to be vaccinated. Many of the world’s airlines and governments require proof of a negative COVID-19 test before a person can board a flight, but very few have said they will require vaccination. The rule will affect international travellers aged 18 and over departing or arriving in New Zealand.”, Sky New, October 3, 2021

“COVID-19: UK’s travel rules are changing this week – what will be different and how will it work? The current traffic light system of red, amber and green countries will be replaced with one red list only. People who are fully vaccinated ‘won’t need a pre-departure test before arrival into England from a non-red country,’ said the transport secretary. And from later this month, the day two PCR test will be replaced ‘with a cheaper lateral flow’.”, Sky News, October 3, 2021

“Britain poised to join EU’s vaccine passport in a boost for travel – Joining the EU Digital Covid Certificate (EUDCC) — the biggest vaccine passport scheme in the world — could make travelling to Europe cheaper for British tourists as some countries, such as France, Portugal and the Netherlands, require non-EU residents to take tests even if they are double-jabbed. The scheme will reduce queues as it makes it easier to verify vaccine status.”, The Times of London, September 24, 2021

“Qatar Airways Backtracks on A380 Withdrawal, Cites A350 Issues – Qatar Airways has revealed that it will return at least five Airbus A380s to service from this November, a complete U-turn on the company’s decision to permanently withdraw the fleet due to the effects of the Covid-19 pandemic.”, Airline Geeks, September 29, 2021

Global Vaccine Update

“99.5% of United employees have now complied with the vaccine mandate – Of United’s 67,000 U.S.-based employees, only 320 of them haven’t complied with the airline’s vaccine mandate.”, The Points Guy, September 30, 2021

“Vaccine Dispensing Machine Deployed In COVID-19 Centers In Singapore – An automated vaccine dispenser developed in Singapore in just six weeks has been deployed to at least seven vaccination centers, eliminating the need for syringes to be loaded manually. The Automated Vaccine Inoculation Dispenser (Avid) system, the first of its kind in Singapore, weighs less than 25kg and can fill six vaccine syringes in less than five minutes.”, Business Times, September 30, 2021

“China, one of the world’s few ‘COVID-zero’ holdouts, sets a loose timeline for easing virus measures – On Sunday, Zhong Nanshan, one of China’s top epidemiologists and government advisers, suggested that the country may begin to loosen its “COVID-zero” restrictions by the end of the year and learn to live with the virus—a potential change in tack for a country that has not budged from its mission to eliminate every single case of COVID-19 since the pandemic began.”, Fortune, October 4, 2021

“45.7% of the world population has received at least one dose of a COVID-19 vaccine. 6.33 billion doses have been administered globally, and 26.6 million are now administered each day. Only 2.3% of people in low-income countries have received at least one dose.”, Our World In Data, October 3, 2021

Country & Regional Updates

Argentina

“Argentine Economy Grew More Than Expected Amid Reopening – The economy grew 11.7% in July from a year ago, faster than the 8.5% median estimate of analysts surveyed by Bloomberg. Activity in July expanded 0.8% on a monthly basis, a slower pace from June, according to government data published Tuesday. Argentina’s hotels and restaurants saw activity grow 55%, while construction and manufacturing also recorded double-digit gains.”, Bloomberg, September 28, 2021

China

“China hit by power cuts and factory closures as energy crisis bites – The world’s top coal consumer implements power rationing as supplies dwindle ahead of winter. China has told railway companies and local authorities to expedite vital coal supplies to utilities as the world’s second largest economy grapples with extensive power cuts that have crippled industrial output in key regions. As many as 20 provinces are believed to be experiencing the crisis to some degree, with factories temporarily shuttered or working on short hours.”, The Guardian, September 29, 2021

“Beijing Olympics to Allow Spectators But Only Those in China – China is limiting spectators for the Beijing Winter Olympics to those residing within the country, as the nation applies its zero-tolerance Covid-19 strategy to the upcoming winter games. Tickets for the 2022 winter games will be sold exclusively to residents in mainland China who meet the requirements of Covid-19 countermeasures, the International Olympic Committee said Wednesday in a statement listing the steps planned by Beijing.”, Bloomberg, September 29, 2021

“China’s population could halve within the next 45 years, new study warns – Researchers say previous estimates may have severely underestimated the pace of demographic decline. Census data says the birth rate was 1.3 children for each woman last year – well below the level needed to stop the population from falling”, South China Morning Post, September 30, 2021

France

“How France Overcame Covid-19 Vaccine Hesitancy – The French have long been wary of vaccines, but a mixture of mandates and inducements encouraged millions to get the shot as the Delta variant spread. When France started vaccinating its population at the start of the year, it had one of the highest rates of hesitancy in the world (66%). Today, it has one of the highest vaccination rates among larger Western countries, after a mix of enticements and government pressure pushed millions of French to receive the shot this summer.”, The Wall Street Journal, September 27, 2021

Japan

“Japan to lift nationwide COVID-19 emergency restrictions – The Japanese government announced Tuesday that the country’s coronavirus state of emergency will end this week. Japanese economic minister Yasutoshi Nishimura said ‘[m]easures will be gradually eased out to prevent early re-infection.’ The government will create more temporary coronavirus treatment facilities, as well as introduce vaccine passports and testing.”, Axios, September 28, 2021

New Zealand

“New Zealand to End ‘Zero Covid-19’ Strategy – Prime Minister Jacinda Ardern says the government is aiming to ‘actively control the virus’ as it prepares to ease restrictions. Pandemic restrictions in the country’s largest city, Auckland—in place after a Covid-19 outbreak in mid-August—will be eased in stages starting this week, New Zealand Prime Minister Jacinda Ardern said Monday.”, The Wall Street Journal, October 4, 2021

“Brand aid – lockdown solution for franchisees – When one franchise had too much work and the other had too little, two well-known franchise brands worked together. Green Acres home cleaning and lawnmowing franchisees weren’t allowed to work during Level 4 lockdown, but a number of them kept busy and earning thanks to an innovative partnership with courier franchise Aramex. The arrangement saw the familiar Green Acres-branded vehicles delivering parcels around the country – a clever solution to the problem of one franchise having too little work while the other was run off its feet.”, Franchise New Zealand magazine, compliments of Simon Lord, Publisher

Thailand

“World Bank cuts Thai GDP growth outlook to 1% this year – Thailand’s economy is forecast to grow 1% this year, down from the 2.2% projected in July, hit by a spike in COVID-19 cases and a delayed reopening to visitors, the World Bank said on Tuesday, as the country fights its biggest virus outbreak to date…..The economy is now expected to return to its pre-pandemic level in 2023, Kiatipong Ariyapruchya, senior World Bank economist for Thailand, told a virtual briefing.”, Reuters, September 27, 2021

United Arab Emirates

“Dubai economy to grow 3.1% this year on Covid-mitigation measures and Expo 2020 – The emirate’s gross domestic product is expected to grow by 3.4% in 2022. The economy of Dubai, the commercial and tourism hub of the Middle East, has bounced back strongly from a pandemic-driven slowdown that disrupted global trade flows and severely affected travel and tourism sectors last year, tipping the world economy into its worst recession since the 1930s.”, The National News, September 21, 2021

United Kingdom

“London’s mojo is rising . . . but it’s still not quite like the old times – Drinkers rub shoulders. Glasses clink. Chatter rises to the rafters. It’s Thursday night in the City of London and Leadenhall Market looks more like its old self. Just weeks earlier, during the summer lull, the City retained the sleepy air of lockdown, with workers staying away for good parts of the week. Now there are signs that workers are finally returning to their offices on a regular basis.”, The Times of London, October 3, 2021

“Fuel crisis: Shoppers warned of Christmas nightmare – Kwasi Kwarteng, the business secretary, admitted yesterday that the fuel crisis could affect Christmas as he announced the deployment of the government’s reserve tanker fleet. He said that the tankers would be on the road this afternoon, driven initially by civilians, but that the public may see soldiers driving some vehicles in the next day or so.”, The Times of London, September 29, 2021

United States

“Small Businesses Continue to be Challenged by Labor Shortages and Supply Chain Disruption – Fifty percent are significantly impacted by supply chain disruptions and another 27% by significant staffing shortages. In a survey of small business owners published last week by the NFIB Research Center, two major headwinds facing small businesses as they fight to recover from the pandemic and business restrictions, remain staffing shortages and supply chain disruptions.”, NFIB, September 27, 2021

“PwC to let US employees in client services work remote full-time – The pandemic has forced more companies to reconcile with employees preferring to work from home…..A company spokesperson told FOX Business PwC is the first professional services firm in the U.S. to offer employees the option to work virtually and live anywhere in the country.”, Fox Business, September 30, 2021

“Freelance Professionals Find That Answering Consumer’s Questions On ‘Expert’ Sites Can Be Lucrative In An Era Of Online Everything – When Billy Wills, a heating and cooling professional from Battle Creek, Michigan, had trouble with a lawnmower repair he was doing, he started hunting online for information that would help him finish the repair. He came across JustAnswer, a site where it’s possible to hire experts for a small flat fee or under a subscription program and sent his question to one of the experts.”, Forbes, September 30, 2021

Vietnam

“HSBC: Two scenarios for Viet Nam’s economy in 2021 – Viet Nam’s economic outlook by year end very much depends on the effectiveness of the vaccine rollout together with the effective and timely re-opening of the economy, said Tim Evans, CEO of HSBC Viet Nam on September 13.”, VF Franchising, September 25, 2021

Brand News

“Denny’s modernizes consumer digital offerings – Family-dining brand refreshes website, on-demand and mobile app components. The Spartanburg, S.C.-based family-dining brand said it was working to make its digital platforms as personalized as the customers’ experience in the company’s more than 1,500 Denny’s locations.”, Nation’s Restaurant News, September 23, 2021

“Dickey’s (Barbecue Pit US) Signs Master Franchise Agreement for Africa – Dickey’s announced today that the company signed a Master agreement with exclusive rights to grow its Africa presence by opening eight locations in Botswana over the span of a decade.”, World Franchise Associates, September 7, 2021

“Five Guys’ first Australian restaurant opening on September 20 – The 500 square metre outlet in Penrith, Sydney will initially offer takeaway. Last year, QSR Media first reported that the American fast casual chain entered into a master franchise agreement with Seagrass Boutique Hospitality Group, the parent company of the Ribs & Burgers, Italian Street Kitchen and Butcher and the Farmer restaurant brands to expand in Australia and New Zealand.”, QSR Media AU, September 16, 2021. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Impossible Foods to launch meatless pork in U.S., Hong Kong and Singapore – The ground pork product will first be available in restaurants, with plans for retail expansion in those markets in the coming months. In a first-on interview, Impossible Foods’ president Dennis Woodside told CNBC that the pork alternative could beat the real deal in both taste and nutritional value.”, CNBC, September 23, 2021

“Lego Profit Doubles as Consumers Turn to Toys During Lockdown – Lego A/S’s first half-profit more than doubled as consumers turned to its well-known building blocks to entertain stuck-at-home children. Families across the globe have increased spending on consumer goods while staying at home and Lego emerged last year as a pandemic winner, booking record profits and sales.”, Bloomberg, September 28, 2021

“Sandwich Chain Subway to Reappear in Indonesia through Franchising Agreement with Sari Sandwich Indonesia – Sari Sandwich Indonesia (SSI) will be the operator of Subway stores in Indonesia. SSI is owned by publicly listed MAP Boga Adiperkasa which already holds exclusive licenses to operate seven premium brands (aside many other brands) in Indonesia: Starbucks, Pizza Marzano, Cold Stone Creamery, Krispy Kreme, Godiva Chocolatier, Genki Sushi, and Paul.”, VF Franchising, September 25, 2021

“Mexican chain Tortilla floats to feed dozens of new sites – Tortilla, which claims to be Britain’s biggest “fast-casual” Mexican chain, has hired Liberum as its adviser and is looking to raise £5 million of new funds to finance its expansion plans, along with a £10 million debt facility from Santander. In addition to the new money, existing shareholders in the chain are expected to raise between £20 million and £25 million from the sale of shares.”, The Times Of London, September 24, 2021

Articles & Studies About Doing Business Going Forward

“How subscriptions became quick service restaurants’ hottest marketing trend – This month, Taco Bell became the latest restaurant chain to launch a subscription service, by testing a “Netflix for Tacos” pass. The pilot program, which launched at Tucson, Arizona locations, allows customers to get one taco a day for a monthly fee. The Taco Lover’s Pass pilot will run between September 9 and November 24, and costs between $5 and $10 for a 30-day pass.”, Modern Retail, September 24, 2021

“What 200 Operations Executives Told Us About Operations Today – FranConnect ‘polled our audience of 200 franchise operations executives about how the current labor shortage is affecting their business, and whether in-person visits have gone up or stayed the same since vaccine rollouts began. three quarters of respondents are moderately or severely affected by the labor shortage.”, Franchising.com, September 24, 2021

“3 Hot Retail Tech Trends to Watch in 2022 – Smart shopping carts and headless tech tools are will be on the minds of retailers looking to get out from under the logistics woes that dominated the last two years. In addition to the automation advancements, here are three tech trends she says retailers should watch heading into 2022: 1. Pricing Technology; 2. Headless Tools; and 3. Smart Carts.”, INC., September 27, 2021

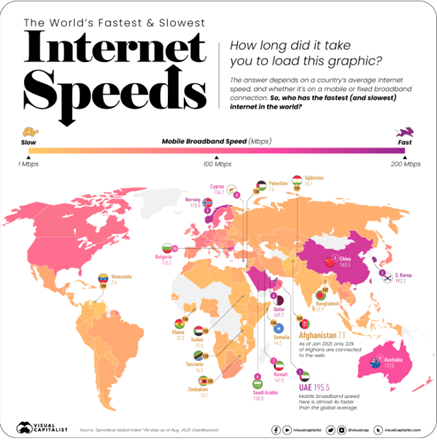

“Which countries have the fastest (mobile broadband) internet connection? Using data from the Speedtest Global Index™, this map ranks the fastest (and slowest) internet speeds worldwide…. The United Arab Emirates (UAE) is first on the list, with a download speed of 195.5 mbps. Not only is mobile data fast in the UAE, it’s also relatively cheap, compared to other countries on the ranking. The average cost of 1 GB of data in the UAE is around $3.78, while in South Korea (#2 on the list) it’s $10.94.”, Visual Capitalist, September 2021

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Bill recently was published on Franchising.com in an article about how global franchise supply chain management is critical for international success. Read the full article here: https://bit.ly/3io0BuK

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest 40 country ranking chart at this link:

July 2021 GlobalVue™ Country Ranking Chart

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.

EGS Biweekly Global Business Newsletter Issue 39, Monday, September 20, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

For two weeks this month, I traveled on business to Italy, Spain, Holland and the United Kingdom in COVID-19 times. Read below for a report on this very interesting and unique trip in my 4+ decades of international travel.

Supply chain issues continue to impact businesses worldwide.

Words of Wisdom from Others

“You are braver than you believe, stronger than you seem, and smarter than you think.:, A. A. Milne

“The future belongs to those who believe in the beauty of their dreams.”, Eleanor Roosevelt

“’Grit’ – Possessing the indomitable spirit, having a drive for achievement regardless of upbringing or situation. Earning success in the trenches through hard work.”, Etsy

Highlights in issue #39:

- Which Vaccine Passport App Should I Use?

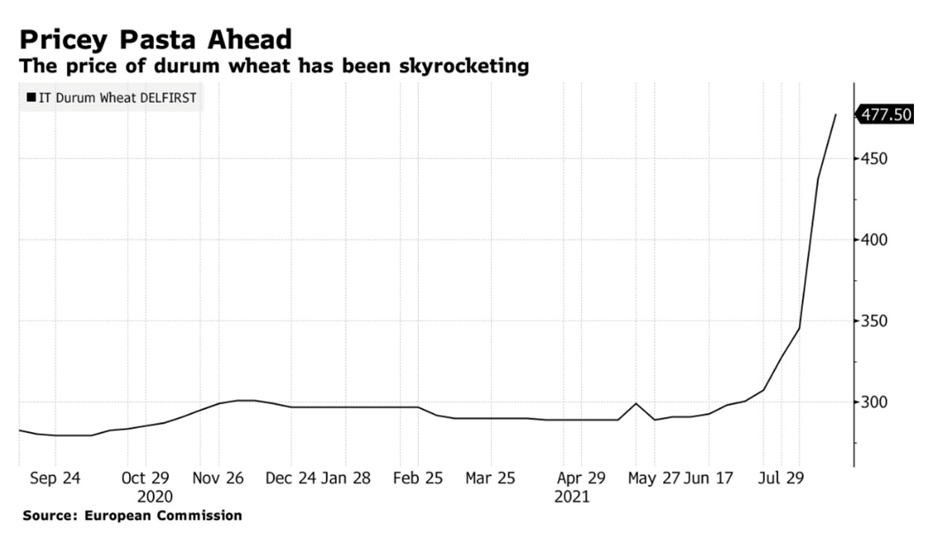

- Italy Braces for Pasta Inflation Amid Soaring Durum Wheat Prices

- The rise of eastern Europe is a forgotten economic success story

- Costa Coffee dishes out 5% pay rise to 14,500 staff in return for pandemic hard work

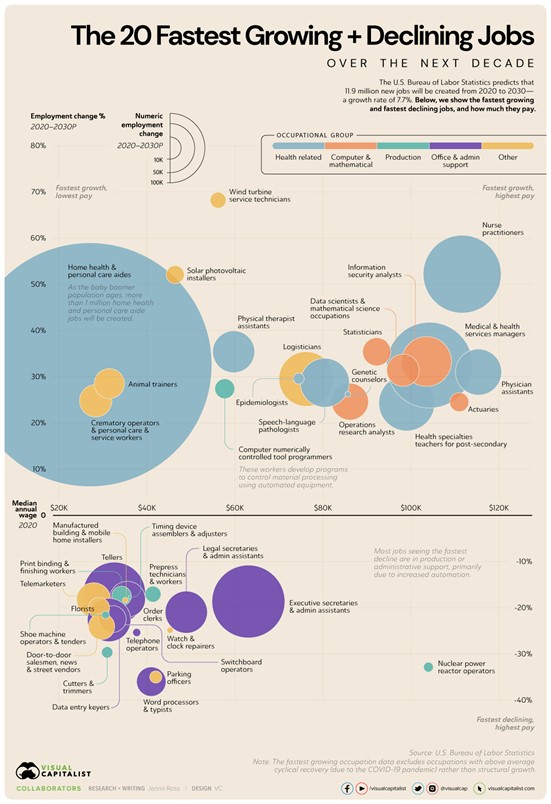

- The 20 Fastest Growing Jobs in the Next Decade

- China Stumbles – China’s economy is in the midst of a mid-year stumble

- Brand News Section: Baskin Robbins®, Costa Coffee®, Del Taco®, Pizza Inn®

Our Mission and Information Sources

Bolded article titles are live links, if available without subscription

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground in 27 countries covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

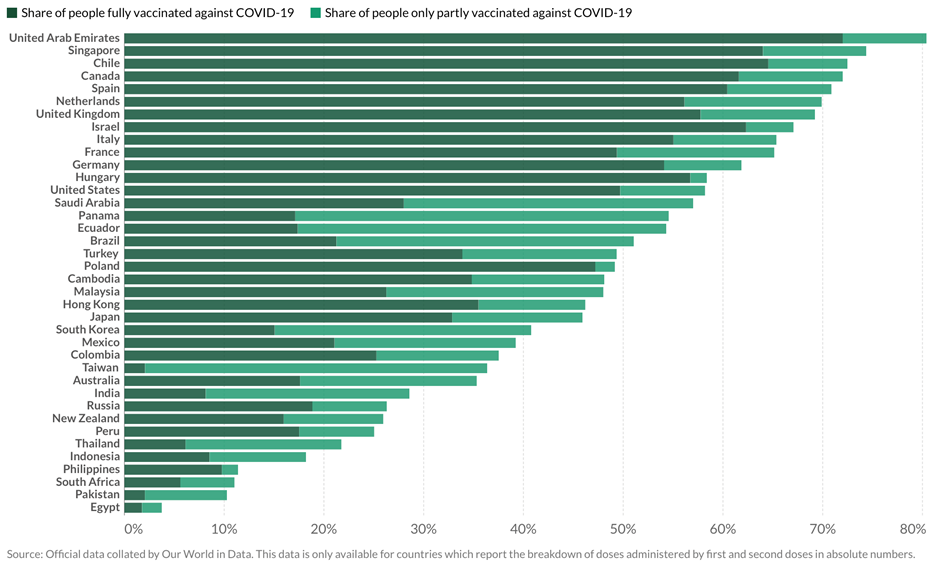

My First International Business Trip Since February 2020

Over the past ten days, I have travelled on business through Germany, Italy, the Netherlands, Spain and the United Kingdom. This meant taking 6 separate COVID tests and completing 10+ separate COVID-19 related forms for the four countries. The company we visited in the Netherlands even wrote a special letter stating that our visit was ‘essential business’ to ensure we did not have to quarantine in Amsterdam before we could meet. The multiple forms – mostly completed online – were needed not only to enter a country but to not have to quarantine because we come from a country with a fully vaccinated population of 53% (USA!) versus most EU countries and the UK which are 60-75% vaccinated. Despite higher vaccination levels, as of this date, none of the people from these countries are allowed to enter the USA!

On the positive side, everyone we met in the various countries were very positive about the future of their businesses, their economies and making new investments. Typical is a comment by EGS’ Spain Associate that Europeans are “learning to live with Covid-19 like the seasonal flu”.

Over my 4+ decades of doing international business and living in other countries I have seen numerous natural, economic and political disasters across all regions. But businesses tend to be forward thinking and opportunistic. That is certainly the case in much of the world we survey today. Having said that, certain parts of the world are recovering at different rates. Asia is still largely shutdown and/or suffering from pandemic challenges either real or caused by government inaction or mistakes. Vaccination rates in Asia Pacific countries average 15-30% including developed countries like Australia, Japan and New Zealand. Business shutdowns remain frequent, travel is very limited.

The Americas have also been slow to recover due to low vaccination rates and/or choosing the wrong ‘free’ vaccines to start with. Fully vaccinated populations are overall at a low level so far in this region. Middle Eastern countries are at 50+% vaccination levels and are reopening at an increasing rate. The winner so far in 2021 – and probably into 2022 – have been the European Union countries and the United Kingdom with higher vaccination rates and progressive business reopening policies. But even in this region airport traffic is between 30-50% of 2019 levels. As stated above, country entry policies and requirements are high.

Bottom Line: After my trip and as a result of communication with our Team around the world I am very optimistic about business recovery in 2022.

Interesting Data and Studies

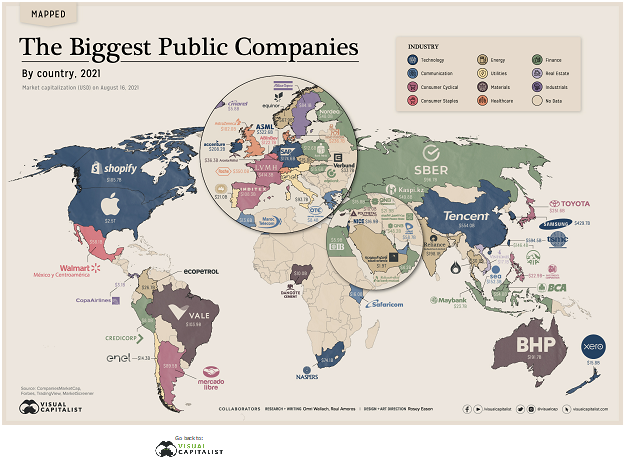

“Mapping The Biggest Companies By Market Cap in 60 Countries – Tech giants are increasingly making up more of the Fortune 500, but the world’s biggest companies by market cap aren’t so cut and dry…..The world has 60+ stock exchanges, and each one has a top company. We looked at the largest local company, since many of the world’s largest firms trade on multiple exchanges, and converted market cap to USD.”, Visual Capitalist, September 16, 2021

Supply Chain – Worldwide Issues

“Supply chain crisis will leave permanent scar, UPS warns – Delivery group’s international head says manufacturing and assembly will become more regional. multinational retailers and manufacturers were making a “big push” towards regionalising their supply chains, said Scott Price, president of UPS International.”, The Financial Times, September 13, 2021

“Ikea (UK) struggles with supply problems due to driver shortage – Furniture giant Ikea is struggling to supply about 1,000 product lines as a shortage of HGV drivers continues to hit businesses. The company said the shortage of products, including mattresses at some stores, was down to Covid and Brexit. Businesses ranging from flu vaccine suppliers to food and drink firms have also been suffering from supply issues.”, BBC News, September 5, 2021

“‘Just Get Me a Box’: Inside the Brutal Realities of Supply Chain Hell – Logistics managers are battling the pandemic, a labor shortage, and huge demand to get goods to your front door. It’s mid-August, and logistics manager RoxAnne Thomas’s phone won’t stop pinging. Her faucets, sinks, and toilets are waylaid near Shanghai, snagged in Vancouver, and buried under a pile of shipping containers in a rail yard outside Chicago. As U.S. transportation manager for Gerber Plumbing Fixtures LLC, a unit of Taiwan’s Globe Union Industrial Corp. that’s based in Woodridge, Ill., Thomas is trying to overcome the biggest shock wave to unsettle global trade since the dawn of container shipping almost seven decades ago.”, Bloomberg, September 16, 2021

“Why skippers aren’t scuppered. Supply chains are adapting, not failing…..firms are neither twiddling their thumbs nor abandoning global supply chains. Instead, they are improvising. Some retailers, like Walmart, have taken to chartering entire ships exclusively for their own cargo. Passenger aircraft are being refitted for freight…..Soaring shipping fees themselves help adjust the flow of goods. Higher freight costs scarcely affect the price of expensive electronics which can be crammed into containers, but matter more for bulky, low-value goods like garden furniture.”, The Economist, September 18, 2021

“M&S closes French stores over supply chain concerns – The company has a further nine franchised stores in partnership with Lagardère Travel Retail in airports and stations, which it said would continue to trade pending discussions over ‘a sustainable future business model’. At its full-year results in May it confirmed that the “lengthy and complex export processes” after Brexit were “significantly constraining” supplies from the UK to Europe, with a knock-on effect on performance.”, The Times of London, August 24, 2021

Global, Regional & Local Travel Updates

“UK Aviation Industry Welcomes Revision of International Travel Restrictions – The U.K. government will abolish its much-maligned “traffic light system” for international travel to England starting in early October. In an announcement released on Friday, the government said it will replace the current system that has been in effect since May 17 with “a single red list of countries and territories and simplified travel measures for arrivals from the rest of the world.” In recognition of the vaccination rollout around the world, travellers who meet the U.K. definition of “fully vaccinated” will not be required to undertake expensive PCR tests upon arrival and in some cases departure to destinations.”, Airline Geeks, September 19, 2021

“Which Vaccine Passport App Should I Use? While you might have first heard of coronavirus vaccination apps for international travel, like the European Union’s Green Pass or airline-favorite VeriFly, the United States has not designated any one technological standard for proof of vaccination. While many destinations and businesses are accepting Centers for Disease Control (CDC) vaccination cards as proof of vaccination, it can be unnerving to walk around with your original coronavirus vaccine certificate. For those who want a digital option instead of always whipping out their vaccine card, there are plenty to choose from.”, Conde Nast Traveler, September 2, 2021

“Emirates Airlines: 3,500 New Employees for Operations Ramp Up – If you are looking for a job in the air transport sector Dubai (DXB) is the place to go as Emirates Airlines (EK) is offering 3,000 positions to future cabin crew and 500 to frontline personnel to be employed in its DBX hub.”, Airways Magazine, September 19, 2021. (Editor’s note: I saw an Emirates 380 take off from Heathrow on September 19.)

“Indian Recovery Continues With Domestic Capacity Increase – The Government of India provided some relief to Indian airlines, announcing that domestic flight capacity has been increased to 85% of pre-COVID levels. The decision comes as COVID cases in India fall and demand for air travel grows steadily.”, Simple Flying, September 20, 2021

Global Vaccine Update

“Asia’s Covid-19 Success Stories Warily Ponder Post-Vaccination Moves – As vaccination rates climb, countries such as Singapore and South Korea consider how fast to ease strategies that have minimized infections and deaths. Widespread vaccination was meant to usher in a long-awaited march back to normal. But for Asia-Pacific countries that tamed Covid-19 by enforcing tight controls, entering a post-vaccination world is complicated.”, The Wall Street Journal, September 14, 2021

“43.3% of the world population has received at least one dose of a COVID-19 vaccine. 5.95 billion doses have been administered globally, and 28.87 million are now administered each day. Only 1.9% of people in low-income countries have received at least one dose.”, Our World In Data, September 20, 2021

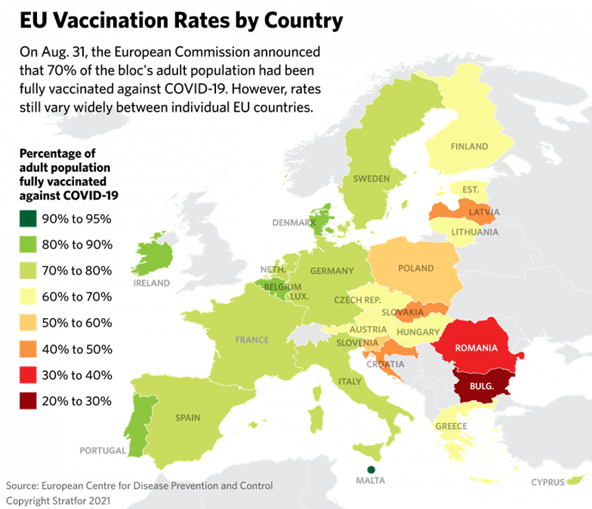

“Tracking EU Vaccination – The European Union recently announced that 70% of adults in the bloc were fully vaccinated against COVID-19, thus achieving the goal Brussels established at the beginning of this year. This milestone makes the European Union one of the most successful political entities in the world in terms of rolling out COVID-19 vaccines…..vaccination rates are well below the average in some member states, especially in Eastern Europe.”, Stratfor, September 6, 2021

Country & Regional Updates

Argentina

“Argentina 2021 economic growth forecast raised to 7.2% – central bank survey – inflation in 2021 is seen at 48.4%, 0.2 points percentage above last month’s estimate, according to 42 respondents to the Market Expectations Survey (REM) by the Argentine central bank on Aug. 27-31. Latin America’s third-largest economy has suffered from high inflation for several years and has been in recession for three years. These economic woes deepened since the 2020 COVID-19 pandemic.”, Reuters, September 4, 2021

Australia

“Australians urged to plan ahead for Christmas shopping amid ‘dramatically bad’ global supply chain crisis. Covid shutdowns of major international ports are putting extreme pressure on retailers to fill orders and keep shelves stocked. The “dramatically bad” global supply chain situation in Asia could also see major Australian retailers dumping Black Friday sales as they are left with limited stock.”, The Guardian, September 4, 2021

“Jim’s Group gives free merchandise to fully vaccinated Australians – Iconic franchising company Jim’s Group has some special freebies lined up for all Australians who get themselves double vaccinated against Covid-19. Chief executive Jim Penman announced via the company’s TikTok account on Monday that the company would be distributing a one-of-a-kind shirt and bucket hat for fully vaccinated Aussies.”, New.au.com, September 7, 2021. Compliments of Jason Gehrke, Franchiseadvice.com.au

China

“China Stumbles – China’s economy is in the midst of a mid-year stumble. That was confirmed Wednesday when data showed retail sales growth slumped in August and both industrial output and investment also slowed. The big question: Is this a hiccup for an otherwise healthy economic recovery, or is the unrelenting regulatory crackdown taking a toll? The answer: It’s a bit of both.”, Bloomberg, September 15, 2021

“UBS: China’s consumer spending to grow by US$5.3 trillion in the next decade, driven by female consumers. A recent UBS report suggests that consumer spending in China is expected to grow by US$5.3 trillion in the next 10 years. As the income of women continues to increase, they will become the key driver of the consumption boom. UBS predicts that the jump in China’s household consumption in the next decade means that China will contribute about 27% of global consumption growth by 2030, compared with 19% for the US.”, Fung Business Intelligence, September 16, 2021

Eastern Europe

“The rise of eastern Europe is a forgotten economic success story – While the west focuses on political backsliding, manufacturing prowess is propelling the region forward. Today eastern Europe shares with east Asia the one proven key to long-term growth: manufacturing prowess. Because it can generate regular export income, which can be reinvested in new factories and roads, manufacturing can become a self-sustaining growth engine.”, The Wall Street Journal, September 13, 2021

India

“Foreign direct investment into India to stay robust – Deloitte survey – International investors remain confident of India’s short- and long-term growth prospects and are readying plans to make additional and new investments in the country, according to a survey of 1200 business leaders released by Deloitte. The survey conducted at the peak of the second wave of the pandemic showed 44% of the respondents across the United States, UK, Japan, and Singapore said they were planning additional or first-time investments in India.”, Reuters, September 14, 2021

Italy

“Italy’s economy could grow this year by more than 5.8% and post better than estimated deficit and debt ratios, Economy Minister Daniele Franco said on Sunday. Since April, the outlook has gradually improved and Italy’s parliamentary budget watchdog (UPB) said last month it expected the country’s economy to grow by 5.8% in 2021. ‘A strong recovery is underway and we cannot exclude that the GDP growth will be stronger than estimated by UPB,’ Franco said. ‘It is important that the recovery is quick, but the most important challenge is achieving a structural stronger growth.’”, Reuters, September 5, 2021

“Italy Braces for Pasta Inflation Amid Soaring Durum Wheat Prices – ‘Our family has been in this business for 110 years, but we have never experienced a situation like this’, Giuseppe Ferro, chief executive officer of La Molisana SpA, one of the country’s biggest pasta producers, said in an interview with Il Sole 24 Ore on Friday. According to Ferro, big pasta producers are already rushing to stock grain, which can be stored for up to two years. Still, he says, wheat semolina, which is essential for pasta making, cannot last longer than a month.”, Bloomberg, September 10, 2021

New Zealand

“Vaccinate, vaccinate, vaccinate – With more than 53,000 doses of the Pfizer vaccine administered on Saturday, 73.1 per cent of eligible Kiwis have now had at least one jab. In Auckland, 78 per cent of those eligible have had their first dose. Director-General of Health Dr Ashley Bloomfield was the first to publicly voice a vaccination target of 90 per cent and NZME – publisher of the NZ Herald – has thrown the weight of its print and radio offerings behind this cause with The 90% Project.”, NZ Herald, September 19, 2021

Singapore

“As Singapore pauses reopening, experts suggest ‘bolder’ COVID-19 strategy – Singapore is ramping up COVID-19 testing and has warned it would not rule out reimposing tighter curbs as infections rise – moves some experts see as too cautious for the vaccine frontrunner that is preparing to live with the virus as an endemic disease.”, Reuters, September 9, 2021

United Kingdom

“Appetite for eating out hits retail sales in August – Martin Beck, senior economic adviser to the EY Item Club, the forecasting body, said that the decline in retail sales was a sign that “spending patterns continue to normalise” after most restrictions were removed on July 19. People holidaying in Britain over the summer made the most of being able to eat out and spend their money on experiences again.”, The Sunday Times of London, September 18, 2021

“UK inflation posts record jump to hit 9-year peak in August – Britain’s inflation rate hit its highest in almost a decade last month after a record jump that was largely fuelled by a rebound in restaurant prices which were artificially pushed down a year ago by government subsidies.”, Reuters, September 15, 2021

“Two in five British businesses are struggling to find workers – Almost a third, 30 per cent, of hospitality businesses said that vacancies were proving more difficult to fill than normal. Official estimates suggest that about 100,000 EU citizens left the UK during the pandemic and the migrant workforce has not recovered to its pre-pandemic size. This has constrained the supply of labour, as has the absence of almost 2 million people who are still on furlough and high levels of economic inactivity among young people, who are disproportionately represented in hospitality jobs.”, The Times of London, September 13, 2021

“Factories remain optimistic despite supply disruptions – Supply chain issues continue to drive up input prices for Britain’s manufacturers but factories remain optimistic about their prospects and the outlook for jobs. The manufacturing purchasing managers index for August dipped to 60.3 from 60.4 in July, dropping to its lowest level in five months, but was well above the 50 mark that separates expansion from contraction.”, The London Sunday Times, September 1, 2021

United States

“(US) Retail Sales Rebound in August With 0.7% Gain – Consumers delivered an unexpected increase in sales despite the delta variant and supply-chain bottlenecks that have hurt auto production. The Commerce Department reported Thursday that retail sales rose 0.7% last month after a revised decline of 1.8% in July. Sales rebounded even though purchases of motor vehicles fell 3.6% amid a global semiconductor shortage that has slowed production. Online retail sales surged 5.3% after tumbling 4.6% in July.”, CFO.com, September 16, 2021

“Sentiment Index Shows Record High (USA) Startup Intentions Within Six Months – Entrepreneurs who agree or strongly agree that “now is a good time to start a business” were 67.9% in August, up slightly from July, but down from the record level of 76.9% reached in June 2021. Nonetheless, a record 78.2% aspiring owners anticipate starting their businesses within six months. FranchiseInsights.com compiles monthly the Small Business Startup Sentiment Index™ (SSI) of individuals who have recently inquired about businesses for sale.”, Franchiseinsights.com, September 8, 2021

“Where Americans Live – Everyone gets a dot. You get a dot. And you get a dot. And you. – Each dot represents a person — 331,449,281 of them — and is randomly placed within their block. So you get a highly granular map of population density.”, Flowingdata.com, September 19, 2021

“SpaceX Launch of Inspiration4 Is a Giant Leap for Space Tourism – SpaceX successfully launched four civilians into space Wednesday evening in the first spaceflight staffed wholly by commercial astronauts—that is, not a government-backed crew—to orbit Earth.”, Barron’s, September 16, 2021

Vietnam

“Covid restrictions force some retailers to rethink Vietnam as a manufacturing hub – Prolonged shutdowns in Vietnam because of the coronavirus pandemic are becoming a bigger headache for retailers. The worries led Wall Street research firm BTIG to downgrade shares of Nike last week, citing serious production issues since the sneaker maker last reported earnings.”, CNBC, September 16, 2021

Brand News

“Baskin-Robbins Opens in Casablanca, Its First Restaurant in Morocco – Baskin-Robbins has opened its first-ever restaurant in Morocco, in Casablanca City. Galadari Ice Cream Company, one of the brand’s largest franchisees, will own and operate the new restaurant, adding to their portfolio of nearly 1,000 Baskin-Robbins locations around the world.”, Franchising.com. September 17, 2021

“Costa Coffee dishes out 5% pay rise to 14,500 staff in return for pandemic hard work – The company also says it will hire a further 2,000 staff to cope with rising demand for coffee following the end of lockdown restrictions in July. The changes will not affect staff working at Costa’s 1,200 franchised coffee shops. The company also said it would hire a further 2,000 staff to cope with rising demand for coffee following the end of lockdown restrictions in July – and a raft of new locations that are slated to open in the coming months.”, Sky News, September 9, 2021