Biweekly Global Business Newsletter Issue 116, Tuesday, September, 2024

Commentary about the 116th Issue: When Will the Global Population Start to Shrink? The average price for fish and chips in the UK rose more than 50 in the five years to July. Global beer consumption is up almost 3% over 2021. Burger King® loses trademark in India. Brazil and Vietnam produce 56% of the world’s coffee. The poisonous global politics of water! Canada becomes the latest country to put huge tariffs on Chinese EVs. Foreigners are pouring US$ billions into Indonesia’s assets. Circle K® bids US$39 billion for 7-11®. Singapore Air to merge with Air India….really!!! Eurozone countries see lower inflation but very low growth. Planning for natural gas in the transition to renewables. And the world’s ports will need US$2 trillion for the renewables conversion.

Editor’s Note: You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier.

========================================================================================

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and we welcome contributions.

https://www.linkedin.com/in/williamedwards/

+1 949 375 1896

========================================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

======================================================================================

First, A Few Words of Wisdom From Others For These Times

“Curiosity is not a trait, it is a superpower.”, Neil Sahota

“All humans are entrepreneurs, not because they should start companies but because the will to create is encoded in human DNA.”, Reid Hoffman

“In the middle of difficulty lies opportunity.”, Albert Einstein

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #116:

- Brand Global News Section: 7-11®, Burger King®, Circle K®, Guzman Y Guzman®, Luckin Coffee®, Mixue®, Potbelly®, Red Lobster® and TeaPanda®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

B2B Payments Platform For Global Businesses

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

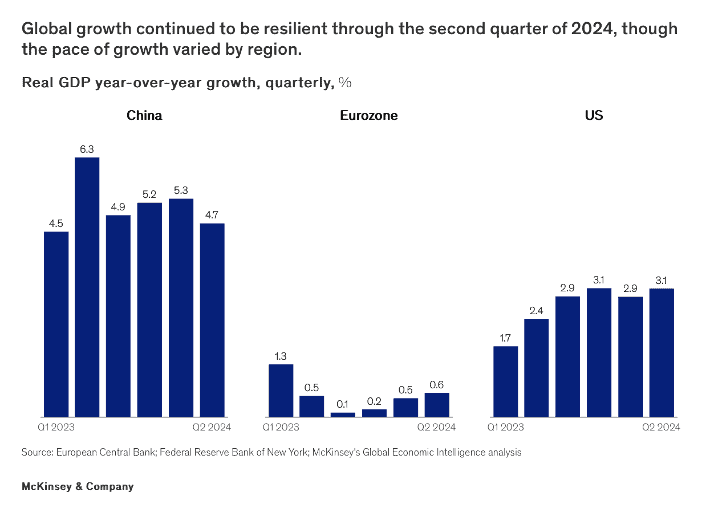

“Global Economics Intelligence executive summary, July 2024 – Despite current geopolitical tensions, the global economy remains resilient. Economic growth in surveyed economies is accelerating, as growth in both the manufacturing and services sectors picked up in June. Manufacturing growth was largely stable (except in the eurozone, where it contracted faster) while services sectors remained bright, albeit expanding at a slower pace. Growth in the second quarter was varied but remained positive across the globe.”, McKinsey & Co., August 23, 2024

=============================================================================================

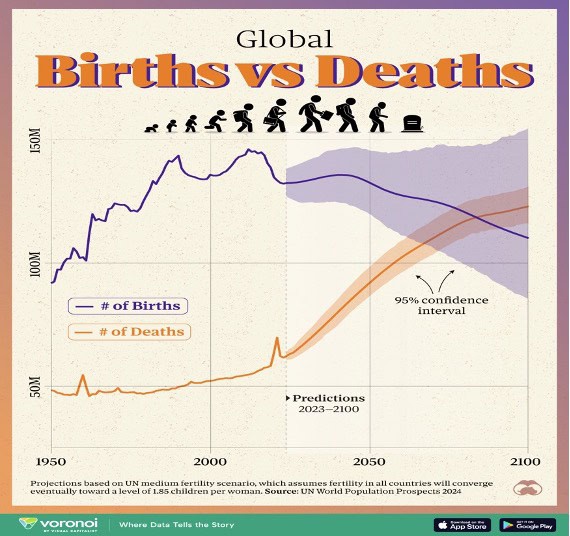

“When Will the Global Population Start to Shrink? – Everyone alive today has only ever lived in a world with a growing population. And for the opposite to be true, the number of people being born would have to be outpaced by the number of people dying. As it happens, that particular inflection point is not too far off according to latest estimates. Figures were sourced from the UN’s World Population Prospects 2024. Global Births and Deaths (1950–2100). In 2023, 132 million babies were born and nearly 62 million people died. Resulting in a population growth of 70 million people (+0.9%). But as birth rates fall around the world, the number of deaths occurring each year is expected to surpass the number of births by 2084. This could potentially kick off an era of global population decline.”, Visual Capitalist & UN, August 13, 2024

============================================================================================

“Which Countries Drink the Most Beer? – The global beer industry is massive, contributing more than half a trillion to global GDP. From barley and hops exporters like France and Argentina to major manufacturers such as Brazil and China, the beer industry is globally interconnected while remaining highly localized. In fact, 89% of supplies used in the beer sector are produced in the domestic market where beer is sold. This graphic shows which countries drink the most beer, based on data from Kirin Holdings. As the above table shows, China, the U.S., and Brazil—the three largest consumers of beer—account for more than 40% of global beer consumption. China takes top spot, a position it has held for the last 20 consecutive years.”, Visual Capitalist and Kirin Holdings, August 30, 2024

==============================================================================================

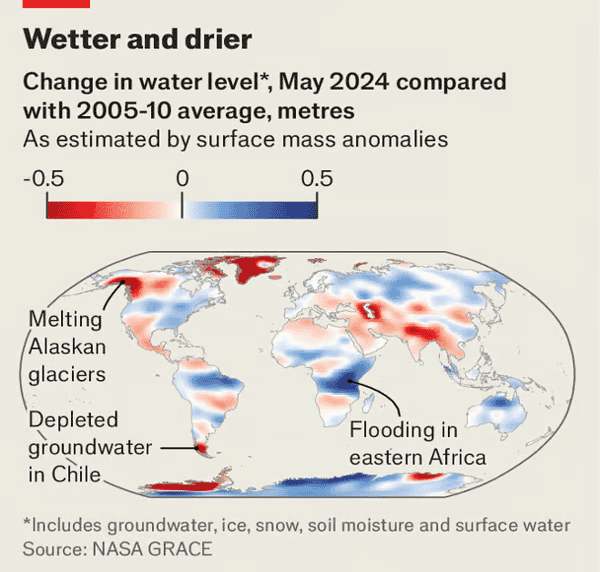

“The poisonous global politics of water – Polarisation makes it harder to adapt to climate change. The world’s water troubles can be summed up in six words: “Too little, too much, too dirty”, says Charlie Iceland of the World Resources Institute (wri), a think-tank. Climate change will only aggravate the problem. Already, roughly half of humanity lives under “highly water-stressed conditions” for at least one month a year. Adapting will require not only new technology but also a new politics. Villages, regions and countries will need to collaborate to share scarce water and build flood defences. The needs of farmers, who use 70% of the world’s freshwater, must be balanced with those of the urbanites they feed, as well as industry. In short, a politics of trust, give-and-take and long-term planning is needed. Yet the spread of “them-and-us” demagoguery makes this harder.”, The Economist, August 26, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

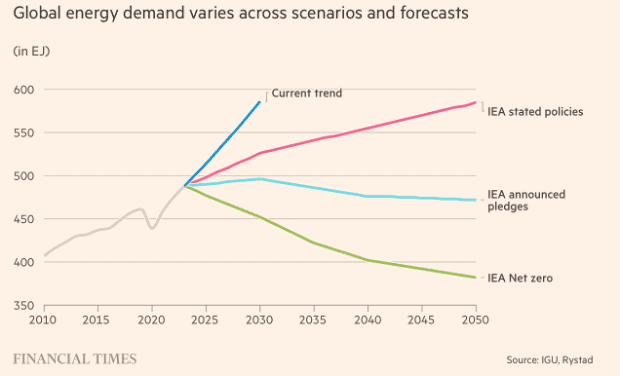

“Gas industry group says energy demand not reflected in climate planning – International Gas Union claims ‘significant gap’ in scenarios to achieve net zero emissions by 2030. The Swiss-based International Gas Union said there was a “significant gap” between what was forecast for demand based on historical consumption patterns and the pathways shown by institutions such as the International Energy Agency to achieve the cuts in emissions behind climate change. The IGU report showed that between 2021 and 2024, global energy demand had risen 2.7 per cent annually. At that pace, the world would consume 586 exajoules (EJ) of energy in 2030, according to the IGU. This would be led by ‘new sources of power demand’ such as the adoption of energy-intensive AI, as well as the increased need for cooling, especially in developing countries, brought about by more extreme temperatures, the group said.”, The Financial Times, August 27, 2024

=============================================================================================

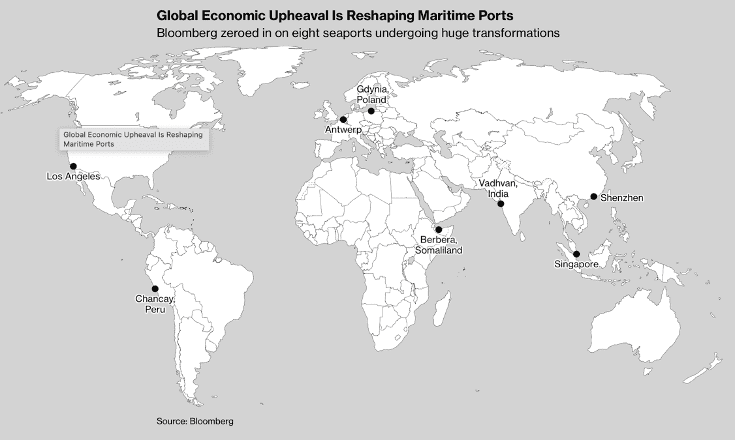

“A $2 Trillion Reckoning Looms as Ports Become Pawns in Geopolitics – The gateways to global trade face costly conversions to retool in new era of rivalry, automation and green energy. For centuries, control of the world’s biggest shipping centers helped expand empires, spark and settle wars, ease poverty and build middle classes while giving international companies access to cheap workers and cash-flush consumers in distant markets. Now, both old and new gateways for seaborne commerce— responsible for handling 80% of the world’s $25 trillion in annual merchandise trade—are economic fortresses in the great-power struggles of a multipolar world. Meantime, they’re having to undergo costly and painstaking conversions to digital technologies, automation and green energy with a price tag estimated at €200 billion ($216 billion) a year in new investment, for a total of €2 trillion over the next decade.”, Bloomberg, August 20, 2024

===============================================================================================

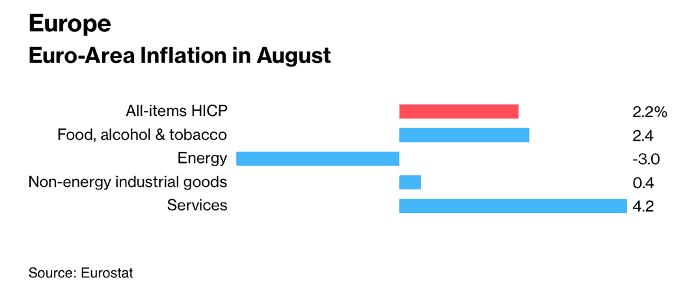

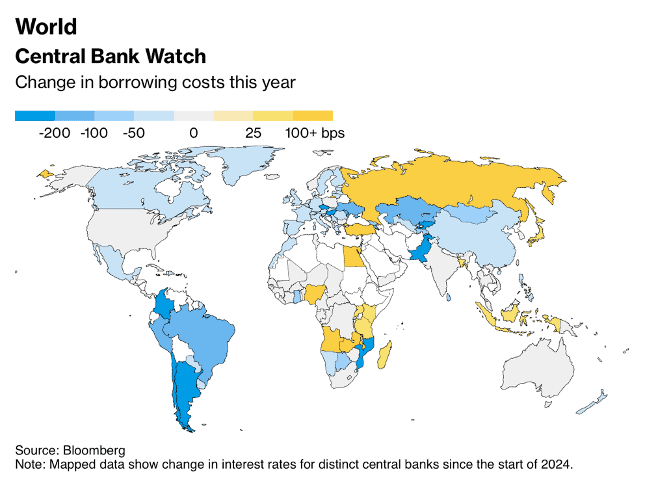

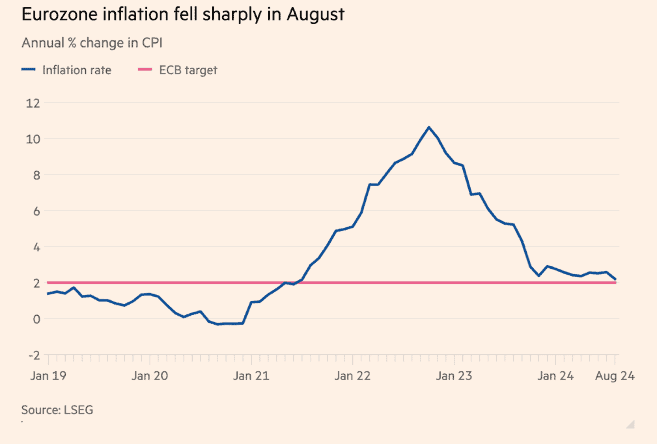

“Inflation Eases in US and Europe & World Borrowing Cost Change in 2024 – Inflation cooled in the US and Europe, setting the stage for policymakers in both regions to lower interest rates in September. On a three-month annualized basis, the Federal Reserve’s preferred measure of underlying US inflation advanced 1.7% in July, the slowest this year. In Europe, consumer prices rose 2.2% in August from a year ago — the tamest since mid-2021 and significantly lower than the 2.6% pace a month earlier. Meantime, inflation in Tokyo — a leading indicator of the national data due in September — picked up speed in August. Hungary kept the key interest rate unchanged for the first time in more than a year, while Guatemala and Kazakhstan also held. Israel’s central bank kept its benchmark interest rate at 4.5%, and said it’s likely to refrain from cuts for the rest of the year as the war in Gaza continues. Dominican Republic cut.”, Bloomberg, August 31, 2024

===========================================================================================

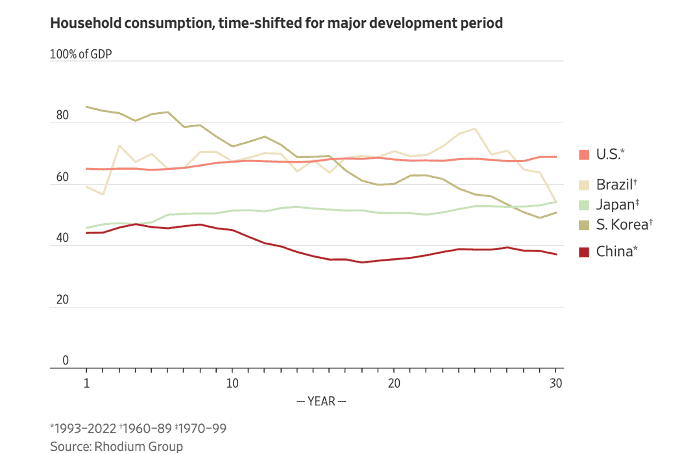

“There’s a China-Shaped Hole in the Global Economy – China’s low-consuming, high-investing economy guarantees conflict with other countries. China’s economy is unusual. Whereas consumers contribute 50% to 75% of gross domestic product in other major economies, in China they account for 40%. Investment, such as in property, infrastructure and factories, and exports provide most of the rest. Lately, that low consumption has become a headwind to China’s growth because property investment, once a major component of demand, has collapsed. This isn’t just a problem for China; it’s a problem for the whole world. What Chinese companies can’t sell to Chinese consumers, they export.”, The Wall Street Journal, August 29, 2024

==============================================================================================

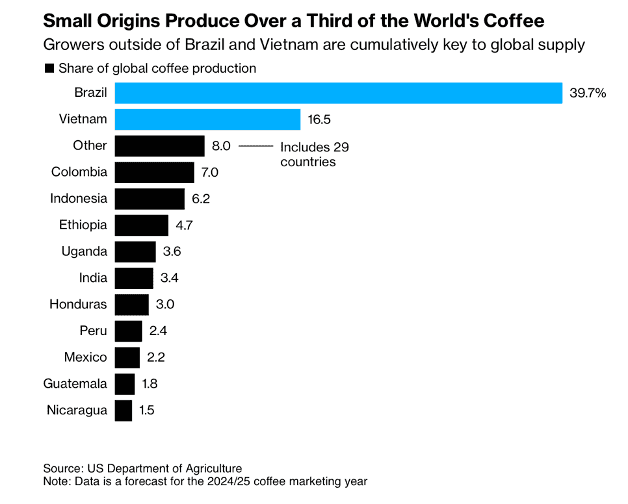

“Climate Change Means Coffee’s Future May Depend on Niche Growers – Some 40 countries grow coffee, but more than half of global production has long come from just two: Brazil and Vietnam. So when bad weather hits both — an increasing risk in a destabilized climate — supplies get threatened and prices soar. Take this year’s $9 lattes, as drought gripped both nations. A similar vulnerability has also played out in chocolate this year as cocoa prices spiked to a record because of bad weather and disease in Ivory Coast and Ghana, which make up the majority of global supplies. Coffee importers and roasters realize this urgency and the need to climate-proof supplies.”, Bloomberg, August 30, 2024

==========================================================================================

Global & Regional Travel & Living

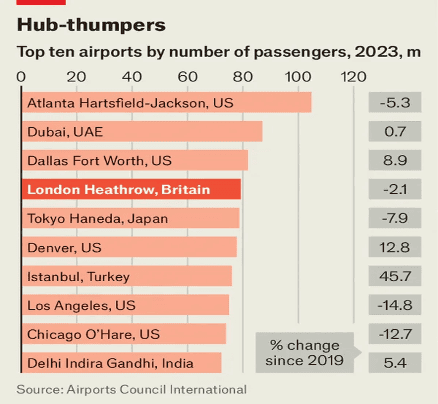

“Heathrow’s third runway asks questions of the airport and Labour – A decades long saga is not over yet. Heathrow has operated at close to maximum capacity for more than a decade. The question facing Thomas Woldbye, Heathrow’s chief executive, and its new backers—Ardian, a French private-equity firm, and the Saudi Public Investment Fund (pif), which have agreed to acquire stakes of 22.6% and 15% respectively—is how to increase the number of passengers it can manage. Heathrow…is focused on simpler fixes for now. The airport says that a new baggage system in Terminal 2 and improvements to security lanes, for instance, would increase capacity. But improvements of this sort will get Heathrow only so far. If it is to handle many more people, it needs another runway.”, The Economist, August 29, 2024

===========================================================================================

“Former Expedia exec’s startup uses AI to help smaller companies book travel – Small businesses and startups often lack a dedicated travel desk, forcing executives and founders to rely on human assistants or consuming and cumbersome travel apps. Expedia’s former SVP of consumer product, Michael Gulmann, is betting on AI to bridge the gap. His company, Otto, emerges from stealth Thursday, with plans to launch an alpha version of the platform to select U.S. participants in September. The service is designed to quickly facilitate flight and hotel bookings through natural language queries. Gulmann told TechCrunch that while the likes of TravelPerk and Concur focus on large enterprises, Otto is looking to serve customers who lack access to the services. ‘Think of Otto as a high-end travel agent or executive assistant that remembers your preferences, such as your choice of hotels and flights. It will also remember other nuances such as if you prefer to stay within 10 minutes of your meeting place,’ Gulmann said.”, Tech Crunch, August 22, 2024

=========================================================================================

“Hilton to maintain breakneck China expansion pace, targets 100 new hotels per year – Global hotel chain operator Hilton is bullish over the growth potential of mainland China’s leisure travel market and plans to maintain its fast-paced expansion in the country, with a focus on niche brands. The company, which owns brands like Conrad and Waldorf Astoria, aims to add at least 100 new hotels in China annually over the next few years to cater to increasing travel demand, Qian Jin, president of Hilton Greater China and Mongolia, said in an interview. ‘Niche brands are in high demand to offer personalised services to tourists,’ he said. ‘We have to fine-tune those brands as we move to some specific destinations to capture the growth opportunities.’”, South China Morning Post, 26 August 2024. Compliments of Paul Jones, Jones & Co., Toronto

===========================================================================================

“Deal to create one of world’s largest airline groups gets regulator approval – Indian government approves Singapore Airlines’ FDI for Vistara-Air India merger. Vistara, a full-service carrier jointly owned by India’s Tata Group and Singapore Airlines, will be absorbed into Air India as part of the deal and cease operating its own flights from 12 November. Air India is also owned by the Tata Group.”, The Independent, August 31, 2024

==========================================================================================

Book Review

“Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones” by James Clear is a practical guide that explores how small, incremental changes, known as “atomic habits,” can lead to significant personal transformation. The book emphasizes the power of consistent actions, suggesting that these tiny behaviors, when compounded, create remarkable results over time. Clear introduces a framework for behavior change based on four principles: make habits obvious, attractive, easy, and satisfying.

He highlights the importance of identity in habit formation, arguing that lasting change comes from adopting an identity aligned with the habits we want to cultivate. The book also discusses the habit loop (cue, craving, response, reward) and the role of environment in shaping behavior. Clear introduces concepts like habit stacking and the Goldilocks Rule, which help make new habits stick and maintain motivation. Overall, “Atomic Habits” offers actionable strategies for mastering small behaviors that lead to long-term success. The book introduces the habit loop, consisting of cue, craving, response, and reward, which is essential for understanding and modifying behavior. Additionally, Clear highlights the role of environment in shaping our habits, advocating for the design of surroundings that support positive behaviors and minimize negative triggers.

==========================================================================================

Country & Regional Updates

Australia

“Retail Food Group brews $14.7m turnaround, plans rebrand to ‘Savora’ – Gold Coast-headquartered Retail Food Group (ASX: RFG) is moving on from its patchy past with a new name after returning to profitability in FY24, lifting its bottom line from a loss of $8.9 million to a net profit after tax of $5.8 million. The profit result is RFG’s highest in seven years, of which four were loss-making and included major setbacks from litigation, franchise closures, reputational damage from public franchisee complaints, and a COVID share price slump from which the group has never recovered.”, Business News Australia, August 20, 2024

=====================================================================================

Canada

“Ottawa to impose 100-per-cent tariff on Chinese-made EVs – On Monday, the federal government announced a 100-per-cent tariff on Chinese-made EVs, as well as a 25-per-cent tariff on steel and aluminum products from China – both of which will come into effect in early October. The EV tariff applies to some hybrid passenger cars, trucks, buses and delivery vans, and is in addition to a pre-existing import tariff of 6.1 per cent that already applies to Chinese-made EVs coming into Canada.”, The Globe and Mail, August 26, 2024

==========================================================================================

China

“China’s milk consumption is climbing, leading U.S. farmers to expand exports – China is only the third largest importer of American dairy, after Mexico and Canada, spending $607 million last year. But, considering the changing cultural attitudes towards dairy, it also represents one of the largest growth opportunities. According to data from the Food and Agriculture Organization of the United Nations, China consumes about 15% of what Americans consume per capita. If that gap closes China would add more than $600 billion to the global dairy market. Even amid rising geopolitical tensions, the U.S. and other countries are fighting for a slice of that…cheese. China’s minister of international trade, Wang Shouwen last month invited American dairy firms to set up shop in China and the U.S. Department of Agriculture announced a $1.2 billion investment in dairy exports.”, Fortune, August 14, 2024

=============================================================================================

“Top private equity firms put brakes on China dealmaking – Activity dries up amid Beijing’s listings crackdown and planned US investment curbs. Dealmaking in the world’s second-largest economy has slowed significantly, with just five new investments — mostly small — by the 10 largest global buyout firms this year. The figures underscore how quickly overseas investors’ enthusiasm for China, once a hot market, has waned in recent years. The same 10 firms collectively made 30 investments in the country as recently as 2021 and similar numbers in earlier years, but the numbers have fallen every year since then. This year, seven of the 10 have made no new investments at all, the figures from Dealogic show. ‘China has been a roller coaster for investors, with geopolitical tensions, regulatory unpredictability and economic headwinds,’ said Kher Sheng Lee, Asia-Pacific co-head for the Alternative Investment Management Association.”, The Financial Times, August 24, 2024

==========================================================================================

Australia

“Retail Food Group brews $14.7m turnaround, plans rebrand to ‘Savora’ – Gold Coast-headquartered Retail Food Group (ASX: RFG) is moving on from its patchy past with a new name after returning to profitability in FY24, lifting its bottom line from a loss of $8.9 million to a net profit after tax of $5.8 million. The profit result is RFG’s highest in seven years, of which four were loss-making and included major setbacks from litigation, franchise closures, reputational damage from public franchisee complaints, and a COVID share price slump from which the group has never recovered.”, Business News Australia, August 20, 2024

========================================================================================

Canada

“Ottawa to impose 100-per-cent tariff on Chinese-made EVs – On Monday, the federal government announced a 100-per-cent tariff on Chinese-made EVs, as well as a 25-per-cent tariff on steel and aluminum products from China – both of which will come into effect in early October. The EV tariff applies to some hybrid passenger cars, trucks, buses and delivery vans, and is in addition to a pre-existing import tariff of 6.1 per cent that already applies to Chinese-made EVs coming into Canada.”, The Globe and Mail, August 26, 2024

===========================================================================================

China

“China’s milk consumption is climbing, leading U.S. farmers to expand exports – China is only the third largest importer of American dairy, after Mexico and Canada, spending $607 million last year. But, considering the changing cultural attitudes towards dairy, it also represents one of the largest growth opportunities. According to data from the Food and Agriculture Organization of the United Nations, China consumes about 15% of what Americans consume per capita. If that gap closes China would add more than $600 billion to the global dairy market. Even amid rising geopolitical tensions, the U.S. and other countries are fighting for a slice of that…cheese. China’s minister of international trade, Wang Shouwen last month invited American dairy firms to set up shop in China and the U.S. Department of Agriculture announced a $1.2 billion investment in dairy exports.”, Fortune, August 14, 2024

==========================================================================================

“Top private equity firms put brakes on China dealmaking – Activity dries up amid Beijing’s listings crackdown and planned US investment curbs. Dealmaking in the world’s second-largest economy has slowed significantly, with just five new investments — mostly small — by the 10 largest global buyout firms this year. The figures underscore how quickly overseas investors’ enthusiasm for China, once a hot market, has waned in recent years. The same 10 firms collectively made 30 investments in the country as recently as 2021 and similar numbers in earlier years, but the numbers have fallen every year since then. This year, seven of the 10 have made no new investments at all, the figures from Dealogic show. ‘China has been a roller coaster for investors, with geopolitical tensions, regulatory unpredictability and economic headwinds,’ said Kher Sheng Lee, Asia-Pacific co-head for the Alternative Investment Management Association.”, The Financial Times, August 24, 2024

=============================================================================================

Europe/Eurozone

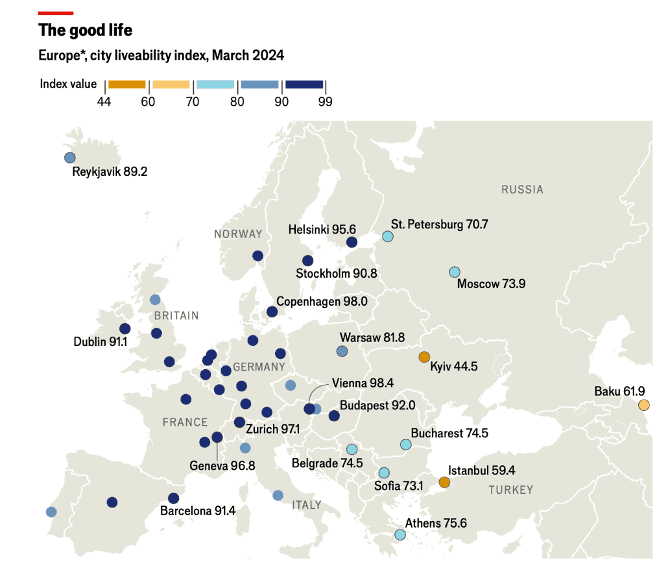

“What makes Europe so liveable? Every year the Economist Intelligence Unit (eiu), our sister company, ranks a big group of global cities on their liveability. This year’s rankings have seen quite a bit of movement. But the top of the index remains dominated by the continent that best combines stability with a high quality of culture and the environment, education, infrastructure and health care, all of which the index’s authors aim to measure objectively. When the scores are done, Europe can take another bow.”, The Economist, August 29, 2024

======================================================================================

“Eurozone inflation falls to 2.2% in August – Markets expect further ECB rate cuts following dip in price pressures. Eurozone inflation fell sharply to a three-year low of 2.2 per cent in August, bolstering expectations that the European Central Bank will reduce interest rates next month. Friday’s preliminary figure was in line with a forecast of 2.2 per cent in a Reuters poll and below last month’s rate of 2.6 per cent. ‘The inflation environment is slowly getting more benign,’ said Bert Colijn, Eurozone economist at ING, referring to the progress in bringing the headline rate of inflation close to the ECB’s 2 per cent target. The data from Eurostat came after Germany and Spain reported sharper than expected reductions in August in figures this week.”, The Financial Times, August 30, 2024

=========================================================================================

Germany

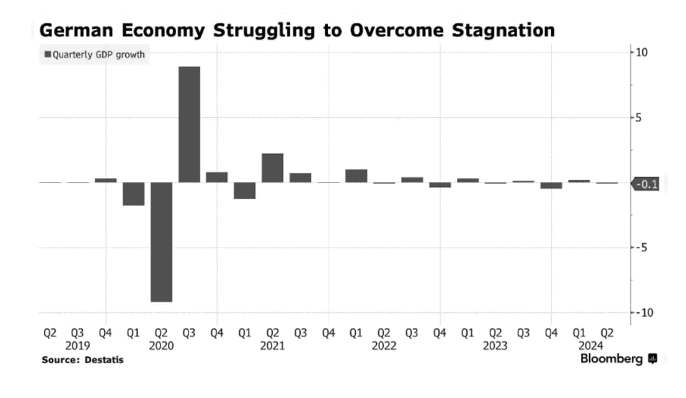

“”Germany ‘Falling Into Crisis’ as Berlin Suffers Vision Deficit – European Central Bank chiefs were vilified in Germany for much of the past decade or so……the country has suffered over the past two decades from the effects of a broad lack of vision on the part of its governments. Now, a near-ideological support for balanced federal budgets has left the economy with no one at the helm to lay out a course for growth. The appetite for setting up a new business in Germany just hit a record low, according to a survey released last week. And, back to the economic stats: Germany’s real GDP last quarter was just 0.4% bigger than five years before.”, Bloomberg, August 28, 2024

=========================================================================================

India

“Burger King loses 13-year legal battle against Indian restaurant – Pune court rules Indian restaurant had been using name for over a decade before American chain started doing business in country. An Indian court dismissed a suit filed by Burger King Corporation alleging trademark infringement by Burger King in Pune city, in the western state of Maharashtra, noting that the restaurant had been in operation since 1992, years before the multinational company started doing business in the country. Burger King Corporation was founded in 1953 as Insta-Burger King and rechristened Burger King in 1959. It entered the Indian market in November 2014, opening its first outlet in the capital Delhi, and arrived in Pune the next year.”, The Independent, August 20, 2024

===========================================================================================

“India Port Workers Reach Pay Deal Averting Strike – The latest showdown between dockworkers in a major trading nation and their port employers appears to be ending without any significant disruptions. Port employees’ unions in India agreed to a new five-year wage dealwith government officials, averting a planned nationwide strike scheduled to start Wednesday, Bloomberg’s Rajesh Kumar Singhand Weilun Soon report today. The new deal halts a walkout that could have involved nearly 20,000 workers and brought widespread disruption to cargo operations at some of the nation’s busiest ports. Unions at India’s 12 major state-run ports have been negotiating with the government since 2021 to try to increase pay.”, Bloomberg, August 28, 2024

=======================================================================================

Indonesia

“Global Money Piles Into Indonesia as Fed Easing Cycle Approaches – Foreigners pour billions of dollars into its assets in August. Indonesia offers fiscal discipline, valuations with rate cuts. lobal money has flooded into Indonesia’s financial markets this month, signaling the country’s assets have quickly become a preferred investment destination as the US Federal Reserve’s easing cycle nears. Overseas investors have bought $933.8 million of the nation’s stocks in August, on course for the biggest monthly purchases since April 2022, while net inflows of $2.5 billion into bonds is the most in more than a year, according to data compiled by Bloomberg. The influx of money saw the rupiah briefly erase this year’s losses against the dollar, with a gain this month surpassed in Asia only by Malaysia’s ringgit.”, Bloomberg, August 26, 2024

==========================================================================================

United Arab Emirates

“Guggenheim Rises in the Desert as Abu Dhabi Morphs Into Expat Hub – The emirate is attempting to draw wealthy foreigners to invest and work. All around, there are growing signs of a massive construction boom that’s changing the face of this once sleepy, oil-rich emirate, which holds about 6% of the world’s crude reserves under its sands and controls $1.5 trillion in sovereign wealth. Sprawling theme parks, five-star hotels, luxury homes, sports complexes and high-end office towers are rising at breakneck speed as the city’s rulers spend billions to diversify the economy and cater to global financial giants……who’ve set up here. The Guggenheim is part of a more than $10 billion push to boost tourism and cultural activity in the emirate, the capital of the United Arab Emirates. Meantime, Abu Dhabi is also pouring billions more into building sprawling residential developments to attract rich expatriates to live and work here. Wealthy buyers from the UK, India, Spain and beyond are snapping up seaside villas costing millions.”, Bloomberg, August 25, 2024

Editor’s Note: I first traveled to the UAE in 1994. There was one western chain hotel on Sheikh Zayed Road in Dubai, the Crown Plaza. Abu Dhabi was the very conservative capital of the Emirates that was 87 miles and a world away from even then flashy Dubai.

============================================================================================

United Kingdom

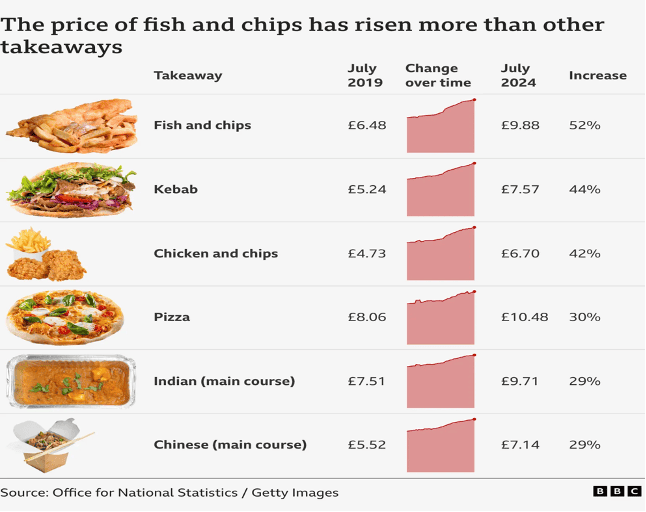

“Fish and chips price rise tops UK takeaways – Fish and chips is a British family favourite equally enjoyed around the table on a Friday night or out of the paper on an often overcast beach. But the deep fried delicacy has seen the biggest price increase of some of the UK’s most popular takeaways, according to new figures. The average price for a portion of fish and chips rose more than 50% to nearly £10 in the five years to July – while the cost of a kebab went up 44% and pizza 30%. Chip shop owners cite a “perfect storm” of costs in recent years, including soaring energy bills, tariffs on seafood imports and extreme weather hammering potato harvests.”, BBC, August 25, 2024

=============================================================================================

United States

“Meet America’s Top Restaurant Groups – The 125 biggest multi-concept groups that are making their mark on communities across the country. With help from our partners at Technomic, we’ve identified 125 of the biggest restaurant groups in the country, breaking down the list by the four U.S. regions as identified by the Census Bureau: Northeast, South, Midwest, and West. Meet them below, and revisit the list throughout the year as we endeavor to profile all 125.”, Nation’s Restaurant News, August 28, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Bill Edwards and Keith Gerson Announce the Formation of The Franchise Consortium

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Potbelly – From Corporate Owned Restaurant Model To A Franchise Model – Potbelly Sandwich Shops has taken significant steps to transition from a corporate store model to a robust franchise system. Lynette McKee, CFE and Senior Vice President of Franchising at Potbelly is leading this transformation. To reach 2,000 franchised units and achieve an 85% franchise system, Potbelly is focused on maintaining its core values while expanding its presence nationwide……the transition requires more than scaling operations—it demands a careful review of existing practices, clear communication, and a commitment to staying true to the brand’s mission. At the heart of Potbelly’s strategy is a comprehensive franchise training program designed to ensure that new franchisees understand the unique elements that set Potbelly apart from competitors. This focus on training and brand consistency is crucial for maintaining the welcoming vibe that has made the brand successful.”, Forbes, August 23, 2024

============================================================================================

“Embracing AI: How Franchise Service Brands Are Revolutionizing Business Operations – The franchising and home service industries are constantly evolving, with technological advancements like artificial intelligence (AI) playing a significant role in shaping how these businesses operate. As consumer expectations shift toward more efficient and personalized services, many home service franchises are turning to AI. The demand for AI systems is expected to grow by 21% annually until 2030, further reflecting this trend. AI is also setting new standards in customer service by improving how businesses interact with and serve their customers. By managing appointments, AI can provide real-time updates, offering clients a more streamlined and efficient service experience while keeping franchise owners a step ahead of the competition. Beyond enhancing customer experiences, AI is also revolutionizing data management. While AI is beneficial for new customers, it can also double-check and organize existing data.“, Franchising.com, August 24, 2024

==============================================================================================

“Guzman Y Guzman’s revenue soars 32 per cent – Guzman Y Guzman (Australia) delivered revenue of $342.2 million in the last fiscal year, up 32.1 per cent, thanks to opening new restaurants. However, the fast-food operator’s statutory net loss widened to $13.7 million. This is the first time the Mexican fast food chain published financial results since its initial public offering on June 20. During the fiscal year, the company saw network sales of $959.7 million, an increase of 26.4 per cent. Australian network sales grew 27.3 per cent to $894.6 million, while Singapore network sales rose 7.5 per cent to $46.4 million. Japan network sales climbed 12.3 per cent to $7.9 million and US network sales surged 81.8 per cent to $10.8 million.”, Inside Retail AU, August 27, 2024

==============================================================================================

“Circle K Owner Makes a Move Toward Acquiring 7-Eleven for a Staggering Sum – If successful, the 7-Eleven acquisition would be the largest-ever foreign buyout of a Japanese company. Canada’s Alimentation Couche-Tard has reportedly approached Japan’s Seven & i Holdings, the owner of 7-Eleven, about a potential takeover valued at around $38 billion. 7-Eleven is the world’s largest convenience store chain, with more than 13,000 locations in North America and over 83,000 worldwide. If successful, the acquisition would be the largest-ever foreign buyout of a Japanese company.”, Entrepreneur magazine, August 21, 2024

===========================================================================================

“Red Lobster’s new owner names former P.F. Chang’s CEO to lead chain – Damola Adamolekun will take the reins of the struggling seafood giant after a sale to Fortress Investment Group is finalized. His tenure at Chang’s made him a rising star in the industry.

Adamolekun has a background in investment banking and was a partner at Paulson & Co. when it took a stake in P.F. Chang’s in 2019. He was then tapped to lead the Asian casual-dining chain as CEO. He helped guide Chang’s through the pandemic and led a refresh of its restaurants, menu and technology.”, Restaurant Business, August 26, 2024

==============================================================================================

“Luckin Coffee planning massive overseas expansion – Latepost, a unit of Caijing Magazine, reported that Luckin is planning to expand overseas with focus on Southeast Asia and the United States. The company was not available for comment. Luckin runs over 20,000 stores in China, with its operations covering both online and offline channels.

There are 38 directly run Luckin stores in Singapore, with the first one having opened in April 2023.Unlike in China, Luckin does not prioritize its low-price approach in Singapore. In the first half of this year, Luckin started discussions with BJ Food, the franchiser of Starbucks in Malaysia, to form a joint venture for entry into the Malaysian market. In June, Luckin announced plans to buy about 120,000 metric tons of coffee beans from Brazil from 2024 to 2025.”, China Daily, August 20, 2024. Compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

“Pressure Builds on Trailblazing Chinese Bubble Tea Brand Mixue – With over 36,000 stores in China and the rest of the world, Mixue Bingcheng Co. Ltd. dominates the market by offering milk tea with tapioca, ice cream, and juice at budget-friendly prices of 2 to 10 yuan (14 U.S. cents to $1.40), far less than competitors like HeyTea and Nayuki which charge double or triple that. On the Chinese mainland, many of its stores are located in smaller cities and suburban areas, offering sugar hits to price-sensitive consumers. But now, local brands are returning fire, and analysts say the lack of product differentiation that facilitated rapid growth could become a weakness. It could also be why firms like Mixue are struggling to mount a successful listing. China’s largest milk tea franchise was an early mover in mounting its global expansion two years before the Covid pandemic hit. But the company’s recently lapsed Hong Kong IPO has cast a shadow over the industry’s prospects.”, Caixin Global, August 23, 2024

=============================================================================================

“TeaPanda opens its first European store in Barcelona and uses the TeaPanda trademark – Chabaidao, which continues to increase the number of stores in South Korea, Thailand and Australia, has extended its overseas reach to Europe and chose Barcelona, Spain as the site for its first European store. Recently, a social media account named “Tea 100 Spain” was launched, announcing that the first store in Spain has officially landed near the Arc de Triomphe in Barcelona. Many local users also posted photos of the current enclosure of the store, revealing that it is currently under renovation. However, some users have doubts about the authenticity of the Spanish store’s English name being “TeaPanda” instead of “Chapanda.”, Caijing.com.cn, August 21, 2024. Compliments of Paul Jones, Jones & Co., Toronto

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

================================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

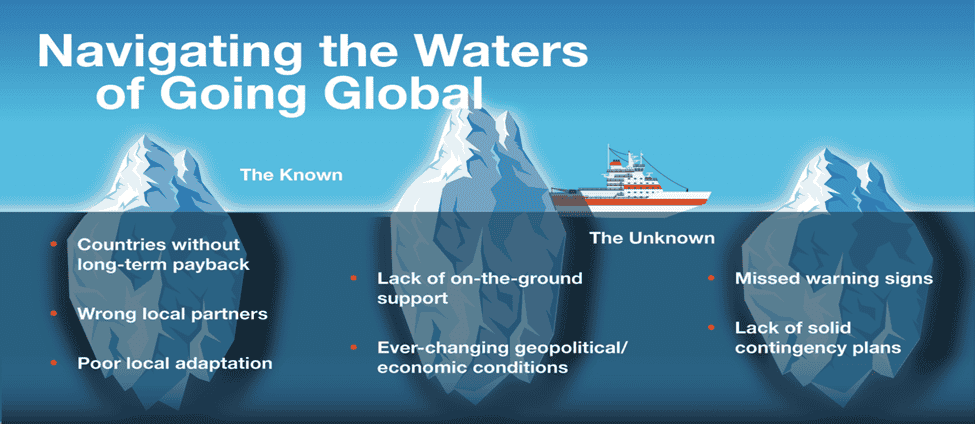

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com ++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896