Biweekly Global Business Newsletter Issue 126, Tuesday, January 21, 2025

The Year of the Wood Snake Starts on January 29, 2025

Commentary about the 126th Issue: Many more 2025 predictions in this issue, of course. It seems every publication and think tank has predictions this year. USA CEO confidence surged in December. The world’s safest and least safe airlines are ranked. Falling birth rates around the world will impact global productivity and living standards. The number of ‘BRICS’ countries are expanding but it is not clear there is much value in this shaky alliance. Wendy’s® opens its first new restaurant in 40 years in Australia. Upcoming U.S. tariffs are coming and are a BIG topic of discussion but are not defined as of the date of this newsletter – next issue!!!

One More Thing: Syria is being flooded with Pepsi and Pringles as the new rulers open the economy. The end of Assad-era restrictions on dollars, exorbitant duties and extortion leads to a boom in foreign goods once again on store shelves.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Many obstacles melt away when you decide to boldly walk through them.”, Martin Luther King

“You miss 100 percent of the shots you don’t take.”, Wayne Gretzty, Hall of Fame Hockey Great

“Go as far as you can see; when you get there, you’ll be able to see further.”, J. Pierpont Morgan. Compliments of Beth Adkisson, Vistage Master Chair

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #124:

CEO confidence surges, indicating growth in 2025

Why the Year of the Wood Snake starting in 2025 could bring major change, and more luck

The world’s safest (and least safe) airlines

Key European Markets and Their Unique Peculiarities

With Indonesia, Brics is adding Southeast Asia to its power base

Wendy’s opens first Australia store in 40 years

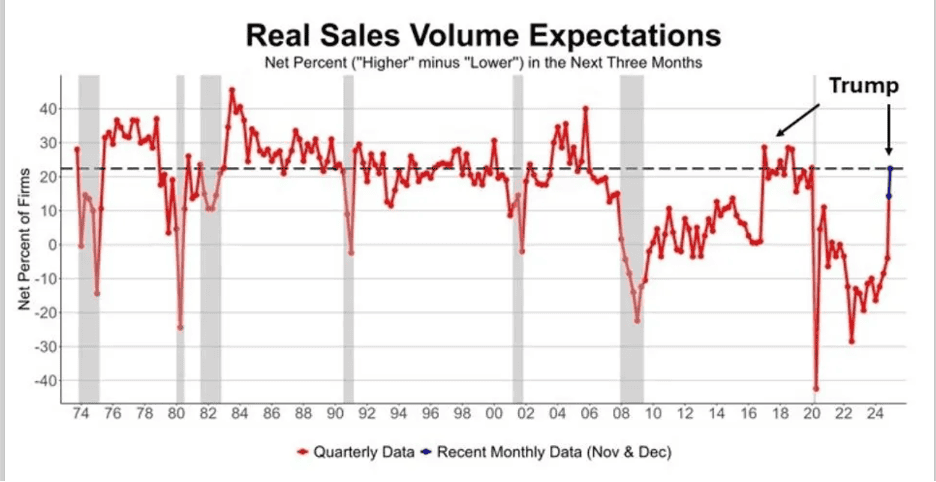

Small Business Sales Expectations Return To Normal

Brand Global News Section: Chipolte®, Crumbl® and Wendy’s

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“2025 Global Forecast Report” – This comprehensive report by the Visual Capitalist and Inigo taps into a wide variety of sources. Here are some of the predictions in the report:

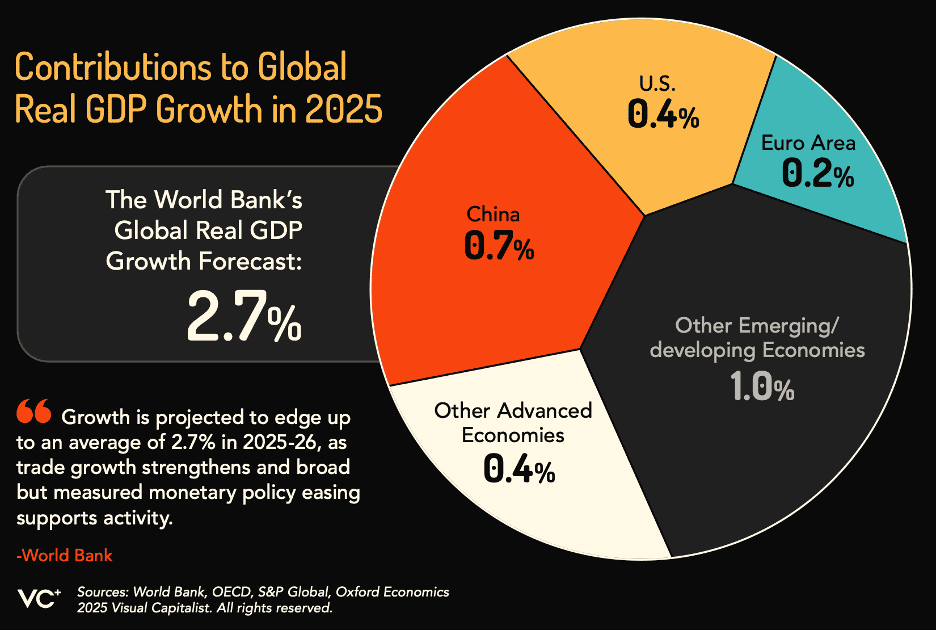

“(GDP) Growth is projected to edge up to an average of 2.7% in 2025-26, as trade growth strengthens and broad but measured monetary policy easing supports activity.”, World Bank

“We remain optimistic that major economies can achieve sustained economic growth as interest rates ease, although the range of potential macroeconomic outcomes has widened following the U.S. elections.”, Goldman Sachs

“Globally we are at the tail end of this idea of unlimited government spending. I think deficit reduction will be the theme through 2025. And the main tradeoff here will be real GDP growth.”, Mark Meldrum

“With growing regional ties Emerging Asian economies are enjoying strong growth, driven by the dominance of their IT supply chain and supportive fiscal and monetary policies.”, Amundi

“We are concerned about three pressing issues: China/Taiwan, Russia/Ukraine, and Israel/Hezbollah/Iran/Middle East. Any or all could be the source of a further dramatic shock to the global economy.”, Apollo

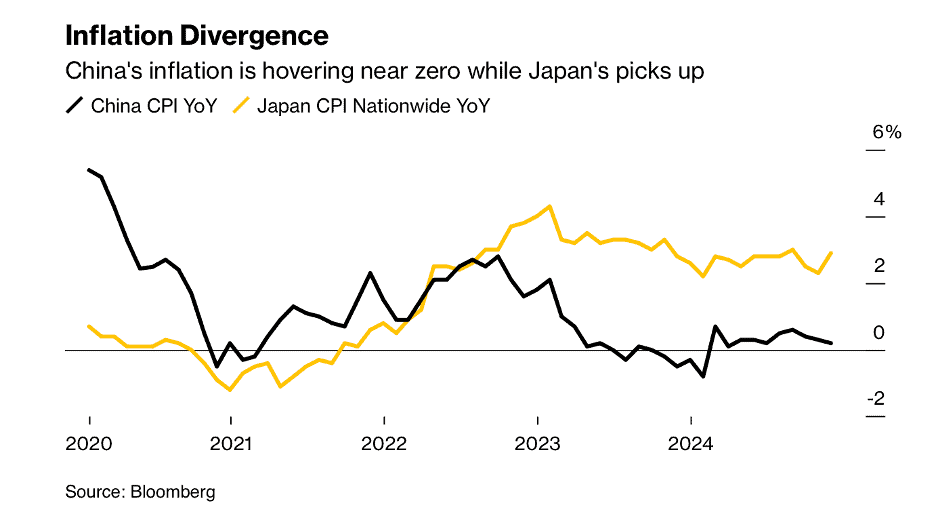

“China is in a deflationary trap. They have an overbuilt real estate and infrastructure market, and you cannot remove 100 million empty homes overnight in a population that is not growing anymore.”, Felix Zulauf

“Governments in developed markets are increasingly competing with those in emerging markets for incremental manufacturing investments. With most countries having already outlined manufacturing incentives in recent years, 2025 should be the year in which capital expenditures are implemented.”, S&P Global

“Annual consumer price inflation in the G20 countries is expected to moderate to 3.5% and 2.9% in 2025 and 2026 respectively, from 5.4% this year. By the end of 2025 or early 2026, inflation is projected to be back to target in almost all major economies.”, OECD

“India will again be a bright spot for long-term investors. The country’s prospects remain solid, underscored by advantageous demographics and investments in infrastructure and manufacturing.”, Fidelity

“While some countries are trying to remain ‘non-aligned’, we expect most countries to eventually fall inside either the U.S. or Chinese ‘sphere of influence’–or at least have to lean one way or the other as the U.S. and China make it increasingly complicated to equally straddle both camps.”, Deutsche Bank

“Voters across the globe sent incumbent parties packing in 2024. We will see if that anti-incumbent mood carries over into 2025.”, James M. Lindsay, Council on Foreign Relations

“The (China) “old economy”, including sectors like housing, construction, and steel continue to experience weak demand. In contrast, the “new economy” including electric vehicles and green transition sectors are suffering from overcapacity.”, KKR

“In 2025, we may see the first AI agents “join the workforce” and materially change the output of companies.”, Sam Altman, CEO OpenAI

“We expect companies across the AI value chain to generate more than $1.1 trillion in revenue by 2027, just five years after the onset of ChatGPT.”, UBS

==========================================================================================

“Why the Year of the Wood Snake starting in 2025 could bring major change, and more luck – On January 29, 2025, the celestial dragon will make way for the earthly snake in the Chinese lunisolar calendar. If history is anything to go by, the year ahead will be a time of dynamic change – much as the world experienced in the previous Year of the Wood Snake. Since each elemental animal follows a 60-year cycle, the last Year of the Wood Snake was in 1965.”, South China Morning Post, January 1, 2025

=======================================================================================

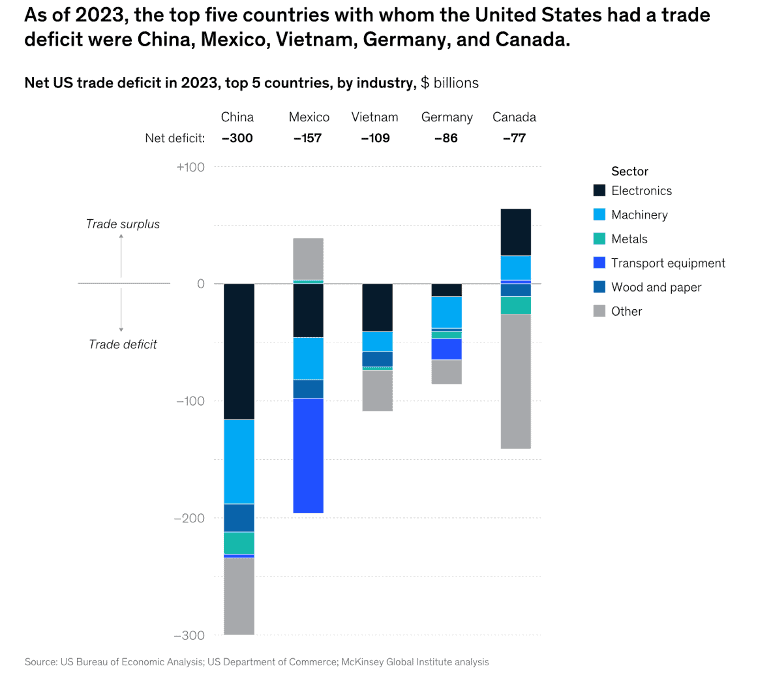

“Tariffs on the move? A guide for CEOs for 2025 and beyond – Tariffs are top of mind for executives—and are likely to stay there. Understanding various tariff scenarios can position leaders to seize opportunities in the coming years. But despite widespread concerns, few leaders have developed robust plans to understand the second- and third-order effects and to steer their businesses through potential scenarios. Those who understand tariffs—and their likely impacts—will be better positioned to navigate the ambiguities of 2025 and beyond.”, McKinsey & Co., December 19, 2024

==============================================================================================

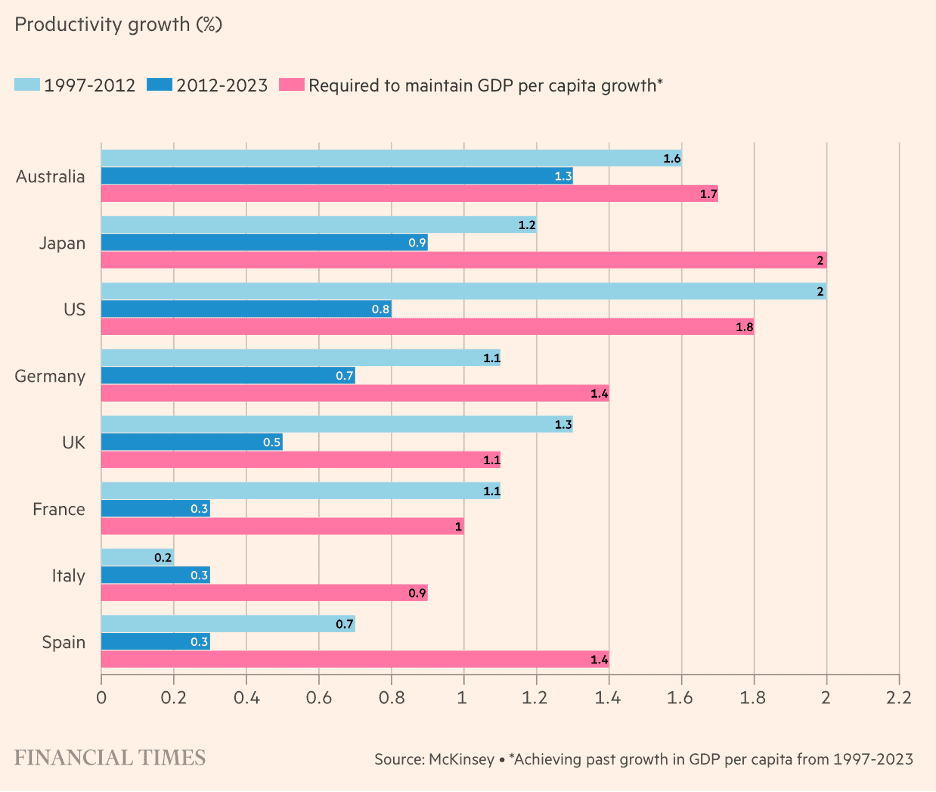

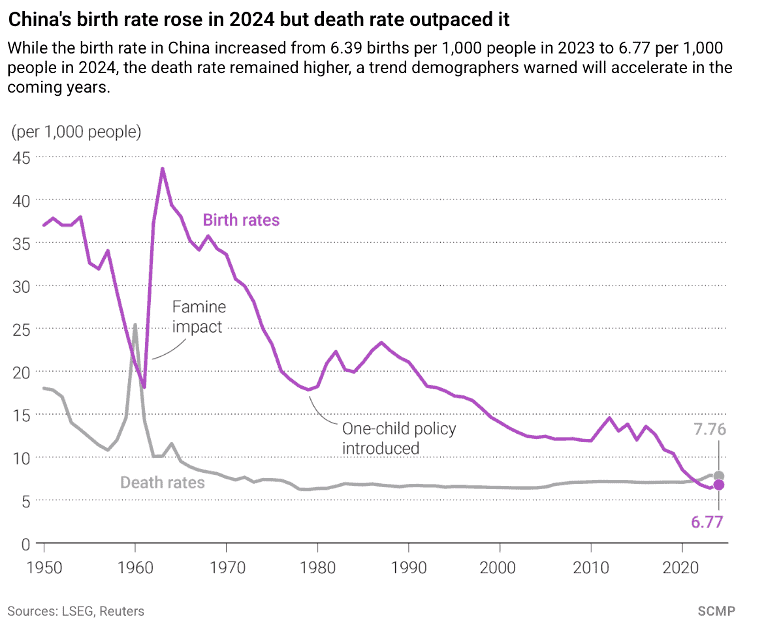

“Falling birth rates raise prospect of sharp decline in living standards – People will need to produce more and work longer to plug growth gap left by women having fewer babies, report says. Many of the world’s richest economies will need to at least double productivity growth to maintain historical improvements in living standards amid sharp falls in their birth rates. Two-thirds of people now live in countries with birth rates per woman below the so-called “replacement rate” of 2.1, while populations are already shrinking in several OECD member states — including Japan, Italy and Greece — along with China and many central and eastern European countries.”, The Financial Times, January 14, 2025

===========================================================================================

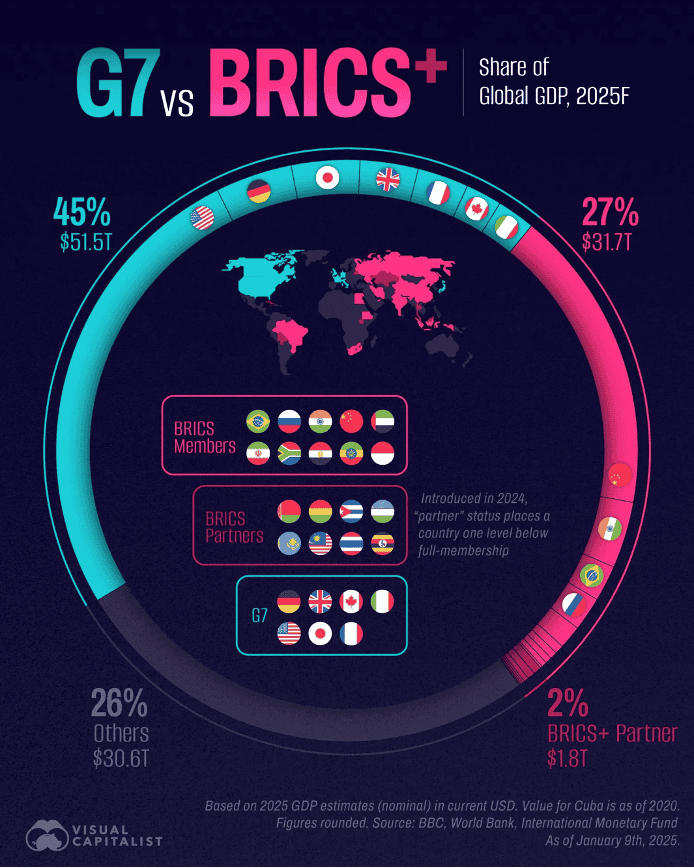

“Is BRICS+ Gathering Steam as a G7 Rival? The BRICS+ sphere is growing, adding five new members and eight new “partner” countries in in the last year. Together this bloc accounts for around 29% of the global economy in 2025, which is still dominated by the G7. The BRICS acronym initially started as a way to signal investment opportunities in fast-growing economies in the 2000s. Since then, the five founding members (Brazil, Russia, India, China, South Africa) have tried to create a platform supporting a multipolar world, with global institutions that are not funded by Western nations.”, Visual Capitalist, January 16, 2025

=============================================================================================

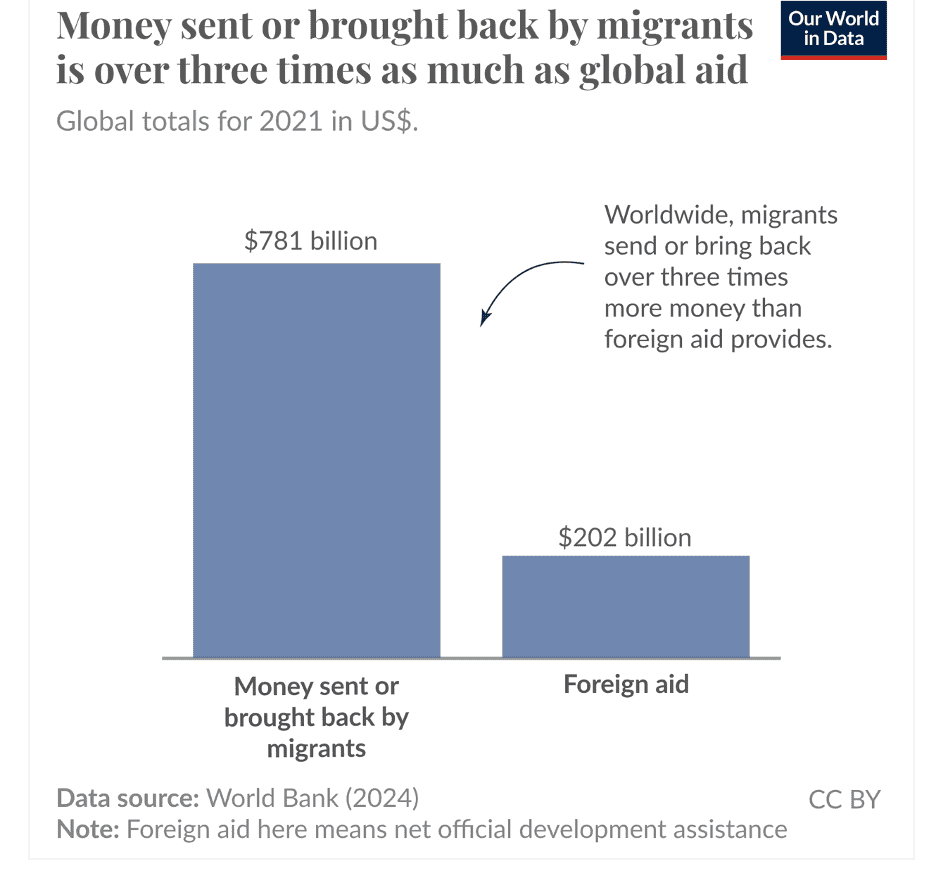

“The great global redistributor we never hear about: money sent or brought back by migrants – Migrants send or bring back over three times the amount of money provided by global foreign aid. Cutting transaction fees could make this support even more effective in reducing poverty. The main beneficiaries are middle-income countries. Upper-middle-income countries send 7% but receive 30%, and lower-middle-income countries send only 4% but receive 44%. This also means that very little money reaches the poorest countries4, where people need it the most. Low-income countries receive just 1.7% of all money sent or brought back by migrants, despite being home to 9% of the global population.”, Our World In Data, January 13, 2025

=============================================================================================

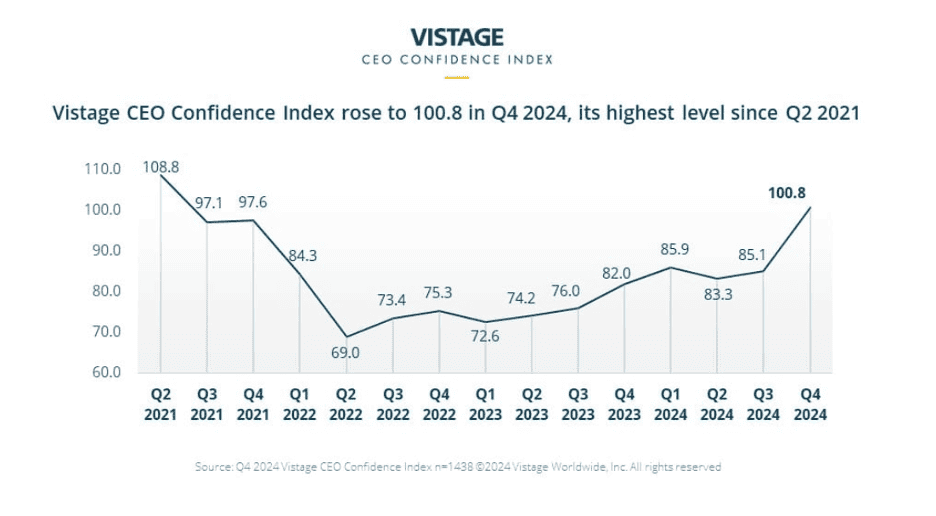

“CEO confidence surges, indicating growth in 2025 [Q4 Vistage CEO Index] – Heading into 2025, CEO confidence is optimistic on all fronts. The Vistage CEO Confidence Index soared 15.7 points to reach 100.8, signaling the approach of the long-anticipated growth cycle. Excluding the post-pandemic surge created by stimulus: Positive sentiment about the future of the U.S. economy spiked to levels last recorded in Q1 2017. Over three-quarters (76%) of CEOs expect increased revenue in the new year. Plans for increased investments and hiring both reached levels above Q4 2019 and the norms from the 2010s.”, Vistage, January 15, 2025

=============================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“EU and Mexico revive stalled trade deal as Trump tariffs loom – The European Union and Mexico revived a stalled free trade agreement on Friday, days before the return to the White House of Donald Trump, who has threatened both sides with tariffs.

The two parties are seeking to update their trade accord from 2000, which covers only industrial goods, by adding services, government procurement, investment and farm produce. EU proponents say the bloc urgently needs new partners to reduce its reliance on China, particularly for critical raw materials, and to insulate it from Trump tariffs. Last month, It struck a deal with South America’s Mercosur bloc.”, Reuters, January 17, 2025

=============================================================================================

“With Port Strike Averted, Dockworkers Draw New Curbs on Automation – A new six-year contract sets a 62% pay increase along with tougher standards for adding robotics to the docks. The pact would allow operators of automated equipment at ports in New Jersey and Virginia, where multiple machines are managed by a single dockworker at a time, to continue to use the semiautonomous cranes, according to people familiar with the matter. But the agreement says that companies that add semiautonomous equipment must hire one dockworker for each new crane added, the people said.”, The Wall Street Journal, January 9, 2025

==========================================================================================

“Chinese Merchants Plow Cash Into Overseas Warehouses Amid Global E-Commerce Boom – China’s e-commerce merchants are investing ever more in overseas warehouses to keep pace with the booming cross-border trade and make deliveries more efficient. As of the end of June (2024), Chinese companies had built more than 2,500 warehouses overseas, of which over 1,800 are dedicated to serving cross-border e-commerce transactions, Ministry of Commerce data showed.”, Caixin Global, January 7, 2025

=============================================================================================

Global, Regional & Country Travel

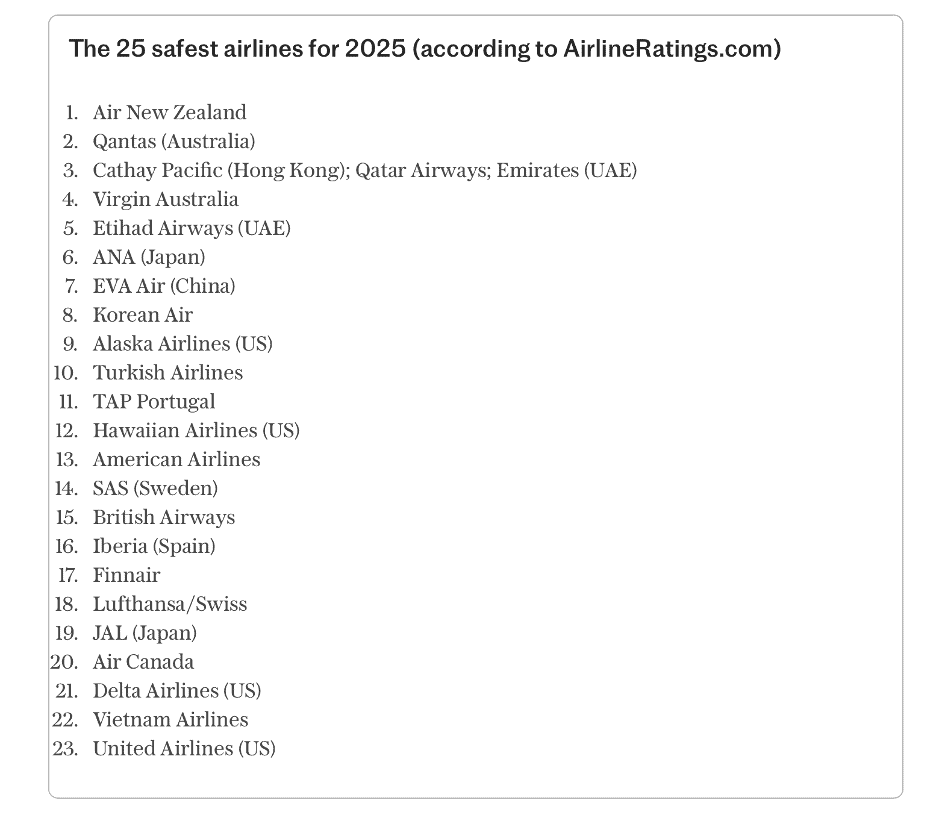

“The world’s safest (and least safe) airlines – A new report has named the best and worst, but is judging the safety of an airline really so straightforward? This month, a new report from AirlineRatings.com takes stock of the publicly available data to rank the world’s safest airlines. Despite a handful of accidents in 2024, the overall message on air travel from authorities remains the same as it has been for decades: flying is significantly safer than driving, with the chances of any kind of accident vanishingly small. When it comes to full-service airlines, the top spots go to Air New Zealand (in first place), followed by Qantas, Cathay Pacific, Qatar Airways and Emirates. British Airways finishes in 15th place, just above Iberia, Finnair, and Lufthansa.”, The Telegraph, January 19, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In How the World Ran Out of Everything, Peter S. Goodman delivers a compelling analysis of how global supply chains collapsed during the COVID-19 pandemic. Through detailed reporting and vivid storytelling, he reveals how decades of prioritizing efficiency through just-in-time manufacturing and concentrated production created dangerous vulnerabilities in the global economy.

His investigation is particularly powerful when examining how supply chain failures disproportionately impacted developing nations, exposing deep inequities in the global economic system.

Key Takeaways:

Efficiency vs. Resilience: The relentless pursuit of lean operations eliminated crucial safety margins

Geographic Risk: Concentrated manufacturing created dangerous global chokepoints

Social Impact: Supply chain failures hit developing nations hardest

System Failure: Traditional risk assessment proved inadequate for global crises

Future Solutions: Strategic redundancy and diversification are essential for resilience

Goodman presents balanced solutions for building resilience while preserving the benefits of global trade. Goodman shows how the pursuit of lean operations led companies to eliminate redundancies and stockpiles that could have helped weather the pandemic’s disruptions. Through compelling case studies, he illustrates how this efficiency-at-all-costs mindset created cascading failures across industries and borders.++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

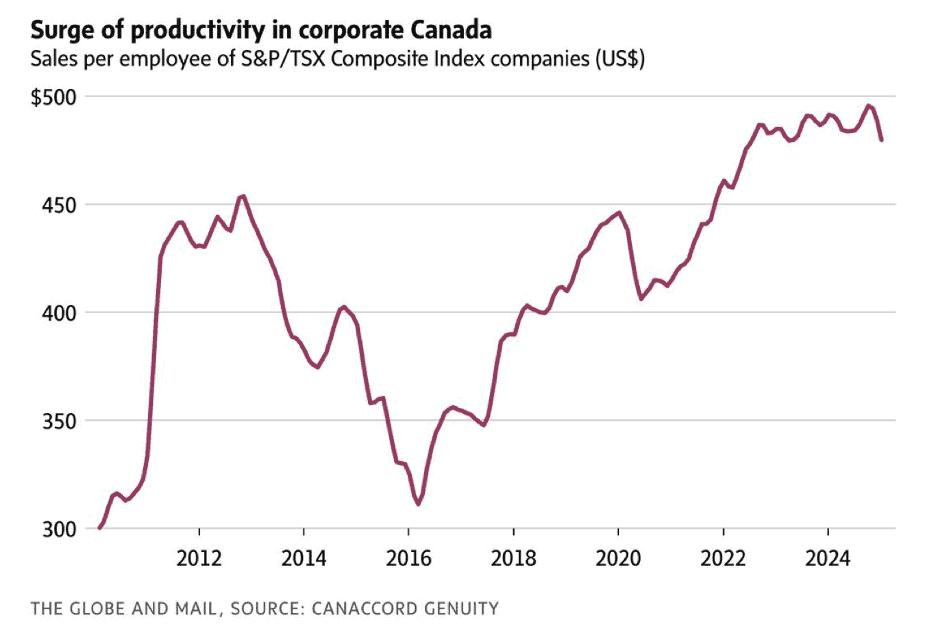

“The one way that productivity is improving in Canada – Since the depths of the COVID-19 pandemic, sales per employee for companies in the S&P/TSX Composite Index are up by about 20 per cent. This spike in productivity has translated into higher profit margins. Now at around 12.5 per cent across the market’s benchmark index, Canadian margins are on par with those of U.S. blue chips. How does this jibe with Canada’s productivity crisis? Economists have sounded the alarm over declining output per hour worked, which has made Canada 30 per cent less productive than the U.S. The first thing to remember is that the stock market is not the economy. The TSX is globally oriented, with considerable strength in the resource industries.”, The Globe and Mail, January 12, 2025

============================================================================================

China

“China’s population drops for third year in a row despite uptick in births – Though China’s birth rate rose this year after an all-time low in 2023, the country’s overall population continued its decline. The total population dropped by 1.39 million in 2024 to 1.4083 billion, down from 1.4097 billion people in 2023, the National Bureau of Statistics (NBS) said on Friday. Demographers have said it is possible China’s fertility rate dropped below 1.0 in 2023, but an official fertility rate for last year has not been provided.”, The South China Morning Post, January 17, 2025

==============================================================================================

“China’s Economic Outlook in 2025 – After declaring that China had “smoothly” achieved its targets for 2024, President Xi Jinping said in late December that the nation faces a “very arduous” year of reform in 2025. He’s not wrong, at least about the second point. Many economists and market watchers think that escaping deflation needs to become China’s top priority this year. Prices are falling as households pare back spending during a property crash, prompting comparisons to Japan’s lost decades. The country’s economy needs reforms that reduce overcapacity and allow inefficient zombie firms to fail — but that would mean layoffs, making things worse in the short term. It remains to be seen how Xi will navigate these issues. But on the last day of 2024, he warned a group of politicians that ‘the journey of Chinese modernization” would include “choppy waters, and even dangerous storms.’”, Extracted from a Bloomberg article on ‘What Wall Street Banks Are Watching in 2025’, January 12, 2025

==============================================================================================

Egypt

“IMF Pressure Breathes New Life Into Egypt’s Privatization Efforts – Egypt’s partial privatization efforts will somewhat reduce the government and the military’s role in the economy, and boost private sector engagement and market competition. However, increasing foreign currency reserves will grant Cairo flexibility in both the timeline and the extent of its privatization efforts. The International Monetary Fund, or IMF, announced on Dec. 24 that it had reached a staff-level agreement with Egypt to disburse $1.2 billion after completing the fourth review of the country’s expanded $8 billion program. To unlock the disbursement, Cairo agreed to meet the Fund’s conditions, including accelerating its ongoing privatization efforts to decrease the government and military’s role in the economy.”, RANE Worldview, January 9, 2025

=============================================================================================

Indonesia

“With Indonesia, Brics is adding Southeast Asia to its power base – Indonesia has become the first Southeast Asian country to join Brics as a full member. Together with its Association of Southeast Asian Nations (Asean) counterparts Malaysia, Thailand and Vietnam, Indonesia was invited last October to be a Brics “partner country”, a category created at the Kazan summit with a path to full membership. Among them, only Vietnam has yet to accept. As countries in the West reorient supply chains in the name of national security, Global South countries are collaborating to align their policies and build their own reliable supply chains for critical minerals and related technologies and industries.”, South China Morning Post, January 12, 2025

===============================================================================================

Syria

“Syria flooded with Pepsi and Pringles as rulers open economy – End of Assad-era restrictions on dollars, exorbitant duties and extortion leads to boom in foreign goods. In the weeks since Assad was deposed in an offensive led by Islamist militant group Hayat Tahrir al-Sham, imported western and regional goods have poured into shops. Around the capital Damascus, stores are now lined with Turkish bottled water, Saudi-produced bouillon cubes, Lebanese powdered milk and western chocolate brands such as Twix and Snickers. In one supermarket in the centre of the city, an entire wall was dedicated to Pringles. Foreign items used to be hidden behind counters and sold in secret to those who knew to ask. The new HTS-led government has since permitted transactions in dollars, and on Saturday announced a new set of unified custom fees that it said reduced fees by 50 to 60 per cent. It added that lower fees on raw material imports would help protect local producers.”, The Financial Times, January 12, 2025

===============================================================================================

United Kingdom

“UK economy will outdo Germany, France and Italy, predicts IMF – UK economic growth will outpace Germany, France and Italy over the next two years, according to data from the International Monetary Fund. Gross domestic product (GDP) is set to expand by 1.6 per cent this year and 1.5 per cent in 2026, well above the projected growth rates for Europe’s major economies, according to the Washington-based group’s analysis. The United States and the UK are the only nations in the G7 to receive upgrades on their growth forecasts for this year since the fund’s last report in October. However, the IMF lowered its growth projection for the UK in 2024 to 0.9 per cent from 1.1 per cent. Spain will also outpace the UK in 2025 and 2026.”, The Times of London, January 17, 2025

================================================================================================

United States

“Small Business Sales Expectations Return To Normal – By industry, manufacturing was most optimistic with a net 34% expecting improved real sales. This sector has been underperforming for years, so they are looking to grow, a fresh start. Firms in finance and real estate are equally positive about sales. Firms in the two services sectors have a positive view of sales growth but less exuberant. On the downside, firms in construction, transportation and communication, and agriculture still have a negative view for sales growth. The trades were balanced, with about as many owners expecting sales improvements as expect sales declines.”, Forbes, January 17, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Exploring Europe: Key European Markets and Their Unique Peculiarities – For restaurant groups and U.S.-based brands considering European franchise expansion, the continent offers a blend of opportunities and challenges. Each country presents unique cultural, economic, and regulatory dynamics that shape franchising strategies. Here’s a closer look at five key European markets and their distinct franchising landscapes.”, Franchising.com, January 2025. Article by Rebecca Viani, White Space Partners

===============================================================================================

“Following Openings in the Middle East, Chipotle Looks to Continue Plans for Global Growth – Chipotle is increasing its strategy for international growth with recent openings in the Middle East and plans for further expansion into Western Europe and beyond. The fast-casual Mexican chain signed its first-ever development agreement with international franchise retail operator Alshaya Group in 2023 to bring the brand to the Middle East. It opened its first restaurants in Kuwait in April and in Dubai in October and will add more locations across the region in coming year. Chipotle has……taken a methodical approach and currently has more than 40 locations in Canada, about 20 in the U.K., six in France, and two in Germany.”, Franchsiing.com, January 2025

================================================================================================

“Bakery franchise chain Crumbl explores US$2 billion sale, sources say – The owners of the cookie chain are hoping to command a valuation for the business equivalent to more than 10 times its annual earnings before interest, taxes, depreciation, and amortization of nearly $150 million, the sources said. Launched in 2017 by cousins Jason McGowan and Sawyer Hemsley, Crumbl in recent years has amassed a sizable social media following across platforms such as TikTok, Instagram, and YouTube. The company, which sells its cookies in a distinctive pink box with its logo, opened its first location in 2017 in Logan, Utah, when Hemsley was finishing his degree at Utah State University. Crumbl is now present in 1,071 locations across North America, according to its website.”, CTV News, January 13, 2025

===============================================================================================

“Wendy’s opens first Australia store in 40 years – The world’s largest franchisee operator Flynn Group is taking a punt on the Australian fast food market opening a Wendy’s store on the Gold Coast. It comes forty years after the last one closed down. Flynn Group purchased the rights to Wendy’s in Australia in late 2023 and has spent more than 15 months planning today’s opening.”, Sky new Australia, January 15, 2025

================================================================================================

“AI and Franchise Sales: Driving Smarter Decisions, Avoiding Costly Errors – The rise of AI and automation is reshaping industries worldwide, and franchising is no exception. From lead generation to candidate engagement, the potential for efficiency and scale is immense. However, the promise of AI often blurs the distinction between meaningful investments and tools that could lead to costly missteps. Franchise sales are not just about technology; they are about relationships, strategy, and aligning with the right candidates. Missteps in adopting AI can lead to inefficiencies, impersonal interactions, and ultimately, financial and reputational losses. For franchisors to truly benefit from automation, it’s critical to assess and refine the foundation of their sales processes. Without this groundwork, even the best AI tools can amplify existing flaws.”, Franchisesales.org, January 13, 2025. From an article by Joe Caruso.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 125, Tuesday, January 7, 2025

Predictions, Predictions, Predictions, Predictions!!!

Commentary about the 125th Issue: This issue has links to 20+ prediction sources that cover just about everything we need to be aware of in 2025 to do business in our own countries and around the world.

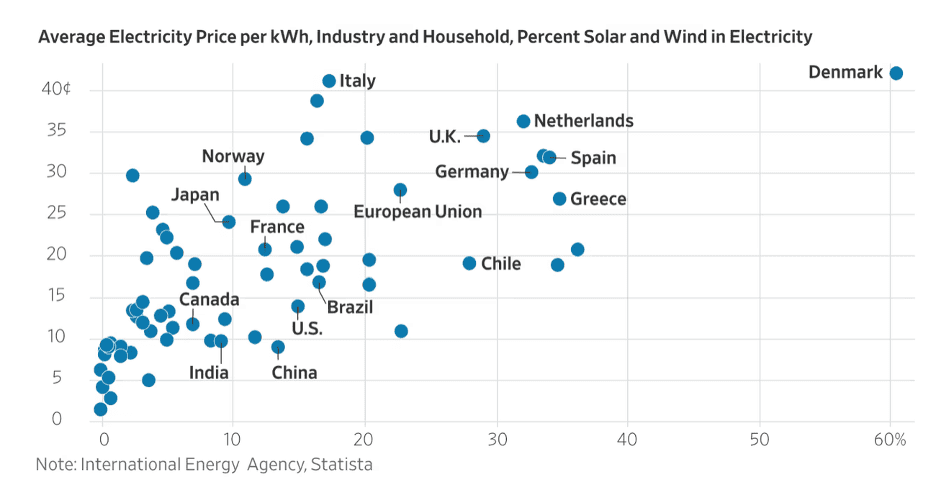

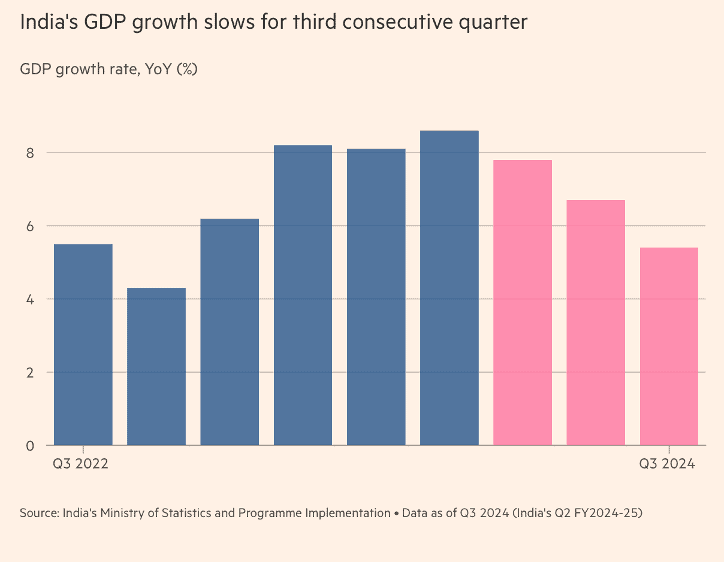

This issue also covers franchise trends for 2025, the world’s top companies and the world’s richest countries, the global semiconductor industry, challenges for the global supply chain, a US$1.3 million-dollar tuna in Japan, the fact that green energy is not cheap, European Union countries may be seeing a slight economic improvement but the United Kingdom is not, a slowing of India’s economy, the decline of TGI Fridays and wonderful quotation from U.S. President Jimmy Carter.

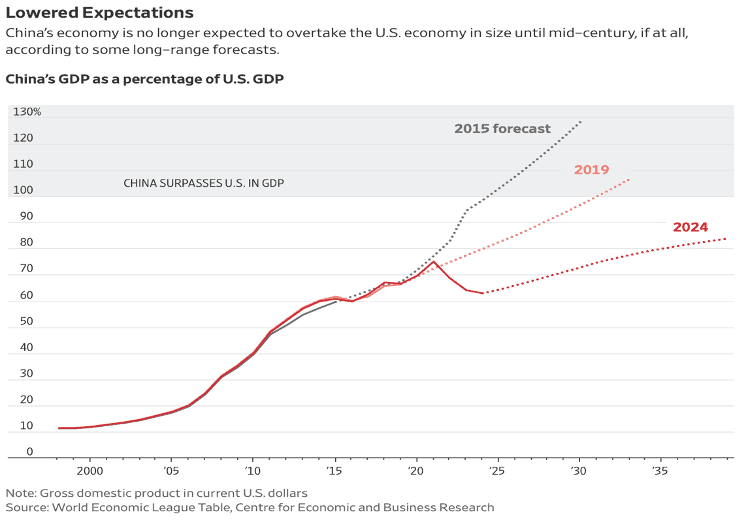

One More Thing: Few now expect China to catch up with the U.S. before midcentury, if it manages to at all.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier. Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“We must adjust to changing times and still hold to unchanging principles.”, U.S. President Jimmy Carter

“A bad attitude is like a flat tire; if you do not change it you won’t go anywhere.”, Joyce Meyer. Compliments of Judge Jim Gray

“Teamwork is dependent on trusting the other folks to come through with their part without watching them all the time.”, Steve Jobs

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #124:

The World’s Top Companies by Revenue in 2024

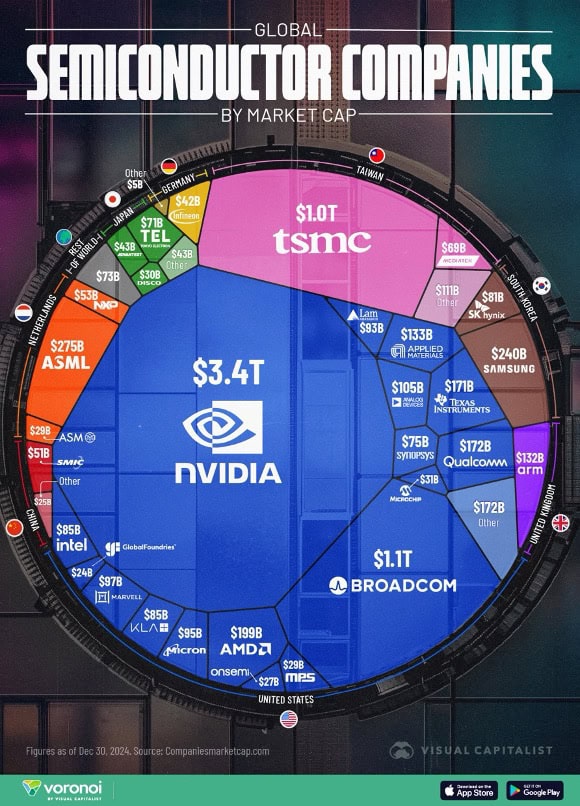

The Value of the Global Semiconductor Industry

Franchise M&A Experts Predict Robust 2025 for Dealmaking

China Industries to Watch in 2025

Year of Global Supply Chains Turbulent Landscape

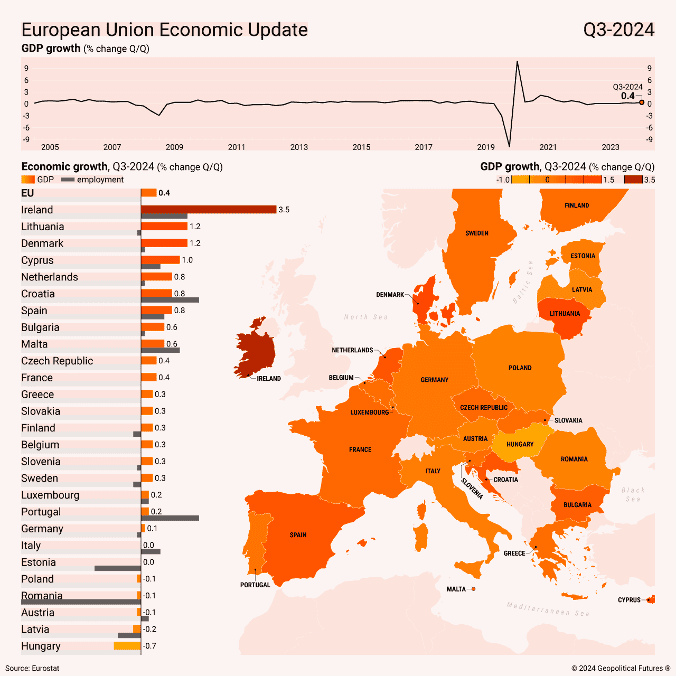

EU Economy Shows Modest Improvement

Brand Global News Section: Cava®, Doner Shack®, Lao Xiang Ji, Raising Canes®, Starbucks®, TGI Fridays® and Wingstop®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

2025 Prediction Sources – The following twenty-one 2025 prediction sources are eclectic, very diverse and some are certain to be wrong. They cover the economy, climate change, technology, China, the Middle East, Europe, the United Kingdom and the United States, the impact of Trump’s election, trade policies, fiscal policies, geopolitical tensions, taxes, health, exports and imports, research, stock markets, bitcoin, interest rates, the U.S. dollar, tariffs, shipping, supply chain, nearshoring, energy, inflation as well as stagflation, employment and unemployment as well as many other factors that go together to impact doing business around the world in 2025. The comments and projections in these predictions are not necessarily those of the editor of this newsletter.

The Times: “Could the boosters be wrong about the global economy in 2025?” – An analysis of differing economic projections for the global economy in 2025, highlighting potential challenges and uncertainties.

El País: “La economía mundial en 2025: claves para entender un año marcado por la vuelta del imprevisible Donald Trump” – An exploration of how global economic dynamics in 2025 may be influenced by significant political changes, particularly in the United States. The article titled “La economía mundial en 2025: claves para entender un año marcado por la vuelta del imprevisible Donald Trump” from El País discusses the potential global economic implications of Donald Trump’s return to the U.S. presidency in 2025.

FocusEconomics: “Global Economic Prospects for 2025” – A comprehensive report providing forecasts on global economic growth, inflation, and other key indicators for 2025.

J.P. Morgan: “Outlook 2025: Building on Strength” – An investment outlook discussing potential global economic scenarios, market strategies, and investment opportunities for 2025.

IMD Business School: “The Business World in 2025” – A report presenting four scenarios to help businesses stress test their strategies against potential future developments by 2025.

“What the “superforecasters” predict for major events in 2025 – The experts at Good Judgment weigh in on the coming year. The Economist

Financial Times: “Business trends, risks and companies to watch in 2025” – This article discusses anticipated global business trends, potential risks, and key companies to monitor in 2025.

Convera: “Are you ready for 2025? A global economic forecast” – An analysis of anticipated global economic conditions in 2025, highlighting opportunities and risks for international businesses.

Forbes: “4 Small Business Predictions For 2025 You Must Read” – An article outlining key predictions and trends that small businesses should prepare for by 2025.

The Atlantic: “Ten Predictions for 2025” – This article explores forecasts such as teleportation testing, the decline of dementia, and solar energy becoming the largest energy source.

World Economic Forum: “Future shocks: 17 technology predictions for 2025”: Insights into technological advancements expected by 2025, including quantum computing and 5G developments.

Quantumrun: “Predictions for 2025 | Future timeline” – A comprehensive list of 785 predictions covering various sectors like culture, technology, science, health, and business.

KnowInsiders: “Prophecies for 2025 from Past and Present Seers” – An exploration of predictions from figures like Baba Vanga, focusing on natural disasters and extreme weather events.

TechAcute: “What 2025 Holds: Predictions Based on Survey” – Survey-based insights into societal and technological changes anticipated by 2025.

Eckerson: “Predictions 2025: Everything is About to Change” – An analysis of upcoming changes in data responsibility platforms and analytics by 2025.

Futurebase: “Predictions for the Year 2025 – Future Timeline” – A curated list of 31 future predictions across transport, technology, food, and health.

Ipsos: “Ipsos Predictions Survey 2025” – A survey revealing global anxieties about climate change and confidence in technological solutions.

Forbes: “What Is Bitcoin’s Price Prediction For 2025?” – An analysis of factors influencing Bitcoin’s potential growth by 2025.

The Times: “The Times view on what the year ahead holds: The World in 2025” – An editorial discussing anticipated global events and trends for 2025.

“2025 – A Year of Complexity, Caution, and Emerging Possibilities”, As 2024 draws to an end, here are the thoughts and predictions on ⑫ areas shaping the coming year from Jonathan Lishawa, award-winning IoT & Smart Energy CEO.

Business, the economy and the pound in your pocket – what to expect from 2025. Biggest cause of uncertainty posed by incoming Trump administration.

=======================================================================================

“The World’s Top Companies by Revenue in 2024 – Today, U.S. retail giants are the largest companies by revenue globally thanks to their international reach and the strength of the American consumer. Looking beyond the U.S., many of the world’s leading companies by this measure are in the energy sector. Notable heavyweights, such as Saudi Aramco and China National Petroleum, are predominantly state-owned with expansive global operations. This graphic shows the top companies by revenue worldwide, based on data from Fortune.”, Visual Capitalist & Fortune magazine, December 30, 2024

===========================================================================================

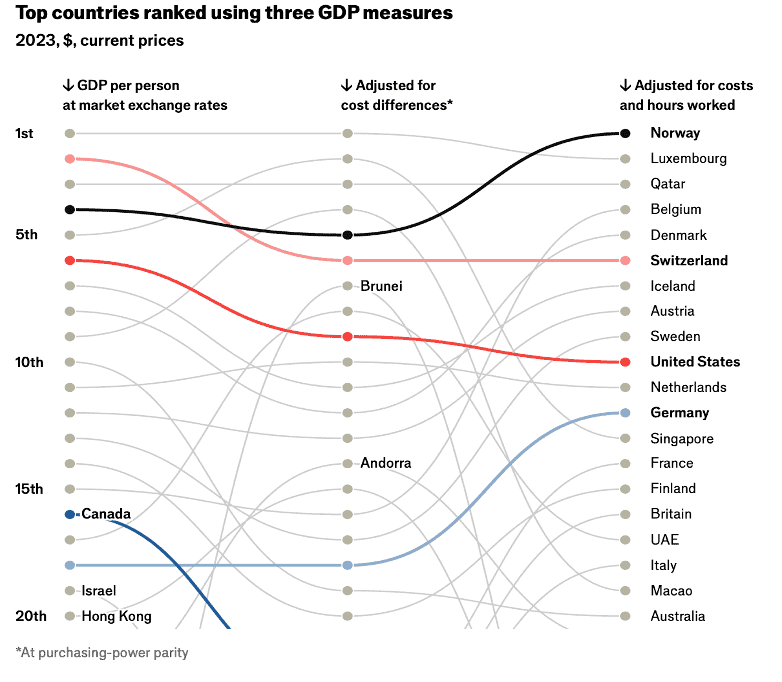

“The world’s richest countries in 2024 – Our annual ranking compares economies in three different ways. The Economisttherefore ranks countries by three measures: dollar income per person, income adjusted for local prices (known as purchasing-power parity, or ppp) and income per hour worked. Take America first. Its gdp has been the largest at market exchange rates for over a century. But by income per person it falls to sixth, behind Luxembourg (first) and Switzerland (second). Adjusting for America’s higher prices pushes it down to ninth; accounting for its long workdays and limited holidays, to tenth. The results for China—the world’s second-largest economy in nominal terms—are even starker: it falls to 69th by gdp per person, 75th at local prices and 97th after accounting for hours worked.”, The Economist, July 4, 2024

=============================================================================================

“The Value of the Global Semiconductor Industry – This graphic visualizes the market capitalization of the entire global semiconductor industry as of Dec. 30, 2024. Data was accessed from Companiesmarketcap.com, and only covers publicly-traded companies.

Nvidia is currently the world’s most valuable semiconductor company, followed by Broadcom and TSMC.”, Visual Capitalist & Companiesmarketcap.com, January 6, 2025

=============================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Green Electricity Costs a Bundle – The data make clear: The notion that solar and wind power save money is an environmentalist lie. The claim that green energy is cheaper relies on bogus math that measures the cost of electricity only when the sun is shining and the wind is blowing. Modern societies need around-the-clock power, requiring backup, often powered by fossil fuels. That means we’re paying for two power systems: renewables and backup. Moreover, as fossil fuels are used less, those power sources need to earn their capital costs back in fewer hours, leading to even more expensive power. This means the real energy costs of solar and wind are far higher than what green campaigners claim. One study shows that in China the real cost of solar power on average is twice as high as that of coal. Similarly, a peer-reviewed study of Germany and Texas shows that solar and wind are many times more expensive than fossil fuels.”, The Wall Street Journal, January 2, 2025

=============================================================================================

“Shipowners switch to smaller vessels as world trade reroutes from China – Attacks on Red Sea ships have also hit demand for bulkiest carriers. The rerouting of global trade from China to ports elsewhere in Asia is leading shipowners to move on from the era of ordering ever-larger vessels and switch to smaller crafts instead. Just six container ships capable of carrying the equivalent of more than 17,000 20-foot containers, known in industry parlance as TEUs, are due to be delivered in 2025, against 17 delivered in 2020, according to shipbroker Braemar. At the same time, 83 mid-sized vessels measuring between 12,000 TEUs and 16,999 TEUs are set to be completed in 2025, almost five times the number five years earlier.”, The Financial Times, January 1, 2025

==========================================================================================

“Year of Global Supply Chains Turbulent Landscape – From escalating geopolitical tensions and persistent inflation to crippling labor shortages and the ripple effects of technological disruption, 2024 has been a year of adaptation and innovation, forcing stakeholders to rethink traditional approaches and embrace new strategies to navigate the complexities of a rapidly evolving global trade landscape. The U.S.-China trade war continued to cast a long shadow over the global economy, with the European Union caught in the crossfire between the two superpowers. The global supply chain faced another hurdle in 2024: a surge of excess inventory, primarily in the technology sector.”, EPS News, December 31, 2025

=============================================================================================

Global, Regional & Country Travel

“Traveling in 2025? Here are some need-to-know changes happening next year – From new ID and entry and exit requirements to updated airline refund policies, there are notable new rules affecting tourists coming in the new year. Starting in 2025, travelers will be impacted by international travel updates, as well as by changes in domestic flight ID rules for U.S. flyers. Meanwhile, advantageous customer protections are finally being locked into place, and some airlines have announced welcome cabin overhauls.”, National Geographic, December 30, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

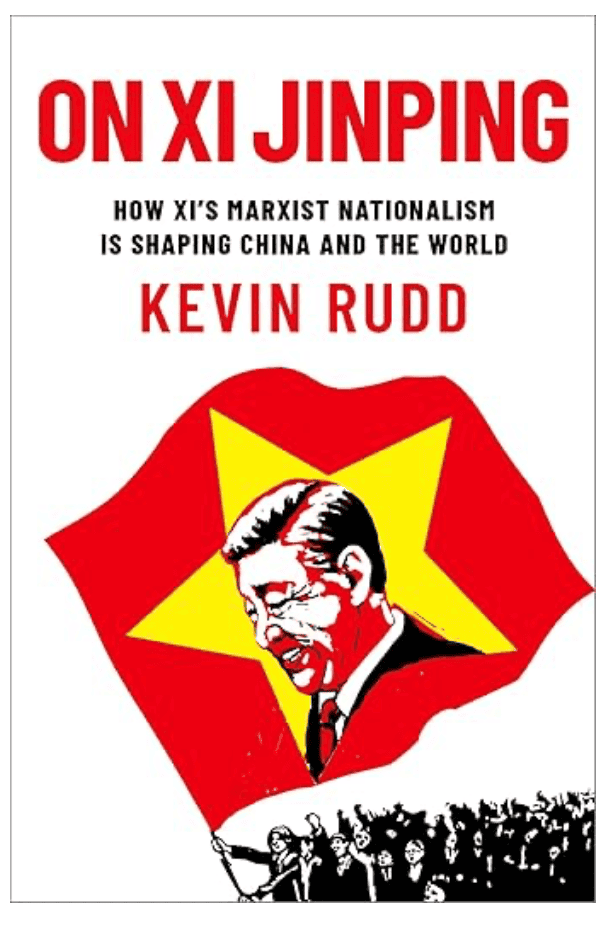

In On Xi Jinping: How Xi’s Marxist Nationalism is Shaping China and the World, Kevin Rudd provides a compelling analysis of Xi Jinping’s leadership style, ideological framework, and the profound impact of his governance on China and global affairs. Rudd explores Xi’s deep-rooted Marxist-Leninist convictions intertwined with Chinese nationalism, revealing how these principles drive his domestic and international policies. Kevin Rudd is the Ambassador to the USA from Australia and the former Prime Minister of Australia.

Under Xi, China has witnessed a centralization of power, aggressive economic reforms, and a return to ideological orthodoxy. Domestically, his emphasis on party discipline and anti-corruption campaigns has solidified the Communist Party’s grip on power. Internationally, Xi’s vision of the “China Dream” and Belt and Road Initiative reflect his ambitions for China to reclaim a dominant global role.

Rudd delves into Xi’s strategic calculus, highlighting how his approach diverges from predecessors by challenging the liberal international order and reshaping global institutions to align with Beijing’s interests. The book also examines Xi’s handling of critical issues, including Taiwan, Hong Kong, and the South China Sea, while addressing the risks posed by escalating tensions with the United States.

Rudd’s work provides crucial insights into understanding Xi Jinping’s China—a nation at the crossroads of its rise and its complex relationship with the world.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Brazil

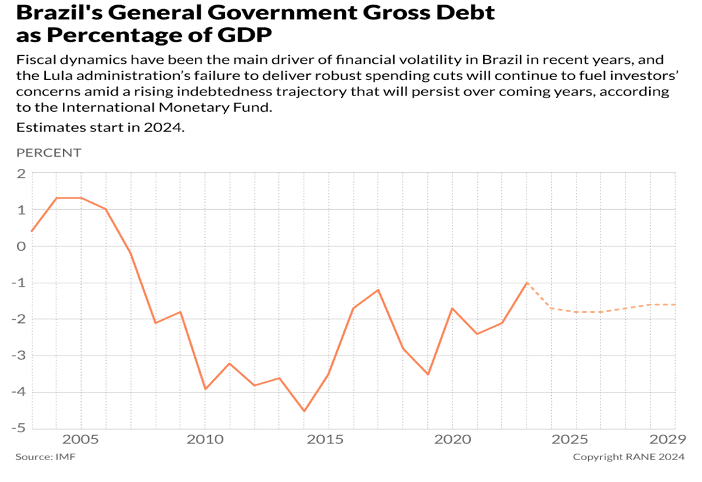

“How Will Brazil’s Financial Crisis Evolve in 2025? Despite financial markets’ recent turbulence, Brazil is unlikely to pursue a harsh fiscal adjustment in the coming months, meaning persistent investor concern over the country’s debt trajectory will continue to undermine macroeconomic conditions and the business environment. Economists now expect the Central Bank’s main interest rate to reach 14.75% by the end of 2025 (up from the 12.25% they forecasted in mid-November); they also expect Brazil’s inflation rate to hit 4.96% by the end of next year (versus the 4.34% forecast in mid-November).”, Geopolitical Futures/RANE World View, December 30, 2024

============================================================================================

China

“China Industries to Watch in 2025 – As the world’s second-largest economy, China continues to be a hub of innovation and economic dynamism. Its vast domestic market, advanced digital ecosystem, and strategic focus on modernization have made it a global leader in several industries. In 2025, China’s evolving consumer preferences, policy shifts, and technological advancements will shape opportunities for businesses and investors alike. From the rise of green technologies to the growing appetite for health-conscious products, the country offers lucrative avenues for foreign firms ready to adapt to its unique market dynamics. However, thriving in China’s competitive environment requires more than just identifying growth areas. Businesses must navigate complex regulatory frameworks, cultural nuances, and a fast-paced digital transformation. By understanding the opportunities and challenges in key sectors, companies can position themselves effectively to succeed in one of the world’s most dynamic markets. This article explores the top industries to watch in China in 2025 and provides insights into overcoming potential hurdles.”, The American Chamber of Commerce in China (AmCham), January 3, 2025 (The link can be very slow to load.)

==============================================================================================

“China’s Economy Is Burdened by Years of Excess. Here’s How Bad It Really Is. Overindebtedness, overbuilding and overcapacity are causing problems at home and abroad. China’s rapid growth meant that for years forecasters expected China to overtake the U.S. as the world’s largest economy. As recently as 2019, some forecasters were expecting China’s GDP to eclipse the U.S.’s around 2030. Today, it is the U.S. powering the global economy and China that is battling stumbling growth. Few now expect China to catch upwith the U.S. before midcentury, if it manages to at all.”, The Wall Street Journal, January 1, 2025

==============================================================================================

European Union

“EU Economy Shows Modest Improvement – The EU economy is recovering modestly but still faces significant structural adjustments and external pressures. In the third quarter of 2024, gross domestic product grew 0.4 percent compared with the previous three-month period in both the eurozone and the broader EU, fueled by steady domestic consumption and a rebound in international tourism. Rising energy costs, worsened by the cutoff of Russian gas, are straining industrial economies, particularly in Central and Eastern Europe. Southern Europe is grappling with high youth unemployment and growing sectoral inequalities, further straining social stability. Global trade uncertainties, including weaker Chinese demand and potential U.S.-EU frictions, are undermining export growth.”, Geopolitical Futures, January 3, 2025

=============================================================================================

India

“Has the ‘India trade’ run out of steam? Slowing growth and high inflation hit household incomes and raise questions about economic fundamentals. Please use the sharing tools found via the share button at the top or side of articles. GDP growth in the quarter ended September came in at just 5.4 per cent year on year, the lowest rate in nearly two years. The Reserve Bank of India in November cut its growth forecast for the 2024-25 financial year from 7.2 per cent to 6.6 per cent. Please use the sharing tools found via the share button at the top or side of articles. India’s finance minister Nirmala Sitharaman said in December that the drop in economic growth was a “temporary blip”. But many economists believe the slowdown is not just seasonal, pointing to a drop in spending among overleveraged urban and middle-class Indians.”, The Financial Times, December 31, 2024

===============================================================================================

Japan

“Sushi restaurateurs fork out $1.3m for motorbike-sized tuna at auction in Tokyo – Onodera Group paid second highest price ever at prestigious annual new year auction at Tokyo’s main fish market. Michelin-starred sushi restaurateurs the Onodera Group said they had paid 207m yen on Sunday for the 276kg (608lbs) bluefin tuna, roughly the size and weight of a motorbike. But the highest ever auction price was 333.6m yen (US$2.l million) for a 278kg bluefin in 2019, as the fish market was moved from its traditional Tsukiji area to a modern facility in nearby Toyosu.”, The Guardian, January 5, 2025

===============================================================================================

United Kingdom

“UK economy shrinks for second month in a row – The UK economy shrank for the second month in a row in October as concerns about the Budget continued to weigh on confidence. Official figures showed a 0.1% drop, despite expectations that the economy would return to growth after a fall in September. The Office for National Statistics (ONS) said that activity had stalled or declined with pubs, restaurants and retail among sectors reporting ‘weak months’.”, BBC News, December 13, 2024

==============================================================================================

“Tax rises ‘to cost businesses £2,000 more’ for each worker – The Centre for Policy Studies says low-paid workers and those re-entering the workforce will cost employers the most. The analysis showed that it would cost an average of £24,806 to employ someone over 21 earning the minimum wage — £2,367 (US$2,939) more than last year. That will partly be driven by the hourly national minimum wage rising from £11.44 to £12.21 (US$15.16) from April.”, The Times of London, January 3, 2025

================================================================================================

United States

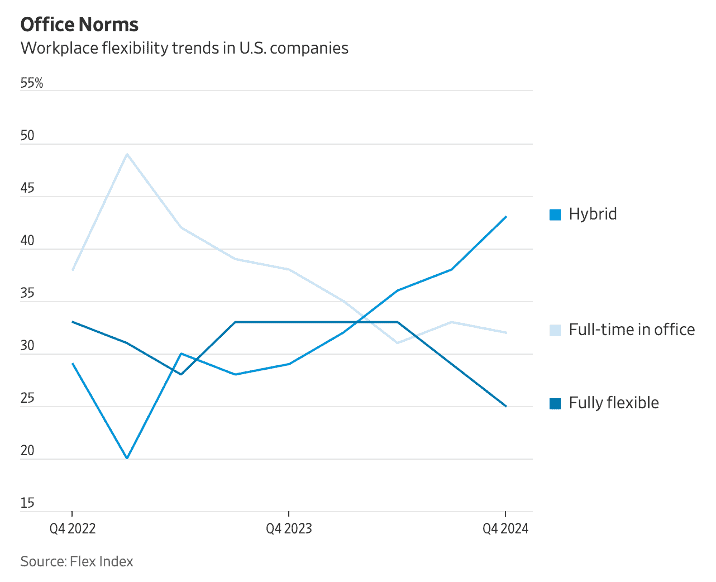

“Will 2025 Be the Watershed Year for Return-to-Office Mandates? That Depends. Executives are paying attention as major companies including Amazon.com and Dell Technologies tell certain workers to return to the office full-time. Years after the Covid-19 pandemic normalized remote work, the recent developments have executives wondering which companies will pull staff back to the office next—and who will benefit. Many employers continue to see the benefits of hybrid working schedules, from the ability to attract employees to retaining top talent. But the degree of flexibility at the workplace is shifting.”, The Wall Street Journal, December 26, 2024

===========================================================================================

Vietnam

“Vietnam’s economy smashes growth forecasts as trade-obsessed Trump returns to the White House – The Southeast Asian economy grew 7.09% in 2024, according to data released by the country’s General Statistics Office on Monday. That smashed the government’s forecast of 6.5% growth for the year, as well as last year’s growth figure of 5.05%. Exports, driven by electronics, smartphones, and garments, grew 14.3% in 2024 to reach $405.5 billion, and that helped drive Vietnam’s growth. Vietnam’s government hopes to have an even better 2025, with Prime Minister Pham Minh Chinh recently expressing hope that the economy will grow by 8% this year.”, Fortune magazine, January 6, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“What’s Ahead for Franchising in 2025? Here are the Key Trends to Watch – With the U.S. election now settled, we have a clearer picture of what to expect for franchise development in 2025. Though nothing is completely certain, the following trends appear likely to play an important factor for franchise development teams in the coming year…..”, Entrepreneur magazine, January 6, 2025. This is an article by Rob Lancit, Stratus Building Solutions

===============================================================================================

“Franchise M&A Experts Predict Robust 2025 for Dealmaking – Buyers are looking for new investments and sellers can get a price closer to what they’re hoping for as the Federal Reserve lowered interest rates toward the end of last year. Private equity firms have been showing increased interest in franchisees of strong, proven concepts—and that trend is set to continue, said Joe Philip of First Horizon Bank. There haven’t been many initial public offerings from franchisors in recent years. But there are indications of some IPOs to come.”, Franchise Times, December 26, 2024

================================================================================================

“Fast casuals had a terrific 2024. Except for those that didn’t – Wingstop, Cava and Raising Cane’s beat all odds, and others had a pretty great year, despite road bumps. But for a few, it was pretty rough. Mostly, however, the leading fast-casual players thrived this year, while restaurant chains in the quick-service and casual-dining segments struggled and were forced into aggressive value promotions to compete for inflation-weary customers. For several fast-casual brands, it was a year of menu transformation.”, Restaurant Business, December 18, 2024

===============================================================================================

“Starbucks Is Said to Consider Selling Stake in Chinese Unit – US coffee chain speaking to advisers about China growth plans. Company gauging interest from domestic private equity firms. A stake sale could also attract interest from Chinese conglomerates or other local companies with experience in the industry, some of the people said.”, Bloomberg, November 22, 2024

================================================================================================

“Chinese fast food chain LXJ seeks IPO in Hong Kong amid market revival – LXJ operates 1,404 restaurants across 53 mainland cities, serving meals costing about 20 yuan (US$2.73) on average. LXJ International, which operates the largest fast-food chain in mainland China, is seeking a stock listing in Hong Kong to raise funds for expansion, after two unsuccessful attempts to float its shares in Shanghai last year. The chain, known as Lao Xiang Ji or Home Original Chicken, submitted its application to the Hong Kong stock exchange on Friday, without disclosing the size of its offering. The funds will be used to enhance its supply chain, expand its restaurant network and improve technologies, among other purposes.”, South China Morning Post, January 3, 2025. Compliments of Paul Jones, Jones & Co., Toronto

=================================================================================================

“Franchising Predictions for 2025 – What’s in store for the franchise sector? Franchise thought leaders share their top predictions for 2025…….. …there will be a continued focus on the people in our organizations in 2025. Creating space for them to be authentic with colleagues and focusing on their personal and professional growth will help retain great people, as well as find new ones to join the team. With hiring and retention remaining the top challenge for most business owners, franchisors and suppliers will need to prioritize strategies to support franchise owners in building strong cultures within their organizations.”, Franchise Business Review, December 13, 2024

=============================================================================================

“Doner Shack Launches Revolutionary Franchise Opportunity in the U.S. – Primed to capitalize on the global popularity of kebabs, Doner Shack has launched a unique franchise opportunity stateside in an untapped sector primed for explosive growth. It’s a move already fueling Doner Shack’s mission to become the world’s No. 1 kebab brand. The brand, founded in 2018, continues to capture the industry’s attention, generating plenty of buzz at the recent Franchise Expo South. As part of a bold expansion strategy, co-founders Sanjeev Sanghera and Laura Bruce plan to relocate the corporate headquarters from Scotland to Miami, underscoring a bullish commitment to franchisee support and long-term U.S. growth. Doner Shack is already making waves on the global stage, with five company-owned stores, 50 franchise restaurants sold in the United Kingdom, and a flurry of development news. The brand continues to expand its global presence, recently inking a 150-store master franchise agreement in India and hatching plans for 100 stores in the Middle East.”, Franchising.com, January 1, 2025

===============================================================================================

“The Epic Mess at TGI Fridays – The chain that spread happy hour and family dining across America has vacated its headquarters and left bills unpaid. One restaurant owner sees a revival plan. The unraveling of a chain that defined happy hour and family dinner out across America is an epic business saga that spans four CEOs, dozens of restaurant closures, bungled refinance attempts and unpaid bills that no Long Island iced tea could cure. Its U.S. restaurant count has dwindled to less than 200, including 39 locations that are bankrupt. Complex financial plans by private-equity investors to try to stabilize the company backfired when Fridays couldn’t meet certain obligations during the pandemic and beyond. Franchise owners became so frustrated with the lack of communication and direction from company leaders that some stopped paying royalties, franchisees and their advisers said. The chain that once said “in here, it’s always Friday” has seen better days.”, The Wall Street Journal, December 26, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896