EGS Biweekly Global Business Newsletter Issue 88, Tuesday, August 8, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, AI driving employees back to the office, Zoom tells employees to come back to the office (?), investors once again positive about Brazil, global shipping up and down, Europe flights delays this summer but few visiting China yet, the latest ‘Economist’ Big Mac Index and an excellent report on franchising in Australia to download.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Don’t sit down and wait for the opportunities to come. Get up and make them.”, Madam C.J. Walker, first female self-made millionaire, 1905

“You have to be burning with an idea, or a problem, or a wrong that you want to right. If you’re not passionate enough from the start, you’ll never stick it out.” , Steve Jobs, CEO and co-founder of Apple Inc.

“Do what you love and success will follow. Passion is the fuel behind a successful career.”, Meg Whitman, CEO of Quibi

Highlights in issue #88:

Inflation Is Cooling. Food Inflation Could Get Worse

Global Shipping Costs Creep Higher After 16-Month Freefall

AI is driving the return to office

Zoom asks employees to return to office for first time since COVID-19 pandemic

Canada sheds jobs in July, unemployment ticks up to 5.5% as evidence of slowing economy mounts

McDonald’s Breakfast In Hong Kong Is Truly Deluxe

- Brand Global News Section: Applebee’s®, Chipotle®, Firehouse Subs®, IHOP®, McDonalds®, Outback®, Papa Johns®, Pollo Tropical®, Starbucks®, Subway® and Taco Bell®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“AI is driving the return to office – AI workers want to be in the office—and it just might solve the real-estate crisis. Artificial intelligence could be the savior of the office building. Unlike many tech companies that are actively downsizing office space and waffling on RTO timing and policies, AI companies are seeing the need for physical office space to do their suddenly desirable work. The real estate services firm JLL estimates that by the end of 2023, AI companies will occupy 17.2 million square feet of office space across the country. To put that number in perspective, it’s equivalent to more than half of the amount of office space that’s been leased or subleased between July 2022 and June 2023, according to JLL’s latest U.S. Office Outlook report.”, Fast Company, August 5, 2023

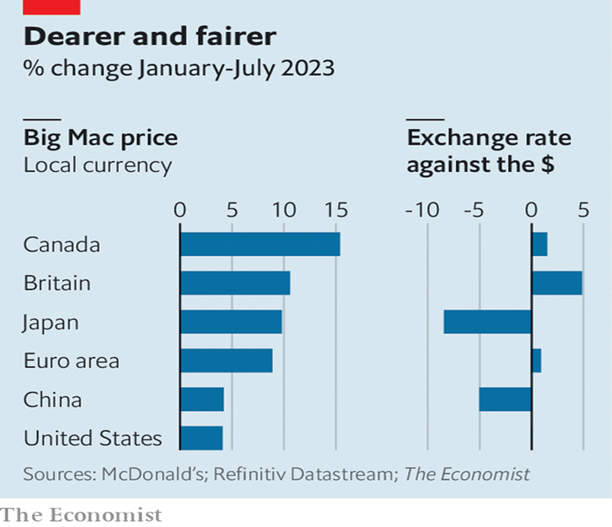

“The dollar is now better value, says the Big Mac index – But not against the Japanese yen. Since 1986 The Economist has tracked the price of a McDonald’s Big Mac around the world as a light-hearted guide to the fair value of currencies. Our index shows that the median price of the burger in its home market rose to $5.58 in July, an increase of over 4% since January and 8.3% compared with a year earlier. That is the beefiest rate of American McFlation recorded in our index since July 2012. Compared with the rest of the world, however, Americans have escaped lightly. From January to July the price of a Big Mac has risen more than twice as fast in the euro zone and Britain, and nearly four times as fast in Canada (see chart).”, The Economist, August 3, 2023

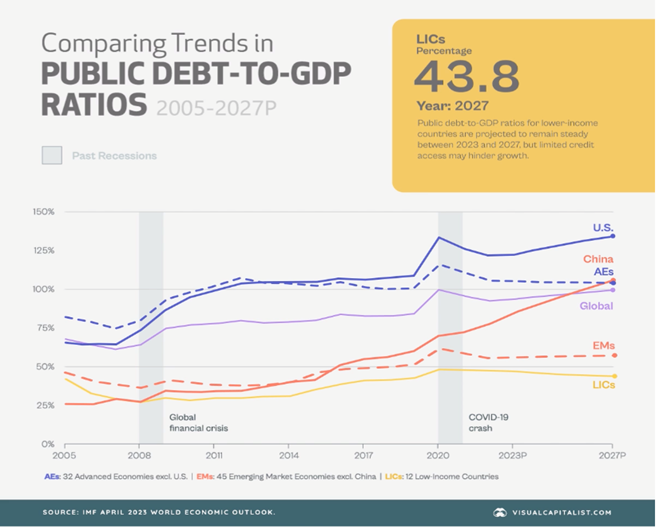

“Global Debt Projections (2005-2027) – Total global debt stands at nearly $305 trillion as of the first quarter of 2023. Over the next five years, it is projected to jump even further—raising concerns about government leverage in a high interest rate and slower growth environment. After rising steadily for years, government debt first ballooned to almost 100% of GDP in 2020. While this ratio has fallen amid an economic rebound and high inflation in 2021 and 2022, it is projected to regain ground and continue climbing. World government debt is now projected to rise to 99.5% of GDP by 2027. Here’s data going back to 2005, as well as the forecast for global public debt-to-GDP:” Visual Capitalist / IMF, August 1, 2023

“Zoom asks employees to return to office for first time since COVID-19 pandemic – Zoom has told its employees to return to the office for the first time since the coronavirus pandemic led employees to use video communications to speak with coworkers. Zoom is asking all employees within 50 miles of a company office to return for at least two days a week. ‘We’ll continue to leverage the entire Zoom platform to keep our employees and dispersed teams connected and working efficiently,’ the spokesperson said.”, Fox Business, August 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

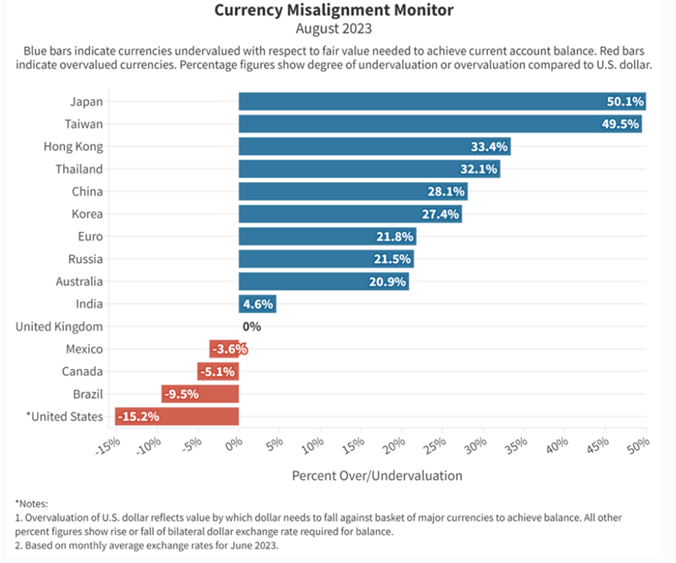

“The ‘Weak Dollar’ Is Overvalued By 15.2% – The ‘weak dollar’ is so strong it is estimated to be 15.2% overvalued against a basket of 34 currencies, according to economists at the Coalition for a Prosperous America and Blue Collar Dollar Institute. The two produce a monthly index on dollar valuation called the Currency Misalignment Monitor (CMM). The index is designed to provide a rough approximation of the degree of movement of exchange rates that would be required to bring the U.S. into a better trade balance with partner countries over a five-year stretch. Why is the dollar always overvalued against most currencies, including the second most used currency in world trade – the euro? Basically, it’s because of the securities market. Stocks and bonds (and real estate) are America’s most important product.”, Forbes, July 31, 2023

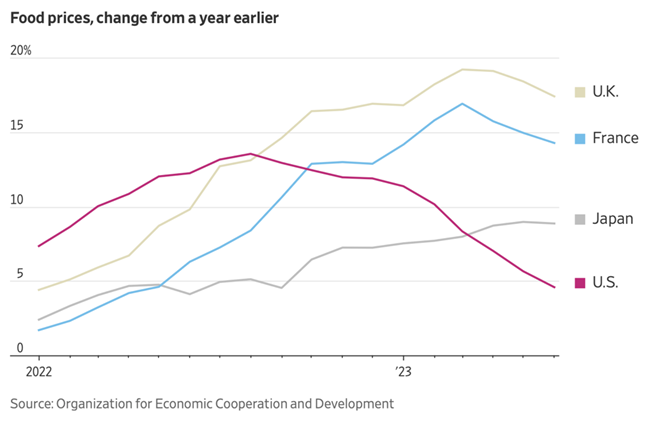

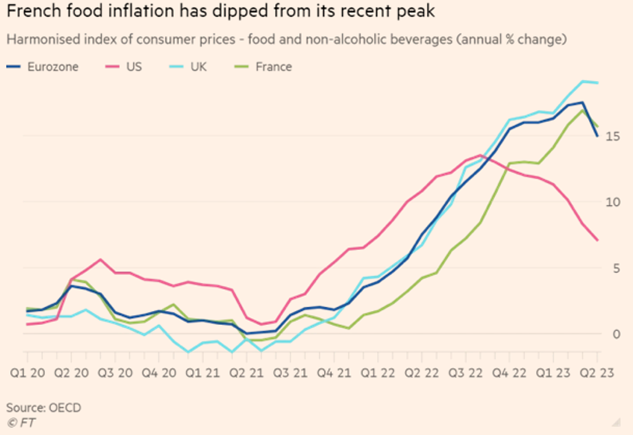

“Inflation Is Cooling. Food Inflation Could Get Worse – Food prices have been rising rapidly for longer than central bankers had expected, and recent setbacks may prolong the agony. A combination of disrupted exports, unusually hot weather and Russia’s continuing pounding of Ukraine, one of the world’s largest grain producers, is likely to add fresh momentum to the main source of global inflation. U.K. food prices rose 17.4% in the year through June, while Japanese prices were up 8.9% and French prices were up 14.3%. While food inflation has slowed slightly in the U.K. and France, it has picked up in Japan. The U.S. has fared better, with food prices up 4.6% from a year earlier in June, more than double the rate of inflation targeted by the Federal Reserve but well down on the August 2022 peak of 13.5%.”, The Wall Street Journal, August 4, 2023

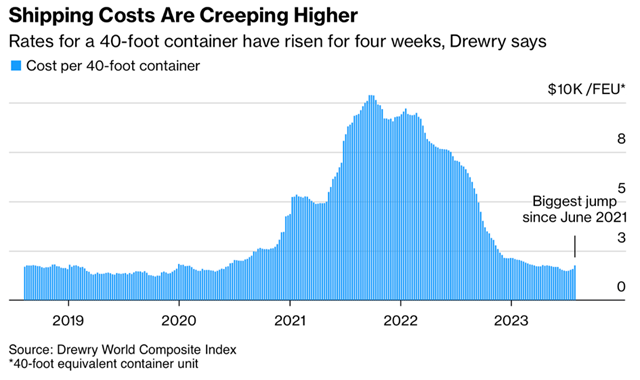

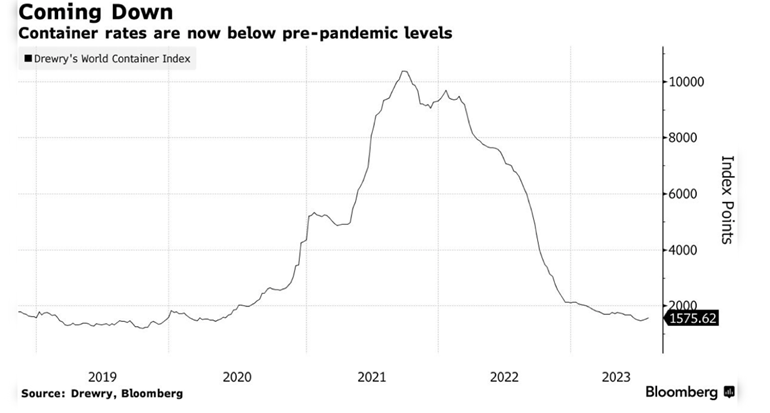

“Global Shipping Costs Creep Higher After 16-Month Freefall – Drewry world container index climbed for fourth week. Rates from Shanghai to LA, Rotterdam also increasing. Spot rates for shipping containers jumped by the most in more than two years, a sign that a 16-month slump in ocean-freight costs that helped ease the sting of goods inflation is over. The Drewry World Container Index composite increased 11.8% to $1,761 for a 40-foot container, the fourth straight advance and biggest week-on-week percentage gain since June 2021. The composite — which reflects short-term rates across eight trade routes connecting Asia, Europe and the US — had fallen in 15 of the 16 months through June.”, Bloomberg, August 3, 2023

“World Trade Forecast Cut as Maersk Flags Fears for Economy – Outlook signals supply shock has turned into demand decline. Maersk controls about one-sixth of world’s container trade. Shipping giant A.P. Moller-Maersk A/S, a bellwether for the world economy, lowered its estimate for global container trade, indicating that weak demand continues to hamper economic activity after years of supply shocks. Global container trade will probably contract as much as 4% this year, down from Maersk’s previous prediction of as much as 2.5%, the Copenhagen-based company said in a statement on Friday, as there are no substantial signs that volumes will recover this year.”, Bloomberg, August 3, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“China’s Latest Problem: People Don’t Want to Go There – As geopolitical tensions rise, fewer visitors are traveling to the world’s No. 2 economy, widening the East-West divide. Half a year after China lifted Covid-19 restrictions and reopened its borders, few international travelers are coming—another sign of decoupling between China and the West that could have negative repercussions for a long time. Foreign travelers’ absence is particularly evident in major cities like Beijing and Shanghai, where the numbers of foreigners who visited in the first half of the year totaled less than a quarter of comparable figures in 2019, before the Covid pandemic. Nationwide, just 52,000 people arrived to mainland China from overseas on trips organized by travel agencies during the first quarter, the latest period for which national data is available, compared with 3.7 million in the first quarter of 2019.”, The Wall Street Journal, August 3, 2023

“Going to Europe This Summer? Brace for Flight Delays – Wildfires, air-traffic control shortages, strikes and the war in Ukraine have led to more delays than last year’s summer of disruption. Passengers traveling across the region have so far experienced more delayed flights this summer than a year ago, when the flying season was marred by long lines, lost baggage and regular cancellations as a rebound in demand overwhelmed airports. This summer airlines and airports are wrestling with an array of challenges. A shortage of air-traffic controllers has impacted the number of flights that can be handled during the day. The war in Ukraine has closed off airspace previously used regularly, and workers, including cabin crew and pilots, are striking across the region.”, The Wall Street Journal, August 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Growth spurt ahead for small and micro businesses – Small business growth has rebounded to pre-pandemic levels despite significant issues such as labour shortages, according to the findings from the latest Quarterly Small and Micro Business Index. The index, compiled by the Council of Small Business Organisations Australia (COSBOA) and payment platform Square, shows a promising outlook for the business landscape despite the current economic climate. Growth rates at Australian businesses have returned to pre-pandemic levels.”, Kochie’s Business Builders, August 7, 2023

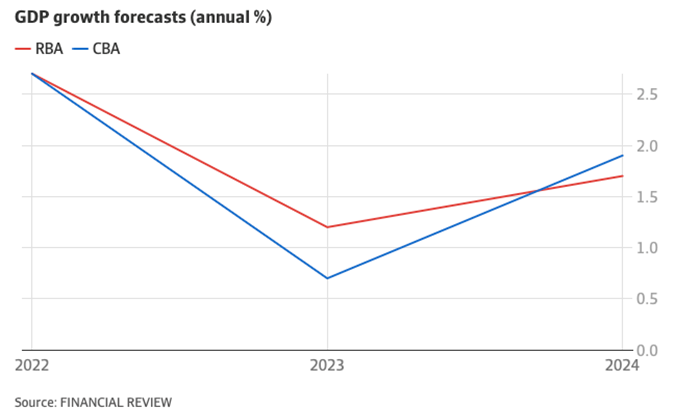

“Growth to slump as high rates smash households, RBA warns – The Reserve Bank downgraded its near-term growth forecasts on Friday as the economy cools in response to the fastest interest rate tightening cycle in decades. The central bank expects real gross domestic product to expand by just 0.9 per cent in the 12 months to December 2023 as a result of a weaker-than-expected March quarter national accounts, down from its previous forecast of 1.2 per cent and below the current rate of 2.3 per cent.”, Australian Financial Review, August 4, 2023

Brazil

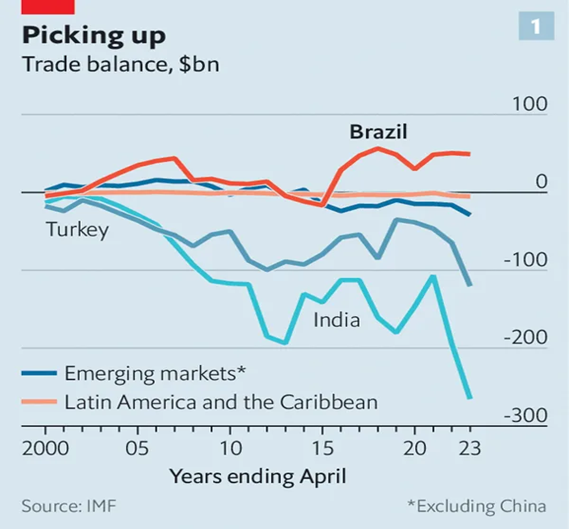

“Investors are increasingly optimistic about Brazil’s economy – An efficient finance minister and the favourable international backdrop are helping. In a recent poll of 94 Brazilian fund managers and analysts, just 44% had an unfavourable view of the government, down from 90% in March. On July 26th Fitch, a ratings agency, upgraded Brazil’s long-term foreign-currency debt for the first time since it was downgraded in 2018.”, The Economist, August 2, 2023

Canada

“Canada sheds jobs in July, unemployment ticks up to 5.5% as evidence of slowing economy mounts – The Canadian economy unexpectedly shed jobs in July while the unemployment rate ticked higher for the third straight month, providing further evidence that the economy is losing momentum in the face of higher interest rates. The country lost a total of 6,400 jobs and the unemployment rate rose to 5.5 per cent, up from 5.4 per cent in the previous month, Statistics Canada reported Friday. Bay Street analysts were expecting a gain of around 21,000 jobs in July, according to Reuters polling.”, The Globe and Mail, August 5, 2023

China

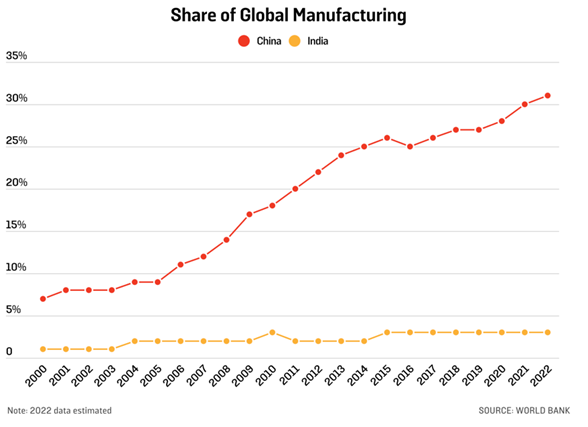

“China’s Private Sector Is Losing Ground. The State Is Gobbling Market Share – Private companies, which enjoyed a 40-year explosion as a proportion of China’s economy, are now ceding market share to the dinosaurs of state enterprises. Among the 100 largest listed companies, measured by market capitalization, the share of companies that are majority-owned by the Chinese state rose to 61% from 57.2% in the first half of 2023, according to the institute. The share of the private sector, defined as firms with less than 10% state ownership, in the same period dropped below 40% for the first time since the end of 2019.”, Barron’s, August 6, 2023

“China eases entry visa and hukou rules in all-out push to save the economy – More businesspeople will be able to get visas on landing and more rural residents should qualify for urban residency. The changes unveiled by the Ministry of Public Security are meant to foster freer movement of people and data. In addition, the ministry will make it easier for overseas business travellers to apply for landing visas, including those wanting to visit China for business meetings, exhibitions or investment but are unable to secure the permission before their trip.”, South China Morning Post, August 4, 2023

Turkey

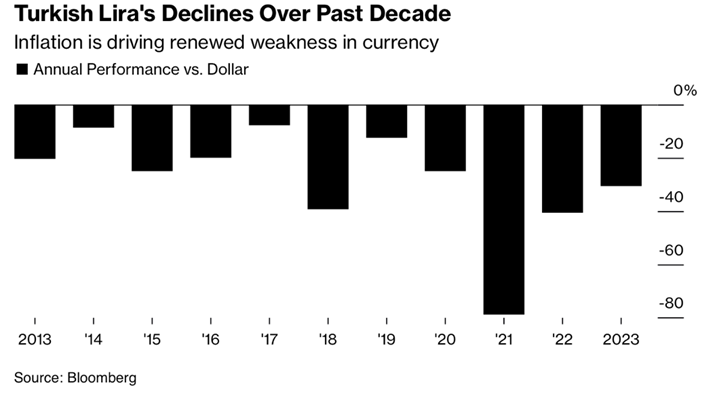

“Deutsche, HSBC See Turkish Lira Diving to New Lows on Inflation – Annual price increases have accelerated to almost 50%. Central bank is keeping to “gradual” tightening cycle. The Turkish central bank, under new Governor Hafize Gaye Erkan, recently acknowledged price pressures and significantly revised up its inflation forecast to 58% by year-end, peaking at 60% in the second quarter of 2024. Deutsche Bank analysts cited the trajectory of price increases and the “challenges confronting policymakers in returning inflation to a more sustainable path” for its revisions. It also said it sees the lira sliding further to 35 per dollar at the end of 2024.”, Bloomberg, August 4, 2023

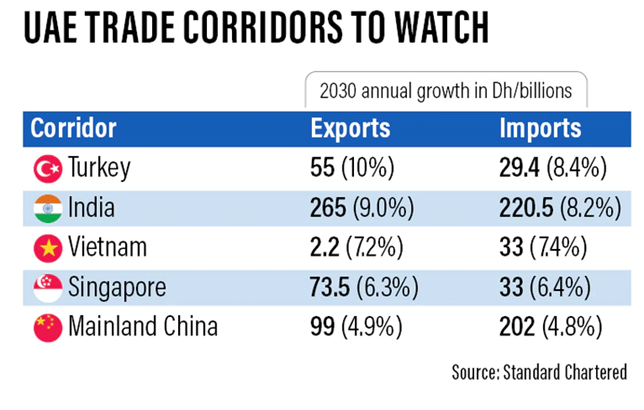

United Arab Emirates

“Dubai Tourist Arrivals Top Pre-Pandemic Levels, Room Rates Surge – Dubai reported a record number of tourist arrivals in the first half of the year, topping levels last seen before the Covid-19 pandemic took hold and helping push hotel room rates to a fresh high. The city reported 8.55 million international overnight visitors, up 20% from the first half of last year and more than the 8.36 million tourists who visited during the same period in 2019. Average daily hotel rates came in at 534 dirhams ($145.40), up by a fifth from 2019 levels.”, Bloomberg, August 6, 2023

United Kingdom

“First-time buyers flee London for more affordable mortgages – In the pandemic, young Londoners moved out of the city in search of space and freedom. Now they are being forced out by rising mortgage costs, according to research. First-time buyers made up 30 per cent of Londoners buying homes outside the capital in the first half of this year, the highest proportion recorded by Hamptons estate agency since it started collecting the data in 2007. Unaffordability is the driving force.”, The Times Of London, August 6, 2023

United States

“Restaurant employment levels inch back up in July – After losing jobs in June for the first time in nearly two and a half years, the restaurant and bar sector gained over 13,000 positions in July. The restaurant workforce remains below pre-pandemic levels by about 64,000 jobs, or 0.5%. In a statement, National Restaurant Association Chief Economist Bruce Grindy said, ‘restaurant operators who are looking to boost staffing levels may find a somewhat less competitive recruiting environment in the months ahead. Job growth in the industry remained in July but remained well below the gains registered during the early months of the year.’”, Nation’s Restaurant New, August 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Applebee’s Is Shrinking & Closing Dozens of Restaurants This Year – The chain has closed hundreds of restaurants in recent years. The casual dining chain announced this week that it expects to end the year with 25 to 35 fewer restaurants than it had at the start. This will be an even bigger decrease than the 10 to 20 net closures that Applebee’s initially expected to see in 2023. Applebee’s net unit count hasn’t taken such a major hit since 2020, when it ended the year with 67 fewer restaurants, according to Restaurant Business Magazine.”, Eat This! Not That, August 4, 2023

“State of (Australia) Franchise Report – Franchise Council of Australia – Despite the multiple challenges of recent times, our 2023 State of Franchise Report shows the ongoing benefits of the resilience and flexibility of franchising in Australia. Our members are predominantly small businesses with fewer than 20 employees. With more than 94,000 franchise outlets across Australia employing almost 600,000 Australians and generating $174 Billion into Australia’s economy.”, Franchise Council of Australia, August 2023

“Outback Steakhouse Is Investing In New Tech To Improve Its Food And Dining Experience – Outback Steakhouse has implemented new tableside technology in all 691 of its U.S.-based restaurants and continues to install new “advanced” grills and ovens in its kitchens this quarter. The purpose? According to Bloomin’ Brands CEO Dave Deno on the second-quarter earnings call on August 1, ‘improved product quality and overall meal pacing.’ And profit growth, of course.”, The Daily Meal, August 4, 2023

“McDonald’s Breakfast In Hong Kong Is Truly Deluxe – McDonald’s offers a fairly extensive breakfast menu in the U.S., but most of these tend to be grab-and-go a la carte items like its signature Egg McMuffins or McGriddles. Perhaps this is because its two Big Breakfast platters may not do so well with the drive-thru customers who could be the chain’s wheelhouse, as it were, since such orders can make up 70% of the chain’s sales in certain markets. McDonald’s in Hong Kong, however, goes all-in on platters when it comes to breakfast. It offers two deluxe versions, one with eggs, English muffins, sausage, and hash browns and the other with pancakes (aka hotcakes), sausage, and hash browns. There’s also a jumbo breakfast featuring all of the aforementioned items.”, Mashed, August 1, 2023

“Papa Johns franchisees see comparable-store sales dip – Papa Johns will provide guidance to franchisees after North American comparable-store sales declined 1.4% in the second quarter ended June 25. Comparable sales increased 2.2% in domestic company-owned restaurants but fell 2.3% in North American franchises restaurants. International comparable-store sales were down 1%, largely attributable to inflation in the United Kingdom, although international comparable-store sales improved 5% from the first quarter.”, Food Business News, August 7, 2023

“Pollo Tropical Restaurant Chain to Be Sold – Authentic Restaurant Brands to buy Fiesta Restaurant Group for $225 million. The Dallas company owned and operated 137 Pollo Tropical restaurants, plus 30 that are franchised, across the U.S., Puerto Rico, Panama, Guyana and the Bahamas as of April 2, according to securities filings. Miami-based Pollo Tropical is known for serving heaping portions of Latin American-inspired cuisine, including marinated and grilled chicken, rice and black beans.”, The Wall Street Journal, August 6, 2023

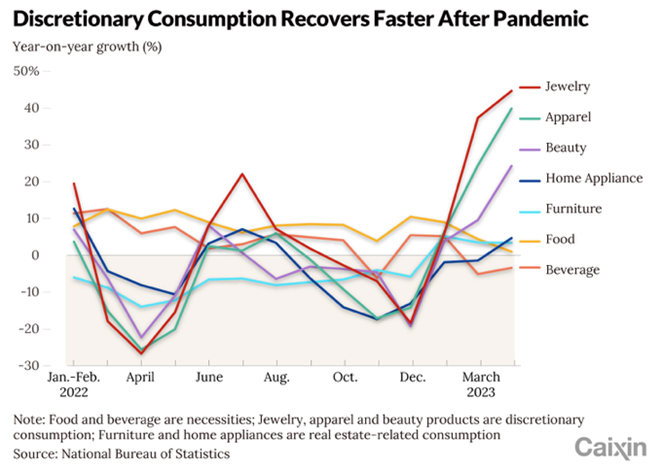

“Starbucks Q3 revenue increased by 12% to US$9.2 billion, and the Chinese market achieved a growth rate of 60% – Global same-store sales increased by 10%, mainly driven by a 5% increase in same-store transaction volume and a 4% increase in average order value. Among them, same-store sales in North America and the United States increased by 7%, driven by a 1% increase in same-store transaction volume and a 6% increase in average customer price. In terms of regions, the net revenue in the Chinese market reached US$821.9 million, an increase of 60% year-on-year (excluding the impact of exchange rate changes), and an increase of 10% from the previous quarter. Same-store sales increased by 46% , same-store transaction volume increased by 48% , and average customer unit price decreased by 1%, which was a significant increase compared to the second quarter.”, Caijing.com.cn, August 2, 2023. Article and translation compliments of Paul Jones, Jones & Co., Toronto

“Subway’s $10 Billion Price Tag Is Tough to Swallow – The sandwich chain’s growth-at-any-cost strategy didn’t work so well, and now it’s having a hard time selling itself. At a time when the value of an increasing number US companies are exceeding the once unthinkable $1 trillion mark, it feels odd to ask whether businesses can be too big to be profitable. And yet that’s the very question sandwich chain Subway Restaurants Inc. is asking itself right now — and it may not like the answer. Subway doesn’t own any of its outlets, which means that to increase profits it either has to add new franchisees or raise fees charged to those franchisees.”, Bloomberg, August 4, 2023

“Taco Bell’s Digital Sales Got A Sizable Boost From In-Store Kiosks – Taco Bell is reaping the return on its investment, and we aren’t just talking about those favorite Mexican pizzas. The Yum! brand food chain recently announced that its digital sales have not only seen a 35% growth, but the chain can back it with the swagger that 100% of its quick service eateries have kiosks, according to QSR Magazine.”, Tasting Table, August 5, 2023

“Here’s what it’s like eating at an AI-generated restaurant: ‘Almost dreamlike’ – When you hear of an AI-generated restaurant, you would probably think of a clean, sterile environment which two bites of food served by robot waiters. But Luminary by RAFI, Australia’s first-ever AI-generated restaurant, is anything but. Luminary, a pop-up restaurant being held for one week only at RAFI in North Sydney, from July 29 to August 5, was first conceptualised with the help of artificial intelligence.”, Honey Kitchen (Australia), August 2, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

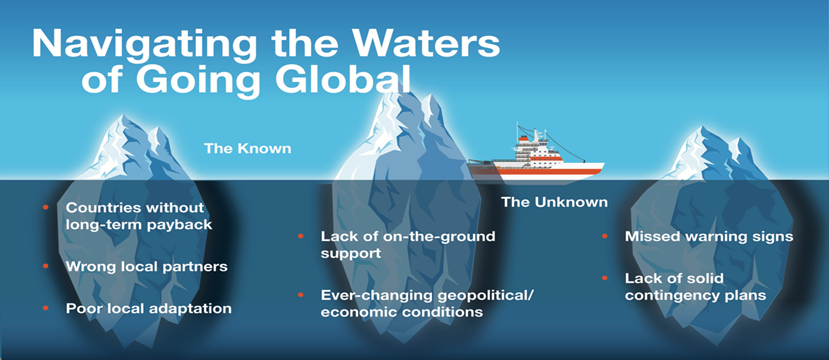

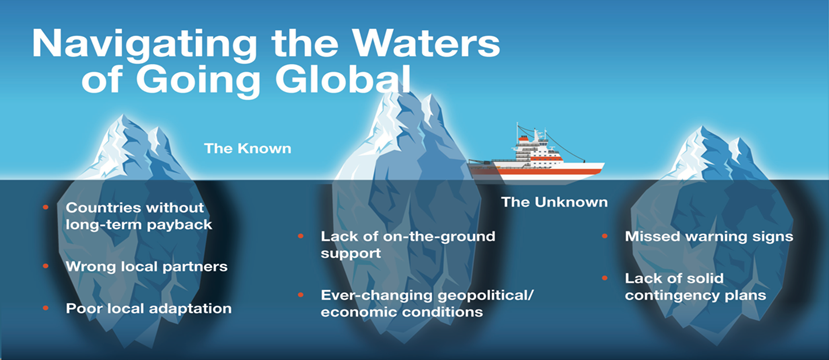

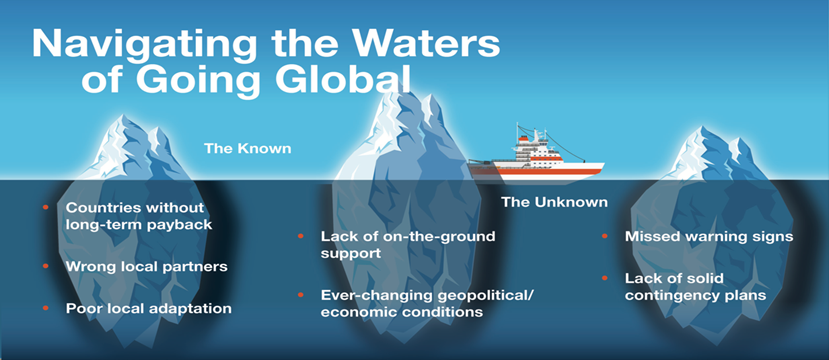

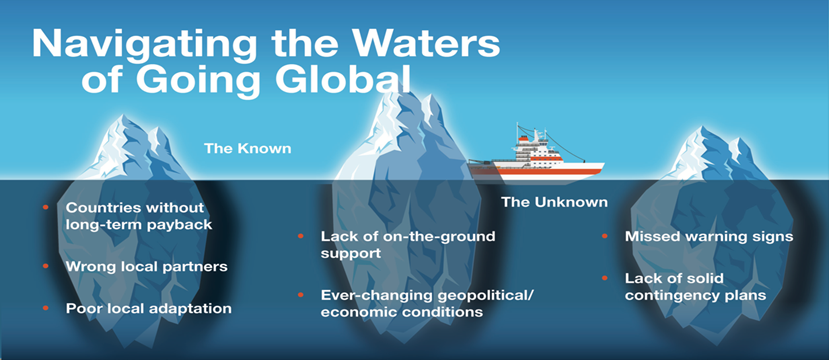

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 87, Tuesday, July 25, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Japan’s inflation rate is higher than in the USA, what is the difference between types of AI, the pandemic’s impact on commercial real estate, China’s growth turns down, globalization remains high, New Zealand ranks #1 in the world in work-life balance, McDonalds® sees global growth and Americans will need a visa to go to Europe soon.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Communication is the key for any global business.”, Anita Roddick

“It is not the strongest or the most intelligent who will survive, but those who can best manage change.”. Leon C. Megginson

“Mistakes are the growing pains of wisdom.”, William George Jordan

Highlights in issue #87:

- The State of Globalization in 2023

- New Zealand ranked best in world for work/life balance

- Will China ever get rich? A new era of much slower growth dawns

- The Difference Between Generative AI And Traditional AI: An Easy Explanation For Anyone

- Meet a Company Pioneering Work-Life Balance

- Brand Global News Section: Anytime Fitness®, Applebee’s®, Chipotle®, Firehouse Subs®, IHOP®, McDonalds® and Sizzler®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“The Difference Between Generative AI And Traditional AI: An Easy Explanation For Anyone – Artificial Intelligence (AI) has been a buzzword across sectors for the last decade, leading to significant advancements in technology and operational efficiencies. However, as we delve deeper into the AI landscape, we must acknowledge and understand its distinct forms. Among the emerging trends, generative AI, a subset of AI, has shown immense potential in reshaping industries. But how does it differ from traditional AI? Let’s unpack this question in the spirit of Bernard Marr’s distinctive, reader-friendly style.”, Forbes, July 24,2023

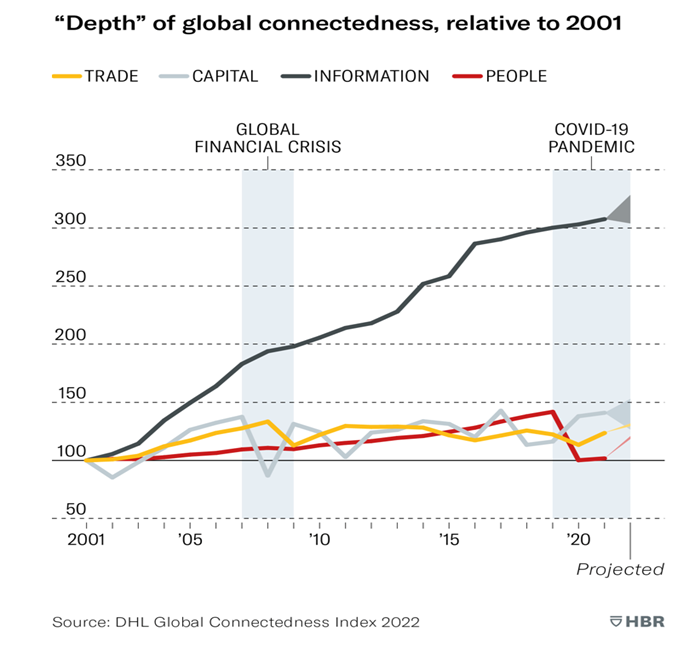

“The State of Globalization in 2023 – Global (Trade) flow have mostly returned to above pre-pandemic levels. The latest DHL Global Connectedness Index shows how the international flows of trade, capital and information were already above pre-pandemic levels by 2021. In 2022, the recovery of international people flows accelerated.”, Harvard Business Review, July 11, 2023

“McKinsey Releases Report on the Pandemic’s Lasting Impact on Real Estate – Hybrid work is here to stay. As a result, office attendance has stabilized at 30% below prepandemic norms. The ripple effects of hybrid work are substantial. Untethered from their offices, residents have left urban cores and shifted their shopping elsewhere. Demand for office and retail space in superstar cities will remain below prepandemic levels.”, Franchising.com, July 23, 2023

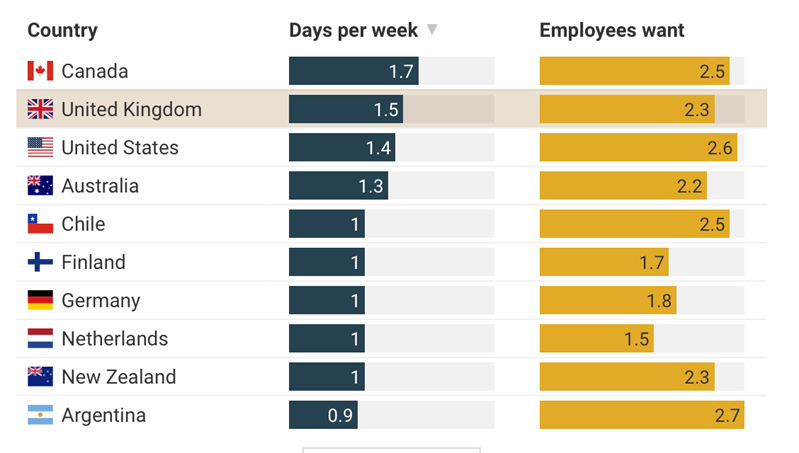

“Britons spend less time in the office than the rest of Europe – Only Canada scores higher for remote hours, study of 34 countries finds. The research, which surveyed 42,400 full-time employees in 34 countries, found that those in France spent less than half as many hours at home as Britons, at only 0.6 days a week. Those in Italy are at home only 0.7 days a week while in Spain the number is 0.9. Britons also show up to the office significantly less than workers in east Asia. However, Britain’s working practices are more similar to other English-speaking nations. In America, workers spend 1.4 days a week at home, while in Australia the number is 1.3. In Canada, the home-working capital of the world, office staff spend 1.7 days a week working remotely.”, The Sunday Times of London, July 18, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“UK signs Comprehensive and Progressive Agreement for Trans-Pacific Partnership – The new agreement will simplify import and export process between the UK and Chile, improving the business environment between the two countries as members of the bloc. Being part of CPTPP will mean that more than 99 per cent of current UK goods exports to CPTPP countries will be eligible for zero tariffs.”, GOV.UK, July 17, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Americans Will Need a ‘Visa’ to Visit Europe in 2024—Here’s What to Know – The new program requires an online application and a minor fee, and is required for all travelers regardless of their age. The new regulations are called the European Travel Information and Authorization System (ETIAS). When the system launches in early 2024, it will require all visitors who currently travel to Europe visa-free, such as citizens from the US, Canada, Australia, and New Zealand, to apply for travel authorization and receive approval prior to their departure.”, Conde Nast Traveler, July 19, 2023

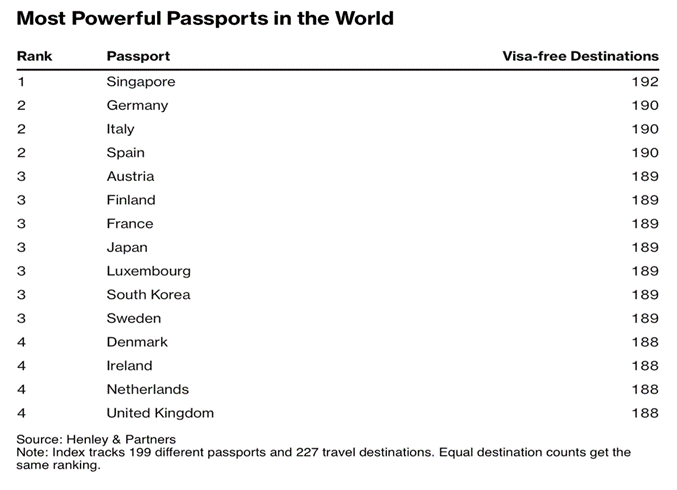

“Singapore Passport Is World’s Most Powerful, Replacing Japan – Singapore has replaced Japan for having the world’s most powerful passport, allowing visa-free entry to 192 global destinations, according to the latest Henley Passport Index. The US, which once topped the ranking nearly a decade ago, slid two places to eighth place. The UK, after a Brexit-induced slump, jumped two places to fourth, a position it last held in 2017.”, Bloomberg, July 18, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Mid-Year Canadian Dollar Outlook – 2023 – The loonie is lifting off. – Fiscal support, stabilising financial conditions, and a historic surge in immigration are helping the Canadian economy – and the loonie – defy bearish expectations. Continued labour market tightness, rebounding housing markets, and high levels of consumer consumption have combined to deliver remarkably-robust growth rates. Yield differentials might narrow – or even flip. But household consumption looks fragile.”, MAPLE Business Council, July 21, 2023

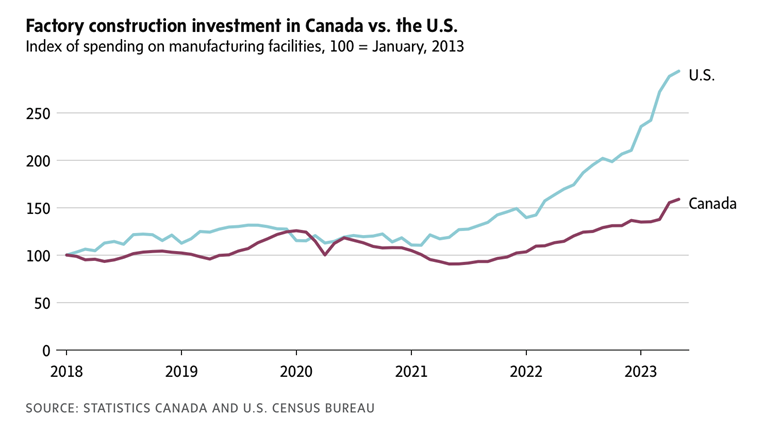

“Waiting for the factory building boom in Canada – The amount spent on the construction of manufacturing facilities in the United States in May jumped 73 per cent to a record US$15.6-billion from the year before, according to the U.S. Census Bureau. Canada’s federal budget this spring aimed to be Ottawa’s response to Washington’s economic activism, with $12-billion in tax credits and incentives for cleantech manufacturing, among other measures. But new data on factory construction investment from Statistics Canada this week shows just how far manufacturers in this country have to go to catch up.”, The Globe & Mail, July 20, 2023

China

“Chinese Consumers Pinch Pennies on Staples as Pandemic Habits Linger – Chinese consumers are being frugal when buying everyday items from toothbrushes to shampoo, a worrisome trend for a country that is trying to shake off the effects of the coronavirus pandemic. A broader retail sales recovery in China this year has masked some of the penny-pinching, which economists say points to underlying weakness in consumer confidence.”, The Wall Street Journal, July 22, 2023

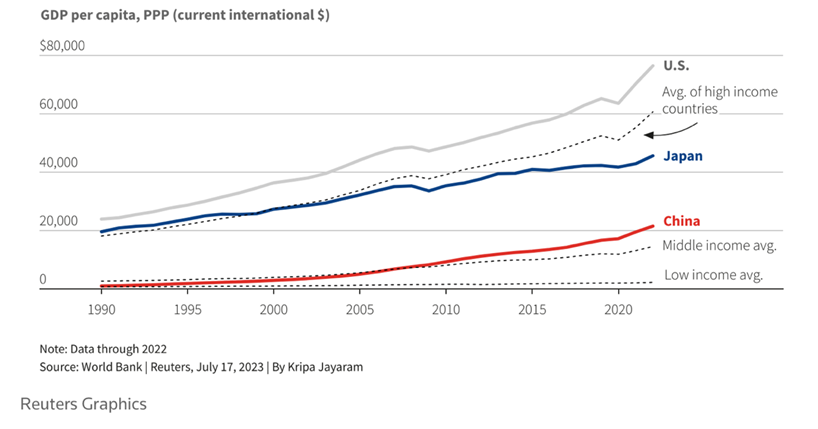

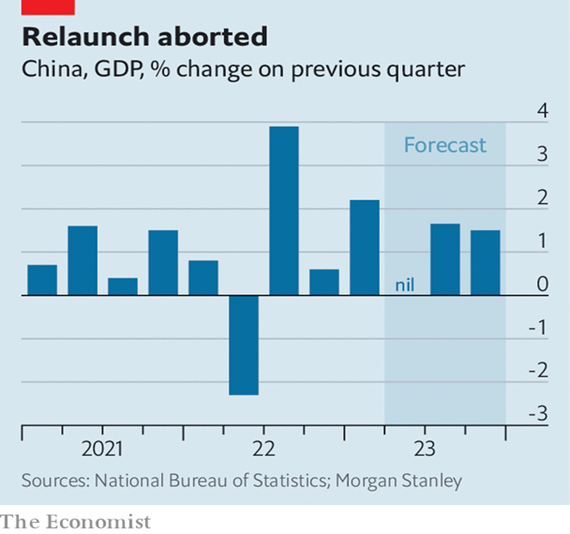

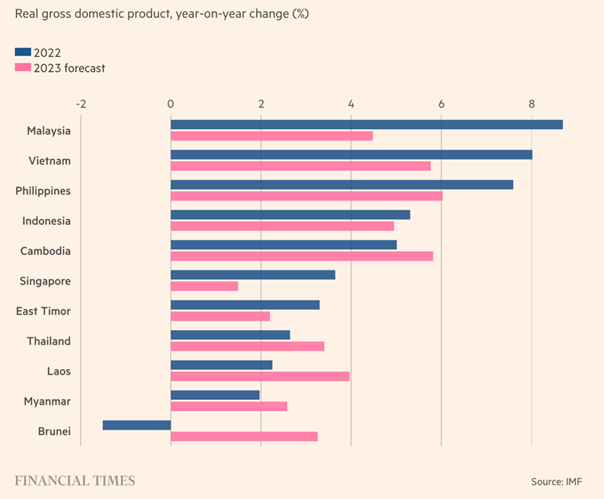

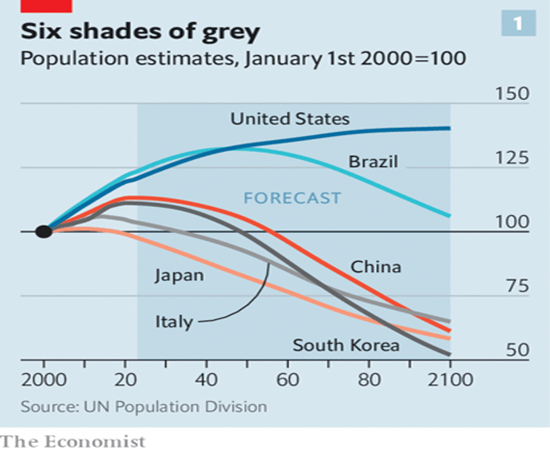

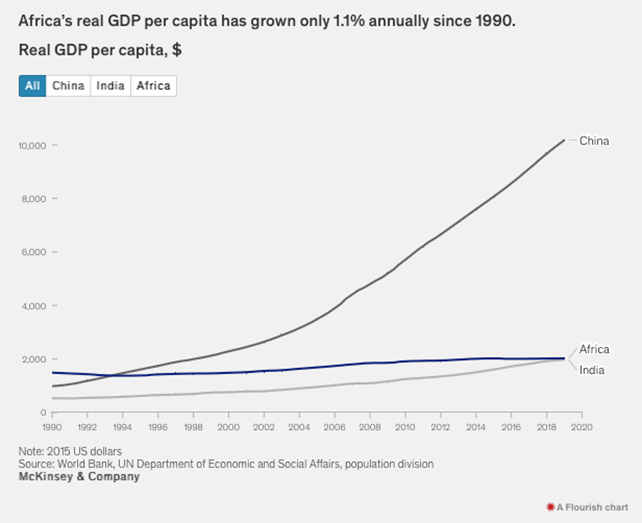

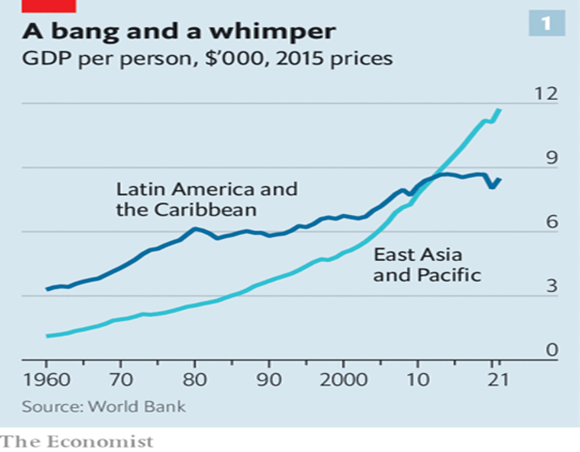

“Will China ever get rich? A new era of much slower growth dawns – China is entering an era of much slower economic growth, raising a daunting prospect: it may never get rich. ‘It is unlikely that the Chinese economy will surpass that of the United States within the next decade or two,’ said Desmond Lachman, a senior fellow at the American Enterprise Institute. And China’s workforce and consumer base are shrinking while the cohort of retirees is expanding.”, Reuters, July 17, 2023

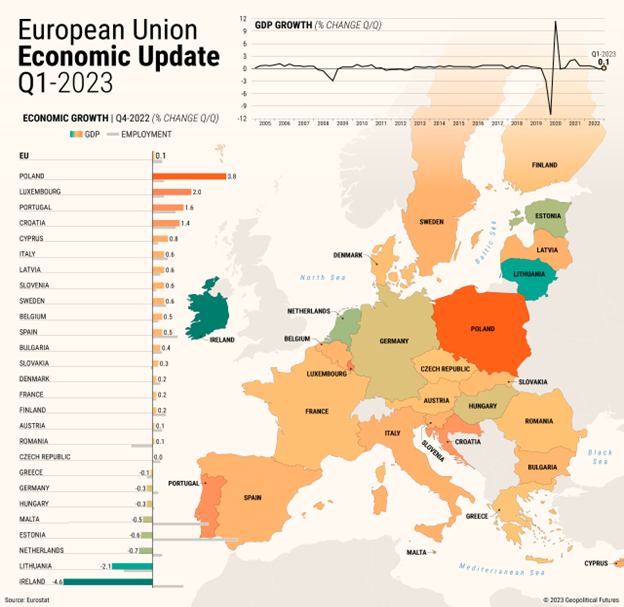

European Union

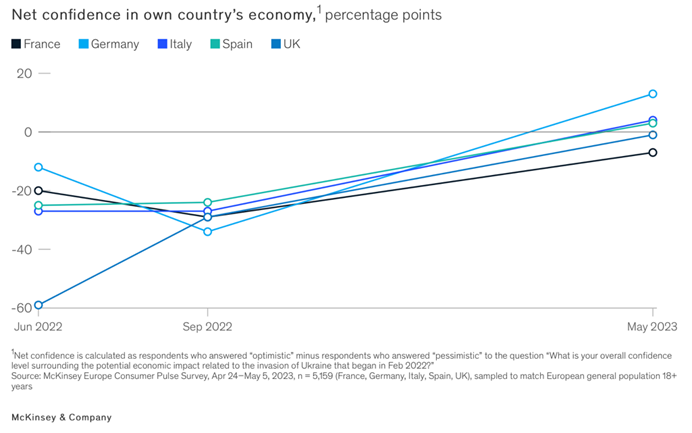

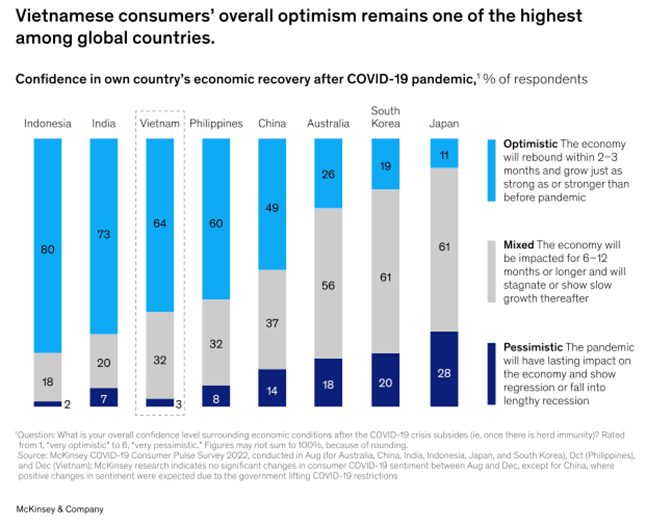

“High hopes despite high prices: An update on European consumer sentiment – Consumer confidence has grown dramatically across the continent—but geopolitical concerns and price increases continue to affect how consumers intend to spend. A sunnier outlook emerges in Europe. German consumers report the highest increase in net confidence, at 13 percentage points (up from –34 in September 2022), as well as the highest level of optimism—31 percent of respondents say they expect their country’s economy to rebound within two to three months and grow just as strong or stronger than it was before the conflict in Ukraine began.”, McKinsey & Co., July 14, 2023

Latin America

“What could a new era mean for Latin America? The pandemic hit Latin America hard, inflation has raised pressure on the continent’s low-income groups, and polarizing political tensions have been escalating. In Latin America, as in the rest of the world, these are volatile and uncertain times. Increasing trade with China and the rest of the world has shifted the balance away from the United States.”, McKinsey & Co., July 20, 2023

Japan

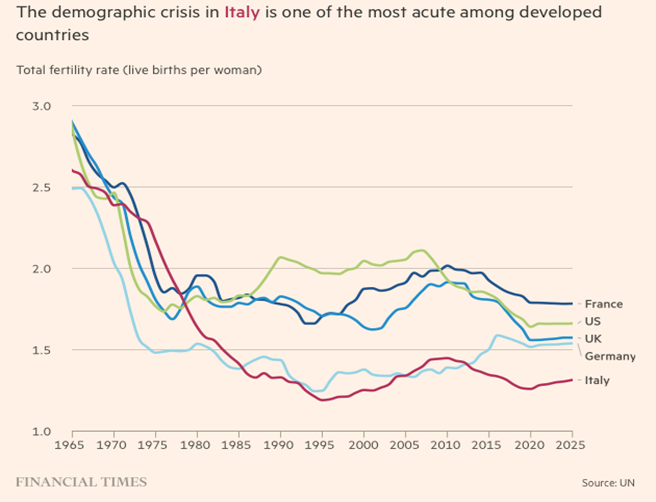

“Meet a Company Pioneering Work-Life Balance – Japanese trading houses like Itochu Corp., Mitsui & Co., Mitsubishi Corp. and Sumitomo Corp. have underpinned our country’s postwar economic miracle. But they also embody our corporate culture, characterized by male dominance, long working hours and pressure to join drinking parties with bosses and clients after work. So when Masahiro Okafuji became chief executive officer of Itochu in 2010, he made improving productivity a top priority to compete against rivals in Japan and made drastic changes to its employees working hours, his approach was counterintuitive. he banned working in the office after 8 p.m. with rare exceptions and had security guards and human resources staff scout Itochu’s office building in Tokyo, telling people to go home. Those clinging to their desks were told to come in early the next day to get their work done — and get paid extra. A decade later, the company — whose businesses range from the FamilyMart convenience store chain to metals trading — reported a change that even surprised management. The fertility rate among full-time employees had doubled in the years since Okafuji became CEO, reaching almost two children per female in the fiscal year ended March 2022. That far exceeds Japan’s current national rate of about 1.3.”, Bloomberg, July 17, 2023

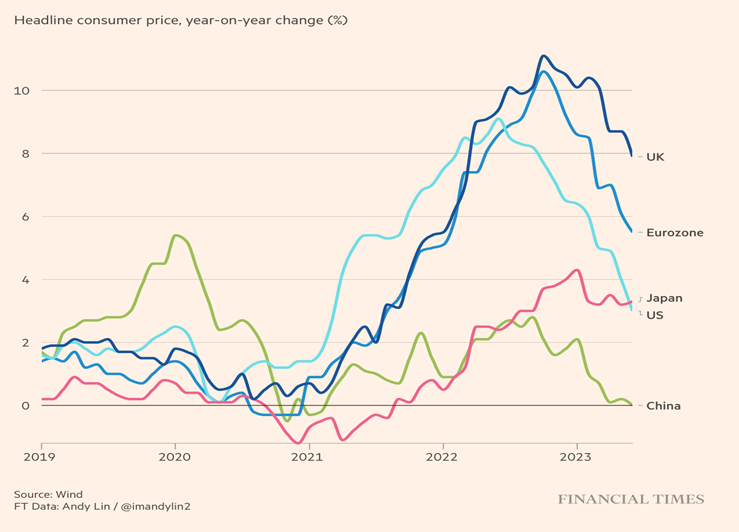

“Japan’s inflation outpaces US price rises for first time in 8 years – Asia’s most advanced economy is no longer an outlier in inflation. Japan remains the world’s only central bank with negative interest rates, and any reversal of this strategy would have massive implications for global financial markets. Annual inflation of the consumer price index and core CPI, which excludes fresh food, rose from 3.2 per cent in May to 3.3 per cent in June, according to data released on Friday.”, The Financial Times, July 20, 2023

Malaysia

“Nasdaq ranks Malaysia best place in Asia to retire ahead of Vietnam, Indonesia – Malaysia was the safest place to retire in Asia, based on its peace score and average monthly cost of living, according to US-based financial services corporation Nasdaq. Malaysia ranks first in a list of the 10 safest places to retire in Asia, according to US-based financial services corporation Nasdaq. “Malaysia takes the number one spot with a cost of living index of 22.9 and a GDP of US$481.9 trillion. With average monthly expenses at just over US$1,000, it’s an excellent place for retirees to consider,” it said. Runner-up in the list is Kuwait, with a global peace index of 1.739 and an average monthly cost of living of US$1,741.”, South China Morning Post, July 16, 2023

New Zealand

“New Zealand ranked best in world for work/life balance – The global index study by Remote, a global payroll, tax, HR and compliance supplier for distributed teams, assesses the quality of life-work balance in the world’s top 60 GDP countries, ranking each nation out of 100. The overall score is determined through factors including minimum wage, sick leave, maternity leave, healthcare availability, public happiness, average working hours, and LGBTQ+ inclusivity. The top 5 places on the list were filled by New Zealand, Spain, France, Australia and Denmark. The United States is ranked a lowly 53rd in the index owing to a lack of statutory annual leave or sick pay, and the absence of a universal healthcare system.”, Franchise New Zealand, June 29, 2023

United Kingdom

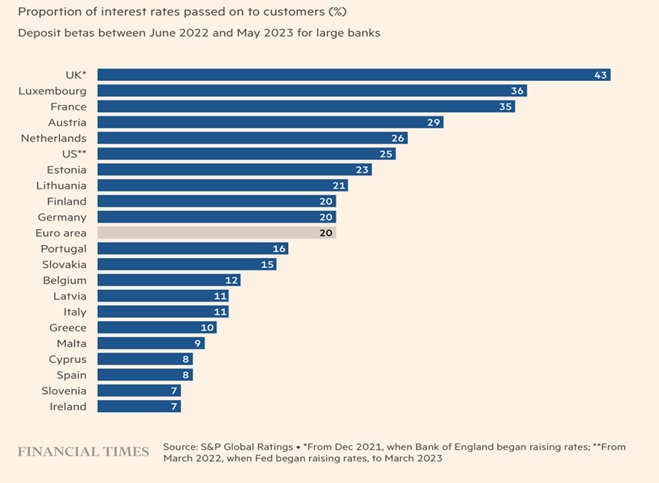

“UK banks lead global rivals in passing on interest rate benefits to savers – US and European lenders come under pressure to share more of their haul with customers. UK banks have handed more of the benefits of interest rate rises to savers than their counterparts in Europe or the US, as politicians, regulators and clients push for a greater share of the haul. Global banks are coming under pressure to pass on the benefits of higher interest rates to their customers — but lenders in less competitive markets have proved far less generous than others, according to an analysis by rating agency S&P.”, The Financial Times, July 23, 2023

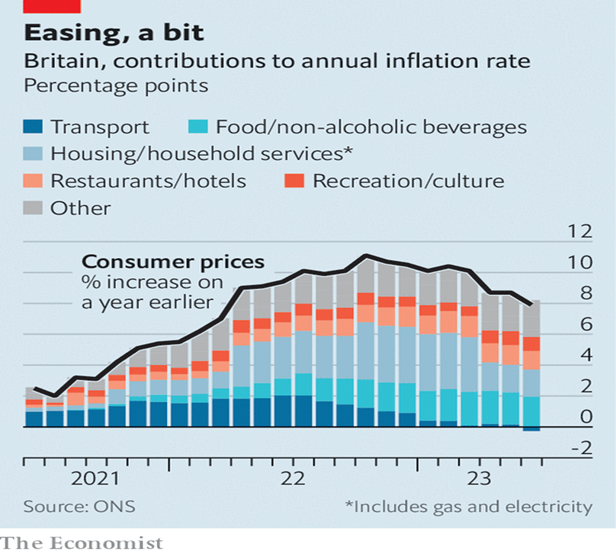

“British inflation may not be as sticky as thought – Inflation figures covering the year to June showed that the rate of price growth is not proving as stubborn as it had previously appeared. The headline rate of inflation fell from 8.7% in May to 7.9% in June, a bigger drop than the fall to 8.2% that economists had been expecting.”, The Economist, July 19, 2023

United States

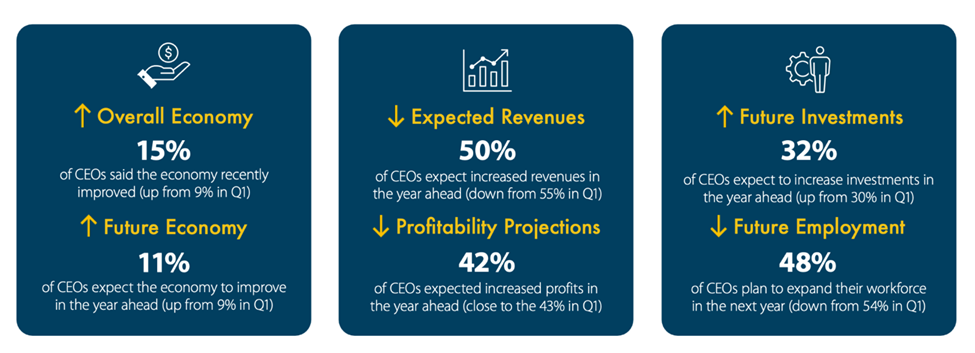

“Vistage CEO Confidence Index Report Q2 – Using ITR Economics rate-of-change methodology, analysis has revealed that the Vistage CEO Confidence Index is a leading indicator of the U.S. Industrial Production Index 9 months in advance. This report captures CEO economic sentiment and strategic intent for the next 12 months. Vistage July 2023

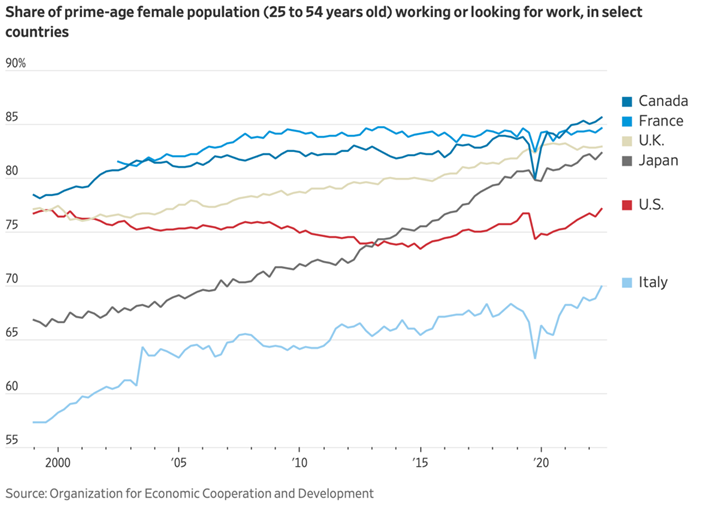

“Americans in Their Prime Are Flooding Into the Job Market – Share of people between 25 and 54 working or seeking jobs rose this year to highest level since 2002. The resurgence of midcareer workers is driven by women taking jobs. The labor-force participation rate for prime-age women was the highest on record, 77.8% in June. (US) Men, however, tend to be employed at higher rates. The overall prime-age participation rate rose in June to 83.5%, the highest since 2002.”, The Wall Street Journal, July 22, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Applebee’s and IHOP head to Japan—virtually – The brands will also make their debuts in France, Belgium and the Netherlands through a partnership with Franklin Junction, which matches brands with “host kitchens” that sell their food for delivery only. Dine’s first virtual location with Franklin Junction is scheduled to open in Japan in the fourth quarter. It will add to a growing international footprint at both brands: At the end of last year, Applebee’s had 109 non-U.S. units, up from 102 the prior year, and IHOP had 104 compared to 94 in 2021.”, Restaurant Business, July 19, 2023

“Chipotle: First International Agreement Intriguing but Unlikely to Move the Financial Needle – We don’t expect wide-moat Chipotle Mexican Grill’s CMG first international development agreement to prove financially material, and we continue to view the shares as pricey. Nevertheless, we appreciate the strategic rationale behind the deal with Alshaya Group and will keep a close eye on its success; reasonable uptake in the Middle East and Africa could augur well for a deeper foray into larger and more strategically important markets in Western Europe while increasing the chances of entry into markets like China that global restaurant peers have traditionally approached through franchise agreements.”, Morningstar, July 18, 2023

“Firehouse Subs Starts Global Expansion With New Swiss Location – Restaurant Brands International (RBI), the parent company of Firehouse Subs, confirmed that the Swiss restaurant opening is the beginning of the brand’s journey to expand internationally across a number of territories, next stop being Mexico where a deal has already been signed. It appears as if the Zurich location is a company-owned one, with RBI confirming that it will be used to as a showcase for future international developments and will be harnessing technology such as self order kiosks and mobile ordering as well as offering click-and-collect and table service options.”, Forbes, July 24, 2023

“McDonald’s to Spend Over A$1 Billion on Australian Stores – McDonald’s Corp. plans to spend more than A$1 billion ($673 million) on opening and renovating stores in the company’s biggest expansion plans for Australia since the 1990s, according the Australian Business Review. The fast food giant plans to spend about A$600 million on 100 new stores in the country over the next three years, and about A$450 million refurbishing over half of its current network, the paper said, citing Australian CEO Antoni Martinez.”, Bloomberg, July 22, 2023

“McDonald’s Franchisee Surges 50% in 3 Months – (The world’s largest independent McDonald’s franchisee) Arcos Dorados stock climbed as much as 56% off its April 6 low this month amid a growing Latin American appetite for QSR food. Growth drivers include a rising adoption of digital ordering platforms, the expansion of its footprint and the introduction of new menu items. Also the largest restaurant chain in Latin America, Arcos Dorados’ growth story goes beyond technological advancement. Adding more restaurants and drive-thrus to the footprint is also a big focus. This month, the company opened its 223rd McDonald’s location in Argentina. It also launched a Japanese-themed McDonald’s in Brazil to recognize the growing Japanese community there.”, Market Beat, July 20, 2023

“Minor International acquires Sizzler for $23.38m – The group will gain control of over 64 restaurants in Thailand and 10 in Japan. As a 31-year franchisee of Sizzler, MINT has established a fruitful partnership with the seller, Collins Foods Limited (Collins Foods) and played a pivotal role in Sizzler’s success, contributing to its growth and reputation in western casual dining in Asia. MINT is one of Asia’s largest restaurant companies with over 2,500 outlets system-wide in 24 countries under The Pizza Company, The Coffee Club, Riverside, Benihana, Thai Express, Bonchon, Swensen’s, Sizzler, Dairy Queen, Burger King, Coffee Journey and GAGA brands.”, QSR Media, July 1, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Birsbane

“Self Esteem Brands Signs Anytime Fitness Master Franchisee in France – With France, Self Esteem Brands will now have Anytime Fitness clubs operating in 41 countries and territories around the globe. Anytime France is owned by Benoit Hanssen and Matt Burgess, who operate Anytime Fitness clubs across Italy. Under the agreement, they will open and operate Anytime Fitness clubs across Paris, Ile-de-France, Auvergne, Rhone-Alpes, Provence-Alpes, and Cote d’Azur.”, Franchising.com, July 19, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 86, Tuesday, July 11, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, United Kingdom ‘leads’ in inflation while EU markets see falling prices, Japan Air eliminates the need to bring clothes to visit, China’s consumers are not spending, McDonald’s cannot afford to use tomatoes in India, European air traffic subject to strikes in the busy summer season, the crude oil market is $2 trillion, Vietnam becomes an alternate to China.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Organization is what you do before you do something, so that when you do it, it’s not all mixed up.”, A.A. Milne, the author of the “Winnie-the-Pooh” series

“It always seems impossible until it’s done.”, Nelson Mandela

“Those who say it cannot be done should not interrupt those doing it.”, Chinese proverb

Highlights in issue #86:

- (Europe) Air traffic control strike will hit up to 1 in 3 summer flights

- Brand Global News Section: Buffalo Wild Wings®, Carrefour, Five Guys®, KFC®, Subway®, McDonalds® and Taco Bell®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

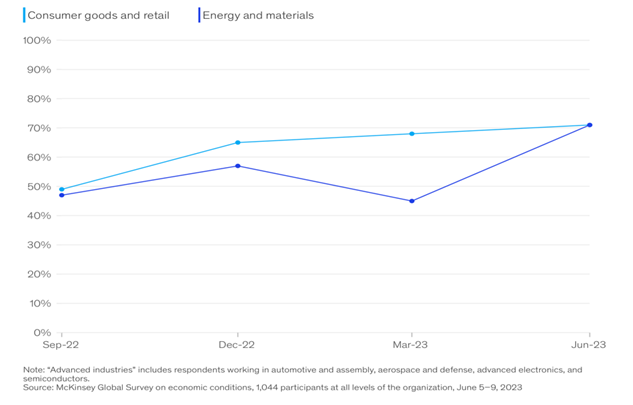

“Profit expectations remain positive, and energy and materials respondents report an upsurge in optimism – After three consecutive quarters of rising expectations, the survey suggests that views on profits have steadied. A clear majority (60 percent) of private-sector respondents still believe their companies’ profits will grow, compared with 63 percent in March. By industry, respondents in energy and materials report the biggest jump since last quarter: 71 percent believe profits will increase in the months ahead, up from 45 percent in March. They are also tied with their peers in consumer and retail as the most optimistic about their companies’ potential profits.”, McKinsey & Co., July 7, 2023

“U.S. Is Top Investment Destination Despite Falling Inflows – Worldwide foreign direct investment fell less sharply than feared last year but there are few signs of a rebound this year. Globally, new overseas investments by businesses fell 12% from 2021 to $1.3 trillion and are unlikely to rebound strongly this year given that executives are “uncertain and risk averse,” the U.N. said. This made last year the worst for foreign investment since 2009 with the exception of 2020, when the Covid-19 pandemic struck.”, The Wall Street Journal, July 5, 2023

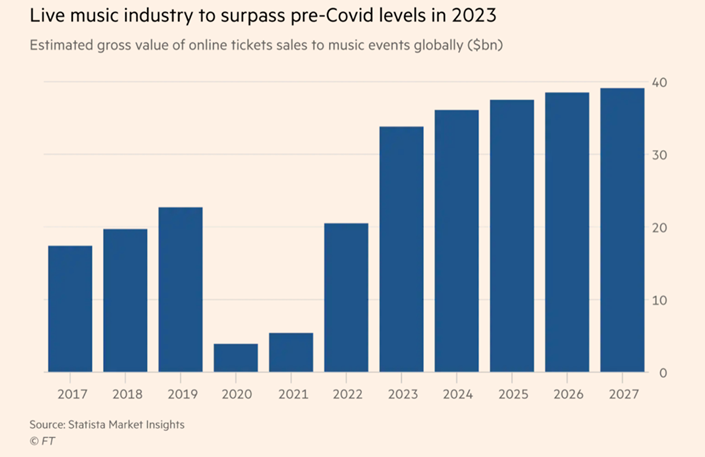

“Live music: concerts lift artist income as AI threat looms – Ticketmaster-owner Live Nation is expecting record sales this year. The value of online ticket sales to concerts, festivals and the opera will surge past pre-Covid levels to hit almost $34bn globally this year. Fake tracks generated by artificial intelligence are already penetrating streaming sites, posing a threat to artists’ brands and income. Singers can be easily mimicked by computers online. In person, fans know the real deal.”, The Financial Times, July 7, 2023

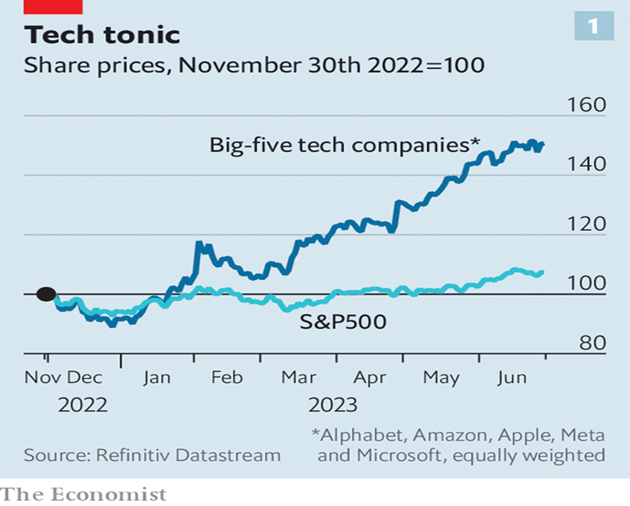

“Our early-adopters index examines how corporate America is deploying AI – Companies of all stripes are using the technology. Technology stocks are having a bumper year. Despite a recent wobble, the share price of the Big Five—Alphabet, Amazon, Apple, Meta and Microsoft—has jumped by 60% since January, when measured in an equally weighted basket. The main reason for the surge is the promise of artificial intelligence (ai). Since the launch in November of Chatgpt, an ai-powered chatbot, investors have grown ever more excited about a new wave of technology that can create human-like content, from poems and video footage to lines of code.”, The Economist, June 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

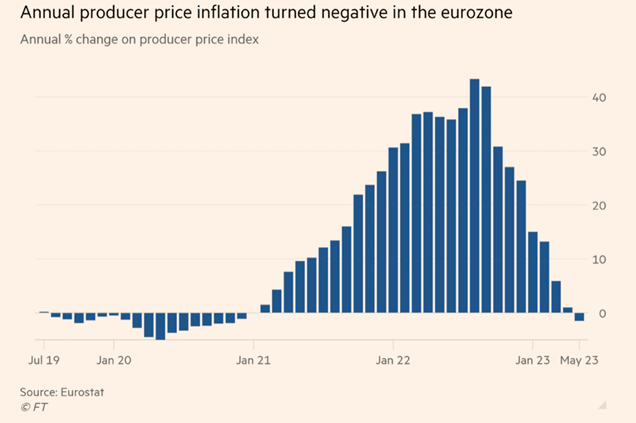

“Eurozone producer prices fall into negative territory for first time since 2020 – House prices decline for two quarters in a row as higher rates weigh on demand. A key measure of eurozone inflation has fallen into negative territory for the first time in two and a half years, in a further sign that the surge in prices that has plagued businesses and households is now in retreat. The EU’s statistics office, Eurostat, said factory gate prices in the region fell 1.5 per cent in the year to May, the first outright decline since December 2020.”, The Financial Times, July 5, 2023

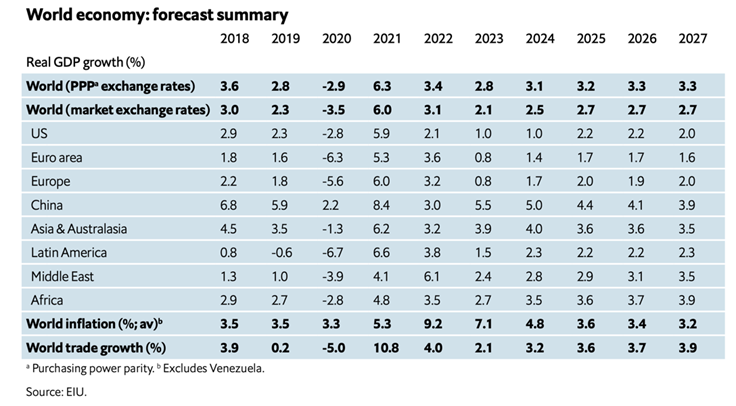

“GLOBAL ECONOMIC OUTLOOK 2023 – Low Growth Amid Persistent Threats – Despite strong headwinds, mostly related to the ripple effects from the war in Ukraine and high global inflation, the global economy has proven resilient so far in 2023. Despite the brighter outlook, growth of 2.1% this year would still represent a slowdown. We expect global commodity prices to continue easing from their 2022 peaks this year, but to remain well above pre-2021 levels. We expect global inflation to ease slightly, from 9.2% in 2022 to 7.1% in 2023.”, The Economist Intelligence Unit, July 2023

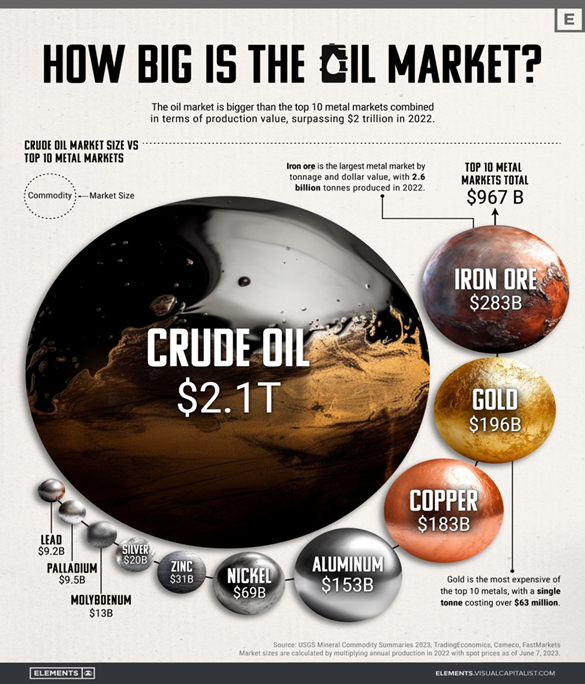

“How Big is the Market for Crude Oil? While the global economy relies on many commodities, none come close to the massive scale of the crude oil market. Besides being the primary energy source for transportation, oil is a key raw material for numerous other industries like plastics, fertilizers, cosmetics, and medicine. As a result, the global physical oil market is astronomical in size and has a significant economic and geopolitical influence, with a few countries dominating global oil production.”, Visual Capitalist / Trading Economics / U.S. Geological Survey, June 30, 2023

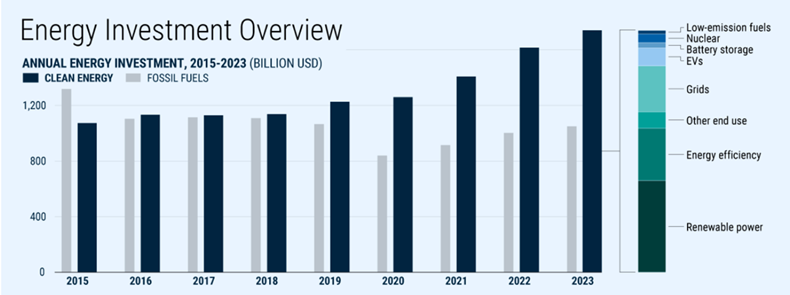

“Investment in Clean Energy Is Booming – China, Europe and the U.S. are leading the way. The International Energy Agency expects $2.8 trillion of investment in energy this year, with roughly 60 percent of that going toward clean energy. In the past two years, clean energy investment has risen 24 percent compared with 15 percent for fossil fuels. Producers of fossil fuels reaped huge profits in 2022, but less than half their cash flow is going toward new supply. Unsurprisingly, Middle Eastern producers lead in terms of spending on new supply.”, Geopolitical Futures, July 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“(Europe) Air traffic control strike will hit up to 1 in 3 summer flights – Up to a third of all European flights are at risk of being delayed or cancelled this summer after air traffic controllers said they would strike. Controllers at Eurocontrol, the European air traffic management body, revealed that they would walk out over the peak summer period after talks over staffing, rosters and pay broke down. An industry source said it could lead to delays or cancellations of up to 12,600 flights across Europe every day. ‘In a full-blown strike, 20 to 30 per cent of flights would be at least delayed,’ the source said. ‘They are big numbers.’”, The Times of London, July 6, 2023

“Japan Airlines gives tourists chance to reduce baggage by renting clothes – Carrier embarks on a year-long experiment designed to help reduce CO₂ emissions. Visitors to Japan are being offered the ultimate chance to travel light: pack underwear and a toothbrush but rent all your clothes on arrival and ditch the environmentally unfriendly suitcase. Under a year-long experiment that began on Wednesday, passengers travelling with Japan Airlines (JAL) can rent outfits by season, size, formality and colour scheme. Under the scheme, a prospective visitor to Japan can reserve their clothes up to a month in advance to use for two weeks.”, The Financial Times, July 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Brazil

“Brazil’s tax reform wins approval in lower house of Congress – Senate vote now needed to simplify one of world’s most complicated tax regimes. Fernando Haddad, finance minister, hailed the successful votes on the legislation to simplify a web of duties and levies. Attempts at tax reform have for years bedevilled lawmakers and officials. It could also boost growth, adding as much as 2.39 per cent to gross domestic product over the next eight years, according to estimates from the Institute for Applied Economic Research.”, The Financial Times, July 6, 2023

Canada

“Canada posts surprise $3.4-billion trade deficit for goods, largest since 2020 – Led by a decline in energy and agriculture exports, Canada posted a $3.4-billion merchandise trade deficit in May, down from a revised $894-million surplus in April, Statistics Canada reported Thursday. Bay Street forecasters had expected a $1.15-billion surplus that month. Goods exports declined 3.8 per cent due to both falling prices and lower shipments. In volume terms, exports decreased 2.5 per cent. Meanwhile, imports were up 3 per cent overall and 3.5 per cent in volume terms.”, The Globe and Mail, July 7, 2023

China

“China on brink of consumer deflation – Latest signs of economic weakness likely to spur calls for government stimulus measures. China’s economy teetered on the brink of deflation in June, adding to calls for Beijing to launch a stronger stimulus package to sustain the country’s sputtering post-Covid recovery. The consumer price index was flat year on year and declined 0.2 per cent compared with the previous month, while factory gate prices fell at the fastest pace since 2016 as demand for consumer and manufactured products softened.”, The Financial Times, July 10, 2023

India

“McDonald’s Stops Using Tomatoes In India Amid Record Prices—Alters ‘Maharaja Mac’ – McDonald’s restaurants in North and East India have stopped serving tomatoes in its burgers and wraps over what the company claims are quality and supply issues as surging prices of the vegetable in parts of the country have triggered internet jokes, music videos, heists and protests. The American fast-food giant’s Indian franchisee, Connaught Plaza Restaurants Ltd, put up notices across its stores on Friday saying it has not been able to get ‘adequate quantities of tomatoes which pass our stringent quality checks,’ despite its ‘best efforts.’”, Forbes, July 7, 2023

Indonesia

“Indonesia Regains Upper-Middle Income Rank on Growth Rebound – Nation’s income per capita increased to $4,580 in 2022 Improved ranking to help nation hit high-income status goals. A strong post-pandemic rebound has pushed Indonesia back into the upper-middle income band of countries, according to the World Bank, putting it back on track to pursue its high-income status goal. Indonesia reclaimed the rank this year as gross national income per capita climbed to $4,580, based on the bank’s latest classifications. It’s an improvement from the previous reading of $4,140, which had kept it in the lower-middle income status for the second straight year in 2022.”, Bloomberg, July 2, 2023

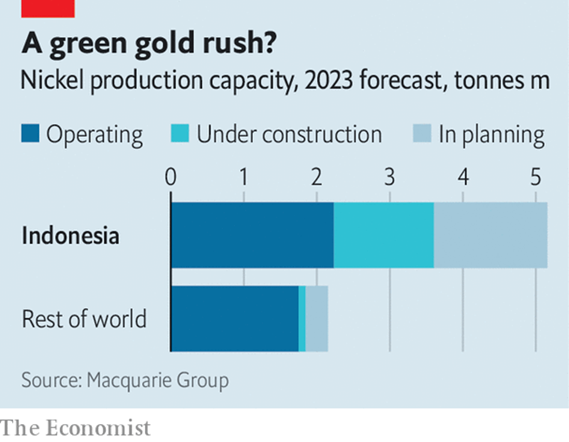

“New technology could cement Indonesia’s dominance of vital nickel – Indonesia is already the world’s biggest producer of nickel, a metal that is—among other uses—vital for building high-performance batteries. Demand for those is expected to increase hugely as demand for electric cars ramps up. Helped by new technologies for extracting nickel from the soil, Indonesia is planning big production increases. Macquarie Group, an Australian financial firm, thinks that by 2025 the country could supply 60% of the world’s nickel, up from around half today.”, The Economist, July 5, 2023

Japan

“Japanese workers are finally seeing their pay rise – Japanese workers have seen their pay go up at a record rate after the government called on companies to help employees facing rising prices. Official figures show that compared to a year earlier wages rose by 1.8% in May, the fastest pace in 28 years. The most recent official reading of Japan’s inflation rate showed that core consumer prices rose by 3.2% in May from a year earlier.”, BBC News, July 7, 2023

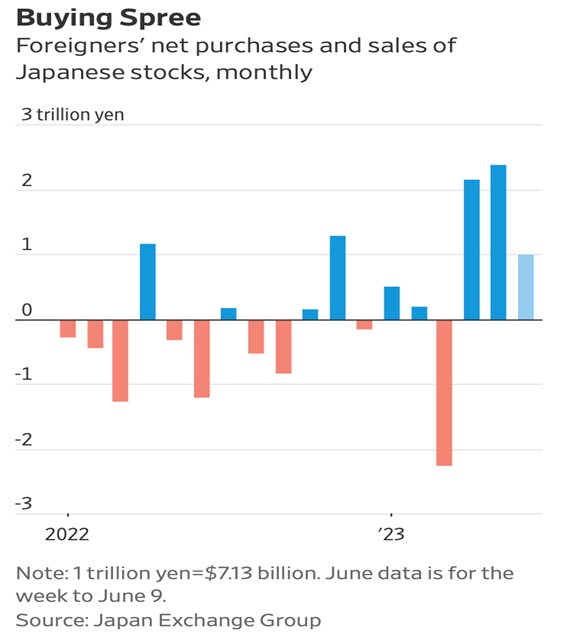

“Japanese stocks soar to 33-year high – The Topix index has jumped by more than 20% in 2023 to become the world’s best-performing major market. The Nikkei 225, another key index, has climbed by 27% to a 33-year high. The world’s third-largest economy is “basking in a post-pandemic glow”, says Vivek Shankar in The New York Times. Consumption is on the rise and tourists have returned. While inflation has wreaked havoc in other economies, in Japan price pressures mark a welcome break from decades of grinding deflation. Growth, which hit an annualised rate of 2.7% in the first quarter, is ‘surprisingly solid’.”, Money Week, July 3,2 2023

United Kingdom

“Britain is the only G7 country where inflation is still rising – Britain has been singled out as currently the least successful country in the G7 at curbing inflation and one of the three worst in the wider 38-nation Organisation for Economic Co-operation and Development. In its latest snapshot of inflation around the developed world, the organisation said that in the UK it picked up speed from 7.8 per cent in April to 7.9 per cent in May. That compared with an average reduction in inflation from 5.4 per cent to 4.6 per cent in the seven-nation club, which includes the United States, Japan and Germany.”, The Times of London, July 5, 2023

“Le Pain Quotidien is closing all but one of its London stores – The brunch and bakery chain has gone into administration. Sarah Rayment, global co-head of restructuring at Kroll, said: ‘Pressures on parts of the hospitality and casual dining sector have been well highlighted. Brunchco UK Limited which is predominantly located in London has suffered from reduced revenues as a result of decreased footfall in the capital, high rents and increased wage costs. Le Pain Quotidien, which is French for ‘the daily bread’, was founded in Brussels in 1990 and has more than 260 locations worldwide.”, Time Out, July 5, 2023

United States

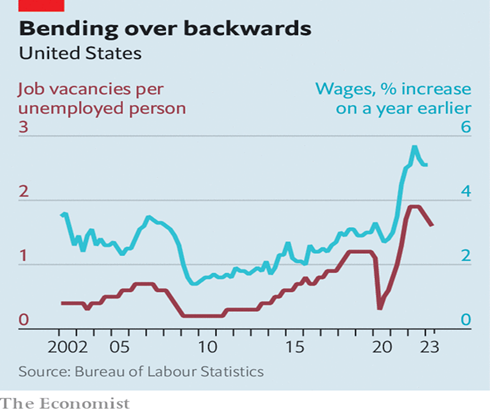

“Does America need more unemployment? The labour market remains too hot for comfort. For every unemployed person in America, there are 1.6 jobs available, a ratio that is down a tad since mid-2022, but well in excess of the pre-pandemic norm. Since February 2020—before covid hit America—the economy has added nearly 4m jobs, putting employment above its long-term trend line. There do not appear to be many workers left on the sidelines: some 84% of prime-age workers (aged between 25 and 54) now participate in the labour force, the most since 2002 and just a percentage point off an all-time high.”, The Economist, July 9, 2023

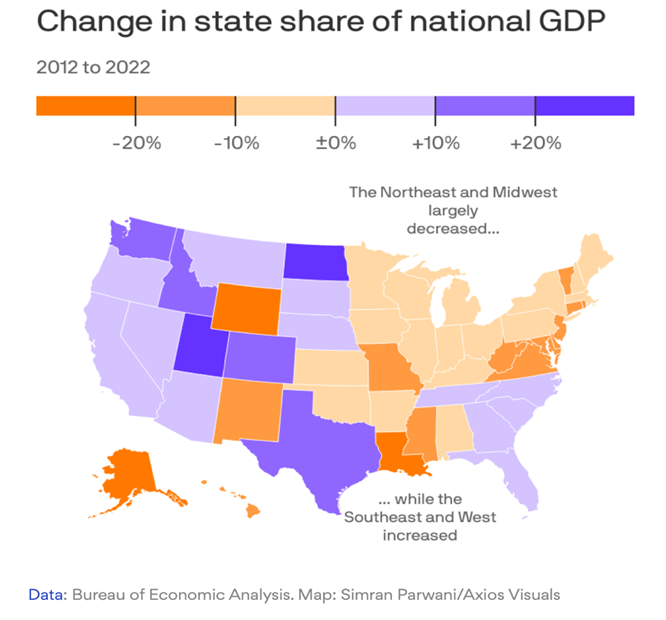

“The Northeast is losing out to America’s new economic hotspots – Six fast-growing states in the South now add more to the national GDP than the Northeast, the perennial powerhouse, Bloomberg reports. Americans are spreading out, physically and economically…..Florida, Texas, Georgia, the Carolinas and Tennessee — are in the middle of a “$100 billion wealth migration” as the U.S. economic center of gravity tilts south, Bloomberg notes. The switch happened during peak COVID. There’s no sign it’ll reverse. A flood of transplants helped steer about $100 billion in new income to the Southeast in 2020 and 2021 alone, while the Northeast bled out about $60 billion, Bloomberg writes from IRS data.”, Axios, July 9, 2023

Vietnam

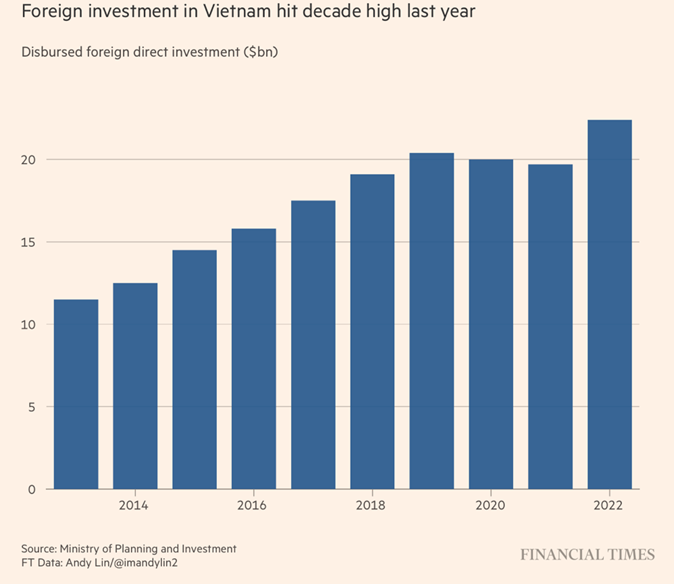

“Vietnam becomes vital link in supply chain as business pivots from China – The accelerating shift to countries such as Vietnam is part of a growing ‘China plus one’ strategy to redraw global supply chains. As rivalries grow between China and the US over technology and security, more companies fear curbs on what and where they can manufacture. As a result, many are supplementing production in China, still the world’s biggest manufacturing hub, with expansion to other countries. ‘Koreans, Taiwanese, Chinese — there seems to be an unstoppable transfer or at least relocation from mainland China into other countries,’ said Koen Soenens, Deep C’s sales and marketing director. ‘Foreign companies currently in China, ask them what’s next. [They say] ‘For the Chinese market, we stay in China; to serve our overseas clients, we are looking for a new location’.”, The Financial Times, July 2, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Buffalo Wild Wings ends its Canadian operations – Buffalo Wild Wings has closed its remaining Canadian restaurants. In a statement, the U.S.-based chicken wing chain thanked its customers for supporting the business ‘throughout the years.’ ‘Buffalo Wild Wings routinely evaluates locations to serve our guests best, and we have made the difficult decision to close our sports bars in Canada,’ a spokesperson for the chain wrote in a statement Wednesday.”, BNN Bloomberg, June 28, 2023

“Carrefour Brasil bets on know-how to expand small stores operation – Grupo Carrefour Brasil (CRFB3.SA) launched a franchise model of convenience stores in the Brazilian market on Wednesday, aiming to tap into its know-how from years of experience in Europe, a top executive said. Carrefour Brasil’s convenience executive director Joao Edson Gravata said that the franchise format would put Carrefour in a stronger position to take on competitors. The convenience segment, which is mainly in stores operated by large chains, is relatively new in Brazil, Gravata said. We are part of this context, we have an important presence, and we want to expand it.’”, Reuters, June 29, 2023

“Five Guys burger scalpers face online criticism as popular US chain makes South Korean debut – The asking price on a second-hand platform for two cheeseburgers and fries from popular US chain Five Guys was more than double the regular cost. A South Korean customer has come under fire for trying to capitalise on the craze for Five Guys burgers, which this week opened its first outlet in the country, by selling a snack set for 100,000 won (US$76) on an online marketplace. The US fast-food chain’s store in Seoul’s wealthy Gangnam district drew snaking queues as diners braving the wet weather jostled to grab a bite.”, South China Morning Post, June 28, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Inflation hits harder at chicken chain – Chicken chain KFC’s price increases are currently outpacing Australian inflation rates and the price increases of rival fast food franchise McDonald’s, according to a media report. On average, KFC’s prices have increased 14.7% over the last 12 months, while McDonald’s have increased by 8% since August 2022, however KFC’s main menu items still retail at an average 6% discount to McDonald’s equivalents. KFC attributes the price increases to growing costs of inputs such as potatoes, chicken, wheat and oil, and the impact of wage increases across its workforce.”, The Guardian, June 20, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“McDonald s opened a new restaurant in the Kyiv region – “Construction of the facility was started back in 2021. Due to a full-scale invasion, the project was postponed, and with the resumption of restaurants, it was resumed. With the opening of each restaurant, the company returns favorite dishes and familiar service to Ukrainians, supports local communities and provides more opportunities for employment. Currently, there are 91 McDonald’s restaurants in Ukraine,” the article says.”, (Ukraine) Economic Truth, June 29, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Subway’s CEO led turnarounds at Burger King and Avis. He’s doing it again before the sandwich chain’s $10 billion sale: ‘I have license to try anything and everything’. But between 2015 and 2021, as business cratered, Subway closed 6,000 of its U.S. stores, almost one-quarter of them. The company has now resumed opening new ones. Four years ago, it tapped Chidsey, a turnaround artist who had fixed Burger King some years earlier as CEO, to work his magic again, with owners now eyeing a sale to private equity that reportedly could fetch $10 billion. While sales per restaurant, excluding newly opened or closed ones, are close to where they were in 2012, they’ve risen in each of the last ten quarters.”, Fortune, July 7, 2023

“Subway celebrates 15 new master franchise agreements – Subway has announced that it is strategically expanding its international footprint and has celebrated the signing of its 15th new master franchise agreement since 2021. The brand’s latest agreements in Bahrain, Georgia, Mainland China, Uruguay, Costa Rica and Panama will reportedly add more than 4,000 future restaurants across Europe, Middle East and Africa (EMEA), Asia Pacific (APAC), and Latin America and the Caribbean (LAC) within the next 20 years. Since 2021, Subway says that it has signed 15 master franchise agreements or country development agreements across EMEA, LAC and Asia Pacific, totalling more than 9,000 future restaurant commitments.”, New Food Magazine, July 4, 2023

“Mexican fast-food brand writes off $37 million – Australia – Mexican food-themed restaurant chain Taco Bell has recorded a $37 million impairment and posted a same-store sales decline of 4.8% for the year, according to a media report. Listed multi-brand franchise operator and local operator of Taco Bell, Collins Foods (CKF), remain confident the brand can succeed in Australia despite its negative impact on the group’s full-year profits. CKF reported revenue of $1.3 billon in the year to April 30, but net profits declined by 76% to $12.7 million due to Taco Bell’s results.”, Brisbane Times, June 27, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 85, Tuesday, June 27, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

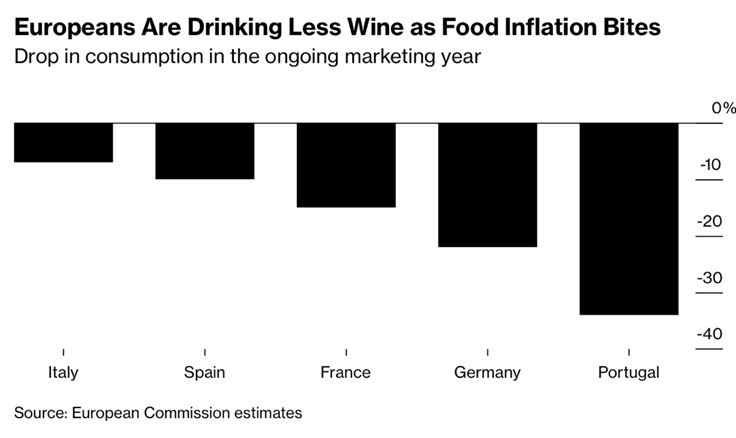

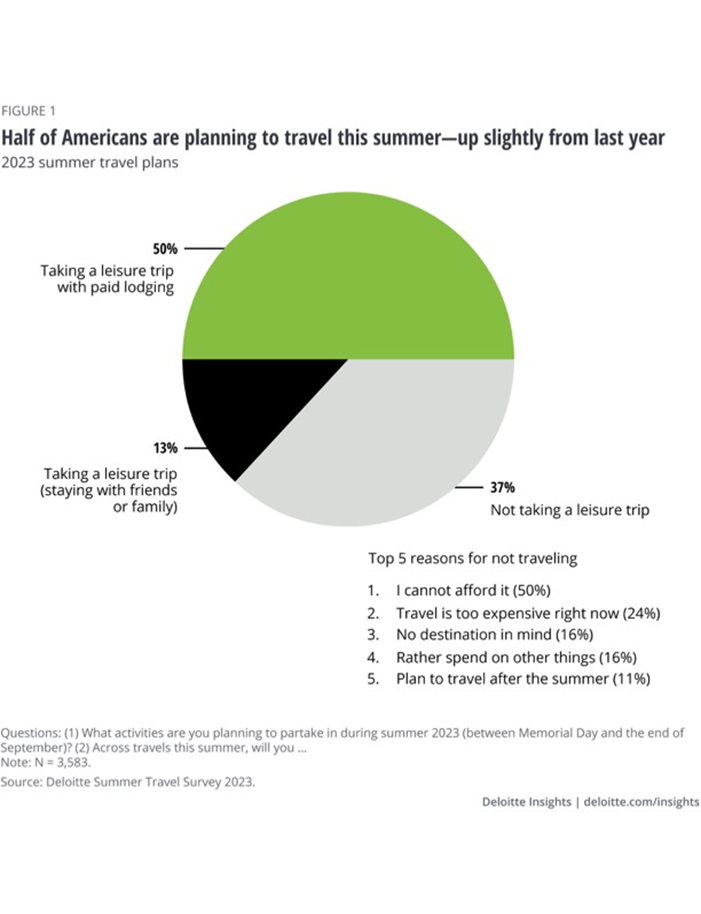

Introduction: In this issue, global inflation is mixed, China is sputtering, there is too much wine in Europe (?), Japan is seeing lots of foreign investment, the United Kingdom will soon charge to enter, global employee engagement reached a record high in 2022, Outback Steakhouse takes over Brazil and Canada is using mass immigration to grow.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

Change before you have to.”, Jack Welch.

“The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday’s logic.”, Peter Drucker

“Whosoever desires constant success must change his conduct with the times.”, Niccolo Machiavelli

Highlights in issue #85:

- Brand Global News Section: 16 Handles®, Burger Fi®, Burger King®, Long John Silver’s®, Outback Steakhouse® and Studio Pilates®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

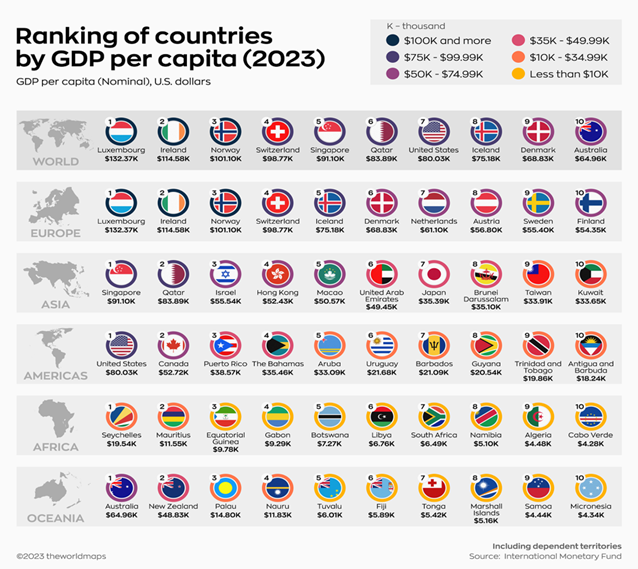

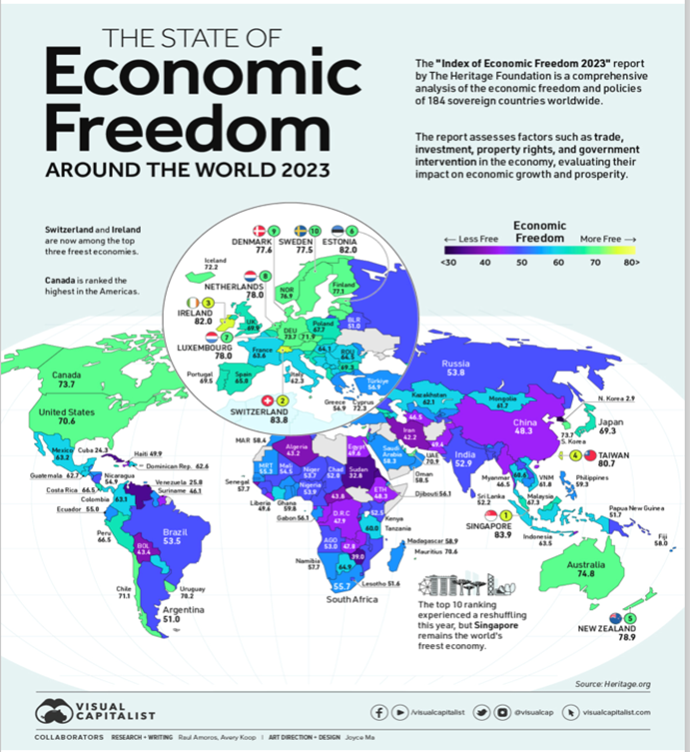

“Top 10 Countries By GDP Per Capita, by Region – GDP per capita attempts to level the playing field by dividing a country’s economic output by its population, effectively giving the average GDP per person. A higher per capita GDP generally corresponds to higher income, consumption levels, and standards of living. The simplicity of this metric also makes it useful for economists and policymakers to communicate levels of economic well-being to the public. The above graphic from the WORLDMAPS ranks the top 10 countries by per capita GDP in different regions, using data from the International Monetary Fund (IMF).”, Visual Capitalist / Worldmaps, June 22, 2023

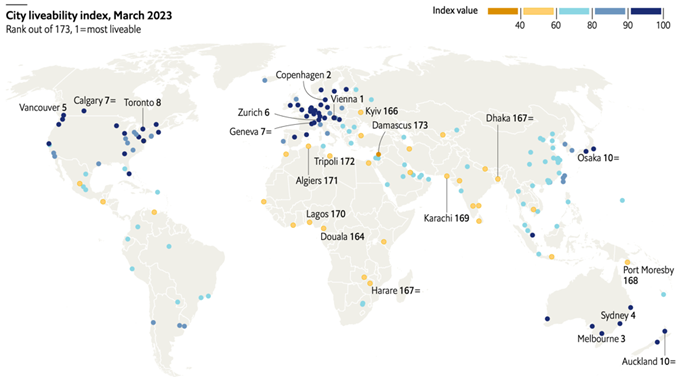

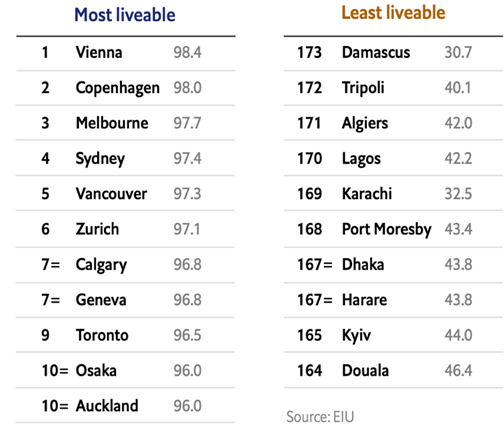

“The world’s most liveable cities in 2023 – Living conditions in cities across the world have fully recovered from the deterioration caused by the covid-19 pandemic, eiu’s latest liveability index shows. It rates living conditions in 173 cities across five categories: stability, health care, culture and environment, education and infrastructure. Cities in the Asia-Pacific region have rebounded the most. The index also suggests that life in cities is a bit better than at any time in the past 15 years.”, The Economist Intelligence Unit, June 21, 2023

“State of the Global Workplace: 2023 Report – Employee engagement reached a record high in 2022. After dropping in 2020 during the pandemic, employee engagement is on the rise again, reaching a record-high 23%. This means more workers found their work meaningful and felt connected to their team, manager and employer. That’s good news for global productivity and GDP growth.”, Gallup, June 2023

“The world’s regulatory superpower is taking on a regulatory nightmare: artificial intelligence – The European Parliament, the legislative branch of the European Union (EU), passed a draft law on Wednesday intended to restrict and add transparency requirements to the use of artificial intelligence (AI) in the twenty-seven-member bloc. In the AI Act, lawmakers zeroed in on concerns about biometric surveillance and disclosures for generative AI such as ChatGPT. The legislation is not final. But it could have far-reaching implications since the EU’s large size and single market can affect business decisions for companies based elsewhere—a phenomenon known as “the Brussels effect.”, The Atlantic Council, June 13, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

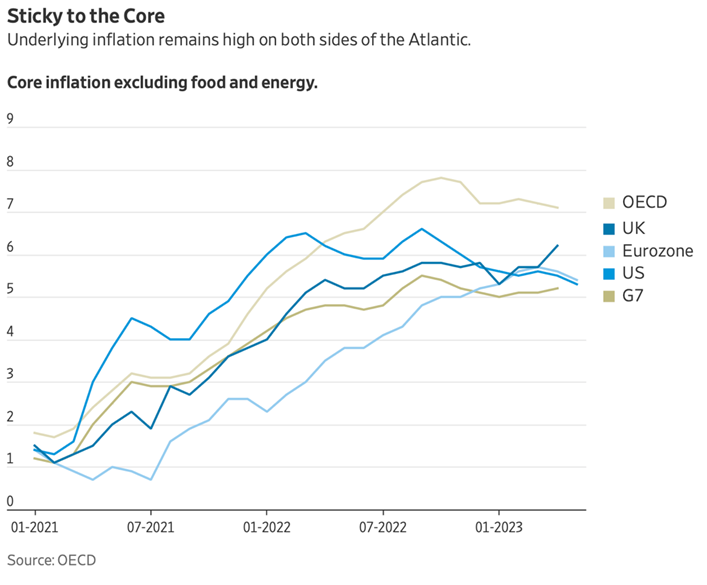

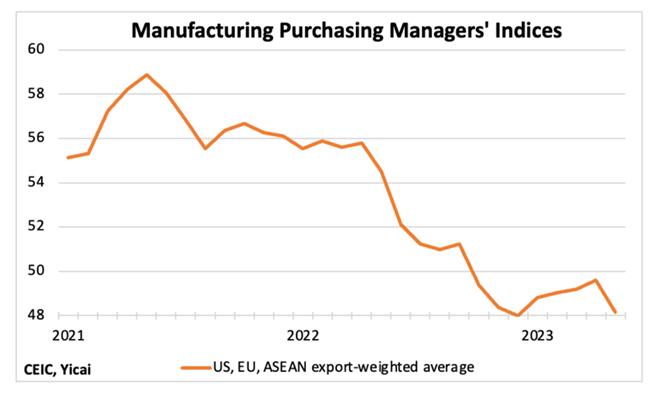

“Why Inflation Around the World Just Won’t Go Away – Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. In the U.S. and Europe, underlying inflation is still around 5% or higher even as last year’s heady increases in energy and food prices fade from view. On both sides of the Atlantic, wage growth has stabilized at high levels and shows few signs of steady declines.”, The Wall Street Journal, June 19, 2023

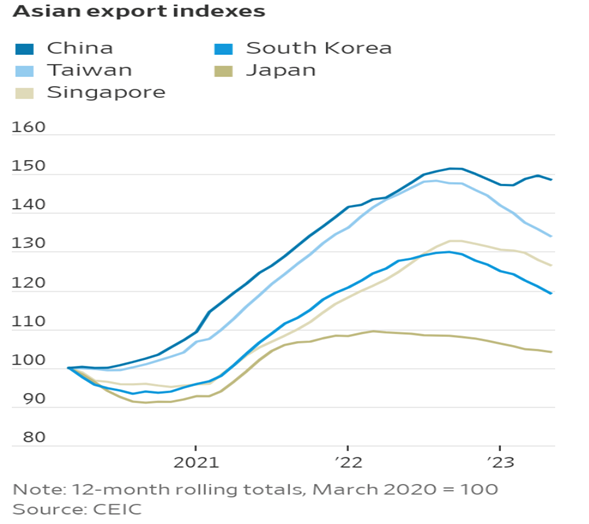

“Trade Woes in Asia Bring Inflation Relief to U.S. Consumers – But slowing exports to Western nations won’t alone stem rapidly rising prices. Sinking global trade is pummeling Asian exports, bringing some relief on inflation to U.S. and other Western consumers. But easing prices for home furnishings, electronics and other manufactured goods don’t signal high inflation will soon be defeated. Wage growth and services price gains are still elevated. And central banks in the U.S. and Europe are warning they aren’t finished raising interest rates in their fight to cool inflation.”, The Wall Street Journal, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The U.K. Will Officially Charge Travelers for Entry Starting This Fall — Here’s How Much: What to know about the U.K.’s Electronic Travel Authorisation visa waiver, which will go into effect in November. The fee, which will be rolled out this fall, will cost travelers £10 ($12.59) per applicant. When it is fully implemented, all foreign visitors without a visa (including those from the United States) will be required to apply for the ETA online in advance of their trip.”, Travel and Leisure, June 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Investors sitting on record $1 trillion cash despite super rebound – Savers have turned away from the volatility of stock markets to the security of term deposits and nervous retirees are drawing down lump sums. Savers have shunned their super funds and deposited a record $1 trillion in term deposits amid growing economic and stock market concerns, despite fund performance rebounding during the past 12 months.”, Australia Financial Review, June 23, 2023

Brazil

“Why beef-loving Brazil is so obsessed with an American steakhouse chain – SÃO PAULO – Deep in the urban sprawl of the Western Hemisphere’s largest city, nestled within a thicket of highways, there is a low-slung shopping mall that boasts an attraction not rivaled anywhere in the United States. The giant Outback Steakhouse. Named the world’s largest Outback in 2018 — and the world’s most lucrative before that — its dimensions and legend since then have only grown. The restaurant is now nearly twice the size of the biggest Outbacks in the United States, where the faux-Australian chain was founded.”, The Washington Post, June 20, 2023

Canada

“Mass Immigration Experiment Gives Canada an Edge in Global Race for Labor – The country’s population growth is among the fastest in the world, bolstering the economy while creating strains in big cities. At a time industrialized countries around the world are confronting declining birth rates and aging workforces, Canada is at the forefront of betting on immigration to stave off economic decline. A country about as populous as California has added more than all the residents in San Francisco in a year. Last week, Canada surpassed 40 million people for the first time ever — with growth only expected to continue at a rapid pace as it welcomes more immigrant workers, refugees and foreign students across its borders.”, Bloomberg, June 18, 2023

“Manufacturer 3M Canada doubles down on remote work in an effort to access broader talent pool – While major employers across North America have spent much of the past year trying to persuade their employees to return to the office more often, the global manufacturing giant 3M Co. is doing just the opposite. The company is making its fully remote-work policy a permanent feature of employment, specifically because it will allow 3M to access a broader global pool of talent, not confined by geographical boundaries. ‘We realized over the pandemic that remote work was an absolutely critical part of being able to meet our hiring needs for knowledge workers,’ said Penny Wise, president and managing director of 3M Canada. ‘So we’re embracing that. It is our comparative advantage.’”, The Globe and Mail, June 17, 2023

China

“Is China’s Recovery Sputtering? Like April’s numbers, the economic data released by the National Bureau of Statistics (NBS) for May were disappointing. For both industrial value added and retail sales, the outcomes the NBS reported were weaker than the predictions of the Chief Economists surveyed by the Yicai Research Institute. There were two areas of weakness. First, it appears that low commodity prices are making it unprofitable for China’s upstream industries to produce. Manufacturers of mid-stream goods have increasingly turned to cheaper imports instead of domestic products. Purchases of foreign coal, crude oil and various ores are all up sharply this year. The second area of weakness was in high-tech consumer products like mobile phones, laptops and tablets. Many of these products are exported and in the cases of mobile phones and laptops, the decline in exports was significantly larger than that of production, suggesting that weak foreign demand for these goods played an outsized role in their reduced production.”, YiCai Global, June 21, 2023