EGS Biweekly Global Business Newsletter Issue 94, Tuesday, October 31, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

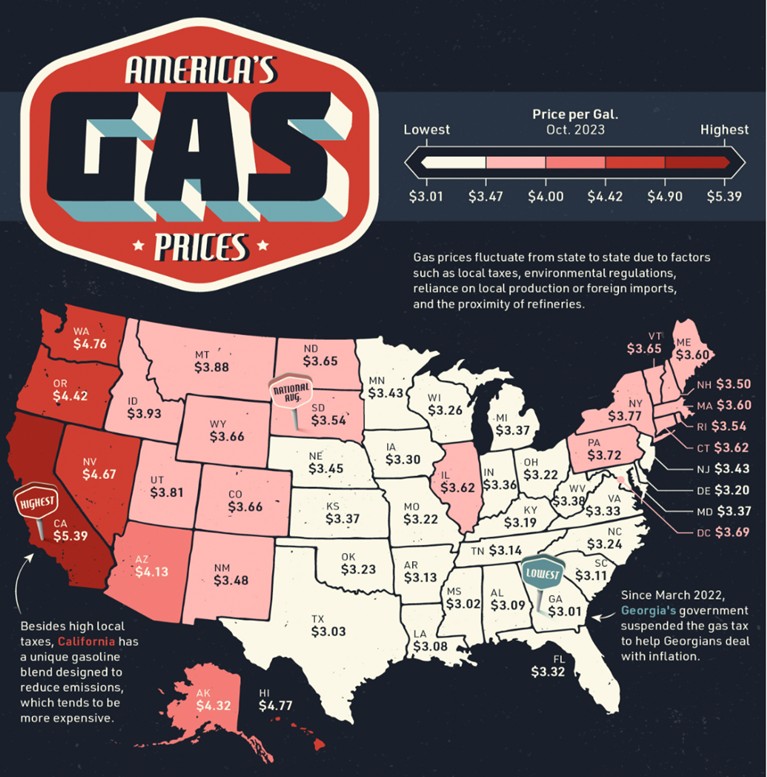

Introduction: In this issue, as we get towards the end of another year there are lots of economic projections coming out. Look at the cost of a gallon of gas in California versus the US Midwest. Overall, global consumer confidence remains broadly stable with some exceptions. And why McDonalds® menu are better in other countries….really.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“The price of greatness is responsibility.”, Winston Churchill

“You cannot escape the responsibility of tomorrow by evading it today.”, U.S. President Abraham Lincoln

“Management is doing things right; leadership is doing the right things.”, Peter Drucker

Highlights in issue #94:

- Brand Global News Section: Cici’s Pizza®, McDonalds®, Pizza Express®, Popeyes®, Pret-A-Manger, Shake Shack® and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

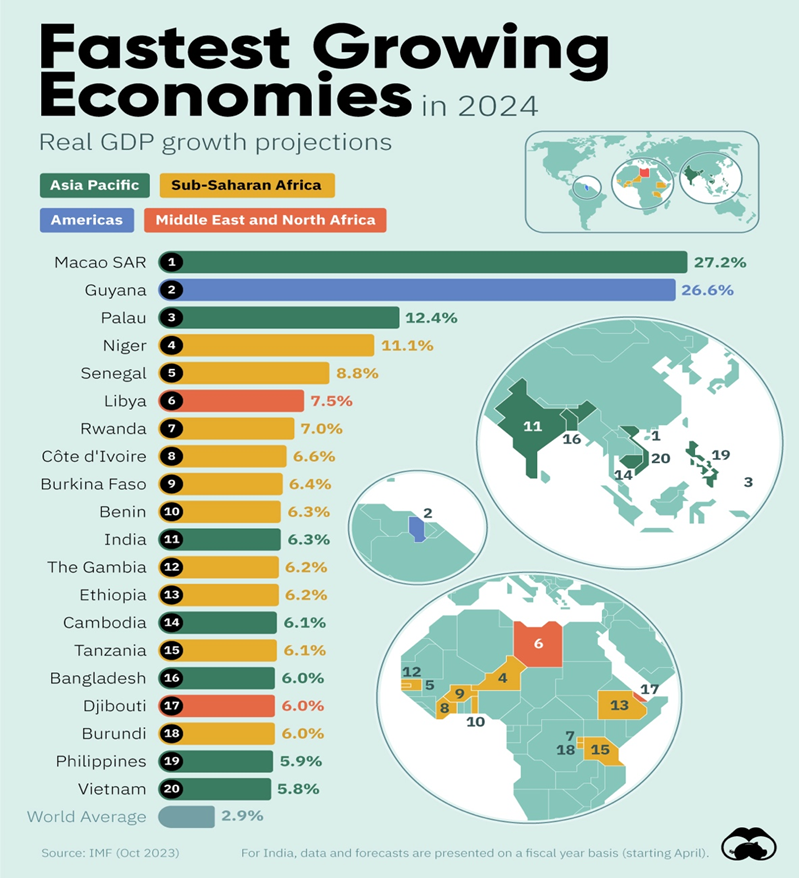

“IMF Projections: The Fastest Growing Economies in 2024 – Which countries will see the most economic growth in 2024? To answer this question, we’ve visualized GDP growth forecasts from the IMF’s October 2023 World Economic Outlook. Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.”, IMF and Visual Capitalist, October 24, 2023

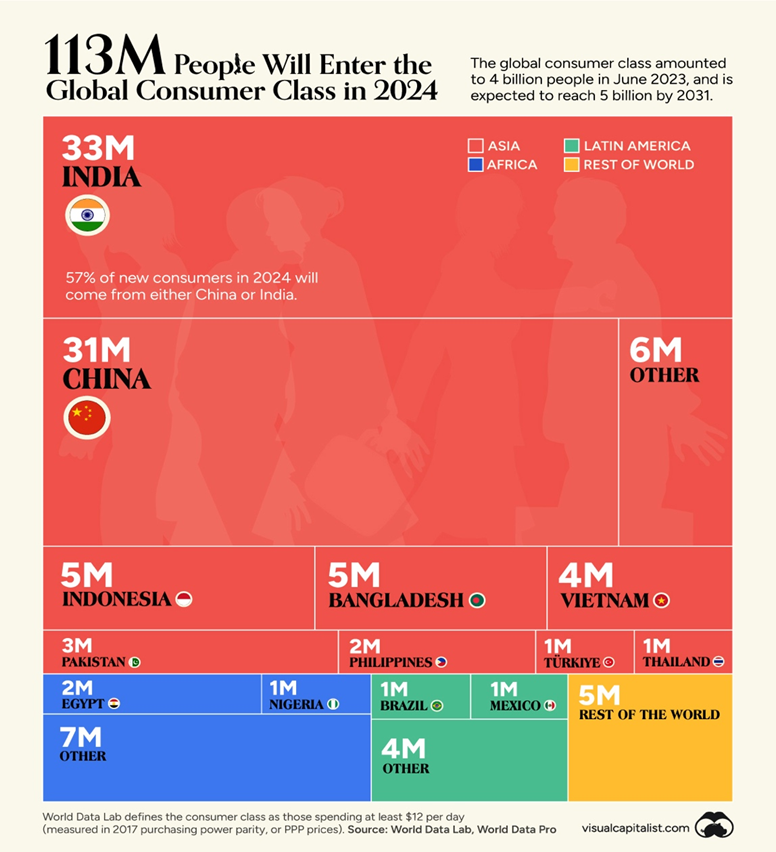

“113 Million People Will Join the Global Middle Class in 2024 – Defined by the World Data Lab as someone who spends at least $12 per day (measured in 2017 purchasing power parity), these individuals are typically rising up in developing regions like Asia and Africa. In this graphic, we’ve created a treemap diagram that shows where the new entrants to this consumer class in 2024 will originate from.”, Visual Capitalist, October 19, 2023

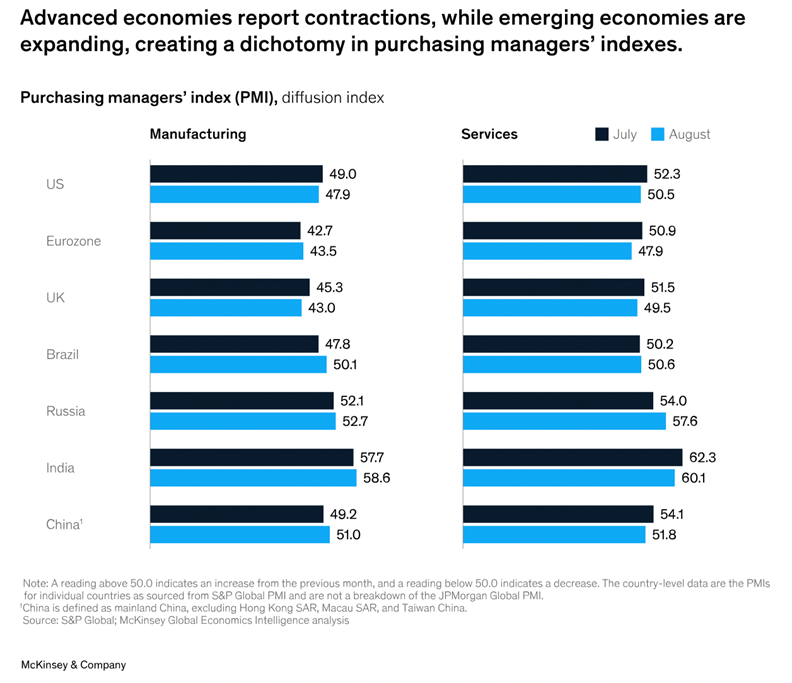

“Global Economics Intelligence executive summary, September 2023 – Some leading indicators improved, though outlook still fragile; confidence stable but consumers lean toward saving; inflation and trade volumes continue downward trend. Overall, consumer confidence remained broadly stable across our surveyed countries but still leaned toward saving rather than spending—although confidence dipped in China. In Brazil, consumer confidence rose to 96.8 in August, up from 94.8 in July—the highest reading since February 2014.”, McKinsey, October 20, 2023

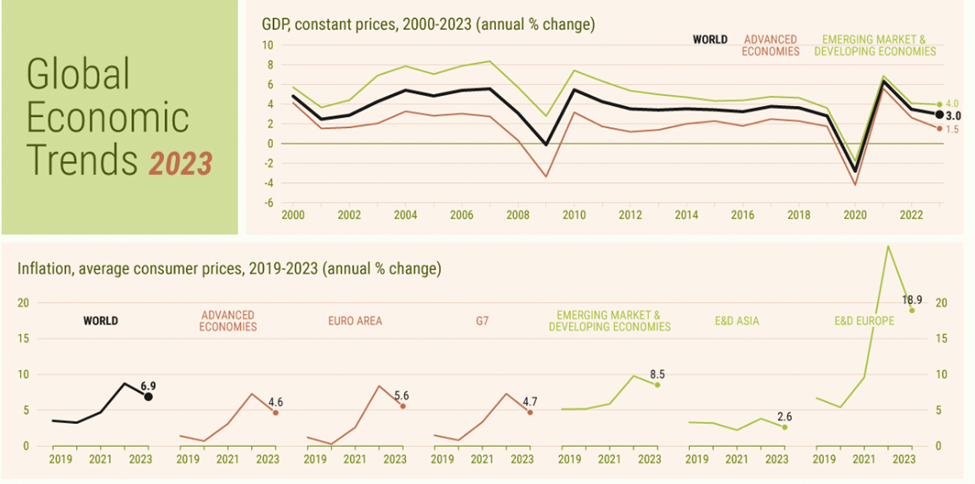

“Global Economic Trends, 2023 – According to a report recently published by the International Monetary Fund, global economic growth will be significantly slower in 2023 and 2024 than the average annual rate over the past two decades. The IMF projects that global gross domestic product growth will be 3 percent in 2023 and 2.9 percent in 2024, lower than the average of 3.8 percent from 2000 to 2019. Meanwhile, inflation is projected to decline this year and next year due to tighter monetary policies in many countries around the world, but it will remain at an elevated level. Overall, global economic growth will be slow and uneven, as it continues its recovery from the pandemic, Russia’s invasion of Ukraine and increases in global commodity prices.”, Geopolitical Futures, October 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

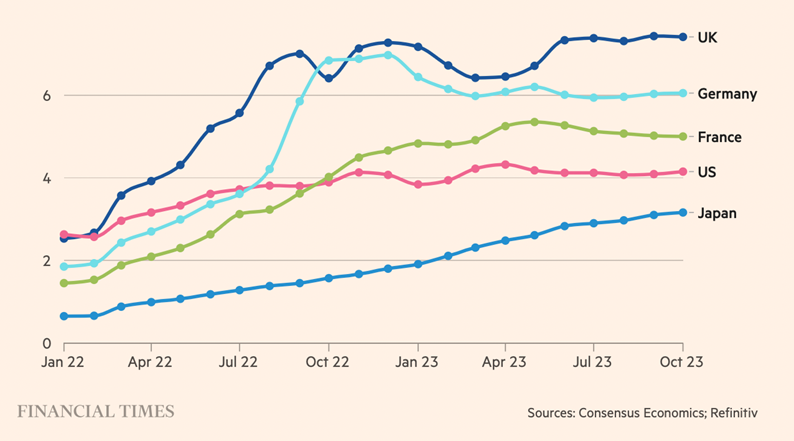

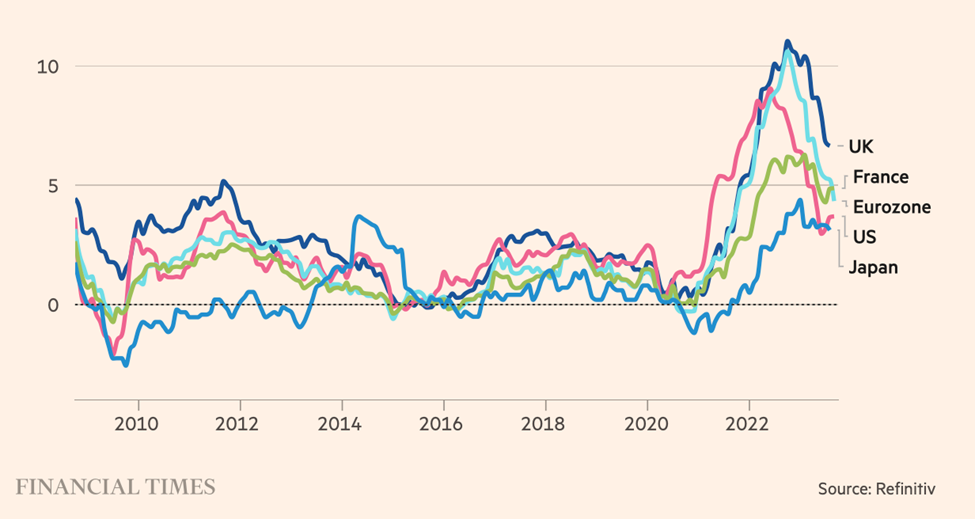

Annual % change in consumer price index, by date of forecast

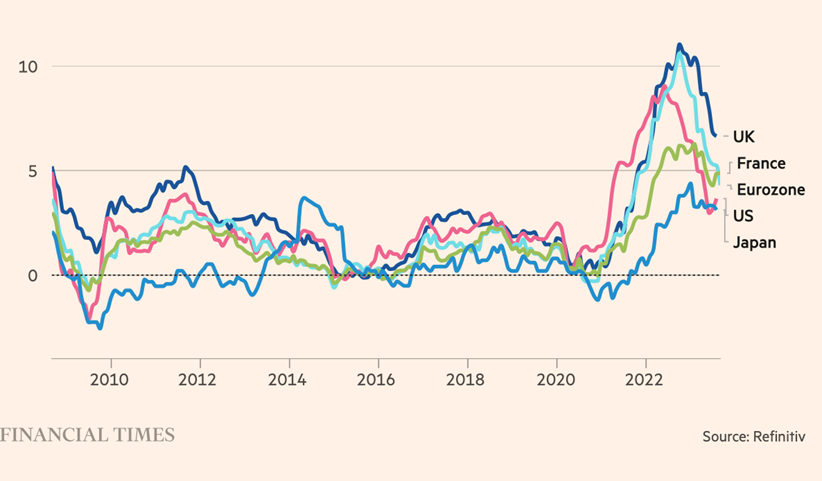

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, October 29, 2023

“World needs 80 million more kilometres of new power lines by 2040, IEA finds – The agency said that grid investment needs to double to more than $600bn (£495bn) a year by 2030, or electrical grids could become a barrier to the deployment of renewables and electric transport options – risking climate catastrophe and frequent blackouts. The report found that 80 million kilometres (49.7 million miles) of transmission lines will be needed by 2040 in order for countries to meet their climate goals and energy demands. This is roughly equivalent to the total number of miles of electrical grid that currently exist in the world, according to the IEA.”, Engineering & Technology, October 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Saudi Arabia expects nearly 100 million tourist visits this year, minister says – Travel and tourism to contribute 6% to kingdom’s gross domestic product this year, up from 3% in 2019. The country will close the year with about 30 million international tourists, which is nearly half of its goal of 70 million overseas visitors by 2030, Saudi Arabia’s Tourism Minister Ahmed Al Khateeb told the Future Investment Initiative in Riyadh this week. Saudi Arabia has also revised upwards its 2030 target for total annual tourist trips – a figure that entails both domestic and international travellers – to 150 million from 100 million, the minister said.”, The National News, October 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Australia under more mortgage stress than any other nation, IMF says – Cost of repaying loans is 15% of income and likely to be higher after this year’s rate hikes, as fund predicts GDP growth of 1.2% next year. The increased cost of borrowing has left Australia at the top of the league for debt with Canada second followed by Norway and the Netherlands.”, The Guardian, October 10, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

Canada

“Bank of Canada holds rate steady, trims growth forecast as inflation risks rise – The Bank of Canada held its benchmark interest rate steady on Wednesday but left the door open to further increases, as its latest forecast showed a thorny combination of weaker economic growth and more-persistent inflation. After 10 rate hikes since March, 2022, including two over the summer, higher borrowing costs are having their intended effect. Canadian consumers are pulling back on spending, unemployment is up and economic growth has slowed to a crawl.”, The Globe and Mail, October 26, 2023

“Small business confidence hits lowest level since COVID-19 onset – The CFIB found in its latest business barometer from this month that more business owners are feeling less confident going into the holiday season. The 12-month small business confidence index dropped 1.5 points to 47.2, the lowest reading since April 2020 and the third lowest reading in nearly 15 years. The CFIB says an index level of around 65 normally indicates that the economy is growing at its full potential.”, Yahoo! Finance Canada, October 26, 2023

China

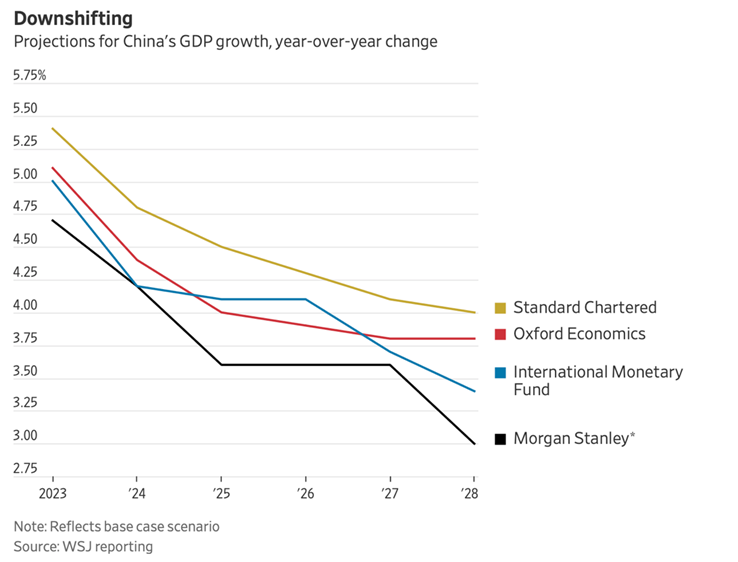

“China’s Economy Faces Deepening Troubles in Years Ahead – The country’s growth is showing signs of emerging from a soft patch, but its long-term prospects are darkening. economists warn China’s economy remains fragile and its long-term prospects are darkening. In recent weeks, a bevy of economists have lowered their forecasts for China’s longer-term growth trajectories, even as they raised their shorter-term predictions. The International Monetary Fund this month lowered its forecast for China’s growth next year to 4.2%, down from 4.5%.”, The Wall Street Journal, October 18, 2023

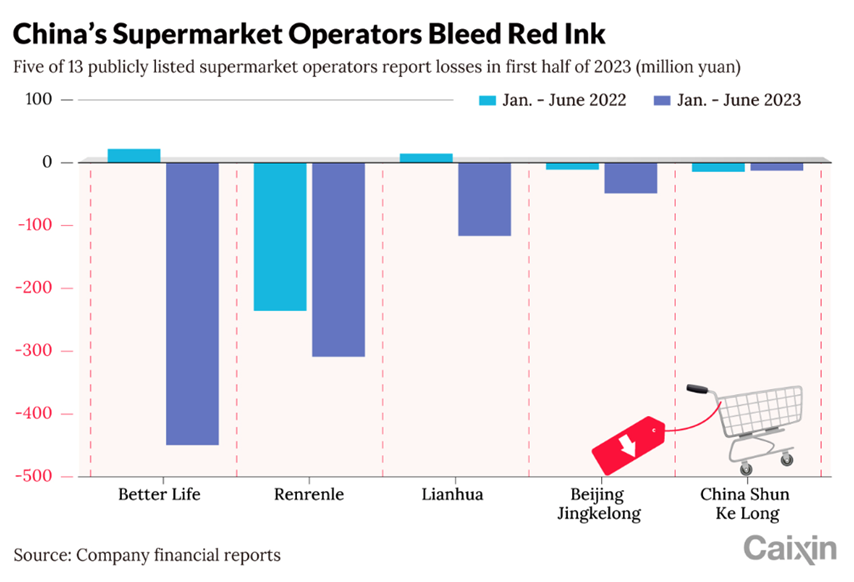

“The Struggle Facing Big-Box Supermarkets in China – Carrefour China, once the country’s largest foreign supermarket chain with nearly 260 stores in 2017, had less than 150 stores remaining at the end of last year. Financial trouble is also reflected in the first-half results of China’s 13 publicly traded supermarket operators, among which five reported year-on-year losses while three posted revenue declines despite making a profit, according to their earnings reports.”, Caixin Global, October 20, 2023

United Kingdom

“Federation of Small Businesses finds companies regaining confidence – Martin McTague, chairman of the federation, said: ‘After the economic turmoil wrought by the cost of doing business crisis over the past year and a half, [there are] signs of stabilisation in small firms’ performance. We need to beware that stabilisation does not turn into stagnation and that intentions to invest and grow are not thwarted by economic circumstances.’”, The Times of London, October 30, 2023

United States

“Gas Prices in Every U.S. State – Gas prices fluctuate from state to state due to factors such as local taxes, environmental regulations, reliance on local production or imports, and the proximity of refineries. In this infographic, we use data from the American Automobile Association (AAA) to illustrate the cost of fueling a vehicle in each U.S. state.

According to the AAA, the national average price of regular unleaded gas was $3.54 per gallon as of October 25, 2023.”, Visual Capitalist, October 25, 2023

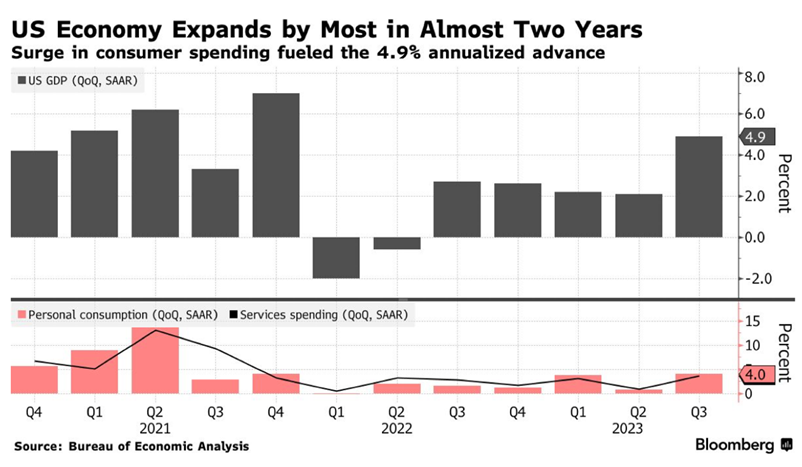

“US Economy Grew at a 4.9% Pace Last Quarter, Fastest Since 2021 – Consumer spending jumped at 4% rate, also the most since 2021 Core PCE price index increased a less-than-forecast 2.4%. The economy’s main growth engine — personal spending — jumped 4%, also the most since 2021. The primary driver of that resilience is the enduring strength of the job market, which continues to fuel household demand.”, Bloomberg, October 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“How Cicis Pulled Itself Out Of Restaurant Ruin – Declining sales and changing dining habits pulled it all the way down into bankruptcy in 2021, but it miraculously rose like a phoenix from the ashes. A restaurant that once seemed on the brink of death now stands as a bold testament to the power of innovation and adaptability in the change-or-die restaurant landscape. CiCi’s reinvented itself with wise innovations and marketing strategies, and the transformation was nothing short of extraordinary.”, Mashed, October 21, 2023

“AI set to transform the restaurant industry – Domino’s announced it has partnered with Microsoft to use the advanced AI to streamline pizza preparation, assist with quality control, inventory management and simplify the ordering process. Customers can expect to see noticeable changes to ordering processes at restaurants that integrate AI into their systems….AI will eventually be integrated across all restaurant operations, playing a pivotal roll at the front of the house by making ordering and payment processes more efficient. He said in the back of the house, AI can be used to provide accurate forecasting, tackle food waste by predicting usage patterns and even streamline employee management and scheduling.”, Fox Business, October 20, 2023

“The Reason McDonald’s International Menus Are Way Better Than The US – Thanks to the nature of the internet and social media sites like TikTok, customers in the United States are acutely aware that they’re missing out on some of McDonald’s bolder offerings. In fact, there’s an entire list of international food items we wish McDonald’s had in the U.S. It seems to be a common discussion point among McDonald’s customers over whether international McDonald’s tastes better than the chain’s domestic offerings.”, The Daily Meal, October 21, 2023

“U.K. pizza franchise PizzaExpress entering the Canadian market – U.K. casual dining pizza restaurant brand, PizzaExpress, has launched its international franchise program into Canada. PizzaExpress has been serving pizza in the UK since it was founded in 1965 in London’s Soho. From urban and suburban casual dining restaurants, quick service kiosks, and express locations, all the way up to its live music venues. PizzaExpress has more than 450 locations in 12 international markets.”, Canada Franchise, October 19, 2023

“Popeyes’ Journey from Cult-Favorite to the Mainstream – When RBI (Restaurant Brands International) acquired the brand on March 27, 2017, for $1.8 billion, there were about 2,600 locations in the U.S. and 25 countries globally. From acquisition to 2020, RBI posted cumulative net restaurant growth of 27 percent at Popeyes. Fast forward and Popeyes finished Q1 2023 with 4,178 restaurants globally—2,947 in the U.S. and 1,231 internationally. There were more than 200 North America debuts in 2022, featuring the loftiest figure of new franchisees and the largest percentage of freestanding single or double drive-thru locations in five years.”, QSR Magazine, October 18, 2023

“Pret adds growth to menu with US venture – Pret A Manger has handed the majority of its American operation to a franchiser, creating a joint venture that will take operational control of 50 stores in New York, Pennsylvania and Washington. The deal gives Dallas Holdings exclusive rights to open new shops in the three markets, with formats including drive-through outlets and a menu with slightly different ingredients and portion sizes. The operation, which comprises 58 stores in total, will be majority-owned by Dallas, which will hold 70 per cent of the joint vehicle.”, The Times of London, October 21, 2023

“Shake Shack® Malaysia: What can you expect to pay for a burger when it arrives next month – The Shake Shack branch in Malaysia is operated by SGP Group, the same group that is handling the brand in South Korea and Singapore. The ShackBurger cost in other countries: United States: USD 6.89 (about RM 32.90), South Korea: 6,900 Won (about RM 24.30) and Singapore: SGD 9.70 (about RM 33.80). If we take the pricing of both the South Korean market and the Singapore market, and we average it, we will get RM 29.05. We may see a slight increase in price due to taxes and raw material availability here. So, we can round up the price to about RM 30 for a basic ShackBurger here in Malaysia.”, Soyacincau, October 27, 2023

“Tim Hortons surpasses 300 stores milestone in the GCC and India – Tim Hortons, a beacon of Canadian coffee culture, has firmly entrenched itself in the Middle East with an impressive 285 outlets and further solidified its presence in India with 22 locations. India, with its vibrant and diverse palate, has warmly embraced Tim Hortons, evident in the growing store count: Delhi NCR boasts 10 stores, Punjab has 7, Mumbai proudly hosts 3, and Bangalore has opened 2.”, The Franchise Talk, October 16, 2023

“Running a franchise business like fast food is getting more expensive – Franchise fees have gone up with inflation, but the economics may get more expensive even as inflation falls, driven by technology costs and wage pressures in the labor market. Royalty fees could continue to rise. Pending changes in (US) federal labor law could upend franchise economics. CNBC, October 20, 2023

“New (U.S.) Labor Rule Could Make it Easier for Franchises Like McDonald’s to Unionize – The revised joint-employer rule was announced by the National Labor Relations Board and applies to workers’ rights to join unions, bargain collectively, and protest work-related conditions under federal law. The new standard replaces a Trump-era regulation on joint-employer status, adopted in 2020, which said a business needed to have “substantial direct and immediate control” over job conditions to be considered a joint employer. Under the new rule, a business could be considered a joint employer whether it has direct or indirect control over one or more “essential” working conditions. Those conditions could include wages, scheduling, assignment of duties, and the safety and health of workers.”, Barron’s, October 27, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

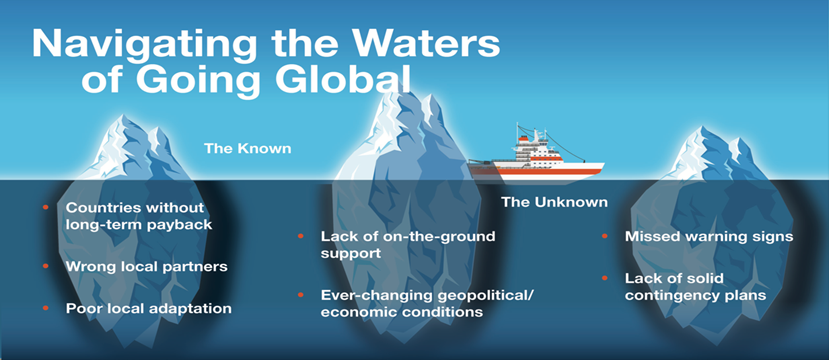

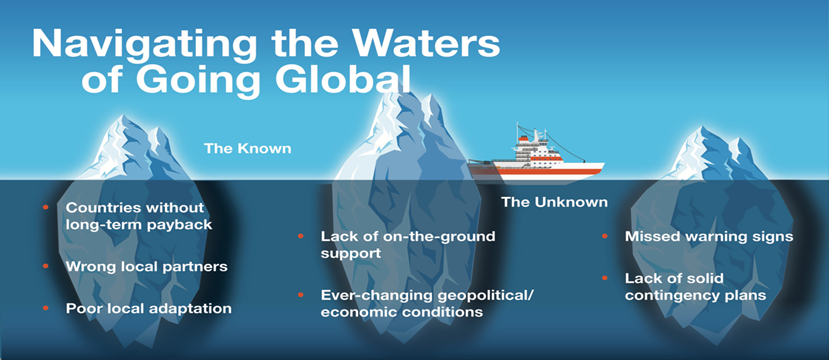

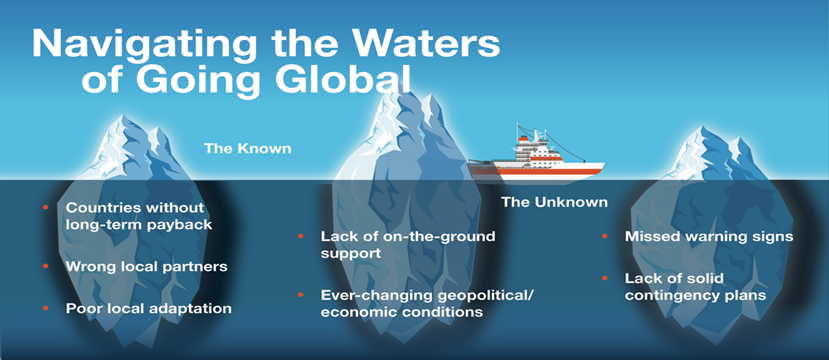

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 93, Tuesday, October 17, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

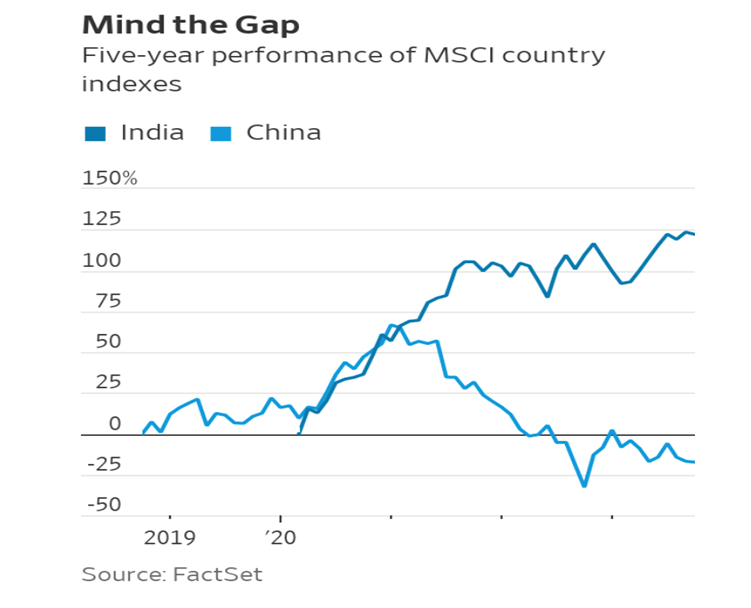

Introduction: In this issue, global trade and inflation are improving while country investment risks are not. 1 in 8 people in the USA worked at McDonalds®! No more paper passports in the future? Asian countries economies are on track to improve in 2024. India’s stock markets pass those in China which is seeing births at the lowest level since 1949.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“There are no such things as limits to growth, because there are no limits on the human capacity for intelligence, imagination, and wonder.’, President Ronald Regan

“Challenges make life interesting, however, overcoming them is what makes life meaningful.”, Mark Twain

“Success is not final, failure is not fatal: It is the courage to continue that counts.”, Winston Churchill

Highlights in issue #93:

- Brand Global News Section: Burger King®, Jack In The Box®, Mathnasium®, McDonalds® and Texas Roadhouse®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

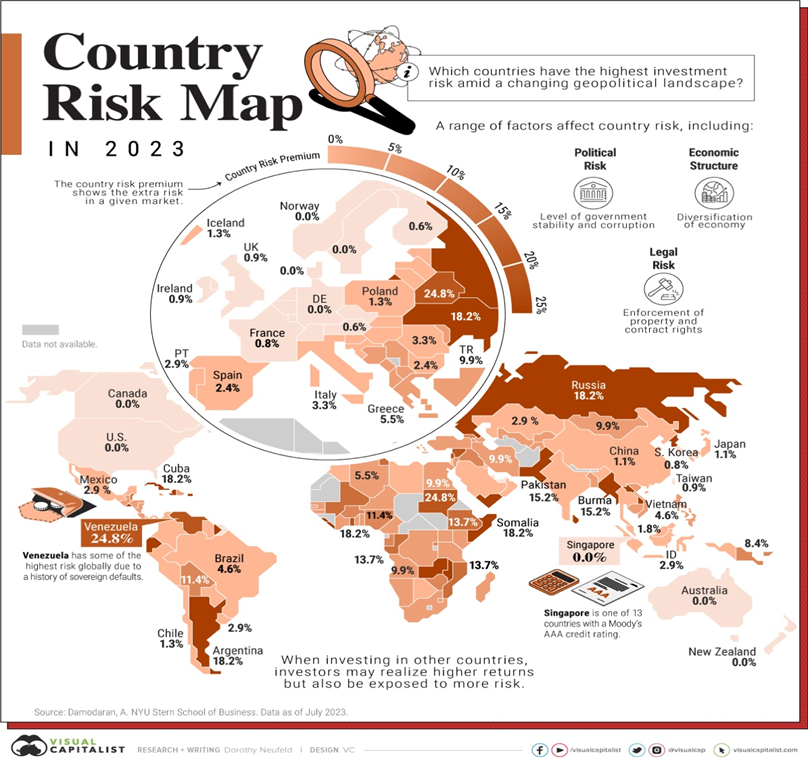

“Which Countries Have the Highest Investment Risk? Given the rapid growth of emerging economies, and the opportunities this may present to investors, it raises the question: does investment exposure abroad come with risk, and how can that risk be analyzed? This graphic shows country risk around the world, based on analysis from Aswath Damodaran at New York University’s Stern School of Business. To get a clearer picture of country risk, Damodaran analyzed the following broad factors: Political risk: Type of regime, corruption, level of conflict; Legal risk: Property rights protections, contract rights; and Economic risk: Diversification of economy.”, Visual Capitalist, October 9, 2023

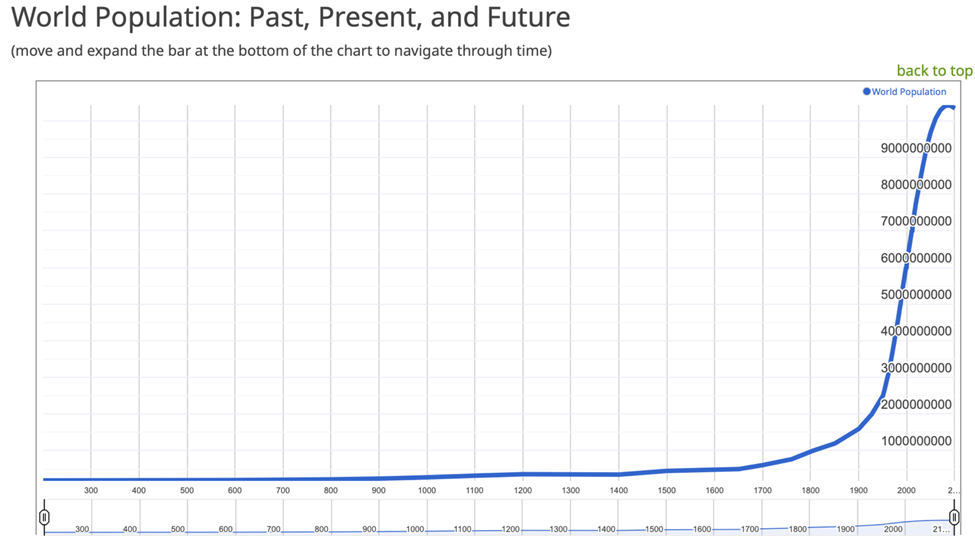

“2023 World Population – The World Population in 2023 is 8,045,311,447 (at mid-year, according to U.N. estimates a 0.88% increase (70,206,291 people) from 2022, when the population was 7,975,105,156, a 0.83% increase (65,810,005 people) from 2021, when the world population was 7,909,295,151. During the 20th century alone, the population in the world has grown from 1.65 billion to 6 billion. In 1970, there were roughly half as many people in the world as there are now. Because of declining growth rates, it will now take over 200 years to double again.”, Worldometer, July 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global Trade Poised to Turn a Corner – Bloomberg’s Trade Tracker shows only four out of 10 gauges sat in below-normal range in early October, compared to six in August. It’s the surest sign yet of recovery since the start of 2023, when as many as nine out of 10 indicators were deep in the red. Consumer demand, though nascent, appears to be firming up. Shipping volumes improved in key ports like Los Angeles, while early export data out of South Korea showed a rare annual increase.”, Bloomberg, October 8, 2023

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, October 11, 2023

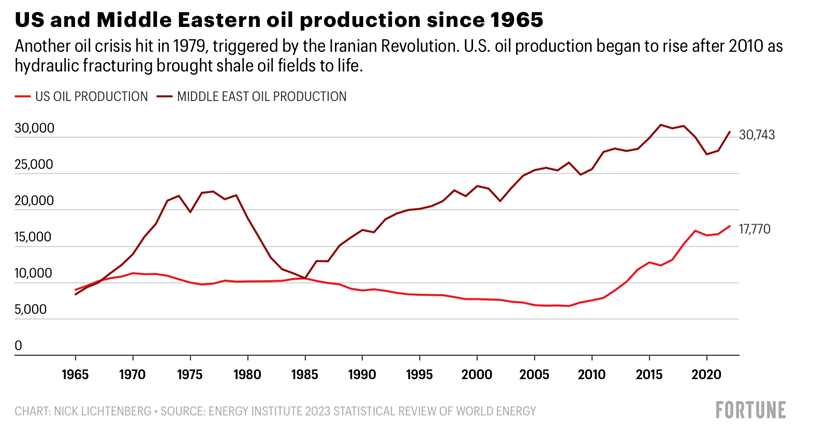

“3 stunning charts show how the world of gas-guzzling has changed—and hasn’t—since the trauma of the 1973 oil embargo – Fifty years ago, a secret deal among Arab governments triggered one of the most traumatic economic crises to afflict the United States and other big oil importers. Fifty years on, markets have changed. But oil continues to be the world’s dominant energy source. On one hand, crude oil use has grown dramatically. Global supply has risen from less than 60 million barrels per day in 1973 to nearly 94 million barrels per day in 2022. On the other hand, OPEC’s importance – and oil’s share of the global energy mix – has declined.”, Fortune, October 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The Future of International Travel Is Passport-Free – Biometric technology is replacing the need for passports at the world’s most modern airports. Travelers at some of the best airports in the world no longer need to show passports, thanks to new technology that is making airport immigration smoother than ever. From travelers’ perspectives, an overwhelming majority are in favor of using biometrics to ease airport processes. According to a November 2022 survey from aviation trade group IATA, “75% of passengers want to use biometric data instead of passports and boarding passes.”, Conde Nast Traveler, October 16, 2023

“Despite Record Passenger Volumes, North American Airports Earn Higher Marks for Traveler Satisfaction – Overall customer satisfaction with North American airports increases 3 points to 780 this year, despite record passenger volume, crowded terminals and a barrage of delays and cancellations. Top-performing airports in the study all saw substantial gains in terminal facilities; food and beverage and retail service; and baggage claim. There is a direct correlation between overall passenger satisfaction and spending at the airport.”, J. D. Power, September 20, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

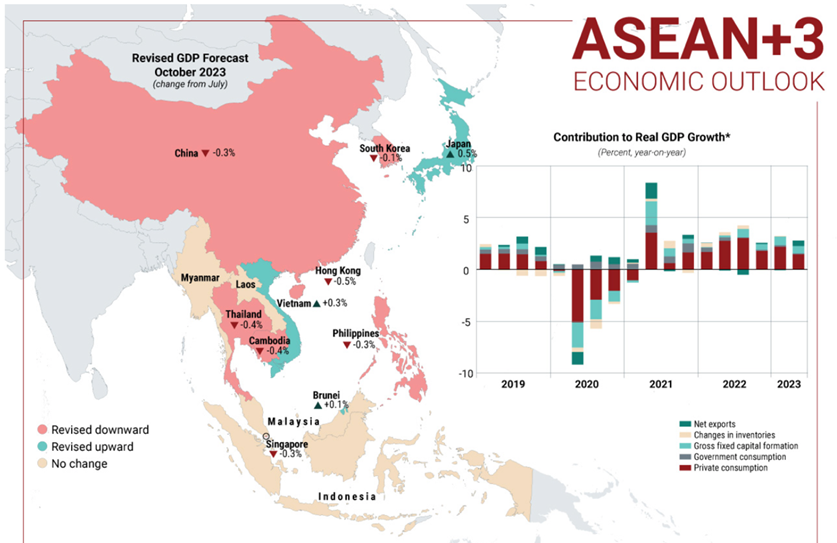

“Asia’s Economic Outlook – Growth prospects may improve next year – Amid China’s weaker-than-expected economic performance, the ASEAN+3 Macroeconomic Research Office cut its 2023 growth forecast for the region to 4.3 percent from July’s projection of 4.6 percent. Given that China is by far the largest economy in the grouping – which comprises the 10 states of the Association of Southeast Asian Nations as well as China, Japan and South Korea – it is natural that its downturn will affect the others’ economic growth prospects. Still, the long-term outlook for the grouping is far from bleak. In China, manufacturing investment is holding up and consumer spending is starting to rise – two factors that will support regional growth.”, Geopolitical Futures, October 13, 2023

“India, Indonesia Risk Biggest Fallout From Geopolitical Shocks – High energy costs, surging dollar, global tensions test Asia Malaysia may be a beneficiary due to status as energy exporter. A triumvirate of high oil prices, a surging dollar and geopolitical instability are set to weigh on India and Indonesia among Asia’s emerging markets, while energy exporter Malaysia may prove a rare beneficiary.”, Bloomberg, October 15, 2023

Canada

“Most small (Canadian) businesses optimistic about future despite economic uncertainty – Still, the top priority for most businesses is to cut costs wherever possible. According to a Scotiabank survey of nearly 1,700 Canadian small businesses with revenue between $50,000 and $5 million, two thirds (66 per cent) say they are very or extremely optimistic about the future of their business. The positive sentiment is even higher in Atlantic provinces (83 per cent) and in Saskatchewan and Manitoba (82 per cent).”, Yahoo Finance, October 12, 2023

China

“Births in China slide 10% to hit their lowest on record – China had just 9.56 million births in 2022, according to a report published by the National Health Commission. It was the lowest figure since records began in 1949. The high costs of childcare and education, growing unemployment and job insecurity as well as gender discrimination have all helped to deter many young couples from having more than one child or even having children at all. Last year, the country’s population also fell for the first time in six decades, dropping to 1.41 billion people.”, Reuters, October 12, 2023

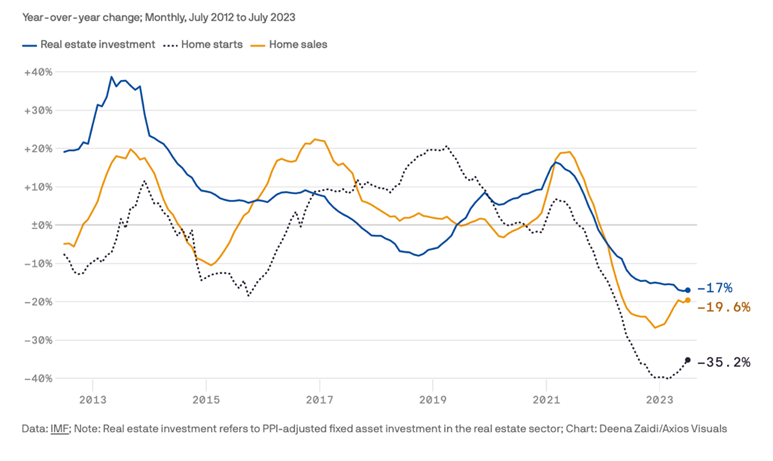

“China’s real estate struggles could threaten global economic growth – At its peak, China’s residential property sector was thought to contribute an estimated 25%-30% of the country’s GDP. Its ongoing struggles present a challenge to economic growth in China that will ripple out to other nations — as China has been the largest single source of growth for the world economy in recent decades. Property developers face severe funding constraints, preventing them from completing pre-sold homes … real estate investment and housing prices continue to decline, putting pressure on local governments’ revenues from land sales and threatening already fragile public finances.”, Axios, October 11, 2023

Germany

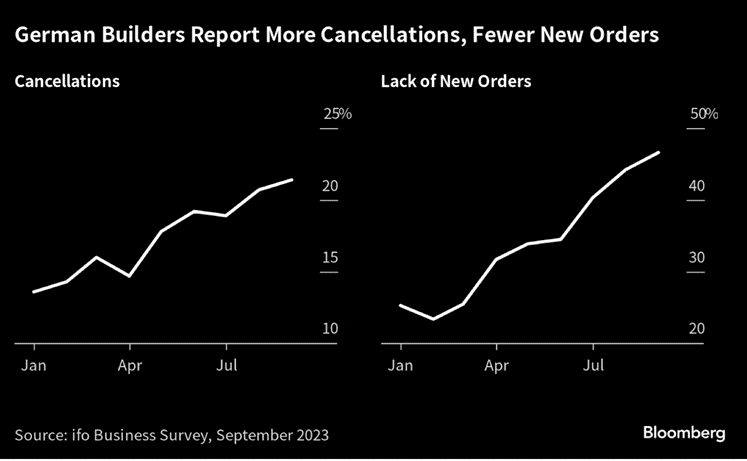

“German Housing Crisis Deepens on Record Building Cancellations – Monthly Ifo survey shows deteriorating conditons for builders Business confidence also slumps to all-time low in September. In September, 21.4% of residential builders said they were affected by construction projects being called off, according to a survey by the Munich-based Ifo Institute. That was the highest level since records began in 1991 and worse than August’s 20.7%.”, Bloomberg, October 16, 2023

India

“India’s Booming Stock Market Is Leaving China in the Dust – The South Asian nation’s market has been a quiet outperformer for a decade. Now foreign investors are starting to pay attention. The MSCI India index has gained more than 7% this year, pulled higher by a rally in the shares of banks and automakers. The MSCI China index has lost almost 11% of its value, while a wider emerging-market index is down 2%. India’s stock market has outperformed China’s for the past three years, partly the result of China’s strict effort to combat Covid-19, which caused economic pain that the country hasn’t fully recovered from.”, The Wall Street Journal, October 9, 2023

Turkey

“Turkey’s republic enters its second century – Legacies of Kemal Atatürk era resonate in the age of strongman Recep Tayyip Erdoğan. Preparations are in full swing in Turkey for the 100th anniversary of the modern republic, proclaimed on October 29 1923. The republic was founded on the ashes of the Ottoman Empire by Mustafa Kemal Atatürk, a hero in the eyes of millions of Turks for having led the nation to independence and embarking on an extensive, rapid modernisation of state and society. Yet Atatürk’s legacy is by no means uncontested.”, The Financial Times, October 14, 2023

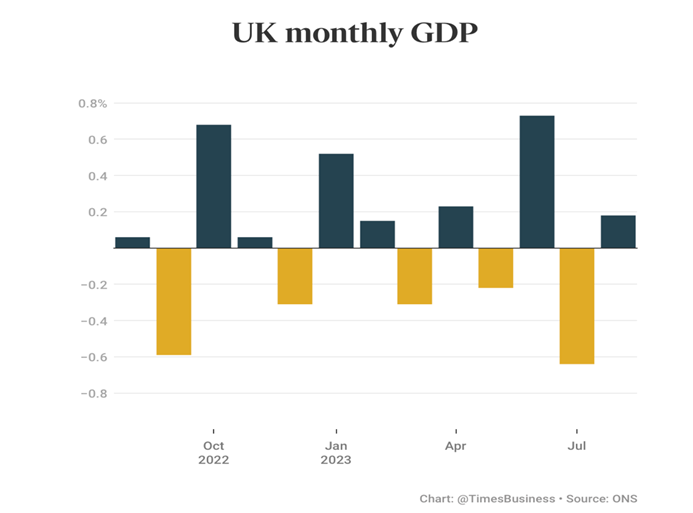

United Kingdom

“UK economy grows 0.2% in August despite drag from higher interest rates – Britain’s economy has outperformed analysts’ expectations this year, dodging a much-touted recession, but GDP is growing at a historically slow rate, leading to fears that the country is in the early stages of a prolonged period of stagnant economic activity. Services businesses, which generate about £2 in every £3 of Britain’s GDP, were the main contributors to the economy’s summer turnaround, providing growth in the sector of 0.4 per cent. Construction output, plagued by a reduction in house building in response to the Bank of England raising interest rates aggressively, contracted 0.5 per cent in August. Industrial production was also weaker as it was drawn into a weak global manufacturing cycle.”, The Times of London, October 12, 2023

United States

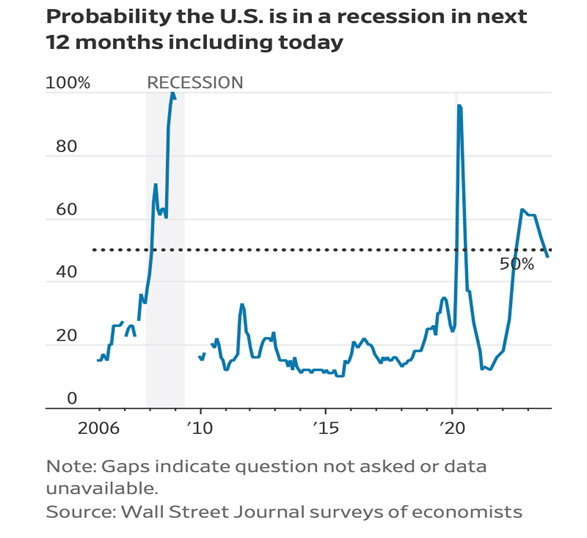

“A (US) Recession Is No Longer the Consensus – In WSJ survey, economists lower recession probability below 50% and say Fed is finished raising interest rates. Economists are turning optimistic on the U.S. economy. They now think it will skirt a recession, the Federal Reserve is done raising interest rates and inflation will continue to ease. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.”, The Wall Street Journal, October 15, 2023

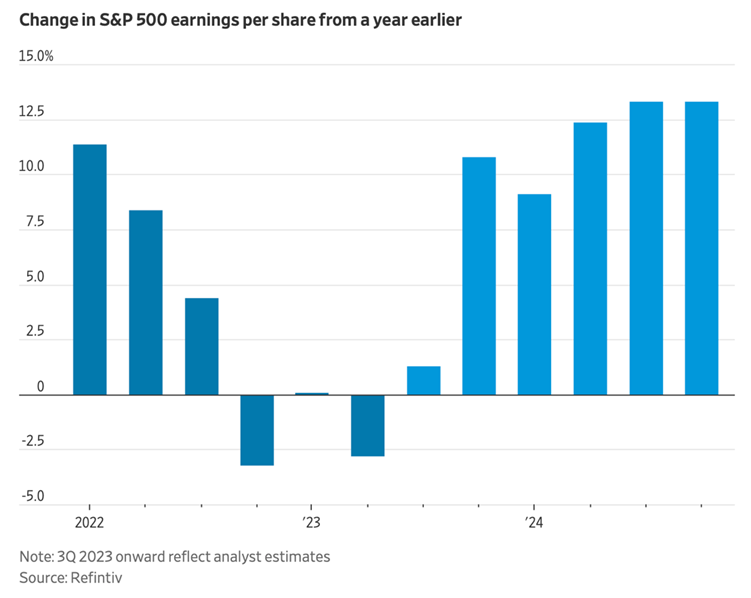

“(US) Profits Are Making a Comeback – Despite challenges including rising labor costs and high interest rates, U.S. corporate earnings are on an upswing. Industry estimates indicate that members of the S&P 500 will report earnings per share were 1.3% higher than a year earlier—a nice improvement from the second quarter’s decline of 2.8%. Finally, analysts reckon that profit growth in the fourth quarter will be substantially better, with estimates pointing to S&P 500 earnings up 10.8% from a year earlier.”, The Wall Street Journal, October 11, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Turkish Burger King Operator Seeks to Sell Shares in Istanbul IPO – TAB Gida operates about 1,500 fast food restaurants in Turkey, Northern Cyprus, North Macedonia and Georgia, including more than 700 Burger King outlets. Its other operations include Arby’s, Popeyes, Sbarro and Subway, as well as a number of domestic brands. Its revenue jumped 125% in 2022 to 8.62 billion liras, while net income was 361.8 million liras, according to the company prospectus.”, Bloomberg, October 13, 2023

“The Rise, Fall, And Resurgence Of Jack In The Box – Emerging from a small San Diego drive-in chain in the 1940s, Jack in the Box evolved into one of the most visible and lucrative of the fast-food brands. Jack in the Box helped popularize the drive-through. After many ups and downs over the decades, It’s in the middle of a big expansion plan.”, Mashed, October 16, 2023

“Mathnasium Announces Renewed Franchise Agreement in Vietnam, Set to Double in Size – Mathnasium Learning Centers announces they have renewed the master franchise agreement in Vietnam with Mr. Phan Tan Nghia for an additional ten years. The renewed agreement confirms a commitment to open an additional 25 centers. Mr. Nghia originally joined Mathnasium in 2013 and has since grown his portfolio to 28 locations across Vietnam. He’s grown his Mathnasium Center’s student-base per center to the highest level in the Mathnasium system.”, Franchising.com, October 4, 2023

“1 out of 8 Americans have worked at the Golden Arches, McDonald’s says – McDonald’s, with its more than 13,000 locations in the U.S. alone, is known for being the first job many teens have, with many folks keeping the Golden Arches as their place of employment well into adulthood. McDonald’s confirmed to TODAY.com that it surveyed a representative sample of American adults and found that 1 in 8 (just over, actually, at 13.7%) reported that they currently or formerly worked at a McDonald’s restaurant. According to the U.S. Census, the population in 2022 was more than 333,287,000 people, meaning that walking among us are more than 41,000,000 current or past McDonald’s employees.”, Today.com. October 11, 2023

“Texas Roadhouse Is America’s Most Beloved Sit-Down Restaurant Chain – Market research company Savanta just released a new report on the most beloved restaurant brands among diners in the US in 2023. The report was based on insights collected from more than 72,000 people through Savanta’s marketing intelligence platform, BrandVue Eating Out. Fast-food chains Chick-fil-A, Starbucks, and McDonald’s ended up receiving the first, second, and third highest brand love scores in the ranking, respectively. Meanwhile, Texas Roadhouse received the fourth-highest score, making it the highest-ranked sit-down chain in the new report.”, Eat This, Not That!, October 12, 2023

“Wagamama owner backs £700m takeover by Apollo – The restaurant operator behind the Wagamama chain has agreed to a £700 million takeover bid from the private equity firm Apollo Global Management after coming under intense pressure from activist investors. TRG has about 380 restaurants and pubs, a concessions business and a 20 per cent stake in a joint venture operating seven Wagamama noodle bars in America. It also has about 60 franchises around the world.”, The Times of London, October 13, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 92, Tuesday, October 3, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

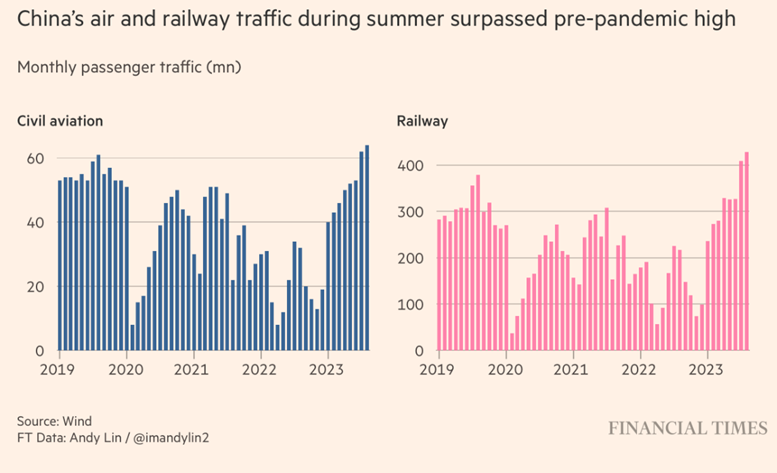

Introduction: In this issue, Japan’s stock market soars, the European Union will need US LNG for decades, McDonalds® raises its franchisee royalty rate for the first time in 30 years, Singapore’s Changi airport to go passport free, Indonesia bans sales on social media, and Eurozone country’s inflation is at a 2 year low.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Tough times never last, but tough people do.” – Robert H. Schuller

“Out of difficulties grow miracles.” – Jean de La Bruyère

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.” – Socrates

Highlights in issue #92:

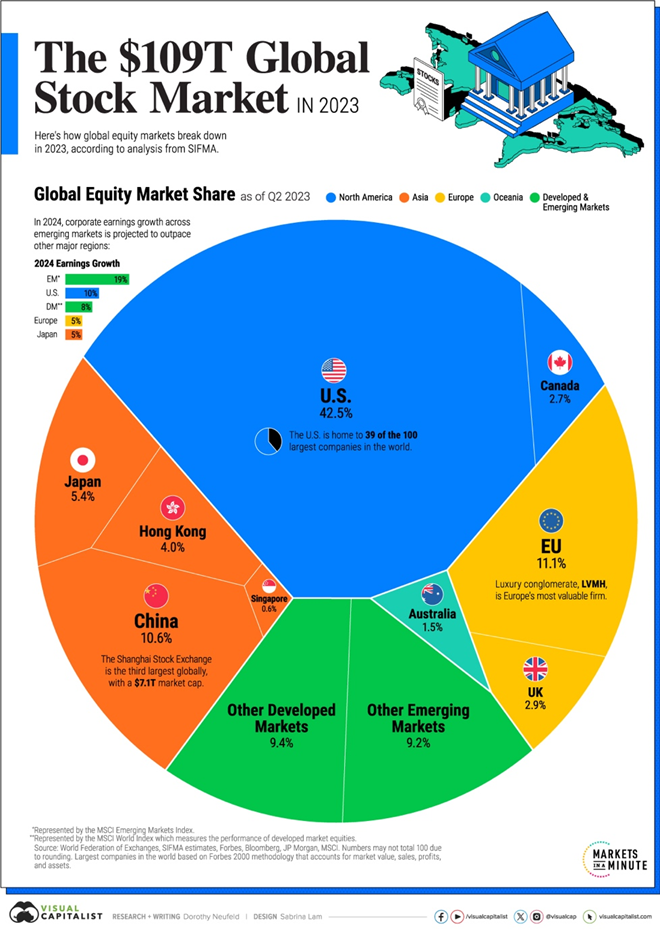

The $109 Trillion Global Stock Market in One Chart

The Lack Of Travelers To The U.S. Is Hurting American Retailers

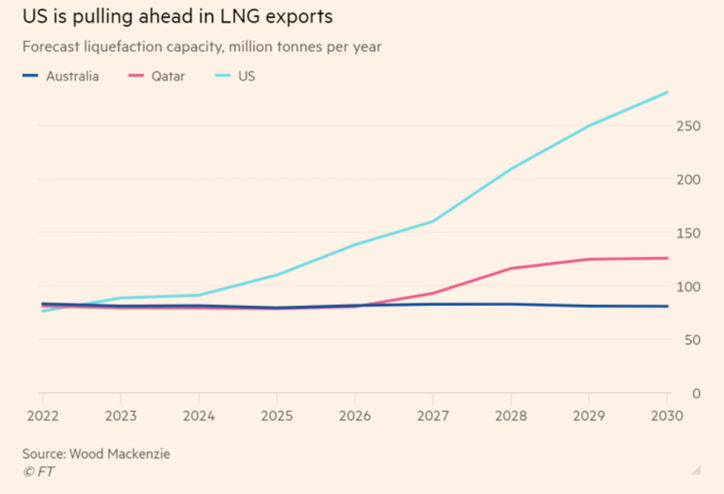

Top EU energy official says US gas will be needed for decades

McDonald’s Is Raising (US) Royalty Fees on New Franchises for the First Time in 30 Years

Four Small States That Show Leadership

A breakout year for Japanese stocks

Brand Global News Section: Coffee Berry®, Guzman y Gomez®, KFC®, McDonalds®, Starbucks®, Subway® and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“The $109 Trillion Global Stock Market in One Chart – Over the last several decades, the growth in money supply and ultra-low interest rates have underpinned rising asset values across economies. With the world’s deepest capital markets, the U.S. makes up 42.5% of global equity market capitalization, outpacing the next closest economy, the European Union by a significant margin.”, Visual Capitalist, September 27, 2023

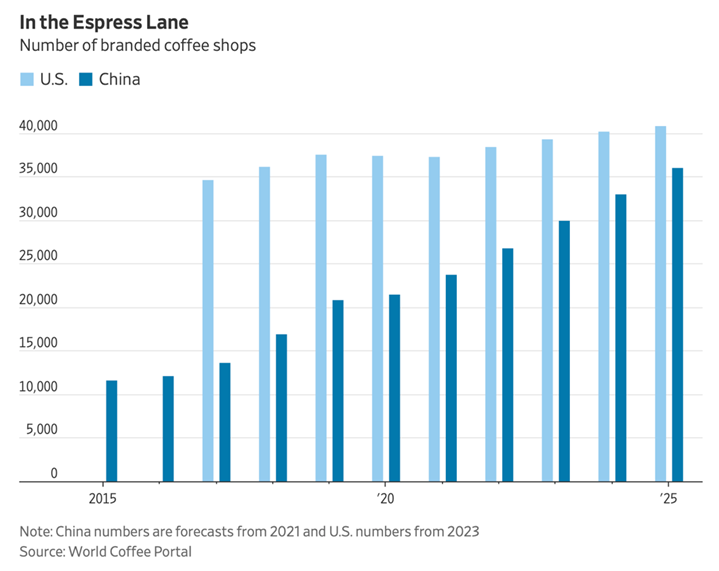

“The Furious Race for the Future of Coffee – Starbucks is making a big push in China. Other chains are pushing even harder. It turns out that selling foamy brown water at an 80% markup is really profitable. Back in 2013, the chief financial officer of what was then called Dunkin’ Donuts dubbed beverages ‘the holy grail of profitability.’, The Wall Street Journal. September 22, 2023

“The Latest On Returning To Offices – As corporate and urban centers around the world continue to resume a more familiar pace, leaders seek the “right” balance between in-person and remote work, as well as between mandates and persuasion. A recent WTW survey reports that leaders expect more than half of their employees (55%) to work either fully remotely or hybrid in three years, compared with 15% before the pandemic. Effective leaders take six actions as employees return to offices.”, Forbes, September 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

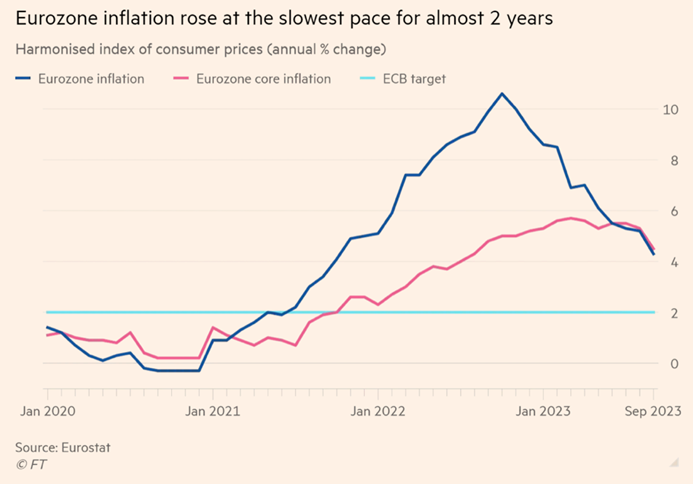

“Eurozone inflation hits 2-year low as US price pressures ease – Data helps steady bond markets and signals prospect of end to interest rate rises on both sides of Atlantic. The last time inflation was lower was in October 2021. US data also bolstered hopes that the biggest surge in consumer prices for a generation is fading fast. ‘The main takeaway is that the tightening cycle is coming to an end,’ said Seema Shah, chief global strategist at Principal Asset Management.”, The Financial Times, September 29, 2023

“Top EU energy official says US gas will be needed for decades – Europe will have to rely on US fossil fuels for decades to come as it races to diversify from Russian natural gas and scale up its renewables sector to boost energy security, the EU’s top energy official has said. ‘We will need some fossil molecules in the system over the coming couple of decades. And in that context, there will be a need for American energy,’ said Jørgensen, director-general for energy in the European Commission, in an interview in New York.”, The Financial Times, September 24, 2023

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, September 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The Lack Of Travelers To The U.S. Is Hurting American Retailers – Due to the global pandemic, the United States saw a drop in international visitors. While travel has been picking up, one industry that isn’t recovering as quickly is the retail industry. In 2023, overseas travel is only nearly 75 percent recovered, which is estimated to cost retailers over $6 billion.”, Forbes, September 29, 2023

“This Airport Is About to Go Passport Free – Soon you’ll only need your face to travel through Singapore’s Changi Airport. Starting sometime in the first half of 2024, you won’t need to show your passport if you’re traveling through Singapore. All you’ll need to pass through security and immigration is your face—the airport is switching to biometric technology and facial recognition technology instead of having agents physically check travel documents to move travelers through the airport more quickly.”, AFAR, September 27, 2023

“More direct China-US flights on the horizon, but return to 2019 traffic far more distant – Direct flights between two countries set to increase in October, a fraction of pre-pandemic routings. Both Chinese and US airlines will expand their schedules, but politics and structural demand shifts may blunt enthusiasm for total resumption. Frequency of flights will increase in October, when US airlines expand their list of direct routes. The US Department of Transportation announced in August that the number of Chinese passenger flights permitted to fly to the US would increase by six in October, up to 24 per week. ‘However, it is important to note that this is still significantly less than the pre-Covid-19 period when there were more than 300 round trips per week,’ said Herman Tse, valuations manager at Cirium Ascend consultancy.”, South China Morning Post, September 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

“Asia faces one of worst economic outlooks in half a century, World Bank warns – Sluggish post-pandemic recovery, China’s property crisis and US trade policies expected to hinder growth next year. The gloomier 2024 forecasts from the bank underline the mounting concern over China’s slowdown and how it will spill into Asia. China’s policymakers have already set one of the lowest growth targets in decades for 2023, of about 5 per cent. It also downgraded its 2024 forecast for gross domestic product growth for developing economies in east Asia and the Pacific, which includes China, to 4.5 per cent, from a prediction in April of 4.8 per cent and trailing the 5 per cent rate expected this year.”, The Financial Times, October 1, 2023

Estonia, New Zealand, Qatar and Singapore

“Four Small States That Show Leadership – While most geopolitical commentators focus on the new duo-polar world with the rise of China or even a multi-polar world of many eastern and western players, the influence of smaller countries is often overlooked. It’s clear there’s an important – even critical – role to play for sophisticated nations to punch above their weight on the regional and world stage, despite the small size of their populations and the power of their much larger neighbours. Four examples show just how it isn’t size but strategy that makes a country successful.”, Forbes, October, 2, 2023

China

“China hopes Golden Week holiday will deliver economic boost – Surge in consumer spending could spill over into fourth quarter and help ailing property sector. Economists will be watching in particular whether Chinese consumers will use the eight-day break, which combines the October 1 National Day and the mid-Autumn festival holidays, to spend not only on restaurants and outings but also on bigger ticket items, particularly property.”, The Financial Times, September 29, 2023

“Chinese consumers much more inclined to buy from foreign brands than last year – With borders opening and Chinese travelling and seeing the world again – either in person or vicariously through their network’s social media, consumers are reminded of many great attributes of foreign countries, lifestyles and brands that has been absent in propaganda. This appeal is reflected in PWCs Global Consumer Insights Survey which polled 18,155 global participants over the past two years, of whom more than 1,276 consumers were from Chinese mainland and Hong Kong. There has been a slight improvement in the perception of foreign brands, with 30% having a preference to buy foreign brands in 2023 versus 28% last year. However the biggest shift is the 15% who are ‘much more’ inclined to buy foreign brands, almost double the 8% last year.”, China Skinny, September 22, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“AmCham report: US firms upbeat on China business prospects – American companies remain generally optimistic about business prospects in China, according to the latest 2023 China Business Report by AmCham Shanghai. It revealed that the end of the pandemic has brought stability to revenue expectations, with an increasing number of companies planning to ramp up their investments in China this year compared with 2022. The report, based on the results of AmCham Shanghai’s 2023 China Business Survey, indicated that 52 percent of companies expect greater revenue in 2023 than in the previous year, among which retail firms are the most optimistic, with 74 percent anticipating higher revenues. This positive outlook emphasizes the resilience and potential of China’s market.”, Shine.cn, September 27, 2023. Compliments of Paul Jones, Jones & Co., Toronto

Germany

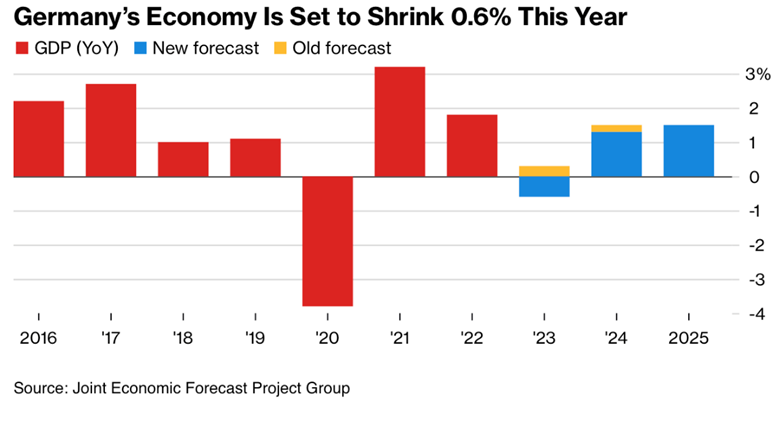

“German Economy to Shrink 0.6% in 2023 Before Wages Drive Rebound – Purchasing power to fuel 1.3% growth next year, institutes say Inflation expected to slow to 2.6% in 2024, 1.9% in 2025. Germany’s economy is on course for its first full year of contraction since the pandemic, new forecasts showed, though rebounding consumption should spur a recovery in 2024.”, Bloomberg, September 28, 2023

India

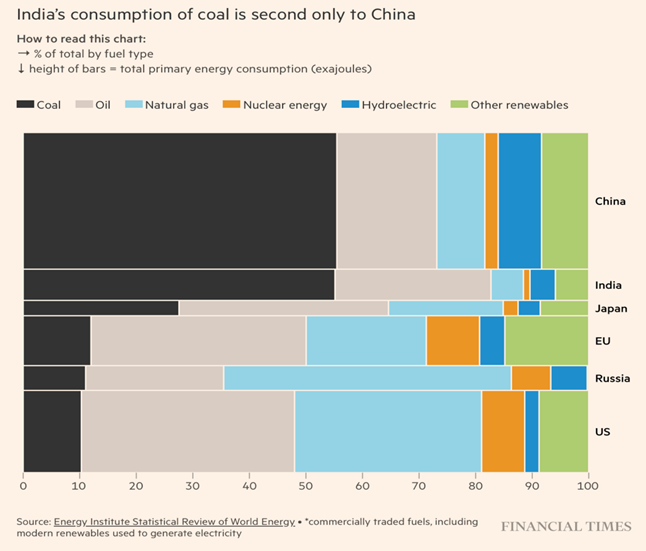

“India’s dream of green energy runs into the reality of coal – The fossil fuel accounts for around three-quarters of power generation and demand is expected to grow, despite an ambitious renewables plan. Prime Minister Narendra Modi has laid out an ambitious target to build 500 gigawatts of non-fossil fuel capacity by 2030. India has also announced billions in subsidies to manufacture clean-energy technology and wants to become a leading green hydrogen exporter. Yet India’s energy transition is complicated by intractable problems, from the difficulty of acquiring land for solar and wind farms to deep financial distress in its power system, which slows new investment. While demand is surging, millions still lack access to reliable electricity. Authorities see the expansion of polluting industries like steel and cement as essential to creating jobs and economic growth.”, The Financial Times, September 24, 2023

Indonesia

“Indonesia bans purchases on social media, in a blow to TikTok’s e-commerce ambitions – Indonesia’s ministry of trade said Tuesday it is working to further regulate e-commerce, adding that the country does not allow transactions on social media platforms. ‘One of the things that is regulated is that the government only allows social media to be used to facilitate promotions, not for transactions,’ the ministry said in an official release. This means that users in Indonesia cannot buy or sell products and services on TikTok and Facebook.”, CNBC, September 27, 2023

Japan

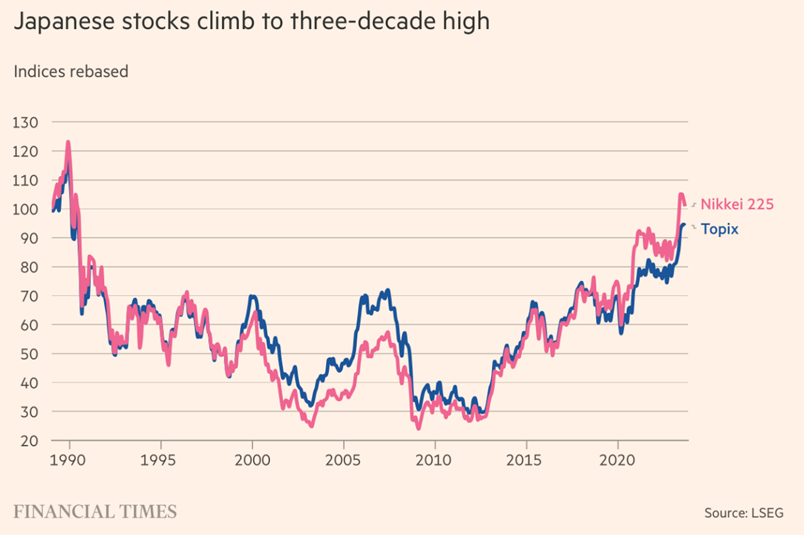

“A breakout year for Japanese stocks – After a series of false dawns, investors sense a long-awaited shift in the Tokyo market. But everything has come together this year, despite the very clear consensus that 2023 would be similarly drab. The Topix and Nikkei 225 are both up more than 20 per cent so far this year. That drops in to single figures in dollar terms but this remains a breakout year.”, The Financial Times, September 29, 2023

Singapore

“Singapore’s population grows 5% as foreign workers return post-pandemic – There were 5.9 million people in Singapore as of June, up from 5.6 million in June last year. Of these, 61% were Singaporeans, 9% were permanent residents and 30% were foreigners working or studying in the country. The bulk of the population increase came from foreign employment, with 162,000 foreign workers coming to Singapore from June 2022 to June this year. The National Population and Talent Division said the largest increase came from workers in the construction, marine shipyard and process sectors as contractors hired more workers for projects that were delayed by the pandemic.”, Reuters, September 29, 2023

“Singapore is now the world’s freest economy, displacing Hong Kong after 53 years – For the first time since the Economic Freedom of the World Index started in 1970, Hong Kong has slipped from its number one position to second place — and its score is about to drop even further. New regulatory barriers to entry, increasing cost of business, and limits on employing foreign labor dented Hong Kong’s ranking, the report stated.”, CNBC, September 21, 2023

United Kingdom

“UK GDP: Economy grew faster than Germany and France after Covid – Gross domestic product is now estimated to be 1.8 per cent larger compared with the final months of 2019, just before the pandemic swept through the country, according to the Office for National Statistics (ONS). The revised figures mean that the economy has added about an extra £10 billion in output since the final quarter of 2019. Under its initial estimates, the statistics agency thought the economy was 0.2 per cent below its pre-pandemic levels. The Times of London, September 29, 2023

United States

“US GDP growth unrevised at 2.1% in second quarter as economy shows resilience – The U.S. economy maintained a fairly solid pace of growth in the second quarter and activity appears to have accelerated this quarter, but a looming government shutdown and an ongoing strike by auto workers are dimming the outlook for the rest of 2023. Inflation also remains elevated and tight labor market conditions continue to prevail, with the number of Americans filing new claims for unemployment benefits rising slightly last week, the reports showed on Thursday.”, Reuters, September 28, 2023

“50% of U.S. Small Business Say Interest Rates Have Hurt Their Businesses – Further, 66% of the poll respondents in this group believe economic issues will persist even if the Federal Reserve doesn’t raise rates further. In fact, 38% of those struggling say that the interest rate must be reduced by at least 3 points before they envision rebounding again. These are just a few findings emerging from a poll of 7,396 randomly selected small-business owners surveyed from August 5 to September 18, 2023.”, Franchising.com, September 22, 2023

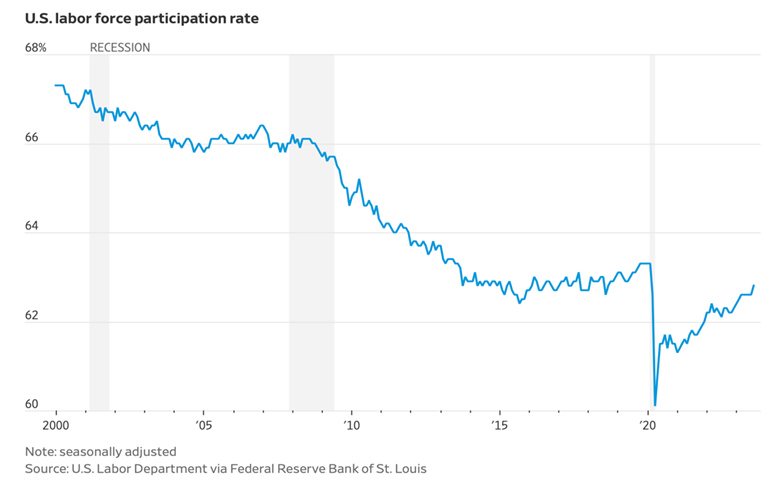

“Why America Has a Long-Term Labor Crisis, In 6 Charts – Participation hasn’t fully recovered from pandemic-era losses, though there have been signs of growth for prime-age workers—those between ages 25 and 54. The overall participation rate is expected to drop to 60.4% in 2032, according to the Labor Department, mainly because of baby boomer retirements. Wages reflect supply and demand. They shot up during the pandemic recovery and have recently outpaced inflation, which gives workers more spending power. Long-term labor shortages could lead to a faster pace of wage growth for the foreseeable future.”, The Wall Street Journal, September 25, 2023

Vietnam

“Boosting Vietnam’s manufacturing sector: From low cost to high productivity – In the past decade, manufacturing in Vietnam has been at the epicenter of the country’s high growth. This sector contributed more than 20 percent to the country’s GDP1 and has been an anchor in Vietnam’s trade balance, helping to attract foreign direct investment (FDI). It played a significant role in the remarkable resilience that Vietnam’s economy demonstrated in the face of global upheaval, which maintained a positive GDP growth rate of 2.6 percent in 2021, even amid the COVID-19 pandemic, and sustained an 8 percent growth rate in 2022.”, McKinsey & Co., September 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“After KFC store went cashless, what are the other fast food giants in Australia planning? A spokesperson from McDonald’s told 9News that the global burger brand had ‘no plans to go cashless at this stage’. Competing chicken brand Red Rooster said they had “no intention of going cashless in the near future,” despite the move by KFC. Domino’s told 9News that going cashless was ‘not currently something we are looking at doing’”. 9News, September 27, 2023

“Coffee Berry, a Greek coffee chain, debuts in Saudi Arabia – Greece’s renowned coffee chain, Coffee Berry, has made its inaugural entry into the Saudi Arabian market by unveiling its first store at the Hayat Mall in Riyadh. This significant move marks Coffee Berry’s fourth international venture, showcasing its growing global presence. In 2022, Coffee Berry, headquartered in Athens and boasting an impressive 210-store count, inked a franchise agreement that paved the way for its Saudi Arabian expansion. The company’s strategic vision includes the establishment of a network comprising a minimum of 20 outlets across the kingdom within the coming years.”, Franchise Talk, September 25, 2023

“Burritos on the bourse: Guzman y Gomez boss preparing to say hola to ASX – Burrito chain Guzman y Gomez could make its debut on the Australian stock exchange as early as next year, founder Steven Marks says, even as the hunt for his own replacement continues. Australia’s fastest-growing Mexican food franchise sold $759 million worth of burritos, tacos, bowls and more in the 2023 financial year, a 32 per cent rise from the year before. Underlying earnings jumped 56 per cent to $32 million.”, Brisbane Times, September 11, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“McDonald’s Is Raising (US) Royalty Fees on New Franchises for the First Time in 30 Years – The change, to 5% from 4%, applies in limited scenarios, McDonald’s said, including when an operator opens a new restaurant or purchases one the company owns. The move is aimed to help McDonald’s maintain its competitive edge, the company said, as many other franchise businesses have royalties that exceed 5%. Indeed, the royalty rate is currently at 5% across McDonald’s markets other than the U.S. and Canada, the company said in an internal memo reviewed by Barron’s.”, Barron’s, September 22, 2023

“A moment of dependable zen on a helter-skelter day’: Grace Dent on the joy of (UK) chain restaurants – They may never dazzle, but your favourite fast food chain never really burns its bridges. Come as you are, come dishevelled, hungover, heartbroken, alone or with a rabble. We’re not going on a culinary journey; rather, this is a culinary cul-de-sac where you’ve been doing a three-point turn for the past 20 years. In fact, I’m fairly sure that, at a moment’s notice, I could step in for the 2pm-10pm shift at Wagamama, say, because I’ve been eating its yaki udon since about 1995; my order rarely deviates and my love never dwindles.”, The Guardian, September 29, 2023

“Subway Is Forcing Franchisees To Accept Mobile App Discounts – According to Subway franchisees, all Subway locations will be required to accept all mobile app discounts as of December 28, 2023. In correspondence with Restaurant Business, franchise operators stated that Subway corporate announced the hard deadline to franchisees on September 26. Unfortunately, food costs and ongoing inflation have had more than a few franchisees opt out of accepting coupons that they couldn’t afford to honor.”, The Tasting Table, October 1, 2023

“Tim Hortons Launches New UK Franchise Model To Fuel Expansion Plans – Since launching its first UK location in 2017, Canadian coffee and donut chain Tim Hortons has become an increasingly familiar name across British towns and cities over recent years. The brand first opened its doors and started serving its signature coffees and baked goods to British customers from its first unit this side of the pond in Glasgow, and now has 75 locations in the UK, all of which are currently company-owned. With its eyes now firmly on rapid UK growth, Tim Hortons this week announced the launch of a franchise model following what it calls a five year ‘test and learn phase’”, Forbes, September 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking