EGS Biweekly Global Business Newsletter Issue 97, Tuesday, December 12, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, global government debt is at $97 trillion. Analysts are mixed in how they see economies in 2024. The European Union proposes the first government rules for AI. Global airfares are expected to stabilize in 2024. And McDonalds® plans to open 9,000 more restaurants worldwide. And dairies take 1st steps to tackle planet-warming cow burps.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“No one who achieves success does so without acknowledging the help of others.” – Alfred North Whitehead.

“Accept challenges so that you may feel the exhilaration of victory.” – General George S. Patten.

“You must do the things you think you cannot do.” – Eleanor Roosevelt

Highlights in issue #97:

- Brand Global News Section: 7-Eleven®, Joe and the Juice®, KFC® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

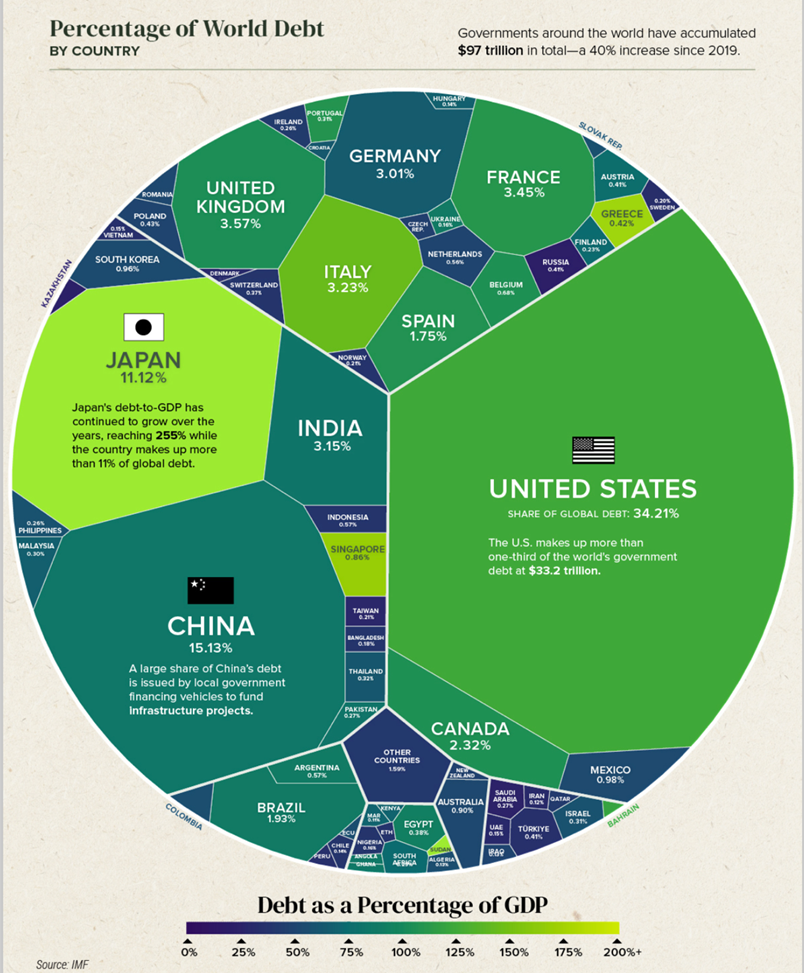

“Global government debt is projected to hit $97.1 trillion this year, a 40% increase since 2019 – During the COVID-19 pandemic, governments introduced sweeping financial measures to support the job market and prevent a wave of bankruptcies. However, this has exposed vulnerabilities as higher interest rates are amplifying borrowing costs. This graphic shows global debt by country in 2023, based on projections from the International Monetary Fund (IMF).”, Visual Capitalist, December 5, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

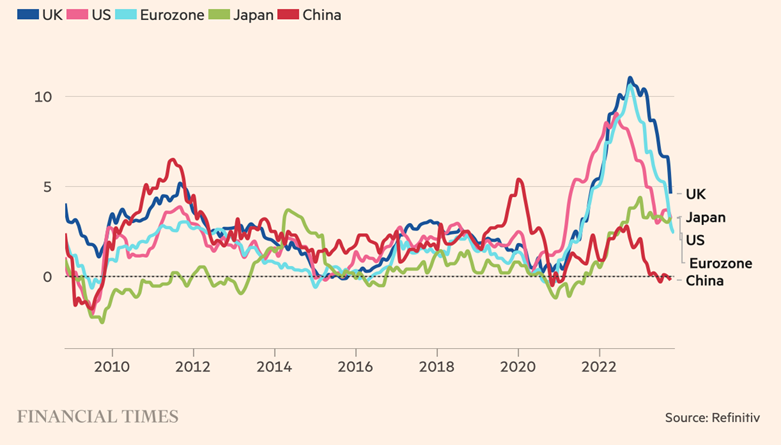

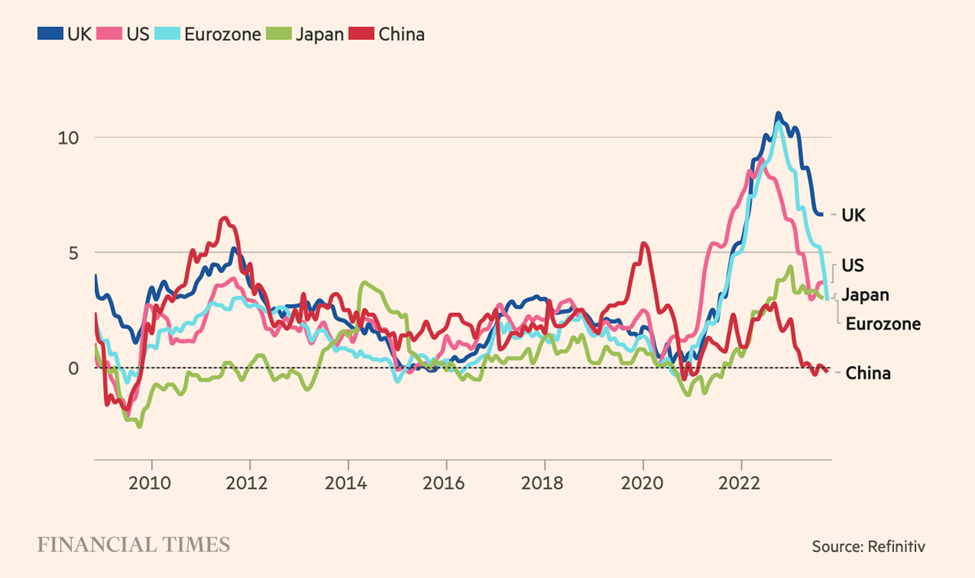

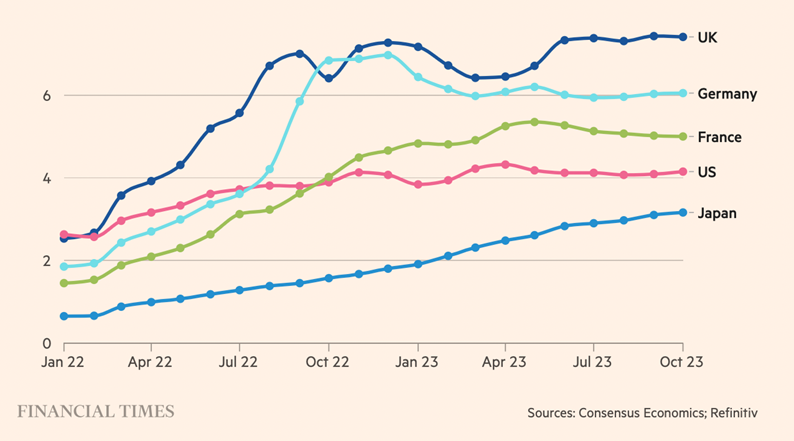

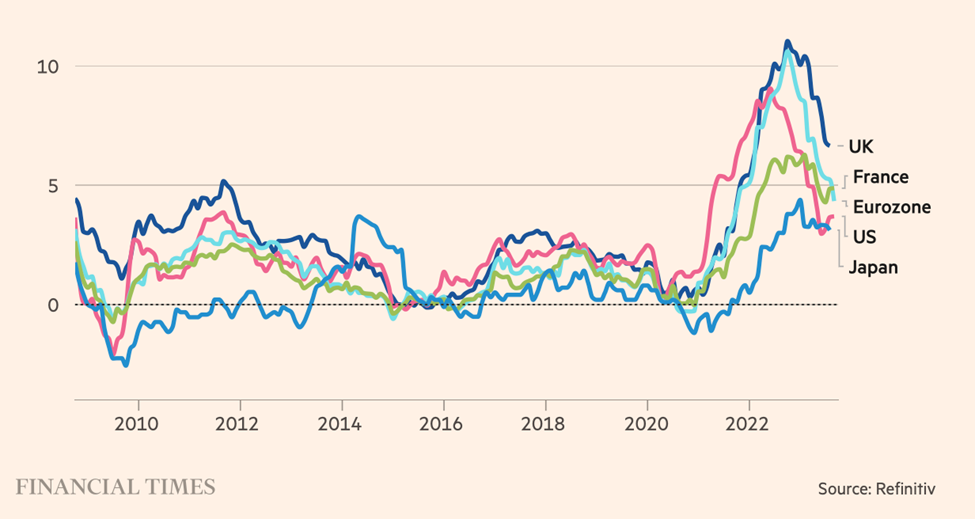

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, December 11, 2023

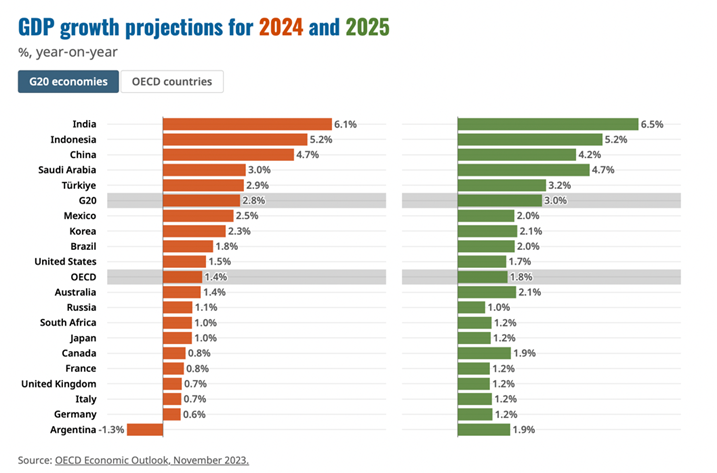

“Restoring Growth – OECD Economic Outlook November 2023 – The global economy continues to confront the challenges of inflation and low growth prospects. GDP growth has been stronger than expected so far in 2023, but is now moderating on the back of tighter financial conditions, weak trade growth and lower business and consumer confidence. Global growth is projected to be 2.9% in 2023, and weaken to 2.7% in 2024. As inflation abates further and real incomes strengthen, the world economy is projected to grow by 3% in 2025. Global growth remains highly dependent on fast-growing Asian economies. On the upside, growth could also be stronger if households spend more of the excess savings accumulated during the pandemic.”, OECD, November 2023

“Global trade to contract by 5% in 2023, UN body says – Global trade is set to contract by 5% in 2023 compared to last year, the United Nations trade body said on Monday, with an overall pessimistic forecast for 2024. In its Global Trade Update, the United Nations Conference on Trade and Development (UNCTAD) projected that commerce this year would amount to approximately $30.7 trillion. Trade in goods is expected to contract by nearly $2 trillion in 2023, or 8%, but services trade should increase by about $500 billion, or 7%, according to the U.N. body.”, Reuters, December 11, 2023

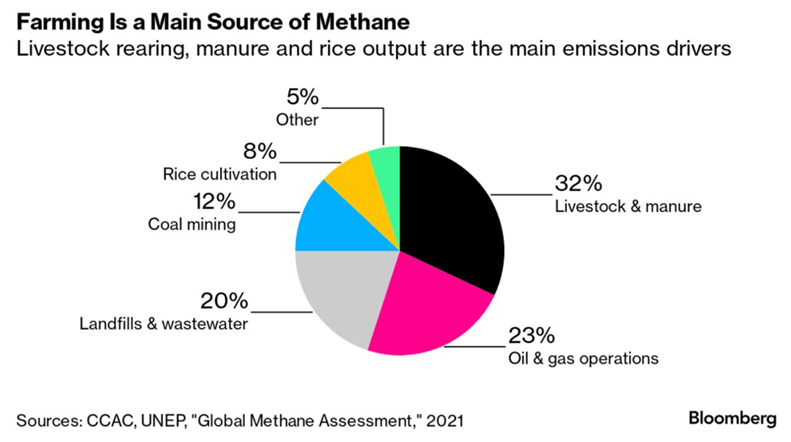

“Dairy Giants Take First Steps to Tackle Planet-Warming Cow Burps – Six of the world’s biggest dairy producers pledged to publicly say how much methane they emit as part of efforts to address livestock’s huge environmental footprint. Agriculture emits about 40% of all methane, a potent gas with 80 times the warming power of carbon dioxide. The majority of that comes from livestock, whether belched from the stomach or through manure. While the focus has been on tackling the problem in the energy sector — such as leaks from oil wells — addressing it in farming has so far proven elusive.”, Bloomberg, December 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

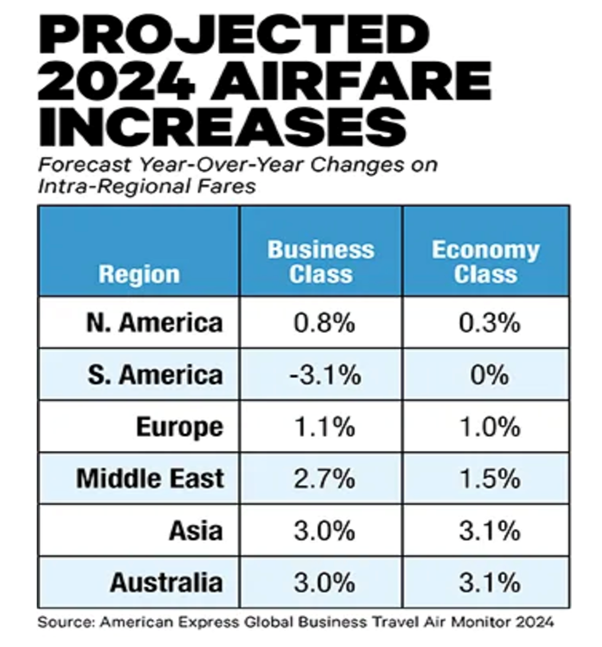

“Amex GBT Projects 2024 Global Airfares to Stabilize – 2024 economy- and business-class airfares throughout the world are projected to stabilize, “with prices falling on some routes,” according to a new American Express Global Business Travel forecast, released Wednesday. Business-class fare projections from North America to other regions are mixed….. Most economy-class fares from North America are expected to decline.”, Business Travel News, December 6, 2023

“Indonesia eyes visa waivers for 20 countries, including US, China, India – The government will finalise the list of countries included in the provision within one month, according to a statement. Minister Sandiaga Uno said the president had instructed the government to consider the visa waiver as a means of boosting the economy, tourism visits and investment.”, Reuters, December 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

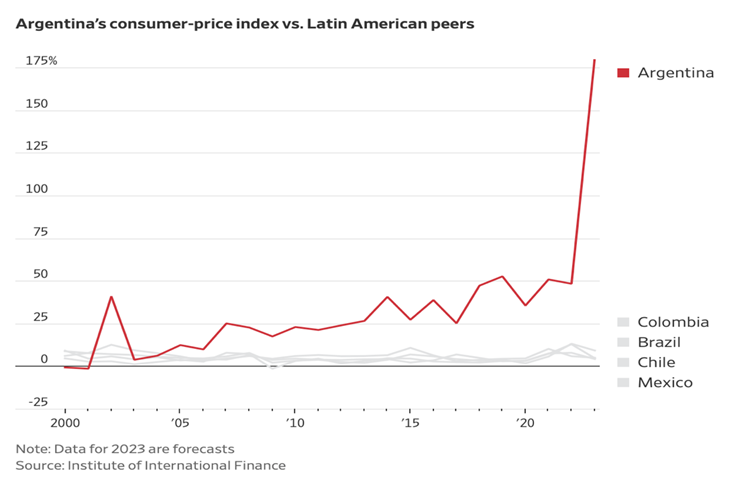

Argentina

“Argentina prepares for Milei to start shock therapy – Argentina’s financial markets were on tenterhooks on Monday to see if new President Javier Milei would immediately launch into his promised economic shock therapy by devaluing the peso. The radical economist took office on Sunday with a warning in his inaugural speech that he had no alternative to a sharp, painful fiscal shock to fix the country’s “titanic” challenges. Milei has promised deep cuts to public spending but his task looks daunting, with inflation nearing 200%, recession looming and payments ramping up while Argentina’s reserves are depleted.”, Reuters, December 11, 2023

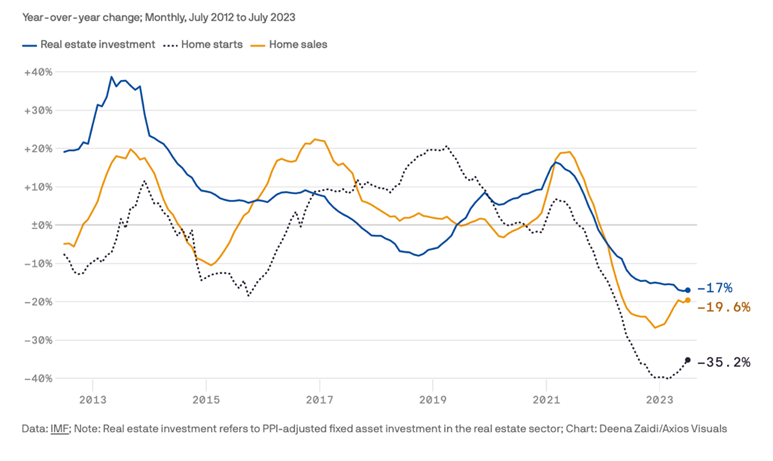

China

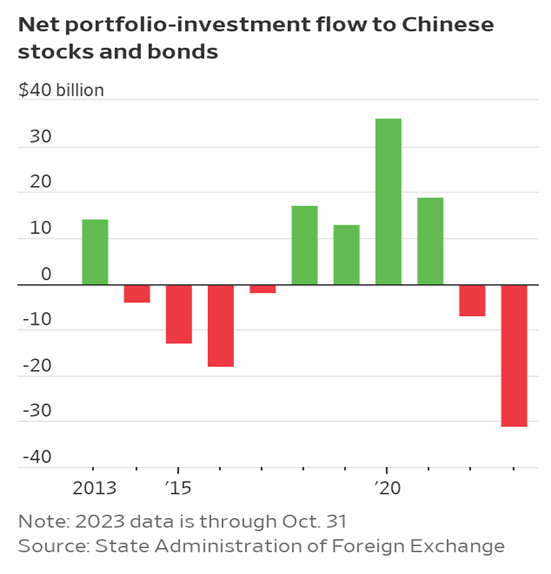

“Wall Street Puts a ‘Sell’ on Its China Holdings – Institutional investments in the nation have plunged as its economy slows and property market craters; ‘a bit of an awakening’. The amount of money that institutional investors have in Chinese stocks and bonds has declined by more than $31 billion this year, through October, the biggest net outflow since China joined the World Trade Organization in 2001, official Chinese data show.”, The Wall Street Journal, December 7, 2023

“China’s deflation worsens as economic pressures mount – Consumer price data comes after policymakers pledge to step up fiscal and monetary support. China’s consumer prices fell 0.5 per cent year on year in November, the sharpest decline in three years as the world’s second-largest economy grapples with worsening deflation. Consumer prices dropped by more than the 0.2 per cent decline forecast by a Bloomberg survey of economists and exceeded October’s fall of 0.2 per cent. Producer prices, which are measured at factory gates and heavily driven by the cost of commodities and raw materials, dropped by 3 per cent and have remained in negative territory for the past year.”, The Financial Times, December 9, 2023

European Union

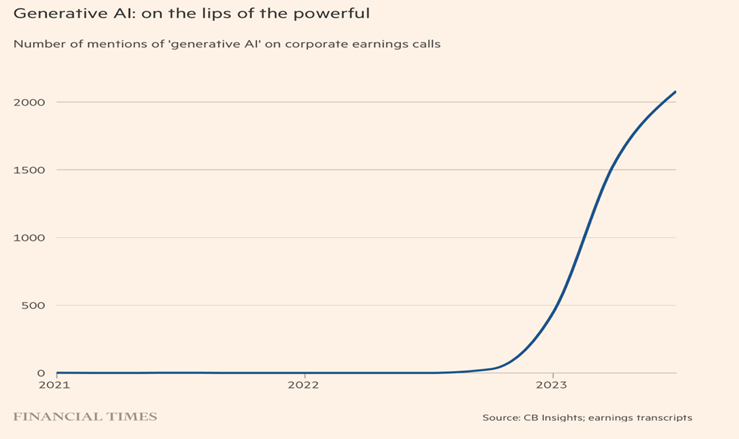

“Europe seals world’s first set of rules regulating artificial intelligence – The deal requires ChatGPT and general purpose AI systems (GPAI) to comply with transparency obligations before they are put on the market. The proposals lay the groundwork for the Artificial Intelligence Act, which will be voted on by the European Parliament and Council next year and will come into effect in 2025. The legislation, if passed, would be the world’s first comprehensive rules to regulate the use of artificial intelligence, paving the way for legal oversight of AI technology.”, Fox Business, December 9, 2023

India

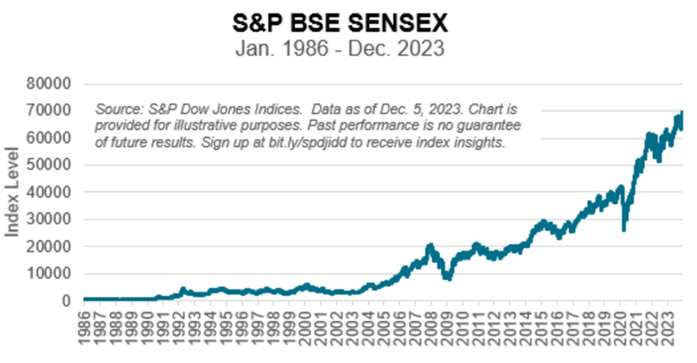

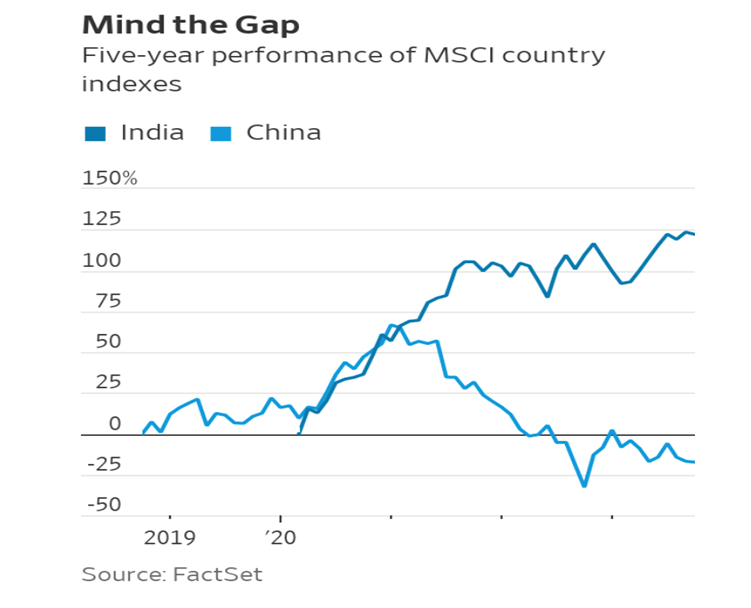

“India’s stock market tops $4 trillion in value as investors buy into world’s fastest growing big economy – The S&P BSE Sensex, India’s benchmark equity index, is up more than 7% in just the past month and has gained 14.3% for the year-to-date as investors seek exposure to the world’s most populous nation and fifth biggest economy. The MSCI China index, in dollar terms, has dropped 13.6%, while the MSCI World Index is up 16.1% over the same period, boosted by an 18.5% gain for the S&P 500 in the U.S. ‘It’s been a fantastic decade for Indian blue chips, with the Sensex hitting a new all-time high in 9 of the past 10 years, for a cumulative total of 243 times,’ noted Benedek Vörös, director, index investment strategy at S&P Dow Jones Indices.”, Market Watch, December 7, 2023

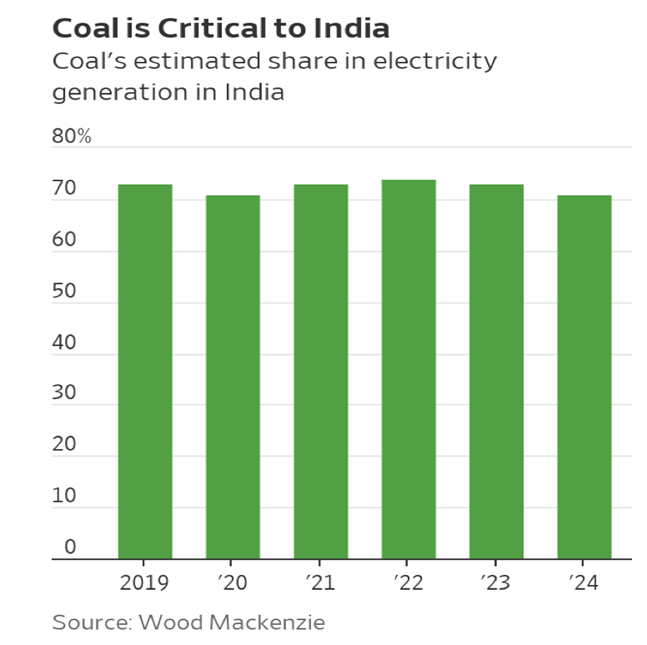

“What India Needs to Ditch Coal – India, along with China, has opted out of the Global Renewables and Energy Efficiency pledge at the COP28 climate conference in Dubai—which included a commitment to curtail investment in new coal power. Coal currently meets nearly three-quarters of India’s growing energy needs. Moreover higher electricity capacity will, ironically, be key to survival in its increasingly hot weather as air conditioning needs rise. So what does India really need to shift decisively toward low carbon power? For one, money—much of it from the developed world.”, The Wall Street Journal. December 11, 2023

The Philippines

“Peso Set to Ride Remittance Wave on Philippine Holiday Spending – The Philippine peso has outperformed its Asian peers this year and a seasonal pick-up in overseas remittances ahead of Christmas will likely extend the gains.

Remittances are a key pillar of the nation’s economy, which typically receives the highest cash transfers in the last month of the year as workers send money home for holiday spending. The inflows have helped strengthen the currency in all but three Decembers in the last 10 years, data compiled by Bloomberg show.”, Bloomberg, December 10, 2023

Turkey

“Türkiye logs 5.9% Q3 GDP growth, sets eye on disinflation – Türkiye’s economy expanded by a more-than-expected 5.9% year-over-year in the third quarter, driven primarily by solid household spending, the official data showed Thursday. The country’s gross domestic product (GDP) thus grew slightly above the market expectations, hovering around 5.6%, data by the Turkish Statistical Institute (TurkStat) showed. ‘As envisaged in our program, we are moving toward a more balanced composition in growth,’ Treasury and Finance Minister Mehmet Şimşek said as he commented on the figures.”, Daily Sabah, November 30, 2023

United Kingdom

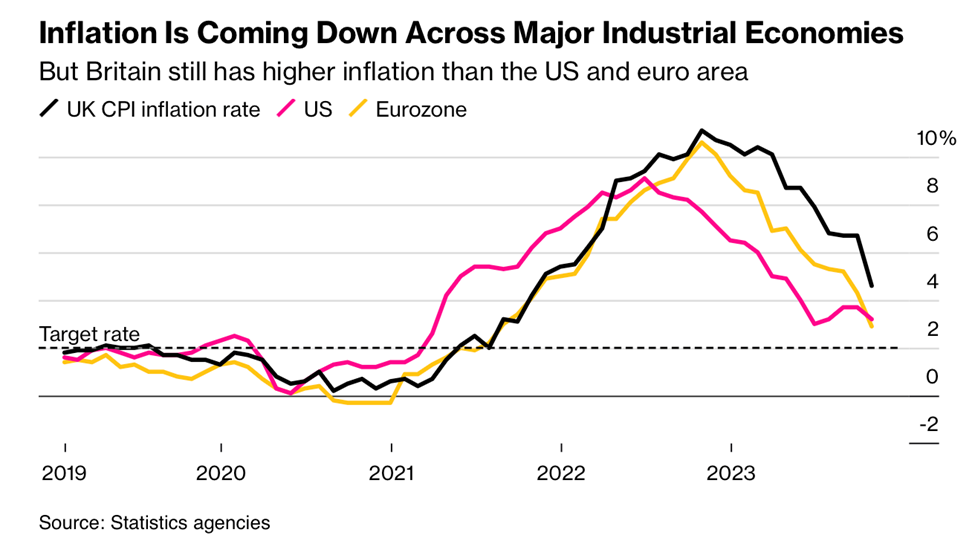

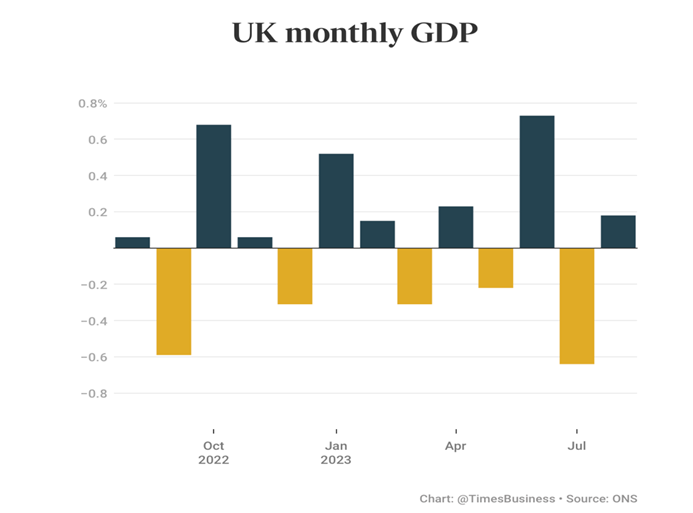

“Interest rates won’t be cut until 2026, predicts CBI – Business lobby group forecast based on inflation not hitting Bank of England’s 2% target until second half of 2025. In its latest outlook on the UK economy, the CBI said the base rate will stay at 5.25 per cent for at least two more years, despite rising market speculation that rates will be cut next year. The forecast is based on projections showing that consumer price inflation will not reach the Bank’s 2 per cent target until the third quarter of 2025. Rate-setters on the monetary policy committee — including Andrew Bailey, the Bank’s governor — have pushed back against traders’ expectations and warned that no monetary easing is imminent, despite inflation falling to a two-year low of 4.6 per cent in October. The Times of London, December 8, 2023

“UK economy showing ‘signs of life’ as eurozone heads towards recession – A closely watched index of private sector activity in the UK returned to growth in November after three months of decline. But in the single currency bloc business continued to struggle – leaving it on the brink of recession. The updates came as an influential ‘hawk’ at the European Central Bank said she believes further interest rate hikes can be taken off the table following the ‘remarkable’ fall in inflation. Isabel Schnabel fuelled speculation that rates in Europe and the UK will be cut in the first half of next year.”, The Daily Mail, December 5, 2023

United States

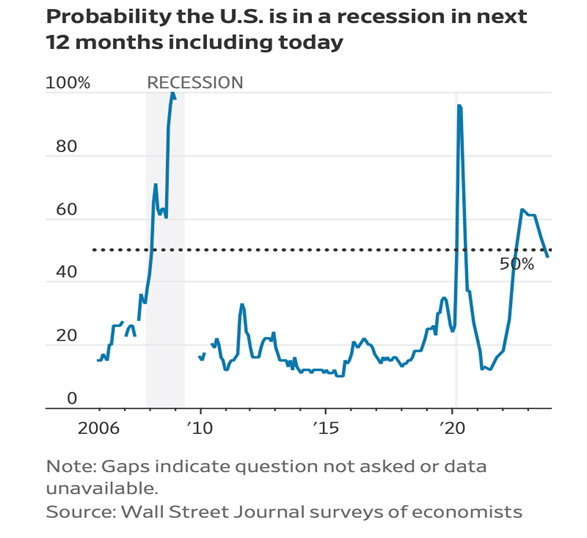

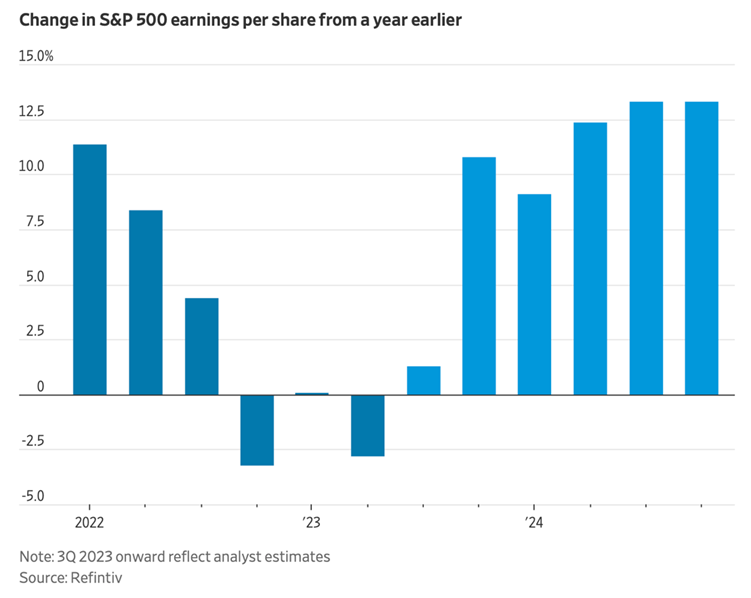

“(U.S.) Stock analysts who got it wrong last year predict a soft landing in 2024 – What a difference a year makes. Heading into 2023, stock forecasters were predicting an imminent recession triggered by high interests would torpedo financial markets. As we head into 2024, by contrast, Wall Street expects a soft landing for the U.S. economy to power the market to record highs. Most strategists also expect the Federal Reserve to turn the page on its rate-hiking offensive and for the S&P 500 to grind higher in the new year. Like most New Year’s resolutions, however, stock forecasts often end up bowing to reality. That imminent recession analysts predicted last year? It never materialized. Instead, the economy continues to grow; inflation is easing and equities are cruising toward year-end having booked double-digit gains.”, CBS News, December 8, 2023

“Market pros are all over the map when it comes to 2024 forecasts – Investment banks and asset managers have wildly varying stock market and currency calls for 2024, reflecting deep division over whether the U.S. economy will enter a long-heralded recession and drag the world with it. The lack of consensus among forecasters is a stark contrast to a year ago, when most predicted a U.S. recession and rapid rate cuts that failed to materialize. The world’s largest economy expanded by 5.2 per cent in the third quarter of this year.”, The Globe and Mail, December 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“From one 7-Eleven store to a $1.71 billion payday – The 7-Eleven Australia convenience store business, which began with one store in the Melbourne suburb of Oakleigh in 1977, has been sold by the Withers and Barlow families in a $1.71 billion payday. It has been acquired by the Japanese parent group Seven-Eleven Japan, which plans to step up expansion in Australia of a business with 752 outlets selling snacks, drinks, coffee and fuel. It has a market share of about 32 per cent in convenience store merchandise. The new owners are aiming to open around 35 stores annually. The Japanese group owns the 7-Eleven global licence and already collects licence fees from the Australian business, which has been owned by the two families since 1976.”, Australian Financial Review, November 30, 2023

“Private Equity Firm to Acquire Majority Ownership in Joe & the Juice – The 360-unit beverage chain wants to expand worldwide, including a new franchise program. Private equity firm General Atlantic announced Monday that it will acquire a majority interest in Joe & the Juice, a growing beverage chain with stores around the world. General Atlantic, which initially made a minority investment in October 2016, has three priorities for Joe & the Juice: accelerate expansion in international markets, capitalize on customer demand, and build digital channels.”, QSR Magazine, November 14, 2023

“Retail Food Group acquires Beefy’s Pies in major business deal – An Aussie award winning pie company has been sold to a major food and beverage group for $10 million. With stores in Gympie, Brisbane and on the Sunshine Coast, Beefy’s Famous Aussie Pies is an institution for many visitors to the southeast Queensland region. RFG CEO Matt Marshall said there was a number of appealing factors for acquiring Beefy’s, including its loyal customer base and its ability to foster a passionate business model since it opened its first store in 1997.”, News.com.au, November 30, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Yum’s KFC division agrees to acquire more than 200 KFC restaurants in the UK and Ireland from franchisee EG Group – The deal “represents a significant opportunity to accelerate KFC’s growth strategy in the large and growing UK and Ireland chicken market, with high average unit volumes and robust margins,” the companies said in a joint statement. No financial terms were disclosed, but the deal is expected to close by the end of the first half of 2024.”, Market Watch, December 6, 2023

“McDonald’s Targets 50,000 Restaurants in Expansion Blitz – Most new stores will be in international licensed markets. The chain currently has more than 41,000 restaurants and already committed to opening an extra 2,000 by the end of this year. The new target highlights the burger giant’s stepped-up ambitions as it looks for its next leg of growth.”, Bloomberg, December 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

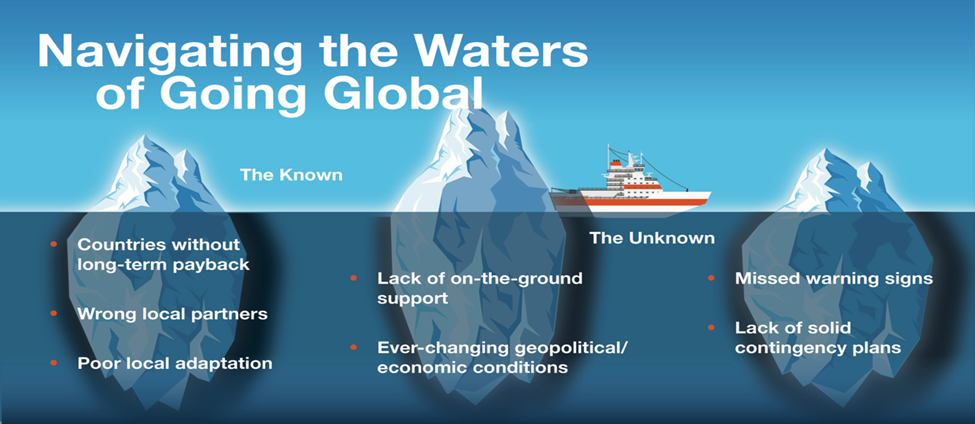

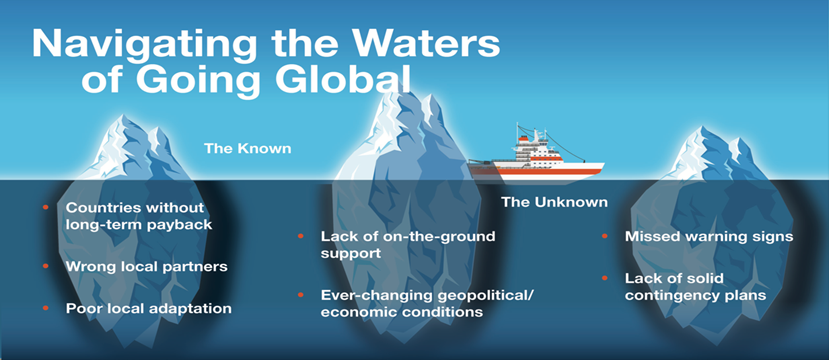

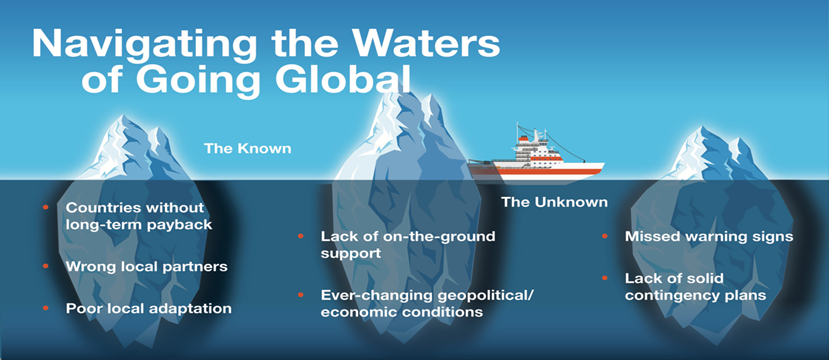

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 96, Tuesday, November 28, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

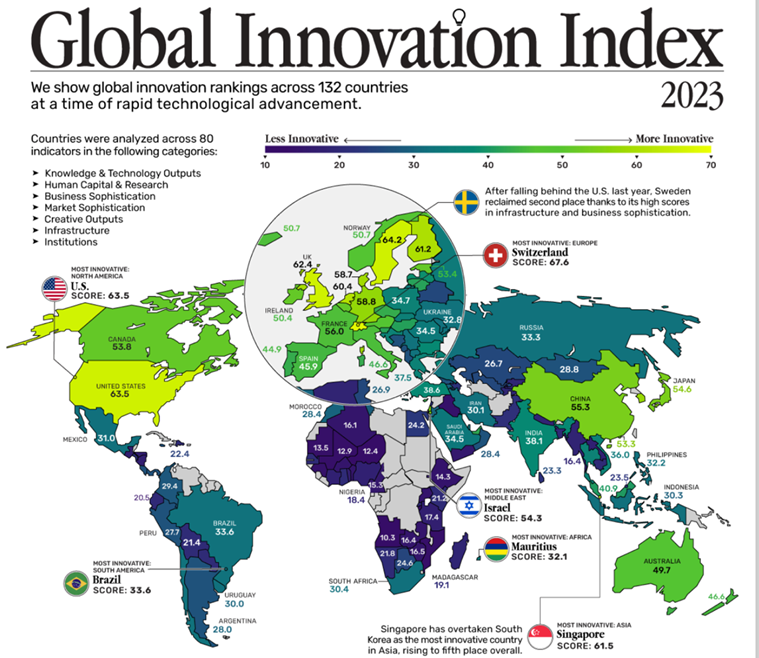

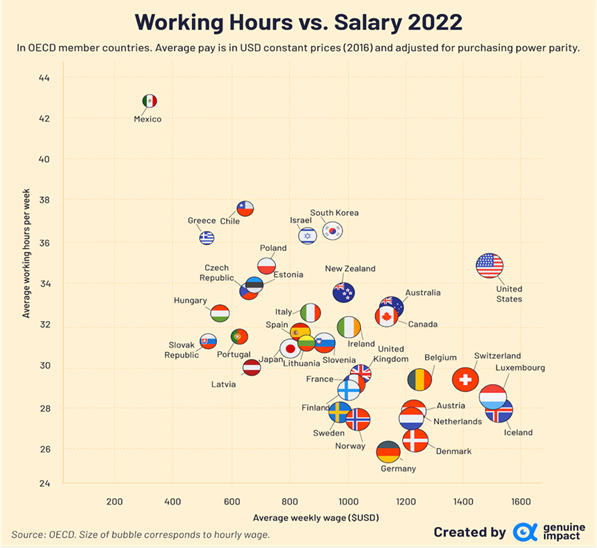

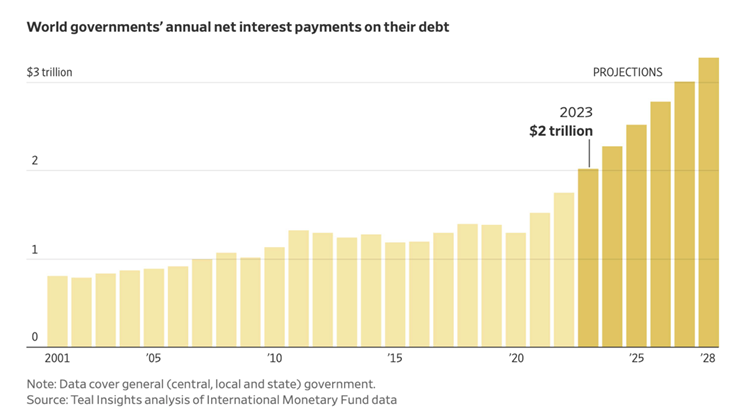

Introduction: In this issue, each day 70 million people visit McDonald’s 40,000 restaurants worldwide. The hours we work each week vary widely by country. Switzerland, Sweden, the United States, the United Kingdom, and Singapore lead the Global Innovation Index this year. And governments are expected to spend $2 trillion on interest on their debt this year.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Every problem is a gift — without problems we would not grow.”, Tony Robbins, motivational speaker and writer

“Only those who will risk going too far can possibly find out how far one can go.”, T.S. Eliot

“The journey of a thousand miles begins with a single step.”, Lao Tzu, Chinese Taoist philosopher

Highlights in issue #96:

- Brand Global News Section: McDonalds®, Pizza Hut® and Jim’s Beauty®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“The Most Innovative Countries in the World in 2023 – Which countries are the global innovation powerhouses? In many ways, the past year has represented an inflection point in technological advancement. Almost overnight, OpenAI’s large language model ChatGPT became a household name and AI was within reach to the masses. Yet looking under the surface, innovation is influenced by several unseen factors, from the institutional environment and high-tech exports to research talent and entrepreneurship culture. This graphic shows the most innovative countries in the world, based on the 2023 Global Innovation Index (GII) put together by the World Intellectual Property Organization.”, Visual Capitalist, November 14, 2023

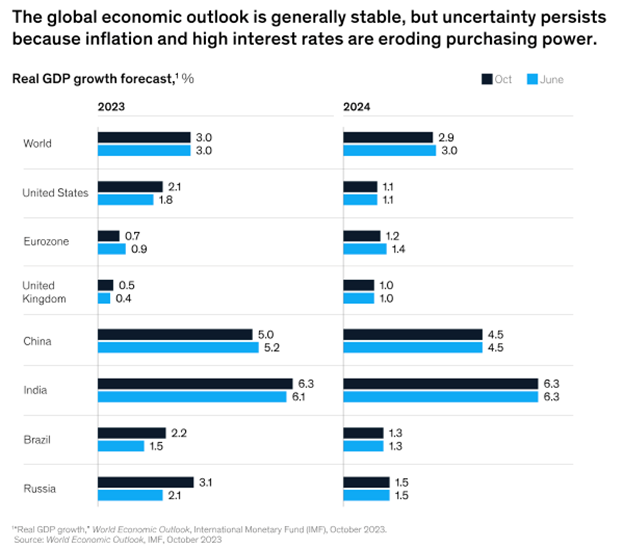

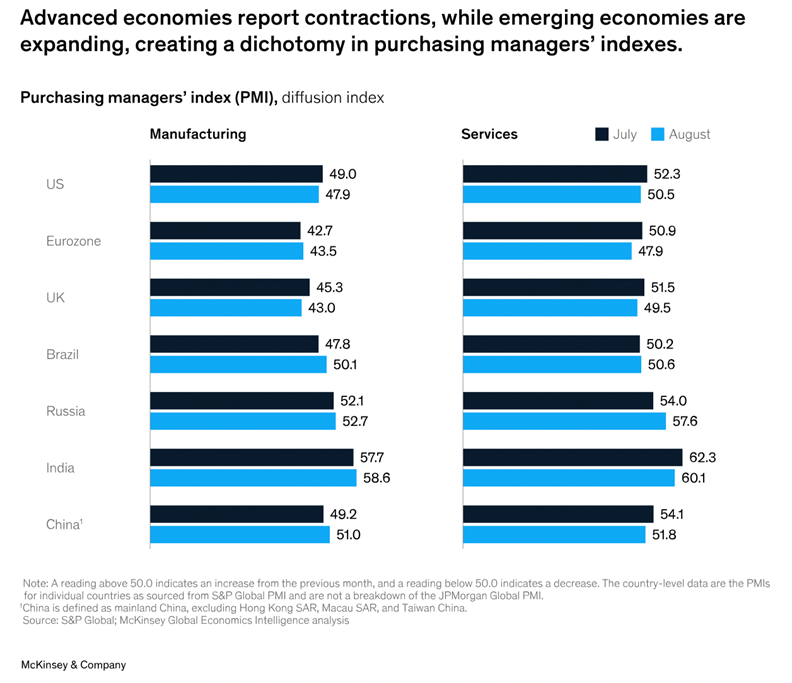

“The global outlook is unchanged despite weaker readings in trade, consumer confidence, and business activity. Still-elevated inflation and interest rates are acting as headwinds to economic growth. According to theInternational Monetary Fund’s (IMF) October World Economic Outlook, global growth is forecast to slow from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024. There are mixed signals from global trade. Overall consumer confidence declined, primarily due to elevated interest rates.”, McKinsey & Co., November 20, 2023

“Comparing Weekly Work Hours and Salaries in OECD Countries – The Organization for Economic Co-operation and Development (OECD) is generally regarded as a collection of highly developed, high income countries. However with 38 member states from across the globe, economic prosperity can still vary widely between these nations.To illustrate this, Truman Du from Genuine Impact charts the average weekly work hours and salaries across the OECD in 2022.”, Visual Capitalist, November 18, 2023

“OpenAI and the rift at the heart of Silicon Valley – The tech industry is divided over how best to develop AI, and whether it’s possible to balance safety with the pursuit of profits. OpenAI was launched as a research firm dedicated to building safe AI for the benefit of all humanity. But the drama of recent days suggests it has failed to deal with the outsized success that has flowed from its own technical advances. It has also thrown the question of how to control AI into sharp relief: was the crisis caused by a flaw in the company’s design, meaning that it has little bearing on the prospects for other attempts to balance AI safety and the pursuit of profits? Or is it a glimpse into a wider rift in the industry with serious implications for its future — and ours?”, The Financial Times, November 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“The $2 Trillion Interest Bill That’s Hitting Governments – Debt-servicing costs complicate plans in many countries for more military, climate spending. Governments are expected to spend a net $2 trillion paying interest on their debt this year as higher interest rates make borrowing more expensive, up more than 10% from 2022, according to an analysis of International Monetary Fund data by research consulting firm Teal Insights and a separate analysis by Fitch Ratings. By 2027, it could top $3 trillion, according to Teal Insights.”, The Wall Street Journal, November 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

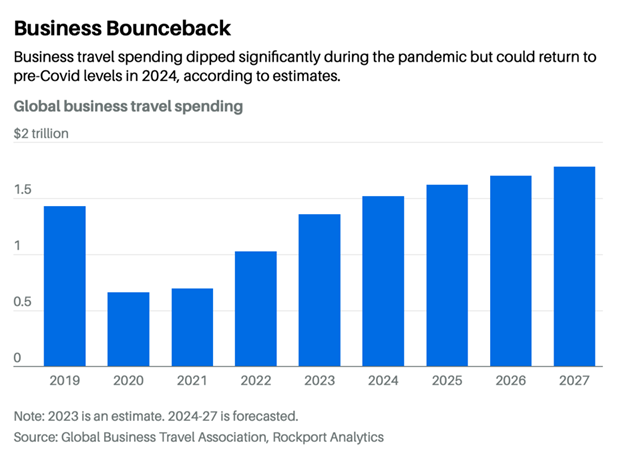

“Business Travel Is About to Pick Up – Corporate travel may finally be back in business, unlocking higher profit margins for airlines and hotel companies and a much-needed revenue boost for the next few months, typically a slow season for leisure travel. Travel manager surveys, anecdotal evidence from airlines, hotel company earnings, and the end of the Hollywood and auto makers’ strikes all signal a long-awaited uptick after a slow postpandemic recovery. The key for investors is that there looks to be more upside ahead.”, Barron’s, November 23, 2023

“China offers visa-free entry for citizens of France, Germany, Italy – China will temporarily exempt citizens of France, Germany, Italy, the Netherlands, Spain and Malaysia from needing visas to visit the world’s second-largest economy in a bid to give a boost to post-pandemic tourism.From Dec. 1 to Nov. 30 next year, citizens of those countries entering China for business, tourism, visiting relatives and friends, or transiting for no more than 15 days, will not need a visa, a foreign ministry spokesperson said on Friday.China has been taking steps in recent months – including restoring international flight routes – to revive its tourism sector following three years of strict COVID-19 measures that largely shut its borders to the outside world.”, Reuters, November 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Argentina’s Economic Turmoil Is Getting Worse – Argentina has long been trapped in recurring cycles of deep and destructive economic contractions brought on by policies that force governments to routinely spend more than they collect through taxes and other income, economists say. President-elect Javier Milei will take office in early December with the task of reversing unsustainable spending policies that have depleted government coffers and caused inflation and interest rates to soar.”, The Wall Street Journal, November 20, 2023

China

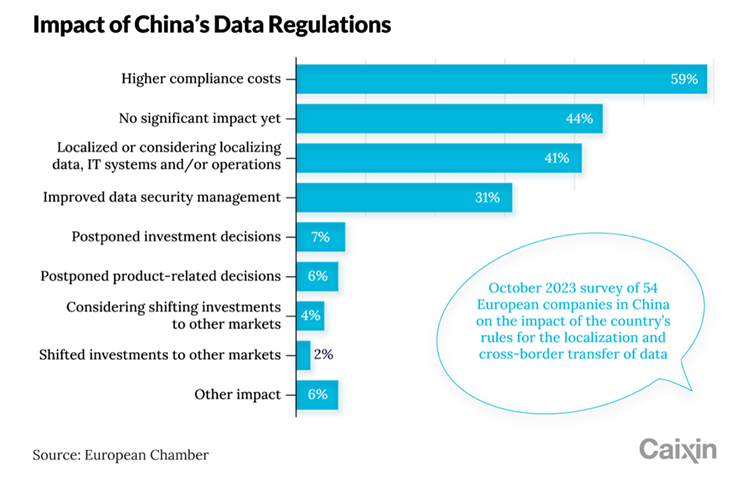

“European Firms Want Clarity on China’s Data Transfer Rules Seen as Raising Costs – A European business group has called on Beijing to clarify cross-border data transfer regulations it considers too vague or too strict, as they have created challenges such as higher costs for companies doing business in China. More than 80% of the respondents want Beijing to further clarify what “important data” encompasses, while 59% and 39% would like to see clearer definitions of “personal information” and “critical information infrastructure,” respectively, according to the survey.”, Caixin Global, November 16, 2023

“China’s shoppers are gloomy and picky – They want to spend on pets and sports, not makeup or perfume. Although the unemployment rate in China’s cities is only 5%, many households are not optimistic about their pay or their job prospects. According to the latest central-bank survey, more people expect their income to fall in the near future than to rise. Consumer confidence collapsed during the pandemic-related lockdowns of 2022. It has yet to recover. The gloom is making customers picky and cost-conscious.”, The Economist, November 16, 2023

European Union

“New car sales in Europe pop as EVs record 36% increase and hybrids account for nearly 3 in 10 vehicles sold – The ACEA said fully electric cars made up 14.2% of sales in October, overtaking sales of diesel cars for the third time. As recently as 2015, diesel models accounted for more than 50% of cars sold in the EU, but they accounted for just 12% of sales in October. For the ten months through October, sales of fully electric cars were up 53.1%. Electrified vehicles – either fully electric models, plug-in hybrids or full hybrids – accounted for over 47% of all new passenger car registrations in the EU between January and October 2023, up from 42% in the same period last year, the ACEA said.”, Fortune magazine, November 22, 2023

India

“India is seeing a massive aviation boom – New airports, hundreds of aircraft and millions of new passengers are on their way. The country’s entire aviation industry is growing at an astonishing clip. Four new airports and four new terminals have opened in the past 12 months. That gives India 149 operational civil airports, twice the number it had a decade ago. Nine additional airports have been approved and many more are planned. Domestic passenger numbers rose from 98m in 2012-13 to 202m in 2019-20. Already the third-biggest domestic aviation market by volume, India is projected to be the third-largest overall by 2026, according to the International Air Transport Association, an industry body.”, The Economist, November 23, 2023

Japan

“Is Japan’s economy at a turning point? Wage and price inflation is coinciding with an exciting corporate renewal. After years of deflation or low inflation, Japan is seeing its fastest price growth in more than 30 years. Wages, long stagnant, are rising faster than at any time since the 1990s. Both increases are driven largely by global supply shocks. But they are not the only changes afoot. As Aoki predicted, gradual institutional and generational shifts are bearing fruit and changing Japan Inc from within.”, The London Economist, November 16, 2023

Mexico

“The city where Mexico’s nearshoring hype is becoming reality – Optimism infects business leaders in Monterrey as manufacturers shift operations close to the US. Industrial real estate is expanding, yet at the same time vacancy rates are below 2 per cent. Developers are even building a physical symbol of the hubris: a skyscraper taller than the Empire State Building. ‘A week doesn’t go by for us without meeting Chinese, Korean, Japanese executives, looking to open offices or a plant,’ said Lorenzo Barrera Segovia, chief executive of Banco Base, a bank based in the city.”, The Financial Times, November 27, 2023

Turkey

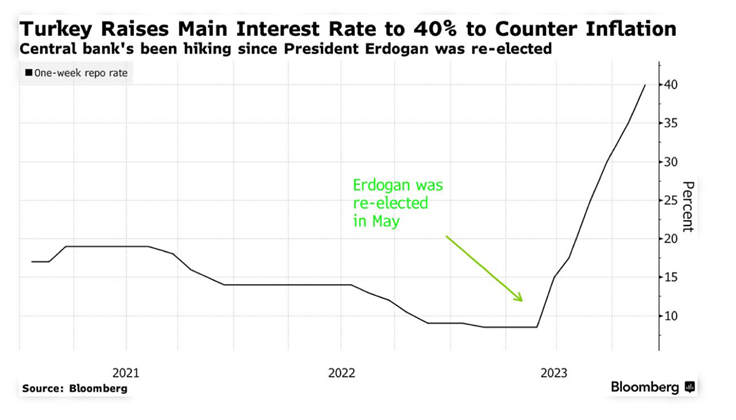

“Turkey Central Bank Hikes Rate by Double the Forecast to 40% – The monetary authority delivers a bigger-than-expected hike Real rates now above zero relative to an inflation gauge. The MPC, led by Governor Hafize Gaye Erkan, signaled it would slow the pace of tightening from now. It’s lifted rates by more than 30 percentage points since President Recep Tayyip Erdogan was re-elected in May, reversing years of loose fiscal and monetary policies that were blamed for enabling inflation to soar and scaring foreign investors away.”, Bloomberg, November 23, 2023

United Kingdom

“UK Inflation Slows to Two-Year Low, Bolstering Rate Cut Bets – UK inflation tumbled to the lowest level in two years, firming up bets that the Bank of England will be able to cut rates as early as the middle of next year. Consumer prices rose 4.6% from a year earlier in October, down sharply from 6.7% in September and the slowest pace since 2021 as energy prices fell, the Office for National Statistics said Wednesday.”, Bloomberg, November 15, 2023

“The UK Economy Continues to Beat Expectations – That’s mostly good news, unless you’re hoping for imminent interest rate cuts. Consumer confidence headed higher this month. It’s still negative, but it’s going in the right direction….the latest snapshot of business activity in the UK (courtesy of S&P Global/CIPS) showed expansion for the first time since July. This was led by the services sector, with manufacturing still in contraction.”, Bloomberg, November 24, 2023

United States

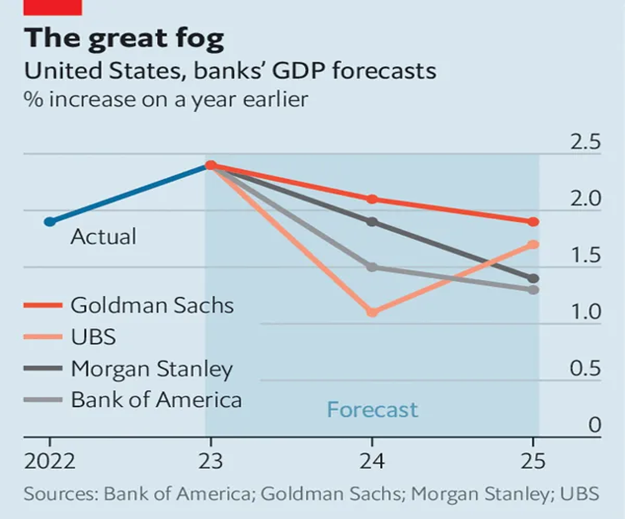

“How will America’s economy fare in 2024? Don’t ask a forecaster – The consensus is that there is no consensus. Goldman Sachs expects growth in America to be robust, at 2.1%, around double the level that economists at ubs foresee. Some banks see inflation falling by half in 2024. Others think it will remain sticky, only dropping to around 3%, still well above the Federal Reserve’s target. Expectations for what the Fed will end up doing with interest rates range, accordingly, from basically nothing to 2.75 percentage points of rate cuts.”, The London Economist, November 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“‘Big Jack’: McDonald’s loses legal food fight over Australian rival’s choice of burger name – Court rules Hungry Jack’s had not infringed on trademark but had misled consumers over ‘25% more Aussie beef’ claim. McDonald’s has lost a three-year trademark battle over the sale of “Big Jack” burgers sold by its rival, Hungry Jack’s. But McDonald’s succeeded on a separate consumer law claim. The court found Hungry Jack’s had misled consumers by advertising that its Big Jack burger contained ‘25% more Aussie beef’ than its Big Mac counterpart.”, The Guardian, November 15, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“McDonalds Global will acquire Carlyle Group s equity in McDonalds China business increasing its shareholding ratio to 48% – McDonald’s Global and Carlyle Group announced that McDonald’s Global agreed to acquire Carlyle’s minority stake in McDonald’s strategic cooperation companies in mainland China, Hong Kong and Macau. The CITIC Consortium, dominated by CITIC Capital, will maintain its controlling position. After the transaction is completed, CITIC Consortium will continue to hold 52% of the shares, and McDonald’s Global, as a minority shareholder, will increase its shareholding ratio from 20% to 48%. It is reported that since September 2019, McDonald’s China has achieved system sales growth of more than 30%.”, Caixin.com.cn, November 21, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“The Number Of People Who Eat McDonald’s Daily Is Enough To Populate A Country – With over 40,275 restaurant locations worldwide, McDonald’s has long reigned as one of the most successful fast food chains on the planet. From South Carolina to the South of France, you can count on finding a McDonald’s no matter where you are (save a few exceptions, of course, such as Iceland and Bolivia). According to statistics from 2021, approximately 70 million people visit a McDonald’s location every day. That is more than the population of France or the United Kingdom…”, The Daily Meal, November 21, 2023

“Pizza Hut set for 400 store Aussie expansion – A fast food battle is looming in Australia with Pizza Hut unveiling aggressive new expansion plans as it aims to take on Domino’s. It currently has about 10 per cent of the Australian pizza market, compared to Domino’s’ 50 per cent market share. In June, US-based Flynn Restaurant Group bought the master licence for Pizza Hut in Australia from private equity firm Allegro Funds. There are currently 260 Pizza Hut stores in Australia…..Pizza Hut Australia CEO Phil Reed added that the company had identified 400 sites across Australian where it could open a store.”, News.com.au, November 27, 2023

“Jim’s Beauty opens offering customers at home beauty treatments – Jim’s Group is renowned for having a long list of franchises, including Jim’s Mowing, Jim’s Cleaning and Jim’s Painting. . Now, Aussies in the beauty industry are being offered the chance to start their own business and join the Jim’s Beauty franchise. The mobile services can be done in the customer’s home or even the franchisee’s house and salon if the customer prefers.”, News.com.au, November 13, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 95, Tuesday, November 14, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, as we get towards the end of another year there are lots of economic projections coming out. Look at the cost of a gallon of gas in California versus the US Midwest. Overall, global consumer confidence remains broadly stable with some exceptions. And why McDonalds® menu are better in other countries….really.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“The people who are crazy enough to think they can change the world are the ones who do.”, Steve Jobs’

“Find the pathway to win, not the excuse to fail.”, Byron Ashley

“Develop success from failures. Discouragement and failure are two of the surest stepping stones to success.”, Dale Carnegie

Highlights in issue #95:

- Brand Global News Section: Planet Fitness®, Popeyes®, and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“Technology trends for 2024 and beyond – As we look forward to 2024, our technology narrative has been consumed by AI. However, we must remember that AI is only a component of a broader digital revolution that includes blockchain, quantum computing, nanotechnology, synthetic biology, robotics, 3D printing, AR/VR, and other emerging innovations. Technology revolutions create more jobs than they destroy. However, history has proven that the period following the rapid deployment of technological innovation arrests wages for unskilled workers (known as Engle’s Pause). In the short term, those who control capital often benefit from technological progress.”, Vistage, October 30, 2023

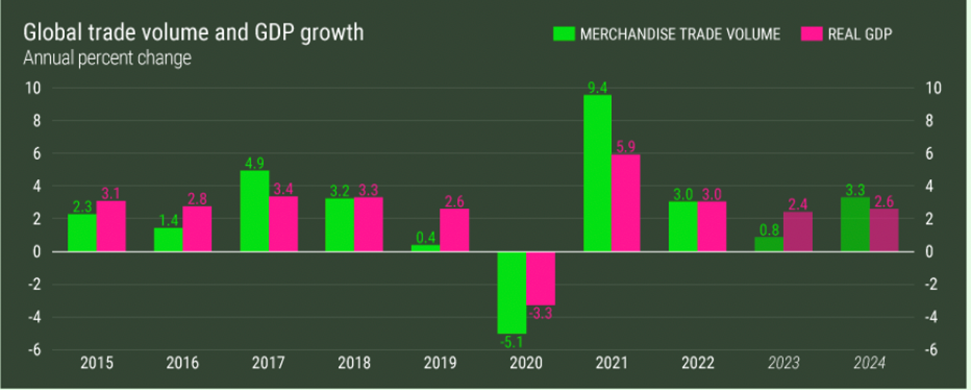

“WTO Downgrades Global Trade Forecast – Last month, the World Trade Organization published its updated Global Trade Outlook in which it downgraded its projection for trade growth this year to just 0.8 percent from 1.7 percent in April. The shift is a result of a number of factors – inflation, high interest rates, China’s underwhelming recovery, a high U.S. dollar and geopolitical tensions – and has affected a broad range of countries and sectors. The WTO’s outlook for 2024 remained relatively unchanged, declining only slightly from 3.3 percent to 3.2 percent. Two key variables, however, could upend this forecast: a weak Chinese economy and high inflation rates in developed economies.”, Geopolitical Futures, November 10, 2023

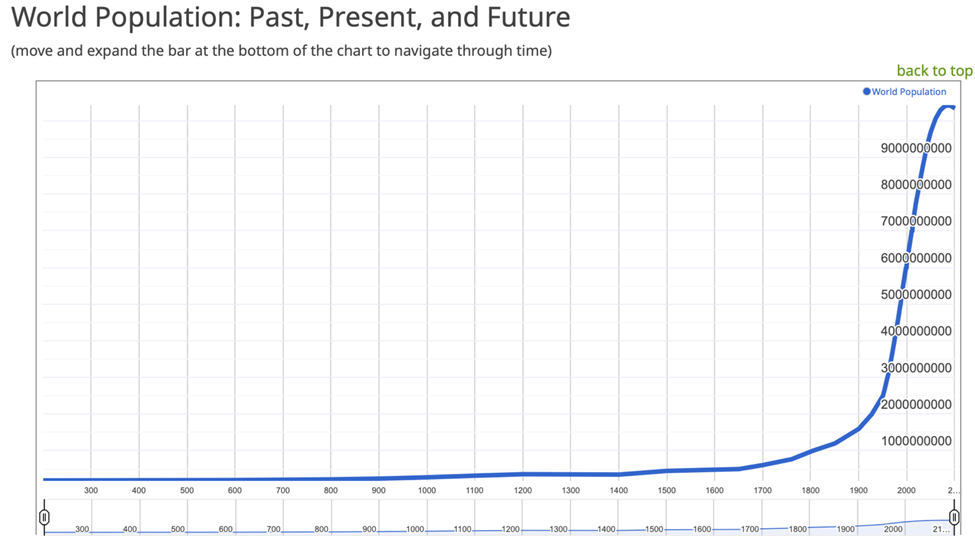

“World’s population has passed 8 billion, says US Census Bureau – The world population growth, however, continues a long-term trend of slowing down. The human species has topped 8 billion, with longer lifespans offsetting fewer births, but world population growth continues a long-term trend of slowing down. The United Nations estimated the number was passed 10 months earlier, having declared 22 November 2022, the “Day of 8 Billion”, the Census Bureau pointed out in a statement.”, The Independent, November 10, 2023

“These Five Countries Are Key Economic ‘Connectors’ in a Fragmenting World – Vietnam, Poland, Mexico, Morocco and Indonesia are benefiting from the reshuffling of supply chains in response to US-China tensions. As a group, these countries logged $4 trillion in economic output in 2022—more than India and almost as much as Germany or Japan. Despite their very different politics and pasts, they share an opportunistic desire to seize the economic windfall to be had by positioning themselves as new links between the US and China—or China, Europe and other Asian economies. They represent 4% of global gross domestic product, yet they’ve attracted slightly over 10%, or $550 billion, of all so-called greenfield investment since 2017.”, Bloomberg, November 2, 2023

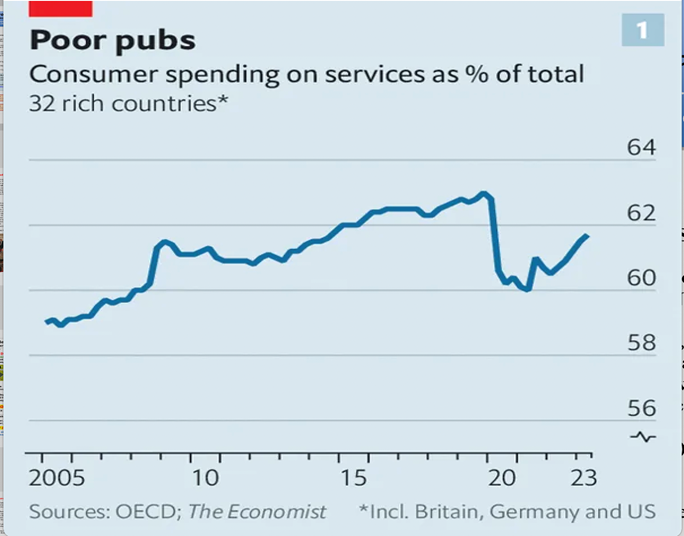

“Welcome to the age of the hermit consumer – The world economy is witnessing a $600bn-a-year shift in behaviour. Before covid, the share of consumer spending devoted to services was rising steadily. As societies became richer, they sought more luxury experiences, health care and financial planning. Then in 2020 spending on services, from hotel stays to hair cuts, collapsed. With people spending more time at home, demand for goods jumped, with a rush for computer equipment and exercise bikes. Three years on, the share of spending devoted to services remains below its pre-covid level. Rich-world consumers are spending around $600bn a year less on services than you might have expected in 2019. In particular, people are less interested in leisure activities that take place outside the home, including hospitality and recreation. Money is being redirected to goods, ranging from durables like chairs and fridges, to things such as clothes, food and wine.”, The Economist, October 22, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

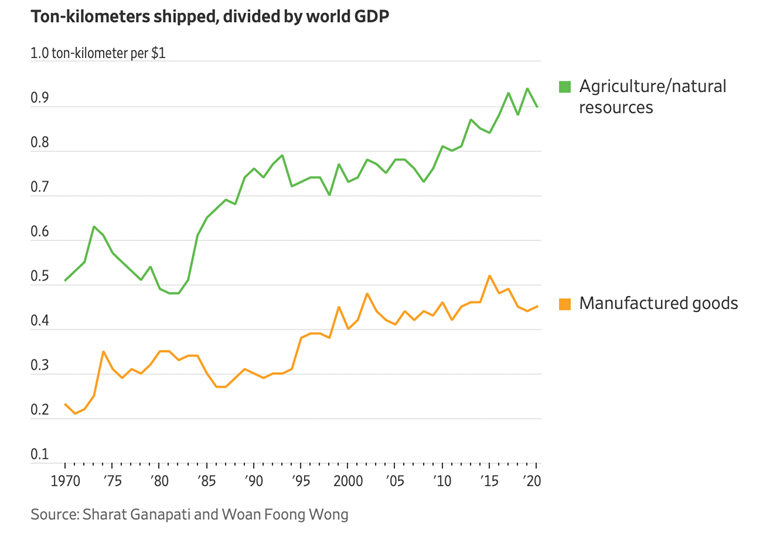

“Is Globalization in Decline? A New Number Contradicts the Consensus – Instead of looking at the dollar value of trade, focus on how many tons of stuff get shipped how far. Over the past 15 years, a consensus has developed that globalization has run its course and gone into decline. One popular number supporting this argument: Trade as a share of global output peaked in 2008 at the cusp of the global financial crisis and has never recovered. How can the value of trade be down, if the tonnage and distance are up? The obvious way this could happen is if the items being shipped are getting cheaper per ton. More goods are traveling greater distances than ever before. Shipping has increased for raw materials such as agricultural goods and natural resources, but has stagnated for manufactured goods”, The Wall Street Journal, November 3, 2023

“Ole! Mexico becomes biggest U.S. importer amid tensions with China – Businesses seek cheaper suppliers closer to U.S. Clothes, iPhones and TVs made in China have long made the Asian giant the biggest supplier of foreign-made goods to American consumers. No longer. A steady increase in imports from Mexico during the past decade have made the southern border the biggest hotspot in global trade. Mexico has doubled its imports to the U.S. since 2010, and this year, it’s on track to surpass China as the nation’s biggest supplier of foreign-made goods and services. China held that unofficial title since 2008.”, Market Watch, November 7, 2023

Annual % change in consumer price index, by date of forecast

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, November 9, 2023

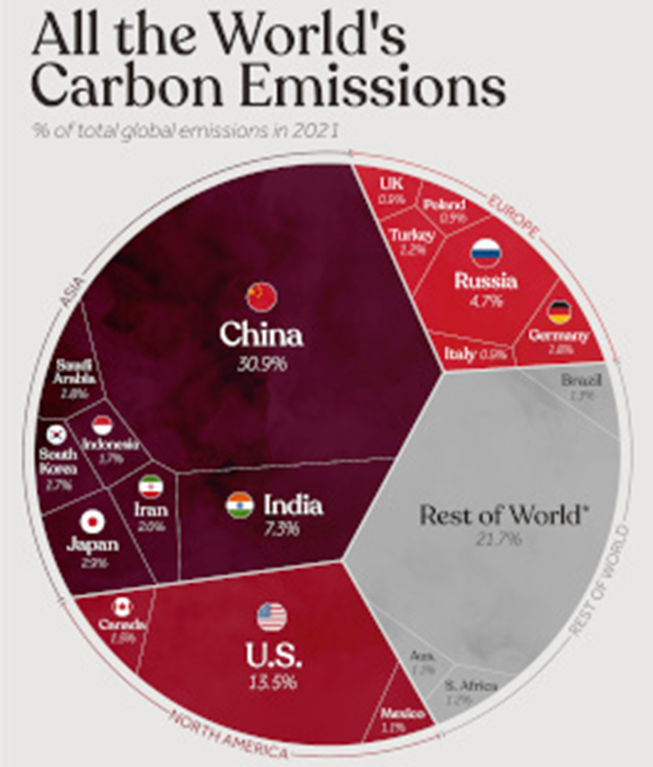

“Visualizing All the World’s Carbon Emissions by Country – The greenhouse effect, essential for sustaining Earth’s life-friendly temperatures, has been intensified by burning fossil fuels. This amplification of the natural greenhouse effect has led to significant alterations to the planet’s climate system. The graphic above uses data from the Global Carbon Atlas to explore which countries contribute the most to CO₂ emissions.”, Visual Capitalist, November 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“International travel demand falls after onset of Israel-Hamas conflict – International flight bookings around the world have fallen since the onset of the Israel-Hamas conflict especially in the Americas as people cancel trips to the Middle East and around the world, according to travel analysis firm ForwardKeys. International flight bookings from the Americas dropped 10% in the three weeks after the Oct. 7th attack, when compared to the number of tickets issued three weeks before the attack, according to flight ticketing data from ForwardKeys.”, Reuters, November 9, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Bank of Canada holds rate steady, trims growth forecast as inflation risks rise – Bank Governor Tiff Macklem and his team kept the policy rate at 5 per cent, the highest level in more than two decades. The decision was widely expected by analysts. It marked the second straight rate announcement in which the bank has remained on the sidelines. After 10 rate hikes since March, 2022, including two over the summer, higher borrowing costs are having their intended effect. Canadian consumers are pulling back on spending, unemployment is up and economic growth has slowed to a crawl.”, The Globe and Mail, October 26, 2023

China

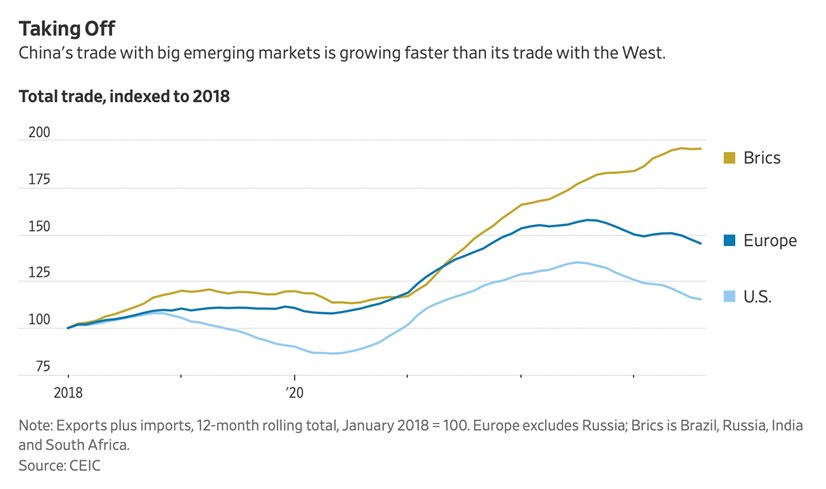

“It’s U.S. vs. China in an Increasingly Divided World Economy – Trade and investment flows settle into new patterns around two rival power centers—with major risks. China passed a significant milestone last fall: For the first time since its economic opening more than four decades ago, it traded more with developing countries than the U.S., Europe and Japan combined. It was one of the clearest signs yet that China and the West are going in different directions as tensions increase over trade, technology, security and other thorny issues.”, The Wall Street Journal, November 3, 2023

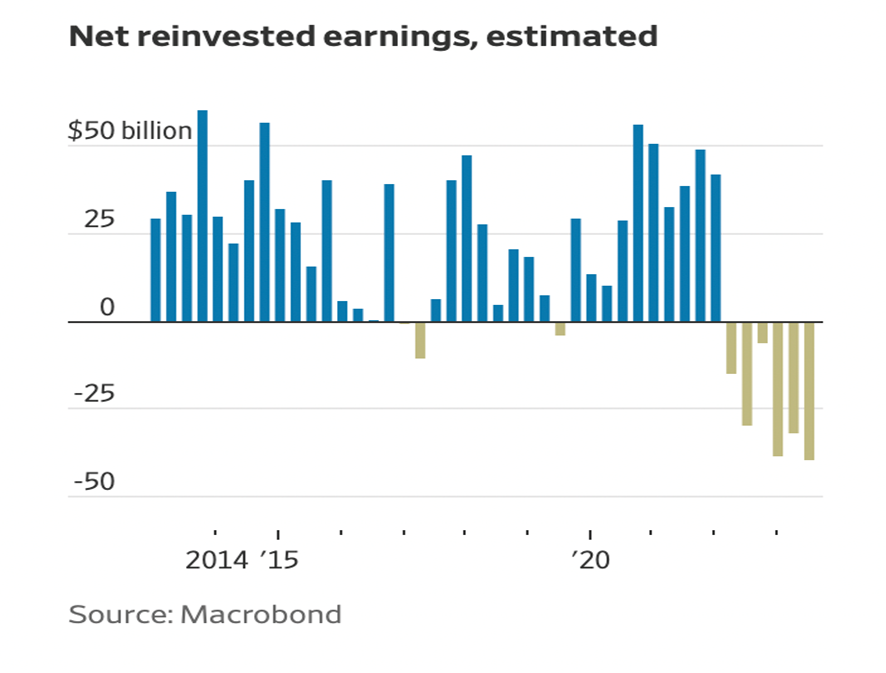

“Foreign Firms Pull Billions in Earnings Out of China – The outflows show interest rates, U.S. tensions and a weak economy are sapping China’s investment appeal. For years, foreign companies plowed the profits they made in China back into China, using the cash to finance new hiring and investment as its giant economy expanded rapidly. Now, as growth slows and tensions between Beijing and Washington rise, they are pulling those profits out.”, The Wall Street Journal, November 6, 2023

“China Is Making Too Much Stuff—and Other Countries Are Worried – Factories lack customers and are pushing exports harder, raising trade tensions. Some Chinese factories, saddled with overcapacity in a struggling economy, are trying to export their way out of trouble and stoking new trade tensions in the process. The tensions are most acute in Europe, where European Union regulators in September unveiled an antisubsidy probe, reflecting concern that China is flooding the region with low-cost electric vehicles. India is investigating whether China dumped a range of goods, from chemicals to furniture parts, into the country at unfair prices. Vietnam in September started examining whether wind towers imported from China have hurt domestic manufacturers.”, The Waal Street Journal, November 10, 2023

European Union

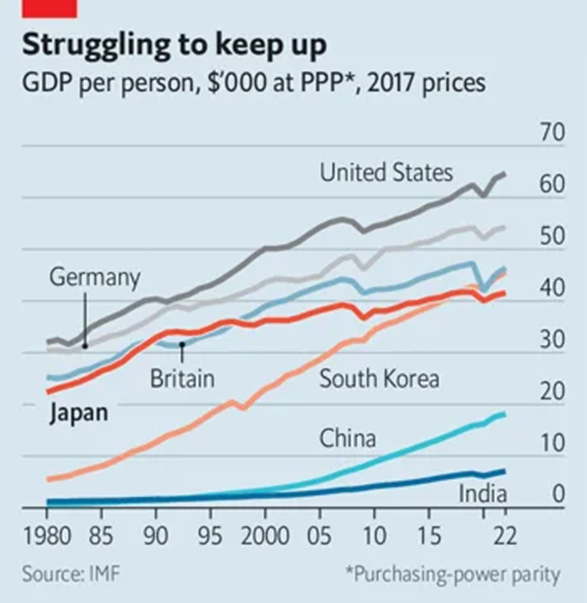

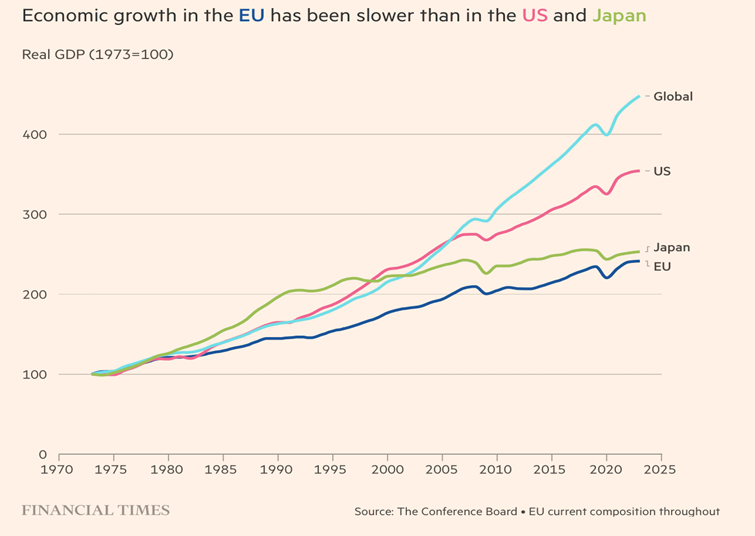

“The EU’s plan to regain its competitive edge – Brussels is trying to devise another new strategy amid fears of being left even further behind the US and China. When the heads of cabinets of the EU’s 27 commissioners huddled in the Belgian countryside in late August for their back-to-work retreat, all were invited to talk about what they thought should be the priority for the autumn. Everyone, over and over again, kept on coming back to competitiveness, and fixing the state of the EU’s economy. The EU economy, in dollar terms, is 65 per cent of the size of the US economy. That’s down from 91 per cent in 2013. Per capita, US gross domestic product is more than twice the size of the EU’s, and the gap is increasing.”, The Financial Times, November 5, 2023

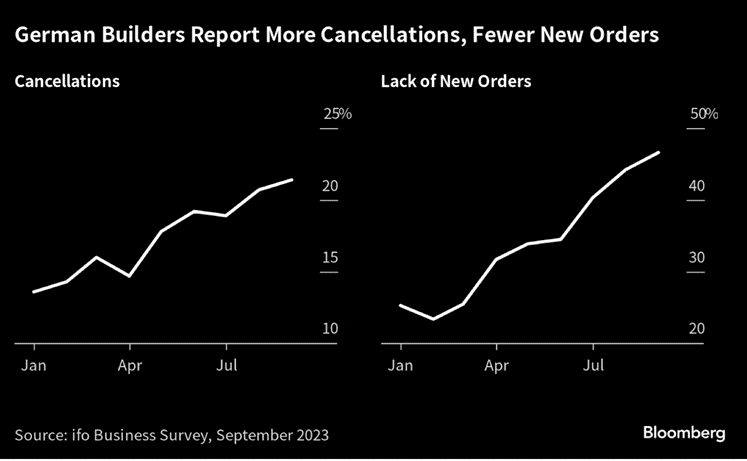

Germany

“Coalition Government Agrees to Reduce Electricity Prices for Industry – The package of measures will lower the electricity tax until at least 2025 and expand and extend existing subsidy schemes for energy-intensive manufacturers. Although electricity prices in Germany have dropped significantly from the record highs seen at the height of the energy crisis, they remain much higher for many energy-intensive manufacturers compared with those faced by their international competitors.”, RANE WorldView, November 9, 2023

India

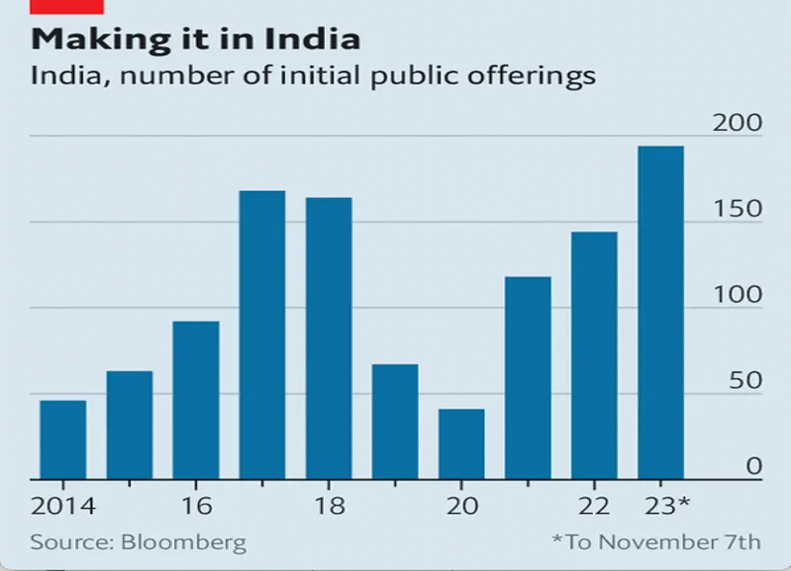

“India is in the midst of an unusual IPO boom – Extraordinary economic growth makes even ordinary companies look good. Beginning late last year, valuations in India’s private markets collapsed as investors lost patience with loss-making startups such as oyo, a hotel chain, and Byju’s, an online-learning business. Public markets sagged, too. The first hint of a shift in mood came in April with the listing of Mankind Pharma, a manufacturer of condoms and pregnancy tests. It quickly became apparent that attractive opportunities abounded in ordinary areas of an economy experiencing extraordinary growth. A flood of listings followed. As of early November, 194 companies had gone public this year, up from 144 for all of 2022.”, The Economist, November 9, 2023

Turkey

“High Court Clash Will Likely Hinder Foreign Investment – Turkey’s top appeals court filed criminal complaints against Constitutional Court judges after they issued a ruling in October calling for the release of Can Atalay, an opposition figure who was elected to the National Assembly in May, from prison on grounds of parliamentary immunity, Reuters reported on Nov. 8. This clash between Turkey’s top courts may cause a judicial crisis and a lack of standardized interpretations of regulations. Without uniform regulations, foreign capital is unlikely to increase, despite Ankara’s efforts to increase foreign investment to boost its economy amid economic turmoil.”, RANE WorldView, November 9, 2023

United States

“Houston overtakes Miami as best place for foreign businesses in annual FT-Nikkei ranking – Texas cities dominate top 10 amid surge of foreign investment in auto and tech sectors. Houston has taken the top slot as the best US city for foreign multinationals to do business in the second annual ranking compiled by the Financial Times and Nikkei. It gained the top spot by offering business friendly policies, excellent logistics, affordable cost of living, and a diverse community for overseas companies. To learn more about how Houston finished on tThe FT-Nikkei Investing in America ranking showcases the top US cities for international business. The ranking measures cities across more than four dozen metrics important to foreign investors.”, The Financial Times, November 8, 2023

Vietnam

“Intel Suspends Factory Expansion Amid Power Grid Limitations, Red Tape – Intel’s decision was based on concerns about Vietnam’s unreliable power grid and overbearing bureaucracy. The reasons for Intel’s suspension demonstrate that Vietnam lacks the capacity to power the many new or expanded factories and fabrication plants streaming into the country. Meanwhile, the country’s ongoing anti-graft campaign has created bureaucratic bottlenecks because officials are wary of signing off on projects. These same issues have constrained Vietnam’s efforts to upskill its workforce while drawing investment and reshoring companies from China.”, RANE WorldView, November 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Planet Fitness shares surge as company raises revenue outlook – The gym chain also boosted its revenue outlook for the year. Revenue jumped nearly 14% to $277.6 million. The company said it now expects to post 14% revenue growth for the year, up from its previous guidance of 12% and higher than analysts’ expectations of 11.6%. New and existing franchise owners received updated agreement details in mid-October that included key changes to the business structure, including: an increased franchise agreement from 10 years to 12 years to eliminate the initial $20,000 franchise fees, shortening grace periods for franchisees from 12 to six months and reequip periods extended to free up capital and reduce store spending.”, CNBC, November 7, 2023

“How America fell back in love with the drive-thru – A taste for tech and dislike of face-to-face interaction among young diners has shifted eating habits. When Harry Snyder opened the first In-N-Out hamburger stand close to Route 66 in 1948, he helped to consummate the love affair between two of America’s favourite things — the car and fast food. Fast-food chains including McDonald’s and Taco Bell are building ever larger drive-thrus to accommodate the growing demand. The biggest, a Chick-fil-A due to open next year in Atlanta, Georgia, will be able to handle 75 cars at a time across four lanes.”, The Times of London, November 11, 2023

NZ Franchise Awards 2023 Results – BATTLE OF THE BRANDS – This year’s Westpac New Zealand Franchise Awards were among the most hotly-contested ever, and it was fitting that there were two new names on the Supreme trophies from franchise brands that had never stood on the top step before. In their 28th year, the Westpac New Zealand Franchise Awards once again celebrated true excellence and achievement, and demonstrated the spirit of support and friendship that makes franchising such a successful business model.”, Franchise New Zealand, November 11, 2023

“Cartesian Capital Plots Rapid Popeyes® Growth in China – When Popeyes made its China debut in August, it “smashed the record” for opening-day transactions with more than 1,760, said Greg Armstrong, a partner at Cartesian Capital, the global private equity firm that’s behind the launch of Popeyes in China with plans to open more than 1,700 restaurants across the country in the next decade. It’s an ambitious development push that might appear overly so, but not for Tims China, said Armstrong. That’s the Cartesian-owned exclusive operator and master franchisee of Tim Hortons in China, which is on track to have more than 1,000 Tims stores open by the end of the year and is the same group behind the Popeyes expansion. Both brands are part of Restaurant Brands International.”, Franchise Times, October 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Subway opens largest Asian store in Shanghai’s West Bund – The new eatery has a submarine-shaped design, the first of its kind in the world, reflecting the signature freshly-made sandwich that allows customers to choose different types of meat, cheese, and other toppings. Covering over 300 square meters (3,230 square feet) of space, it features an interactive menu ordering device, and decorative drawings are in place to offer a more immersive dining experience. Earlier this year, Subway reached a deal with master franchisee Shanghai Fu-Rui-Shi Corporate Development Co to open nearly 4,000 new sandwich shops across mainland China over the next 20 years.”, Shine.com, November 11, 2023.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 94, Tuesday, October 31, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, as we get towards the end of another year there are lots of economic projections coming out. Look at the cost of a gallon of gas in California versus the US Midwest. Overall, global consumer confidence remains broadly stable with some exceptions. And why McDonalds® menu are better in other countries….really.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“The price of greatness is responsibility.”, Winston Churchill

“You cannot escape the responsibility of tomorrow by evading it today.”, U.S. President Abraham Lincoln

“Management is doing things right; leadership is doing the right things.”, Peter Drucker

Highlights in issue #94:

- Brand Global News Section: Cici’s Pizza®, McDonalds®, Pizza Express®, Popeyes®, Pret-A-Manger, Shake Shack® and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

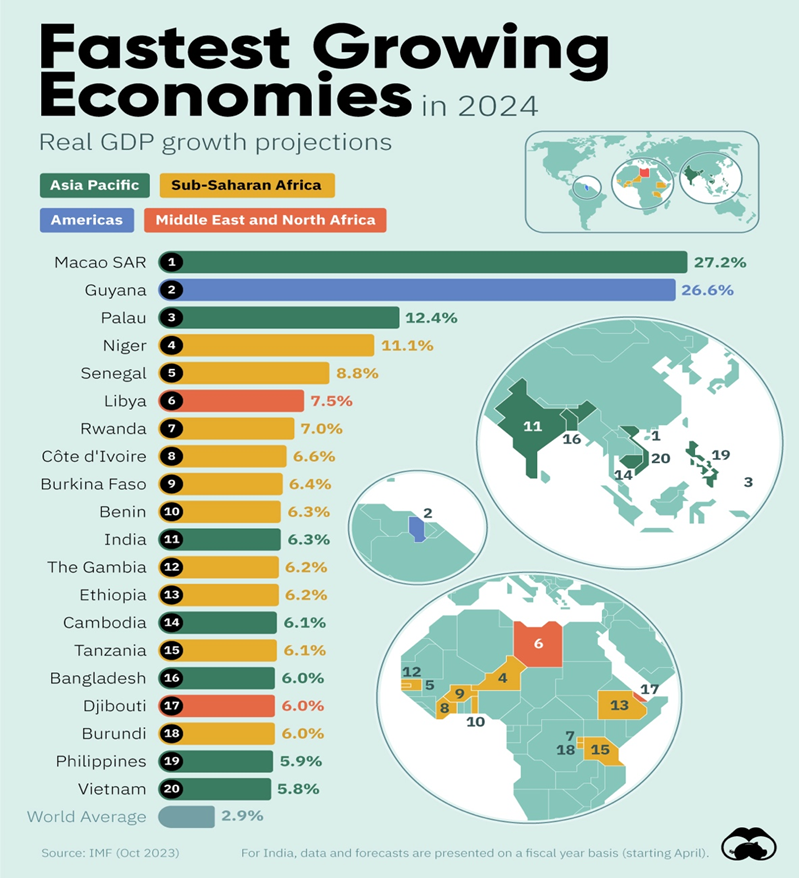

“IMF Projections: The Fastest Growing Economies in 2024 – Which countries will see the most economic growth in 2024? To answer this question, we’ve visualized GDP growth forecasts from the IMF’s October 2023 World Economic Outlook. Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.”, IMF and Visual Capitalist, October 24, 2023

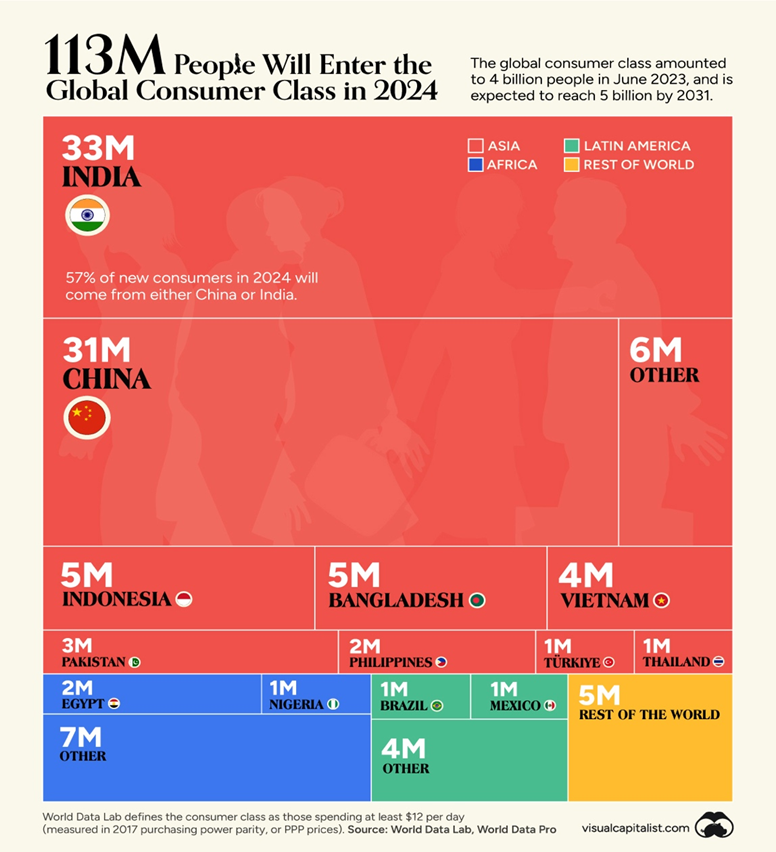

“113 Million People Will Join the Global Middle Class in 2024 – Defined by the World Data Lab as someone who spends at least $12 per day (measured in 2017 purchasing power parity), these individuals are typically rising up in developing regions like Asia and Africa. In this graphic, we’ve created a treemap diagram that shows where the new entrants to this consumer class in 2024 will originate from.”, Visual Capitalist, October 19, 2023

“Global Economics Intelligence executive summary, September 2023 – Some leading indicators improved, though outlook still fragile; confidence stable but consumers lean toward saving; inflation and trade volumes continue downward trend. Overall, consumer confidence remained broadly stable across our surveyed countries but still leaned toward saving rather than spending—although confidence dipped in China. In Brazil, consumer confidence rose to 96.8 in August, up from 94.8 in July—the highest reading since February 2014.”, McKinsey, October 20, 2023

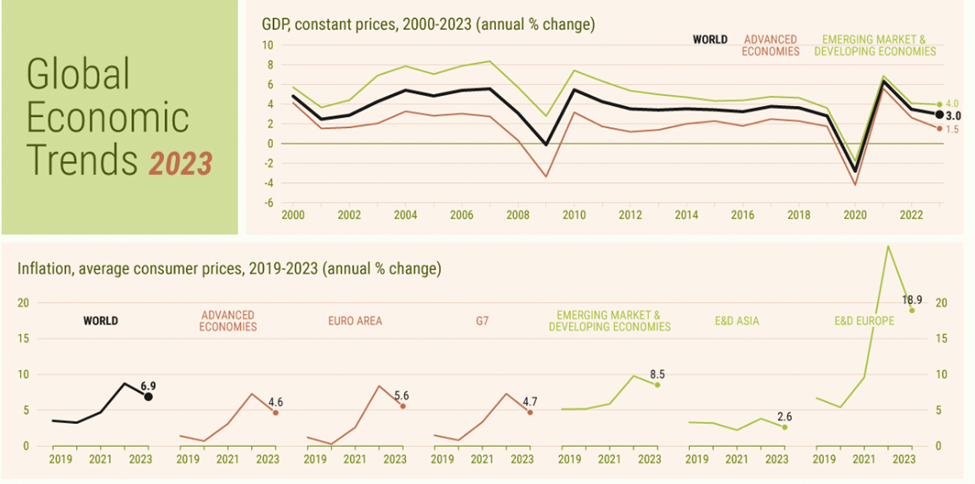

“Global Economic Trends, 2023 – According to a report recently published by the International Monetary Fund, global economic growth will be significantly slower in 2023 and 2024 than the average annual rate over the past two decades. The IMF projects that global gross domestic product growth will be 3 percent in 2023 and 2.9 percent in 2024, lower than the average of 3.8 percent from 2000 to 2019. Meanwhile, inflation is projected to decline this year and next year due to tighter monetary policies in many countries around the world, but it will remain at an elevated level. Overall, global economic growth will be slow and uneven, as it continues its recovery from the pandemic, Russia’s invasion of Ukraine and increases in global commodity prices.”, Geopolitical Futures, October 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

Annual % change in consumer price index, by date of forecast

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, October 29, 2023

“World needs 80 million more kilometres of new power lines by 2040, IEA finds – The agency said that grid investment needs to double to more than $600bn (£495bn) a year by 2030, or electrical grids could become a barrier to the deployment of renewables and electric transport options – risking climate catastrophe and frequent blackouts. The report found that 80 million kilometres (49.7 million miles) of transmission lines will be needed by 2040 in order for countries to meet their climate goals and energy demands. This is roughly equivalent to the total number of miles of electrical grid that currently exist in the world, according to the IEA.”, Engineering & Technology, October 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Saudi Arabia expects nearly 100 million tourist visits this year, minister says – Travel and tourism to contribute 6% to kingdom’s gross domestic product this year, up from 3% in 2019. The country will close the year with about 30 million international tourists, which is nearly half of its goal of 70 million overseas visitors by 2030, Saudi Arabia’s Tourism Minister Ahmed Al Khateeb told the Future Investment Initiative in Riyadh this week. Saudi Arabia has also revised upwards its 2030 target for total annual tourist trips – a figure that entails both domestic and international travellers – to 150 million from 100 million, the minister said.”, The National News, October 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Australia under more mortgage stress than any other nation, IMF says – Cost of repaying loans is 15% of income and likely to be higher after this year’s rate hikes, as fund predicts GDP growth of 1.2% next year. The increased cost of borrowing has left Australia at the top of the league for debt with Canada second followed by Norway and the Netherlands.”, The Guardian, October 10, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

Canada

“Bank of Canada holds rate steady, trims growth forecast as inflation risks rise – The Bank of Canada held its benchmark interest rate steady on Wednesday but left the door open to further increases, as its latest forecast showed a thorny combination of weaker economic growth and more-persistent inflation. After 10 rate hikes since March, 2022, including two over the summer, higher borrowing costs are having their intended effect. Canadian consumers are pulling back on spending, unemployment is up and economic growth has slowed to a crawl.”, The Globe and Mail, October 26, 2023

“Small business confidence hits lowest level since COVID-19 onset – The CFIB found in its latest business barometer from this month that more business owners are feeling less confident going into the holiday season. The 12-month small business confidence index dropped 1.5 points to 47.2, the lowest reading since April 2020 and the third lowest reading in nearly 15 years. The CFIB says an index level of around 65 normally indicates that the economy is growing at its full potential.”, Yahoo! Finance Canada, October 26, 2023

China

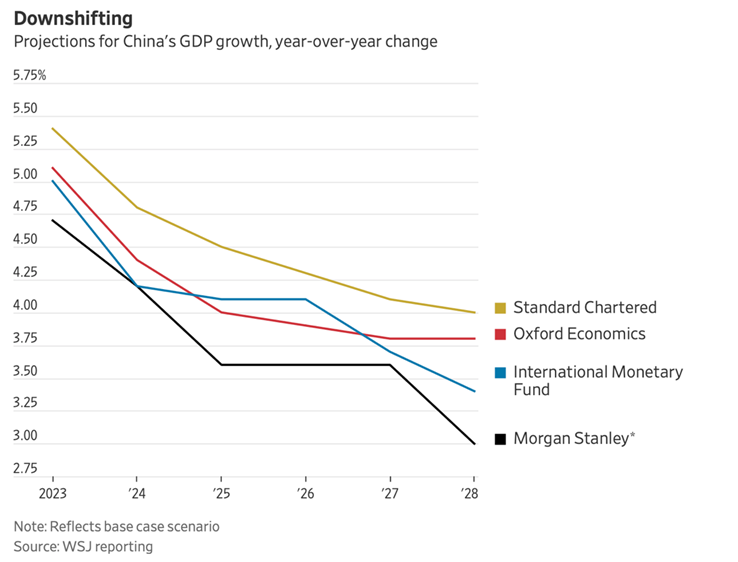

“China’s Economy Faces Deepening Troubles in Years Ahead – The country’s growth is showing signs of emerging from a soft patch, but its long-term prospects are darkening. economists warn China’s economy remains fragile and its long-term prospects are darkening. In recent weeks, a bevy of economists have lowered their forecasts for China’s longer-term growth trajectories, even as they raised their shorter-term predictions. The International Monetary Fund this month lowered its forecast for China’s growth next year to 4.2%, down from 4.5%.”, The Wall Street Journal, October 18, 2023

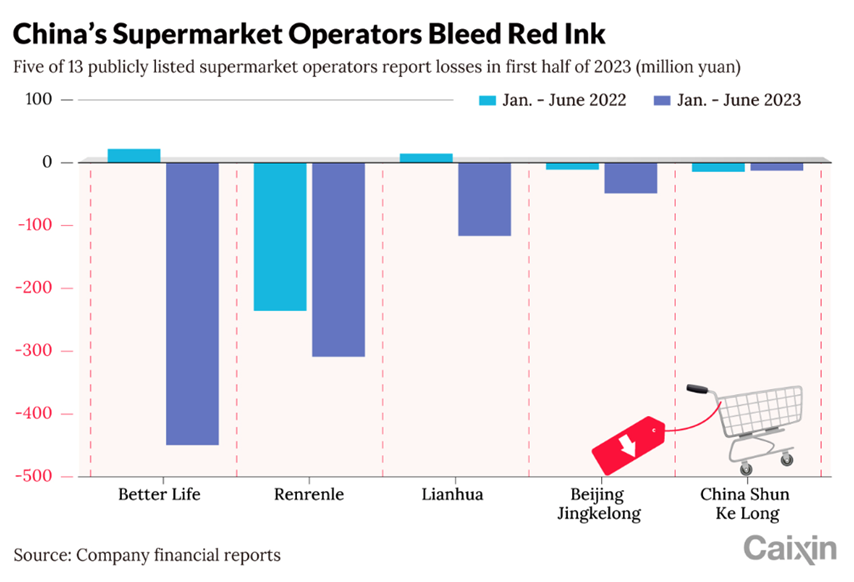

“The Struggle Facing Big-Box Supermarkets in China – Carrefour China, once the country’s largest foreign supermarket chain with nearly 260 stores in 2017, had less than 150 stores remaining at the end of last year. Financial trouble is also reflected in the first-half results of China’s 13 publicly traded supermarket operators, among which five reported year-on-year losses while three posted revenue declines despite making a profit, according to their earnings reports.”, Caixin Global, October 20, 2023

United Kingdom

“Federation of Small Businesses finds companies regaining confidence – Martin McTague, chairman of the federation, said: ‘After the economic turmoil wrought by the cost of doing business crisis over the past year and a half, [there are] signs of stabilisation in small firms’ performance. We need to beware that stabilisation does not turn into stagnation and that intentions to invest and grow are not thwarted by economic circumstances.’”, The Times of London, October 30, 2023

United States

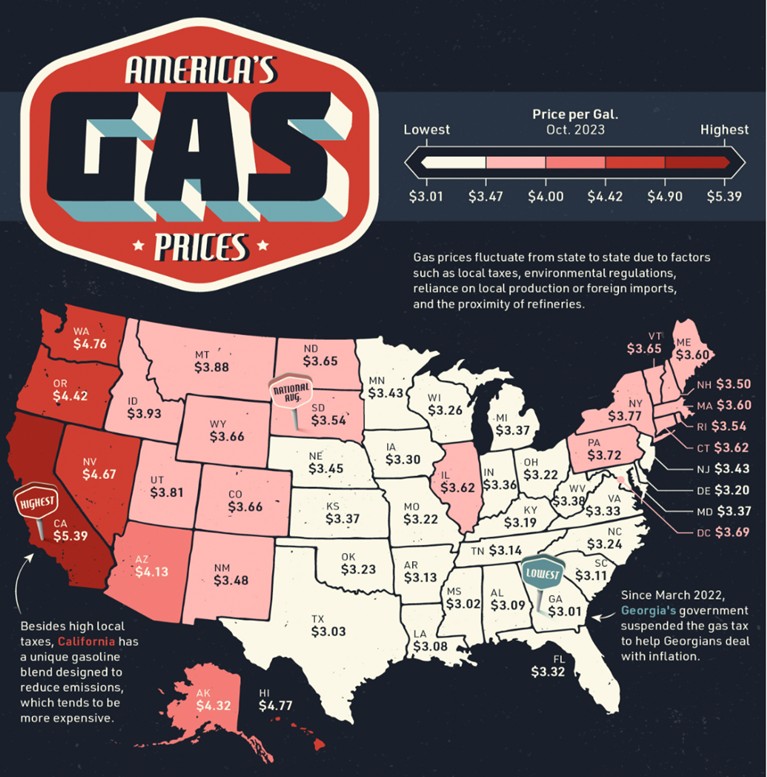

“Gas Prices in Every U.S. State – Gas prices fluctuate from state to state due to factors such as local taxes, environmental regulations, reliance on local production or imports, and the proximity of refineries. In this infographic, we use data from the American Automobile Association (AAA) to illustrate the cost of fueling a vehicle in each U.S. state.

According to the AAA, the national average price of regular unleaded gas was $3.54 per gallon as of October 25, 2023.”, Visual Capitalist, October 25, 2023

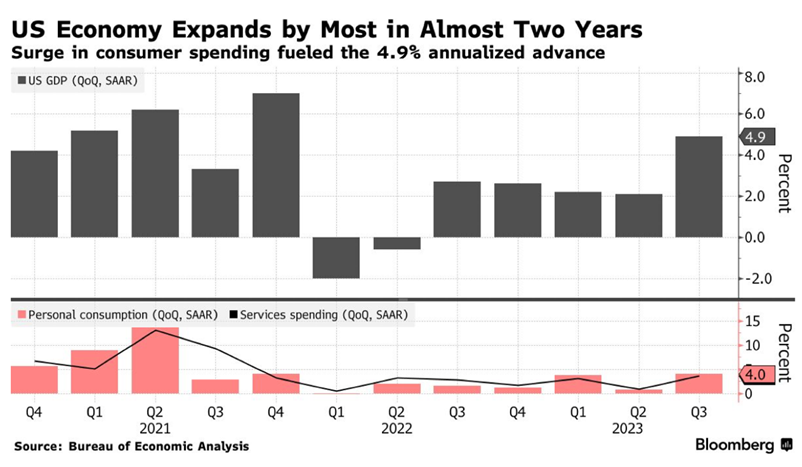

“US Economy Grew at a 4.9% Pace Last Quarter, Fastest Since 2021 – Consumer spending jumped at 4% rate, also the most since 2021 Core PCE price index increased a less-than-forecast 2.4%. The economy’s main growth engine — personal spending — jumped 4%, also the most since 2021. The primary driver of that resilience is the enduring strength of the job market, which continues to fuel household demand.”, Bloomberg, October 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“How Cicis Pulled Itself Out Of Restaurant Ruin – Declining sales and changing dining habits pulled it all the way down into bankruptcy in 2021, but it miraculously rose like a phoenix from the ashes. A restaurant that once seemed on the brink of death now stands as a bold testament to the power of innovation and adaptability in the change-or-die restaurant landscape. CiCi’s reinvented itself with wise innovations and marketing strategies, and the transformation was nothing short of extraordinary.”, Mashed, October 21, 2023

“AI set to transform the restaurant industry – Domino’s announced it has partnered with Microsoft to use the advanced AI to streamline pizza preparation, assist with quality control, inventory management and simplify the ordering process. Customers can expect to see noticeable changes to ordering processes at restaurants that integrate AI into their systems….AI will eventually be integrated across all restaurant operations, playing a pivotal roll at the front of the house by making ordering and payment processes more efficient. He said in the back of the house, AI can be used to provide accurate forecasting, tackle food waste by predicting usage patterns and even streamline employee management and scheduling.”, Fox Business, October 20, 2023

“The Reason McDonald’s International Menus Are Way Better Than The US – Thanks to the nature of the internet and social media sites like TikTok, customers in the United States are acutely aware that they’re missing out on some of McDonald’s bolder offerings. In fact, there’s an entire list of international food items we wish McDonald’s had in the U.S. It seems to be a common discussion point among McDonald’s customers over whether international McDonald’s tastes better than the chain’s domestic offerings.”, The Daily Meal, October 21, 2023

“U.K. pizza franchise PizzaExpress entering the Canadian market – U.K. casual dining pizza restaurant brand, PizzaExpress, has launched its international franchise program into Canada. PizzaExpress has been serving pizza in the UK since it was founded in 1965 in London’s Soho. From urban and suburban casual dining restaurants, quick service kiosks, and express locations, all the way up to its live music venues. PizzaExpress has more than 450 locations in 12 international markets.”, Canada Franchise, October 19, 2023

“Popeyes’ Journey from Cult-Favorite to the Mainstream – When RBI (Restaurant Brands International) acquired the brand on March 27, 2017, for $1.8 billion, there were about 2,600 locations in the U.S. and 25 countries globally. From acquisition to 2020, RBI posted cumulative net restaurant growth of 27 percent at Popeyes. Fast forward and Popeyes finished Q1 2023 with 4,178 restaurants globally—2,947 in the U.S. and 1,231 internationally. There were more than 200 North America debuts in 2022, featuring the loftiest figure of new franchisees and the largest percentage of freestanding single or double drive-thru locations in five years.”, QSR Magazine, October 18, 2023

“Pret adds growth to menu with US venture – Pret A Manger has handed the majority of its American operation to a franchiser, creating a joint venture that will take operational control of 50 stores in New York, Pennsylvania and Washington. The deal gives Dallas Holdings exclusive rights to open new shops in the three markets, with formats including drive-through outlets and a menu with slightly different ingredients and portion sizes. The operation, which comprises 58 stores in total, will be majority-owned by Dallas, which will hold 70 per cent of the joint vehicle.”, The Times of London, October 21, 2023

“Shake Shack® Malaysia: What can you expect to pay for a burger when it arrives next month – The Shake Shack branch in Malaysia is operated by SGP Group, the same group that is handling the brand in South Korea and Singapore. The ShackBurger cost in other countries: United States: USD 6.89 (about RM 32.90), South Korea: 6,900 Won (about RM 24.30) and Singapore: SGD 9.70 (about RM 33.80). If we take the pricing of both the South Korean market and the Singapore market, and we average it, we will get RM 29.05. We may see a slight increase in price due to taxes and raw material availability here. So, we can round up the price to about RM 30 for a basic ShackBurger here in Malaysia.”, Soyacincau, October 27, 2023

“Tim Hortons surpasses 300 stores milestone in the GCC and India – Tim Hortons, a beacon of Canadian coffee culture, has firmly entrenched itself in the Middle East with an impressive 285 outlets and further solidified its presence in India with 22 locations. India, with its vibrant and diverse palate, has warmly embraced Tim Hortons, evident in the growing store count: Delhi NCR boasts 10 stores, Punjab has 7, Mumbai proudly hosts 3, and Bangalore has opened 2.”, The Franchise Talk, October 16, 2023

“Running a franchise business like fast food is getting more expensive – Franchise fees have gone up with inflation, but the economics may get more expensive even as inflation falls, driven by technology costs and wage pressures in the labor market. Royalty fees could continue to rise. Pending changes in (US) federal labor law could upend franchise economics. CNBC, October 20, 2023

“New (U.S.) Labor Rule Could Make it Easier for Franchises Like McDonald’s to Unionize – The revised joint-employer rule was announced by the National Labor Relations Board and applies to workers’ rights to join unions, bargain collectively, and protest work-related conditions under federal law. The new standard replaces a Trump-era regulation on joint-employer status, adopted in 2020, which said a business needed to have “substantial direct and immediate control” over job conditions to be considered a joint employer. Under the new rule, a business could be considered a joint employer whether it has direct or indirect control over one or more “essential” working conditions. Those conditions could include wages, scheduling, assignment of duties, and the safety and health of workers.”, Barron’s, October 27, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 93, Tuesday, October 17, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

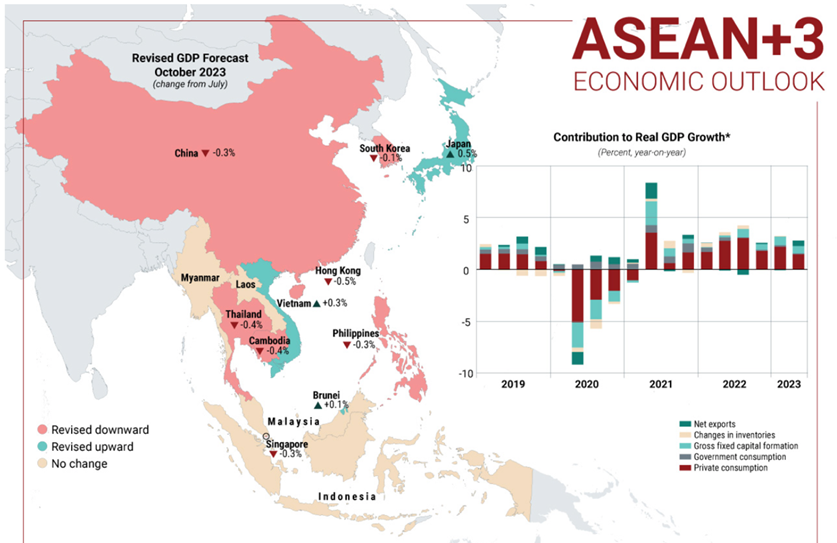

Introduction: In this issue, global trade and inflation are improving while country investment risks are not. 1 in 8 people in the USA worked at McDonalds®! No more paper passports in the future? Asian countries economies are on track to improve in 2024. India’s stock markets pass those in China which is seeing births at the lowest level since 1949.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“There are no such things as limits to growth, because there are no limits on the human capacity for intelligence, imagination, and wonder.’, President Ronald Regan

“Challenges make life interesting, however, overcoming them is what makes life meaningful.”, Mark Twain

“Success is not final, failure is not fatal: It is the courage to continue that counts.”, Winston Churchill

Highlights in issue #93:

- Brand Global News Section: Burger King®, Jack In The Box®, Mathnasium®, McDonalds® and Texas Roadhouse®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

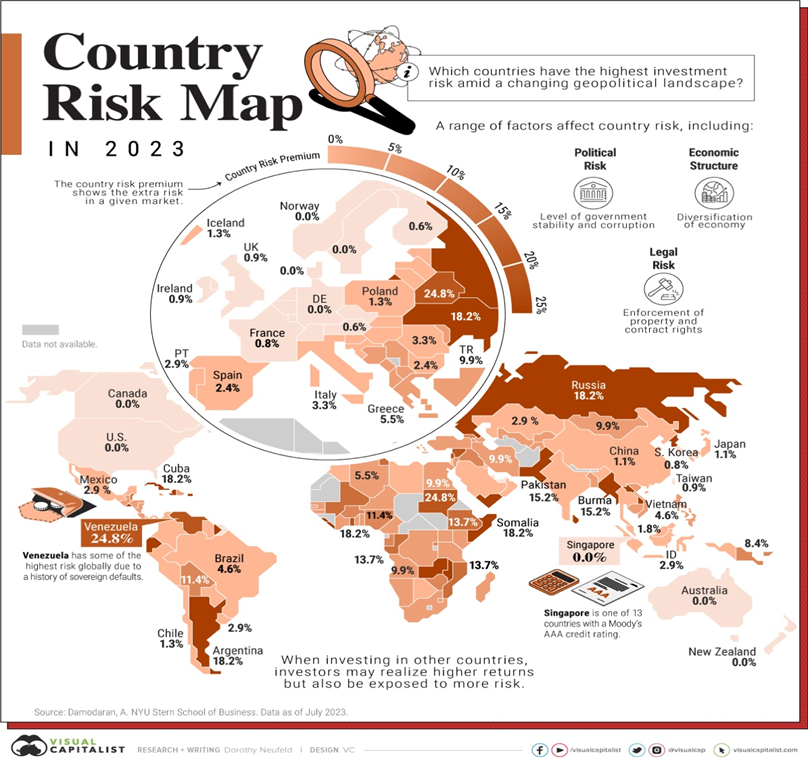

“Which Countries Have the Highest Investment Risk? Given the rapid growth of emerging economies, and the opportunities this may present to investors, it raises the question: does investment exposure abroad come with risk, and how can that risk be analyzed? This graphic shows country risk around the world, based on analysis from Aswath Damodaran at New York University’s Stern School of Business. To get a clearer picture of country risk, Damodaran analyzed the following broad factors: Political risk: Type of regime, corruption, level of conflict; Legal risk: Property rights protections, contract rights; and Economic risk: Diversification of economy.”, Visual Capitalist, October 9, 2023

“2023 World Population – The World Population in 2023 is 8,045,311,447 (at mid-year, according to U.N. estimates a 0.88% increase (70,206,291 people) from 2022, when the population was 7,975,105,156, a 0.83% increase (65,810,005 people) from 2021, when the world population was 7,909,295,151. During the 20th century alone, the population in the world has grown from 1.65 billion to 6 billion. In 1970, there were roughly half as many people in the world as there are now. Because of declining growth rates, it will now take over 200 years to double again.”, Worldometer, July 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global Trade Poised to Turn a Corner – Bloomberg’s Trade Tracker shows only four out of 10 gauges sat in below-normal range in early October, compared to six in August. It’s the surest sign yet of recovery since the start of 2023, when as many as nine out of 10 indicators were deep in the red. Consumer demand, though nascent, appears to be firming up. Shipping volumes improved in key ports like Los Angeles, while early export data out of South Korea showed a rare annual increase.”, Bloomberg, October 8, 2023

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, October 11, 2023