Biweekly Global Business Newsletter Issue 13, Tuesday, June 10, 2025

“In the midst of every crisis, lies great opportunity.”, Albert Einstein

Welcome to Issue #136 of the Global Business Update – As we hit the midpoint of 2025, the global economy is sending mixed—and at times, conflicting—signals. In this issue, we cover everything from rising gold prices to sinking tourist numbers, from trade skirmishes to surprising growth pockets.

The global economy sputters as new tariffs return under Trump, intensifying trade tensions now hitting on three fronts. We’re seeing ripple effects: jobs at the Port of Los Angeles are down by half, international tourist arrivals to the U.S. continue to decline, and tariffs are already making dolls more expensive for American families. Yet, in a twist, AmCham reports no polled U.S. firms in China are planning to reshore to the USA.

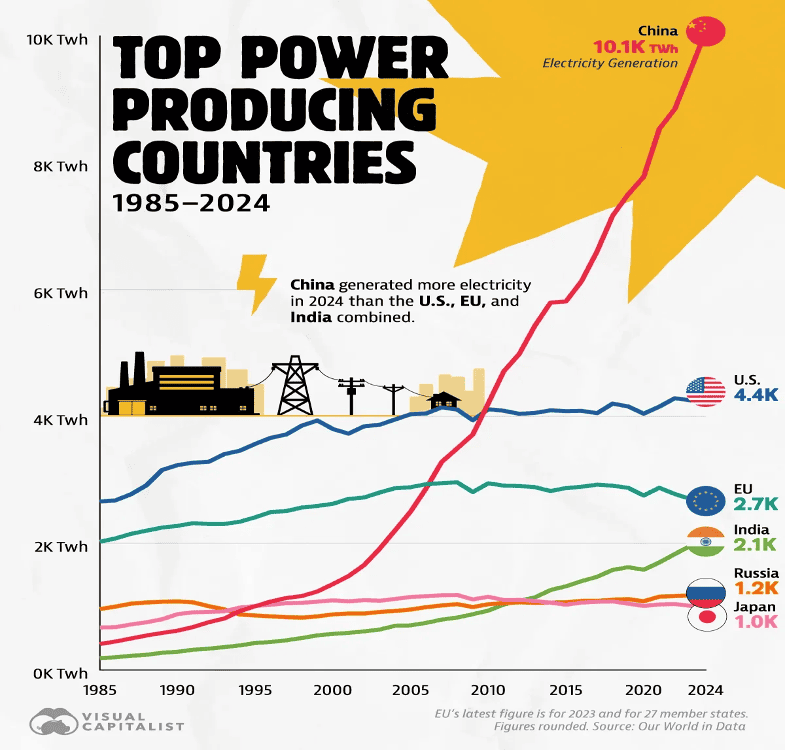

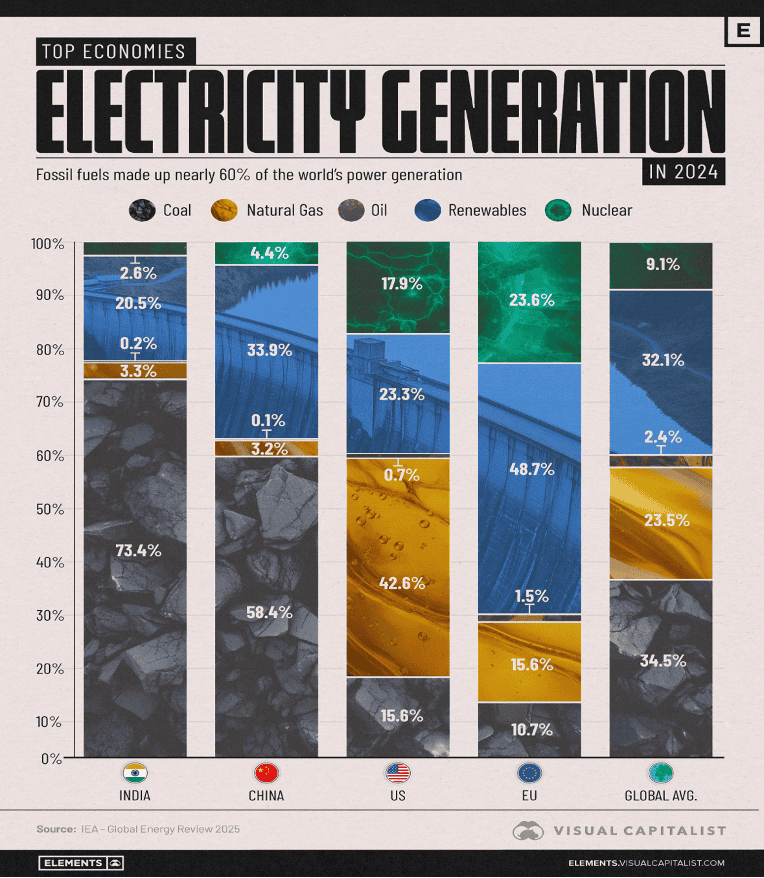

Meanwhile, China generated more electricity in 2024 than the U.S., EU, and India combined, and Starbucks is cutting prices in China as competition grows. Vietnam emerges as a high-growth market, while Canada pushes for faster project approvals and freer trade. Europe quietly doubles its growth pace, attracting investor attention.

This issue also features a deep dive into life expectancy by country, a timely look at The Art of Uncertainty, and what America’s Pizza Economy says about the real one. But despite the tariff challenges, Freddies® is opening its first restaurant in Canada!

One More Thing… In this issue’s book, The Art of Uncertainty: How to Navigate Chance, Ignorance, Risk and Luck, global strategist and philosopher Dennis Shirshikov challenges conventional views on control and prediction in business. This thought-provoking book argues that embracing uncertainty—not avoiding it—is the most powerful way to succeed in today’s complex and volatile global environment.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Uncertainty is the new norm. Leaders must rely on their ‘muscle memory’—past experience and foundational knowledge—to navigate challenges like trade policy shifts, fluctuating markets, AI integration, and evolving workforce dynamics.”, Janet Truncale – Global Chair & CEO, Ernst & Young (EY)

“Never to let one’s self be beaten down by persons or by events.”, Marie Curie

“Commitment is what transforms a promise into reality.”, Abraham Lincoln

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #136:

How Long People Live, by Country

Global Economy Sputters as Trump Inks New Tariff

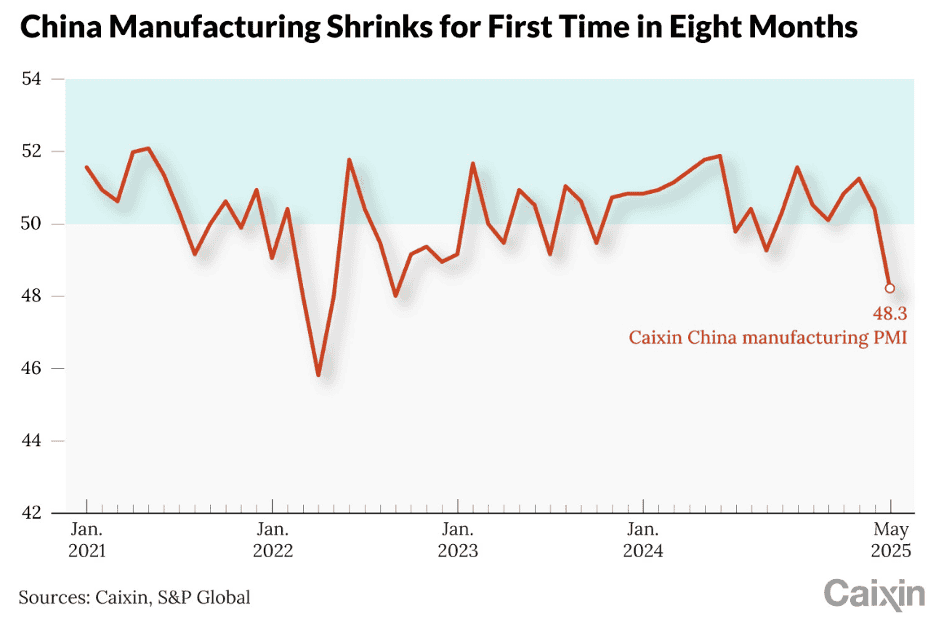

Plunge in Overseas Demand Hits China Manufacturing, Caixin PMI Shows

Jobs at the Port of Los Angeles are down by half, executive director says

Fewer international tourists are visiting the U.S.

What America’s Pizza Economy Is Telling Us About the Real One

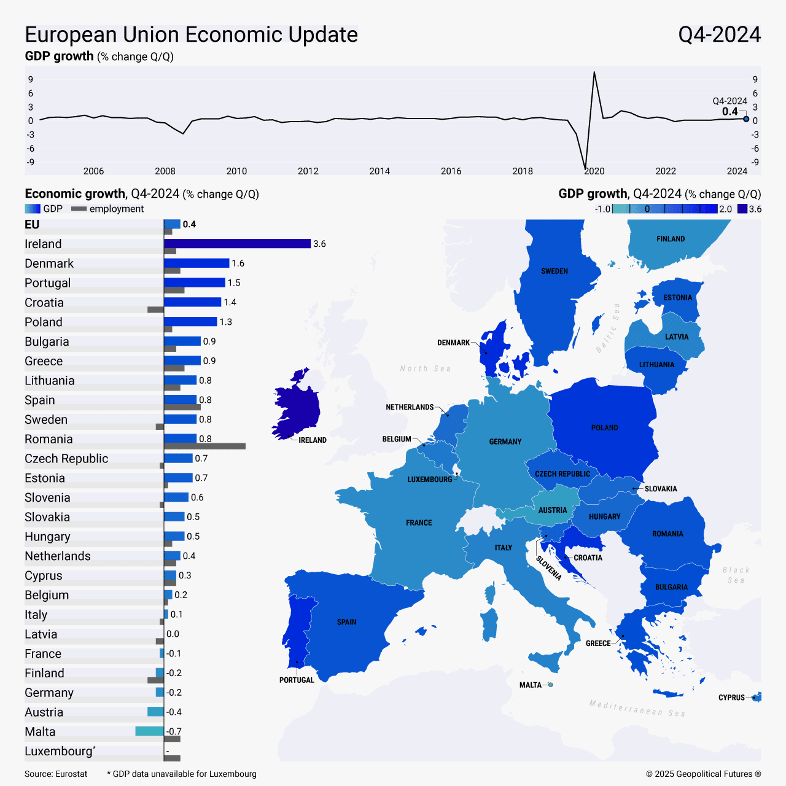

Euro Economies Doubling Growth Grabs Investor Attention –

Brand Global News Section: Dave’s Hot Chicken®, Freddies®, Little Cesars® and Starbucks®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

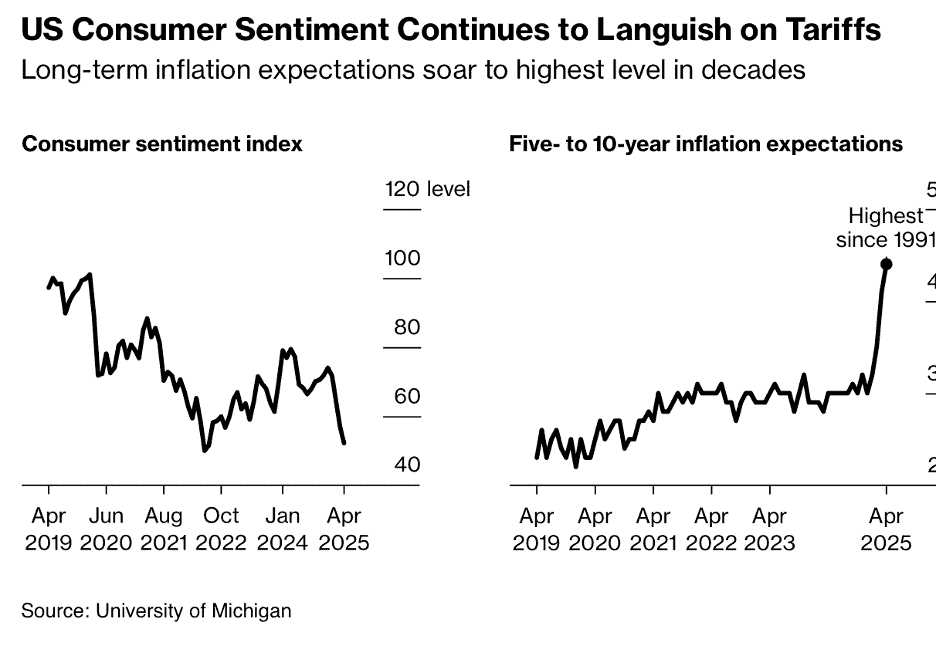

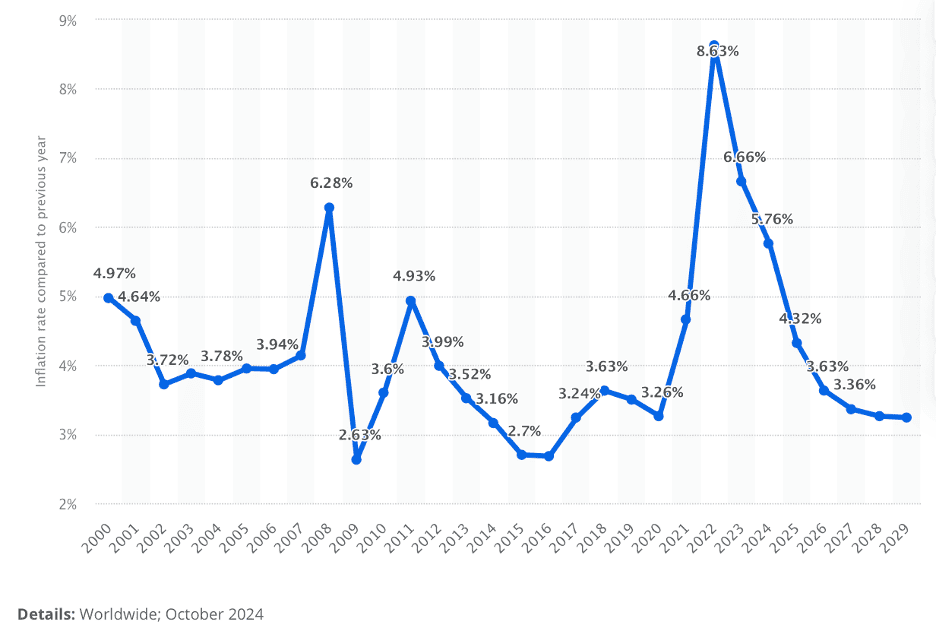

Interesting Data, Articles and Studies

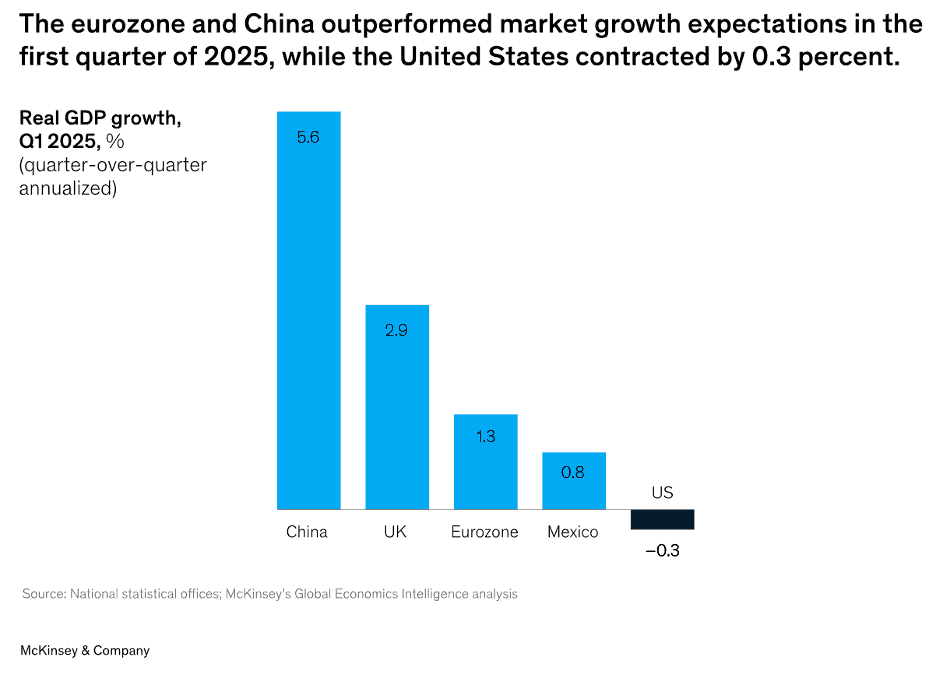

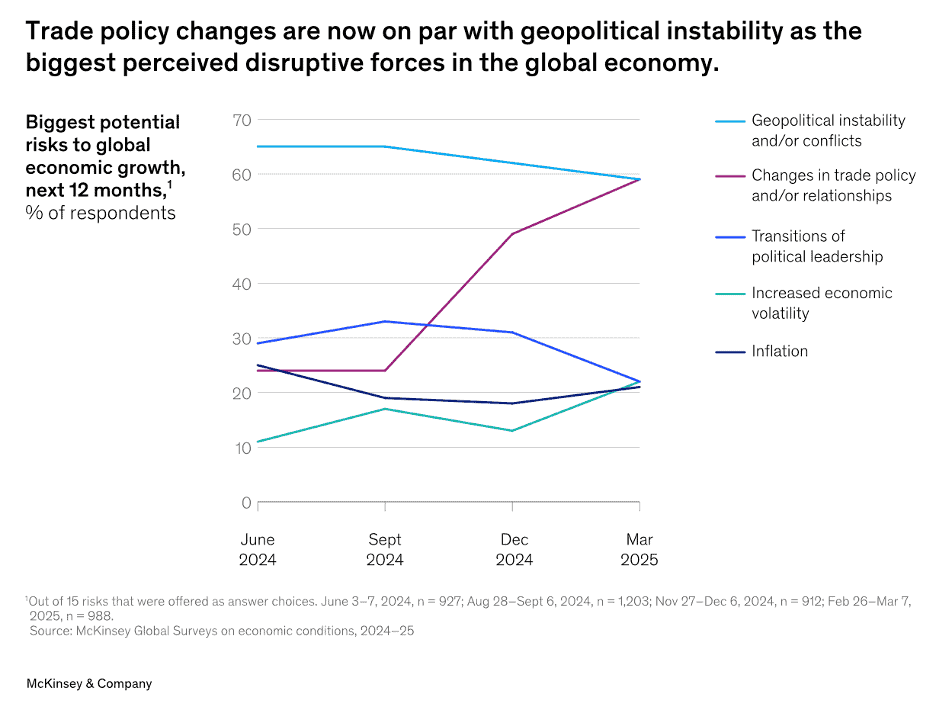

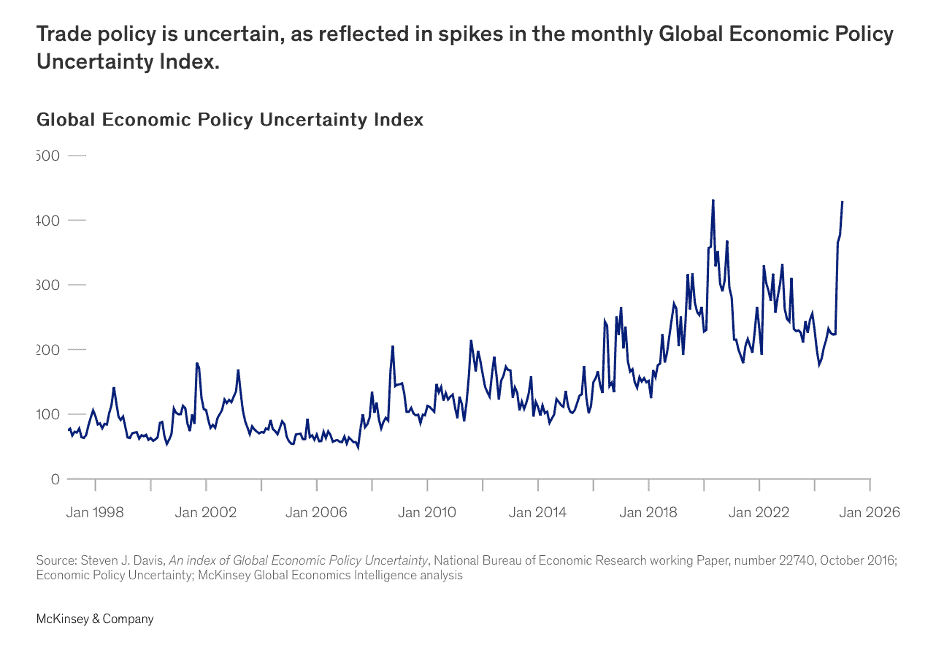

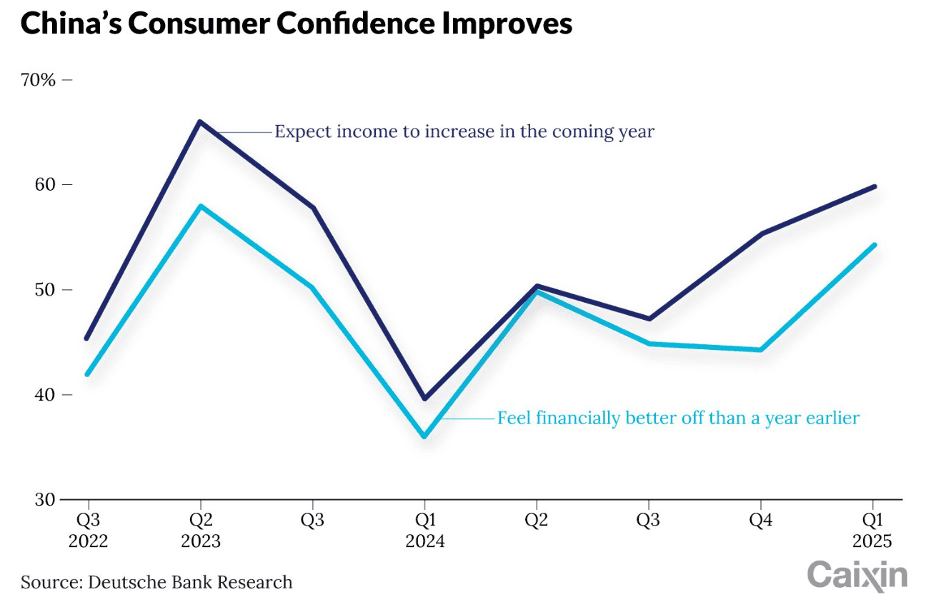

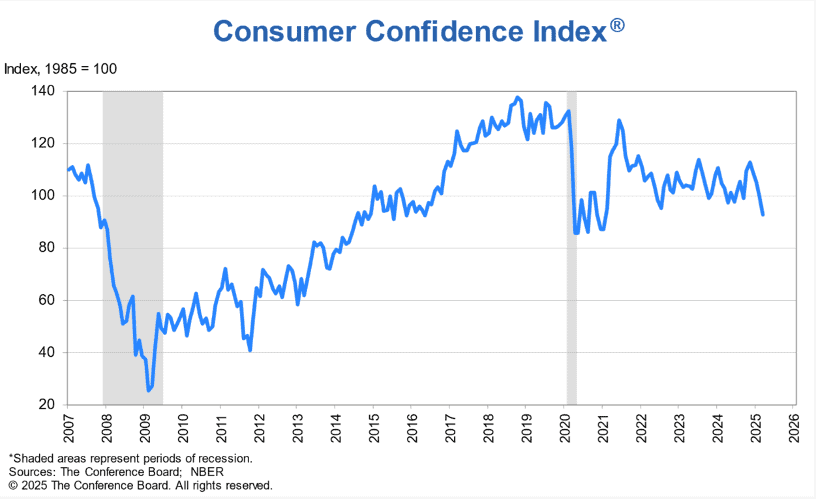

“Global Economics Intelligence executive summary, April 2025 – Markets fluctuate but return to early April levels; first-quarter US GDP data indicates consumer spending and investment growth despite 0.3% contraction, while China and Europe outpace expectations. Persistent high consumer prices and elevated levels of uncertainty continue to affect households, leading to low levels of overall consumer confidence in the US and beyond. Despite the uncertainty, leading indicators were above long-term trends across the main economies during March. Economies are continuing to reduce interest rates, except Russia and Brazil, which have been raising rates to combat high inflation.”, McKinsey & Co., May 29, 2025

==================================================================================================

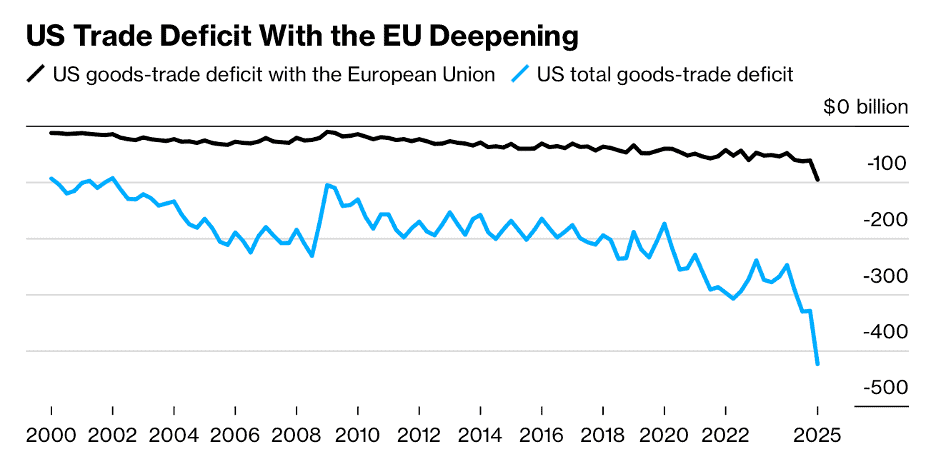

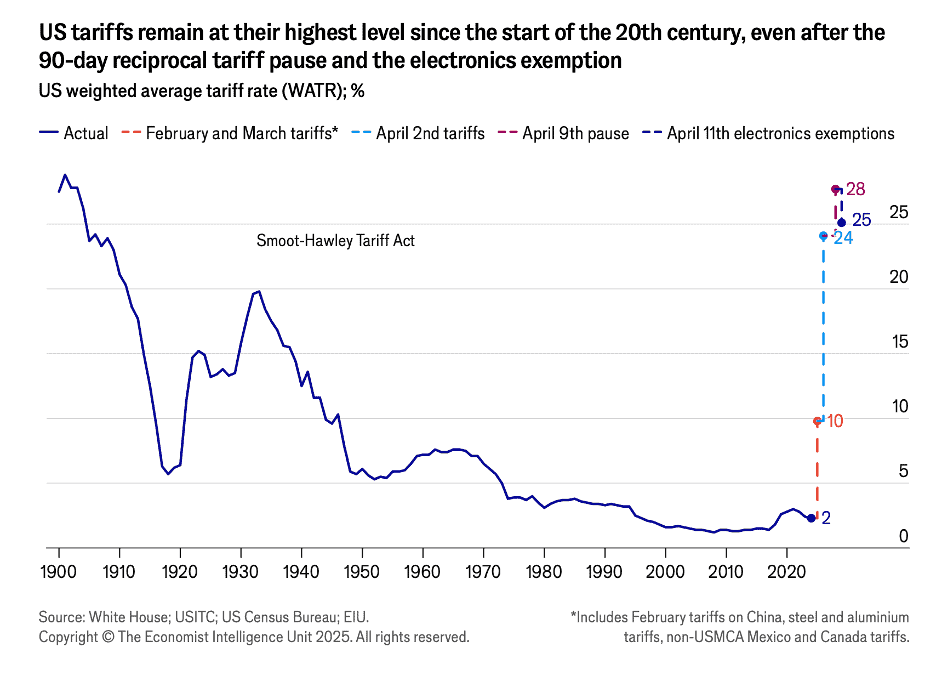

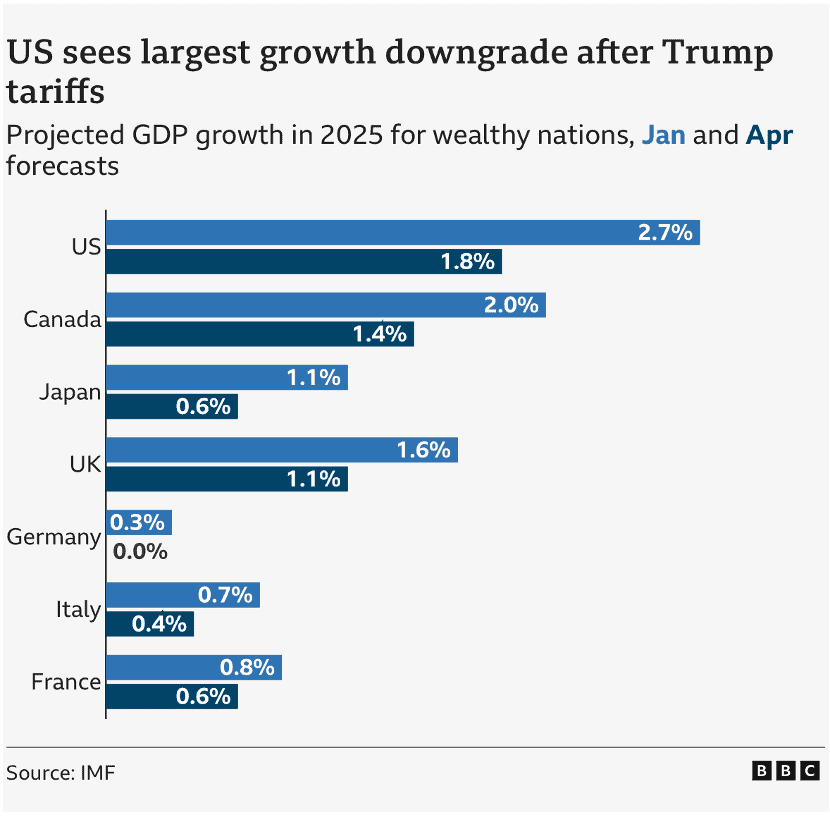

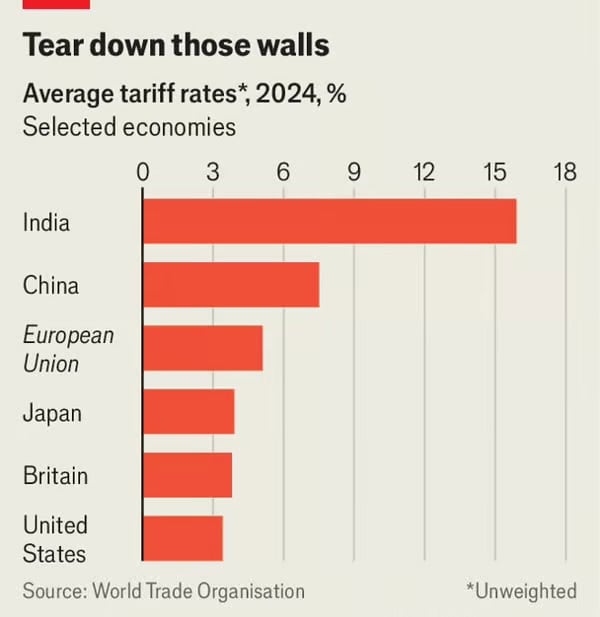

“Global Economy Sputters as Trump Inks New Tariff – Despite promised blowback from Europe, Donald Trump formally raised steel and aluminum tariffs to 50% from 25% on Tuesday. The move by the president raises trade tensions at a time when the US is locked in negotiations with numerous trading partners over his so-called “reciprocal” duties before a July 9 deadline. While those tariffs have been deemed by US courts to likely be illegal, they remain in place as litigation over them proceeds. The steel levies aren’t implicated by the rulings.”, Bloomberg, June 3, 2025

============================================================================================

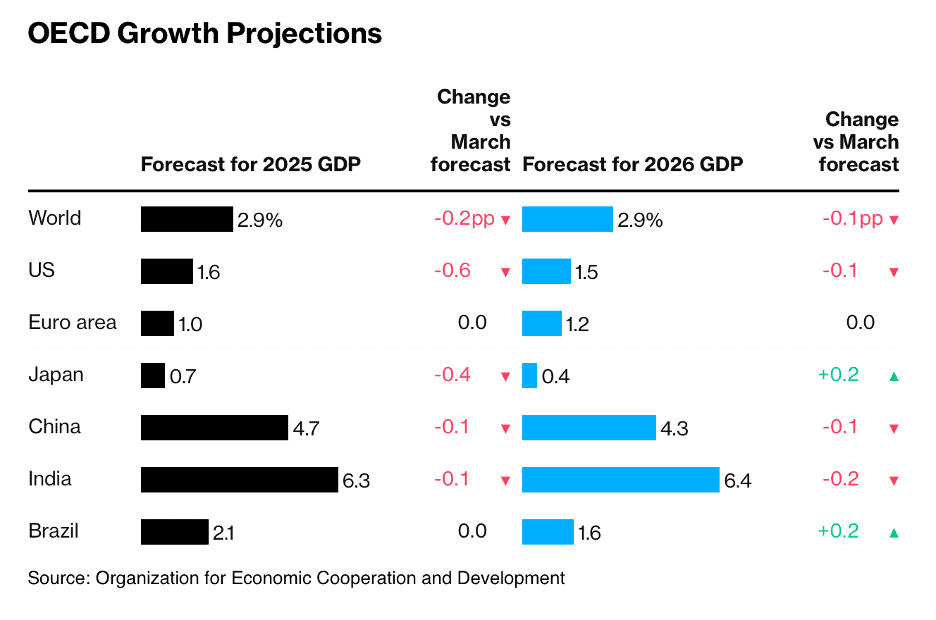

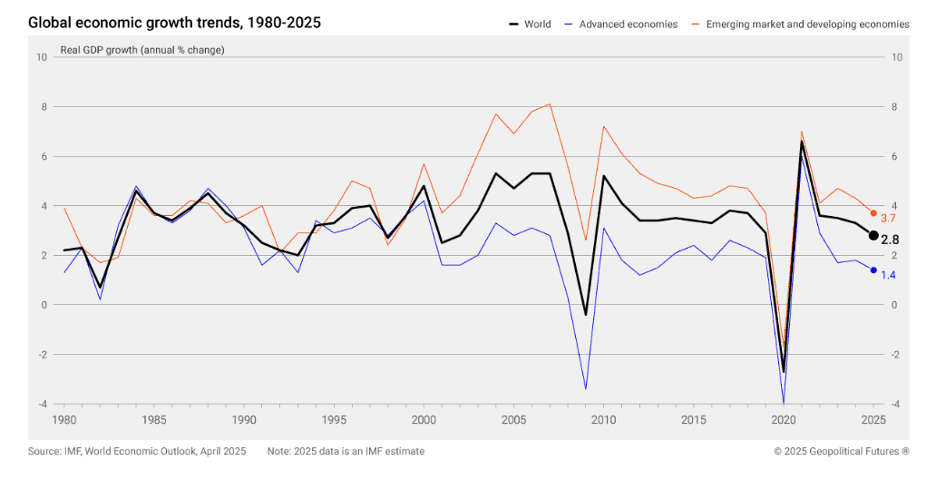

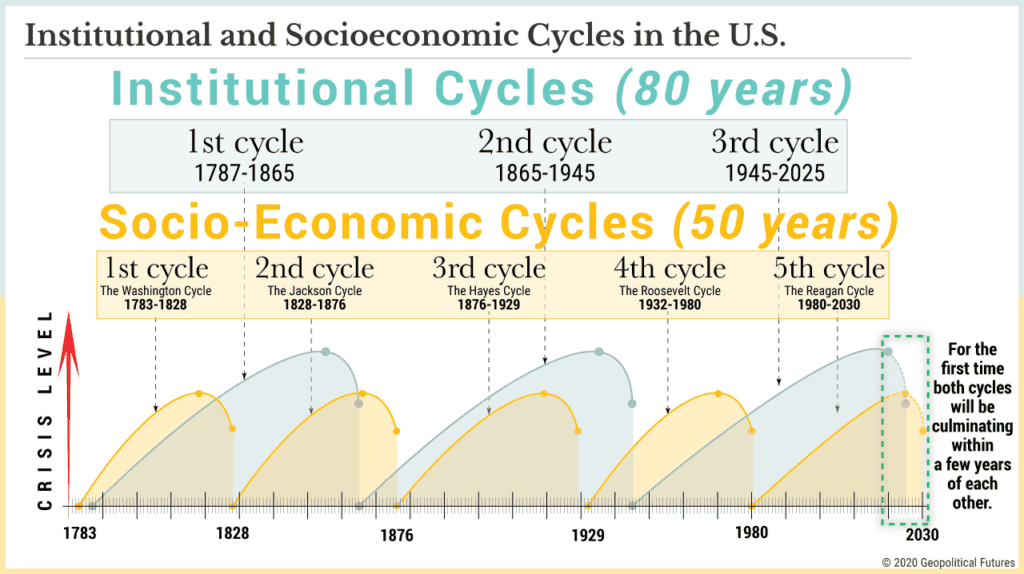

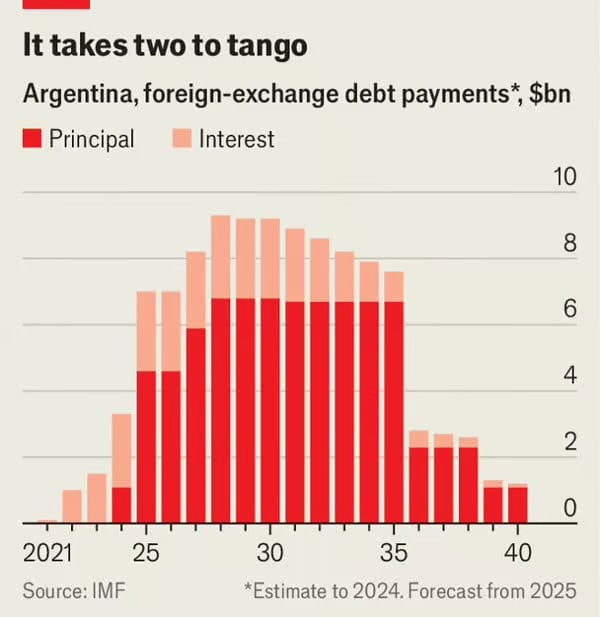

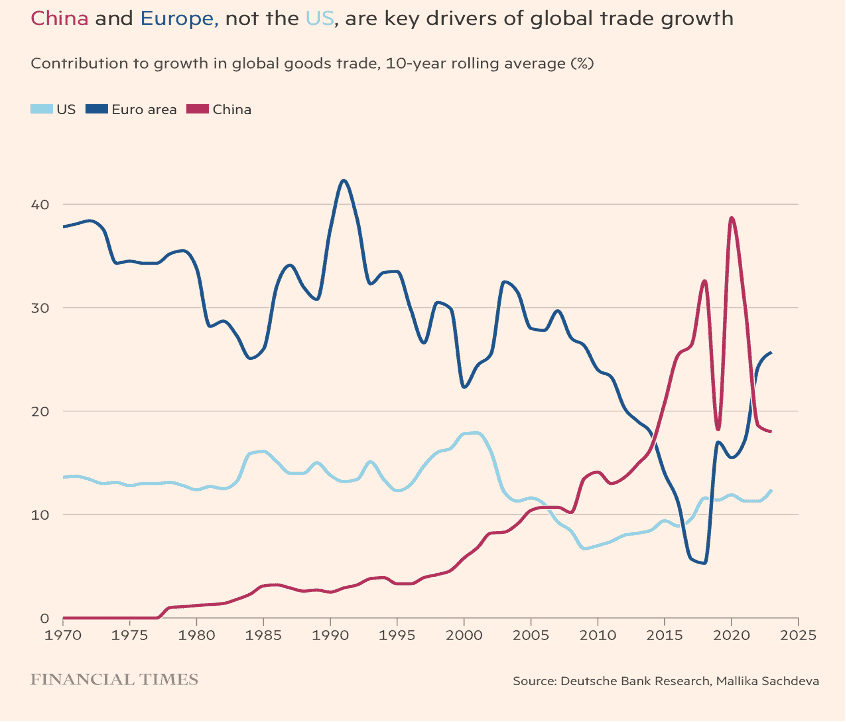

“A New Era for the Global Economy – Established economic and trade rules are being eroded, without a clear replacement emerging. Over the past two decades, the global economy has endured significant shocks – most notably the 2008 financial crisis and the economic fallout from pandemic-related lockdowns. These events severely hindered real GDP growth. Despite these disruptions, the primary indicator of economic activity has remained resilient. Growth rebounded quickly after the pandemic, surpassing 3 percent for many countries. Still, the IMF expresses caution. It does not expect strong economic growth to continue into the coming year, although it does forecast positive growth overall. Ongoing instability – especially in trade relationships and global conflicts – poses serious risks. These factors threaten supply chains and the flow of goods, shifting economic risks to the downside. For example, new tariffs imposed by the United States, along with retaliatory measures by its trading partners, prompted the IMF to lower its global growth forecast in the January 2025 World Economic Outlook update to 2.8 percent for the year.”, Geopolitical Futures, May 28, 2025

============================================================================================

“How Long People Live, by Country – How long you live depends a lot on where you’re born. For example, Western European countries have an 80+ life expectancy at birth. However, several African countries have a below 60 life expectancy, a lifespan that is a full 20 years shorter. Parts of already Africa battle a perfect storm of difficult living conditions: poor nutrition, not enough clean water, and violence. However, the biggest difference between life expectancies of Africans and residents of high-income regions are for those before the age of 5 and after 60.”, Visual Capitalist and UN World Population Prospects 2024, May 22, 2025

================================================================================================

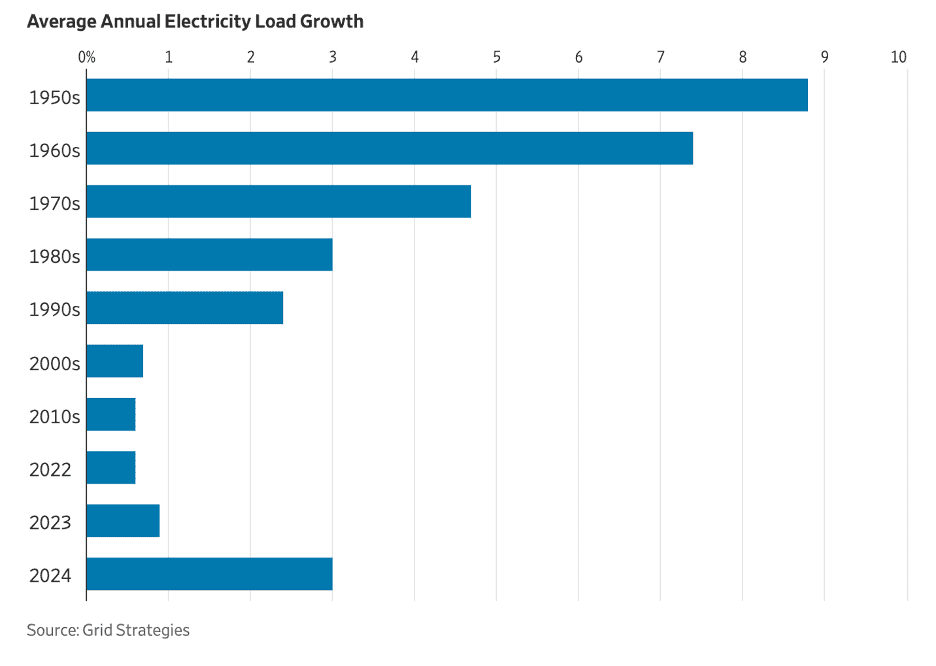

“China Generated More Electricity in 2024 Than the U.S., EU, & India Combined – China generated over 10,000 TWh (terawatt-hour) of electricity in 2024. That’s more than the combined output of the U.S., EU, and India—the next three biggest producers.”, Our World In Data, June 1, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

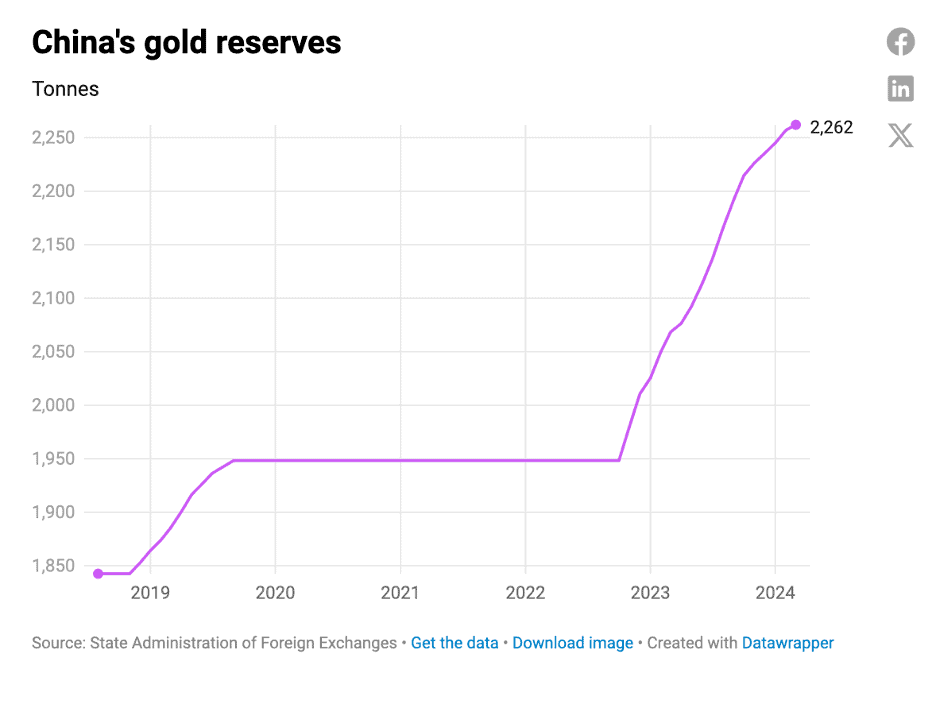

“Why central banks are playing a big role in pushing up gold prices – Governments are buying up gold as they see it as a safe investment – and, in some cases, a tool for evading Western sanctions. Gold prices have surged this year as investors seek safe investments amid a spike in economic uncertainty unleashed by US President Donald Trump’s tariff policies. Countries are increasingly experimenting with creating gold-backed digital assets and trading systems that bypass the dollar-denominated financial system, according to an article by Kimberly Donovan and Maia Nikoladze of the Atlantic Council’s Economic Statecraft Initiative published earlier this month.”, South China Morning Post, May 27, 2025

=============================================================================================

Global & Regional Travel News

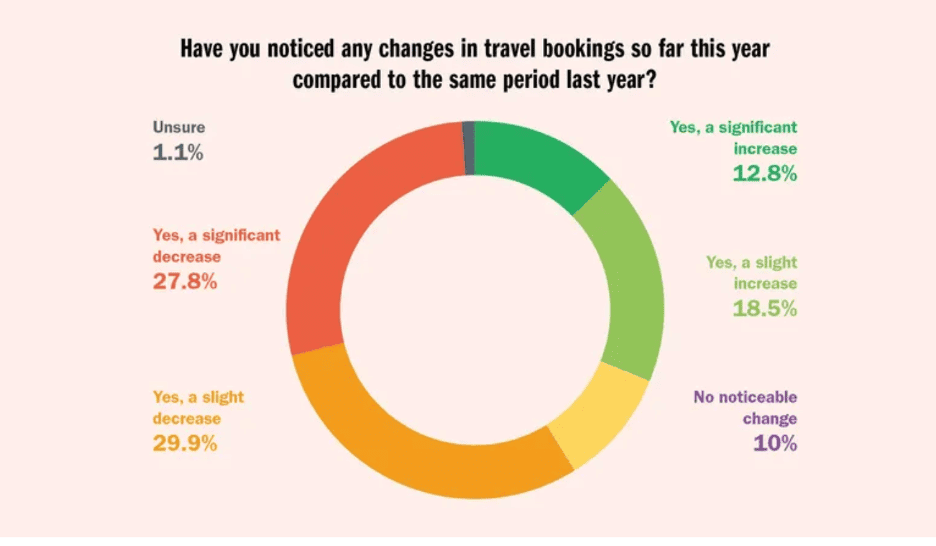

“Travel advisor survey shows bookings decline, but not across the board – A majority of travel advisors say that bookings are down this year compared to last, with the economy, consumer confidence and price sensitivity all playing roles. A Travel Weekly survey fielded last month found that 27.8% of respondents reported a significant decrease in bookings so far in 2025, while 29.9% reported a slight decrease. That adds up to 57.7% who are reporting some kind of decrease. Ten percent reported no change in bookings, 18.5% reported a slight increase, and 12.8% reported a significant increase.”, Travel Weekly, June 2, 2025

==============================================================================================

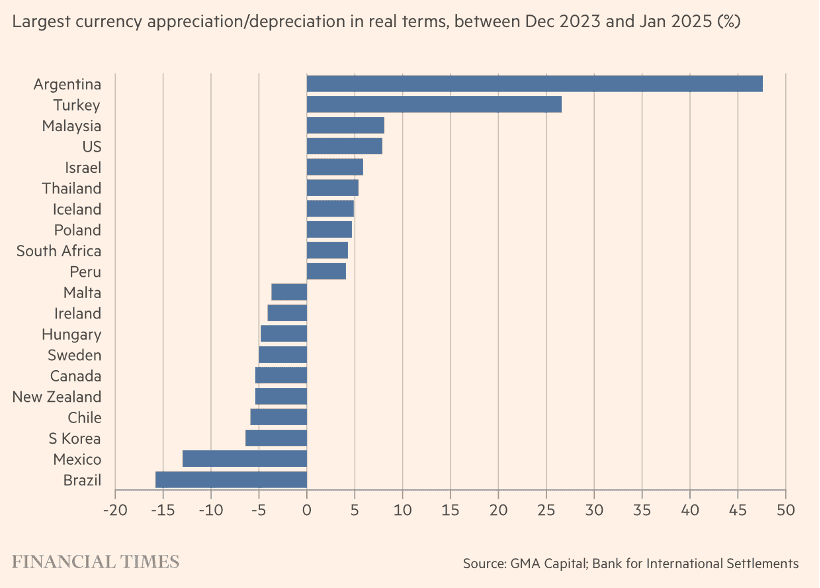

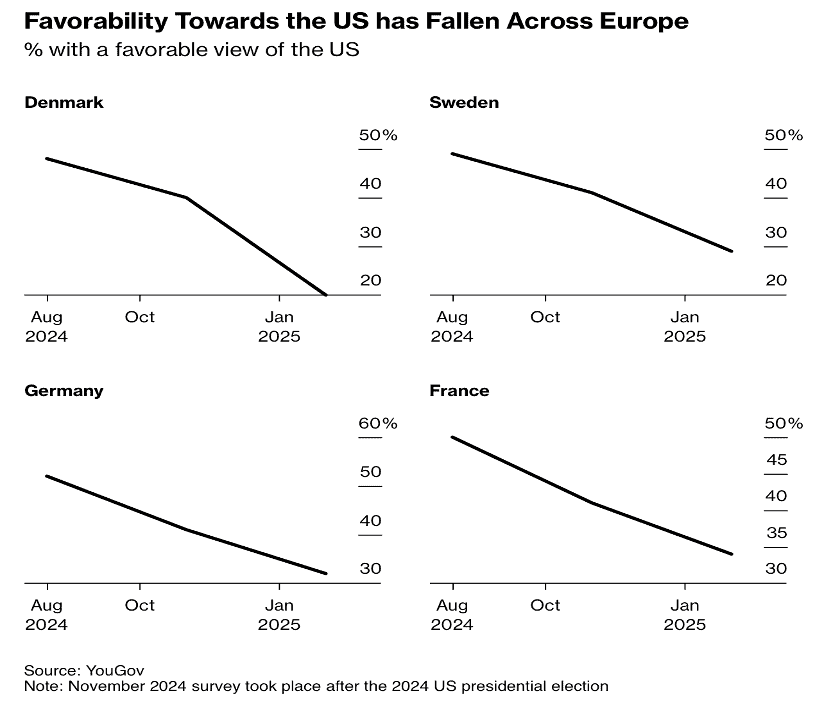

“Fewer international tourists are visiting the U.S. — economic losses could be ‘staggering,’ researchers estimate. Spending among international visitors to the U.S. is poised to fall $8.5 billion this year, according to Oxford Economics. Tourists are avoiding the U.S. as a destination amid tensions tied to Trump administration policy related to trade and the border, experts said. A relatively strong dollar and weak global growth prospects are also playing a role, they said. Spending from foreign visitors to the U.S. is poised to fall by $8.5 billion this year as negative perceptions tied to trade and immigration policy lead overseas tourists to look elsewhere, according to a research note published by Oxford Economics. The spending decline, which works out to a drop of about 5% relative to last year, is a result of less foot traffic. International arrivals to the U.S. are expected to fall about 9% this year, Aran Ryan, director of industry studies at Tourism Economics, part of Oxford Economics, wrote in a research note last week.”, CNBC, May 28, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In The Art of Uncertainty: How to Navigate Chance, Ignorance, Risk and Luck, global strategist and philosopher Dennis Shirshikov challenges conventional views on control and prediction in business. This thought-provoking book argues that embracing uncertainty—not avoiding it—is the most powerful way to succeed in today’s complex and volatile global environment. For professionals in international business, Shirshikov’s insights are particularly resonant.

Through compelling case studies and psychological insights, the book explores how successful decision-makers don’t eliminate risk; instead, they learn to work with randomness, incomplete information, and ambiguity. This mindset is essential in international markets, where variables such as cultural nuance, regulatory shifts, economic volatility, and geopolitical tension can disrupt even the most well-planned strategies.

Shirshikov emphasizes agility, scenario thinking, and the use of probabilistic models to guide choices—not for perfect forecasts, but to build resilience and adaptability. His discussion of “productive ignorance” is especially valuable for global business leaders, reminding us that humility and curiosity often yield better long-term outcomes than false confidence.

Ultimately, The Art of Uncertainty offers a compelling toolkit for thriving amid global ambiguity. For entrepreneurs, executives, and strategists operating across borders, this book is not only timely—it’s indispensable.

5 Key Takeaways for International Businesspeople

1. Embrace Uncertainty as a Strategic Asset: Use uncertainty to identify opportunities and drive innovation in unpredictable markets.

2. Make Decisions with Incomplete Information: Take action using probabilities and patterns, essential for navigating new territories.

3. Leverage “Productive Ignorance”: Recognize gaps in knowledge to ask better questions and build stronger local partnerships.

4. Design Flexible, Resilient Strategies: Use scenario planning and optionality to adapt to shifting global conditions.

5. Differentiate Luck from Skill: Understand the role of timing and luck to remain humble and prepared for change.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

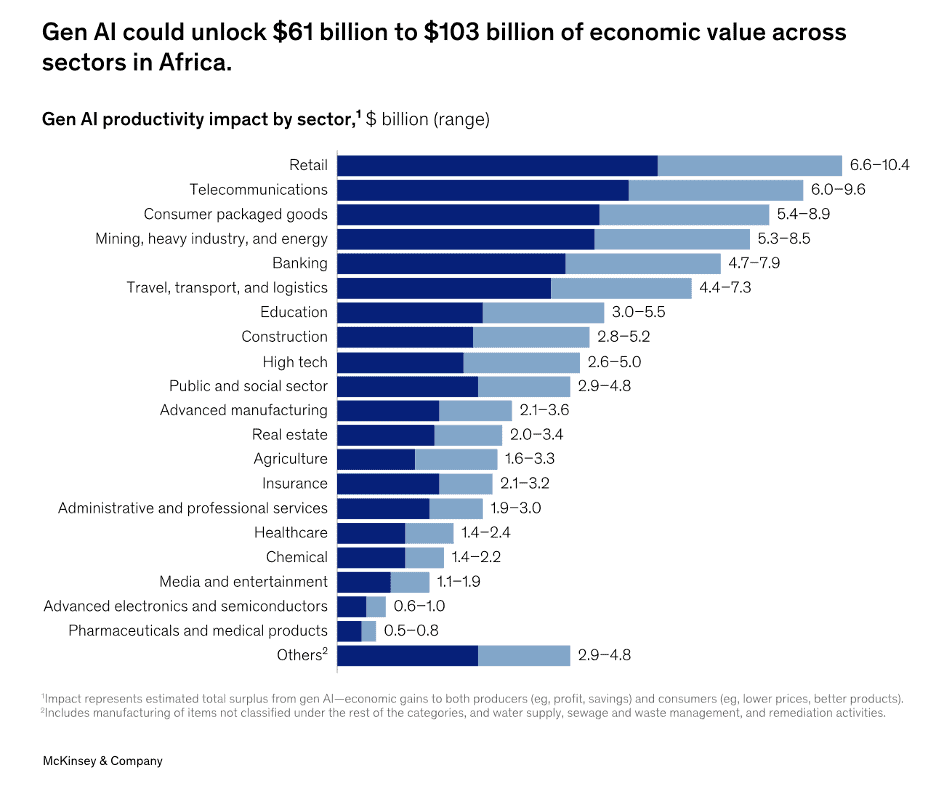

“Africa’s gen AI potential – Africa has embraced gen AI with remarkable speed, and its institutions are quickly catching up with and in some instances leading global developments. However, the continent’s progress so far with both gen AI and AI more broadly is only the tip of the iceberg, say Partner Mayowa Kuyoro and coauthors. Gen AI adoption varies widely by sector, with digitally mature sectors such as technology, telecommunications, and financial services leading the way. The authors estimate that at-scale deployment of gen AI could lead to $61 billion to $103 billion of additional economic value across Africa.”, McKinsey & Co., May 29, 2025

==============================================================================================

Canada

“Geography has made us neighbors. History has made us friends. Economics has made us partners. And necessity has made us allies”., President Kennedy, Ottawa in 1961.

==============================================================================================

“Canada Introduces Bill to Speed Up Project Approval, Dismantle Trade Barriers – Officials say removing internal trade barriers and expediting approval of major infrastructure and resource projects would help maximize Canada’s economic potential. Canada introduced legislation on Friday that aims to accelerate approval of resource and infrastructure projects, and knock down internal trade barriers that analysts estimate cost the domestic economy tens of billions of dollars in growth. As for internal trade barriers, this marks the federal government’s boldest effort yet to get the country’s 10 provinces and three territories to mutually recognize their rules and regulations. For instance, provinces have different rules regarding how long truckers can work, and minimum energy efficiency requirements in appliances like washing machines. Wine made in one province can’t be directly sold to customers in another. Further, labor mobility is hampered as provinces have differing rules on who is qualified to work in the trades.”, The Wall Street Journal, June 6, 2025

===============================================================================================

China

“Plunge in Overseas Demand Hits China Manufacturing, Caixin PMI Shows – China’s manufacturing shrank in May at the fastest pace since September 2022, with overseas demand falling at a quicker pace, a Caixin-sponsored survey showed Tuesday. The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, came in at 48.3, down from 50.4 in April. A reading above 50 indicates an expansion in activity, while a number below that signals a contraction. The Caixin PMI is one of the earliest available monthly indicators of activity in the world’s second-largest economy. Manufacturing accounted for around 26% of China’s GDP in the first quarter, according to government data.”, Caixin Global, June 3, 2025

=============================================================================================

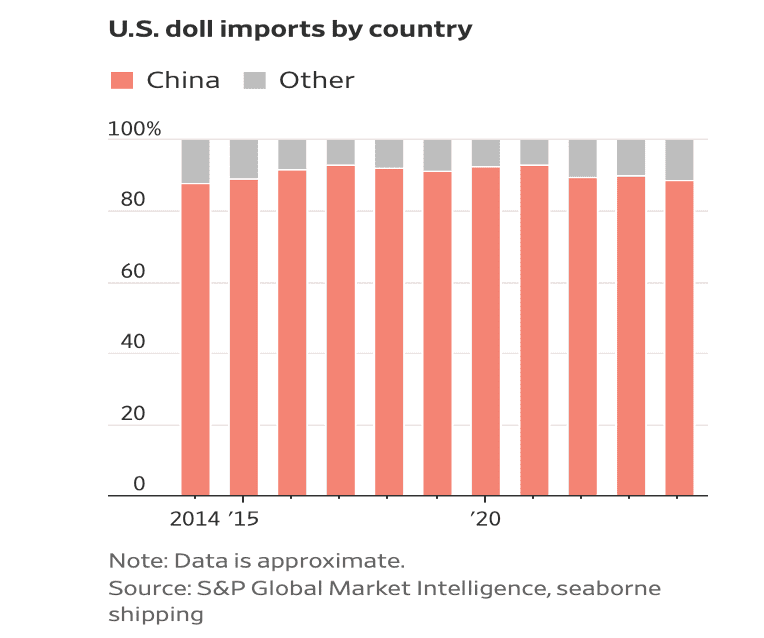

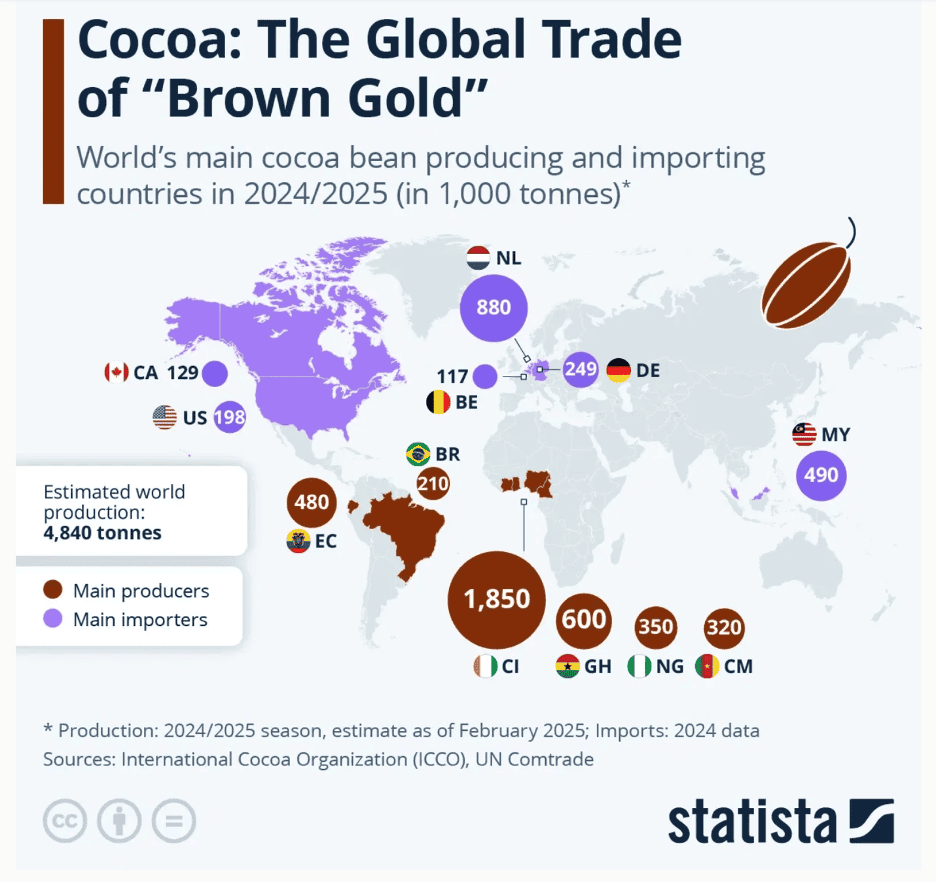

“China Tariffs Already Mean Fewer, More Expensive Dolls for American Kids – Toy makers are raising prices and are cautious about producing more amid uncertainty over tariff levels. Trump’s tariffs on China are hurting U.S. toy makers, who face higher costs and reduced assortment. A federal trade court ruling on tariffs was put on hold, adding to uncertainty for businesses. Smaller toy makers struggle to fulfill orders as Chinese factories prioritize larger customers. Trump’s China tariffs have been hurting low-margin industries such as toy makers, where companies say there are few alternatives to raising prices. As a result, these businesses expect American shoppers to face a smaller assortment of goods this Christmas—and at a higher cost.”, Wall Street Journal, June 7, 2025

=============================================================================================

“No polled US firms in China shifting production back to US, AmCham survey finds – ‘Instead, they are localising operations or shifting some production to third countries,’ the American Chamber of Commerce says after poll of 112 member companies in China. “Tariffs are an added challenge for our member companies at a time when operating in China is already becoming more complex,” said Alvin Liu, AmCham China chair. Despite the challenges, however, most companies are not planning to exit China, the survey found. None report shifting production back to the US.”, South China Morning Post, June 6, 2025. Compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

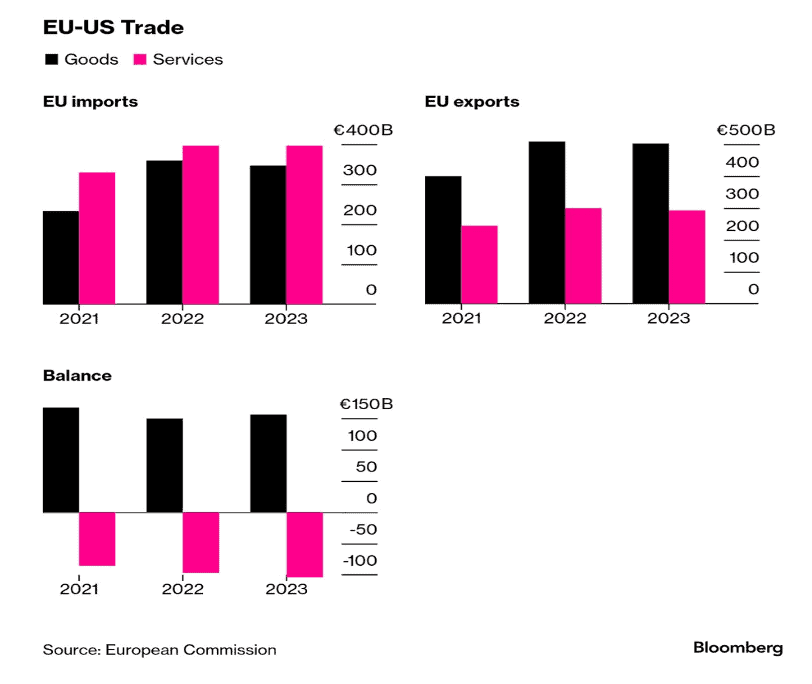

European Union & The Euro Zone

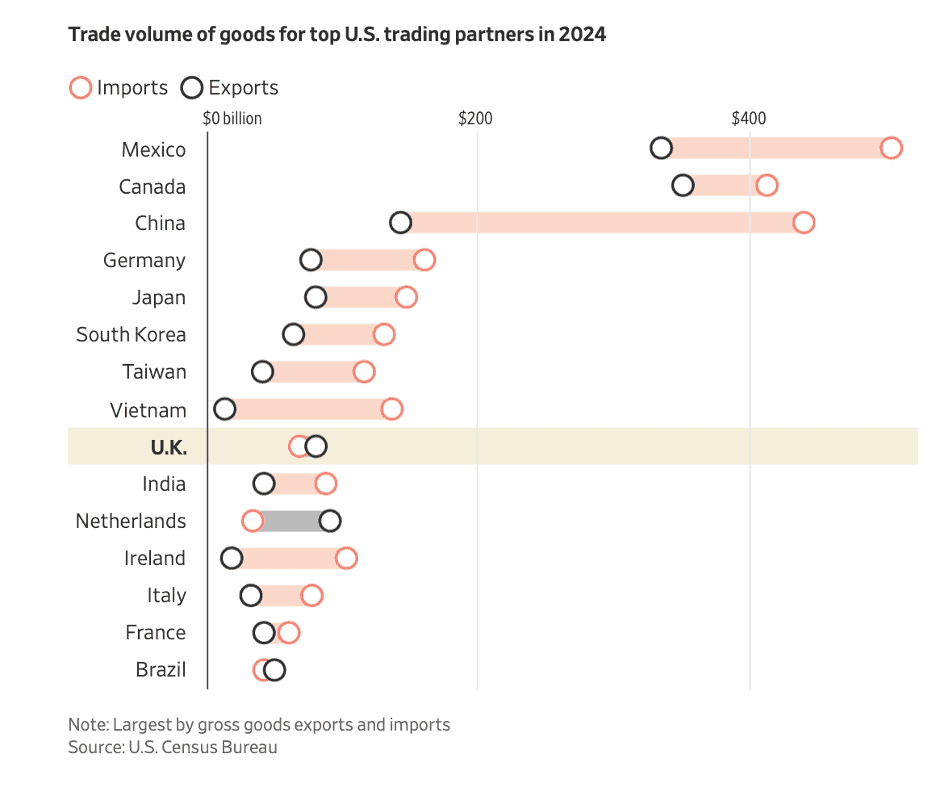

“Trump’s Trade Fight Now a War on Three Fronts – The European Union is preparing for another round of trade talks with the US, but it’s also warning that it may speed up retaliatory measures if President Donald Trump follows through on his latest threat: a 50% levy on steel and aluminum imports. The European Commission, which handles trade matters for the EU, said Monday it “strongly” regrets the tariff hike—up from an originally planned 25%—and said the move is undermining efforts to reach a solution to the trade conflict.”, Bloomberg, June 2, 2025

================================================================================================

“Euro Economies Doubling Growth Grabs Investor Attention – Eurozone economies led by Ireland and Germany expanded twice as much as previously reported to begin the year, with exports surging in anticipation of US tariffs. Eurostat’s upward revision to 0.6% growth caught most economists by surprise and capture a currency union that’s so far proving resilient. For all the Sturm und Drang hurled by the Trump administration, Europe’s macro-economic picture still shows light on the horizon. Private equity investors have a new-found love for Germany and are prowling for deals. Defense technology stocks are booming as investors pour into meeting EU security requirements. The reassessment of European fortunes takes place as jitters spread among investors eyeing what’s taking place on the other side of the Atlantic. The US has ceased to be a secure destination because of risks stemming from Trump’s tax and spending bills, according to the chief economist at French asset manager Carmignac.”, Bloomberg, June 6, 2025

============================================================================================

Middle East

“Etiquette Is Not Fluff: It is Strategy in the Gulf Market – When Western companies think about business expansion into the Gulf, their minds often jump straight to legal structures, market size, product fit, and perhaps even localisation. And yes, they are important. But one area often dangerously overlooked is this: Etiquette! Not as a nice-to-have. Not as an afterthought. Not to be googled as quick fix. But as a strategic imperative.

In the Gulf region — comprising countries like Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain, and Oman — Etiquette is not just about saying the right thing or offering the correct greeting. It’s about showing respect, building trust, and signalling that you understand the invisible rules of the game. If you don’t understand these rules, you are not just being seen as impolite. You are being seen as untrustworthy, incompetent, or simply not ready for serious business.”, Star Kat – Middle East Sunday Pages, May 25, 2025. Compliments of Corina Goetz

============================================================================================

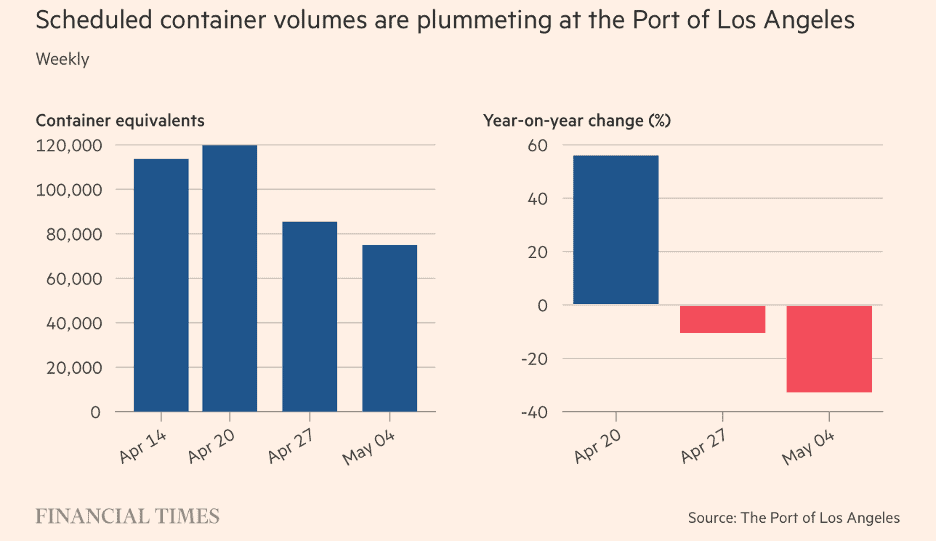

United States

“Jobs at the Port of Los Angeles are down by half, executive director says – Job opportunities at the Port of Los Angeles are dwindling as President Trump’s steep tariffs take a hit on global trade and a major economic engine for the regional economy. Nearly half of the longshoremen who support operations at the port went without work over the last two weeks, Gene Seroka, executive director of the Port of Los Angeles, said in an interview. The port processed 25% less cargo than forecast for the month of May, he said.”, The Los Angeles Times, June 7, 2025

==================================================================

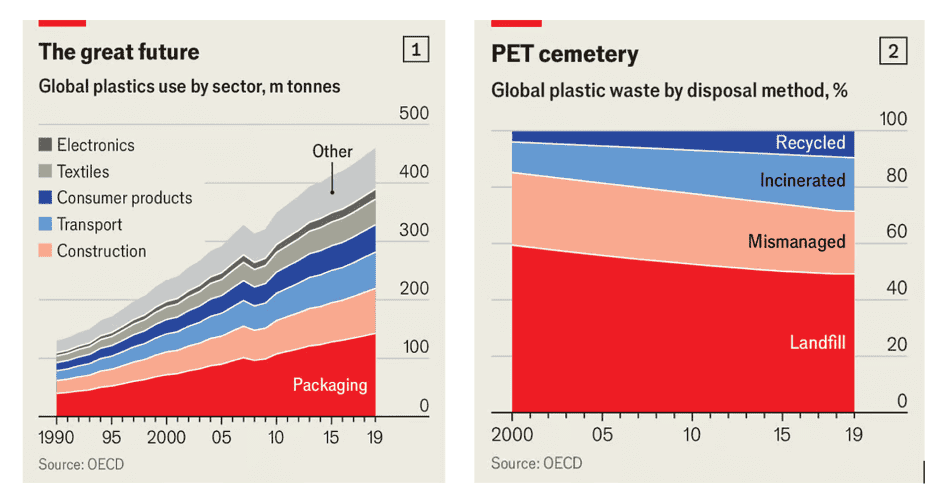

“How big trade deficit drop as tariffs hit imports is playing out inside U.S. supply chain and economy – The U.S. trade deficit has plunged as imports surged and then plummeted as a result of President Trump’s trade war and tariffs. The impact of rapid global economic shifts can be seen in the supply chain activity across the U.S., from warehouses to freight orders and inventory. The data points to greater pain for small businesses. The U.S. trade deficit fell by the largest amount on record in April as imports fell by over 16% after a surge in orders to beat President Trump’s tariffs, but there’s a worrying flip side for the consumer. As the trade war whipsaws global economic activity, supply chain data shows that the retail inventory crunch could be next and small business across the country are bearing the brunt of the pain. From freight orders to inventory and warehousing, the latest logistics data shows the inability of many importers to make business decisions related to inventory levels.”, CNBC, June 5, 2025

============================================================================================

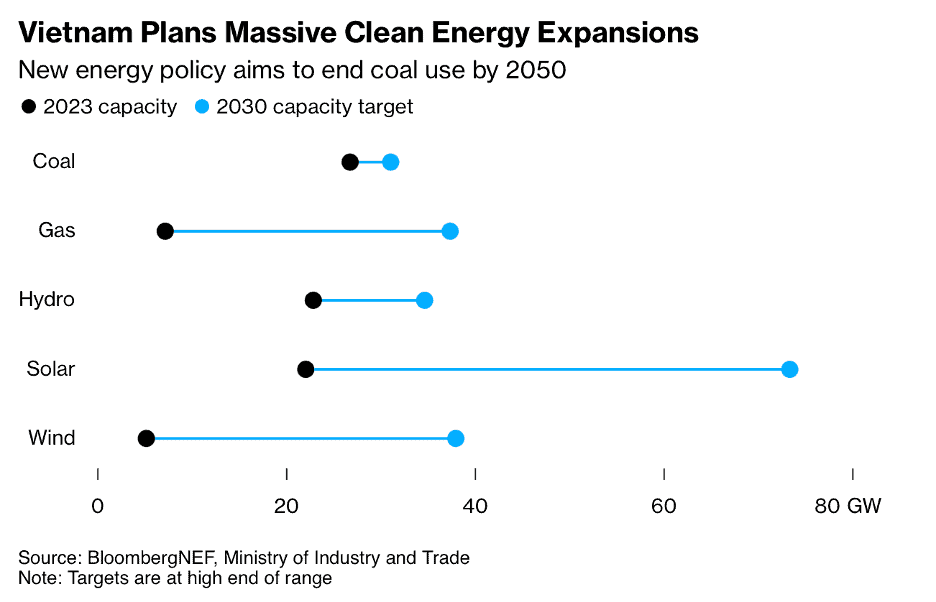

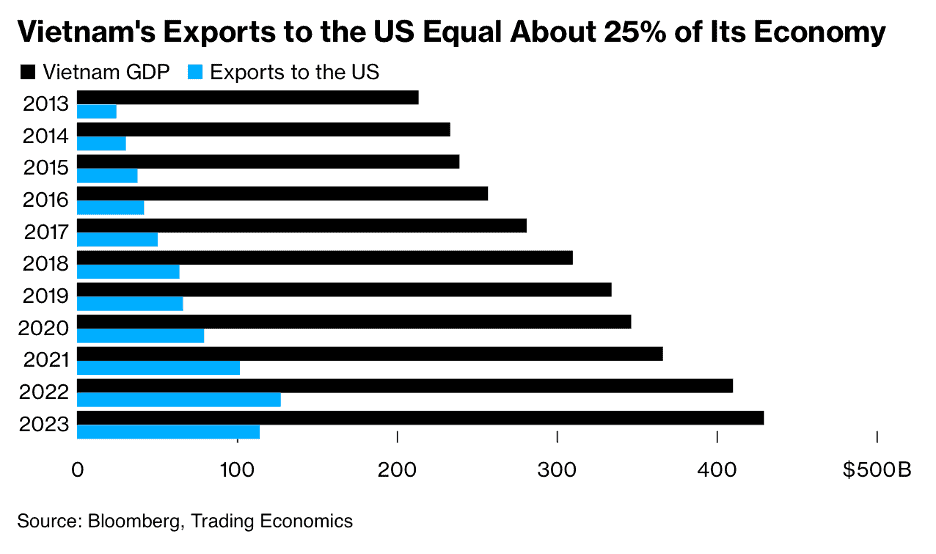

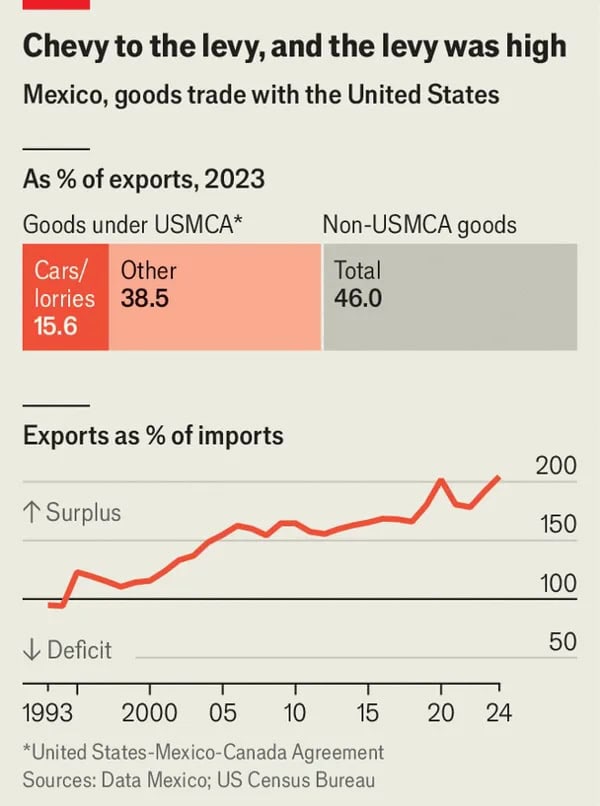

Vietnam

“Vietnam: a high-growth market going cheap – It has been 50 years since Vietnam was reunited after a 25-year war that devastated the country………..in the late 1980s, the government performed a sharp U-turn and turned Vietnam into a very capitalist country under autocratic rule. Since then, GDP per capita has risen from $270 a year to $4,300 in an economy that has grown from $6.3 billion to $430 billion, notes Tod Davis of brokers Deutsche Numis. Wider signs of social progress are equally impressive: the population has increased from 44 million to 100 million, male life expectancy at birth has risen from 61 to 75, literacy has risen from 57% to 96%, and the poverty rate has fallen from 78% to around 3%. With the economy growing at 6% per annum, ‘Vietnam is likely to become a high income nation similar to Taiwan and South Korea, with a GDP per capita of $12,500 within 20 years’, says Brook Taylor, chief executive of VinaCapital. The threat of tariffs is the current worry (America’s trade deficit with Vietnam is its third-largest), but this may be exaggerated. VinaCapital expects the US to settle for a 20% tariff in the end, probably with a high-tech exemption. This would reduce GDP growth from 7% to about 6% for 2025.”, Money Week, June 6, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

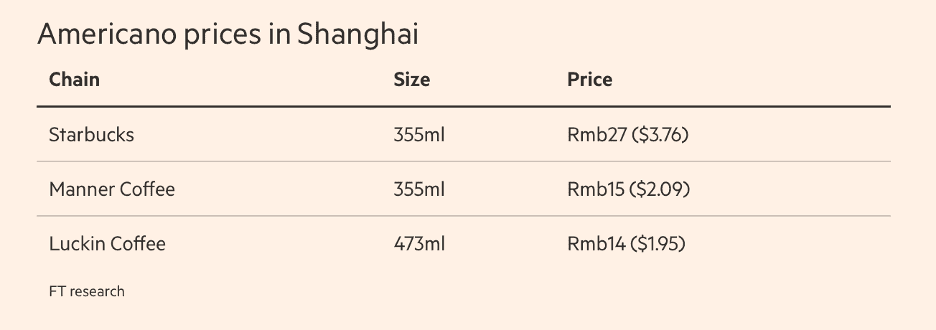

“Starbucks to cut prices in China – Consumer businesses under pressure from weaker economic backdrop and intense competition. Starbucks will cut the prices of several iced and tea-based drinks in China, as the coffee chain grapples with heated competition in its second-biggest market. The Seattle-based company said in a social media post on Monday it would reduce the prices of products, including tea lattes and frappucinos, by an average of Rmb5, taking the price of certain drinks to Rmb23 ($3.20). Businesses in Chinese consumer sectors from cars to food and beverage have been under pressure to lower prices amid a weaker economic backdrop and intense competition.”, The Financial Times, June 9, 2025

Editor’s Note: The Shanghai price is the same as it is in Southern California!!

===============================================================================================

Roark Capital Investment Adds Sizzle to Dave’s Hot Chicken’s Explosive Growth Plans –With the private equity firm now a majority owner, the fast casual plans to become a worldwide sensation, with 155-165 stores opening this year. Dave’s Hot Chicken president Jim Bitticks remembers visiting restaurants five years ago and asking cofounder Dave Kopushyan what he thinks the brand will be someday. His answer? ‘We won’t sell until it’s a billion.’ Dave’s, founded in 2017 by childhood friends Kopushyan, Arman Oganesyan, and Tommy Rubenyan, started with $900 and a parking lot pop-up in East Hollywood. The brand became an instant sensation, and a couple of years later, it brought on Phelps—the former CEO of Wetzel’s Pretzels and Blaze Pizza—to begin franchising.

Since then, Dave’s has grown swiftly. After opening roughly 80 stores each in 2023 and 2024, the plan is to open 155 to 165 locations this year and around the same in 2026. The fast casual is working through a pipeline of over 1,000 franchise locations across the U.S., the Middle East, and Canada.”, QSR Magazine, June 2, 2025

================================================================================================

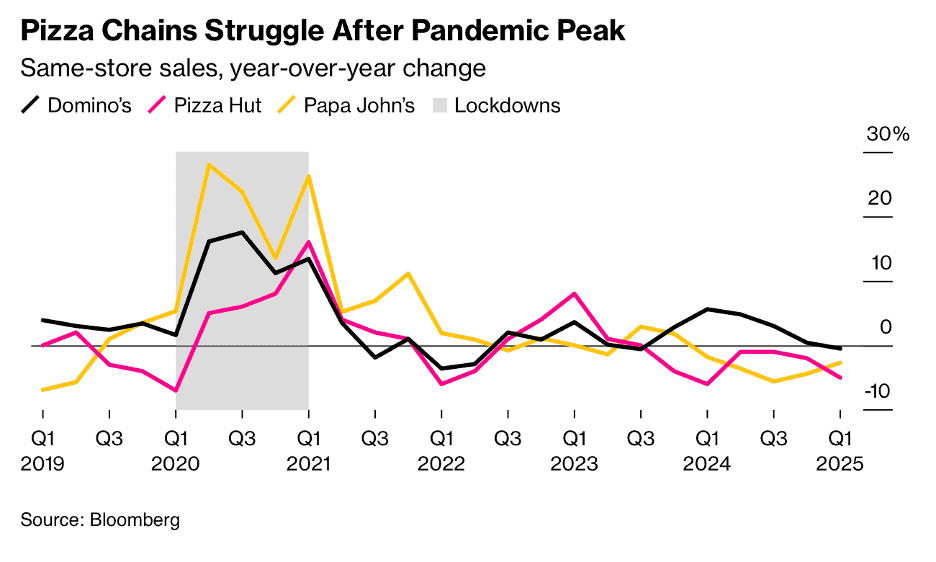

“What America’s Pizza Economy Is Telling Us About the Real One – Higher-end pies are still selling, but for lower-income consumers even frozen pizza is becoming a luxury. For the longest time, pizza has been the go-to dinner order for anyone looking to feed a family fast and on the cheap. What’s often touted as America’s favorite food took on another attribute during the pandemic: safe. Domino’s Pizza Inc., the largest of the delivery chains, and its smaller rival Papa John’s International Inc. each registered double-digit year-over-year same-store sales increases in the US and North America, respectively, in 2020, helped by Covid-19 lockdowns. Four years on, though, it looks as if low-income consumers are being priced out of pizza. Those same-store sales were down at all three pizza chains in the first quarter of 2025, declining 5% at Pizza Hut, 2.7% at Papa John’s and 0.5% at Domino’s. Domino’s did have one metric to celebrate, at least: Takeout ticked up 1%, because, as Chief Financial Officer Sandeep Reddy explained in an earnings call, it costs less than delivery.”, Bloomberg, June 6, 2025

==============================================================================================

“Little Caesars makes India debut with NCR outlet plan – Harnessing Harvest to lead franchise push. Little Caesars, the world’s third-largest pizza chain by global presence, is set to enter India this month by opening its first outlet in the Delhi-NCR region, the company said on Friday. This will be the brand’s 30th global market. The Detroit-based brand, known for its ‘hot-n-ready’ pizzas and Crazy Bread, has partnered with Harnessing Harvest as its India franchisee. ‘Launching in India marks an exciting milestone for Little Caesars as we expand into our 30th country,’ said Paula Vissing, President, Global Retail at Little Caesars Pizza, in a statement. The company’s foray into India is part of a wider global expansion that recently included markets like Cambodia and Kuwait, PTI reported.”, The Times Of India, June 7, 2025

=============================================================================================

“Freddy’s to open first Canadian restaurant – The Winnipeg unit is the first outside the U.S. for the growing burger chain, which is building out a significant store pipeline. The fast-growing burger brand is developing its Canadian footprint through a master franchise agreement with North 49 Frozen Custard and Steakburgers, and the first unit has been in the works for some time. Freddy’s has grown rapidly since its 2021 acquisition by Thompson Street Capital, according to its franchise disclosure document. In 2022, the brand said it was targeting a total unit count of about 1,000.”, Restaurant Dive, June 2, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 135, Tuesday, May 27, 2025

“Making predictions is hard to do, especially about the future.”,

Commentary about the 135th Issue: The global business landscape is more unpredictable than ever—tariffs come and go, regional conflicts disrupt supply chains, populist regimes change the rules overnight, and doing business in China gets trickier by the day. It’s tough to know what’s coming next. But here’s the thing—we don’t have to be perfect forecasters. What matters more is how quickly we can adapt. Flexibility, diversification, and staying informed give us a fighting chance in a world full of surprises. The goal isn’t to guess right every time, but to be ready to pivot when the ground shifts. Yogi had a funny way of saying it, but he was right—these days, smart business means being ready for anything.

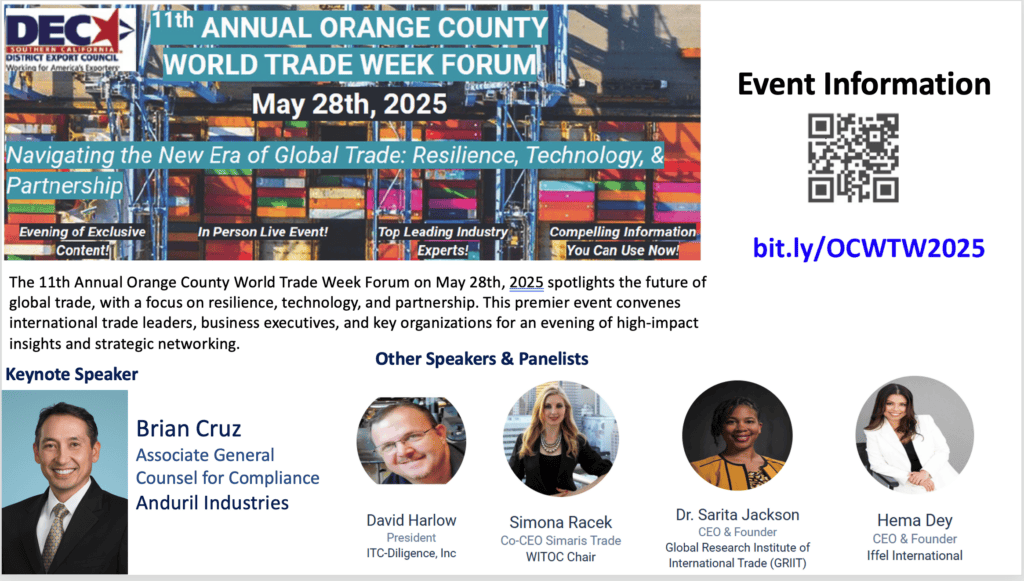

One More Thing… Join us on May 28th at the Beall Center for Innovation and Entrepreneurship on the campus of the University of California, Irvine for an evening filled with very timely world-class keynote speakers, engaging panel discussions, and unparalleled business-to-business networking opportunities related to global trade, trade policy and even tariffs at the 11th Annual Orange County World Trade Week Forum Event.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.”, Sun Tzu

“No nation was ever ruined by trade.”, Benjamin Franklin

“Trade creates bridges where politics builds walls.”, Anonymous

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #135:

Visualizing the World’s Shadow Economies

The World’s Largest Economies, Including U.S. States

What AI Means for the Future of Accounting Jobs

What It’s Like to Travel in China Right Now—And How to Do It

Will consumers pay more for EVs?

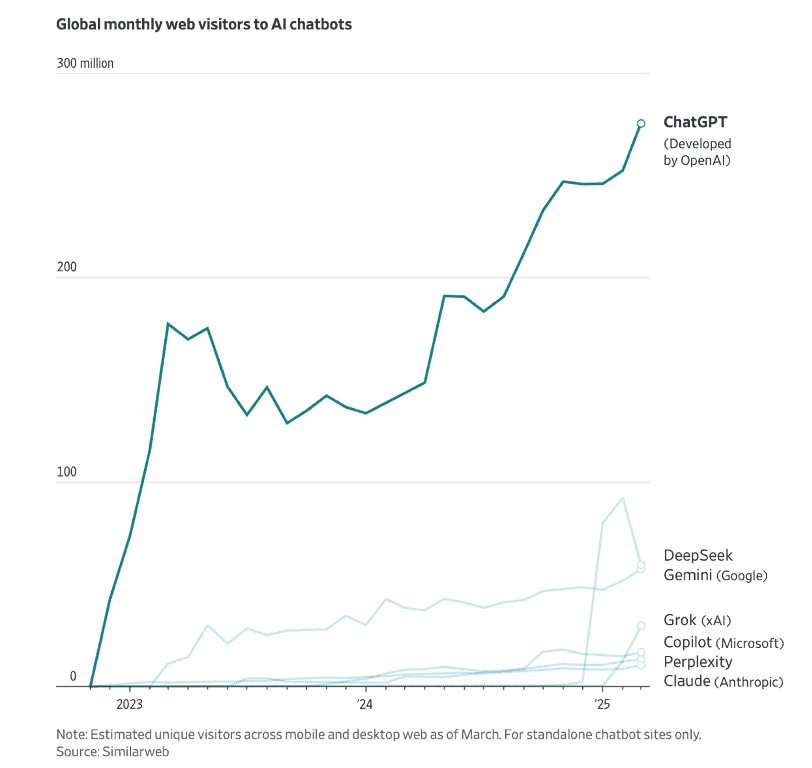

Supremacy: AI, ChatGPT, and the Race That Will Change the World.

Brand Global News Section: McDonalds® and Slim Chickens®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

MAY 28TH SPECIAL EVENT ANNOUNCEMENT

Join us tomorrow, May 28th at the Beall Center for Innovation and Entrepreneurship on the campus of the University of California, Irvine for an evening filled with very timely world-class keynote speakers, engaging panel discussions, and unparalleled business-to-business networking opportunities at 11th Annual Orange County World Trade Week Forum Event. This is your chance to connect with key trade organizations, international business groups, the diplomatic corps, academics and to earn about the extensive global resources available in Southern California.

Presented by the District Export Council of Southern California and supported by key partners such as the Greater Irvine Chamber of Commerce, The Ports Of Los Angeles and Long Beach and the U.S. Commercial Service, this gathering is essential for those in Southern California ready to embrace the future of international trade.

There is still time to register for this Wednesday, May 28th event at this link: bit.ly/OCWTC2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“The World’s Largest Economies, Including U.S. States – California passed Japan to become the fourth-largest economy in 2024, new data from the BEA reveals. Nine U.S. states feature in the world’s 30 largest economies as measured by their 2024 GDP. It’s in the name really. The United States of America began as a union of separate entities coming together. And while the U.S. is seen as a single global economic and political hegemon today, many of its 50 states are major economies on their own. To show just how big they are, we’ve mapped and ranked 30 of the world’s largest economies, including U.S. states, to see how they stack up against entire countries.”, Bureau of Economic Analysis(BEA) and International Monetary Fund (IMF), May 16, 2025

==================================================================================================

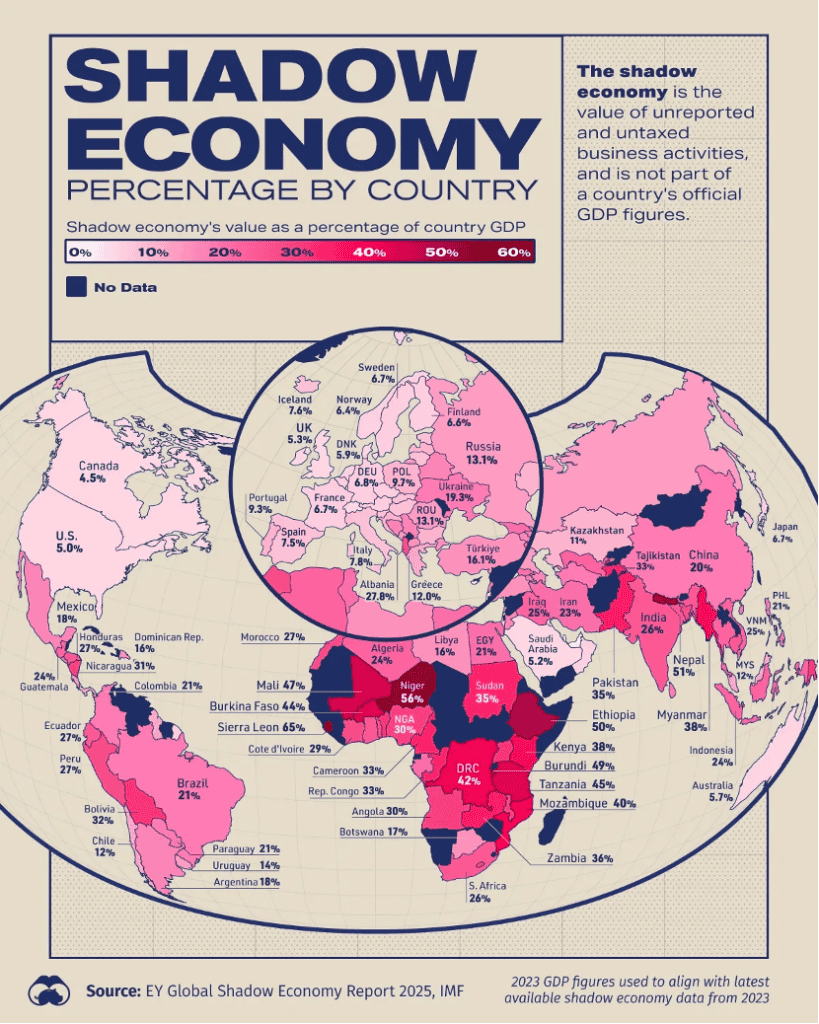

“Visualizing the World’s Shadow Economies – Globally, the shadow economy is estimated to equal 11.3% of GDP based on analysis of 131 countries from Ernst and Young. In the U.S., the shadow economy is estimated to be valued at $1.4 trillion, or 5% of GDP. Meanwhile, the underground economy is valued at more than half of GDP in Sierra Leone, Niger, and Nepal. Shadow economies are highly prevalent. The shadow economy, which includes unreported and untaxed business activities, drug trafficking, and other illegal activities generates trillions annually in revenue. On average, the shadow economy is equal to 42.4% of GDP in low-income countries, with the highest concentration in Africa.”, EY Global Shadow Economy Report 2025 and the IMF, May 14, 2025

============================================================================================

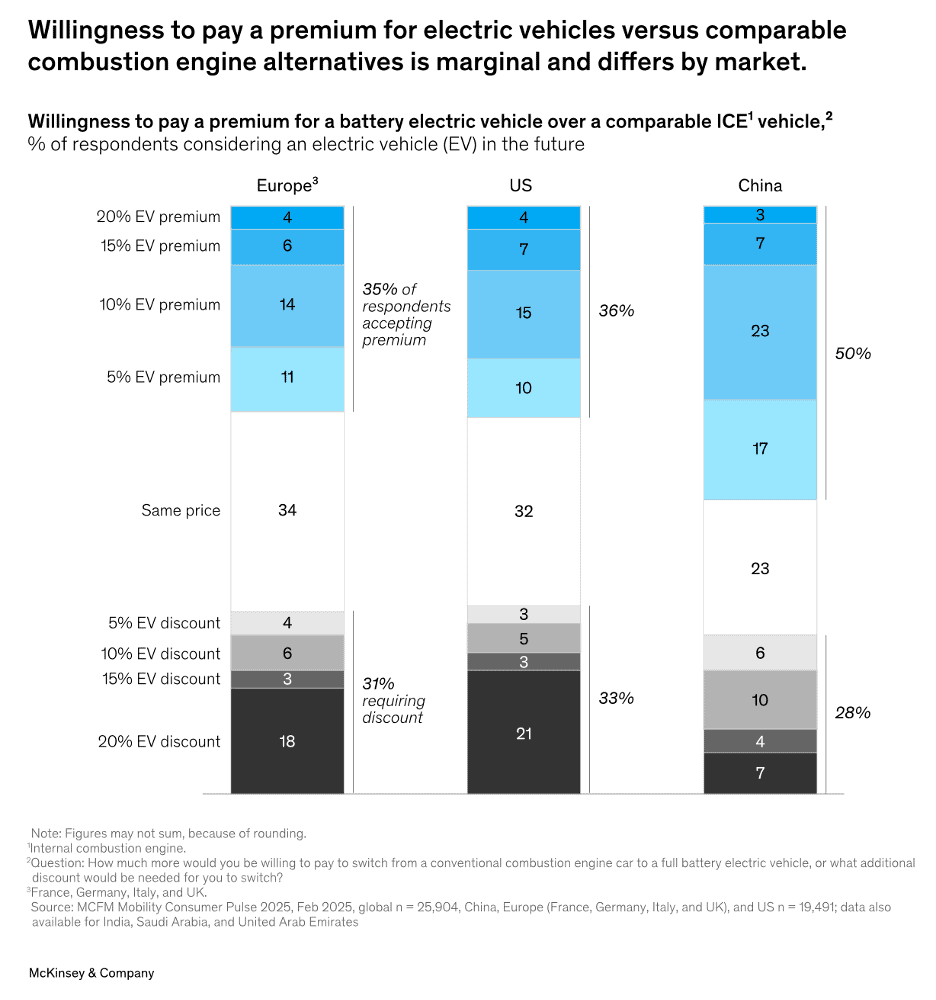

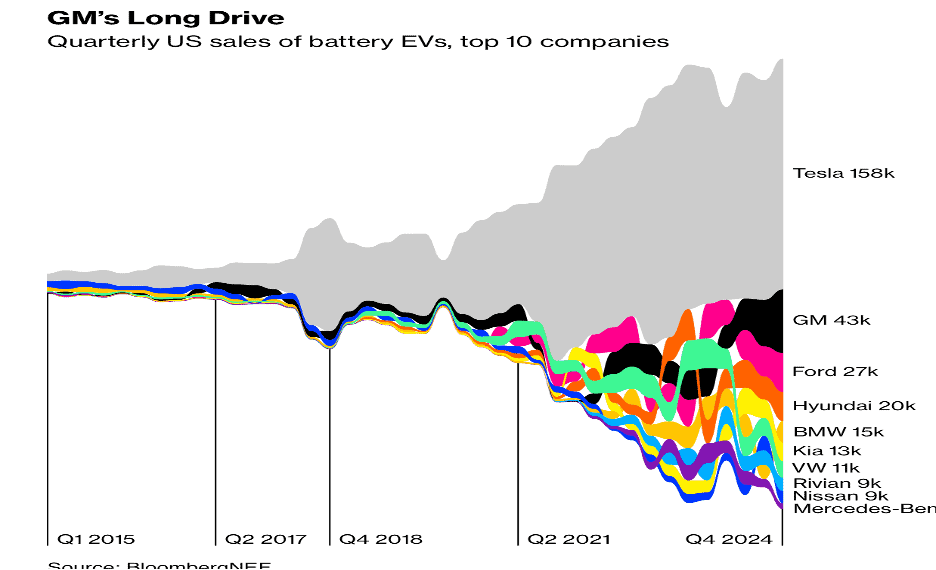

““Will consumers pay more for EVs? Despite the ongoing increase in market share for electric vehicles (EVs), sales growth has slowed in many regions after years of rapid expansion. Consumer behavior is one important piece of the EV adoption puzzle, say Senior Partner Philipp Kampshoff and coauthors. Our annual mobility survey revealed that the price difference between comparable internal combustion engine (ICE) vehicles and battery electric vehicles (BEV) factors into purchasing decisions. In Europe and the United States, only about a third of respondents say they would accept a BEV premium.”, McKinsey & Co., May 22, 2025

============================================================================================

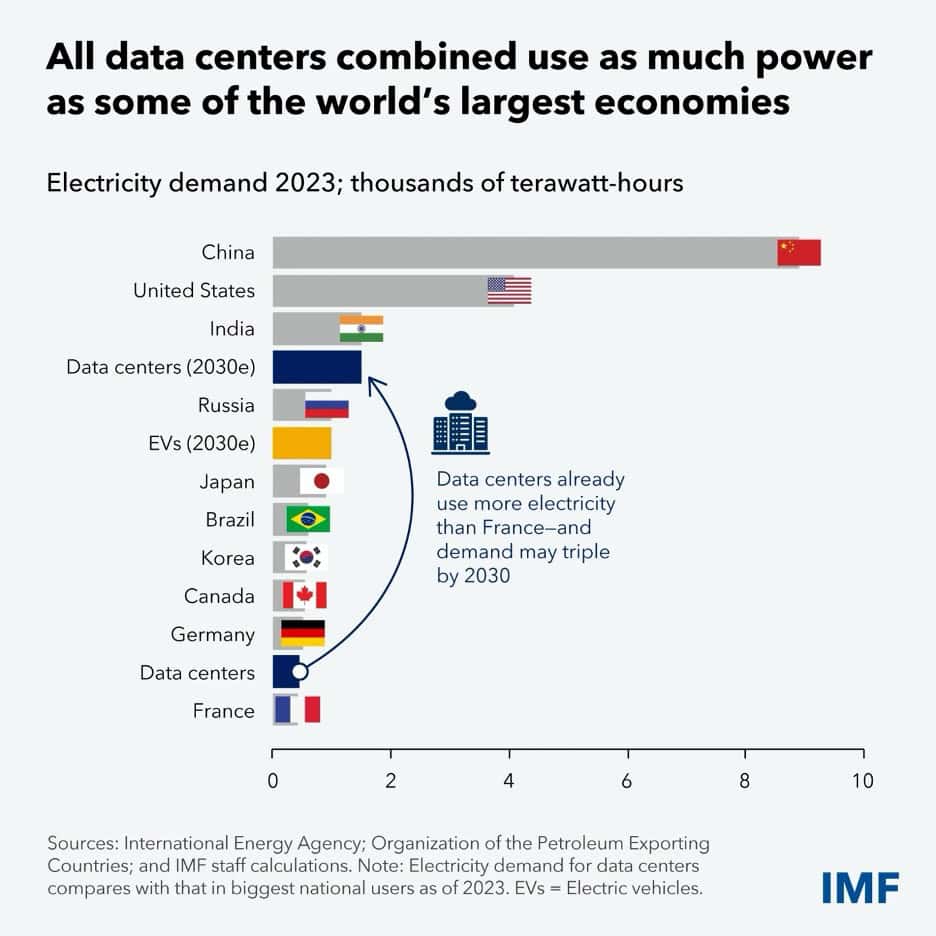

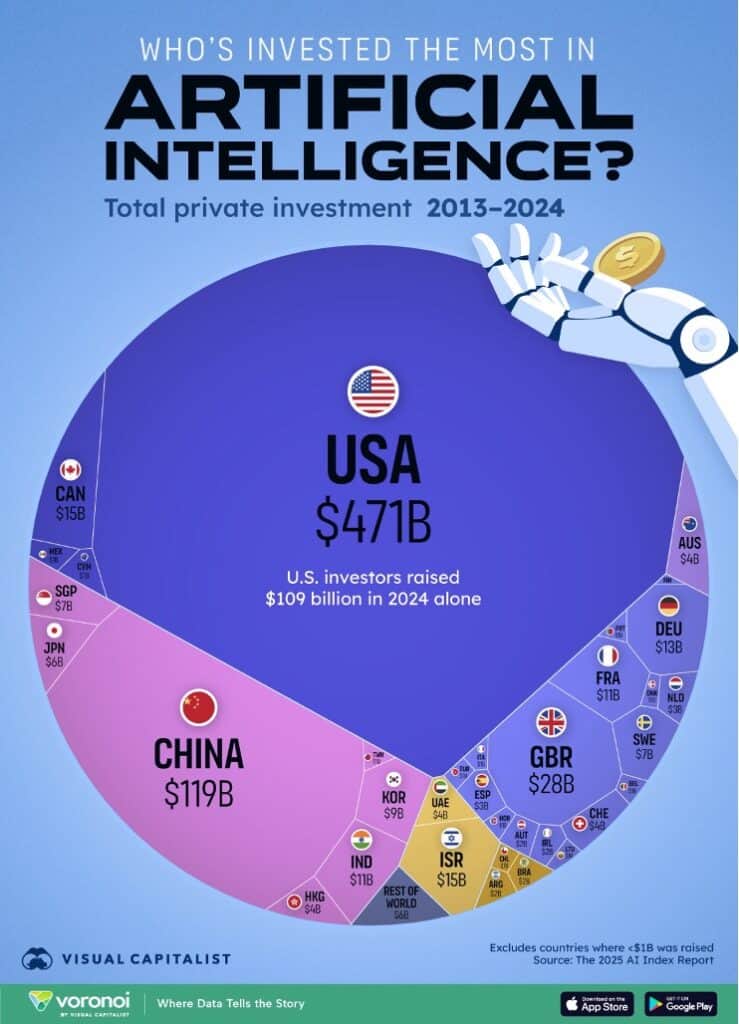

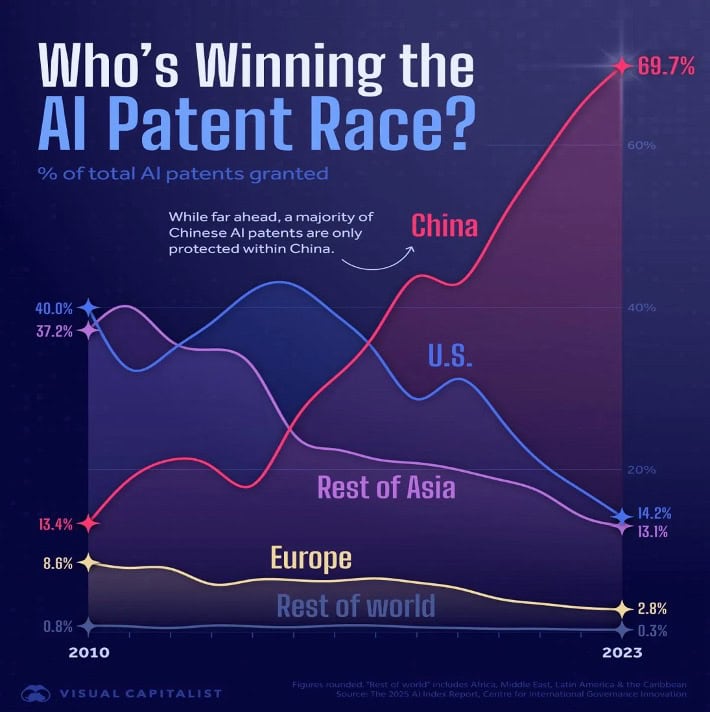

“AI Needs More Abundant Power Supplies to Keep Driving Economic Growth – Artificial intelligence is an emerging source of productivity and economic growth that’s also reshaping employment and investment. AI has the potentialto raise the average pace of annual global economic growth according to scenarios in our recent analysis, included in the IMF’s April 2025 World Economic Outlook. AI, however, needs more and more electricity for the data centers that make it possible. The resulting strain on power grids has major implications for global electricity demand. The world’s data centers consumed as much as 500 terawatt-hours of electricity in 2023, according to the most recent full-year estimate by the Organization of the Petroleum Exporting Countries. That total, which was more than double the annual levels from 2015-19, could triple to 1,500 terawatt-hours by 2030, OPEC projects. As this Chart of the Week shows, electricity used by data centers alone, already as much as that of Germany or France, would by 2030 be comparable to that of India, third world’s largest electricity user. This would also leapfrog over the projected consumption by electric vehicles, using 1.5 times as much power than EVs by the decade’s end.”, Visual Capitalist & International Energy Agency, May 18, 2025

================================================================================================

“What AI Means for the Future of Accounting Jobs – New AI tools are redefining the future of accounting jobs. Learn how upskilling, adaptability, and human judgment define what comes next. Based on the Intuit QuickBooks poll, 98% of American bookkeepers and accountants used artificial intelligence (AI) in the last year. Consistent with other industry developments, AI usage increased from 37% to 58% among finance leaders between 2023 and 2024. Among those not yet using it, half reported active preparations for implementation. According to Thomson Reuters, support for generative AI increased from 52% to 71%in tax-focused firms. These shifts point to more than technology adoption. As AI becomes part of daily work, accounting roles are evolving. With automation handling routine processes, professionals are moving into more strategic, client-facing responsibilities. Still, communication, decision-making, and creative thinking continue to shape the value accountants bring to their teams and clients.”, Neil Sahota, Substack, May 20, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

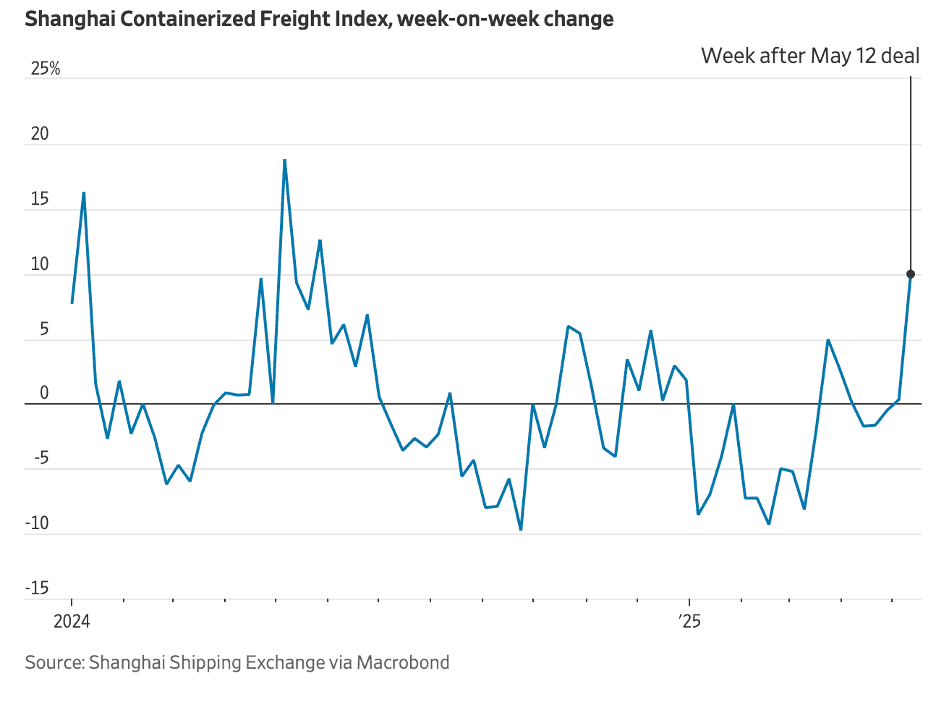

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“The 90-Day Rush to Get Goods Out of China – American and Chinese firms are racing to clear a backlog of orders during a pause in trade war hostilities. Sky-high tariffs pummeled U.S.-China trade and now the cease-fire is causing a snapback. Firms across the U.S. are racing to rebook canceled orders and find space on containerships to get products out of China and bring them stateside before the 90-day window closes in August. Shipping executives in Asia say one headache for importers is there aren’t enough ships available to move goods to the U.S. right away. Carriers diverted some of the vessels that would usually ship goods to the U.S. West Coast from China to other busy routes when tariffs slammed U.S.-China trade. Some carriers replaced their biggest containerships with smaller vessels, while others canceled some scheduled sailings altogether, shipping executives say.”, The Wall Street Journal, May 25, 2025

=============================================================================================

“China Resumes Rare Earth Exports Under Tight Controls as Global Prices Soar – Chinese rare earth magnet producers are gradually resuming overseas shipments under a new export license regime, after Beijing tightened controls on mid-to-heavy rare earth exports in April — sending shockwaves through global supply chains and driving up prices in Europe and the United States. Three leading Chinese rare earth magnet companies confirmed to Caixin that they had recently received export licenses from the Ministry of Commerce, enabling them to resume shipments to customers in Europe and North America. The approvals fall under China’s “one batch, one license” rule, requiring separate permits for each shipment due to varying metal content.”, Caixin Global, May 15, 2025

===============================================================================================

“EU Takes Swing at Making a Deal With Trump – The European Union has shared a revised trade proposal with the US as it aims to inject momentum in talks with President Donald Trump’s administration amid lingering skepticism that a transatlantic deal can be reached. The new offer is said to include proposals that take into account US interests, including international labor rights, environmental standards, economic security and gradually reducing tariffs to zero on both sides for non-sensitive agricultural products as well as industrial goods. The 27-nation bloc has put together plans to hit $108 billion of US exports with additional tariffs in response to Trump’s “reciprocal” levies and 25% tariffs on cars and some auto parts. The EU agreed earlier this month to delay for 90 days the implementation of a separate set of retaliatory tariffs against the US over 25% duties Trump imposed on the bloc’s steel and aluminum exports. That move came after Trump lowered his so-called reciprocal rate on most EU exports to 10% from 20% for the same amount of time.”, Bloomberg, May 21, 2025

==============================================================================================

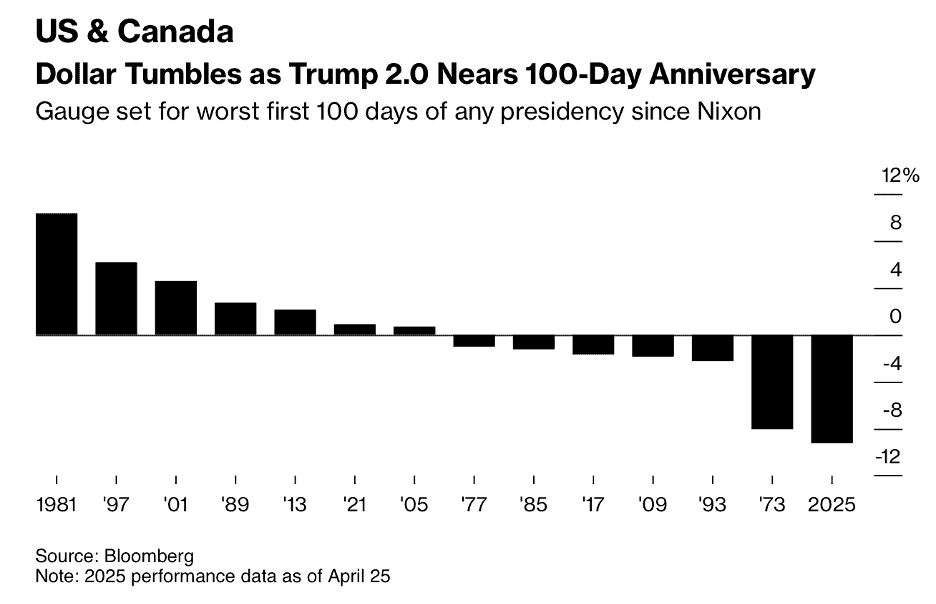

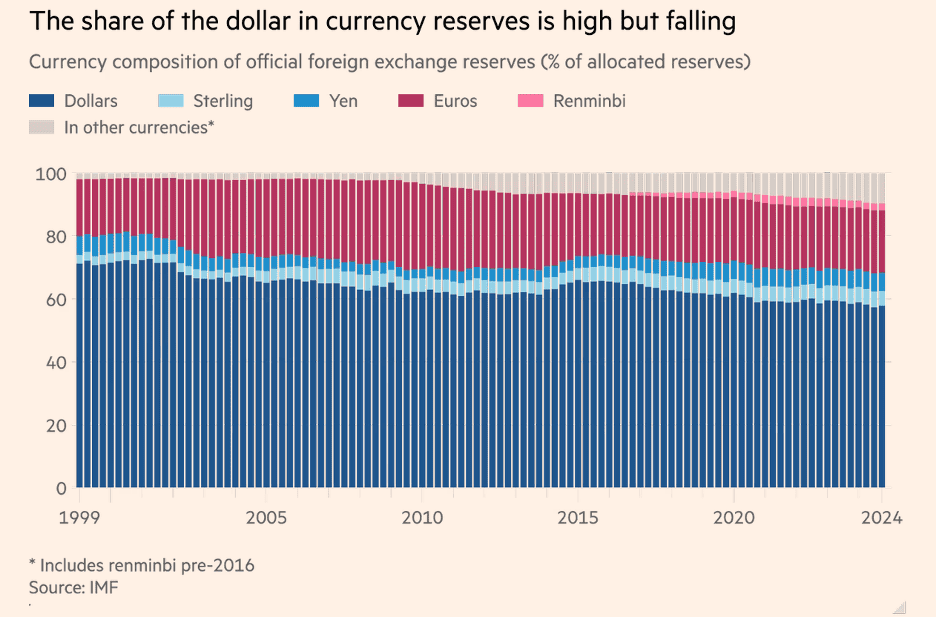

“Trump’s assault on the global dollar – The difficulty is that, however unsatisfactory the hegemon might be, the alternatives look worse. Is the dominance of the dollar about to fade away? Donald Trump insists that “if we lost the dollar as the world currency . . . that would be the equivalent of losing a war”. Yet he himself could be the cause of such a loss. Reliance on a foreign currency depends on trust in its own soundness and liquidity. Trust in the dollar has been slowly eroding for a while. Now, under Trump, the US has become erratic, indifferent and even hostile: why would one trust a country that has launched a trade war on allies? The dollar has been the world’s leading currency for a century. Yet the dollar itself replaced the pound sterling after the first world war, as the UK’s power and wealth declined. Given the rise of China’s economy during that period, this is remarkable. The US also remains at the frontier of world technological development and the foremost military power. Its financial markets are still much the deepest and most liquid. Moreover, in the fourth quarter of last year, 58 per cent of global reserves were in dollars, down from 71 per cent in the first quarter of 1999, but far ahead of the euro’s 20 per cent.”, The Financial Times, May 20, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“What It’s Like to Travel in China Right Now—And How to Do It – Less stringent visa policies and a flurry of new hotels are strong incentives for U.S. travelers to visit the country. Here’s what to know. For years, the country has been an enigma and a challenge for travelers. It’s a vast, deeply historic nation where ancient traditions fuse with hyperfast modernization and where language barriers, digital restrictions, and visa policies often deter casual tourists. But times are changing, and despite its complex global reputation, China has once again opened its doors with newly relaxed entry requirements and a slew of new hotels. In the past two years, China has made drastic changes to its visa policies, and visiting as a tourist has become easier than ever before. A recently extended visa waiver program allows nationals from 38 countries, including Ireland, Australia, Germany, and Japan, to enter China without a visa for up to 30 days. American citizens face fewer hurdles too. Last December, China extended its visa-free transit policy and now allows visitors with a U.S. passport (or passports from one of the other 53 eligible countries) to stay in China for up to 10 days.”, AFAR, May 22, 2025

==================================================================

“Crypto travelers bring 3x greater lifetime value than fiat users – Crypto travelers tend to have higher spending per transaction, greater loyalty and more frequent bookings. Travelers using cryptocurrency for booking arrangements spend more than twice as much as regular travelers using fiat money, according to a joint report from Binance Pay and crypto travel platform Travala shared with Cointelegraph. Crypto-based bookings on Travala reached $80 million in 2024, up from $45 million the year before. Crypto travelers are also outspending their fiat counterparts, with an average booking value of $1,211 per transaction, over 2.5 times more than fiat users who spend $469. Additionally, the report said crypto users were three times more valuable over their lifetime due to longer stays and higher repeat bookings, with crypto travelers 57% more likely to make a repeat hotel purchase.”, Cointelegraph, May 22, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Supremacy: AI, ChatGPT, and the Race That Will Change the World. Parmy Olson’s Supremacy offers a compelling narrative on the intense competition between OpenAI and DeepMind, two leading entities in the artificial intelligence (AI) arena. The book delves into the personal and professional journeys of Sam Altman and Demis Hassabis, highlighting their ambitions to develop artificial general intelligence (AGI) and the ethical dilemmas they encounter. Olson sheds light on how initial altruistic goals often clash with commercial pressures, leading to compromises that shape the trajectory of AI development.

For global business leaders, Supremacy serves as a critical examination of how technological innovation intersects with corporate strategy, ethics, and governance. It underscores the importance of understanding the broader implications of AI advancements on society and the global economy.

Key Takeaways for Global Businesspeople:

1. AI’s Dual Impact: AI holds the potential for both groundbreaking advancements and significant societal disruptions.

2. Ethical Considerations: The pursuit of AI supremacy often involves ethical compromises, necessitating vigilant oversight.

3. Corporate Influence: Large tech corporations play a pivotal role in steering AI development, raising concerns about monopolistic practices.

4. Global Regulation: There’s an urgent need for international regulatory frameworks to ensure responsible AI deployment.

5. Strategic Adaptation: Businesses must adapt to the evolving AI landscape, balancing innovation with ethical responsibility.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

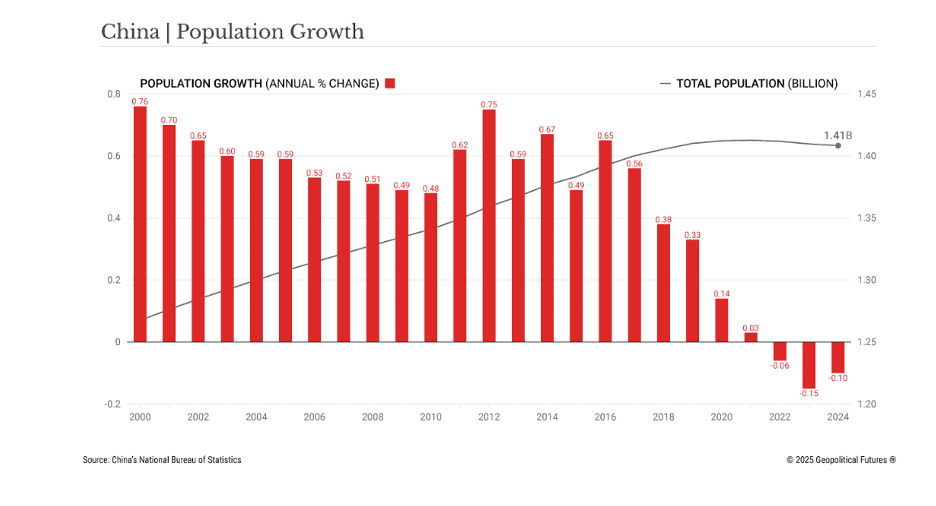

“A Shrinking China Scrambles for a New Economic Model – A declining, aging population is a poor foundation for consumption-driven growth. China is shifting from an export- and investment-driven economy to one based on domestic consumption. The reason is persistent economic stagnation and a growing risk that the country will fall short of its growth targets. In the past, China could rely on its large and steadily growing population as a foundation for economic advancement, but now its population is aging and shrinking rapidly. A full transition to a consumption-based model appears out of reach for now, partly due to the demographic decline.”, Geopolitical Futures, May 14, 2025

==============================================================================================

South Korea

“Navigating Norms and Expectations in the Korean Workplace – Navigating Korean workplace norms can be challenging for executives and teams around the world, as expectations often differ across cultures, writes Don Southerton. Steering Korean workplace norms and expectations can be challenging for the executives and teams worldwide, as workplace norms differ. Long-time global teams have observed Korean groups significantly adopt Western business norms, reducing the dispatch of expats, although a few divisions still adhere to the old model. What stands out is the shift from embedding expat operational teams with divisions acquired through M&A to forming partnerships.”, Branding In Asia, May 22, 2025

=============================================================================================

United Kingdom

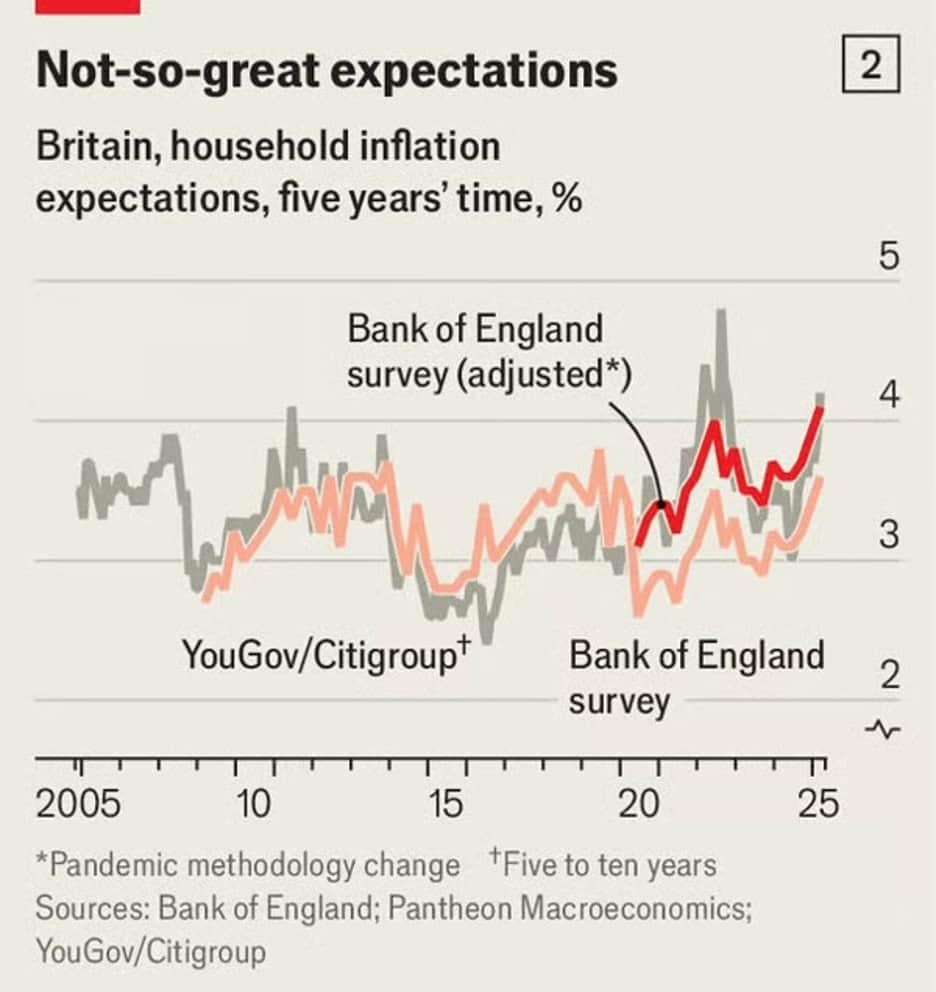

“An eccentric set of one-offs has knocked inflation up in Britain – Troublingly, the public no longer thinks inflation will keep falling. Annual headline inflation rose from 2.6% in March to 3.5%, blowing past forecasters’ expectations of a 3.3% rise. Core inflation, which strips out food and energy, rose to 3.8%. Water and energy bills, as well as vehicle-excise duty, a car tax, explain nearly all of the increase.”, The Economist, May 22, 2025

=============================================================================================

“Why developers are snapping up billions of pounds worth of unwanted offices – Over £3.4 billion worth of UK office space has been purchased for conversion in three years. But what’s driving this unexpected surge in repurposing? These offices, which are usually older and require expensive renovations, have been converted into everything from hotels and flats to laboratories and student halls. Developers’ plans vary by location, depending on what types of property are most in-need in the local area. In most cities — including Bristol, Glasgow and Leeds — residential is the dominant alternative use type, but in Cambridge, Oxford and London, where there is an acute shortage of life sciences space, there is the greatest proportion of offices being converted into laboratories.”, The Times of London, May 25, 2025

=============================================================================================

United States

“The 15 U.S. Fast Food Chain Restaurants That Make The Most Money Annually – Fast food chains feed America cheap snacks and beverages that go down easily. It’s woven into the cultural food landscape, encompassing a massive ecosystem of franchises and loyal customers. Here, we dug through the data to compile our list of the 15 top-selling chains in the country per their 2024 revenue. According to Stock Analysis, revenue is “the amount of money a company receives from its business activities, such as sales of products or services….[revenue] does not take any expenses into account and is therefore different from profits.” The information we leveraged is publicly available — typically intended for shareholders — where we parsed the data for specifics on U.S. divisions of these companies since many are often globally scaled.”, Chowhound, May 24, 2025

================================================================================================

“Gen Z is actually the most enthusiastic generation about working in the office and are there 3 days a week – Gen Z is leading the charge in return-to-office, with an average in-person commitment of three days a week, according to recent survey findings from property group JLL. The company surveyed more than 12,000 workers around the world and found Gen Z is the generation that sees the most value in in-person work. Gen Z workers get a bad rap for being lazy and not wanting to go to the office, while in fact, many of them do want to see their coworkers in person. Contrary to popular belief, Gen Z—people who were born between 1997 and 2012—is actually leading the charge in return-to-office, according to a late March report by property group JLL shared with Fortune. JLL found workers under 24 years old are more likely to be in office than other generations and come in an average of 3 days a week.”, Fortune, May 3, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“McDonald’s plans to hire 375,000 U.S. workers this summer – McDonald’s said Monday it plans to hire up to 375,000 U.S. restaurant employees this summer, its biggest hiring push in years. The Chicago burger giant said the beefed-up job openings at both company-owned and franchised stores are partly due to a U.S. expansion. The company, which has more than 13,500 restaurants in the U.S., plans to open 900 more by 2027. Its decision to staff up for this summer signals optimism that U.S. restaurant traffic will improve as the year unfolds.”, AP News, May 12, 2025

===============================================================================================

“A Fast-Growing Chicken Chain Uses AI in Quest to Become a Household Name – Slim Chickens’ new chief marketing officer wants to play up its made-to-order Southern food with technology—and a music studio. If you haven’t heard of Slim Chickens, it is Patrick Noone’s job to make sure that changes. Noone this year became chief marketing officer at the Fayetteville, Ark.-based chain, which has opened about 300 restaurants, up from around 100 in 2020, with 1,000 more in development globally. Slim Chickens, which opened its first location in 2003, sells buttermilk-brined, hand-breaded chicken tenderloin sandwiches and other Southern fare. Noone previously led a brand transformation at Checkers & Rally’s and held marketing roles at Noodles& Company, Krispy Kreme and Domino’s Pizza.”, Wall Street Journal, May 14, 2025

================================================================================================

“So You Want to Take Your Restaurant(s) Oversees – A Six Part Series – Expanding your restaurant internationally is more than a growth strategy—it’s a major leap that tests every part of your business, from operations and supply chains to culture, finance, and of course, law. It’s easy to get swept up in the excitement of new markets and emerging culinary scenes, but international expansion is not just about translating your brand into a new language or replicating your menu abroad. It’s about understanding and complying with a new legal ecosystem, managing risk, structuring your business intelligently, and ensuring your intellectual property survives the journey intact.”, Lexology, May 19, 2025

==============================================================================================

“Survey: 1 in 5 Small Businesses May Not Survive 2025 – A new report from Alignable in collaboration with Harvard Business School and MIT researchers reveals a dramatic surge in small business anxiety as the U.S. trade war continues. ‘Business owners are incredibly resourceful, but tariffs are creating more intense cost pressures and deeper uncertainty with each passing month,’ said Eric Groves, Alignable’s co-founder and CEO. ‘With half of small business owners now expecting sales to decline, it’s a clear signal that we need to act together. One of the most effective ways to push through this turbulence is by leaning on your community and tapping into your most trusted relationships.’ Drawn from 2,392 survey responses collected from April 9 to 24 and 13,000-plus earlier responses this year, the report highlights growing distress even among businesses without direct trade exposure.”, Franchising.com, May 14, 2025

=============================================================================================

“Franchise Supply Chains Under Pressure: How to Stay Ahead of Tariff Fallout – Currently, the business world is abuzz with discussions about the tariffs recently imposed by the Trump administration. Targeting not only hostile countries but also some of the United States’ closest neighbors and trade allies, these tariffs are having a significant impact on businesses and franchises across the nation, both economically and operationally. Unfortunately, virtually no business is immune to the effects of these tariffs, including franchises. In the US, several restaurant chains have already raised their prices, passing on the costs of the tariffs to their customers. Although franchises might be tempted to hold out in the hopes that the situation will improve, the outlook is not encouraging that the tariff situation will be resolved anytime soon. One of the most obvious ways franchises will feel the impact of tariffs is in sourcing their ingredients, as many restaurant franchises obtain ingredients, produce, and meat from other countries.”, Franchising.com, May 20, 2025

==============================================================================================

“Starbucks 1 Billion China Shake Up Major Deal Talks Brewing Behind the Scenes – Starbucks is makingquiet moves behind the scenes and they could reshape its future in China. The company has reached out to private equity firms, tech giants, and other strategic players to test interest in its China business, according to people familiar with the talks. While nothing’s locked in, insiders say a partial stake sale is on the table, potentially valuing the business in the billions. Conversations are still early, but investors are expected to send in feedback soon. The company hasn’t committed to any deal just yet but when a global brand starts taking meetings like this, you know the playbook is shifting. This comes as Starbucks faces intense pressure in what used to be one of its brightest growth stories. China is still its second-largest market, but local champions like Luckin Coffee and Cotti Coffee are moving fast and grabbing wallets. Luckin raked in $1.2 billion in revenue last quarter, outpacing Starbucks’ $740 million haul in the same region. With more than 7,750 stores across China and a 25% stock drop since February, Starbucks is under the gun to prove it still has room to run and that may require fresh capital, new partners, or both.”, Yahoo Finance, May 15, 2025. Compliments of Paul Jones, Jones & Co., Toronto

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 134, Tuesday, May 13, 2025

“When the winds of change blow, some build walls, others build windmills.”

Chinese Exporters Elated by Reprieve in US-China Trade War

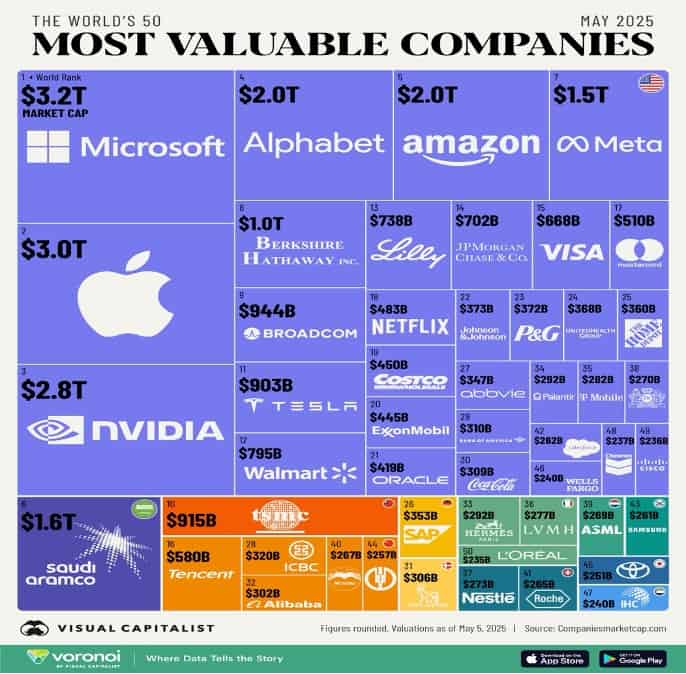

The World’s 50 Most Valuable Companies in 2025

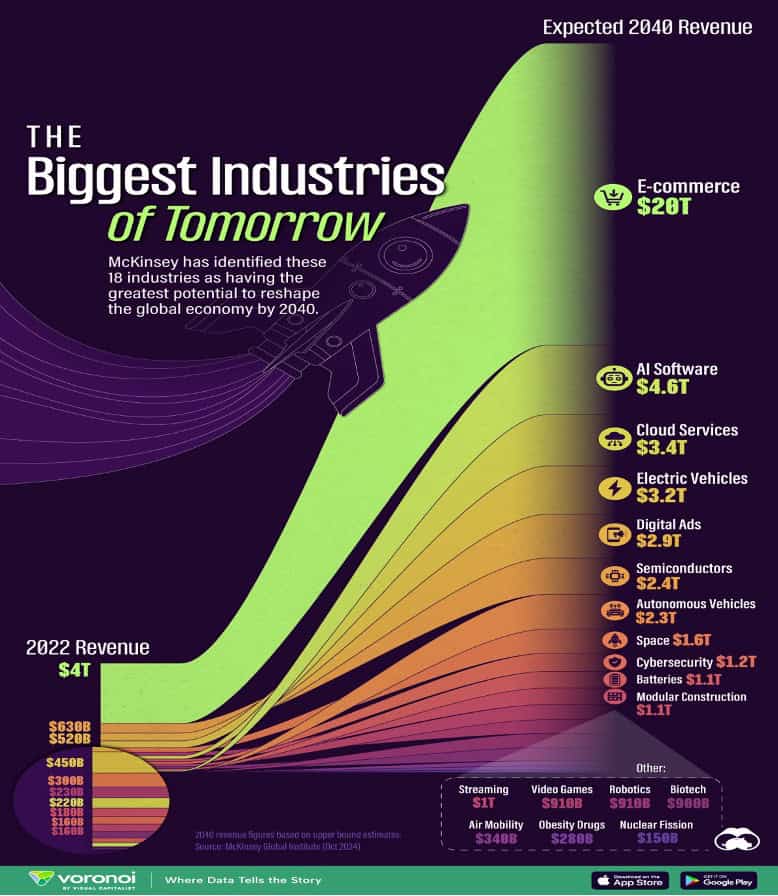

These 18 Industries Could Reshape the Global Economy by 2040

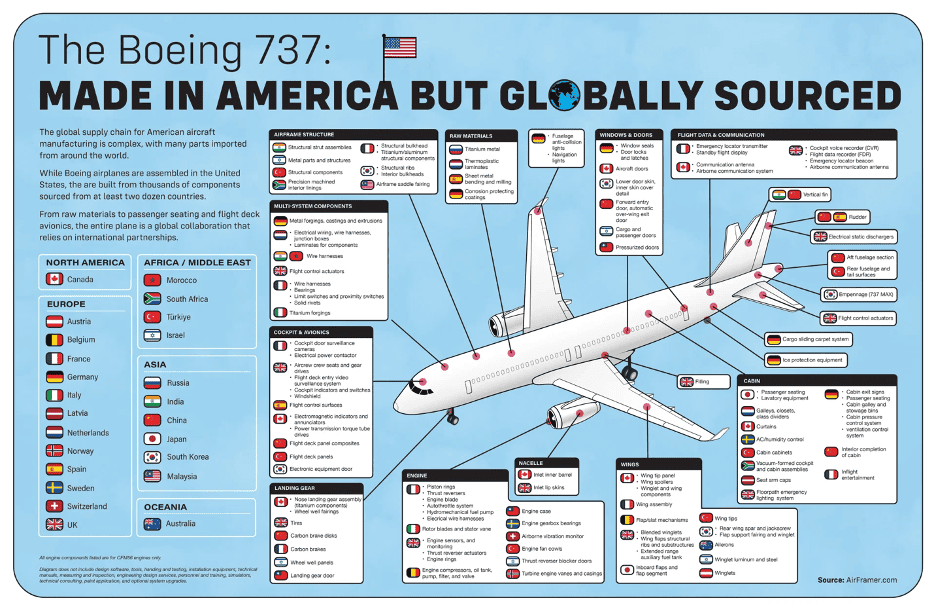

Boeing 737: American Made but Globally Sourced

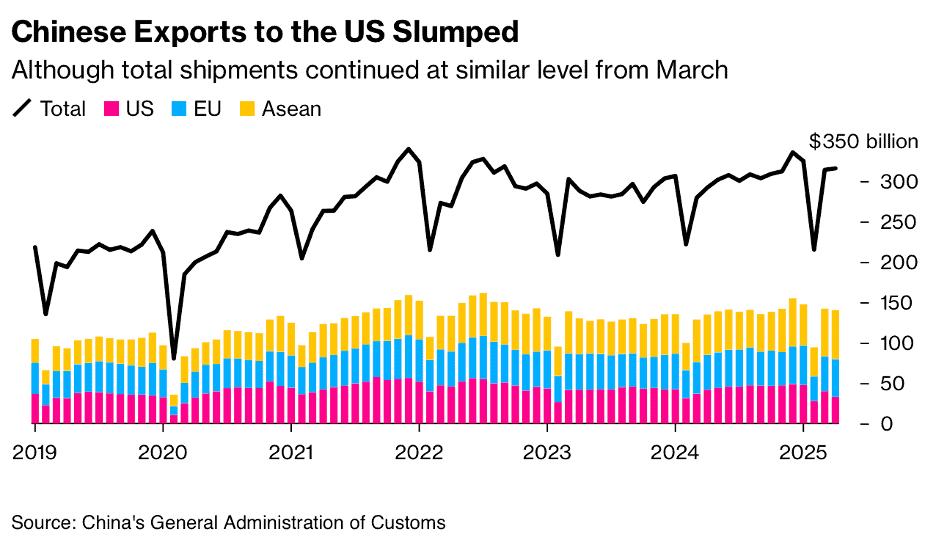

Chinese Exports to US Slump 21% But Soar to Asia and Europe

Indonesia to Cut Fuel Imports From Singapore in Favor of US

Disney Announces Its First Middle East Theme Park in Abu Dhabi

Commentary about the 134th Issue: Perhaps it is the fact that I lived in China in the 1980s and have taken several U.S. brands into the country over the years but I always like Chinese proverbs as they are often based on thousands of years of history and not just what is happening to us today. There’s an old Chinese proverb that applies to where we find ourselves today: “When the winds of change blow, some build walls, others build windmills.” It’s a simple idea, but incredibly relevant in today’s global business landscape. Change is always coming—whether it’s new technology, shifting consumer behavior, or economic and political uncertainty. Some people try to block it out, stick with what’s familiar, and hope things settle down. That’s building a wall. But the smart ones, the successful leaders I’ve seen around the world, they do the opposite. They lean in. They find ways to use those winds to generate momentum. That’s building a windmill. They adapt, innovate, and look for new opportunities in the disruption. It’s not about avoiding risk—it’s about being strategic with it. In international business, especially, the ability to harness change instead of resisting it can make all the difference.

One More Thing…On Monday morning, May 12, 2025, the U.S. White House released a statement that the U.S. and China had reached agreement on new trade policies for at least the next 90 days. Under the agreement, China agreed to reduce its tariff on U.S. goods from 125 % to 10% and the U.S. agreed to slash its levy on China from 145% to 30%. The immediate result is that goods destined for the U.S. market for Christmas will probably make it on time and at a fairly low tariff of 30%.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“When the winds of change blow, some build walls, others build windmills.”, Chinese Proverb

“To improve is to change; to be perfect is to change often.”, Winston Churchill

“In a time of drastic change, it is the learners who inherit the future.”, Eric Hoffer

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #134:

Chinese Exporters Elated by Reprieve in US-China Trade War

The World’s 50 Most Valuable Companies in 2025

These 18 Industries Could Reshape the Global Economy by 2040

Boeing 737: American Made but Globally Sourced

Chinese Exports to US Slump 21% But Soar to Asia and Europe

Indonesia to Cut Fuel Imports From Singapore in Favor of US

Disney Announces Its First Middle East Theme Park in Abu Dhabi

Brand Global News Section: Dairy Queen®, Krispy Kreme®, Luckin®, McDonalds®, Starbucks®, TGI Fridays® and Wendy’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

SPECIAL EVENT ANNOUNCEMENT

Join us on May 28th at the Beall Center for Innovation and Entrepreneurship on the campus of the University of California, Irvine for an evening filled with very timely world-class keynote speakers, engaging panel discussions, and unparalleled business-to-business networking opportunities at 11th Annual Orange County World Trade Week Forum Event. This is your chance to connect with key trade organizations, international business groups, the diplomatic corps, academics and to earn about the extensive global resources available in Southern California.

Presented by the District Export Council of Southern California and supported by key partners such as the Greater Irvine Chamber of Commerce, The Ports Of Los Angeles and Long Beach and the U.S. Commercial Services, this gathering is essential for those in Southern California ready to embrace the future of international trade. Don’t miss this opportunity to propel your trade ambitions forward! Please register for this Wednesday, May 28th event at this link: bit.ly/OCWTC2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“The World’s 50 Most Valuable Companies in 2025 – The world’s most valuable companies hold immense sway over the global economy, shaping everything from technology to consumer trends. As of May 2025, U.S. giants like Apple, Microsoft, and Nvidia are worth trillions of dollars, reflecting America’s long-standing leadership in innovation and capital markets. The figures we used to create this graphic were sourced from companiesmarketcap.com, as of May 5, 2025.”, Visual Capitalist, May 9, 2025

==================================================================================================

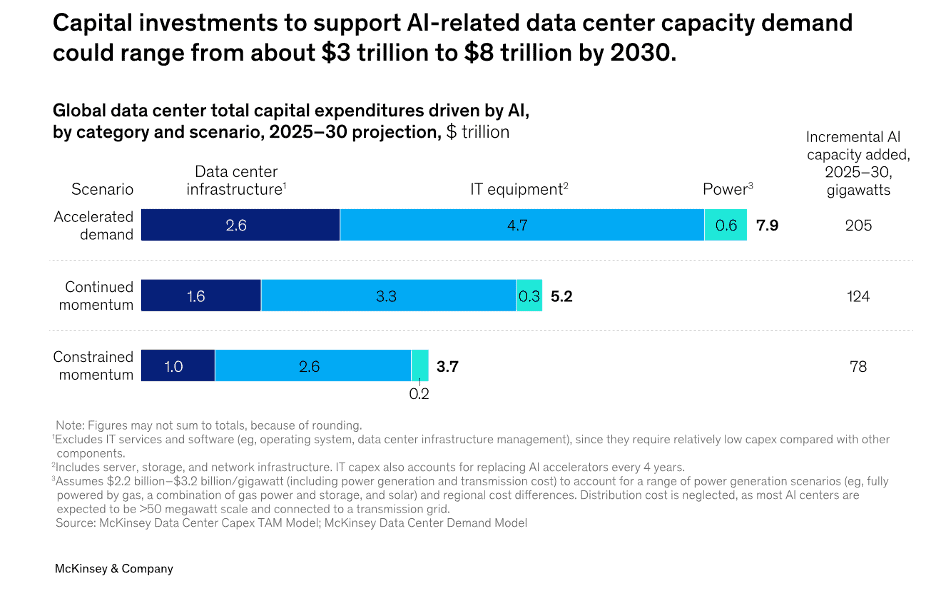

“The cost of compute: A $7 trillion race to scale data centers – Our research shows that by 2030, data centers are projected to require $6.7 trillion worldwide to keep pace with the demand for compute power. Data centers equipped to handle AI processing loads are projected to require $5.2 trillion in capital expenditures, while those powering traditional IT applications are projected to require $1.5 trillion in capital expenditures (see sidebar “What about non-AI workloads?”). Overall, that’s nearly $7 trillion in capital outlays needed by 2030—a staggering number by any measure.”, McKinsey & Co., Aoril 28, 2025

============================================================================================

“These 18 Industries Could Reshape the Global Economy by 2040 – McKinsey identified these industries as having the most potential for future growth, generating up to $48 trillion in revenues by 2040. AI Software & Services is expected to have a CAGR of up to 25% between 2022 and 2040. As the world evolves, new industries are emerging as the key drivers of future economic growth. According to McKinsey Global Institute, there are 18 high-growth arenas—including AI, cybersecurity, biotech, and air mobility—which could generate up to $48 trillion in annual revenue by 2040.”, Visual Capitalist and McKinsey & Co., May 7, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Chinese Exporters Elated by Reprieve in US-China Trade War – The US-China deal temporarily lowering tariffs comes as a relief for Chinese exporters in limbo since the onset of a trade war between the world’s two largest economies. The Trump administration’s 145% duties on most Chinese imports will be cut to 30% by May 14, while China’s 125% retaliatory levy on US goods will drop to 10% during a 90-day cooling off period, Beijing and Washington said Monday following negotiations in Geneva.”, Bloomberg, May. 12, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“US Lawmakers Request $400 Million in Transit Aid for World Cup – Next year’s games are expected to be the most highly attended in FIFA’s history, with more than five million fans expected to attend the tournament’s 104 matches in the US, Canada and Mexico. Boston, New York City, Kansas City, Philadelphia and Los Angeles are among the 11 host US cities. The nonprofit advocacy group US Travel Association said that the US would need to make more than $10 billion in transit infrastructure upgrades to be able to shuttle visitors to and from the games. ‘The tournament’s anticipated economic impact of over $17 billion will rely on the successful movement of people across our cities,” wrote Representative Sharice Davids and 55 other lawmakers in a letter penned to the Subcommittee on Transportation, Housing and Urban Development. It will be officially sent to the appropriations committee on May 23. “Adequate funding is critical to ensure that transit systems meet the heightened safety, security, and efficiency demand.’ ‘, Bloomberg, May 5, 2025

============================================================================================

“Business travel was making a post-Covid comeback — until the trade war diverted it – Corporate bookings haven’t collapsed, but U.S. policy swings have upended what was a sunny outlook for the $1 trillion global industry just months ago. Business travel’s four-year crawl out the pandemic was on track to continue this year, but the U.S. trade war has scrambled that outlook. ‘The big word is uncertainty,’ said Suzanne Neufang, CEO of the Global Business Travel Association, which had forecast worldwide spending to surge to $1.64 trillion in 2025, up from an expected $1.48 trillion in 2024. Last year’s estimated total, if preliminary data bears out, would mark the first time the sector surpassed its pre-Covid levels. Now, about 29% of U.S. corporate travel managers and an equal share abroad expect business travel to decline this year due to government actions, according to a recent GBTA survey. The expected pullbacks could dent business trips by as much as 22%, the group found. Industry experts caution that souring expectations so far haven’t translated to a collapse in bookings, despite signs of cooler demand. Business travel ‘hasn’t fallen off a cliff, said Jonathan Kletzel, a travel, transportation and logistics leader at the consulting firm PwC.”, NBC News, May 10, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In Peak Human: What We Can Learn from the Rise and Fall of Golden Ages, historian Johan Norbergdelivers a compelling analysis of seven of history’s most remarkable civilizations—Ancient Athens, the Roman Republic, Abbasid Baghdad, Song China, Renaissance Italy, the Dutch Republic, and the modern Anglosphere. Through these case studies, Norberg identifies the patterns that led to their ascents and the missteps that precipitated their declines. The book serves as both a celebration of human progress and a cautionary tale about the fragility of prosperity.

Norberg’s central thesis is that openness—to ideas, trade, and diversity—is the cornerstone of societal flourishing. He argues that societies thrive when they embrace external influences and foster internal innovation. Conversely, periods of decline often follow when societies become insular, resistant to change, or overly reliant on past successes.

For global business leaders, Peak Human offers valuable insights into the dynamics of cultural and economic vitality. Norberg’s analysis underscores the importance of adaptability, inclusivity, and forward-thinking leadership in sustaining growth and competitiveness.

Five Key Takeaways for Global Business Leaders:

1. Openness Drives Innovation: Historical golden ages were characterized by a willingness to adopt and adapt foreign ideas and technologies. Modern businesses should similarly cultivate openness to external insights and diverse perspectives to foster innovation.

2. Inclusivity Enhances Resilience: Societies that encouraged participation across different segments of the population were more adaptable and resilient. Companies that promote inclusive cultures can better navigate challenges and seize opportunities.

3. Learning from Others Accelerates Progress: Just as past civilizations advanced by learning from their neighbors, businesses can benefit from benchmarking against industry leaders and adopting best practices.

4. Complacency Leads to Decline: A recurring theme in the book is that success can breed complacency. Organizations must remain vigilant and proactive to avoid stagnation.

5. Optimism Fuels Growth: A culture that believes in progress and the possibility of improvement is more likely to invest in the future. Leaders should inspire optimism to drive sustained growth.

Peak Human is a thought-provoking read that combines historical analysis with practical lessons for today’s leaders.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Canadian companies shift focus to Europe for exports, growth – For decades, most Canadian businesses rarely looked beyond the United States for export opportunities and expansion plans. The move southward made sense given the size and proximity of the U.S., and the long history of free trade between both countries. In a matter of months, Mr. Trump has upended those deeply entrenched ties and alienated Canadians by mocking former prime minister Justin Trudeau and calling for the annexation of Canada. As companies assess the fallout of Mr. Trump’s actions, many have begun looking elsewhere for new customers, especially to Europe. There’s also been renewed interest in the trade deal between Canada and the European Union, known as the Comprehensive Economic and Trade Agreement, which was signed in 2016. A similar pact that governs trade between Canada and Britain came into force in 2021.”, The Globe and Mail, May 9, 2025

=============================================================================================

China

“Chinese Exports to US Slump 21% But Soar to Asia and Europe – Shipments to the US fell 21% from a year earlier after the imposition of duties earlier in April, according to data from the customs administration Friday. China’s tariffing of American goods meant that imports from the US fell almost 14% last month. Shipments to India and the 10 Southeast Asian nations in the Asean group soared by more than 20%, while exports to the European Union were up 8%. Imports fell 0.2% for the second straight monthly decline, leaving a trade surplus of $96 billion.”, Bloomberg. May 8, 2025

==============================================================================================

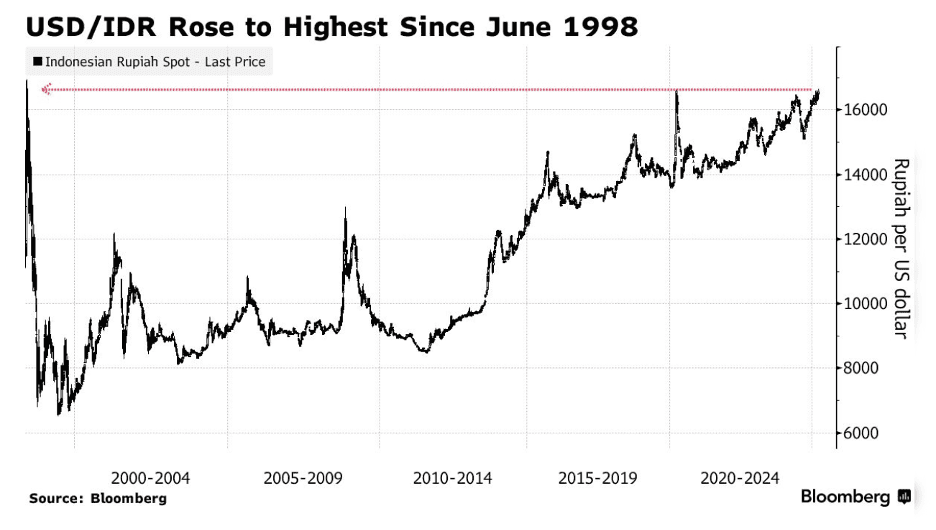

Indonesia

“Indonesia to Cut Fuel Imports From Singapore in Favor of US – Southeast Asia’s largest economy will look to gradually eliminate its shipments of oil products from Singapore, which account for more than half its imports, Energy Minister Bahlil Lahadalia told reporters on Friday. Purchases will be switched to suppliers in the US and Middle East as Indonesia seeks lower prices and a “better balance” in the changing global geopolitical environment, Lahadalia said. ‘It is not only a matter of price but also geopolitical issues, we need to have a balance with other countries,’ Lahadalia said, adding that imports from Singapore would be reduced to zero ‘some day’.”, Bloomberg, May 9, 2025

=============================================================================================

United Arab Emirates