EGS Biweekly Global Business Newsletter Issue 71, Tuesday, December 13, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The biggest news in global business for this issue is the very rapid dismantling of ‘zero Covid’ in China. After three years of shutdowns, personal monitoring by the government, constant PCR tests, monitoring apps and little intercity travel, China is rapidly opening back up. Stay tuned to future newsletters to see what happened to mainland China’s economy.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“If you want the rainbow, you have to put up with the rain.”, Dolly Parton

“When creativity melds together with global issues, I believe you can bring the world together.”, Virgil Abloh

“A smooth sea never made a skilled sailor.”, Franklin Roosevelt

Highlights in issue #71:

- Brand Global News Section: Burger King®, Denny’s®, Dine Brands Global, Domino’s Pizza Enterprises (DPE), Empower Brands, McDonalds®, 9Round®, Wendy’s® and Xponential Brands®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

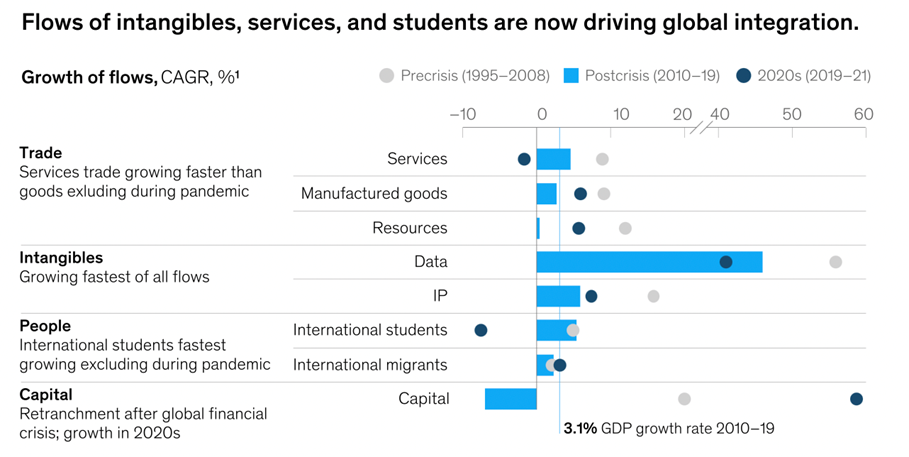

“Global flows: The ties that bind in an interconnected world – Economic and political turbulence have prompted speculation that the world is already deglobalizing. But the evidence suggests that global integration is here to stay, albeit with nuance. Ours is an interdependent world, connected by global flows of goods, services, capital, people, data, and ideas. Global value chains have been built on these flows, creating a more prosperous world. However, in light of the pandemic, Russia’s invasion of Ukraine, and years of rising tensions between the United States and China, some have speculated that the world is already deglobalizing. New MGI analysis finds a more nuanced reality.”, McKinsey, November 15, 2022

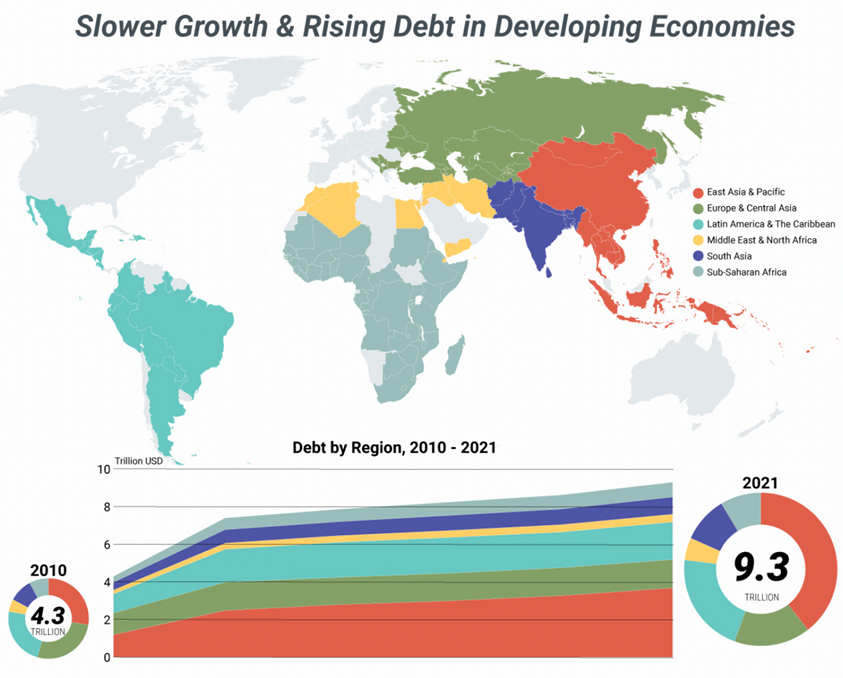

“Around the globe, spiraling debt in low- and middle-income countries is threatening their pursuit of sustainable development. Between 70 percent and 85 percent of developing nations’ debt is in a foreign currency. So far in 2022, around 90 percent of countries have seen their currencies depreciate against the U.S. dollar. Government debt levels as a share of gross domestic product have increased by about $2 trillion.”, Geopolitical Futures, December 9, 2022

“World’s oldest DNA reveals Ice Age ecosystem – Scientists harvested eDNA from sediment thawed from permafrost in northern Greenland. Unlike genetic material from one animal, eDNA is the microscopic spoor of many different species, including plants and micro-organisms. The 2m-year-old ecosystem was home to birch trees, geese, lemmings, reindeer and even mastodons, an extinct elephantine creature.”, The Economist, December 10, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

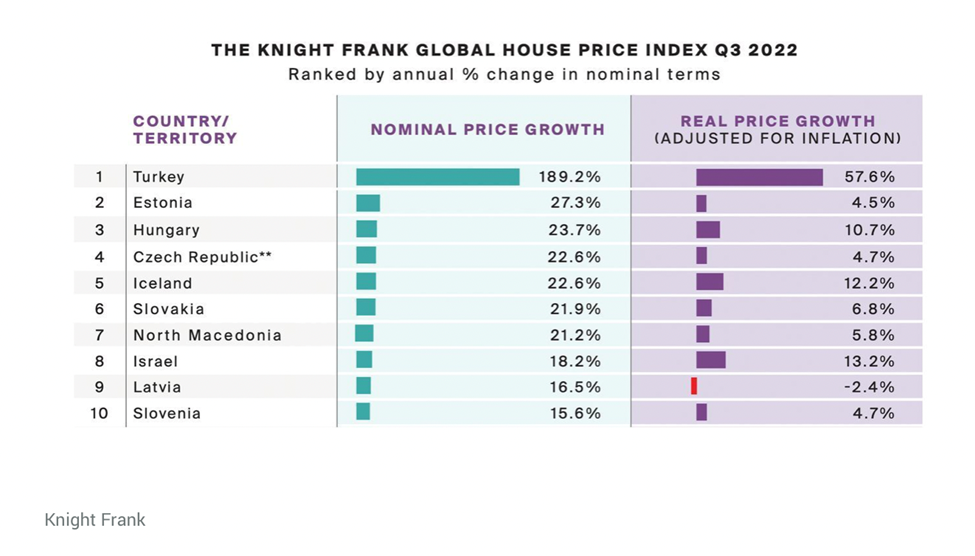

“Globally, Home Prices Climbed a Robust 8.8% in the Third Quarter Despite Rocky Economies – The third-quarter figure is in nominal terms—that is, not adjusted for inflation—and is down from its peak of close to 11% registered during the first quarter of 2022, the brokerage and property consultant said in its analysis of 56 countries and territories around the world. Property markets that are slipping down the table are those that have seen the most significant interest rate hikes, the report said. In the past three months, Canada has moved from 10th to 34th place in the rankings, and Australia from 28th to 47th.”, Barron’s, December 8th.

“Why the price of oil has dropped despite new constraints on Russian supply – Crude settles at lowest level of 2022 after European embargo and G7 price cap take effect. This week marked a pivotal moment in global geopolitics, as a European embargo and G7 price cap on Russian crude came into force. All of this would ordinarily have sent oil prices sharply higher, especially just weeks after the Opec+ cartel surprised the market by announcing deep new supply cuts. Yet on Thursday, the international oil benchmark Brent settled at $76.15 a barrel, a new low for 2022. What is going on? But the G7’s price cap plan aims to take the edge off.”, The Financial Times, December 8, 2022

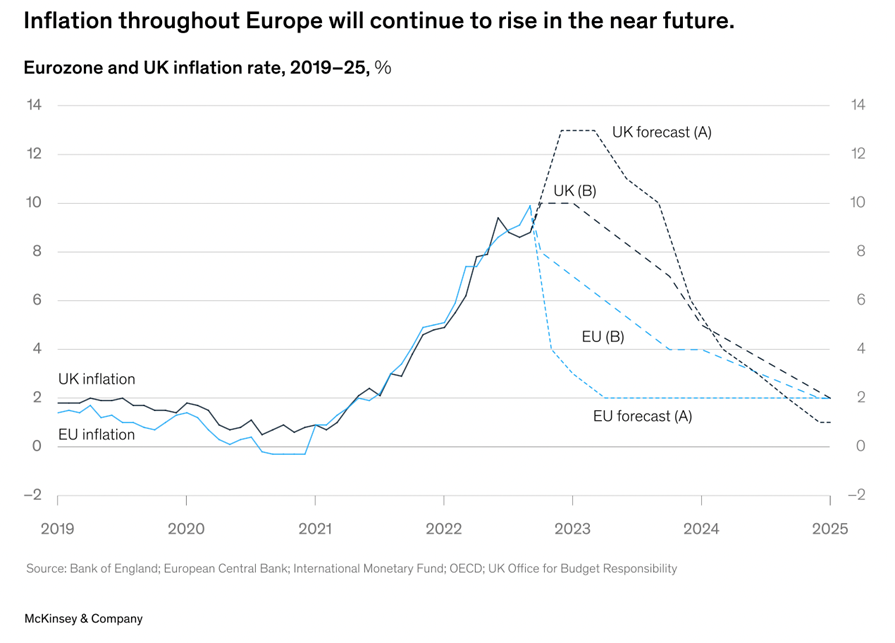

“How retailers in Europe can navigate rising inflation – With inflation at record highs throughout Europe, retailers are under more pressure than ever. Those that act quickly and follow a holistic playbook can be well positioned to thrive. In this article, we examine the current state of inflation in Europe, take a quick dive into rapidly changing consumer behavior and sentiment, and draw lessons from previous periods of economic volatility. Finally, we describe a holistic approach that can help retailers think about how to simultaneously tackle inflationary challenges and build long-term resilience.”, McKinsey, December 7, 2022

Global & Regional Travel Updates

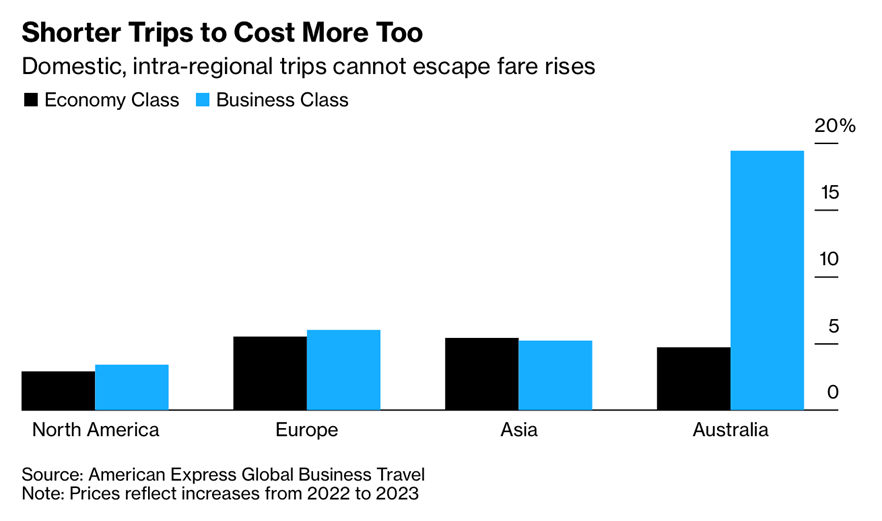

“Airfares Set for Big Jump Again in Business and Economy in 2023 – Airfares will increase around the world next year, by as much as 12% on Europe-Asia routes and 10% for North America-Asia flights, according to American Express Global Business Travel. Asia, which was slower to lift Covid travel curbs, is set for some of the biggest changes as demand swells, Amex GBT said in its Air Monitor 2023. The region’s relatively strong economic prospects could also push up prices, it said. With Europe also seeing a shortfall of airline capacity versus demand, intra-regional airfares are expected to climb 6% in business and 5.5% in economy next year, Amex GBT said.”, Bloomberg, December 8, 2022

“Delta Will Restart Service to Cuba Next Year — What to Know. Starting April 10, 2023, the airline will fly two daily nonstop flights from Miami International Airport. Delta joins JetBlue and American Airlines, which each received permission to service more flights to Cuba. The new service also comes months after the Biden administration started allowing commercial and charter flights to fly to cities beyond just Havana.”, Travel and Leisure magazine, December 12, 2022

Country & Regional Updates

Asia

Australia

“Soaring coal delivers Chalmers a Christmas miracle – Soaring iron ore, coal and natural gas prices are set to add $58 billion to tax revenue over four years and deliver Treasurer Jim Chalmers a Christmas miracle – a federal budget bottomline temporarily in balance. But while a boon for exporters, high commodity prices are driving domestic inflation, placing huge strain on household budgets, and forcing a major intervention in the energy market by the Albanese government.”, Australian Financial Review, December 4, 2022

China

“Chinese Cities Continue Shift From ‘Zero-Covid’ – Major cities across China including Beijing, Shanghai and Guangzhou, have further eased local Covid-19 restrictions on travel and quarantine after the country announced sweeping changes to its virus control regime. Following the announcement, searches containing the key word “air tickets” surged 160% on ctrip.com. Searches for the tickets on flights departing a few days before next month’s Lunar New Year soared to the highest level in three years on the online travel service platform.”, Caixin Global, December 8th, 2022

“Shanghai Disneyland Reopens as Businesses in China Welcome Covid-Control Easing – Cautious optimism spread among foreign companies over the rollback of some zero-Covid measures, though challenges remain…..Beijing on Wednesday announced the end of many measures, including requirements covering quarantine and testing as well as restrictions on domestic travel…The policies have damaged consumer sentiment, curtailed economic growth and brought heavy disruptions to foreign businesses with large operations in the world’s second-largest economy.”, The Wall Street Journal, December 8, 2022

“China Halts Location Tracking App as Covid Restrictions Fall – Some residents say they have seen a surge in Covid cases even as official daily tallies drop. China is pulling the plug on a nationwide mobile tracking app that collects data on users’ travel movements, dismantling a symbol of one of the world’s sternest and most durable Covid-19 containment regimes even as cases continue to surge across the country. Authorities said Monday that the mobile app, a cornerstone of Beijing’s technocentric approach to throttling the pandemic, would disappear by day’s end, part of China’s swift retreat from the “zero-Covid” approach that it has adhered to for the past three years.”, The Wall Street Journal, December 12, 2022

European Union

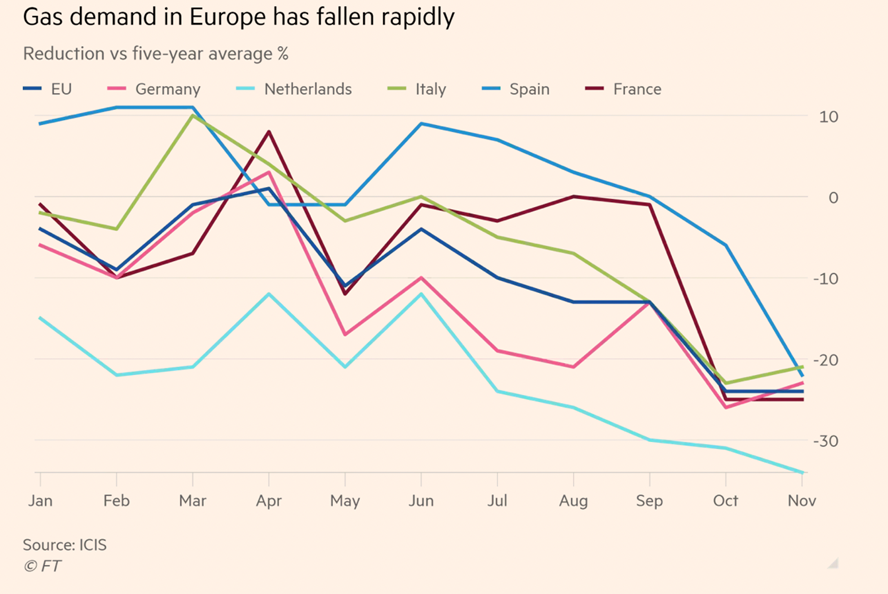

“Where next for Europe’s industry? More evidence that factories have weathered the energy crisis well. The impact of the energy crisis on European industry continues to be debated hotly. When I (Martin Sandbu) highlighted in last week’s Free Lunch how well the continent’s manufacturing has held up, the reactions varied from denial to surprised delight. Start with Europe’s impressive ability to adapt to higher natural gas prices. My colleague Shotaro Tani added to the evidence of this, reporting on Monday that European users cut consumption by one-quarter in both October and November, relative to five-year averages. This was largely accounted for by cuts in industry demand for gas.”, The Financial Times, December 8, 2022

India

“India’s Outlook Is Surprisingly Bright – Why investors might want to park their cash in the Asian country. India’s resilient economic growth—despite global weakness—gives India’s central bank leeway to tackle inflation without worrying about a steep slowdown, particularly with Brent oil down about $40 a barrel from its midsummer highs. India’s September quarter growth came in at 6.3%, significantly lower than the previous quarter’s but much better than developed markets and many emerging markets. The RBI expects India to grow 6.8% in the current fiscal year ending in March.”, The Wall Street Journal, December 8, 2022

Mexico

“Mexican state brings back mask mandate as COVID numbers rise – A northern Mexican state reintroduced the obligatory use of face masks in closed public spaces, officials said on Monday, in a bid to reduce rising COVID-19 infections, as well as the spread of other respiratory diseases. The health minister of Nuevo Leon state, home to Mexico’s third-biggest city Monterrey, highlighted the updated guidelines in a news conference, and said that the measure will go into effect immediately.”, Reuters, December 12, 2022

New Zealand

“Air New Zealand raises first half profit outlook on travel demand – The increased profit outlook follows a moderation in fuel prices in recent weeks and assumes that the airline will fly about 75% of its pre-COVID capacity levels across the network in December, according to Air New Zealand.”, Reuters, December 7, 2022

United Kingdom

“UK banking rules in biggest shake-up in more than 30 years – The government has announced what it describes as one of the biggest overhauls of financial regulation for more than three decades. It says the package of more than 30 reforms will “cut red tape” and “turbocharge growth”. Rules that forced banks to legally separate retail banking from riskier investment operations will be reviewed.”, Yahoo News, December 9, 2022

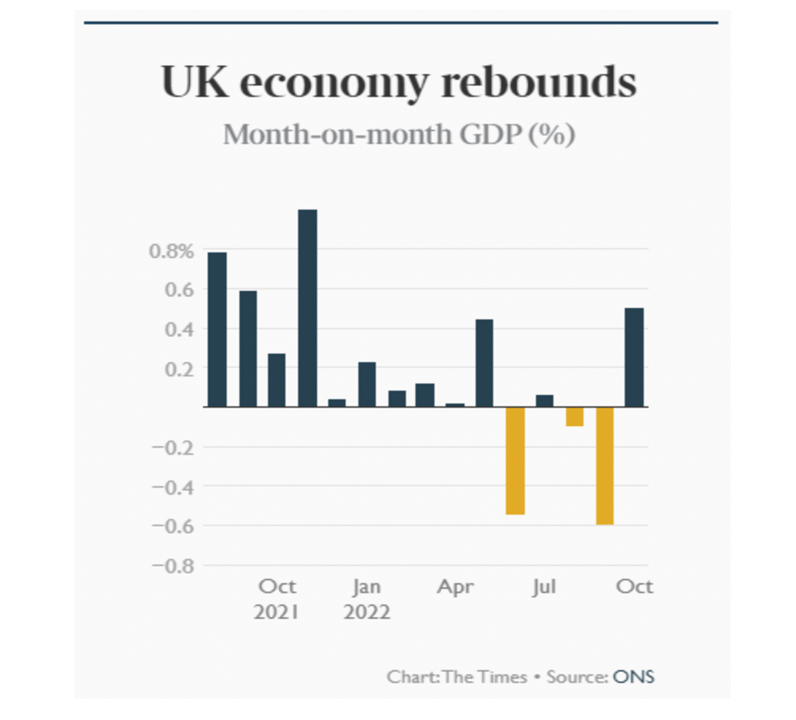

“UK Economy Rebounds – The UK economy returned to growth in October following a 0.6 per cent fall in September, according to the latest data released this morning by the Office for National Statistics. Month-on-month gross domestic product rose 0.5 per cent. City economists had forecast growth of 0.4 per cent. September’s fall was largely attributed to the extra Bank holiday for the Queen’s funeral. In the three months to the end of October the economy contracted 0.3 per cent.”, The Times of London, December 12, 2022

United States

“U.S. third-quarter productivity raised; labor costs still running high – U.S. worker productivity rebounded at a bit faster pace than initially thought in the third quarter, though the trend remained weak, keeping labor costs elevated. Nonfarm productivity, which measures hourly output per worker, rose at a 0.8% annualized rate last quarter. That was revised up from the 0.3% pace reported last month and ended two straight quarterly decreases.”, Reuters, December 7, 2022

“Economists think inflation has peaked. Main Street is preparing for more pain – More players in the stock market and among the ranks of professional economists have come around to the view that inflation has peaked or already is in decline, but small business owners on Main Street don’t expect a reprieve from high prices any time soon, according to a new CNBC poll.An overwhelming majority (78%) of America’s entrepreneurs say they expect inflation to continue to rise, according to the quarterly CNBC|SurveyMonkey Small Business Survey. That is effectively unchanged from last quarter when 77% said they expected inflation to continue to rise.”, CNBC, December 10, 2022

“The Next Career Move For Americans Looking For A Healthier Lifestyle: Working For Themselves – Even with a record number of traditional jobs available, the number of independent workers in the U.S. keep climbing, according to new research. There are now 64.6 million independent workers in the U.S., according to “Happier, Healthier Wealthier: The State of Independence in America,” issued by MBO Partners, a provider of back-office services to independent workers. The report found that the number of full-time independents—those working 15 hours a week or more—is 21.6 million, up from 15.3 million in 2019.”, Forbes, November 30, 2022

Brand & Franchising News

“Applebee’s owner to acquire Fuzzy’s Taco Shop for $80M – Dine Brands Global, which also operates IHOP, will get its long-desired growth concept in the 138-unit fast-casual brand. On Monday, the owner of Applebee’s and IHOP, which has been expressing a desire to acquire a third concept for years, finally pulled the trigger on one, agreeing to acquire Fuzzy’s Taco Shop from NRD Holding Co. for $80 million in cash. Dine believes this will give it a growth chain and its first limited-service concept.”, Restaurant Business, December 5, 2022

“Burger King Has Released A Winter Whopper In Japan – Earlier this year in August, (Wendy’s) Japan released an Icy Whopper with a layer of shaved ice in the burger. Thankfully, this latest edition of the Whopper won’t include any ice, which probably wouldn’t be the top meal choice on a chilly winter day. According to The Street, the Winter Whopper includes gouda cheese and a spicy hot sauce. Burger King Japan’s Twitter account posted a photo that reveals this burger will hit stores on Friday, December 9.”, Mashed.com, December 12, 2022

“Here’s how Denny’s fits into the evolving family-dining breakfast category – Denny’s CEO Kelli Valade discusses brand synergy with new acquisition Keke’s, the future of the 24-hour operations model, and how customers are evolving. Valade spoke about the evolution of family dining— including the brand’s new acquisition of Florida-based Keke’s Breakfast Café, labor challenges, and operations changes — during the last CREATE Live Digital Learning Session of 2022 with NRN Senior Editor Ron Ruggless.”, Nation’s Restaurant News, December 8, 2022

“Listed Australian pizza chain franchisor Domino’s Pizza Enterprises (DPE) is expanding its footprint in Asia and Europe with a completed acquisition and the launch of an equity capital raising, according to a media report. On November 30, Domino’s advised stakeholders that their acquisition of Domino’s Malaysia and Domino’s Singapore was complete. The company’s acquisition of Domino’s Cambodia is expected to be completed in Q1 of 2023, subject to regulatory approvals. Meanwhile, DPE is also seeking to raise a total of $165 million to buy out its business partner in the German market.”, Compliments of Jason Gerhrke, the Franchise Advisory Centre, Brisbane.

“Lynx Franchising and Outdoor Living Brands Rebrand as Empower Brands – The launch of Empower Brands comes following Lynx’s September 2021 acquisition of Outdoor Living Brands. After months of integrating the two organizations, Lynx Franchising and Outdoor Living Brands decided the best way to continue moving these brands forward was to combine forces under one, unified name. Together as Empower Brands, the team can provide more experience and an even stronger commitment to providing franchisees with a winning playbook and the right resources to pursue their long-term goals.”, Franchising.com, December 9, 2022

“9Round Finalizes Deal to Bring Facilities to South India – 9Round Franchising, LLC, has finalized a master franchise agreement to expand into South India. South India’s master franchisees Arun Bharathi, Balaji Jeyakumar and Sharmila Jayakumar will open the country’s first 9Round location in Chennai or Bangalore in early 2023. Balaji is an accomplished professional with more than nine years of experience in operations and supply chain management. Sharmila has experience in supply chain management, product development, and market research, as well as strategic planning.”, Franchising.com, December 9, 2022

“McDonald’s Careful Moves Pay Off – The fast-food leader introduces new store concepts, new menu items, and more. McDonald’s is possibly the most old-fashioned of all the big fast-food chains, rarely making major changes to its classic menu. That’s not to say Mickey D’s doesn’t embrace modernity in its own way, though. Its new test restaurant concept in Fort Worth, Texas, is smaller than its usual locations and introduces the Order Ahead lane, specifically designed for people who placed their orders using the McDonald’s app.”, The Street, December 12, 2022

“Wendy’s Is Now the Most Expensive Fast Food Restaurant in the U.S., New Data Says – Wendy’s earns the notorious title of the most expensive fast food chain this year, beating out last year’s “winner” Burger King. Wendy’s prices increased by an eyebrow-raising 35% this year, representing the largest increase in 2022 among analyzed chains (average price: $6.63).”, Eat This, Not That!, December 9, 2022

“Xponential Fitness Signs Master Franchise Agreement in Japan – The agreement was signed with Wellness X Asia, Xponential’s existing Master Franchise Partner in Japan for Club Pilates and CycleBar. Wellness X Asia (formerly Club Pilates Japan Co. Ltd.) will now be responsible for the country-wide development of Rumble and AKT, in addition to Club Pilates and CycleBar.”, Franchising.com, December 9, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

During an extraordinary four-decades in international business, William (Bill) Edwards has played a leadership role in the global growth of more than 40 brands. He is widely recognized as an International Problem Solver, Strategist, Advisor and a specialist on global cultures. His career covers international operations, executive and entrepreneurial experience in the energy, technology, licensing, management consulting and retail sectors. He has been a technical specialist, manager, brand senior executive and country president.

Over the years, Bill has made or seen almost every mistake that companies can make when going global. He understands the global company world like few others. As a Global Advisor, he now shares his experiences and wisdom with senior executives to help them successfully navigate the complex international company growth landscape. For hard learned advice on taking your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

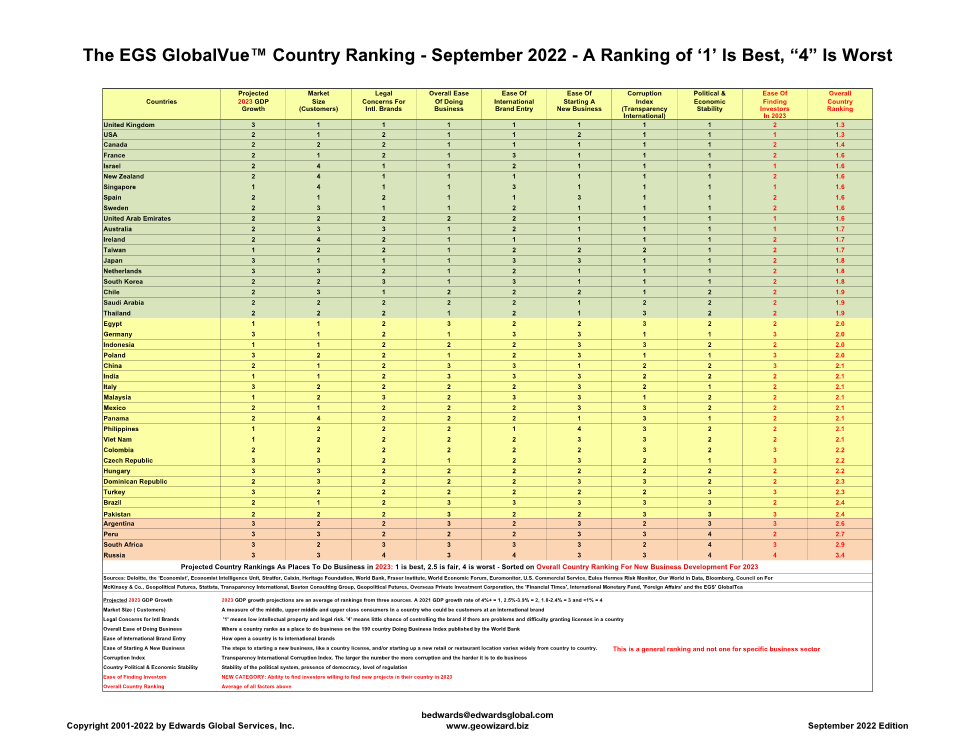

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 70, Tuesday, November 29, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

China begins to loosen Zero COVID travel Well so much for China relaxing zero COVID rules. Fall out needs to be watched closely for global impact. Mixed signals on global and country inflation and growth. McDonald’s reopens in the Ukraine, sort of. Who knew the Airbus 380 would come back into service so fast post pandemic? A look at the world’s most livable cities and the cost of gasoline worldwide.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The miracle of gratitude is that it shifts your perception to such an extent that it changes the world you see.”, Dr. Robert Holden

“Whether you think you can, or you think you can’t, you’re right.”, Henry Ford

“Success is the sum of small efforts, repeated day in and day out.”, Robert Collier

Highlights in issue #70:

- Brand Global News Section: California Pizza Kitchen®, Dominos®, FATB Brands, Nando’s®, Taco Bell®, Tim Horton’s®, Title Boxing® and Wendy’s®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

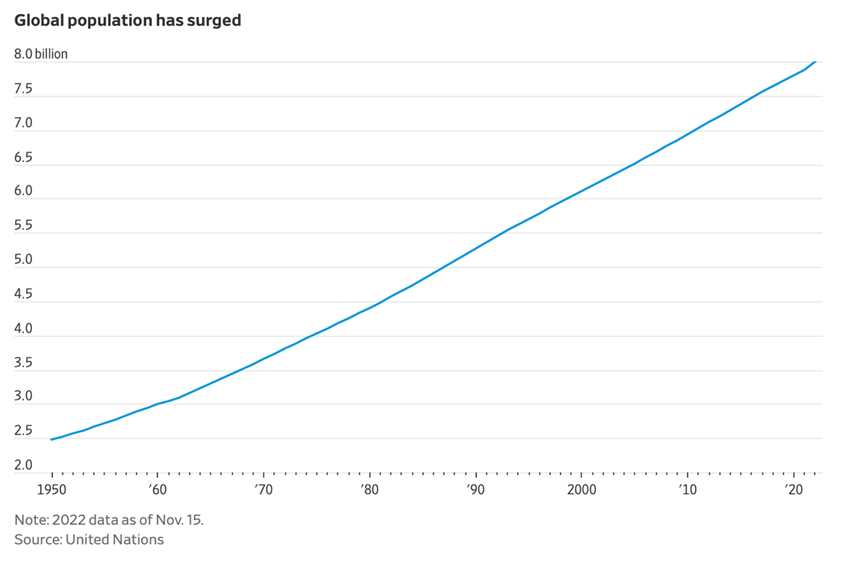

“World Population Hits 8 Billion, U.N. Says – The planet reached the milestone about a year later than expected because of the Covid-19 pandemic. U.N. officials said the milestone was an indicator of humanity’s achievements in medicine, nutrition, public health and personal hygiene. The world’s population has grown rapidly since 1900 largely thanks to soaring birthrates in some regions and healthcare advancements, according to the U.N.”, The Wall Street Journal, November 15, 2022

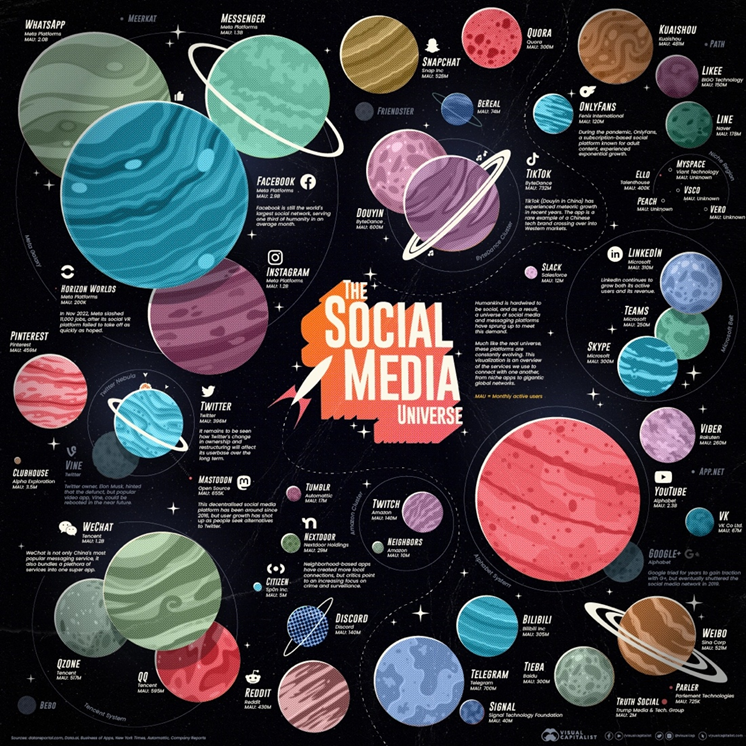

“Visualizing the World’s Top Social Media and Messaging Apps – In 2022, the social universe is looking more crowded than in previous years. The scale of Meta’s platforms still dominate thanks to their global reach, but there are a number of smaller networks fighting for market share. Here’s a look at popular platforms, organized from largest to smallest active userbase…..”, Visual Capitalist, November 18, 2022

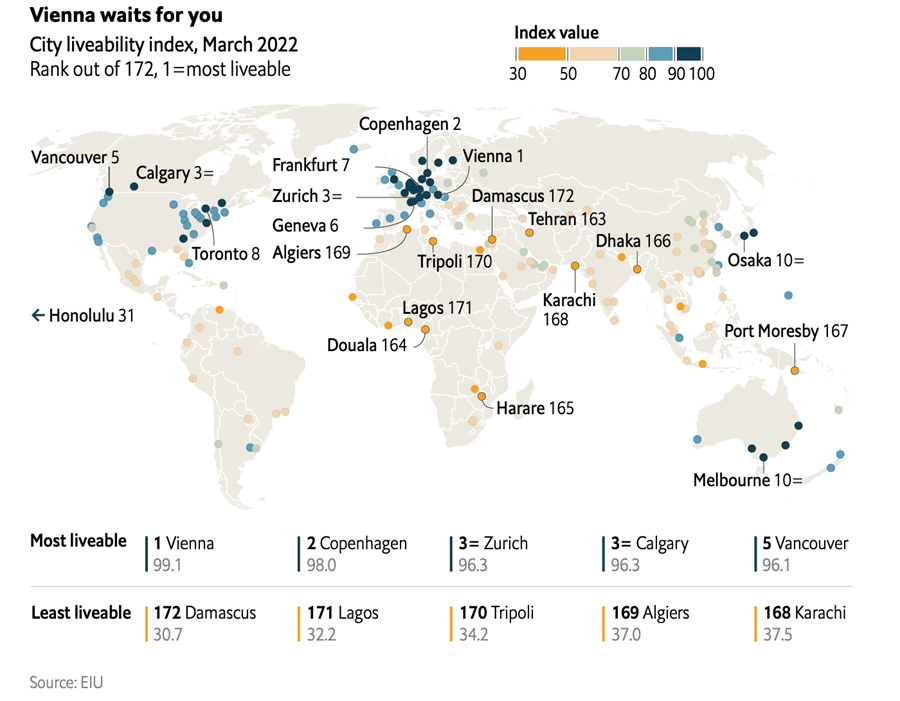

“The world’s most liveable cities – Life is getting back to normal, if not quite everywhere. For the third time in the past five years, Vienna has come top of the EIU’s ranking. Originally designed as a tool to help companies assign hardship allowances as part of expatriates’ relocation packages, the EIU’s (Economist Intelligence Unit) index rates living conditions in 172 cities (up from 140 last year) based on more than 30 factors. These are grouped into five categories: stability, health care, culture and environment, education and infrastructure.”, The Economist, June 22, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

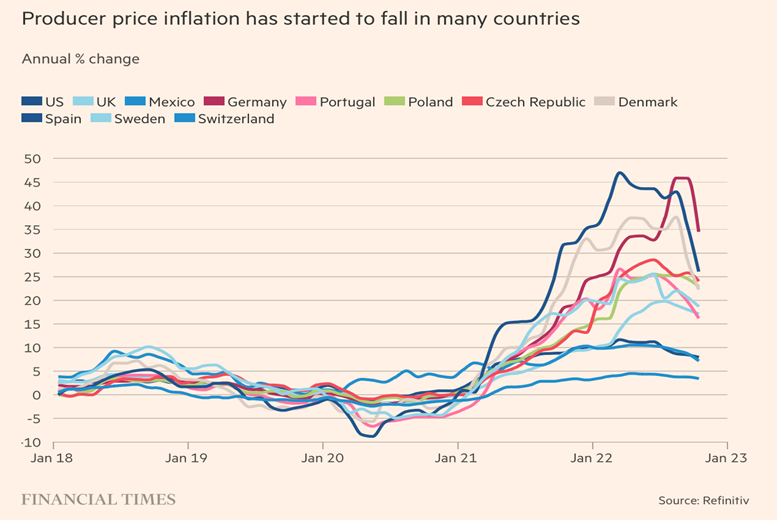

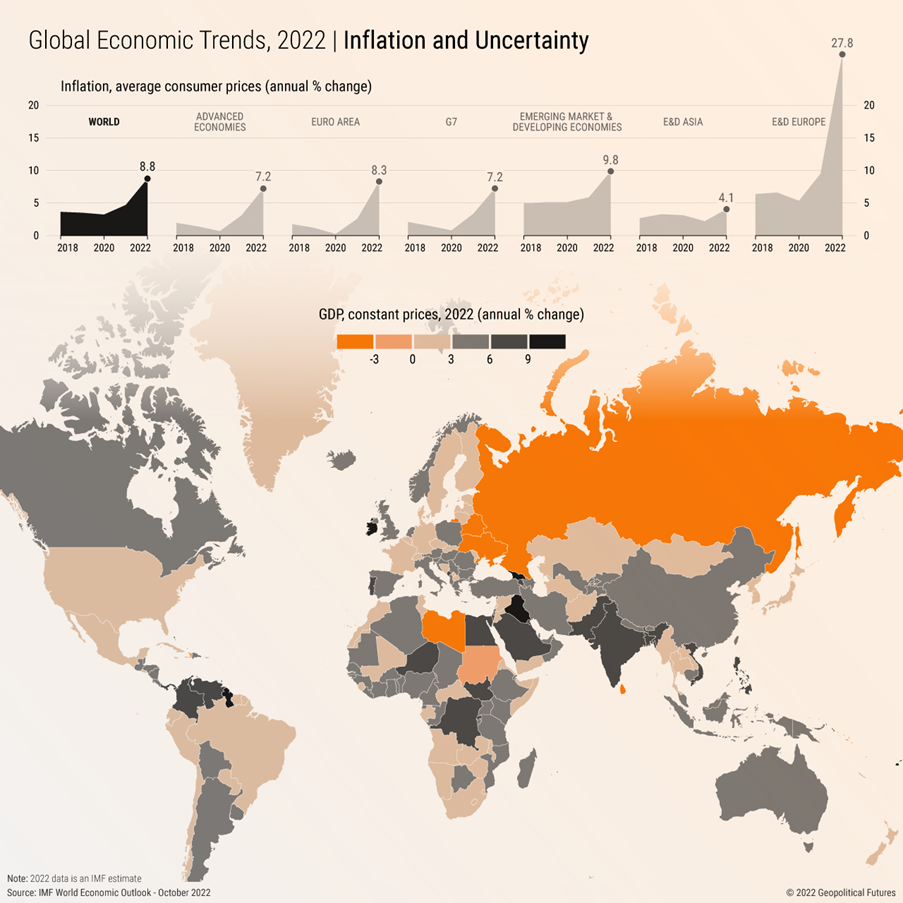

“Global inflation likely to have peaked, key data indicators suggest – Factory gate prices, shipping rates and expectations suggest headline price growth will slow. According to economists, the figures suggest that price pressures on global supply chains are easing, making it likely that headline inflation will fall from the historically high rates that hit household finances and business activity in recent months.”, The Financial Times, November 27, 2022

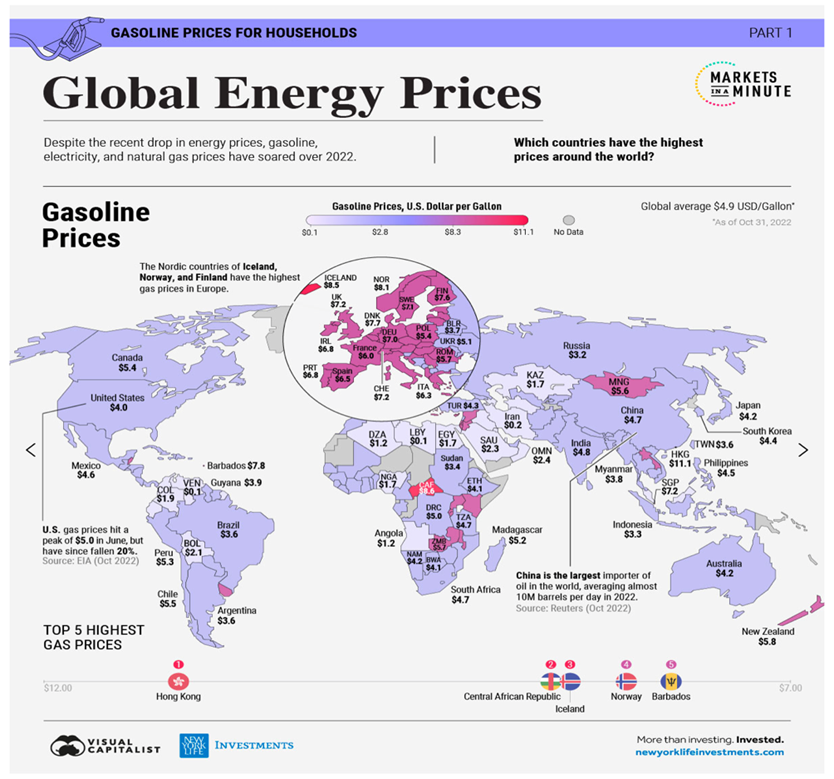

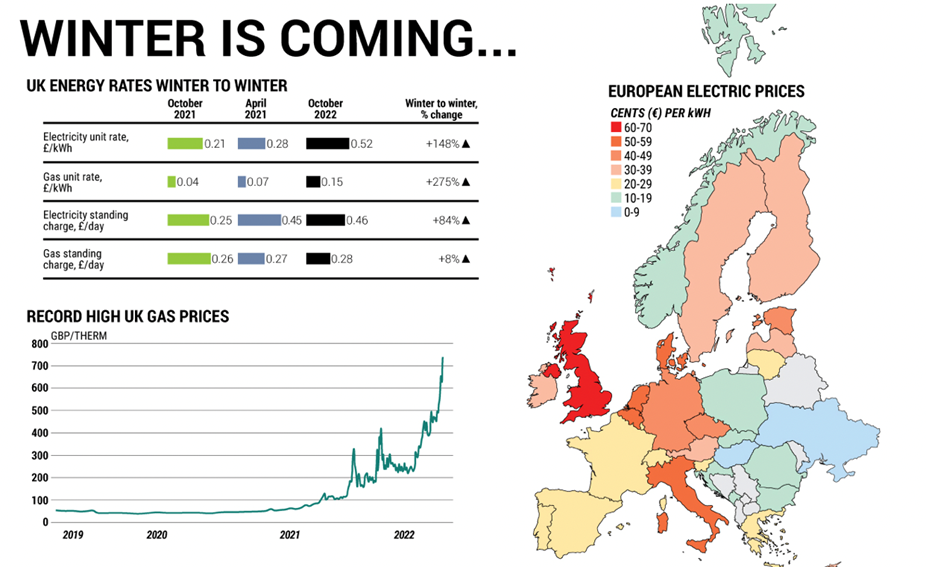

“Global Energy Prices, by Country in 2022 – For some countries, energy prices hit historic levels in 2022. Gasoline, electricity, and natural gas prices skyrocketed as Russia’s invasion of Ukraine ruptured global energy supply chains. Households and businesses are facing higher energy bills amid extreme price volatility. Uncertainty surrounding the war looms large, and winter heating costs are projected to soar.”, Visual Capitalist and New York Life, November 17, 2022

Global & Regional Travel Updates

“The world’s biggest plane is back – Here’s why – Covid nearly killed the popular Airbus A380, but now the double-decker plane is making a comeback. But the A380’s days were numbered, even before Covid. Airlines got their passenger predictions wrong. Demand for air travel post pandemic has recovered so fast that carriers cannot get their hands on enough jets to satisfy it. Global supply chain snarl-ups and shortages of everything from microchips to labour that have delayed production of new long-haul jets have made matters worse.”, The Times of London, November 18, 2022

“Japan to Welcome Cruise Ships Back after More than 2 Years – Japan will once again welcome cruise ships back to the country for the first time since the pandemic began. The country, which captured the world’s attention at the start of the pandemic with the outbreak of COVID-19 on the Diamond Princess ship, will now look to lift a more than 2 1/2-year ban on international cruise ships, The Associated Press reported.”, Travel and Leisure, November 17, 2022

Country & Regional Updates

Asia

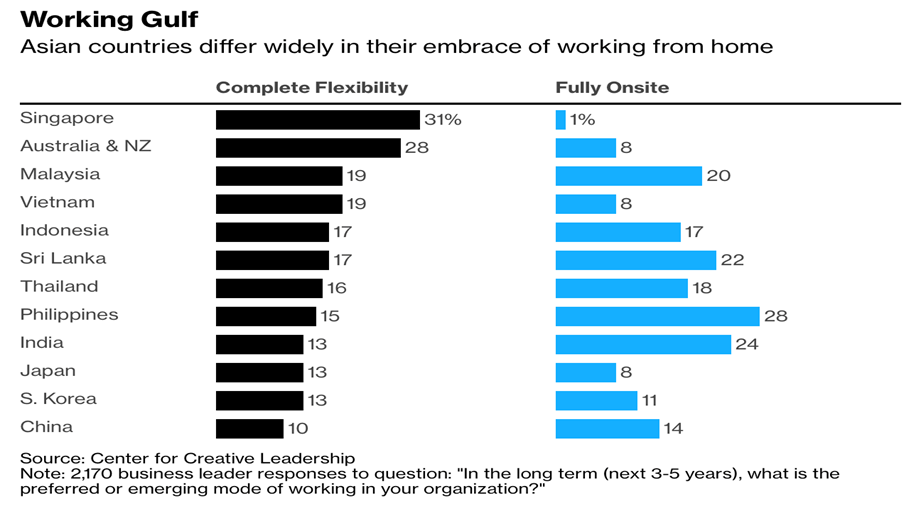

“Asia Embraces Work from Home But Bosses Say No to Four-Day Week – A survey found that remote work is likely here to stay. Attitudes about work from home vary across the region. The number of Asian businesses expecting employees to spend their entire working life operating from an office has plummeted during the pandemic, in a pivot to hybrid working that looks here to stay. Though over half of companies in Asia expected their staff to work in the office full time before the pandemic, the number has now fallen to 13%, according to a questionnaire conducted by the Center for Creative Leadership, a US-based education nonprofit.”, Bloomberg, November 18, 2022

China

“Chinese lenders to pump $162bn of credit into property developers – Injection is most direct move yet by Beijing to counter a real estate crisis. ‘The move is unprecedented,’ said Yan Yuejin, research director of E-house China Research and Development Institute in Shanghai. Yan said the rare disclosure of the loan details by Chinese commercial banks indicated authorities want to shore up confidence.”, The Financial Times, November 24, 2022

“Will Unrest In China Spook Markets? China has been hit by twin shocks. First of all the rate of COVID infections has spiked dramatically higher, pushing above levels seen at the last peak and this suggests that China following its very strict COVID policy we’ll have to lock down further and greater parts of its economy. The second shock which many did not expect, is the reaction of ordinary Chinese to the COVID shutdowns. There have been riots and unrest reported across China and this is relatively unusual.”, Forbes, November 27, 2022

Czech Republic

“Prague Christmas market returns after COVID but with fewer lights – Thousands of people poured into Prague’s medieval Old Town Square at the weekend for the lighting of a 25-metre (80-foot) Christmas tree and the reopening of the annual market after a two-year COVID-19 shutdown, but the energy crisis meant fewer lights than usual. The market, which is popular with Czechs and foreign tourists alike thanks to its mulled wine, sausages, sweets and gifts, was set up with more energy-efficient bulbs to both save money and send a seasonal message of energy efficiency.”, Reuters, November 27, 2022

European Union

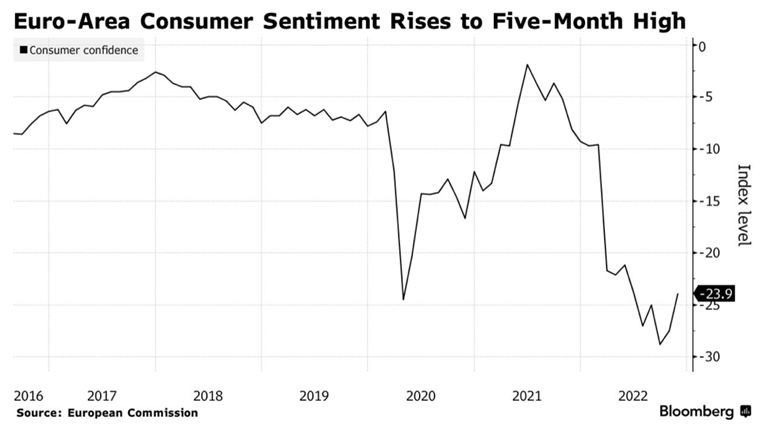

“Euro-Area Consumer Confidence Increases to 5-Month High – Consumer sentiment in the euro area rose to a five-month high, a sign of resilience among households at a time when the region is probably in recession. The gauge of confidence increased to -23.9 in November, according to the European Commission. The (European) Commission observed that consumer confidence still ‘remains at a very low level, well below its long-term average.’”, Bloomberg, November 22, 2022

Germany

“German manufacturing PMI rises for first time since outbreak of Ukraine war – Activity in Europe’s largest manufacturing economy improved in November for the first time since Russia’s invasion of Ukraine, according to a closely-watched business survey. The manufacturing purchasing managers index compiled by S&P Global rose to 46.7 from 45.1 in October……The comparable index for the services sector also improved surprisingly, leading the composite PMI to rebound to 46.4 from 45.1.”, Investing.com, November 23, 2022

Thailand

“Tourism revival likely boosted Thailand’s GDP growth in Q3 – Thailand’s economy grew at its fastest pace in more than a year last quarter, boosted by a rebound in tourism and private consumption, but the outlook was clouded by risks of a global economic slowdown, a Reuters poll predicted. Growth in Southeast Asia’s second-largest economy was estimated at 4.5% year-on-year in the third quarter, according to the median forecast of 13 economists polled on Nov. 11-16, up from 2.5% growth in the previous quarter.”, Reuters, November 16, 2022

Ukraine

“The McDonalds restaurant has resumed work in Khmelnytskyi (Ukraine) – ‘In accordance with the enhanced safety regulations, during the air raid alert, the facilities will be closed to allow employees and patrons to move to the nearest shelter. In doing so, the team will promptly issue pre-paid orders while halting production processes and turning off equipment before closing. The restaurant will resume work approximately one hour after the alarm is canceled: this time is needed to turn on and set up the equipment and to prepare the employees for work.”, Epravda, November 17, 2022. Translation and article compliments of Paul Jones, Jones & Co., Toronto

United Kingdom

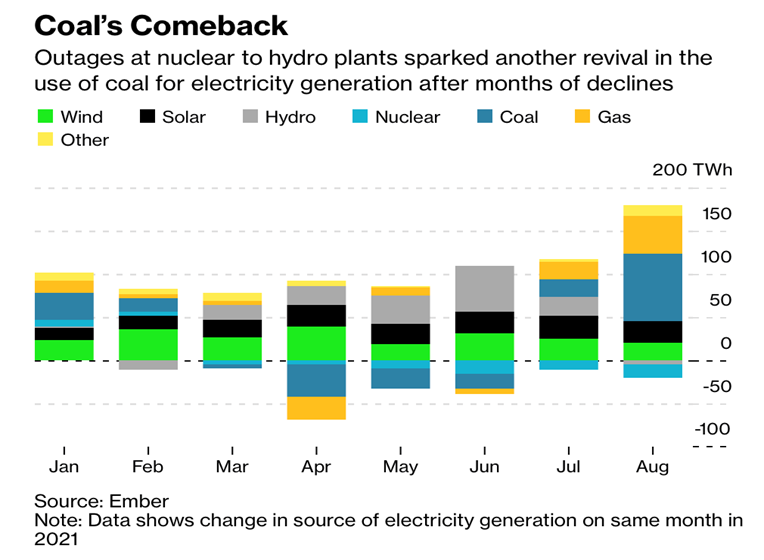

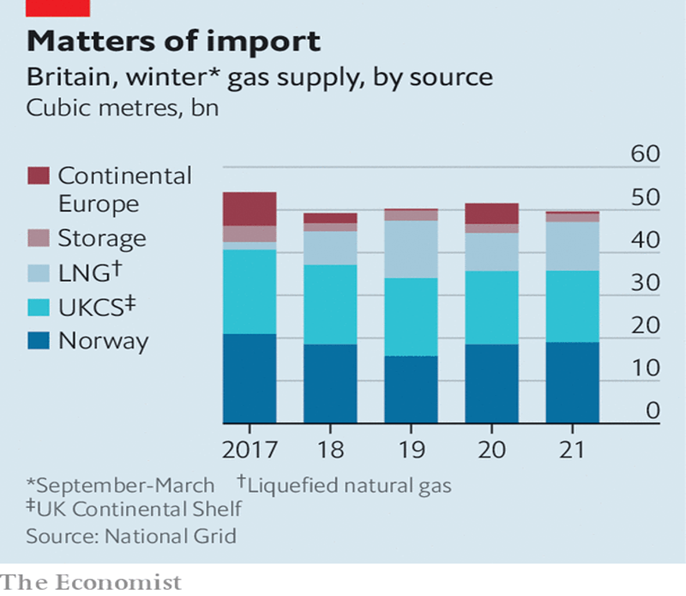

“UK doubles coal imports to head off winter energy crisis – The increasing use of coal-generated power in the UK comes after years of the country shifting to cleaner electricity from gas-fired power plants and renewables, but is deemed vital as Russian president Vladimir Putin crimps gas supplies to Europe. Figures from Kpler, a commodity analytics firm, show that last month more than 560,000 tonnes of coal came into British ports, compared to the 291,089 tonnes that arrived in October 2021, a 93 per cent increase.”, The Times of London, November 27, 2022

United States

“Black Friday Traffic Up 2.9% As Shoppers Return To Stores – The foot traffic to non-indoor mall locations, including lifestyle centers, open-air malls, neighborhood centers, and stand-alones, increased by 4.7%. ‘The strong traffic numbers for Black Friday show that shoppers are returning to stores and enjoying the socialization the holiday brings,’ said Brian Field, global leader of retail consulting and analytics at Sensormatic Solutions.”, Forbes, November 26, 2022

Brand & Franchising News

“Why the (US) Pet Industry Is a Recession-Resistant Franchise Sector – More than 23 million American households — nearly 1 in 5 nationwide — adopted a pet during the pandemic, according to the ASPCA. The pet market grew 14% in 2021— an increase over the 10% growth the industry experienced in 2020. The industry is evolving to meet the needs of modern pet ownership, resulting in a shift toward more convenient and tech-forward services, as well as more sustainable and environmentally friendly products.”, Franchising.com, November 27, 2022

“California Pizza Kitchen Announces Franchise Opening in Costa Rica – This newest CPK franchise builds on a momentous year for the brand, which opened new restaurants in Canada, India, and Chile earlier this year. CPK’s latest franchise location will be owned and operated by Byron Mora Porras, Chairman of Conceptos Gastronomicos, part of a larger company that currently operates restaurants and retail stores in eleven countries throughout Central and South America.”, Franchising.com, November 18, 2022

“Domino’s is building a fleet of GM Chevy Bolt EVs for the future of pizza delivery – Domino’s will roll out 800 custom-branded 2023 Chevy Bolt electric vehicles at locations across the U.S. in the coming months. The pizza chain restaurant has previously set a goal of net-zero carbon emissions by 2050, and CEO Russell Weiner said optimizing how it delivers pizza is key.”, CNBC, November 26, 2022

“FAT Brands reaches new milestone with 100th store opening this year. FAT Brands, the global franchising company that owns restaurants including Johnny Rockets, Fatburger, Round Table Pizza, Twin Peaks and 13 other concepts, announced that it has opened a record-breaking 100 new franchised locations so far this year and is poised for further growth, with approximately 25 additional stores slated to open by year-end. This is the first year since the company’s inception in 2017 that it has surpassed 100 openings in a year.”, VF Franchising, November 24, 2022

“Nando’s (UK) defies costs to serve up recovery – Pre-tax losses fell to £99.5 million compared with £241.8 million in the previous year. However, like many other businesses, the chain has been saddled with costs stemming from high inflation and global supply chain disruption, forestalling a return to profitability. The company’s wage bill increased from £243 million last year to £363 million. Rob Papps, chief executive, ……said: ‘The 2022 financial year saw a significant bounceback in customer demand following a return to eating out since the peak of the pandemic.’”, The Times of London, November 28, 2022

“What Does The Taco Bell Menu Look Like In India? In 2010, according to QSR, Taco Bell opened its first outlet in India, and in the 12 years since then, millions of people on the subcontinent have eaten tacos, burritos, and other specialties, adapted or invented for the market. There’s no beef at Taco Bell India.”, The Daily Meal, November 17, 2022

“Tim Hortons teams up with Alibaba to woo Chinese coffee drinkers – The operator of Canadian coffee chain Tim Hortons in China said on Thursday it had forged a two-year partnership with Alibaba Group’s (9988.HK) grocery chain that will see the two launch co-branded products. E-commerce giant Alibaba’s Freshippo will begin sales next month at its stores, of which it has more than 300, as well as through its official app, it said in a statement. Products will include drinks such as Velvet Cocoa Coffee.”, Reuters, November 17, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“TITLE Boxing Club Announces International Deal Across Nine Countries – The nine countries being added to TITLE Boxing Club’s roster are: Bangladesh, Cambodia, Indonesia, Nepal, New Zealand, Philippines, Singapore, South Korea and Thailand.”, Franchising.com, November 18, 2022

“Burger chain Wendy’s cooks up plans for Ireland – The Dublin, Ohio-headquartered company announced on Monday that it plans to continue its expansion into the European market following on from the success of its return to the UK in 2021. Wendy’s, which has around 7,000 restaurants worldwide, currently owns 25 in the UK, ten of which are operated by the main company behind the brand and 15 of which are franchised out. The chain said that it is seeking ‘well-established franchisee candidates in Ireland that have strong operations experienced, local development expertise, ambition to grow quickly and a proven track record of growing brands in Ireland.’”, The Irish Times, November 28, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 69, Tuesday, November 15, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

China begins to loosen Zero COVID travel quarantine, coal not going away just yet, China and the USA have half the world’s wealth, India’s coming decade of growth, US back to pre-COVID air travel, coffee bean prices are falling, 2 billion trees to be planted in Brazil and the dominant global marketing trends for 2023.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Nothing is impossible, the word itself says ‘I’m possible’“., Audrey Hepburn

“Wisdom comes from experience. Experience is often a result of lack of wisdom.”, Terry Pratchett

“The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty.”, Winston Churchill

Highlights in issue #69:

- Brand Global News Section: Dunkin®, Carl’s Jr.®, Jolibee®, Kinderdance®, Tim Hortons® and Wetzel’s Pretzels®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

“Battle of the Biggest – Today we look at who really has the world’s biggest economy……..But how to measure comparative sizes when countries have different currencies? A popular way to get around fluctuating exchange rates is to use a method called purchasing power parity, which accounts for the cheaper prices of goods and services in poorer countries. PPP, as it’s known, accounts for the bigger punch that $1 packs in, say, Laos than it does in the US. It’s not unlike looking at “real” GDP, which strips out the impact of inflation to look at the underlying state of the economy.”, Bloomberg, November 8, 2022

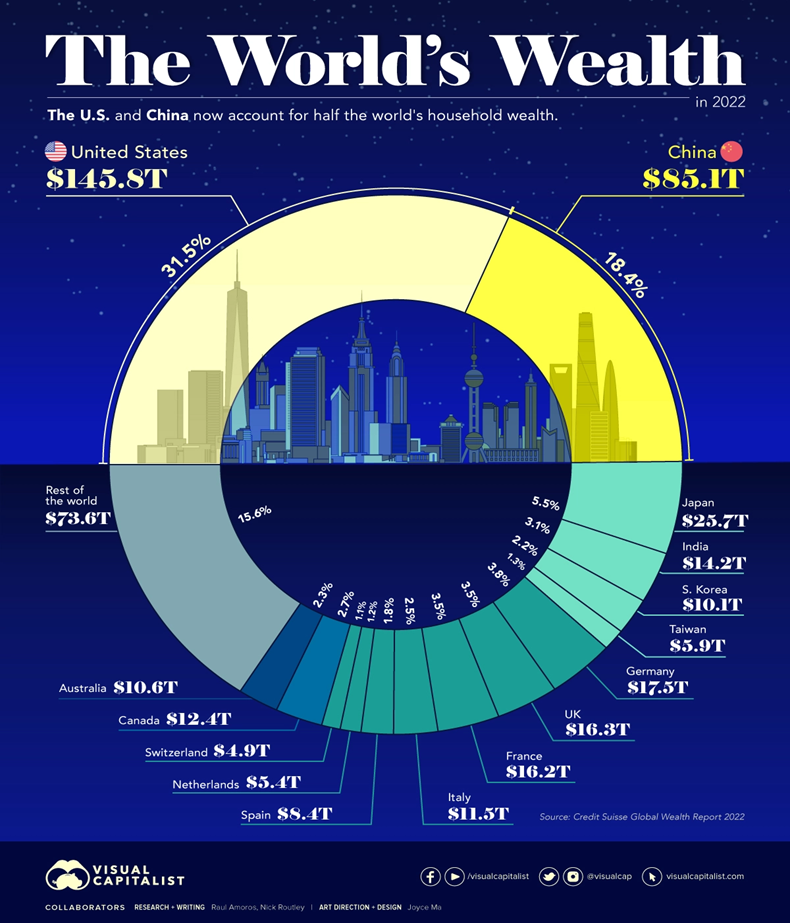

“The U.S. and China Account for Half the World’s Household Wealth – Measures like GDP are commonly used to understand the overall wealth and size of the economy. While looking at economic output on an annual basis is useful, there are other metrics to consider when evaluating the wealth of a nation. This visual utilizes data from Credit Suisse’s annual Global Wealth Report to break down the latest estimates for household wealth by country.”, Visual Capitalist / Credit Suisse, November 9, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

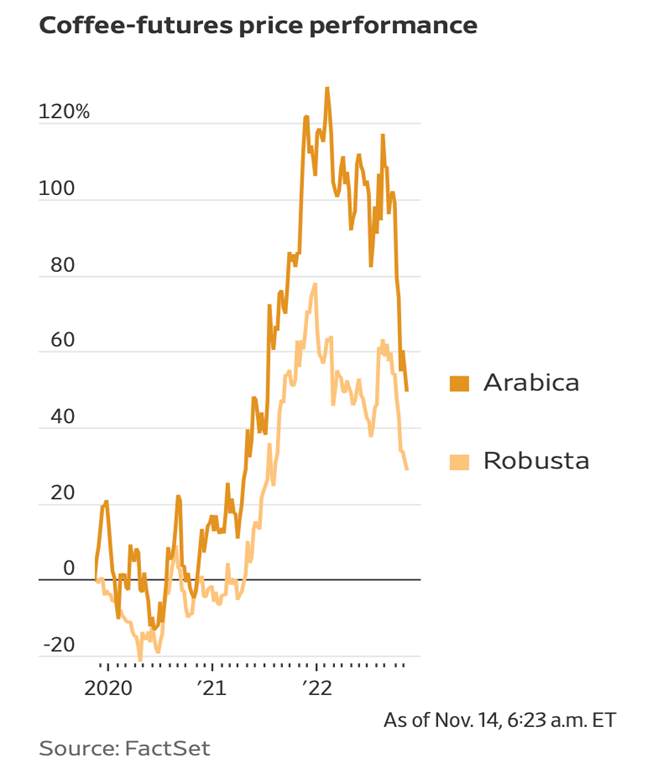

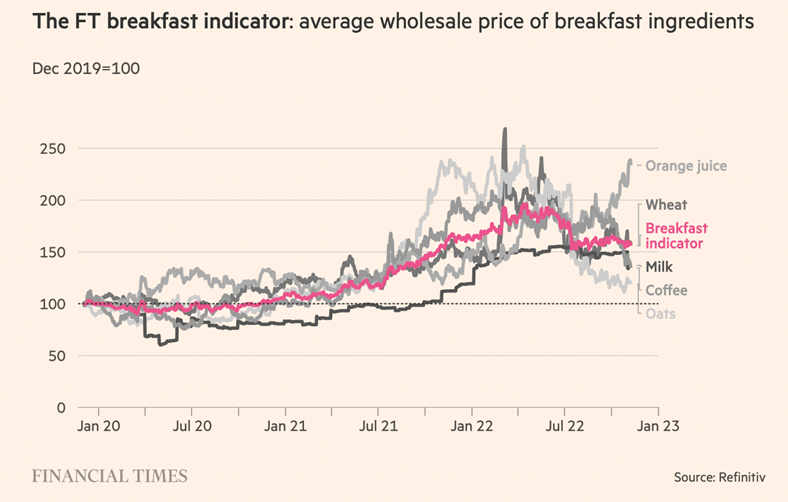

“Coffee Market Goes Cold as Brazilian Weather Normalizes – Futures prices have plunged since August, with coffee-growing conditions bouncing back from last season’s drought and frost. Wet weather in farming areas such as Brazil and Indonesia is raising the prospect of a good crop and bigger coffee supply, sending prices down. Arabica coffee futures have shed 22% in the past month.”, The Wall Street Journal, November 14, 2022

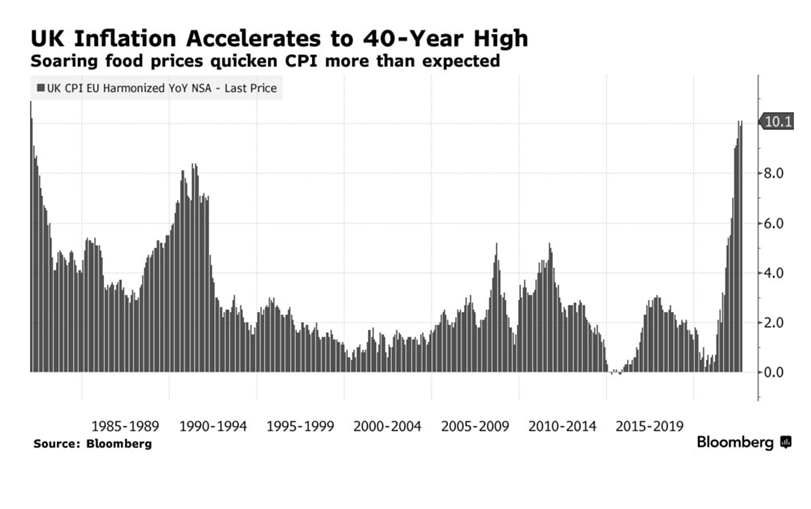

“Global inflation tracker: see how your country compares on rising prices –Russia’s invasion of Ukraine has increased prices for everything from energy to wheat, adding to the inflationary pressures affecting major economies of the world including the US, UK, Germany and France.”, The Financial Times, November 10, 2022

“Coal Was Meant to Be History. Instead, Its Use Is Soaring – The demise of the dirtiest fossil fuel has been delayed as power shortages and the war in Ukraine drive consumption, while China and India construct new plants. Prices of exported coal have skyrocketed to records and futures contracts suggest they’ll remain at historic highs for years to come.”, Bloomberg, November 4, 2022

Global & Regional Travel Updates

“These are the top 10 airlines in the world for 2022 – Airline-ranking company Skytrax ranked the world’s best carriers, and not a single U.S. airline made it to the top 10. Delta Airlines did rank in the 24th spot and earned the title of the best airline in North America—a result backed up by this year’s travelers satisfaction survey from The Points Guy.”, CNBC, November 10, 2022

“Americans Have Spent $11 Billion More on Domestic Flights This Year Than They Did in 2019 – Domestic flight prices in October alone were 24 percent higher than pre-pandemic levels. Through October 17, U.S. travelers spent a total of $76 billion on domestic flights, compared to $65 billion in 2019.”, Conde Nast Traveler, November 11, 2022

“WH Smith sales take off with return of global travel – WH Smith has reinstated dividend payments after reporting that the rebound in global travel had propelled it to the highest sales figures in 15 years. The group beat market expectations with a headline pre-tax profit of £61 million for the year to the end of August, against a £104 million loss last year, on sales of £1.4 billion. The company said it would pay a final dividend of 9.1p per share after suspending dividends during the pandemic.”, The Times of London, November 11, 2022

Country & Regional Updates

Brazil

“2 Billion New Trees (in Brazil): Suzano, Santander Launch Massive Planting Push in Brazil – An area the size of Switzerland, made of protected trees. The world’s largest pulp producer is among six companies aiming to plant millions of hectares of trees in Brazil, financed by the sale of carbon offsets.”, Bloomberg, November 12, 2022

China

“China Loosens ‘Zero-Covid’ Controls on Quarantine, Inbound Flights – China ended its “circuit breaker” mechanism for inbound flights and shortened the quarantine period for overseas travelers in an effort to “optimize” the country’s Covid-19 response, health authorities announced Friday. Travelers arriving in the country now must submit to five days of centralized quarantine plus three days of home confinement, rather than seven days of centralized isolation and three days of observation at home, according to the Joint Prevention and Control Mechanism of the State Council.”, Caixin Global, November 11, 2022

“Why Is China’s Youth Unemployment So High? This year’s cohort of college graduates has been facing China’s toughest job market in recent memory. Nearly one in every five young Chinese urbanites was unemployed in July, a record since data began to be released at the start of 2018. Their chances of finding a job have been hit by a perfect storm of economic disruption and uncertainty.”, Caixin Global, November 11, 2022

“Yum China Net profit in the third quarter increased by 98 percent to US 206 million with a total of 239 net new stores – In terms of the number of stores, a total of 239 new stores were added in the quarter, mainly driven by the development of the KFC and Pizza Hut brands, bringing the total number of stores to 12,409 as of September 30, 2022.”, Caijing Network, November 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

India

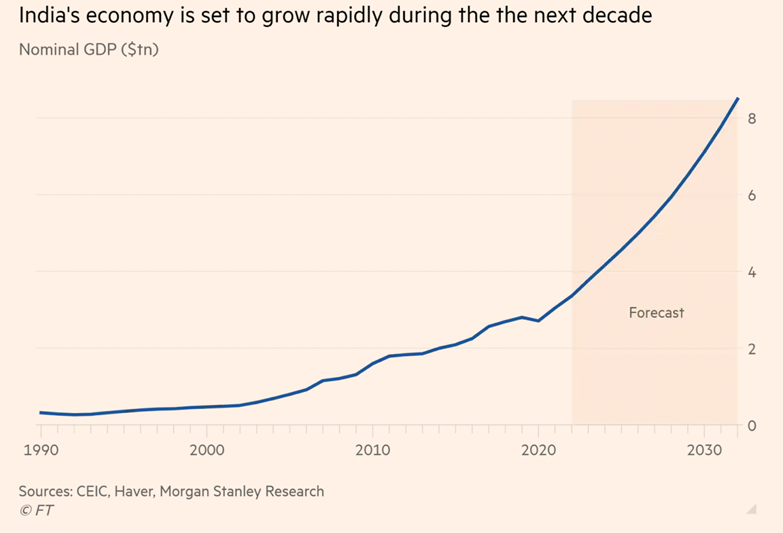

“India’s coming decade of outperformance – The country will provide a compelling opportunity in a world starved of growth. We forecast that India will be the third-largest economy by 2027, with its GDP more than doubling from the current $3.4tn to $8.5tn over the next 10 years. Incrementally, India will add more than $400bn to its GDP every year, a scale that is only surpassed by the US and China.”, The Financial Times, November 8, 2022

Malaysia

“Malaysia posts fastest economic growth in over a year, outlook clouded – Malaysia grows 14.2% y/y in Q3, beating forecasts. Central bank expects 2022 growth to surpass govt projections. Outlook clouded by risk of global slowdown.”, Reuters, November 11, 2022

The Philippines

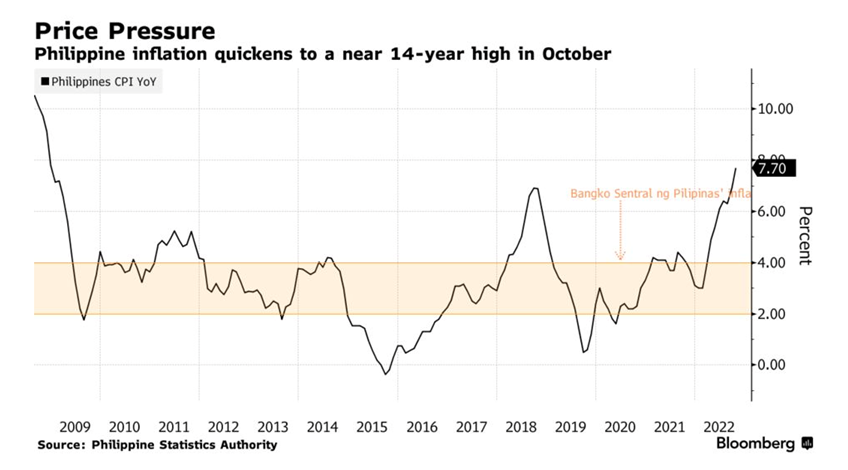

“Philippines Is Open to Matching More Fed Hikes to Tame Inflation – The Philippines central bank may keep on matching the Federal Reserve’s next rate increases should domestic inflation continue to quicken, according to Governor Felipe Medalla. Medalla’s comments came after the Philippines reported the fastest inflation in almost 14 years last month and a day after the governor announced that the monetary authority will match this week’s 75-basis-point hike at the Nov. 17 meeting.”, Bloomberg, November 4, 2022

United Kingdom

“Inflation ‘very possibly’ peaking – Is global inflation nearing its peak? Kristalina Georgieva, the head of the International Monetary Fund, has dared to say it might be. Georgieva believes the united action of central banks around the world to raise interest rates could be starting to push down on consumer price rises, which have surged to double-digit highs in the UK and elsewhere.”, The Times of London, November 7, 2022

“UK Energy Costs Are Through the Roof – A price cap is set to expire in April. Following the downfall of another prime minister and the British pound’s collapse to its lowest level ever against the dollar, the U.K. urgently needs to tackle energy prices. In June, regulatory body Ofgem reported that more than 2.3 million British households are behind on their electricity bills and 1.9 million are behind on gas bills. Both figures are some 70 percent higher than at the end of 2020.”, Geopolitical Futures, October 28, 2022

United States

“US Air-Passenger Traffic Tops Pre-Pandemic Levels of 2019 – Just over 15 million people went through Transportation Security Administration security portals in the past seven days, about 39,000 more than in 2019, or an increase of less than 1%, according to TSA data. The uptick comes in a traditionally slack period for travel. The recent volume is still well below the 18 million people a week who flew during peaks in the summer of 2019.”, Bloomberg, November 1, 2022

“Visualizing America’s Most Popular Fast Food Chains – Fast food is big business in America. From national chains to regional specialties, the industry was worth $331.4 billion as of June 2022. Which fast food brands are currently dominating this space? This graphic by Truman Du uses data from Quick Service Restaurant (QSR) Magazine to show the most popular fast food chains across America.”, Visual Capitalist / QSR Magazine, October 28, 2022

Brand & Franchising News

“MUMBO-fication: Multi-branding grows across international borders – It is becoming increasingly common to find multi-brand franchisees of foreign brands worldwide. This may be at the local or regional level, country level, or even a multi-country level. This is a major trend we see in the U.S. and increasingly in EU countries. These franchisees are often referred to as MUMBOs: multi-unit, multi-brand operators.”, Franchising.com, November 13, 2022. This article is by William Edwards, Editor of this newsletter

“Boost Juice (Australia) and EFG (Cambodia) sign agreement to bring Boost to Cambodia – EFG is committed to open 20 Boost locations within five years in Cambodia. The agreement also covers future store openings in Laos and Myanmar. Stores are expected to be located in airports, shopping malls and gas stations tapping into Asian needs for Grab & Go, Convenience Retail and a healthy daily beverage trend.”, Franchising.com, November 13, 2022

“Carl’s Jr. Signs Deal to Grow in Switzerland – CKE Restaurants Holdings, Inc. announced a franchise agreement with Spycher Burger Gang AG to develop Carl’s Jr. restaurants in Switzerland. Spycher will open restaurants across Switzerland in key cities including Zurich, Basel, Bern, and Lucerne.”, QSR Magazine, November 9, 2022

“Jollibee And Dunkin’ Are Breaking Up Their Partnership Overseas – This partnership, between Dunkin’ and Jollibee Food Corp., planned to expand the donut empire within southeast Asia, with a focus on China. Jollibee hoped to open more than 1,500 Dunkin’ locations, per The Philippine Star, but unfortunately, this expansion proved to be more difficult than anyone expected. In early November 2022, Jollibee and Dunkin’ announced that they would be ending their partnership.”, Mashed, November 10, 2022

“Kinderdance® A Top Kids Franchise Soars In Romania – Franchise owner Dana Iancu and her team of instructors are offering Kinderdance programs to children in Romania. Kinderdance programs are designed to be an integral part of a child’s school day and afterschool schedule.”, Franchising.com, November 2, 2022

“The next generation of ghost kitchens is stepping out from the shadows – Ghost kitchens and virtual brands in a post-pandemic world will favor more flexible, transparent business models from industry veterans like Reef and Nextbite, to newcomers like Oomi and Meal Outpost.”, Nation’s Restaurant News, October 31, 2022

“Papa Murphy’s® Owner MTY Foods to Buy Wetzel’s Pretzels® – The Canadian brand collector continues its U.S. shopping spree with its second deal this year, following an earlier acquisition of Famous Dave’s. The Canadian brand collector, which made its name through the ownership of dozens of mall-based concepts north of the border, on Tuesday announced the acquisition of the 350-unit Wetzel’s Pretzels for $207 million in cash.”, Restaurant Business, November 2, 2022

“Restaurant Brands profit, sales gain as Tim Hortons® looks to expand lunch, dinner offerings – Tim Hortons® has been adding lunch and dinner items to its menu, such as wraps and bowls, and such items are now included in 10 per cent of its transactions, which helped to drive sales momentum for the chain in the third quarter.”, The Globe and Mail, November 3, 2022

Articles & Studies For Today And Tomorrow

The Dominant Global Marketing Trends of 2023 – The world around us continues to change rapidly and drastically. With this change comes new and exciting opportunities for brands to connect with their customers. Global marketing teams are bracing for leaner budgets going into 2023. As budgets are tightening, marketing teams everywhere are finding that they need to optimize the campaigns that they can run and ensure that every dollar spent can make the most impact.”, Marcom Central, September 19, 2022. Compliments of Steve Dobbins, Founder and CEO of the Dobbins Group

“Unilever to extend four-day working week trial to Australia – Move follows successful New Zealand pilot scheme during which company reported happier and more engaged staff. Unilever is to extend its trial of a four-day working week to 500 employees in Australia after a successful 18-month pilot in New Zealand, becoming the largest company yet to offer a vote of confidence in the shorter schedule. Placid Jover, chief talent officer at the UK-based maker of Dove soap and Hellmann’s mayonnaise, said positive results from paying about 80 staff full salaries for four rather than five-day weeks in New Zealand had prompted the extension.”, The Financial Times, November 1, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 68, Tuesday, November 1, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

In this issue, the sudden reversal of the global chip shortage, global consumer spending declines, air fares are high, natural gas prices decline, fossil fuel demand might peak this decade, Euromonitor makes its 2023 economic predictions and McKinsey says we may be seeing a ‘New Dawn’ for global economies.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“It always seems impossible until it’s done.”, Nelson Mandela

“Victory is sweetest when you’ve known defeat.”, Malcolm S. Forbes

“Fortune befriends the bold.”, Emily Dickinson

Highlights in issue #68:

- A New Era Dawns – McKinsey & Co.

- Brand Global News Section: Dominos® Pizza China, Guzman y Gomez®, Happy Joe’s Pizza & Ice Cream®, KFC®, Xponential Fitness®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

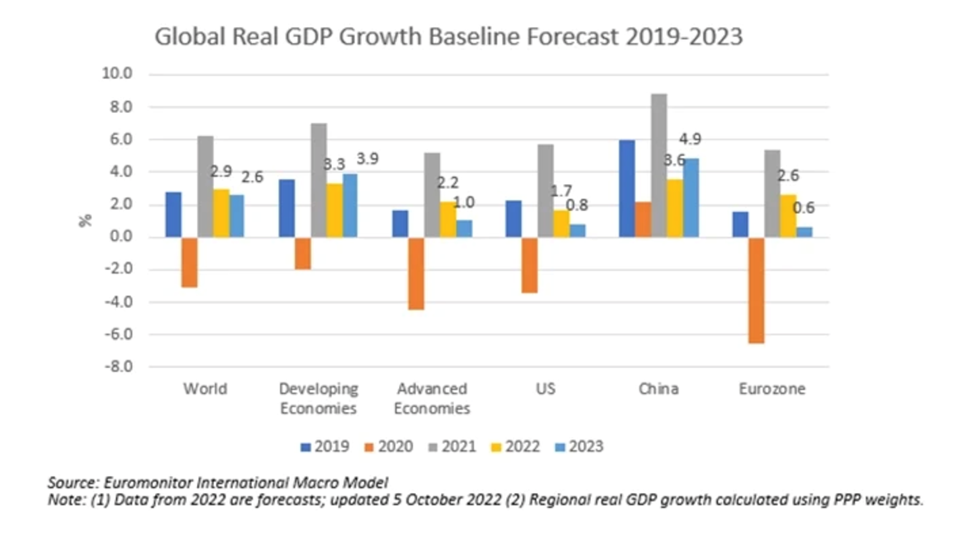

“Euromonitor’s Q4 Global Economic Forecast Predicts Worsening Conditions – Global real GDP growth is expected to decline from 6.2% in 2021 to 2.9% in 2022 and 2.6% in 2023, 0.1 and 0.3 percentage points lower than our predictions made in Q3 2022, respectively. Global inflation will peak at 9.0% in 2022 before it recedes somewhat in 2023.”, Euromonitor, October 24, 2022

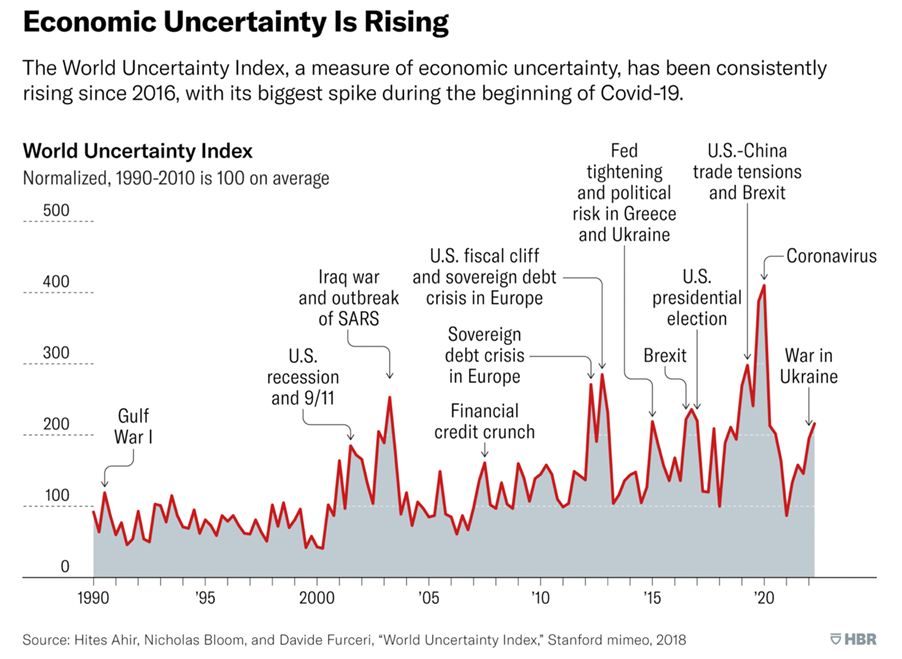

“A New Era Dawns – With a growing US-China rift, pandemic-induced supply-chain breakdown and war-induced energy crisis unfolding alongside demographic aging, it’s arguably a cliché to say humanity is entering a new era. That said, a paper from the McKinsey Global Institute details a compelling case for why the world is likely going through something akin to major step changes of the 20th century, including World War II, the 1970s oil crisis and the breakup of the Soviet empire in 1989-92, which powerfully shaped socio-economic outcomes in following decades.”, Bloomberg and McKinsey & Co., October 26, 2022

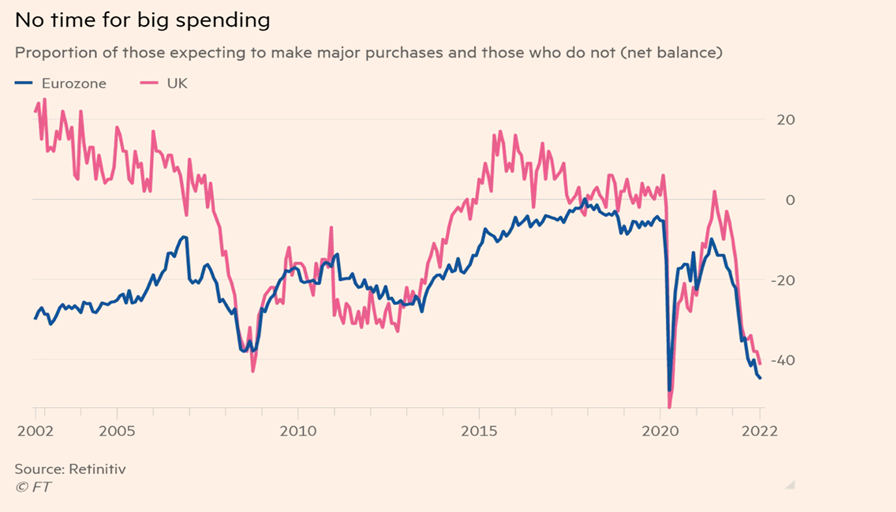

“European consumers cut back on discretionary spending – Shoppers postpone big purchases and reduce leisure outlays as cost of living crisis bites. European consumers’ intentions of spending on major goods, such as cars and houses, are at their lowest levels for two decades, excluding the early months of the pandemic.”, The Financial Times, October 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

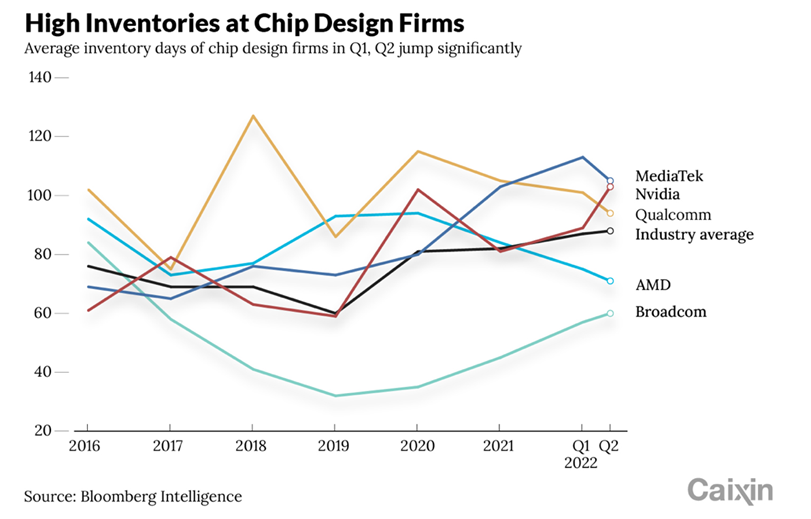

“The Sudden Reversal of the Global Chip Shortage – Remember the global semiconductor shortage a few months ago? It’s over. Now quickly shrinking demand for consumer electronics is causing canceled orders and unsold stockpiles at makers of integrated circuits including Taiwan Semiconductor Manufacturing Co. (TSMC), Advanced Micro Devices Inc. (AMD) and Nvidia. It’s a stark contrast with the disruptions that chip shortages caused for makers of autos, smartphones, computers and other goods relying on the advanced electronic devices.”, Caixin Global, October 20, 2022

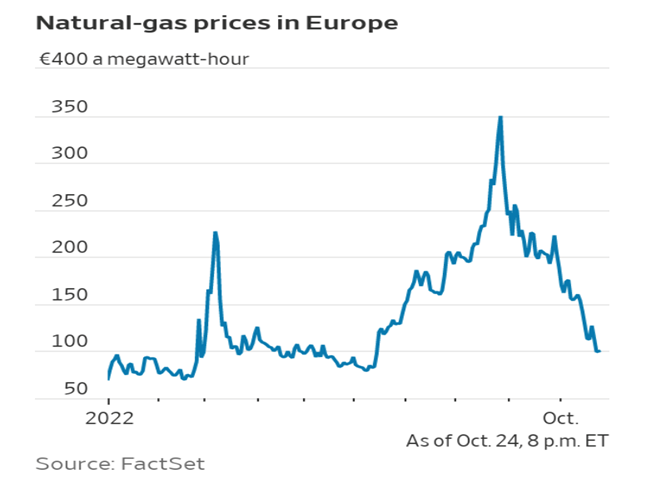

“Europe, Once Fearing Gas Rationing This Winter, Has a Glut – Prices for natural gas have tumbled more than 70% from their late-August high, thanks in part to a burst of warm weather. The comfortable position Europe finds itself in could be temporary. Starting next week, seasonal forecasts will be able to show with some accuracy how winter weather will affect storage.”, The Wall Street Journal, October 26, 2022

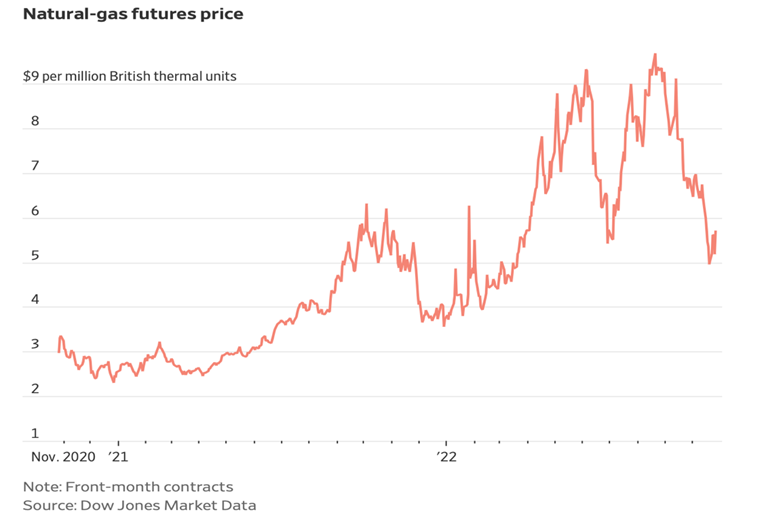

“(US) Natural-Gas Prices Have Plunged Into Autumn – A big driver of inflation is down about 40% in two months as U.S. inventories have swelled since air-conditioning season ended. The decline is due to warm autumn weather, record domestic production and gas-storage facilities that have filled up fast since the end of air-conditioning season. Now, one of the big drivers of inflation costs roughly the same as it did a year ago.”, The Wall Street Journal, October 30, 2022

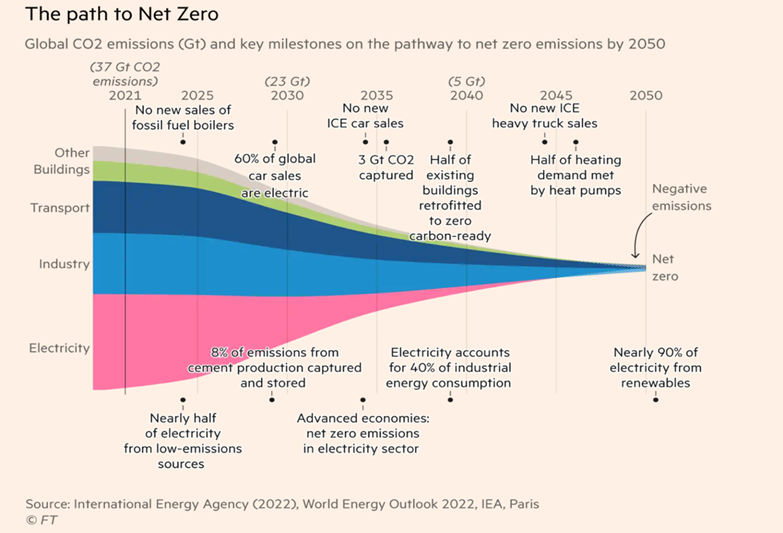

“IEA forecasts fossil fuel demand will peak this decade – World is approaching a ‘pivotal moment’ and ‘golden age of gas’ is coming to an end. The International Energy Agency has said Russia’s invasion of Ukraine will accelerate a peak in the world’s consumption of fossil fuels, with gas demand now expected to join oil and coal in topping out near the end of this decade.”, The Financial Times, October 27, 2022

Global & Regional Travel Updates

“Why Airfares Have Risen Five Times Faster Than The Overall Inflation Rate – Airline ticket prices have climbed much faster than overall inflation during the pandemic recovery due to several factors. The industry ground to a virtual standstill in the earliest days of the pandemic and recovery was initially slow. Russia’s war in Ukraine has driven up fuel costs substantially and, in recent months, an extraordinarily strong rebound in travel demand has collided with massive challenges to supply, including labor shortages, aircraft delivery delays and other issues.”, Forbes, October 14, 2022

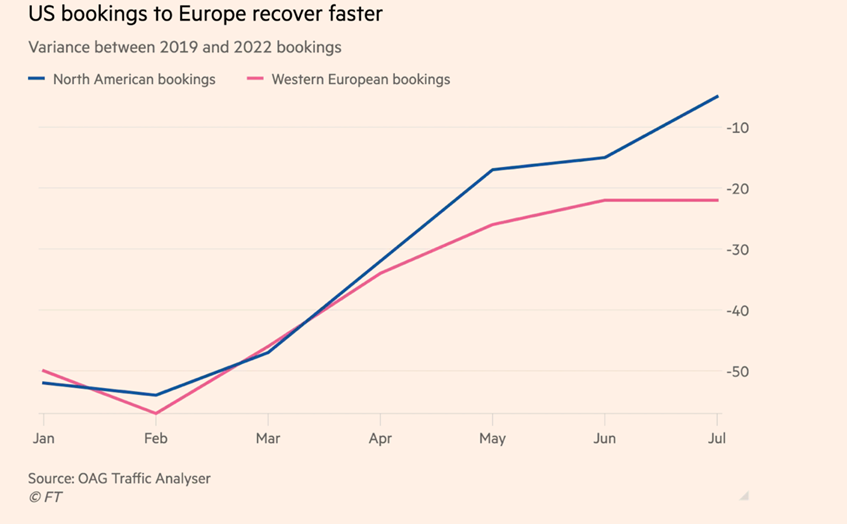

“Transatlantic travel soars as Americans make most of strong dollar – Virgin boss says UK holidays are ‘on sale’ for US tourists. Transatlantic travel is booming, driving airline revenue as Americans armed with a strong US dollar fly to Europe and the UK.”, The Financial Times, October 22, 2022

Country & Regional Updates

Southeast Asia

“Southeast Asia’s top digital economies expected to hit $200 billion in 2022 – The milestone comes three years ahead of earlier projections and is a 20% increase from last year’s $161 billion in gross merchandize value (GMV). An earlier report in 2016 estimated the internet economy in the region’s six major countries will close in on $200 billion in GMV by 2025. The six major economies covered in the report are: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.”, CNBC, October 26, 2022

Australia

“Australia to cut economic growth forecasts on lower consumer spending – Australia’s economic growth is expected to slow sharply next financial year as rising inflation curbs household consumption, according to new forecasts to be unveiled by Treasurer Jim Chalmers in Tuesday’s budget. Budget papers are set to show gross domestic product (GDP) for fiscal 2023-2024 will be downgraded to 1.5% from the 2.5% forecast in April. GDP is also due to be downgraded to 3.25% from 3.5% for 2022-2023, according to draft figures from the Treasury.”, Reuters, October 24, 2022

Brazil

“Lula wins Brazil presidential election in historic comeback – Lula won 50.83 per cent of the vote versus 49.17 for Bolsonaro after a cliffhanger three-hour count, followed by millions across the country on television and online.’, The Financial Times, October 31, 2022

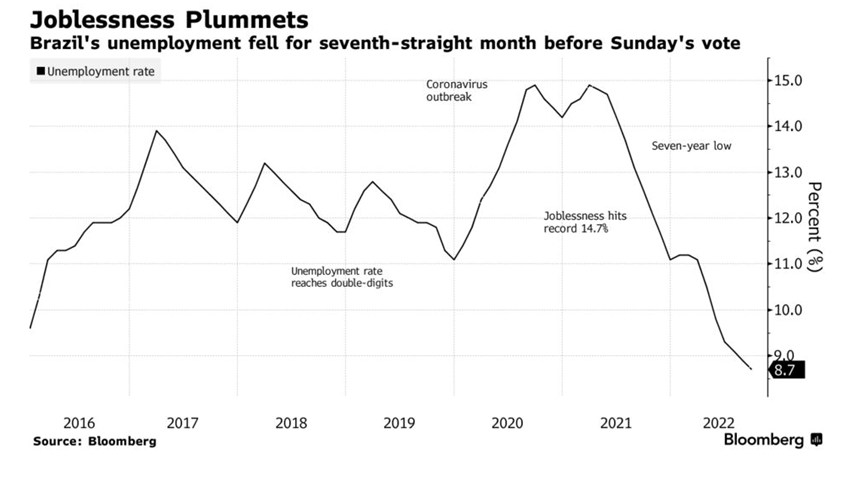

“Brazil Unemployment Hits New Seven-Year Low Before Presidential Runoff Vote – Jobless rate at 8.7% in three months through Sept.; est. 8.7% Brazilians head to the polls on Sunday with Lula leading polls. Brazil’s unemployment rate declined for the seventh-straight month to the lowest level since 2015, signaling the job market continued to improve ahead of Sunday’s presidential runoff.”, Bloomberg, October 27, 2022

Canada

“Bank of Canada raises interest rate for sixth time in a row, but signals campaign nearing end – The central bank raised its benchmark rate by 0.5 percentage points, its sixth consecutive hike since March. The move was smaller than financial markets were expecting, but still brings the policy rate to 3.75 per cent, its highest level since early 2008. Bank Governor Tiff Macklem told a news conference that further rate hikes are needed to get inflation, currently running near a four-decade high, under control.”, The Globe and Mail, October 27, 2022

China

“US companies’ sales forecasts drop to 10-year low in AmCham Shanghai’s 2022 poll, as zero-Covid rules upend operations – The number of companies expecting annual revenue growth plunged by 29 percentage points to 47 per cent this year, from 82.2 per cent in 2021. The annual AmCham Shanghai survey, featuring 307 respondents this year, was a stark contrast to the optimism found in the 2021 poll.”, South China Morning Post, October 28, 2022

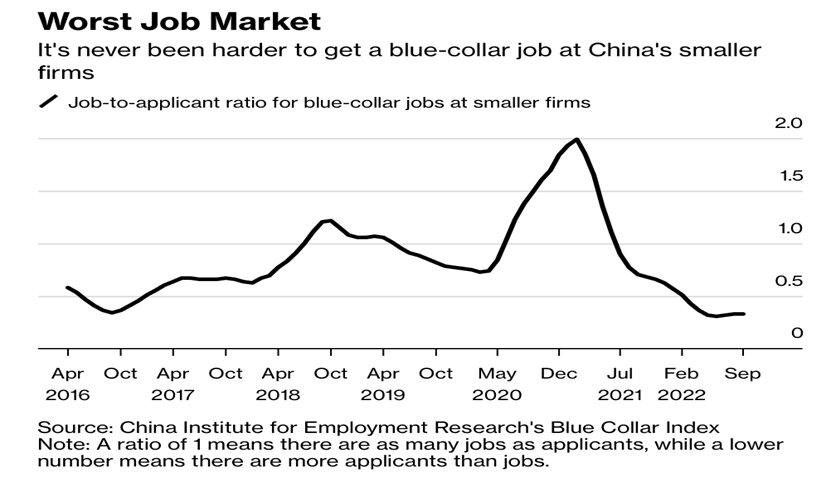

“Hiring at China’s Small Firms Fails to Pick Up from Record Low – Situation for blue-collar jobs near the worst since 2016. Jobs that declined most are related to property, construction. The ‘Blue Collar’ Job Index for small and medium-sized businesses, which are mostly in manufacturing and services, showed little improvement in the third quarter after hitting an all-time low of 0.3 in June, according to the Beijing-based China Institute for Employment Research. That means there’s more than three times as many applicants as there are jobs available.”, Bloomberg, October 27, 2022

India

“India economic outlook, October 2022 – India will likely post a 6.8%–7.1% growth during FY22–23, provided global uncertainties and inflation don’t weigh on domestic demand and investment sentiment in the near term. The purchasing managers’ index (PMI) suggests that economic activity stayed strong in July and August. Input cost inflation also fell to the lowest in 2022 due to falling commodity prices, including the lower prices of aluminum and steel.”, Deloitte, October 21, 2022

Japan

“Japan unleashes $200bn stimulus – The Japanese government on Friday unveiled Y29.1tn ($197bn) in fresh spending to ease the impact on consumers of soaring commodity prices and a falling yen, while the Bank of Japan stuck by its ultra-loose policy. Japan’s inflation rate, at 3 per cent in September, is much lower than price rises in the US and Europe.”, The Financial Times, October 28, 2022

Spain

“Economic Slowdown Starts to Weigh on Spain’s Stellar Job Market – Spain created fewer jobs in third quarter that during the same periods in the two previous years, a first sign that the job market is cooling after an impressive post-pandemic recovery. Unemployment rose slightly to 12.7% in the July to September period, according to data released by the statistics institute on Thursday.”, Bloomberg, October 27, 2022

United Kingdom

“UK Inflation May Hit 15% Without Further Energy Support – Backtracking on aid plan exposes households to surge in prices Government’s fiscal plan will have a big impact on economy. “The key question for the 2023 inflation outlook now relates to the energy price guarantee,” said James Smith, an economist at ING, who estimated that Hunt’s decision could add up to 3 percentage points to the headline inflation rate from April onwards.”, Bloomberg, October 20, 2022

United States

“Americans in Gallup poll say holiday spending will rise to 2019 level – The Gallup poll released Thursday shows Americans plan to spend an average of $932 on gifts this season, close to the $942 that the survey giant recorded in 2019. Pollsters found 37 percent of Americans plan to spend at least $1,000 on Christmas gifts this year, while 20 percent plan to spend between $500 and $999. Only 3 percent said they plan to spend less than $100, in line with previous years.”, The Hill, October 27, 2022

“U.S. economy grows in third quarter, reversing a six-month slump – Latest GDP report shows the economy expanded at an annual rate of 2.6 percent, even though many signs point to slowdown. Even though consumers bought fewer goods, they continued to spend on health care, which helped lift the reading on GDP, which sums up goods and services produced in the U.S. economy. The biggest boost, though, came from a narrowing trade deficit, with American retailers importing fewer items and exporting more goods as well as services, such as travel.”, The Washington Post, October 27, 2022

Brand News

“Three year revenue nearly doubled Domino s Pizza China s replicable economic model to build a broad moat – As the exclusive master franchisee of the world-renowned pizza brand Domino’s Pizza in Mainland China, Hong Kong Special Administrative Region of China and Macau Special Administrative Region of China, Domino’s Pizza China’s growth rate is impressive: as of June 30, 2022, it has 12 These cities quickly exceeded 500 directly-operated stores, while the number of stores in 2019 was 268.”, EEO.com.cn, October 21, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“This Aussie food business is valued at A$1.5b as sport stars, super giant invest – Superannuation giant Aware Super and a syndicate of elite Australian athletes have backed Mexican food chain Guzman y Gomez in a share sale which values the company at $1.5 billion. Guzman y Gomez founder Steven Marks said the investments were a testament of the group’s recent past performance and plans for the future. “We’re well positioned to build and bring even more [Guzman y Gomez eateries] to life here in Australia and globally,” he said.”, Brisbane Times, October 19, 2022. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Happy Joe’s to Increase Footprint by Over 50% with Monumental Master Franchise Agreement – Happy Joe’s CEO Tom Sacco announced this year that the popular family-centric concept has signed a master franchise agreement with H.J. Happy Joe’s for Restaurants L.L.C. to grow the brand abroad and open multiple new restaurants throughout the Middle East and North Africa. Led by Master Franchisee Ahmed Elbatran, the group will develop or sub-franchise at least 25 Happy Joe’s restaurants across Bahrain, Egypt, Jordan, Kuwait, Morocco, Qatar, Saudi Arabia and the U.A.E. over the next 10 years.”, Franchising.com, October 29, 2022

“Xponential Fitness Signs Master Franchise Agreement in Kuwait – Xponential Fitness, Inc. announced today it has signed a Master Franchise Agreement in Kuwait for its brands Rumble, Club Pilates, StretchLab and CycleBar. The deal, signed with Kuwait Real Estate Company, Aqarat, will result in the opening of a minimum of eight studios early in the initial 10-year term of the agreement. The Master Franchisee for Xponential in Kuwait is the publicly traded real estate development company, Aqarat, a prominent developer and manager of commercial, residential and hospitality properties in Kuwait and the Middle East, as well as Europe and the United States.”, Franchising.com, October 29, 2022

“KFC Owner Yum Exits Russia, Sells Business to Local Franchisee – Yum! Brands Inc., owner of the KFC fast-food chain, is exiting Russia and selling the business there to Smart Service Ltd., which is operated by one of the company’s existing KFC franchisees there. The new owner will be responsible for rebranding the restaurants to non-Yum concepts and retaining the company’s employees, the company said in a statement Monday. Yum said that after the transaction, it will cease having any corporate presence in Russia.”, Bloomberg, October 25, 2022

Articles & Studies For Today And Tomorrow

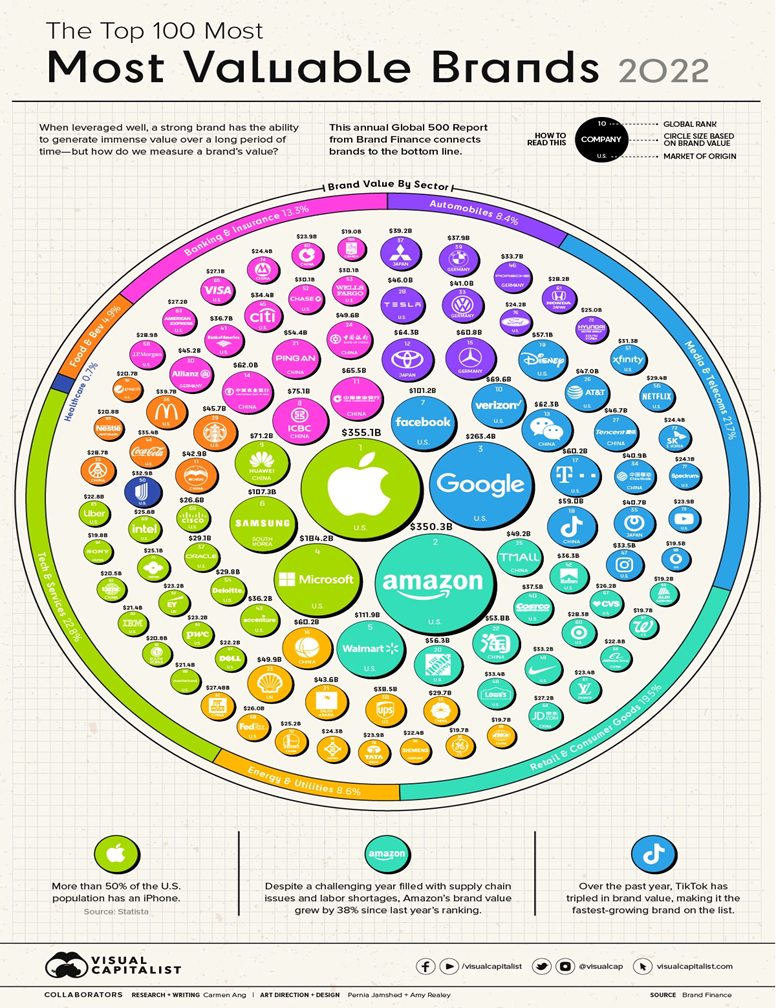

“The Top 100 Most Valuable Brands in 2022 – Given the allusive nature of brands, determining a brand’s financial value is a difficult task. Despite a brand’s intangibility, it’s hard to deny just how effective a strong one can be at boosting a company’s bottom line. With this in mind, Brand Finance takes on the challenge of identifying the world’s most valuable brands in the world in its annual Global 500 Report. The graphic above, using data from the latest edition of the report, highlights the top 100 most valuable brands in 2022.”, Visual Capitalist / Brand Finance, October 27, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 67, Tuesday, October 17, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Our latest GlobalVue™ country ranking chart is out with changes. How global opinion of China has changed in recent years. The latest global economic growth forecast and the rise of global uncertainty. Germany and Singapore are to pay bills for consumers, France is running out of gas and Hong Kong is giving away 500,000 free air tickets once they fully reopen to travelers.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“ I look to the future because that’s where I’m going to spend the rest of my life.:, George Burns

“However difficult life may seem, there is always something you can do and succeed at.”, Stephen Hawking

“It is better to fail in originality than to succeed in imitation.”, Herman Melville

Highlights in issue #67:

- Brand Global News Section: BurgerFuel®, Chick-Fil-A®, Chipolte®, F45®, McDonalds®, Qdoba® and Starbucks®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

The latest quarterly EGS GlobalVue™ country ranking report is out and has a few key changes. We dropped the COVID recovery category and add a section for the ease of finding investors in a country. In September’s EGS GlobalVue™ report, Australia, China, Indonesia, Saudi Arabia, Singapore, South Korea, Thailand and United Arab Emirates climbed in rankings while the Czech Republic, Germany, Hungary, Italy, Mexico and the Philippines dropped down since the Q2 report was released in June of 2022.

“The Latest Global Growth Forecast – In its new report on the outlook for the global economy, the International Monetary Fund confirmed a slowdown for 2022 and was pessimistic about 2023. In identifying the causes of the gloomier forecast, the IMF highlighted Russia’s war in Ukraine, pandemic-related supply disruptions and high inflation expectations.”, Geopolitical Futures, October 14, 2022. Compliments of William (Bill) Ellermeyer, Ellermeyer Connect

“Visualizing the Rise of Global Economic Uncertainty – Over the last six years, companies have had to grapple with five major “uncertainty shocks”: First it was Brexit in 2016, followed by the U.S. presidential election, China-U.S. trade-tensions, the Covid-19 pandemic, and in 2022 the Ukraine war.”:, Harvard Business Review, September 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

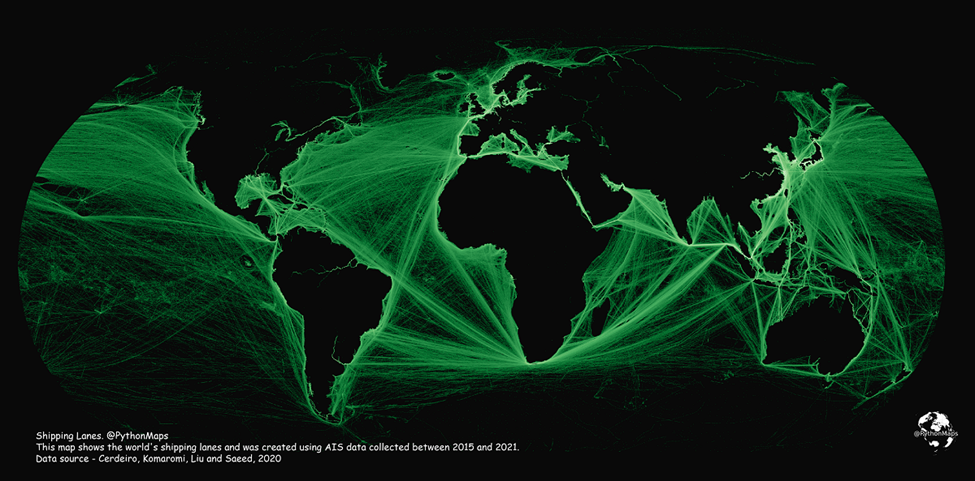

“Mapping Shipping Lanes: Maritime Traffic Around the World – Each year, thousands of ships travel across the globe, transporting everything from passengers to consumer goods like wheat and oil. But just how busy are global maritime routes, and where are the world’s major shipping lanes? This map by Adam Symington paints a macro picture of the world’s maritime traffic by highlighting marine traffic density around the world. It uses data from the International Monetary Fund (IMF) in partnership with The World Bank, as part of IMF’s World Seaborne Trade Monitoring System. Data …….includes five different types of ships: commercial ships, fishing ships, oil & gas, passenger ships, and leisure vessels.”, Visual Capitalist / Adam Symington, June 20, 2022

Global & Regional Travel Updates

“Hong Kong to give away 500,000 airline tickets next year as part of global campaign to revive tourism – Head of Tourism Board says plan is part of global promotion next year once Hong Kong removes all epidemic curbs for arrivals. The free plane tickets are not all for inbound tourists. Some of them will be given to outbound travellers, while some will be distributed via travel agents.”, South China Morning Post, October 6, 2022

“International Flights Continue Returning to China – Chinese authorities are releasing the controls on international flights, and such action has attracted dozens of carriers to resume and open new routes in and out of China. In May, China reduced the mandatory quarantine period from 14+ days to 7 days. Since Aug, the Chinese authority changed the fusing mechanism for international flights, from the original absolute confirmed Covid-19 cases to a percentage of all passengers on a flight.”, Airline Geeks, October 13, 2022

Country & Regional Updates

Argentina

“What Is the Value of an Argentine Peso? It Depends on What You’re Buying – Government adds new currency rules, multiplying existing rates Goal is to avoid devaluation even if it faces IMF opposition. In Argentina, where about a dozen different exchange rates overlap, the government is creating ever more rules about who can access dollars and for what, making an already vexing system more complicated in a bid to delay a devaluation.”, Bloomberg, October 12, 2022

Canada

“Canada’s oil sands firms to invest $24-billion on emissions projects – Canadian oil sands companies plan to spend more than $24-billion on emissions-reduction projects by 2030, as they accelerate their bid to get production to net zero by 2050. The investment by members of the Pathways Alliance – a group that covers about 95 per cent of oil sands production – includes $16.5-billion for a massive carbon capture and storage (CCS) network in northern Alberta. Another $7.6-billion will be spent on advancing other emissions-reduction technologies….”, The Globe and Mail, October 14, 2022

China

“How Global Public Opinion of China Has Shifted in the Xi Era – The Chinese Communist Party is preparing for its 20th National Congress, an event likely to result in an unprecedented third term for President Xi Jinping. Since Xi took office in 2013, opinion of China in the U.S. and other advanced economies has turned precipitously more negative. How did it get to be this way?”, Pew Research Center, October, 2022

“China’s economic crisis, led by a faltering property sector, looms over Xi Jinping’s expected third term – On Sunday, a collection of 2,300 delegates from the Communist Party of China will convene for a weeklong conference to choose China’s next leader. The victor is almost certain to be current President and General Secretary Xi Jinping, who would be the first to serve more than two terms as the Party’s leader since Mao Zedong.”, Fortune, October 15, 2022

France

“Heading to France? It’s running out of gas – For the past two weeks, French trade union General Confederation of Labour has been locked in a bitter standoff with fuel giants TotalEnergies and Esso-ExxonMobil in a dispute over pay for its members. Dozens of workers at several oil refineries owned by the multinationals walked out, blockaded several refineries and stymied gasoline supplies; as a result, more than a quarter of gas stations are now out of at least one type of fuel and 19% are completely dry.”, The Points Guy, October 13, 2022

Germany

“Germany to pay December gas bills for households and businesses – Under the scheme, the one-off full reimbursement in December would be followed up next spring with a more differentiated subsidy scheme designed to cap bills but still incentivise people to save energy. From March 2023 to the end of April 2024, private households would pay €0.12 (£0.11) per kilowatt hour for the first 80% of last year’s use of gas. Industry, meanwhile, would from 1 January 2023 until end of April 2024 pay €0.07 per kilowatt hour for the first 70% of last year’s use.”, The Guardian, October 10, 2022

India

“India festival spending booms despite inflation worries, global slowdown – Indian consumers are lapping up everything from cars, houses and television sets to travel and jewellery in the festive season that began last month, according to early data, giving a fillip to growth prospects despite economic gloom elsewhere in the world. Online and offline sales during the Hindu festival period starting in the last week of September and lasting until early November are estimated to cross $27 billion, almost double the amount in the same pre-COVID period in 2019, and nearly 25% higher than last year, according to industry estimates.”, Reuters, October 14, 2022

Japan