EGS Biweekly Global Business Newsletter Issue 66, Tuesday, October 4, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

We say goodbye to Queen Elizabeth II. Chinese consumers get frugal, China’s energy imports decline and Starbucks will add 3,000 more stores in China. The war weighs down European Union country economies. And a new study says 90% of franchised businesses in the USA are negatively impacted by inflation.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Some people dream of success, while other people get up. Every morning and make it happen.”, Wayne Huizenga

“Success is walking from failure to failure with no loss of enthusiasm.”, Winston Churchill

“Remain a lifelong student. Don’t lose that curiosity.”, Indra Nooyi

HiiHighlights in issue #66:

- Brand Global News Section: Chipolte®, Dave & Buster’s®, Pokeworks®, Tommy Car Wash Systems®, Tous les Jours® and Wayback Burgers®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

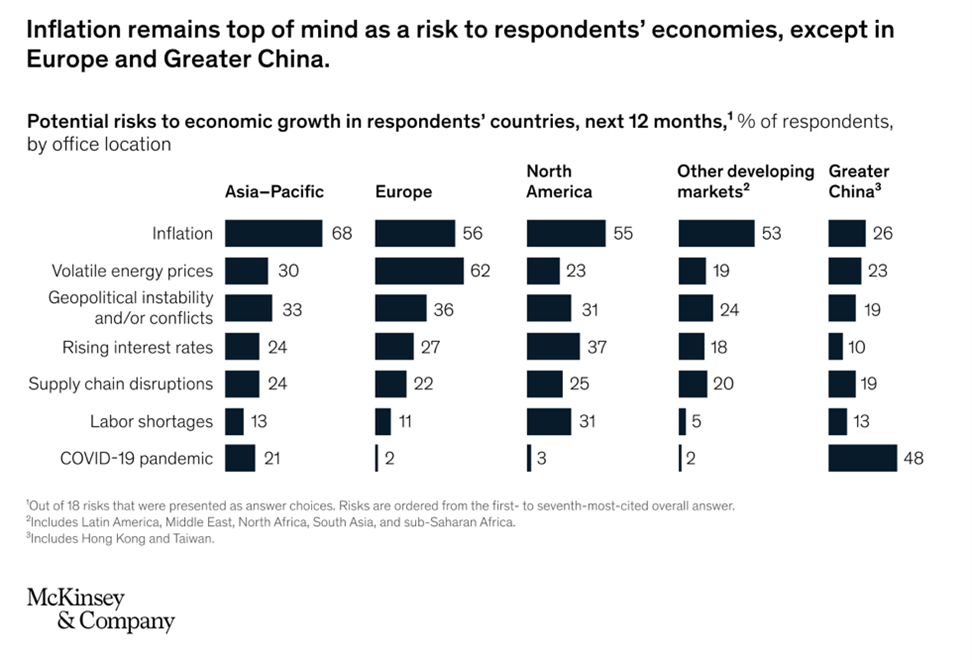

“Economic conditions outlook, September 2022 – In stormy weather, survey respondents maintain realism about the global economy. While geopolitical conflicts and inflation remain top of mind, concerns about energy volatility predominate in Europe. In September, respondents in most regions cite inflation as the main risk to growth in their home economies for the second quarter, according to the latest McKinsey Global Survey on economic conditions.1 Geopolitical instability and conflicts remain a top concern as well, most often cited as the greatest risk to global growth over the next 12 months.”, McKinsey & Co., September 29, 2022

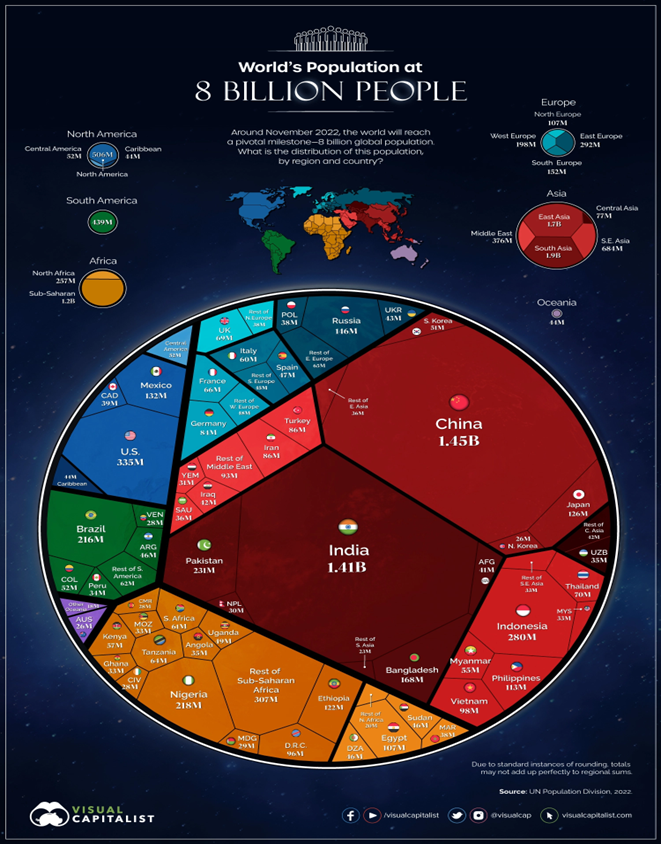

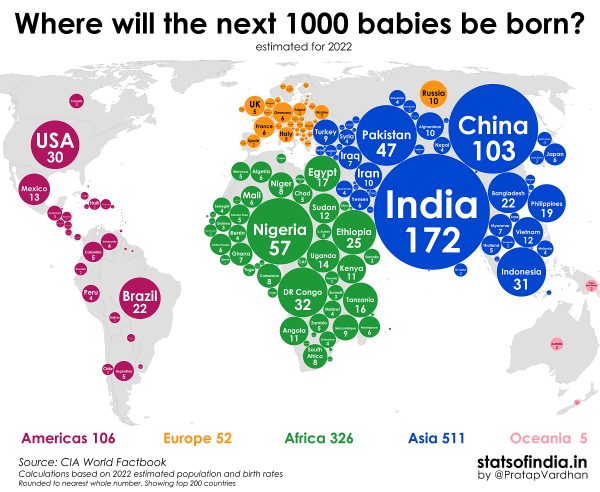

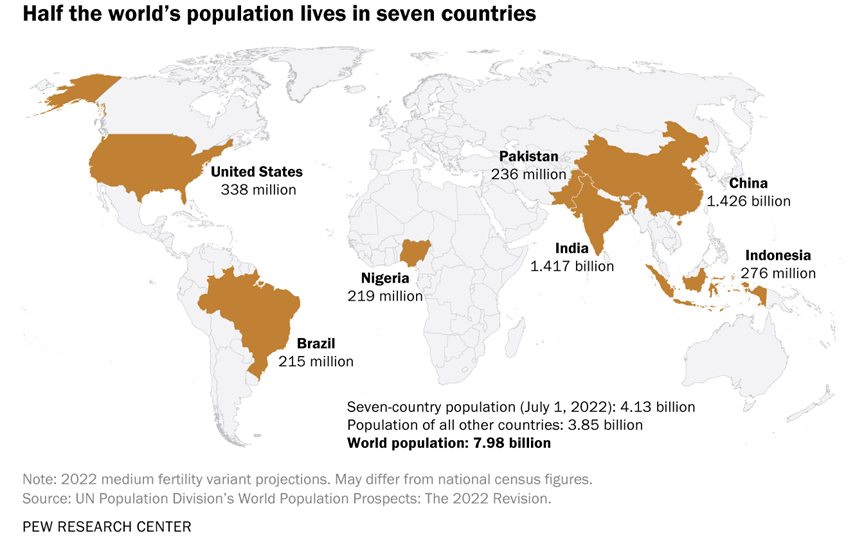

“The World’s Population at 8 Billion – At some point in late 2022, the eight billionth human being will enter the world, ushering in a new milestone for humanity.In just 48 years, the world population has doubled in size, jumping from four to eight billion. Of course, humans are not equally spread throughout the planet, and countries take all shapes and sizes. The visualizations in this article aim to build context on how the eight billion people are distributed around the world.”, Visual Capitalist / UN Population Division 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

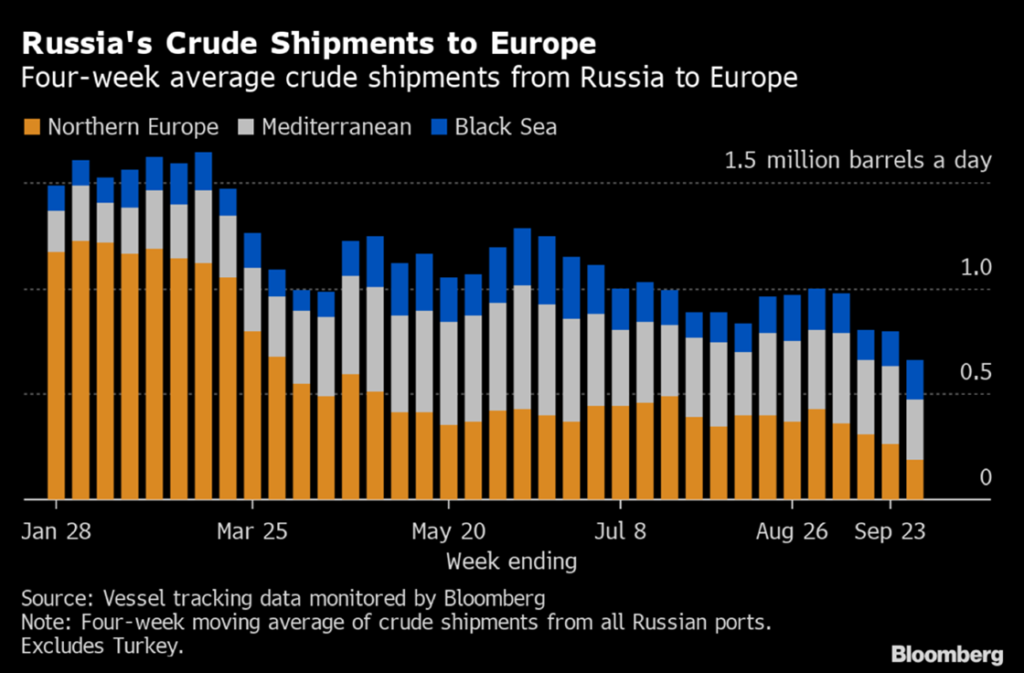

“Europe Turns Its Back on Russian Crude as Sanctions Draw Closer – Shipments to Europe are down 60%. The European market for Russia’s seaborne crude is drying up as sanctions draw nearer, and the country’s Asian customers aren’t picking up the slack like they once were. With just over two months until a European Union ban on seaborne crude imports comes into effect, shipments to the bloc plus the UK are down by about 60% from where they were before Moscow’s troops invaded Ukraine.”, Bloomberg, October 3, 2022

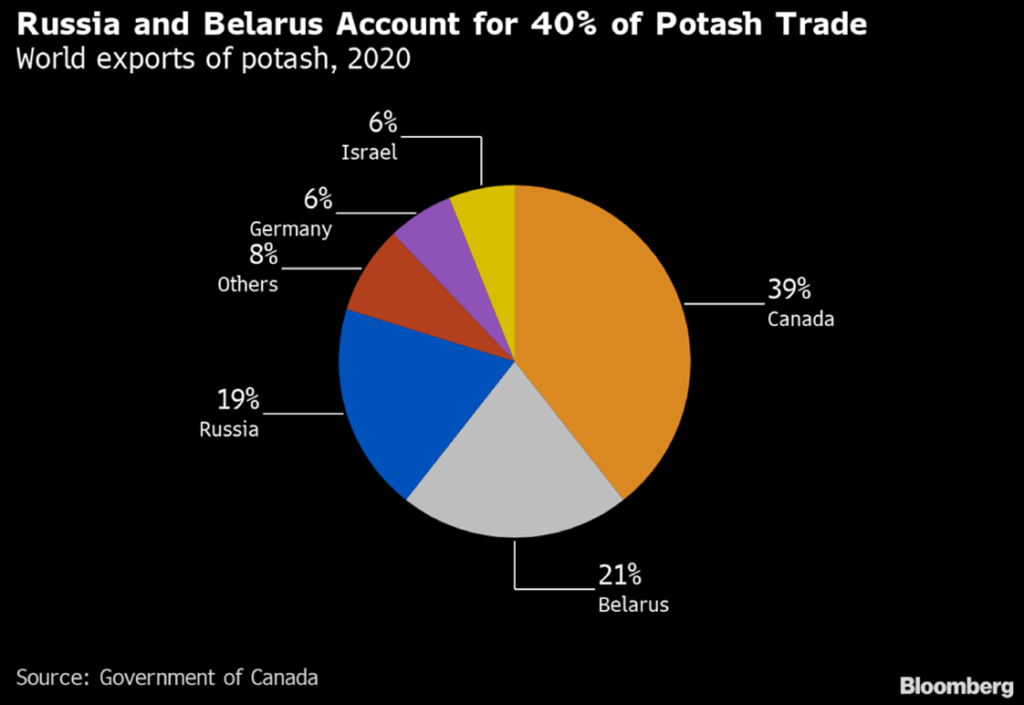

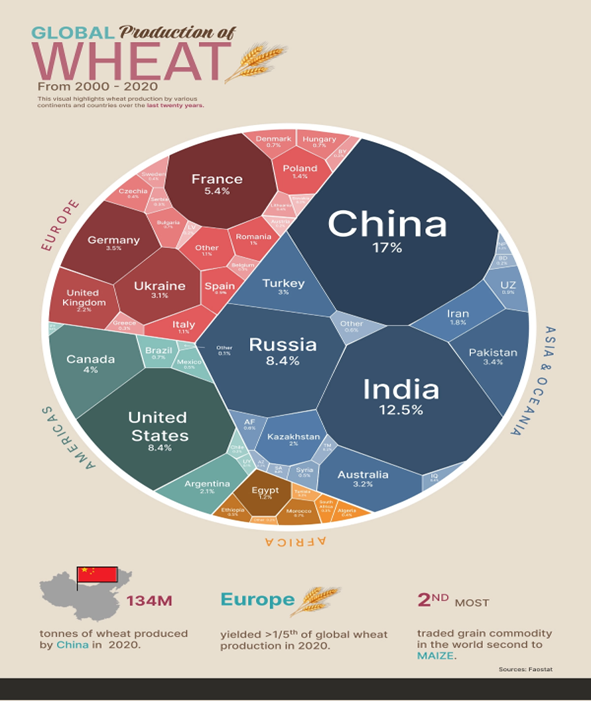

“India’s Potash Demand Languishes as World Reels From High Prices – Supplies from Russia, Belarus have been cut off amid sanctions Price talks will begin soon with companies in Russia, Canada – India, one of the world’s biggest potash importers, is facing demand destruction due to high prices and the loss of critical supplies from Belarus and Russia. Potash consumption will probably fall to 3 million tons in the year through March 2023 from 5 million a year earlier……Farmers have been using less of it to grow crops like rice, wheat and sugar.”, Bloomberg, September 27, 2022

“Oil Heads for First Quarterly Loss Since 2020. OPEC Expected to Cut Output. Crude oil prices are set for a quarterly loss for the first time in more than two years as global economic concerns outweigh the prospect of lower production. Brent crude , the international benchmark, was down 1.0% at $86.30 in morning trading and down 21% over the last three months. West Texas Intermediate , the U.S. standard, was down 0.9% at $80.50, down 24% over a three-month period. The last time the price of oil fell over a quarter was March 2020, although prices remain substantially elevated since their pandemic-driven lows. The potential for output cuts from the Organization of Petroleum Exporting Countries and its allies at their upcoming October meeting could support oil prices.”, Barron’s, September 30, 2022

Global & Regional Travel Updates

“Hong Kong-Los Angeles Business Class Fares Hit $13,000 in Rush to Fly – Travel to and from Hong Kong is easier now that hotel quarantine has ended. It is also more expensive. A business class ticket between Hong Kong and Los Angeles leaving Friday and returning on Oct. 7 cost HK$102,270 ($13,029) Monday with Cathay Pacific Airways Ltd., the only carrier offering the nonstop service in the wake of the pandemic. That’s more than double the HK$44,499 fare for the same flight next year.”, Bloomberg, September 26, 2022

Country & Regional Updates

Australia

“More than one in three Aussies would quit if they couldn’t work from home – Researchers from the National Bureau of Economic Research in the US found Australians worked an average of two days a week at home at the time of the surveys, higher than the survey average across 27 countries of 1.5 days. They found Australian employers on average wanted workers to have just one day working from home, while employees on average would like to work remotely two days a week. And if their employer required them to return to the office full-time, 35 per cent of Australians said they would quit or immediately start looking for a new job that allows working from home.”, Brisbane Times, September 18, 2022

Canada

“Canadian economy is slowing, but still eking out growth – Real (inflation-adjusted) gross domestic product rose 0.1 per cent in July, stronger than a previous estimate of a 0.1-per-cent drop, Statistics Canada said in a report on Thursday. In a preliminary estimate, the agency said growth was essentially unchanged in August……GDP is on track to grow at an annualized pace of about 1 per cent in the third quarter. That is considerably slower than growth of 3.1 per cent in the first quarter and 3.3 per cent in the second, along with the Bank of Canada’s forecast of 2-per-cent growth.”, The Globe & Mail, September 29, 2022

“COVID-19 air travel restrictions lifted in Canada – All COVID-19 restrictions for air travel are officially gone as of Oct. 1, with ArriveCan no longer being used for public health checks. Masks are now optional on flights.”, Global News, October 1, 2022

China

“Microsoft plans 1 000 new jobs in China despite slowing economy and widespread tech layoffs – The US technology giant says it will grow its workforce in China to over 10,000 next year, up from roughly 9,000 currently. Microsoft’s announcement comes amid a spate of lay-offs among some of the largest technology companies operating in China.”, South China Morning Post, September 22, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks opens 6 000th store in Chinese mainland – Starbucks Tuesday celebrated its 6,000th store in the Chinese mainland, located in downtown Shanghai. Shanghai thus became the first city in the world to have 1,000 Starbucks stores. In 2018, Starbucks announced it would have 6,000 stores on the Chinese mainland by the end of its fiscal year in September 2022. Starbucks opened its first store on the Chinese mainland in January 1999 in Beijing.”, Shine.cn, September 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto

European Union

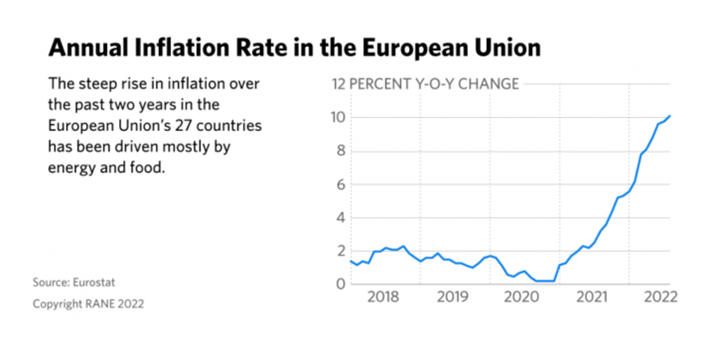

“A Slowing Economy Raises Social and Political Risks – A combination of high inflation, high energy prices, lingering geopolitical uncertainty and monetary tightening will slow economic activity in Europe during the quarter and increase social and political risks. Inflation will remain high in Europe, driven primarily by pervasively high energy prices.”, RANE/Worldview, September 28, 2022

Germany

“Berlin Introduces Debt-Financed Natural Gas Price Cap – The German government set out a 200 billion euro ($196 billion) debt-financed special fund to implement a natural gas price cap aimed at shielding German consumers and energy companies from soaring gas prices, Politico reported Sept. 29. Under the plan, which will run until March 2024, the government will use the fund to pay natural gas importers the difference between the cap and what importers pay for gas on the global market.”, RANE/Worldview, October 3, 2022

“New German COVID-19 rules come into force as infections rise in colder months – Germany has modified rules on mask-wearing and hygiene as it prepares for a rise in COVID-19 cases. But not all restrictions have been tightened — and not everyone is satisfied. Health Minister Karl Lauterbach called the new rules strict compared with other European countries but said Germany was being “not smarter but more cautious” in its approach.”, Deutsche Welle, October 1, 2022

India

“India Jobless Rate Drops to Four-Year Low Before Festival Season – India’s unemployment rate dropped to the lowest in more than four years in September, buoyed by a strong rise in new jobs, according to a private research firm. The jobless rate sharply fell to 6.43%, data from the Centre for Monitoring Indian Economy Pvt. showed. The reading is the lowest since August 2018 and compares with a one-year high of 8.3% in August.”, Bloomberg, October 3, 2022

Middle East

“Trade and security ties are knitting Israel into its region – Former enemies drawing closer, offering hope of a more stable and prosperous Middle East. For the first time since its creation in 1948, Israel has a warm peace with an Arab country, not just the formal, often frosty ones with Egypt and Jordan, its immediate neighbours. The accords are underpinning a realignment of trade, diplomacy and security arrangements in the Gulf. They are largely economic, built on the hope that trade can bring peace and restore the Middle East to its historic role as the crossroads of the world’s trade, linking Asia and Europe through the Silk Road and Africa through the Incense Road.”, The Economist, September 22, 2022

Pakistan

“How worried should we be about Pakistan’s economy? Concerns are rising again over the health of Pakistan’s economy as foreign reserves run low, the local currency weakens and inflation stands at decades-high levels despite the resumption of an International Monetary Fund funding programme in August. But then Pakistan was hit by major floods in late August that killed more than 1,500 people and caused billions of dollars worth of damage, heaping even more pressure on its finances. The biggest worries centre around Pakistan’s ability to pay for imports such as energy and food and to meet sovereign debt obligations abroad.”, Reuters, September 30, 2022

South East Asia

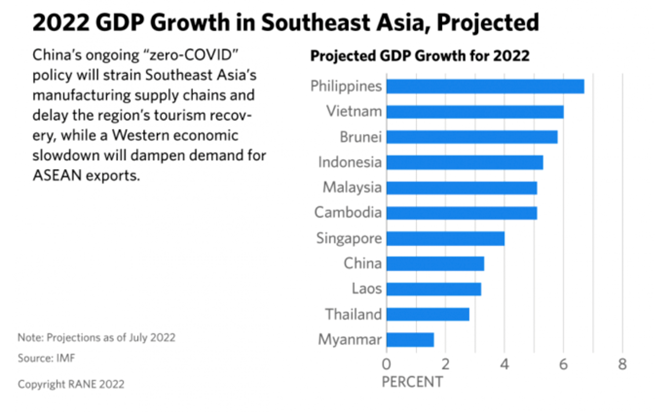

“Southeast Asian Economic Recovery Will Lag – Continued Chinese lockdowns and weaker consumer demand in the West will strain budgets and limit economic growth in Southeast Asia…… monetary policy tightening and looming recessions in the United States and the European Union will reduce demand, which will negatively impact Southeast Asian exports.”, RANE/Worldview, September 28, 2022

Thailand

“Thailand to Eliminate All Pandemic-related Travel Restrictions This Week – Thailand will drop the last of its remaining pandemic-related travel rules this week as the country ends its nationwide COVID-19 Emergency Decree. Starting Oct. 1, the Southeast Asian country will no longer require travelers to show proof of vaccination or proof of a negative test to enter.”, Travel & Leisure, September 26, 2022

United Kingdom

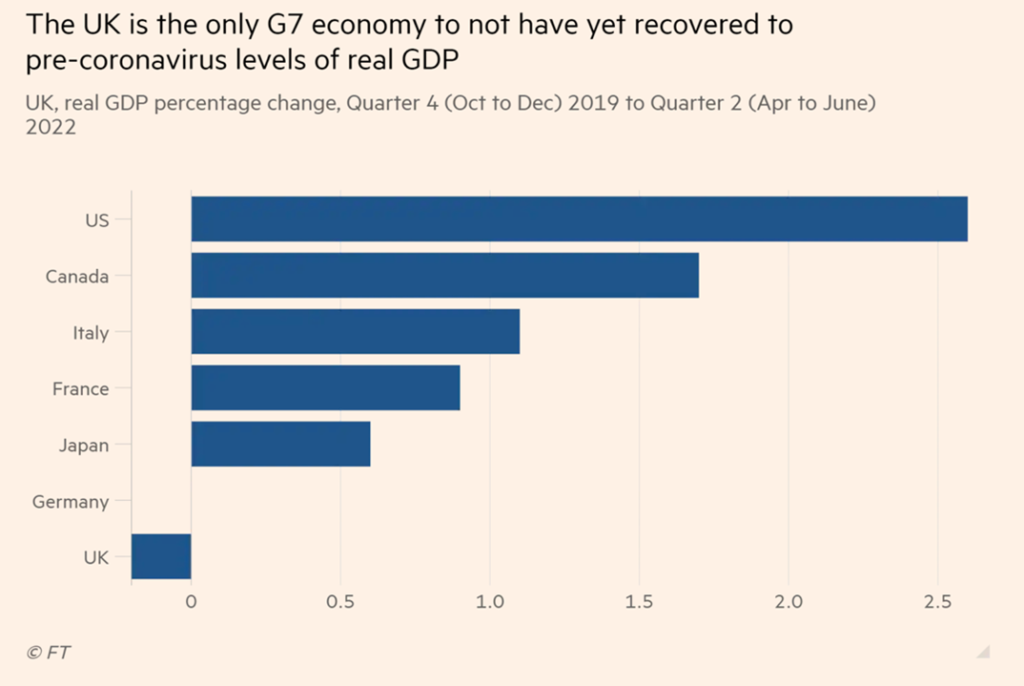

“UK remains only G7 economy to languish below pre-pandemic levels – GDP stuck 0.2% below final quarter of 2019, but latest growth data now positive. Office for National Statistics figures released on Friday showed that UK gross domestic product for the three months to June this year remained 0.2 per cent below the level it reached in the final quarter of 2019. By contrast with the UK’s failure to return to pre-pandemic levels, the eurozone economy reached 1.8 per cent above 2019 levels in the second quarter. The US had recovered to pre-pandemic levels by the start of last year.”, The Financial Times, September 30, 2022

“Why ‘digital literacy’ is now a workplace non-negotiable – Digital literacy used to mean being able to send an email or type using a word-processing programme. It was a skill largely required of knowledge workers – people who might use specific software at work, and need to be fluent in how to use it accordingly. Now, digital literacy means having the skills to thrive in a society where communication and access to information are increasingly done via digital technologies, such as online platforms and mobile devices. Today, digital literacy is no longer a functional proposition, it’s a mindset. In the modern workplace, there is a greater expectation for employees to nimbly adopt whatever technology comes with their job as well as adapt to ever-changing tools and approaches.”, BBC News, September 25, 2022

United States

“Vast Majority Of Manufacturers Plan Price Increases In 2023 – The poll of 150 manufacturing CEOs surveyed in late August found that nearly half of companies (45%) had passed on the costs of inflation to customers today, while 38% said they had avoided doing so and 17% said their companies absorbed the costs despite the financial hit. Those price increases had an impact. More than half (55%) said they had lost customers over the past year due to price increases, while nearly one in five (19%) have cut their workforce to keep costs in line.”, Forbes, September 28, 2020

“US Business Equipment Orders Rise by Most Since Start of Year – Capital goods orders ex-defense, aircraft rose 1.3% in August Overall durable goods bookings fell on softer plane orders. Orders for business equipment at US factories rose in August by the most since the start of the year, reflecting broad advances across categories, including machinery and computers, even as interest rates rise. The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 1.3% last month.”, Bloomberg, September 27, 2022

Brand News

“Franchise Times Top 500 Ranks the Largest Brands in Franchising – With many of the measures meant to slow down the coronavirus pandemic coming to an end and a sense of normalcy returning, 2021 marked a rebound year for hundreds of franchises. Those comebacks are reflected across the Franchise Times Top 500, the annual ranking of the largest U.S.-based franchise systems by worldwide sales.”, Franchise Times,

“Chipotle is moving its tortilla robot to a real restaurant – Chipotle’s tortilla-making robot will soon help out in a restaurant you can visit. The chain has unveiled a slew of technology updates that include moving the Miso Robotics-made Chippy robot to a real restaurant. The machine will start cooking tortilla chips in a Fountain Valley, California location in October. The chain is also piloting AI that tells kitchen staff what to cook.”, Engadget, September 27, 2022

“Dave and Buster’s to Open 11 Units Across KSA, UAE, and Egypt – Announces international franchise partnership with Abdul Mohsen Al Hokair Holding Group. The Brand will begin its expansion with sites in the Kingdom of Saudi Arabia, followed by the United Arab Emirates and Egypt.”, Company press releases, September 14, 2022

“Pokeworks Continues Global Growth with Talabat Partnership in the Middle East – In the first phase, Pokeworks expects to open 10 delivery-only locations in the UAE, Kuwait, and Bahrain over the next 3 years, starting with Dubai in 2023. Talabat is part of Germany’s Delivery Hero, which operates a network of online food delivery companies worldwide.”, September 30, 2022

“Tommy Car Wash Systems and Tommy’s Express Car Wash set their Sights on Development in Canada – U.S.-based car wash franchise, Tommy’s Express, announced earlier this year it will break ground on its first international franchise location in Ontario, Canada in Q4 2022. As front runners in the car wash industry, the brand is continuing to focus on expansion in Canada by exhibiting at the Convenience U CARWACS Show taking place September 13th – 14th at the Toronto Congress Centre.”, Franchising.com, September 13, 2022

“French-Asian Bakery Tous les Jours Makes U.S. Franchise Push – Tous les Jours means “every day” in French, and the French-Asian bakery-café chain hopes to make its artisan pastries, gourmet cakes and freshly baked bread an everyday habit in its push in the United States. With more than 70 cafes stateside, 1,631 worldwide and $697 million in system sales in 2021, Tous les Jours debuts on the Franchise Times Top 500 this year at No. 122. Franchise Times, September 2022

“Wayback Burgers Signs New Master Franchisee in the Dominican Republic – Wayback Burgers has announced a new master franchise agreement with Farhiell Exil to bring the U.S. burger concept to the Caribbean. Under the agreement, Exil will open eight Wayback restaurants across the Dominican Republic within the next 8 years. The first opening is planned for Santo Domingo, the nation’s capital, in early 2023.”, Franchising.com, September 27, 2022

Articles & Studies For Today And Tomorrow

“Unit-Level Economics for Franchise Businesses – After working with more than 900 franchise brands, we’ve (FranConnect) found that a common practice is working together with their franchisees to improve their unit-level economics – not only their top-level sales but also their bottom line. If you’re not doing this today, you will have trouble selling franchises in the future. Unit-level economics is a means by which franchisors and franchisees identify, measure, track, and manage the performance of their businesses at individual unit levels.”, FranConnect on Franchising.com, September 30, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 40 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 65, Tuesday, September 20, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

We say goodbye to Queen Elizabeth II. Chinese consumers get frugal, China’s energy imports decline and Starbucks will add 3,000 more stores in China. The war weighs down European Union country economies. And a new study says 90% of franchised businesses in the USA are negatively impacted by inflation.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“What you think, you become. What you feel, you attract. What you imagine, you create.”, Buddha

“The way I see it, if you want the rainbow, you gotta put up with the rain.”, Dolly Parton

“Perpetual optimism is a force multiplier.”, Colin Powell

Highlights in issue #65:

- Brand Global News Section: Hard Rock Café®, KFC®, Nandos®, Starbucks®, Tim Hortons®, TGI Fridays®, Wendy’s®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

The Passing of Queen Elizabeth II

“Queen Elizabeth II – The long reign of Queen Elizabeth II was marked by her strong sense of duty and her determination to dedicate her life to her throne and to her people. She became for many the one constant point in a rapidly changing world as British influence declined, society changed beyond recognition and the role of the monarchy itself came into question. Her success in maintaining the monarchy through such turbulent times was even more remarkable given that, at the time of her birth, no-one could have foreseen that the throne would be her destiny.”, BBC News, September 8, 2022

“Elizabeth II: an appreciation by Simon Schama – The UK’s longest-serving monarch was so much more than a head of state — she was quintessential Britain.

Interesting Data and Studies

“New International Franchise Association Report Shows Inflation is Negatively Impacting 90% of Franchised Businesses. The most impacted sectors include lodging (90%), quick-services restaurants (83%), and child-related services (61%), which report a substantial increase. 89% of (franchised) units have had to raise their prices of goods and services to absorb cost increases. 64% of respondents reported lower earnings due to rising prices, with quick-service restaurants, retail stores, and the beauty-related industry being the top three industries to feel the impact on their bottom line. The most significant cost increases are driven by rising fuel prices, increases in labor cost and inventory costs. 60% of franchisees expect increases in cost to get worse in near future. 92% of franchisees with 11+ units say growth is constrained by labor issues.”, The International Franchise Association, September 15, 2022

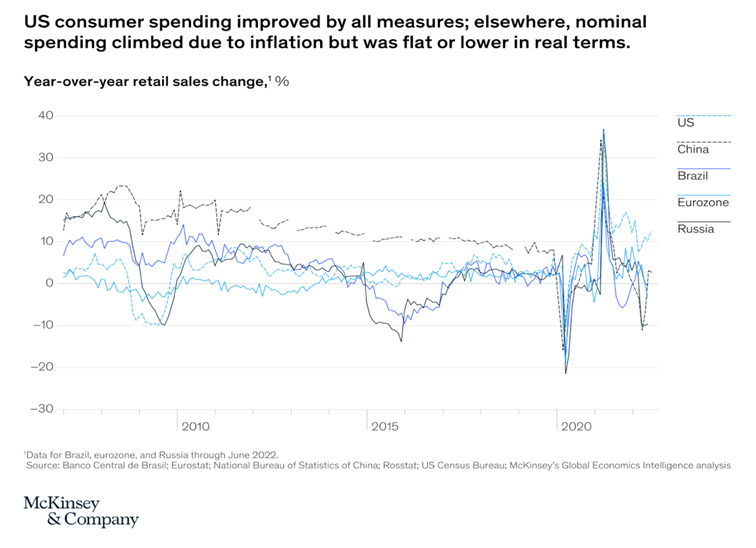

“Growth moderates globally in an inflationary environment – High inflation is eroding household budgets, leading to a decline in consumer sentiment and, outside the United States, static or declining retail sales in real terms. Production is flattening under persisting supply chain pressures, high input costs, and softening demand. Investor uncertainty over rising interest rates is roiling financial markets. GDP growth in China was 2.5% in the first half of 2022 but slowed to 0.4% in the second quarter, with output constrained by pandemic restrictions, softer external demand, and the financially troubled real-estate sector. In the eurozone, GDP growth outpaced expectations at 0.6% in the second quarter and 1.1% for the first half.”, McKinsey & Co., September 9, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“UN FAO’s global food prices fall for fifth month in a row – The index fell to 138 in August and is now lower than it was before Russia’s invasion of Ukraine. The countries were both major exporters of crops including sunflower oil, corn and wheat. The UN’s Food and Agricultural Organisation says July’s UN backed deal to re-open Ukrainian ports has eased cereal and vegetable oil prices.”, BBC News, September 2, 2022

Global & Regional Travel Updates

“Singapore opens up to travellers – During the pandemic Singapore’s national carrier, Singapore Airlines, was so short of business that it sold locals dining spots on board a grounded double-decker A380 plane. Between 2019 and 2021 passenger numbers at Changi airport, the main air hub, plunged by 96%. But since the government began loosening border restrictions late last year, tourists have started returning. This summer traffic at Changi reached 50% of pre-pandemic levels.”, The Economist, September 13, 2022

Country & Regional Updates

Asia

“Casino Suppliers Quit Macau for Resurgent Singapore, Philippines – Companies move staff, inventory out of city as slump continues. Casino revenue collapses on Covid policies, China crackdown. Suppliers of slot machines, baccarat table systems and other casino equipment are moving out of Macau to more welcoming markets, evidence of the damage China’s Covid Zero policy has wrought on the formerly bustling gambling hub.”, September 5, 2022

Australia

“Australia’s Jobless Rate Climbs for First Time in 10 Months – Australian unemployment unexpectedly rose in August, the first increase in 10 months, a result that supports the Reserve Bank’s signal of a potential shift to smaller interest-rate increases. The jobless rate’s rise to 3.5% came even as employment advanced by 33,500, the Australian Bureau of Statistics said Thursday. That was slightly below economists’ estimates for a 35,000 increase.”, Bloomberg, September 14, 2022

Canada

“Prices at Toronto restaurants to soar by up to 15% — as industry deals with ‘anything but normal’ situation. Higher prices are on the menu as inflation drives up operating costs, while industry continues to see closures. Half of restaurants were operating at a loss or just breaking even as of July 2022 — typically one of the busiest months of the year, the report found. As a result of higher costs, more than a third of full-service restaurant operators plan to raise their prices by more than seven per cent, and many between 10 and 15 per cent.”, Toronto Star, September 15, 2022

China

“China’s Economy Beats Expectations in a Range of Areas – New Chinese data showed better-than-expected results for August in a swath of sectors, all while Covid cases finally began to fall, giving hope of a rebound or at least stabilization in an economy beleaguered all year. Compared with the previous month, improvements were seen in retail sales, industrial production, fixed-asset investment, and unemployment….(Retail) Sales leapt to 5.4% year-on-year, compared to July’s 2.7%, and well above consensus forecast of 3.4%.”, Barron’s, September 16, 2022

“Frugal is the new cool for young Chinese as economy falters – Before the pandemic, Doris Fu imagined a different future for herself and her family: new car, bigger apartment, fine dining on weekends and holidays on tropical islands. Instead, the 39-year old Shanghai marketing consultant is one of many Chinese in their 20s and 30s cutting spending and saving cash where they can, rattled by China’s coronavirus lockdowns, high youth unemployment and a faltering property market. This new frugality, amplified by social media influencers touting low-cost lifestyles and sharing money-saving tips, is a threat to the world’s second-largest economy, which narrowly avoided contraction in the second quarter. Consumer spending accounts for more than half of China’s GDP.”, Reuters, September 18, 2022

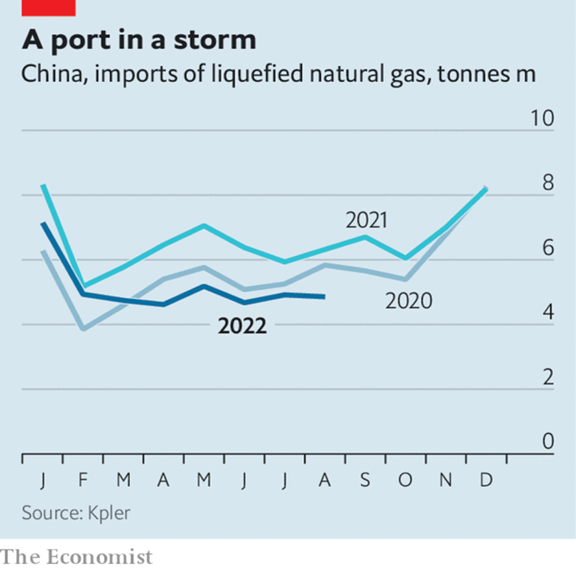

“China’s plunging energy imports confound expectations – A revival would cause problems—and not just for Europe. With the price of fuels surging, the collapse in Chinese purchases of natural gas and other forms of energy has been an unexpected boon to countries around the world. Arrivals of seaborne liquefied natural gas (lng) have declined most markedly. China remains the largest lng importer in the world but, between January and August, imports dropped by a fifth compared with the same period last year. That shortfall, at roughly 14bn cubic metres, is roughly equivalent to the entire annual lng imports of Britain.”, The Economist, September 15, 2022

European Union

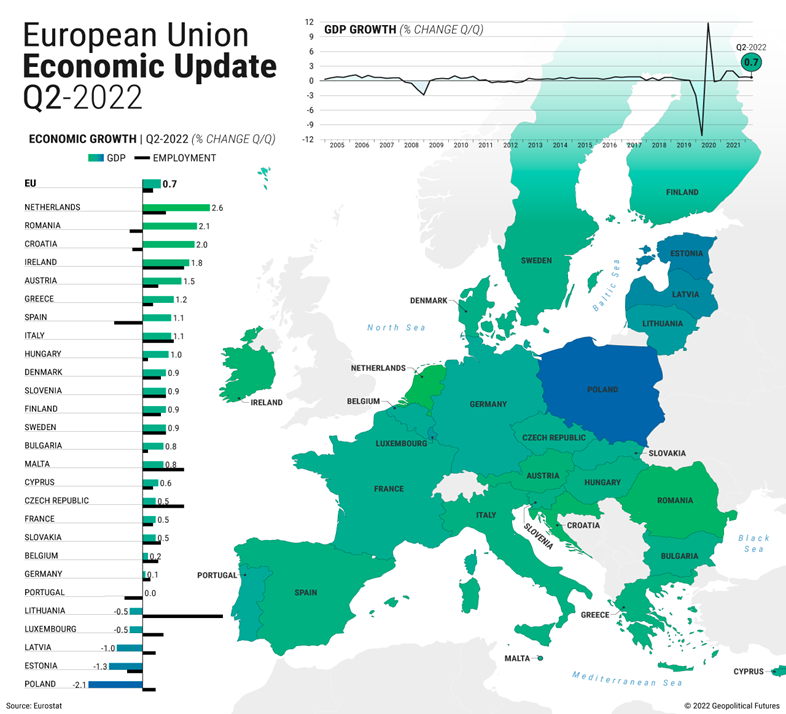

“Ukraine War Weighs Down European Economies – The countries closest to the war in Ukraine saw their economies shrink in the second quarter. Europe is bearing the brunt of the economic war raging between Russia and the West. On the whole, European economies grew in the second quarter of the year, driven by household consumption and government spending. However, the countries closest to the Russia-Ukraine war, such as Poland and the Baltic states, saw their economies shrink for a variety of reasons.”, Geopolitical Futures, September 16, 2022

India

“93% Indians Used At Least One Mode Of Digital Payment In Last Year – Digital payments are rising rapidly in the country and more and more Indians are adopting the cashless payment method. According to a survey commissioned by Mastercard, 93% of Indians are likely to have used at least one mode of digital payment in the past year.

Indian consumers are among those who are most open to digital payments methods in the Asia-Pacific region, Mint reported citing the survey. Compared to Indians, only Chinese consumers are more open to digital payments (98%).”, INC42, September 19, 2022

“Travel Etiquette: 10 Things to Consider When You Visit India – Saying that India is vast is an understatement. Its population of 1.38 billion ascribes to many different religions and beliefs. People are spread across 28 states and eight union territories; they communicate in hundreds of languages and local dialects and practice diverse cultural norms. The myriad cultural and religious differences, and the contrast between the urban and rural areas, mean there are a lot of dos and don’ts in order to be respectful and considerate of the local people and their customs.”, Fodor’s Travel, September 14, 2022

Italy

“Italy’s Draghi presents new aid package – Italy approved an aid package worth some 14 billion euros ($14 billion) on Friday to shield firms and families from surging energy costs,….The latest measures come on top of some 52 billion euros already budgeted since January to soften the energy crisis in Italy. They will be funded by higher value added tax revenues as a result of rising electricity and gas bills and by adjustments elsewhere in the state budget, without resorting to extra borrowing which had been requested by some parties.”, Reuters, September 16, 2022

Switzerland

“Swiss to dial down thermostats in government buildings – Swiss bureaucrats will need to dress warmly this winter after the government decided public buildings would be heated to no more than 20 degrees Celsius (68°F) to save energy. The measures agreed by the cabinet on Friday cover federal office buildings and universities and military properties. They aim to save 6-10% of the energy used to heat federal buildings.”, Reuters, September 16, 2022

United Kingdom

“Kentucky Fried Crisis: How surging chicken costs hit Nando’s and KFC – The rising cost of chicken is turning customers away, while farmers are leaving their sheds empty. The Office for National Statistics said last week that the price tag for chicken in shops had jumped by 14.9 per cent on average over the past year. The Producer Price Index, which measures the cost of goods for factories, showed that imported chicken and red meat from the EU had shot up 69 per cent. Feed prices for livestock were up 61 per cent, and fresh red meat and poultry was 21 per cent higher.”, The Times of London, August 21, 2022

“Pound hits new 37-year low as retail sales slide – The larger-than-expected drop in sales volumes of 1.6% prompted fresh concerns over the state of the economy. Sales across all retail sectors fell in August as households cut back in the face of rising prices. One analyst suggested the figures showed the UK is already in recession. Sterling fell more than 1% against the dollar to $1.1351 at one point, its lowest since 1985, following the release of the retail sales figures. The pound recovered later to climb above $1.14.”, BBC News, September 16, 2022

United States

“Women are reentering the workplace, but employers will have to do more for them to stick around – Last month, U.S. women saw a major gain in labor force participation, with the proportion of women in the workforce between the ages of 25 and 54 finally rising to a pre-pandemic level of almost 75%. But researchers say such celebration is premature if structures aren’t put in place to ensure women stay in the workforce. Fewer than 30% of women say they feel included in the workplace, according to a recent report from Bain & Company. This poses a major retention risk, considering a lack of belonging is one of the top reasons employees say they’d leave a company.”, Fortune, September 15, 2022

“Small business revenue doubles, but profits are flat – Seventy-five percent of U.S. small business owners say they are being impacted by inflationary pressures— prompting them to modify their practices in order to grow, according to a new study……’47% of all small business respondents reported that inflation is impacting their labor market by pushing them to accommodate and compensate for higher health care, enriched employee benefits and more frequent pay raises,’ said Brett Sussman, VP head of sales & marketing for Kabbage from American Express.”, Yahoo! Finance, September 14, 2022

Brand News

“Hard Rock CEO makes $100M employee wage investment: We wanted to ‘really thank them’ – Reporting that the Hard Rock brand “has been doing very well this year,” (Hard Rock International Chairman Jim) Allen announced an initiative Tuesday to thank the company’s line employees with a $100 million investment to raise starting wages for half of its U.S. workforce at company-managed hotel, café and casino locations nationwide.”, Fox Business, September 16, 2022

“Starbucks Plans to Add 3 000 Stores in China by 2025 – In the next three years, Starbucks China aims to accelerate its development potential through six growth engines and a series of major investments. By 2025, the total number of Starbucks stores in China is targeted to reach 9,000, while the number of employees will increase by 35,000, totaling more than 95,000.”, Pan Daily, September 14, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks (USA) to revamp stores to speed service, boost morale – The company also said it plans to open 2,000 net new stores in the U.S. by 2025, with an emphasis on meeting the growing demand for new types of service, including drive-thru, mobile ordering and delivery. Starbucks — ringing up record sales but struggling with low employee morale — plans to spend $450 million next year to make its North American stores more efficient and less complex.”, Chicago Sun Times, September 16, 2022

“TGI Fridays signs historic deal to expand chain to South and Southeast Asia – The development agreement is for 75 new restaurants over the next 10 years. The casual restaurant company said Friday that it expects the 10-year deal with Singapore-based Universal Success Enterprises Ltd. to boost its annual revenue by $500 million.”, Dallas Morning News, September 16, 2022

“Cartesian Capital Pushes Massive Growth of Tim Hortons China – Zero to 450. Less than four years after opening its first store in Shanghai, Tim Hortons China crossed the 450-unit mark this summer with plans to continue its dizzying development push on the way to 2,750 stores by 2026. It’s a pace necessary to compete in a consumer market that Peter Yu, chairman of Tim Hortons China, called the most compelling in the world.”, Franchise Times, August 29, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“US burger chain Wendy’s is coming to Australia – The US Wendy’s burgers brand is heading to Australia and is on the hunt for a master franchisee. The iconic brand is reportedly the world’s third largest quick service restaurant burger chain, with about 7000 outlets worldwide….Now the chain is readying to hit the market Down Under, with consultancy firm DC Strategy tasked with recruiting master franchisees.”, Smart Company AU, September 15, 2022

Articles & Studies For Today And Tomorrow

“Franchising Isn’t for Entrepreneurs, It’s for Systempreneurs – First determine if you can follow a system, then find the right system for you. The franchise model leverages a system and business approach to help entrepreneurs start and run their own businesses. But a franchisee is really more of a systempreneur than an entrepreneur. True entrepreneurs invent a business from scratch and develop everything from the ground up. Systempreneurs use leverage of all types — debt, an existing operating system, best practices and information — to build their business.”, Entrepreneur Magazine, September 12, 2022

“These are the top 10 healthiest countries for digital nomads – Lemon.io, a marketplace of software developers, analyzed data from the 2022 Global Health Security Index by the Economist Intelligence Unit to determine the healthiest countries for digital nomads. The study ranked 195 countries based on their preparedness for epidemics and pandemics.”, CNBC, September 18, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 40 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 64, Tuesday, September 6, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

A new Prime Minister for the UK. A timely quote from Albert Einstein. There are up to 8,755 commercial flights in the air at any given time of day. Indonesia is a pleasant surprise among emerging markets. Japan turns back to nuclear power. Energy prices continue to rise to rise. And a must read 2022 Member survey from the U.S. China Business Council to know what is happening in China.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The world as we have created it isa process of our thin king. It cannot be changed without changing our thinking.”, Albert Einstein

“The ones who are crazy enough to think that they can change the world are the ones who do.”, Steve Jobs.

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.” – Seth Godin

Highlights in issue #64:

- Brand Global News Section: Bonchon®, Denny’s®, Dominos®, Hardees®, Marco’s Pizza®, Pret A Manger®, Planet Smoothie® and Red Rooster®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

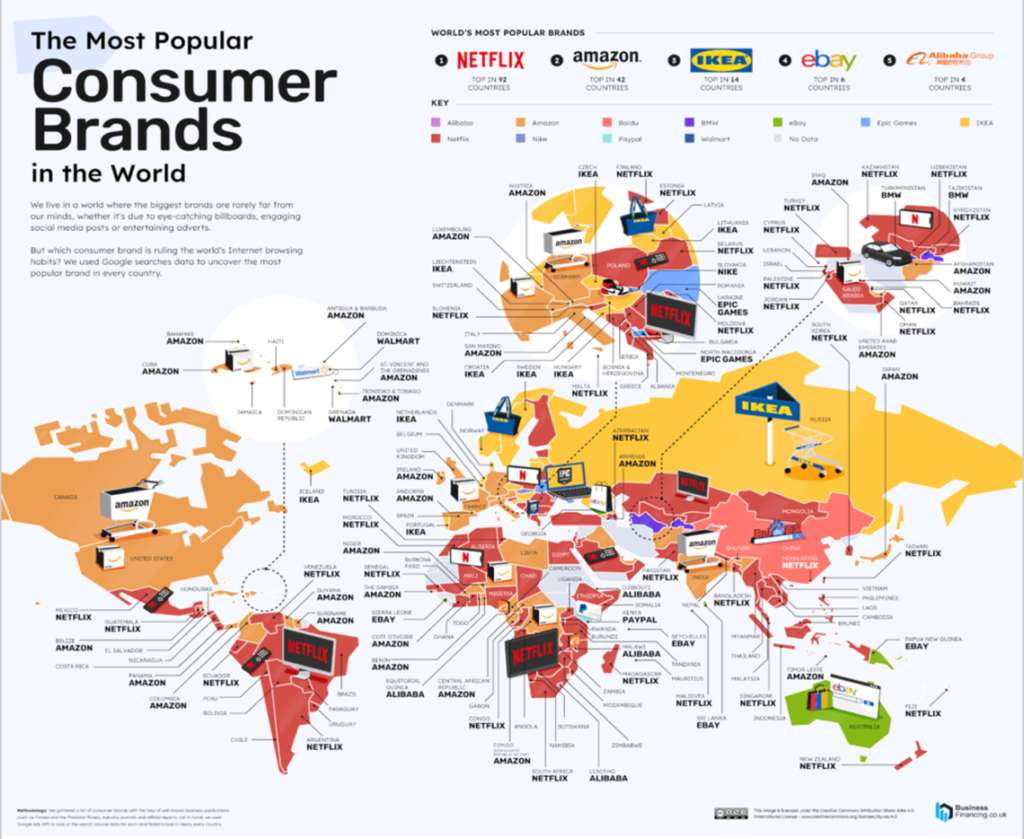

“The Most Searched Consumer Brands in 2022 – In today’s fast-paced world, a strong brand is a powerful asset that helps a business stand out in a sea of competition. What are some of the most popular brands around the world? One way to gauge this is by looking at Google searches to see what consumers are searching for online (and therefore, what brands they’re paying the most attention to). This graphic by BusinessFinancing.co.uk uses data from Google Keyword Planner to show the world’s most searched consumer brands in the twelve months leading up to March 2022.”, Visual Capitalist / Business/Finance, September 4, 2022

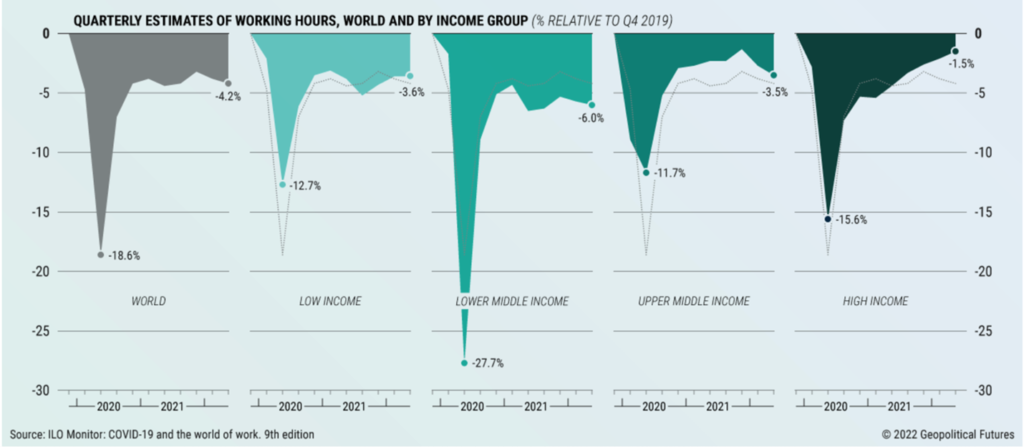

“How Work Has Changed Since COVID-19 – Labor markets everywhere are digging themselves out of a deep hole. The International Labor Organization predicts continued global labor market disruptions for at least the remainder of the year because of the war in Ukraine and China’s domestic economic problems. Predictably, problems are especially pronounced in low- and middle-income countries. When it comes to hours worked, high-income economies are again faring much better than the rest.”, Geopolitical Futures, August 26, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

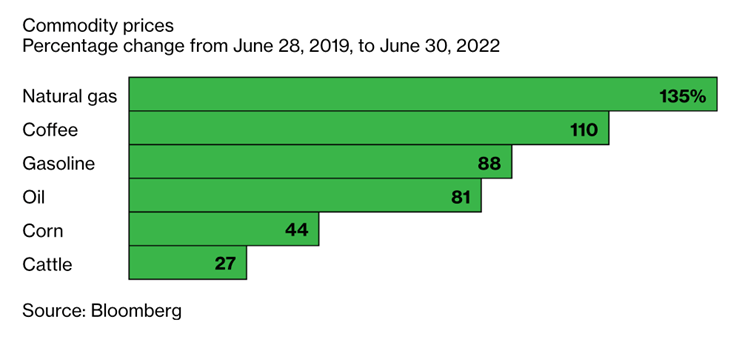

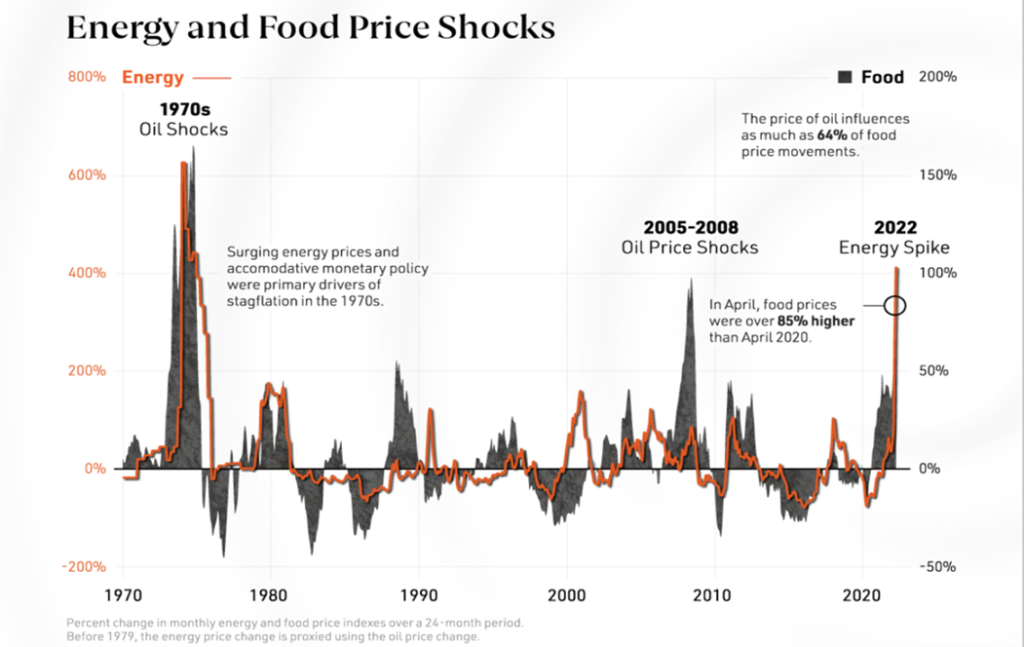

“How Rising Food and Energy Prices Impact the Economy – Since Russia’s invasion of Ukraine, the effects of energy supply disruptions are cascading across everything from food prices to electricity to consumer sentiment. In response to soaring prices, many OECD countries are tapping into their strategic petroleum reserves. In fact, since March, the U.S. has sold a record one million barrels of oil per day from these reserves. This, among other factors, has led gasoline prices to fall more recently—yet deficits could follow into 2023, causing prices to increase. With data from the World Bank, the above infographic charts energy shocks over the last half century and what this means for the global economy looking ahead.”, Visual Capitalist / World Bank, September 1, 2022

Global & Regional Travel Updates

“Ryanair passenger numbers hit new all-time high in August – Ryanair (RYA.I) in August flew a record number of passengers for the fourth month in a row as it continued to consolidate its position as Europe’s largest airline by passenger numbers. The Irish low-cost carrier, which unlike many airlines made a point of keeping its pilots and crew up-to-date with their flying hours during the pandemic, flew 16.9 million passengers in August compared to a pre-COVID peak of 14.9 million in August 2019.”, Reuters, September 1, 2022

“Mapping Airways: The World’s Flight Paths and Airports – There are up to 8,755 commercial flights in the air at any given time of day. These flights transport thousands of people (and millions of dollars worth of goods) around the world. But where are these people and goods headed? This map from Adam Symington uses historical data from OpenFlights to visualize the world’s flight paths. The graphic shows a comprehensive data set encompassing 67,663 different routes that connect 10,000 different airports across the globe. Visual Capitalist / OpenFlights, September 2, 2022

Country & Regional Updates

Asia

“Relief in sight for cheese lovers as Domino’s expands in Asia – Australia’s largest pizza chain, Domino’s Pizza Enterprises, says there are early signs that price pressures for key ingredients such as wheat and cheese are starting to flatten, but the company will still have to lift some product prices to combat inflation. The company also stepped up its expansion in Asia with the acquisition of 287 stores in Malaysia, Singapore and Cambodia in a deal with an upfront price of $214 million, in what is the biggest acquisition in the company’s history. It aims to grow to 600 stores in total across the three countries.”, The Australia Financial Review, August 24, 2022

China

“U.S.-China Business Council 2022 Member Survey – The US-China Business Council’s 2022 Member Survey was conducted in June 2022, shortly after a period of widespread COVID-19 lockdowns across China, most prominently in Shanghai. This report is based on responses from 117 member companies, a similar participation rate to past years. Most respondents are large, US-headquartered multinational companies that have operated in China for more than 20 years. China’s COVID-19 policies are the top challenge. Bilateral tensions continue to hurt American companies. Trajectory of commercial relations at another inflection point.”, U.S-China Business Council, August 29, 2022

“China Was One of the Best Places for Private Equity. Not Anymore. The number of Investments by U.S. PE and venture-capital firms in that country declined by about 31% in the second quarter this year, while their value plunged 79%, according to data from S&P Global Market Intelligence. Concerns about the country’s macroeconomic picture spurred the drop, S&P said.”, Barron’s, September 5, 2022

India

“India overtakes former colonial ruler UK to become 5th largest world economy – According to the calculation, based on US dollars, India overtook the U.K. in the final three months of 2021 and extended its lead into the first quarter. Nirmala Sitharaman, Minister of Finance and Corporate Affairs noted that a decade ago, India ranked 11th among the largest economies, while the U.K. was the 5th. The news came just after the country celebrated its 75th anniversary of independence from the U.K., which it achieved after nearly 100 years of direct rule. ”, Fox Business, September 4, 2022

Indonesia

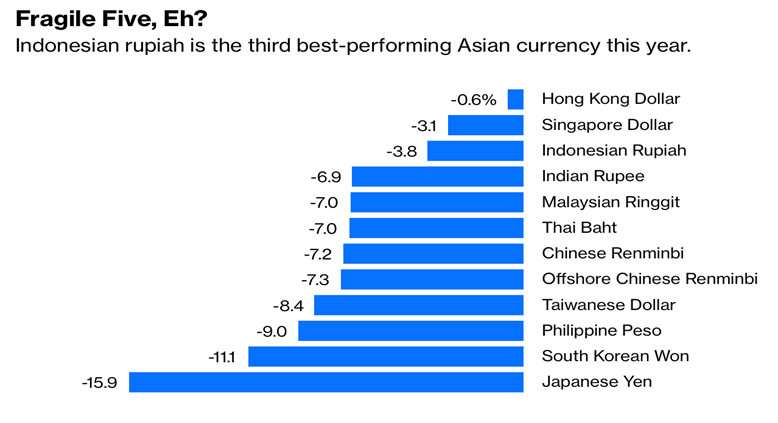

“A Surprise Winner as Emerging Markets Crumble – President Joko Widodo wants Indonesia to be more than a source of commodities, and investors are buying it. Developing nations are reeling from the double whammy of Federal Reserve interest-rate hikes and China’s economic slowdown. They are burning through foreign reserves at the fastest pace since the 2008, to defend their currencies and cover higher import bills for food and fuel. Indonesia, which was singled out as a Fragile Five less than a decade ago for its vulnerable currency and reliance on hot foreign money, has been a haven of relative calm.”, Bloomberg, August 25, 2022

Italy

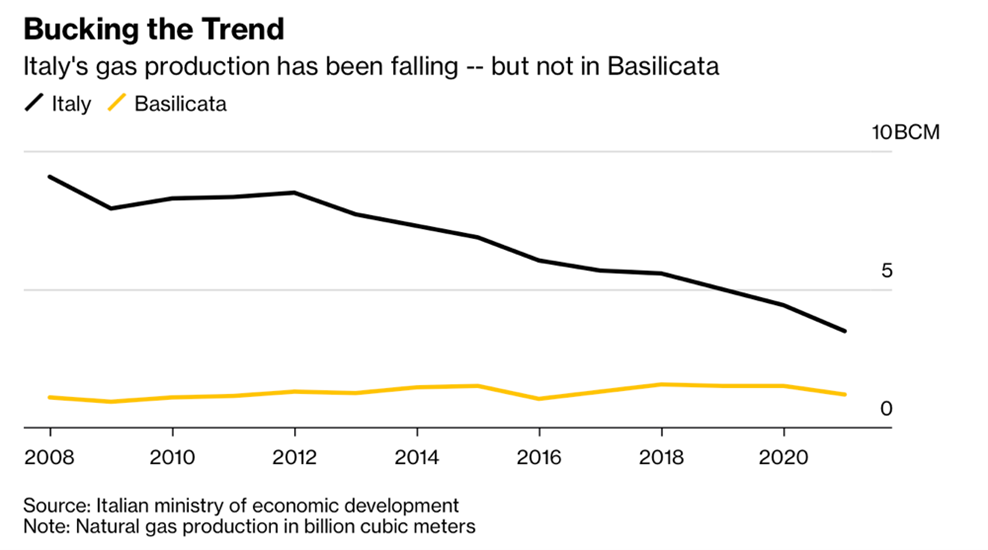

“An Italian Region Is Cutting Gas Bills as Prices Soar Elsewhere – Basilicata residents are due to get free gas from Shell, Eni – Southern region has bucked trend of reducing gas production. A small region in Italy’s impoverished south is about to enjoy a discount on gas bills of as much as 50% just as prices keep breaking records across Europe. Basilicata is reaping the benefits of a controversial decision to continue exploiting its vast gas reserves even as the rest of Italy reduced or halted production, largely over environmental concerns. Expanding domestic oil and gas production has become a divisive issue ahead of elections next month.”, Bloomberg, August 26, 2022

Japan

“Japan turns back to nuclear power in post-Fukushima shift – Prime minister says government will step up reactor restarts and study construction of new plants. (Prime Minister Fumio) Kishida’s decision to throw his political weight behind the nuclear power sector is intended to rein in soaring energy costs for households and companies and to support Japan’s nuclear technology manufacturers.”, The Financial Times, August 24, 2022

Nigeria

“Nigeria Pays Part of Airline Dues Amid Flight Suspension Threats – Nigeria released some funds owed to international air carriers to try and avert a crisis in the aviation sector amid warnings of flight suspensions from operators including Dubai’s Emirates Airline. The Central Bank of Nigeria released $265 million to settle ticket sales owed to airline operators, it said late on Friday. Nigeria — Africa’s biggest economy — owes carriers $464 million, the International Air Transport Association said this month.”, Bloomberg, August 27, 2022

Portugal

“Foreign tourism to Portugal surpasses pre-COVID levels in July – The number of foreign tourists visiting Portugal slightly surpassed pre-pandemic levels in July for the first time since the end of most COVID-19 restrictions, data from the National Statistics Institute (INE) showed on Wednesday. More than 1.8 million foreigners stayed in Portuguese hotels last month, up from around 600,000 a year ago, when the country still had some restrictions in place, and slightly above 1.78 million in July of 2019, which was a record year for tourism.”, Reuters, August 31, 2022

Singapore

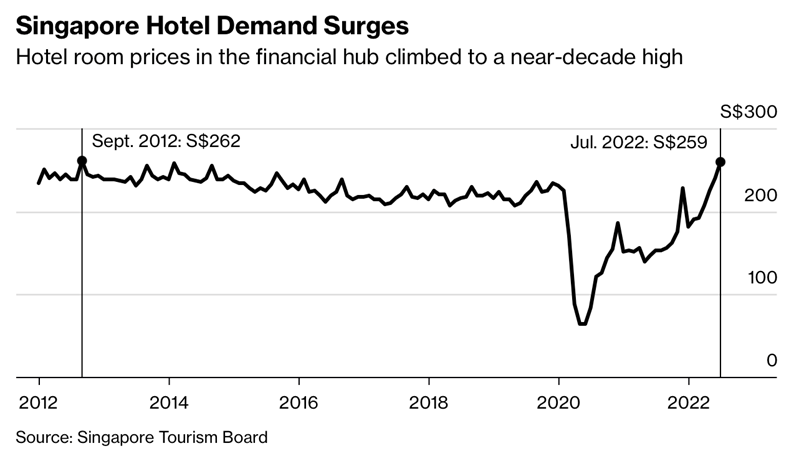

“Singapore Hotel Prices Hit 10-Year High as City Roars Back to Life – Arrivals accelerating as Covid-19 restrictions are eased. Pace expected to continue with F1 event, slew of concerts. Hotel rooms in Singapore are now the most expensive in almost a decade as the city-state seeks to position itself as the tourism and business destination in Asia with a slew of high-profile events lined up for the coming months.”, Bloomberg, September 4, 2022

United Kingdom

“Liz Truss vows to ‘deliver’ after winning race to be new prime minister – In her acceptance speech, Truss promised to cut taxes, deal with energy bills and fix the NHS, and appeared to rule out an early election, saying: ‘We will deliver a great victory for the Conservative Party in 2024’.”, The Time of London, September 5, 2022

“Britain heading for recession as business contracts – The likelihood of the British economy sliding into recession has risen after a closely-watched survey showed business activity contracted last month for the first time in a year and a half. The latest composite purchasing managers’ index (PMI), which encompasses the services and manufacturing sectors, has been revised down to 49.6 for August, from an initial flash reading of 50.9, S&P Global said. In a further sign of the faltering economy, the survey result for the services sector last month was also lowered from the preliminary flash reading of 52.5 to 50.9, which represented the weakest growth for 18 months.”, The Times of London, September 3, 2022

United States

“US Goods-Trade Gap Narrows to Least Since October as Imports Drop Again – (Value) of consumer-goods imports fell most since at least 1992 Overall imports declined 3.5% to $270 billion, Census says. The US merchandise-trade deficit narrowed in July to the smallest since October as imports fell for a fourth month, suggesting a tailwind for economic growth in the third quarter.”, Bloomberg, August 26, 2022

“KPMG to Cut Manhattan Office Space in Move to New U.S. Headquarters at Hudson Yards – Firm shrinking its New York office space by over 40% as it pursues hybrid-work strategy. The KPMG deal also highlights the harsh new reality for the office sector. Companies are still willing to spend big on modern office space with more amenities, outdoor space and energy efficiency. But they often want far less of it. That leaves landlords with increasingly large holes to fill, especially in older buildings.”, The Wall Street Journal, August 23, 2022

Vietnam

“Good morning Vietnam: the world’s new factory is emerging – Amid tensions with China, the nation’s manufacturing sector is booming. In 2021, Vietnam’s exports hit $336 billion (£282 billion) in value, up 19 per cent from 2020 despite the pandemic. Foreign-invested production dominates, with 73 per cent of last year’s export turnover generated by international firms.”, The Times Of London, August 28, 2022

Brand News

“American chain Planet Smoothie opens its first two Australian stores – Kahala Brands, the franchisor and owner of the Planet Smoothie brand, has collaborated with the Docklands-based Smoothie Group to expand into Australia. The company plans to open an additional location in the second quarter of next year.”, Insideretail.com.au, August 24, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Bonchon is Crunching the Competition with Record Sales Numbers – The Korean fried chicken brand is on fire and outperforming the industry average as it leads the fast-casual and casual dining segments, according to mid-year data from research firm Black Box Intelligence™. Bonchon has experienced a year-over-year sales increase of 12 percent and the brand’s AUV has increased by 24.7% to $1.57 million since VIG Partners invested in the company in 2018. It’s full-steam ahead for the second half of the year, with plans to grow by 20 percent before the end of the year.”, Franchising.com, September 5,l 2022

Denny’s hires presidents for both its brands – Denny’s has promoted John Dillon, chief brand officer, to president of Denny’s effective Sept. 1, the company announced Thursday. David Schmidt, who recently served as CFO at Red Lobster, has been hired as president for Keke’s Breakfast Cafe, effective Sept. 12. These appointments come a month after Denny’s closed its $82.5 million acquisition of Keke’s Breakfast Cafe, which will operate independently of Denny’s.”, Restaurant Dive, August 26, 2022

“Hardee’s Has Teamed Up With A Nashville Brewery To Create A Beer That Includes The Chain’s Signature Biscuits – Hardee’s announced today it is working with Nashville-based Southern Grist Brewing Co. to turn its famous biscuits into a Strawberry Biscuit Ale. Specifically, the brewer has figured out a way to infuse Hardee’s biscuits into a full-bodied, cream ale that incorporates hints of strawberry jam and buttermilk.”, Forbes, August 30, 2022

“Top Pizza Franchise Becomes Billion-Dollar Brand – Marco’s Pizza, the nation’s fastest-growing pizza brand*, recently crossing the $1B annual systemwide sales mark and opening its 1,100th store. Marco’s expects greater expansion of its geographic footprint with more than 230 stores currently in development. Multi-unit franchisees play a huge part in the continuous growth of the brand. In fact, nearly half of Marco’s current franchise network is made up of multi-unit operators……”, Franchising.com, September 5, 2022

“Overweight in the coffee market McDonald’s (China) plans to add about 1 000 McCafé stores in 2023 – On August 31, McCafé, a professional handcrafted coffee brand owned by McDonald’s, announced the launch of the “Milk Iron Series”. This product is a brand-new milk coffee product developed by McCafe on the basis of understanding the coffee taste of Chinese consumers. “Milk Iron” will be sold in nearly 2,500 McAfee stores nationwide as an exclusive star product of McAfee. As a result, McCafe also announced the latest plan. It is expected that about 1,000 new stores will be added in 2023, mainly in third-tier cities.”, Beijing Business Daily, September 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“American chain Planet Smoothie opens its first two Australian stores – Kahala Brands, the franchisor and owner of the Planet Smoothie brand, has collaborated with the Docklands-based Smoothie Group to expand into Australia. The company plans to open an additional location in the second quarter of next year.”, Insideretail.com.au, August 24, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“PRET-flation! How lunchtime and pub favourites have soared in price amid cost-of-living crisis – with Pret A Manger tuna sandwich up 50p to £3.80. It comes after fast-food chain McDonalds last month raised the price of its iconic – and once seemingly inflation-beating – 99p cheeseburger to £1.19. It was the first time the burger’s price had been increased in more than 14 years. It comes as all restaurants and grab and go spots face a double whammy of increasing costs. Ingredients such as flour and cooking oils have all gone up in price as a knock on from Russia’s invasion of Ukraine, while shops, cafes and restaurants are also feeling the pinch due to spiraling gas prices.”, DailyMail.com, September 3, 2022

“Red Rooster (Australia) celebrates 50 years of Red – Red Rooster is celebrating 50 years of serving as Australia’s chicken shop through promotions such as limited merchandise collection and a chance to win 50,000 Red Royalty Dollars. The chicken shop is ‘painting the town Red’ by offering various initiatives to more than 360 Red Rooster restaurants.”, Qsrmedia.com.au, August 22, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Articles & Studies For Today And Tomorrow

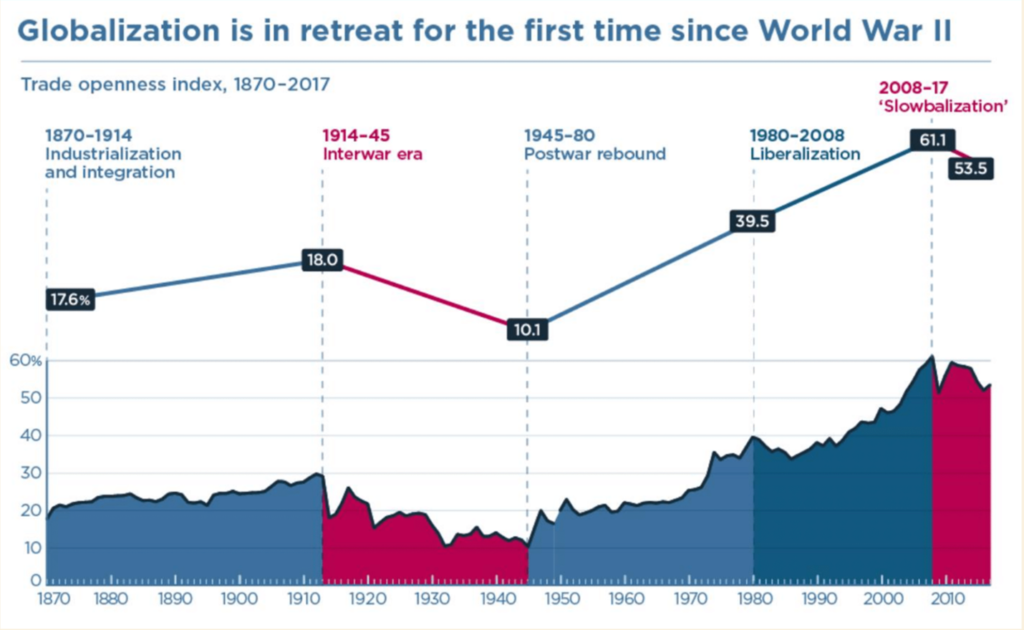

“Slowbalization – This chart is from “Globalization ’22 – What Will The Future Hold”, a presentation made by Team 4 in the Executive MBA 23 course at the University of Southern California, Irvine led by Dr. Leonard Lane. Bill Edwards was asked to monitor and contribute to the final course team presentations. https://bit.ly/3D2ba1y

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 63, Tuesday, August 23, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Lots of individual country and brand updates in this issue. Plus, mixed signals on global oil & gas demand, inflation and economic growth. And, as you know if you travel a lot like me, the ease of travel is not back to 2019 when ‘ease’ was not the right word either!

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Not everything that counts can be counted, and not everything that can be counted counts.”, William Bruce Cameron

“Life is what happens when you’re busy making other plans.”, John Lennon

“You never really learn much from hearing yourself speak.”, George Clooney

Highlights in issue #63:

- Brand Global News Section: Aqua-Tots®, Dutch Bros.®, F45®, Jollibee”s®, Krispy Kreme®, Marco’s Pizza®, McDonalds®, Popeyes®, Tom Hortons® and Wendy’s®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

“Brands Play A Role In Happiness Even When The World Is In Crisis – Happiness is currently getting a lot of attention and it should. It’s a vital element to a healthy balanced life and in the current climate it feels in short supply. During times of turmoil, like now, it can seem wrong to be focused on something so individual when bigger problems fill our thoughts and news feeds. Research is showing that it’s more helpful to think of happiness as an active noun and complex concept that requires regular review and updating. To make happiness part of life we need to reframe our understanding of it to encompass a wider emotional and intellectual range. Brands can help with that.”, Forbes, August 11, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Inflation Rates Are Rising Unevenly Around the World – Prices are rising all over the world at a pace that hasn’t been seen in decades, and central banks have responded by lifting rates. Here, we provide a snapshot of global and US data that help explain what’s happening. The war in Ukraine, the pandemic, and supply chain stress are all playing a role. Larger economies in Europe and the Americas, particularly Brazil, have seen a more dramatic upswing in consumer prices in the past few years than countries in Asia, where inflation gains in Japan and China have been muted.”, Bloomberg, August 12, 2022

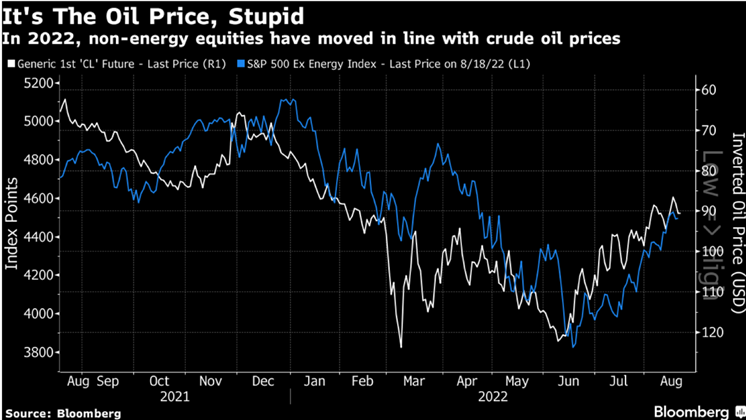

“Oil Demand Accelerates as Gas Crisis Spurs Switch, IEA Says – Consumption growth boosted by 380,000 b/d to 2.1 million b/d Oil market spared squeeze as stockpiles seen accumulating. World oil consumption will now increase by 2.1 million barrels a day this year, or about 2%, up 380,000 a day from the previous forecast, the Paris-based agency said in its latest monthly report. The extra demand that prompted the revision is “overwhelmingly concentrated” in the Middle East and Europe.”, Bloomberg, August 11, 2022

“OPEC Cuts Oil-Demand Forecasts as Economic Growth Slows – Oil supply and demand were close to balanced in second quarter. OPEC’s revisions come as oil prices have eased significantly from the highs they hit in the wake of Russia’s invasion of Ukraine. Fears about slowing economic growth and signs of respite from a global energy crisis have undercut oil prices, which this month fell to their lowest level since February. While OPEC lowered its forecast for global economic growth this year and next, it said demand for oil—while more modest—would still be robust.”, The Wall Street Journal, August 11, 2022

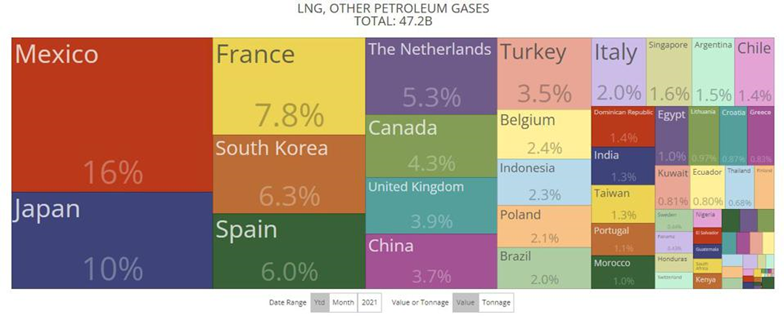

“LNG, Fastest-Growing U.S. Export Since Covid-19, Heading To Europe – The fastest-growing top 100 U.S. export from pre-pandemic 2019 is LNLN 0.0%G and other natural gases, up almost 10 times as much in value as the overall average. This year, the fastest-growing markets for the United States’ No. 3-ranked export are in Western Europe, when compared to the comparable first six months of last year. According to the latest U.S. Census Bureau data, overall U.S. exports topped $1 billion through June for the first time.”, Forbes, August 13, 2022

“Key European Power Price Doubles in Two Months as Crisis Deepens – German and UK day-ahead prices also soar to record highs Governments are under pressure to ease burden on households. Next-year electricity rates in Germany advanced as much as 3.7% to 477.50 euros ($487) a megawatt-hour on the European Energy Exchange AG. That’s almost six times as much as this time last year, with the price doubling in the past two months alone.”, Bloomberg, August 15, 2022

Global & Regional Travel Updates

“Forget 2022: Travel isn’t expected to improve until next year – As predicted, the summer 2022 travel season turned out to be unlike any summer in recent memory. After a trickle of COVID-19 restrictions eased over many months, travelers flooded airports and tourist destinations at rates not seen in three years and with a fervor not seen in even longer than that. It’s safe to say it did not all go according to plan. While hours-long waits and piles of luggage proved nightmarish for travelers overseas, flight disruptions in the U.S. surpassed ordinary frustration.”, The Points Guy, August 19, 2022

Country & Regional Updates

Australia

“A third of Aussie workers would trade a small pay cut for better work-life balance: LinkedIn – One in four workers would also take lower pay in exchange for a stronger chance to grow in the role, more flexibility to work onsite or remote, more inspiring company leadership, and a greater focus on their whole self at work, according to the index released this week. Cayla Dengate, LinkedIn Careers Expert, said a focus on workplace flexibility may be driven by many Aussies taking stock of what’s most important in their life following two years of disruption.”, Smart Company AU, August 5, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Brazil

“Brazil’s central bank chief predicts end of credit cards – Brazil’s central bank chief Roberto Campos Neto on Friday said he believes credit cards will cease to exist soon due to the growth of the open finance system, through which clients authorize financial data sharing with different institutions. Open finance is a central bank project that has been implemented in phases since 2021. Speaking at an event about cryptocurrencies, Campos Neto projected that, through the system, users will control all aspects of their financial life in one “integrator” on their mobile, rather than having many apps from different banks.” Reuters, August 12, 2022

Canada

“Metro shoppers ‘trading down’ as inflation weighs, executives say retailer absorbing some cost increases – Grocery store owner Metro Inc. executives say they are not passing on all of their cost increases to shoppers, even as prices in stores have increased and the company reported a 9-per-cent jump in third-quarter profit. ‘Our costs have gone up significantly. We are absorbing some of those costs’, chief executive officer Eric La Flèche said on a call with analysts Wednesday to discuss the financial results. The Montreal-based retailer reported that its food basket inflation was 8.5 per cent. According to Statscan, grocery prices across the country rose by 9.4 per cent in June compared to a year earlier, slowing from a 9.7-per-cent jump in May.”, The Globe and Mail, August 11, 2022

“The Great Resignation has arrived in Canada – It took a while for a version of the Great Resignation to take hold in Canada, but now it’s here. It has taken the form of a retirement wave – and its arrival further clouds the outlook for an already murky economy. Last week’s July employment report from Statistics Canada revealed that a record 300,000 Canadians have retired over the past 12 months. That’s up nearly 30 per cent from the same time last year, and nearly 15 per cent from the months leading up to the pandemic in early 2020.”, The Globe and Mail, August 11, 2022

China

“China’s Youth Unemployment Rate Rises to Another Record – China’s urban youth unemployment rate reached 19.9% in July, the highest level since record keeping began in January 2018, according to National Bureau of Statistics (NBS) data released on Monday. It’s the fourth consecutive month of record high unemployment among urbanites from 16 to 24 years old, with the rate increasing 0.6 percentage points from June. Fu Linghui, a spokesperson for NBS, cited the slow recovery of the service industry, hampered by Covid-19, and the large cohort of graduates entering the job market during the graduating season around July and August, as reasons for the heightened youth joblessness.”, Caixing Global, August 15, 2022

“Shanghai Schools to Reopen After Classes Suspended in March – Shanghai will reopen kindergartens, primary and secondary schools in September, almost six months after in-person classes were suspended, with strict measures in place to avoid the spread of Covid-19. Students and teachers must be in Shanghai for two weeks before schools start on Sept. 1, and take two nucleic acid, or PCR, Covid tests within three days before returning to campuses, the city’s education authority said in a statement on Sunday. They will also need to produce a negative test result everyday to attend classes as China continues to pursue a Covid Zero policy.”, Bloomberg, August 13, 2022

Euro Zone Countries

“Economists Say a Euro-Zone Recession Is Now More Likely Than Not – Respondents in survey see 60% chance of downturn in next year……The risk of a euro-area recession has reached the highest level since November 2020 as energy shortages threaten to drive already record inflation higher still, according to economists polled by Bloomberg.”, Bloomberg, August 14, 2022

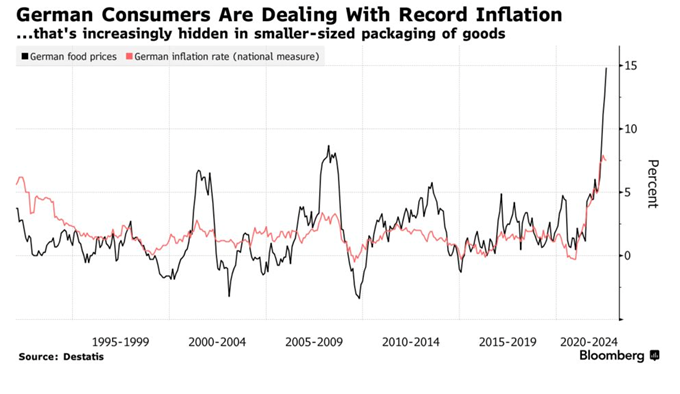

Germany

“Forget Inflation. Shrinkflation Is Sparking Fury in Germany – Packages of goods are getting smaller as prices hold firm Shoppers are inundating consumer authorities with complaints. German shoppers are getting increasingly angry at attempts to hike goods prices by stealth. While so-called shrinkflation — where the cost of a product stays the same though its size declines — isn’t a new phenomenon, consumer-protection authorities in Europe’s top economy are being inundated by complaints. Food prices are the biggest driver of German inflation after energy, rising at an annual pace of 14% in July — almost twice as much as the overall index.”, Bloomberg, August 12, 2022

Indonesia

“Shiny EVs in Sight, Indonesia Mulls Nickel Export Tax – The biggest producer of the EV battery metal, which is also used to make stainless steel, Indonesia is looking to add more value locally in a bid to boost revenues and jobs, President Joko Widodo told Bloomberg Editor-in-Chief John Micklethwait in a wide-ranging interview in Jakarta. The potential move, which was flagged earlier this year by another official, is one step on a path that could ultimately mean a ban on exports of all raw materials.”, Bloomberg, August 19, 2022

Israel

“Israel inflation rate jumps to new 14-year high of 5.2% y/y in July…..the most since October 2008 and following a 4.4% rate in June, as more aggressive interest rate hikes loom and keep the soaring cost of living centre stage ahead of an election in November. A Reuters poll of analysts had projected an inflation rate of 4.6%. CPI rose 1.1% in July from June, led by gains in transport, housing rentals and fresh fruit, the Central Bureau of Statistics said on Monday.”, Reuters, August 15, 2022

Malaysia

“Malaysia’s GDP Growth to Quicken on Pent-Up Demand……Local demand, robust trade to help maintain momentum, FM says Government won’t boost borrowings to pay for subsidies. Malaysia’s economic growth will accelerate this quarter after expanding at the fastest pace in a year, driven by private consumption as activities resume, Finance Minister Zafrul Aziz said. ‘People are underestimating the strength of the pent-up demand,’ he said in an interview on Saturday. ‘Restaurants are packed, traffic jams have returned, the unemployment rate has fallen to below 4% and the first-half tax collections have been way above our estimate.’”, Bloomberg, August 13, 2022

The Philippines

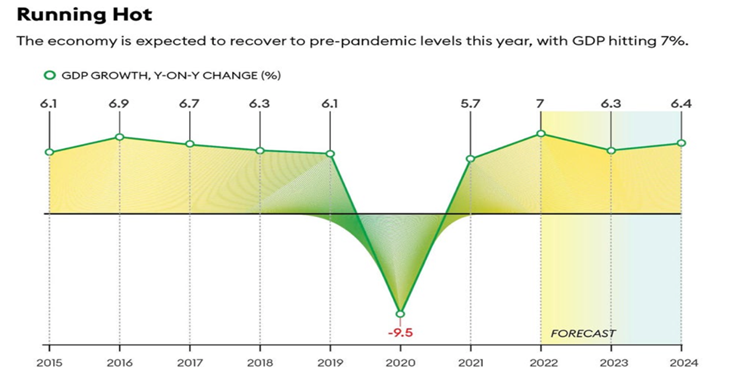

“Philippines Wealth Creation: Economic Recovery Gains Momentum In 2022 – The Philippines’ economy is expected to shrug off the impact of rate hikes and rising commodity prices to recover to pre-pandemic levels this year. GDP is forecast to hit 7%—thanks to returning tourists and a rise in household spending—before inflationary headwinds slow growth to 6.3% in 2023 and 6.4% in 2024. Even with the budget deficit running over 8% of GDP (the highest in Southeast Asia), the new administration of Ferdinand “Bongbong” Marcos Jr. is eyeing an expansionary fiscal policy as it tackles unemployment and poverty.”, Forbes, August 10, 2022

Thailand

“Tourists Pouring Back Into Thailand Underpin Outperforming Baht – Earlier this month, a government spokesman said the nation expects to attract 10 million international tourists this year, compared with the 6.1 million forecast in April. Visitors are seen rising to 30 million people next year, still shy of the 40 million who traveled to the country in the year before Covid spread. That rebound is important for Thailand, considering that the travel-related sector accounted for about a fifth of the nation’s economy before the pandemic.”, Bloomberg, August 14, 2022

Ukraine

“McDonald’s Charts Path to Reopen in Ukraine – McDonald’s Corp. plans to reopen some restaurants in Ukraine after shuttering them when Russia invaded the country in February. The world’s biggest fast-food chain will begin working with partners in the coming months to supply locations with products, prep the properties and bring employees back on site, the company said in a statement. McDonald’s didn’t provide a specific reopening date.”, Bloomberg, August 11, 2022

United Kingdom

“Workers going into office 1.5 days a week, survey suggests – UK workers are going into the office an average of 1.5 days a week, with only 13% coming in on a Friday, a survey suggests. Consultancy Advanced Workplace Associates surveyed 43 offices in the UK, representing nearly 50,000 people, in June and July. It suggests average attendance was 29%, with a peak of 39% mid-week. Pre-Covid, UK workers were going into the office an average of 3.8 days a week, according to the research which covered sectors including banking, energy, engineering, healthcare, insurance and tech.”, BBC News, August 15, 2022

United States

“If the Economy Is Shrinking, Why Is Everything Going Gangbusters? Economists are struggling to explain the global outlook. Maybe it’s better to ask someone in oil. A lot of recent data doesn’t sit well with the prevailing economic narrative. The US economy has shrunk for two consecutive quarters, yet the labor market is still going gangbusters, inflation looks increasingly subdued and retail sales for July beat expectations. But this is not a conventional business cycle, argues Jared Dillian. The damage wrought on supply chains by the pandemic, unprecedented fiscal stimulus and years of negative real interest rates have made soothsaying particularly troublesome. ‘But just because the data doesn’t fit Wall Street’s longstanding models that worked in the pre-pandemic era doesn’t mean that it’s “noise,”’ writes Jared. ‘It probably means the models are in dire need of updating.’”, Bloomberg, August 19, 2022

“U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs – After Covid-19 pandemic upended supply chains, American companies are shifting jobs and processes to the U.S. U.S. companies are bringing workforces and supply chains home at a historic pace. American companies are on pace to reshore, or return to the U.S., nearly 350,000 jobs this year, according to a report expected Friday from the Reshoring Initiative. That would be the highest number on record since the group began tracking the data in 2010.”, The Wall Street Journal, August 20, 2022

Brand News

“Aqua-Tots Dives Deeper into Mexico with New Tijuana Location – Aqua-Tots Swim Schools has been renowned for its work teaching children across the United States how to swim for more than 30 years. Now, that same opportunity is available to more families south of the U.S. border in Baja California! Aqua-Tots opened its second location in Mexico – and 22nd international site – on July 18, just miles from the California border in Tijuana.”, Franchising.com, July 29, 2022

“Dutch Bros. on track for 130 new stores in 2022; Q2 revenue jumps – The fast-growing coffee opened 65 stores during the second quarter — including its 600th location — and is on track for at least 130 openings for the full year. Dutch Bros., which is celebrating its 30th anniversary this year, currently operates 603 locations across 14 states. ‘Our newest shops are exhibiting predictable and consistent sales and upward margin progression, while our 2020 and 2021 classes are generating annualized volumes that are 10% higher than our system average,’ said Joth Ricci, CEO and president, Dutch Bros.”, Chain Store Age, August 11, 2022

“How F45’s cash-draining celebrity deals left it gasping for air – Embattled Aussie fitness franchise F45 has had to overcome some significant hurdles in its rise to prominence and more recently, its fight for survival. And that includes multi-million dollar payments to the celebrities who were brought in to turbocharge its now-abandoned global expansion plans. F45’s US-listed shares plunged following a July 26 market update stating it had lost the financing underpinning its franchise sales. The update also revealed the company’s plans to slash staff and downgrade earnings and revenue forecasts for this year.”, Brisbane Times, August 19, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Jollibee’s Profit Nearly Triples as System-Wide Sales Hit Record – Jollibee Foods Corp., the largest Philippine restaurant operator, saw its profit jump by nearly 200% in the second quarter as diners returned with the easing of Covid restrictions. ‘We are encouraged to see further improvement in dine-in sales while at the same time sustaining growth in our delivery business,’ chief executive officer Ernesto Tanmantiong said in a statement Thursday. Sales were better than expected and have returned to pre-pandemic levels, he said.”, Bloomberg, August 10, 2022

“Why Krispy Kreme Isn’t Doing As Well As You Think – Although Krispy Kreme performed well in 2021 and predicted strong growth due to the implementation of its Hub and Spoke business model, unexpected economic circumstances have caused issues for the brand in 2022. According to Restaurant Business Online, the company’s shares dropped 15% earlier this week due to projected revenues not living up to expectations. Krispy Kreme’s international stores helped drive revenue growth in 2021, but in 2022, the company is taking a hit from its U.K. stores. According to CNN, operating costs for businesses are up across the board in the U.K.”, Mashed, August 19, 2022

“Marco’s Pizza Reaches 1,100 Stores and $1B in Annual Sales – These achievements come on the heels of aggressive franchise expansion with more than 200 stores in development, alongside record-breaking growth that has helped catapult its strong performance as America’s No. 5 pizza brand in systemwide sales. Multi-unit growth continues to play a strategic role in Marco’s rapid expansion, with nearly half of its current franchise network made up of multi-unit operators.”, Franchising.com, August 10, 2022

“Only two Popeyes outlets now open in Shanghai – Only two restaurants of the American fried chicken chain Popeyes Louisiana Kitchen remain operational in Shanghai, according to local restaurant review and booking site Dianping. The two outlets are the Popeyes flagship store on Huaihai Road and another at the Shinmay Union Square in the Pudong New Area. The four other stores, however, have closed. Popeyes China is operated by PLK APAC Pte Ltd, a subsidiary of Restaurant Brands International Inc, and it’s not yet clear whether the remaining two stores will stay operational.”, Shina.cn, August 9, 2022. Compliments of Paul Jones, Jones & Co., Toronto