EGS Biweekly Global Business Newsletter Issue 62, Tuesday, August 9, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

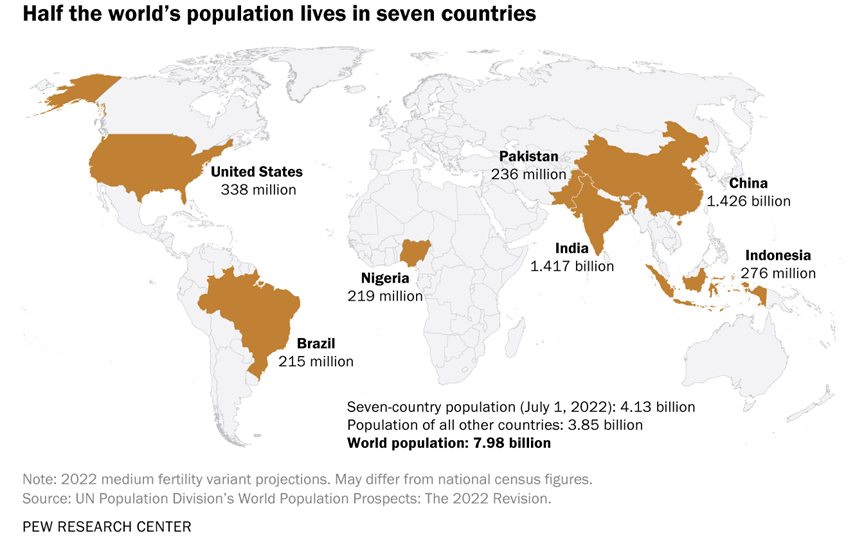

As someone who travels to many countries as part of my job, I am encouraged by the level of increased global business travel. Not so much by the lack of staff in airports! On the other hand, an increasing percentage of professionals around the world have chosen not to return to central city offices. And who knew that half of the world’s population live in just seven countries?

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Being positive is a sign of intelligence.”, Maxime Lagacé

“You can, you should, and if you’re brave enough to start, you will.”, Stephen King

“A problem is a chance for you to do your best.”, Duke Ellington

Highlights in issue #62:

- Brand Global News Section: Anytime Fitness®, California Pizza Kitchen®, McDonald’s®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

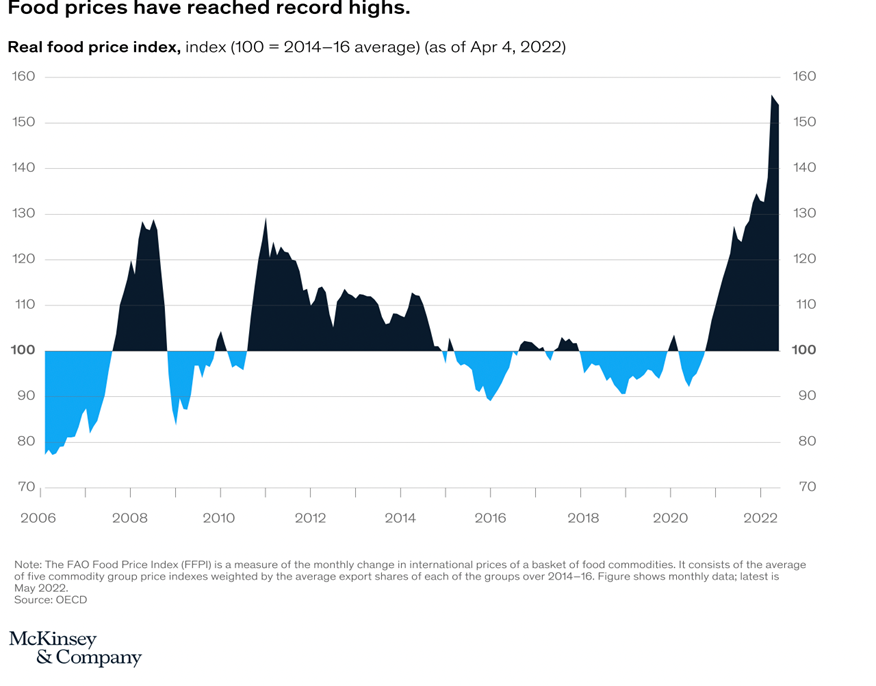

“World Food Prices Post Biggest Decline Since 2008 in July – Drop offers some relief amid deepening cost-of-living crisis. Ukraine restarted some grain shipments after deal with Russia. Global food prices fell the most since 2008 after concerns over supplies of grains and vegetable oils eased as Ukraine moved toward restarting exports. A United Nations index of world food costs plunged almost 9% in July. The index fell to the lowest since January, before Russia’s blockade of ports in Ukraine — a major food exporter — pushed up food costs to a record.”, Bloomberg, August 5, 2022

“Global population projected to exceed 8 billion in 2022; half live in just seven countries – As recently as 2015, half the world’s population was concentrated in just six countries – the same as above, with the exception of Nigeria, which was then the seventh most populous country and has since passed Brazil to move into sixth place. Recent population growth, however, has been faster in the rest of the world than in these nations, meaning that the top six now hold slightly less than half (49%) of the world’s people.”, Pew Research, July 21, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

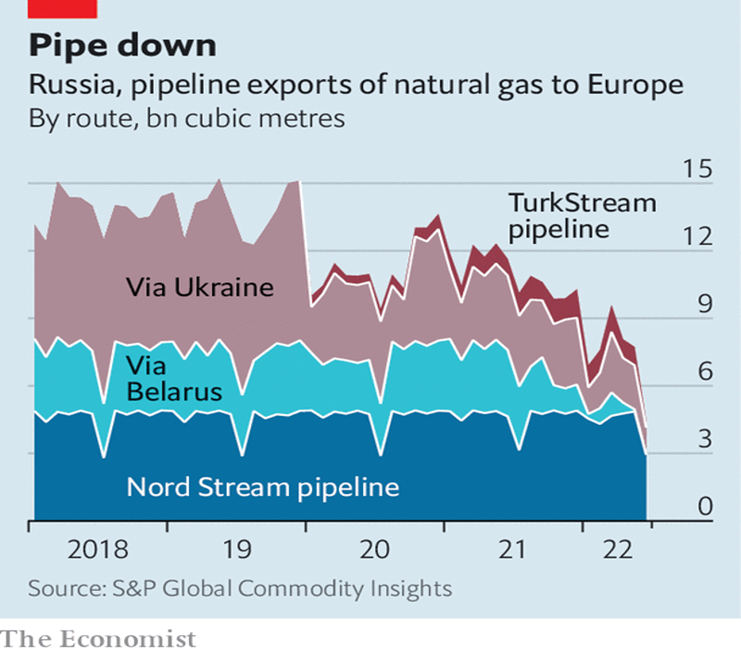

“European gas prices soar after Russia deepens supply cuts – Futures contracts hit five-month high after Gazprom announces drop in flows. Russian state-backed energy group Gazprom on Monday said flows on the Nord Stream 1 (NS1) pipeline would plummet to 33mn cubic metres from Wednesday because of turbine maintenance issues. That would amount to a fifth of the pipeline’s capacity and half of current levels.”, The Financial Times, July 26, 2022. (NOTE: USA price per megawatt hour was US$54 on July 26, 2022.

“The World’s Largest Container Shipping Companies – Did you know that 80% of the global goods trade is transported over sea? Given the scale of human consumption, this requires an enormous number of shipping containers, as well as ships to carry them. At an industry level, container shipping is dominated by several very large firms. Companies are ranked by two metrics. First is the number of ships they own, and second is their total shipping capacity measured in twenty-foot equivalent units (TEUs). A TEU is based on the volume of a twenty-foot long shipping container.”, Visual Capitalist, July 26, 2022

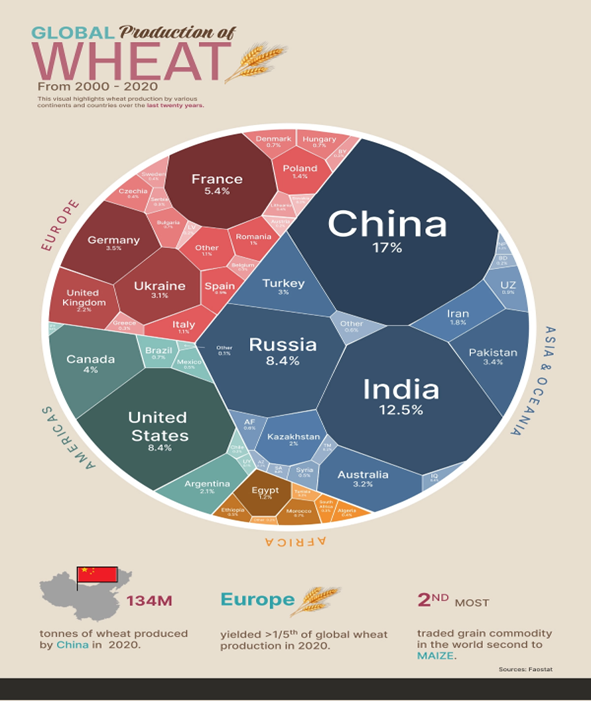

“Which Countries Produce the Most Wheat? While more than 80 different countries produce wheat around the world, the majority of global wheat production comes from just a handful of countries, according to data from The Food and Agriculture Organization of the United Nations (FAO). China, the world’s largest wheat producer, has yielded more than 2.4 billion tonnes of wheat over the last two decades, making up roughly 17% of total production from 2000-2020. The second-largest wheat-producing country is India. Over the last two decades, India has produced 12.5% of the world’s wheat.”, Visual Capitalist and FAOSTAT, July 31, 2022

Global & Regional Travel Updates

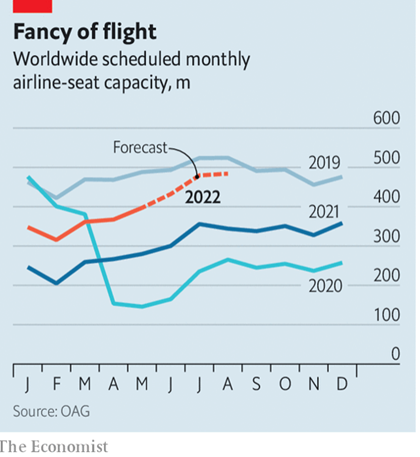

“International Passenger Demand Triples in June – The International Air Transportation Association (IATA) has released the passenger data for June showing an unsurprising rise in passenger demand. Using the industry metric of Revenue Passenger Kilometres (RPKs) to indicate total passenger traffic IATA’s figures indicate a 76.2% increase over 2021. As a comparison passenger traffic was at approximately 71% of pre-pandemic levels.”, Air Geeks, August 5, 2022

“Qantas Airways Ltd. needs executives from head office to leave their jobs for three months and haul luggage full-time to address a stubborn labor shortage that’s disrupting flights. The airline is looking for at least 100 volunteers to carry out shift work at Sydney and Melbourne airports, Chief Operating Officer Colin Hughes wrote in a note to managers that was shared by Qantas Monday. Tasks include loading and unloading luggage, as well as driving the vehicles that take bags to planes and between terminals. Applicants must be able to move suitcases weighing as much as 32 kilograms (70 pounds), according to the memo.”, Bloomberg, August 7, 2022

“Europe’s airport staff continue to strike over low pay and working conditions – Across Europe, airport and airline staff have been striking, causing severe disruption to summer travel. Employees including ground staff, baggage handlers, cabin crew and pilots have been walking out in countries like Spain, Italy and the UK. With traveller numbers almost back to pre-pandemic levels, the industrial action has caused chaos at airports around Europe.”, Euro News, August 8, 2022

“Hong Kong Cuts Hotel Quarantine to Three Days to Revive Travel – Quarantine will be followed by four days of health monitoring Strict rules had deterred travelers to Asian financial hub.”, Bloomberg, August 7, 2022

Country & Regional Updates

Australia

“In a post-pandemic world, 30 per cent of work will be at home – About 30 per cent of all working days will be done from home in the post-pandemic “new normal” – up to 50 per cent among those who can easily work remotely – according to a respected survey of American workers to be presented to a Sydney audience this week. The research also suggests employers could use working from home to limit wage growth and that employees would sacrifice a portion of their income to preserve their right to work from home.”, Brisbane Times, July 27, 2022. Compliments of Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

Canada

“Canada sheds jobs again, but unemployment rate holds at record low – The economy shed 31,000 positions last month, after a decline of 43,000 in June, Statistics Canada said in a report on Friday. Financial analysts on Bay Street were expecting a stronger return of 15,000 jobs added. Despite the decline, the unemployment rate remained at 4.9 per cent – the lowest in nearly five decades of data.”, The Globe And Mail, August 5, 2022

China

“Beijing Reopens Its Doors to International Flights – Previously, as part of the efforts to reduce the possibility of Covid-19 spreading in the nation’s capital, China rerouted all international flights bound to Beijing to alternative destinations for passengers to complete quarantine first. To reduce the effort of inspection and quarantine, all Beijing-bound international flights, and regional flights from Hong Kong, Macau, and Taiwan will arrive at Beijing’s Capital International Airport. Beijing’s Daxing International Airport is still only open to domestic flights.”, Airline Geeks, July 28, 2022

“China’s IPO Queue Gets Longer as Covid Curbs Ease – The number of companies waiting in line to go public on the Chinese mainland’s stock markets has reached around 1,000, as the economy began to pick up steam after Covid restrictions in some of its largest cities were eased. Many Chinese companies rush to launch IPOs not just for the money that they can raise, but also because they want the gloss that comes with a listed firm, a brokerage source told Caixin. Some local governments also see increasing the number of listed companies based in their area as one of their development goals, the source said.”, Caixing Global, August 8, 2022

India

“Apple Postpones Opening of First Physical Store in India to 2023, Report Says – Apple’s flagship store in India was reportedly scheduled to open in 2021 before it was hit with pandemic-related delays. Apple is seeking to open a 22,000-square-foot store at an upscale shopping mall in the teeming financial capital of Mumbai.”, CNET, July 28, 2022

Russia

“McDonald’s writes off $1.2 billion due to withdrawal from Russia – In March, McDonald’s suspended operations in Russia in response to the start of Russia’s military operation in Ukraine. On May 16, the company officially announced the sale of its business in Russia. In June, the new owners of McDonald`s Russian assets opened some of the restaurants.”, Kommersant.ru, July 26, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Singapore

“Think U.S. car prices are bad? In Singapore you have to spend $82,000 just for the right to buy a car, on top of the car itself – In a bid to manage a large population squeezed onto a tiny island, and in an effort to cut down on traffic and pollution, the tiny island nation has made it prohibitively expensive to own a car. The country requires citizens to bid on—and win—a state-issued “certificate of entitlement” (COE) before they’re legally entitled to purchase, operate and own a car for a 10-year period. After the 10-year mark, residents must buy another COE if they want to maintain their car ownership. If they fail to do so, they must scrap or sell their vehicle or export it to another country.”, Fortune magazine, July 25, 2022

South Korea

“South Korea Accelerates LNG Purchases to Avoid Winter Shortage – Nation seeking to purchase additional cargoes to ensure supply Inventories have been depleted as heat boosted summer demand. South Korea is looking to buy more liquefied natural gas to replenish stockpiles before winter. The world’s third-biggest importer of the chilled fuel is seeking additional cargoes to meet forecasts for increased domestic demand and is targeting to lift inventories to about 90% full by November, from about 34% currently, the Energy Ministry said Monday.”, Bloomberg, August 8, 2022

Spain

“Spain edges closer to pre-pandemic tourism levels with 7.5 mln visitors in June – More than twice as many tourists visited Spain in June than in the same month last year and they spent almost three times as much during their stay, National Statistics Institute data showed on Tuesday…….Before the pandemic put a halt to travel in 2020, Spain received a total of 38.2 million tourists in 2019, with 8.8 million visiting in June.”, Reuters, August 2, 2022

United Kingdom

“How ready is Britain for a gas crisis this winter? It is true that we get very little energy from Russia, but the country is still heavily exposed. As Russia tightens the screw on gas supplies to Europe and amid growing fears of winter shortages, the government has stayed resolute in its insistence that the country’s energy is secure. “Unlike Europe, Britain isn’t dependent on Russian gas,” it has said. ‘The UK’s secure and diverse energy supplies will ensure households, businesses and industry can be confident they can get the electricity and gas they need.’”, The Times of London, August 8, 2022

United States

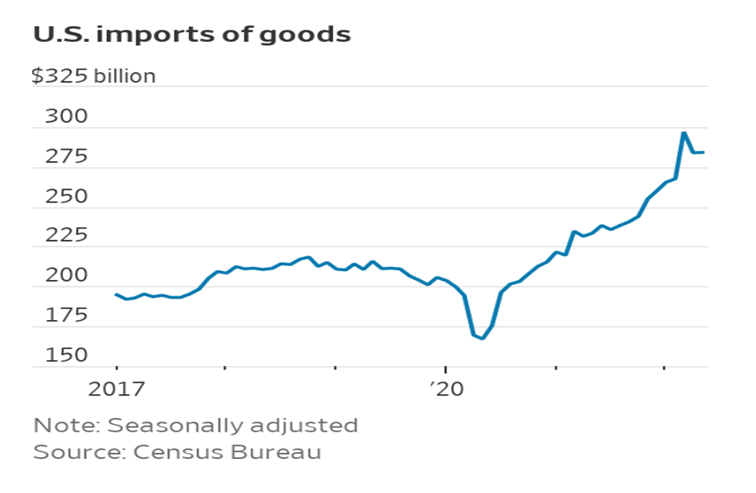

“U.S. trade deficit narrows sharply; exports at record high – The Commerce Department said on Thursday that the trade deficit decreased 6.2% to $79.6 billion. Exports of goods and services shot up 1.7% to an all-time high of $260.8 billion, while imports slipped 0.3% to $340.4 billion.”, Reuters, August 4, 2022

“Hiring Gets Easier for Some Employers Despite Hot Job Market – Verizon, Uber, Marriott and others hardest hit by the pandemic say recruiting is up or turnover down. Some big U.S. companies say hiring is getting easier, at least by a little. Employers in hospitality, retail, healthcare and other industries hardest hit by worker shortages over the past two years say they are seeing emerging signs that recruiting workers—and getting them to accept jobs when offered—is becoming less of a challenge, even as the overall job market remains tight.”, The Wall Street Journal, August 8, 2022

Brand News

“Largest Anytime Fitness Franchisee Sold to PE Firm – Bandon Holdings, the largest Anytime Fitness franchisee, has been acquired by Sentinel Capital Partners. Terms of the deal were not disclosed. The Austin-based multi-unit franchisee operates 213 Anytime Fitness clubs and has more than 140,000 members in 24 states.”, Franchising.com, August 4, 2022

“California Pizza Kitchen Re-Enters India with New Store Opening – The new franchise is owned and operated by Sanjay Mahtani, co-founder and operator of JSM Corporation Pvt. Ltd., an India-based international restaurant group established in 2005. JSM is the master franchisee in India for California Pizza Kitchen as well as the U.S.-based Hard Rock Cafe, in addition to operating its own restaurant brands.”, Franchising.com, July 28, 2022

“Domino’s (Australia) fails to deliver for investors – Investors have soured on Domino’s Pizza Enterprises after the US company that owns the brand warned of rising costs including a 30 per cent jump in mozzarella prices. Shares in the ASX listed $6.1 billion Domino’s are down 43 per cent for the year and 6 per cent since Thursday, when the separately owned American company blamed soaring costs for missing quarterly profits.”, Australia Financial Review, July 25, 2022. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

Articles & Studies For Today And Tomorrow

“These are the top 10 best and worst places to live in the world—and you won’t find the U.S. on either list – This week, the Economist Intelligence Unit (EIU) released their Global Liveability Index ranking of the top 10 best and 10 worst places to live in the world in 2022. The index scored 172 cities in five categories: culture, health care, education, infrastructure, and entertainment. Cities in Scandinavia dominate the list of Most Liveable Cities thanks to the stability and good infrastructure in the region.”, CNBC, August 7, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 61, Tuesday, July 26, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

As a 40 year China Hand, I find the “Foreign enterprises in China a decade of opportunities and transformation” article one of the most important in years as to how it for foreign brand to do business in China. We may be close to the top of the inflation curve. Will grain exports begin again soon to the Africa and the Middle East?

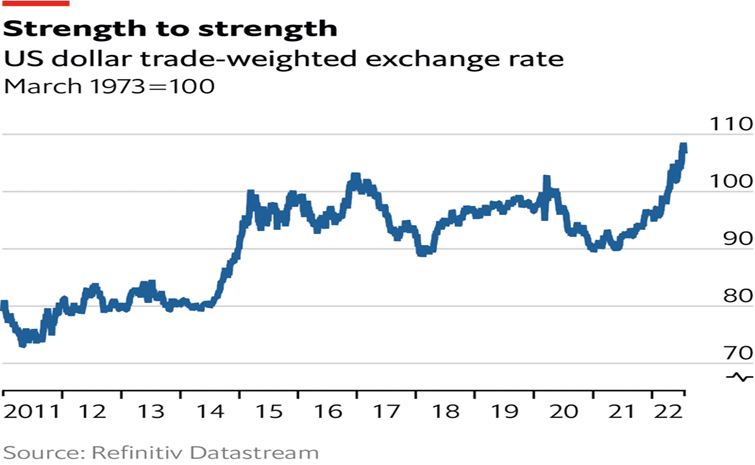

The U.S. trade gap narrows. A strong dollar makes this a good time for U.S. tourist in Europe. Africa and Egypt are becoming new tech start-up centers and who knew there were 13 distinct styles of fried chicken around the world?

As of this issue, 1,450 people in 20 countries receive this newsletter.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.” Zig Ziglar

“Keep your eyes on the stars and your feet on the ground.”, Theodore Roosevelt

“Life is like and ocean, it goes up and down.”, Vanessa Paradis

Highlights in issue #61:

- Brand Global News Section: Five Guys®, Habit Burger®, Starbucks®, Subway® and Tom Horton’s®

NOTE: Bolded headlines in this newsletter are live links to published articles where the article is freely available

Interesting Data and Studies

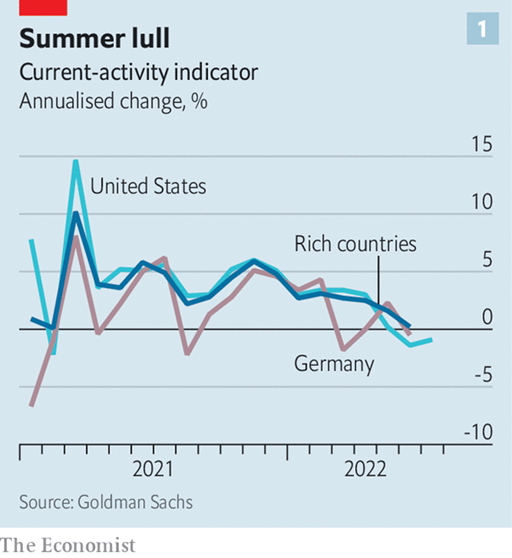

“Why it is too early to say the world economy is in recession – Growth in the rich world is slowing, but has not crashed to a halt. It is clear that central banks have to take the proverbial punchbowl away from the party. Wage growth in the rich world is far too strong given weak productivity growth. The few remaining optimists point to the strength of households and firms. Moreover, surveys suggest that people seem more confident about their personal finances than about the state of the economy. Across the eu as a whole, households are about one-third more likely to be positive about their own finances than they have been, on average, since the data began in the mid-1980s.

, The Economist, July 24, 2022

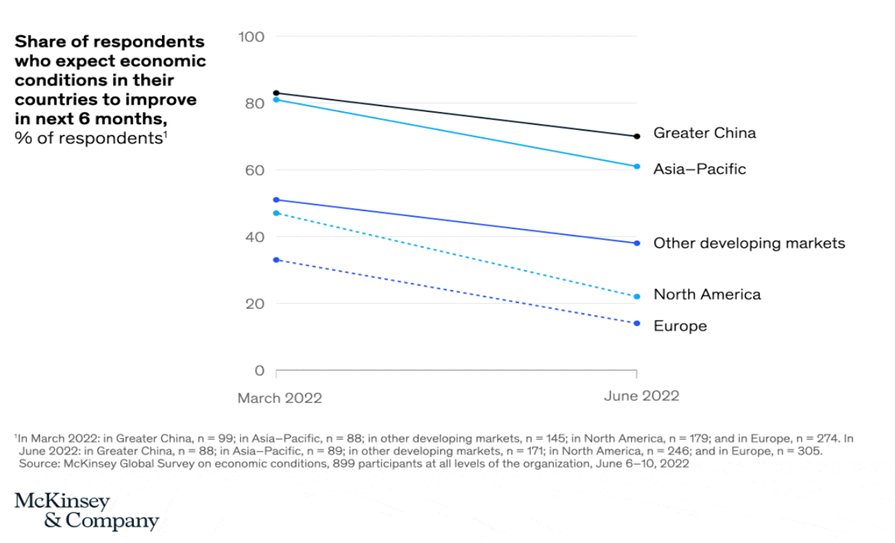

“According to a recent McKinsey survey, most Asia–Pacific and Greater China respondents are optimistic their economies will improve through 2022—although overall optimism has declined—whereas those in Europe and North America are more pessimistic, bracing for the worst.”, McKinsey, July 15, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Why the dollar is so strong – It is a good time to be an American tourist in Europe. Earlier this month the euro briefly dipped below parity with the dollar for the first time in two decades. The greenback is up by nearly 20% against that basket of currencies compared with June last year. It has climbed to heights last scaled in 2002. That is in large part because of the Federal Reserve’s hawkish shift. Determined to rein in inflation, it has increased interest rates by 1.5 percentage points since March.”, The Economist, July 20, 2022

“There are 4 possible recession scenarios, UBS says, including one where the S&P 500 rises 16% by the end of 2023 – UBS’ economic models show just a 40% chance of a recession in the U.S. over the next year. Still, the UBS team acknowledged that “the economy is flying quite low to the ground and looks vulnerable to turbulence.” The team laid out four potential recession scenarios, including one with good news for investors: an S&P 500 rebound by the end of 2023.”, Fortune, July 18, 2022

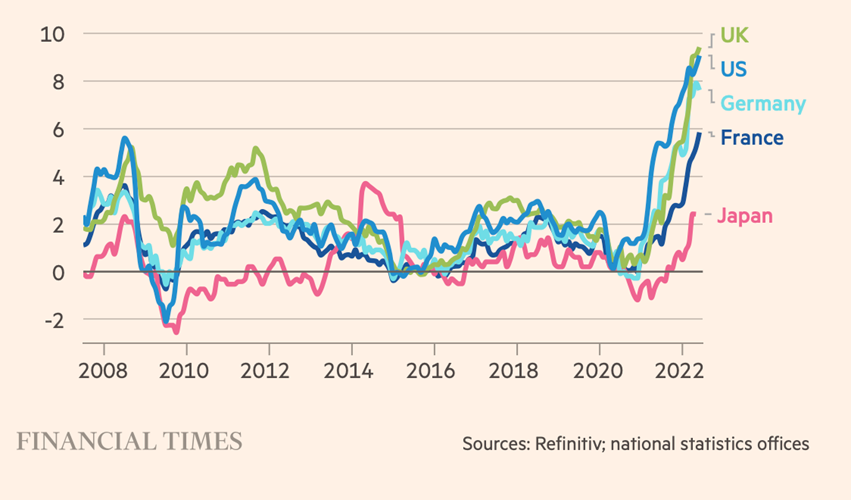

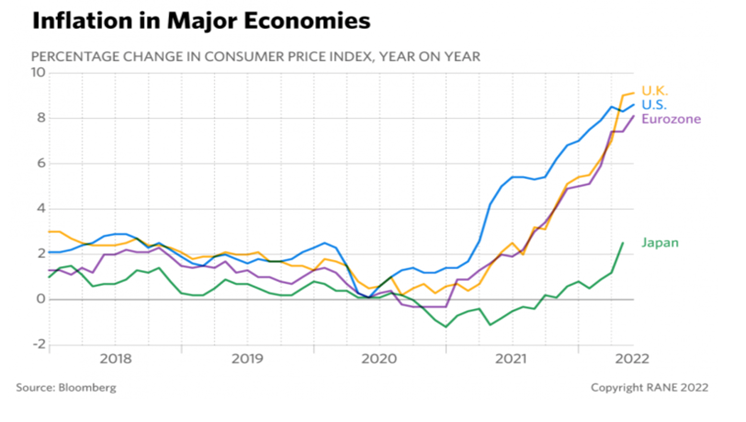

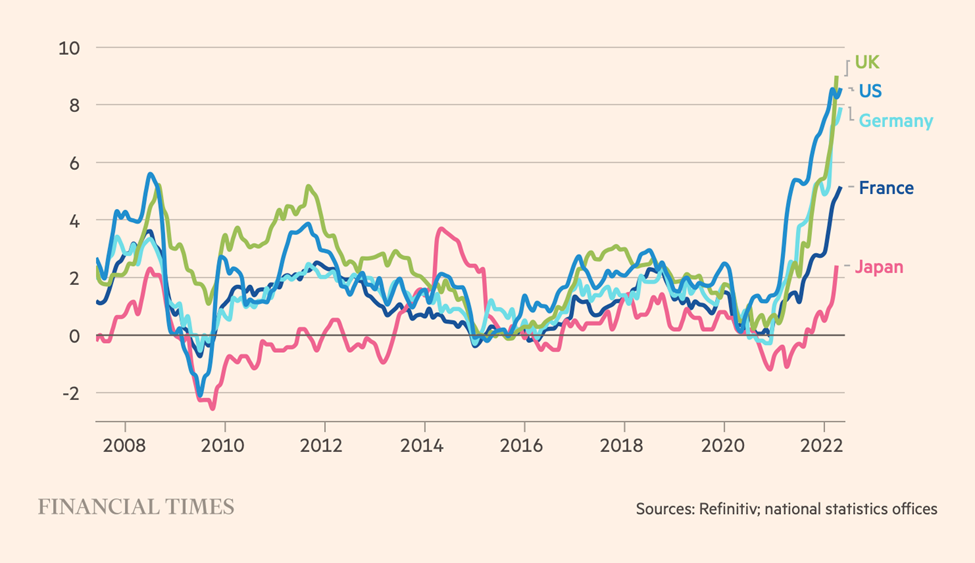

Consumer price inflation – % Annual change – The Financial Times, July 20, 2022

“When Will Inflation Subside? – We clearly are seeing the impact of inflation as it increases operating costs across supply and labor inputs in 2022. Is there relief coming from this profit-eroding upward pressure? What should we expect next year?”, Darrell Johnson, FRANdata, Franchising.com, July 22, 2022

Global, Regional & Local Travel Updates

“AirlineRatings picks best carriers in the world – 1. Qatar Airways. 2. Air New Zealand, 3. Etihad Airways. 4. Korean Air, 5. Singapore Airlines, 6. Qantas, 7. Virgin Australia, 8. EVA Air, 9. Turkish Airlines, 10. All Nippon Airways, 11. Cathay Pacific Airways, 12. Virgin Atlantic, 13. Japan Air Lines, 14. JetBlue, 15. Finnair, 16. Emirates, 17. Hawaiian Airlines, 18. Air France/ KLM, 19. Alaska Airlines and 20. British Airways”, NZ Herald, July 13, 2022

“Singapore Hotel Room Rates Hit Six-Year High as Tourism Recovers – Singapore in April became one of the first major regional economies to announce it would end all testing for incoming vaccinated travelers as the government furthered efforts for living with Covid-19. A revival of conferences and major events have also attracted visitors, and STB data showed a nearly 12-fold increase in arrivals in the first half of 2022 compared with the same period a year ago.”, Bloomberg, July 23, 2022

“Toronto Airport Is World’s Worst For Delays Amid Current Travel Chaos – Pearson International has won top honors for airport service for years, but now is at the epicenter of a global air-travel meltdown. Over 53% of flights departing Toronto Pearson between June 1 and July 18 arrived late at their destinations, according to flight-data specialist FlightAware. That was the highest rate among the world’s top 100 airports by number of flights.”, Wall Street Journal, July 24, 2022

Country & Regional Updates

Africa

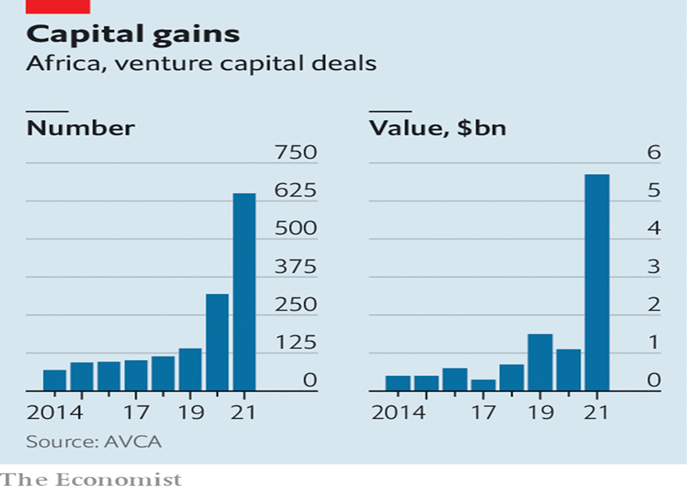

“African startups are raising unprecedented amounts. What next? The continent is the only region in the world not suffering from a slowdown in venture capital. Last year 604 African startups raised a total of $5.2bn, according to the African Private Equity and Venture Capital Association (avca), an industry group. This was more than the total invested in the seven preceding years. Five of Africa’s seven “unicorns” (startups valued at more than $1bn) won their horns last year. American investors led the charge, with 357 involved in deals last year, compared with 268 in total in 2014-20.”, The Economist, July 21, 2022

Australia

“Australia’s near-record low unemployment stokes staffing crisis – Labor government discusses work visas with Pacific Island leaders to alleviate worker shortage. The unemployment rate dropped to 3.5 per cent in June, lower than the 3.8 per cent predicted by economists. In 1974, the jobless rate fell to 2.7 per cent. Data released on Thursday revealed that 88,000 more people were employed in June from the previous month and that the workforce participation rate hit an all-time high of 66.8 per cent.”, The Financial Times, July 13, 2022

“Gig economy: Workers and customers are exiting the sector. How can we make it better? The gig economy is in trouble. Rideshare drivers are cancelling in droves. Wait times for food delivery are ballooning out and driver shortages are leading to food waste.”, Smart Company Australia, July 14, 2022

China

“Foreign enterprises in China a decade of opportunities and transformation – In January 1999, Starbucks entered the Chinese mainland market by opening its first store in the China World Trade Center, Beijing’s most popular commercial center. But with a latte priced at around 20 yuan (about $2.4 back then) and the average monthly salary of Beijing residents just surpassing 1,000 yuan, coffee was a niche market at that time. It took several years for the U.S. coffee chain to get traction in the Chinese market. Since 2010, China has risen to become the largest overseas market for Starbucks. Over the past decade, the number of Starbucks stores jumped by about 9 times to over 5,700 across the country.”, Beijing Review, July 22, 2022. This important analysis was provided by Paul Jones, Jones & Co., Toronto

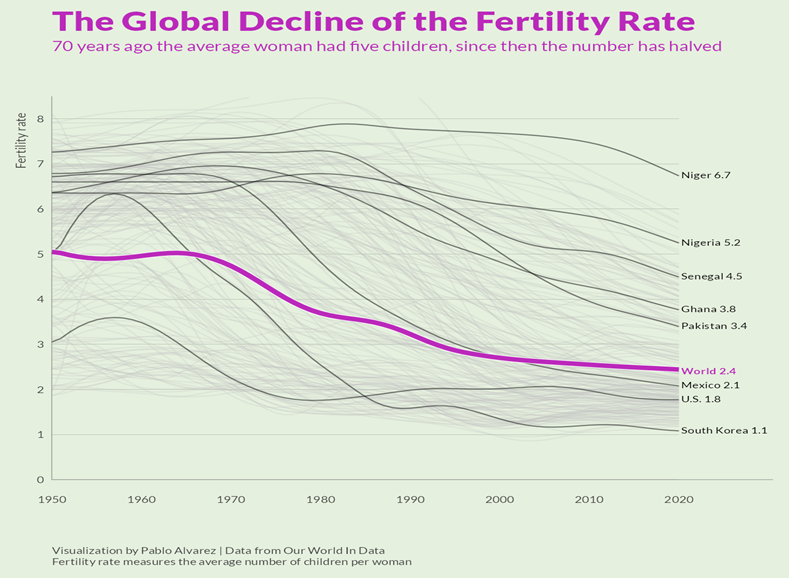

“China’s population expected to start to shrink before 2025 – China is battling to reverse a rapid shrinkage in natural population growth as many young people opt not to have children due to factors including the high cost and work pressure. A change in China’s laws last year to allow women to have three children has not helped, with many women saying the change comes too late and they have insufficient job security and gender equality.”, Reuters, July 24, 2022

Egypt

“Egypt’s booming startup scene is becoming the gateway to MENA – In the last few years, Egypt’s startup ecosystem has become one of the most vibrant on the continent, presenting rapid growth potential for the near future. According to a recent report by Startup Genome, Cairo, the country’s bustling capital, marked an overall increase of 60% in VC funding rounds over the past five years, and in 2021, saw a 156% increase in total VC funding rounds compared to 2020.”, The Next Web, July 25, 2022

Japan

“Japan Leaves Weak Yen Alone Despite Above-Target Inflation – Central bank sees core prices rising 2.3% this fiscal year as Japanese currency stands near 24-year low. The BOJ’s low interest rates have fueled the yen’s fall against the dollar. Last week, a dollar bought more than ¥139, the weakest level for the Japanese currency since 1998. On Thursday afternoon, the dollar was changing hands at ¥138.55.”, The Wall Street Journal, July 21, 2022

Ukraine

“First Ukraine Black Sea grain shipments could move in days – The agreement aims to allow safe passage for grain shipments in and out of Ukrainian ports, blockaded by Russia since its Feb. 24 invasion. Russia has blamed Ukraine for stalling shipments by mining the port waters. Russia and Ukraine are major global wheat suppliers, and Moscow’s invasion sent food prices soaring, stoking a global food crisis the World Food Programme says has pushed some 47 million people into ‘acute hunger’.”, Reuters, July 25, 2022

United Kingdom

“Aldi Staff Get Another Pay Rise as Brits Shift to Discounters – Aldi is giving its UK staff a pay rise for the second time this year as the German discount supermarket attracts more shoppers seeking to cope with the higher cost of living.”, Bloomberg, July 25, 2022

“Five Guys (UK) franchisee launches on-demand pay – Five Guys franchisee Life’s Food has introduced on-demand pay for its more than 200 employees, based across 23 locations in North Carolina, South Carolina and Tennessee. Through a partnership with on-demand salary provider DailyPay, Five Guys staff in Life’s Food-run locations have been given the option to access their pay immediately after finishing a shift, in a bid to provide greater flexibility and help staff manage their finances.”, Employee Benefits UK, July 22, 2022

“Starbucks explores UK business sale – Starbucks has been in the UK since 1998 and has about 1,000 outlets, of which about 70% are franchises while the remainder are owned by the firm. The company is also facing increased competition in the UK from rival coffee chains including Costa, Pret A Manger and Tim Hortons., The BBC, July 18, 2022

United States

“Survey Finds Majority of Companies Plan to Continue Hiring Despite Recession Worries – With the possibility of a recession on the horizon, 57% of American companies said they still plan to forge ahead with hiring, according to a new survey from The Harris Poll……more than half (51%) of U.S. companies think the next recession will happen within the next year. If a recession were to occur soon, more than 2 in 5 businesses (44%) feel their company won’t survive much longer. Nevertheless, companies don’t appear poised to pump the brakes on hiring like in previous recessions. 30% will continue hiring but cut back on the volume of workers, while 27% anticipate extending offers as planned.”, Franchising.com. July 22, 2022

“U.S. Trade Gap Narrowed in May as Imports of Goods Slowed – American companies, meanwhile, exported more oil and natural gas as the Ukraine crisis deepened. The U.S. trade deficit narrowed for the second consecutive month in May as imports were held down by lower goods spending by American households and exports jumped on energy shipments. The trade gap in goods and services shrank 1.3% in May from the previous month to $85.5 billion, the Commerce Department said Thursday, down from April’s revised $86.7 billion.”, Wall Street Journal, July 7, 2022

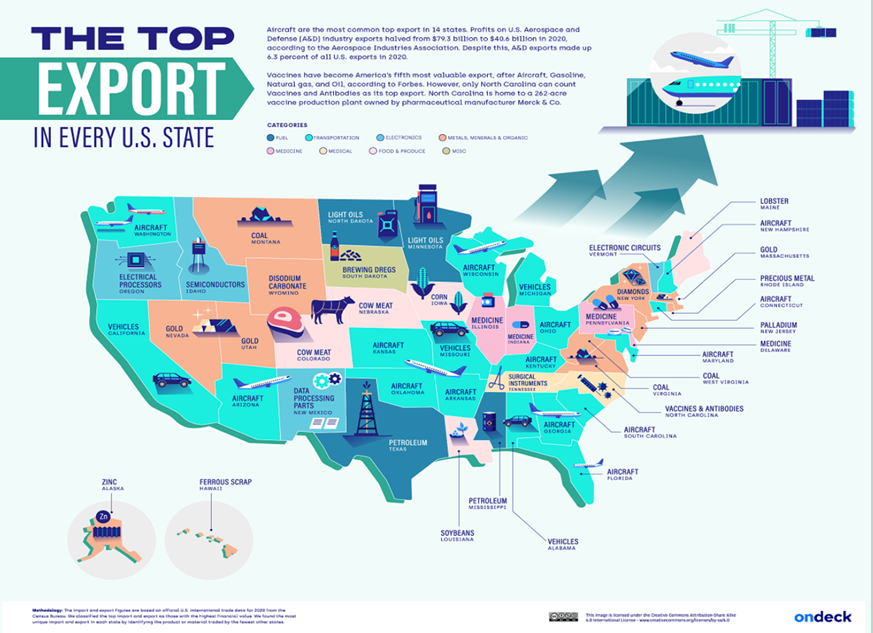

“The Top U.S. Exports by State – The U.S. exported over $1.3 trillion in goods in 2020, the second-highest amount worldwide. While refined petroleum was the top export overall at $58.4 billion, aircraft exports were actually the highest across 14 states—more than any other form of export. This infographic from OnDeck shows America’s top exports by state, using January 2022 data from the U.S. Census Bureau.” Visual Capitalist, July 19, 2022

Brand News

“The Habit Burger’s 2,000-Unit Journey Takes Shape – On the fifth page of its franchise brochure, The Habit Burger Grill quickly lets prospective operators know what type of track it’s on—more than 2,000 locations in the U.S. As it stands now, the fast casual has 330-unit restaurants in more than a dozen states. The long-term growth objective is steep, but John Phillips, chief global brand partnerships officer, has little doubt in The Habit Burger’s aims.”, QSR Magazine, July 18, 2022

“Subway is Ready to Crack its International Growth Potential – Among three biggest restaurant players in the U.S. in terms of footprint—Subway, McDonald’s, and Starbucks—the sandwich chain is the only one with a bigger domestic footprint than international. The brand believes there’s potential to double its international footprint. Subway has more than 37,000 stores worldwide, including roughly 21,000 in the U.S.”, QSR Magazine, July 15, 2022

“Tim Hortons first drive-thru-only stores will open later this summer! The unit will be just 900 square feet and will feature a mobile pickup shelf along with mobile order parking spots. This is a great model for the brand as they aim to maximize efficiency’s and cut costs while not compromising the guest experience.” LinkedIn, June 2022

Articles & Studies For Today And Tomorrow

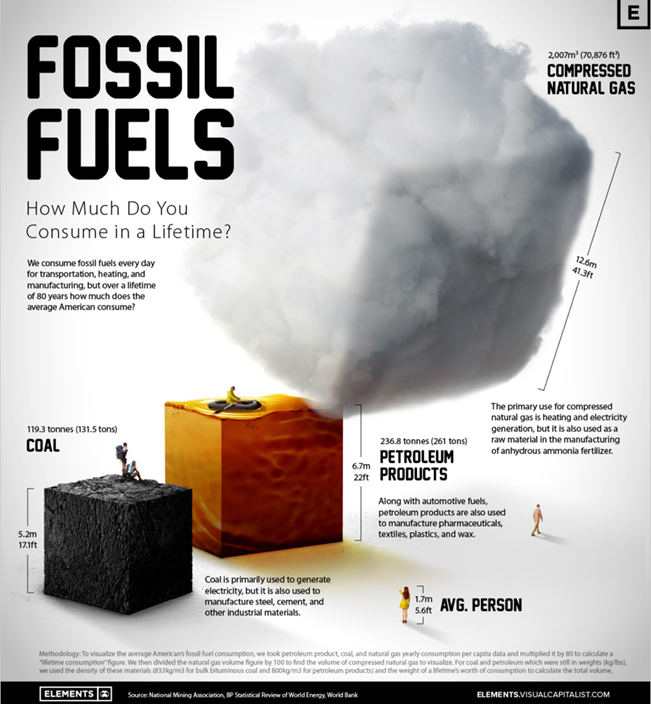

“A Lifetime’s Consumption of Fossil Fuels, Visualized – From burning natural gas to heat our homes to the petroleum-based materials found in everyday products like pharmaceuticals and plastics, we all consume fossil fuels in one form or another. In 2021, the world consumed nearly 490 exajoules of fossil fuels, an unfathomable figure of epic proportions. To put fossil fuel consumption into perspective on a more individual basis, this graphic visualizes the average person’s fossil fuel use over a lifetime of 80 years using data from the National Mining Association and Worldometer.”, Visual Capitalist, July 22, 2022

“13 Styles Of Fried Chicken Around The Globe – Across the globe, unique styles of fried chicken can be found in street corner stalls, fast food takeaways, and family dinner tables. Thankfully, there are home cooks, expat chefs, and even entire restaurant franchises devoted to the crispy poultry sharing both traditional and modern styles of the beloved dish across regions and borders. With so many ways to marinate and season, each country’s signature style of fried chicken has evolved to reflect its distinct history, culture, and tastes.”, Tasting Table, July 25, 2022

“The 12 Covenants of Success – True success is developed and built in a multimodal fashion. There is never one sure path to any goal, or one sure path to any climb up the mountain. Success, however, can be built upon following certain covenants or formulas that have been passed down throughout history for us to utilize in our own unique ways. If you follow these covenants, success is sure to follow.”, Entrepreneur, May 19, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 60, Tuesday, July 12, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

I am on a two week business trip to Australia and New Zealand which are fast coming out of two years of pandemic lockdown. This issue we look at where China’s economy is going for the rest of 2022, more foreign brands fully exit Russia, the cost of living around the world, the COVID-19 pandemic impact on global executive sentiment and beating supply chain challenges for food brands. And my favorite airplane – the Airbus 380 – has returned to service. And India will surpass China’s population next year.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“ Change something by even the smallest percentage and your outcomes will be different.”, Elaine Harrison

“Adapting does not mean permanent changes, it just means making small, quick adjustments.” Hany Kubba, The Teaching Blueprint

“Disruption is the new order. The only constant is change.”, Rob Moore

Highlights in issue #60:

- Brand Global News Section: Checkers & Rallys®, Dominos®, Holiday Inns®, KFC®, McDonalds®, PoolWerx®, Restaurant Brands, Starbucks®, YUM Brands,

NOTE: Bolded headlines are live links to published articles where the article is freely available

Interesting Data and Studies

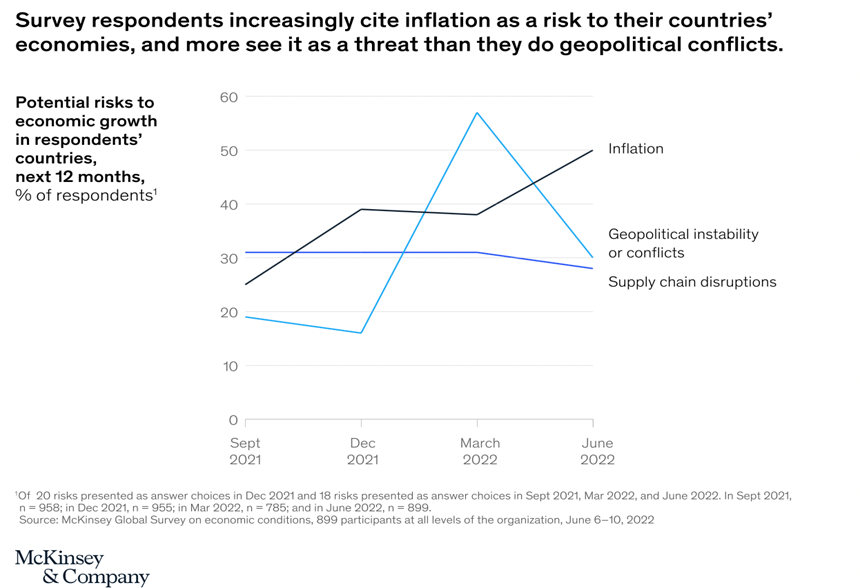

“The coronavirus effect on global economic sentiment – Just one quarter after geopolitical conflicts and instability overtook the COVID-19 pandemic as the leading risk to economic growth, (global executive) survey respondents’ concerns over inflation now exceed their worries about the effects of geopolitical issues on their countries’ economies. In the latest McKinsey Global Survey on economic conditions, respondents most often cite inflation as a risk over the next year.”, McKinsey & Co., June 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Europe is preparing for Russian gas to be cut off this winter – An EU-wide plan is needed to cope. Gazprom, Russia’s state-controlled gas goliath, has been squeezing the Europeans for months. s&p Global, a research firm, reckons that in June Russia piped just 4.7bn cubic metres (bcm) to Europe, barely a third of the level in early 2021. Now Russia is squeezing even harder. On June 16th it slashed exports via ns1 to 40% of capacity, citing technical snags. On the morning of July 11th Russia shut down all gas exports via ns1 for about ten days of maintenance.”, The Economist, July 11, 2022

“There’s a massive pile-up of car, furniture exports bound for U.S. and it’s spreading across European ports – Labor slowdowns and strikes at the German and Netherland ports are creating a massive pile-up of export containers bound for the U.S. that will take months to clear out. “U.S. importers need to look four to five weeks in advance to see if there is a vessel available,” said Andreas Braun, Europe, Middle East, and Africa ocean product director of Crane Worldwide Logistics. “This is not normal. Also, if you are lucky to book a slot on a vessel you then have to locate an empty container which can be in the hinterland.”, CNBC, July 1, 2022

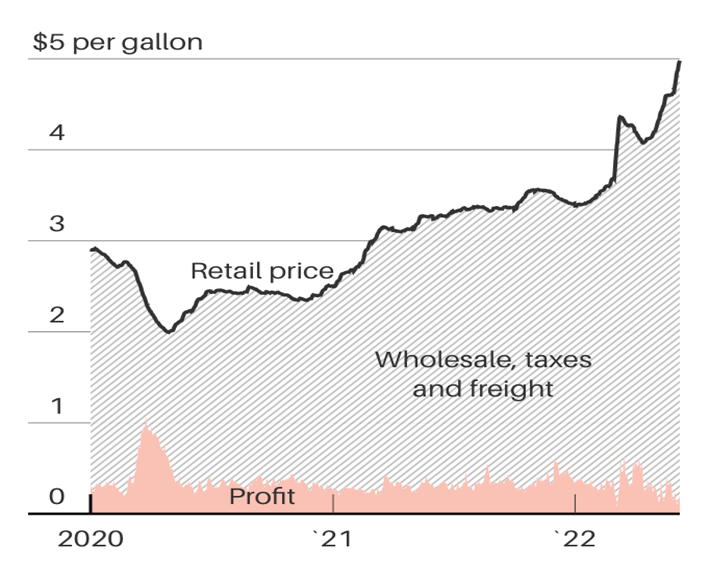

“How inflation is flipping the economic script – The liftoff in fertilizer prices, along with other fallout from the war in Ukraine, has pushed prices for basic foods much higher. Since 2021, food prices have risen to their highest level since the United Nations’ Food & Agriculture Office began its index. And the war in Ukraine has lifted food prices to an entirely new level.”, McKinsey & Co., July 6, 2022

“How to fight supply chain issues in food service – When asked what issues plague operators the most, among the answers are supply chain disruptions, which affect suppliers and distributors, too, said Brian Warrener, an associate professor at Johnson and Wales University, at the National Restaurant Association in May. Warrener teaches food & beverage hospitality and management. Warrener said that food costs are up 13%, industry wages are up 11% and industry prices are up 8%. When it comes to food costs, beef is up 23%, eggs 31%, chicken 27% and cooking oil 44%. He said 96% of operators report delays in the supply chains.”, QSRweb.com, June 29, 2022

Global, Regional & Local Travel Updates

“Three British bosses plot a ‘golden age of air travel’ in the Gulf – The chief executives of Emirates, Etihad and Dubai airport have different plans for luring passengers, going green — and making money. These three British chief executives handle more long-haul international passengers than the bosses of any other airlines or airports. As rival operators, notably British Airways and Heathrow and Manchester airports struggle to cope with rising demand, they want to cash in and “create a new golden age of travel,” as Griffiths puts it.”, The Sunday Times of London, July 10, 2022

“Swiss travel retailer Dufry to acquire Italy’s Autogrill – Duty-free retailer Dufry said on Monday it would acquire Italian airport and motorway caterer Autogrill expanding the Swiss company’s growth opportunities in international markets as travel rebounds. Basel-based Dufry operates around 2,200 shops at airports, cruise liners, seaports and other tourist locations worldwide. Autogrill runs bars, cafes and restaurants at 139 airports internationally, including 80 in North America, as well as on motorways in Europe. Dufry said the combined company will cater to 2.3 billion passengers in more than 75 countries….”, Reuters, July 11, 2022

“A380 Superjumbo Makes Return as Travel Demand Skyrockets – Qantas, who parked all 12 of its A380s in the California desert, said when the pandemic began that it wouldn’t need any of them for at least three years and now, just over two years later, the carrier says it will begin to return to service. British Airways has already begun to fly the A380 again and plans to ramp up service over the coming months. Asiana Airlines announced it would bring back its A380s within a month and Lufthansa announced on Monday that its A380s would make a return to service in 2023.”, AirlineGeeks, June 28, 2022

“Flying will become more expensive for passengers’, warns former British Airways boss – Flying will become more expensive because of soaring oil prices, the former head of British Airways has warned. Willie Walsh, the former chief executive of the airline, also said passengers are set to face problems at UK airports as they try to go away this summer…..The aviation industry is suffering major disruption as a surge in demand for travel coincides with staff shortages across roles such as airline crew, ground handlers, airport security staff and air traffic controllers.”, Yahoo! News, July 11, 2022

Country & Regional Updates

Canada

“Canada’s unemployment rate fell to record low in June, despite losing 43,000 jobs – Financial analysts were expecting a gain of 22,500 positions. The job losses were concentrated among the self-employed and those 55 and older. Hiring conditions remain challenging in Canada, and at last count employers were recruiting for about one million positions – far higher than job-vacancy levels before the pandemic.”, The Globe and Mail, July 8, 2022

China

“Where Analysts Think China’s Economy Is Going This Year – In late May, policymakers rolled out a stimulus package containing 33 measures, including tax and fee cuts, favorable loans for certain sectors and accelerated local government bond issuances for infrastructure investment…..It’s possible that there will be further regional outbreaks and lockdowns due to the harder-to-contain omicron variant, while low confidence is likely to be more persistent, they said.”, Caixing Global, June 24, 2022

“Record 274 Companies Apply for IPOs in Last Week of June – A record number of companies are rushing to submit applications for initial public offerings (IPOs) on China’s A-share market even as a rising number of others are withdrawing flotation plans. In the last week of June, 247 companies submitted IPO applications, the highest weekly number on record. A total of 921 companies are in line to raise money by selling shares on the Shanghai, Shenzhen and Beijing stock exchanges.”, Caixing Global, July 7, 2022

“Coffee is fragrant again about 800 Starbucks Shanghai stores resume dine in – On June 29, 2022, the first day that Shanghai opened its dine-in restaurants in an orderly manner, the long-awaited coffee shop also opened its doors to welcome guests. On the same day, about 800 Starbucks Shanghai stores took the lead in fully resuming dine-in.”, Yical, June 29, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Germany

“The German Trade Deficit Is No Cause for Alarm – Germans have long placed too much emphasis on the importance of a surplus to their country’s prosperity. In May, for the first time in more than three decades, Germany’s storied trade surplus disappeared. Not only is imported natural gas more expensive, but demand in China is falling — neither of which is good news for Germany. Nevertheless, the fallout will be more manageable than many people expect, the Germans included.”, Bloomberg, July 7, 2022

Greece

“Greek Tourism Boom Means Growth May Top 3.2%, Stournaras Says – The Greek economy may grow more than expected as tourists return to the country in greater numbers, according to the central bank chief. The country also is in a better situation than some of its euro-area peers in regard to the threat of Russia cutting off energy deliveries. Greece will likely avoid a recession should shipments halt completely, Stournaras said.”, Bloomberg, July 10, 2022

India

“India to Surpass China as Most-Populous Nation in 2023 – UN had previously estimated India to cross milestone by 2027 Report pegs global population growth at 8.5 billion by 2030. The UN expects global population to hit 8 billion on Nov. 15 and grow to 8.5 billion by 2030. More than half the projected rise between now and 2050 is expected to be in just eight countries: Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines and Tanzania….”, Bloomberg, July 12, 2022

Japan

“Why most overseas visitors to Japan are on business trips, with the country opening up cautiously. Japan is allowing in overseas visitors on official tour groups, but most arrivals are there on business trips and fitting in some sightseeing. Some of these ‘bleisure’ travellers said they had no problem getting into Japan, while others complained of having to jump through too many hoops.”, South China Morning Post, July 11, 2022

Russia

“Russians served mouldy burgers in McDonald’s replacement restaurants – Now diners at the new Vkusno & Tochka outlets (translated from Russian as “tasty and that’s it”) posted photos of their food on social media, New York Post reports. The disturbing images show mould on the hamburger buns. Other customers have reported finding insect legs in the meat patties, according to the Daily Mail.”, News.com.au, July 6, 2022. Compliments of Jason Gehrke, Publisher & Editor, Franchise Advisory Centre, Brisbane

“McDonald’s simplifies franchising policies to attract more diverse candidates – Starting in 2023, the fast-food giant will evaluate every potential new operator equally. In the past, the spouses and children of current franchisees have been given preferential treatment. The company recently came under pressure for a plan to roll out a new grading system early next year that rankled some franchisees, who have concerns about potentially alienating workers.”, CNBC, June 23, 2022

“Starbucks found a buyer for the Russian business – Restaurateur Anton Pinsky will most likely become the new owner of the chain. The deal can be closed as early as the 20th of July, it will include lease rights to all areas of Starbucks coffee shops with renovation (but without the possibility of using Starbucks products and technologies), as well as premises in the Pushkino Park shopping center, which is located at the company owned, say the interlocutors of Vedomosti. The new owner of the network will also have to rebrand it, as happened with McDonald’s earlier (renamed to “Tasty – and that’s it!”)…”, Vedomosti, July 7, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Fast Food Giant Yum Brands Announces Plans to Leave Russia With KFC Sale – One of the world’s largest restaurant companies, Yum Brands Inc, announced Tuesday it is “in advanced talks” to sell its KFC restaurants and franchise in Russia. The American company plans to fully exit the Russian market after selling the brand to a local buyer, state-run news agency Interfax reported. The company has already sold its Pizza Hut business to a Russian company Noi-M.”, The Moscow Times, July 5, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“IHG Hotels and Resorts To Cease All Operations in Russia – On April 8, the company shared it was in discussions with the owners of its 28 IHG-branded hotels in Russia “regarding the complex, long-term management and franchise contracts under which these hotels operate,” according to the statement. The InterContinental Moscow – Tverskaya opened in 2011 and is the company’s highest-profile branded hotel in the country. Crowne Plaza and Holiday Inn hotels are prevalent across the country, and a Staybridge Suites and a Hotel Indigo round out the company’s portfolio there.”, Hotel News Now / Costar, June 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Singapore

“Singapore’s Sky-High Car Prices Are Warning for Global Cities – City-state’s taxes have pushed car prices to as much as a flat Government restricts sales to prevent congestion, pollution. Singapore media professional Ellie Lim gave up her plan to buy a new Volvo SUV to ferry her newborn baby when she realized it was going to cost her more than S$200,000 ($142,000). ‘I was quite shocked,’ said Lim, 34. Coupled with high interest rates on car loans, fuel prices and maintenance fees, buying a new car is ‘a financially unsound decision,’ she said.”, Bloomberg, July 6, 2022

Turkey

“Turkey hit with soaring prices as inflation nears 80% – Growth in annual prices rose from 73.5% in May to 78.6% in June, but real rate could be double official figure. The growth in annual prices rose from 73.5% in May to 78.6% in June, according to the Turkish statistics agency. However, opposition parties and economists said recent hikes in oil and gas prices meant the real rate of inflation was almost double the official figure.”, The Guardian, July 4, 2022

United Kingdom

“UK Tax Cuts Feature at Heart of Race to Replace Johnson – The contest to succeed Boris Johnson as UK prime minister is likely to become a battle over hand-outs for households, with limited interest in fiscal restraint. Tax cuts and aid for families struggling with a surge in the cost of living are already at the heart of the political debate, and pressures for largess from the Treasury will only increase during the next few weeks. By September, when the ruling Conservative Party aims to install a new leader, the government is likely to face strike threats from public sector workers demanding higher pay.”, Bloomberg, July 10, 2022

United States

“Supply Chain Taking Toll on US Business – More than a third of US retailers are just two months away from running out of cash, according to a new survey from Brightpearl. There’s more. The study of 500 retailers also found 80 percent have been hit with supply problems in the last year; 52 percent have experienced stockouts, resulting in a loss of sales; and the supply crisis has added 23 percent to retailers’ costs over the last year, with 51% saying they have increased prices as a result.”, Franchising.com, July 2022

“Workers in America’s biggest cities are defying their bosses and avoiding the office – In-office visits in San Francisco, New York City, and Chicago still aren’t as frequent as they were before the pandemic, according to new research from locational analysis software Placer.ai that analyzed foot traffic data in nearly 200 office buildings in all three cities. If any trend has emerged from the Great Resignation and the past two years of remote work, it’s that white-collar employees generally like workplace flexibility. What they don’t like as much—the office. Research from McKinsey & Co. found that 58% of Americans have the option to work remotely at least one day a week.”, Fortune, July 2, 2022

“A Small Business Hiring Surge – Owners fear recession but are still adding workers. The owners of small U.S. firms went on a hiring binge last month and continue to raise compensation to attract and retain scarce workers. That’s according to the latest monthly employment survey from the National Federation of Independent Business, due out later today. What makes this strong desire to hire especially odd is that it is occurring even as the owners of small firms are more pessimistic about future business conditions than they’ve been in at least 48 years, according to NFIB.”, The Wall Street Journal, July 7, 2022

Brand News

“Checkers & Rally’s Taking a Big Bite Out of Franchise Fees and Royalties – In 2022, the brand is offering incentives of as little as 2% royalties for the first year for franchisees opening one or two restaurants on schedule, to 0 percent royalties for franchisees who open three restaurants on schedule and within a set time period. Beyond those enticing incentives, there is also a reduction in franchise fees for veterans and women entrepreneurs interested in franchising with the Tampa, Florida-based brand.”, Franchising.com, July 2022

“Domino’s (Australia) adds pizza delivery charges as costs bite fast food sector – Pizza chain Domino’s has introduced a 6 percent delivery fee for online orders as rising food and fuel costs begin to bite across Australia’s fast food industry. The ASX-listed pizza maker told The Sydney Morning Herald and The Age it had introduced the fee to cover the increasing costs of doing business.”, Brisbane Times, July 5, 2022

Global investment firm Norwest invests in Poolwerx pool and spa franchise network – US-based global venture and growth equity investment firm Norwest has invested a substantial amount in Poolwerx to support the franchisor’s plans for ambitious growth. Poolwerx founder and CEO John O’Brien says the investment will bring additional expertise and opportunities to enable Poolwerx to grow bigger and faster in Australia, New Zealand and the US.”, Splash Magazine (Australia), July 7, 2022

“Restaurant Brands International – Second Quarter Results Likely To Beat Expectations On Strong Business Momentum. The opening up of Canada and the firm’s international markets was possibly a continued predominant tailwind for sales. Digital, delivery, and increased dine-in sales which drove upside over the first quarter, probably delivered during the second quarter as well. Burger King U.S. likely continued to recapture market share due to turnaround efforts.”, Seeking Alpha, June 30, 2022

“Yum Brands is completely exiting Russia – After Yum completes the transfer of ownership of all KFC restaurants in Russia to a local operator, the process of exiting the contentious country will be complete.”, Nation’s Restaurant News, July 5, 2022

Articles & Studies For Today And Tomorrow

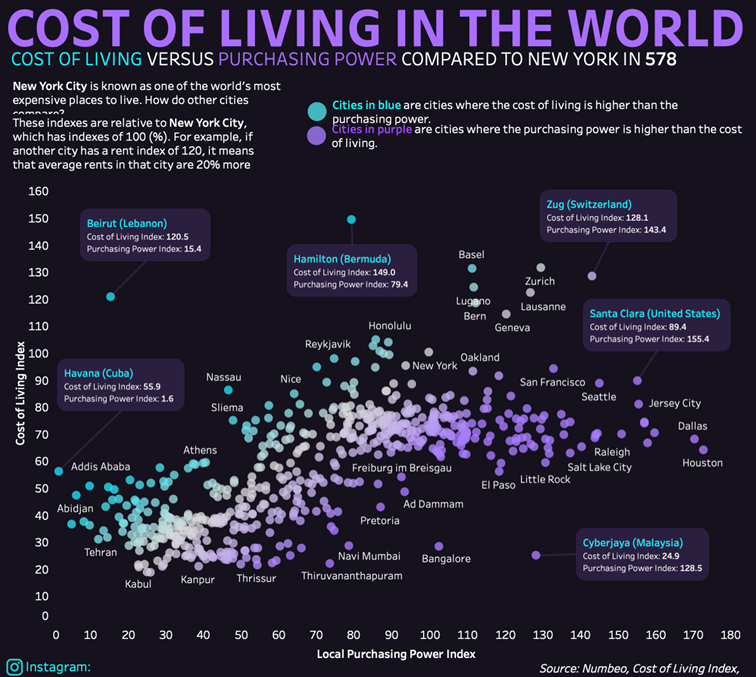

“Comparing the Cost of Living Around the World – The amount of money that’s needed to pay for day-to-day expenses like housing and food varies greatly from city to city. And some cities, like New York City, are known as especially expensive places to live. This graphic by Victor Dépré (hypntic.data) uses 2022 data from Numbeo to compare the cost of living and purchasing power in 578 different cities around the world, using New York City as a benchmark for comparison.”, Visual Capitalist / Numbeo, July 8, 2022 NOTE: The graphic at the link is interactive for the 578 cities.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 59, Tuesday, June 28, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

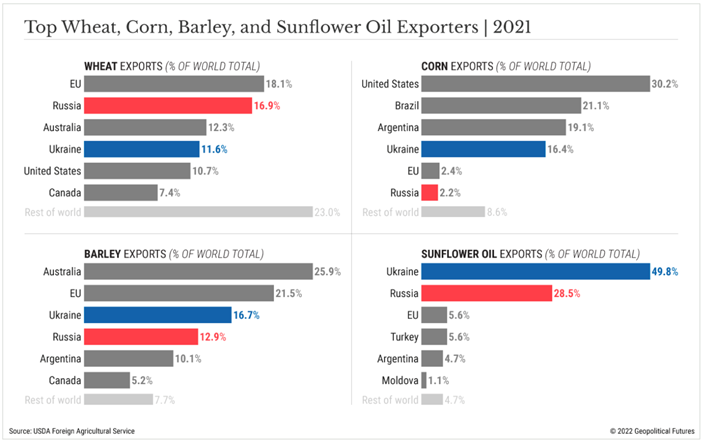

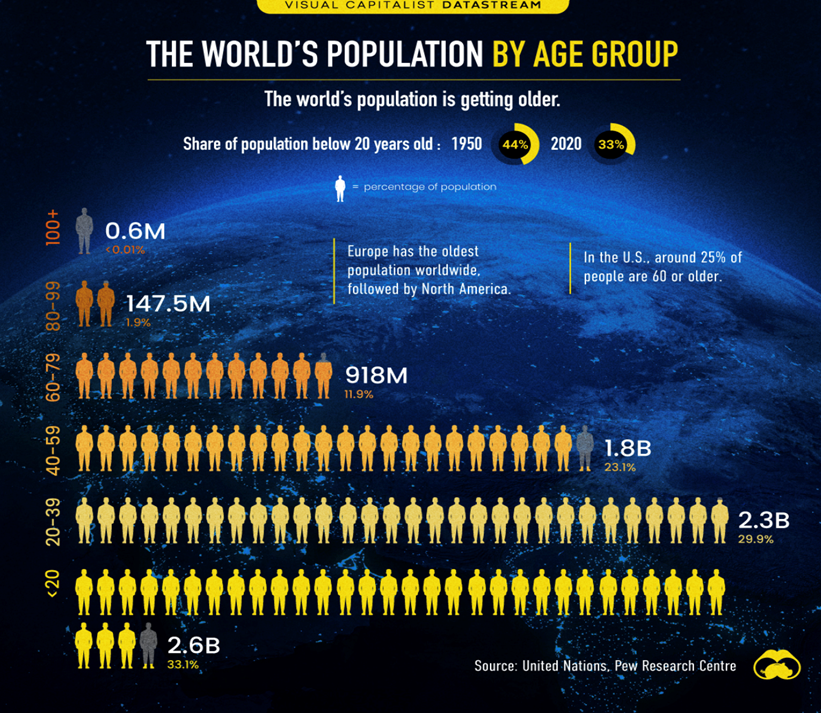

How interest rate hikes around the world tie to inflation rates. Asia Pacific air travel begins to recover. How the pandemic impacted the rule of law worldwide. Lego’s® to be made once again in the USA. The top wheat, corn and sunflower oil exporters. And breaking down the world’s population by age group.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Good judgement comes from experience, and experience comes from bad judgement.”, Rita Mae Brown

“Experience is the teacher of all things.”, Julius Caesar

“The only source of knowledge is experience.”, Albert Einstein

Highlights in issue #59:

- Brand Global News Section: Lego’s®, Little Caesar’s®, McDonald’s®, Pizza Hut®, Popeyes®, Wendy’s® and Wingstop®

Interesting Data and Studies

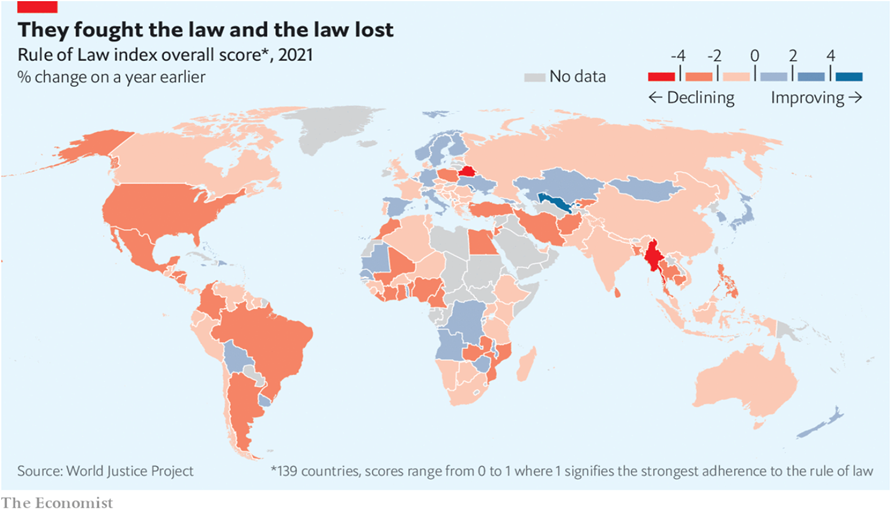

“The pandemic has accelerated a global decline in the rule of law – But it has also brought some needed change to the way justice is administered. Compiled by the World Justice Project (wjp), a Washington-based charity, the Rule of Law index, published annually since 2009 and now covering 140 countries, draws on tens of thousands of responses from households, legal practitioners and experts. It asks about people’s experience of the justice systems in their countries, and produces scores based on factors such as the constraints on government power, corruption, regulatory implementation, order and security, and the enforcement of civil and criminal law.”, The Economist, June 7, 2022

Global Energy & Commodities

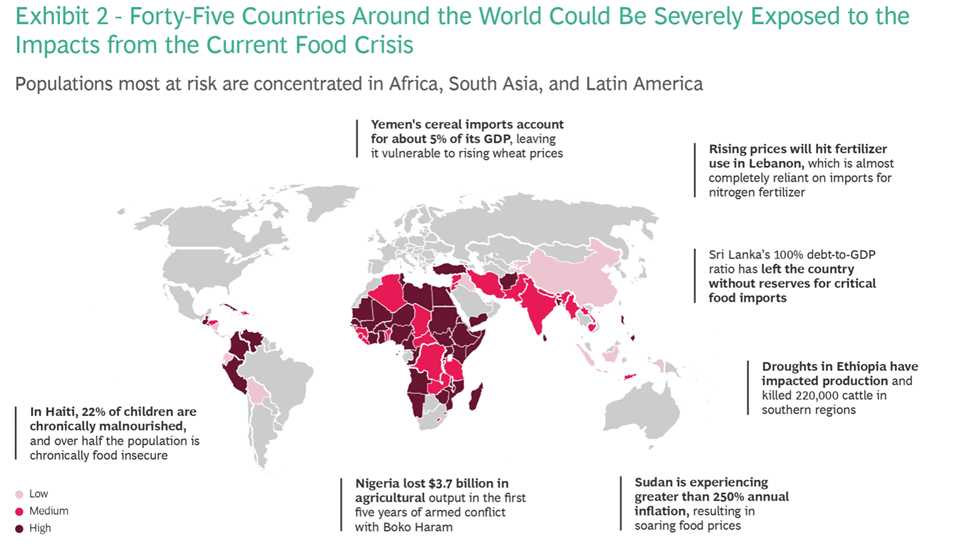

“The Global Economy: Commodities Crisis – The war in Ukraine is exacerbating pre- existing problems with global grain supplies and prices. Although higher prices will be felt by all, North African and Middle Eastern countries along the Mediterranean will be more directly and severely affected. Sudden spikes in food prices are directly linked to increased social unrest and conflict. Further, instability in this region could put fertilizer supplies at risk, which would put only more upward pressure on food prices.”, Geopolitical Futures, June 2022

Global Supply Chain, Commodities, Inflation & Trade Update

“2022 Third-Quarter Forecast – During the third quarter of 2022, the combination of high energy and food prices, supply chain bottlenecks, geopolitical uncertainty and the tightening of monetary policy by central banks will slow economic activity in most parts of the world. While the drivers of slowing growth will be similar, the consequences will change from region to region.” Stratfor Worldview, June 27, 2022

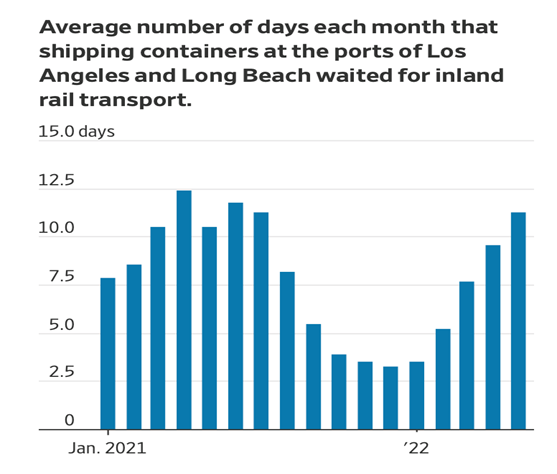

“U.S. Port Backups Are Extending Into Freight Rail Supply Chains – The congestion is raising costs and adding complications for importers managing the flow of goods in a fragile U.S. economy.

Some retailers are waiting weeks to move cargo by train out of Southern California’s ports of Los Angeles and Long Beach, while others are giving up on the railroads and shifting shipments of furniture, apparel and other consumer goods to trucks for long inland journeys on highways.” Wall Street Journal, June 24, 2022

Global, Regional & Local Travel Updates

“Pent-up demand for travel is becoming un-pent,’ says Andrew Charlton of Aviation Advocacy, a consultancy.

The number of seats available on European airlines in the week commencing June 6th was only 9% below the same week in 2019. In North America it was just 5.6% down, according to oag, another consultancy…..up to September sales for international routes are at 72% of their level in 2019 and those on domestic ones are at 66%, according to iata, an industry body.”, The London Economist, June 9, 2022

“Air New Zealand Relaunches International Routes to Meet Travel Demand – Air New Zealand has announced the recommencement of 14 international routes over a 16-day period in July. According to the New Zealand Herald, the airline will relaunch services from Auckland to destinations such as Tahiti, Honolulu and Houston that have not seen service for just over 800 days.” , Air Geeks, June 24, 2022

Country & Regional Updates

Australia

“Minimum wage increase: Bosses slam Fair Work Commission’s pay boost – On Wednesday morning, the Fair Work Commission announced the national minimum wage would rise by 5.2 per cent to $21.38 per hour or $812.60 per week, representing an increase of $40 per week. Modern award minimum rates will also go up 4.6 per cent “subject to a minimum increase of $40 per week”, and both increases will come into effect from July 1 for most workers.”, News.com.au, June 16, 2022. Compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

China

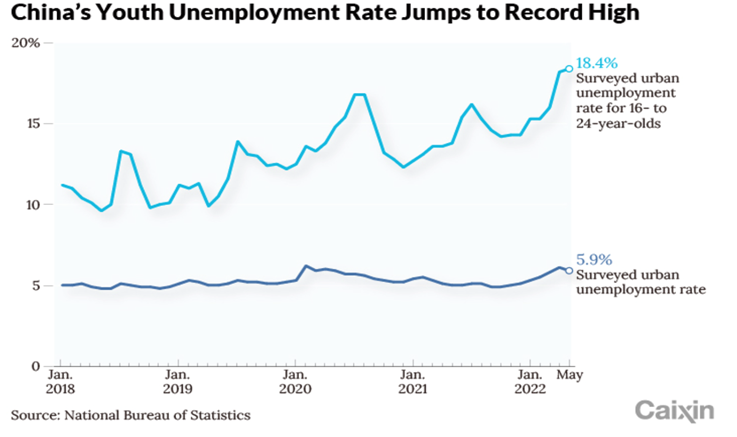

“China’s Record High Youth Unemployment Rate – China’s youth unemployment rate in urban areas in May was the highest since records began in 2018 as Covid-19 lockdowns restricted mobility and weighed on the labor market, with the government warning the situation could get worse as millions of fresh graduates start looking for work. The surveyed urban unemployment rate among workers aged 16 to 24 — which captures graduates from high school and college — climbed to 18.4% in May from 18.2% in April….”, Caixing Global, June 15, 2022

Germany

“Another strike at major German ports as pay negotiations break down again – As the RMT union leads UK rail workers in their second day of walkouts, new industrial action is also under way at German ports. Negotiations in Bremen between German trade union ver.di and the Central Association of German Seaport Companies (ZDS) broke down yesterday. Beginning at 6am, the strikes are affecting the ports of Bremerhaven, Hamburg and Wilhelmshaven – road, rail and sea cargo, Maersk said – and run until 6am tomorrow.”, The Loadstar, June 23, 2022. Compliments of Vince Iacopella, EVP Growth and Strategy, Alba Wheels Up International Inc.

Spain

“Amazon to add 2,000 jobs to its Spanish payroll in 2022 – U.S. online retailer plans to add 2,000 new jobs to its Spanish payroll in 2022, the company’s local unit said on Thursday, a move that will take the total number of employees in Spain to 20,000 by the end of the year. The new hirings include more than 500 jobs within high-demand sectors such as engineering, software development, data science and machine learning….”, Reuters, June 23, 2022

United Kingdom

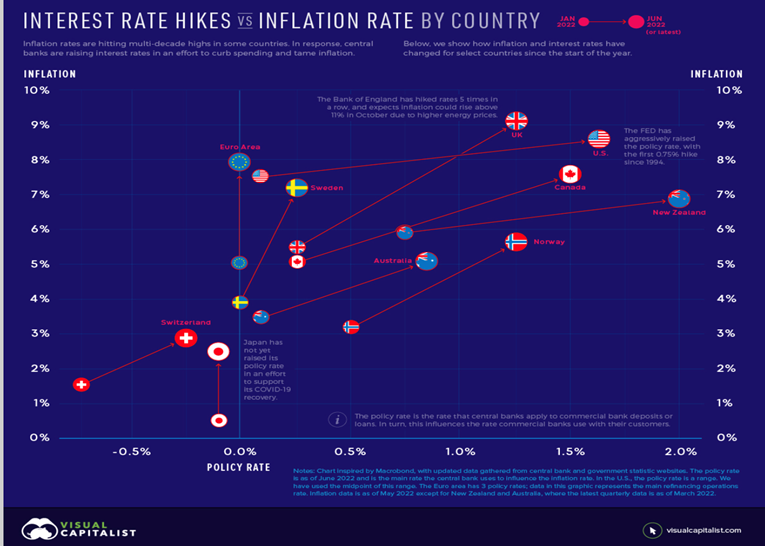

“Interest rates set to rise to 1.25% as Bank tries to curb inflation – Interest rates will rise today for the fifth time in a row to 1.25 per cent amid calls for Boris Johnson to level with the public about the cost of living crisis. The Bank of England is expected to increase rates by 0.25 percentage points from what was already a 13-year high as it seeks to rein in inflation. The Federal Reserve, America’s central bank, went further yesterday, increasing interest rates by 0.75 percentage points, the sharpest rise since 1994.”, The Times of London, June 15, 2022

United States

“Lego Brings Manufacturing Back To The U.S., 15 Years After Pulling Plug – The Denmark-based toy company, which makes the colorful plastic building blocks that kids have played with for nine decades, said on Wednesday that it plans to invest more than $1 billion in a new manufacturing plant in Virginia. The move will allow it to shorten the distance that its products have to travel to reach the U.S., one of its biggest markets, it said, and thereby avoid the global supply chain chaos that has resulted in major delays and increased costs during the pandemic.”, Forbes, June 15, 2022

Brand News

“This National Pizza Chain Just Announced Plans to Open 1,000 New Locations – In the mood for some pizza? Little Caesars is counting on it and making moves that will ensure every corner of the country has access to their hot-n-ready pies. The majority of Little Caesars franchises currently dominate the New York, New England, and Hawaii markets—but the brand recently expanded internationally in Russia, Spain, Columbia, and Barbados. It’s looking to also open more in Brazil, France, the Philippines, Malaysia, and the United Arab Emirates.”, Eat This, Not That, June 23, 2022

“The former McDonald s opened under the new brand Vkusno and that’s it – Big Mac and McFlurry will disappear from the menu, and prices will be higher. The first 15 restaurants of the former fast food chain McDonald’s opened last weekend under the new brand “Tasty – and that’s it.” By the end of the month, the number of open restaurants will increase to 200. The American corporation, which managed 718 restaurants in 45 regions, sold the Russian business at a significant discount, reserving the opportunity to buy it back within 15 years, the new owner of the chain, Alexander Govor, told Vedomosti in an interview.”, Vemdoosti.ru, June 13, 2022. Compliments of Paul Jones, Jones & Co., Toronto. (English translation available on Google)

“Allegro taps bankers to deliver Pizza Hut exit – Allegro Funds’ turnaround at Pizza Hut Australia looks just about complete, with the private equity firm preparing to hang up the for-sale sign and seek a growth-minded buyer. Six years after taking the reins, and after a lengthy restructure, it is understood Allegro Funds has hired Miles Advisory and had the firm’s dealmakers preparing potential buyers for a confidential auction.”, Australia Financial Review, June 13, 2022. Compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

“US Fried-Chicken Chain Popeyes Expands in UK With Six New Sites….where its first location has become the brand’s best-performing restaurant globally since it launched last year. Popeyes, owned by Restaurant Brands International Inc., will roll out sites in Nottingham, Gateshead, Oxford, Reading, Brighton and Ealing. It currently runs delivery kitchens around London and a take-away restaurant in east London’s Stratford, now the best-performing of Popeyes’ 3,600 worldwide. The company also opened a sit-in restaurant in Chelmsford over the weekend.”, BBN Bloomberg, June 13, 2022

“Wendy’s New Zealand up for sale – The New Zealand arm of the well-known Wendy’s hamburger chain is on the market, including all 22 company-owned stores. Wendy’s NZ, the current master franchisee, owner and operator of all Wendy’s hamburger restaurants throughout New Zealand, is on the market for the first time in 34 years.:”, Franchise New Zealand magazine, June 23, 2022

“Wingstop opens its first restaurant in Canada – the company is opening a location this month in Toronto, one of 100 planned for the country as the chicken wing chain pushes international growth more aggressively…..The vast majority of the brand’s 1,800 locations are in the U.S., but a growing number of them are outside the country. Wingstop finished 2021 with just under 200 locations, up by 160% over the past five years, according to Technomic. The brand has found success in Mexico, Europe, Asia Pacific and the Middle East.”, Restaurant Business, June 20, 2022

Articles & Studies For Today And Tomorrow

“Interest Rate Hikes vs. Inflation Rate, by Country – Imagine today’s high inflation like a car speeding down a hill. In order to slow it down, you need to hit the brakes. In this case, the “brakes” are interest rate hikes intended to slow spending. However, some central banks are hitting the brakes faster than others. This graphic uses data from central banks and government websites to show how policy interest rates and inflation rates have changed since the start of the year. It was inspired by a chart created by Macrobond.”, Visual Capitalist, June 24, 2022

“Visualizing the World’s Population by Age Group – An aging population can have far-reaching consequences on a country’s economy. With this in mind, today’s graphic looks at the age composition of the global population in 2020, based on the latest figures from the United Nations. Our global population is getting older, largely because of increasing life expectancies and declining birth rates. In 2020, more than 147 million people around the world were between the ages of 80-99, accounting for 1.9% of the global population.”, United Nations, Pew Research Center, June 16, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 58, Tuesday, June 14, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Our company’s June 2022 quarterly EGS GlobalVue™country ranking chart is out. The U.S. stops requiring COVID tests to enter the country. Economic optimism in India and Indonesia. Premium gasoline is US$7/gallon in California. McDonald’s clones open in Moscow. China’s small businesses are the post-COVID focus.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Life is like a camera. Focus on what is important. Capture the good times. Develop from the negatives. And if things do not work out, take another shot!!”, Anonymous

“Yesterday is history. Tomorrow is a mystery. And today? Today is a gift. That’s why we call it the present.”, Babatunde Olatunji

“Happiness is not something ready made. It comes from your own actions.”, The Dalai Lama

Highlights in issue #58:

- Brand Global News Section: Denny’s®, KFC®, McDonald’s®, Panera Bread®, Subway®, Taco Bell®

Interesting Data and Studies

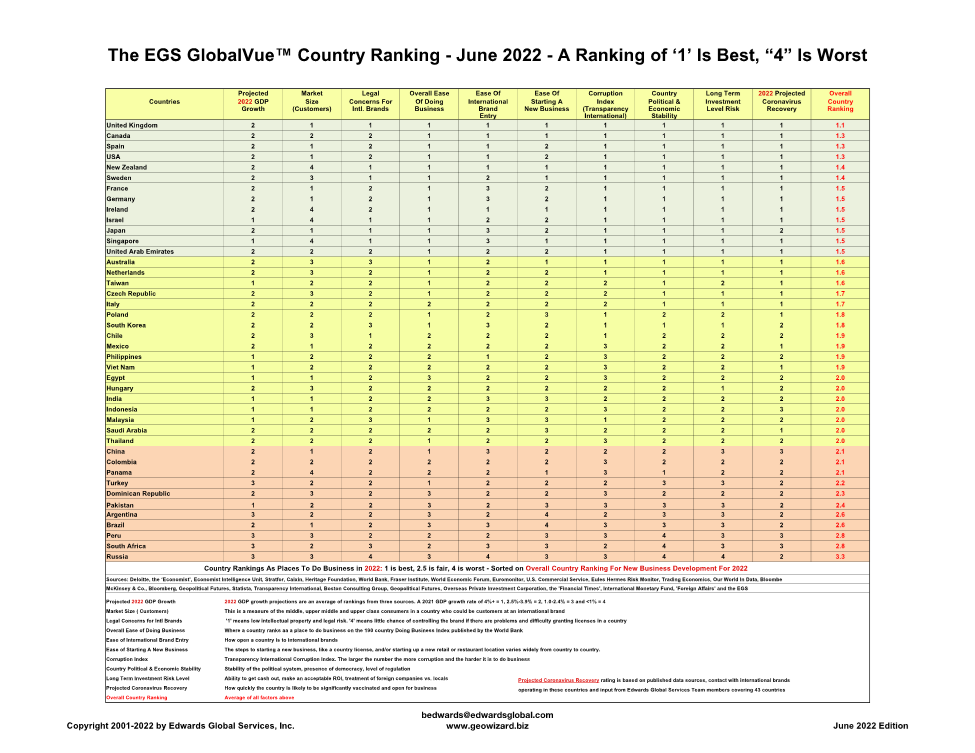

The EGS GlobalVue™ June 2022 Country Ranking Chart

In the June 2022, the EGS GlobalVue™ country ranking, Canada, Indonesia, Mexico, New Zealand and the Philippines have moved up since the March report and is primarily due to continued recovery from the COVID-19 pandemic. Russia moved down due to the Ukraine war cutting off its trade with other countries.

The EGS GlobalVue™ country ranking of places to do business was established in 2001 and is released 4x annually. The report contents are based on the latest economic and political trends in 40+ countries across the globe; feedback from EGS GlobalTeam™ members covering 43 countries; and our daily review of over 30 international vetted information sources.

Global Energy & Commodities

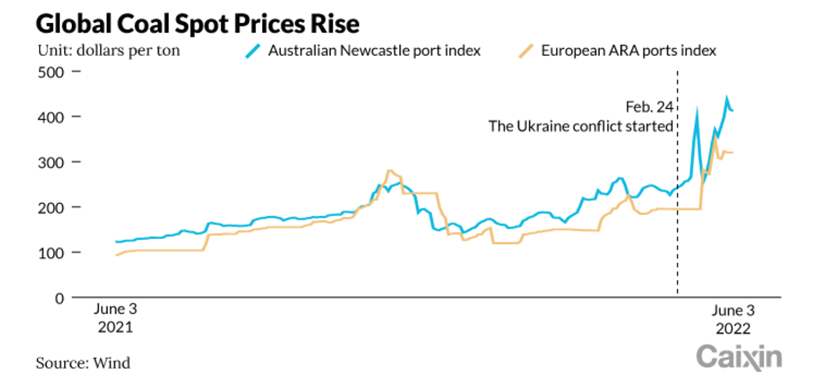

“China’s Never-Ending Coal Price Woes – Since the week of March 10, the price for a ton of the benchmark 5,500 kilocalorie per kilogram (kcal/kg) thermal coal has mostly been over 1,155 yuan ($173). Even after that figure was set as the cap for coal prices by the National Development and Reform Commission (NDRC) on May 7, prices remained well above that level. As of the week of May 26, the latest weekly report available, the price had reached 1,255 yuan, figures from the China Electricity Council (CEC) showed.”, Caixing Global, June 9, 2022

“UK ramps up gas and oil exports to EU amid Russia’s war in Ukraine – Britain’s goods exports to EU a record £16.4bn in April despite impact of Brexit. Reflecting the impact of the war in Ukraine as EU nations seek to diversify energy supplies away from Russia, the data suggests the UK is acting as a hub for liquified natural gas (LNG) imports from the rest of the world before pumping it through pipelines to the continent. UK fuel exports rose by £500m on the month, driven by gas and crude oil to the Netherlands and Ireland, in a sign of heightened demand on the continent to refill gas storage sites in the run-up to winter.”, The London Guardian, June 13, 2022

Global Supply Chain, Commodities, Inflation & Trade Update

“The War in Ukraine and the Rush to Feed the World – Russia’s invasion of Ukraine has led to a major humanitarian crisis, not just in Ukraine but also around the world. Given the region’s importance as a breadbasket to the world, the impact on key food commodities such as wheat and sunflower oil has been immediate, resulting in massive shortages and price shocks. What’s worse, Russia is a key producer of fertilizers and of the energy needed to distribute available food and to grow more. According to the World Bank, global food prices are on track to rise 23% this year, after having risen 31% in 2021, and the cost of the inputs and fuel required to produce and move the food that the world will need tomorrow is also rising.”, Boston Consulting Group, May 17, 2022

“Financial Times Data explorer: consumer price inflation – Annual % change in consumer price index. The latest figures for most of the world’s largest economies make for worrying reading, with price pressures surging to the highest level in many decades.”, Financial Times, June 13, 2022

Global, Regional & Local Travel Updates

“Airline travel to take off after COVID testing drops for international trips – The Biden administration will stop requiring air travelers to take Covid-19 tests in order to fly to the U.S. starting on Sunday, said federal officials, ending one of the last vestiges of travel restrictions employed during the pandemic to try to stem the spread of the disease. The Centers for Disease Control and Prevention said it has determined that people flying to the U.S. from abroad no longer need to test negative a day before their departures, based on available science and data, ending a requirement that has been in place since last year. The testing requirement is set to end on June 12 at 12:01 a.m. (Eastern time).”, The Wall Street Journal, June 10, 2022

“Singapore Changi Airport to Reopen Terminals to Meet Demand – Terminal 4 and rest of Terminal 2 to reopen in coming months Transport minister expects the growth trajectory to continue. Terminal 4 will reopen in September and departure operations in the southern wing of Terminal 2 will restart from October, Changi Airport Group (Singapore) Pte said in a statement Friday. The added capacity will allow the airport to better cope with an influx of passengers in the northern hemisphere winter.”, Bloomberg, June 10, 2022

“Thailand Ready to Scrap Last of Pandemic-Era Curbs on Tourists – Tourism ministry to propose ending pre-travel registrations Visa-on-arrival expansion planned to attract foreign visitors. Thailand plans to end mandatory pre-travel registration for foreigners, rolling back the last of the pandemic-era curbs, as the tourism-reliant nation bets on global visitors to power its economic recovery. The move would go into effect next month and has the backing of the Health Ministry, he said.”, Bloomberg, June 9, 2022

Country & Regional Updates

Australia

“Endota buys in NZ to try to replicate Aussie success – Australian spas and wellness products company Endota has acquired New Zealand’s largest day spa group Forme Spa to try to put a rocket under its international expansion plans. Endota operates 120 spas and distributes products to 11 countries including Canada, Thailand, Malaysia, and China with a group turnover of approximately $170 million. The Forme acquisition adds nine locations around New Zealand to Endota’s studio chain.”, Franchise Advisory Centre, Brisbane, June 10, 2022

Canada

“Nutrien plans major potash production hike as war in Ukraine exerts relentless pressure on global supplies. Nutrien Ltd. is planning a major ramp up in potash production, as the war in Ukraine exerts relentless pressure on global supplies of the key fertilizer. The world’s biggest fertilizer producer, based in Saskatoon, said on Thursday that it intends to boost its annual potash production to 18 million tonnes by 2025 – about 21.5 per cent higher than current levels. This year, Nutrien expects to produce about 14.8 million tonnes, a figure that had already been revised upward.”, The Globe & Mail, June 9, 2022

China

“China’s struggling private firms tasked with lifting nation out of economic doldrums – Call to action comes at annual gathering of China’s business leaders that serves as an influential idea-exchange forum. China’s private firms have taken an especially hard economic hit over the past year, whereas state-owned enterprises have remained mostly intact or even thrived. With China’s economic headwinds intensifying amid rising internal and external uncertainties, the country’s private sector has been tasked with rebooting the economy, despite having borne most of the pain of the current economic downturn.”, South China Morning Post, June 13, 2022

“Uncertainty Weighs on British Businesses in China Amid Lockdowns, Chamber Says – A majority of British companies in China have forecast falling revenues for 2022 as they expect the country’s current wave of Covid-19 outbreaks and the resulting government response to take a serious toll on business this year. That’s according to an annual business sentiment survey conducted by the British Chamber of Commerce in China, which says “increasing uncertainty” threatens to undermine what many foreign companies see as a major strength of doing business in the country.”, Caixing Global, May 31, 2022

India

“India’s Factory Output Expands to Eight-Month High in April – Index of industrial production rises 7.1%, versus 5% estimate Increasing commodity prices could hurt nascent recovery. Domestic demand is powering the Indian economy from the pandemic-induced slump but geopolitical tensions threaten to thwart the nation’s nascent recovery. Rising commodity prices and supply chain disruptions have further fueled inflationary concerns forcing the country’s central bank to cumulatively raise rates by 90 basis points this year to tame prices.”, Bloomberg, June 10, 2022

Indonesia

“Optimism in Indonesia as youth prospects improve amid economic recovery – Experts say nation ‘on track to recovery’ post Covid and doing better than other countries, with controlled inflation and subsidies to poorest citizens. Adhi Saputro, a senior economist at Prospera Indonesia, a partnership between Australia and Indonesia to support the latter’s economy, said Indonesia was “on track to recovery” and faring “better relative to other countries” particularly with inflation under control and windfall profits from commodity price surges.”, South China Morning Post, June 13, 2022

Russia