EGS Biweekly Global Business Newsletter Issue 102, Tuesday, February 20, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Democracy continues to be at risk and then 64 major elections around the world this year may not help. AI moves closer to government regulation in more countries. Business travel seems back to 2019 levels. U.S. LNG exports continue to climb. U.S. food brands are hit by the Middle East war’.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“I’m a great believer in luck, and I find the harder I work, the more I have of it.” – Thomas Jefferson

“If you want to go fast, go alone. If you want to go far, go together.” – African Proverb

“A diamond is a piece of coal that stuck to the job.” – Michael Larsen

Highlights in issue #102:

- Brand Global News Section: McDonalds®, Tim Hortons®, Popeyes® , Firehouse Subs®, Taco Bell®, Burger King®, KFC® and Pizza Hut®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

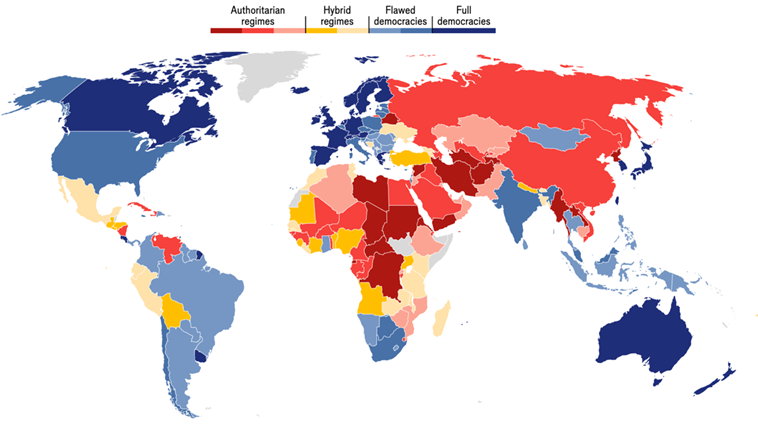

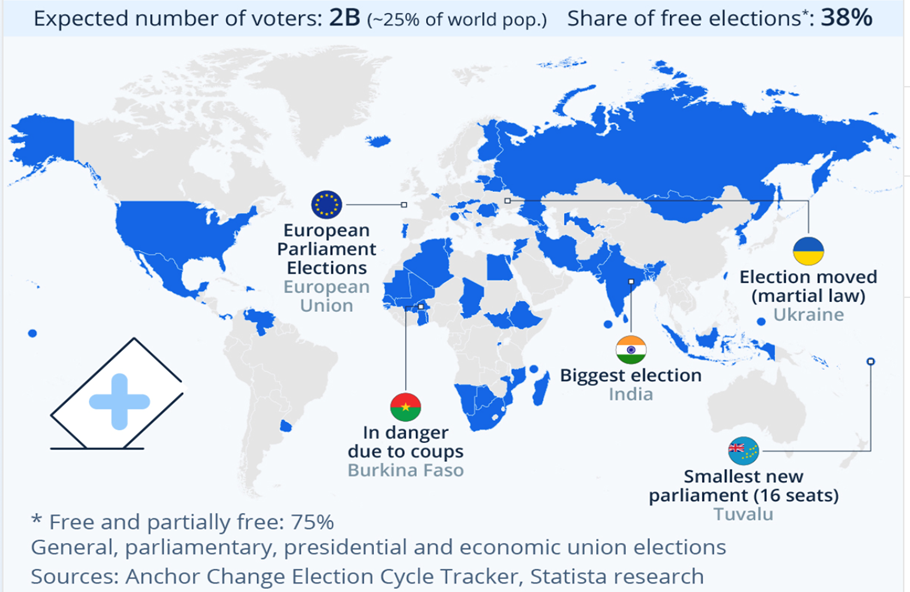

“Where democracy is most at risk – Four lessons from EIU’s new ranking of democracies. This year’s democracy index published by EIU, our sister company, shows that only 43 of the more than 70 elections are expected to be fully free and fair. Each year EIU (Economist Intelligent grades 167 countries and territories on a scale of ten according to the strength of their democratic practices, including how fairly they run elections and how well they protect civil liberties. More than half the world’s people live in countries that are holding elections this year. But EIU’s index shows that in democracy, quality trumps quantity.”, The Economist, February 14, 2024

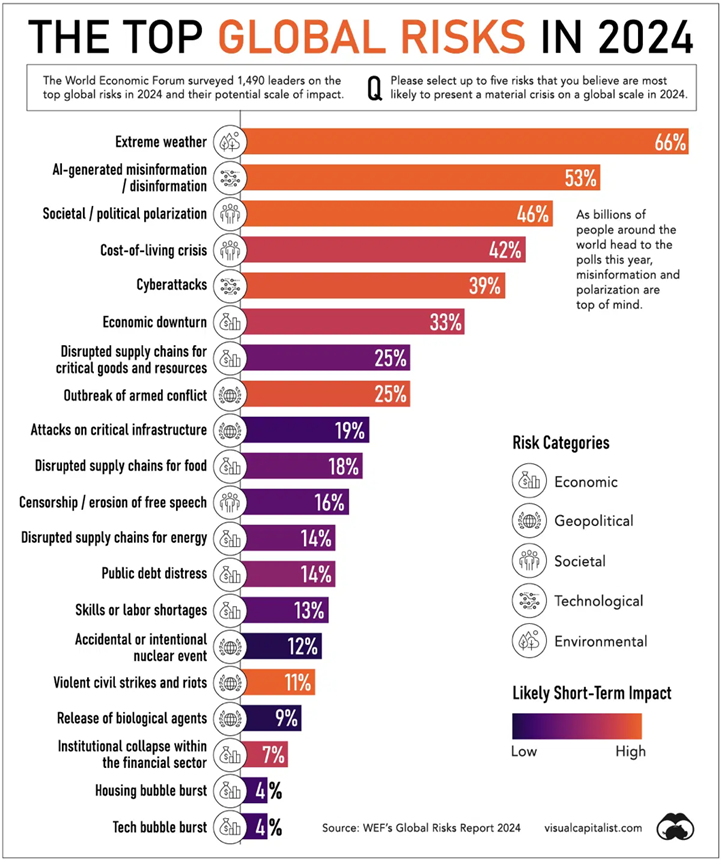

“Extreme Weather Tops this Year’s List of Global Risks – Record global temperatures are leading to increasingly harmful impacts, a cost-of living crisis is making everyday life harder for people around the world, and escalating tensions in the Middle East have the potential to widen into a broader regional conflict. Meanwhile, in 2024 it’s expected to be the world’s biggest election year ever with 4 billion people casting a vote across 60 countries. The threat of misinformation looms large as people head to the polls. This graphic shows the biggest global risks in 2024, based on the World Economic Forum’s 2024 Global Risks Report.”, Visual Capitalist, January 11, 2024

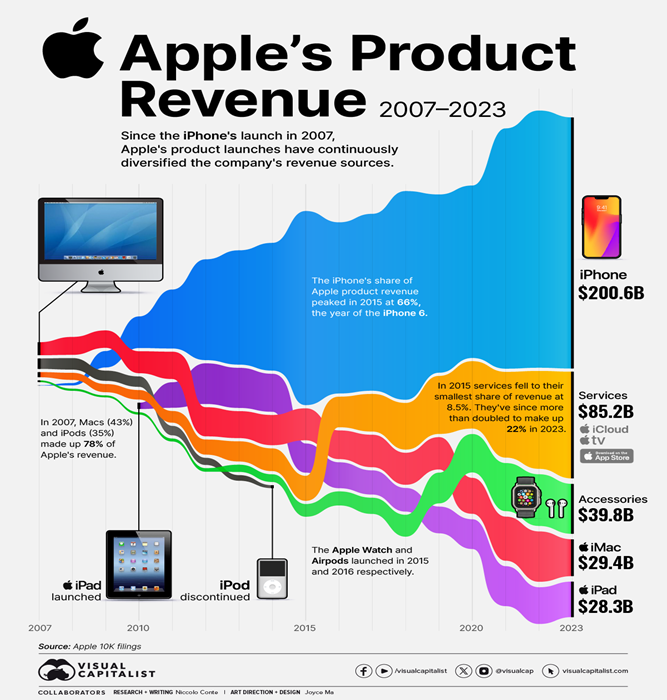

“Since the iPhone’s launch in 2007, Apple’s product launches have continuously diversified the company’s revenue sources. This infographic illustrates Apple’s revenue by product between 2007 and 2023, based on the company’s 10-K filings for the period. When Apple introduced the iPhone in 2007, Steve Jobs labeled it a “revolutionary product”. That same year, the phone represented just 0.5% of the company’s total revenue. Today, it corresponds to over half of it.”, Visual Capitalist., February 6, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

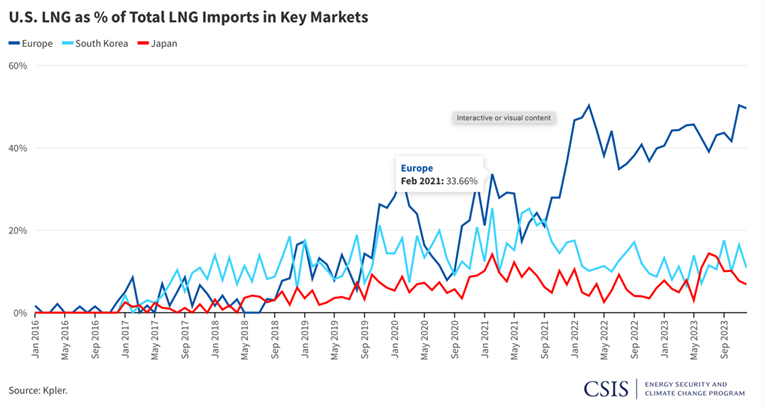

“Geopolitical Significance of U.S. LNG (Liquid Natural Gas) – When Russia’s war on Ukraine in 2022 created a scramble for alternative gas supplies, U.S. LNG featured heavily in the transatlantic response. The Biden administration pledged in March 2022 to ensure at least 15 billion cubic meters (bcm) of U.S. LNG supply to Europe that year, and the European Commission agreed to work with member states to ensure “stable demand for additional U.S. LNG until at least 2030 of approximately 50 bcm/annum.” The market delivered. LNG exports to Europe far exceeded targets for 2022 and 2023, reaching 56 bcm (billion cubic feet) and 63 bcm, respectively. Today, about 50 percent of Europe’s LNG imports come from the United States.”, CSIS, February 7. 2024

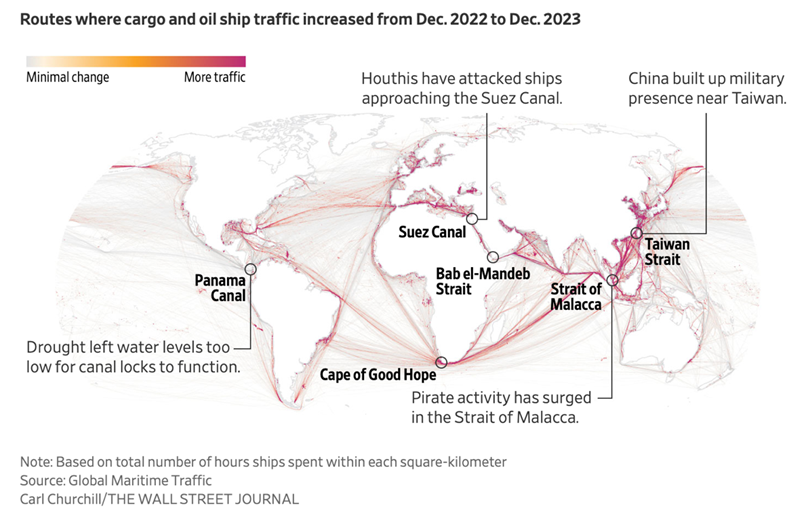

“Panama Canal traffic cut by more than a third because of drought – A severe drought that began last year has forced authorities to slash ship crossings by 36% in the Panama Canal, one of the world’s most important trade routes. One of the most severe droughts to ever hit the Central American nation has stirred chaos in the 50-mile (80-kilometer) maritime route, causing a traffic jam of vessels, casting doubts on the canal’s reliability for international shipping and raising concerns about its affect on global trade. The disruption of the major trade route between Asia and the United States comes at a precarious time. Attacks on commercial ships in the Red Sea by Yemen’s Houthi rebels have rerouted vessels away from the crucial corridor for consumer goods and energy supplies.”, AP News, January 18, 2024

“Some Volkswagen cars delayed in U.S. ports over Chinese part – VW said on Wednesday it expected to resolve by the end of March delays in the delivery of thousands of vehicles held up at U.S. ports due to a customs problem. The Financial Times reported on Wednesday that about 1,000 Porsche sports cars and SUVs, several hundred Bentleys and several thousand Audi vehicles were impounded by customs officials at U.S. ports because a Chinese subcomponent breached anti-forced labour laws. VW said it takes allegations of human rights violations very seriously, and its investigations could result in the end of a supplier relationship if a serious violation is confirmed.”, Reuters, February 14, 2024

“Cargo traffic jumped at L.A. and Long Beach ports in January, rebounding from labor troubles – The boom in business may also have legs. Port officials have said they have heard from shippers that they are shifting cargo to the massive Southern California cargo container complex — the nation’s largest — to avoid attacks on shipping in the Red Sea and the drought-driven bottleneck at the Panama Canal. The Los Angeles docks had the second-busiest January on record, handling 855,652 cargo containers….. Long Beach’s port handled 674,015 containers in January, up 17.5% from a year earlier. The two ports, which handle nearly 40% of U.S. container imports from Asia, are a key economic engine in Southern California, home to a sprawling freight transportation and warehouse network that employs thousands of people.”, Los Angeles Times, February 14, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Travel

“Business Travel Set to Reach $1 Trillion by 2030 – Business travel will shake off the pandemic over the next decade, with particular growth in the lodging and food sector and in China. While the post-pandemic recovery in business travel has lagged behind the resurgence of leisure travel, the market was estimated at $665.3 billion in 2022. By 2030, that figure will stand at $928.4 billion, following a decade of 4.3 percent compound annual growth (CAGR), a new report from Research and Markets forecasts.”, Business Travel USA, February 14, 2024

“Citizens from 54 countries can enjoy China’s 72/144-hour visa-free transit policy offered in 23 Chinese cities, covering 20 cities and 29 entry and exit ports. To be eligible for visa-free transit, the visitor must be going on to a third country after leaving China. Entering China under the visa-free transit policy when not continuing travel to a third country will be considered illegal entry. This represents the removal of one of the last travel restrictions imposed under the previous ‘zero-COVID’ policy.”, Woodburn Global, February 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Generative AI and the future of work in Australia – Advances in generative AI have accelerated Australia’s automation opportunity. If implemented well, these technologies could improve Australia’s productivity—and the quality of life of its people. With its advanced natural language capabilities, gen AI could become ubiquitous, embedded into knowledge workers’ everyday tools. As gen AI continues to evolve through 2030, it could affect a more comprehensive set of work activities, transforming skills demand in Australia.”, McKinsey & Co., February 12, 2024

“Australia Moves Closer to Mandatory Artificial Intelligence Restrictions – Expert panel named by industry minister to examine regulation Mandatory guardrails in ‘high-risk’ scenarios to be considered. AI development has been a growing area of concern for governments around the world, with the technology accelerating faster than many had anticipated. The Australian government has named a panel of legal and scientific experts to advise on potential.”, Bloomberg, February 13, 2024

Brazil

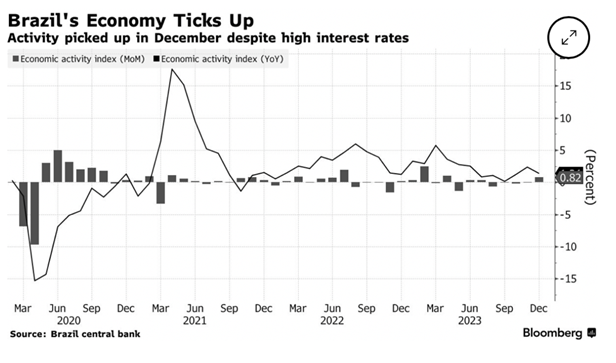

“Brazil’s Economic Activity Caps 2023 With Better-Than Expected Growth – Activity grew 0.82% on month in December, 2.45% in all 2023. President Lula wants government spending to boost economy. The central bank’s economic activity index, a proxy for gross domestic product, rose 0.82% from the month prior, more than the 0.75% median estimate from analysts in a Bloomberg survey. From a year ago, the gauge gained 1.36%, according to data published on Monday.”, Bloomberg, February 19, 2024

China

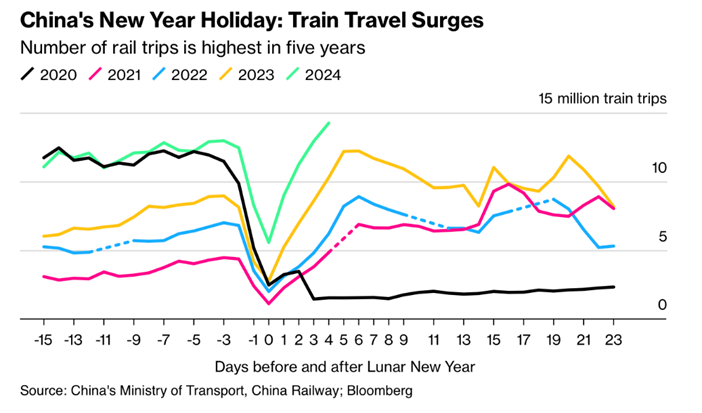

“Chinese Travelers Splurge in Year of the Dragon – Travel over China’s Lunar New Year holiday season is surging compared to the last few years, according to some initial data. That’s provided some sorely needed optimism for the world’s second-largest economy. More than 61 million rail trips were made in the first six days of the week-long national holiday, a 61% spike over the same time last year. State media reports suggest travel by road and air improved too.”, Bloomberg, February 16, 2024

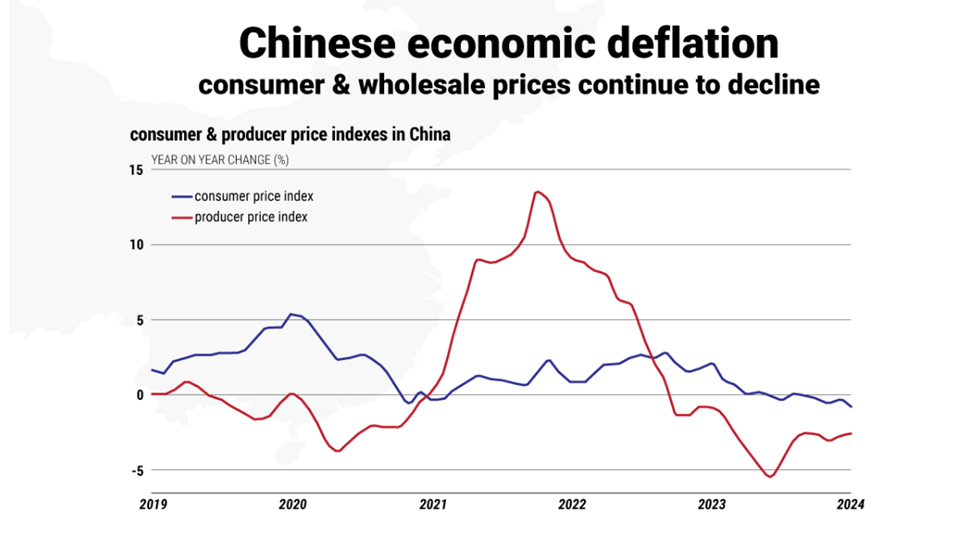

“China’s Deflation Spiral – Reversing the trend becomes more difficult the longer it lasts. Recent data show China experiencing its sharpest decline in consumer prices in over 14 years, while producer prices fell by 2.5 percent, dropping for the 16th month in a row. This situation indicates a significant risk of prolonged deflation in China, exacerbated by challenges like a real estate slump, stock market downturn, loss of investor confidence, weaker exports and low consumer demand.”, Geopolitical Futures, February 17, 2024

European Union & Eurozone

“Batteries for Europe’s Grids May Finally Be Ready to Take Off – Region may see sevenfold surge in storage by 2030: Aurora UK, Italy and Ireland are named top markets for investment. Europe is on the brink of an enormous surge in battery projects for the grid after a half-decade of stumbling without a clear strategy. There could be a sevenfold increase to more than 50 gigawatts in capacity connected to transmission networks by 2030, according to Aurora Energy Research Ltd. The UK, Italy and Ireland are the top three markets for storage investment within the region, with Spain and Greece emerging.”, Bloomberg, February 14, 2024

Indonesia

“‘Continuity’ Prabowo means change for Indonesia – Prabowo Subianto used the endorsement of the popular outgoing president to win power – but is unlikely to govern as Jokowi’s ‘proxy’. Indonesia’s choice of leader matters far beyond its archipelagic shores, given its prominent role within Southeast Asia, its position on the forefront of US–China rivalry, the scale and rapid growth of its G20 economy, and its status as the world’s largest Muslim-majority nation.”, Chatham House, February 15, 2024

Japan

“Japan Loses Its Spot as World’s Third-Largest Economy as It Slips Into Recession. Data underscore weak domestic consumption, investment Economy falls to fourth-largest in world behind Germany. Japan’s economy unexpectedly slipped into recession after shrinking for a second quarter due to anemic domestic demand, prompting some central bank watchers to push back bets on when the nation’s negative interest rate policy will end. Gross domestic product contracted at an annualized pace of 0.4% in the final three months of last year, following a revised 3.3% retreat in the previous quarter, the Cabinet Office reported Thursday.”, Bloomberg, February 15, 2024

Mexico

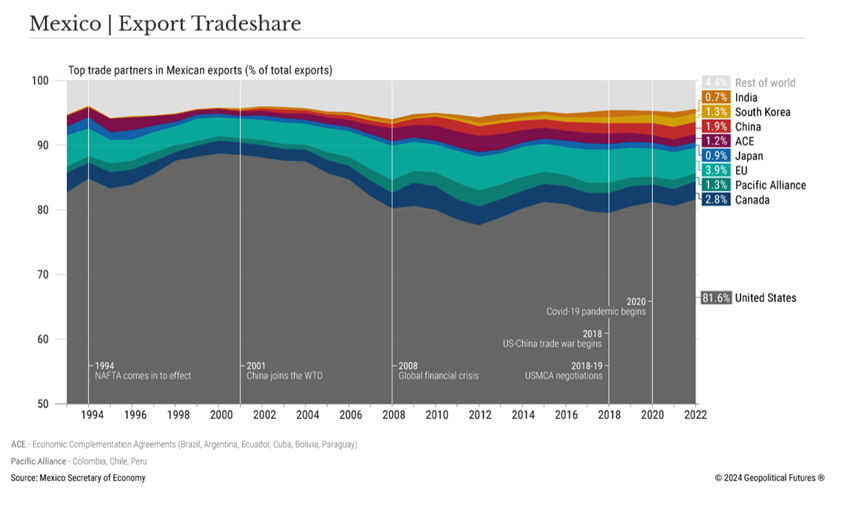

“The Big Picture of Mexican Exports – Recent data suggest its pivot to Asia may pay off. Mexico’s economy made headlines late last week when the latest data from the U.S. Commerce Department showed that, for the first time in more than 20 years, Mexican exports to the U.S. surpassed exports from China to the U.S. Mexico’s exports rose 5 percent year over year in 2023, while Chinese exports fell by 20 percent.”, Geopolitical Futures, February 12, 2024

“Elon Musk Woos Chinese Suppliers to Set Up Right Next Door to US – Exports of Chinese-made parts to US reached $1 billion in 2023 US worries cheap Chinese EVs also will be made in Mexico. On the outskirts of Monterrey, Mexico, Chinese auto-parts makers are rapidly setting up plants to supply Tesla Inc.’s next factory. They join the ranks of Chinese manufacturers that opened Mexican facilities in response to Trump-era tariffs — and this new surge has set off alarm bells in Washington.”, Bloomberg, Feruary 14, 2024

Thailand

Thailand Mulls $1 Billion Global Sovereign Bond Offer, First in Two Decades – Public debt office set to wrap up study on global bond by May Foreign offering meant to set benchmark for private borrowers. Thailand’s government is weighing a plan to raise about $1 billion from the global market via what would be the country’s first foreign-currency sovereign bond sale in two decades. Such a deal is meant to provide a benchmark for Thai companies tapping the overseas markets for their funding….”, Bloomberg, February 18, 2024

Turkey

“This City Was the World’s Most Visited in 2023 – Twenty million people flew to Istanbul last year. Whatever the reason, people truly seem to be flocking to Istanbul. And those more than 20 million arrivals made it the number one city for international arrivals on earth in 2023, according to Euromonitor International’s World’s Top 100 City Destinations report. Istanbul was followed by London in second place for most international arrivals (up 17 percent) and Dubai in third (up 18 percent). Rounding out the top five is the beachside Turkish city of Antalya, followed by Paris in fifth.”, Travel and Leisure magazine, February 7, 2024

United States

“Big U.S. food and drink brands are getting hit by the Israel-Hamas war – Some of the biggest names in the fast food industry, including McDonald’s, Taco Bell, and Burger King, have said their fourth-quarter sales were impacted by Israel’s war in Gaza. But executives of these companies kept things as vague as possible in their recent calls with investors, and some went so far as to avoid the word “war” altogether. A few company chiefs walked an even finer line — sharing their condolences with victims of the violence without saying who exactly they think is the victim.”, Quartz, February 15, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Franchisee profitability soars for Burger King and its sister chains – Sales were positive at Restaurant Brands International concepts, including Tim Hortons, Popeyes and Firehouse Subs. At Burger King, operator profitability increased 46%. A typical Burger King location last year generated $205,000 in profits, RBI said. That’s 46% more than 2022, when a typical location generated just $140,000. Per-store profits increased 17% at Popeyes Louisiana Kitchen to $245,000. They increased 27% at Tim Hortons Canada to C$280,000 ($208,000 U.S.). They increased 38% at Firehouse Subs to $110,000 per store.”, Restaurant Business, February 13, 2024

“Yum! is Building Restaurants at an Unprecedented Pace – In 2024, the company will not only reach 60,000 units worldwide, but also 30,000 at KFC and 20,000 at Pizza Hut. Nearly 25 percent of all current Yum! locations have been built in the past three years. Given the company ended 2023 with 58,708 locations worldwide—extending its claim as the largest restaurant group in the world—roughly 15,000 of them are 3 years old or younger.”, QSR Magazine, February 7, 2024

“Flynn Group, world’s largest franchisee, explores $5 bln-plus sale – Flynn Group, the world’s largest franchisee operator of restaurants and fitness clubs, is exploring a majority stake sale that could value it at more than $5 billion, including debt, according to people familiar with the matter. Flynn Group, which operates Applebees, Taco Bell, Panera Bread, Arby’s, Pizza Hut, Wendy’s and Planet Fitness franchises, is working with Bank of America on a sale process, the sources said. Flynn Group, which is based in San Francisco, generates over $450 million of annual earnings before interest, taxes, depreciation and amortization, according to the sources.”, Reuters, February 8, 2024

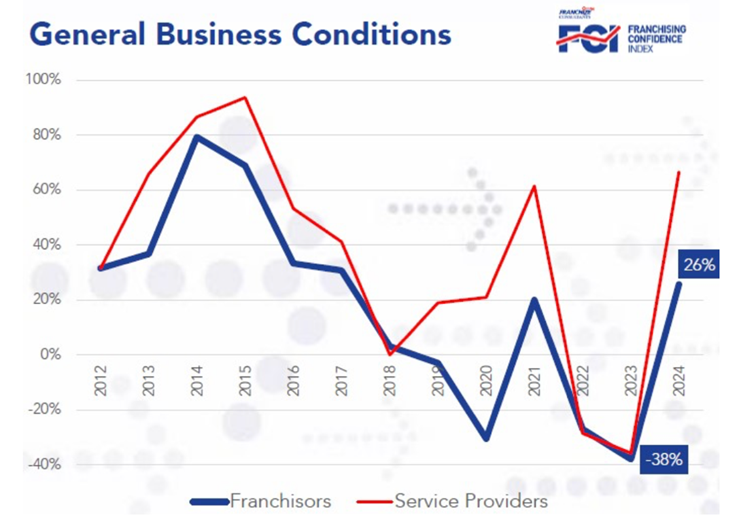

“Outlook improves for NZ (New Zealand) franchisors, franchisees – Franchize Consultants’ annual Franchising Confidence Index has measured the mood of the sector, revealing predictions and insight from franchisors and specialist service providers. After the turbulent times of recent years, responding franchisors were much more positive about general business conditions, access to financing, franchisees, and suitable staff. They were also generally more positive about franchisee topline sales levels, although there were concerns for franchisee operating costs and the resultant impact on franchisee profitability levels. They identified the top trends impacting franchising in New Zealand as the future regulatory environment and changing customer expectations.”, Franchise New Zealand, February 14, 2024

This issue we are sharing an upcoming book written by Alicia Miller, Co-Founder and Managing Director of Emergent Growth Advisors, that will be important to Franchisors everywhere. “Big Money in Franchising, Scaling Your Enterprise in the Era of Private Equity” will be published shortly and is now available on Amazon for pre-order.

To receive this biweekly newsletter, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

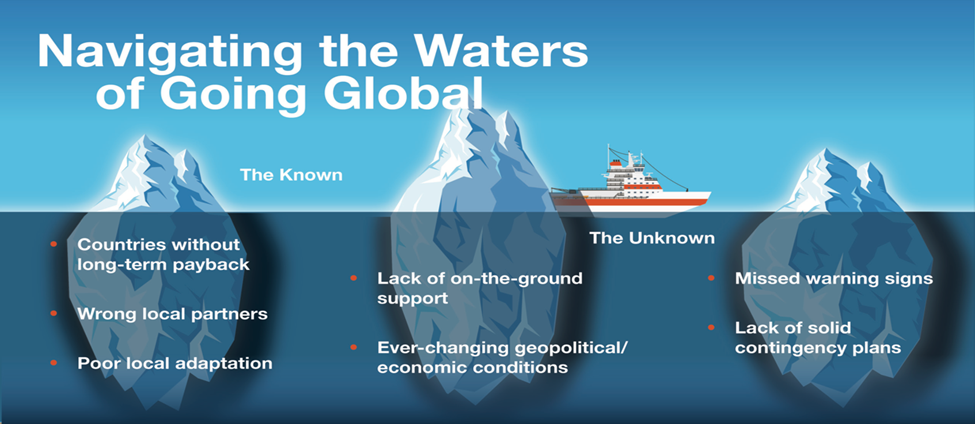

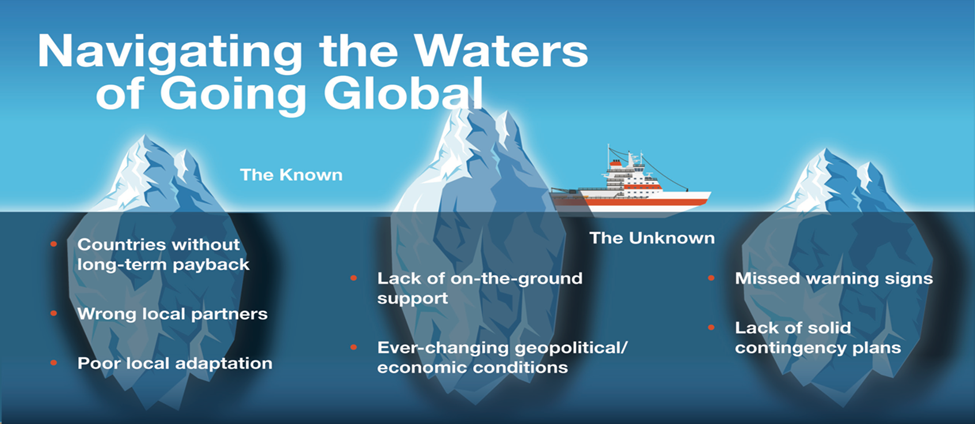

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 101, Tuesday, February 6, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: This year 64 countries covering 49% of the world’s population and 57% of the world’s GDP will have elections that will impact global business. The European Union is about to finalize their Artificial Intelligence Act. Has the world passed ‘Peak Child’? Growth of established Western brandcd continues in China. Red Sea challenges grow.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“A people free to choose will always choose peace”, President Ronald Reagan

“Time is what we want most, but what we use worst.”, William Penn

“Even if you’re on the right track, you’ll get run over if you just sit there.”, Will Rogers

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #101:

The World Has Passed ‘Peak Child’

EU Artificial Intelligence Act

Why US small businesses will lead in AI investments in 2024

Big businesses take more space in London

Big Brands Are Playing the Long Game in China

(U.K.) Business confidence at its highest for January in eight years

Brand Global News Section: Body Shop®, Pizza Inn®, School of Rock®, Starbucks® and STRONG Pilates®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

2024 will see elections in 64 countries covering 49% of world’s population and 57% of the world’s GDP. These elections have the potential for major changes to economic policies in major business countries. Statista, January 2024

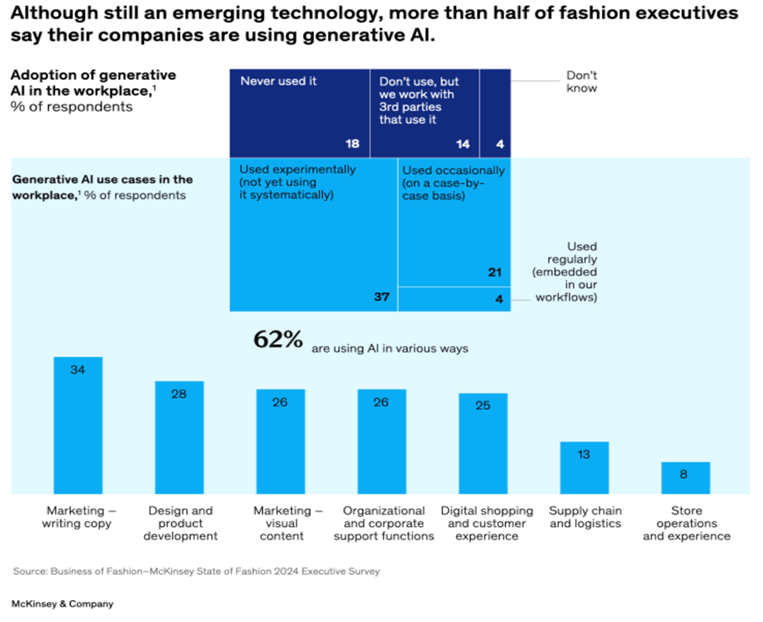

“Gen AI is so hot right now – The fashion industry has witnessed its share of ephemeral tech buzz, trends that disappear before they start. Generative AI, though, could have some staying power. Seventy-three percent of recently surveyed global fashion executives indicate generative AI will be a key priority for their businesses in the coming year, senior partner Achim Berg and colleagues note. And 62 percent of fashion leaders say their companies already use the technology, in areas such as online shopping assistance and writing product descriptions.”, McKinsey & Co., February 1, 2024

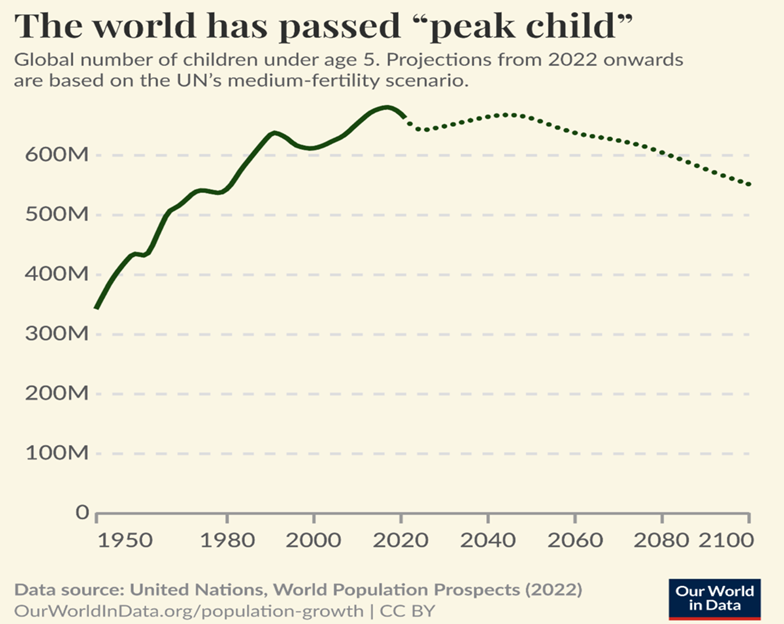

“The World Has Passed ‘Peak Child’ – Hans Rosling famously coined the term “peak child” for the moment in global demographic history when the number of children stops increasing. According to UN data, the world has now passed “peak child,” which is defined as the number of children under the age of five. The chart shows the UN’s historical estimates and projections of the global number of children under five. It estimates that the number of under-fives in the world peaked in 2017. Demographers expect a decades-long plateau before a more rapid decline in the second half of the century.”, Our World In Data, February 2, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Falling US inflation opens door to rate cuts within months, says OECD – Price pressures in UK forecast to be highest among G7 nations over next two years. The OECD’s interim outlook, published on Monday, predicted US inflation of just 2.2 per cent in 2024 and 2 per cent in 2025 — among the lowest rates in the G7. The Paris-based organisation said that only in Italy would price growth be less this year.”, The Financial Times, February 5, 2024

“Central bankers gear up for interest rate cuts – Policymakers may need to reduce the cost of credit sooner than they convey. Milton Friedman believed the “long and variable lags” of active monetary policy made its goal of hitting an inflation target essentially unachievable. Central bankers invoked these flaws earlier in this cycle to allay fears of runaway inflation, by claiming that their rate rises would eventually come to tame it. Now that price growth has fallen rapidly, they could end up contradicting themselves by being too slow to cut rates. Caution is understandable. Central bankers fear that inflation could bounce back. Wage growth is still high by historic standards.”, The Financial Times, February 1, 2024

“On the High Seas, a Pillar of Global Trade Is Under Attack – Security crises from Red Sea to Black Sea pose a troubling question: How much has freedom of navigation been an anomaly? The modern economy rests on a rule so old that hardly anybody alive can remember a time before it: Ships of any nation may sail the high seas. Suddenly, that pillar of the international order shows signs of buckling.”, The Wall Street Journal, February 1, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

“Factories in developing Asia may have seen the worst of manufacturing slump – South Korea’s S&P manufacturing PMI recorded a first expansionary reading since June 2022. Similar readings for Vietnam, Indonesia, the combined ASEAN, Taiwan, Malaysia and Thailand also saw improvements in January from December. In its January forecast, the International Monetary Fund said it expects emerging economies in Asia to grow 5.2% this year — a 0.4 percentage point upgrade from its forecast in October. The IMF upped its global economic growth projection to 3.1% in 2024 due to the greater-than-expected resilience of the U.S. and several large developing economies as well as fiscal support in China.”, CNBC, February 1, 2024

“IMF ups emerging Asia growth forecast, warns of China property risks but says India is a bright spot – IMF expects emerging economies in Asia to grow at 5.2% in 2024, a 0.4 percentage point upgrade from its forecast in October. It also estimates China’s economy will grow 4.6% in 2024, or 0.4 percentage point higher than the IMF’s forecast in October. Growth in India will remain strong at 6.5% in both 2024 and 2025, according to the IMF, on resilient domestic demand. The IMF also lifted its global growth forecast on the unexpected strength of the U.S. economy and fiscal support measures in China. It expects 3.1%, global growth this year, up 0.2 percentage point from its October projection, followed by a 3.2% expansion in 2025.”, CNBC, January 30, 2024

Brazil

“Volkswagen Investing $1.8 Billion in Brazil – Betting on Hybrids Carmaker plans flex, hybrids and electric models by 2028 Resources to be directed to all of brand’s factories in Brazil. The German carmaker, which wants to boost its profits in the region, announced the initiative a week after General Motors Co. disclosed plans to invest 7 billion reais in Brazil through 2028.”, Bloomberg, February 1, 2024

China

“‘Uninvestable’: China’s $2tn stock rout leaves investors scarred – Some global fund managers fear government efforts to stabilise the market are too little, too late. Chinese authorities’ promise of “forceful” measures last week was their most vocal attempt yet to halt a stock market sell-off that has wiped out almost $2tn in value. For many investors at a Goldman Sachs conference in Hong Kong, that vow was too little, too late. More than 40 per cent of those surveyed while attending a session on Chinese equities held by the US bank on Wednesday said they believed the country was ‘uninvestable’”., The Financial Times. February 2, 2024

“Big Brands Are Playing the Long Game in China – Apple, Mondelez and Procter & Gamble are bullish on consumer spending growth in China despite recent economic turmoil there. For years, the world’s biggest companies poured into China, enticed by the promise of generating hefty revenue from a growing class of consumers. China is now grappling with significant youth unemployment, dour economic forecasts and the collapse of what was once the country’s largest property developer. While U.S. executives have lamented weaker demand for some consumer products in China during earnings calls in recent weeks, a breakup is unlikely soon.”, The Wall Street Journal, February 4, 2024. Compliments of Paul Jones, Jones & Co., Toronto

European Union & Eurozone

“EU Artificial Intelligence Act — Final Form Legislation Endorsed by Member States – The long-awaited proposed AI Act, once enacted, will be a comprehensive cross-sectoral regulatory framework for artificial intelligence (AI). Its aim is to regulate the development and use of AI by providing a framework of obligations for parties involved across the entire AI supply chain. As with the General Data Protection Regulation (GDPR), the EU is seeking, through its first-mover advantage, to set the new global standard for AI regulation.”, Faegre Drinker, February 5, 2024

India

“India Cuts Tariffs to Entice More iPhone Manufacturing – Country lowering import taxes on smartphone components Move set to make assembly in India more cost-effective. ndia is reducing import taxes on several mobile-device components to boost smartphone production, a boon for companies like Apple Inc. that are increasingly considering the country as a global manufacturing base. Modi is trying to make India an electronics manufacturing powerhouse, luring global brands such as Apple away from China. At the same time, he’s trying to build an ecosystem of domestic suppliers to ensure India grabs a larger part of the value chain instead of being just an assembly location.”, Bloomberg, January 31, 2024

South Korea

“South Korea’s Exports Get off to Strong Start in 2024 – Exports from Asia’s fourth-largest economy rose 18.0% in January from a year earlier. January’s result marked a fourth consecutive month of expansion in exports for South Korea—the latest of a series of signs pointing to a recovery in global trade. Shipments grew at a stronger-than-expected pace, handily beating the median forecast from 11 economists polled by The Wall Street Journal for a 16.8% rise.”, The Wall Street Journal. January 31, 2024

Saudi Arabia

“Saudi Arabia Unveils Initiatives to Attract Global Investors and Entrepreneurs – In a strategic move to entice global investors and skilled professionals, Saudi Arabia has taken significant steps, opening its sectors to public-private partnerships, implementing new regulations for foreign companies, and launching the regional headquarters program. As part of its ambitious Vision 2030, the kingdom aims to host 480 global company headquarters by the end of the decade.”, Franchise Talk, January 22, 2024

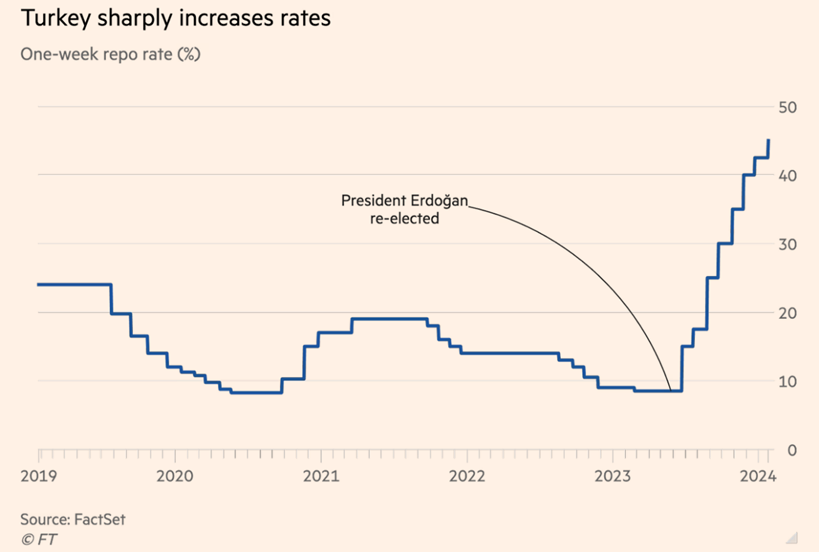

Turkey

“Turkey still must shake off its inflation addiction – A target of low double-digit percentage price growth will do. Turkey’s devastating earthquakes one year ago horrified the nation. The disaster brought a shake-up in economic policy as well. Soaring annual price inflation, over 50 per cent, forced President Recep Tayyip Erdoğan to deal with the inflationary scourge — embracing economic orthodoxy in the form of higher interest rates.”, The Financial Times – February 5, 2024

United Kingdom

“Big businesses take more space in London – The number of companies looking for new offices in London is at its highest level in a decade, with leasing agents working to find 12 million sq ft of space for their clients. About 80 per cent of companies in the market for a new office are looking for either the same amount of space or more, Knight Frank found. However, there is a shortage of the most modern, eco-friendly office blocks that corporate renters are demanding. As such, companies are battling it out for high-end offices, rents for which are increasing quickly.”, The Times of London, January 30, 2024

“UK Border Checks on Food Begin on Brexit’s 4th Anniversary – Starting Wednesday, which marks the fourth anniversary of Brexit, health certificates will be required for medium- to high-risk foods, such as eggs for hatching, milk, cheese, fish and meat. It’s the latest stage of Britain’s split from the European Union. All this is coming just as the UK’s sticky consumer price inflation rate was finally coming down. Government officials are confident the introduction of paperwork checks will go smoothly, ahead of further physical checks to be introduced starting in April.”, Bloomberg, January 31, 2024

“(U.K.) Business confidence at its highest for January in eight years – Widespread anticipation of several interest rate cuts by the Bank of England this year has bolstered business confidence. Inflation is expected to continue its descent in the first half of this year, with several economic consultancies projecting that the rate will be back to the Bank of England’s 2 per cent target by April from its present level of 4 per cent.”, The Times of London, January 25, 2-24

United States

“Small Businesses Upbeat About 2024 Performance, Says Goldman Sachs Survey – While fundamental optimism is spreading, access to capital and high interest rates is stressing out Main Street and Wall Street. Of the 1,459 businesses that responded to the most recent 10,000 Small Businesses Voices survey from Goldman’s small business unit, 75 percent were positive about their financial prospects for the year, according to a summary released by the investment bank. The upbeat views contrast with respondents’ concerns and challenges: 71 percent said inflationary pressures increased for their businesses over the past three months, and 77 percent remain concerned about their ability to access capital.”, INC., February 2, 2024

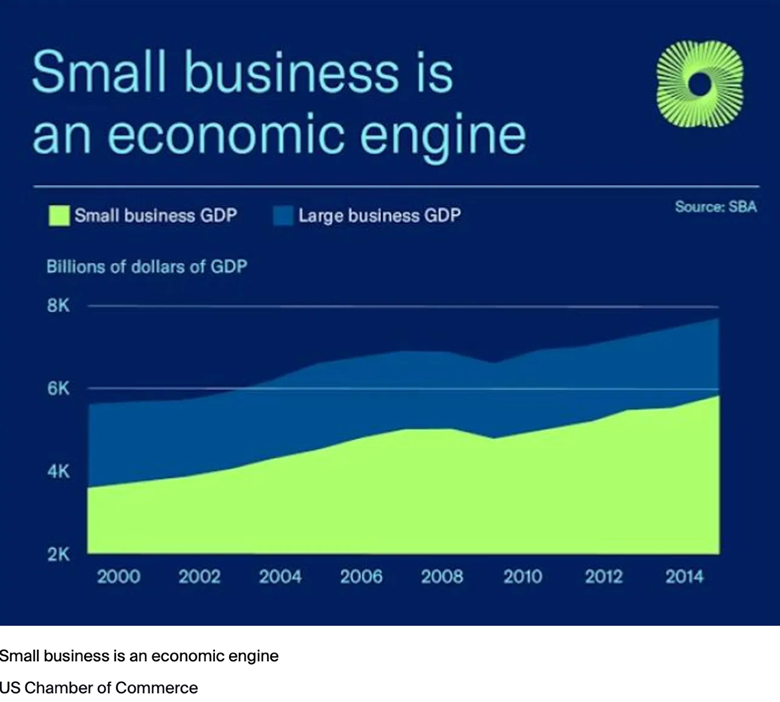

“Why US small businesses will lead in AI investments in 2024 – A new survey of US small business owners finds that 60% seek to improve productivity and communications by allocating bigger budgets to new technologies like artificial intelligence. Small businesses employ nearly half of the entire American workforce and represent 43.5% of America’s GDP. They are a critical part of our economic ecosystem, where big businesses and small businesses are vendors, employees, partners, and customers to each other.”, ZDNET, February 2, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

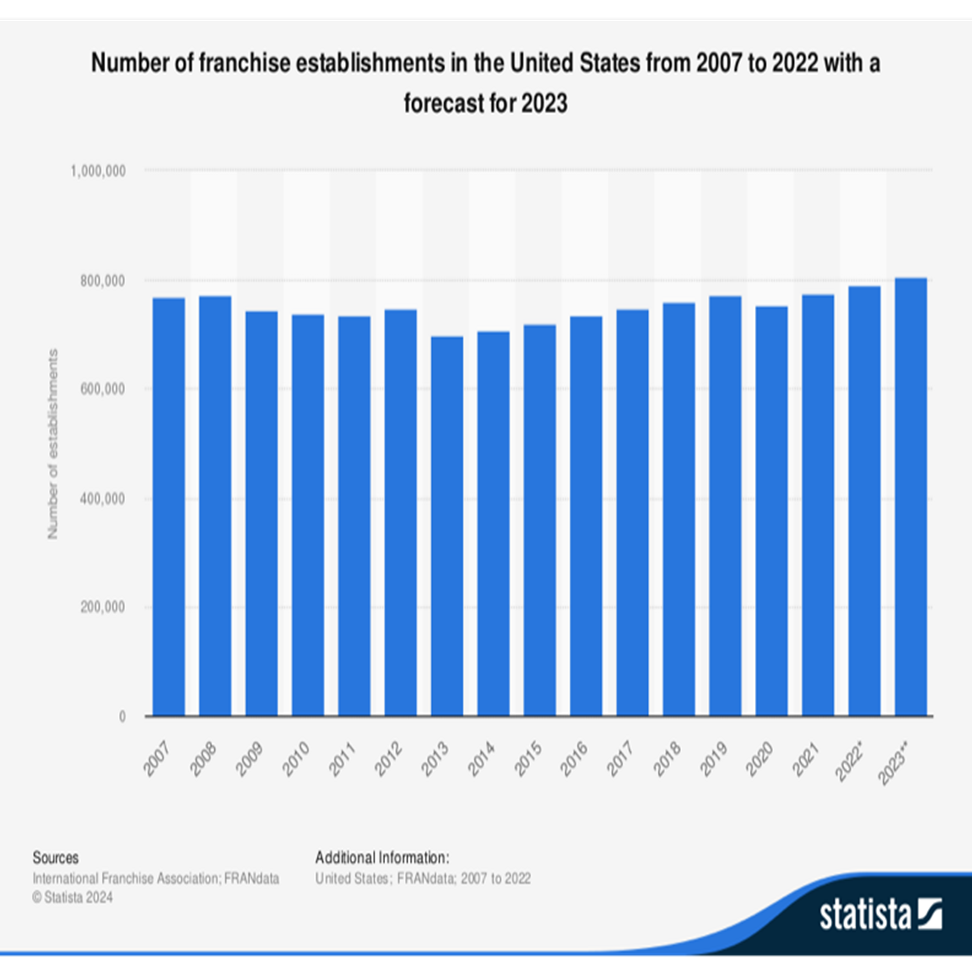

From a recent study by the International Franchise Association and FRANdata

“Under New Ownership, The Body Shop Is Shedding Most European and Some Asian Business – Financial terms of the deal, which includes both physical and digital operations, were not disclosed. The part of the activity effected equals to about 14 percent of The Body Shop’s business worldwide. The sale does not impact its global head franchise partners, which operate on a country or territory level, but some sub-franchise partners are to be included in the sale.”, WWD, February 1, 2024

“Pizza Inn and New Franchise Partner Team Up to Bring 50 New Locations to Saudi Arabia – Pizza Inn today announced a major franchise agreement with Blessings Basket Company for Serving Food to substantially expand its footprint in the Kingdom of Saudi Arabia. The 50-unit deal will kick off with the opening of the first two locations in January 2024.”, Franchising.com, February 4, 2023

“School of Rock Awards Master Franchise Agreement for Four New Countries – School of Rock announced today that Matias Puga Hamilton, School of Rock’s Latin America master franchisee, is set to double his portfolio with the brand with 13 new locations throughout Argentina, Bolivia, Ecuador and Uruguay. Beginning with a primary focus on Argentinian development, Matias Puga Hamilton awarded his first sub-franchise rights for a new School of Rock location in Buenos Aires’ northern suburbs, specifically in the Nordelta area. Sub-franchisees Roberto Sambrizzi and Fernando Tuer aim to open the school in April 2024.”, Franchising.com, February 4, 2024

“STRONG Pilates Launches in Japan – STRONG Pilate has announced the appointment of STRONG Pilates Japan (SPJ) as its master franchisee partner. Established by Chair and CEO, John B. Boardman, with extensive experience and success in the fitness market in Japan, SPJ plans to roll out 50 studios in Japan over the next 5 years.”, Franchising.com, February 4, 2024

“Starbucks stores on Chinese mainland exceed 7,000 – During a conference call on Wednesday, Belinda Wong, chairperson and CEO of Starbucks China, said that in January 2024, the company had achieved a milestone in the Chinese mainland market by surpassing 7,000 stores, while adding that Starbucks is dedicated to reaching its goal of 9,000 mainland stores by 2025. The year 2024 marks the 25th anniversary of Starbucks entering the Chinese mainland market. Wong said Starbucks will accelerate its expansion into more communities, aiming to provide high-quality coffee and the unique Starbucks experience to a broader range of Chinese customers.”, Shine.cn, January 31, 2024. Compliments of Paul Jones, Jones & Co., Toronto

This issue we are sharing an interesting franchise sector a book written by Gary Prenevost, a long-time franchise industry thought leader long-time relationship partner of ours has just been picked for USA Today’s top 10 business books to help you scale in 2024. The ‘Unstoppable Franchisee’ addresses several core operational challenges and is entirely focused on helping existing franchisees take their business to the next level. The book made the USA top 10 list and highly suggest you recommend this book to your franchisees to read as part of their growth plans in 2024.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking