EGS Biweekly Global Business Newsletter Issue 56, Tuesday, May 17, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

In 2022, our company is actively seeking international partners for our Clients in Australia, Canada, Egypt, Germany, Israel, Italy, Japan, Mexico, New Zealand, Spain, the United Arab Emirates and the United Kingdom. Getting back to pre-COVID activity!!!!

Prior to the pandemic, 60% of our business for the first 18 years of our company was in Asia. Most of Asia and the Americas remain either partially shutdown or do not have investors ready for new projects this year. 2023 will see Asia come back.

Since September 2021, I have been back on the road in Canada, Israel, Germany, Italy, Mexico, the Netherlands and the United Kingdom meeting and evaluating Client partners. Next are Australia and New Zealand. Then India, Mexico, the United Arab Emirates and the United Kingdom.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Play by the rules, but be ferocious.”, Phil Knight, Founder and CEO of Nike

“Success usually comes to those who are too busy to be looking for it.”, Henry David Thoreau

One small positive thought can change your whole day.”, Zig Ziglar

Highlights in issue #56:

- Brand Global News Section: Chipotle®, Denny’s®, McDonald’s®, Papa John’s® and Wendy’s®

Interesting Data and Studies

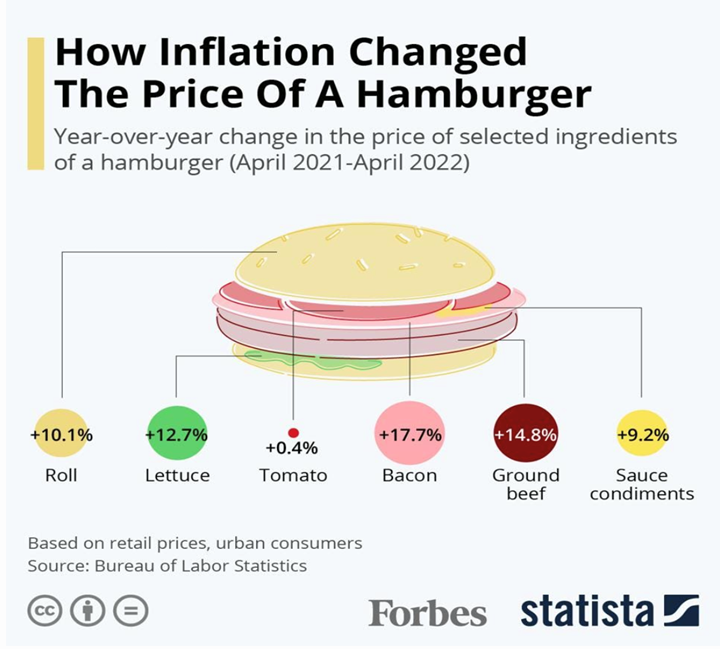

“How Inflation Changed The Price Of A Hamburger – Food and energy—the more volatile items in the Consumer Price Index—drove rising cost of living. Especially energy, in short supply following the Russian invasion of Ukraine and ensuing sanctions, was a major culprit. Costs rose by more than 30% since April 2021 independent of the base effect, as energy prices had already reached pre-pandemic levels one year ago. Food prices also took some significant steps up, as seen in the example of shopping for hamburger ingredients.”, Forbes, May 13, 2022

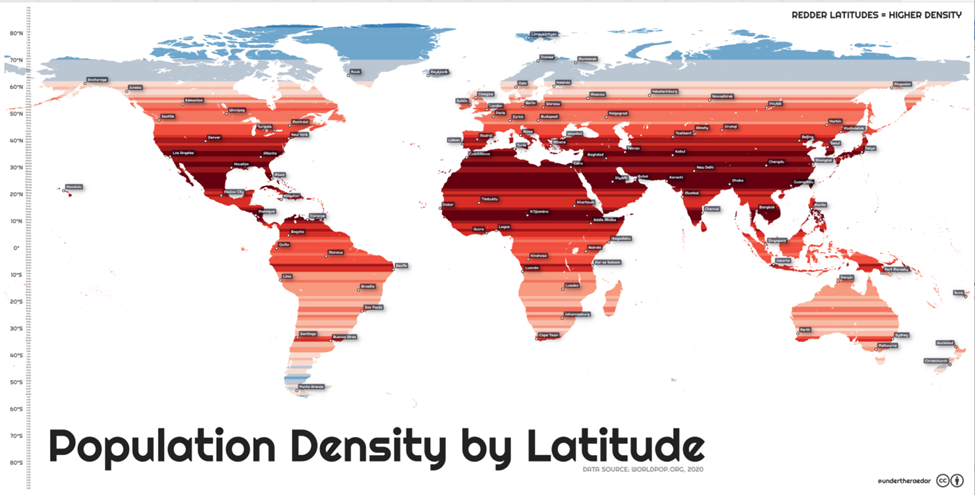

“The World’s Population Density by Latitude – When you think about areas with high population densities, certain regions spring to mind. This could be a populous part of Asia or a cluster of cities in North America or Europe. Usually density comparisons are made using cities or countries, but this map from Alasdair Rae provides another perspective. This world map depicts population density by latitude, going from the densest populated coordinates in deep red to the sparsest in light blue.”, Visual Capitalist / Worldpop.org, 2020

Global Energy

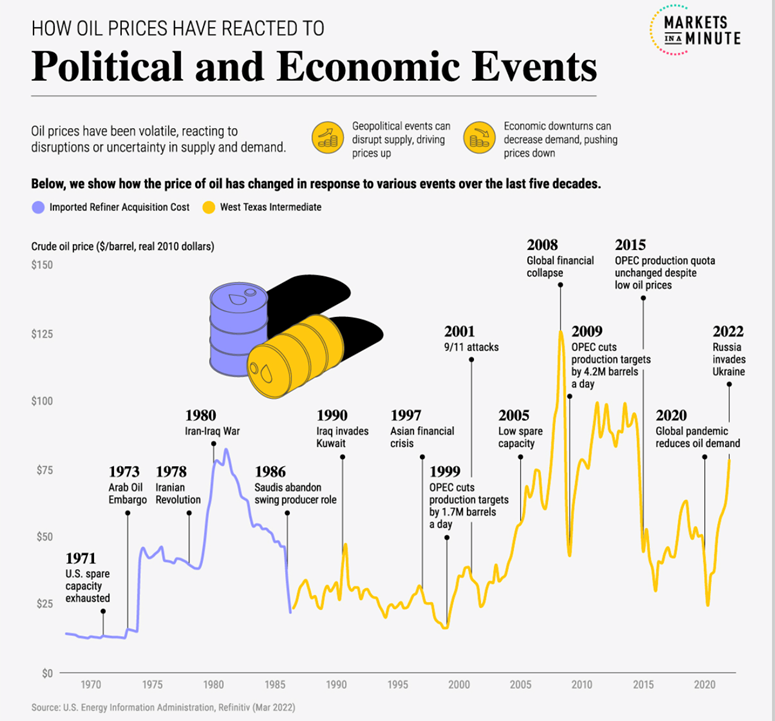

“Visualizing Historical Oil Prices (1968-2022) – Amid Russia’s invasion of Ukraine, the inflation-adjusted price of oil reached a seven-year high. Russia is one of the world’s largest producers of crude oil, and many countries have announced a ban on Russian oil imports amid the war. This has led to supply uncertainties and, therefore, rising prices.

How does the price increase compare to previous political and economic events? In this Markets in a Minute from New York Life Investments, we look at historical oil prices since 1968.”, Visual Capitalist / U.S.. Energy Information Administration, March 2022

Global Supply Chain & Trade Update

“Diversify global supply chains, don’t dismantle them, IMF says – The COVID-19 pandemic wreaked havoc on global supply chains but new International Monetary Fund research shows that more diversification of source countries and inputs can significantly reduce the economic drag from supply disruptions.

In an analytical chapter of its forthcoming World Economic Outlook, IMF researchers said that countries experienced larger declines of goods imports, and GDP, in the first half of 2020 when trading partners imposed strict COVID-19 lockdowns. ‘Dismantling global value chains is not the answer. More diversification, not less, improves resilience,’ the researchers wrote in a blog post accompanying the chapter.”, Reuters, April 12, 2022

Global, Regional & Local Travel Updates

“Business Travel CEOs Say the Sector is Back as Border Controls Evaporate – Fliers are spending big to get back in the air, and away from Zoom. Business travel, contrary to some expectations in the thick of the pandemic, is coming back. While bookings may not have reached pre-Covid levels, there’s mounting evidence of a rebound, the strength of which is taking some by surprise.”, Bloomberg, May 13, 2022

“European Union To Lift Airport And Airline Mask Requirements Next Week – The European Union says it will no longer require masks at airports and on planes starting next week throughout its 27-country bloc. The lifting of the mask mandate is in response to lowering COVID-19 cases throughout the EU, but officials say each member can decide for itself to reinstate the mask mandate should COVID-19 cases spike.”, Travel Awaits, May 13, 2022

Country & Regional Updates

China

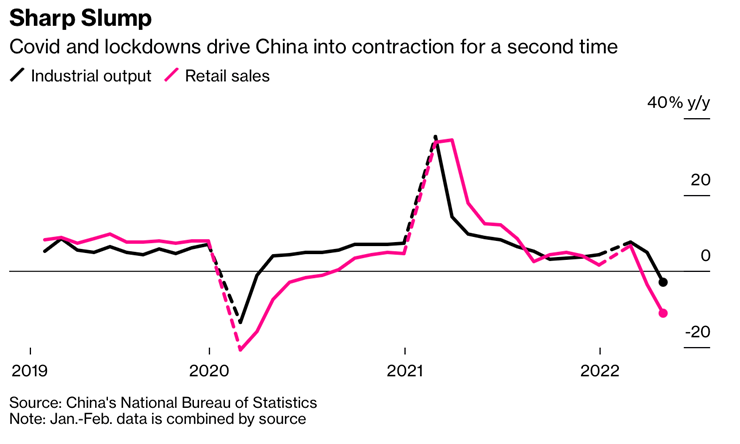

“China’s Economic Activity Collapses Under Xi’s Covid Zero Policy – Factory output, retail plunged in April; joblessness rose Economists say Covid restrictions mean slow recovery. China’s economy is paying the price for the nation’s Covid Zero policy, with industrial output and consumer spending sliding to the worst levels since the pandemic began and analysts warning of no quick recovery.

Industrial output unexpectedly fell 2.9% in April from a year ago, while retail sales contracted 11.1% in the period, weaker than a projected 6.6% drop. The unemployment rate climbed to 6.1% and the youth jobless rate hit a record. Investors responded by selling everything from Chinese shares to US index futures and oil.”, Bloomberg, May 15, 2022

“Small Businesses Suffer as Lockdowns Cut Revenue, Cash Flow – China’s small businesses are grappling with tighter cash flow and diminishing revenue as their costs rise and demand weakens, a survey shows.

The pressure on smaller companies’ liquidity reflects the impact of the country’s “zero-Covid” strategy, as extended lockdowns disrupt or altogether prevent activity and weaken sentiment going forward. In the first quarter, the polled micro and small businesses had enough cash flow to operate for 2.4 months on average, down 0.3 months for the fourth quarter of 2021, according to a survey jointly conducted by Peking University and fintech giant Ant Group Co. Ltd.”, Caixin Global, May 13, 2022

European Union

“The European Union has downgraded its growth forecasts as high energy and food costs caused by Russia’s invasion of Ukraine hit economies across Europe. GDP growth in both the EU and the eurozone is expected to be 2.7 per cent this year, down from its previous estimate of 4 per cent growth. Growth next year is forecast to slow to 2.3 per cent from 2.8 per cent (2.7 per cent in the eurozone) previously.

Inflation in the euro area, which hit 7.5 per cent in March, is projected to be 6.1 per cent this year, before falling to 2.7 per cent in 2023. This compares with the winter forecast of 3.5 per cent. For the EU, inflation is expected to increase to 6.8 per cent in 2022, up from 2.9 per cent in 2021, and fall back to 3.2 per cent in 2023.”, The Times of London, May 16, 2022

India

“Morgan Stanley cuts India growth forecasts on inflation, global slowdown – Gross domestic product growth will be 7.6% for fiscal 2023 and 6.7% for fiscal 2024, 30 basis points lower than the previous estimates, the brokerage said in a note dated Tuesday.

The cut reflects a pronounced economic impact from the Russia-Ukraine conflict that has driven up crude prices, pushing retail inflation in India – the world’s third-biggest oil importer – to its highest in 17 months.”, Reuters, May 11, 2022

New Zealand

“New Zealand March Visitor Arrivals Surged 517% as Kiwis Returned – Overseas arrivals surged 517%, to 28,600 from 4,640 a year earlier, Statistics New Zealand said Thursday in Wellington. The total is the most since July last year, when New Zealand closed a quarantine-free travel arrangement with Australia amid concerns about a fresh wave of Covid-19 infections. New Zealand tourist operators are hopeful the progressive reopening of the border will revive their industry, which has been decimated since the pandemic struck in March 2020.”, Bloomberg, May 11, 2022

The Philippines

“Philippines’ Outperforming Economy Boosts Case for Rate Hike – First quarter GDP growth at 8.3% versus 6.8% survey estimate. Gross domestic product in the three months through March grew 8.3% from a year ago, the Philippine Statistics Authority said Thursday, versus the median estimate for a 6.8% expansion in a Bloomberg survey. That compares with a revised 3.8% contraction in the same quarter in 2021.”, Bloomberg, May 12, 2022

Russia

“Almost 1,000 Companies Have Curtailed Operations in Russia—But Some Remain. Originally a simple “withdraw” vs. “remain” list, our list of companies now consists of five categories—graded on a school-style letter grade scale of A-F for the completeness of withdrawal.”, Jeffrey Sonnenfeld and his team of experts, research fellows, and students at the Yale Chief Executive Leadership Institute, May 16, 2022

United Kingdom

“UK Salaries Rise as Firms Face Growing Candidate Shortages – Fewer foreign workers, geopolitical uncertainty stoke scarcity REC report will fuel pressure on BOE for more rate increases. As candidate availability declined for the 14th straight month, starting-salary inflation held close to a record high, the Recruitment and Employment Confederation and KPMG said in a report published Thursday.”, Bloomberg, May 11, 2022

“The economy contracted in March as the war in Ukraine and rising prices hit confidence, according to the latest data from the Office for National Statistics (ONS). Month-on-month gross domestic product fell 0.1 per cent. City economists had forecast flat growth. In the three months to the end of March the economy grew 0.8 per cent, against expectations for 1 per cent growth.”, The Times of London, May 12, 2022

United States

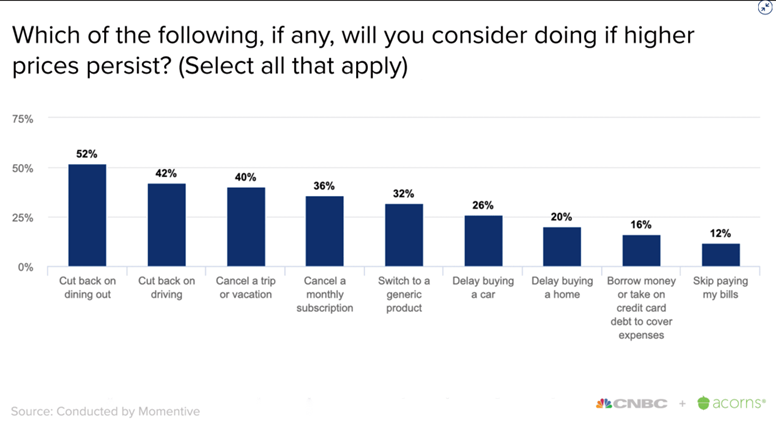

“Inflation remained near a 40-year high in April. Here’s where consumers plan to cut spending. If price pressure continues, more than 50% of adults say they’ll cut back spending on dining out and will consider reducing that further, according to the CNBC + Acorns Invest in You survey, conducted by Momentive. The online survey of nearly 4,000 adults was taken March 23-24.”, CNBC, May 11, 2022

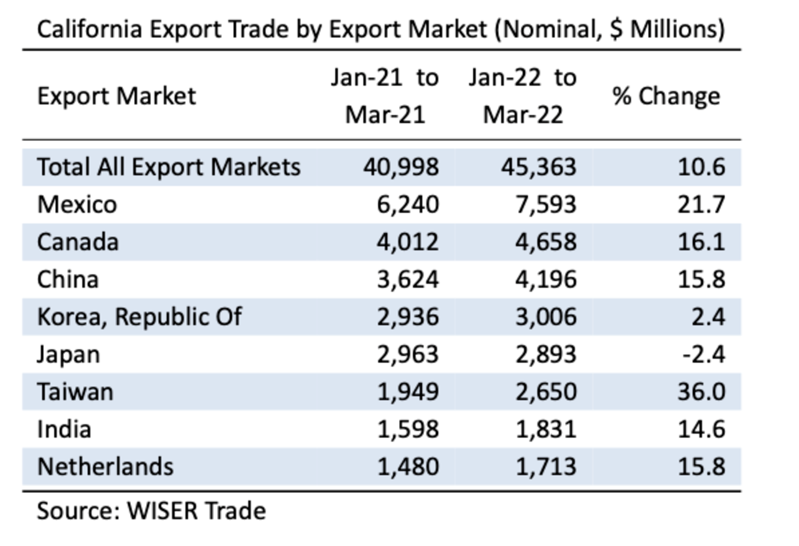

“Double-digit jump in California export value reflects growth and inflation”, Beacon Economic, May 4, 2022

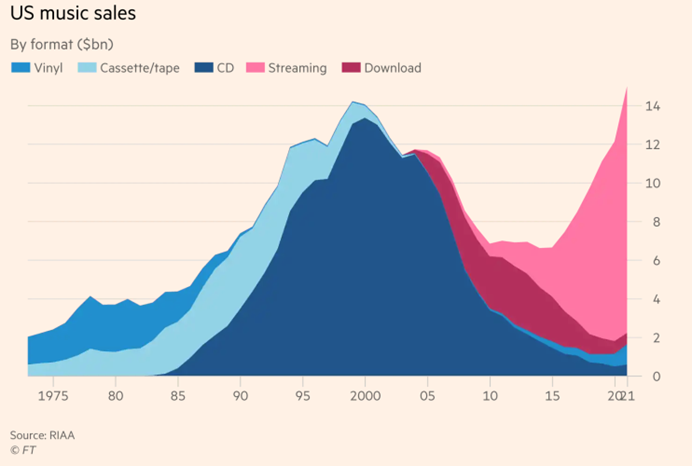

“iPod: technology’s ever changing beat – Enduring love of retro will ensure portable music device’s survival even as US tech group discontinues it. RIP iPod. Apple’s pioneering music-in-your-pocket has gone the way of the BlackBerry, the 244-year-old Encyclopedia Britannica and the dodo. The Cupertino-based tech group this week said it was discontinuing the iPod Touch, its last remaining portable music device.

At 20 years, the iPod had half as long a run as Sony’s Walkman, its clunkier predecessor. The Walkman allowed 1980s cool kids to listen to music cassettes while rollerblading or doing aerobics.”, The Financial Times, May 13, 2022

Brand News

“Denny’s preps for growth as it hires Kelli Valade as CEO – Denny’s has appointed Kelli Valade as CEO and president, effective June 13, the company announced Tuesday. Valade will succeed John Miller, who is retiring on Aug. 3, but will retain his position on the board of directors to help ensure a seamless transition. Valade brings 30 years of experience, and most recently served as CEO at Red Lobster for less than a year. Prior to that position, she was CEO at Black Box Intelligence from 2019 to 2021 and held various roles within Brinker International.”, Restaurant Dive, May 4, 2022

“McDonald’s To Exit from Russia – After more than 30 years of operations in the country, McDonald’s Corporation announced it will exit the Russian market and has initiated a process to sell its Russian business. This follows McDonald’s announcement on March 8, 2022, that it had temporarily closed restaurants in Russia and paused operations in the market. The humanitarian crisis caused by the war in Ukraine, and the precipitating unpredictable operating environment, have led McDonald’s to conclude that continued ownership of the business in Russia is no longer tenable, nor is it consistent with McDonald’s values.”, McDonald’s® press release, May 16, 2022

“McDonald’s Convenience of the Future digital orders offer 11 ways to get a meal – Ordering and eating a Big Mac and fries from a McDonald’s restaurant used to be a binary experience: you went up to the counter, placed your order with a member of the crew and either ate it on the premises or took it away with you.

No longer. A new-look restaurant, unveiled today under the fast-food operator’s £250 million Convenience of the Future investment programme, reflects customers’ increasingly diverse expectations, providing 11 ways of getting a meal. The revamp also reflects the fact that about half of sales are now made through digital channels. In addition to the traditional walk-in and drive-thru, a redesign of the kitchens and dining areas caters to the growth of digital sales channels such as self-order touchscreen terminals….”, The Times of London, May 16, 2022

“Papa Johns plans to open nearly 2,000 stores by the end of 2025 – The quick-service pizza restaurant chain announces big development plans after reporting a successful first quarter, ending with same-store sales up 1.9% in North America. In addition to the sales growth, the Louisville-based pizza chain is also planning an aggressive footprint expansion — especially in international markets — with plans for 1,400-1,800 new stores opening by the end of 2025, and 320 units opening in fiscal ’22, CEO Rob Lynch said.”, Nation’s Restaurant News, May 5, 2022

“Restaurants’ Virtual Stores Test Consumers’ Appetite for Metaverse Marketing

Wendy’s and Chipotle join a growing number of companies exploring the potential of virtual worlds – Fast-food chains Wendy’s Co. and Chipotle Mexican Grill Inc. are testing new experiences in virtual worlds as brands try to better understand the marketing potential of the metaverse. The metaverse is a term used to describe a virtual environment in which people can use digital avatars to work, play and shop. The concept has drawn attention particularly since the parent company of Facebook last year promised to spend heavily on building the metaverse and changed its name to Meta Platforms Inc.

Wendy’s last week opened a virtual restaurant in Horizon Worlds, the virtual reality game from Meta. Visitors cannot buy food there, virtual or otherwise, but they can play a basketball-themed game located near the restaurant.”, The Wall Street Journal, April 5, 2022

Articles & Studies For Today And Tomorrow

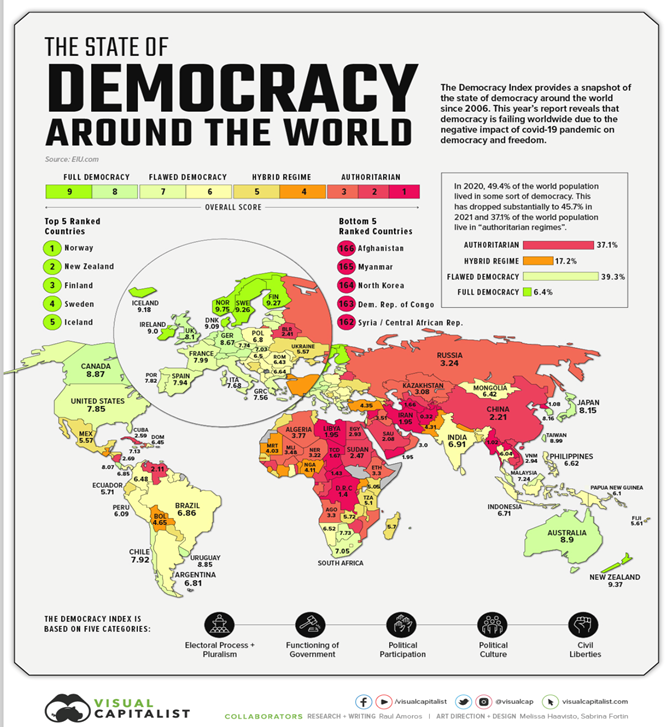

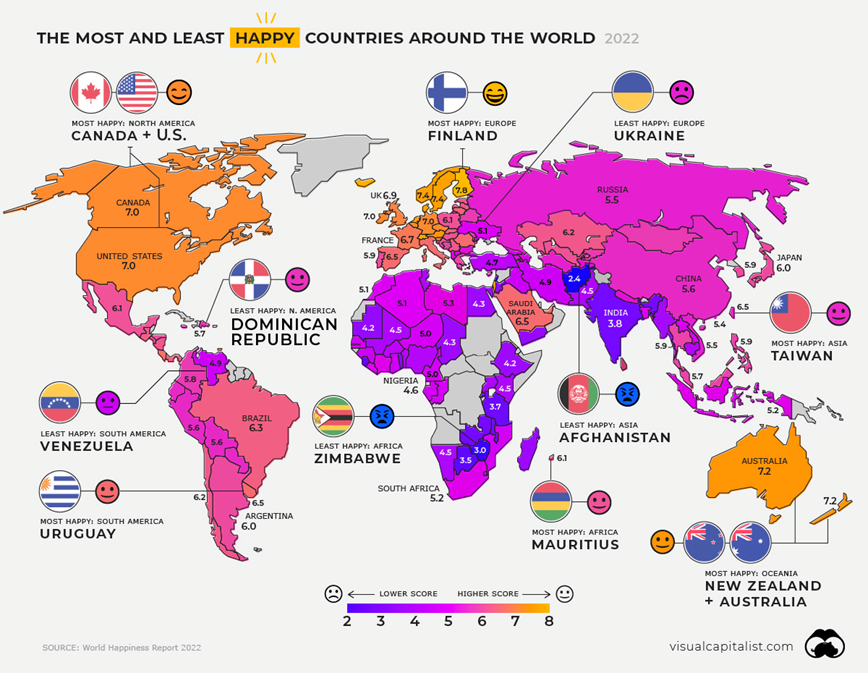

“The State of Global Democracy in 2022 – The world’s (almost) eight billion people live under a wide variety of political and cultural circumstances. In broad terms, those circumstances can be measured and presented on a sliding scale between “free” and “not free”—the subtext being that democracy lies on one end, and authoritarianism on the other.

According to EIU, the state of democracy is at its lowest point since the index began in 2006, blamed in part on the pandemic restrictions that saw many countries struggling to balance public health with personal freedom.”, Visual Capitalist, May 13, 2022

“IFA CEO on what’s ahead for franchise businesses – The past two years have presented unique challenges, with business owners managing the impact of the pandemic and, more recently, elevated inflation. Matthew Haller, president and CEO of the International Franchise Association, discusses the growth outlook for franchising, the group’s advocacy efforts and the advantages of franchised businesses.”, SmartBrief, May 12, 2022

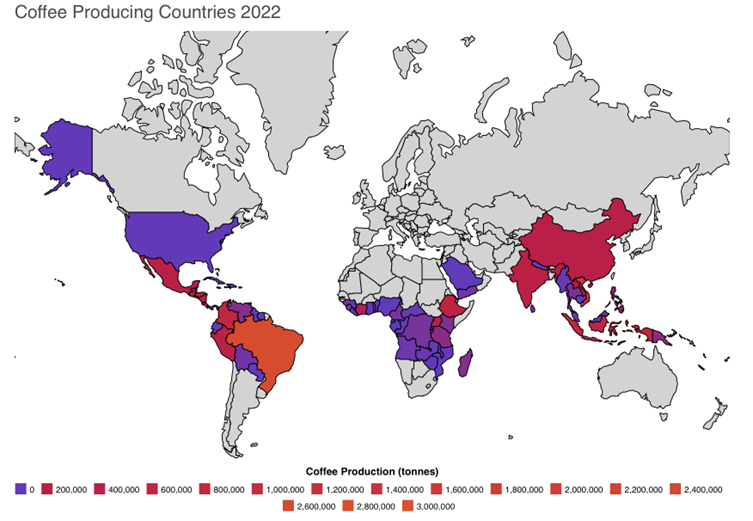

“Coffee Producing Countries 2022 – There’s a prime location for coffee growth and it is called the Bean Belt. This title refers to the area between 25° N and 30° S. Coffee thrives in warmer locations, so anywhere that is too extreme in relation to the northern and southern poles will not be substantial or feasible places to grow coffee. Coffee exportation, as well as coffee as imports, is most common in Africa, Asia, South America, and North America, with the exception of the country of Canada.”, World Population Review, May 13, 2022

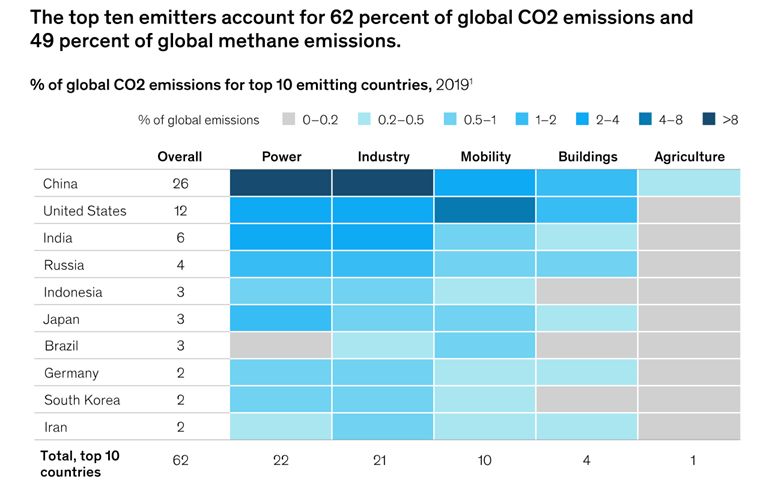

“Asia’s net-zero transition: Opportunity and risk amid climate action – Within just a few generations, life expectancy in Asia–Pacific has more than doubled, the infant mortality rate has fallen more than 70 percent and per capita GDP has risen nearly eighty-fold. People are living longer, healthier, and more prosperous lives. Yet, the environmental cost of human progress, in Asia and elsewhere, is now threatening the stability of the Earth’s climate.”, McKinsey, April 29, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country rankingFor advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 55, Tuesday, May 3, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

In this issue: Did the U.S. economy really shrink in the 1st quarter of 2022? What will it cost the European Union to switch to clean energy by 2050? Did White Castle really sell 28 billion hamburgers? Australia and New Zealand are open for business! And China decides to jump start their COVID hampered economy.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The future does not belong to the fainthearted, it belongs to the brave.”, President Ronald Regan” Space Shuttle Disaster Speech, January 28, 1986

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”, Socrates

“Every day the clock resets. Your wins don’t matter. Your failures don’t matter. Don’t stress on what was, fight for what could be.”, Sean Higgins

Highlights in issue #55:

- Brand Global News Section: Jack’s Café®, McDonald’s®, Sonic®, Unleashed Brands, White Castle® and WingStop®

Interesting Data and Studies

“Lessons from the Pandemic: How Covid is changing franchising – Which industries continued to experience franchise growth and, conversely, which shrank? How well did they perform, and how much “new” unit activity was there? In a typical year, we see about 300 new brands emerge. What about an atypical year like the one we just experienced? As you consider your next franchise investment opportunity, let’s shed some light on these questions.”, Franchising.com, April 2022

Global Energy

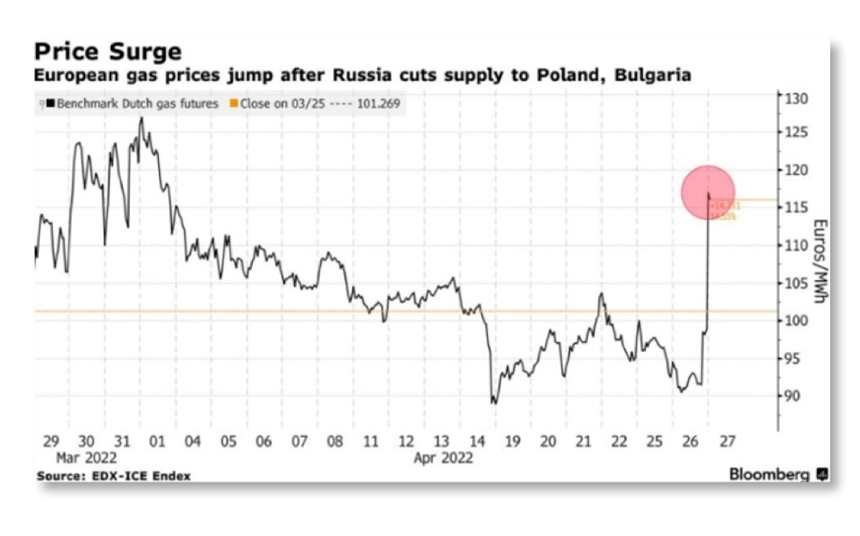

“Citing failure to pay in rubles, Russia halts gas supplies to NATO members Poland and Bulgaria. European gas prices rose roughly 20 percent after state-owned Gazprom announced it would stop supplying gas to Poland and Bulgaria—a move the European Commission President called ‘another attempt by Russia to use gas as an instrument of blackmail.’”, Exiger, April 2022 Supply Chain Report

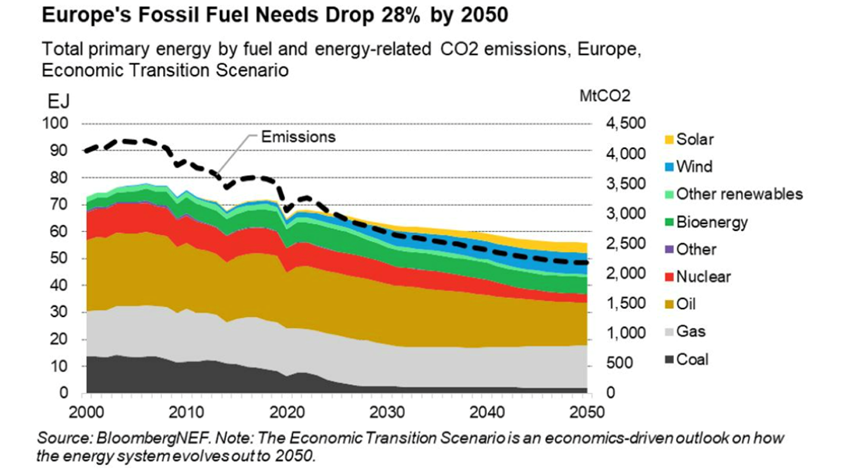

“How much will it cost Europe to switch to clean energy by 2050? Europe could free itself from fossil fuels by 2050, according to a new report from BloombergNEF. However, it will require $3.8 trillion of investment in mostly wind and solar projects. And another $1.5 trillion would need to be spent on green hydrogen developments.”, World Economic Forum, April 27, 2022

Global Supply Chain & Trade Update

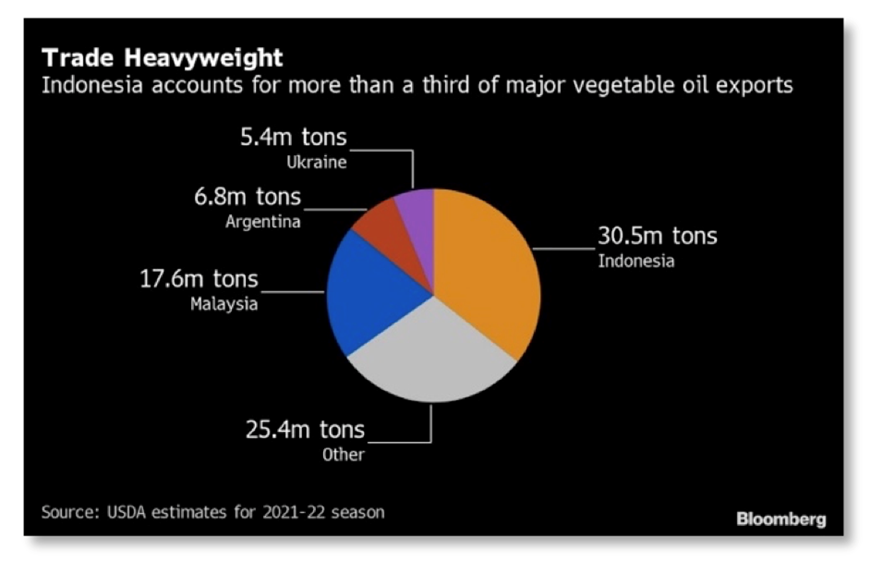

“Indonesia bans palm oil exports, including crude palm oil. The move comes as the price of crude palm oil rose sharply and after the country scrapped previous restrictions imposed in January. In 2020, Indonesia accounted for 46.8 percent of global crude palm oil exports and 52.4 percent of refined exports. Palm oil is the most widely consumed vegetable oil and has applications in other consumer products and biofuels.”, Exiger, April 2022 Supply Chain Report.

Global, Regional & Local Travel Updates

“Global airline capacity hits 2022 high as China demand rebounds – OAG – Global airline capacity has surged to its highest level in 2022 this week because of a rebound in Chinese domestic demand despite extended lockdowns in Asia’s biggest aviation market, travel data firm OAG said on Tuesday. Total global domestic and international airline capacity increased by 3.3% this week to 88.6 million seats, about 20% lower than in 2019.”, Reuters, April 26, 2022

“WH Smith (U.K.) back in black as travel restrictions ease – The stationery chain posted a headline pre-tax profit of £14 million for the six months to the end of February compared with a £19 million loss a year earlier and consensus forecast of £12.5 million. Statutory pre-tax profit came in at £18 million, against a £38 million loss a year ago, on the back of sales rising by 45 per cent to £608 million. Carl Cowling, 48, the chief executive, said the business had delivered a ‘good performance with a strong rebound in profitability. We have seen a recovery across all of our travel markets despite the impact of the Omicron variant.’”, The Times of London, April 28, 2022

Country & Regional Updates

Australia

“Australia set for small business boom, with younger and more diverse founders to start 3.5 million new businesses by 2031, with a massive influx of construction, professional services, and transportation firms helping to add $60 billion to the annual GDP in a decade’s time. A new report from accounting and business services software provider Xero, released Tuesday, states a pandemic-era boom in new business signups, technological progress, and a younger, more diverse class of entrepreneurs will support a million new jobs by 2031. Those new firms are slated to provide 3% to the national GDP in 2031, the report states.”, Smart Company AU, April 26, 2022

Chile

“Chile’s economic activity index bolstered by increase in services – Chile’s IMACEC economic activity index, a close proxy of gross domestic product (GDP), rose 7.2% in March from the same month last year, the country’s central bank said on Monday. That was above market expectations of a 6.3% rise, according to a Reuters poll of economists. In a statement, the central bank said the rise was ‘mainly explained by the increase in services activity.’ It said services, including transport and business services, rose 12.2%. Commerce also registered a 8.6% rise, boosted by retail sales, household equipment and automobile sales.”, Reuters, May 2, 2022

China

“China Puts Its Foot on the Gas to Spur a Faltering Economy – The State Council, China’s cabinet, issued sweeping guidelines Monday for bolstering economic activity after retail sales fell 3.5% year-on-year in March, the first contraction since August 2020. The guidelines call for greater assistance to businesses hit by the pandemic, including implementation of tax cuts, tax rebates and fee reductions to support manufacturing, small and micro companies, and sole proprietors. Caixing Global, April 27, 2022

“China to end regulatory storm over Big Tech and give sector bigger role in boosting slowing economy, sources say – The key message to tech companies is that the state wants them to grow and play a role in Beijing’s efforts to bolster an economy battered by Covid-19 controls, such as through the distribution of consumption vouchers, according to one source.”, South China Morning Post, April 29, 2022

Germany

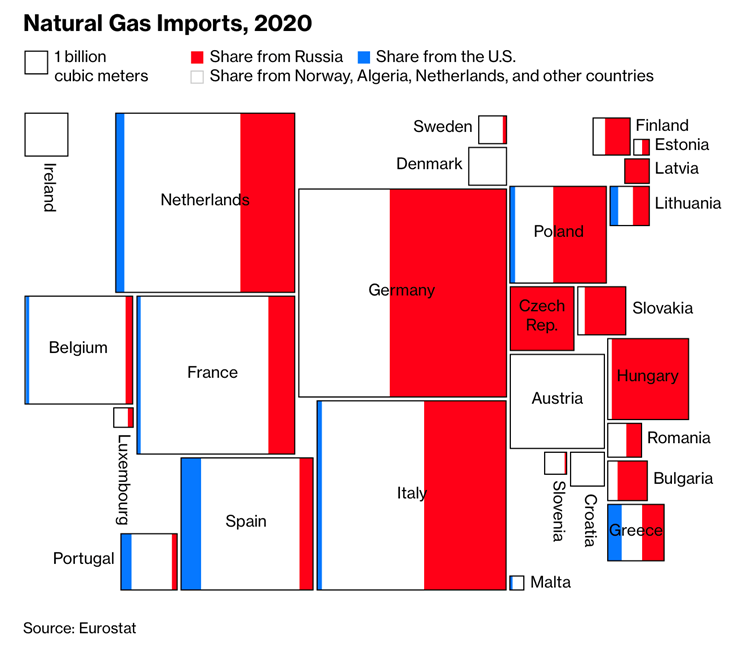

“Germany Speeds Up Time Frame For Ending Russian Oil Dependence – Germany could end its reliance on Russian oil by the close of summer, the country’s Federal Ministry of Economics and Technology reportedly announced Sunday, stepping up its previous timeline by at least three months—barely three weeks after the European Union announced a ban on Russian coal imports. The ministry said a German oil embargo taking effect near the end of summer following “a sufficient transition period” would be manageable, according to a government report released Sunday and translated by Bloomberg.”, Forbes, May 1, 2022

New Zealand

“New Zealand welcomes first tourists in two years as Covid restrictions lifted – Tourists from more than 50 countries including the UK travelled to New Zealand for the first time in more than two years this week after the government dropped most of its pandemic border restrictions. Before the pandemic more than three million tourists visited each year, accounting for 20 per cent of New Zealand’s foreign income and more than 5 per cent of the overall economy.”, The Times of London, May 2, 2022

The Philippines

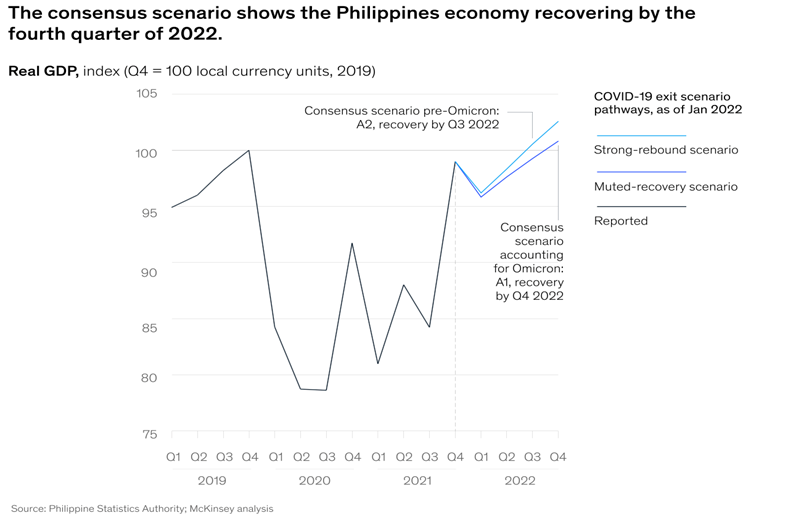

“Companies doing business in the Philippines are assessing the implications of COVID-19 on the country’s economy. They are likely to find that three shifts introduced during the pandemic will persist into the future: economic activity will be digitally enabled but also hyperlocal; the wealth gap is widening, and new consumer segments have emerged; and the pandemic is likely to result in a greener and more sustainable economy. Meanwhile, the consensus view shows the Philippines economy recovering by the fourth quarter of 2022 under a muted scenario, even taking the Omicron wave into account.”, McKinsey, April 26, 2022

Saudi Arabia

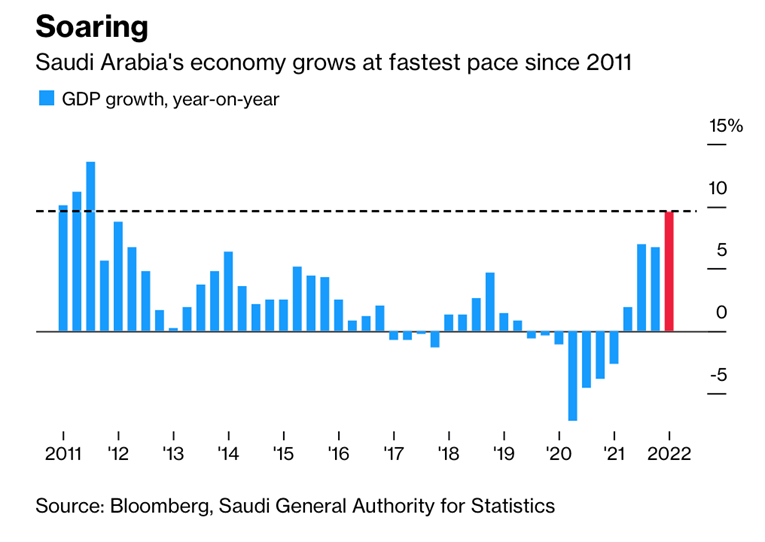

“Saudi Economy Grows at Fastest Pace in a Decade on Oil Boom – Kingdom’s GDP rose by 9.6% year-on-year in the first quarter. Economy benefiting as crude prices and production increase. Gross domestic production rose by 9.6% year-on-year, the Saudi General Authority for Statistics said. That’s the highest figure since the third quarter of 2011, according to data compiled by Bloomberg.”, Bloomberg, May 1, 2022

South Korea

“South Korea’s Recovery Eased Last Quarter Amid Omicron Wave – Gross domestic product expanded 0.7% from prior three months Policy makers aiming to support growth while curbing inflation. The result highlights the challenge for policy makers: supporting an economy that’s set to be buffeted by war in eastern Europe and widespread lockdowns in key trading partner China; yet also battling to stem inflationary pressure that’s mounting worldwide. The upshot is economists expect the Bank of Korea will raise interest rates further, having already hiked twice this year.”, Bloomberg, April 25, 2022

United Kingdom

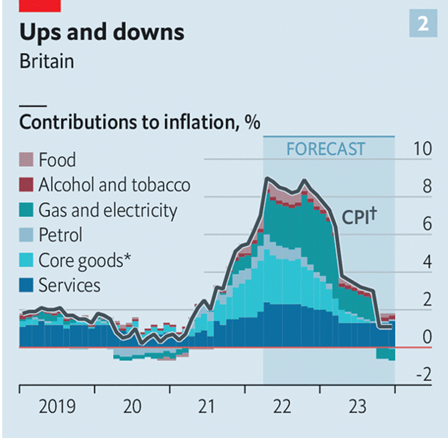

“A guide to Britain’s cost-of-living crunch – In March the rate of annual inflation in Britain reached 7%, the biggest such increase in 30 years. Energy bills are rising most sharply, but price increases are occurring across the board. The consequence will be a fall in living standards over the coming fiscal year of 2.2%, a drop not seen since records began in the 1950s. Energy prices have been rising dramatically for many months, but after Russia’s invasion of Ukraine some types saw a particular surge. The cost of heating oil, used by around 3% of Britons to heat their homes in winter, soared by 44% in March compared with the prior month.”, The Economist, April 23, 2022

United States

“Did the U.S. Economy Really Shrink in Early 2022? Is a Recession Near? No, and Here’s Why. Let’s start with the 1.4% drop in gross domestic product, the headline number that gets all the attention. GDP is the official scorecard of sorts for the economy. Most of the decline was tied to a record U.S. trade deficit, shrinking inventories and less government spending. Added altogether and these oft-volatile categories subtracted a whopping 4.5 points from GDP.

Strip out reduced U.S government spending and final sales to private customers—that is, households and businesses—rose an even stronger 3.7%. Looked at that way, the U.S. economy actually strengthened from January to March compared to the end of last year, when the headline GDP numbers were much higher. GDP rose at a 6.9% rate in the fourth quarter and 2.3% in the third quarter.”, Barron’s, April 28, 2022

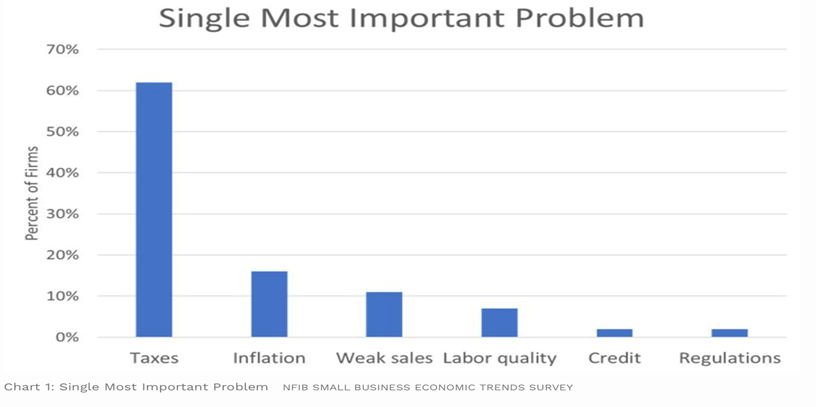

“Small Business’ Number One Problem – New small business owners face a myriad of challenges getting their business ideas up and running. Marketing, securing products, staffing, and establishing processes are just few challenges new owners might have to navigate. However, there is a whole other set of challenges that are often unexpected, the unwelcomed “partnership” with government, federal, state, and local. Likely aware of the tax law, what probably surprised them was the plethora of regulations, compliance costs, licensing, etc. associated with their new firm and location.”, Forbes, April 28, 2022

Brand News

“Cutting-edge technology is nothing new for Sonic – The concept owes its long run in no small part to recognizing a game-changing piece of equipment back when TV was a novelty. After seven decades in business, Sonic finds itself once again in alignment with the lifestyles of the times, President Claudia San Pedro commented while being honored last week as the 2022 Restaurant Leader of the Year.”, Restaurant Business Online, April 19, 2022

“Hungry Jack’s launches Jack’s Cafe across WA restaurants – Hungry Jack’s has launched its sister coffee chain Jack’s Cafe across its 65 restaurants in Western Australia. The state-wide launch is part of the business’ plan to roll out the beverage brand across all 450-plus locations by June.”, QSR Media AUS, April 20, 2022. Compliments of Jason

“McDonald’s lost $127m from shuttering restaurants in Russia and Ukraine – The fast-food giant said they’re losing about $55m a month in sales from their pull-out in Russia….CEO Chris Kempczinski noted that the company continues to pay the salaries of its 62,000 employees in Russia, as well as their Ukrainian staff, who similarly saw their 108 restaurants closed in the fallout from the ongoing conflict.”, Independent, April 30, 2022

“Unleashed Brands Acquires XP League Esports Franchise – XP League addresses the void between traditional youth athletics and competitive esports. (For the uninitiated, esports are multiplayer video game competitions that are played with spectators.) XP League, an esports league that’s structured like classic youth sports organizations, promotes development of sportsmanship, teamwork and other positive behaviors related to competition.”, FranchiseWire, April 28, 2022

“You Won’t Believe How Many Total Hamburgers White Castle Has Sold – century is a long time to do anything. How many living people have even existed for that long? But White Castle can boast that it’s a centenarian of the food business, selling its famous sliders for around 101 years……..White Castle has hit a major stat when it comes to sales. The company announced that it has sold more than 28 billion Original Sliders and Cheese sliders.”, Mashed, April 30, 2022

“Wingstop doubles its expansion plans in Indonesia – The wing chain on Wednesday said its franchisee will double its commitment in the Southeast Asian country, from 60 to 120 restaurants, by 2028. Wingstop has previously stated a goal to open more than 7,000 global locations, with at least 3,000 of them located outside the U.S. Wingstop ended 2021 with 1,731 restaurants worldwide, 197 of which were outside the U.S.”, Restaurant Business Online, April 27, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 54, Tuesday, April 19,2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

As I return from a two week business trip to them Middle East and Central Europe, the 54th issue of our newsletter focuses on energy, globalization, global trade, inflation, rapidly opening global travel, social media a fully automated Pizza Hut® restaurant in Israel. A truly eclectic sample of global business trends today including the first automated Pizza Hut® restaurant in the world in Israel.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“In the midst of chaos, there is also opportunity” – Sun Tzu

“The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function,” F. Scott Fitzgerald.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”, Warren Buffett, Yahoo Finance

Highlights in issue #54:

Brand Global News Section: California Pizza Kitchen®, Chipotle®, Dairy Queen®, Lawn Rite® (New Zealand), McDonalds®, Pizza Hut® and QC Kinetix®

Interesting Data and Studies

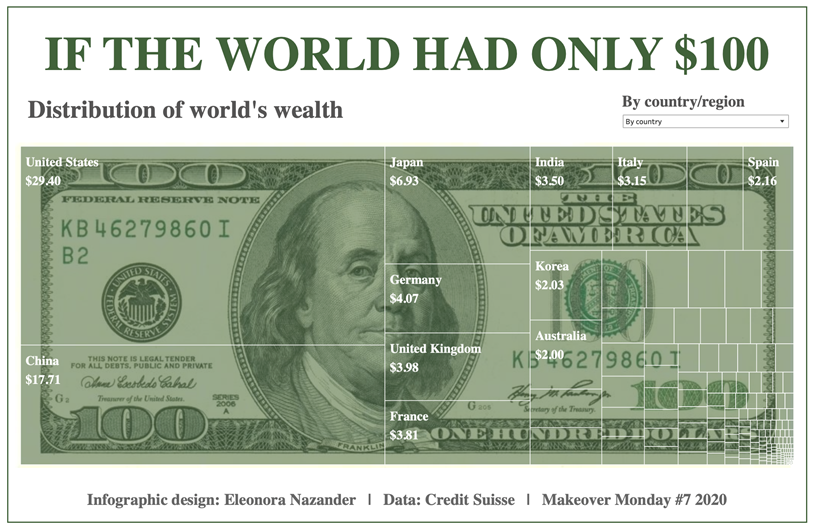

“Visualizing the Distribution of Household Wealth, By Country – A majority of the world’s wealth is concentrated in just a few countries. In fact, almost a third of household wealth is held by Americans, while China’s population accounts for nearly a fifth. Using data from Credit Suisse, this graphic by Eleonora Nazander shows the distribution of household wealth worldwide, highlighting the wealth gap that exists across regions. To help simplify things, this graphic shows how much household wealth each country would have if the world only had $100.”, Visual Capitalist, April 13, 2022

Global Energy

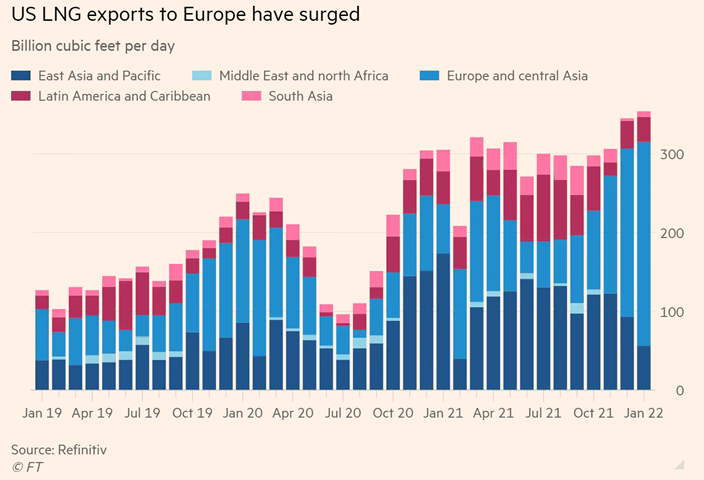

“US natural gas export fever tempered by costs and climate concerns – Suppliers must weigh Europe’s demand for LNG with its long-term goal to reduce fossil fuel use. European Commission president Ursula von der Leyen announced a deal with US president Joe Biden last month under which the EU would guarantee long-term demand for another 50 bcm (billion cubic meters) a year of LNG. The volumes would offset some of the 155 bcm of gas the EU imported from Russia last year.”, The Financial Times, April 17, 2022

““Biden’s Energy Marshall Plan for Europe Is No Quick Fix – Facilities to export and receive liquefied natural gas cost billions of dollars and take years to build. Six years after the first cargo of American shale gas sailed out of Cheniere Energy Inc.’s Louisiana terminal, the U.S. is vying with Qatar and Australia for the title of world’s top LNG exporter. (It’s a constantly shifting ranking, but the U.S. is currently in the lead.) Nevertheless, U.S. exports alone won’t be enough to wean Europe off Russian gas completely, at least in the short term.”, Bloomberg, March 30, 2022

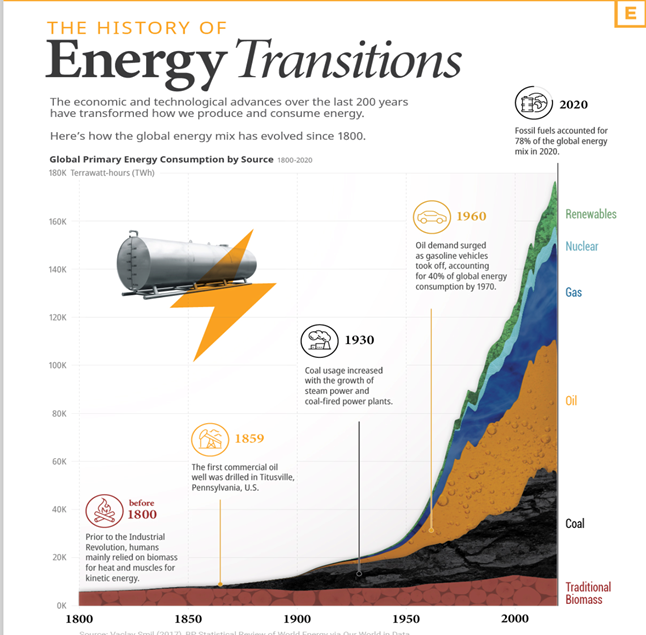

“The History of Energy Transitions – Over the last 200 years, how we’ve gotten our energy has changed drastically. These changes were driven by innovations like the steam engine, oil lamps, internal combustion engines, and the wide-scale use of electricity. The shift from a primarily agrarian global economy to an industrial one called for new sources to provide more efficient energy inputs. The current energy transition is powered by the realization that avoiding the catastrophic effects of climate change requires a reduction in greenhouse gas emissions. This infographic provides historical context for the ongoing shift away from fossil fuels using data from Our World in Data and scientist Vaclav Smil.”, Visual Capitalist and Our World in Data, April 8, 2022

Global Supply Chain & Trade Update

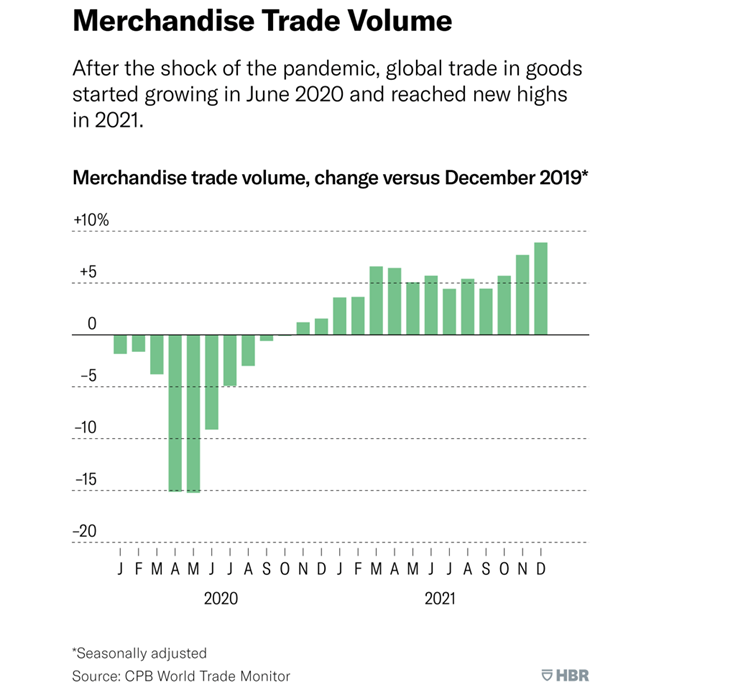

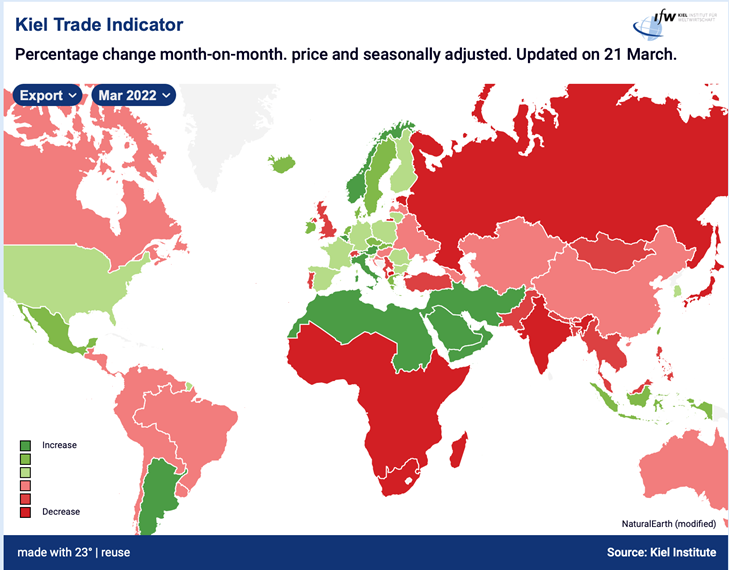

“The State of Globalization in 2022 – The DHL Global Connectedness Index, which our team develops at the NYU Stern Center for the Future of Management, measures globalization based on international flows of trade, capital, information, and people. We look here at the latest trends across those four categories of flows — and consider early signals of how the war might alter their trajectories moving forward.”, Harvard Business Review, April 12, 2022

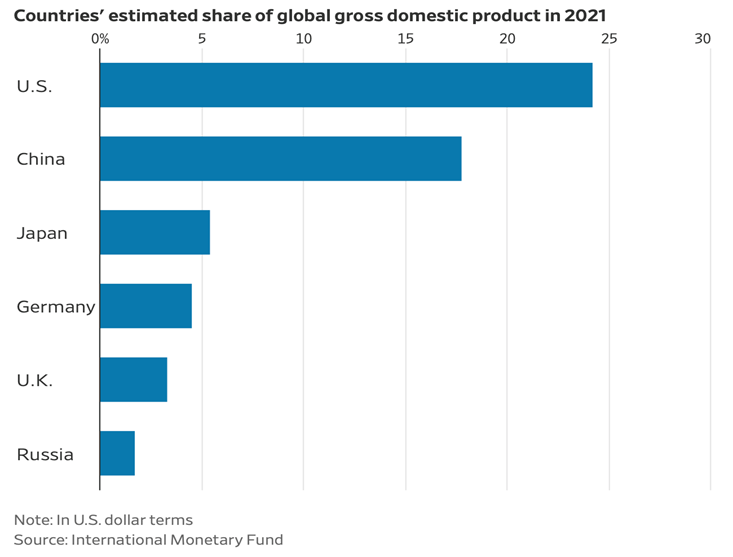

“Globalization Isn’t Unraveling. It’s Changing – The flow of trade, people and ideas among countries isn’t inevitably headed toward decline following Russia’s invasion of Ukraine. But it could be reshaped. Adjusting for the differing costs of goods and services across countries, Germany’s economy in 1913 accounted for 8.7% of global GDP, according to estimates by economic historian Angus Maddison. Russia’s share of global GDP last year was just 3.1% on that basis, estimates the International Monetary Fund, and an even smaller 1.7% in dollar terms.”, The Wall Street Journal, April 15, 2022

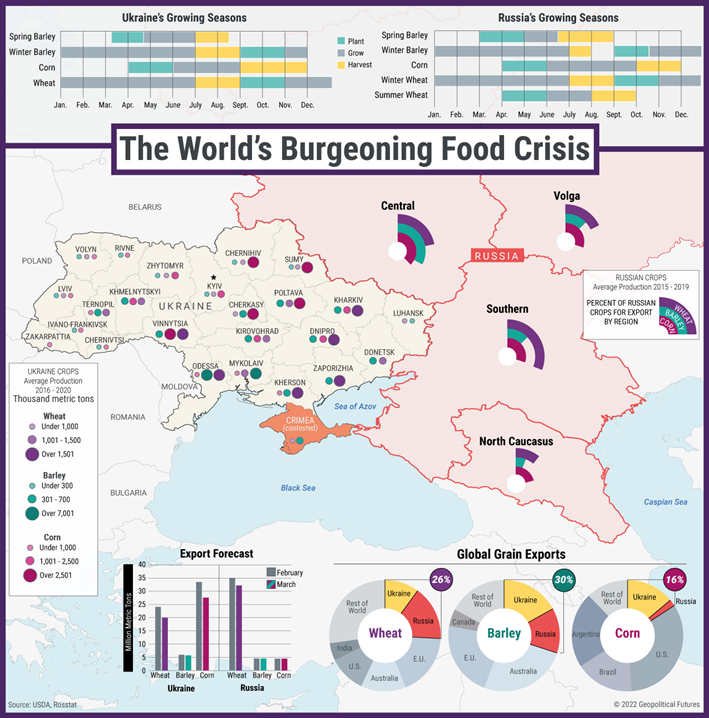

“World food prices hit new record on impact from Ukraine war – Global food prices have struck a new high, soaring at the fastest monthly rate in 14 years after the war in Ukraine hit the supply of grains and vegetable oils, in a shift likely to do the greatest harm in poorer countries around the world. March’s food price index from the UN Food and Agriculture Organization rose to its third record high in a row, jumping 34 per cent from the same time last year, after the war shut down supply lines from Ukraine and Russia.”, The Financial Times, April 8, 2022

Global, Regional & Local Travel Updates

“Delta sees ‘meaningful’ profit as travel demand hits ‘historic’ levels – The company said robust consumer demand not only translated into a ‘solid’ profit in March, but is also allowing it to offset soaring fuel costs with higher fares. ‘The demand environment that we have today is at a historic high,’ Chief Executive Officer Ed Bastian told Reuters in an interview. ‘The last five weeks have been the strongest period of bookings that Delta has ever seen in our history.’”, Reuters, April 13, 2022

“The Latest Covid-19 Travel Requirements For Central America, Including Belize And Costa Rica – Countries in Central America have been easing their travel restrictions in recent months, making them even easier destinations for Americans to plan visits to during the busy spring summer travel seasons. Still, each country has its own sets of rules and restrictions, and what’s acceptable in one destination may not work for another. Here are the latest travel requirements and restrictions in Central American countries, according to the Central America Tourism Agency.”, Forbes, April 18, 2022

Country & Regional Updates

South East Asia

“Why Southeast Asia Will See Stronger Growth in 2022 – Tourism is finally on the rebound. Increasing vaccination numbers are helping the private sector gain momentum. A revitalized private sector means improved supply chains. Increased energy demands mean innovation and jobs.”, Entrepreneur Magazine, April 9, 2022

Australia

“Sydney Harbour turns on sunshine as first cruise liner returns since March 2020 – CLIA Australasia’s managing director, Joel Katz, said more than a million Australians a year took an ocean cruise before the pandemic. ‘We now have an opportunity to return to sailing and revive an industry that was worth more than $5bn annually to the Australian economy,’ he said.”, The Guardian, April 18, 2022

China

“China GDP: economy grew by 4.8 per cent in first quarter despite ‘complicated, uncertain’ headwinds – Retail sales fell by 3.5 per cent in March from a year earlier, while industrial production grew by 5 per cent last month. But China’s economy slowed sharply in March due to the Covid outbreaks in many cities. The unemployment rate for those aged 16 to 24 rose to 16 per cent in March, up from 15.3 per cent in combined figures for January and February.:, South China Morning Post, April 18, 2022

India

“India’s annual wholesale inflation rate accelerated to 14.55% in March, completing a year in double-digit territory as firms grapple with rising input costs and pass on higher prices to consumers. Rising input costs for products such as fuel, metals and chemicals have pushed up wholesale prices, a proxy for producer prices. This is adding to pressure on retail prices, economists said. Headline retail inflation accelerated to 6.95% in March, its highest in 17 months and above the upper limit of the central bank’s tolerance band for a third straight month, putting pressure on the bank to raise interest rates.”, Reuters, April 18, 2022

Israel

“First Automated Pizza Hut Now Open in Israel – From afar, the restaurant looks like a shipping container, but the 40-foot rectangular unit is packed with all manner of robotics arms, conveyor belts and other gizmos that add toppings and cook the pizza. It’s operated with input 120 sensors, 20 AI-powered cameras and it’s plugged into the location’s ordering and digital infrastructure. To keep it clean, the kitchen floods with ozone-infused water every 40 minutes. The output is a fully cooked, boxed pizza in a drawer, ready for delivery or pickup.”, Franchise Times, February 4, 2022

New Zealand

“Why a (New Zealand) lawn mowing company is ditching petrol power for battery power – A swap to solar was a no-brainer for Troy Hillard. Over the past six months as the managing director for the Rite Group franchise, he decided it was time to take the lawn mowing business ‘off grid’. The Waikato-based group has since switched to battery-powered mowing equipment.” Stuff.co.nz, March 28, 2022. Compliments of Jason Gehrke, Founder and Director, Franchise Advisory Centre.

United Kingdom

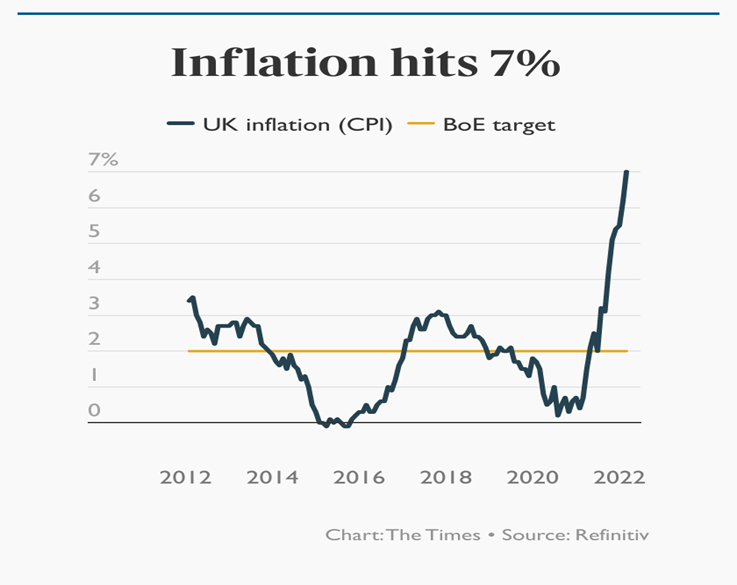

“The headline annual rate of CPI inflation rose to a higher-than-expected 7 per cent in March, according to the Office for National Statistics. City economists had forecast a rise of 6.7 per cent. Amid soaring inflation, traders are pricing as a dead-cert the Bank of England increasing the base rate next month. Money markets suggest that the probability of the base rate rising to 1 per cent, from the current 0.75 per cent, is 100 per cent.”, The Times of London, April 13, 2022

United States

“The huge service side of the U.S. economy speeds up in March, ISM finds – An ISM barometer of business conditions at service-oriented companies such as restaurants and theaters rose 1.8 points in March to 58.3%, signaling a faster expansion in the U.S. economy after an omicron-induced slowdown earlier in the year. Yet prices of oil, grains, metals and other supplies rose even faster and indicated little relief from high inflation. Ongoing supply-chain bottlenecks were also complicated by the Russian invasion of Ukraine. Numbers over 50% are viewed as positive for the economy and anything over 55% is considered exceptional.”, Market Watch, April 5, 2022

“New Study On How Labor Shortages Impact Franchising – The results were culled from responses from more than 200 franchise executives representing 197 brands and approximately 90,000 units. The results make it clear the availability of qualified labor is the number one challenge facing small businesses and franchisors are helping their franchisees address the shortage. ‘Four out of five franchise systems have experienced labor shortages in recent months,’ said FRANdata CEO Darrell Johnson.”, Franchising.com, April 2022

Brand News

“California Pizza Kitchen (US) Signs Two International Franchise Agreements – Recently signed international deals include agreements in Costa Rica and Chile, bringing the brand’s locations to approximately 50 overseas restaurants. Additionally, new locations are set to open in India, Chile, Costa Rica, Alberta, Canada, as well as in the Santiago, Chile and Costa Rica, San Jose airports.”, CISION PR Newswire, March 30, 2022. Compliments of World Franchise Associates

“Dairy Queen (US) Plans to Open 600 Locations in China – Dairy Queen on Thursday announced a deal with the investment firm FountainVest Partners to open 600 locations in the country by 2030, joining a rapidly growing number of U.S. brands making a bigger push in the fast-growing country. The agreement promises to further speed the growth of Minneapolis-based Dairy Queen, which already has 1,100 locations in China.”, Restaurant Business News, March 10, 2022. Compliments of World Franchise Associates

“Metaverse is restaurants’ new frontier – American restaurant chain Chipotle recently teamed up with online platform Roblox to have users create meals that earn credits for real food. When they began inviting people to join their restaurant in the metaverse and collect credits for their next Chipotle order by receiving special codes, more than 20,000 people were waiting to get in. McDonald’s recently announced that it intends to open restaurants in the metaverse. Wendy’s and Hooters have also made announcements in recent days. In Canada, Restaurants Canada launched a metaverse marketplace for its industry, a trend-hunter partnership to revive the food service industry. It will be launched in May.”, Winnipeg Free press, April 18, 2022

“What Makes McDonald’s France So Different From McDonald’s America – You may have heard the old saying: “if you’ve been to one, you’ve been to them all.” That same concept can apply to McDonald’s. No matter where you go, be the McDonald’s down the block or across the country, you’ll know exactly what to expect. In France, however, your trip to Mickey Dee’s may be a little more high-class than you were expecting. When you think of French cuisine, you’re probably thinking more along the lines of cheese and wine than anything resembling fast food. While this is a fair assumption, you’d be surprised to learn that McDonald’s in France are designed more around the food and the atmosphere than Playlands or drive-thru’s.”, Mashed, April 11, 2022

“Regenerative Medicine Group Celebrates 100th Clinic Opening – QC Kinetix, a regenerative medicine franchise that offers a cutting-edge, non-surgical alternative to joint and pain relief, recently celebrated its 100th clinic opening. On March 26, they celebrated their 100th clinic opening in Mishawaka, Indiana, near South Bend. To mark the milestone opening, the company’s top brass and founders hopped on a plane and made a surprise visit to Mishawaka to congratulate the new team and show their support on the clinic’s first day of business.”, Franchising.com, April 1, 2022

“How COVID Forever Changed the Future of Fast-Food Design – Across the U.S., quick-service brands are aggressively altering store designs to accommodate shifting consumer preferences, so many powered by the COVID-19 pandemic. In TD Bank’s 2021 Restaurant Franchise Pulse survey released earlier this year, 55 percent of restaurant operators said they planned to add more space for pickup orders, while 45 percent were plotting additional drive-thru locations, and another 43 percent were looking to add outdoor dining space. Those figures underscore the fast-changing world of restaurant design.”, QSR Magazine, April 2022. Compliments of Ron Rosenblat, Managing Partner at GlobalKoncepts, LLC

Articles & Studies For Today And Tomorrow

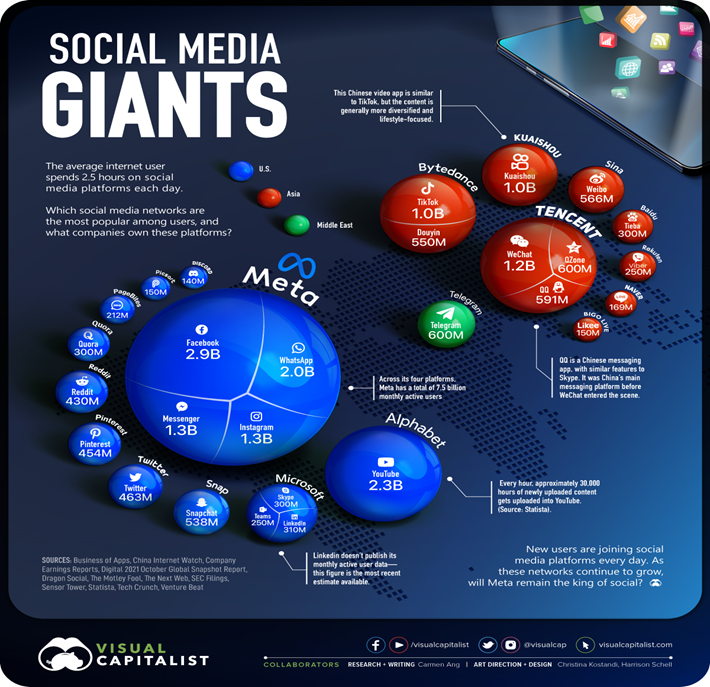

“Currently, there are over 4.5 billion people around the world who use some form of social media—about 57% of the global population. Yet, while social media’s audience is widespread and diverse, just a handful of companies control a majority of the world’s most popular social media platforms. Meta, the tech giant formerly known as Facebook, owns four of the five most widely used platforms.”. Visual Capitalist, December 6, 2021

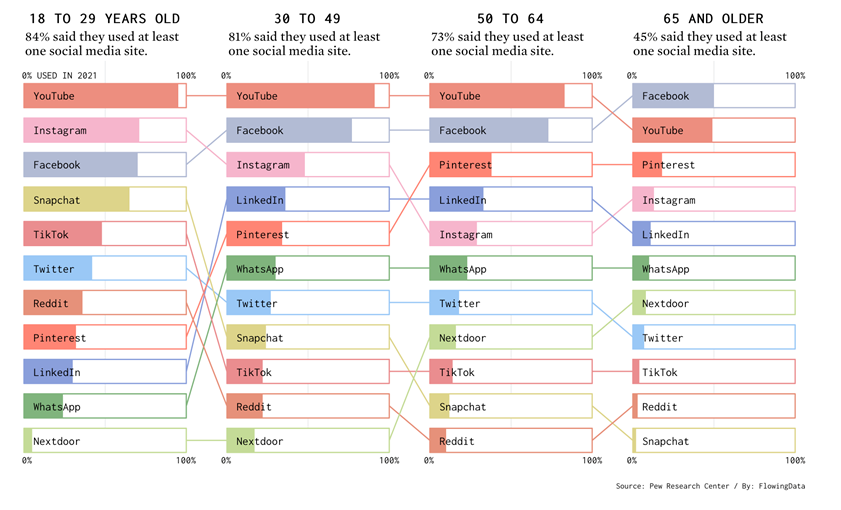

“(U.S.) Social Media Usage by Age – Social media apps are on a lot of phones these days, but some tend towards a younger audience and others an older. Some are common across the population. Here’s the breakdown by age for American adults in 2021, based on data from Pew Research Center. Snapchat, TikTok, and Reddit tend towards a younger audience, as you might expect. Facebook most common in the oldest group seems right. Nextdoor likely rises with home ownership, so that seems to make sense. LinkedIn relies on employment, so the bump up at middle age makes sense.”, Flowing Data, April 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 53, Tuesday, April 5,2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Inflation is up but so is international travel. The impact of the war in the Ukraine continues to cause major economic, political and policy changes in Europe and much of the rest of the world.

For a look at the impact of the war on franchising, listen to my podcast with Larry Weinberg, a truly global franchise attorney at the link below.

First, A Few Words of Wisdom From Others

“There is no sin punished more implacably by nature, then the sin of resistance to change.”, Anne Morrow Lindbergh. Compliments of Beth Adkisson

“What you can do today can improve all your tomorrows.”, Ralph Marston

“Play by the rules, but be ferocious.” – Phil Knight.

Highlights in issue #52:• Seven Themes to Define Europe• Russian invasion of Ukraine forces China-Europe rail transit to sea.• China Manufacturing Activity Slumps to Two-Year Low, Caixin PMI Shows• After 73% Collapse, Latin American Stocks Finally Start to Soar• Understanding International Franchising: Ukraine and Russia – a podcast• No one asked for a hamburger vending machine, and RoboBurger answered• 7 Mistakes That Make or Break Small Businesses• What Makes A Quality Franchise?• Brand Global News Section: Dairy Queen®, KFC® and Texas Roadhouse®

Interesting Data and Studies

“Geopolitical instability is now cited as the top risk to both global and domestic economies in our latest McKinsey Global Survey on economic conditions.That’s the consensus among executives worldwide, who have cited the COVID-19 pandemic as a leading risk to growth for the past two years.

Our quarterly survey was launched four days after the invasion of Ukraine, and executives express uncertainty and concern about its impact on the economy. About three-quarters of respondents cite geopolitical conflicts as a top risk to global growth in the near term, up from one-third who said so in the previous quarter. Meanwhile, the share of respondents citing the pandemic as a top risk fell from 57 to 12 percent, as much larger percentages now identify energy prices and inflation as threats to the global economy.”, McKinsey, March 30,2022

“The European member states are countries mainly in Europe, and three outside, that are part of one or more of the four major treaty groups, namely the European Union (EU), NATO, Schengen, and eurozone. Beginning with six countries in 1958, the European Economic Community has since added 21 more countries (the UK left the EU in 2020), with a primary focus on single or internal markets.”, Visual Capitalist, March 7, 2022

Global Energy

“U.S. liquefied natural gas exports rise 16%, to new record – U.S. LNG is in high demand as European countries try to cut gas imports from Russia following its invasion of Ukraine while also looking to rebuild low inventories. U.S. LNG exports to all destinations were about 7.43 million tonnes (MT) last month, according to Refinitiv, up from 6.4 MT in February and topping the prior record of 7.25 MT in January. Europe was the top importer of U.S. LNG for a fourth straight month, taking about 65% of U.S. exports. About 12% of exports went to Asia, and 3% to Latin America, the data showed. About 20 vessels responsible for 20% of volumes had not signaled a destination.”, Reuters, April 1, 2022

Global Supply Chain & Trade Update

“Russian invasion of Ukraine forces China-Europe rail transit to sea. Over 1 million containers scheduled to go by train between Europe and China via Russia must now find alternate routes. Exporters and logistics firms transporting goods between China and Europe are now looking to avoid land routes passing through Russia or the conflict zone in Ukraine, putting additional pressure on ports already struggling because of COVID-19.”, ExigerTrends Report, March 2022

“Stratfor 2022 Second-Quarter Forecast – During the second quarter, the world will continue to feel the impact of the war in Ukraine, high inflation, energy crunches, supply chain bottlenecks and a weakening — but still present — COVID-19 pandemic. Even if negotiations between Moscow and Kyiv make progress, the West will keep most of its sanctions against Russia in place, which will result in prolonged political and economic uncertainty. In the meantime, high energy prices will slow economic growth worldwide, negatively impacting households’ cost of living and businesses’ operating costs. Food and energy inflation will be particularly problematic because it will keep the risk of social unrest high, especially in emerging and developing countries where governments have less fiscal room to mitigate its impact.”, Stratfor, March 28, 2022

“Russia’s war on Ukraine has adversely affected the Arab region, which heavily depends on wheat imports, including from these two countries. The fallout from the war varies from country to country, but it has hurt one Arab nation more than the others: Egypt. In Egypt, wheat shortages have further exacerbated supply issues precipitated by poor government planning and the country’s rapid population growth. Since the war began last month, food prices have increased 25-50 percent and are likely to keep rising.”, Geopolitical Futures, March 31, 2022

Global, Regional & Local Travel Updates

“What it’s like to travel to Australia right now – Four weeks after the country opened to vaccinated visitors, international flight bookings are nearly half (49%) of pre-pandemic levels, according to the travel technology company Travelport. On average, fewer than 500 weekly international flights landed in Australia in March — down from 2,000 in March 2019 — according to Tourism Australia. However, international flights are expected to double in the next three months, mainly from Singapore, New Zealand, Indonesia and Hong Kong, according to Tourism Australia.”, CNBC, March 28, 2022

“Traveling to France? Here’s what to know about booster and testing requirements – In the eyes of the French government, American travelers age 12 and older must fulfill two vaccine-related requirements to be treated as fully vaccinated. The first is that you must show proof of receipt of either two doses of the Pfizer, Moderna or AstraZeneca vaccine or one dose of the J&J vaccine.Regardless of whether you received a single- or double-dose vaccine, if nine months or more have elapsed since your final dose, you must also show proof of a booster in order to maintain a full vaccination status.”, The Points Guy, April 2, 2022

“India has finally reopened its borders to international visitors – Even those countries that took a rather cautious approach to the pandemic are finally reopening their borders. New Zealand has started allowing travellers in again, South Korea is reopening next month and Thailand is scaling back its strict testing requirements. Now, after two years cut off from the world, India is also reopening to travellers. Until this week the country had only been letting in chartered flights, meaning it was essentially off-limits to most international visitors. But as of this weekend, 66 airlines from 41 countries – including the UK, US and Australia – will be allowed to fly a limited number of weekly flights to the country.”, Timeout.com, March 29, 2022

Country & Regional Updates

China

“China changes audit secrecy rules in bid to stop US delistings – Watchdog will allow foreign regulators to access sensitive financial information on overseas-listed companies. Beijing has revised its audit secrecy laws in a bid to stop around 270 Chinese companies from being delisted from US exchanges, in a significant concession to pressure from Washington.

The China Securities Regulatory Commission, Beijing’s top financial watchdog, said on Saturday it would change confidentiality laws that prevent its overseas-listed companies from providing sensitive financial information to foreign regulators.”, The Financial Times, April 2, 2022

“China Manufacturing Activity Slumps to Two-Year Low, Caixin PMI Shows – Activity in China’s manufacturing sector contracted at the steepest pace in 25 months in March, a Caixin-sponsored survey showed Friday, as restrictions aimed at containing a fresh wave of Covid-19 outbreaks hit supply and demand, while the war in Ukraine hurt export orders. The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, fell to 48.1 from 50.4 in February.”, Caixin Global, April 1, 2022

Europe

“Seven Themes to Define Europe – The Russia-Ukraine conflict will have far-reaching effects that look set to redefine many megatrends in Europe. We believe it is one of those rare events in history that will reshape geopolitics, societies and markets. Europe will transition to be more independent and redefine many of its sectors and economic paradigms. The consequences will range from the development of new industries, the acceleration of existing ones, additional infrastructure and technologies, while reaching independence and leadership for some.”, Bank Of America Study, March 22, 2022. Compliments of Steve Kwang, Vice President, Senior Financial Advisor, Merrill, Lynch Wealth Management

“European Inflation Soars to Record – Euro-zone inflation surged to a record 7.5% in March from a year ago as Russia’s war in Ukraine further boosted already soaring energy costs. While that’ll cost consumers about 230 billion euros ($254 billion) this year, household savings should help cushion the blow.”, Bloomberg, April 2, 2022

Latin America

“After 73% Collapse, Latin American Stocks Finally Start to Soar – Commodity rally is boosting exports and buoying weak economies Morgan Stanley favors Brazil and Chile despite political risks. The spark is the same today as it was then: a boom in global demand for the region’s exports of oil, copper, soybeans, corn and iron ore. Russia’s invasion of Ukraine only further squeezed global supplies of key commodities, pushing up prices more and generating a steady stream of dollars that is breathing life into long-stagnant economies from Mexico to Brazil. The result: The MSCI’s regional index, known as MXLA, has jumped 26% in the first quarter, its best start to a year since the early 1990s.”, Bloomberg, March 31, 2022

India

“Cost of Living Rises in India as Companies Pass on Higher Prices – Inflation spike risks denting disposable incomes, consumption RBI to decide on rates April 8 amid above-target inflation. Bloomberg, April 4, 2022

Israel

“Why Israel Drew 28 Times More Venture Capital Per Capita Than the U.S. – Despite the flourishing of work from anywhere during the pandemic, it still matters where a startup is located….This comes to mind in considering the flow of venture capital around the world in 2021. A striking conclusion is that on a per capita basis, capital flows into Israel were a whopping 28 times more than those in the U.S. To be sure, 2021 venture capital flow into the U.S. was way larger – up at 154 percent in 2021 to $330 billion – than to Israel – 136 percent higher to $25.4 billion, according to ‘NoCamels’. But Israel’s population of about nine million is a fraction of the U.S.’s 330 million people. Hence, Israel’s $28,000 in venture capital invested per capita in 2021 is far above the U.S.’s $1,000.”, Inc., March 29, 2022

Italy

““Italy’s Factories Feel the Economic Shocks of Ukraine War – Russia accounts for just 1.6% of Italy’s exports but in some sectors the proportion is much higher. And that’s without taking into account the impact of higher gas and power costs on energy-intensive sectors such as steel making, paper manufacturing or ceramics. Overall, according to a study by the Fim-Cisl union, more than 25,000 workers have already been affected by the economic fallout of the fighting, mostly in the highly industrial regions in the northeast of the country.”, Bloomberg, March 29, 2022

Russia

“Bloomberg logs off at Moscow terminals – The parent company of Bloomberg News has suspended its operations in Russia and Belarus after President Putin’s invasion of Ukraine. Customers in the two countries will be unable to access financial products including the terminal, data licence, data feed and electronic trading platforms, the company said. Trading functions for a range of Russian securities also have been disabled in accordance with international sanctions, Bloomberg said.”, The Times of London, March 30, 2022

Singapore

“Singapore Restaurants See Surge as Pandemic Early Closing Ends – At 10:31 p.m. on Tuesday, cheers went up from the crowds who had flocked to Singapore’s bars and restaurants. It wasn’t a World Cup match or the Super Bowl, but simply the first time in ages that people could still be drinking alcoholic beverages past 10:30 p.m. at food-and-beverage establishments in the city-state. The 10:30 limit, put in place as a pandemic restriction mainstay, has finally been lifted as Singapore slowly works its way back to normal.”, Bloomberg, April 1, 2022

Turkey

“Turkish Inflation’s Rush Toward a New 20-Year High Leaves Lira Vulnerable – A three-month policy pause by the central bank means Turkey’s interest rates — already the world’s lowest when adjusted for prices — are set to reach new depths as the cost of everything from food to energy surges. Data due Monday will show inflation climbed to an annual 61.5% in March from 54.4% a month earlier, according to the median of 19 estimates in a Bloomberg survey.”, Bloomberg, April 4, 2022

United Kingdom

“City talent hunt drives rise in visa sponsorship – Finance firms in rush for overseas recruits. City firms are sponsoring overseas recruits to come to work for them in the UK at the fastest rate since before Britain left the European Union, according to Home Office figures. About 200 foreign-based workers a week are being hired by British banks, fund managers, insurers and other City firms as the search for talent intensifies and as visa rules are relaxed.”, The Times of London, April 4, 2022

United States

“The (March 2022) Future Of Everything Report – Keys to Surviving and Thriving in Post COVID-19 and BeyondWe discuss the economy, the markets, and megatrends that disrupt everything including our careers, our money, and our lifestyle”, Brian Connors, NPB Financial Group, March 30, 2022. Editor’s Note: At the start of each monthwe will include a link to this timely and comprehensive report.

“No one asked for a hamburger vending machine, and RoboBurger answered – If a startup from New Jersey has its way, the next Ray Kroc will be a robot. In the last week, a company called RoboBurger installed an autonomous burger chef in Jersey City’s Newport Centre Mall. Over on its website, RoboBurger breathlessly describes its vending machine as the ‘biggest innovation in hot food vending since the invention of the microwave.’”, Engadget, March 29, 2022

Brand News

“Dairy Queen Just Made Its Biggest Menu Change In Over 20 Years – The restaurant chain now plans to shake up its entire menu with the biggest revamp that the chain has seen in about 20 years. TODAY reports that Dairy Queen plans to make diners think about burgers when they walk through the door with a new line of Stackburgersthat come in five different topping combinations.”, Mashed, March 29, 2022

“KFC’s first fine dining restaurant includes a gravy candle that melts into chicken fat – KFC opened its doors to an innovative fine-dining experience for one weekend only, taking their famed crunchy chicken to a whole new level. Over 200,000 people applied for tickets, but only 180 of them successfully got a place at the exclusive experience in Sydney (Australia). Luckily, TikTokuser Samantha (@samantha.khater) provided the platform with all the juicy details.”, Indy 100, April 3, 2022

“Texas Roadhouse Is Growing Impressively – In 2021, the company’s sales growth and operating profitability was better than pre-covid levels…..Louisville, Kentucky based Texas Roadhouse opened its first restaurant in 1993 and since then has expanded to over 667 restaurants in 49 states and ten countries. The company’s business approach is to position each of its restaurants as a local favorite for a wide range of customers looking for quality, low-cost meals provided with a friendly, attentive service. As of December 28, 2021, the company employed around 73,300 people.”, Seeking Alpha, April 1, 2022

“These Restaurant Chains Are Raising Their Prices – Be it Starbucks or Taco Bell, Dunkin’ or Domino’s, every chain seems to have felt the burn of red hot inflation, and is turning to customers to cool it down. But as we know, there is little that’s more exasperating than seeing your favorite restaurant ask you to pay more. Here’s a run-down of restaurant chains that are unfortunately asking you to do exactly that.”, The Mashed, April 1, 2022

Articles & Studies For Today And Tomorrow

“Understanding International Franchising: Ukraine and Russia – In this episode (of the Franchise Voice podcast), we are discussing the impact of the war in Ukraine on franchised businesses and the decision of many to cease operations in Russia, as highly reported in the media. We will dive in to how all of this works, answer frequent questions, and address common misperceptions about the franchise business model. We have two international franchise experts who will help set the record straight about how franchising works and what this means for businesses with units in these areas.

William Edwards, CEO & Global Advisor to Senior Executives, Edwards Global Services, Inc., Larry Weinberg, Partner, Cassels, Jack Monson, Host and Bill Meierling, Host

“What Makes A Quality Franchise? – The cover story of this issues ‘Franchise New Zealand’ magazine describes the ingredients that successful franchises have in common., Franchise New Zealand Autumn 2022 issue

“7 Mistakes That Make or Break Small Businesses – Launching a new business is risky — learn from other’s mistakes and set yourself up for success. It is arguable that the mistakes that make or break small businesses are similar across industries and geography. Whether it’s focusing attention on places that don’t produce income or build relationships, not setting boundaries or ignoring their online reputation, I’ve watched small businesses make these mistakes that make or break them.” Entrepreneur magazine, March 31, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To receive our biweekly newsletter click on this link: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 52, Tuesday, March 22, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

The war in the Ukraine is having an impact on other countries due to suspended commodity shipments. Western brands are exiting Russia in waves – 400 to date. But the most important aspect of the war is it impact on the people of the Ukraine. Hopefully, a positive solution will be found very soon.

First, A Few Words of Wisdom

“I have no special talents; I am only passionately curious.”, Albert Einstein

“Coming together is the beginning. Keeping together is progress. Working together is success.”, Henry Ford

“Success is not final; failure is not fatal: It is the courage to continue that counts.”, Winston S. Churchill

Highlights in issue #52:

- Brand Global News Section: Black Rifle Coffee®, Dominos®, McDonalds®, Papa John’s®, Tim Horton’s and Subway®

Interesting Data and Studies

“The implications for the world economy of the Russian government’s invasion of Ukraine will become more visible in the coming weeks and months. Emergent economic conditions are briefly addressed at the end of the report, which is otherwise focused on the most recent economic data available prior to the invasion.

Much of the recent data show a growing global economy, but at a restrained pace due to rising inflation, supply chain bottlenecks, and effects of more recent pandemic restrictions. The Organisation of Economic Co-operation and Development (OECD) measured a drop in consumer confidence as inflation accelerated. Retail sales have been subdued globally, except in the United States, where spending is strongest, with purchases slowly shifting from goods to services. Notable, however, is that during the crisis, eurozone households retained significant currency and deposits, estimated at one thousand billion euros, representing a record level of disposable income.”, McKinsey, March 8, 2022

“International Tax Competitiveness by Country – This Markets in a Minute from New York life Investments looks at international tax competitiveness among countries within the Organization for Economic Co-operation and Development (OECD). The Tax Foundation measured international tax competitiveness using two aspects of tax policy: competitiveness and neutrality.”, Visual Capitalist / New York Life Investments, March 10, 2022

Global Energy

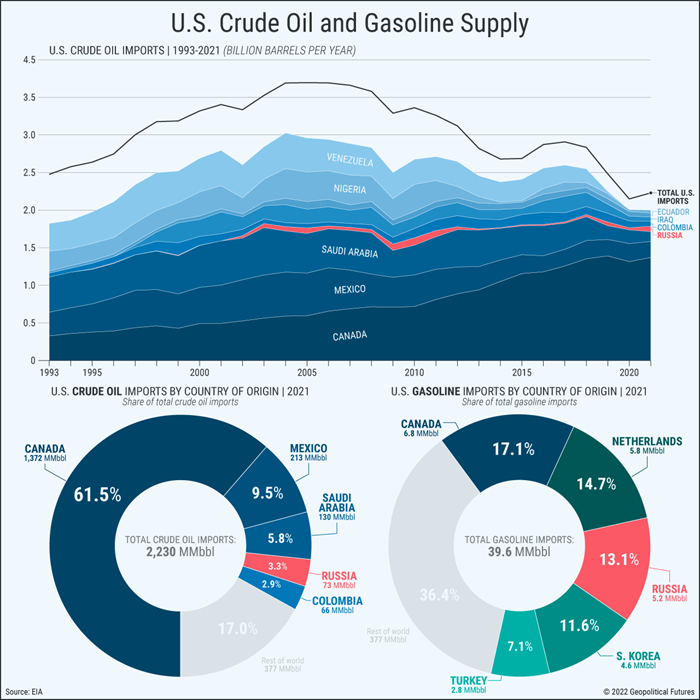

“After banning imports of Russian oil, the U.S. is searching for new supplies. The U.S. consumes more oil than any other country by far. Before the pandemic, the U.S. had been reducing its crude oil imports for more than a decade, largely thanks to increased domestic production and the growth of renewables. But with its ban on oil imports from Russia, the U.S. now needs to replace about 7 percent of its imports.”, Geopolitical Futures, March 11, 2022

“Germany says it has clinched long-term gas supply deal with Qatar – Berlin and other EU countries seek alternative suppliers to Russia and ways to shield consumers from rising prices. Germany’s economy minister Robert Habeck on Sunday said the deal would be a “door-opener” for the country’s economy because it would reduce its reliance on imported Russian gas, which currently accounts for more than half of annual supply. ‘We might still need Russian gas this year, but not in the future,’ Habeck was quoted as saying by DPA in Doha.”, The Financial Times, March 20, 2022

Global Supply Chain & Trade Update

“The Ukraine War’s Effects on Global Food Supplies – Record food prices and disrupted grain supply due to the war in Ukraine bode poorly for global food security. Ukraine and Russia are both top grain exporters, but the closing of Ukrainian ports and sanctioning of Russian trade are causing severe market disruption. Fighting and cold weather has also interrupted Ukraine’s March to early April sowing campaigns, which could impact future exports as well.”, Geopolitical Futures, March 18, 2022