EGS Biweekly Global Business Newsletter Issue 87, Tuesday, July 25, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Japan’s inflation rate is higher than in the USA, what is the difference between types of AI, the pandemic’s impact on commercial real estate, China’s growth turns down, globalization remains high, New Zealand ranks #1 in the world in work-life balance, McDonalds® sees global growth and Americans will need a visa to go to Europe soon.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Communication is the key for any global business.”, Anita Roddick

“It is not the strongest or the most intelligent who will survive, but those who can best manage change.”. Leon C. Megginson

“Mistakes are the growing pains of wisdom.”, William George Jordan

Highlights in issue #87:

- The State of Globalization in 2023

- New Zealand ranked best in world for work/life balance

- Will China ever get rich? A new era of much slower growth dawns

- The Difference Between Generative AI And Traditional AI: An Easy Explanation For Anyone

- Meet a Company Pioneering Work-Life Balance

- Brand Global News Section: Anytime Fitness®, Applebee’s®, Chipotle®, Firehouse Subs®, IHOP®, McDonalds® and Sizzler®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

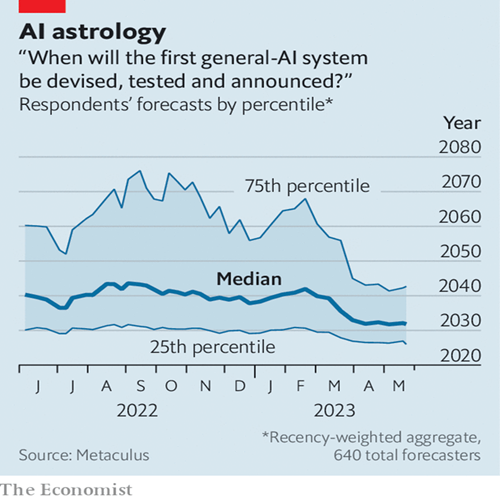

“The Difference Between Generative AI And Traditional AI: An Easy Explanation For Anyone – Artificial Intelligence (AI) has been a buzzword across sectors for the last decade, leading to significant advancements in technology and operational efficiencies. However, as we delve deeper into the AI landscape, we must acknowledge and understand its distinct forms. Among the emerging trends, generative AI, a subset of AI, has shown immense potential in reshaping industries. But how does it differ from traditional AI? Let’s unpack this question in the spirit of Bernard Marr’s distinctive, reader-friendly style.”, Forbes, July 24,2023

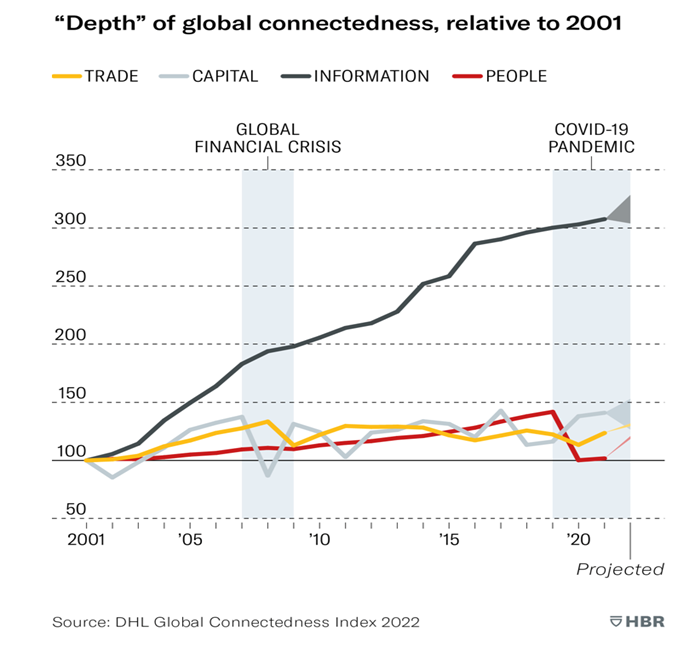

“The State of Globalization in 2023 – Global (Trade) flow have mostly returned to above pre-pandemic levels. The latest DHL Global Connectedness Index shows how the international flows of trade, capital and information were already above pre-pandemic levels by 2021. In 2022, the recovery of international people flows accelerated.”, Harvard Business Review, July 11, 2023

“McKinsey Releases Report on the Pandemic’s Lasting Impact on Real Estate – Hybrid work is here to stay. As a result, office attendance has stabilized at 30% below prepandemic norms. The ripple effects of hybrid work are substantial. Untethered from their offices, residents have left urban cores and shifted their shopping elsewhere. Demand for office and retail space in superstar cities will remain below prepandemic levels.”, Franchising.com, July 23, 2023

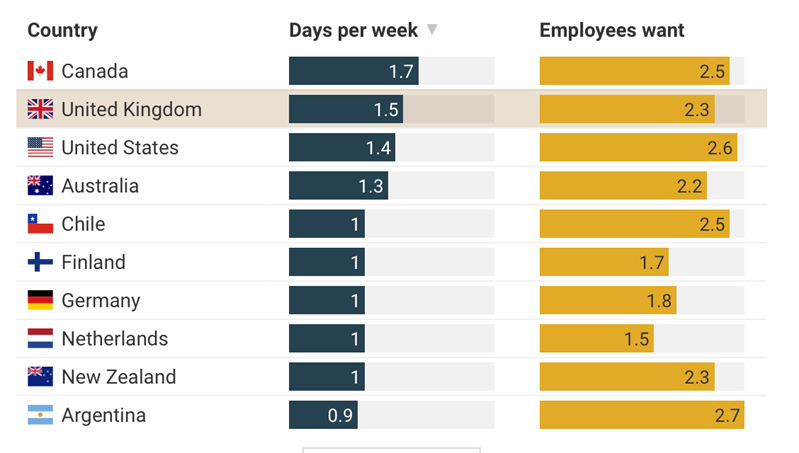

“Britons spend less time in the office than the rest of Europe – Only Canada scores higher for remote hours, study of 34 countries finds. The research, which surveyed 42,400 full-time employees in 34 countries, found that those in France spent less than half as many hours at home as Britons, at only 0.6 days a week. Those in Italy are at home only 0.7 days a week while in Spain the number is 0.9. Britons also show up to the office significantly less than workers in east Asia. However, Britain’s working practices are more similar to other English-speaking nations. In America, workers spend 1.4 days a week at home, while in Australia the number is 1.3. In Canada, the home-working capital of the world, office staff spend 1.7 days a week working remotely.”, The Sunday Times of London, July 18, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“UK signs Comprehensive and Progressive Agreement for Trans-Pacific Partnership – The new agreement will simplify import and export process between the UK and Chile, improving the business environment between the two countries as members of the bloc. Being part of CPTPP will mean that more than 99 per cent of current UK goods exports to CPTPP countries will be eligible for zero tariffs.”, GOV.UK, July 17, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Americans Will Need a ‘Visa’ to Visit Europe in 2024—Here’s What to Know – The new program requires an online application and a minor fee, and is required for all travelers regardless of their age. The new regulations are called the European Travel Information and Authorization System (ETIAS). When the system launches in early 2024, it will require all visitors who currently travel to Europe visa-free, such as citizens from the US, Canada, Australia, and New Zealand, to apply for travel authorization and receive approval prior to their departure.”, Conde Nast Traveler, July 19, 2023

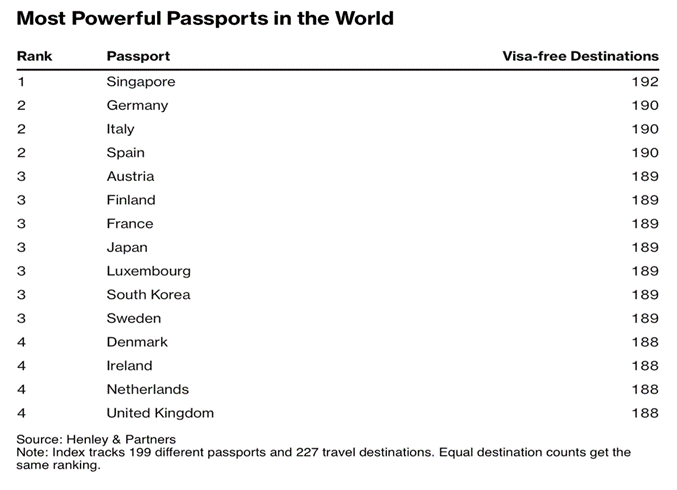

“Singapore Passport Is World’s Most Powerful, Replacing Japan – Singapore has replaced Japan for having the world’s most powerful passport, allowing visa-free entry to 192 global destinations, according to the latest Henley Passport Index. The US, which once topped the ranking nearly a decade ago, slid two places to eighth place. The UK, after a Brexit-induced slump, jumped two places to fourth, a position it last held in 2017.”, Bloomberg, July 18, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Mid-Year Canadian Dollar Outlook – 2023 – The loonie is lifting off. – Fiscal support, stabilising financial conditions, and a historic surge in immigration are helping the Canadian economy – and the loonie – defy bearish expectations. Continued labour market tightness, rebounding housing markets, and high levels of consumer consumption have combined to deliver remarkably-robust growth rates. Yield differentials might narrow – or even flip. But household consumption looks fragile.”, MAPLE Business Council, July 21, 2023

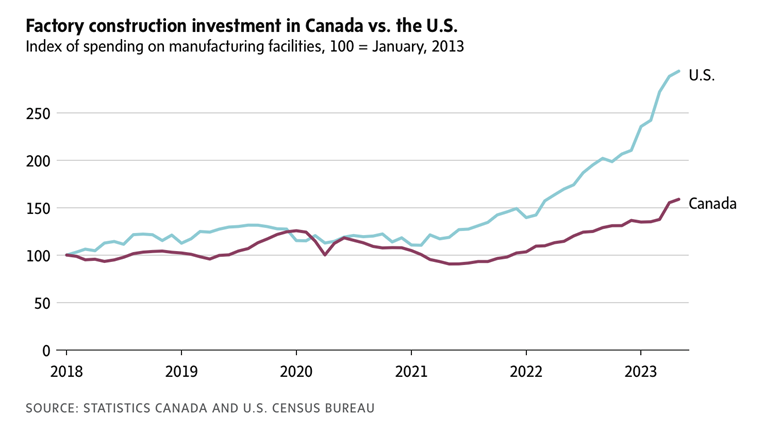

“Waiting for the factory building boom in Canada – The amount spent on the construction of manufacturing facilities in the United States in May jumped 73 per cent to a record US$15.6-billion from the year before, according to the U.S. Census Bureau. Canada’s federal budget this spring aimed to be Ottawa’s response to Washington’s economic activism, with $12-billion in tax credits and incentives for cleantech manufacturing, among other measures. But new data on factory construction investment from Statistics Canada this week shows just how far manufacturers in this country have to go to catch up.”, The Globe & Mail, July 20, 2023

China

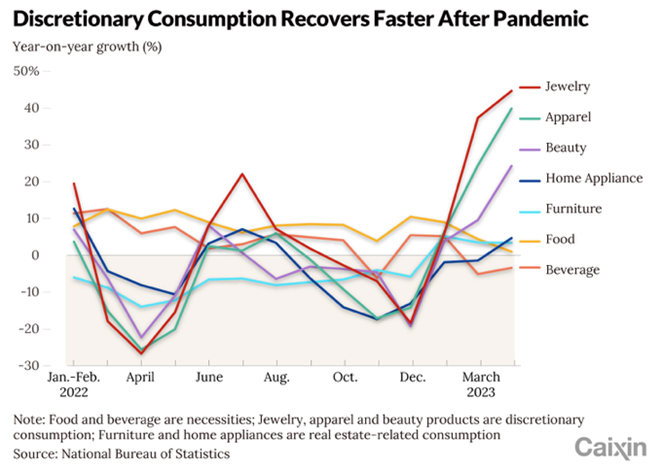

“Chinese Consumers Pinch Pennies on Staples as Pandemic Habits Linger – Chinese consumers are being frugal when buying everyday items from toothbrushes to shampoo, a worrisome trend for a country that is trying to shake off the effects of the coronavirus pandemic. A broader retail sales recovery in China this year has masked some of the penny-pinching, which economists say points to underlying weakness in consumer confidence.”, The Wall Street Journal, July 22, 2023

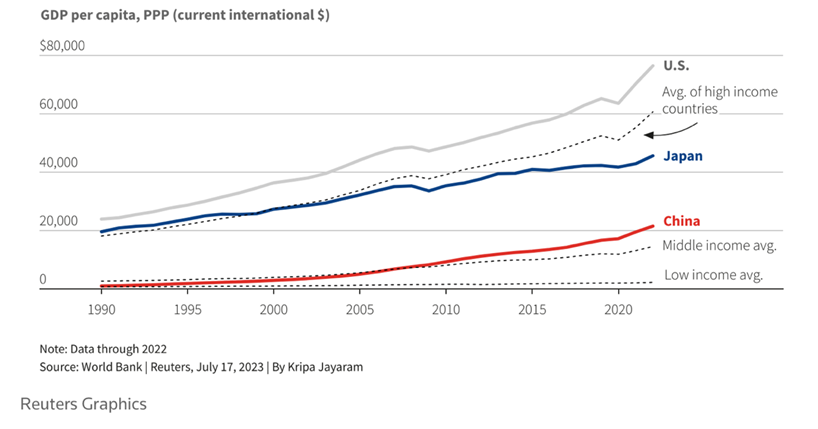

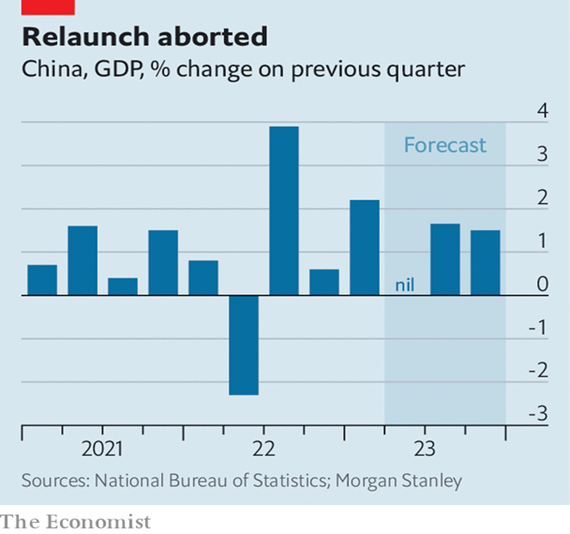

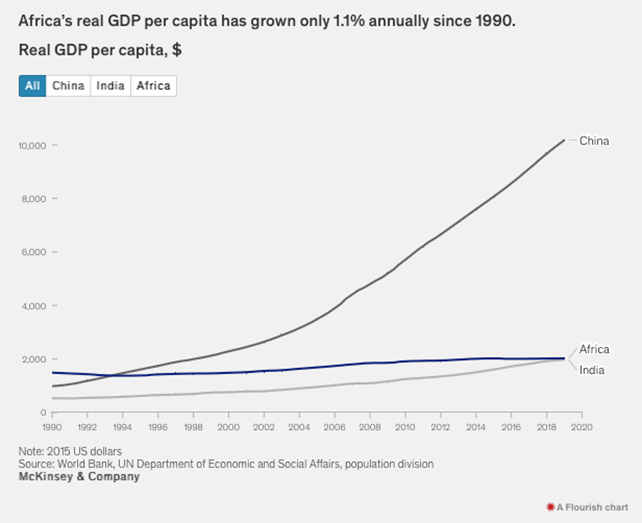

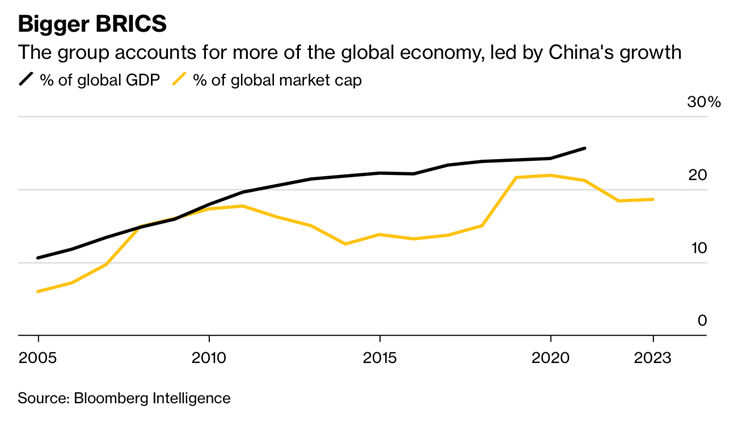

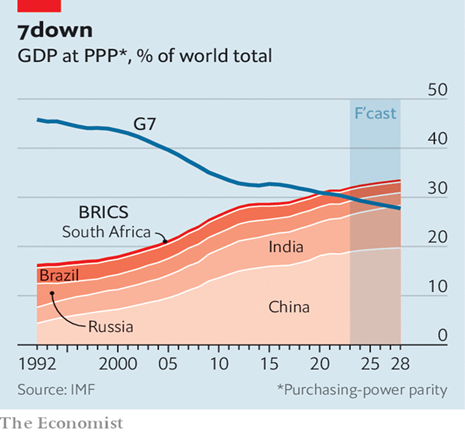

“Will China ever get rich? A new era of much slower growth dawns – China is entering an era of much slower economic growth, raising a daunting prospect: it may never get rich. ‘It is unlikely that the Chinese economy will surpass that of the United States within the next decade or two,’ said Desmond Lachman, a senior fellow at the American Enterprise Institute. And China’s workforce and consumer base are shrinking while the cohort of retirees is expanding.”, Reuters, July 17, 2023

European Union

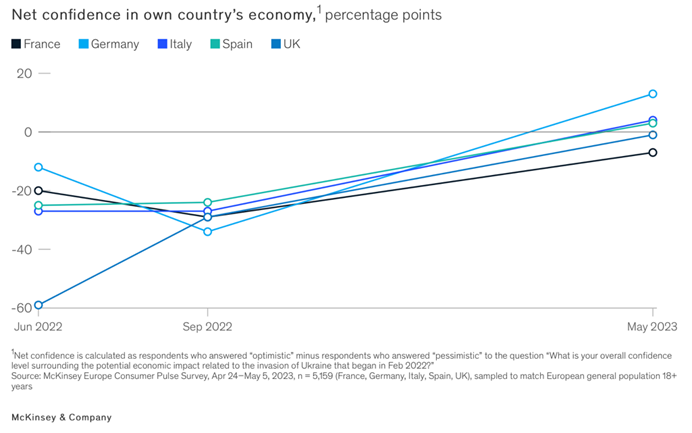

“High hopes despite high prices: An update on European consumer sentiment – Consumer confidence has grown dramatically across the continent—but geopolitical concerns and price increases continue to affect how consumers intend to spend. A sunnier outlook emerges in Europe. German consumers report the highest increase in net confidence, at 13 percentage points (up from –34 in September 2022), as well as the highest level of optimism—31 percent of respondents say they expect their country’s economy to rebound within two to three months and grow just as strong or stronger than it was before the conflict in Ukraine began.”, McKinsey & Co., July 14, 2023

Latin America

“What could a new era mean for Latin America? The pandemic hit Latin America hard, inflation has raised pressure on the continent’s low-income groups, and polarizing political tensions have been escalating. In Latin America, as in the rest of the world, these are volatile and uncertain times. Increasing trade with China and the rest of the world has shifted the balance away from the United States.”, McKinsey & Co., July 20, 2023

Japan

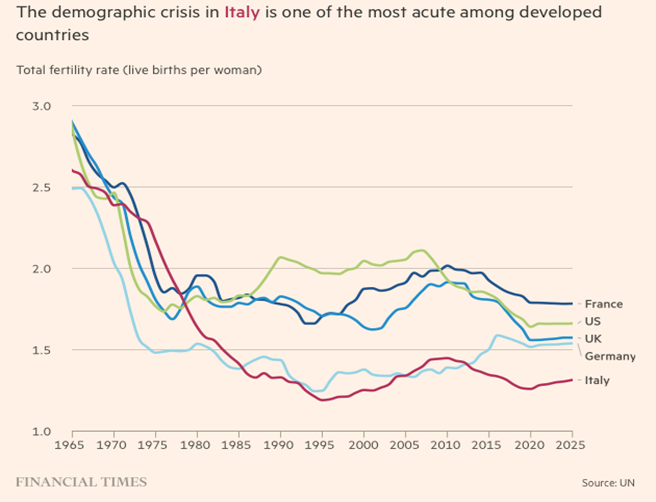

“Meet a Company Pioneering Work-Life Balance – Japanese trading houses like Itochu Corp., Mitsui & Co., Mitsubishi Corp. and Sumitomo Corp. have underpinned our country’s postwar economic miracle. But they also embody our corporate culture, characterized by male dominance, long working hours and pressure to join drinking parties with bosses and clients after work. So when Masahiro Okafuji became chief executive officer of Itochu in 2010, he made improving productivity a top priority to compete against rivals in Japan and made drastic changes to its employees working hours, his approach was counterintuitive. he banned working in the office after 8 p.m. with rare exceptions and had security guards and human resources staff scout Itochu’s office building in Tokyo, telling people to go home. Those clinging to their desks were told to come in early the next day to get their work done — and get paid extra. A decade later, the company — whose businesses range from the FamilyMart convenience store chain to metals trading — reported a change that even surprised management. The fertility rate among full-time employees had doubled in the years since Okafuji became CEO, reaching almost two children per female in the fiscal year ended March 2022. That far exceeds Japan’s current national rate of about 1.3.”, Bloomberg, July 17, 2023

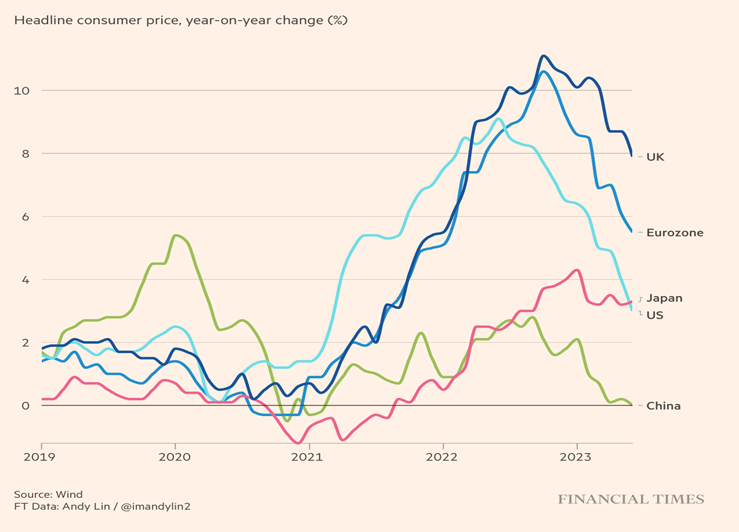

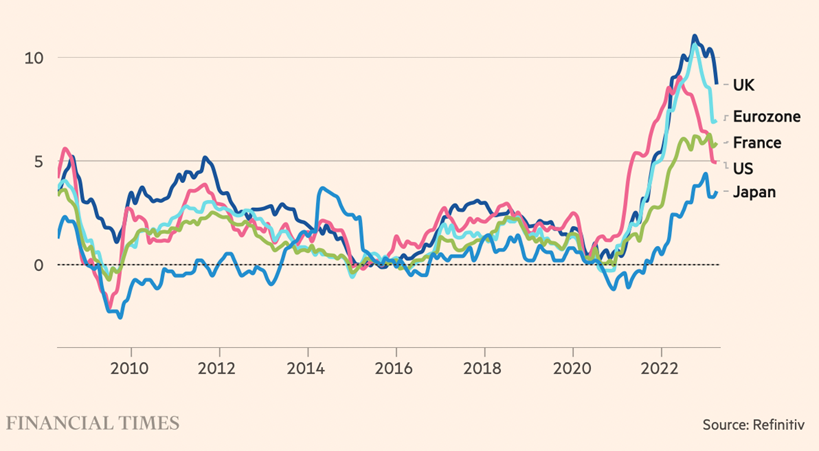

“Japan’s inflation outpaces US price rises for first time in 8 years – Asia’s most advanced economy is no longer an outlier in inflation. Japan remains the world’s only central bank with negative interest rates, and any reversal of this strategy would have massive implications for global financial markets. Annual inflation of the consumer price index and core CPI, which excludes fresh food, rose from 3.2 per cent in May to 3.3 per cent in June, according to data released on Friday.”, The Financial Times, July 20, 2023

Malaysia

“Nasdaq ranks Malaysia best place in Asia to retire ahead of Vietnam, Indonesia – Malaysia was the safest place to retire in Asia, based on its peace score and average monthly cost of living, according to US-based financial services corporation Nasdaq. Malaysia ranks first in a list of the 10 safest places to retire in Asia, according to US-based financial services corporation Nasdaq. “Malaysia takes the number one spot with a cost of living index of 22.9 and a GDP of US$481.9 trillion. With average monthly expenses at just over US$1,000, it’s an excellent place for retirees to consider,” it said. Runner-up in the list is Kuwait, with a global peace index of 1.739 and an average monthly cost of living of US$1,741.”, South China Morning Post, July 16, 2023

New Zealand

“New Zealand ranked best in world for work/life balance – The global index study by Remote, a global payroll, tax, HR and compliance supplier for distributed teams, assesses the quality of life-work balance in the world’s top 60 GDP countries, ranking each nation out of 100. The overall score is determined through factors including minimum wage, sick leave, maternity leave, healthcare availability, public happiness, average working hours, and LGBTQ+ inclusivity. The top 5 places on the list were filled by New Zealand, Spain, France, Australia and Denmark. The United States is ranked a lowly 53rd in the index owing to a lack of statutory annual leave or sick pay, and the absence of a universal healthcare system.”, Franchise New Zealand, June 29, 2023

United Kingdom

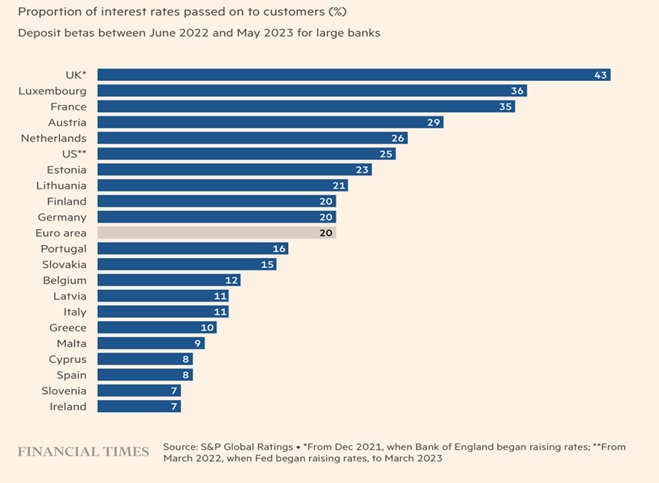

“UK banks lead global rivals in passing on interest rate benefits to savers – US and European lenders come under pressure to share more of their haul with customers. UK banks have handed more of the benefits of interest rate rises to savers than their counterparts in Europe or the US, as politicians, regulators and clients push for a greater share of the haul. Global banks are coming under pressure to pass on the benefits of higher interest rates to their customers — but lenders in less competitive markets have proved far less generous than others, according to an analysis by rating agency S&P.”, The Financial Times, July 23, 2023

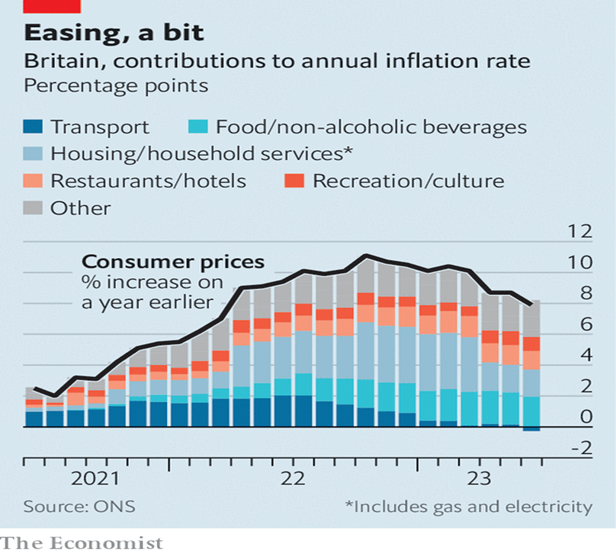

“British inflation may not be as sticky as thought – Inflation figures covering the year to June showed that the rate of price growth is not proving as stubborn as it had previously appeared. The headline rate of inflation fell from 8.7% in May to 7.9% in June, a bigger drop than the fall to 8.2% that economists had been expecting.”, The Economist, July 19, 2023

United States

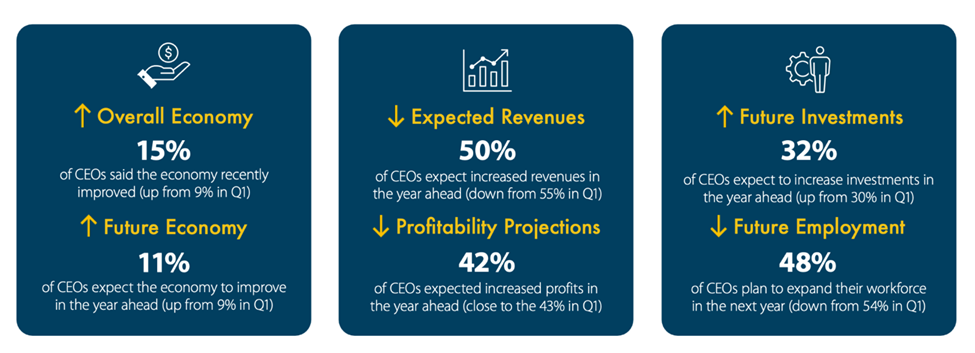

“Vistage CEO Confidence Index Report Q2 – Using ITR Economics rate-of-change methodology, analysis has revealed that the Vistage CEO Confidence Index is a leading indicator of the U.S. Industrial Production Index 9 months in advance. This report captures CEO economic sentiment and strategic intent for the next 12 months. Vistage July 2023

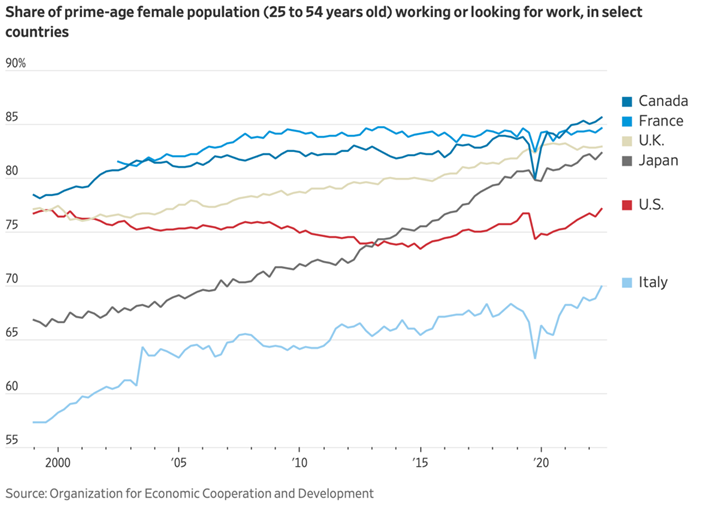

“Americans in Their Prime Are Flooding Into the Job Market – Share of people between 25 and 54 working or seeking jobs rose this year to highest level since 2002. The resurgence of midcareer workers is driven by women taking jobs. The labor-force participation rate for prime-age women was the highest on record, 77.8% in June. (US) Men, however, tend to be employed at higher rates. The overall prime-age participation rate rose in June to 83.5%, the highest since 2002.”, The Wall Street Journal, July 22, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Applebee’s and IHOP head to Japan—virtually – The brands will also make their debuts in France, Belgium and the Netherlands through a partnership with Franklin Junction, which matches brands with “host kitchens” that sell their food for delivery only. Dine’s first virtual location with Franklin Junction is scheduled to open in Japan in the fourth quarter. It will add to a growing international footprint at both brands: At the end of last year, Applebee’s had 109 non-U.S. units, up from 102 the prior year, and IHOP had 104 compared to 94 in 2021.”, Restaurant Business, July 19, 2023

“Chipotle: First International Agreement Intriguing but Unlikely to Move the Financial Needle – We don’t expect wide-moat Chipotle Mexican Grill’s CMG first international development agreement to prove financially material, and we continue to view the shares as pricey. Nevertheless, we appreciate the strategic rationale behind the deal with Alshaya Group and will keep a close eye on its success; reasonable uptake in the Middle East and Africa could augur well for a deeper foray into larger and more strategically important markets in Western Europe while increasing the chances of entry into markets like China that global restaurant peers have traditionally approached through franchise agreements.”, Morningstar, July 18, 2023

“Firehouse Subs Starts Global Expansion With New Swiss Location – Restaurant Brands International (RBI), the parent company of Firehouse Subs, confirmed that the Swiss restaurant opening is the beginning of the brand’s journey to expand internationally across a number of territories, next stop being Mexico where a deal has already been signed. It appears as if the Zurich location is a company-owned one, with RBI confirming that it will be used to as a showcase for future international developments and will be harnessing technology such as self order kiosks and mobile ordering as well as offering click-and-collect and table service options.”, Forbes, July 24, 2023

“McDonald’s to Spend Over A$1 Billion on Australian Stores – McDonald’s Corp. plans to spend more than A$1 billion ($673 million) on opening and renovating stores in the company’s biggest expansion plans for Australia since the 1990s, according the Australian Business Review. The fast food giant plans to spend about A$600 million on 100 new stores in the country over the next three years, and about A$450 million refurbishing over half of its current network, the paper said, citing Australian CEO Antoni Martinez.”, Bloomberg, July 22, 2023

“McDonald’s Franchisee Surges 50% in 3 Months – (The world’s largest independent McDonald’s franchisee) Arcos Dorados stock climbed as much as 56% off its April 6 low this month amid a growing Latin American appetite for QSR food. Growth drivers include a rising adoption of digital ordering platforms, the expansion of its footprint and the introduction of new menu items. Also the largest restaurant chain in Latin America, Arcos Dorados’ growth story goes beyond technological advancement. Adding more restaurants and drive-thrus to the footprint is also a big focus. This month, the company opened its 223rd McDonald’s location in Argentina. It also launched a Japanese-themed McDonald’s in Brazil to recognize the growing Japanese community there.”, Market Beat, July 20, 2023

“Minor International acquires Sizzler for $23.38m – The group will gain control of over 64 restaurants in Thailand and 10 in Japan. As a 31-year franchisee of Sizzler, MINT has established a fruitful partnership with the seller, Collins Foods Limited (Collins Foods) and played a pivotal role in Sizzler’s success, contributing to its growth and reputation in western casual dining in Asia. MINT is one of Asia’s largest restaurant companies with over 2,500 outlets system-wide in 24 countries under The Pizza Company, The Coffee Club, Riverside, Benihana, Thai Express, Bonchon, Swensen’s, Sizzler, Dairy Queen, Burger King, Coffee Journey and GAGA brands.”, QSR Media, July 1, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Birsbane

“Self Esteem Brands Signs Anytime Fitness Master Franchisee in France – With France, Self Esteem Brands will now have Anytime Fitness clubs operating in 41 countries and territories around the globe. Anytime France is owned by Benoit Hanssen and Matt Burgess, who operate Anytime Fitness clubs across Italy. Under the agreement, they will open and operate Anytime Fitness clubs across Paris, Ile-de-France, Auvergne, Rhone-Alpes, Provence-Alpes, and Cote d’Azur.”, Franchising.com, July 19, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

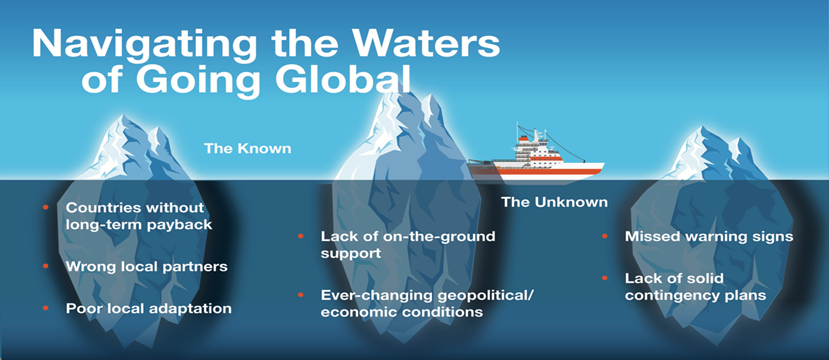

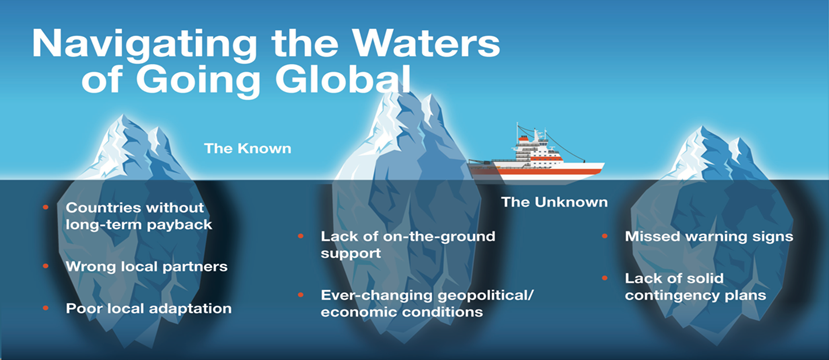

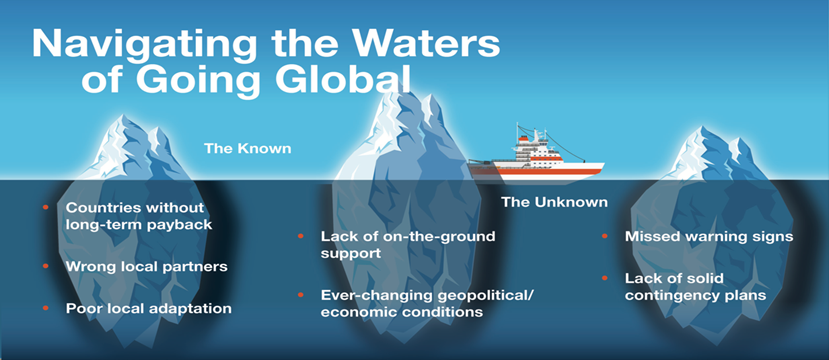

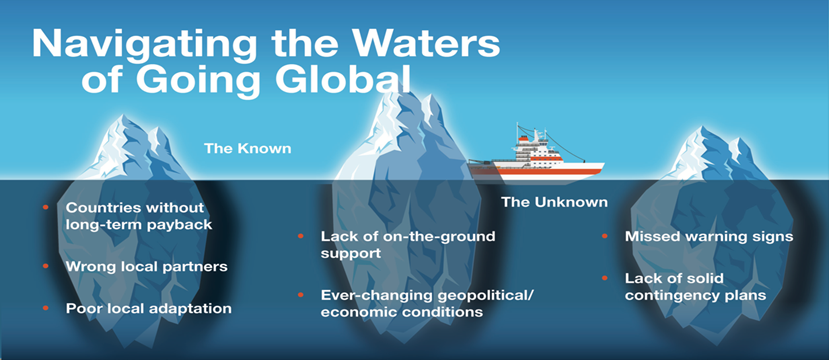

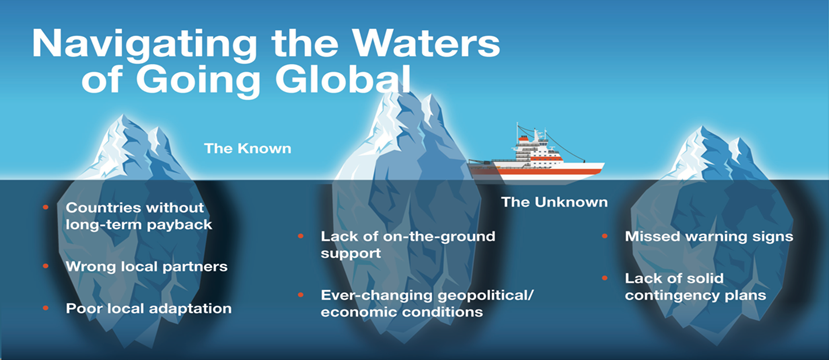

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 86, Tuesday, July 11, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

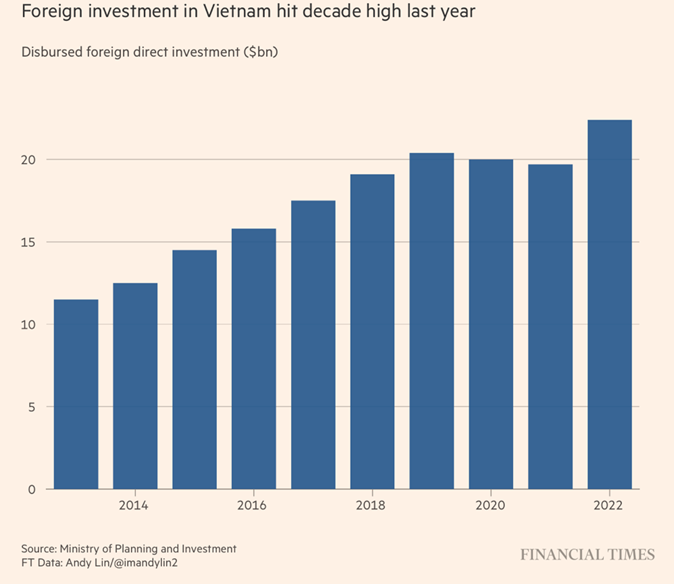

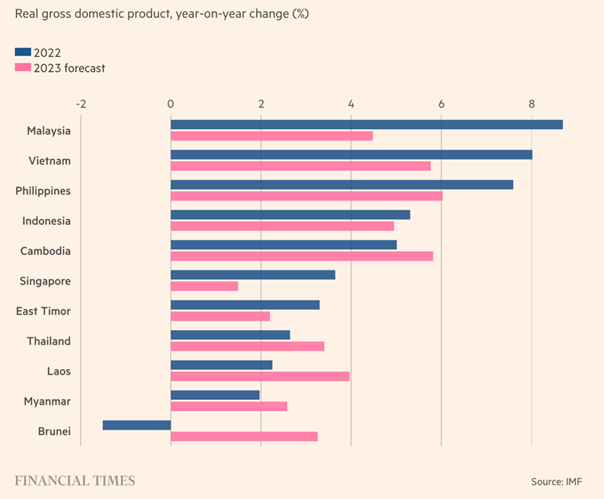

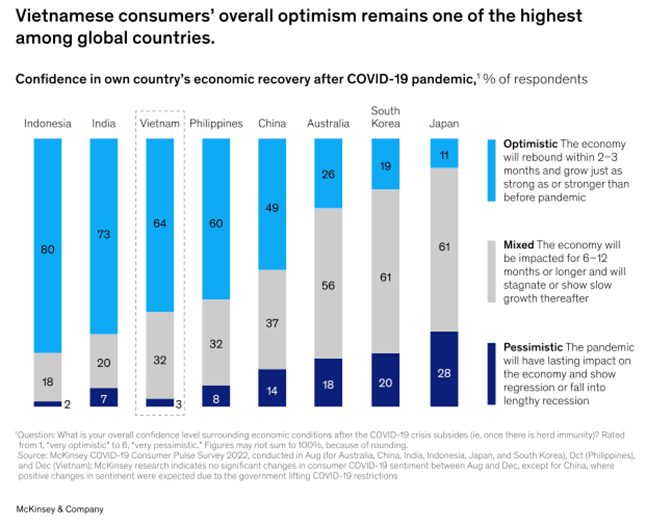

Introduction: In this issue, United Kingdom ‘leads’ in inflation while EU markets see falling prices, Japan Air eliminates the need to bring clothes to visit, China’s consumers are not spending, McDonald’s cannot afford to use tomatoes in India, European air traffic subject to strikes in the busy summer season, the crude oil market is $2 trillion, Vietnam becomes an alternate to China.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Organization is what you do before you do something, so that when you do it, it’s not all mixed up.”, A.A. Milne, the author of the “Winnie-the-Pooh” series

“It always seems impossible until it’s done.”, Nelson Mandela

“Those who say it cannot be done should not interrupt those doing it.”, Chinese proverb

Highlights in issue #86:

- (Europe) Air traffic control strike will hit up to 1 in 3 summer flights

- Brand Global News Section: Buffalo Wild Wings®, Carrefour, Five Guys®, KFC®, Subway®, McDonalds® and Taco Bell®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

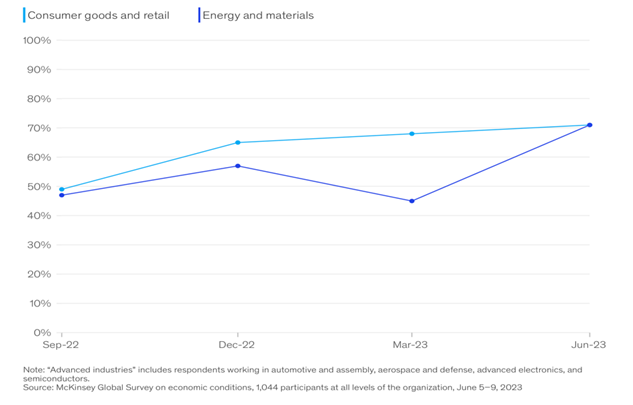

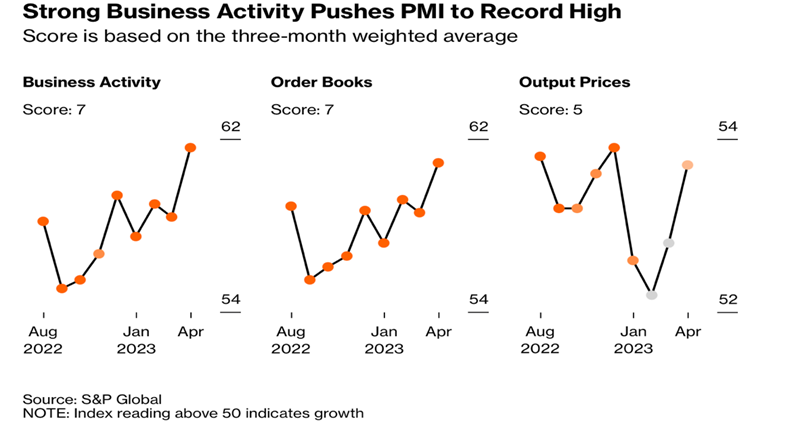

“Profit expectations remain positive, and energy and materials respondents report an upsurge in optimism – After three consecutive quarters of rising expectations, the survey suggests that views on profits have steadied. A clear majority (60 percent) of private-sector respondents still believe their companies’ profits will grow, compared with 63 percent in March. By industry, respondents in energy and materials report the biggest jump since last quarter: 71 percent believe profits will increase in the months ahead, up from 45 percent in March. They are also tied with their peers in consumer and retail as the most optimistic about their companies’ potential profits.”, McKinsey & Co., July 7, 2023

“U.S. Is Top Investment Destination Despite Falling Inflows – Worldwide foreign direct investment fell less sharply than feared last year but there are few signs of a rebound this year. Globally, new overseas investments by businesses fell 12% from 2021 to $1.3 trillion and are unlikely to rebound strongly this year given that executives are “uncertain and risk averse,” the U.N. said. This made last year the worst for foreign investment since 2009 with the exception of 2020, when the Covid-19 pandemic struck.”, The Wall Street Journal, July 5, 2023

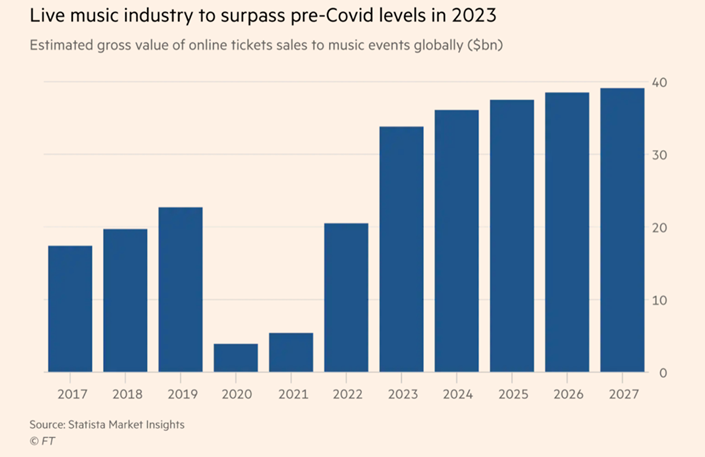

“Live music: concerts lift artist income as AI threat looms – Ticketmaster-owner Live Nation is expecting record sales this year. The value of online ticket sales to concerts, festivals and the opera will surge past pre-Covid levels to hit almost $34bn globally this year. Fake tracks generated by artificial intelligence are already penetrating streaming sites, posing a threat to artists’ brands and income. Singers can be easily mimicked by computers online. In person, fans know the real deal.”, The Financial Times, July 7, 2023

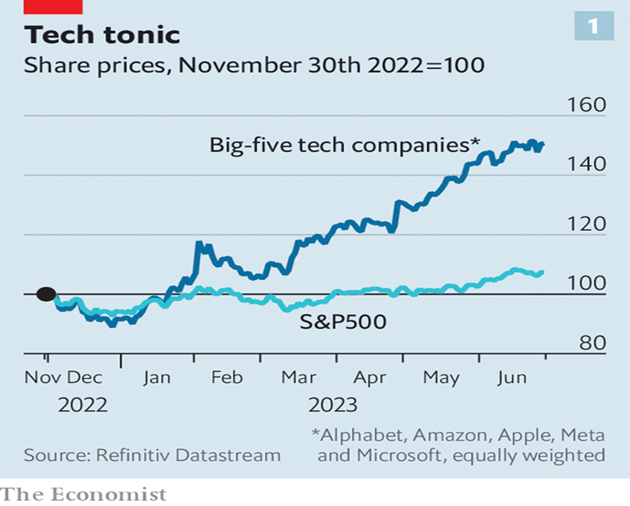

“Our early-adopters index examines how corporate America is deploying AI – Companies of all stripes are using the technology. Technology stocks are having a bumper year. Despite a recent wobble, the share price of the Big Five—Alphabet, Amazon, Apple, Meta and Microsoft—has jumped by 60% since January, when measured in an equally weighted basket. The main reason for the surge is the promise of artificial intelligence (ai). Since the launch in November of Chatgpt, an ai-powered chatbot, investors have grown ever more excited about a new wave of technology that can create human-like content, from poems and video footage to lines of code.”, The Economist, June 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

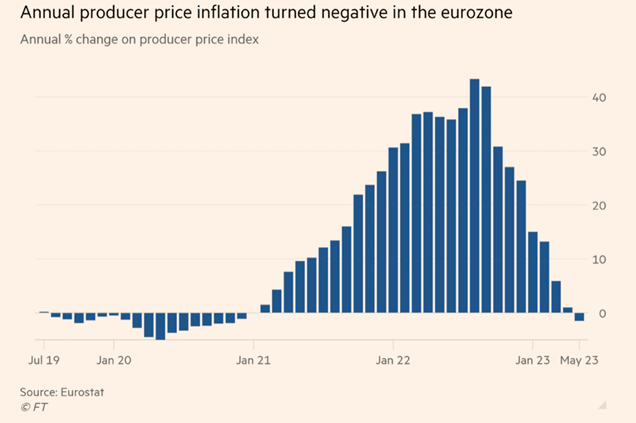

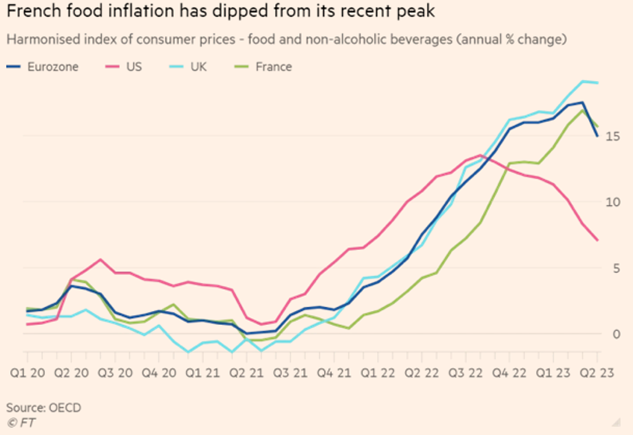

“Eurozone producer prices fall into negative territory for first time since 2020 – House prices decline for two quarters in a row as higher rates weigh on demand. A key measure of eurozone inflation has fallen into negative territory for the first time in two and a half years, in a further sign that the surge in prices that has plagued businesses and households is now in retreat. The EU’s statistics office, Eurostat, said factory gate prices in the region fell 1.5 per cent in the year to May, the first outright decline since December 2020.”, The Financial Times, July 5, 2023

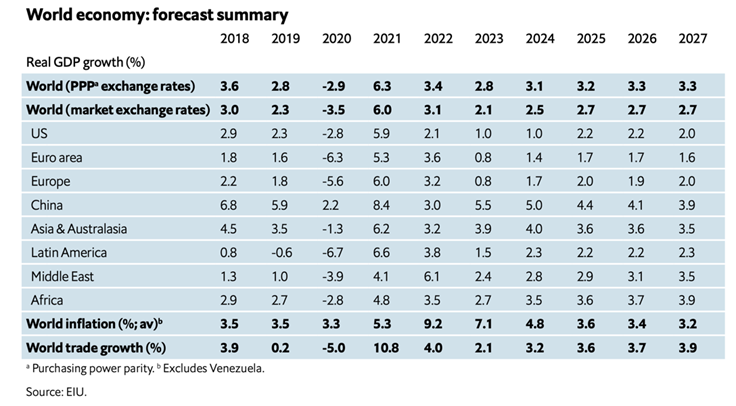

“GLOBAL ECONOMIC OUTLOOK 2023 – Low Growth Amid Persistent Threats – Despite strong headwinds, mostly related to the ripple effects from the war in Ukraine and high global inflation, the global economy has proven resilient so far in 2023. Despite the brighter outlook, growth of 2.1% this year would still represent a slowdown. We expect global commodity prices to continue easing from their 2022 peaks this year, but to remain well above pre-2021 levels. We expect global inflation to ease slightly, from 9.2% in 2022 to 7.1% in 2023.”, The Economist Intelligence Unit, July 2023

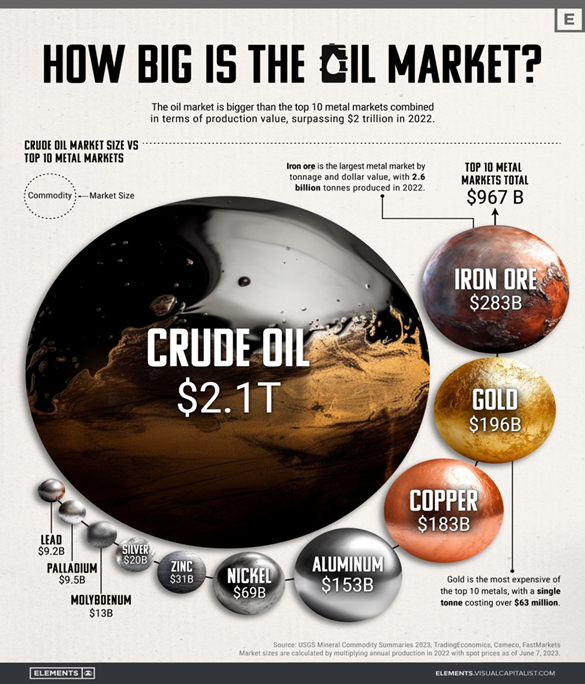

“How Big is the Market for Crude Oil? While the global economy relies on many commodities, none come close to the massive scale of the crude oil market. Besides being the primary energy source for transportation, oil is a key raw material for numerous other industries like plastics, fertilizers, cosmetics, and medicine. As a result, the global physical oil market is astronomical in size and has a significant economic and geopolitical influence, with a few countries dominating global oil production.”, Visual Capitalist / Trading Economics / U.S. Geological Survey, June 30, 2023

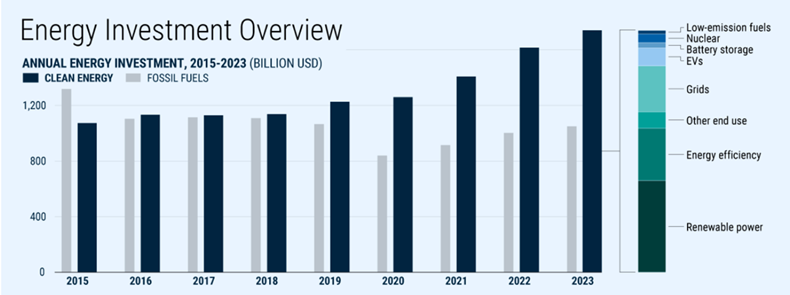

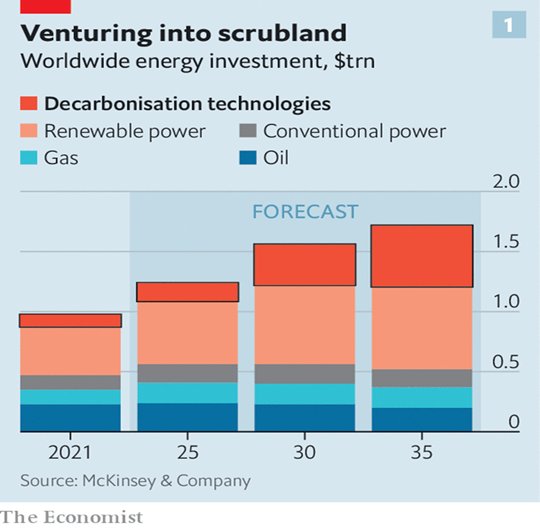

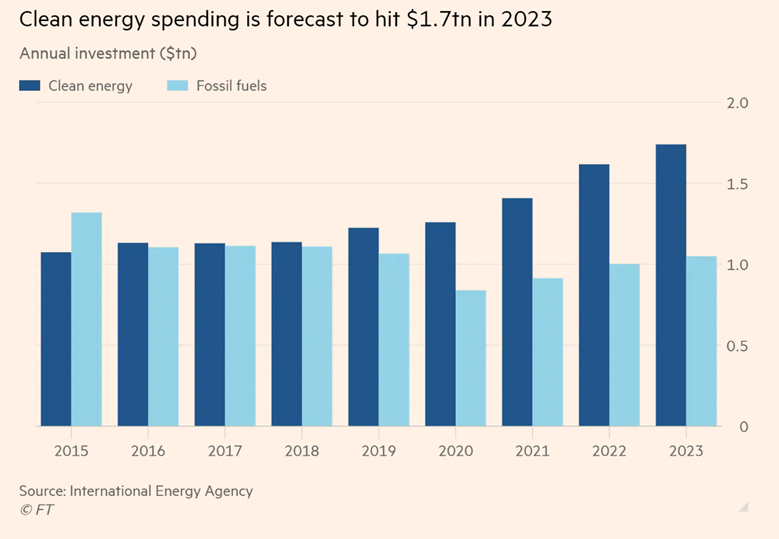

“Investment in Clean Energy Is Booming – China, Europe and the U.S. are leading the way. The International Energy Agency expects $2.8 trillion of investment in energy this year, with roughly 60 percent of that going toward clean energy. In the past two years, clean energy investment has risen 24 percent compared with 15 percent for fossil fuels. Producers of fossil fuels reaped huge profits in 2022, but less than half their cash flow is going toward new supply. Unsurprisingly, Middle Eastern producers lead in terms of spending on new supply.”, Geopolitical Futures, July 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“(Europe) Air traffic control strike will hit up to 1 in 3 summer flights – Up to a third of all European flights are at risk of being delayed or cancelled this summer after air traffic controllers said they would strike. Controllers at Eurocontrol, the European air traffic management body, revealed that they would walk out over the peak summer period after talks over staffing, rosters and pay broke down. An industry source said it could lead to delays or cancellations of up to 12,600 flights across Europe every day. ‘In a full-blown strike, 20 to 30 per cent of flights would be at least delayed,’ the source said. ‘They are big numbers.’”, The Times of London, July 6, 2023

“Japan Airlines gives tourists chance to reduce baggage by renting clothes – Carrier embarks on a year-long experiment designed to help reduce CO₂ emissions. Visitors to Japan are being offered the ultimate chance to travel light: pack underwear and a toothbrush but rent all your clothes on arrival and ditch the environmentally unfriendly suitcase. Under a year-long experiment that began on Wednesday, passengers travelling with Japan Airlines (JAL) can rent outfits by season, size, formality and colour scheme. Under the scheme, a prospective visitor to Japan can reserve their clothes up to a month in advance to use for two weeks.”, The Financial Times, July 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Brazil

“Brazil’s tax reform wins approval in lower house of Congress – Senate vote now needed to simplify one of world’s most complicated tax regimes. Fernando Haddad, finance minister, hailed the successful votes on the legislation to simplify a web of duties and levies. Attempts at tax reform have for years bedevilled lawmakers and officials. It could also boost growth, adding as much as 2.39 per cent to gross domestic product over the next eight years, according to estimates from the Institute for Applied Economic Research.”, The Financial Times, July 6, 2023

Canada

“Canada posts surprise $3.4-billion trade deficit for goods, largest since 2020 – Led by a decline in energy and agriculture exports, Canada posted a $3.4-billion merchandise trade deficit in May, down from a revised $894-million surplus in April, Statistics Canada reported Thursday. Bay Street forecasters had expected a $1.15-billion surplus that month. Goods exports declined 3.8 per cent due to both falling prices and lower shipments. In volume terms, exports decreased 2.5 per cent. Meanwhile, imports were up 3 per cent overall and 3.5 per cent in volume terms.”, The Globe and Mail, July 7, 2023

China

“China on brink of consumer deflation – Latest signs of economic weakness likely to spur calls for government stimulus measures. China’s economy teetered on the brink of deflation in June, adding to calls for Beijing to launch a stronger stimulus package to sustain the country’s sputtering post-Covid recovery. The consumer price index was flat year on year and declined 0.2 per cent compared with the previous month, while factory gate prices fell at the fastest pace since 2016 as demand for consumer and manufactured products softened.”, The Financial Times, July 10, 2023

India

“McDonald’s Stops Using Tomatoes In India Amid Record Prices—Alters ‘Maharaja Mac’ – McDonald’s restaurants in North and East India have stopped serving tomatoes in its burgers and wraps over what the company claims are quality and supply issues as surging prices of the vegetable in parts of the country have triggered internet jokes, music videos, heists and protests. The American fast-food giant’s Indian franchisee, Connaught Plaza Restaurants Ltd, put up notices across its stores on Friday saying it has not been able to get ‘adequate quantities of tomatoes which pass our stringent quality checks,’ despite its ‘best efforts.’”, Forbes, July 7, 2023

Indonesia

“Indonesia Regains Upper-Middle Income Rank on Growth Rebound – Nation’s income per capita increased to $4,580 in 2022 Improved ranking to help nation hit high-income status goals. A strong post-pandemic rebound has pushed Indonesia back into the upper-middle income band of countries, according to the World Bank, putting it back on track to pursue its high-income status goal. Indonesia reclaimed the rank this year as gross national income per capita climbed to $4,580, based on the bank’s latest classifications. It’s an improvement from the previous reading of $4,140, which had kept it in the lower-middle income status for the second straight year in 2022.”, Bloomberg, July 2, 2023

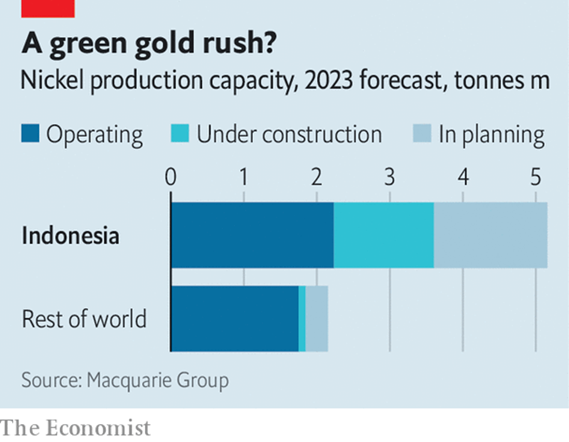

“New technology could cement Indonesia’s dominance of vital nickel – Indonesia is already the world’s biggest producer of nickel, a metal that is—among other uses—vital for building high-performance batteries. Demand for those is expected to increase hugely as demand for electric cars ramps up. Helped by new technologies for extracting nickel from the soil, Indonesia is planning big production increases. Macquarie Group, an Australian financial firm, thinks that by 2025 the country could supply 60% of the world’s nickel, up from around half today.”, The Economist, July 5, 2023

Japan

“Japanese workers are finally seeing their pay rise – Japanese workers have seen their pay go up at a record rate after the government called on companies to help employees facing rising prices. Official figures show that compared to a year earlier wages rose by 1.8% in May, the fastest pace in 28 years. The most recent official reading of Japan’s inflation rate showed that core consumer prices rose by 3.2% in May from a year earlier.”, BBC News, July 7, 2023

“Japanese stocks soar to 33-year high – The Topix index has jumped by more than 20% in 2023 to become the world’s best-performing major market. The Nikkei 225, another key index, has climbed by 27% to a 33-year high. The world’s third-largest economy is “basking in a post-pandemic glow”, says Vivek Shankar in The New York Times. Consumption is on the rise and tourists have returned. While inflation has wreaked havoc in other economies, in Japan price pressures mark a welcome break from decades of grinding deflation. Growth, which hit an annualised rate of 2.7% in the first quarter, is ‘surprisingly solid’.”, Money Week, July 3,2 2023

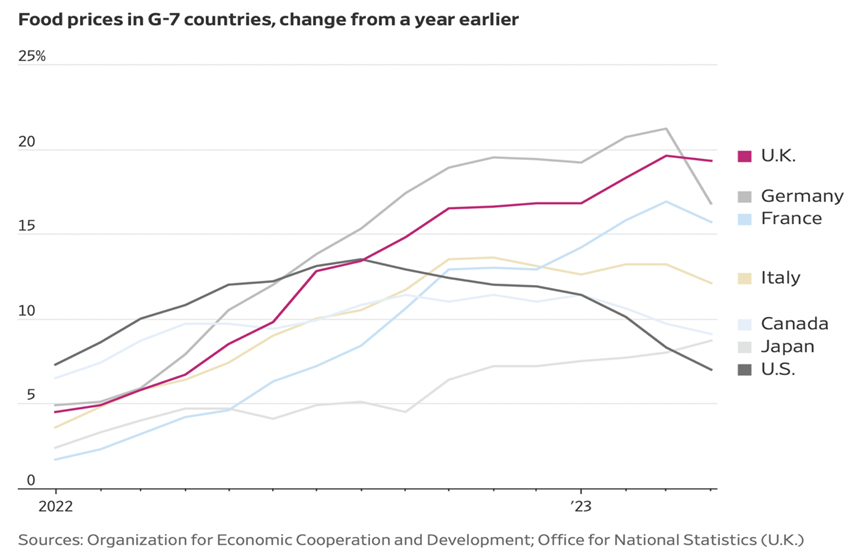

United Kingdom

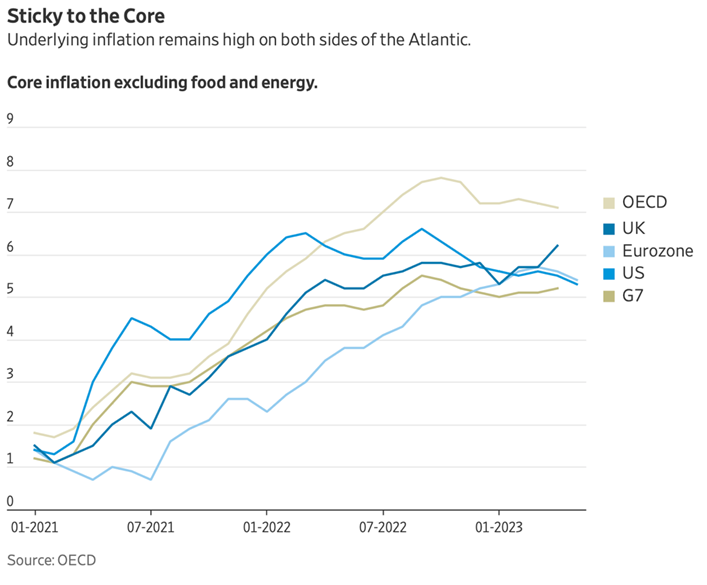

“Britain is the only G7 country where inflation is still rising – Britain has been singled out as currently the least successful country in the G7 at curbing inflation and one of the three worst in the wider 38-nation Organisation for Economic Co-operation and Development. In its latest snapshot of inflation around the developed world, the organisation said that in the UK it picked up speed from 7.8 per cent in April to 7.9 per cent in May. That compared with an average reduction in inflation from 5.4 per cent to 4.6 per cent in the seven-nation club, which includes the United States, Japan and Germany.”, The Times of London, July 5, 2023

“Le Pain Quotidien is closing all but one of its London stores – The brunch and bakery chain has gone into administration. Sarah Rayment, global co-head of restructuring at Kroll, said: ‘Pressures on parts of the hospitality and casual dining sector have been well highlighted. Brunchco UK Limited which is predominantly located in London has suffered from reduced revenues as a result of decreased footfall in the capital, high rents and increased wage costs. Le Pain Quotidien, which is French for ‘the daily bread’, was founded in Brussels in 1990 and has more than 260 locations worldwide.”, Time Out, July 5, 2023

United States

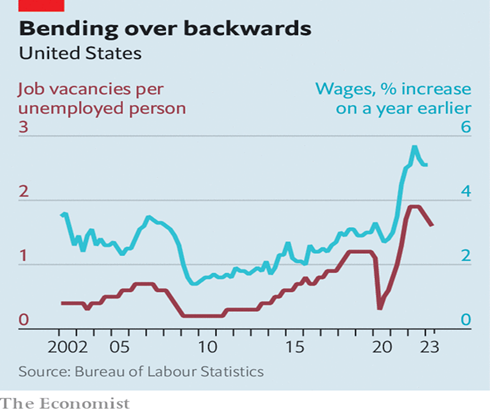

“Does America need more unemployment? The labour market remains too hot for comfort. For every unemployed person in America, there are 1.6 jobs available, a ratio that is down a tad since mid-2022, but well in excess of the pre-pandemic norm. Since February 2020—before covid hit America—the economy has added nearly 4m jobs, putting employment above its long-term trend line. There do not appear to be many workers left on the sidelines: some 84% of prime-age workers (aged between 25 and 54) now participate in the labour force, the most since 2002 and just a percentage point off an all-time high.”, The Economist, July 9, 2023

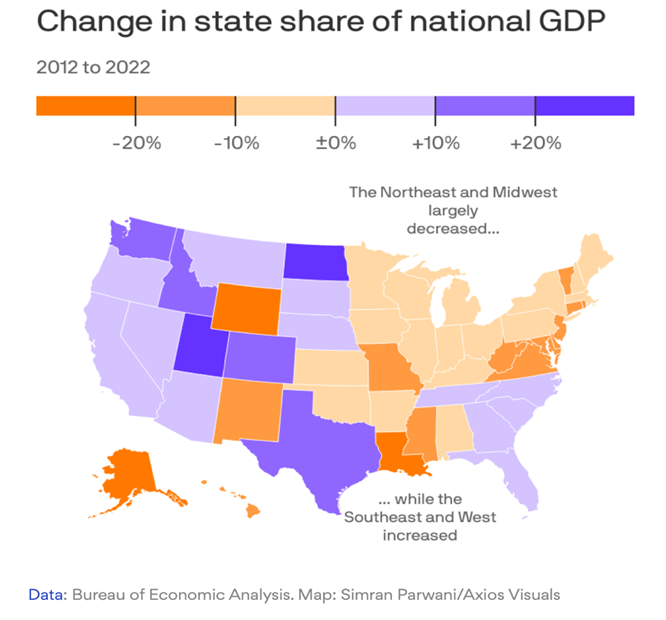

“The Northeast is losing out to America’s new economic hotspots – Six fast-growing states in the South now add more to the national GDP than the Northeast, the perennial powerhouse, Bloomberg reports. Americans are spreading out, physically and economically…..Florida, Texas, Georgia, the Carolinas and Tennessee — are in the middle of a “$100 billion wealth migration” as the U.S. economic center of gravity tilts south, Bloomberg notes. The switch happened during peak COVID. There’s no sign it’ll reverse. A flood of transplants helped steer about $100 billion in new income to the Southeast in 2020 and 2021 alone, while the Northeast bled out about $60 billion, Bloomberg writes from IRS data.”, Axios, July 9, 2023

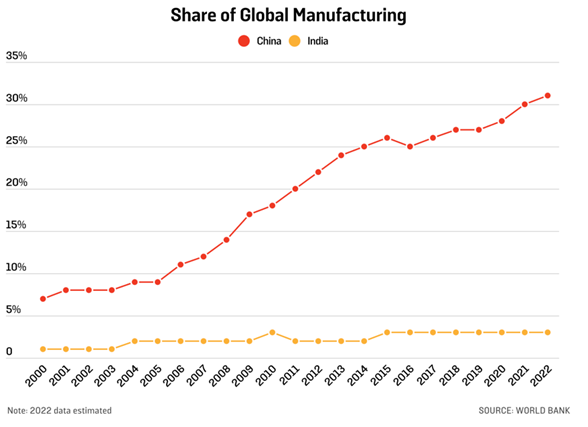

Vietnam

“Vietnam becomes vital link in supply chain as business pivots from China – The accelerating shift to countries such as Vietnam is part of a growing ‘China plus one’ strategy to redraw global supply chains. As rivalries grow between China and the US over technology and security, more companies fear curbs on what and where they can manufacture. As a result, many are supplementing production in China, still the world’s biggest manufacturing hub, with expansion to other countries. ‘Koreans, Taiwanese, Chinese — there seems to be an unstoppable transfer or at least relocation from mainland China into other countries,’ said Koen Soenens, Deep C’s sales and marketing director. ‘Foreign companies currently in China, ask them what’s next. [They say] ‘For the Chinese market, we stay in China; to serve our overseas clients, we are looking for a new location’.”, The Financial Times, July 2, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Buffalo Wild Wings ends its Canadian operations – Buffalo Wild Wings has closed its remaining Canadian restaurants. In a statement, the U.S.-based chicken wing chain thanked its customers for supporting the business ‘throughout the years.’ ‘Buffalo Wild Wings routinely evaluates locations to serve our guests best, and we have made the difficult decision to close our sports bars in Canada,’ a spokesperson for the chain wrote in a statement Wednesday.”, BNN Bloomberg, June 28, 2023

“Carrefour Brasil bets on know-how to expand small stores operation – Grupo Carrefour Brasil (CRFB3.SA) launched a franchise model of convenience stores in the Brazilian market on Wednesday, aiming to tap into its know-how from years of experience in Europe, a top executive said. Carrefour Brasil’s convenience executive director Joao Edson Gravata said that the franchise format would put Carrefour in a stronger position to take on competitors. The convenience segment, which is mainly in stores operated by large chains, is relatively new in Brazil, Gravata said. We are part of this context, we have an important presence, and we want to expand it.’”, Reuters, June 29, 2023

“Five Guys burger scalpers face online criticism as popular US chain makes South Korean debut – The asking price on a second-hand platform for two cheeseburgers and fries from popular US chain Five Guys was more than double the regular cost. A South Korean customer has come under fire for trying to capitalise on the craze for Five Guys burgers, which this week opened its first outlet in the country, by selling a snack set for 100,000 won (US$76) on an online marketplace. The US fast-food chain’s store in Seoul’s wealthy Gangnam district drew snaking queues as diners braving the wet weather jostled to grab a bite.”, South China Morning Post, June 28, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Inflation hits harder at chicken chain – Chicken chain KFC’s price increases are currently outpacing Australian inflation rates and the price increases of rival fast food franchise McDonald’s, according to a media report. On average, KFC’s prices have increased 14.7% over the last 12 months, while McDonald’s have increased by 8% since August 2022, however KFC’s main menu items still retail at an average 6% discount to McDonald’s equivalents. KFC attributes the price increases to growing costs of inputs such as potatoes, chicken, wheat and oil, and the impact of wage increases across its workforce.”, The Guardian, June 20, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“McDonald s opened a new restaurant in the Kyiv region – “Construction of the facility was started back in 2021. Due to a full-scale invasion, the project was postponed, and with the resumption of restaurants, it was resumed. With the opening of each restaurant, the company returns favorite dishes and familiar service to Ukrainians, supports local communities and provides more opportunities for employment. Currently, there are 91 McDonald’s restaurants in Ukraine,” the article says.”, (Ukraine) Economic Truth, June 29, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Subway’s CEO led turnarounds at Burger King and Avis. He’s doing it again before the sandwich chain’s $10 billion sale: ‘I have license to try anything and everything’. But between 2015 and 2021, as business cratered, Subway closed 6,000 of its U.S. stores, almost one-quarter of them. The company has now resumed opening new ones. Four years ago, it tapped Chidsey, a turnaround artist who had fixed Burger King some years earlier as CEO, to work his magic again, with owners now eyeing a sale to private equity that reportedly could fetch $10 billion. While sales per restaurant, excluding newly opened or closed ones, are close to where they were in 2012, they’ve risen in each of the last ten quarters.”, Fortune, July 7, 2023

“Subway celebrates 15 new master franchise agreements – Subway has announced that it is strategically expanding its international footprint and has celebrated the signing of its 15th new master franchise agreement since 2021. The brand’s latest agreements in Bahrain, Georgia, Mainland China, Uruguay, Costa Rica and Panama will reportedly add more than 4,000 future restaurants across Europe, Middle East and Africa (EMEA), Asia Pacific (APAC), and Latin America and the Caribbean (LAC) within the next 20 years. Since 2021, Subway says that it has signed 15 master franchise agreements or country development agreements across EMEA, LAC and Asia Pacific, totalling more than 9,000 future restaurant commitments.”, New Food Magazine, July 4, 2023

“Mexican fast-food brand writes off $37 million – Australia – Mexican food-themed restaurant chain Taco Bell has recorded a $37 million impairment and posted a same-store sales decline of 4.8% for the year, according to a media report. Listed multi-brand franchise operator and local operator of Taco Bell, Collins Foods (CKF), remain confident the brand can succeed in Australia despite its negative impact on the group’s full-year profits. CKF reported revenue of $1.3 billon in the year to April 30, but net profits declined by 76% to $12.7 million due to Taco Bell’s results.”, Brisbane Times, June 27, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 85, Tuesday, June 27, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

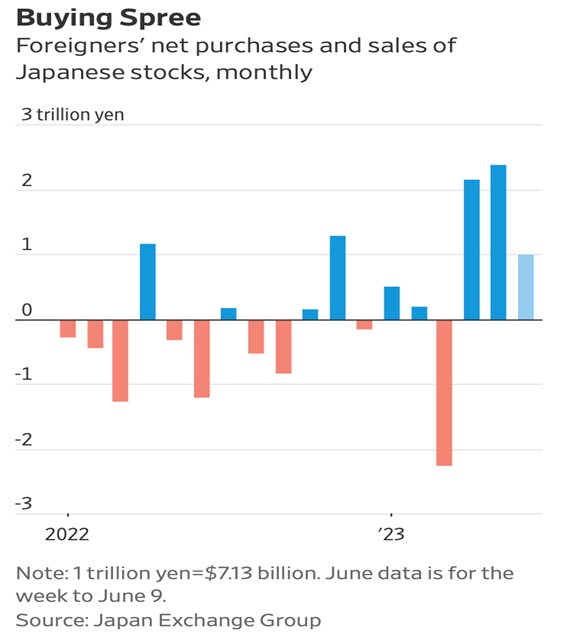

Introduction: In this issue, global inflation is mixed, China is sputtering, there is too much wine in Europe (?), Japan is seeing lots of foreign investment, the United Kingdom will soon charge to enter, global employee engagement reached a record high in 2022, Outback Steakhouse takes over Brazil and Canada is using mass immigration to grow.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

Change before you have to.”, Jack Welch.

“The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday’s logic.”, Peter Drucker

“Whosoever desires constant success must change his conduct with the times.”, Niccolo Machiavelli

Highlights in issue #85:

- Brand Global News Section: 16 Handles®, Burger Fi®, Burger King®, Long John Silver’s®, Outback Steakhouse® and Studio Pilates®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

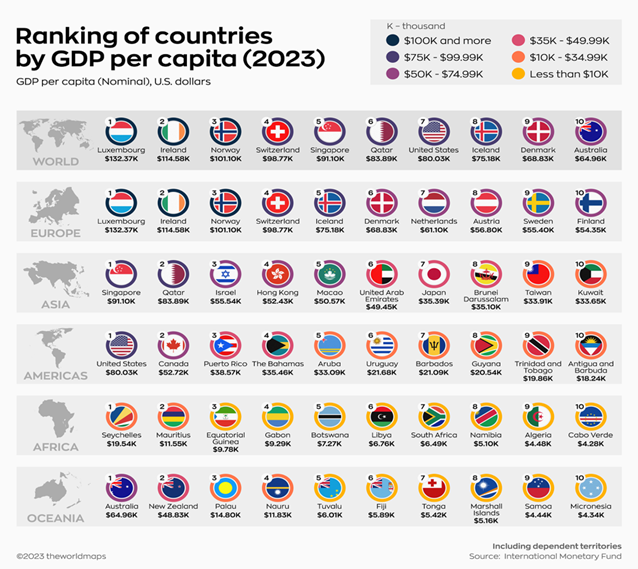

“Top 10 Countries By GDP Per Capita, by Region – GDP per capita attempts to level the playing field by dividing a country’s economic output by its population, effectively giving the average GDP per person. A higher per capita GDP generally corresponds to higher income, consumption levels, and standards of living. The simplicity of this metric also makes it useful for economists and policymakers to communicate levels of economic well-being to the public. The above graphic from the WORLDMAPS ranks the top 10 countries by per capita GDP in different regions, using data from the International Monetary Fund (IMF).”, Visual Capitalist / Worldmaps, June 22, 2023

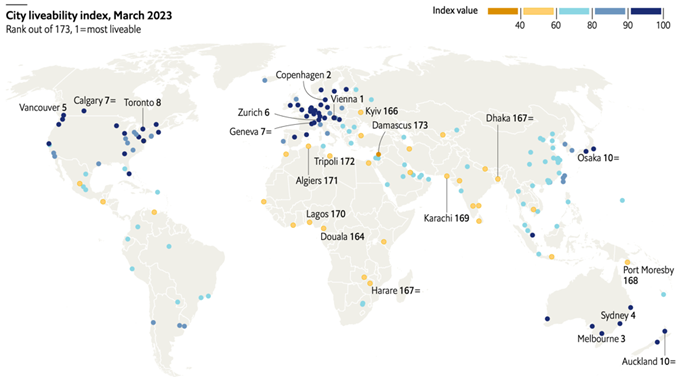

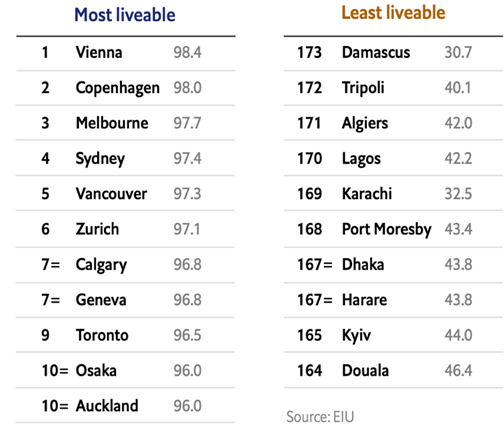

“The world’s most liveable cities in 2023 – Living conditions in cities across the world have fully recovered from the deterioration caused by the covid-19 pandemic, eiu’s latest liveability index shows. It rates living conditions in 173 cities across five categories: stability, health care, culture and environment, education and infrastructure. Cities in the Asia-Pacific region have rebounded the most. The index also suggests that life in cities is a bit better than at any time in the past 15 years.”, The Economist Intelligence Unit, June 21, 2023

“State of the Global Workplace: 2023 Report – Employee engagement reached a record high in 2022. After dropping in 2020 during the pandemic, employee engagement is on the rise again, reaching a record-high 23%. This means more workers found their work meaningful and felt connected to their team, manager and employer. That’s good news for global productivity and GDP growth.”, Gallup, June 2023

“The world’s regulatory superpower is taking on a regulatory nightmare: artificial intelligence – The European Parliament, the legislative branch of the European Union (EU), passed a draft law on Wednesday intended to restrict and add transparency requirements to the use of artificial intelligence (AI) in the twenty-seven-member bloc. In the AI Act, lawmakers zeroed in on concerns about biometric surveillance and disclosures for generative AI such as ChatGPT. The legislation is not final. But it could have far-reaching implications since the EU’s large size and single market can affect business decisions for companies based elsewhere—a phenomenon known as “the Brussels effect.”, The Atlantic Council, June 13, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

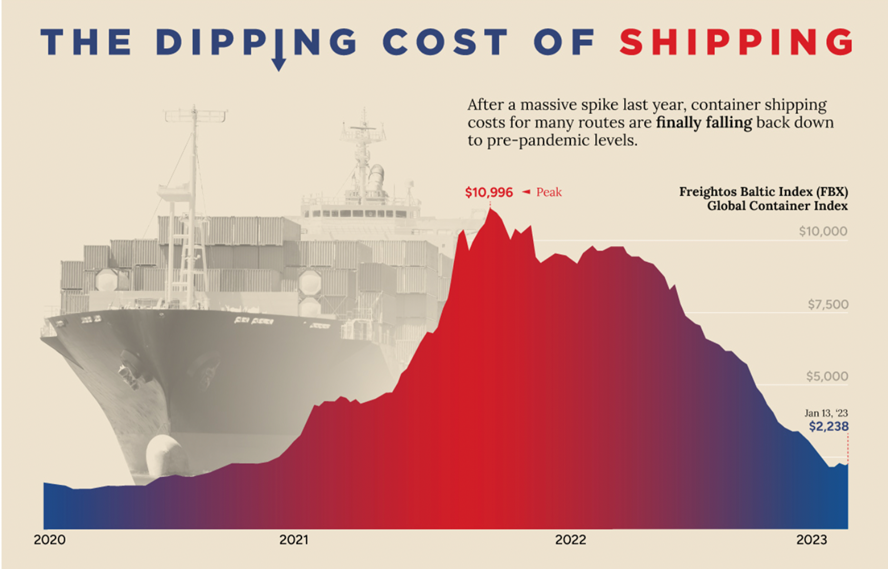

“Why Inflation Around the World Just Won’t Go Away – Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. In the U.S. and Europe, underlying inflation is still around 5% or higher even as last year’s heady increases in energy and food prices fade from view. On both sides of the Atlantic, wage growth has stabilized at high levels and shows few signs of steady declines.”, The Wall Street Journal, June 19, 2023

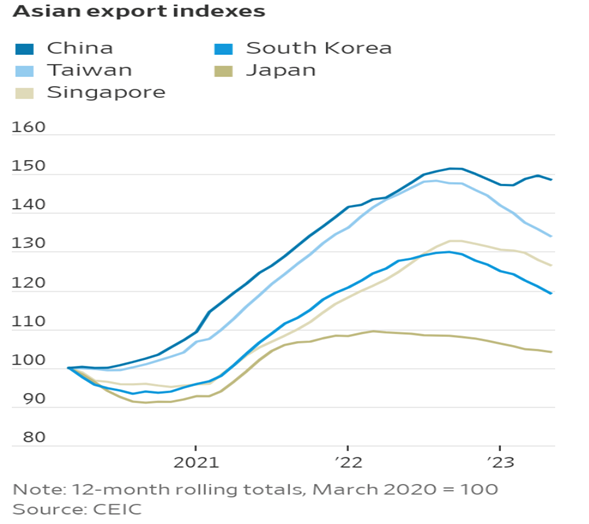

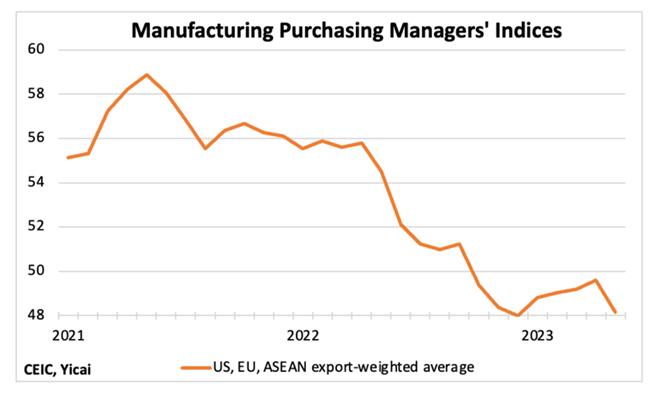

“Trade Woes in Asia Bring Inflation Relief to U.S. Consumers – But slowing exports to Western nations won’t alone stem rapidly rising prices. Sinking global trade is pummeling Asian exports, bringing some relief on inflation to U.S. and other Western consumers. But easing prices for home furnishings, electronics and other manufactured goods don’t signal high inflation will soon be defeated. Wage growth and services price gains are still elevated. And central banks in the U.S. and Europe are warning they aren’t finished raising interest rates in their fight to cool inflation.”, The Wall Street Journal, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The U.K. Will Officially Charge Travelers for Entry Starting This Fall — Here’s How Much: What to know about the U.K.’s Electronic Travel Authorisation visa waiver, which will go into effect in November. The fee, which will be rolled out this fall, will cost travelers £10 ($12.59) per applicant. When it is fully implemented, all foreign visitors without a visa (including those from the United States) will be required to apply for the ETA online in advance of their trip.”, Travel and Leisure, June 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Investors sitting on record $1 trillion cash despite super rebound – Savers have turned away from the volatility of stock markets to the security of term deposits and nervous retirees are drawing down lump sums. Savers have shunned their super funds and deposited a record $1 trillion in term deposits amid growing economic and stock market concerns, despite fund performance rebounding during the past 12 months.”, Australia Financial Review, June 23, 2023

Brazil

“Why beef-loving Brazil is so obsessed with an American steakhouse chain – SÃO PAULO – Deep in the urban sprawl of the Western Hemisphere’s largest city, nestled within a thicket of highways, there is a low-slung shopping mall that boasts an attraction not rivaled anywhere in the United States. The giant Outback Steakhouse. Named the world’s largest Outback in 2018 — and the world’s most lucrative before that — its dimensions and legend since then have only grown. The restaurant is now nearly twice the size of the biggest Outbacks in the United States, where the faux-Australian chain was founded.”, The Washington Post, June 20, 2023

Canada

“Mass Immigration Experiment Gives Canada an Edge in Global Race for Labor – The country’s population growth is among the fastest in the world, bolstering the economy while creating strains in big cities. At a time industrialized countries around the world are confronting declining birth rates and aging workforces, Canada is at the forefront of betting on immigration to stave off economic decline. A country about as populous as California has added more than all the residents in San Francisco in a year. Last week, Canada surpassed 40 million people for the first time ever — with growth only expected to continue at a rapid pace as it welcomes more immigrant workers, refugees and foreign students across its borders.”, Bloomberg, June 18, 2023

“Manufacturer 3M Canada doubles down on remote work in an effort to access broader talent pool – While major employers across North America have spent much of the past year trying to persuade their employees to return to the office more often, the global manufacturing giant 3M Co. is doing just the opposite. The company is making its fully remote-work policy a permanent feature of employment, specifically because it will allow 3M to access a broader global pool of talent, not confined by geographical boundaries. ‘We realized over the pandemic that remote work was an absolutely critical part of being able to meet our hiring needs for knowledge workers,’ said Penny Wise, president and managing director of 3M Canada. ‘So we’re embracing that. It is our comparative advantage.’”, The Globe and Mail, June 17, 2023

China

“Is China’s Recovery Sputtering? Like April’s numbers, the economic data released by the National Bureau of Statistics (NBS) for May were disappointing. For both industrial value added and retail sales, the outcomes the NBS reported were weaker than the predictions of the Chief Economists surveyed by the Yicai Research Institute. There were two areas of weakness. First, it appears that low commodity prices are making it unprofitable for China’s upstream industries to produce. Manufacturers of mid-stream goods have increasingly turned to cheaper imports instead of domestic products. Purchases of foreign coal, crude oil and various ores are all up sharply this year. The second area of weakness was in high-tech consumer products like mobile phones, laptops and tablets. Many of these products are exported and in the cases of mobile phones and laptops, the decline in exports was significantly larger than that of production, suggesting that weak foreign demand for these goods played an outsized role in their reduced production.”, YiCai Global, June 21, 2023

“China’s economy is on course for a “double dip” – The post-covid economy was meant to roar. But it is faltering again. Early this year, for example, China’s economy grew faster than expected, thanks to the country’s abrupt exit from covid-19 controls. Then, in April and May, the opposite happened: the economy recovered more slowly than hoped. Figures for retail sales, investment and property sales all fell short of expectations. The unemployment rate among China’s urban youth passed 20%, the highest since data were first recorded in 2018. Some now think the economy might not grow at all in the second quarter, compared with the first. By China’s standards this would be a “double dip”, says Ting Lu of Nomura, a bank.”, The Economist, June 18, 2023

European Union

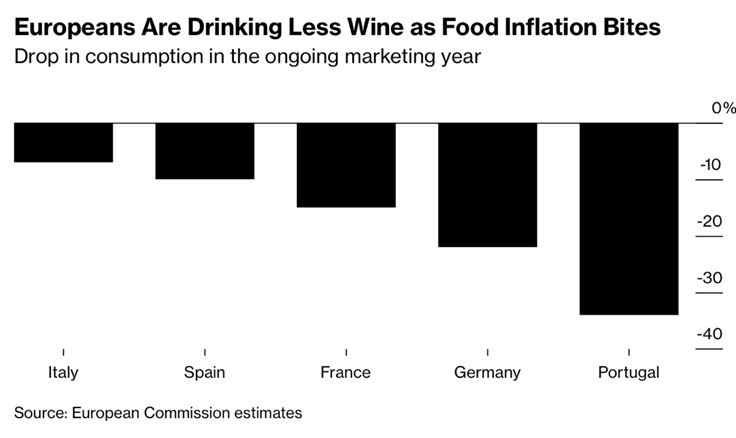

“There’s Too Much Wine in Europe as Drinkers Shun High Prices – Market faces large harvest plus lower consumption and exports. Government set to boost support measures to curb the buildup. High inflation and sliding exports, coupled with a strong 2022 harvest, have fueled a buildup in the bloc, the European Commission said Tuesday. That’s created a “serious loss of income,” especially for rosé and red wine producers in France, Spain and Portugal. The government is boosting support measures for the industry to curb the glut. That includes letting growers distill wine for alcohol — only meant for non-food purposes — and compensating them based on a share of recent market prices.”, Bloomberg, June 23, 2023

India

“Will India Surpass China to Become the Next Superpower? Four inconvenient truths make this scenario unlikely. When India overtook China in April to become the world’s most populous nation, observers wondered: Will New Delhi surpass Beijing to become the next global superpower? India’s birth rate is almost twice that of China. And India has outpaced China in economic growth for the past two years—its GDP grew 6.1 percent last quarter, compared with China’s 4.5 percent. At first glance, the statistics seem promising.

Japan

“Global Investors Are Flooding Into Japan. That Is Making Some People Nervous. Foreign investors have bought a net $39 billion of Japanese stocks since the start of April. That has helped the benchmark Nikkei 225 index rise almost 30% this year, bringing it back to levels it last traded at over 30 years ago. The country’s economy expanded faster than the U.S. in the first quarter, its stock exchange is pushing companies to improve their valuations and its central bank is committed to low interest rates, making it cheap for investors to take out loans to buy shares. And Warren Buffett has given the market a vote of confidence, saying in March that his conglomerate held more shares in Japan than anywhere outside the U.S.”, The Wall Street Journal, June 21, 2023

United Kingdom

“Stubborn UK inflation piles pressure on Bank of England to raise rates – May figure of 8.7% higher than expected after prices rise across range of goods and services. The Institute for Fiscal Studies think-tank said interest rate increases over the past year were already on track to absorb 8.3 per cent of mortgage holders’ disposable income — a figure that rises to 20 per cent for 1.4mn people. ‘We have an inflation problem that is not associated with economic growth,’ said Lyn Graham-Taylor, a senior rates strategist for Rabobank. ‘The market is saying that the Bank of England will have to push the UK economy into recession to get on top of this problem.’”, The Financial Times, June 21, 2023

“Surprise rise in retail sales thanks to bank holidays and sun – The Office for National Statistics says retail sales volumes grew by 0.3% in May, far better than the 0.2% decline forecast by economists, as warm weather and bank holidays boosted sales of outdoor goods and summer clothes. Garden centres and DIY shops also benefitted. More was spent on takeaways and fast food during the month as people celebrated the coronation and the usual May bank holiday. But food store sales fell as supermarkets increased prices, the ONS said. Food inflation has risen nearly 20% in the year up to April.”, Sky News, June 23, 2023

United States

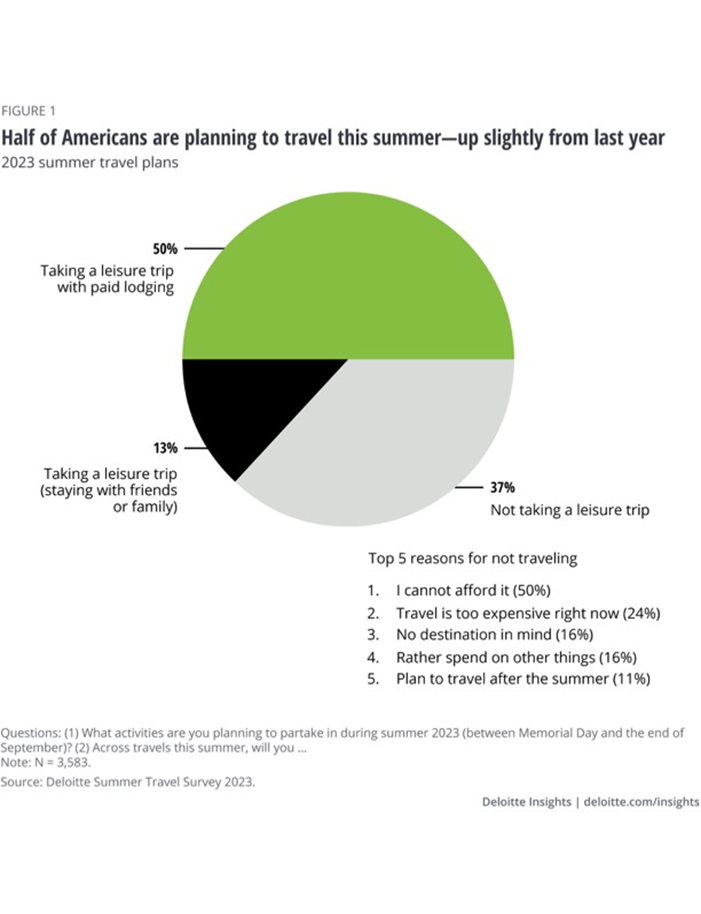

“The experience economy endures: 2023 Deloitte summer travel survey – Signs point to a busy season, as pricing pressure does not seem to deter Americans from enjoying their vacations. Half of Americans say they will take a leisure vacation (involving a stay in paid lodging; see figure 1) this summer, up from 46% in 2022. And they are doing so with enthusiasm, taking more international flights and adding an average of one trip to their calendar. Concerns, however, persist—50% of nontravelers say they will stay home due to financial worries.”, Deloitte, May 2023

Vietnam

“Vietnam must take ‘aggressive’ action to meet growth goals, says finance minister – Export-driven manufacturing hub has been hit hard by drop in demand amid global economic slowdown. Vietnam was one of Asia’s fastest-developing economies last year, expanding more than 8 per cent, its highest growth rate since 1997. But growth slowed in the first quarter of 2023 to 3.3 per cent, down from 5.9 per cent in the fourth quarter of last year, as a grim global economic picture and high inflation cut into demand for the country’s exports.”, The Financial Times, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Australia’s $172 billion franchising industry thriving in the regions due to internal migration – A recently released report has shed light on the changing demographics of Australia’s ….. franchising industry. According to the report, the franchising industry has undergone a significant transformation in adapting to the technological advancements of the modern era and a notable shift in the industry’s mindset has been showcased in the report, moving away from a singular focus on franchise sales towards a growth mindset that places emphasis on innovation, integration of advanced systems and a deep understanding of the Australian market. The report also highlights that over the past 15 years, there has been a notable migration of people from capital cities to regional areas in Australia, according to the Regional Australia Institute.”, Smart Company, June 14, 2023

“Could BurgerFi Be the Next Shake Shack Arising? BurgerFi is a growing upscale fast-casual burger restaurant selling 100% hormone-free, never frozen, 100% Angus beef chargrilled burgers. The company has a combined company owned and franchised 172 locations and plans to open 15 to 20 locations in 2023. Upscale fast-casual burger restaurant chain BurgerFi International Inc. shares have been staging an impressive rally rising 39% year-to-date.”, Market Beat, June 19, 2023

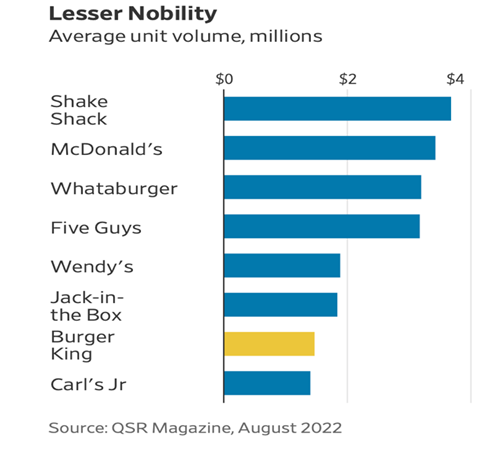

“Fixing Burger King’s Royal Mess – Struggling fast-food chain’s turnaround will take time to pay off. Burger King, the longtime No. 2 U.S. burger chain, looked even more like a pretender to the throne after slipping to third place in 2020 behind Wendy’s by revenue. But market share was the least of its concerns after the pandemic roiled the restaurant industry. Its franchisees have seen revenue and profitability sag, and two of its largest owners have been forced into bankruptcy recently with another failing to pay royalties. Now the chain is nine months into a mission to “reclaim the flame”—a tough-love approach to beef up its best operators and encourage weaker ones to cut back.”, The Wall Street Journal, June 20, 2023

“Franchisee Takes Over 16 Handles And Aims To Reinvigorate It – Neil Hershman, an experienced franchisee of 16 Handles, a New York City-based frozen yogurt chain, owns seven of its 30 all-franchised units. In August 2022, he and Danny Duncan, a noted You Tuber and influencer with over 1.5 billion views on his channel, acquired 16 Handles from its long-time founder. Their goal is to reinvigorate it, boost sales, and open more franchised units. Who knows better how a franchise operates, and what is holding it back, than one of its own franchisees? And Hershman, who is 28-years old, based in New York City, and a former analyst at a hedge fund, is also a franchisee of other brands since he also operates three Dippin’ Dots, an ice cream store.”, Forbes, June 26, 2023

“Studio Pilates International Set To Launch First UK Studio in Exeter in early June – Having conquered the Australian, New Zealand and US markets, the brand is now set to take on the UK, with locations in South London, Dublin and Exeter expected to be open by late Spring.”, Franchising.com, June 14, 2023

“US chain Long John Silver’s opens first restaurant in Indonesia – Long John Silver’s, the US-based seafood restaurant, has opened a global flagship store in Gading Serpong, Indonesia, and signalled plans to expand further in the country. The flagship store is the brand’s first location in Indonesia under a new partnership with local franchisee, Cipta Putra Nusantara, which plans a second flagship outlet in the last quarter of this year and a longer-term target of more than 50 restaurants in the market. ‘We have seen great success establishing brand recognition and customer satisfaction in Singapore, which encouraged us to look at neighbouring markets for expansion opportunities,’ said Nate Fowler, Long John Silver’s brand president.”, Inside retail Asia, June 14, 2023. Compliments of Paul Jones, Jones & Co., Toronto

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 84, Tuesday, June 13, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, the state of economic freedom around the world in 2023, inflation continues to ‘cool’, international firms are cutting their office space needs, 5 lessons COVID taught businesses, lower global birth rates, Europe’s economy slows, what the Chinese consumer is spending on and worker productivity in Latin America

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Change is the law of life. And those who look only to the past or present are certain to miss the future.”, John F. Kennedy

“Life is not about how fast you run or how high you climb, but how well you bounce.”, Vivian Komori

“Opportunities don’t happen. You create them.”, Chris Grosser

Highlights in issue #84:

- Brand Global News Section: Luckin Coffee®, Pizza Hut®, Starbucks®, Subway® and Sweetgreen®’

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

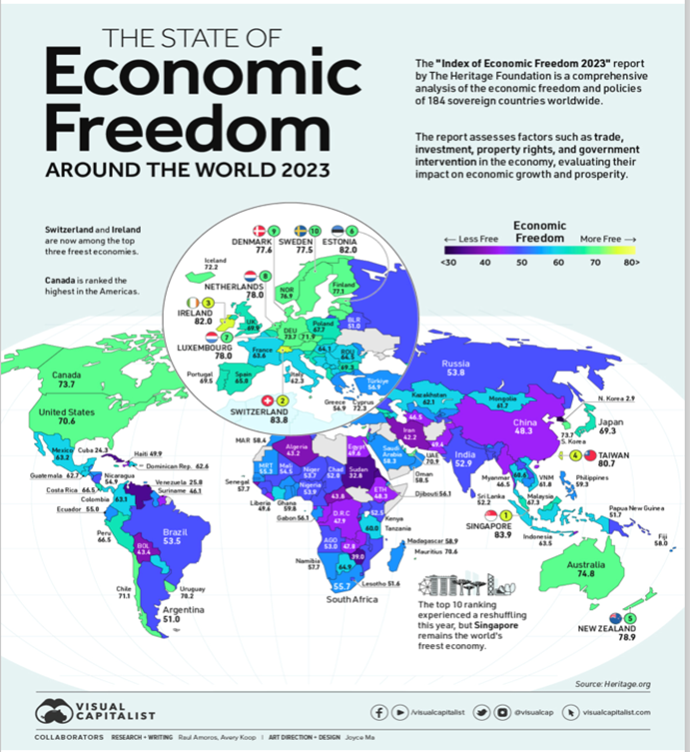

“The State of Economic Freedom in 2023 – The concept of economic freedom serves as a vital framework for evaluating the extent to which individuals and businesses have the freedom to make economic decisions. In countries with low economic freedom, governments exert coercion and constraints on liberties, restricting choice for individuals and businesses, which can ultimately hinder prosperity. The map above uses the annual Index of Economic Freedom from the Heritage Foundation to showcase the level of economic freedom in every country worldwide on a scale of 0-100, looking at factors like property rights, tax burdens, labor freedom, and so on. The ranking categorizing scores of 80+ as free economies, 70-79.9 as mostly free, 60-69.9 as moderately free, 50-59.9 as mostly unfree, and 0-49.9 as repressed.”, Visual Capitalist / Index Of Economic Freedom, June 6, 2023

“World Bank Brightens View of Global Growth This Year, Downgrades 2024 – Bank warns of risks to poorer nations from rising interest rates. The World Bank sees better global economic growth than previously estimated in 2023, thanks to resilient U.S. consumer spending and China’s faster-than-expected reopening in the early part of the year. The bank still expects slowing growth in the second half of this year and a muted expansion into next year, according to its forecast released Tuesday. It warned that stubbornly high inflation and interest-rate increases are weighing on economic activity around the world, particularly in developing countries.”, The Wall Street Journal, June 6, 2023

“These are the top 10 countries where small businesses are flourishing globally – E-commerce company Shopify partnered with Deloitte to create a database that measures the top countries and U.S. states where entrepreneurship is flourishing. To calculate this, they measured the impact of entrepreneurs on GDP, jobs supported, exports, and business activity. According to the index, the top 10 countries where entrepreneurship is thriving are:

United States

Lithuania

Romania

United Kingdom

Czech Republic

Australia

Denmark

China

Hong Kong

Japan

Fast Company, May 16, 2023

“Half of big international firms to cut office space in next three years – Survey of 350 businesses shows 56% favour hybrid working. The survey of 350 businesses by property consultants Knight Frank and commercial real estate firm Cresa found that 50% the largest businesses they questioned – those with more than 50,000 employees – expect to shrink their global workspaces, although most are only planning to reduce by between 10% and 20%. However, this contrasts with the expectations of smaller firms surveyed – those with up to 10,000 employees – just over half (55%) of whom said they were expecting to increase their global office space.”, The Guardian, June 6, 2023

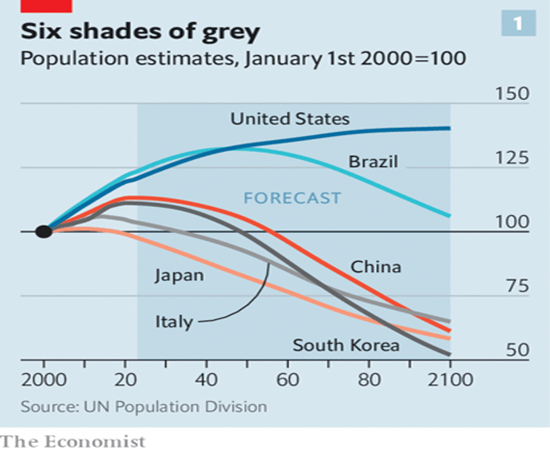

“It’s not just a fiscal fiasco: greying economies also innovate less – That compounds the problems of shrinking workforces and rising bills for health care and pensions. Italy and Japan, in particular, are the poster pensioners for demographic decline and its economic consequences. In both countries the fertility rate (the number of children a typical woman will have over her lifetime) fell below 2.1 in the 1970s. That level is known as the replacement rate, since it keeps a population stable over time. Anything lower will eventually lead to a declining population.”, The Economist, May 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Today’s supply chain disruptions reaffirm the importance of a multilateral trading system based on WTO rules – Economic security has come to the forefront of policy discussions, as a series of crises—most recently the COVID-19 pandemic and the war in Ukraine—have disrupted global supply chains. Governments around the world are looking for ways to make their countries less vulnerable to such disruptions, especially now that rising geopolitical tensions add new uncertainty. In this regard, reshoring and friend-shoring have become popular policy prescriptions, and talk of global fragmentation abounds.”, International Monetary Fund, June 2023

“These Are the World’s 20 Most Expensive Cities for Expats in 2023 – New York has leapfrogged Hong Kong as the world’s most expensive city to live in as an expat, while skyrocketing rents saw Singapore crash into the top five, according to a new study. Soaring inflation and rising accommodation costs were cited as reasons for New York topping ECA International’s Cost of Living Rankings for 2023, while Geneva and London remained in third and fourth places. These are the world’s top 20 most expensive places for expats to live (with the 2022 rankings in parentheses):

New York, US (2022 ranking: 2)

Hong Kong, China (1)

Geneva, Switzerland (3)

London, UK (4)

Singapore (13)

Zurich, Switzerland (7)

San Francisco, US (11)

Tel Aviv, Israel (6)

Seoul, South Korea (10)

Tokyo, Japan (5)

Bern, Switzerland (16)

Dubai, UAE (23)

Shanghai, China (8)

Guangzhou, China (9)

Los Angeles, US (21)

Shenzhen, China (12)

Beijing, China (14)

Copenhagen, Denmark (18)

Abu Dhabi, UAE (22)

Chicago, US (25)

Bloomberg, June 6, 2023

“Food producers agree to cut prices in France after government pressure – Finance minister Bruno Le Maire says 75 groups will make reductions in line with falling wholesale costs. French food prices rose 14.1 per cent in the year to May, close to the eurozone average, and have overtaken energy as the region’s biggest driver of inflation, raising alarm among politicians and consumer groups. Some French food prices have risen faster: olive oil prices are up a quarter and eggs cost a fifth more.”, The Financial Times, June 9, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Heathrow strikes: security staff announce summer of walkouts – More than 2,000 staff who scan bags and frisk passengers at the UK’s biggest airport will walk out for all but two of the busiest weekends of the year, the Unite union said yesterday. The 31 days of strike action, between June 24 and August 27, will affect passengers flying from terminals 3 and 5, the two busiest departure points. It raises the prospect of long delays for security screening during the school summer holidays and the August bank holiday weekend.”, The Times of London, June 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

“Reimagining economic growth in Africa: Turning diversity into opportunity – Africa’s economy downshifted over the last decade, yet half of its people live in countries that have thrived on the continent. Africa has the human capital and natural resources to accelerate productivity and reimagine its economic growth, which is, more than ever, vital for the welfare of the world.”, McKinsey & Co., June 5, 2023

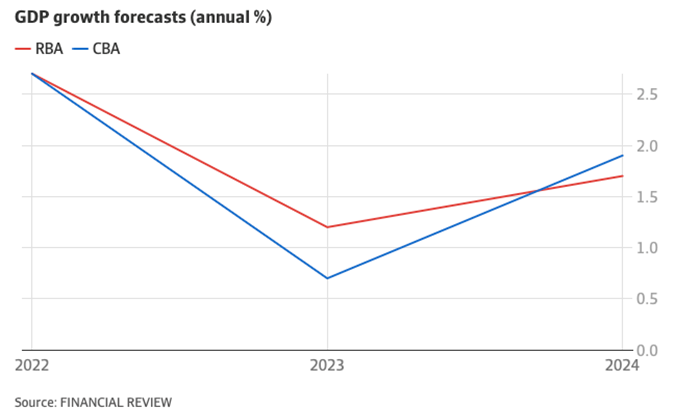

Australia

“CBA cuts growth forecasts, places odds of recession at 50pc – Economists are warning of the serious risk of recession this year after sticky inflation and concerns about wages fuelling price pressures forced the Reserve Bank of Australia to lift interest rates and flag more rises to come. Commonwealth Bank of Australia and HSBC economists now both put the odds of a recession at 50 per cent, after cutting their economic growth forecast in response to the RBA raising the cash rate a quarter percentage point to 4.1 per cent on Tuesday.”, Australia Financial Review, June 9, 2023

Canada

“Canada lost 17,000 jobs in May, bringing interest rate hike into question – The drop was driven largely by a fall in youth employment, as 77,000 people between the ages of 15 and 24 lost their jobs. The lacklustre jobs report raised questions over whether the Bank of Canada may have acted too quickly in raising interest rates Wednesday, some economists suggested.”, The Toronto Star, June 9, 2023

“Complexities of international sanctions – Canada is increasingly using international trade sanctions. These sanctions target foreign individuals and entities, and compliance has become increasingly complex and important for companies operating abroad. What happens when you have been added to a sanctions list and want to be removed? We consider below two recent cases on this topic.”, Dentons, June 7, 2023

China

“China’s Services Sector Continues to Rebound Faster Than Industrial Sector – The combined profits of major state-owned industrial companies declined 17.9% year-on-year in the first four months, the National Bureau of Statistics (NBS) reported May 27. Over the same period, total profits of state-owned enterprises (SOEs) in all sectors climbed 15.1%, the Ministry of Finance said the following day. Since the beginning of 2023, the year-on-year growth of the service production index published by the NBS has been consistently higher than increases in industrial value added.”, Caixing Global, May 31, 2023

“Where Are Chinese Consumers Willing to Spend? Chinese consumers are resuming spending on travel and dining out but are not buying necessities and other consumer goods as much as before the pandemic. Spending on services was the main driving force for the first-quarter rebound in consumption. Retail sales of consumer goods in the first quarter rose 5.8% year-on-year, significantly rebounding from a decline of 2.7% in the fourth quarter of 2022, data from the National Bureau of Statistics (NBS) showed. Per capita spending on services grew 6.2% year-on-year in the period, faster than overall consumption growth, a report by KPMG showed.”, Caixing Global, June 8, 2023

“U.S. Business Interest In China Is Slowly Recovering, Ex-American Diplomat Says – Strained relations between Washington and Beijing appear to be stabilizing, a shift that is stirring renewed business interest in China among U.S. companies, a former long-term U.S. diplomat who is the current chairman of the American Chamber of Commerce in Shanghai told Forbes on Tuesday. ‘There are some positive signs in the relationship, particularly the high-level contact among the two countries’ economic officials,’ said Sean Stein in Beijing via Zoom. That advance, however, is constrained by continuing concerns about security issues and the economic outlook, he added.”, Forbes, June 7, 2023

European Union

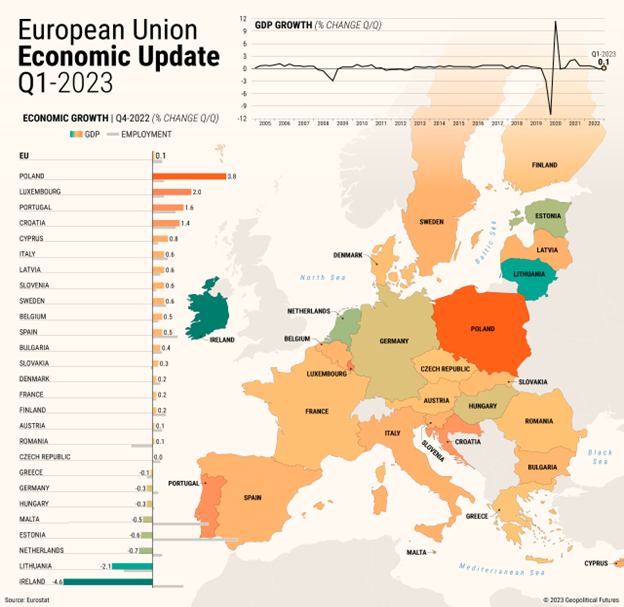

“Europe’s Economy at a Standstill – Ukraine and uncertainty about prices remain the major obstacles to EU growth. The European Union as a whole achieved slight economic growth in the first quarter of the year, but weaknesses abound……Poland recorded 3.8 percent growth compared with final quarter of 2022, powered by household consumption and exports. The war and uncertainty about prices remain the major obstacles to European growth. On the other hand, employment is still rising and energy prices have returned to Earth.”, Geopolitical Futures, June 9, 2023

Latin America

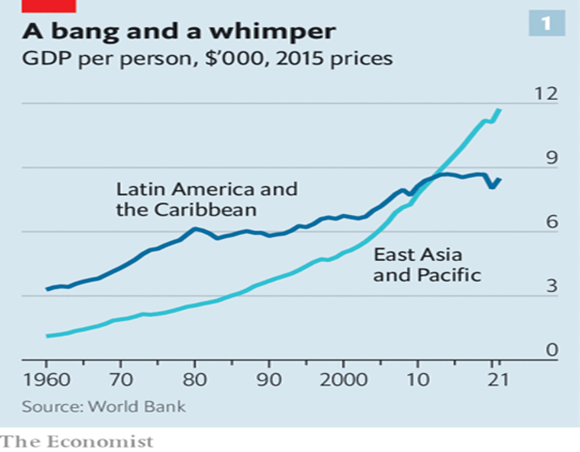

“Why are Latin American workers so strikingly unproductive? Blame education, corruption and a huge shadow economy. In 1962 Latin America’s income per person was three times that of East Asia. By 2012 both regions had the same level. By 2022 East Asia’s was roughly 40% higher than Latin America’s (see chart 1). When the differences in purchasing power are taken into account, Latin Americans’ gdp per person has been stuck at little more than a quarter of that of their neighbours in the United States for the last three decades. According to the World Bank, between 2010 and 2020 Latin America was the world’s slowest-growing regional economy.”, The Economist, June 8, 2023

India