EGS Biweekly Global Business Newsletter Issue 102, Tuesday, February 20, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Democracy continues to be at risk and then 64 major elections around the world this year may not help. AI moves closer to government regulation in more countries. Business travel seems back to 2019 levels. U.S. LNG exports continue to climb. U.S. food brands are hit by the Middle East war’.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“I’m a great believer in luck, and I find the harder I work, the more I have of it.” – Thomas Jefferson

“If you want to go fast, go alone. If you want to go far, go together.” – African Proverb

“A diamond is a piece of coal that stuck to the job.” – Michael Larsen

Highlights in issue #102:

- Brand Global News Section: McDonalds®, Tim Hortons®, Popeyes® , Firehouse Subs®, Taco Bell®, Burger King®, KFC® and Pizza Hut®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

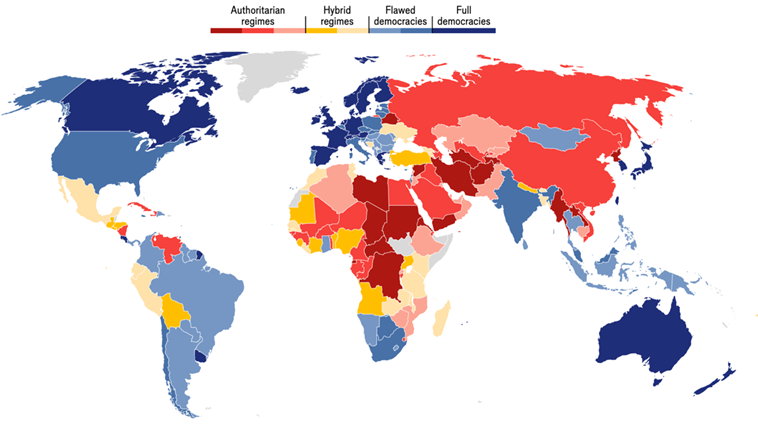

“Where democracy is most at risk – Four lessons from EIU’s new ranking of democracies. This year’s democracy index published by EIU, our sister company, shows that only 43 of the more than 70 elections are expected to be fully free and fair. Each year EIU (Economist Intelligent grades 167 countries and territories on a scale of ten according to the strength of their democratic practices, including how fairly they run elections and how well they protect civil liberties. More than half the world’s people live in countries that are holding elections this year. But EIU’s index shows that in democracy, quality trumps quantity.”, The Economist, February 14, 2024

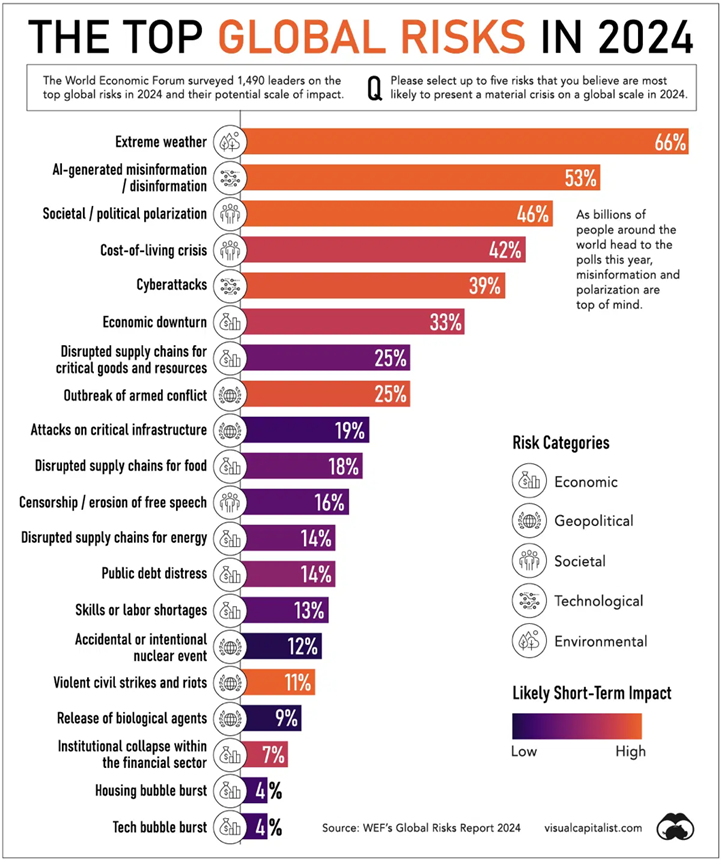

“Extreme Weather Tops this Year’s List of Global Risks – Record global temperatures are leading to increasingly harmful impacts, a cost-of living crisis is making everyday life harder for people around the world, and escalating tensions in the Middle East have the potential to widen into a broader regional conflict. Meanwhile, in 2024 it’s expected to be the world’s biggest election year ever with 4 billion people casting a vote across 60 countries. The threat of misinformation looms large as people head to the polls. This graphic shows the biggest global risks in 2024, based on the World Economic Forum’s 2024 Global Risks Report.”, Visual Capitalist, January 11, 2024

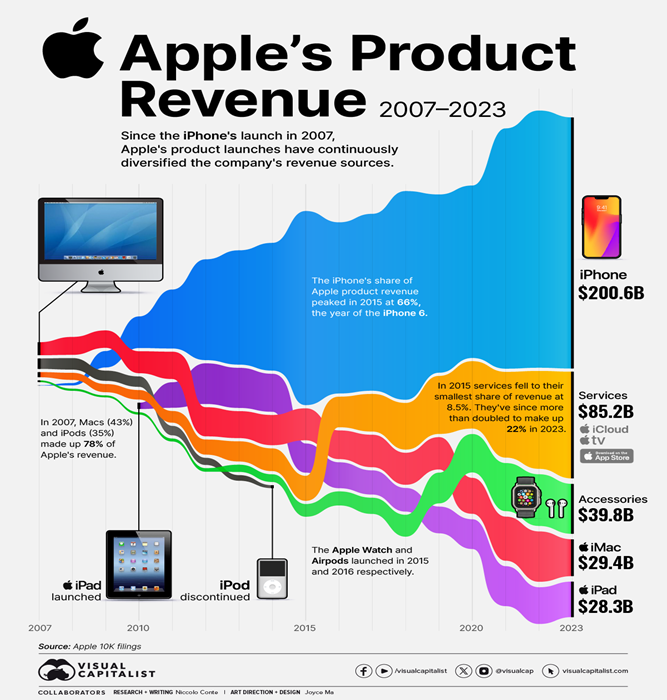

“Since the iPhone’s launch in 2007, Apple’s product launches have continuously diversified the company’s revenue sources. This infographic illustrates Apple’s revenue by product between 2007 and 2023, based on the company’s 10-K filings for the period. When Apple introduced the iPhone in 2007, Steve Jobs labeled it a “revolutionary product”. That same year, the phone represented just 0.5% of the company’s total revenue. Today, it corresponds to over half of it.”, Visual Capitalist., February 6, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

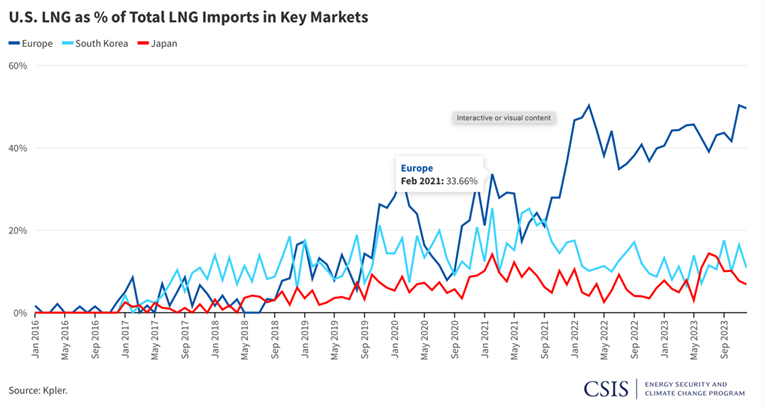

“Geopolitical Significance of U.S. LNG (Liquid Natural Gas) – When Russia’s war on Ukraine in 2022 created a scramble for alternative gas supplies, U.S. LNG featured heavily in the transatlantic response. The Biden administration pledged in March 2022 to ensure at least 15 billion cubic meters (bcm) of U.S. LNG supply to Europe that year, and the European Commission agreed to work with member states to ensure “stable demand for additional U.S. LNG until at least 2030 of approximately 50 bcm/annum.” The market delivered. LNG exports to Europe far exceeded targets for 2022 and 2023, reaching 56 bcm (billion cubic feet) and 63 bcm, respectively. Today, about 50 percent of Europe’s LNG imports come from the United States.”, CSIS, February 7. 2024

“Panama Canal traffic cut by more than a third because of drought – A severe drought that began last year has forced authorities to slash ship crossings by 36% in the Panama Canal, one of the world’s most important trade routes. One of the most severe droughts to ever hit the Central American nation has stirred chaos in the 50-mile (80-kilometer) maritime route, causing a traffic jam of vessels, casting doubts on the canal’s reliability for international shipping and raising concerns about its affect on global trade. The disruption of the major trade route between Asia and the United States comes at a precarious time. Attacks on commercial ships in the Red Sea by Yemen’s Houthi rebels have rerouted vessels away from the crucial corridor for consumer goods and energy supplies.”, AP News, January 18, 2024

“Some Volkswagen cars delayed in U.S. ports over Chinese part – VW said on Wednesday it expected to resolve by the end of March delays in the delivery of thousands of vehicles held up at U.S. ports due to a customs problem. The Financial Times reported on Wednesday that about 1,000 Porsche sports cars and SUVs, several hundred Bentleys and several thousand Audi vehicles were impounded by customs officials at U.S. ports because a Chinese subcomponent breached anti-forced labour laws. VW said it takes allegations of human rights violations very seriously, and its investigations could result in the end of a supplier relationship if a serious violation is confirmed.”, Reuters, February 14, 2024

“Cargo traffic jumped at L.A. and Long Beach ports in January, rebounding from labor troubles – The boom in business may also have legs. Port officials have said they have heard from shippers that they are shifting cargo to the massive Southern California cargo container complex — the nation’s largest — to avoid attacks on shipping in the Red Sea and the drought-driven bottleneck at the Panama Canal. The Los Angeles docks had the second-busiest January on record, handling 855,652 cargo containers….. Long Beach’s port handled 674,015 containers in January, up 17.5% from a year earlier. The two ports, which handle nearly 40% of U.S. container imports from Asia, are a key economic engine in Southern California, home to a sprawling freight transportation and warehouse network that employs thousands of people.”, Los Angeles Times, February 14, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Travel

“Business Travel Set to Reach $1 Trillion by 2030 – Business travel will shake off the pandemic over the next decade, with particular growth in the lodging and food sector and in China. While the post-pandemic recovery in business travel has lagged behind the resurgence of leisure travel, the market was estimated at $665.3 billion in 2022. By 2030, that figure will stand at $928.4 billion, following a decade of 4.3 percent compound annual growth (CAGR), a new report from Research and Markets forecasts.”, Business Travel USA, February 14, 2024

“Citizens from 54 countries can enjoy China’s 72/144-hour visa-free transit policy offered in 23 Chinese cities, covering 20 cities and 29 entry and exit ports. To be eligible for visa-free transit, the visitor must be going on to a third country after leaving China. Entering China under the visa-free transit policy when not continuing travel to a third country will be considered illegal entry. This represents the removal of one of the last travel restrictions imposed under the previous ‘zero-COVID’ policy.”, Woodburn Global, February 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Generative AI and the future of work in Australia – Advances in generative AI have accelerated Australia’s automation opportunity. If implemented well, these technologies could improve Australia’s productivity—and the quality of life of its people. With its advanced natural language capabilities, gen AI could become ubiquitous, embedded into knowledge workers’ everyday tools. As gen AI continues to evolve through 2030, it could affect a more comprehensive set of work activities, transforming skills demand in Australia.”, McKinsey & Co., February 12, 2024

“Australia Moves Closer to Mandatory Artificial Intelligence Restrictions – Expert panel named by industry minister to examine regulation Mandatory guardrails in ‘high-risk’ scenarios to be considered. AI development has been a growing area of concern for governments around the world, with the technology accelerating faster than many had anticipated. The Australian government has named a panel of legal and scientific experts to advise on potential.”, Bloomberg, February 13, 2024

Brazil

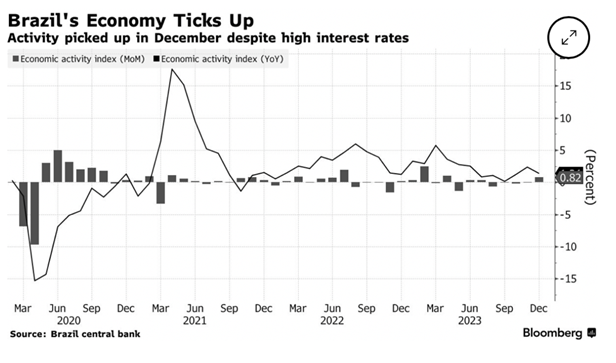

“Brazil’s Economic Activity Caps 2023 With Better-Than Expected Growth – Activity grew 0.82% on month in December, 2.45% in all 2023. President Lula wants government spending to boost economy. The central bank’s economic activity index, a proxy for gross domestic product, rose 0.82% from the month prior, more than the 0.75% median estimate from analysts in a Bloomberg survey. From a year ago, the gauge gained 1.36%, according to data published on Monday.”, Bloomberg, February 19, 2024

China

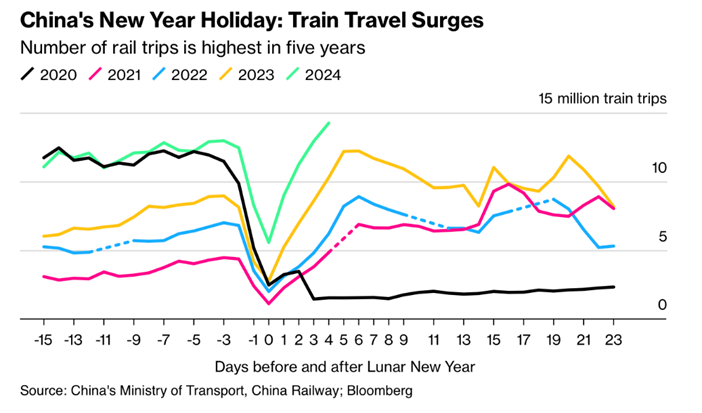

“Chinese Travelers Splurge in Year of the Dragon – Travel over China’s Lunar New Year holiday season is surging compared to the last few years, according to some initial data. That’s provided some sorely needed optimism for the world’s second-largest economy. More than 61 million rail trips were made in the first six days of the week-long national holiday, a 61% spike over the same time last year. State media reports suggest travel by road and air improved too.”, Bloomberg, February 16, 2024

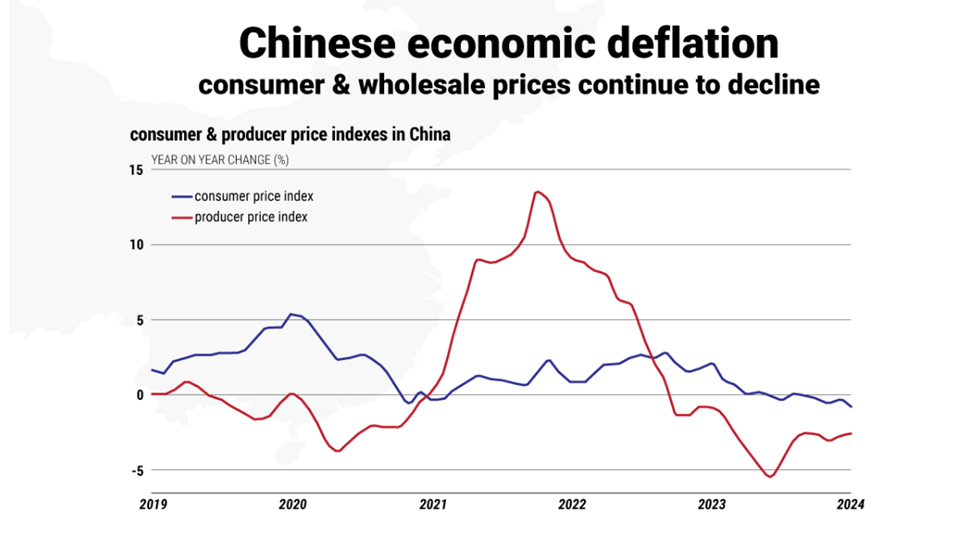

“China’s Deflation Spiral – Reversing the trend becomes more difficult the longer it lasts. Recent data show China experiencing its sharpest decline in consumer prices in over 14 years, while producer prices fell by 2.5 percent, dropping for the 16th month in a row. This situation indicates a significant risk of prolonged deflation in China, exacerbated by challenges like a real estate slump, stock market downturn, loss of investor confidence, weaker exports and low consumer demand.”, Geopolitical Futures, February 17, 2024

European Union & Eurozone

“Batteries for Europe’s Grids May Finally Be Ready to Take Off – Region may see sevenfold surge in storage by 2030: Aurora UK, Italy and Ireland are named top markets for investment. Europe is on the brink of an enormous surge in battery projects for the grid after a half-decade of stumbling without a clear strategy. There could be a sevenfold increase to more than 50 gigawatts in capacity connected to transmission networks by 2030, according to Aurora Energy Research Ltd. The UK, Italy and Ireland are the top three markets for storage investment within the region, with Spain and Greece emerging.”, Bloomberg, February 14, 2024

Indonesia

“‘Continuity’ Prabowo means change for Indonesia – Prabowo Subianto used the endorsement of the popular outgoing president to win power – but is unlikely to govern as Jokowi’s ‘proxy’. Indonesia’s choice of leader matters far beyond its archipelagic shores, given its prominent role within Southeast Asia, its position on the forefront of US–China rivalry, the scale and rapid growth of its G20 economy, and its status as the world’s largest Muslim-majority nation.”, Chatham House, February 15, 2024

Japan

“Japan Loses Its Spot as World’s Third-Largest Economy as It Slips Into Recession. Data underscore weak domestic consumption, investment Economy falls to fourth-largest in world behind Germany. Japan’s economy unexpectedly slipped into recession after shrinking for a second quarter due to anemic domestic demand, prompting some central bank watchers to push back bets on when the nation’s negative interest rate policy will end. Gross domestic product contracted at an annualized pace of 0.4% in the final three months of last year, following a revised 3.3% retreat in the previous quarter, the Cabinet Office reported Thursday.”, Bloomberg, February 15, 2024

Mexico

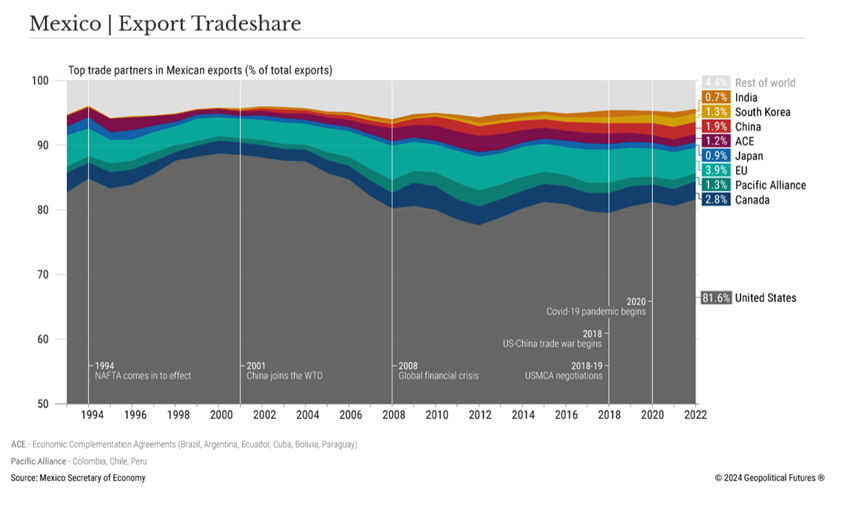

“The Big Picture of Mexican Exports – Recent data suggest its pivot to Asia may pay off. Mexico’s economy made headlines late last week when the latest data from the U.S. Commerce Department showed that, for the first time in more than 20 years, Mexican exports to the U.S. surpassed exports from China to the U.S. Mexico’s exports rose 5 percent year over year in 2023, while Chinese exports fell by 20 percent.”, Geopolitical Futures, February 12, 2024

“Elon Musk Woos Chinese Suppliers to Set Up Right Next Door to US – Exports of Chinese-made parts to US reached $1 billion in 2023 US worries cheap Chinese EVs also will be made in Mexico. On the outskirts of Monterrey, Mexico, Chinese auto-parts makers are rapidly setting up plants to supply Tesla Inc.’s next factory. They join the ranks of Chinese manufacturers that opened Mexican facilities in response to Trump-era tariffs — and this new surge has set off alarm bells in Washington.”, Bloomberg, Feruary 14, 2024

Thailand

Thailand Mulls $1 Billion Global Sovereign Bond Offer, First in Two Decades – Public debt office set to wrap up study on global bond by May Foreign offering meant to set benchmark for private borrowers. Thailand’s government is weighing a plan to raise about $1 billion from the global market via what would be the country’s first foreign-currency sovereign bond sale in two decades. Such a deal is meant to provide a benchmark for Thai companies tapping the overseas markets for their funding….”, Bloomberg, February 18, 2024

Turkey

“This City Was the World’s Most Visited in 2023 – Twenty million people flew to Istanbul last year. Whatever the reason, people truly seem to be flocking to Istanbul. And those more than 20 million arrivals made it the number one city for international arrivals on earth in 2023, according to Euromonitor International’s World’s Top 100 City Destinations report. Istanbul was followed by London in second place for most international arrivals (up 17 percent) and Dubai in third (up 18 percent). Rounding out the top five is the beachside Turkish city of Antalya, followed by Paris in fifth.”, Travel and Leisure magazine, February 7, 2024

United States

“Big U.S. food and drink brands are getting hit by the Israel-Hamas war – Some of the biggest names in the fast food industry, including McDonald’s, Taco Bell, and Burger King, have said their fourth-quarter sales were impacted by Israel’s war in Gaza. But executives of these companies kept things as vague as possible in their recent calls with investors, and some went so far as to avoid the word “war” altogether. A few company chiefs walked an even finer line — sharing their condolences with victims of the violence without saying who exactly they think is the victim.”, Quartz, February 15, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Franchisee profitability soars for Burger King and its sister chains – Sales were positive at Restaurant Brands International concepts, including Tim Hortons, Popeyes and Firehouse Subs. At Burger King, operator profitability increased 46%. A typical Burger King location last year generated $205,000 in profits, RBI said. That’s 46% more than 2022, when a typical location generated just $140,000. Per-store profits increased 17% at Popeyes Louisiana Kitchen to $245,000. They increased 27% at Tim Hortons Canada to C$280,000 ($208,000 U.S.). They increased 38% at Firehouse Subs to $110,000 per store.”, Restaurant Business, February 13, 2024

“Yum! is Building Restaurants at an Unprecedented Pace – In 2024, the company will not only reach 60,000 units worldwide, but also 30,000 at KFC and 20,000 at Pizza Hut. Nearly 25 percent of all current Yum! locations have been built in the past three years. Given the company ended 2023 with 58,708 locations worldwide—extending its claim as the largest restaurant group in the world—roughly 15,000 of them are 3 years old or younger.”, QSR Magazine, February 7, 2024

“Flynn Group, world’s largest franchisee, explores $5 bln-plus sale – Flynn Group, the world’s largest franchisee operator of restaurants and fitness clubs, is exploring a majority stake sale that could value it at more than $5 billion, including debt, according to people familiar with the matter. Flynn Group, which operates Applebees, Taco Bell, Panera Bread, Arby’s, Pizza Hut, Wendy’s and Planet Fitness franchises, is working with Bank of America on a sale process, the sources said. Flynn Group, which is based in San Francisco, generates over $450 million of annual earnings before interest, taxes, depreciation and amortization, according to the sources.”, Reuters, February 8, 2024

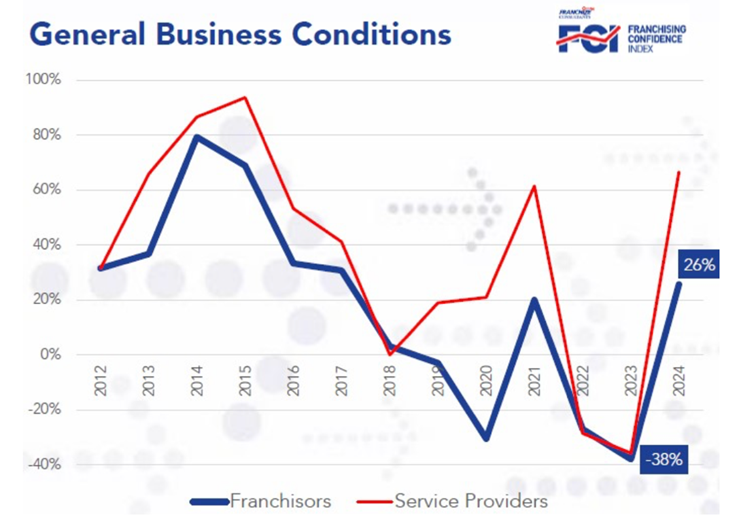

“Outlook improves for NZ (New Zealand) franchisors, franchisees – Franchize Consultants’ annual Franchising Confidence Index has measured the mood of the sector, revealing predictions and insight from franchisors and specialist service providers. After the turbulent times of recent years, responding franchisors were much more positive about general business conditions, access to financing, franchisees, and suitable staff. They were also generally more positive about franchisee topline sales levels, although there were concerns for franchisee operating costs and the resultant impact on franchisee profitability levels. They identified the top trends impacting franchising in New Zealand as the future regulatory environment and changing customer expectations.”, Franchise New Zealand, February 14, 2024

This issue we are sharing an upcoming book written by Alicia Miller, Co-Founder and Managing Director of Emergent Growth Advisors, that will be important to Franchisors everywhere. “Big Money in Franchising, Scaling Your Enterprise in the Era of Private Equity” will be published shortly and is now available on Amazon for pre-order.

To receive this biweekly newsletter, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

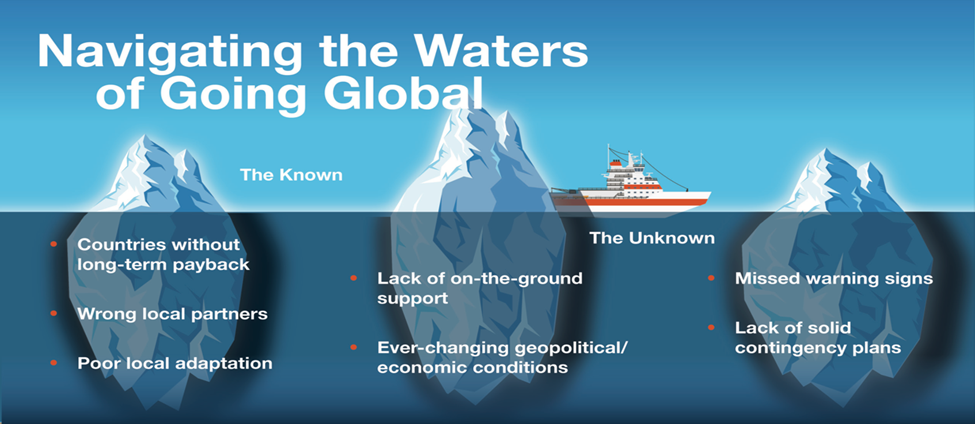

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link: