EGS Biweekly Global Business Newsletter Issue 46, Monday, December 27, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The world economy is predicted to top US$100 trillion for the first time in 2022: As we come to the end of 2021 and prepare to start 2022, the Year of the Tiger, this special issue focuses on predictions for the coming year.

And we also look back at how 2021 predictions turned out.

First, please click on this link to go to my latest article in ‘Global Trade’ magazine:

“5 Strategies To Expand Your Business Globally, Even in Trying Times”

Global Business Predictions for 2022, Year of the Tiger

“World economy to top $100 trillion in 2022 for first time – The world’s economic output will exceed $100 trillion for the first time next year and it will take China a little longer than previously thought to overtake the United States as the No.1 economy, a report showed on Sunday.”, Reuters, December 25, 2021

“2022 Market Outlook: More Upside For Stocks, Economic Growth To Rebound – ‘Our view is that 2022 will be the year of a full global recovery, an end of the global pandemic and a return to normal conditions we had prior to the COVID-19 outbreak. We believe this will produce a strong cyclical recovery, a return of global mobility and strong growth in consumer and corporate spending, within the backdrop of still-easy monetary policy. For this reason, we remain positive on equities, commodities and emerging markets and negative on bonds.’”, J.P. Morgan, December 15, 2021

“Corporate predictions for 2022: what the business schools say – Academics share their thoughts on what’s to come — and how to thrive. With demand and supply in many sectors pitching like ships in a hurricane so that the twain hardly ever seem to meet, leaders need resilient people and systems that can cope with the oscillation and not become prostrated by organisational seasickness. Julian Birkinshaw, professor of strategy and entrepreneurship at London Business School, identified the three key areas — finance, people and operations — where that resilience lies.”, The Times of London, December 22, 2021

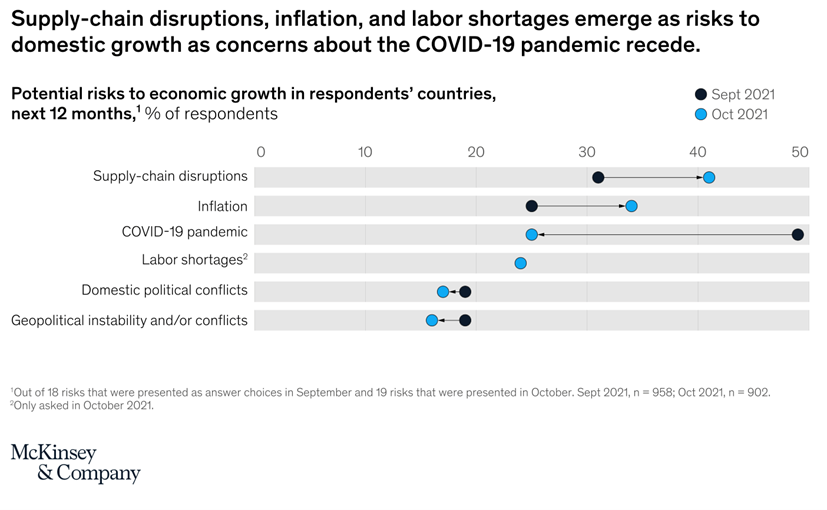

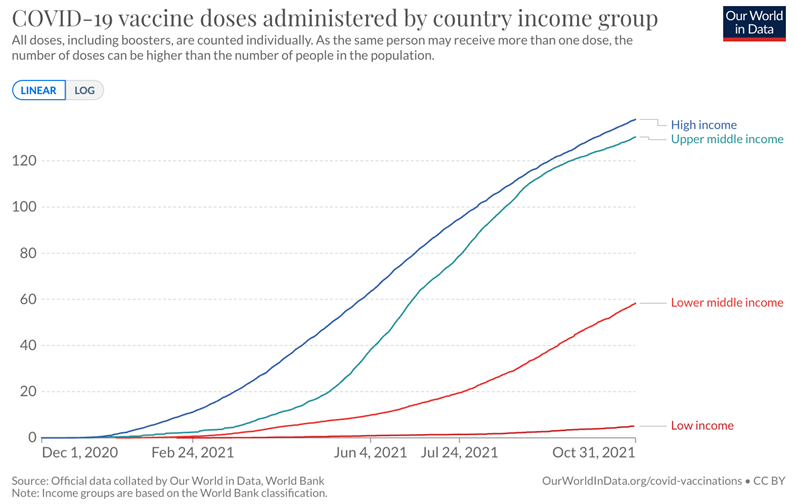

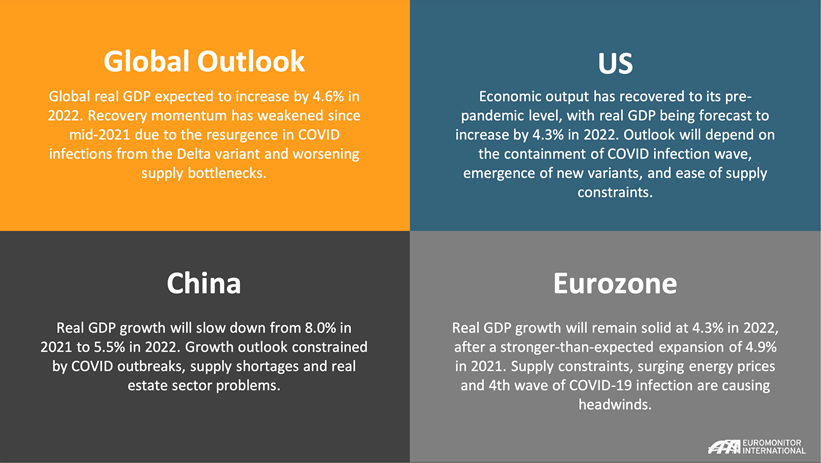

“2022 Annual Forecast: A Global Overview – The global economy will continue its uneven recovery amid progress in COVID-19 vaccinations in most developed countries, lagging vaccinations in much of the rest of the world and the threat of new outbreaks. While global growth will be relatively strong, it is likely to slow from 2021 due to setbacks from the pandemic, persistent supply chain disruptions, higher inflation and tightening financial conditions, as well as constraints on public spending in many countries as they cope with high levels of debt and increased interest rates.”, Stratfor Worldview, December 20, 2021

“Five areas will shape the global operating environment for business in 2022 – Embedded in this year’s predictions are increased demand for virtual healthcare, continued pressures on the availability of critical raw materials and advanced manufacturing products, and lingering social and economic pressures. All have been magnified by the festering pandemic.”, Kearney Global Business Policy Council, December 2021

“Wall Street’s 2022 Outlook – New Challenges And Opportunities – Growth through easy money and deficit spending is being replaced by realistic expectations, planning and actions. Add in the Federal Reserve move to market-determined interest rates, and the 2022 outlook necessarily includes shifts in the financial markets. Among the shifts will be serious valuation adjustments of all assets, not just bonds.”, Forbes, December 22, 2021

“Global Airline Capacity Is Seen Rising in 2022, Along With Fares – Carriers poised to return to 2015 level, U.K. consultancy says Ticket prices to be affected by labor, debt, other factors. Bloomberg, December 22, 2-21

“Japan govt weighs raising FY22 growth forecast to +3.0% or more – The projection would be an upgrade from a forecast for 2.2% real GDP growth for the fiscal year starting in April 2022 released at a mid-year review in July. ‘The projected growth figure is not that overly bullish, considering the continued growth thanks to eased restrictions and a high vaccination rate,’ said Saisuke Sakai, senior economist at Mizuho Research and Technologies.”, Reuters, December 20, 2021

“What to Expect of China’s Economy in 2022 – After a bumpy ride in 2021, China enters a politically important year ahead…..one thing that’s certain is that growth will become the top priority in 2022. The readout from the Central Economic Work Conference (CEWC) that concluded on Dec. 10 became the most widely dissected document of this economically turbulent year. ‘Stability,’ mentioned 25 times in the CEWC readout this time, is the paramount goal before the party’s 20th National Congress later in 2022.”, Caixing Global, December 23, 2021

“Wall Street’s 2022 Outlook – New Challenges And Opportunities – Growth through easy money and deficit spending is being replaced by realistic expectations, planning and actions. Add in the Federal Reserve move to market-determined interest rates, and the 2022 outlook necessarily includes shifts in the financial markets. Among the shifts will be serious valuation adjustments of all assets, not just bonds.”, Forbes, December 22, 2021

“2022 Projected to Be Another Record Year For New Business Starts – A recent survey reveals that almost three out of five U.S. employees (57%) want to start a business and one in five (20%) will make the leap in 2022. After two record-breaking years of new business creation, there’s no sign of the trend slowing down as QuickBooks projects as many as 17 million new small businesses could be set up in 2022. The prediction comes from a recent survey of 8,000 U.S. employees, commissioned by QuickBooks in November 2021.”, The Street, December 22, 2021

“The business builders – The more new businesses you build, the better you get at building them. That’s the lesson from the companies that do it best. Business building helps companies diversify their revenues and keep pace with shifting customers and markets.” McKinsey & Co., December 25, 2021

“What major themes will we see in global media in 2022? What should we see more of? 0McKinsey Global Publishing’s Raju Narisetti asked dozens of journalists and media leaders around the world for their own perspectives on what’s to come—their personal lens on what’s likely to be covered heavily in 2022, and what issues might fly under the radar.”, McKinsey & Co., December 26, 2021

“Technomic Releases 2022 Foodservice Predictions – 2022 Global Restaurant Trends Forecast…….read ahead for Technomic’s take on six major trends poised to make a global impact on foodservice in 2022, plus some up-and-comers likely to break out.”, Technomic, via Franchising.com, December 21, 2021

“India Is on a Tear – Massive modernization presents opportunities for investors. ‘Adventures do occur, but not punctually,’ writes E.M. Forster in A Passage to India. In other words, exciting things happen in India, but a little patience is required. In recent years, however, it seems events have sped up in the Asian subcontinent, and that’s fueling a stock market rally.”, Kiplinger.com, December 21, 2021

“Global demand for coal could hit all-time high in 2022 – Electricity from coal plants has risen by 9% this year to fuel economic recovery from Covid, says watchdog. Coal power is on track to hit a new global record this year after an economic rebound that could drive worldwide coal demand to an all-time high in 2022, according to the International Energy Agency.”, The London Guardian, December 17, 2021

“2022 Global Public Real Estate Outlook – We expect 2022 to be another solid year for the global economy with consensus forecasts calling for global real GDP growth of +4.4%. Job growth is anticipated to be strong in 2022. Segments we believe are exceptionally well positioned to outperform in 2022 include: Industrial Facilities in North America; Data Centers in Asia; U.S. Residential Sector; European Office REITs; and Cell Towers.”, Hazelview Securities Inc., December 2021

A Look Back at 2021 Predictions

“Who Got It Right? A Look Back at Expert Predictions For 2021 – Last year, the editorial team at Visual Capitalist scoured through 200+ reports, articles, podcasts, and more, to create our 2021 Prediction Consensus—a big picture and aggregated look at the key trends that experts predict for the year ahead. If 2021 taught us anything, it’s that things can change at the drop of the hat. Amidst all this uncertainty, how many of the highlighted predictions came to fruition, and which ones didn’t pan out exactly as expected?”, Visual Capitalist, December 13, 2021

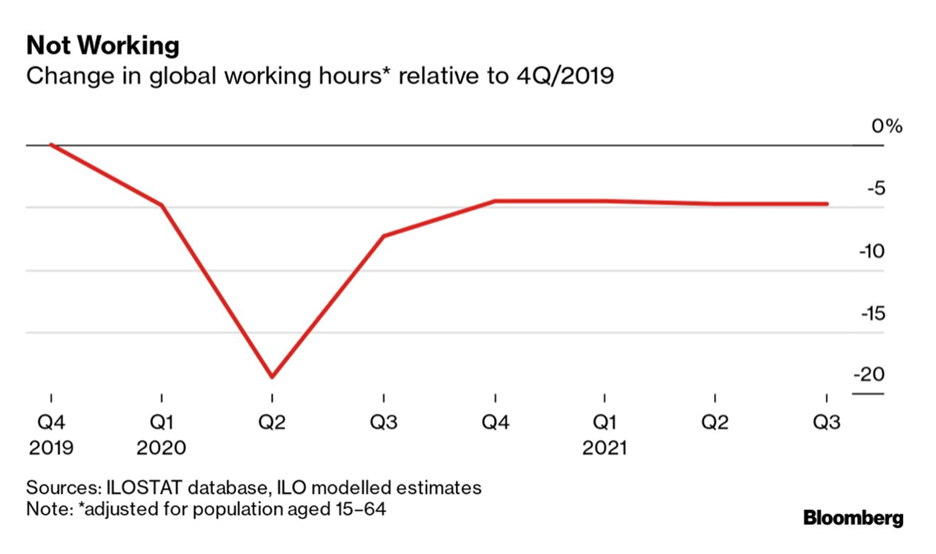

“2021: The year in (McKinsey & Co.) charts – While the quick arrival of vaccines buoyed optimism, the persistence of COVID-19 and the rise of variants continue to pose stumbling blocks toward achieving herd immunity. In this new normal, people are learning to live with an endemic disease. The future of work is at a pivotal crossroad—with many workers reassessing their options. During the pandemic, people grappled with finding meaning and purpose in their work. Will the future of work be hybrid, purposeful, inclusive, and built for balance?”, McKinsey & Co., December 17, 2021

“What Happened to Supply Chains in 2021? Pandemic-related disruptions threw a wrench into global supply chains this year, causing shortages of goods. Significantly, the pandemic-induced increase in demand for goods persisted even as demand for services (such as dining out, entertainment, and travel) largely returned to pre-pandemic levels.”, Council on Foreign Relations, December 13, 2021

“How 2021 became the year of ESG investing – Investors concerned about climate change and social justice had a bumper year in 2021, successfully pushing companies and regulators to make changes amid record inflows to funds focused on environmental, social and corporate governance (ESG) issues.”, Reuters, December 23, 2021

Our Information Sources & Who We Are

We constantly monitor 30+ countries, 40+ international information sources and ten business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

William (Bill) Edwards, CFE and CEO and Global Advisor, Edwards Global Services, Inc. (EGS) has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. Over the years, Bill has solved global challenges in the franchise, oil and gas, information technology and management consulting sectors. Along the way, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

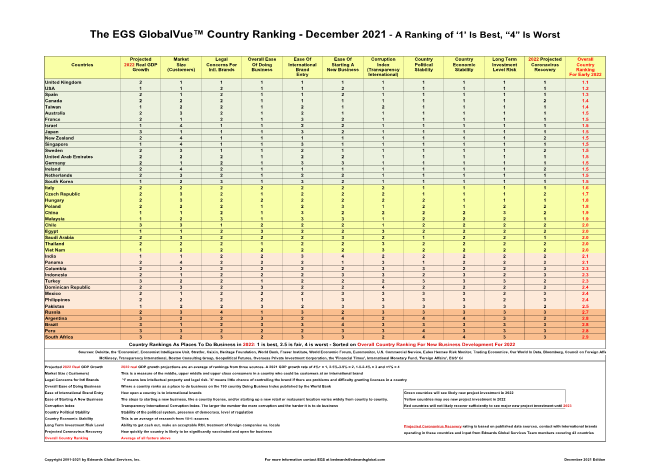

Download our December 2021 chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country Ranking

Our global business update blog can be found at:

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to solve challenges as you grow your company around the world.

EGS Biweekly Global Business Newsletter Issue 45, Monday, December 13, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

A Major Change in our newsletter: We are changing the format of our biweekly newsletter. As of today, this email will include a summary of the global business trends and happenings over the past two weeks. We hope this will make it easier for our readers to catch up on the top global business trends.

A more detailed look at the world today for each section of our newsletter is on our blog at www.staging.geowizard.biz if you wish to click through.

All of us at EGS wish all of our readers Happy Holidays and a prosperous and healthy 2022. Our next issue will come out on Monday, January 10, 2022.

First, Some Words of Wisdom

“Kindness is like snow. It beautifies everything it covers.” – Kahlil Gibran

“Cheers to a new year and another chance for us to get it right.” – Oprah Winfrey

“Last year’s words belong to last year’s language. And next year’s words await another voice.” – T.S. Eliot

Highlights in issue #45:

- Brand Global News Section: 9Round®, Chipotle®, Del Taco®, Jack In The Box®, The Melting Pot®, Nathan’s Famous®, Shake Shack®

Our Mission and Information Sources

Bolded article titles are live links if the article is available without subscription. Specifically, articles from the ‘Economist’ and the ‘Financial Times’ do not have direct links to the article.

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

To sign up for this free newsletter click on this link: https://lnkd.in/d_XkTGN.

Interesting Data and Studies

Our company has released our last 2021 GlobalVue™ countries as a place to do business in 2022 ranking analysis. Countries going up in the ranking include Egypt, Germany and Taiwan. Countries dropping in the ranking include Ireland, Italy, New Zealand. Hong Kong has been dropped as it is no longer considered separate from Mainland China. A major factor continues to be how well business in a country is recovering from the COVID-19 pandemic.

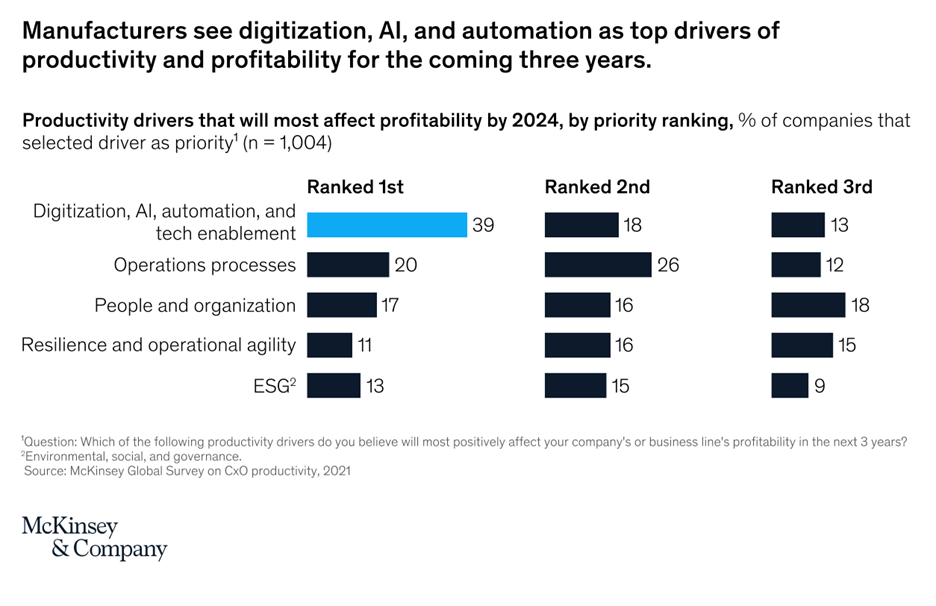

“If you could say anything positive about the COVID-19 pandemic—and its latest twist, the Omicron variant—it might be that it forced a lot of people to get better at accepting and acting upon the need for change. This week, we looked at three ways in which business leaders are transforming their organizations, as well as changes reshaping mortgages, infrastructure, healthcare, and the workplace.”, McKinsey, December 8, 2021

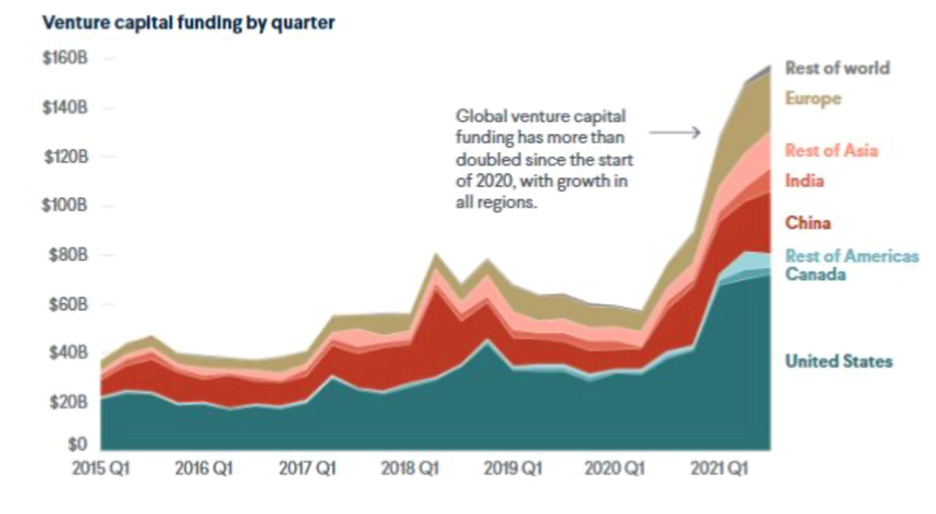

“During the pandemic, venture funding has boomed globally. The United States has retained its lead, accounting for roughly half of total venture dollars invested worldwide. China comes second, reflecting its status as the world’s second-largest economy. The striking change is that other regions are catching up: the rest of Asia has grown fast, and so too has Europe.”, Council on Foreign Relations, December 6, 2021

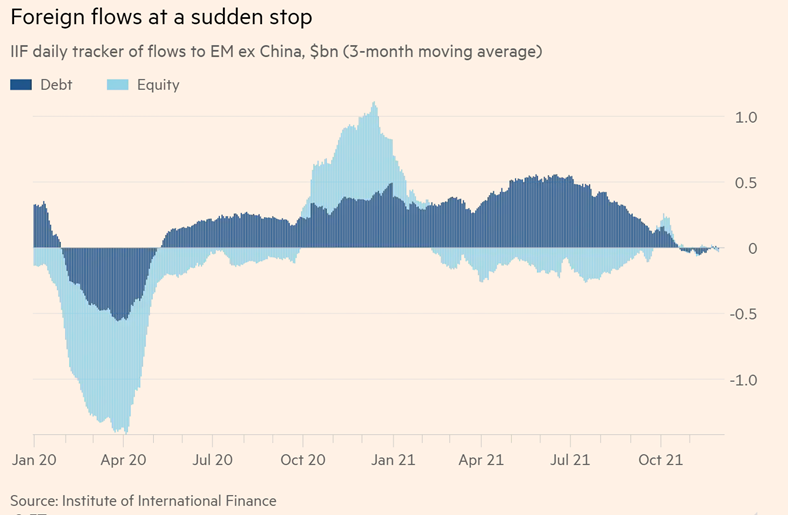

“Emerging markets hit by abrupt slowdown in new foreign investment – Flows into asset class ‘dry up’ on worries over US monetary policy and Omicron. Foreign investment in emerging market stocks and bonds outside China has come to an abrupt halt over fears that many economies will not recover from the pandemic next year, their prospects worsened by the Omicron coronavirus variant and expectations of higher US interest rates.”, Financial Times, December 8, 2021

“What comes after the Great Resignation? 4 workplace predictions for 2022? 4 workplace predictions for 2022. Daniel Zhao, senior economist and lead data scientist at employer review aggregator Glassdoor, thinks 2022 will be defined by the new normal and skyrocketing employee power within a historically tight labor market. The companies to find success in the new year will be the ones who ‘embrace the opportunities to rethink old ways of hiring, employee engagement, and how business is done.’”, Fortune, December 9, 2021

“J.P. Morgan says 2022 will be a great year: COVID’s impact will diminish and the economy will fully recover. In its annual global economic outlook, the U.S. investment bank optimistically predicted that 2022 will mark a huge improvement from the past two years. ‘Our view is that 2022 will be the year of a full global recovery,’ Marko Kolanovic, J.P. Morgan’s chief global markets strategist, wrote in a note to clients this week.”, Fortune, December 9, 2021

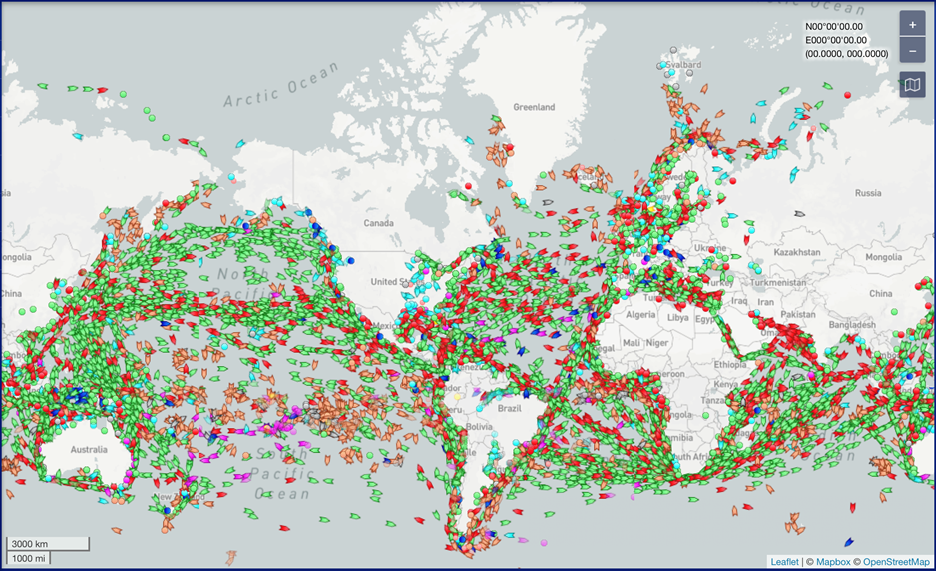

Global Supply Chain & Trade Update

“When Shipping Containers Are Abandoned, the Cargo Becomes a Mystery Prize –

Supply chain carnage creates opportunities for companies willing to take a chance on random goods, from cheese to used cars—and maybe even pumpkin seeds…… JS Cargo & Freight Disposal, acquires containers filled with abandoned goods that shipping lines want to get rid of. And business is booming in his line of work. Snarls in the global supply chain have left an estimated 3 million containers idling on ships queued up at ports around the world, according to Niels Larsen, president of Air & Sea North America at DSV, a global transport and logistics company.”, Bloomberg, November 29, 2021

“Toy sellers ponder reliance on China as supply problems bite – Companies hit by delays and soaring shipping costs are rethinking production options. The global supply chain crunch has led retailers from grocers to toy stores to warn of product shortages and higher prices. Recent manufacturing delays in China have added to the pressure, leading some in the $95bn global toy market to reconsider their reliance on the country.”, The Financial Times, December 11, 2021

“Supply Chain Woes Force Murata to Ship Lithium Batteries by Air – ‘We are being forced to use airfreight to deliver our batteries because ships are unavailable, and that costs an outrageous amount of money. If we were able to use sea routes, we should be able to make a profit.’ (President Norio Nakajima said in an interview.) On top of inflated base cargo fees fueled by high demand, batteries shipped via air incur extra handling charges because they’re a fire hazard.”, Bloomberg, December 9, 2021

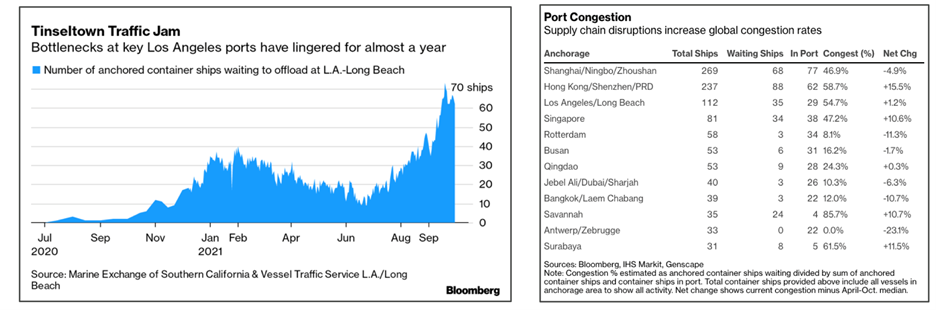

“Vanishing Ships Underscore Supply Woe: Crisis Peak Is a Mirage – A line of more than 80 container ships waiting to dock at the ports of Los Angeles and Long Beach, California, was cut in half in late November — or so it seemed. Turns out the vessels disappearing from the queue were merely hiding from it, loitering in the Pacific out of reach of the official count. The actual bottleneck at midweek stood at 96 ships. In a recurring theme in economies from Germany to the U.S., progress repairing this supply snarl proved to be a mirage.”, Bloomberg, December 9, 2021

“Shipping container lines on track make a record-breaking $150 billion this year from the supply chain breakdown – Container shipping pre-tax profit for 2021 and 2022 could be as high as $300 billion, according to Drewry, an independent maritime research consultancy. In 2021, the industry is forecast to make $150 billion. That’s a new record. In 2020, the industry brought in $25.4 billion, according to The Journal of Commerce. And even though 2021 has been a banner year, Drewry expects the industry to make even more in 2022.”, Fortune, December 3, 2021

“China shipping to Southeast Asia sees prices surge tenfold as reopening demand picks up – Already taxed by the coronavirus pandemic, intra-Asian shipping routes have entered their traditional peak season. Reopening and work resumption in Southeast Asia, as well as ongoing disruptions in the global logistics network, have contributed to record high prices. A 20-foot container, shipped from Shenzhen to Southeast Asia, cost about US$100 to US$200 before the pandemic, but the price has since surged tenfold, from US$1,000 to US$2,000, said Yan Zhiyang, a manager with a logistics company based in Guangdong province.”, South China Morning Post, December 10, 2021

Global, Regional & Local Travel Updates

“Qantas reopens Singapore, London lounges – Qantas’ Singapore and London business class lounges are once again open as the airline prepares to ramp up flights for the December/January holiday season. Along with the rest of Qantas’ international lounges, these were shuttered in March 2020 as the sweeping scope of the Covid pandemic became clear.”, Executive Traveller, December 11, 2021

“China’s domestic air traffic recovery faltering due to zero-COVID policy – China’s domestic air traffic, once the world’s envy after a fast rebound during the pandemic, is faltering due to a zero-COVID policy that has led to tighter travel rules in Beijing and weaker consumer confidence after repeated small outbreaks. The outlook for the fourth quarter, normally a popular time for southerners to head north for winter breaks and northerners to head south for warmer weather, is dimming due to COVID-19 related disruptions at a time when international traffic is negligible.”, Reuters, December 9, 2021

“International passenger flights will not resume till January 31, says India’s aviation regulator – The restrictions will not apply to flights specifically approved by the Directorate General of Civil Aviation and international all-cargo operations. International passenger flights to and from India will remain suspended till January 31, the Directorate General of Civil Aviation announced on Thursday, amid concerns about the spread of the Omicron variant of Covid-19.”, Scroll, December 9, 2021

“Big Airline Orders Moving Ahead Despite Variant, Executive Says – Airlines are moving forward to finalize big commercial aircraft orders despite the newly discovered coronavirus variant and a fresh wave of travel restrictions to contain its spread, Pratt & Whitney’s top sales executive said. ‘The campaign activity is as high as I’ve seen, maybe ever,’ said Rick Deurloo, chief commercial officer of Pratt & Whitney, a unit of Raytheon Technologies Corp.”, Bloomberg, December 3, 2021

Global COVID & Vaccine Update

“COVID-19 cases are plummeting in Asia, and scientists aren’t 100% sure why – After recording nearly 200,000 cases per day on Sept. 1, the region is recording 43,000 cases per day as of Thursday, according to the United Nations Office for the Coordination of Humanitarian Affairs, meaning the entire continent is logging roughly a third of the daily cases in the United States……Asia’s COVID-19 decline comes as Delta-driven waves are fueling surges elsewhere.”, Fortune, December 9, 2021

“Covid-19 booster jab results raise hopes of beating Omicron (UK) – Third dose gives immune system a massive lift. A third dose not only increased antibody levels thirtyfold, but roughly tripled levels of T-cells, a part of the immune system that experts believe could be the critical weapon against the heavily mutated Omicron strain.”, The Times of London, December 2, 2021

Country & Regional Updates

Africa

“African Startup Inflows Seen Hitting Record $5 Billion This Year – The jump partly reflects greater interest in Africa from investors in the U.S. and China as well as institutional bankers, according to Nina Triantis, global telecoms and media head at Standard Bank Plc, who spoke at the Africa Tech Summit in London this week.”, Bloomberg, December 8, 2021

Australia

“Australia GDP Falls Less Than Feared, Shows Signs of Resilience – Australia’s economy posted a smaller-than-forecast contraction, a result that’s likely to reinforce views the Reserve Bank will taper or potentially even scrap its bond buying program early next year. The result is “much stronger and consistent with the resilience theme,” said Su-Lin Ong at Royal Bank of Canada.”, Bloomberg, November 30, 2021

“Beer Shortage Is a Nightmare Before Christmas for Australians – The nation’s two biggest brewers — Lion and Carlton & United Breweries — have flagged protracted delays and lower production of some of the beer-loving country’s most popular brews due to supply chain problems. That’s sparked fears major retail chains might start imposing limits on booze purchases at the worst possible time, with millions of Australians only recently emerging from a series of bleak lockdowns and hoping for a summer holiday season resembling some kind of normality.”, Bloomberg, December 9, 2021

China

“Analysts Offer Clues for Where to Invest in Xi’s New China – Before the coronavirus struck, investing in luxury stocks and Chinese internet giants like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. was a surefire way of tapping the world’s largest consumer base……But as investors are learning, Xi’s vision goes further than just reducing inequality. His speech also made clear that efforts to foster “common prosperity” would come amid a drive for “high-level development” of China’s economy.”, Bloomberg, December 11, 2021

“China’s vegetable prices surge 30.6% in November as food costs soar – The gains followed a 15.9% year-on-year rise in October, as floods and other extreme weather in recent months have hit farms. Although the bureau noted the supply of vegetables increased in November, prices were still up on a monthly basis by 6.8%. Investors have been watching for signs of whether rapidly rising prices and stagnant economic activity might further drag down growth.”, CNBC, December 8, 2021

European Union

“Few Europeans want a return to 9-5 at office after pandemic, survey shows – Only 14% of European workers want to return to the office 9-5, and more than half say they have become more productive as a result of working from home, which has boomed amid COVID-19 lockdowns and restrictions, a survey showed on Thursday. About 12% of employed people in the European Union usually worked from home in 2020, up from around 5% before the pandemic, according to data from Eurostat.”, Reuters, December 8, 2021

The Middle East

“In the Middle East, a New Era of Alliances Emerges – Middle Eastern relations as we’ve known them for decades are over. As ambitious states try to expand their influence throughout the region, interests, not ideology, are driving the creation of new alliances. Even ultra-religious movements are showing signs of pragmatism.”, Geopolitical Futures, December 2, 2021

New Zealand

“2021 Survey – FRANCHISING COUNTS – Highlights from Massey University’s latest survey show the resilience of franchising in difficult times. Sales through franchised units are estimated to be a massive $36.8 billion – equivalent to a remarkable 12 percent of our GDP – and this figure doesn’t include motor vehicle or fuel retail through franchised outlets. Add those in, and the total comes to $58.5 billion. The survey has also confirmed that New Zealand is still the most franchised country in the world.”, Franchise New Zealand Magazine, December 8, 2021. Compliments of Stewart Germann, Stewart Germann Law Office, and Simon Lord, Publisher, Franchise New Zealand Magazine

“After 108 Days Of Lockdown, New Zealand’s Largest City Reopens As Nation Shifts Away From ‘Zero Covid’ Approach – Restaurants, cafes, cinemas and other public venues reopened in Auckland on Friday as New Zealand’s largest city exited 108 days of Covid-19 lockdown, a move that comes as the highly vaccinated south Pacific nation moves forward with its plans to ease pandemic restrictions despite the emerging threat from the Omicron variant.”, Forbes, December 3, 2021

Peru

“Peru Lifts Key Rate to 2.5% as Economy Grows Most in Region – Peru raised interest rates for a fifth straight month as the economy grows at the fastest pace in Latin America and inflation exceeds the upper limit of its target range.”, Bloomberg, December 9, 2021

United Arab Emirates

“UAE to shift weekend and create shorter working week – Gulf state will introduce four-and-a-half day office week to boost economy and attract expats. The United Arab Emirates government is shifting the national weekend to Saturday and Sunday to synchronise with global markets, instituting a four-and-a-half day working week from January next year. Changes to the working week, which at present runs from Sunday to Thursday, are intended to “boost work-life balance and enhance social wellbeing, while increasing performance to advance the UAE’s economic competitiveness”, the government said in a statement.”, The Financial Times, December 7, 2021

United Kingdom

“U.K. Warned of ‘Unsustainable’ Shortage of Workers as Pay Soars – Survey by REC and KPMG shows no easing of labor market strains Starting-pay inflation hits record as firms try to fill roles. U.K. employers increased starting salaries at a record pace in November amid an ‘unsustainable’ shortage of workers, according to a survey published Thursday.”, Bloomberg, December 8, 2021

“Want to start a business? Next year could be a great time to do it – Among the positives, Covid-19 has had a significant impact on reducing costs inside companies, especially in areas such as business travel and property, and we are still seeing the beneficial effects of the enormous fiscal and monetary stimulus pumped into the economy by governments around the world in response to the pandemic. Unesco estimates the total stimulus at $16 trillion out of a global economy valued at $93 trillion.”, The Times of London, November 11, 2021

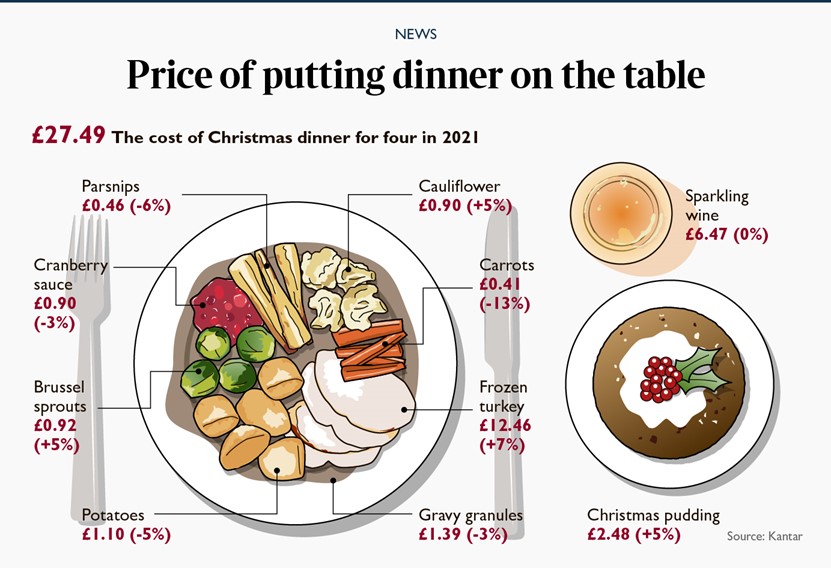

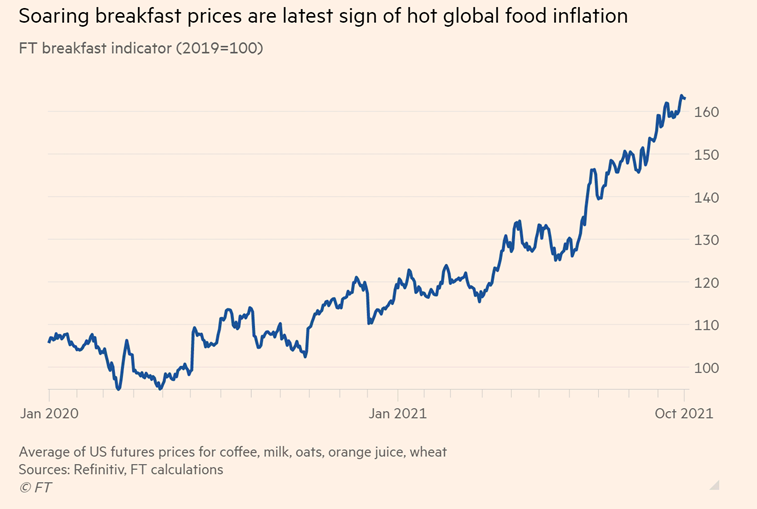

“Christmas lunch burns hole in pockets – The price of a Christmas dinner has risen by 3.4 per cent as food inflation reaches its highest level so far this year. The average price of a festive meal for four is £27.48 (US$36.48), with the price of a frozen turkey rising by 7 per cent and brussels sprouts and Christmas puddings 5 per cent more expensive than last year, according to figures from Kantar.”, The Times of London, December 7, 2021

United States

“Record Share of U.S. Small Businesses Raise Pay, NFIB Says – Forty-four percent of firms boosted pay, matching the largest share in monthly data back to 1986, according to the NFIB’s November survey. Those wage gains may be beginning to pay off. Some 48% of respondents reported having job openings they could not fill, and while still very high, it’s the second straight monthly decline.”, Bloomberg, December 2, 2021

“Disneyland employees vote for union contract, avoid strike – The tentative agreement endorsed by Master Services Council leadership raises minimum pay from $15.50 to $18.50 per hour — a 19% increase….The union coalition represents approximately 40% of the 25,000 Disneyland resort cast members — Disney parlance for employees.”, OC Register, December 4, 2021

Brand News

“13 restaurant prototypes unveiled in 2021, from Taco Bell to Denny’s – Restaurant chains unveiled plans for new prototypes in 2021, almost entirely catering to consumers’ evolving needs during the pandemic. Quick-service and fast-casual chains nationwide made plans to add drive-thrus and specific pickup areas for digital orders, with many shrinking or even eliminating dining rooms. Not every redesign came from limited-service chains, however. At least two family-dining restaurants joined in the trend.”, Nation’s Restaurant News, December 11, 2021

“As 2022 Arrives, The Restaurant of the Future Comes Into Focus – The pandemic brought a catalog of questions to restaurateurs’ tables. Nothing was revolutionary, necessarily. Notions like mobile ordering and loyalty. Finding ways to alleviate drive-thru capacity. Whether or not guests even needed a dining room. And just like early lockdown days, three vectors have driven evolution as operators approach 2022, according to new data from consulting giant Deloitte, which polled 1,000 consumers who dined in a restaurant within the past three months to field its latest “Restaurant of the Future Report.’”, QSR Magazine, December 8, 2021

“9Round finalizes South Korean expansion plans, expands Middle Eastern operations – “We are thrilled to welcome South Korea to our roster and to continue to expand our presence across the Middle East,” said 9Round founder and CEO Shannon Hudson.”, Upstate Business Journal, December 2, 2021

“America’s Most Popular Fast-Casual Chain Could Double Its Locations, CEO Says – Chipotle is on a meteoric rise, and according to CEO Brian Niccol, not afraid of the competition. While expressing cautious concern about the impact of the latest COVID-19 variant Omicron on the chain’s operations, Niccol was optimistic about Chipotle’s ability to continue its dominance of the fast-casual market in a recent interview with CNN.”, Eat This, Not That!, December 1, 2021

“Jack in the Box to acquire Del Taco for over $450 mln – Jack in the Box, which would now have over 2,800 restaurants spanning 25 states, said the deal would help the chain beef up its off-restaurant premise sales. About 99% of Del Taco restaurants feature a drive-thru.”, Reuters, December 5, 2021

“How the Melting Pot is re-emerging from COVID-19 stronger – The 100+-unit fondue chain is expanding its franchising footprint amid a menu overhaul. Moving forward, The Melting Pot is looking to expand franchising and add new franchisees to the team, with plans for the new Melting Pot Social spinoff: the “younger, hipper cousin” to the Melting Pot with shorter experience times (which originally could run up to 2-3 hours per table) and an emphasis on the bar program.”, Nation’s Restaurant News, December 1, 2021

“Nathan’s Famous (US) Expands to Saudi Arabia – Nathan’s Famous, Inc., the American tradition serving New York favorites for more than 100 years, announces a new expansion plan into Saudi Arabia. Nathan’s Famous will serve their world-famous hot dogs and fries in seven kiosks across Saudi Arabia, with plans to open three more in the coming weeks.”, World Franchise Associates, November 4, 2021

“Shake Shack expands into drive-thru industry – In 2022, Shake Shack plans to open 45 to 50 new restaurants, including up to 10 drive-thru locations….In addition to ordering directly in Shack and at drive-thru lanes, guests will have the option of placing orders ahead of time for pickup via the Shack app and online at order.shakeshack.com., Fox Business, December 7, 2021

Articles & Studies For Today And Tomorrow

“The Year In Franchising: Reflecting On 2021, And Anticipating 2022 – Over the past two years, the world has changed in ways it never has before, and the franchise industry is no exception. It has taken a while, but following the challenges of the Covid-19 pandemic, 2022 is positioned to be a massive year for franchise development and sales growth.”, Forbes, November 30, 2021

“The digital transformation market size is expected to grow from $521.5 billion as of this year to $1.25 trillion by 2026. Corporations need to create bionic capabilities so that they can harness the potential of disruptive technologies and integrate them into new processes, business models, and ways of working. Evidence shows that successful digital transformation drives performance and competitive advantage and directs companies towards becoming bionic. In the short term, digital technology improves productivity and customer experiences. Longer term, it opens up new growth opportunities and sets up companies for sustained success.”, NMS Consulting, December 2021

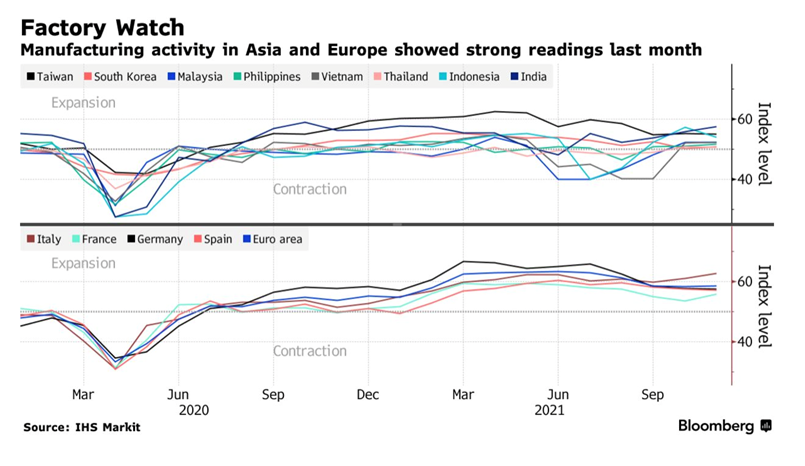

“Global Factory Output Stabilizes But New Threat of Omicron Lurks – Euro-area PMI ends four-month slowdown from record expansion. Asia benefits from looser lockdown and border restrictions. Factories across Southeast Asia had been on a recovery path as loosened movement restrictions allowed output to catch up before the crucial year-end holiday season.”, Bloomberg, November 30, 2021

“How Technology is Evolving to Make Companies More Productive – What’s one of the biggest goals of most small businesses? Efficiency. Emerging technology is helping to make companies more productive. When operations are fast, effective, and accurate, the company can do more with less. Though the dream of full-on productivity might not be entirely feasible, many professional teams are making headway.”, Entrepreneur Magazine, December 9, 2021

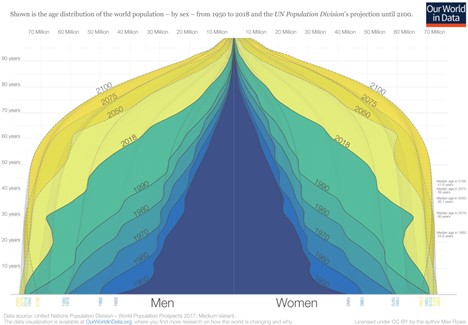

“Back in the 1960s, global population growth peaked at a 2.1% annual rate, but since then it has been on a historic downtrend. In fact, according to the most commonly cited United Nations projection, which is based on a medium fertility rate scenario, it’s expected that annual population growth could drop all the way to 0.1% by the end of the 21st century.”, Visual Capitalist and Our World In Data, December 2, 2021

William (Bill) Edwards, CFE and CEO and Global Advisor, Edwards Global Services, Inc. (EGS) has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Our Latest GlobalVue™ Country Ranking

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to successfully grow your company around the world.

EGS Biweekly Global Business Newsletter Issue 44, Monday, November 29, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

We are monitoring the impact the new COVID-19 variant will have on international business travel through the end of 2022. Some countries limit travel. Supply chain issues remain but are lessening in some areas of the world. Labor shortages in OECD countries continue as workers resign to try something new, including starting their own companies.

First, Some Words of Wisdom

“Success is the sum of small efforts, repeated day in & day out.”, R. Collier

“There are far better things ahead than any we leave behind.”, C. S. Lewis

“Don’t sit down and wait for the opportunities to come. Get up and make them.”, Madam C. J. Walker

Highlights in issue #44:

- The Post-Covid Evolution of Consumer Demographics

- Distribution of Global GDP by Region

- Everything You Need to Know About the Global Supply Chain Crisis

- Global Innovation Index 2021 – Tracking Innovation through the COVID-19 Crisis

- British economic growth ‘set to overtake China’

- Brand International News Section: 7-Eleven®, Dairy Queen®, Denny’s®, Gong Cha®, Popeyes®, Papa John’s®, Sweetgreen®, Wendy’s®

Our Mission and Information Sources

Bolded article titles are live links if the article is available without subscription

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

To sign up for this free newsletter click on this link: https://lnkd.in/d_XkTGN.

Interesting Data and Studies

“Global Innovation Index 2021 – Tracking Innovation through the COVID-19 Crisis.”, 14th edition, World Intellectual Property Organization (WIPO)

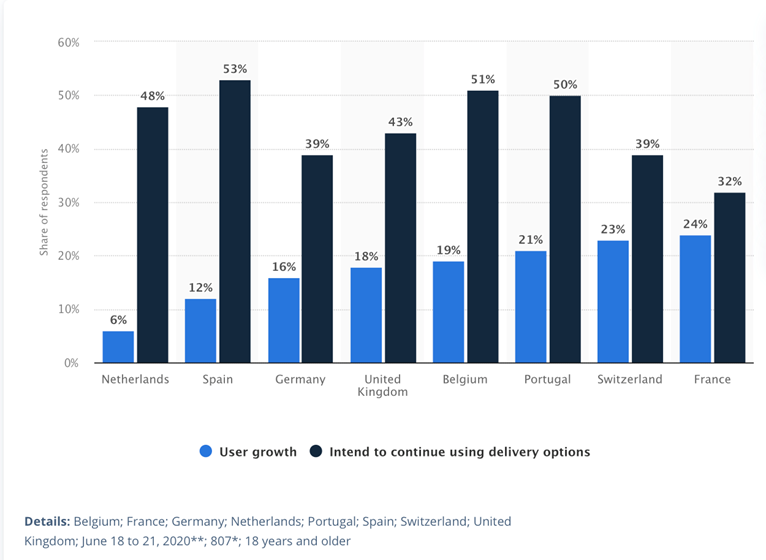

“Increase in restaurant delivery users during the coronavirus (COVID-19) pandemic in selected European countries in 2020 – As the coronavirus (COVID-19) pandemic caused restaurants all over Europe to close their dine-in operations, there was a noticeable increase in the number of users of food delivery services. For example, France saw a 24 percent increase of restaurant delivery users compared to pre-pandemic times. Meanwhile, more than half of the respondents from Spain intended to continue using food delivery services after the pandemic is over.”, Statista, September 23, 2021

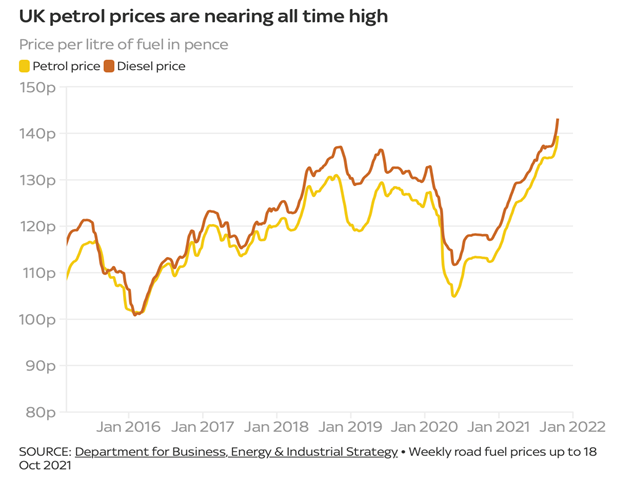

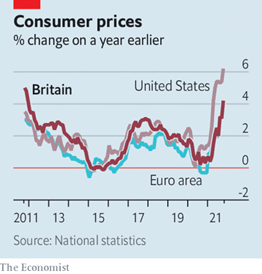

Britain’s annual inflation rate jumped to 4.2% in October, the highest level in a decade and up from 3.1% in September. This was mostly because of higher energy costs and supply-chain shortages, but a tightening labour market has added to inflationary pressures. The number of people in employment rose sharply in October, allaying fears that many of the 1m still on the government’s furlough scheme, which ended in September, would lose their jobs. Record job-vacancy rates persist, which often leads to higher wages to attract staff.

From the ‘Economist’ issue on November 20, 2021

Global Supply Chain & Trade Update

“Everything You Need to Know About the Global Supply Chain Crisis – The kinks in the U.S. may be getting worked out, but it’s a worldwide crisis and there are still plenty of threats, from Covid and energy shortages to an aged shipping fleet.”, Bloomberg, November 26, 2021

“California ports report supply chain progress, delay fines for lingering cargo containers – The executive directors of the ports of Los Angeles and Long Beach said in a joint statement on Monday that since the October announcement of the new fee, the ports have seen a decline of 33% in aging cargo on the docks.”, CNBC, November 22, 2021

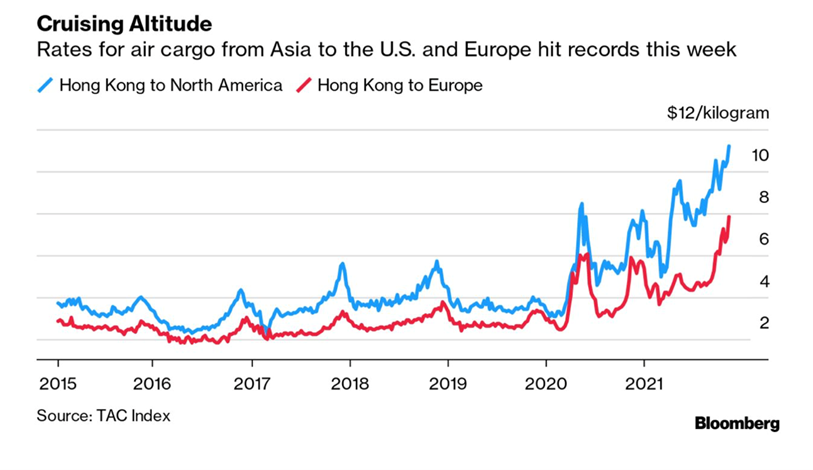

“Digital advances are accelerating across all the world’s main cargo markets as the pandemic drags on, but the technological strides in air freight are emerging as perhaps the most remarkable. According to the TAC Index, rates to move goods in planes from Hong Kong to either North America or Europe rose to fresh records this week, as importers nervous about depleting holiday stockpiles decided to fly over bottlenecks on the ground.”, Bloomberg, November 18, 2021

Global, Regional & Local Travel Updates

“Airlines Scramble to Navigate Fast-Degrading Travel Outlook – Airlines, passengers and businesses scrambled to respond to a deluge of travel restrictions announced over the weekend to slow the spread of the omicron coronavirus variant. Leisure travel will also see an impact, while friends and relatives visiting loved ones after long absences are more likely to go through with a trip, said Alex Irving, an analyst at Bernstein in London.”, Bloomberg, November 28, 2021

Global COVID & Vaccine Update

“54.1% of the world population has received at least one dose of a COVID-19 vaccine. 7.9 billion doses have been administered globally, and 27 million are now administered each day. Only 5.7% of people in low-income countries have received at least one dose. Our World In Data, November 28, 2021

“Stocks Rise as Investors Weigh Omicron Variant – Oil recovers, Moderna jumps as vaccine maker says it is working on Omicron booster. The S&P 500 gained 1% in midday trading Monday. The index suffered its worst one-day percentage decline in nine months on Friday after South Africa identified a fast-spreading strain of the coronavirus, which the World Health Organization has named Omicron. The technology-focused Nasdaq Composite Index advanced 1.5%, while the Dow Jones Industrial Average added just over 100 points, or 0.3%.”, The Wall Street Journal, November 29, 2021

“Omicron Variant Is Reported in More Countries as Officials Grapple With How to Respond – Nearly two years after the first confirmed outbreaks of Covid-19 in China, the rapid spread of a new variant in southern Africa shows how the coronavirus can still thwart the best efforts of policy makers world-wide to return to a post-pandemic normal. Further analysis of the Omicron variant will determine whether governments will react by reimposing unpopular and economically damaging restrictions on their populations.”, The Wall Street Journal, November 28, 2021

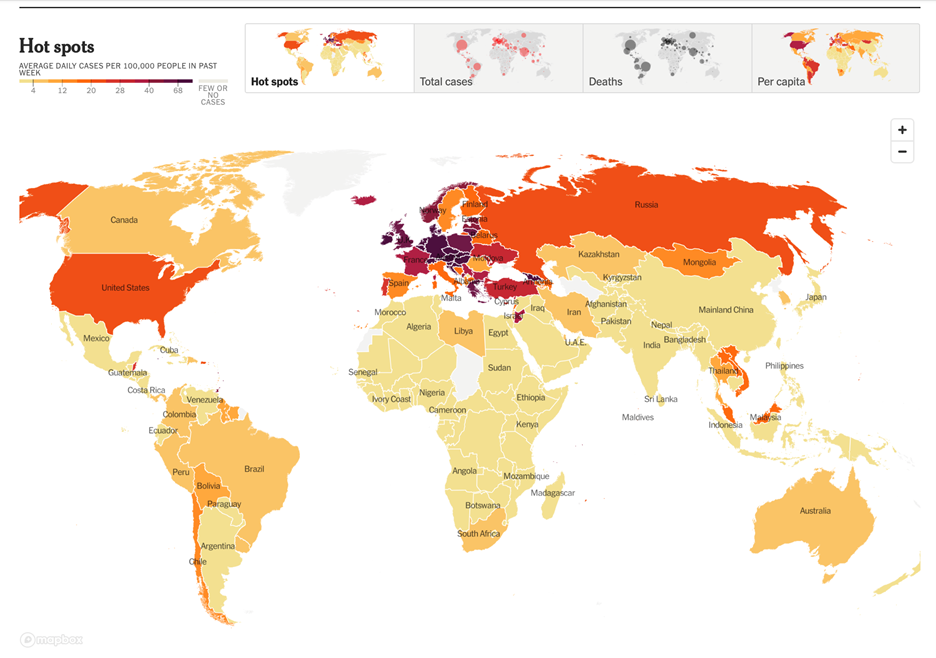

“Coronavirus World Map: Tracking the Global Outbreak – New York Times, November 28, 2021

“Apple delays return to in-person work to February, will allow up to four weeks of remote work per year – Apple is officially planning to begin its “hybrid work pilot” on February 1, according to a new memo sent to employees by Tim Cook today and obtained by The Information. In the memo, Cook says that employees will first work from Apple offices one or two days each week.”, 9to5Mac.com, November 18, 2021

“Vietnam on verge of 100 million Covid-19 vaccine doses milestone – Releasing this information, the Health Ministry also said both Hanoi and Ho Chi Minh City have both fully covered more than 80 percent of their adult populations.”, VN Express International, November 16, 2021. Compliments of Sean Ngo, CEO, VF Franchise Consulting, Ho Chi Minh City

Country & Regional Updates

Australia

“Australian Retail Sales Surge as Economy’s Recovery Builds – Australian retailers recorded their best month of sales in nearly a year as consumers splashed out on everything from dining out to clothing, taking advantage of the easing of protracted lockdowns and building momentum in the economy for the final quarter.”, Bloomberg, November 25, 2021

“The regional towns where small business transactions are up 260% since the pandemic – Small businesses in regional towns are riding stronger growth compared to their metro counterparts, after people flocked to the country throughout the pandemic to avoid city-wide lockdowns.”, Smaetcompany.com.au, November 19, 2021. Compliments of Jason Gehrke, Publisher & Editor, ‘Franchise News’, Brisbane

Canada

“Restaurant owners say they have the answer to the current labour shortage: Better pay, benefits and balance – Employment in the food services and accommodation sector is still down more than 200,000 jobs from what it was before the pandemic, according to Statistics Canada. But the low employment is not only a function of businesses struggling under lockdown, it’s also because workers haven’t returned to jobs they held before the pandemic. The number of job vacancies – positions that businesses have advertised but can’t fill – climbed to nearly 160,000 in August.”, The Glove and Mail, November 22, 2021

“Restaurants just might come out of the pandemic better than before. Here’s why: The food industry has always been volatile, writes Corey Mintz in “The Next Supper.” Making it better depends on you.”, The Toronto Star, November 18, 2021

China

“People in Beijing open up about China’s zero-Covid approach and reveal where they dream of visiting once borders reopen. Residents of China’s capital generally support the authorities’ handling of the coronavirus pandemic while harbouring dreams of overseas travel. A teaching assistant wants to see penguins in Antarctica, a housewife hopes to resume trips in Asia, an entrepreneur dreams of a Greek holiday with his partner.”, South China Morning Post, November 28, 2021

“Supermarket companies are enthusiastically discussing how to survive the cold winter the president of China Chain Store and Franchise Association proposed lean management. Zheng Luoxin, a reporter from Economic Observation Network, ‘At present, the domestic supermarket industry is facing unprecedented difficulties and there is great uncertainty in the future. But one thing is certain. Now is a very difficult transition period for supermarkets for more than 20 years.’ On November 18, at the 2021 Supermarket Development Strategy Summit Forum, Pei Liang, President of the China Chain Store & Franchise Association, said in his speech that the current basic consensus for the transformation and development of supermarket enterprises is to shift from extensional expansion to intensive development, and the core of intensive development It is “lean”.

In Pei Liang’s view, lean is manifested in many aspects, such as refined product selection, more grounded meals and life proposals, more intimate services, more attractive and super cost-effective products, etc. These are all companies. After lean management, a kind of attraction to customers is formed, and it is also the core competitiveness of supermarkets to allow customers to return to offline.” , EEO.com.cn, November 18, 2021. Translation and article compliments of Paul Jones, Jones & Co., Toronto

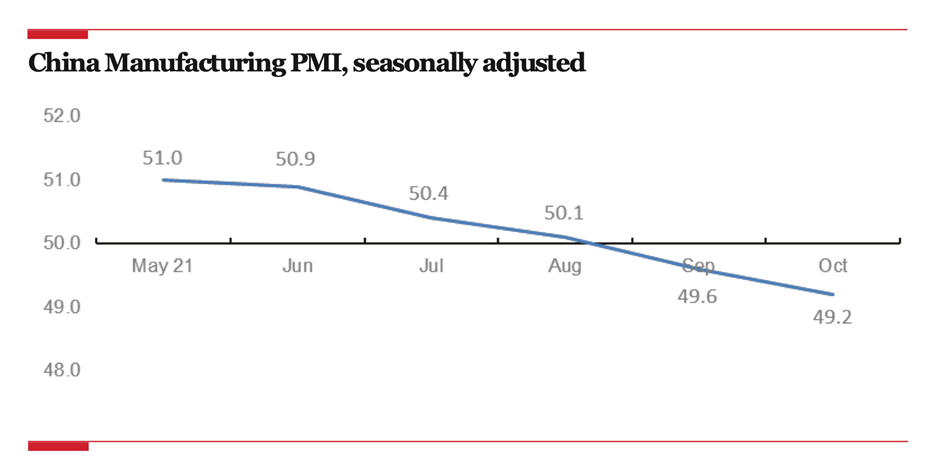

“China’s economic growth slows in 3Q21 as ‘energy dual controls’ and power shortages take a toll. Growth in retail sales softens in 3Q21. Chinese government takes steps to ensure energy supplies.”, Fung Business Intelligence, November 22, 2021

Italy

“Italy ski slopes finally reopen after 2020 closure with France and Austria to follow suit – Italian skiers finally returned to the slopes after nearly two years on Saturday since the first pandemic lockdown in March 2020. As if on cue, snow fell overnight, blanketing the slopes of Plan de Corones in South Tyrolean town of San Vigilio di Marebbe, giving a fresh covering to the man-made base just in time for opening day. Skiers came from as far away as Croatia and the Italian capital Rome, as well as from neighbouring valleys where slopes have yet to open.”, Euronews, November 28, 202

South Korea

“South Korean Exports Extend Double-Digit Gains in Early Data – The value of Korea’s overseas shipments advanced 27.6% during the first 20 days of this month, the customs office reported Monday, following a 24% increase for the whole of October. Imports surged 41.9% during the period, led by a jump in the purchase costs of crude oil, gas and related products.”, Bloomberg, November 21, 2021

“7-Eleven introduces autonomous delivery robot in Seoul – Convenience store chain 7-Eleven said Monday that it will begin test driving ‘Neubie’, an autonomous, short-range delivery robot, at a store in Seoul’s Seocho district. The robot, equipped with a camera-based autonomous driving system, demonstrates outstanding performance in maneuvering in urban areas and is capable of delivery under various weather conditions, the company said.”, Inside FMCG, November 24, 2021. Compliments of Jason Gehrke, Publisher & Editor, ‘Franchise News’, Brisbane

Thailand

“A month after reopening, Thailand sees gradual tourism recovery – Thailand was among the first countries in Asia to reopen for foreign arrivals, and it is seeing a slow recovery, including new hotels touting longer stays for individual travellers.”, Reuters, November 25, 2021

United Kingdom

“British economic growth ‘set to overtake China’ – The predictions, which were first reported by The Telegraph, would mark the first time since the era of Mao Zedong that Britain would grow more rapidly than China.”, The Times of London, November 26, 2021

“UK to require charge points for electric vehicles in new buildings – Charging points for electric vehicles will be required to be installed in new buildings in Britain from next year under new legislation to be announced by Prime Minister Boris Johnson, his office said in a statement on Sunday. It said the regulations would lead to up to 145,000 extra charge points being installed in England each year in the run-up to 2030, when the sale of new petrol and diesel cars will end in Britain.”, Reuters, November 21, 2021

United States

“Keys to Surviving and Thriving in Post ‐COVID‐19 and Beyond: Self-sufficiency; Analytics; Exponential Thinking; Automation; Assets and Liquidity; Virtualization and Decentralization.”, The Connor’s Report, November 2021

“U.S. new jobless claims hit 52-year low – U.S. government data out Wednesday showed the lowest number of new weekly jobless claims since 1969.”, Reuters, November 27, 2021

“Coffee prices surge to 7-year high as inflation hits Americans’ pocketbooks – The cost of everyday products and commodities such as coffee and gas has surged in recent months. Bloomberg noted the price surge could result in higher costs over time for U.S. firms such as Starbucks and Peet’s Coffee and Tea.”, Fox Business, November 12, 2021

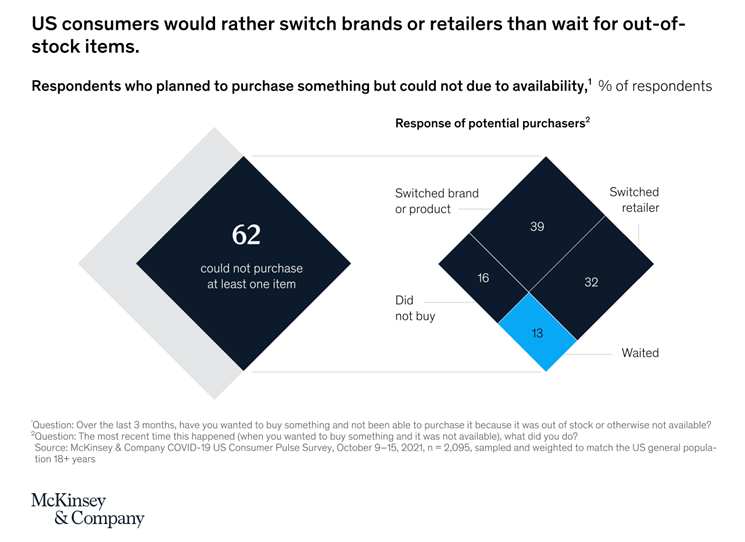

“The ship has sailed but many US shoppers won’t wait – As supply-chain woes persist, retailers are faced with waning customer loyalty this holiday season. Our recent COVID-19 US Consumer Pulse Survey unveiled that rather than wait for a replenishment of an out-of-stock item, 39 percent of respondents said they switched brands, while 32 percent went to another retailer.”, McKinsey, November 26, 2021

Vietnam

“Vietnam’s resort island welcomes first tourists after nearly 2 yrs – Two hundred vaccinated foreign tourists arrived in Vietnam’s beach-fringed island of Phu Quoc on Saturday, the first wave of visitors to the country in nearly two years as it seeks to resurrect its pandemic-ravaged tourism economy.”, Reuters, November 21, 2021

Brand News

“(Denny’s®) MVP Dawn Lafreeda Did It Her Way: 2020 Single-Brand Leadership Award recipient – Today her company, Den-Tex Central, operates 81 Denny’s and employs more than 3,000 people in restaurants in 6 states. Each month, nearly 1.2 million customers dine at her restaurants, generating $100 million in sales each year.”, Franchising.com, November 21, 2021

“Taiwanese Bubble Tea Brand Gong cha’s Playbook for Global Expansion – To grow the brand, Gong cha uses the common direct franchising model in our native fortress markets of Taiwan, South Korea, and Japan. Outside of our Asian-nation strongholds, Gong cha has found success employing a master franchising model, growing to nearly 1,700 locations worldwide including in Australia, New Zealand, England, Mexico, Canada, and the U.S.”, Franchising.com, November 19, 2021

“FountainVest to Buy Papa John’s Pizza China Franchisee From EQT – FountainVest Partners has agreed to purchase China F&B Group, which runs Papa John’s Pizza and Dairy Queen outlets in the world’s most-populous country, people familiar with the matter said. The Hong Kong-based private equity firm will take over the restaurant chain from current owner EQT AB, a Swedish buyout firm, and other holders for about $160 million, the people said, asking not to be identified as the information is private.”, Bloomberg, November 18, 2021

“Papa Johns expands into Kenya and Uganda – Papa Johns on Tuesday said that it has a deal with Kitchen Express LTD to open 60 locations in Kenya and Uganda in the coming years. The first four of these locations are set to open in 2022, starting in Nairobi.”, Restaurant Business, November 23, 2021

“This One Popeyes Menu Item Caused Major Confusion at First U.K. Restaurant Opening – Popeyes opened its first U.K. restaurant last weekend, drawing in a crowd of hundreds eager for a taste of the chain’s famous chicken sandwich. The true talk of the town, however, turned out to be a far humbler menu item—a side dish, in fact.”, Eat This, Not That!, November 27, 2021

“Sweetgreen Raises $364 Million in IPO That Prices Above Marketed Range – The initial public offering for Sweetgreen, the restaurant chain known for its salads and bowls, was priced at $28 a share, higher than the marketed range of $23 to $25. The company raised $364 million in the sale of 13 million shares, higher than the marketed 12.5 million shares.”, Barron’s, November 18, 2021

“Wendy’s plans 50 restaurants across UK in 2022 – The fast-food chain returned to the UK this year after a 22-year absence and has seen sales beat expectations. US burger chain Wendy’s has revealed a relaunch in the UK is proving so successful bosses plan to open a further 50 sites across the country next year.”, The London Independent, November 25, 2021

“8 new virtual or ghost restaurant brands – From celebrity partnerships to existing chains expanding their reach, check out the latest in the virtual brand space. Restaurant-celebrity partnerships aren’t new, but it seems those in the public eye are getting more into putting their names on delivery-only restaurants concepts than ever before.”, Nation’s Restaurant News, November 10, 2021

Articles & Studies For Today And Tomorrow

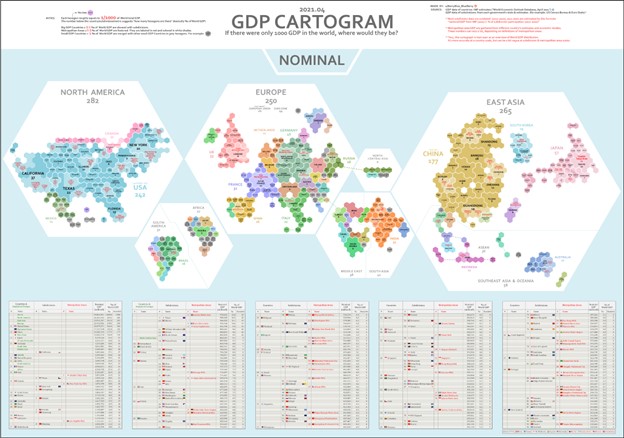

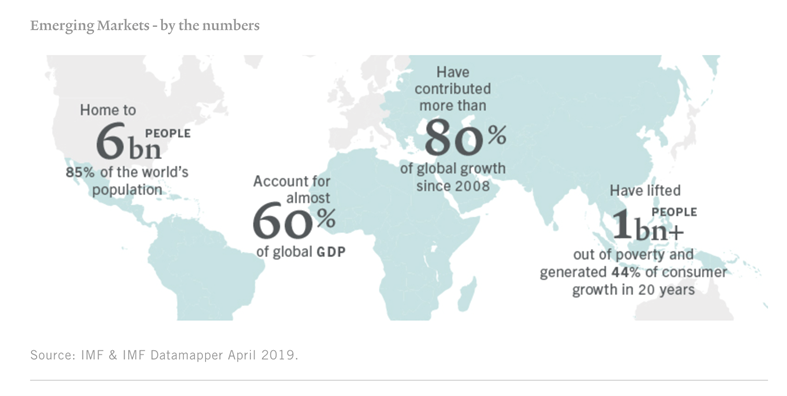

“Distribution of Global GDP by Region – Gross domestic product (GDP) measures the value of goods and services that an economy produces in a given year, but in a global context, it is typically shown using country-level data. In these cartograms, global GDP has been normalized to a base number of 1,000 in order to show a more regional breakdown of economic activity. Created by Reddit user /BerryBlue_Blueberry, the two maps show the distribution in different ways: by nominal GDP and by GDP adjusted for purchasing power parity (PPP).”, Visual Capitalist, October 12, 2021

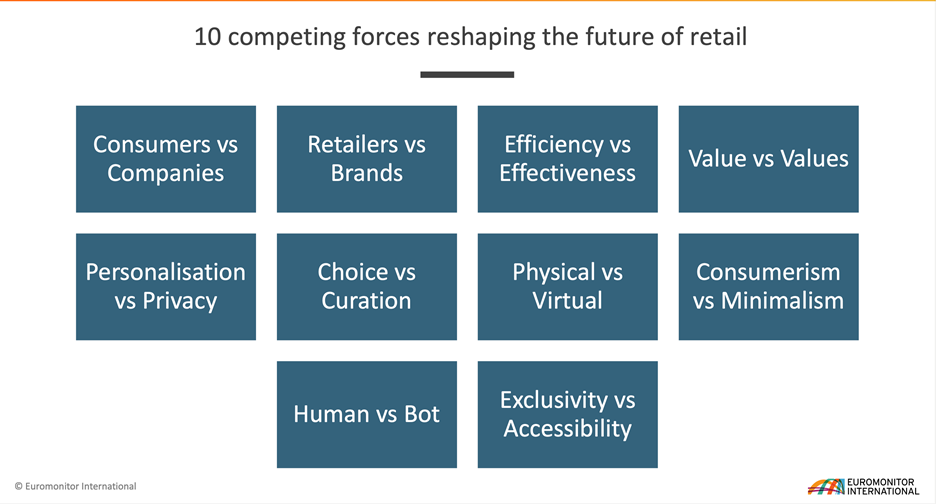

“The Post-Covid Evolution of Consumer Demographics – After a year of uncertainty, it’s no surprise that businesses are looking ahead to refresh and refine their digital advertising techniques and strategies to ensure a lucrative and successful future. With this in mind, businesses must consider how consumer perceptions have changed and reinvented themselves over the past year or so, and what can be done to appeal to these new priorities and behaviors.”, Franchising.com, November 2021

William (Bill) Edwards, CFEand CEO and Global Advisor, Edwards Global Services, Inc. (EGS) has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Our Latest GlobalVue™ Country Ranking

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to successfully grow your company around the world.

EGS Biweekly Global Business Newsletter Issue 43, Monday, November 15, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Inflation spreads, air travel restarts to the USA, some good news for Asian economies, global port congestion continues, global PMIs once again positive, COVID passes remain in Europe this winter and the U.S. starts giving out visas in China again.

But First, Some Words of Wisdom

“You will either step forward into growth or you will step back into safety.”, Abraham Maslow

“Intellectual growth should commerce at birth and cease only as death.”, Albert Einstein

“You don’t have to see the whole staircase, just take the first step.”, Martin Luther King, Jr.

Cultural Wisdom

In China, “Yes” does not always mean yes. When a person nods their head, they may be merely following what you are saying, not giving a definitive answer. District Export Council of Southern California, December 16, 2020 webinar

Highlights in issue #43:

- With rising vaccination rates, surveyed economies are reopening more fully; industry and trade are expanding despite the pandemic’s knock-on effects.

- Status of the Global Economic Recovery

- U.S. Resumes Visa Services in China After Reopening Borders

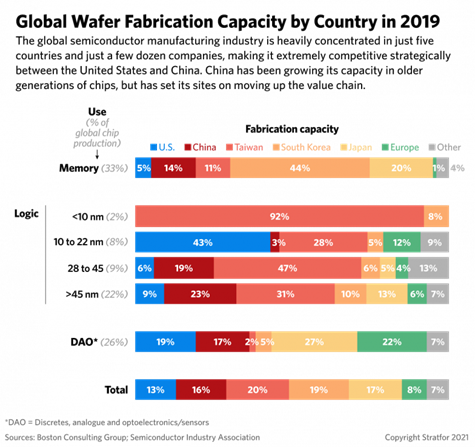

- In the Race to Boost Semiconductor Manufacturing, Global Powers Take Their Marks

- Worst Is Over for Indonesia’s Growth as Consumers Head to Malls

- Southeast Asia Digital Economy to Reach $363 Billion by 2025

- Covid vaccine mandates around the world

- Brand International News Section: Appleby’s® and IHOP®, Betty’s Burgers®, Fat Brands®, Firehouse Subs®, Sonic® (Inspire Brands®), Legendary Restaurant Brands®, Panera Bread®, Planet Fitness®, Roll’d®, Steak n Shake®, Subway®, Little Gym® (Unleashed Brands®)

Our Mission and Information Sources

Bolded article titles are live links if article is available without subscription

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground in 27 countries covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

To sign up for this free newsletter click on this link: https://lnkd.in/d_XkTGN.

First, Something a bit Different

“Jane Goodall on a life as a woman defending the wild – In a series exploring women in international affairs, global environmentalist, Dr Jane Goodall DBE, speaks to Gitika Bhardwaj about why humanity still has reason to hope.”, Chatham House, November 12, 2021

Interesting Data and Studies

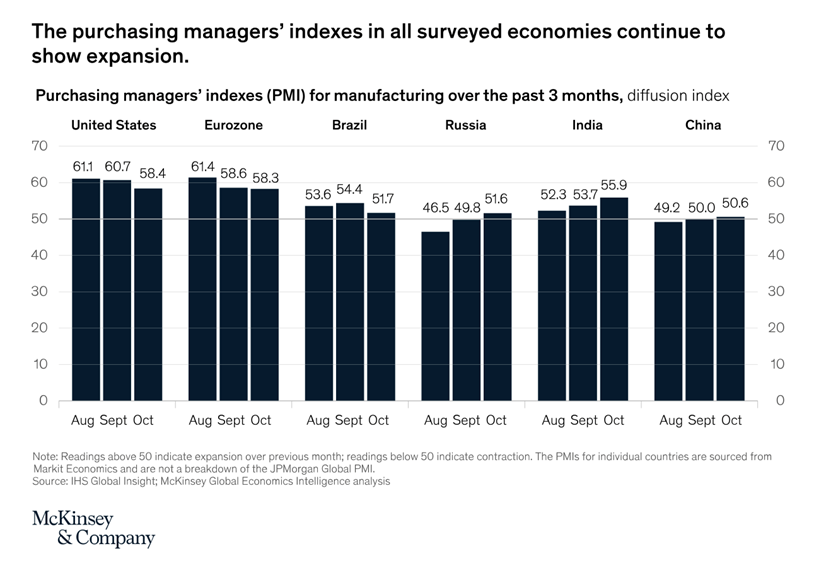

“With rising vaccination rates, surveyed economies are reopening more fully; industry and trade are expanding despite the pandemic’s knock-on effects. The global purchasing managers’ indexes (PMIs) for manufacturing and services show healthy expansion, with respective readings of 54.1 and 53.4. Unemployment is generally falling, and world trade has effectively recovered to prepandemic levels.”, McKinsey, November 8, 2021

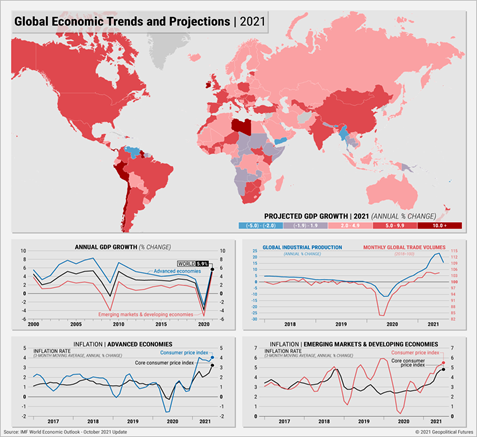

“Status of the Global Economic Recovery – Economies around the world are still climbing out of the hole created by the pandemic, and plenty of things could derail the recovery, from supply chain shortages to rising prices.”, Geopolitical Futures, November 5, 2021

Global Supply Chain & Trade Update

“Major Ports Are Congested. Shipping Companies Maersk and Hapag-Lloyd Are Thriving – This year is likely to end as the best year on record for the sector. Global trade volumes jumped by 8% to 10% this year as the global economy started recovering from months of lockdowns and other trade restrictions. Meanwhile, shipping rates have more than doubled between January and August, amid signs of a shortage of container transport capacity.”, Barron’s, November 11, 2021

“Supply chain disruption: is the worst over? As companies, investors and policymakers fret over port logjams, freight costs and chip shortages, some indicators are starting to signal that global supply chain stress may be on the wane. The coming months will show if the snarl-ups portend a toxic scenario of stagflation for the world economy or are just a bump in the road to recovery. They will also determine how inflation expectations, monetary policy and corporate earnings pan out.”, Reuters, November 3, 2021

“(UK) Supply chain crisis ‘will last into 2023’ – Henrik Pedersen, chief executive of Associated British Ports (ABP), said he would be ‘positively surprised’ if the problem eased before the end of next year. ‘We have a shortage of truck drivers in the UK, and in other countries, too, so it [the problem] is in the shipping leg and the road leg.’ Pedersen said ABP’s ports were still clogged up with empty containers that Asian ports were reluctant to take back because they did not have the space.”, The Times of London, November 14, 2021

“Small-business owner faces fees of at least $30K due to delays after shipping container flagged for inspection – A small-business owner could be on the hook for tens of thousands of dollars in fees after her container was flagged for inspection by the Canada Border Services Agency amid international shipping congestion.”, CBC, November 11, 2021

“The global port backlog continues. Domestically, L.A. and Long Beach ports are the most severe pinch points for U.S. trade, while shortages of trucking, rail, and warehouse capacity at alternative gateways are challenging importers seeking to avoid the Southern California port logjam. Meanwhile, port congestion extends worldwide and container freight prices are surging, including in China from two of the three biggest container ports in the world.”, Exiger Trends Report, September – October 2021

“The Busiest Port in America: Los Angeles – U.S. e-commerce grew by 32.4% in 2020—the highest annual growth rate in over two decades. Such rapid growth has resulted in many more goods being imported, leaving America’s western ports completely overwhelmed.”, Visual Capitalist, November 2, 2021

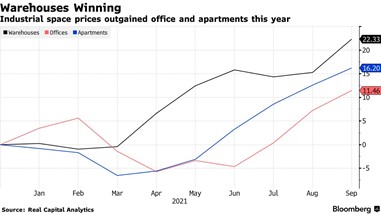

“Snarled Supply Chain Is Making U.S. Warehouse Shortage Worse – Record numbers of cargo ships bob in the waters off Southern California, unable to unload. A late shipment of patio furniture gets moved — three times — before finding a home for the winter. With no warehouse space, a crew assembles holiday displays in a parking lot in an effort to get them to clients on time.”, Bloomberg, November 9, 2021

Global, Regional & Local Travel Updates

“U.S. Resumes Visa Services in China After Reopening Borders – The U.S. embassy and consulates in China resumed regular visa services as the country reopened its border to international travelers after barring them for nearly two years under Covid-19 restrictions.”, Caixing Global, November 10, 2021

“British Airways and Virgin Atlantic Synchronize Departures to Celebrate U.S. Reopening – More than 600 days after the U..S.’s travel ban was introduced aimed to reduce the spread of coronavirus infections, arch-rivals British Airways and Virgin Atlantic momentarily put rivalries aside as both airlines departed from London Heathrow to New York’s John F. Kennedy Airport, symbolizing the end of restrictions on travel to the U.S.”, Airline Geeks, November 8, 2021

“Delta bookings soar in six weeks after U.S. move to open borders – Delta Air Lines (DAL.N) has seen a 450% surge in international bookings in the six weeks since Sept. 20 when the United States said it would reopen for fully vaccinated visitors. The U.S. carrier said that international flights were expected to operate in full capacity on Nov. 8, with high passenger volume throughout the following weeks.”, Reuters, November 4, 2021

“Chinese Airlines Struggle While the World Slowly Reopens – Carriers attributed the subpar performance to the repeated appearance of Covid-19 cases in China and rising oil prices over the past months. The year 2021 is turning to be worse than 2020 for some carriers.”, Airline Geeks, November 11, 2021

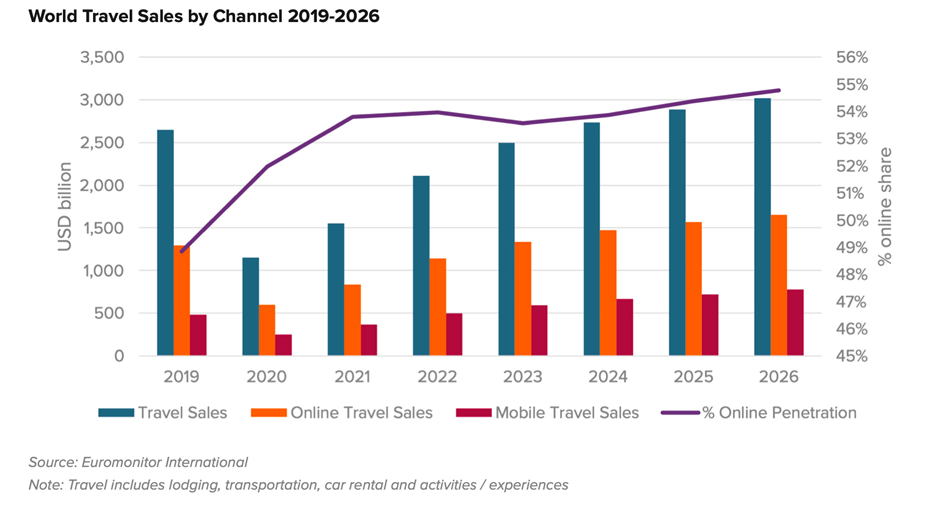

“The pandemic has accelerated digitalisation as businesses pivot online. Mobile travel sales are expected to regain all lost ground by 2022, hitting almost USD500 billion. Online travel will continue to grow, accounting for 54% of travel sales in 2021. Online sales gained five years’ worth of growth during the pandemic.”, Euromonitor International, “Travel Rewired: Innovation Strategies for a Resilient Recovery” report, November 2021

“LATAM Confirms Demand Recovery for November – LATAM Airlines Group’s operational passenger projection for November 2021 is estimated to reach 62% compared to the same month in 2019, as measured in available seat kilometers.”, Airline Geeks, November 14, 2021

Global COVID & Vaccine Update

“51.2% of the world population has received at least one dose of a COVID-19 vaccine. 7.34 billion doses have been administered globally, and 28.14 million are now administered each day. Only 4.2% of people in low-income countries have received at least one dose.”, Our World In Data, November 13, 2021

“Covid vaccine mandates around the world – Many countries have made inoculation mandatory for at least some of their citizens, with penalties for those who do not get jabbed. The UK became the latest country to introduce vaccine mandates on Tuesday after the government announced all NHS workers would need to be jabbed by next spring. Although obligatory shots have been ordered in many other countries, some have balked at the measures and resorted to protests and legal action.”, The Guardian, November 9, 2021

“Covid passes set to stay as Europe heads for winter – There have been protests and complaints of restricted freedom, but much of Europe is now using Covid passports to enter bars, restaurants, cinemas and museums.”, BBC News, October 28, 2021

“Pfizer says antiviral pill 89% effective in high-risk cases – A pill to treat Covid developed by the US company Pfizer cuts the risk of hospitalisation or death by 89% in vulnerable adults, clinical trial results suggest. The drug – Paxlovid – is intended for use soon after symptoms develop in people at high risk of severe disease.”, BBC News, November 6, 2021

“Rising Covid infections in Europe spark fears of new wave – WHO says pace of transmission across continent and Central Asia is a ‘grave concern’. Europe is experiencing a surge in coronavirus infections to levels not seen in months, alarming health officials and sparking fears that the continent could be engulfed by a new wave of the pandemic this winter.”, The Financial Times, November 4, 2021

Country & Regional Updates

Argentina

“Argentina Reopens to Vaccinated Tourists Around the World — What to Know – Argentina opened its borders to the world Monday, welcoming fully vaccinated travelers to experience the country’s amazing wine, breathtaking mountains, and deep-rooted culture. Eligible travelers must have received a completed vaccination at least 14 days before coming and must show proof of a negative COVID-19 PCR test taken within 72 hours of entering the country, according to the Ministry of Tourism and Sports.”, Travel and Leisure, November 2, 2021

Australia

“Why Australia’s ‘great resignation’ is a myth – There is no evidence of such a phenomenon here. if there was, it would be no bad thing. Australia’s resignation rate has fallen to an all-time low.”, Inside FMCG, November 9, 2021. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

China

“Soaring inflation at China’s factory gates raises fears for rest of world – Producer prices increased by 13.5 per cent in the year to October, accelerating still further from the 10.7 per cent jump recorded for September. The new figure showed producer inflation picking up to a level not seen since July 1995 and exceeding analysts’ consensus forecast of 12.4 per cent.”, The Times of London, October 19, 2021

“China industrial output, retail sales accelerate but property clouds outlook – China’s industrial output and retail sales grew more quickly than expected in October, despite fresh curbs to control COVID-19 outbreaks and supply shortages, but the slowing property sector weighed on the economic outlook. Output grew 3.5% in October from the same period a year ago, official data showed on Monday, accelerating from a 3.1% increase in September. Retail sales growth also picked up.”, Reuters, November 14, 2021

“Consumers win in public interest civil lawsuit – The Wuxi Intermediate People’s Court recently awarded punitive damages to consumers of counterfeit coffee purporting to be from US coffee-maker Starbucks. Unlike traditional trademark infringement cases, where the rights owner is the plaintiff, this case was unusual as it had been initiated by the Consumers Council of Jiangsu Province (JSCC)….”, INTA Bulletin, November 8, 2021. Compliments of Paul Jones, Jones & Co., Toronto

“The first digital convenience store in the country landed in Shanxi – This is the first digital convenience store in the country. Customers can shop while receiving coupons and enjoy Alipay prices; they can also experience personalized services such as laundry delivery, old clothes recycling, and mobile phone teaching for the elderly through the ‘small program convenience corner’.”, China Chain Store & Franchise Association, October 29, 2021. Compliments of Paul Jones, Jones & Co., Toronto

India

“India opens for international travel — what happens next? India has opened up for travelers and will allow commercial flights from November. The Home Ministry announced that tourist visas would be issued to those arriving on chartered flights first, whereas travelers on commercial flights would start getting their visas approved from November.”, Deutsche Welle, November 2, 2021

Indonesia

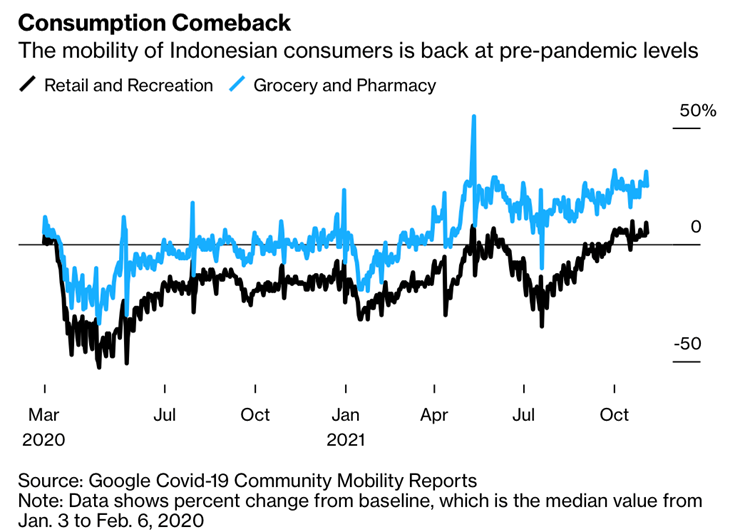

“Worst Is Over for Indonesia’s Growth as Consumers Head to Malls – Indonesia will likely catch up on growth in the fourth quarter as its all-important consumption engine returns to high gear. More Indonesians are venturing outside to malls and supermarkets as a sharp decline in Covid-19 cases lets the government ease movement restrictions. Traffic in retail and recreation areas has largely returned to pre-pandemic levels, while mobility in groceries and pharmacies have rebounded well beyond that, according to Google data.”, Bloomberg, November 9, 2021

Japan

“Toyota accelerating vehicle production in December as COVID-induced parts shortages ease. The automaker’s 14 plants, 28 production lines in Japan will be operating normally for the first time since May. The automaker expects to build approximately 800,000 vehicles globally during the month, up from approximately 760,000 vehicles built during the same period a year ago.”, Fox Business, November 12, 2021

“Japan’s wholesale inflation hits 40-year high as fuel costs spike – The corporate goods price index (CGPI), which measures the prices companies charge each other for their goods and services, surged 8.0% in October from a year earlier, exceeding market expectations for a 7.0% gain, Bank of Japan data showed onThursday.”, Reuters, November 10, 2021

Malaysia

“Malaysian Economy Returns to Contraction as Virus Curbs Hit – GDP shrank 4.5% y/y in 3Q, deeper than est. for 2.6% decline. BNM sees growth rebounding in 4Q as virus curbs are lifted. Gross domestic product in the three months ended September shrank 4.5% from a year earlier, Malaysia’s central bank said Friday, worse than the 2.6% drop predicted by analysts in a Bloomberg survey.”, Bloomberg, November 11, 2021

Southeast Asia

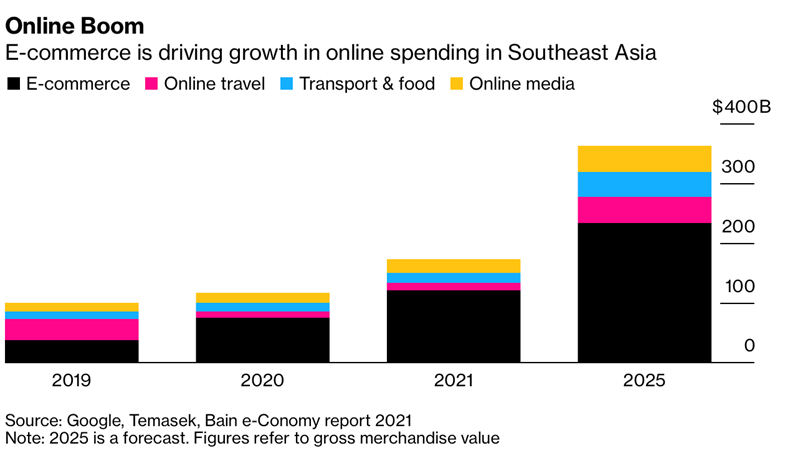

“Southeast Asia Digital Economy to Reach $363 Billion by 2025 – E-commerce, travel, media, transport and food are driving the region’s digital growth, with online spending rising 49% in 2021 to $174 billion, the companies said in their latest annual report. The region added 60 million new digital consumers since the start of the pandemic, led by Thailand and the Philippines.”, Bloomberg, November 10, 2021

New Zealand

“New Zealand Jobless Rate Falls to 14-Year Low, Hiring Surges – New Zealand’s unemployment rate fell to its lowest level in almost 14 years in the third quarter as employment surged, sending the currency higher as traders boosted bets on interest-rate increases. The jobless rate dropped to 3.4% from 4% in the second quarter, the lowest rate since the fourth quarter of 2007 and matching the lowest on record, Statistics New Zealand data showed Wednesday in Wellington. Economists expected 3.9%.”, Bloomberg, November 2, 2021

United Kingdom

“Most furloughed workers returned to their jobs – The Office for National Statistics said yesterday that 65 per cent of these employees returned to work on the same hours, while 16 per cent went back with reduced hours and 6 per cent went back with hours increased. Another 6 per cent were either laid off or left their jobs voluntarily.”, The Times of London, October 22, 2021

“Ingredient costs push up price of food – Food prices have risen by 2.1 per cent over the past four weeks, driven higher by the rising cost of ingredients and supply chain pressures. Cash-conscious shoppers are beginning to shop around, visiting an average of 3.3 supermarkets a month to find the best value for money.”, The Times of London, November 10, 2021

“Christmas comes early to high streets amid fear of shortages – More than a third of shoppers are changing their approach to Christmas shopping this year with 52 per cent buying gifts earlier than normal, particularly children’s presents, according to figures from Barclaycard. Online spending at toy retailers jumped by 38.4 per cent in October compared with 9.9 per cent in September.”, The Times of London, November 9, 2021

United States

“How the Great Resignation is fueling the passion economy – In a post-pandemic world, the notion of having a job and working in a single role felt old-fashioned, several people who recently resigned from their jobs told Fortune. In a world where work is made increasingly autonomous through gig work, social media, and ecommerce, seeking out entrepreneurial endeavors is likely to become the rule, rather than the exception.”, Fortune, November 3, 2021

“NFIB’s Latest Covid-19 Survey: Supply Chain Disruptions, Staffing Shortage, And The Holiday Season – About half of small business owners (48%) reported that supply chain disruptions are having a significant impact on their business, almost unchanged from September’s survey.:, Franchising.com, November 9, 2021

“U.S. consumer prices jump 6.2% in October, the biggest inflation surge in more than 30 years – Core inflation, stripping out food and energy, increased 4.6%, the fastest gain since August 1991. Energy, shelter and vehicle costs led the gains, which more than wiped out the wage increases that workers received for the month.”, CNBC, November 10, 2021

Brand News