EGS Biweekly Global Business Newsletter Issue 100, Tuesday, January 23, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Welcome to the 100th edition of my biweekly global business update newsletter. It started on March 30th, 2020, as a report to companies we were helping take their brands into new countries. International travel had stopped due to COVID. But the companies wanted to know what was going on in countries where they already had operations and/or were in negotiations with potential partners in a country.

My team and I added to the information sources we were already monitoring to eventually daily monitor 40 publications. And we expanded our communication with the more than 20 Country Associates who helped us find partners for our clients. 100 biweekly editions later more than 1,400 people in more than 20 countries read this diverse report that watches countries, business sectors and trends that impact global business.

This issue continues to look at trends and events that impact the ability of companies to expand their business into new countries successfully. Thanks to our readers for your time to read this newsletter and for your input.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“There is no such thing as a normal period of history. Normality is a fiction of economic textbooks.”, Joan Robinson

“Opportunities multiply as they are seized.”, Sun Tzu

“Don’t judge each day by the harvest you reap, but by the seeds you plant.”, Robert Louis Stevenson

Highlights in issue #100:

- Brand Global News Section: Burger King®, Jimmy Johns®, and Papa Johns®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

Research across many sources yielded the topics above on what will impact doing business around the world in 2024. Perhaps the most important is the fact that 64 countries will see elections this year covering 49% of the world’s population and 50% of the world’s Gross Domestic Product (GDP). Elections have consequences. Elections often mean changes in economic policies which impact a company’s ability to do business in a country. From a presentation by William (Bill) Edwards to the 4th Annual Growth & Scale Summit – AI Transformation on January 18, 2024, at the University of California, Irvine’s Beall Applied Innovation Center put on by the Executive Next Practices Institute. (https://enpinstitute.com)

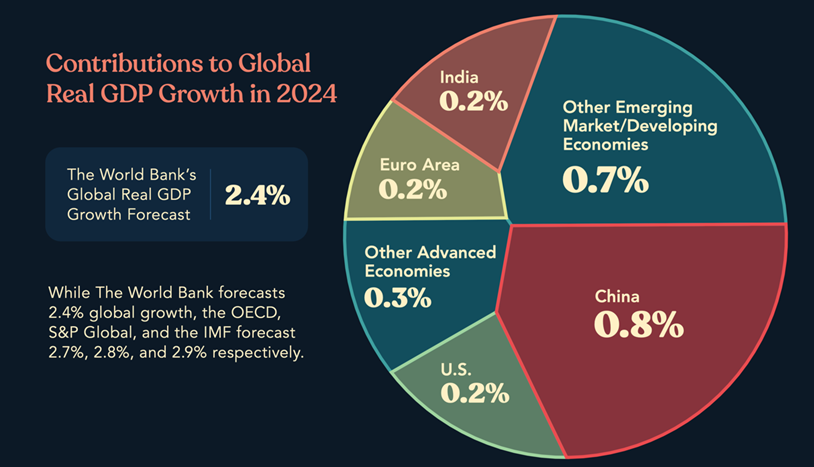

“Global Economic Prospects – Global growth is set to slow further this year, amid the lagged and ongoing effects of tight monetary policy, restrictive financial conditions, and feeble global trade and investment. Downside risks to the outlook include an escalation of the recent conflict in the Middle East and associated commodity market disruptions, financial stress amid elevated debt and high borrowing costs, persistent inflation, weaker-than-expected activity in China, trade fragmentation, and climate-related disasters.”, The World Bank and Visual Capitalist, January 2024

“Davos 2024: Global elite gather against WEF’s most complex backdrop so far – A challenging global economic picture, with shifting interest rate policies and rising debt, will also confront the central bankers, financiers and business leaders attending. Geopolitical risks have mounted around the globe in recent years, with Russia’s war in Ukraine and Israel’s war with Hamas militants, and the recent related impact on shipping in the Red Sea. China, meanwhile, has been increasing military pressure to assert sovereignty claims over Taiwan.”, Reuters, January 11, 2024

“Amazon CEO Andy Jassy says AI is both the biggest risk and biggest opportunity facing companies in 2024 – Companies around the world are all facing an interesting dilemma in 2024, according to Amazon CEO Andy Jassy: their biggest problems and solutions might be one and the same. ‘The opportunity and risk is pretty similar in that there is this wildly transformative, disruptive technology in generative AI that you can’t get through any conversation without talking about,’ Jassy says. At a dinner in Davos, Switzerland, on Thursday, Jassy told Fortune CEO Alan Murray that prior to the pandemic, companies were largely moving to modernize their preexisting technology to innovate and lower costs.”, Fortune, January 18, 2024

“Confidence improves as CEOs wait for takeoff – The Q4 Vistage CEO Confidence Index rose 6 points to reach 82.0 — the fifth time in six quarters — and while optimism is improving, the historical lows of economic confidence show that takeoff is still delayed. Despite healthy GDP in 2023, CEOs’ concerns regarding the current and future economy stay within ranges not seen since the waning days of the Great Recession in 2008. Compared to Q4 2022, both expectations for the next 12 months and a review of last year are well above the lows hit in Q2 2022, yet still well below the norm established during the rising economic tide of the 2010s.”, Vistage, January 2024

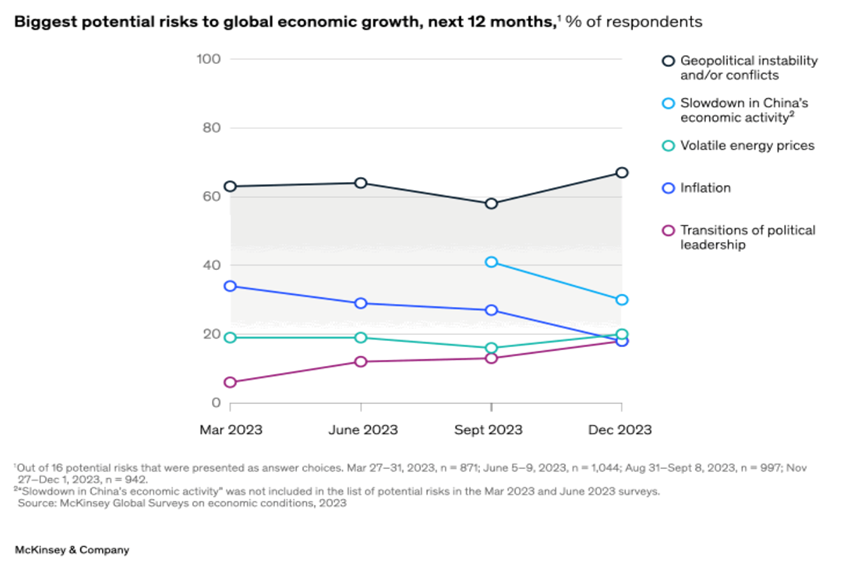

“Geopolitical conflicts loom large – Geopolitical instability has risen as a potential threat to global growth for 2024, cited by 67 percent of executives in a recent McKinsey Global Survey. Concerns about transitions of political leadership also rose, senior partner Sven Smit and colleagues find. Fears about inflation, meanwhile, have continued to recede, dropping from more than 30 percent in March 2023 to less than 20 percent at the end of the year.”, McKinsey & Co., January 16, 2024

“Life in a New Normal: Navigating our way into an uncertain future – Ever since the pandemic began, pundits have been trying to predict the glide path for returning to normal, with “normal” implicitly defined by the way things were in the before times. The problem is the way of life we knew—socially, culturally, economically—has irrevocably changed. It’s impossible to go through a major collective event, such as the pandemic, without having alterations to the way we view…For investors and business owners, this has made the intervening years exceedingly treacherous to navigate. The rules seemed to have changed overnight about how consumers purchase, how (and where) employees want to work, and how suppliers want to do business. Millions of decisions, large and small, had to be renegotiated not just once, but many times.”, Franchising.com, December 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

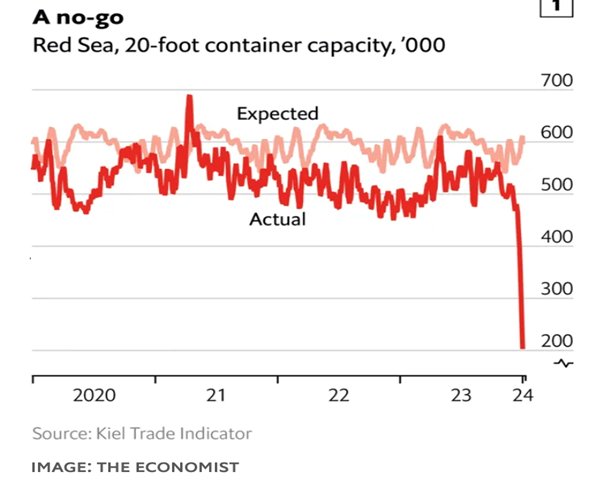

“Tracking ships in the Red Sea – More than 200 container ships travelled through the Red Sea and the Suez Canal between January 4th and 11th last year. During the same week in 2024 only 122 dared to make the journey. Container firms accounting for 95% of the capacity that usually sail the Suez have suspended services in the area. A few energy firms, such as BP and Equinor, have also temporarily stopped using the canal. By January only 200,000 standard containers were passing through the waterway per day, compared with around 450,000 in December 2022—the lowest point of the pandemic. Instead of sailing through the Red Sea, ships travelling between Asia and Europe are now being re-routed around Africa and the Cape of Good Hope.”, The Economist, January 18, 2024

“Ocean Premiums Rocket – The Red Sea Crisis and its Ripple Effects on Global Shipping. The Red Sea crisis is unleashing unprecedented challenges on the global shipping industry, notably marked by a staggering surge in ocean freight rates. Major shipping companies are diverting vessels due to the looming threat of Houthi attacks, leading to an abrupt spike in rates. Logistics managers are quoting rates as high as $10,000 per 40-foot container, a stark contrast to last week’s rates of $1,900 to $2,400. The rerouting of 158 vessels, carrying over $105 billion worth of cargo, intensifies strains on the supply chain.”, Alba Wheels Up, January 18, 2024

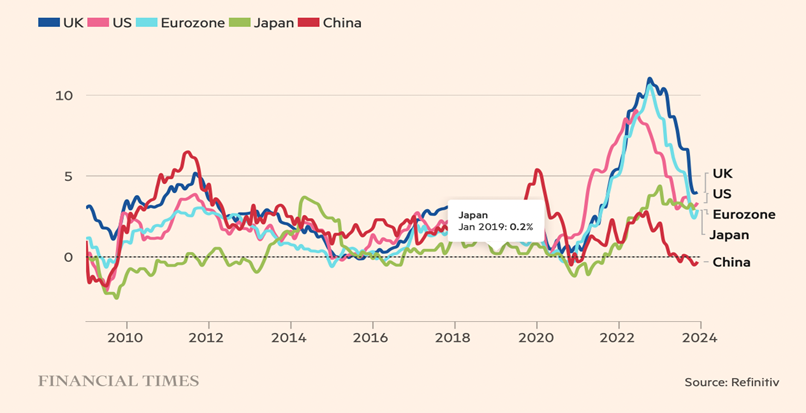

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, January 16, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

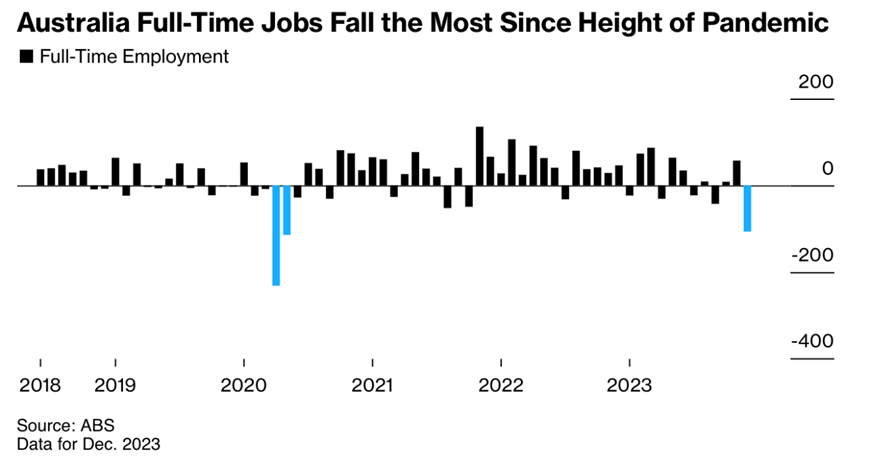

“Jobs Slump: Australia Briefing – Employment tumbled in December, boosting the odds of the Reserve Bank of Australia pivoting to monetary easing. The economy shed 65,100 roles, an unexpected outcome led by the biggest monthly drop in full-time employment since the height of pandemic, government data showed.”, Bloomberg, January 19, 2024

Canada

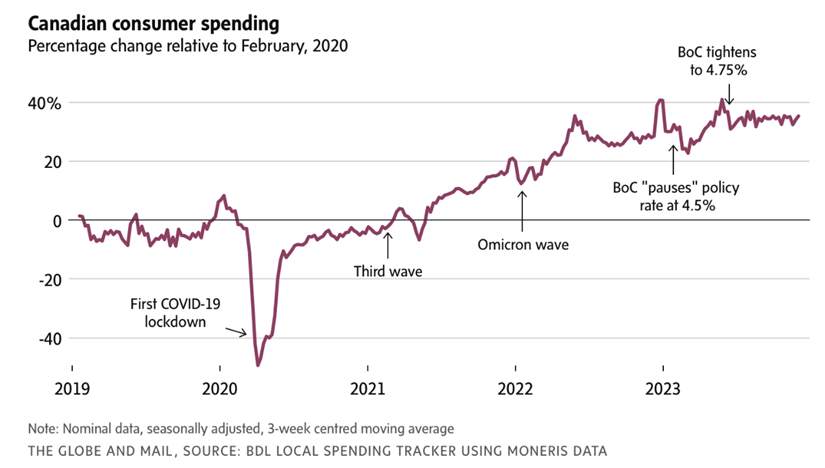

“Experts predict what’s to come for housing, jobs, wages, interest rates and more – Economists, academics, investors and business leaders pick a chart that highlights an issue that will be important to watch in 2024. After a year of surprising resilience in the face of high interest rates, Canada’s economy enters 2024 in an uneasy state. The Globe and Mail reached out to dozens of experts, including economists, academics, investors and business leaders, and asked them to each pick a chart that highlights an issue that will be important to watch in 2024 and explain why….”, The Globe and Mail, January 14, 2024

China

“China orders indebted local governments to halt some infrastructure projects-sources – China has instructed heavily indebted local governments to delay or halt some state-funded infrastructure projects, three people with knowledge of the situation said, as Beijing struggles to contain debt risks even as it tries to stimulate the economy. Increasing its efforts to manage $13 trillion in municipal debt, the State Council in recent weeks issued a directive to local governments and state banks to delay or halt construction on projects with less than half the planned investment completed in 12 regions across the country, the sources said.”, Reuters, January 19, 2024

“Chinese stock rout accelerates as foreign investors sell out – Fall in Hong Kong and Chinese indices defies many Wall Street banks’ hopes of rebound after last year’s losses. International investors “just threw in the towel” after a speech by Premier Li Qiang at Davos on Tuesday lacked any hint of new government measures to boost the economy or financial markets, said the head of trading at one investment bank in Hong Kong. Foreign investors, who by the end of 2023 had sold about 90 per cent of the $33bn of Chinese stocks they had purchased earlier in the year, have continued selling this year. Year-to-date outflows more than doubled on Wednesday after Beijing confirmed China’s annual growth was the slowest in decades and revealed the country’s population decline had accelerated in 2023.”, The Financial Times, January 18, 2024

European Union & Eurozone

“Too early to say inflation is defeated, warns ECB – Many traders think the ECB will start loosening its policy in March and will deliver rate reductions of 125 to 150 basis points over the next 12 months. The deposit rate stands at 4 per cent, the highest point since the central bank was created in 1998. Rapidly declining inflation and poor economic growth have fuelled expectations for interest rate cuts. Carsten Brzeski, global head of macro at ING, the Dutch bank, said: “The European Central Bank (ECB) is more cautious about the growth outlook, but far from relaxed about inflation.”, The Times of London, January 15, 2024

“EV Sales Run Out of Juice in Europe as Germans Tighten Belts – Steep drop in electric sales in Germany was main factor in sending EU sales down for the first time in 16 months. Germany’s new-car market went into a free fall in December, led by a near halving of new electric-vehicle sales, pulling the sale of new EVs in the broader European Union down for the first time since early 2020. Automotive executives in Germany have been warning about an approaching cliff in EV sales for months, blaming the impending gloom on a combination of high manufacturing costs at home and a government decision to end incentives for consumers.”, The Wall Street Journal, January 18, 2024

India

“Why India Isn’t the New China – The country’s population surpassed China’s last year. But India’s path forward is likely to look very different from its neighbor’s. There are plenty of reasons for optimism. The country’s population surpassed China’s last year. More than half of Indians are under 25. And at current growth rates, it could become the world’s third-largest economy in less than a decade, having recently overtaken the U.K., its old colonial ruler, for the no. 5 spot. While its labor resources are, in theory, plentiful, a host of barriers still make it difficult to connect workers with employers. Only a third of India’s female working-age population was in the labor force in fiscal year 2022. India’s love-hate relationship with trade is another problem”, Wall Street Journal, January 17, 2024

“India takes investment spotlight while risks weigh in China – Suntory CEO – Japanese drinks maker Suntory is prioritising expansion in India while taking a cautious stance on business in China, especially given concerns over spy laws recently used to detain foreign workers, Chief Executive Takeshi Niinami said in an interview. Suntory is looking for local partners in India to expand its drinks and nutrition businesses, he said, although in China, which he acknowledged is still an attractive market, he cannot justify sending in international staff for an investment push in the current environment.”, The Daily Mail, January 19, 2024

Middle East

“The Middle East faces economic chaos – Escalating conflict threatens to tip several countries over the brink. Just over 100 days after Hamas’s brutal attack on Israel started a war in Gaza, the conflict is still escalating. On January 11th America and Britain started attacking Houthi strongholds in Yemen, after months of Houthi missile strikes on ships in the Red Sea. Five days later Israel fired its biggest targeted barrage yet into Lebanon. Its target is Hizbullah, a militant group backed by Iran. A full-blown regional war has so far been avoided, largely because neither Iran nor America wants one. Yet the conflict’s economic consequences are already vast.”, The Economist, January 18, 2024

Singapore

“Singapore seeks expanded governance framework for generative AI – Looking to balance user security with innovation, Singapore wants feedback on proposed updated to the country’s existing artificial intelligence governance framework. Singapore has released a draft governance framework on generative artificial intelligence (GenAI) that it says is necessary to address emerging issues, including incident reporting and content provenance. The proposed model builds on the country’s existing AI governance framework, which was first released in 2019 and last updated in 2020.”, ZD Net, January 14, 2024

United Kingdom

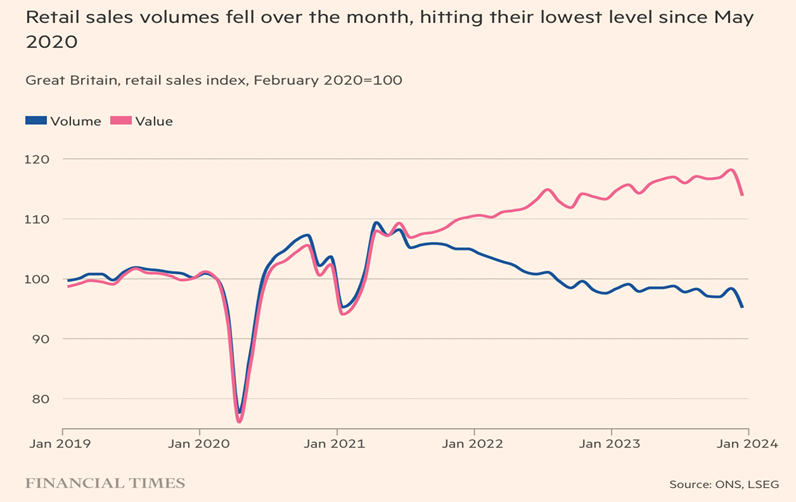

“British retail sales fell more than expected in run-up to Christmas – Figures raise risk that UK fell into technical recession at the end of 2023. The decline was much steeper than the 0.5 per cent fall forecast by economists polled by Reuters, and was the largest monthly fall since January 2021, when coronavirus restrictions hit sales. The fall was driven in part by people doing their Christmas shopping early, particularly during the Black Friday sale period in November, the ONS said. Economists also blamed high prices and borrowing costs for damping consumer confidence and spending power.”, The Economist, January 19, 2024

United States

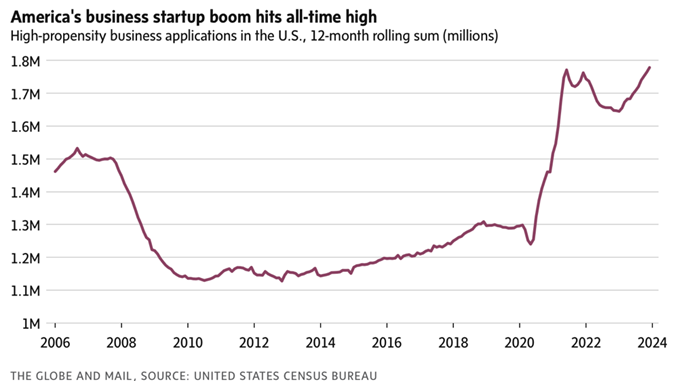

“America’s economy is creating new businesses at a feverish pace – If the Great Recession put U.S. entrepreneurship into a deep freeze, the COVID-19 pandemic lit a fire under American self-starters, and the boom in business creation that began in 2020 has kicked into overdrive. December marked the fastest 12-month stretch of startup activity on record, based on the number of what the U.S. Census Bureau calls “high-propensity business applications.” It’s the latest sign that America’s economic engine continues to defy expectations of a slowdown.”, The Globe and Mail, January 18, 2024

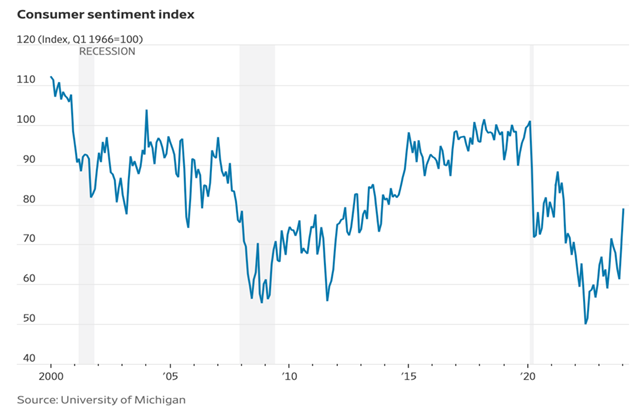

“Americans Are Suddenly a Lot More Upbeat About the Economy – Consumer sentiment gauge posted the largest two-month gain since 1991. Consumer sentiment surged 29% since November, the biggest two-month increase since 1991, the University of Michigan said Friday, adding to gauges showing improving moods. The pickup in sentiment was broad-based, spanning consumers of different age, income, education and geography.”, The Wall Street Journal, January 19, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Commanding a Premium Franchise Sale in a Cautious 2024 Private Equity Investment Climate – Perfect market timing is difficult to pull off, but excellent preparation and building a valuable business in the first place is much more under your control. The valuation of private equity exits in 2023 has seen a significant drop compared to the boom in 2021. This shift requires franchise owners to recalibrate their strategies when considering a sale. To attract premium offers, businesses need to stand out with unique value propositions and robust operational efficiencies.”, Entrepreneur magazine, January 19, 2024

“Inspire Brands to Take Jimmy John’s Global – The sandwich fast casual signed deals to grow in Canada and Latin America. Jimmy John’s is now set to grow in Canada and Latin America. The former will expand through a partnership with Foodtastic, a franchisor that oversees north of 1,100 locations through a collection of brands, including Pita Pit and Freshii, and $1.1 billion in sales. The Latin America deal comes via Franquicias Internacionales, a group based in El Salvador whose portfolio expands from F&B to digital media and logistics.”, QSR Magazine, January 2024

“Burger King parent company to buy out largest franchisee to modernize stores – Restaurant Brands International Inc. announced Tuesday that it would purchase the issued and outstanding shares of Burger King franchisee Carrols Restaurant Group Inc. for $9.55 per share at a value of approximately $1 billion. Carrols is the largest Burger King franchisee in the country, operating 1,022 Burger King restaurants in 23 states and 60 Popeyes locations. Restaurant Brands said that it will invest $500 million to renovate approximately 600 restaurants that were acquired in the transaction.”, People Magazine, January 18, 2024

“Giant pizza chain Papa John’s to shut up to 100 locations – The family favourite global pizza chain said it will “strategically close low-performing locations” in a bid to boost profits. A family favourite pizza chain is to shut scores of locations across the UK this year in a fresh wave of closures as restaurants battle high costs and fewer visitors. Dozens of Papa John’s branches will close for good, according to The Sun. It comes after the chain, which operates 524 locations in the UK, told investors it anticipates “additional strategic restaurant closures of low-performing restaurants” in a bid to boost profits.”, News.com.au, January 9, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

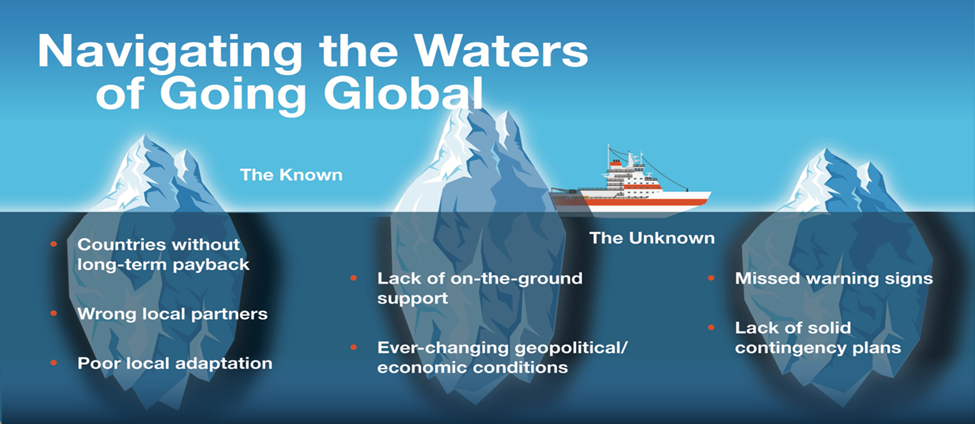

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:Our latest GlobalVue™ 40 country ranking