Biweekly Global Business Newsletter Issue 112, Tuesday, July 9, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Commentary about the 112th Issue: The world’s most livable cities, the countries preferred by expats, the world’s richest countries, the corporate tax rates for the G20 countries (the USA is near the bottom!) and European’s are the happiest in the world. Which young consumers are the most optimistic in the world. Greece starts 6 day work weeks. Pan Am Airlines is making another comeback. The young and rich in China are trying to leave. And we are adding a book review to each newsletter going forward.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

===================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

===================================================================

First, A Few Words of Wisdom From Others For These Times

“For the only way in which a durable peace can be created is by world-wide restoration of economic activity and international trade.”, James Forrestal

“Laws are like sausages, it is better not to see them being made.”, Otto von Bismarck

“If you don’t know where you are going, you might wind up someplace else.”, Yogi Berra

===================================================================

Highlights in issue #112:

- Brand Global News Section: Burritobar®, Little Caesars®, Mod Pizza® and Tim Hortons®

===================================================================

Interesting Data, Articles and Studies

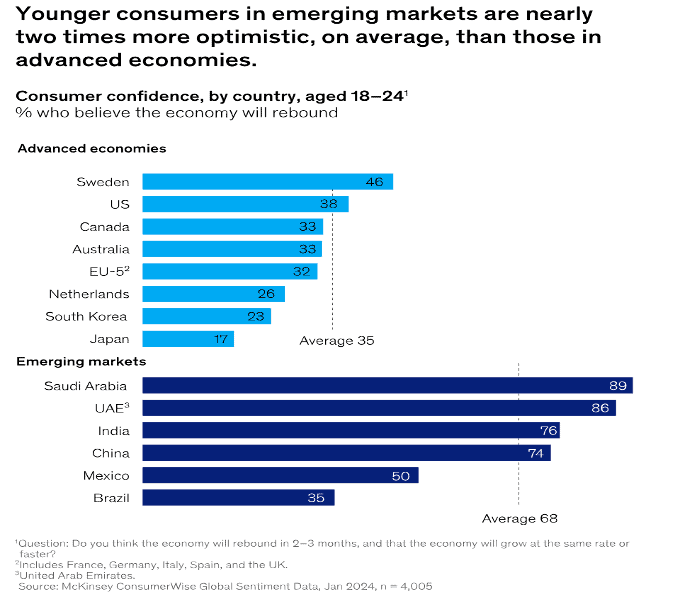

“State of the Consumer 2024: What’s now and what’s next – Amid massive shifts in the consumer landscape, companies can’t afford to rely on yesterday’s consumer insights. Here are nine trends that merit close attention. Middle-income consumers are feeling the squeeze and worrying about inflation but aren’t holding back on splurges. Rather than sticking to tight budgets in retirement, aging consumers are splurging too. Speaking of older shoppers, it turns out that the brand loyalty they’ve long been known for is a thing of the past. And young consumers in Asia and the Middle East are more likely than those in Western markets to switch to higher-priced brands.”, McKinsey, June 10, 2024

===================================================================

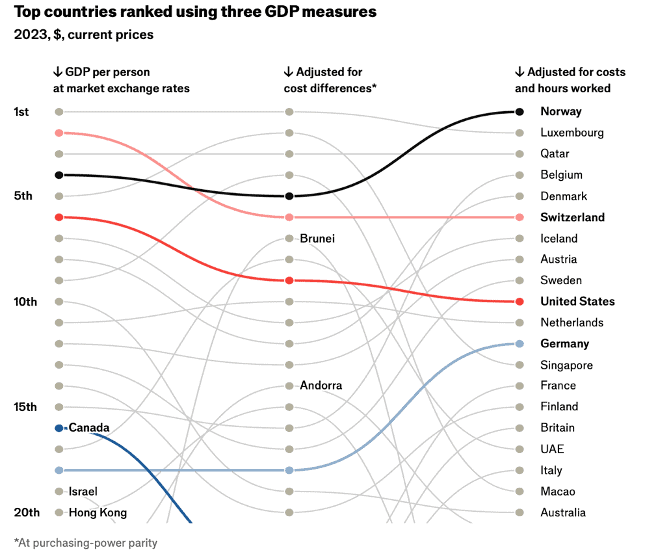

“The world’s richest countries in 2024 – Sorting Countries into rich and poor can be difficult. Measures such as GDP are affected by population size (more people generally mean more output). But adjusting for population alone is not enough. Dollar income per person does not account for differences in prices between countries (a Big Mac, for example, will set you back more in some places than in others, even after converting into dollars). Nor does it account for productivity (overall output per hour worked). To get a fuller picture, The Economist therefore ranks countries by three measures: dollar income per person, income adjusted for local prices (known as purchasing-power parity, or PPP) and income per hour worked. Take America first. Its GDP has been the largest at market exchange rates for over a century. But by income per person it falls to sixth, behind Luxembourg (first) and Switzerland (second). The results for China—the world’s second-largest economy in nominal terms—are even starker: it falls to 69th by GDP per person, 75th at local prices and 97th after accounting for hours worked.”, The Economist, July 4, 2024

===================================================================

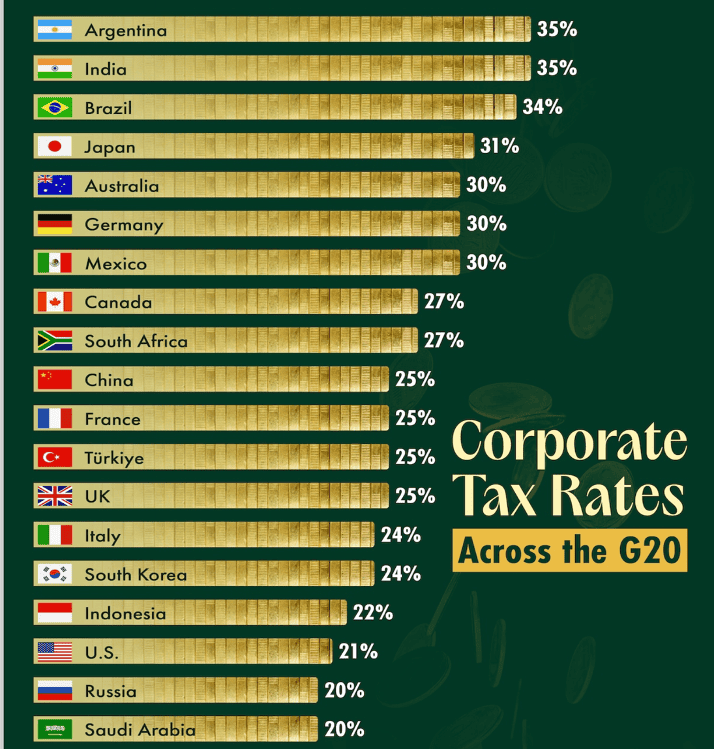

“Which Countries Have the Highest Corporate Tax Rates in the G20?– In the wake of the 1999 Asian financial crisis, government representatives from the 20 largest economies in the world decided to informally gather to coordinate policy on trade. Thus began the G20. Together the bloc accounts for more than 85% of the world economy and has been credited with unified policy action in response to world events. However, despite this shared affiliation, this group is still made of fundamentally different economies with varied policies towards their business entities.”, Visual Capitalist, June 26, 2024

===================================================================

“Top 10 most expensive cities for expats in 2024 – Hong Kong retained its pole position as the world’s most expensive city for expats in 2024, according to Mercer. Asia’s biggest financial hubs have once again clinched the top spots for being the costliest cities for international workers to live in, according to Mercer. Hong Kong was ranked as the most expensive city for expats to live in, followed by Singapore and Zurich, according to the Cost of Living City Ranking 2024. Cities in Switzerland — Zurich, Geneva, Basel and Bern — snagged four out of 10 spots. New York City ranked No. 7. The top five spots had no change from the year before, but London climbed 9 positions from No. 17 to 8. The survey compared the costs of more than 200 items in each of the 226 cities studied — including the price of housing, transportation, food, clothing, household goods and entertainment. New York City was used as the benchmark and currency fluctuations were measured against the U.S. dollar.”, June 18, CNBC

===================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

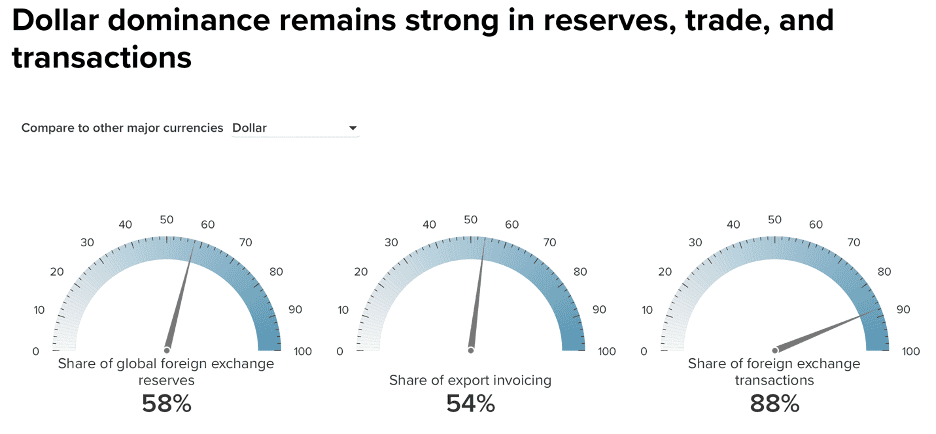

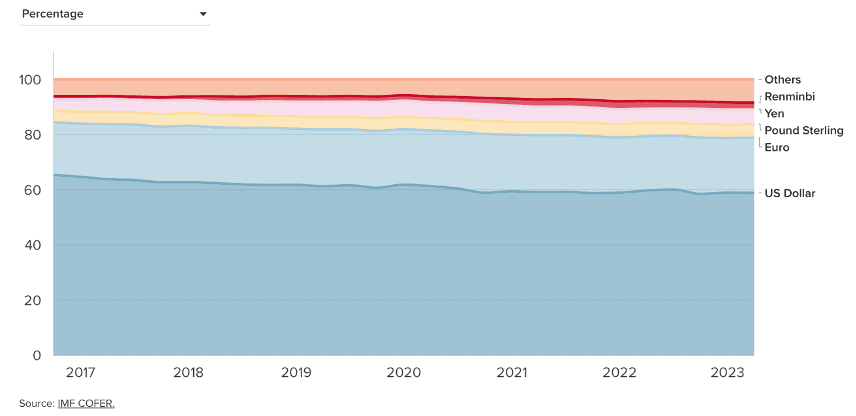

“Dollar Dominance Monitor – The US dollar has served as the world’s leading reserve currency since World War II. Today, the dollar represents 58 percent of the value of foreign reserve holdings worldwide. The euro, the second-most-used currency, comprises only 20 percent of foreign reserve holdings. Over the past twenty-four months, the members of BRICS (a grouping of Brazil, Russia, India, China, and South Africa that recently added Egypt, Ethiopia, Iran, and the United Arab Emirates; Saudi Arabia is considering joining) have been actively promoting the use of national currencies in trade and transactions. During this same time, China has been expanding its alternative payment system to its trading partners and seeking to increase international usage of the renminbi. But in recent years, and especially since Russia’s invasion of Ukraine and the Group of Seven (G7)’s subsequent escalation in the use of financial sanctions, some countries have been signaling their intention to diversify away from dollars.”, Atlantic Council, July 7, 2024

===================================================================

Global & Regional Travel & Living

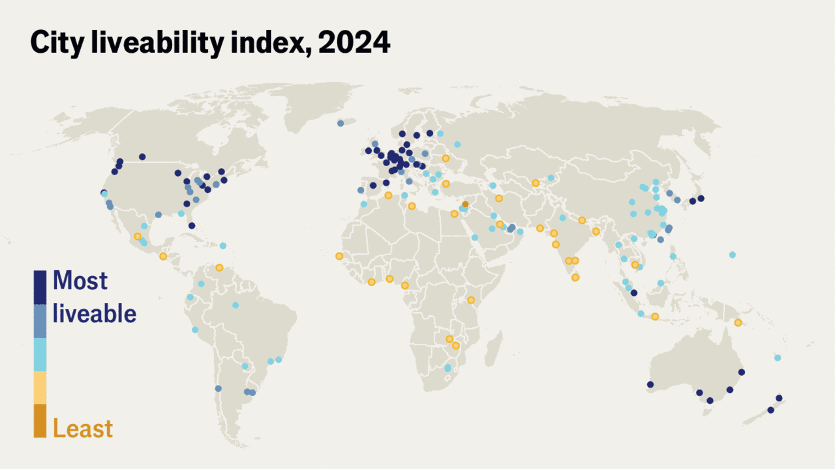

“The world’s most liveable cities – Which city is the most liveable in the world? Hint: it’s the historic capital of the Babenberg dynasty and the birthplace of the snow globe. This week EIU (Economist Intelligence Unit), our sister company, crowned it the world’s most liveable city for a third consecutive year. EIU’s index measures liveability using criteria like good schools, access to health care and so on. These are all relevant factors if you’re considering a move. But if you ask me, some important qualities of a city can’t be easily quantified. The general buzz and unpredictability can be what makes it exciting. “, The Economist (LinkedIn post), July 3, 2024

===================================================================

“Dream of moving abroad? This Central American destination is the No. 1 country for expats – Panama was named the No. 1 country for expats out of 53 countries in this year’s report, which surveyed more than 12,500 people in February about how satisfied they feel with their lives in a foreign country. The InterNations report ranked 53 global countries across five indices: quality of life, ease of settling in, working abroad, personal finance and an “expat essentials” index, which covers housing, administration, language and digital life. These are the top 10 countries for expats to live and work abroad, according to InterNations data: Panama, Mexico, Indonesia, Spain, Colombia, Thailand, Brazil, Vietnam, Philippines and the United Arab Emirates. (The USA ranks 35th).”, CNBC Make It, July 4, 2024

===================================================================

“Marriott International opens its 100th Sheraton Hotel in China – Marriott International is accelerating investment in China’s booming hospitality industry with the announcement of more than 40 new upper upscale hotels by the end of 2025. Sheraton Hotels & Resorts, part of Marriott Bonvoy’s global portfolio of more than 30 hotel brands, announced the opening of Sheraton Lanzhou Anning in Lanzhou, northwest China’s Gansu Province, on Monday, which marks the 100th Sheraton Hotel in China, where the brand made its market debut 50 years ago. Marriott International operates nearly 270 upper upscale hotels in China at present.”, Shine, July 3, 2024. Compliments of Paul Jones, Jones & Co., Toronto

===================================================================

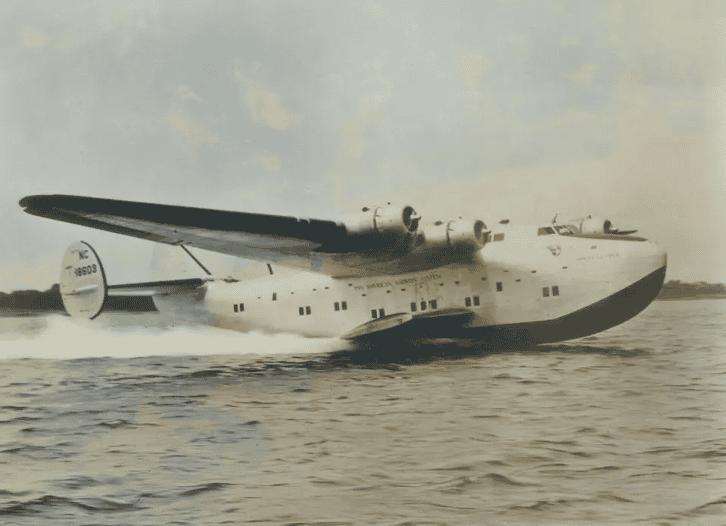

“New Pan Am Soars, Reviving The Golden Age Of Air Travel – Under new ownership, Pan American World Airways has announced the first in a series of planned themed journeys that harken back to its heyday. For decades, the Pan Am brand and its distinctive blue and white logo symbolized the excitement and elegance of air travel’s golden age. Even after the airline ceased operations in 1991, memories of its attentive service, gourmet meals, impeccably dressed crew, and spacious seating endure. Now, Pan Am is ready to take flight once more. Its inaugural journey will be a 12-day commemorative voyage limited to 50 guests. Craig Carter, CEO of Pan American World Airways and owner of Pan Am Brands, will host the trip, which will fly round-trip to Europe from New York City with stops in Bermuda, Lisbon, Marseille, London, and Foynes in Ireland.”, Forbes, July 7, 2024

===================================================================

Book Review – New Section

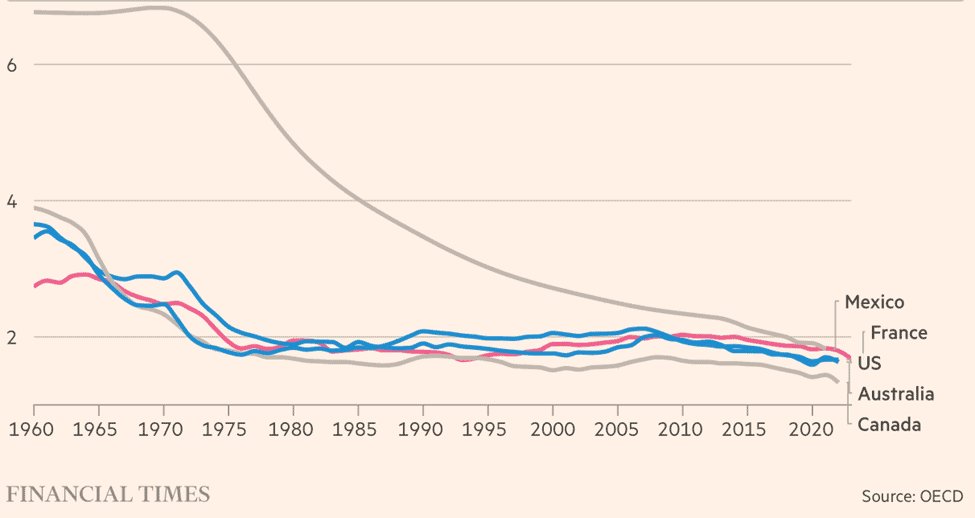

“’No One Left: Why the World Needs More Children’ by Paul Morland – A population calamity is unfolding before our eyes. It started in parts of the developed world and is spreading to the four corners of the globe. There are just too few babies being born for humanity to replace itself. Leading demographer Paul Morland argues that the consequences of this promise to be calamitous. Labour shortages, pensions crises, ballooning debt: what is currently happening in South Korea – which faces population decline of more than 85% within just two generations – threatens to engulf us all, and sooner than we think. In the developed world we may be able temporarily to stave off the worst of its effects with immigration, but many countries, including those the immigrants come from, will get old before they get rich. ‘No One Left’ charts this future, explains its causes and suggests what might be done.”, Hachelle Australia, July 4, 2024

===================================================================

Country & Regional Updates

Canada

“For the first time in more than 150 years, Alberta’s electricity is coal free – At 10:57 p.m. on Sunday, June 16, Alberta’s last coal plant went offline. An official announcement shortly followed, quietly signalling the end of coal-fired electricity in Alberta. Coal accounted for 80 per cent of Alberta’s electricity grid in the early 2000s and it still amounted to 60 per cent just 10 years ago. Rapidly growing, low-cost renewable energy further supported the phase-out, along with companies investing in gas-fired electricity. All these actions accelerated the transition away from coal at a faster rate than anticipated.”, The Globe and Mail, July 6, 2024

===================================================================

China

“Decathlon, Lululemon and other sportswear brands accelerate store openings and adjust China store strategies – Sports fashion brands are considering opening larger stores or upgrading services as brand upgrading strategies. Since the beginning of this year, many sports and fashion brands such as Decathlon, lululemon, Zara, and Arc’teryx have opened large stores or upgraded store services, such as creating sports communities, in order to enhance user experience and improve brand positioning. On June 27, yoga wear brand Lululemon opened its first store in North China in Beijing Sanlitun Taikoo Li. The brand’s store in this business district was originally very small and located on the underground floor of the shopping mall. After the upgrade, it became a large street-side store covering three floors.”, Caixin, July 5, 2024. Compliments of Paul Jones, Jones & Co., Toronto

===================================================================

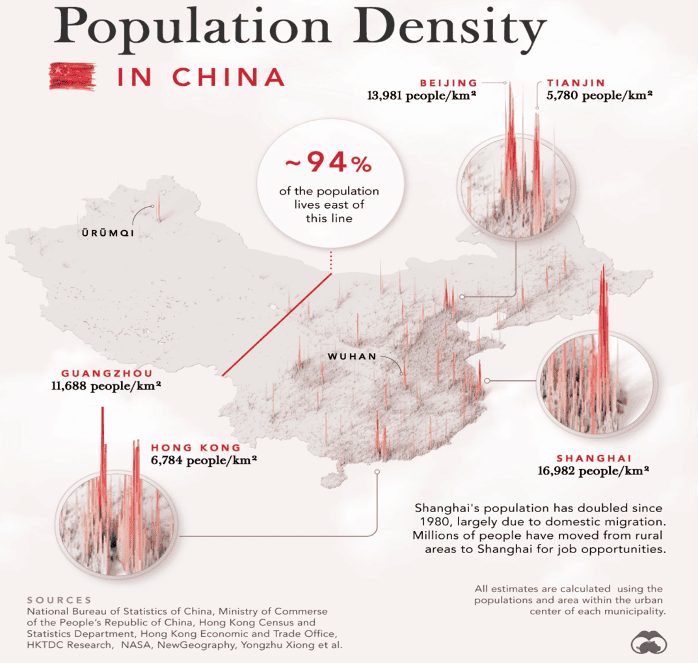

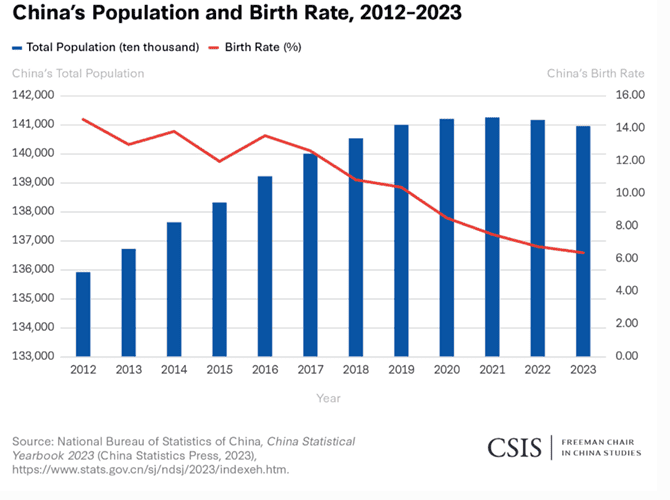

“China’s Population Density Visualized Using a 3D Map– For seven decades, China’s population was the world’s largest until India took that particular crown in 2023. Still, 1.4 billion people live in the country that stretches across 3.7 million square miles (9.6 million km²). However, as seen in the map above, 94% of the Chinese population lives east of the Heihe-Tengchong line, which is only 43% of the country’s area. Here are all of China’s cities with at least one million residents, from the 2020 census. Clearly noticeable are the provinces they are found in—on the eastern edge of the country, matching the population spikes seen above.”, Visual Capitalist, July 3, 2024

===================================================================

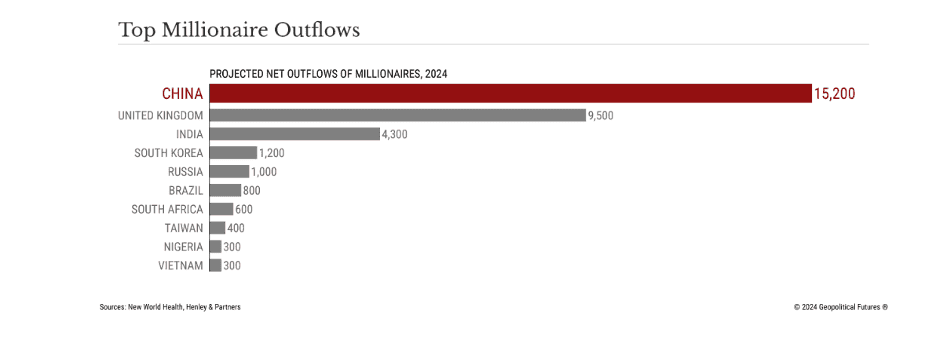

“Young, Rich and Restless in China – Economic conditions and draconian regulatory campaigns have led to record breaking levels of emigration. China is at the top of the list, having already seen an exodus of millionaires thanks to the COVID-19 pandemic and its economic discontents – not to mention President Xi Jinping’s anti-corruption campaign. All told, H&P estimates that China is set to lose some 15,200 of its most wealthy people this year, up from 13,800 the year before. (According to one estimate, there were in 2023 roughly 1.7 million people in China with personal wealth worth over 10 million yuan, or $1.4 million.) Importantly, young Chinese are starting to follow suit.”, Geopolitical Futures, June 28, 2024

===================================================================

Egypt

“Cairo Inks $72.4 Billion in Agreements and MOUs at Egypt-EU Investment Conference – Following the expanded agreement between Cairo and the International Monetary Fund (IMF), in which Egypt has largely aligned with IMF recommendations, investor confidence in Egypt has increased and will continue to draw in similar agreements and MOUs. Gaining additional investment is essential for boosting private sector growth and expanding jobs in Egypt. The Egypt-EU Investment Conference follows a March 2024 agreement between the European Union and Egypt in which they agreed to a financing package worth 7.4 billion euros ($8.1 billion) between 2024 and 2027 to support Egypt’s economic reforms, boost energy exports from Egypt to Europe and curb irregular migration through Egypt.”, Worldview Stratfor, July 1, 2024

===================================================================

European Countries

“Europeans feel the happiest and most respected in the world. Will the threat of an aging population change everything? When it comes to a life well-lived, there’s no beating Europe. For years, its countries have ranked among the highest in many lifestyle metrics. In 2024 and for the six years prior, Finland has held the crown as world’s happiest country, according to the World Happiness Report. Its other European peers followed—such as Denmark, Iceland, and the Netherlands. There’s more—Europeans felt respected and well-rested at varying degrees, pointing to an overall higher living standard and stronger social networks around people, according to Gallup’s Global Emotions Report. That scale varied from country to country—for instance, 97% of Portuguese respondents said they felt respected, while that figure dropped to 58% in Romania. Meanwhile, 75% of those in Ireland felt well-rested compared to just 53% in Greece.”, Fortune, July 5, 2024

===================================================================

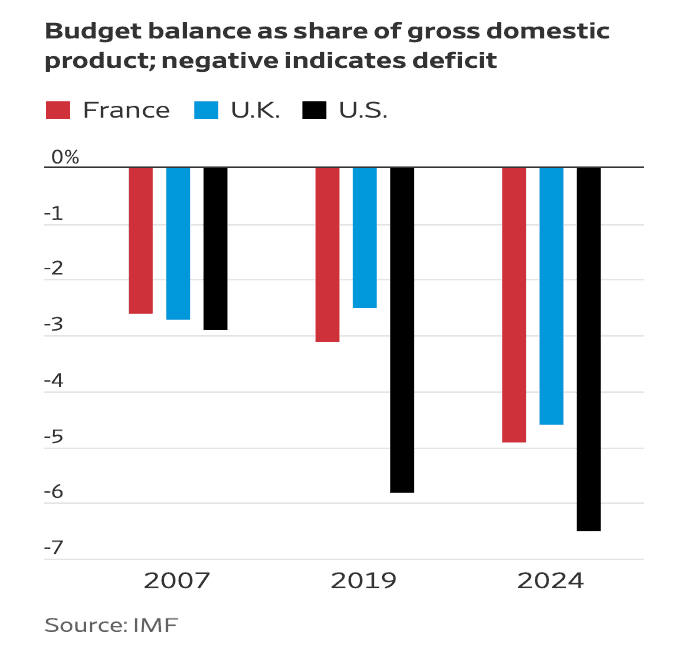

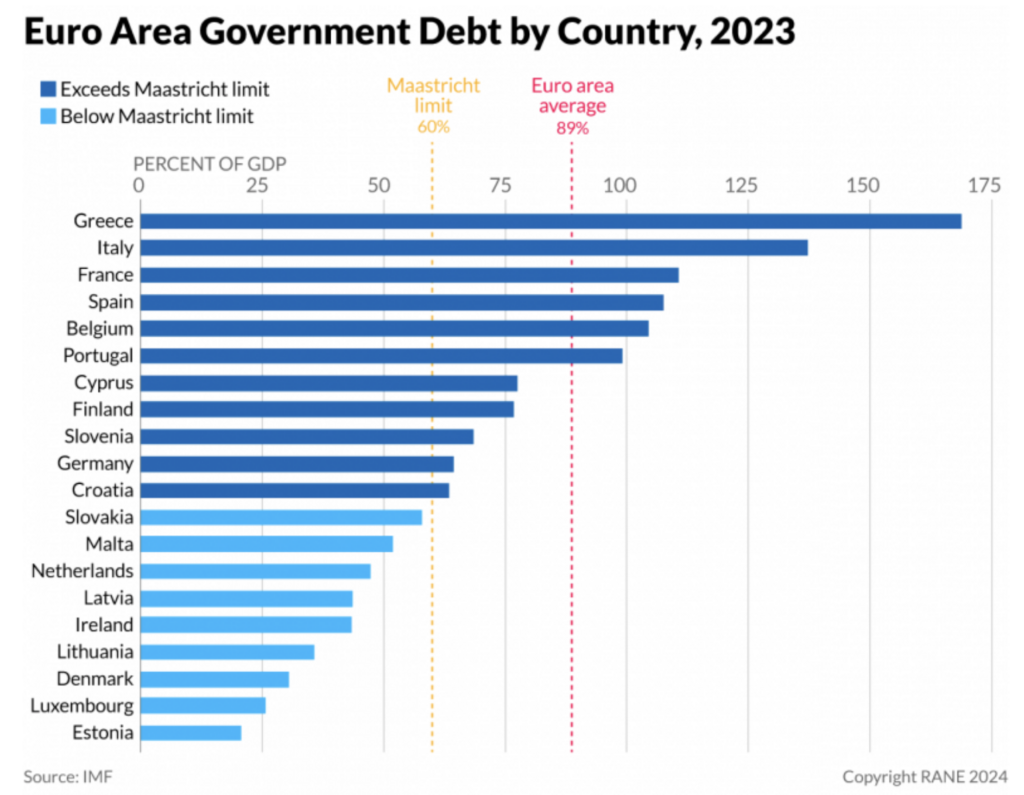

“Crushing Debts Await Europe’s New Leaders – Planned largess by election winners in Britain and France is on a collision course with soaring debts and deficits. Public debt is close to multidecade highs on both sides of the English Channel, where voters this week were electing new parliaments. In both France and the U.K., government spending and budget deficits as a share of gross domestic product are significantly above prepandemic levels. Economic growth remains lackluster, borrowing costs have surged, and demands on the public purse are rising, from defense to old-age pensions. All that means fiscal restraint—less spending or higher taxes—will be necessary, economists say. But politicians haven’t prepared electorates for that. On the contrary, they have signaled bold new spending plans.”, The Wall Street Journal, July 7, 2024

===================================================================

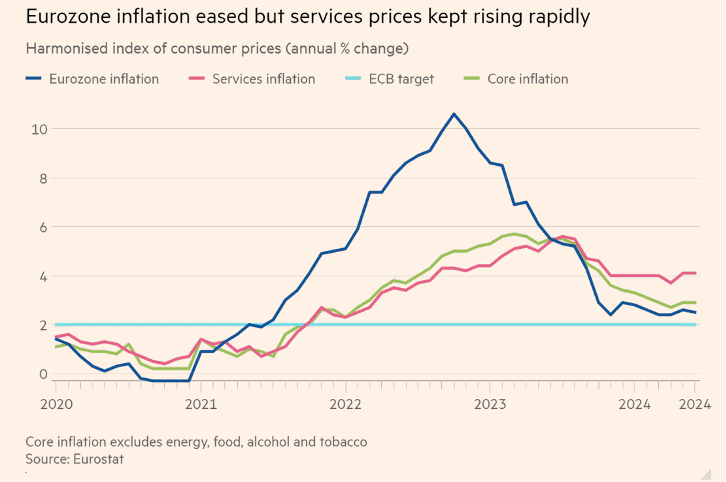

“Eurozone inflation slows to 2.5% – Lower rises in energy and fresh food costs are offset by persistently high services prices. Please use the sharing tools found via the share button at the top or side of articles. The figure for the year to June marked a slowdown from 2.6 per cent in the previous month. It was in line with economists’ forecast of 2.5 per cent in a Reuters poll. Please use the sharing tools found via the share button at the top or side of articles. Economists said the figures made it likely that the ECB would keep its benchmark deposit rate at 3.75 per cent at its next meeting on July 18 and further reductions in borrowing costs could hinge on how quickly services inflation comes down.”, The Financial Times, July 2, 2024

===================================================================

Greece

“Greece starts six-day working week for some industries – New legislation, which came into effect at the start of July, allows employees to work up to 48 hours in a week as opposed to 40. It only applies to businesses which operate on a 24-hour basis and is optional for workers, who get paid an extra 40% for the overtime they do. However, the move by the Greek government is at odds with workplace culture elsewhere in Europe and the US, where four-day working patterns are becoming more common.”, BBC, July 3, 2024

===================================================================

India

“Accenture taps Indian talent to take on the Big Four in consulting – Amid a downturn in the sector, using highly qualified Indian staff for complex tech work allows the consultancy to cut its prices when pitching to clients. There was a time when companies outsourced only their simpler work to India, but now Accenture is using the growing number of people there with MBAs and PhDs to do its highest-level advisory work for British and European clients. The consultancy is turning to top-ranking workers in India so it can cut its prices when pitching to clients, especially for IT-based work. In some cases, where the firm is bidding to transform or upgrade companies’ IT systems, up to 95 per cent of the skilled consultancy teams are based in India.”, The Times of London, June 23, 2024

===================================================================

“India’s big fat wedding industry is a US$130 billion gold mine for the economy – While many Indian weddings are elaborate affairs, there has been a notable shift in the scale of such ceremonies in recent years, according to industry observers. More couples are opting for intimate affairs that involve increased spending per guest. The sector is worth US$130 billion annually and is an immense driver of economic activity, according to a recent market report by the brokerage and investment research firm Jefferies. India holds more wedding ceremonies each year than any other country, with between 8 million and 10 million – or nearly 25 per cent of the global total. In comparison, about 2 million weddings and 8 million weddings take place annually in the United States and China, respectively. The value of India’s wedding industry is about twice that in the US, according to the report.”, The South Morning Post, July 6, 2024

===================================================================

Indonesia

“‘Not enough jobs’: Indonesia’s 10 million Gen Z face looming unemployment crisis – With so many young Indonesians neither working nor studying, experts warn of a demographic challenges in the coming years……..according to a recently released report by Statistics Indonesia (BPS), unemployment among those aged 20 to 24 had been on the rise in recent years, climbing from 12.86 per cent in 2015 to 17.02 per cent in 2022. This figure is significantly higher than the country’s average unemployment rate, which in February 2023 stood at 5.45 per cent, meaning that unemployment is particularly high for the younger age bracket. Jakarta is hoping to reach the status of a developed country in the next two decades, under its “Golden Indonesia 2045” vision, and the government is counting on young people to drive economic growth.”, (Edited for length), The South Morning Post, July 5, 2024

===================================================================

The Philippines

“Philippines overtakes China and Indonesia to be most dependent on coal-generated power – The Philippines’ dependency on coal-fired power surged 62% last year, overtaking China, Indonesia and Poland, according to London-based energy think-tank Ember. The Philippines was also the most coal-dependent country in Southeast Asia in 2023, as adoption of renewable electricity generation remained low. The share of electricity generated from coal in the country climbed to 61.9% last year compared to 59.1% in 2022. ‘Indonesia and the Philippines are the two most coal dependent countries in Southeast Asia and their reliance on coal is growing fast,’ the report said, adding that the Southeast Asian region saw a 2% uptick in coal reliance from 31% in 2022 to 33% last year.”, CNBC, July 3, 2024

===================================================================

South Korea

“South Korea Hikes Growth Forecast Sharply as Demand for AI Booms – South Korea revised its economic growth forecast sharply higher as booming global demand for artificial intelligence drives its semiconductor exports to record levels. The government sees gross domestic product expanding 2.6% this year, an upward revision from its previous forecast of 2.2%, according to a statement Wednesday from the Finance Ministry. The inflation forecast has been kept unchanged at 2.6%, matching an estimate by the Bank of Korea. The pick-up in economic projections underscores optimism about an economy that has bounced back from last year’s slump in semiconductor demand even as interest rates have stayed elevated.”, Bloomberg, July 2, 2024

===================================================================

Turkey

“Turkish inflation cools for first time in 8 months – Consumer prices increased 71.6 per cent in June from the same month in the previous year, a slower rate than expected and down from a nearly two-year high of 75.5 per cent in May, according to official data. The decline in inflation is one of the strongest signs to date that Turkey’s pivot away from unconventional monetary policy following President Recep Tayyip Erdoğan’s re-election in May last year is starting to bear fruit. The centrepiece of the new programme, which is slowly drawing back foreign investors who deserted the market in recent years, has been huge increases in borrowing costs. The central bank raised its main interest rate from 8.5 per cent in June last year to 50 per cent by March in an attempt to stomp out runaway price growth.”, The Financial Times, July 3, 2024

===================================================================

United Kingdom

“U.K. tech overtakes China, cementing its position as the world’s second-largest ecosystem by funding – China may be the world’s second-largest economy, but when it comes to startup funding, the U.K. is punching above its weight. Startups in the U.K. raised $6.7 billion in funding during the first half of 2024, helping dethrone China and propelling the U.K. to second place globally for funds raised, according to a new report. While the overall U.K. figure was down 2% year on year, according to data from global market intelligence platform Tracxn, it remained more robust than that of China, whose funding sat at $6.1 billion in H1 2024, helping the U.K. move into the No. 2 spot globally.”, Fortune, July 5, 2024

===================================================================

United States

“Empty Offices Risk Wiping Out $250 Billion in Commercial Property Value – US office vacancy rate is forecast to hit a peak of 24% by 2026. Nearly one-quarter of all US office space will be vacant by 2026 as working from home persists, slicing commercial-property values by as much as $250 billion, according to a report from Moody’s. Office-vacancy rates are expected to rise to 24% from 19.8% in the first quarter of this year in the US, reducing revenue for office landlords by between $8 billion and $10 billion when combined with the impact of lower rents and lease turnovers, the authors of the report said.”, Bloomberg, June 27, 2024

===================================================================

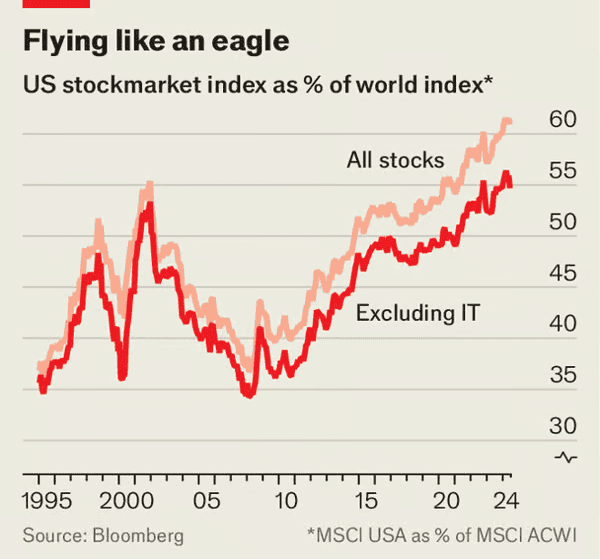

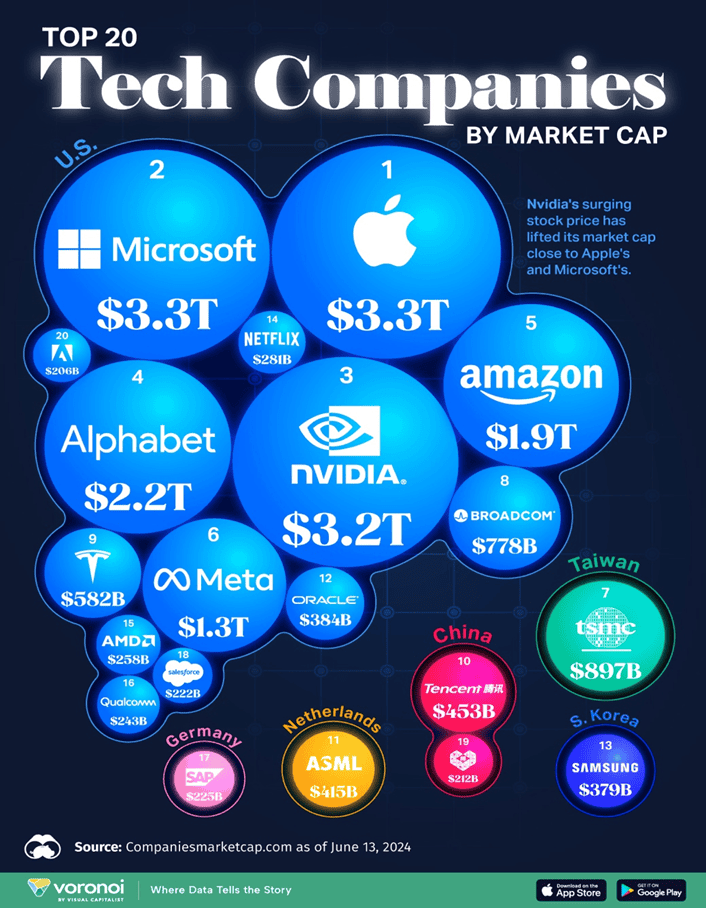

“American stocks are consuming global markets– That does not necessarily spell trouble. America’s share of the world’s stockmarket capitalisation has climbed pretty consistently over the past decade and a half, and sharply this year. It now stands at 61%. That is astonishing dominance for a country which accounts for just over a quarter of global gdp. The extent of market concentration is all the more extreme given what is happening within the American stockmarket itself. Just three companies—Apple, Microsoft and Nvidia—make up a tenth of the market value of global stocks.”, The Economist, June 27, 2024

===================================================================

Brand & Franchising News

“Leveraging AI in franchising: opportunities and legal considerations – In the context of franchising, AI presents opportunities to streamline operations, automate tasks and promote data-driven decision-making. The following are examples of several current and potential use cases of AI in franchising: Automation, Supply chain, Customer support and Personalized marketing. Franchisees are increasingly leveraging AI to tailor marketing strategies, optimize product assortments and create targeted promotions that would improve consumer conversion rates and bolster the bottom-line profitability of the franchise system.”, Osler law firm. July 5, 2024

===================================================================

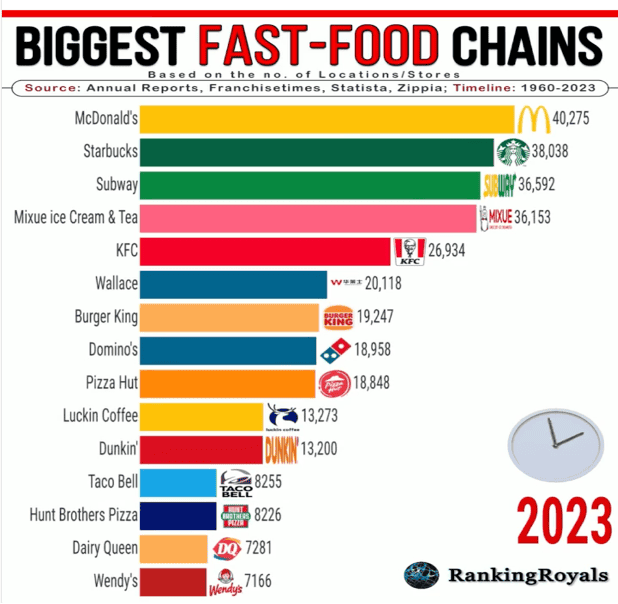

“63 years of progress distilled into one eye-opening video – What fascinated me was observing the constant churn. Brands rose, fell, and then completely disappeared over the decades, a harsh reality of how brutal the food industry can be. But among this sea of change, a few exceptional companies thrived and fought their way to the top. That meteoric rise wasn’t pure luck – it was the result of a laser focus on quality, an uncanny ability to tap into evolving customer tastes, and treating their people as the cornerstone of their success. Today, let’s recognise that an unwavering drive for excellence and a willingness to adapt can transform even the simplest ideas into enduring legacies.”, From a LinkedIn post by Akshay Jatia, with the video by Justin Fischer, July 2, 2024.

===================================================================

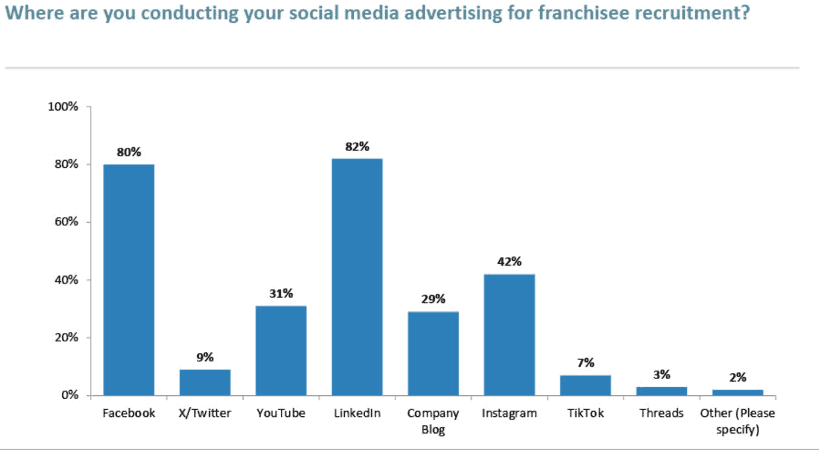

“2024 AFDR Data – The Use of Social Media with (U.S.) Franchise Recruitment – Franchise Update Media has been researching franchise lead generation and franchisee recruitment processes for more than a decade. An annual in-depth online survey queries franchise development professionals about a number of issues related to their lead generation and recruitment strategies. All the responses are collected, aggregated, and analyzed to produce a detailed look into the recruitment and development practices, budgets, spending allocations, and strategies of a wide cross-section of franchisors. The results are presented each year in the Annual Franchise Development Report (AFDR), which can be ordered online at afdr.franchiseupdate.com. The 2024 AFDR report is a valuable resource that can provide crucial insights on franchise development lead generation and recruitment best practices. It’s the kind of information that can help brands assess what they are doing right, and what needs improvement.”, Franchising.com, July 8, 2024

===================================================================

“Fast-Growing (Canadian) Burrito Chain Plans to Open 750 Restaurants In the U.S. – Burritobar, a Toronto-based Tex-Mex chain that offers classics like burritos, tacos, and bowls, just announced a franchise agreement with U.S. partners in New Jersey, planning for 93 new franchised restaurants across the state within the next two decades. The new agreement follows similar franchise plans in Michigan, Florida, Virginia, Maryland, Tennessee, Iowa, Nebraska, North Texas, Illinois, and Ohio, totaling 750 Burritobar restaurants planned for opening in the United States in the near future. Known as BarBurrito in Canada, the chain first opened in Toronto in 2015, quickly becoming a go-to for fast-casual Tex-Mex food across Canada. With 325 restaurants, the brand is Canada’s fastest-growing Mexican food franchise. In 2020, BarBurrito changed its name to Burritobar for its debut in the American market, with new franchise agreements opening two locations in Michigan and one in Delaware.”, Eat This, Not That!, July 5, 2024

===================================================================

“National pizza chain based in the Northwest reportedly on brink of bankruptcy– A national fast-casual pizza chain is exploring a potential bankruptcy filing as the company looks for a buyer, according to several report…..people familiar with MOD Pizza say the Seattle chain with 512 locations across the country has hired legal and financial advisers to work on a possible sale of the business or bankruptcy filing. ‘We’re working diligently to improve our capital structure and are exploring all options to do so. Since this is an ongoing process, it would be inappropriate to speculate about an outcome,’ a MOD representative shared with Nation’s Restaurant News in a statement. MOD was founded in 2008 as part of a wave of build-your-own pizza places. It currently has 32 locations in Oregon.”, Oregon Live, July 6, 2024

===================================================================

“Q&A with Little Caesars International Franchisee Leo Gonzalez – Was the process of acquiring a franchise in another country more difficult than in the United States? No, it wasn’t more difficult to build a franchise in Mexico. It’s actually easier to find the space to build out new franchise locations and also more cost effective. Mexico has a lot more space to franchise with restaurants that are bigger in size. About 65% of our Little Caesars there are free-standing with drive-thrus. These tend to do well with our guests and provide the convenient dining experience the brand is known for at all hours of the day.”, Franchising.com, July 2024

===================================================================

“Tim Hortons’ parent company inks two deals to bolster presence in China – Restaurant Brands International says it’s spending up to $45 million on two deals intended to boost its presence in China and spur growth in what the company sees as a promising market. The parent company behind Tim Hortons, Burger King, Popeyes Louisiana Kitchen and Firehouse Subs says the first deal will see it acquire Popeyes China from Tims China, which operates Tim Hortons franchises in the country. RBI values the purchase at $15 million, noting Popeyes China has opened 14 restaurants in Shanghai since initially launching in August 2023.”, CTV, July 2, 2024

===================================================================

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

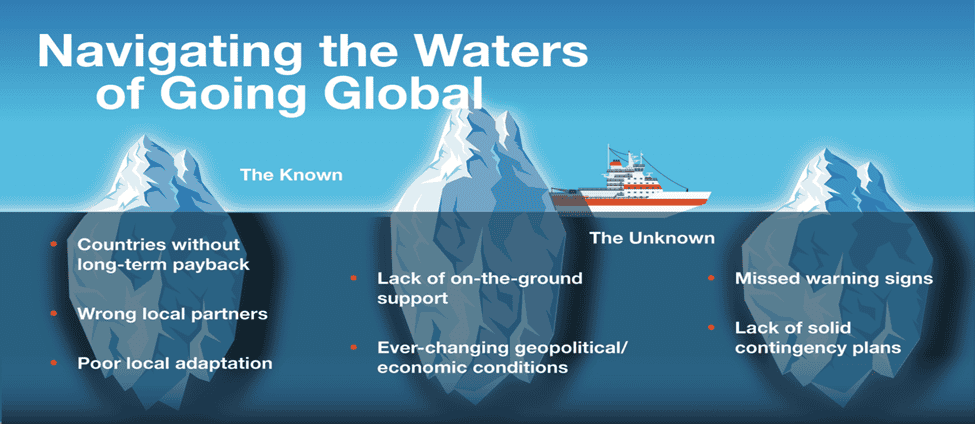

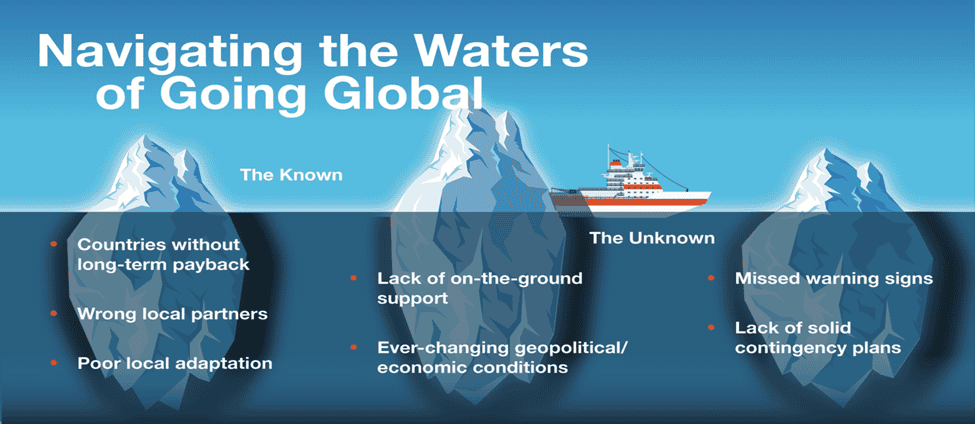

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it, click on the QR code for a complimentary call with Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 111, Tuesday, June 25, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Commentary about the 111th Issue: The USA now gets a third of all global capital flows while China inbound investment craters. Birth rates in rich countries halve to hit record low. Norway discovers a huge source of rare minerals. The Philippines becomes the world’s hottest luxury housing market. The new owner of the chicken Big Mac trademark will expand into Europe. Southeast Asia is the go to place for companies leaving China. Managers around the world are learning Gen Z is different. Starbucks® and Hilton® ‘marry’. The top 20 tech companies control almost 20% of the world’s stock market value. India will need 100 million new homes in the next decade. India’s stock market out grows China. And KFC® is selling panini sandwiches, wagyu burgers and hot bagels in their new ‘healthy’ brand in Shanghai.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

===================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

===================================================================

First, A Few Words of Wisdom From Others For These Times

“The biggest threat to your organization is the lack of imagination in your leadership” Hari Abburi .

“One day you will wake up and there won’t be any more time to do the things you’ve always wanted. Do it now.”, Paul Coelho

“Only those who will risk going too far can possibly find out how far one can go.”, T. S. Eliot

Highlights in issue #111:

- We’re in a new era’ of supply chain disruption, HSBC analyst says

- Southeast Asia is a top choice for firms diversifying supply chains amid U.S.-China tensions

Brand Global News Section: Guzman y Gomez®, Hilton®, KFC®, Mathnasium®, McDonalds®, Quiznos®, Starbucks® and Supermac®

==================================================================

Interesting Data, Articles and Studies

“The 20 Biggest Tech Companies by Market Cap – The world’s 20 biggest tech companies are worth over $20 trillion in total. To put this in perspective, this is nearly 18% of the stock market value globally. This graphic shows which companies top the ranks, using data from Companiesmarketcap.com. Market capitalization (market cap) measures what a company is worth by taking the current share price and multiplying it by the number of shares outstanding. Here are the biggest tech companies according to their market cap on June 13, 2024. It’s clear from the biggest tech companies that involvement in AI can contribute to investor confidence. Among S&P 500 companies, AI has certainly become a focus topic. In fact, 199 companies cited the term “AI” during their first quarter earnings calls, the highest on record. The companies who mentioned AI the most were Meta (95 times), Nvidia (86 times), and Microsoft (74 times).”, Visual Capitalist, June 17, 2024

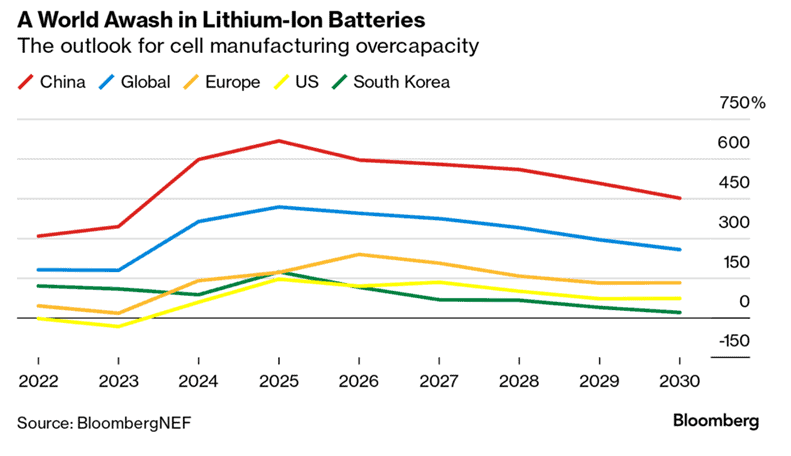

“Europe’s EV Battery Plans Are Getting Crushed by China, US – As electric-vehicle sales slow, companies including Volkswagen, Stellantis and Mercedes-Benz are scaling back or refocusing battery projects. Chinese manufacturers are slashing costs and the US is drawing away investment with lucrative subsidies. China already has excess battery-making capacity, can make cells at a fraction of the cost it takes in Europe, and has a head start on the next generation of cell technology.”, Bloomberg, June 20, 2024

==================================================================

Number of Children Per Woman

“Birth rates in rich countries halve to hit record low – Steep decline in fertility will ‘change face of societies’ and affect growth prospects, says OECD Steep decline in fertility will ‘change face of societies’ and affect growth prospects, says OECD. The average number of children per woman across the 38 most industrialised countries has fallen from 3.3 in 1960 to 1.5 in 2022, according to a study by the OECD published on Thursday. The fertility rate is now well below the “replacement level” of 2.1 children per woman — at which a country’s population is considered to be stable without immigration…”, The Financial Times, June 20, 2024

==================================================================

“Top 10 most expensive cities for expats in 2024 – Hong Kong retained its pole position as the world’s most expensive city for expats in 2024, according to Mercer. Asia’s biggest financial hubs have once again clinched the top spots for being the costliest cities for international workers to live in, according to Mercer. Hong Kong was ranked as the most expensive city for expats to live in, followed by Singapore and Zurich, according to the Cost of Living City Ranking 2024. Cities in Switzerland — Zurich, Geneva, Basel and Bern — snagged four out of 10 spots. New York City ranked No. 7. The top five spots had no change from the year before, but London climbed 9 positions from No. 17 to 8. The survey compared the costs of more than 200 items in each of the 226 cities studied — including the price of housing, transportation, food, clothing, household goods and entertainment. New York City was used as the benchmark and currency fluctuations were measured against the U.S. dollar.”, June 18, CNBC

==================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“This Mexican Port Is Angling to Be a Nearshoring Gateway – The Guaymas Port in Mexico is looking to reposition itself as a transport hub that officials say will accelerate nearshoring in the region. Sonora Governor Alfonso Durazo announced this week that the port in the northwest region of Mexico would be revamped under a deal signed with the Port of Antwerp-Bruges International in Belgium and backed by a $220 million investment from the federal government. Ford Motor is one of the first companies looking to take advantage. The carmaker will kick off a pilot out of Guaymas starting this week— some 2,000 cars will make their way out of the port to Chile by the end of the year. Ford estimates that switching to exporting from Guaymas will reduce highway transport by 3,300 kilometers (2,050 miles) per vehicle.”, Bloomberg, June 19, 2024

==================================================================

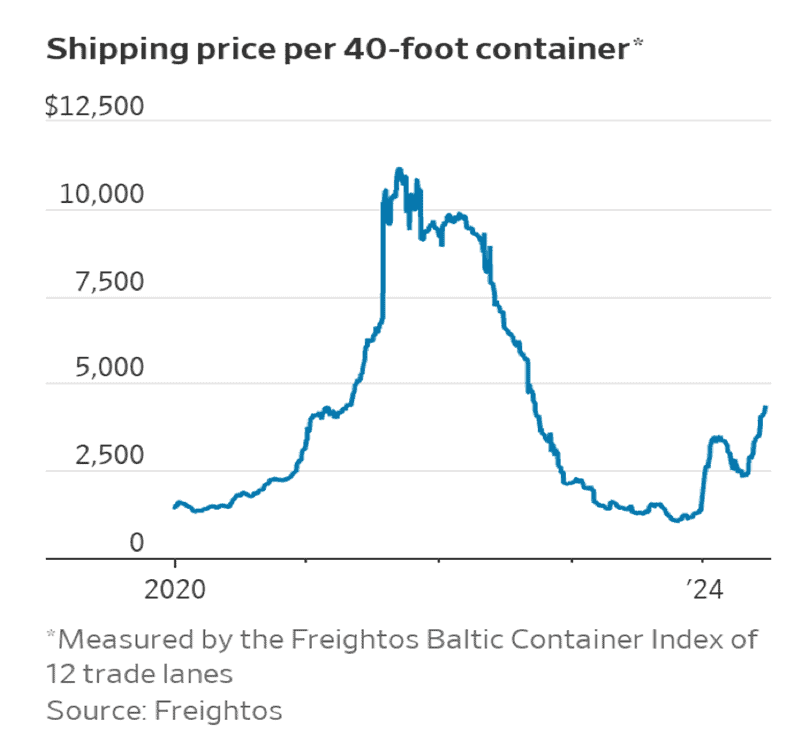

“Ocean Shipping Prices Are Pushing Toward Pandemic-Era Highs as Congestion Swells – Disruptions from the diversions around the Red Sea violence are backing up vessels with the peak shipping season still looming. The Port of Singapore, a global hub for container lines, has been swamped, leading to long wait times for a berth and increased shipping costs. Ship backups that plagued seaports during the Covid pandemic are making a comeback, as vessel diversions because of attacks in the Red Sea trigger gridlock and soaring costs at the start of the peak shipping season. Flotillas of containerships and bulk carriers are growing off the coasts of Singapore, Malaysia, South Korea and China while ports in Spain and other parts of Europe look to dig out from container piles. Houthi rebel attacks on commercial shipping in the Red Sea, which have effectively closed the Suez Canal since the end of last year, are being felt at faraway ports as the disruptions extend voyage times, throw ships off schedule and strand sea containers. T he average worldwide cost of shipping a 40-foot container hit $4,119 the week ending June 14, according to Freightos, more than triple the cost in June last year and the highest rate since September 2022.”, The Wall Street Journal, June 24, 2024

==================================================================

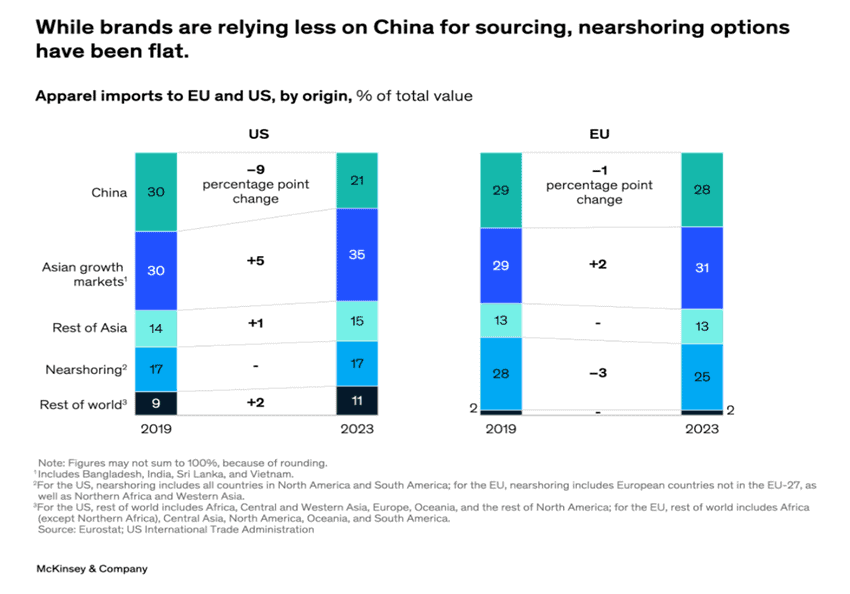

“Is nearshoring in fashion? Nearshoring—locating production close to consumer markets—has been a top priority for US and European apparel executives since 2016, according to McKinsey surveys. But in practice, nearshoring has remained flat, senior partner Karl-Hendrik Magnus and colleagues find. Although apparel companies are shifting sourcing away from China, production has moved primarily to other Asian countries.”, McKinsey & Co., June 12, 2924

==================================================================

“Norway just loosened China’s stranglehold on rare minerals critical to the global economy—and it’s a huge win for Europe and the U.S. Norway just struck a gold mine. Well, a rare mineral mine – The Norwegian mining company, Rare Earths Norway, just uncovered the largest deposit of rare earth elements in Europe. The discovery has major implications not just for the company, which is certainly poised for a windfall, but for global geopolitics. Norway’s discovery would finally make Europe a player in the industry. In January, the Norwegian parliament voted 80–20 to allow offshore, deep-sea mining of rare minerals in remote waters to the north of the country. Norway, which is already a major producer of oil and natural gas, would become the first country to allow its seabed to be mined for rare minerals.”, Fortune, June 11, 2024

“We’re in a new era’ of supply chain disruption, HSBC analyst says – After a series of COVID-19 pandemic disruptions, ongoing geopolitical conflicts, and now a historic year in which more than 60 countries are holding elections, supply chain managers face a growing number of challenges. ‘I would actually say that we’re in a new era,’ HSBC Americas head of global trade solutions Marissa Adams told Yahoo Finance in a video interview. ‘I don’t think that there is a normalization anymore. I think that what companies are now facing is that supply chain disruption is the new norm.’ Supply chain disruptions have always been a part of global trade, even dating back to the Silk Road, which connected trade routes in Europe, the Middle East, and Asia. However, companies in the current market are more exposed to unexpected global events, which impacts their ability to trade effectively.”, Yahoo Finance, June 16, 2024

==================================================================

Global & Regional Travel

“Thailand is still attracting fewer visitors than before COVID – But its tourism sector is thriving thanks to AI, savvy marketing, and Season 3 of ‘White Lotus’. “There are three reasons for the slow recovery,” says Bill Barnett, founder and managing director of C9 Hotelworks, a Phuket-based hospitality consultancy: “China, China, and China.” The country was the largest source of tourists for Thailand in 2019, sending 11 million. But just 3.5 million Chinese visited in 2023, mostly because of China’s gloomy economy. Hotels have also cut costs by choosing not to restore positions slashed during COVID. They’ve automated repetitive tasks like check-ins. Chatbots can answer many guest inquiries, and existing staff have learned to multitask.”, Fortune, June 17, 2024

Country & Regional Updates

BRICS Countries

“Malaysia, Thailand Declare Intentions to Join BRICS Ahead of Russia Summit – (Malaysia) Prime Minister Anwar Ibrahim declared his intention to apply to the bloc after it doubled in size this year by luring Global South nations — partly by offering access to financing but also by providing a political venue independent of Washington’s influence.

Thailand — a U.S. treaty ally — last month announced its own bid to join BRICS, named after members Brazil, Russia, India, China and South Africa. The bloc “represents a south-south cooperative framework which Thailand has long desired to be a part of,” Foreign Minister Maris Sangiampongsa told reporters last week. For countries seeking to mitigate the economic risks of intensifying U.S.-China competition, joining BRICS is an attempt to straddle some of those tensions. In Southeast Asia, many nations depend economically on trade with China while also simultaneously welcoming the security presence and investment Washington provides.”, Caixin Global, June 21, 2024

==================================================================

Brazil

“Market conditions drive international airlines away from Brazil, Airbus says – Airbus executive Gilberto Peralta said in an interview last week that the reluctance from international airlines to enter Brazil was mainly due to judicial uncertainty, citing a high number of legal actions taken by Brazilian customers against airlines, as well as high fuel prices. ‘Capital barriers are gone, a foreigner could come and set up a company in Brazil, but they don’t… It’s a lot of trouble,’ he said. Brazil’s strong consumer protections make it easy for flyers to sue carriers for a range of issues, including delayed or canceled flights.”, Reuters, June 17, 2024

==================================================================

Canada

“What managers are getting wrong about early career Gen Z talent – Generation Z, the demographic cohort born between 1997 and 2012, may be the most misunderstood generation in the work force. Despite their dynamic capabilities and intelligence, Gen Z professionals have gained a reputation for being ‘difficult.’ Consider a recent survey by online resume platform Resume Builder, 40 per cent of hiring managers self-reported a bias against hiring Gen Z workers. But to address these issues, a recent panel of experts at the University of British Columbia found Gen Z needs empowerment that meets their needs as individuals, rather than criticism. In this case, generational prejudice, may, more than anything, be a sign that this is a cohort of early career workers unlike any the workplace has seen before.”, The Globe and Mail, June 18, 2024

==================================================================

China

“How China’s Human Capital Impacts Its National Competitiveness – China’s efforts to maintain economic growth, strengthen supply chains, develop strategic science, technology, engineering, and mathematics (STEM) sectors, and secure a modern military edge hinges on the ability to cultivate and utilize human capital. China’s ability to cultivate, attract, and retain human capital—or as Beijing more commonly puts it, national “talent”—will shape its competitiveness vis-à-vis the United States as a global power and impact the future of innovation and talent on the world stage. Inequality between urban and rural populations in China presents a critical challenge to the country’s economic productivity and opportunities to develop human capital.”, Center for Strategic and International Studies, June 17, 2024

==================================================================

India

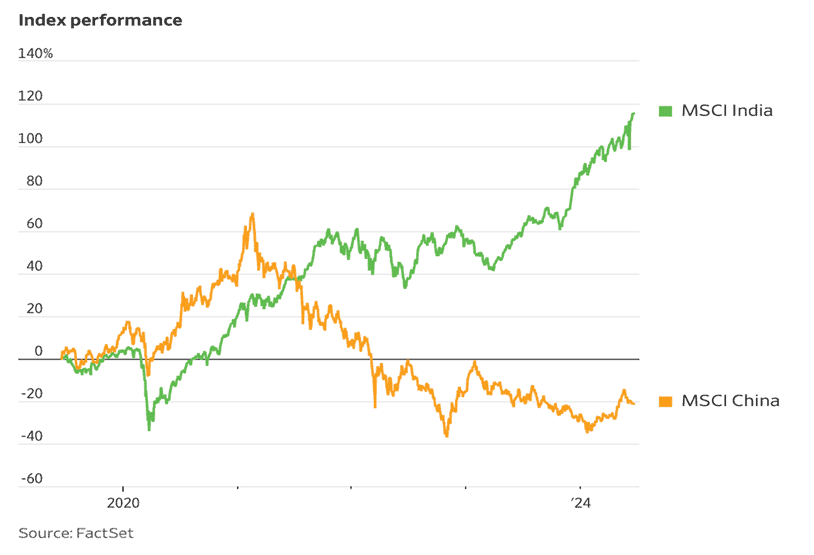

“India Beats China in Stock Performance – India’s market has boomed while China’s has slumped, and their wide valuation gap seems justified. Not many stock markets can hold a candle to the red-hot Nasdaq. India is an exception. Strong profit growth, geopolitical tailwinds and favorable demographics have presented a compelling investment case for the country. From the end of 2019 through Tuesday, the MSCI India Index surged 110%, ahead of the U.S. tech-heavy index’s 99% gain. Even more surprising, though, is how well India has fared compared with what is—for now, at least—the world’s largest emerging stock market: MSCI China is down by 30% over the same period.”, The Wall Street Journal, June 19, 2024

==================================================================

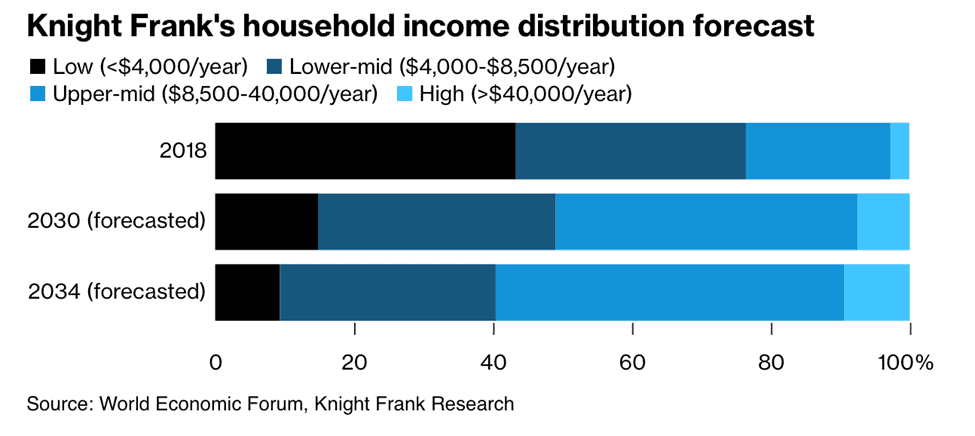

“India Will Need to Build 100 Million Homes This Decade Amid Rising Household Incomes – The nation’s property market has heated up since the pandemic. About 70 million Indian households will turn eligible for home ownership over the next 10 years, which, along with people seeking to upgrade their apartments, should create requirement for as many as 100 million new houses. Real estate consulting firm Knight Frank expects the demand for homes created by rising income levels to translate into $906 billion of economic output over the next ten years.’, Bloomberg, June 12, 2024

==================================================================

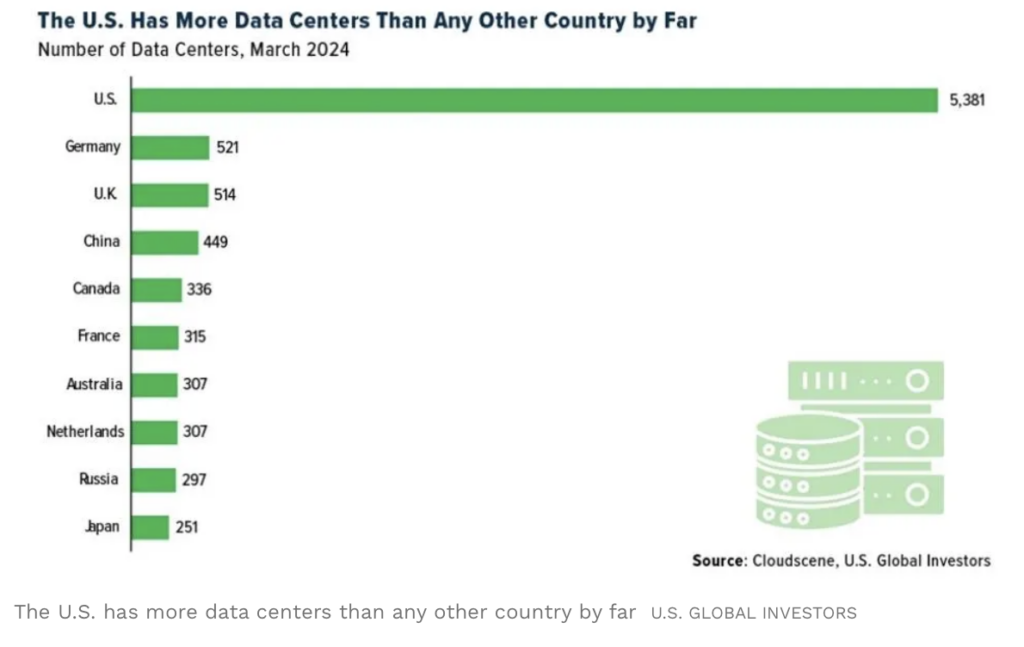

Malaysia

“Malaysia is emerging as a data center powerhouse amid booming demand from AI – Over the past few years, the country has attracted billions of dollars in data center investments, including from tech giants like Google, Nvidia and Microsoft. Much of the investments have been in the small city of Johor Bahru, located on the border with Singapore, according to James Murphy, APAC managing director at data center intelligence company DC Byte. ‘It looks like in the space of a couple of years, [Johor Bahru] alone will overtake Singapore to become the largest market in Southeast Asia from a base of essentially zero just two years ago,’ he said.”, CNBC, June 16, 2024

==================================================================

The Philippines

“Philippines Becomes World’s Hottest Luxury Housing Market As Developers Push Million Dollar Homes – Major real estate companies are accelerating the development of luxury residential projects in the Philippines and introducing more million dollar homes to tap resilient demand from both affluent local and foreign buyers in the world’s best-performing prime housing market.Prime residential prices in the Makati financial district and nearby towns climbed 26% in the 12 months through March 2024, the biggest jump among 44 cities tracked by Knight Frank in the Prime Global Cities report published in May. The growth can be attributed to the Philippines’ robust economic performance (among Southeast Asia’s fastest growing economies), as well as significant infrastructure investments in and around Metro Manila, according to the British property consultancy.”, June 11, 2024

==================================================================

South Africa

“South Africa’s Big Chance to Move Beyond Its Past – Some South Africans are prone to saying that the country has a habit of rushing to the cliff’s edge, staring into the abyss and then stepping back. Avoiding a civil war and negotiating the end of Whites-only rule in 1994 was one such moment. This month’s unlikely alliance between the African National Congress and its most implacable critic, the Democratic Alliance, may be another. The magnitude of the ANC’s decline in popularity means the only alternative would have been an alliance with one or both of its large populist rivals. Negotiations over cabinet positions have only just started, and compromises need to be made in areas where the ANC and DA remain diametrically opposed.”, Bloomberg, June 22, 2024

==================================================================

Southeast Asia

“Fortune Southeast Asia 500 – The region’s GDP grew more than 56% to nearly $4 trillion between 2015 to 2023, according to the International Monetary Fund. The Fortune Southeast Asia 500 debuts right as global business is starting to pay closer attention to the region. Southeast Asian economies are benefiting from supply chain diversification as rapid domestic development builds the next wave of global middle-class consumers. Our new ranking reflects the rise and fall of energy markets, multinational supply chains, and tourism in some of the world’s most dynamic economies.”, Fortune, June 22, 2024

==================================================================

“Southeast Asia is a top choice for firms diversifying supply chains amid U.S.-China tensions – Southeast Asia has emerged as a top beneficiary of the “China Plus One” strategy where businesses seek to reduce the risks associated with full reliance on China’s market or supply chain. Companies, even as they maintain a presence in China, have been diversifying manufacturing operations by expanding into other countries such as Vietnam and Indonesia. ‘Southeast Asia is well-placed to benefit significantly from the China+1 phenomenon as both foreign and Chinese companies diversify their supply chains and operations,’ said Kuo-Yi Lim of Monk’s Hill Ventures. ‘Geopolitical [tensions have] accelerated these activities, which started during the Covid lockdowns’ Lim added. The ‘China Plus One’ strategy seeks to reduce the risks associated with total reliance on China’s market or supply chain through diversifying manufacturing operations, expanding into other countries even as companies’ maintain a presence in China.”, CNBC, June 23, 2024

==================================================================

United Kingdom

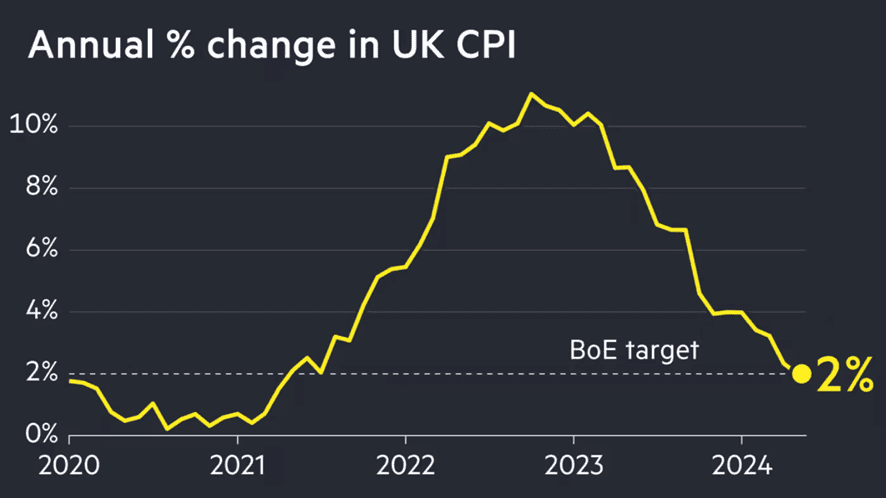

“UK inflation hits Bank of England’s 2% target in May – The figure marks a milestone for the UK economy after the worst inflationary upsurge in a generation. The Bank of England last hit its 2 per cent inflation target in July 2021. The Office for National Statistics data, which was in line with forecasts by economists polled by Reuters, means that headline inflation in the UK is now below that of the US and Eurozone. Core inflation, which strips out food and energy, fell to 3.5 per cent in May, down from 3.9 per cent in April but still relatively high.”, The Financial Times, June 19. 2024

==================================================================

United States

“How the US Mopped Up a Third of Global Capital Flows Since Covid – De-dollarization narrative swept aside by overseas investors Key question is whether policies shift, upending the dynamic. In the face of calls around the world to diversify out of the dollar in recent years, the US has nabbed almost one-third of all the investment that flowed across borders since Covid struck. An International Monetary Fund analysis sent by request to Bloomberg News shows that the share of global flows has climbed — not fallen — since a shortage of dollars in 2020 spooked global investors and the 2022 freezing of Russian assets stoked questions about respect for free movement of capital. The trend marks a major shift from the pre-pandemic days when capital poured into emerging markets, including a rapidly growing China. The big US geopolitical rival has seen its share of gross global inflows more than halve since the pandemic hit.”, Bloomberg, June 16, 2024

==================================================================

“California restaurants have lost traffic since the minimum wage increase – According to new data from Placer.ai, traffic patterns in California shifted to negative compared to the national average after the minimum wage increase went into place April 1. It’s probably still way too early to understand the full impact of California’s minimum wage increase to $20 an hour on April 1. But for now, we do know several chains have raised their prices in response to that 25% increase and, so far, those increases have led to lower foot traffic. It has also led to a perception shift among consumers, 78% of whom now think of fast food as a “luxury,” according to recent Lending Tree data. As such, several brands have adjusted their strategy to be more value focused and that value is defined differently depending on market.”, Nation’s Restaurant News, June 14, 2024

=================================================================

Vietnam

“Vietnam F&B industry in 2024 continues growth with new trends – The value of the Vietnamese F&B market is expected to grow by 10.92% this year compared to 2023. In 2024, the value of the food and beverage (F&B) market in Vietnam is expected to increase by 10.92% compared to 2023, generating revenues of over VND655 trillion (US$26.1 billion). Despite the economic challenges, the survey found that around 80% of businesses in Vietnam remain positive and have the resources to grow in the future, with nearly 52% planning to expand.”, VF Franchising, Ho Chi Min City, June 2024

==================================================================

Brand & Franchising News

“Gen Z demand makes Guzman y Gomez the hottest (Australian) retail stock – Guzman y Gomez accounted for nearly a third of all trades on some of the country’s most popular retail platforms after it hit the ASX on Thursday, as investors rushed to buy as many shares as they could in the Mexican-themed restaurant group. Guzman y Gomez has set a target of 1000 stores in Australia.”, Australian Financial Review, June 21, 2024

==================================================================

“‘Big Mac’ trademark win increases appetite for Supermac’s – as inquiries from potential franchisees in Europe flood in. Supermac’s, the fast-food restaurant chain founded by entrepreneur Pat McDonagh, received around 50 enquiries from potential franchisees across Europe after winning a trademark case against McDonald’s. Any expansion into Europe or Great Britain would be Supermac’s first foray outside the island of Ireland.”, Irish Independent, June 15, 2024

“KFC explores new KPro store type in Shanghai focusing on healthy light meals with single items priced at 30 yuan (US$4) per person – It is reported that the menu of the Shanghai store mainly promotes five staple foods: panini, wagyu burger, energy bowl, hot bagel, and toto rolls. It also provides snacks such as chicken wings, and drinks such as yogurt shakes, coffee, cola, and lemon tea. Most of the single products are priced at more than 30 yuan, and some products are more than 40 (US$5) yuan. There are already many players in the healthy light food market, including Wagas, Super Bowl FOODBOWL, and Shaye Light Food, all of which have advantages in different price ranges. The new KPro store in Shanghai focuses on “five signature energy staple foods, all-time, easy”, “high-quality protein, frying and grilling, cooked to order”., Industry Caiking, June 17, 2024. Compliments of Paul Jones, Jones & Co., Toronto

==================================================================

“What Actually Caused The Downfall Of Quiznos – The reasons are complicated — while it does seem that sub sandwiches have declined in popularity, the reason for Quiznos’ precipitous downfall seems to be more about poor management rather than changing tastes. A big issue was that it expanded too fast — its initial decade was tame, starting from one Denver store in 1981, and only growing to 18 by 1991. Then it went public in 1994, and started expanding faster: Franchisees complained that there were too many locations too close together. The stores simply weren’t selling that many sandwiches: At the chain’s peak, Restaurant Business reports that the average per-restaurant revenue was $400,000 per year, a little over $1,000 per day.”, Chowhound, June 10, 2024

==================================================================

“McDonald’s scraps AI drive-thrus after customer complaints – The automated system struggled with accents and served the wrong food. McDonald’s partnered with IBM in 2021 to introduce the system, which promised to simplify and speed up operations with voice-activated ordering. It has been used in more than 100 restaurants in the US. There have been reports that the technology has struggled to differentiate between different accents, leading to incorrect orders. Customers shared videos online of the wrong orders, including the machine adding nine orders of sweet tea to one woman’s bill and adding bacon to another’s dessert. McDonald’s did not comment on accuracy or technology challenges. In a statement, IBM said its automated technology ‘is proven to have some of the most comprehensive capabilities in the industry’”., The Times of London, June 18, 2024

==================================================================

“Mathnasium Expands into Romania with New Master Franchise Agreement – Mathnasium, a prominent name in math education, is set to launch in Romania following the announcement of a master franchise agreement. Led by Ms. Dana Bănică, this agreement aims to establish a minimum of 25 Mathnasium Learning Centers across Romania within the next six years, marking a significant expansion into a new market for the brand.”, VF Franchising, June 2024

==================================================================

“Starbucks and Hilton marry (in mainland China) – Although they did not join the price war they rolled in the membership system. On June 20, Starbucks China announced that the Starbucks Rewards Club membership system has been upgraded. For the first time, Starbucks has joined hands with Hilton Group to jointly innovate the membership experience. From now on, members of both parties can join each other’s membership system through their respective apps and other channels to enjoy special benefits. Although it has its own rhythm, it is not difficult to see that Starbucks faces very fierce competition in the Chinese market. In the first fiscal quarter of 2024, Starbucks China’s same-store sales increased by 10% year-on-year, but the average customer spending decreased by 9% year-on-year.”, Yical. June 29, 2024. Compliments of Paul Jones, Jones & Co., Toronto

==================================================================

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 110, Tuesday, June 11, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Comments About This 110th Issue: Countries – other than the USA – begin to cut interest rates. McDonald’s loses the right to call a chicken Big Mac, a Big Mac. The almost continually strong US$ is not helping US exports of products and services. Heathrow is like a Second World War airport (but we knew that!). The world’s biggest shopping center is getting bigger. A query into ChatGPT requires about 10 times as much electricity to process as a Google search

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“Technological advancements are vastly overrated in the short term, and vastly underrated in the long term. All failure is failure to adapt, all success is successful adaptation.” ― Arthur C. Clarke

“Risk-taking is the cornerstone of empires.” — Estée Lauder

“The key is not to prioritize what’s on your schedule, but to schedule your priorities.” — Stephen Covey

Highlights in issue #110:

The Dollar Is at Its Strongest Since the 1980s. Can It Last?

The Great Global Rate Cut Cycle Is Going to Be a Bumpy Ride

China economy gathers pace on back of services growth

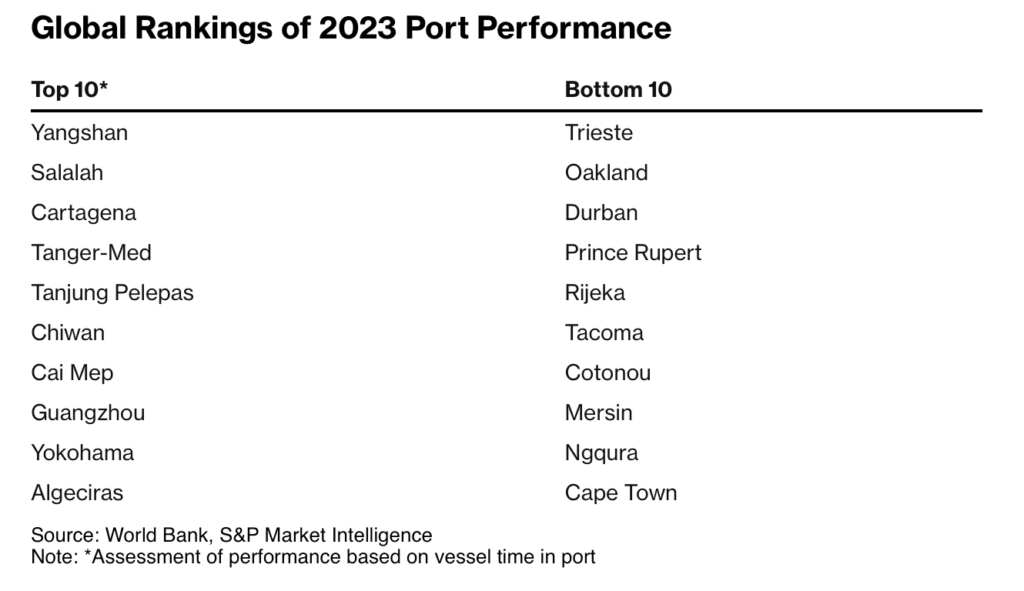

Asia and Mideast Dominate Latest Port Performance Ranking

The world’s largest shopping mall is about to get even bigger

Irish fast food chain’s victory over McDonald’s to use Big Mac name

Brand Global News Section: Anthony’s Coal Fired Pizza & Wings®, Jimmy Johns®, McDonalds® and Starbucks®

Interesting Data, Articles, and Studies

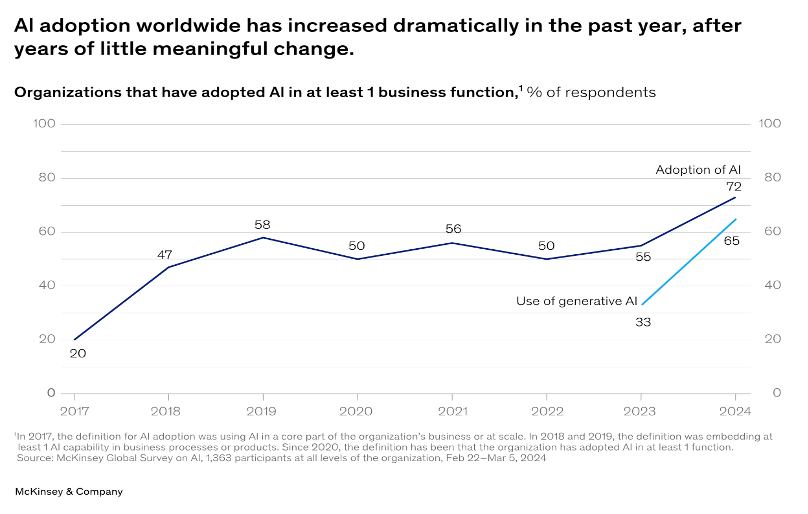

“The state of AI in early 2024: Gen AI adoption spikes and starts to generate value – As generative AI adoption accelerates, survey respondents report measurable benefits and increased mitigation of the risk of inaccuracy. A small group of high performers lead the way. If 2023 was the year the world discovered generative AI (gen AI), 2024 is the year organizations truly began using—and deriving business value from—this new technology. In the latest McKinsey Global Survey on AI, 65 percent of respondents report that their organizations are regularly using gen AI, nearly double the percentage from our previous survey just ten months ago.”, McKinsey & Co., May 30, 2024

=========================================================================

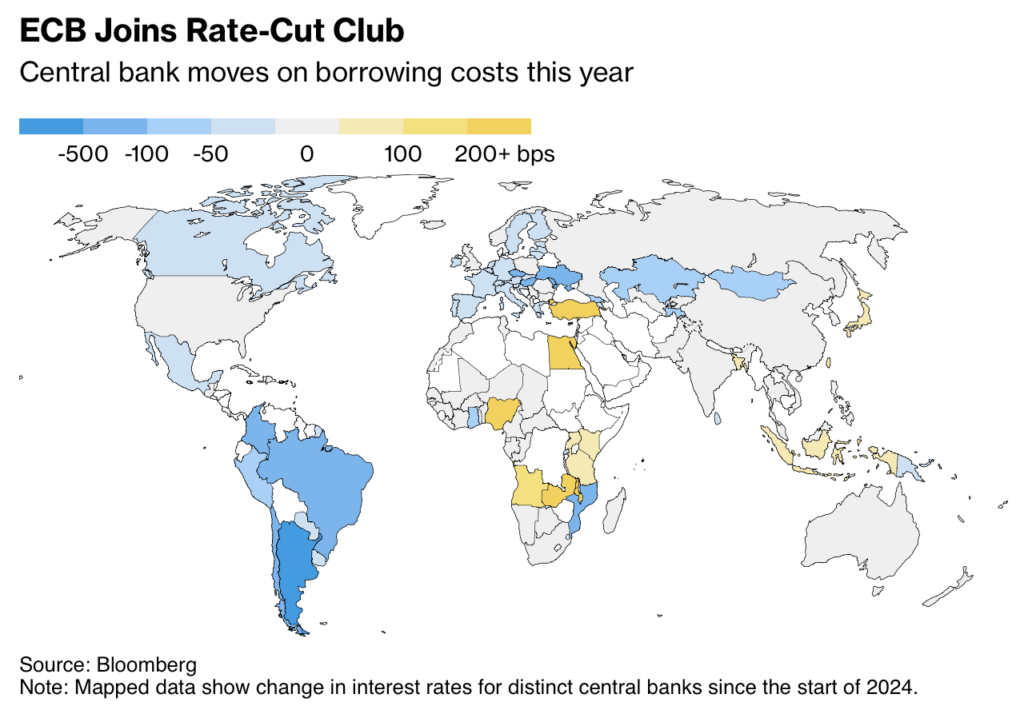

“The Great Global Rate Cut Cycle Is Going to Be a Bumpy Ride– After the steepest interest-rate tightening cycle in decades and a long holding cycle, how fast to unwind such settings is now a dominant theme. The Bank of Canada and European Central Bank both cut rates by 25 basis points in the Group of Seven’s first easing moves since the pandemic. They joined officials in Switzerland and Sweden who moved earlier this year.”, Bloomberg, June 7, 2024

“The U.S. Global Food Security and Global Water Strategies: Increasing Coherence and Navigating Challenges – Adequate supplies of clean water and nutritious food are vital to human well-being. They are also increasingly important to U.S. foreign policy. Globally, 71 percent of all the water withdrawn from the Earth’s rivers, lakes, and aquifers is devoted to agriculture. Worldwide, food production will have to rise 50 percent by 2050 to meet the increasing demands of growing populations, prospectively requiring global water withdrawals 30 percent greater than today.”, Center for Strategic and International Studies, May 30, 2024

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Costs of Economic Fragmentation Include Moving to Hard-to-Work Places – Global supply chains are realigning through geopolitically neutral economies to boost resilience and hedge dependencies on the US and China. In some cases, though, shifting to new places comes with a costly drawback: extra red tape. Four of nine so-called bridge nations — a grouping Bloomberg dubbed “connectors” in an analysis last year — were among the world’s top 20 most complex jurisdictions in which to start and operate a business, according to TMF Group….Greece ranks as the most complex jurisdiction, according to TMF Group. The gauge, which ranks 79 economies based on 292 business indicators like the speed of obtaining a business license…..The ranking shows how re-globalization, while necessary to diversify sourcing in a world of geopolitical fragmentation, often moves operations to markets where companies might sacrifice productivity gains and back-office efficiencies.”, Bloomberg, May 30, 2024

“The mounting strains on global shipping – Pirate attacks, Middle East instability and drought are causing disruption and congestion at the world’s ports. The problems follow many shipping lines’ decisions, at the end of 2023, to reroute voyages away from the waters off Yemen after facing attacks from Iran-backed Houthi militias. Container ship arrivals in the Gulf of Aden, at the entrance to the Red Sea, are down 90 per cent on the same period last year according to data from Clarksons, the shipping services provider. Diverting vessels from Asia and bound for Europe around the Cape of Good Hope adds an additional nine to 14 days to voyage times.”, The Financial Times, May 27, 2024

“Asia and Mideast Dominate Latest Port Performance Ranking – Global container ports got a breather in 2023 as the pandemic’s hit to supply chains eased and trade volumes stabilized after a few turbulent years. But even in a so-called normal year, labor issues, extreme weather and attacks on vessels near Yemen complicated operations at marine gateways all over the world. Despite that, more than 100 ports improved their efficiency ranking from the year before, according to a new report.”, Bloomberg, June 5, 2024

Global & Regional Travel

“Hyatt reaches record global pipeline of 129K rooms – Hyatt Hotels Corporation has revealed that its pipeline has grown by nearly 85% since 2017, reaching a record 129,000 rooms. The company said it has doubled its luxury rooms, tripled its resort rooms and quintupled its lifestyle rooms since 2017. Additionally, the World of Hyatt loyalty program has quadrupled its membership since 2017 and was up 22% as of the end of the first quarter compared to the same period last year, reaching 46 million members globally.”, Hotel Business, June 3, 2024

“Heathrow like a Second World War airport, laments Emirates chief – Airline president Sir Tim Clark says the airport is lagging behind in terms of customer experience. The president of Emirates airlines has likened Heathrow to a dilapidated Second World War airport in terms of the experience it offers customers. Sir Tim Clark, the boss of the UAE flag-carrier, said the airport put its shareholders and paying dividends before running a world-class business. Clark said the terminal needs to be redesigned, with the plaza reduced in size to allow more room for security and check-in. He said: ‘It’s an old airport. I’m afraid it’s very difficult. You need to open up the whole terminal. Where we are based, new airports are being built employing the latest technologies to streamline the process of all the customer-facing elements. That is not the case at Heathrow.”, The Times of London, June 3, 2024

Country & Regional Updates

Canada

“Canada first major central bank to cut rates ahead of ECB – The Bank of Canada became the first major central bank among the Group of Seven countries to cut interest rates, opening the door for others to follow suit before the US Federal Reserve. While the Canadian central bank’s decision to cut its cash rate by a quarter of a percentage point to 4.75 per cent was widely expected, BoC governor Tiff Macklem flagged further reductions which bolstered market sentiment. Inflation in Canada has slowed this year to hit a three-year low of 2.7 per cent in April. While inflation has stayed below 3 per cent for four straight months, it is still above the central bank’s 2 per cent target.’, Australian Financial Review, June 6, 2024

China

“Hedge fund billionaire Ray Dalio says benefits of investing in China outweigh risks – ‘Diversification and investment in China is desirable,’ Dalio said in a virtual presentation at the Greenwich Economic Forum in Hong Kong on Wednesday. ‘Chinese assets are very attractively priced.’ There are concerns among international investors about potentially being penalised by their governments for investing in the country, with anti-China policies set to gain bipartisan support in the US election this year, he said. Meanwhile, China’s own economic problems, including its protracted real estate crisis, debt issues and the knock-on effects of those, are also making investors anxious.”, South China Morning Post, June 5, 2024

“China economy gathers pace on back of services growth – Caixin services sector purchasing managers’ index for May jumped to 54, the highest reading since July 2023. Interest rates have been lowered, borrowing increased to lift public investment and taxes cut, all as part of a concerted effort to reverse slowing economic activity. The International Monetary Fund recently raised its GDP growth projection for China this year to 5 per cent from 4.6 per cent on the back of more policy support, matching Beijing’s 5 per cent annual target. The IMF urged the CCP to focus future policy on stimulating domestic demand rather than prioritising strategic industries.”, The Times of London, June 5, 2024

Euro Zone

“The Eurozone Has Come a Long Way Since the 2009 Debt Crisis, but Risks Remain – In the face of the quasi-existential debt crisis, the euro area has seen major institutional reform, which have helped make the single currency more resilient. Although the euro area proved resilient in the face of recent shocks brought on by the COVID-19 pandemic and the war in Ukraine, the current institutional architecture continues to make it vulnerable to severe shocks.”, Stratfor Worldview, June 6, 2024

Saudi Arabia

“Aramco Sale Set to Raise at Least $11.2 Billion for Saudi Arabia – Saudi Aramco’s mega stock offering is set to raise at least $11.2 billion, the biggest such deal globally in three years that will help fund the government’s multitrillion-dollar push to transform the kingdom’s economy. The proceeds will help Crown Prince Mohammed Bin Salman’s ambitious plans to revamp the economy with investments including in sports, artificial intelligence, tourism and the desert project of Neom. The kingdom’s budget has been in a deficit for six quarters, and it has raised over $40 billion from local and international markets this year to fill the gap.”, Bloomberg, June 6, 2024

==================================================================

United Arab Emirates

“The world’s largest shopping mall is about to get even bigger – United Arab Emirates real estate developer Emaar Properties announced Monday plans for a 1.5 billion dirham ($408 million) expansion of Dubai Mall. The 12-million-square-foot mall is already the largest shopping center in the world by total area, and the expansion will add a further 240 luxury stores, along with new food outlets. Last year, Dubai welcomed a record number of tourists, and the mall says it received 105 million visitors last year, up 19% from 2022.”, CNN, June 5, 2024

United Kingdom

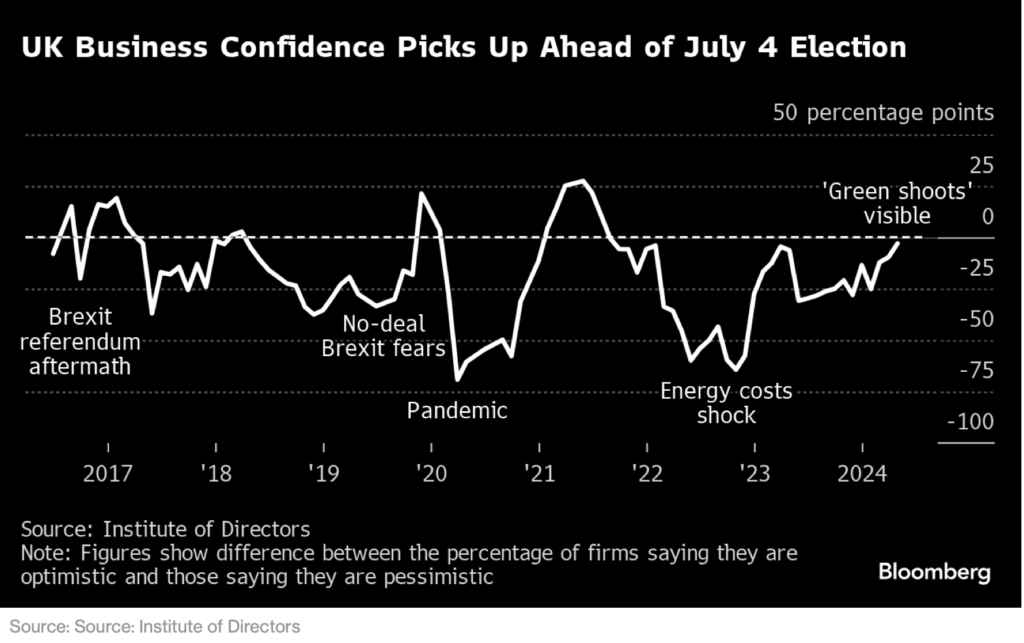

“UK Survey of Executives Finds Confidence at Highest Since 2021 – UK businesses entered the general election campaign at their most optimistic in over 2 1/2 years after the economy quickly bounced back from recession, according to the Institute of Directors. The business lobby group said “green shoots” of recovery are “clearly visible” after its economic confidence index rose to minus 3 in May. It was up from minus 10 the previous month and the highest since September 2021 just after the economy emerged from lockdown. Business sentiment has moved into a ‘neutral phase’ after being relatively pessimistic for much of last year, said Roger Barker, director of policy at the IOD. ‘Green shoots are clearly visible, and the direction of travel is positive.’”, Bloomberg, May 31, 2024

United States