EGS Biweekly Global Business Newsletter Issue 92, Tuesday, October 3, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Japan’s stock market soars, the European Union will need US LNG for decades, McDonalds® raises its franchisee royalty rate for the first time in 30 years, Singapore’s Changi airport to go passport free, Indonesia bans sales on social media, and Eurozone country’s inflation is at a 2 year low.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Tough times never last, but tough people do.” – Robert H. Schuller

“Out of difficulties grow miracles.” – Jean de La Bruyère

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.” – Socrates

Highlights in issue #92:

The $109 Trillion Global Stock Market in One Chart

The Lack Of Travelers To The U.S. Is Hurting American Retailers

Top EU energy official says US gas will be needed for decades

McDonald’s Is Raising (US) Royalty Fees on New Franchises for the First Time in 30 Years

Four Small States That Show Leadership

A breakout year for Japanese stocks

Brand Global News Section: Coffee Berry®, Guzman y Gomez®, KFC®, McDonalds®, Starbucks®, Subway® and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

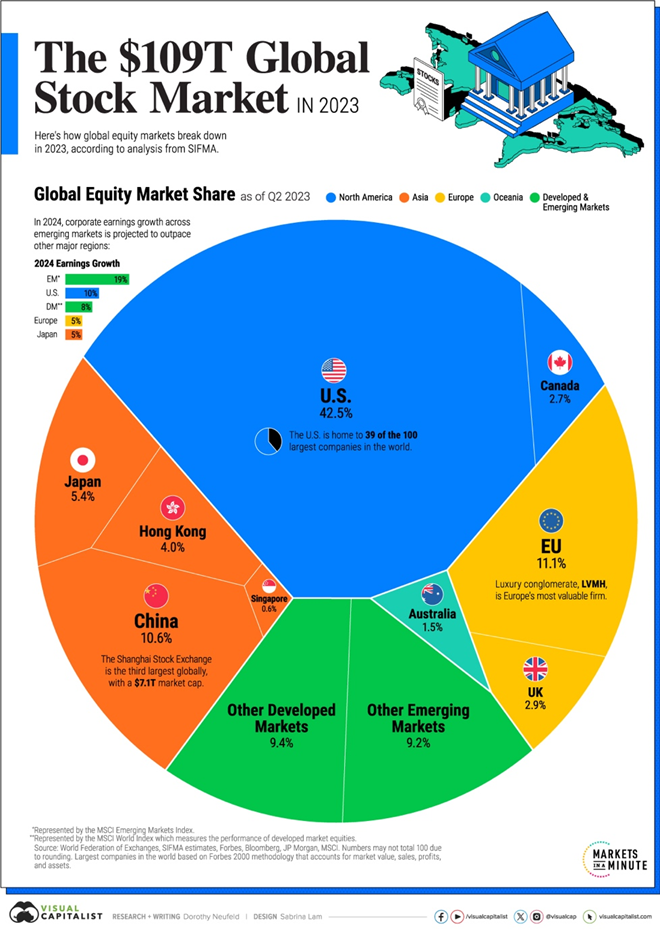

“The $109 Trillion Global Stock Market in One Chart – Over the last several decades, the growth in money supply and ultra-low interest rates have underpinned rising asset values across economies. With the world’s deepest capital markets, the U.S. makes up 42.5% of global equity market capitalization, outpacing the next closest economy, the European Union by a significant margin.”, Visual Capitalist, September 27, 2023

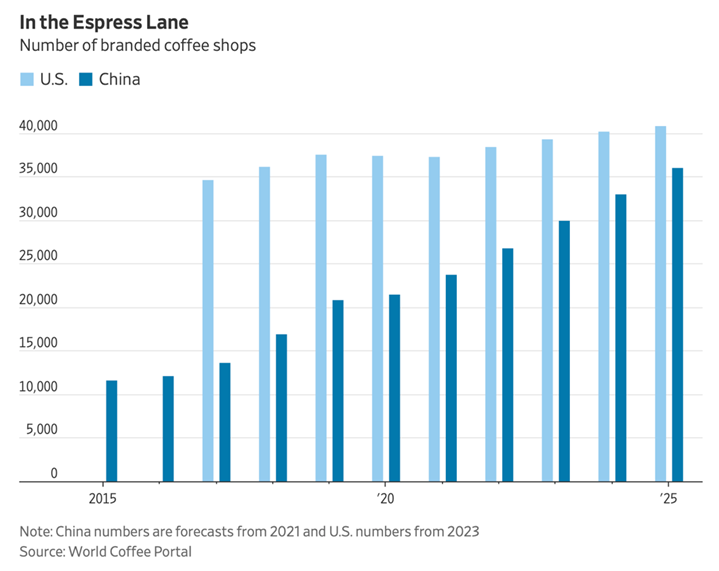

“The Furious Race for the Future of Coffee – Starbucks is making a big push in China. Other chains are pushing even harder. It turns out that selling foamy brown water at an 80% markup is really profitable. Back in 2013, the chief financial officer of what was then called Dunkin’ Donuts dubbed beverages ‘the holy grail of profitability.’, The Wall Street Journal. September 22, 2023

“The Latest On Returning To Offices – As corporate and urban centers around the world continue to resume a more familiar pace, leaders seek the “right” balance between in-person and remote work, as well as between mandates and persuasion. A recent WTW survey reports that leaders expect more than half of their employees (55%) to work either fully remotely or hybrid in three years, compared with 15% before the pandemic. Effective leaders take six actions as employees return to offices.”, Forbes, September 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

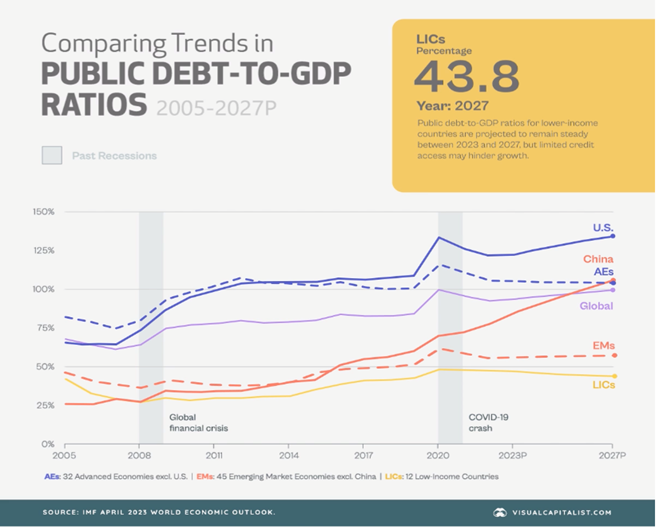

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

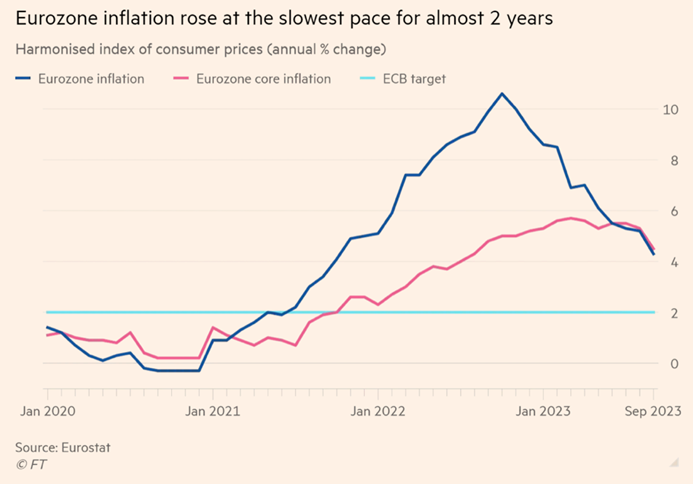

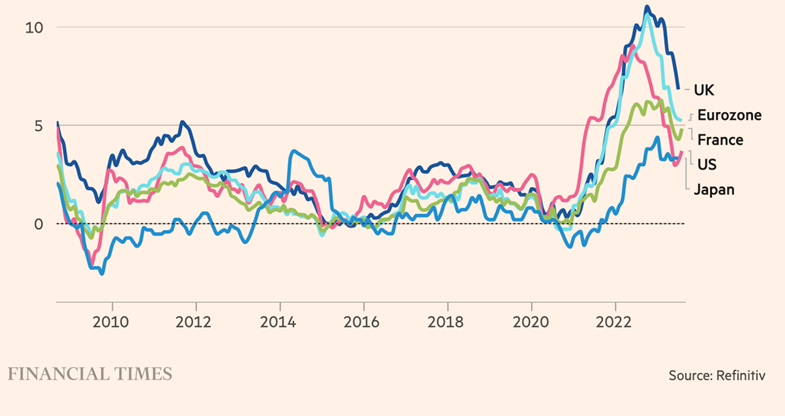

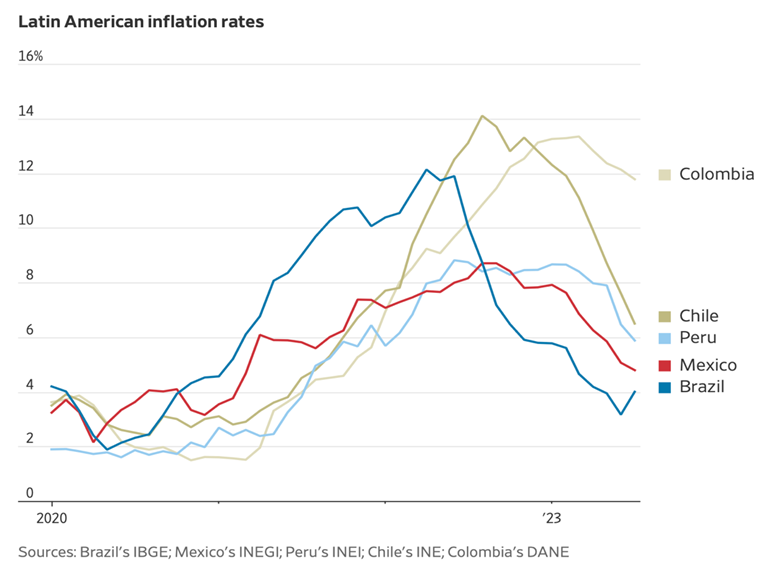

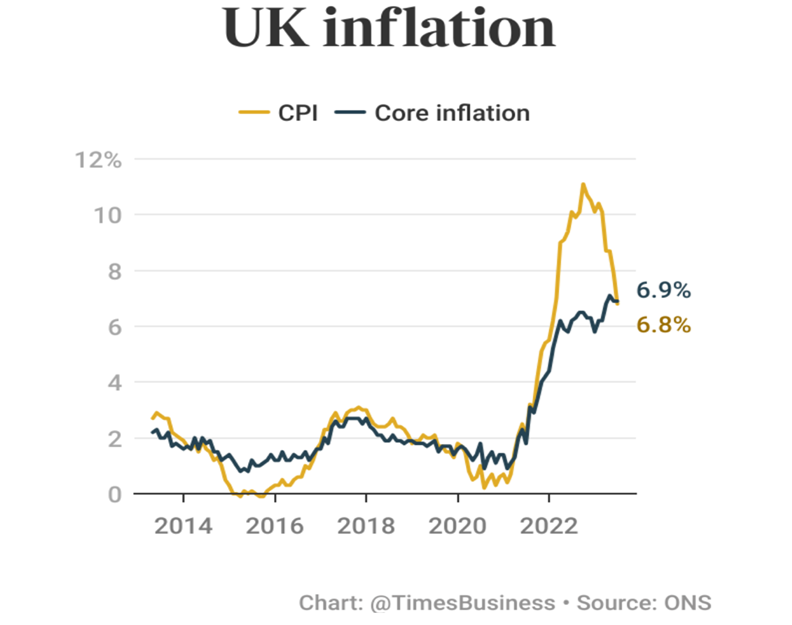

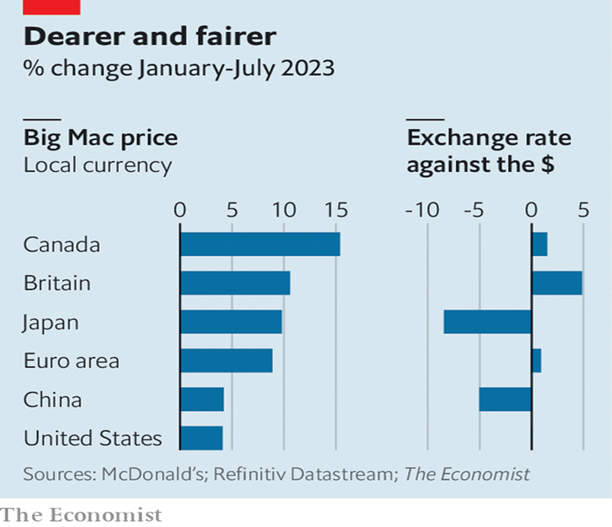

“Eurozone inflation hits 2-year low as US price pressures ease – Data helps steady bond markets and signals prospect of end to interest rate rises on both sides of Atlantic. The last time inflation was lower was in October 2021. US data also bolstered hopes that the biggest surge in consumer prices for a generation is fading fast. ‘The main takeaway is that the tightening cycle is coming to an end,’ said Seema Shah, chief global strategist at Principal Asset Management.”, The Financial Times, September 29, 2023

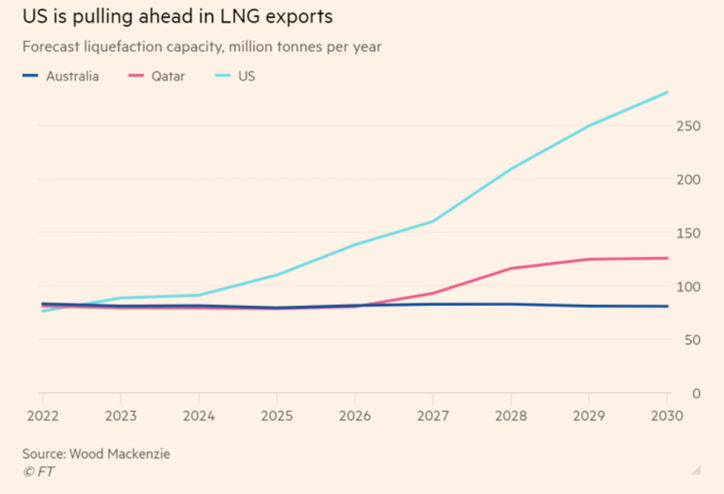

“Top EU energy official says US gas will be needed for decades – Europe will have to rely on US fossil fuels for decades to come as it races to diversify from Russian natural gas and scale up its renewables sector to boost energy security, the EU’s top energy official has said. ‘We will need some fossil molecules in the system over the coming couple of decades. And in that context, there will be a need for American energy,’ said Jørgensen, director-general for energy in the European Commission, in an interview in New York.”, The Financial Times, September 24, 2023

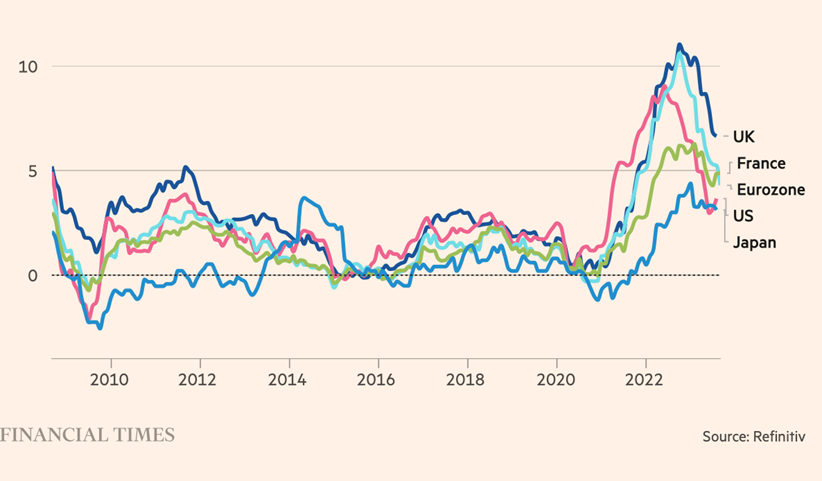

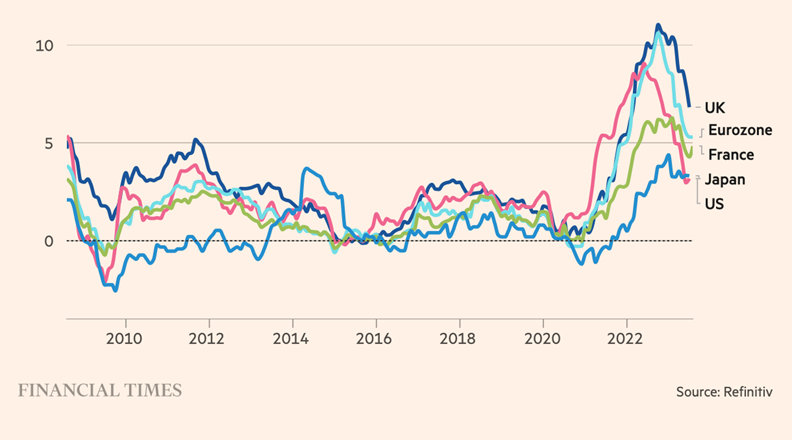

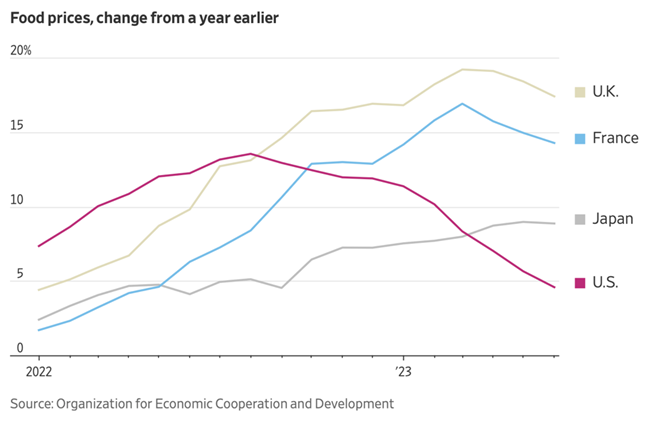

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, September 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The Lack Of Travelers To The U.S. Is Hurting American Retailers – Due to the global pandemic, the United States saw a drop in international visitors. While travel has been picking up, one industry that isn’t recovering as quickly is the retail industry. In 2023, overseas travel is only nearly 75 percent recovered, which is estimated to cost retailers over $6 billion.”, Forbes, September 29, 2023

“This Airport Is About to Go Passport Free – Soon you’ll only need your face to travel through Singapore’s Changi Airport. Starting sometime in the first half of 2024, you won’t need to show your passport if you’re traveling through Singapore. All you’ll need to pass through security and immigration is your face—the airport is switching to biometric technology and facial recognition technology instead of having agents physically check travel documents to move travelers through the airport more quickly.”, AFAR, September 27, 2023

“More direct China-US flights on the horizon, but return to 2019 traffic far more distant – Direct flights between two countries set to increase in October, a fraction of pre-pandemic routings. Both Chinese and US airlines will expand their schedules, but politics and structural demand shifts may blunt enthusiasm for total resumption. Frequency of flights will increase in October, when US airlines expand their list of direct routes. The US Department of Transportation announced in August that the number of Chinese passenger flights permitted to fly to the US would increase by six in October, up to 24 per week. ‘However, it is important to note that this is still significantly less than the pre-Covid-19 period when there were more than 300 round trips per week,’ said Herman Tse, valuations manager at Cirium Ascend consultancy.”, South China Morning Post, September 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

“Asia faces one of worst economic outlooks in half a century, World Bank warns – Sluggish post-pandemic recovery, China’s property crisis and US trade policies expected to hinder growth next year. The gloomier 2024 forecasts from the bank underline the mounting concern over China’s slowdown and how it will spill into Asia. China’s policymakers have already set one of the lowest growth targets in decades for 2023, of about 5 per cent. It also downgraded its 2024 forecast for gross domestic product growth for developing economies in east Asia and the Pacific, which includes China, to 4.5 per cent, from a prediction in April of 4.8 per cent and trailing the 5 per cent rate expected this year.”, The Financial Times, October 1, 2023

Estonia, New Zealand, Qatar and Singapore

“Four Small States That Show Leadership – While most geopolitical commentators focus on the new duo-polar world with the rise of China or even a multi-polar world of many eastern and western players, the influence of smaller countries is often overlooked. It’s clear there’s an important – even critical – role to play for sophisticated nations to punch above their weight on the regional and world stage, despite the small size of their populations and the power of their much larger neighbours. Four examples show just how it isn’t size but strategy that makes a country successful.”, Forbes, October, 2, 2023

China

“China hopes Golden Week holiday will deliver economic boost – Surge in consumer spending could spill over into fourth quarter and help ailing property sector. Economists will be watching in particular whether Chinese consumers will use the eight-day break, which combines the October 1 National Day and the mid-Autumn festival holidays, to spend not only on restaurants and outings but also on bigger ticket items, particularly property.”, The Financial Times, September 29, 2023

“Chinese consumers much more inclined to buy from foreign brands than last year – With borders opening and Chinese travelling and seeing the world again – either in person or vicariously through their network’s social media, consumers are reminded of many great attributes of foreign countries, lifestyles and brands that has been absent in propaganda. This appeal is reflected in PWCs Global Consumer Insights Survey which polled 18,155 global participants over the past two years, of whom more than 1,276 consumers were from Chinese mainland and Hong Kong. There has been a slight improvement in the perception of foreign brands, with 30% having a preference to buy foreign brands in 2023 versus 28% last year. However the biggest shift is the 15% who are ‘much more’ inclined to buy foreign brands, almost double the 8% last year.”, China Skinny, September 22, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“AmCham report: US firms upbeat on China business prospects – American companies remain generally optimistic about business prospects in China, according to the latest 2023 China Business Report by AmCham Shanghai. It revealed that the end of the pandemic has brought stability to revenue expectations, with an increasing number of companies planning to ramp up their investments in China this year compared with 2022. The report, based on the results of AmCham Shanghai’s 2023 China Business Survey, indicated that 52 percent of companies expect greater revenue in 2023 than in the previous year, among which retail firms are the most optimistic, with 74 percent anticipating higher revenues. This positive outlook emphasizes the resilience and potential of China’s market.”, Shine.cn, September 27, 2023. Compliments of Paul Jones, Jones & Co., Toronto

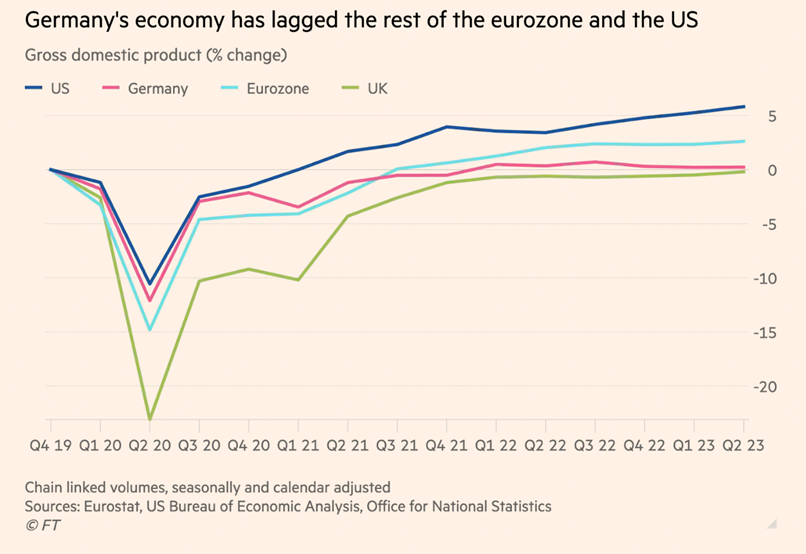

Germany

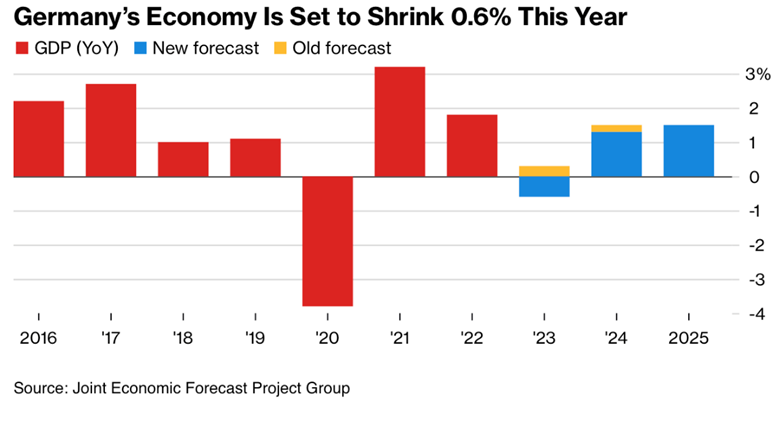

“German Economy to Shrink 0.6% in 2023 Before Wages Drive Rebound – Purchasing power to fuel 1.3% growth next year, institutes say Inflation expected to slow to 2.6% in 2024, 1.9% in 2025. Germany’s economy is on course for its first full year of contraction since the pandemic, new forecasts showed, though rebounding consumption should spur a recovery in 2024.”, Bloomberg, September 28, 2023

India

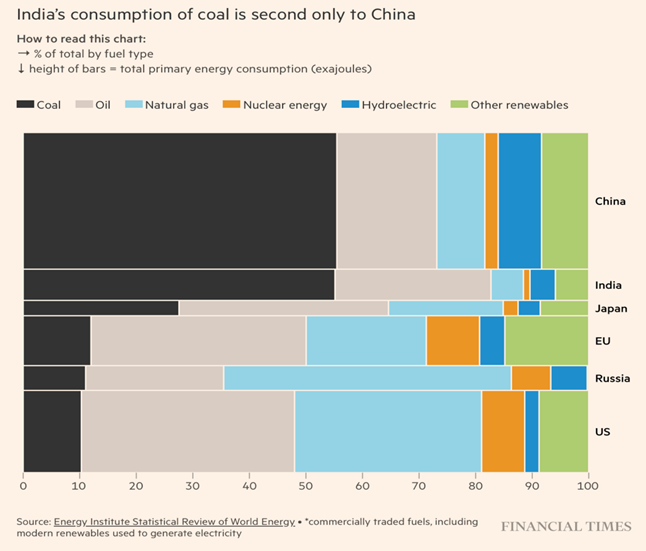

“India’s dream of green energy runs into the reality of coal – The fossil fuel accounts for around three-quarters of power generation and demand is expected to grow, despite an ambitious renewables plan. Prime Minister Narendra Modi has laid out an ambitious target to build 500 gigawatts of non-fossil fuel capacity by 2030. India has also announced billions in subsidies to manufacture clean-energy technology and wants to become a leading green hydrogen exporter. Yet India’s energy transition is complicated by intractable problems, from the difficulty of acquiring land for solar and wind farms to deep financial distress in its power system, which slows new investment. While demand is surging, millions still lack access to reliable electricity. Authorities see the expansion of polluting industries like steel and cement as essential to creating jobs and economic growth.”, The Financial Times, September 24, 2023

Indonesia

“Indonesia bans purchases on social media, in a blow to TikTok’s e-commerce ambitions – Indonesia’s ministry of trade said Tuesday it is working to further regulate e-commerce, adding that the country does not allow transactions on social media platforms. ‘One of the things that is regulated is that the government only allows social media to be used to facilitate promotions, not for transactions,’ the ministry said in an official release. This means that users in Indonesia cannot buy or sell products and services on TikTok and Facebook.”, CNBC, September 27, 2023

Japan

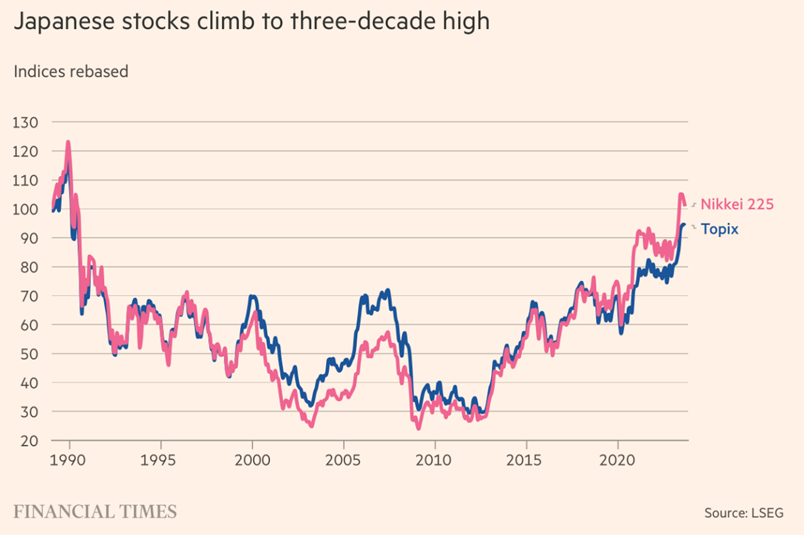

“A breakout year for Japanese stocks – After a series of false dawns, investors sense a long-awaited shift in the Tokyo market. But everything has come together this year, despite the very clear consensus that 2023 would be similarly drab. The Topix and Nikkei 225 are both up more than 20 per cent so far this year. That drops in to single figures in dollar terms but this remains a breakout year.”, The Financial Times, September 29, 2023

Singapore

“Singapore’s population grows 5% as foreign workers return post-pandemic – There were 5.9 million people in Singapore as of June, up from 5.6 million in June last year. Of these, 61% were Singaporeans, 9% were permanent residents and 30% were foreigners working or studying in the country. The bulk of the population increase came from foreign employment, with 162,000 foreign workers coming to Singapore from June 2022 to June this year. The National Population and Talent Division said the largest increase came from workers in the construction, marine shipyard and process sectors as contractors hired more workers for projects that were delayed by the pandemic.”, Reuters, September 29, 2023

“Singapore is now the world’s freest economy, displacing Hong Kong after 53 years – For the first time since the Economic Freedom of the World Index started in 1970, Hong Kong has slipped from its number one position to second place — and its score is about to drop even further. New regulatory barriers to entry, increasing cost of business, and limits on employing foreign labor dented Hong Kong’s ranking, the report stated.”, CNBC, September 21, 2023

United Kingdom

“UK GDP: Economy grew faster than Germany and France after Covid – Gross domestic product is now estimated to be 1.8 per cent larger compared with the final months of 2019, just before the pandemic swept through the country, according to the Office for National Statistics (ONS). The revised figures mean that the economy has added about an extra £10 billion in output since the final quarter of 2019. Under its initial estimates, the statistics agency thought the economy was 0.2 per cent below its pre-pandemic levels. The Times of London, September 29, 2023

United States

“US GDP growth unrevised at 2.1% in second quarter as economy shows resilience – The U.S. economy maintained a fairly solid pace of growth in the second quarter and activity appears to have accelerated this quarter, but a looming government shutdown and an ongoing strike by auto workers are dimming the outlook for the rest of 2023. Inflation also remains elevated and tight labor market conditions continue to prevail, with the number of Americans filing new claims for unemployment benefits rising slightly last week, the reports showed on Thursday.”, Reuters, September 28, 2023

“50% of U.S. Small Business Say Interest Rates Have Hurt Their Businesses – Further, 66% of the poll respondents in this group believe economic issues will persist even if the Federal Reserve doesn’t raise rates further. In fact, 38% of those struggling say that the interest rate must be reduced by at least 3 points before they envision rebounding again. These are just a few findings emerging from a poll of 7,396 randomly selected small-business owners surveyed from August 5 to September 18, 2023.”, Franchising.com, September 22, 2023

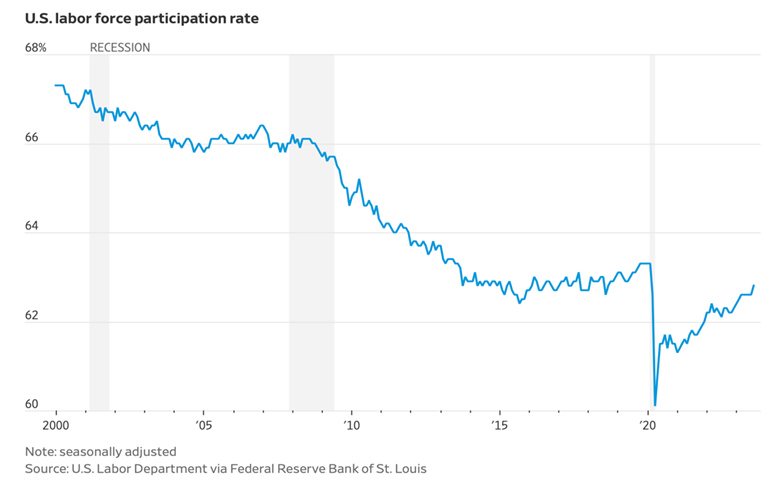

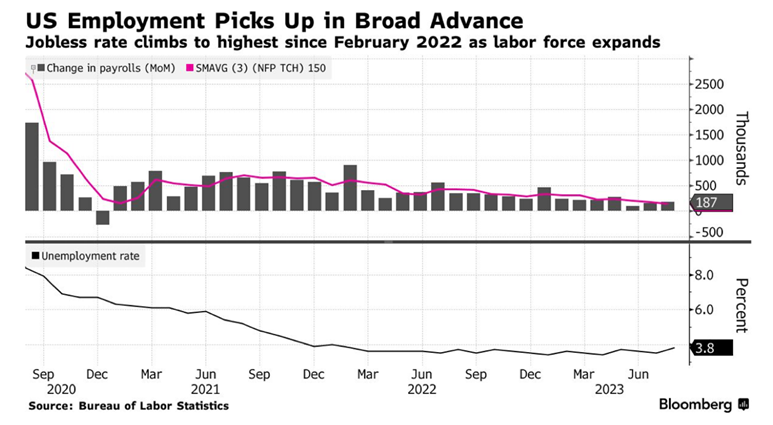

“Why America Has a Long-Term Labor Crisis, In 6 Charts – Participation hasn’t fully recovered from pandemic-era losses, though there have been signs of growth for prime-age workers—those between ages 25 and 54. The overall participation rate is expected to drop to 60.4% in 2032, according to the Labor Department, mainly because of baby boomer retirements. Wages reflect supply and demand. They shot up during the pandemic recovery and have recently outpaced inflation, which gives workers more spending power. Long-term labor shortages could lead to a faster pace of wage growth for the foreseeable future.”, The Wall Street Journal, September 25, 2023

Vietnam

“Boosting Vietnam’s manufacturing sector: From low cost to high productivity – In the past decade, manufacturing in Vietnam has been at the epicenter of the country’s high growth. This sector contributed more than 20 percent to the country’s GDP1 and has been an anchor in Vietnam’s trade balance, helping to attract foreign direct investment (FDI). It played a significant role in the remarkable resilience that Vietnam’s economy demonstrated in the face of global upheaval, which maintained a positive GDP growth rate of 2.6 percent in 2021, even amid the COVID-19 pandemic, and sustained an 8 percent growth rate in 2022.”, McKinsey & Co., September 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“After KFC store went cashless, what are the other fast food giants in Australia planning? A spokesperson from McDonald’s told 9News that the global burger brand had ‘no plans to go cashless at this stage’. Competing chicken brand Red Rooster said they had “no intention of going cashless in the near future,” despite the move by KFC. Domino’s told 9News that going cashless was ‘not currently something we are looking at doing’”. 9News, September 27, 2023

“Coffee Berry, a Greek coffee chain, debuts in Saudi Arabia – Greece’s renowned coffee chain, Coffee Berry, has made its inaugural entry into the Saudi Arabian market by unveiling its first store at the Hayat Mall in Riyadh. This significant move marks Coffee Berry’s fourth international venture, showcasing its growing global presence. In 2022, Coffee Berry, headquartered in Athens and boasting an impressive 210-store count, inked a franchise agreement that paved the way for its Saudi Arabian expansion. The company’s strategic vision includes the establishment of a network comprising a minimum of 20 outlets across the kingdom within the coming years.”, Franchise Talk, September 25, 2023

“Burritos on the bourse: Guzman y Gomez boss preparing to say hola to ASX – Burrito chain Guzman y Gomez could make its debut on the Australian stock exchange as early as next year, founder Steven Marks says, even as the hunt for his own replacement continues. Australia’s fastest-growing Mexican food franchise sold $759 million worth of burritos, tacos, bowls and more in the 2023 financial year, a 32 per cent rise from the year before. Underlying earnings jumped 56 per cent to $32 million.”, Brisbane Times, September 11, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“McDonald’s Is Raising (US) Royalty Fees on New Franchises for the First Time in 30 Years – The change, to 5% from 4%, applies in limited scenarios, McDonald’s said, including when an operator opens a new restaurant or purchases one the company owns. The move is aimed to help McDonald’s maintain its competitive edge, the company said, as many other franchise businesses have royalties that exceed 5%. Indeed, the royalty rate is currently at 5% across McDonald’s markets other than the U.S. and Canada, the company said in an internal memo reviewed by Barron’s.”, Barron’s, September 22, 2023

“A moment of dependable zen on a helter-skelter day’: Grace Dent on the joy of (UK) chain restaurants – They may never dazzle, but your favourite fast food chain never really burns its bridges. Come as you are, come dishevelled, hungover, heartbroken, alone or with a rabble. We’re not going on a culinary journey; rather, this is a culinary cul-de-sac where you’ve been doing a three-point turn for the past 20 years. In fact, I’m fairly sure that, at a moment’s notice, I could step in for the 2pm-10pm shift at Wagamama, say, because I’ve been eating its yaki udon since about 1995; my order rarely deviates and my love never dwindles.”, The Guardian, September 29, 2023

“Subway Is Forcing Franchisees To Accept Mobile App Discounts – According to Subway franchisees, all Subway locations will be required to accept all mobile app discounts as of December 28, 2023. In correspondence with Restaurant Business, franchise operators stated that Subway corporate announced the hard deadline to franchisees on September 26. Unfortunately, food costs and ongoing inflation have had more than a few franchisees opt out of accepting coupons that they couldn’t afford to honor.”, The Tasting Table, October 1, 2023

“Tim Hortons Launches New UK Franchise Model To Fuel Expansion Plans – Since launching its first UK location in 2017, Canadian coffee and donut chain Tim Hortons has become an increasingly familiar name across British towns and cities over recent years. The brand first opened its doors and started serving its signature coffees and baked goods to British customers from its first unit this side of the pond in Glasgow, and now has 75 locations in the UK, all of which are currently company-owned. With its eyes now firmly on rapid UK growth, Tim Hortons this week announced the launch of a franchise model following what it calls a five year ‘test and learn phase’”, Forbes, September 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

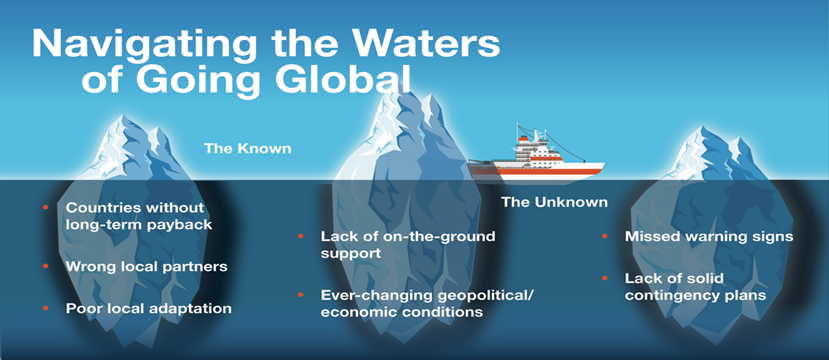

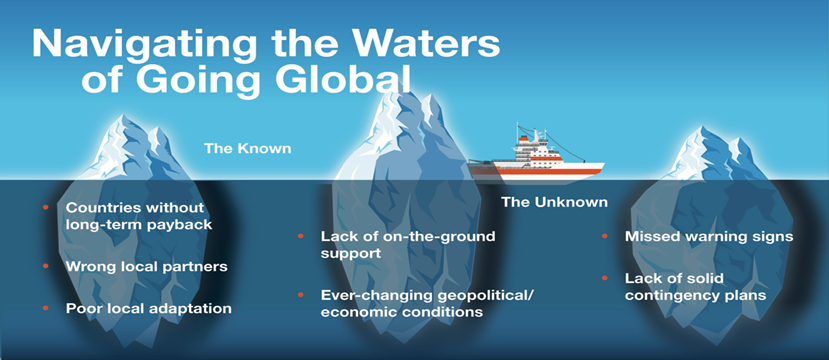

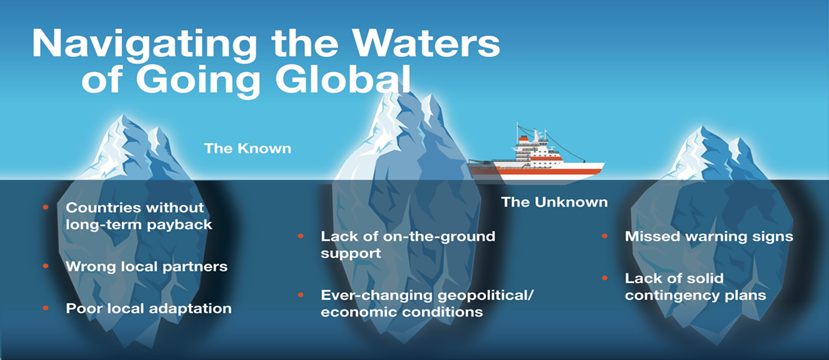

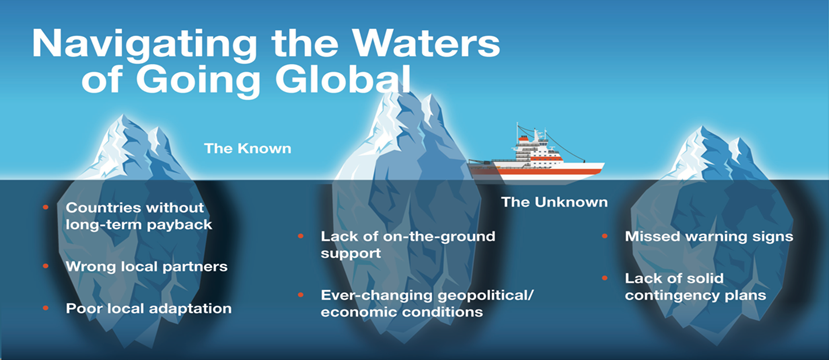

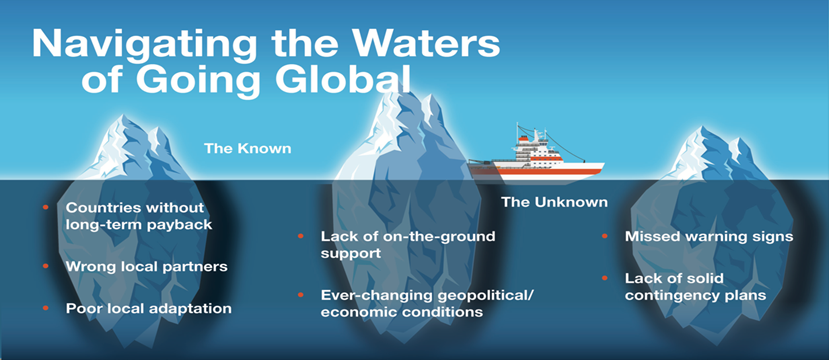

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 91, Tuesday, September 19, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

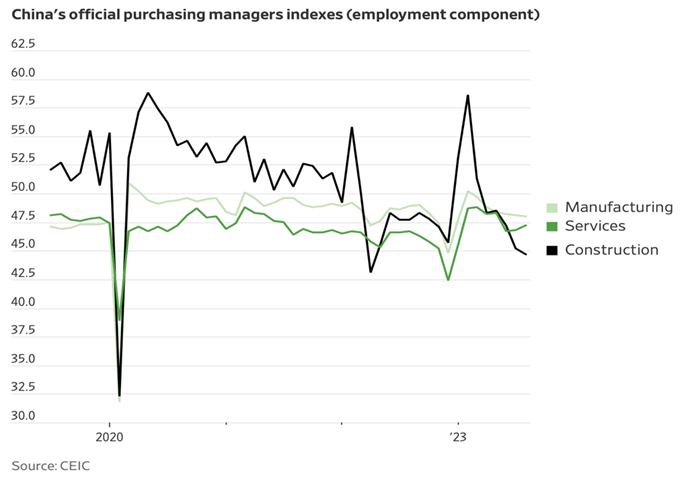

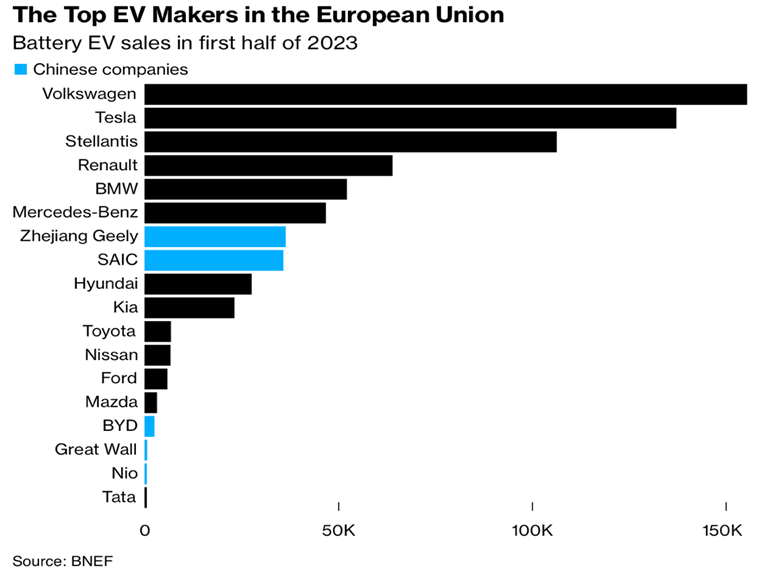

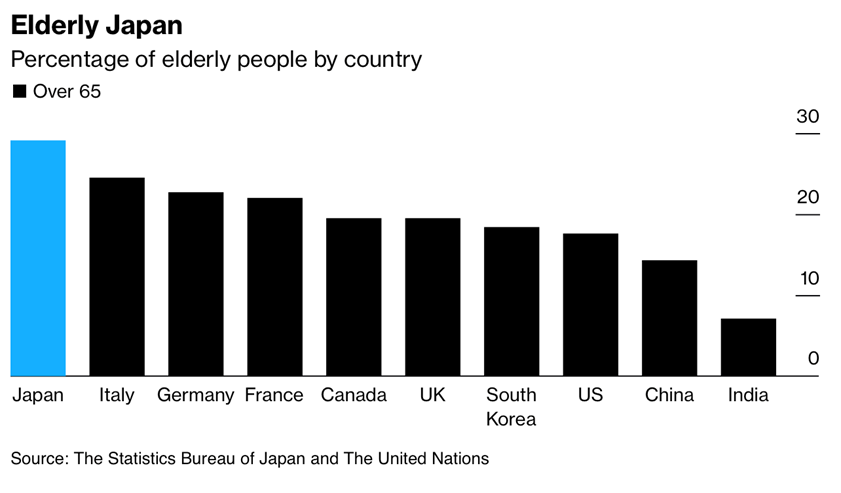

Introduction: In this issue, problems brewing for Europe’s coffee supply, China seems to be turning a corner if the data is real, the French government is selling fuel at a loss (?), rice supply is having a bad year, Germany’s EVs are having trouble competing, the Middle East is an ATM, Japan is old, the UK is inactive, Mexico’s airlines appear safe again and the USA continues to have lots of job openings.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Opportunities don’t happen. You create them.” – Chris Grosser

“The best way to predict the future is to create it.” – Peter Drucker

“In the middle of every difficulty lies opportunity.” – Albert Einstein

Highlights in issue #91:

- Brand Global News Section: Chick-fil-A®, Church’s Chicken®, Paradies Lagardère and Twisted by Wetzel’s®,

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

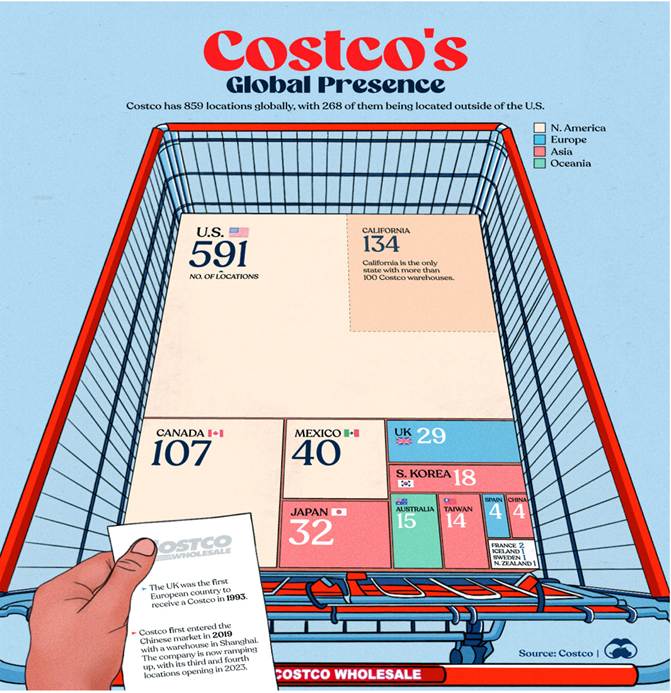

“Visualizing Costco’s Global Presence – Costco is a membership-based retail chain founded in 1983 in Seattle, Washington. Best known for its unique warehouse stores and high-quality products, Costco offers everything from electronics to groceries. Since its founding, Costco has become a major retailer in the U.S., while also greatly expanding its international presence. As of August 2023, the company has 859 locations globally, with a split of 69% domestic (591 stores) and 31% international (268 stores).”, Visual Capitalist, September 8, 2023

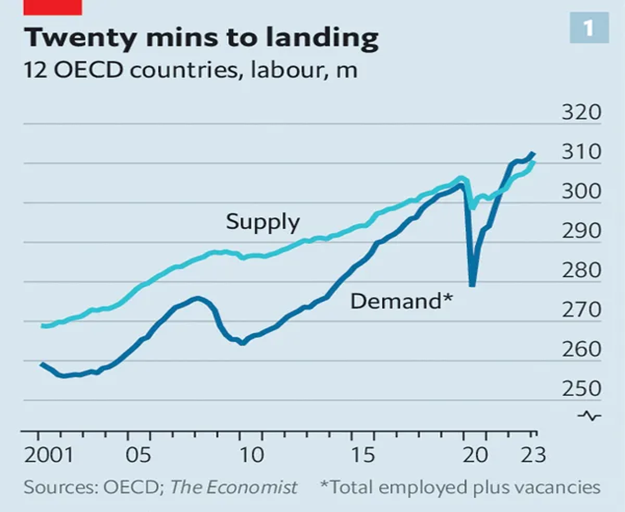

“Why aren’t more people being sacked? – How inflation has fallen without mass job casualties. If central bankers are to defeat inflation, they must cool the labour market. For two years rich-world wage growth has added to corporate costs, sending prices relentlessly upwards. But as they began raising interest rates to slow the economy, policymakers hoped for an even rosier outcome. They wanted to achieve a “soft landing”, which involves both bringing down inflation, and doing so without mass job losses. It is a lot to ask of a tool as blunt as monetary policy. Are they succeeding? And so far the evidence suggests that—against widespread expectations—labour markets from San Francisco to Sydney are co-operating.”, The Economist, September 17, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Peak Oil Demand ‘Wilting Under Scrutiny,’ Aramco CEO Says – Nasser sees 2030 crude usage of 110 million barrels per day – CEO’s pared-back forecast still outstrips IEA projections. Last week, OPEC projected global oil markets would face a supply shortfall of more than 3 million barrels a day next quarter — potentially the biggest deficit in more than a decade. The IEA’s (International Energy Agency) prediction that oil consumption will peak this decade and grow at a slower rate in the near term as the energy transition gathers pace has been proven to be unrealistic, Nasser said Monday.”, Bloomberg, September 18, 2023

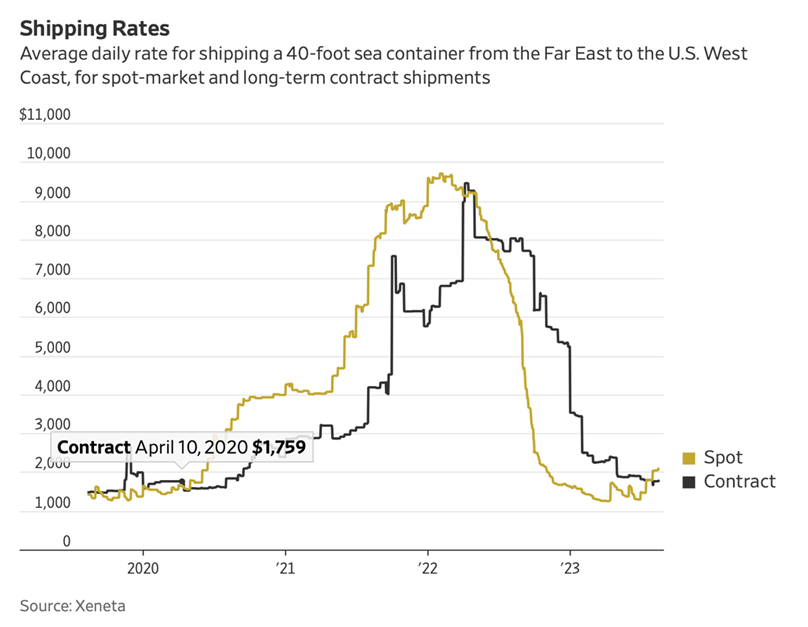

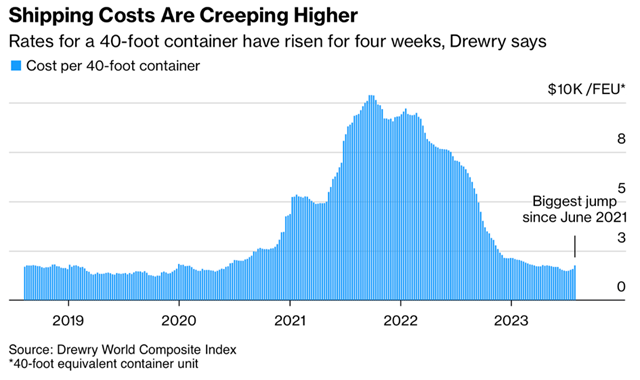

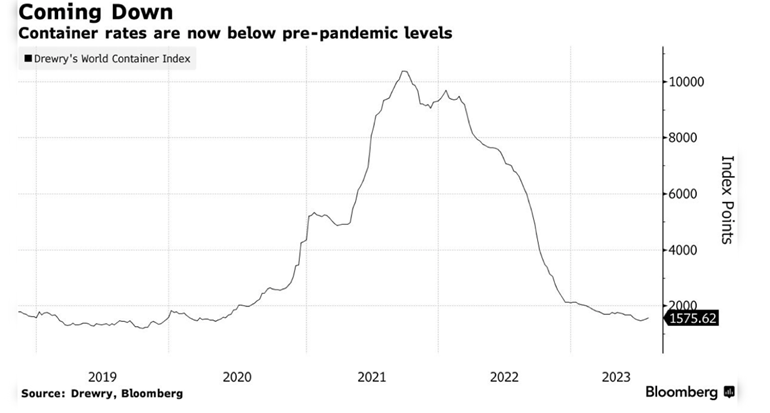

“Shipping giant Maersk is seeing tentative signs of a bounce back in global trade – Consumers in the U.S. and Europe have been key drivers in the demand uptick, Vincent Clerc (CEO of shipping titan Maersk) told CNBC’s Silvia Amaro, and those markets have continued to ‘surprise on the upside.’ The upcoming pickup would be fueled by consumption, he said, rather than the “inventory correction” which has featured heavily in 2023. ‘Barring any negative surprises, we would hope for a slow pickup as we get into 2024, a pickup that will not be a boom like what we have known in the past few years, but certainly … a demand that is a bit more in line with with what we see in terms of consumption, and not so much an inventory correction.’”, CNBC, September 15, 2023

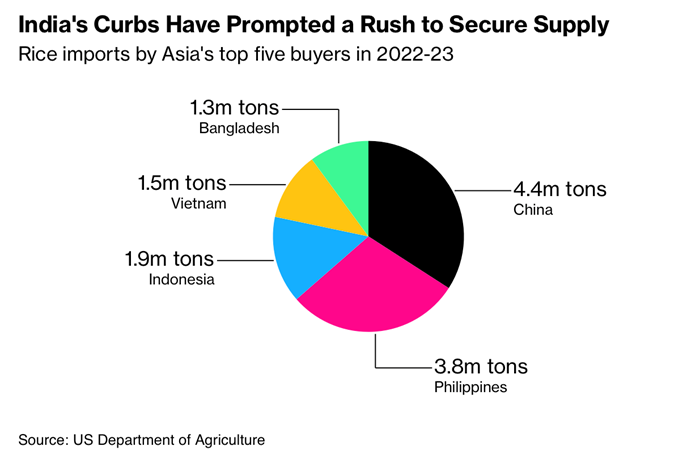

“Rice Crisis in the Philippines Sounds a Global Inflation Alarm – Indonesia agrees on first deal with Cambodia in over a decade Malaysia implements purchase limit, starts enforcement checks. Rice inflation in the Southeast Asian nation increased at the fastest pace in almost five years in August, reviving memories of a 2018 shock that led to the end of a two-decade-old limit on imports. India’s restrictions have upended the market and prompted worried nations to secure supply as they try and contain the rising cost of rice, which is a vital part of the diets of billions of people across Asia and Africa.”, Bloomberg, September 8, 2023

“What ‘Friend-Shoring’ Means for the Future of Trade – Over the past few years, the world has experienced an escalating series of trade disruptions: the US-China trade war, the Covid-19 pandemic and its supply chain disruptions, Russia’s invasion of Ukraine and the sanctions and export controls that followed. Their cumulative impact has called into question the vision of a globalized economy. In response, some US officials pushed “friend-shoring” — a happy-sounding name for a policy that would lead to a world divided between free-market democracies and countries that align with the authoritarian regimes of China or Russia. It’s a world in which supply chains could be more robust and less subject to economic blackmail. It’s also likely a world that’s poorer and less productive.

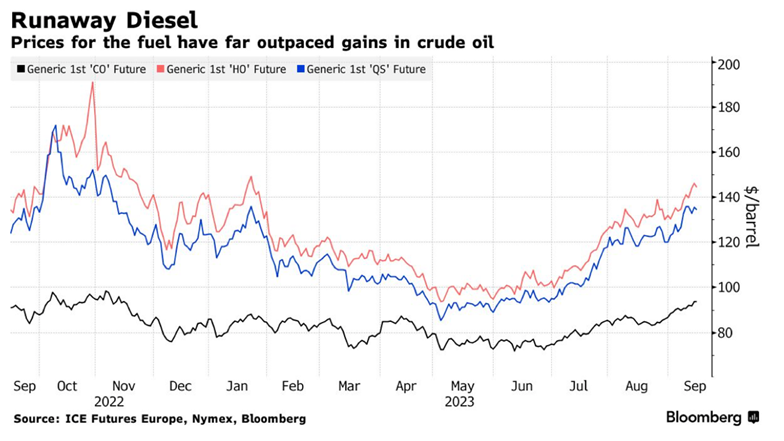

“The World Is Struggling to Make Enough Diesel – Crude production cuts have been detrimental to diesel supply – Refineries have sought to satisfy demand surge for other fuels. While oil futures are rocketing — on Friday they were just below $95 a barrel in London — the rally pales in comparison with the surge in diesel. US prices jumped above $140 to the highest ever for this time of year on Thursday. Europe’s equivalent soared 60% since summer.”, Bloomberg, September 17, 2023

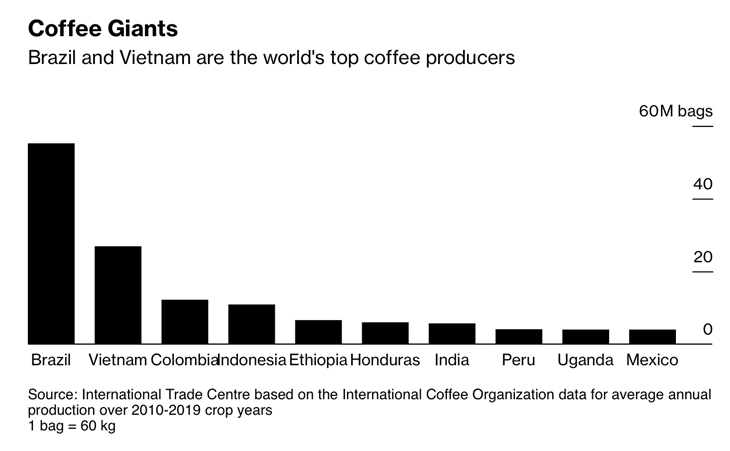

“Coffee Storm Is Brewing: Proving a Latte’s Sustainable Journey From Farms – How do you trace a journey of beans from millions of farms around the world all the way to cappuccinos and lattes sipped in cafes from Vienna to Rome? That’s the conundrum the coffee industry faces as it scrambles to get ready for Europe’s ground-breaking sustainability rules. Coffee is grown in about 70 countries, with five of them — including Brazil and Vietnam — making up about 85% of the world’s output. The rest comes from some 9.6 million growers in smaller producers, who often lack the resources to meet sustainability standards, according to Ethos.”, Bloomberg, September 15, 2023

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, September 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“US raises Mexico air safety rating in boost for country’s airlines – US raises Mexico air safety rating in boost for country’s airlines. The Federal Aviation Administration (FAA) said on Thursday it has upgraded Mexico’s air safety rating, a move that will allow Mexican carriers to expand U.S. routes and add new service. Mexico was downgraded by the U.S. regulator in May 2021 after the agency found the country did not meet safety standards. The downgrade was a major blow to Mexico carriers, as U.S. airlines were able to scoop up market share.”, Reuters, September 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

“China May Dodge Deflation, After All – But it will probably be a near miss, and economic data still hints at a bottom rather than a strong rebound. After a grim June and July, China’s main August economic data, released Friday, contained clear hints of improvement. The news from the critical housing sector, which is mired in a protracted slump, was less encouraging: Price falls accelerated in lower-tier cities. But growth in retail sales accelerated to 4.6% from a year earlier, from just 2.5% in July. Unemployment ticked down marginally.”, The Wall Street Journal, September 15, 2023

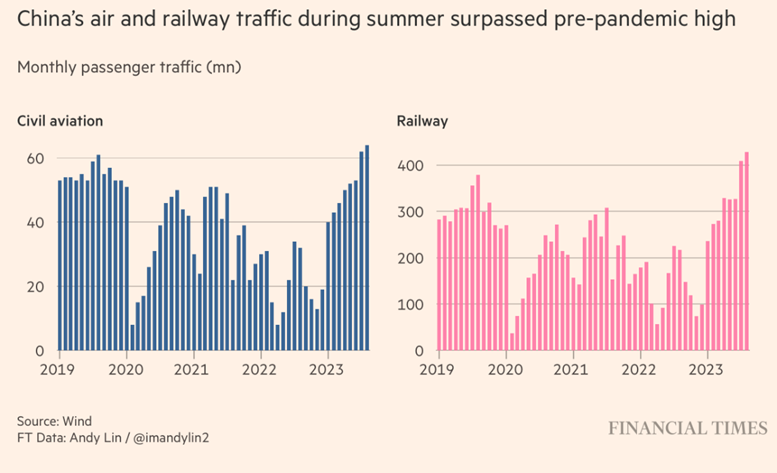

“China expects ‘golden week’ holiday journeys to beat pre-pandemic figures – China Railway said it had recorded a record single day’s sales, with 22.9 million tickets being bought in one day. Airline tickets are also selling well as the National Day holiday coincides with Mid-Autumn Festival. That is roughly double the 72 million trips made during the same holiday last year and well above the 138 million trips made in 2019 before the Covid pandemic.”, South China Morning Post, September 17, 2023

“Beijing “Has Plenty Of Dry Powder” – Can Manage Economic Stresses: U.S-China Business Forum. China’s economy is facing two sources of stress at the same time – cyclical and structural, yet the government ‘has plenty of dry powder’ and is ‘able to manage this situation,’ U.S.-China Business Council President Craig Allen said in a recent interview in New York. Authorities recognize ‘the problems that they face and are working on those problems in an incremental manner — (through) incremental stimulus and incremental reform,’ Allen said. ‘But it’s slow and steady and not as dramatic as many people would like to see.’”, Forbes, September 13, 2023

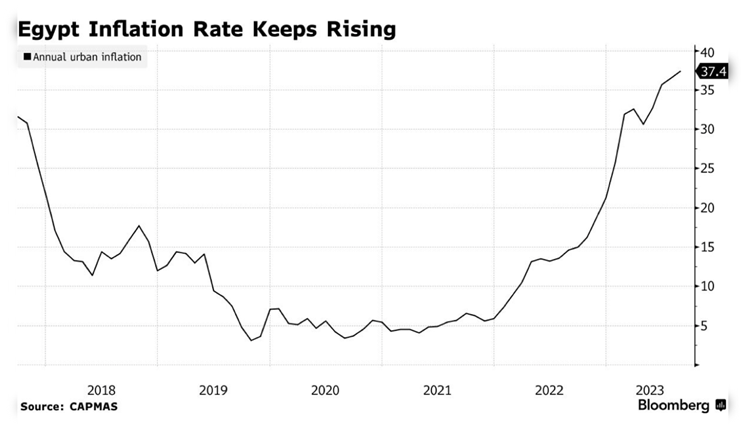

Egypt

“Egypt Inflation Soars as Higher Food Costs Add to Currency Angst – Egyptian inflation soared to a fresh record, with consumer costs now increasingly at the mercy of whether authorities will allow the pound to weaken again. Price growth in urban parts of the country accelerated to an annual 37.4% in August from 36.5% the previous month, according to figures released Sunday by the state-run CAPMAS statistics agency. On a monthly basis, inflation was 1.6%, compared with 1.9% in July. A 71.4% increase in the cost of food and beverages, the largest single component of the inflation basket, was a major contributor to last month’s price pickup.”, Bloomberg, September 9, 2023

France

“France to Allow Selling Fuel at Loss to Curb Inflation – Prime Minister Borne announces plan in Le Parisien Newspaper. The French government plans to allow gas stations to sell fuel at a loss, overriding a law from 1963, as it struggles to find new ways of containing inflation without adding to vast sums of public money already spent. Such a move would in theory allow greater competition between distributors, who could cut prices below costs and aim to make up lost margin with sales of other products and services.”, Bloomberg, September 17, 2023

“France’s Carrefour puts up ‘shrinkflation’ warning signs – French supermarket Carrefour has put stickers on its shelves this week warning shoppers of “shrinkflation” – where packet contents are getting smaller while prices are not. Lipton Iced Tea, Lindt chocolate and Viennetta ice cream are among the products being named and shamed. Shoppers are being told if bottles are smaller or pack contents lighter. Carrefour has identified 26 products that have shrunk, without a price reduction to match, made by food giants including Nestle, PepsiCo and Unilever.”, BBC News, September 14, 2023

Germany

“VW Lays Off Workers at Key EV Factory Over Cratering Demand – Volkswagen is having a tough time selling enough mostly made-in-Germany electric cars to challenge Tesla Inc.’s global dominance. Lackluster economic growth as well as higher energy, living and borrowing costs in Europe have weighed on demand for its ID fleet of EVs.”, Bloomberg, September 14, 2023

India

“Apple to Sell Made-in-India iPhones on Launch Day for First Time – Devices from India to debut at same time as China-made ones IPhone 15 marks a milestone for India’s electronics ambitions. It would also underscore India’s growing production prowess and reflect a significant departure from Apple’s previous strategy of selling mostly Chinese-made new devices to frenzied customers across the world.”, Bloomberg, September 12, 2023

Japan

“One in 10 Japanese Now Aged Over 80, Population Report Shows – Japan’s persistently low birthrate and long lifespans have made it the oldest country in the world in terms of the proportion of people aged over 65, which this year hit a record of 29.1%. Ballooning social security spending has added to Japan’s massive debt and the shortage of young people has left many industries short of labor — not least carers for the elderly.”, Bloomberg, September 17, 2023

The Middle East

“The Middle East Becomes the World’s ATM – Flush with cash from an energy boom, Saudi Arabia and other Gulf monarchies have a moment on the world’s financial stage. Middle East monarchies eager for global influence are having a moment on the world’s financial stage. They are flush with cash from an energy boom at the very time traditional Western financiers—hampered by rising interest rates—have retreated from deal making and private investing. The region’s sovereign-wealth funds have become the en vogue ATM for private equity, venture capital and real-estate funds struggling to raise money elsewhere.”, The Wall Street Journal, September 7, 2023

Saudi Arabia

“Why Saudi Arabia is the Future Frontier for Global Entrepreneurs – The Saudi horizon is vast, and it’s gleaming with golden opportunities for the discerning entrepreneur. Saudi Arabia’s Vision 2030 is a clarion call for diversification. The nation is proactively steering away from its oil-dependent past, investing heavily in entertainment, tourism, technology and sports sectors. For budding entrepreneurs, this evolution translates into a broader spectrum of business avenues, a more varied market and an ever-evolving consumer base. Recent years have witnessed a startup explosion, with young Saudis taking the entrepreneurial plunge, driven by passion and the promise of a supportive ecosystem. But perhaps the most heartening aspect of this entrepreneurial surge is the rise of female founders and business leaders.”, Entrepreneur, September 7, 2023

Sweden

“Sweden is the No. 1 country for affordability, safety and overall quality of life – To rank the 87 countries listed, U.S. News and World Report, WPP and the Wharton School of the University of Pennsylvania surveyed more than 17,000 people worldwide. According to Numbeo, the cost of living in Sweden is, on average, 20.9% lower than in the United States, while renting is 57.5% lower. Sweden’s people boast one of the longest life expectancies, with an average age of 82.8 years, according to the CIA World Factbook.”, CNBC, September 17, 2023

United Kingdom

“Remote working to require ‘total rewiring of UK – The shift means people drove 19 billion fewer miles last year as the pandemic continued to redraw how Britons live. Last year cars travelled a total of 244 billion miles, according to the Department for Transport. While this is higher than the pandemic years of 2020 and 2021, it remains 7 per cent lower than the 263 billion miles driven in 2019. It is the lowest non-pandemic year for almost a decade. Data also shows a shift from traffic peaks before 9am on weekdays, to later in the day and at weekends. Bloom said the changes brought in by the pandemic had now been “baked in”, and companies that tried to force a return to the office full-time would struggle to recruit and retain workers.”, The Times of London, September 13, 2023

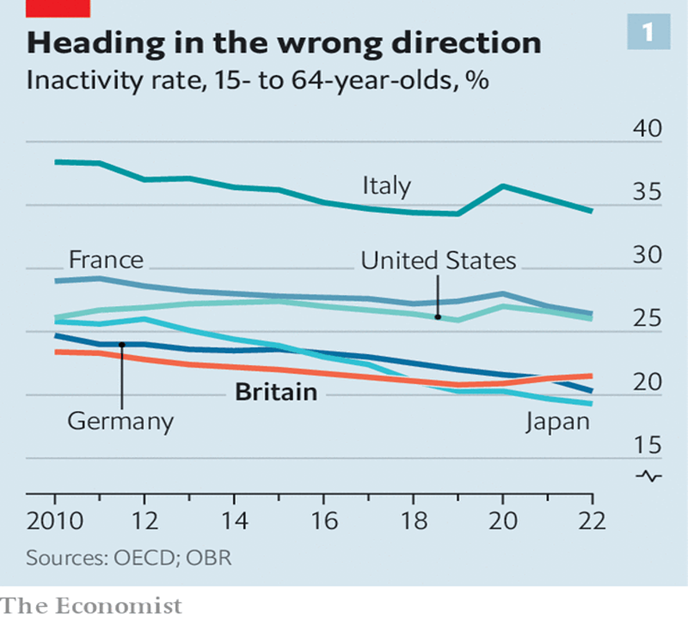

“Why Britain has a unique problem with economic inactivity – A series of policy blunders is to blame. In contrast to most other rich countries, benefits for those of working age were rather stingy. Meanwhile, rates of labour-force participation were admirably high. The inactivity rate—the proportion of working-age people not working or actively seeking a job—was among the lowest internationally and on a downward path from the mid-1990s until 2019.’, The Economist, September 14, 2023

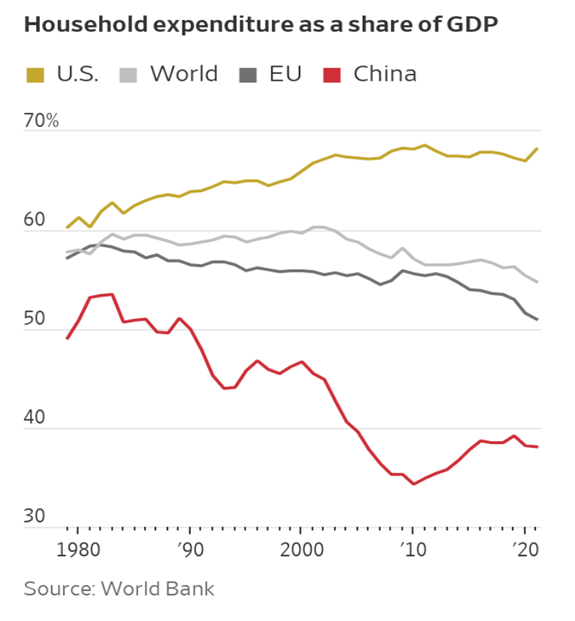

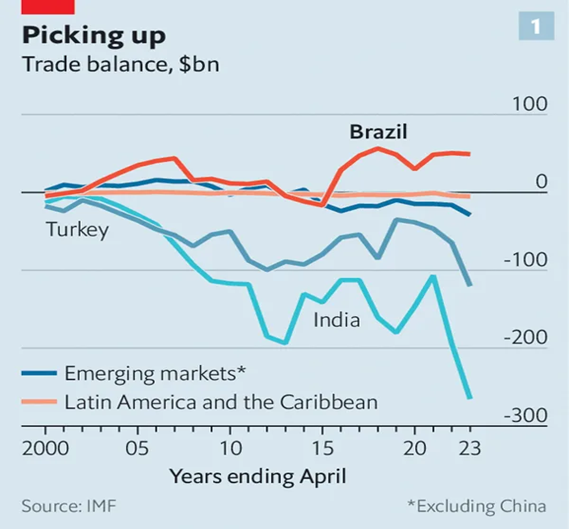

United States

“The U.S. economy is chugging along while the rest of the world falls behind – Driving the division among the world’s most powerful economies: a slowdown in trade that is hurting some much more than others. At the losing end are “extroverted” economies that have traditionally recorded trade surpluses and are now seeing their growth lag behind those of the U.S. and India, for instance, vast markets that have historically relied more on domestic demand for growth relative to their peers. “Global trade will be less global” in the future, with exchanges occurring more within regional blocs, said Holger Schmieding, chief economist at Berenberg Bank. It will also shift away from goods and toward services, he added, providing a boost to economies like the U.S. and India that specialize in IT and other services at the expense of manufacturing powerhouses like Germany and China.”, The Wall Street Journal, September 9, 2023

“Leisure and Hospitality Job Openings Remain Disproportionately High – Job openings for the leisure and hospitality segment of the U.S. economy remain disproportionately high compared to other industries, which could slow the travel industry’s growth as the country considers its future following its post-pandemic recovery period. While employment in this country is at its lowest level since March 2021, the U.S. Bureau of Labor Statistics finds that employment in leisure and hospitality is 1.7 percent lower now than it was in February of 2020, before the pandemic. That’s a lack of 290,000 people, but the disparity deepens when you consider the number of hotels and resorts in the U.S. continues to grow at a fast pace.”, Travel Pulse, September 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“6 Shifting Consumer Trends Affecting Quick-Service Restaurants – According to industry data, food spending is expected to rebound through 2024 and into 2025. Consumers’ preferences are shifting like never before, due to a variety of societal and economic dynamics. How can quick-service restaurants adjust to maintain—and potentially increase—foot traffic during these transformative times? The good news is that consumers aren’t trading out of foodservice; however, many are trading down within the segment. According to industry data, food spending is expected to rebound through 2024 and into 2025 as the country moves into a recovery phase following a mild recession.”, QSR Magazine, September 15, 2023

“Chick-fil-A to re-enter UK market – Chick-fil-A, the American fast-food brand, is renewing its attempt to enter the UK market, four years after its debut pop-up closed amid a row over its ties to anti-gay beliefs. The first restaurants will open in early 2025, the first permanent outlets outside North America. The 55-year-old family-owned business runs more than 2,800 restaurants across the US, Canada and Puerto Rico. It is aiming to open five restaurants in the UK in the first two years of launch, creating between 80 and 120 jobs per branch.”, The Times of London, September 15, 2023

“Paradies Lagardère Swoops On Airport Dining Specialist Tastes On The Fly – The French parent company of North American travel retailer Paradies Lagardère has signed an agreement to acquire airport restaurateur Tastes on the Fly. Tastes on the Fly operates about 25 concepts across five major airports, including San Francisco, Denver, New York’s JFK, Boston, and Vancouver in Canada. Added to Paradies’ existing portfolio, Tastes on the Fly’s addition takes the number of F&B brands to more than 100, ranging from full-service to fast-casual and quick-serve.”, Forbes, September 7, 2023

“Southlake man couldn’t get job at Church’s Chicken years ago. Now he owns 140 locations – Aslam Khan’s life story is often described as rags to riches. Which he finds ironic because he was actually wearing a suit and tie when he was turned away from his first job interview with Church’s Chicken nearly four decades ago. He thinks it might have been because he was overdressed. It was for a fast-food restaurant, after all, he said. Now, at 69, he is the largest franchisee in the organization of the fast-food restaurant with his company, Falcon Holdings, operating over 140 stores.”, Star Telegram, September 14, 2023

“How Twisted by Wetzel’s is planning to disrupt the snack category – The streetside restaurant concept is bigger than a traditional Wetzel’s and features a broader, more creative menu. In the spring, Wetzel’s Pretzels opened a new concept called Twisted by Wetzel’s that is quite different from anything the company has done in its nearly-30-year history. The company describes Twisted as a ‘street concept that takes Wetzel’s fun-loving brand and timeless menu and elevates it to a whole new level.’”, Nation’s Restaurant News, September 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 90, Tuesday, September 5, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, The BRICs countries ‘proposed’ expansion, a history of franchising, the state of AI in 2023, no more plastic water bottles at LAX. Updates the economy in Brasil, Indonesia, the Philippines, Turkey, the United Kingdom, and the USA. Krispy Kreme® and Popeyes® celebrate news. Popeyes tries to justify the almost US$10 billion sale price. And China’s grain problem. Finland issues digital passports.

This is one of the longest issues so far. Perhaps partly due to my having excellent Internet access on my 13-and-a-half-hour flight back from Sydney, Australia this past weekend. I spent almost a week in both Australia and New Zealand on business on this trip. In New Zealand I gave a keynote talk on the state of global franchising covering 20 countries. In Australia, I found the new investment climate strong.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“If knowledge is power, knowing what we don’t know is wisdom.” – Adam Grant

“However difficult life may seem, there is always something you can do and succeed at.” – Stephen Hawking

“People begin to become successful the minute they decide to be.” – Harvey MacKay

Highlights in issue #90:

- Brand Global News Section: Body Fit Training (BFT), Krispy Kreme®, Pizza Hut®, Popeyes® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

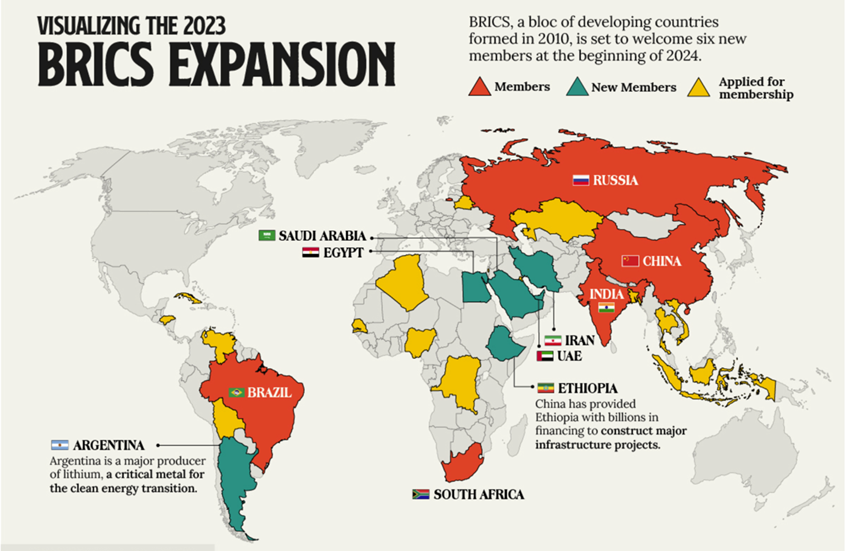

“Visualizing the BRICS Expansion – BRICS is an association of five major countries including Brazil, Russia, India, China, and South Africa. Distinguished by their emerging economies, the group has sought to improve diplomatic coordination, reform global financial institutions, and ultimately serve as a counterbalance to Western hegemony. On Aug. 24, 2023, BRICS announced that it would formally accept six new members at the start of 2024: Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates (UAE).”, Visual Capitalist, August 24, 2023

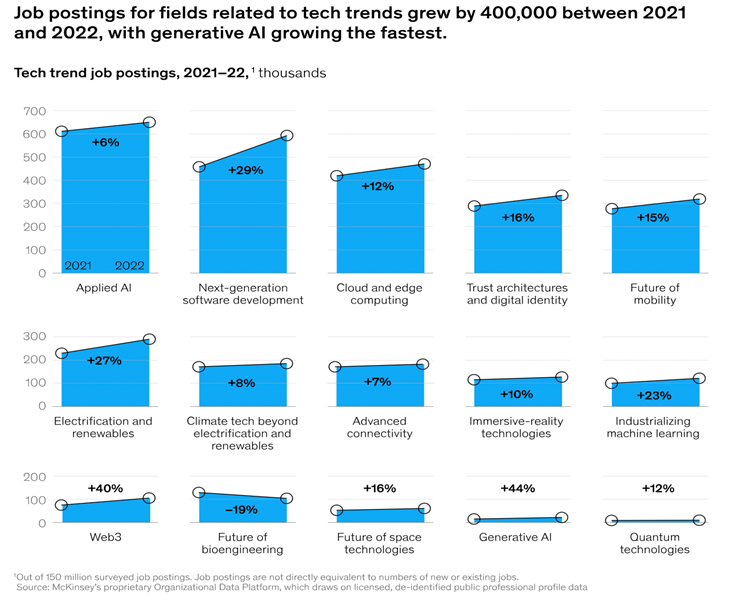

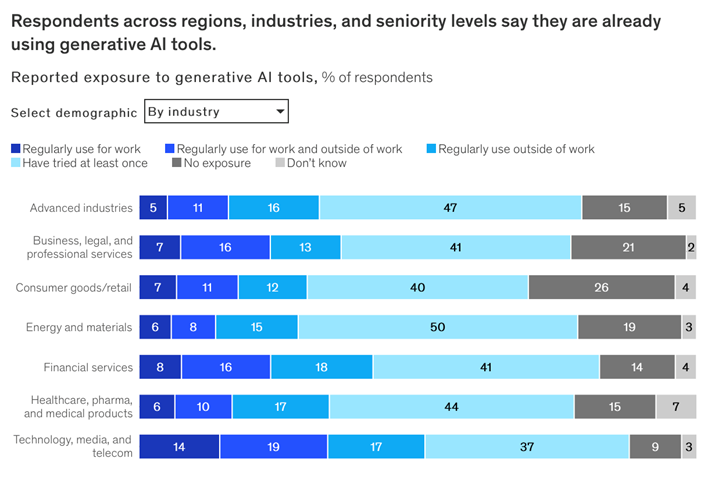

“McKinsey Technology Trends Outlook 2023 – Which technology trends matter most for companies in 2023? New analysis by the McKinsey Technology Council highlights the development, possible uses, and industry effects of advanced technologies. After a tumultuous 2022 for technology investment and talent, the first half of 2023 has seen a resurgence of enthusiasm about technology’s potential to catalyze progress in business and society. Generative AI deserves much of the credit for ushering in this revival, but it stands as just one of many advances on the horizon that could drive sustainable, inclusive growth and solve complex global challenges. To help executives track the latest developments, the McKinsey Technology Council has once again identified and interpreted the most significant technology trends unfolding today.”, McKinsey & Co., July 20, 2023

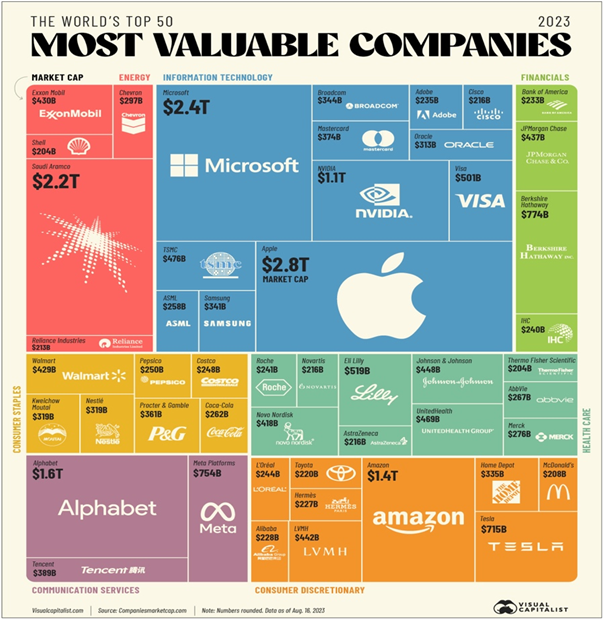

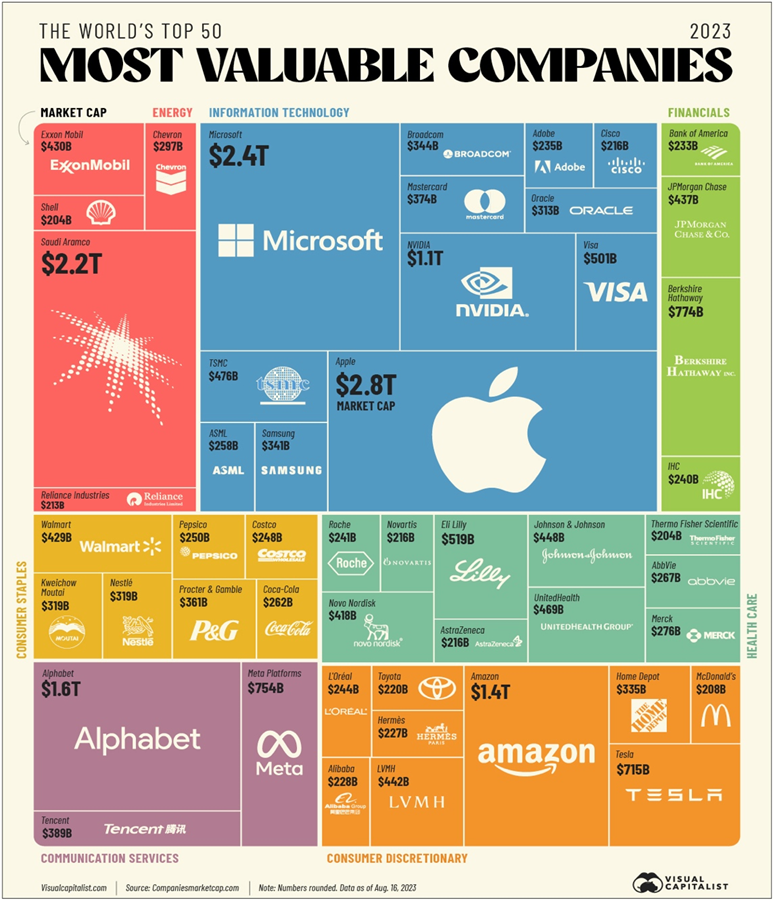

“The 50 Most Valuable Companies in the World – Market capitalization, or market cap, is one measure of a company’s value as determined by the stock market. It is easily calculated by multiplying the company’s outstanding shares by its current share price…..as of Aug. 16, 2023. From this data, we can see that there are only a handful of trillion dollar companies in the world, including Apple, Microsoft, Saudi Aramco, Amazon, Alphabet, and Nvidia. Altogether, the 50 most valuable companies represent over $26.5 trillion in shareholder value. Visual Capitalist, August 20, 2023

“The state of AI in 2023: Generative AI’s breakout year – As organizations rapidly deploy generative AI tools, survey respondents expect significant effects on their industries and workforces. Less than a year after many of these tools debuted, one-third of our survey respondents say their organizations are using gen AI regularly in at least one business function. Amid recent advances, AI has risen from a topic relegated to tech employees to a focus of company leaders: nearly one-quarter of surveyed C-suite executives say they are personally using gen AI tools for work, and more than one-quarter of respondents from companies using AI say gen AI is already on their boards’ agendas.”, McKinsey & Co., August 1, 2023

“Friday is just a dead day’: how a summer perk became a year-round staple. More white-collar employees are clearing the decks at the end of the week after pandemic upended in-office work. Corporate America’s working rhythms have been evolving since the start of the pandemic. In late 2020, as employers started pushing for a return to the office, some insisted on workers showing up in-person on Fridays to avoid a slide into effective three-day weekends, said Nick Bloom, a Stanford economics professor who studies workplace data. But as a labour shortage shifted the balance of power towards workers, some employees have been able to negotiate working from home on Fridays in particular, and increasingly giving themselves more flexible working hours on that day.”, The Financial Times, August 31, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

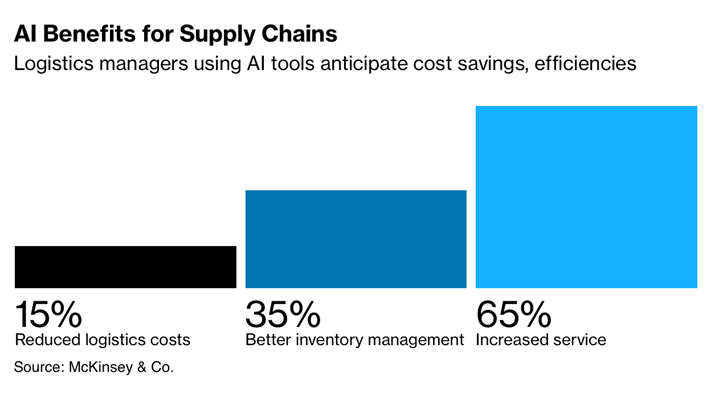

“AI Fused With Trade Data May Finally Smooth Clunky Supply Chains – AI models may help make trade more transparent, predictable. The dawn of artificial intelligence tools like ChatGPT may revolutionize the way both the public and private sector use data to ferret out risks and opportunities in the $32 trillion global trading system…..AI tools are helping many organizations simplify trade-data analysis in ways that may help smooth cross-border commerce — a notoriously labor-, spreadsheet- and carbon-intensive engine of the world economy.”, Bloomberg, September 2, 2023

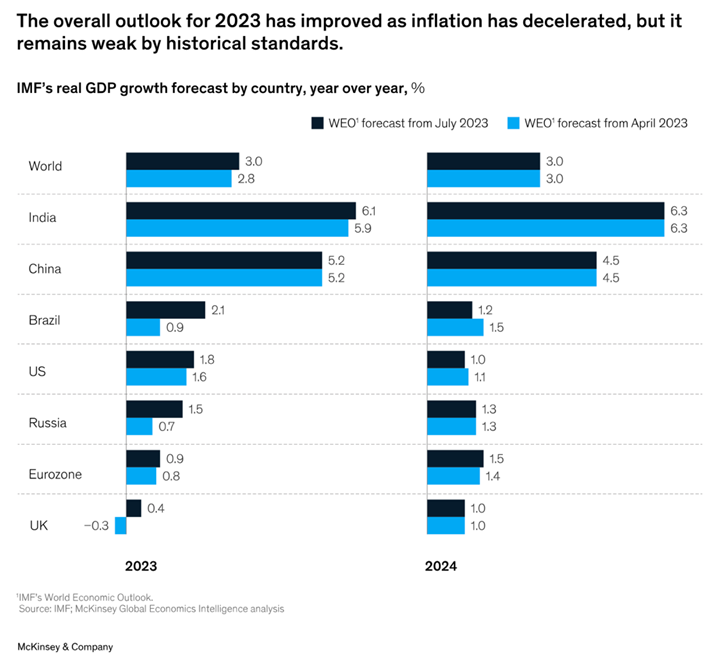

“Global Economics Intelligence executive summary – Mixed economic picture with patchy positives; consumers cautious but confidence rising; inflation in developed economies decelerates, while producer prices decline; trade volumes down. July’s World Economic Outlook Update from the IMF projects global growth to fall from an estimated 3.5% in 2022 to 3.0% in both 2023 and 2024. Meanwhile, the IMF expects global headline inflation to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2% in 2024. It anticipates that underlying (core) inflation will decline more gradually, with forecasts for inflation in 2024 revised upward.”, McKinsey & Co., August 21, 2023

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back. Investors’ expectations of where inflation will be five years from now have declined from their recent peaks.”, The Financial Times, August 31, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Tourists’ slow return to China post-Covid causing headaches for travel industry – China recorded a 70 per cent drop in international travellers in the first half of this year compared with pre-Covid levels. Lasting damage of the pandemic as well as China’s negative image amid geopolitical tensions have been blamed for the poor recovery. Analysts and industry figures attributed the poor figures to the lasting damage from the pandemic as well as China’s negative global image and loss of business confidence amid geopolitical tensions.”, South China Morning Post, September 3, 2023

“Los Angeles Airport Has Now Banned This Common Item – You’re going to have to figure out a new way to hydrate at LAX – In security queues at airports, there are signs asking passengers to get rid of their water bottles. Los Angeles World Airports (LAWA) has banned single-use plastic bottles at the Los Angeles International Airport and the non-commercial Van Nuys Airport. All restaurants, vendors, lounges, and vending machines are required to eliminate plastic bottles, but they will still be available on flights.”, Fodor’s, September 2, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“School’s in: Sam Kerr to launch her own Australian academy for future Matildas and Socceroos – Just days after the Matildas finished their Cup campaign, Kerr will unveil her own academy for the next batch of players – complete with her signature backflip celebration as part of its branding. The program will be fronted by Australia’s record goalscorer and include opportunities for business people to buy a Sam Kerr Football franchise, as well as allowing coaches to lend their expertise. Having spoken about wanting to leave a legacy after the Matildas finished fourth in a home World Cup – the highest finish for an Australian men’s or women’s team – Kerr has opted to set up her own development pathway.”, The Sydney Morning Herald, August 23, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Brazil

“An economic evaluation for Lula – Brazil welcomed higher-than-expected growth figures on Friday. The economy expanded 0.9% in the second quarter, more than forecast, thanks to a bullish domestic market. The news follows a 1.9% rise in the first quarter, driven by a bumper harvest. That is good news for Luiz Inácio Lula da Silva, Brazil’s president. Lula took office in January amid fears of a spending spree like the one that characterised his party’s last stint in government (which ended in a recession in 2016). Instead, the economy looks rosier than before. The inflation rate, which hit 12% in 2022, is at 3.99%. Unemployment, at 7.9%, is at its lowest level since 2014. But analysts remain sceptical about the longer term. Predictions for GDP growth for 2024 and 2025 remain stuck below 2%.”, The Economist, September 1, 2023

China

“Why is China’s economy slowing down and could it get worse? China’s economic growth is slowing down as policymakers try to fix a property market downturn, with troubles at major developer Country Garden in focus. Concerns are mounting over whether the world’s second-largest economy is coming closer to a crunch point. Unlike consumers in the West, Chinese people were left largely to fend for themselves during the COVID-19 pandemic and the revenge spending spree that some economists expected after China re-opened never took place. Moreover, demand for Chinese exports has been softening as key trading partners have been grappling with rising living costs. And with 70% of Chinese household wealth tied up in real estate, a big slowdown in the sector is trickling through to other parts of the economy.”, Reuters, August 31, 2023

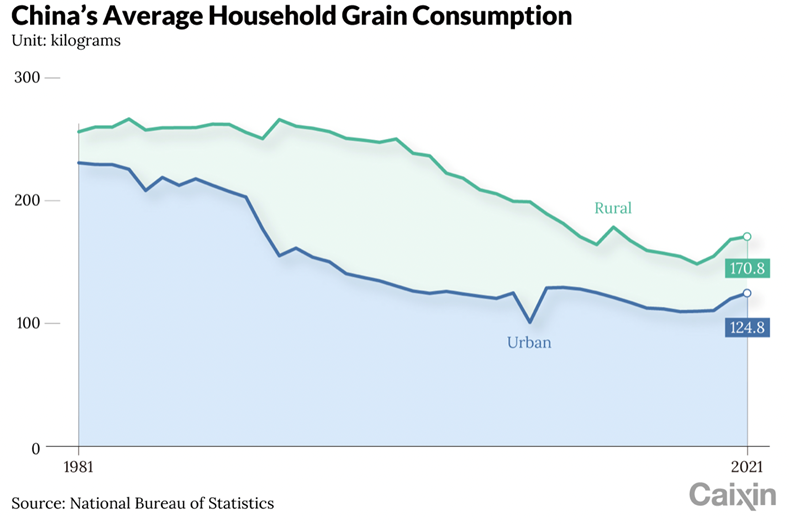

“China’s Richer Diet Is Straining the Agricultural Industry – For years China had more than enough wheat and rice to feed its 1.4 billion people. But since the nation grew richer and diets shifted to more meat and dairy, the world’s second-most populous country is running out of enough arable land to keep up with the demand for high-protein food. As household incomes increase, average Chinese meat consumption is expected to rise 38% from the current 55 kilograms per year to 76 kilograms in 2035. As production of animal products such as meat, eggs and milk requires a large amount of grain as feed, the rising consumption of such foods means that China will have to produce more grain for animal feed — or expand imports.”, Caixin Global, August 30, 2023

Finland

“This Country Just Became the First to Introduce Digital Passports – Could physical passports soon be replaced by an app? This pilot program aims to find out. Finland is changing the way it handles border security—specifically by doing away with physical passports. During the trial period, which runs until February 2024, the digital passport will only work on Finnair flights between Finland’s Helsinki Airport and three U.K. airports: Edinburgh, London, and Manchester.”, AFAR, September 1, 2023

Indonesia

“Indonesia Introduces Golden Visa to Draw Foreign Investors – Five year visa requires investment of at least $350,000. Government is targeting quality investors. Indonesia will issue so-called golden visas allowing foreigners who make substantial investments to remain for between five and 10 years, in an effort to boost the country’s economic development. Last year, the Southeast Asian nation rolled out a second home visa for wealthy tourists with at least 2 billion rupiah ($130,000) in their bank account.”, Bloomberg, September 3, 2023

“PepsiCo returns to Indonesia, breaks ground for snack factory – U.S. food and beverage maker PepsiCo (PEP.O) began building a snack factory in Indonesia’s West Java on Wednesday, marking its return to Southeast Asia’s largest economy after splitting with a local partner two years ago. The factory, part of PepsiCo’s $200 million commitment to invest in Indonesia over a 10-year period, is expected to start producing snacks by 2025. Building the new factory without a local partner, PepsiCo pledged to source most raw materials for its snacks, including corn and palm oil, from sustainable sources and to use renewable power sources.”, Reuters, August 29, 2023

The Philippines

“The promise of the Philippines: A retail success story – Retail in the Philippines has been showing great promise, with players encouraged by its high growth rate across various retail categories. This is particularly true in luxury goods, with the Philippines set to be the fast-growing market in Southeast Asia for this sector, a 30 percent increase from 2021 to 2022. In addition, retail e-commerce growth rates in the Philippines are set to surpass all other markets in the region. This retail success is driven primarily by increased supply chains and distribution, leading to greater accessibility to consumer products and services. Affluence translates into higher consumer spending. Beauty and personal care also offers opportunities in the Philippines.”, Retail Asia, late July 2023

Switzerland

“UBS breaks record with $29bn profit after Credit Suisse deal – Swiss bank plans to complete integration and make $10bn of cost cuts by 2026. The Swiss lender announced the figures on Thursday as it said it would press ahead with absorbing Credit Suisse’s domestic business despite local and political opposition to a deal that is expected to result in thousands of job cuts and branch closures. UBS agreed to rescue its ailing rival five months ago and its record $29bn pre-tax profit was almost entirely thanks to the accounting gain it recorded on the $3.4bn takeover.”, The Financial Times, September 1, 2023

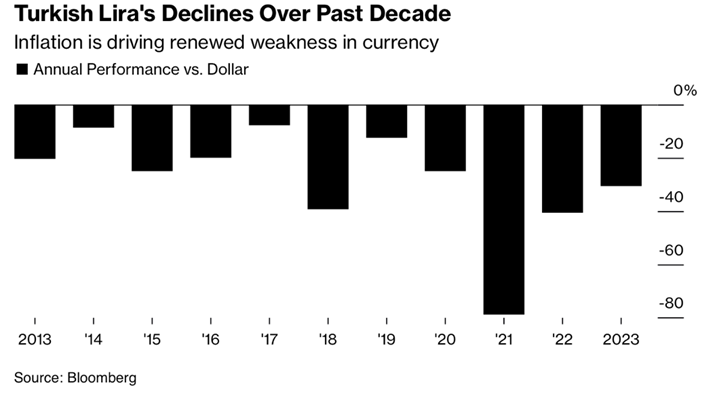

Turkey

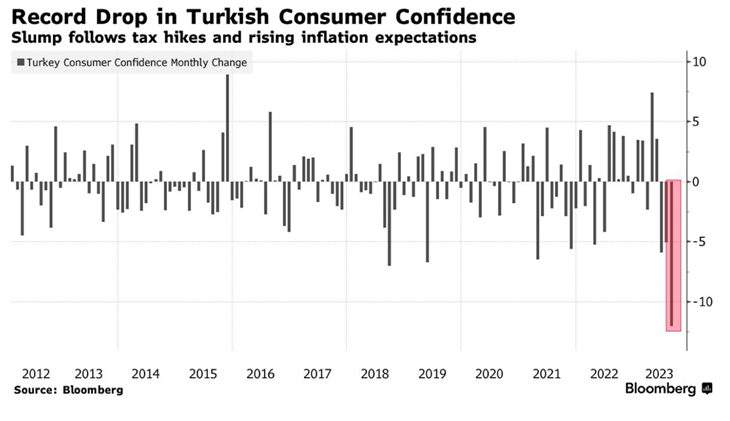

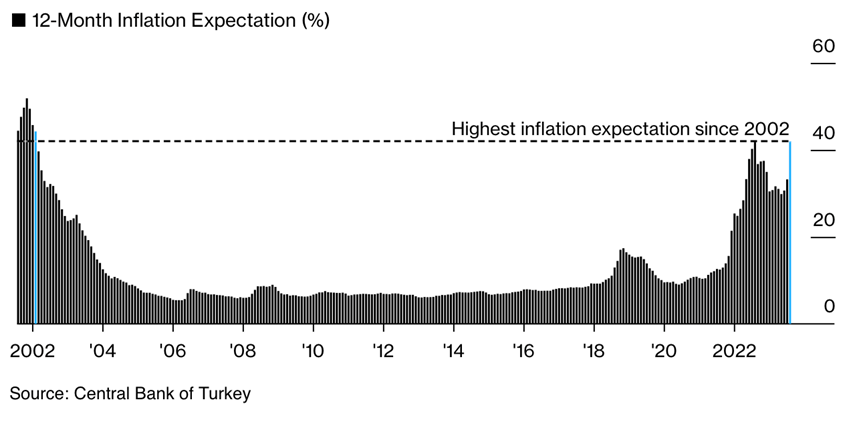

“Turkish Consumers Suffer Biggest Confidence Drop of Erdogan Era – The consumer confidence index plummeted to 68 points in August from 80.1 a month earlier, according to the Turkish Statistical Institute. That’s the biggest drop since records began in 2004, months after Erdogan first became prime minster. The precipitous slump follows a series of tax hikes, several increases in interest rates and a sharp upward revision in official inflation expectations for the year. The central bank’s new governor, Hafize Gaye Erkan, and Treasury and Finance Minister Mehmet Simsek are orchestrating a return to orthodox policy after years of growth-at-all-costs measures.”, Bloomberg, August 23, 2023

United Kingdom

“UK economy bigger than before Covid, revised ONS figures show – Official data has revealed that the recovery from the pandemic was far faster than thought. It means the economy is no longer the worst performer among the world’s richest nations as the growth rate is likely to have surpassed Germany’s. Analysts said that the perception of the UK as the G7’s laggard was ‘no longer valid’. Jeremy Hunt, the chancellor, welcomed the data, which he said was more evidence that those talking down the British economy ‘have been proved wrong’. GDP performed much better than initially thought during the Covid-19 crisis and was 0.6 per cent larger in the final three months of 2021 than before the onset.”, The Times Of London, September 1, 2023

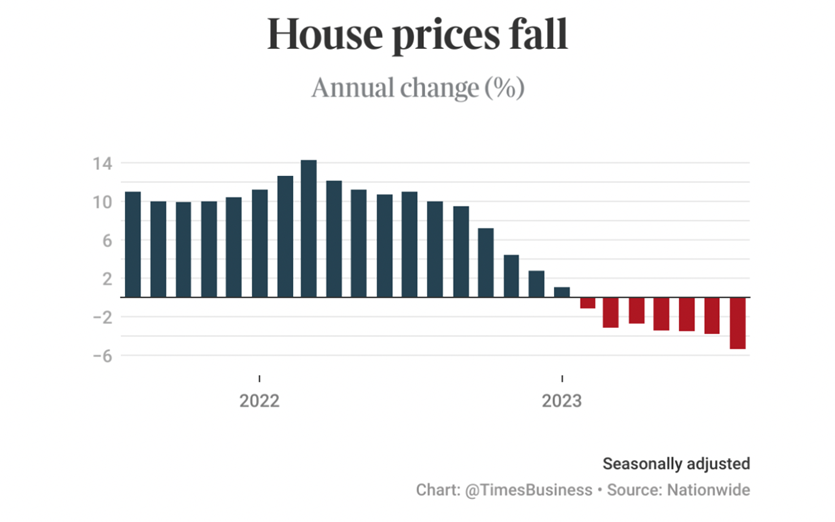

“The fall in house prices accelerated in August – House prices fell by a larger than expected 5.3 per cent year-on-year in August, accelerating from the 3.8 per cent fall recorded in July. It was the biggest annual decline since July 2009 and the seventh consecutive annual drop reported by Nationwide. City economists had forecast a 4.7 per cent fall. Month-on-month house prices fell by 0.8 per cent. The average house price is now £259,153 (US$327,546), down from £260,828 in July.”, The Times of London, September 1, 2023

United States

“US Jobs Report Signals Smooth Downshift in Labor Market – Still-solid hiring, slower wage growth gives Fed room to pause More people returned to the labor force but couldn’t find jobs. The latest US job data showed a labor market undergoing a controlled cooling, illustrated by solid hiring, slower earnings growth and more people returning to the workforce. Employers in August added 187,000 jobs in a broad-based advance, following downward revisions to payrolls in the prior two months, government figures showed Friday. Hundreds of thousands more joined the labor force, though a growing number was unable to find work right away.”, Bloomberg, September 1, 2023

“Study Finds Consumers Remain Concerned About Economy – 59% of consumers have a high level of concern regarding the economy, up from July. 65% of consumers feel as though the country is in an economic recession, and the same amount think the US economy will worsen in the next few months. 76% think inflation will increase in the next few months. Over the next few months, 38% of consumers say their primary concern will most likely be personal finances. 77% of consumers say rising prices on essential goods and services is their main economic concern (+5 points from July), followed by rising prices on gas/fuel (70%, +9 points from July).”, Franchising.com, August 31, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“A History of Franchising – From a Founding Father’s Printing Press to Fast Food Chains In honor of Franchise Appreciation Day on September 2, we look at the history of franchising. Benjamin Franklin is often credited as one of the pioneers of franchising in America, having established the first franchise-like agreement in 1731 through a printing business partnership. Martha Matilda Harper, who, in 1891, introduced the Harper Method Shops, including standardized training, proprietary branded products, and advertising support, was another franchising trailblazer. The decades following World War II witnessed a franchising boom, giving birth to legendary brands like McDonald’s, KFC, and Dunkin’ Donuts.”, Entrepreneur magazine, September 1, 2023

“Franchise Opportunities In An Unconventional Economy – The current economy is characterized by an interesting mix of optimism and anxiety. Franchises are a significant segment of the economy and despite a challenging economy, growth is expected to continue. For example, the International Franchise Association forecasted that franchises in the U.S. would grow by 3.0% in 2023, adding 254,000 jobs, reaching a total of 8.7 million employees. But while growth among franchisors is expected to continue, rising interest rates are impacting their growth and expansion outlook according to a confidence survey just released in Franchise Times by financial technology company Boefly.”, Forbes, August 30, 2023

“Australia’s BFT expands across South-East Asia and Spain as gym chains face an economic workout – The chain opened its first Hong Kong franchise this month and has recently sold its first two franchises in Malaysia, plus an additional two franchises across Madrid and Barcelona. The additions will complement BFT’s 175 Australian studios, and an additional 75 spread across New Zealand, the US, Canada, England, and Singapore. BFT’s franchise expansion comes in a difficult economic environment for many gym businesses, which are balancing the post-lockdown return to group physical activity against mounting operating costs.”, Smart Company (Australia), August 22, 2023

“Krispy Kreme celebrate 20 years in Australia with free doughnuts – To celebrate 20 years since they opened their first Aussie store in Penrith in 2003, Krispy Kreme will be slinging one of their famous glazed doughnuts to anyone that has the courage to shout the iconic Aussie birthday chant “Hip Hip Hooray” in store during their birthday weekend, from September 7 to 10.”, Kitchen Nine, September 1, 2023

“Will Pizza Hut be next giant to disappear from the (UK) High Street? Future of restaurant in doubt after 50 years in the UK with soaring prices pushing it further into losses. The UK franchise of the fast-food chain admitted that they were heavily affected by the pandemic, which limited the demand for people dining in their restaurants. And this has only been worsened by the war in Ukraine, which caused prices of energy, food and transportation to rocket. The chain was founded in the US state of Kansas in 1958 and the first UK outlet opened in Islington, north London, in 1972. Since then, Pizza Hut has soared in popularity and at its peak employed 10,000 workers in more than 260 restaurants up and down the country, serving three million guests a month.”, The Daily Mail, August 28, 2023

“Popeyes Announces Major Plans For Reopening In China – The popular chicken conglomerate, which last year announced plans to build locations across North America, has now added China to its list once again. As of Monday, Popeyes is planning the opening of 1,700 outposts across China, at least 10 of which will be in Shanghai. The expansion announcement comes on the heels of the chain’s purchase by Tims China, owner of Canada’s beloved Tim Hortons, which made the acquisition in March.”, The Tasting Table, August 22, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Restaurant Brands appoints Arif Khan as permanent CEO – Khan has been acting group CEO since April and had spent several years in management at the business in his early career. In 2018, he returned to oversee the Restaurant Brands New Zealand business as CEO after serving as global chief operating officer from November to April of last year. Restaurant Brands is a corporate franchisee that manages multi-location branded food retail franchises. It operates the KFC and Taco Bell chains in Australia and KFC, Pizza Hut, Taco Bell and Carl’s Jr in New Zealand.”, Inside Retail (Australia), September 1, 2023

“Subway’s New Owner Faces Tough Decisions on Sandwich Chain’s Massive Size in US – Company still has about 20,000 locations in the US alone Sandwich chain says existing management will stay in place. Subway’s restaurant count currently stands at nearly 37,000 worldwide, with around 20,000 in the US. That’s even after the company aggressively pared back in recent years amid fierce competition and locations in close proximity to each other that cannibalized sales and squeezed franchisees. Management shuttered more than 6,500 US locations between 2015 and 2022, according to food-service research firm Technomic. But per-store sales still trail rivals’, the data show.”, Bloomberg, Aufust 24, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 89, Tuesday, August 22, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Barbie on the menu in restaurants? A new McDonald’s® brand, Subway® sold? The world’s 50 most valuable companies, travel to be US$15 trillion by 2035, more flights to China soon, Latin American banks lowering interest rates, inflation remains high in the UK, Germany sees a slowdown while the US heads for 5%+ GDP growth (?).

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“The best way to predict the future is to create it.”, Abraham Lincoln

“You miss 100% of the shots you don’t take.”, Wayne Gretzky

“If you really look closely, most overnight successes took a long time.”, Steve Jobs

Highlights in issue #89:

- Brand Global News Section: CosMc®, Jollibee®, Marrybrown®, Potato Corner®, Rally’s & Checkers®, Subway®, Wendys®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“The 50 Most Valuable Companies in the World in 2023 – Market capitalization, or market cap, is one measure of a company’s value as determined by the stock market. It is easily calculated by multiplying the company’s outstanding shares by its current share price. In this graphic, we present a treemap chart that visualizes the world’s top 50 publicly-traded companies by market cap, using data as of Aug. 16, 2023. Altogether, the 50 most valuable companies represent over $26.5 trillion in shareholder value. At a sector level, Information Technology is the most represented in the top 50, with $9.3 trillion in combined market cap. The next biggest sectors are Consumer Discretionary ($4.0 trillion) and Health Care ($3.3 trillion).”, Visual Capitalist, August 20, 2023

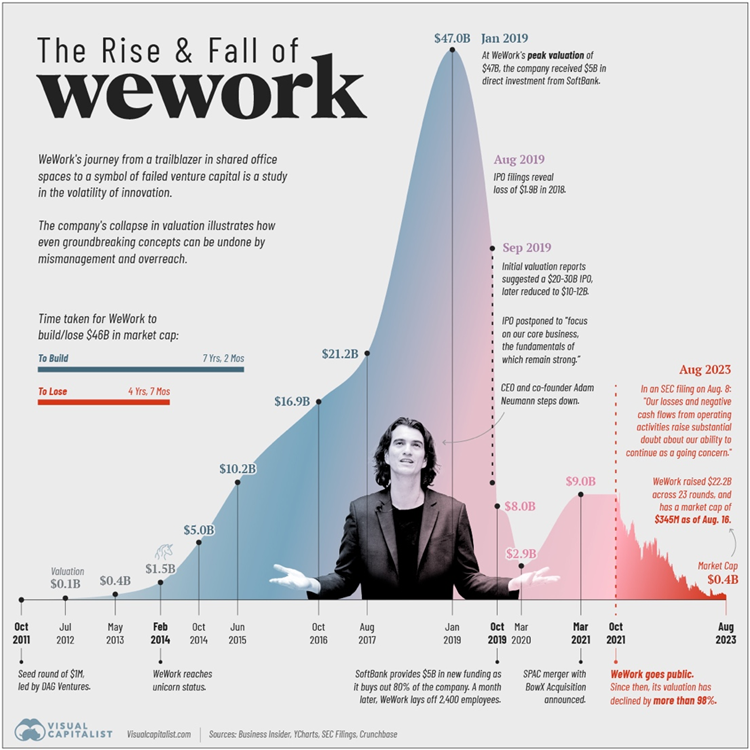

“The Rise and Fall of WeWork – Despite its recommitment to core business fundamentals in the last few years, WeWork’s management—which saw a shakeup in May 2023 when CEO Sandeep Mathrani departed—is setting off a signal flare about the company’s future. WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey with the primary objective of providing shared workspaces catered to freelancers, startups, and companies seeking ‘flexible office solutions.’ The business model, which rested on renting space from developers long-term, renovating and parceling the property, and subsequently leasing it out to short-term clients, thrived in a decade of low interest rates.”, Visual Capitalist, August 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“U.S. Importers Are Absorbing Higher Shipping Costs This Summer – Container lines have reversed a big drop in freight rates this year, but experts say the price increases may be short-lived. Costs to ship goods from Asia to the U.S. are turning sharply upward, but American importers appear to be absorbing the higher prices after watching freight rates plummet this year from record highs. The average spot rate to ship a 40-foot container from China to the U.S. West Coast rose 61% during the six weeks through Aug. 15 to $2,075….”, The Wall Street Journal, August 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Travel Will Represent a $15.5 Trillion Economy by 2033 – Data from the World Travel & Tourism Council points to global tourism’s significant growth in the next decade. That includes the US, where travel will soon be worth $3 trillion. As a whole, the industry will employ up to 430 million people by 2033, compared with 334 million in 2019. That accounts for roughly 1 of every 9 jobs globally. In 2033, China’s travel sector is forecast to contribute $4 trillion and will make up 14.1% of the Chinese economy. By contrast, the US industry is projected to reach $3 trillion and will represent 10.1% of the US economy.”, Bloomberg, August 21, 2023

“Hilton bets on China’s middle class as it eyes about 730 hotels in next 10 years – The operator of Waldorf Astoria and Conrad hotels said its performance received a boost from Chinese travellers this year. Hilton said its properties in Asia-Pacific stood out in the second quarter, with revenue-per-room surging 79 per cent year on year. Hilton, which was previously majority owned by HNA Group until 2019 before the Chinese conglomerate fell into financial difficulties, currently manages 512 hotels in 170 destinations across China. It had closed 60 per cent of its properties across Asia-Pacific at the height of the pandemic that ravaged the industry for three years between 2020 and 2022.?, South China Morning Post, August 20, 2023

“Delta Air Lines to Expand China Flights For Winter Season – Delta Air Lines is gearing up for an extensive flight schedule expansion to China. The airline will introduce 10 weekly China flights to Shanghai-Pudong International Airport from its Seattle-Tacoma International Airport and Detroit Metropolitan Wayne County Airport hubs. These new services will kick off on Oct. 29, featuring daily flights from Seattle-Tacoma International Airport and three weekly flights from Detroit Metropolitan Wayne County Airport. Delta Air Lines is reinstating a four-times-weekly Shanghai Pudong International Airport route from its Los Angeles hub in March next year. In doing that, the company brings back a route that was last operational in February 2020.”, Travel Noire, August 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

“New Indicator Shows China’s Consumers Are Spending — on Services. Retail sales of services jumped 20.3% year-on-year in the January to July period compared with 7.3% growth for overall retail sales. Spending on services now accounts for more than 40% of the nationwide per capita consumption expenditure. The surge in retail sales from services this year was fueled by pent-up demand for culture, sports, health care and business services.”, Caixing Global, August 18, 2023